- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The dollar declined as US stocks advanced, damping demand for safer investments.

The euro’s gains were tempered before Spain and Italy sell debt this week amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros of bonds due in 2015 and 2016 on Jan. 12, and Italy will sell 12 billion euros of bills the same day.

The dollar and yen weakened against higher-yielding currencies before Germany’s chancellor meets with the International Monetary Fund’s managing director amid signs European leaders are taking steps to end the debt crisis.

EUR/USD $1.2700, $1.2750, $1.3000

USD/JPY Y76.45, Y76.50, Y77.00, Y77.10, Y77.30

AUD/USD $1.0400, $1.0250, $1.0225

GBP/USD $1.5370, $1.5400, $1.5500, $1.5800

EUR/CHF Chf1.2100

USD/CHF Chf0.9400, Chf0.9420, Chf0.9500

07:45 France Industrial Production, m/m November 0.0% +0.1% +1.1%

07:45 France Industrial Production, y/y November +1.8% -0.4% +0.1%

The euro’s gains were tempered before Spain and Italy sell debt this week amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros of bonds due in 2015 and 2016 on Jan. 12, and Italy will sell 12 billion euros of bills the same day.

The dollar and yen weakened against higher-yielding currencies before Germany’s chancellor meets with the International Monetary Fund’s managing director amid signs European leaders are taking steps to end the debt crisis.

The U.S. currency declined as European and Asian stocks advanced, damping demand for safer investments.

EUR/USD: the pair has grown above $1,2800.

GBP/USD

Offers $1.5590/600, $1.5550/60, $1.5520/25, $1.5485

Bids $1.5440, $1.5425/20, $1.5400/390

EUR/USD

Offers $1.2840/60, $1.2830/20

Bids $1.2720, $1.2710/695, $1.2660/50

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.00 (Jan 9 high)

Current price: Y76.83

Support 1:Y76.75 (session low and Jan 9 low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.00 (psychological level)

Resistance 3: Chf0.9600 (area of session high)

Resistance 2: Chf0.9540 (high of american session on Jan 9)

Resistance 1: Chf0.9510 (session high)

Current price: Chf0.9483

Support 1: Chf0.9465/60 (area of session low and Dec 29 high)

Support 2: Chf0.9445/40 (area of Jan 4 high and МА (200) for Н1)

Support 3: Chf0.9410 (Jan 5 low)

Resistance 3 : $1.5555 (61,8 % FIBO $1,5670-$ 1,5375)

Resistance 2 : $1.5630 (50,0 % FIBO $1,5670-$ 1,5375, Jan 6 high)

Resistance 1 : $1.5500 (area of session high and МА(200) for Н1)

Current price: $1.5461

Support 1 : $1.5440 (area of session low)

Support 2 : $1.5420 (Jan 9 american session low )

Support 3 : $1.5375/60 (area of Dec and Jan 6 lows)

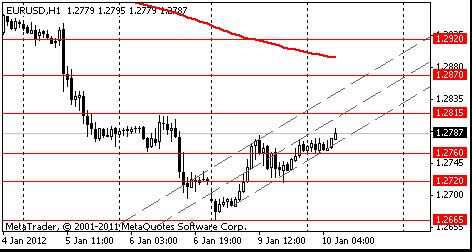

Resistance 3: $ 1.2890 (МА (200) for Н1)

Resistance 2: $ 1.2860/70 (Dec 29 low, 50,0 % $1,3080-$ 1,2660)

Resistance 1: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 high, session high)

Current price: $1.2783

Support 1 : $1.2740 (session low)

Support 2 : $1.2720 (low of american session on Jan 9)

Support 3 : $1.2660 (Jan 9 low)

EUR/USD $1.2700, $1.2750, $1.3000(large)

USD/JPY Y76.45, Y76.50, Y77.00, Y77.10, Y77.30

AUD/USD $1.0400, $1.0250, $1.0225

GBP/USD $1.5370, $1.5400, $1.5500, $1.5800

EUR/CHF Chf1.2100(large)

USD/CHF Chf0.9400, Chf0.9420, Chf0.9500

Asian stocks climbed, with China shares set for the biggest three-day gain in a year, amid speculation that policy makers may act to spur growth in the world's second-largest economy.

Nikkei 225 8,422 +31.91 +0.38%

Hang Seng 19,004 +138.56 +0.73%

S&P/ASX 200 4,152 +46.79 +1.14%

Shanghai Composite 2,286 +59.85 +2.69%

Honda increased 1.4 percent to 2,488 yen. Hyundai Motor Co. (005380), South Korea’s largest automaker, advanced 2.3 percent to 226,500 won in Seoul. Samsung Electronics Co., the world’s second- biggest maker of mobile phones by sales, added 1 percent to 1.026 million won.

Olympus Corp. (7733) surged 20 percent to 1,263 yen after the Nikkei reported the scandal-hit camera maker will likely retain its listing on the Tokyo Stock Exchange and as the company took legal action against executives over a $1.7 billion accounting fraud.

Asian stocks reversed losses as shares of Chinese lenders and developers rallied after China’s new lending and money supply increased. Exporters dropped after a Federal Reserve official said the central bank probably won’t begin a new round of bond purchases.

Samsung Electronics, the world’s second-biggest maker of mobile phones by sales, decreased 2.3 percent in Seoul. HTC Corp. sank 5.2 percent in Taipei as the maker of smartphones posted its first drop in quarterly profit in two years. Industrial & Commercial Bank of China Ltd. and China Overseas Land & Investment Ltd. led a rally among China’s lenders and developers as the new loans and money supply data stoked speculation the government is already taking steps to ease a cash crunch.

