- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose to a one-week high versus the dollar after European Central Bank President Mario Draghi said he saw signs of stabilization in the economy and Spain sold almost twice its maximum target at a note auction.

The shared currency appreciated versus 14 of its 16 most- traded peers as Italian borrowing costs dropped at a bill auction. The ECB left its benchmark interest rate unchanged.

The dollar fell the yen after data showed U.S. retail sales increased less than economists forecast.

The dollar fell bafter the Commerce Department said U.S. retail sales gained 0.1 percent last month, following a revised 0.4 percent increase in November. Economists in a Bloomberg survey forecast a 0.3 percent advance in December.

The Australian dollar erased gains versus its U.S. counterpart as stocks declined after the sales report and after more Americans than forecast filed claims for jobless benefits last week.

Can See Signs Of UK Economy Turning The Corner

- I Believe The Euro Will Survive

- Inflation Will Fall In 2012

Can See Signs Of UK Economy Turning The Corner

I Believe The Euro Will Survive

Inflation Will Fall In 2012

EUR/USD $1.2550, $1.2600, $1.2750, $1.2800, $1.2810, $1.2820

USD/JPY Y76.30, Y77.00, Y77.20, Y77.35, Y77.50

AUD/USD $1.0300, $1.0450

GBP/USD $1.5400, $1.5470

EUR/JPY Y100.00

USD/JPY Chf0.9500, Chf0.9300

- never comment on exchange rates, stick to G7- communique;

- we reaffirmed strong interest in stable glob fin system.

- never comment on exchange rates, stick to G7- communique;

- we reaffirmed strong interest in stable glob fin system.

- global econ,protectionism, imbalances also among risks;

- 3-yr refi shows providing support to banks;

- all nonstandard measures are temporary in nature;

- infl has been elevated since end-2010, mainly due energy;

- risks to inflation as broadly balanced in medium term.

- global econ,protectionism, imbalances also among risks;

- 3-yr refi shows providing support to banks;

- all nonstandard measures are temporary in nature;

- infl has been elevated since end-2010, mainly due energy;

- risks to inflation as broadly balanced in medium term.

- infl to stay above 2% several months, then decline;

- fin tensions still dampen econ activity;

- tentative signs of stabilization of activity;

- high uncertainty, substantial downside risks.

- infl to stay above 2% several months, then decline;

- fin tensions still dampen econ activity;

- tentative signs of stabilization of activity;

- high uncertainty, substantial downside risks.

Bids $1.5500, $1.5450, $1.5400/10, $1.5380/85

Offers $1.5270, $1.5225/20, $1.5200/190

06:30 France CPI, m/m December +0.3% +0.2% +0.4%

06:30 France CPI, y/y December +2.5% +2.3% +2.7%

07:00 Germany CPI, m/m December +0.7% +0.7% +0.7%

07:00 Germany CPI, y/y December +2.1% +2.1% +2.1%

09:30 United Kingdom Industrial Production (MoM) November -0.7% +0.1% -0.6%

09:30 United Kingdom Industrial Production (YoY) November -1.7% -2.2% -3.1%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.1% -0.2%

09:30 United Kingdom Manufacturing Production (YoY) November +0.3% -0.5% -0.6%

10:00 Eurozone Industrial production, (MoM) November -0.1% -0.2% -0.1%

10:00 Eurozone Industrial Production (YoY) November +1.3% +0.3% -0.3%

12:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50% 0.50%

12:45 Eurozone ECB Interest Rate Decision 0 1.00% 1.00% 1.00%

The euro strengthened after Spain sold almost twice its maximum target of debt at an auction today, boosting demand for the region’s assets.

The euro rose as Italian borrowing costs dropped at a bill sale, spurring optimism the sovereign-debt crisis is easing.

European Central Bank policy makers meeting today leave their benchmark interest rate of 1.00%.

The euro extended gains after a government report showed industrial production in the region declined by less than economists forecast.

The pound stayed lower against the euro after the Bank of England kept borrowing costs at a record low.

The pound weakened as the Bank of England’s Monetary Policy Committee held its key interest rate at 0.5 percent, in line with the forecast of analysts. The central bank maintained its bond-buying target at 275 billion pounds.

The Dollar Index declined for the third time in four days before a U.S. report that economists said will show retail sales increased in December, damping demand for the relative safety of the U.S. currency.

