- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose to a 16-month low against the dollar after today's meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy, specify a new set of rules of financial discipline discussed at the summit on December 9. As per the last meeting, German Chancellor Angela Merkel said that negotiations on the fiscal pact are good. Merkel also noted the need for a fiscal pact included measures to stimulate economic growth. In turn, French President Nicolas Sarkozy pledged that France's budget deficit in 2011 will be lower than expected.

It became known today of the resignation of the head of the Swiss National Bank Philipp Hildebrand. The resignation is related to the recent scandal of illegal operations with the use of insider information. Frank has become stronger after reports of the resignation of the head of the Swiss central bank.

U.S. stocks were little changed, following last week’s advance in the Standard & Poor’s 500 Index, as leaders discussed shoring up the euro and investors awaited the start of the fourth-quarter earnings season.

Dow 12,384.71 +24.79 +0.20%, Nasdaq 2,677.67 +3.45 +0.13%, S&P 500 1,280.10 +2.29 +0.18%

Alcoa Inc. (AA) increased 2.4 percent as it becomes the first company in the Dow Jones Industrial Average to report quarterly results after the market close.

Broadcom Corp. rallied 2.8 percent after Deutsche Bank AG said soft fourth-quarter results for chipmakers create a buying opportunity for the shares.

Costco Wholesale Corp. lost 2.5 percent after Sanford C. Bernstein & Co. cut its rating for the warehouse-club chain.

Now is not a time to lock into a rigid (mon-policy) position

He expects more US econ progress in '12 but says growth is slow

Gold prices are stable, as traders remained cautious ahead of a meeting of leaders of France and Germany on the problems of the eurozone. It was expected that at today's meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy,specify a new set of rules of financial discipline discussed at the summit on December 9. As per the last meeting, German Chancellor Angela Merkel said that negotiations on the fiscal pact. Merkel also noted the need for a fiscal pact included measures to stimulate economic growth. In turn, French President Nicolas Sarkozy pledged that France's budget deficit in 2011 will be lower than expected.

Although gold has fallen in price by 10 percent in December, a record-low interest rate sand concerns about the level of debt and economic growth are supporting prices.

February gold in electronic trading on the New York Stock Exchange on Comex fell to1605.7 dollars per troy ounce.

Oil dropped a third day as German industrial output declined, signaling that growth in Europe’s largest economy may have stalled, and as concern eased that Iran will block crude shipments from the Persian Gulf.

Futures fell as much as 1 percent after German production fell 0.6 percent in November, the Economy Ministry in Berlin said today. Oil climbed to a seven-month high as manufacturing in the U.S. improved.

Oil for February delivery fell 85 cents, or 0.8 percent, to $100.71 a barrel at 10:07 a.m. on the New York Mercantile Exchange. The price fell as low as $100.44. Futures are up 13 percent from a year earlier.

Brent oil for February settlement decreased 48 cents, or 0.4 percent, to $112.58 a barrel on the London-based ICE Futures Europe exchange.

EUR/USD $1.2600, $1.2700, $1.2750, $1.2800

USD/JPY Y76.00, Y76.50, Y77.50, Y78.00

AUD/USD $1.0150, $1.0200, $1.0250

GBP/USD $1.5700

GBP/JPY Y120.00

EUR/CHF Chf1.2000, Chf1.2200, Chf1.2300

06:45 Switzerland Unemployment Rate December 3.1% 3.1% 3.3%

07:00 Germany Trade Balance November 12.6 12.6 15.0

07:45 France Trade Balance, bln November -6.2 -5.8 -4.4

08:15 Switzerland Retail Sales Y/Y November -0.2% +0.6% +1.8%

09:30 Eurozone Sentix Investor Confidence January -24.0 -23.5 -21.1

11:00 Germany Industrial Production s.a. (MoM) November +0.8% -0.4% -0.6%

11:00 Germany Industrial Production (YoY) November +4.1% -0.5% +3.6%

The euro rose before the leaders of Germany and France met to craft a plan for rescuing the 17-nation common currency.

German Chancellor Angela Merkel and French President Nicolas Sarkozy held talks in Berlin today to flesh out a new rulebook for fiscal discipline negotiated at a Dec. 9 summit that seeks to create a “fiscal compact” for the euro area. Futures traders’ bets that the euro will decline against the dollar reached a record.

Merkel welcomed progress on talks on the fiscal pact at a joint press conference with Sarkozy after their meeting and said there was “very close agreement” between their two countries.

The euro pared gains as a report showed industrial production in Germany, Europe’s biggest economy, declined in November.

German industrial production dropped 0.6% after an 0.8% increase the previous month.

EUR/USD: the pair has shown high in $1,2780 area then receded.