European stocks fell as a summit between German Chancellor Angela Merkel and French President Nicolas Sarkozy failed to assuage concern over the debt crisis.

UniCredit SpA tumbled as rights to buy the bank’s shares slumped in their first day of trading in Milan. GlaxoSmithKline fell 4.1 percent after saying its experimental respiratory drug Relovair failed to prove its superiority to an existing medicine in a late-stage study. Nokia Oyj fell 2.8 percent as supplier RF Micro Devices Inc. reported preliminary quarterly revenue that trailed its earlier forecast.

U.S. stocks advanced, extending last week’s rally for the Standard & Poor’s 500 Index, as European leaders discussed shoring up the region’s currency and investors awaited the start of the fourth-quarter earnings season.

Measures of industrial, energy and financial shares had the biggest gains in the S&P 500 among 10 groups. Alcoa Inc. (AA), the largest U.S. aluminum producer, increased 2.9 percent before reporting its quarterly results. Broadcom Corp. rallied 2.5 percent as Deutsche Bank AG said soft fourth-quarter results for chipmakers create a buying opportunity for the industry.

00:01 United Kingdom BRC Retail Sales Monitor y/y December -1.6% +0.5% +2.2%

00:01 United Kingdom RICS House Price Balance December -17% -18% -16%

00:30 Australia Building Permits, m/m November -10.7% +6.3% +8.4%

00:30 Australia Building Permits, y/y November -29.8% -19.8% -18.9%

02:00 China Trade Balance, bln December 14.5 8.3 16.5

Yesterday the euro rose to a 16-month low against the dollar after meeting, German Chancellor Angela Merkel and French President Nicolas Sarkozy, specify a new set of rules of financial discipline discussed at the summit on December 9. As per the last meeting, German Chancellor Angela Merkel said that negotiations on the fiscal pact are good. Merkel also noted the need for a fiscal pact included measures to stimulate economic growth. In turn, French President Nicolas Sarkozy pledged that France's budget deficit in 2011 will be lower than expected.

It became known of the resignation of the head of the Swiss National Bank Philipp Hildebrand. The resignation is related to the recent scandal of illegal operations with the use of insider information. Frank has become stronger after reports of the resignation of the head of the Swiss central bank.

EUR/USD: yesterday the pair grew.

GBP/USD: yesterday the pair was restored.

USD/JPY: yesterday the pair holds in range Y76.80-Y77.00.

Macroeconomic data releases are generally second-tier for Tuesday, starting at 0730GMT with the Bank of France business survey, which is followed at 0745GMT by France industrial output data. US data starts at 1245GMT with the ICSC Weekly Shopping mall sales, which are followed at 1355GMT by the Redbook weekly store sales data. US data continues at 1500GMT with Wholesale Inventories and the IBD/TIPP Economic Optimism Index.

Resistance 3: Chf0.9595 (Jan 9 high)

Resistance 2: Chf0.9540 (high of the American session on Jan 9)

Resistance 1: Chf0.9500 (session high)

The current price: Chf0.9469

Support 1: Chf0.9450 (50.0% FIBO Chf0.9595-Chf0.9305)

Support 2: Chf0.9415 (61.8% FIBO Chf0.9595-Chf0.9305)

Support 3: Chf0.9395 (Dec 29 low)

Resistance 3: $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2: $1.2870 (50.0% FIBO $1.2665-$1.3075)

Resistance 1: $1.2815 (Jan 6 high)

The current price: $1.2787

Support 1 : $1.2760 (session low)

Support 2 : $1.2720 (low of the American session on Jan 9)

Support 3 : $1.2665 (Jan 9 low)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2763 +0,53%

GBP/USD $1,5456 +0,22%

USD/CHF Chf0,9494 -0,84%

USD/JPY Y76,83 -0,08%

EUR/JPY Y98,07 +0,46%

GBP/JPY Y118,73 +0,12%

AUD/USD $1,0238 +0,20%

NZD/USD $0,7870 +0,84%

USD/CAD C$1,0233 -0,43%

Change % Change Last

Oil $101.33 +0.02 +0.02%

Gold $1,610.90 -0.80 -0.05%

Change % Change Last

Nikkei 225 closed

Hang Seng 18,866 +272.66 +1.47%

S&P/ASX 200 4,105 -3.07 -0.07%

Shanghai Composite 2,226 +62.49 +2.89%

FTSE 100 5,612 -37.42 -0.66%

CAC 40 3,128 0.00 0.00%

Xetra DAX 6,017 -40.69 -0.67%

S&P 500 1,281 +2.89 +0.23%

NASDAQ 2,677 +2.34 +0.09%

Dow 12,393 +32.77 +0.27%

00:01 United Kingdom BRC Retail Sales Monitor y/y December -1.6% +0.5%

00:01 United Kingdom RICS House Price Balance December -17% -18%

00:30 Australia Building Permits, m/m November -10.7% +6.3%

00:30 Australia Building Permits, y/y November -29.8% -19.8%

02:00 China Trade Balance, bln December 14.5 8.3

07:45 France Industrial Production, m/m November 0.0% +0.1%

07:45 France Industrial Production, y/y November +1.8% -0.4%

13:15 Canada Housing Starts December 181.1 188.5

15:00 U.S. Wholesale Inventories November +1.6% +0.6%

16:10 U.S. FOMC Member Pianalto Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.