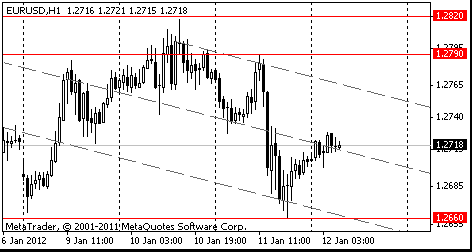

EUR/USD: during european session the pair grown, showed high in $1,2770 area.

US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

EUR/USD

Offers $1.2840/60, $1.2820/30, $1.2800, $1.2790/800, $1.2780

Bids $1.2730/20, $1.2650, $1.2640, $1.2625/20, $1.2600

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.05 (Jan 11 high)

Current price: Y76.85

Support 1:Y76.80 (session low, support line from Jan 4)

Support 2:Y76.55 (lows of November and January)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9600 (area of Jan 9 high)

Resistance 2: Chf0.9565 (Jan 11 high)

Resistance 1: Chf0.9520 (low of asian session)

Current price: Chf0.9494

Support 1: Chf0.9480 (session low, Jan 11 low)

Support 2: Chf0.9465/50 (area of Dec 29 and Jan 4 high, МА (200) for Н1 and Jan 10 low)

Support 3: Chf0.9410 (Jan 5 low)

Resistance 3 : $1.5410 (61.8 % FIBO $1.5500-$ 1.5275)

Resistance 2 : $1.5390 (50.0 % FIBO $1.5500-$ 1.5275)

Resistance 1 : $1.5360 (38,2 % FIBO $1.5500-$ 1.5275)

Current price: $1.5351

Support 1 : $1.5310/00 (area of Jan 11 low and low of asian session)

Support 2 : $1.5275/70 (session low and low of 2011)

Support 3 : $1.5200 (psychological level)

Resistance 3: $ 1.2860/70 (50,0 % $1,3080-$ 1,2660, Dec 29 low)

Resistance 2: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 and 10 highs)

Resistance 1: $ 1.2770 (low of asian session)

Current price: $1.2749

Support 1 : $1.2700 (session low)

Support 2 : $1.2660 (Jan 9 and 11 lows)

Support 3 : $1.2590 (low of August’2010)

sold E8.5bln 12-mont; average yield 2.735% (5.952%), cover 1.47 (1.92);

sold E3.5bln 3-month "flexi" BOT; average yield 1.644%, cover 1.853.

EUR/USD $1.2550, $1.2600, $1.2750, $1.2800, $1.2810, $1.2820

USD/JPY Y76.30, Y77.00, Y77.20, Y77.35, Y77.50

AUD/USD $1.0300, $1.0450

GBP/USD $1.5400, $1.5470

EUR/JPY Y100.00

USD/JPY Chf0.9500, Chf0.9300

01:30 China PPI y/y December +2.7% +1.6% +1.7%

05:00 Japan Eco Watchers Survey: Current December 45.0 46.3 47.0

05:00 Japan Eco Watchers Survey: Outlook December 44.7 45.0 44.4

06:00 Japan Prelim Machine Tool Orders, y/y December +15.8% +17.4%

The euro was 0.5 percent from a 16- month low against the dollar on speculation European Central Bank policy makers won’t take steps today to support growth even as reports signal the euro-area economy is struggling.

The 17-nation currency held a drop from yesterday versus the yen before figures estimated to show European output shrank in November. Demand for the euro was limited before Spain and Italy sell debt today, amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros ($6.4 billion) of bonds due 2015 and 2016 today, while Italy is scheduled to sell 12 billion euros of bills. The ECB will probably keep its key interest rate at 1 percent at a policy meeting today, the median estimate of economists surveyed by Bloomberg News showed.

New Zealand’s dollar touched a two- month high against the greenback as a report showed China’s inflation cooled for the fifth straight month in December, increasing speculation the Asian nation will provide more monetary stimulus.

The so-called kiwi also rose to its strongest level since November versus the yen before data that may show U.S. retail sales grew, supporting demand for riskier assets. China’s consumer prices rose 4.1 percent from a year earlier, the National Bureau of Statistics said in Beijing today. That compares with the median estimate of 4 percent in a Bloomberg News survey and 4.2 percent in November.

The People’s Bank of China in November cut the amount of cash that lenders need to set aside as reserves, the first reduction since 2008. China is Australia’s biggest trading partner and New Zealand’s second-largest export market.

Sales at U.S. retailers probably climbed 0.3 percent in December, following a 0.2 percent gain in November, according to the median forecast in a Bloomberg survey of economists before the Commerce Department issues the figure today.

EUR/USD: on Asian session the pair traded in range $1.2700-$1.2730.

GBP/USD: on Asian session the pair traded in range $1.5305-$1.5330.