GBP/USD: the pair has grown in $1,5460 area.

USD/JPY: the pair was limited Y76,75-Y77,00.

GBP/USD

Offers $1.5580, $1.5550, $1.5520/30, $1.5490/500, $1.5470

Bids $1.5360/50, $1.5330/20, $1.5270

EUR/USD

Offers $1.2830/40, $1.2810/00

Bids $1.2740, $1.2725/20, $1.2710/695, $1.2660/50, $1.2640, $1.2625/20, $1.2600

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.00 (session high)

Current price: Y76.85

Support 1:Y76.75 (session low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.00 (psychological level)

Resistance 3: Chf0.9780 (high of 2011)

Resistance 2: Chf0.9600 (area of session high)

Resistance 1: Chf0.9540 (intraday high)

Current price: Chf0.9517

Support 1: Chf0.9500 (area of session low and Jan 6 low)

Support 2: Chf0.9470 (Dec 29 high)

Support 3: Chf0.9450 (Jan 4 high)

Resistance 3: $ 1.2860/70 (Dec 29 low, 50,0 % $1,3080-$ 1,2660)

Resistance 2: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 high)

Resistance 1: $ 1.2790 (session high)

Current price: $1.2752

Support 1 : $1.2700 (psychological mark)

Support 2 : $1.2660 (session low)

Support 3 : $1.2590 (low of 2011)

EUR/USD $1.2600, $1.2700, $1.2750, $1.2800

USD/JPY Y76.00, Y76.50, Y77.50, Y78.00

AUD/USD $1.0150, $1.0200, $1.0250

GBP/USD $1.5700

GBP/JPY Y120.00

EUR/CHF Chf1.2000, Chf1.2200, Chf1.2300

00:30 Australia Retail sales (MoM) November +0.2% +0.4% 0.0%

00:30 Australia Retail Sales Y/Y November +2.8% +3.1%

The euro touched an 11-year low against the yen before the German and French leaders meet amid signs Europe’s sovereign-debt crisis is damping the region’s prospects for growth.

The 17-nation euro traded 0.4 percent from the least in nearly 16 months versus the dollar ahead of a report today forecast to show industrial production in Germany, Europe’s biggest economy, declined in November. German Chancellor Angela Merkel and French President Nicolas Sarkozy meet in Berlin today to flesh out a new rulebook for fiscal discipline negotiated at a Dec. 9 summit that seeks to create a “fiscal compact” for the 17-member euro area. The talks will be followed by a joint press conference.

Spain is scheduled to sell bonds due in 2015 and 2016 on Jan. 12. Italy will auction securities on the same day and on Jan. 13. Spain’s 10-year bond yield (GSPG10YR) climbed seven basis points, or 0.07 percentage point, to 5.71 percent on Jan. 6, while the rate on similar-maturity Italian debt (GBTPGR10) gained four basis points to 7.13 percent, above the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts.

The Australian dollar weakened against all of its 16 major peers.

The so-called Aussie fell for a fourth day after data showed the South Pacific nation’s retail sales unexpectedly stagnated in November and Pacific Investment Management Co. said the Reserve Bank will need to ease monetary policy. New Zealand’s dollar, nicknamed the kiwi, maintained a three-day drop after a report showed the nation’s trade deficit widened. Australia’s retail sales (AURSTSA) were unchanged in November, a report from the statistics bureau showed today, compared with the 0.4 percent gain estimated by economists in a Bloomberg News survey.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair traded in range $1.5390-$1.5440.

USD/JPY: on Asian session the pair traded in range Y76.80-Y77.00.

European events start at 0700GMT with Germany foreign trade data, which is followed by France foreign trade at 0745GMT.

Core-European data also includes the 1100GMT release of German industrial output data. At 1230GMT German Chancellor Angela Merkel and French President Nicolas Sarkozy are due to meet and hold a joint press conference, in Berlin. US data starts at 1430GMT with the weekly Capital Goods Index, which is followed at 1500GMT by the Employment Trends Index and then at 1530GMT by the weekly Retail Trade Index. Back in Europe at 1530GMT, German Chancellor Angela Merkel delivers a speech at a conference of the DBB trade union, in Cologne.

On Tuesday the dollar fell the most more than a month against the euro as signs manufacturing is expanding in the U.S. and China damped the appeal of safer assets. The euro advanced after German unemployment fell more than forecast. The euro extended gains after the Nuremberg-based Federal Labor Agency said German unemployment fell in December more than economists forecast. The number of people out of work slid a seasonally adjusted 22,000 to 2.89 million, the agency said. Australia’s and New Zealand’s dollars rose to the strongest since November.