USD/JPY: on Asian session the pair traded in range Y76.80-Y76.90.

European data starts at 0630GMT with France HICP, which is followed by German final HICP at 0700GMT and then France balance of

payments and central government deficit data at 0745GMT. At 0900GMT, ECB Governing Council member Jens Weidmann, German Finance Minister Wolfgang Schaeuble and German Chancellor Angela Merkel all attend a New Year's reception of the German President, in Berlin. EMU data at includes industrial output at 1000GMT and the OECD leading indicator at 1100GMT. UK data at 0930GMT sees the Index of Production as well as Industrial Production and Manufacturing Output data. Manufacturing output plunged on the month in October, and unless there is a sharp rebound in November and December the sector will end up making a negative contribution to Q4 GDP. US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

Yesterday the euro weakened to a 16-month low versus the dollar and dropped for the first time in three days against the yen amid speculation France’s credit rating may be downgraded and Europe’s sovereign debt crisis will worsen. The shared currency declined against 14 of its 16 most- traded peers even after French Finance Minister Francois Baroin denied having been notified by a ratings company that the nation’s top rating will be cut. The euro extended losses as leading members of the European Parliament objected to a planned German-led euro fiscal treaty.

Sterling was the worst performer against the dollar after data showed the U.K. trade deficit increased more than forecast. British retail-store inflation also slowed to the least in 16 months, fueling bets the Bank of England will need to add stimulus to aid the economy.

The pound dropped 1 percent to $1.5303 and fell 0.3 percent to 82.76 pence per euro.

The U.S. currency rose against most of its major peers as investors sought the safety of Treasuries. Yields on 10-year notes dropped to the lowest level in two days, 1.92 percent.

The Dollar Index (DXY), which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, gained as much as 0.7 percent to 81.493, approaching Jan. 9’s 81.503, the highest since September 2010.

EUR/USD: yesterday the pair fell and has updated a monthly’s low.

GBP/USD: yesterday the pair has lost one and a half figure.

USD/JPY: yesterday the pair has a little grown.

European data starts at 0630GMT with France HICP, which is followed by German final HICP at 0700GMT and then France balance of

payments and central government deficit data at 0745GMT. At 0900GMT, ECB Governing Council member Jens Weidmann, German Finance Minister Wolfgang Schaeuble and German Chancellor Angela Merkel all attend a New Year's reception of the German President, in Berlin. EMU data at includes industrial output at 1000GMT and the OECD leading indicator at 1100GMT. UK data at 0930GMT sees the Index of Production as well as Industrial Production and Manufacturing Output data. Manufacturing output plunged on the month in October, and unless there is a sharp rebound in November and December the sector will end up making a negative contribution to Q4 GDP. US data starts at 1330GMT with both initial jobless benefit claims and retail sales data. At 1500GMT, US business inventories are expected to rise 0.5% in November after the 0.8% increase in October. Factory inventories were already reported up 0.5%. Late US data sees the 2130GMT release of Money Supply.

Japanese stocks advanced as increased U.S. hiring boosted the earnings outlook for exporters. Gains were limited before reports expected to show Europe may be edging toward recession.

Sony Corp., which depends on the U.S. for 20 percent of its sales, rose 0.5%.

Nomura Holdings Inc. climbed 3.2% on speculation the resignation of its wholesale banking chief will allow the brokerage to revamp after overseas losses.

Tokyo Electric Power Co., which operates the crippled Fukushima Dai-Ichi nuclear plant, fell 6.1% after soaring as much as 29% yesterday on speculation it will avoid delisting.

European stocks fell from a one-week high as Fitch Ratings said the European Central Bank must do more to prevent debt crisis from spreading and a report indicated the German economy is shrinking.

Metro AG, Germany’s largest retailer, declined 3.3% after Benjamin Peters, an analyst at UBS AG, cut the stock to “sell” from “neutral.” The shares “will come under increasing pressure from earnings downgrades,” Peters wrote in a report.

Nestle SA, the world’s biggest food company, fell 1.7% after Bank of America Corp. downgraded the stock to “neutral” from “buy.”

Aryzta AG, a Swiss supplier of bakery products to supermarkets and restaurants, tumbled 6.8% after it sold 4.25 million new shares at 41 francs each. That was the largest drop since April 2009 and the worst performance in the Stoxx 600 today.