On Wednesday the dollar rose against most traded currencies of the partner against the background of the declining interest in risky assets. Support the dollar had released statistical data showing that in November, orders for U.S. manufactured goods increased the maximum for the last 4 months of growth. As shown by the Department of Commerce, factory orders rose 1.8% against the previous value of the revised -0.2%. Increased demand for aircraft, automobiles and metals offset the decline in orders for computers and electronics. Euro fell against major currencies against the weak auction results for German government bonds, which resulted in the 4,057 billion euros drawn on 10 years with plans to 5.0 billion euros.

On Thursday the euro fell to an 11-year low against the yen and the weakest level in 15 months versus the dollar on concern Europe’s debt crisis is worsening and as reports showed the U.S. labor market is strengthening. The 17-nation currency weakened against most major peers after France’s borrowing costs rose at a bond sale as credit-rating companies threaten to cut the nation’s top AAA ranking.

The dollar extended gains versus the euro after ADP Employer Services reported U.S. companies added 325,000 workers in December, beating the highest projection in a Bloomberg News survey and following a revised 204,000 gain the prior month.

On Friday the dollar gained to a 15-month high versus the euro as U.S. employers added more jobs than forecast and investors speculated Europe’s debt crisis is worsening. The greenback headed for its fifth weekly advance versus the euro in what would be its longest winning streak since February 2010 amid optimism the U.S. economic recovery is gaining momentum. The 17-nation European currency fell to an 11- year low against the yen. It’s the worst week for Europe’s common currency in four months. Europe’s shared currency lost 5.1 percent versus the dollar over the past month and dropped 5.9 percent against the yen as investors sought refuge amid Europe’s sovereign-debt turmoil.

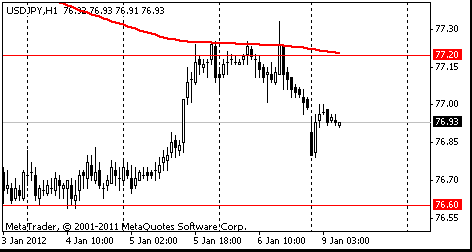

Resistance 3: Y77.88 (high of the European session on Dec 29)

Resistance 2: Y77.55 (Dec 28 low)

Resistance 1: Y77.20 (MA (233) H1)

The current price: Y76.93

Support 1:Y76.60 (Jan 3-4 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

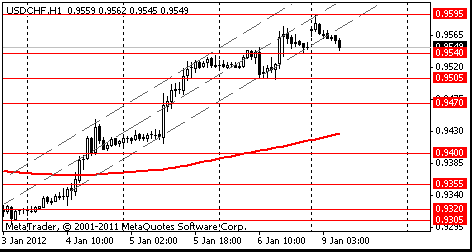

Resistance 3: Chf0.9700 (Feb 10 high)

Resistance 2: Chf0.9650 (Feb 9 high)

Resistance 1: Chf0.9595 (session high)

The current price: Chf0.9550

Support 1: Chf0.9540 (low of the American session on Jan 6)

Support 2: Chf0.9505 (Jan 6 low)

Support 3: Chf0.9470 (Dec 29 high)

Resistance 3: $1.2810 (Jan 6 high)

Resistance 2: $1.2760 (low of the Asian session on Jan 6)

Resistance 1: $1.2730 (resistance line from Jan 4)

The current price: $1.2697

Support 1 : $1.2665 (session low)

Support 2 : $1.2625 (100% FE $1.2943-$1.2769 from $1.2798)

Support 3 : $1.2590 (support line from Jan 4)

00:00 Australia HIA New Home Sales, m/m November +5.5%

00:30 Australia Retail sales (MoM) November +0.2% +0.4%

00:30 Australia Retail Sales Y/Y November +2.8%

06:45 Switzerland Unemployment Rate December 3.0% 3.1%

07:00 Germany Trade Balance November 12.6 12.6

07:45 France Trade Balance, bln November -6.2 -5.8

08:15 Switzerland Retail Sales Y/Y November -0.2% +0.6%

09:30 Eurozone Sentix Investor Confidence January -24.0 -23.5

11:00 Germany Industrial Production s.a. (MoM) November +0.8% -0.4%

11:00 Germany Industrial Production (YoY) November +4.1% -0.5%

13:30 Canada Building Permits (MoM) November +11.9% -3.1%

15:30 Canada Bank of Canada Senior Loan Officer IV quarter -26.9

15:30 Canada Bank of Canada business outlook future sales IV quarter 6.0 10.0

17:40 U.S. FOMC Member Dennis Lockhart Speaks 0

20:00 U.S. Consumer Credit November 7.6 7.2

21:45 New Zealand Building Permits, m/m November +11.2% +3.3%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.