Italian banks advanced today, with Banca Popolare di Milano Scarl jumping 9.4%. Banca Monte dei Paschi di Siena SpA increased 8.1%. UniCredit SpA gained 5.5% as the shares were raised to “outperform” from “underperform” by Sanford C. Bernstein & Co. analysts, who cited the stock’s “now attractive” valuation. The bank was also upgraded to “neutral” from “reduce” by WestLB.

U.S. stocks rose as gains in banking and technology shares helped the market recover from an early slump spurred by growing signs Europe may slip into a recession.

Citigroup Inc. (+4,23%) led banks higher after analyst Dick Bove said the shares could “easily” triple in five years.

Germany’s Federal Statistics Office said the economy probably shrank in the fourth quarter from the third and three research institutes forecast in a joint report that the euro-area economy contracted in the fourth quarter and will continue to decline in the first three months of 2012. The Federal Reserve said that the U.S. economy improved last month across most of the country even as hiring was limited and housing remained stagnant.

Microsoft (MSFT) Corp. (-0,43%) recovered from earlier losses triggered after the world’s largest software maker said industrywide sales of personal computers will probably be lower than analysts projected in the fourth quarter because supply was hurt by flooding in Thailand.

Resistance 3: Chf0.9650 (Feb 9 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9565 (Jan 11 high)

The current price: Chf0.9525

Support 1: Chf0.9465 (Jan 10 low, MA (233) H1)

Support 2: Chf0.9415 (61.8% FIBO Chf0.9595-Chf0.9305)

Support 3: Chf0.9395 (Dec 29 low)

Resistance 3: $ 1.2870 (50.0% FIBO $1.2665-$1.3075)

Resistance 2: $ 1.2820 (Jan 10 high)

Resistance 1: $ 1.2790 (Jan 11 high)

The current price: $1.2718

Support 1 : $1.2660 (Jan 11 low)

Support 2 : $1.2625 (Aug 31 low)

Support 3 : $1.2590 (Aug 24 low)

Change % Change Last

Oil $101.07 +0.20 +0.20%

Gold $1,643.60 +4.00 +0.24%

Change % Change Last

Nikkei 8,448 +25.62 +0.30%

Hang Seng 19,152 +147.66 +0.78%

Shanghai Composite 2,276 -9.70 -0.42%

FTSE 5,671 -25.88 -0.45%

CAC 3,205 -5.96 -0.19%

DAX 6,152 -10.64 -0.17%

Dow 12,456.27 -6.20 -0.05%

Nasdaq 2,712.49 +9.99 +0.37%

S&P 500 1,293.16 +1.08 +0.08%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2705 -0,56%

GBP/USD $1,5326 -1,02%

USD/CHF Chf0,9539 +0,51%

USD/JPY Y76,85 +0,01%

EUR/JPY Y97,64 -0,56%

GBP/JPY Y117,78 -1,00%

AUD/USD $1,0308 -0,04%

NZD/USD $0,7968 +0,33%

USD/CAD C$1,0195 +0,40%

01:30 China CPI y/y December +4.2% +4.0%

01:30 China PPI y/y December +2.7% +1.6%

05:00 Japan Eco Watchers Survey: Current December 45.0 46.3

05:00 Japan Eco Watchers Survey: Outlook December 44.7

06:00 Japan Prelim Machine Tool Orders, y/y December +15.8%

06:30 France CPI, m/m December +0.3% +0.2%

06:30 France CPI, y/y December +2.5% +2.3%

07:00 Germany CPI, m/m December +0.7% +0.7%

07:00 Germany CPI, y/y December +2.1% +2.1%

09:30 United Kingdom Industrial Production (MoM) November -0.7% +0.1%

09:30 United Kingdom Industrial Production (YoY) November -1.7% -2.2%

09:30 United Kingdom Manufacturing Production (MoM) November -0.7% +0.1%

09:30 United Kingdom Manufacturing Production (YoY) November +0.3% -0.5%

10:00 Eurozone Industrial production, (MoM) November -0.1% -0.2%

10:00 Eurozone Industrial Production (YoY) November +1.3% +0.3%

12:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50%

12:45 Eurozone ECB Interest Rate Decision 0 1.00% 1.00%

13:30 Eurozone ECB Press Conference 0

13:30 Canada New Housing Price Index November +0.2% +0.3%

13:30 U.S. Initial Jobless Claims 07.01.2012 372 370

13:30 U.S. Retail sales December +0.2% +0.3%

13:30 U.S. Retail sales excluding auto December +0.2% +0.3%

15:00 United Kingdom NIESR GDP Estimate December +0.3%

15:00 U.S. Business inventories November +0.8% +0.4%

19:00 U.S. Federal budget December -137.3 -79.0

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.