- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

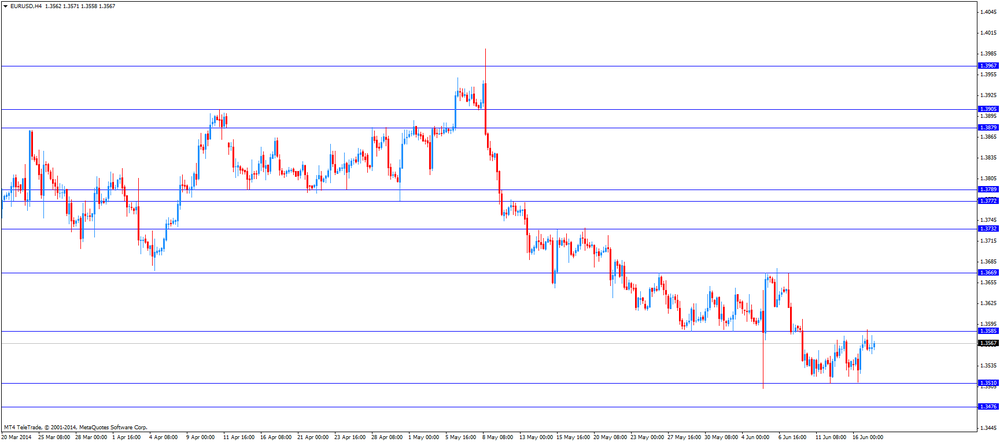

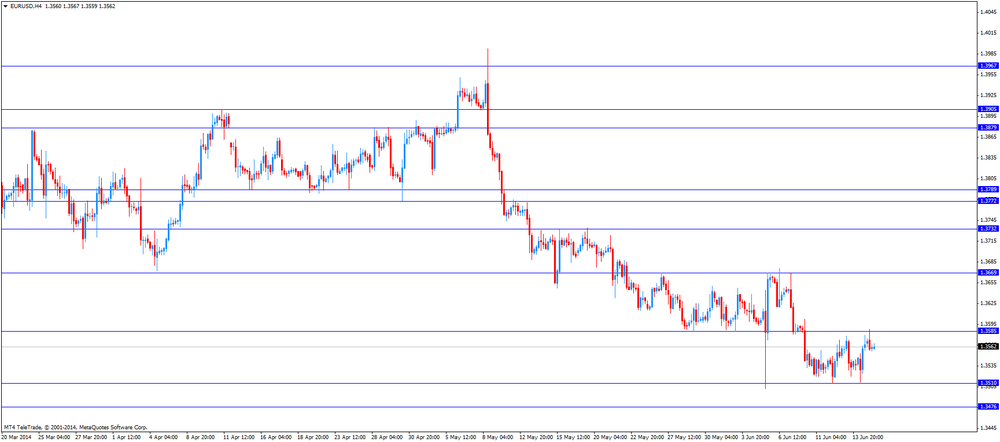

EUR/USD $1,3546 -0,18%

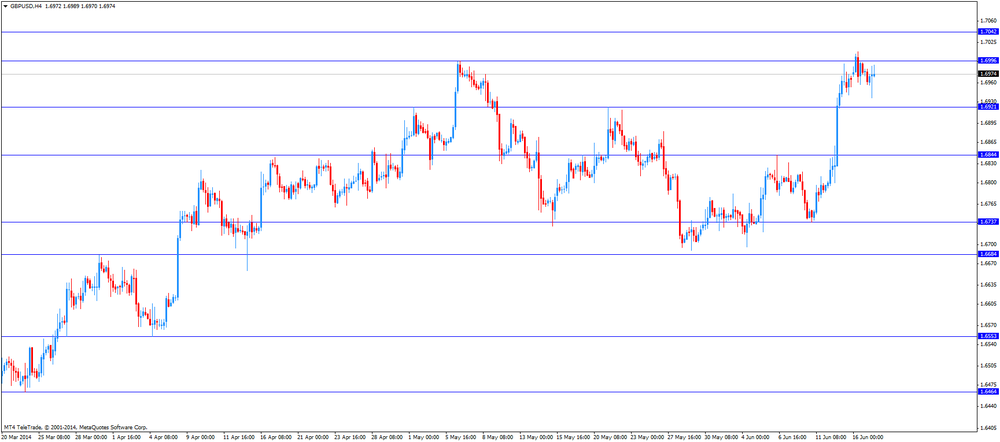

GBP/USD $1,6961 -0,11%

USD/CHF Chf0,8992 +0,24%

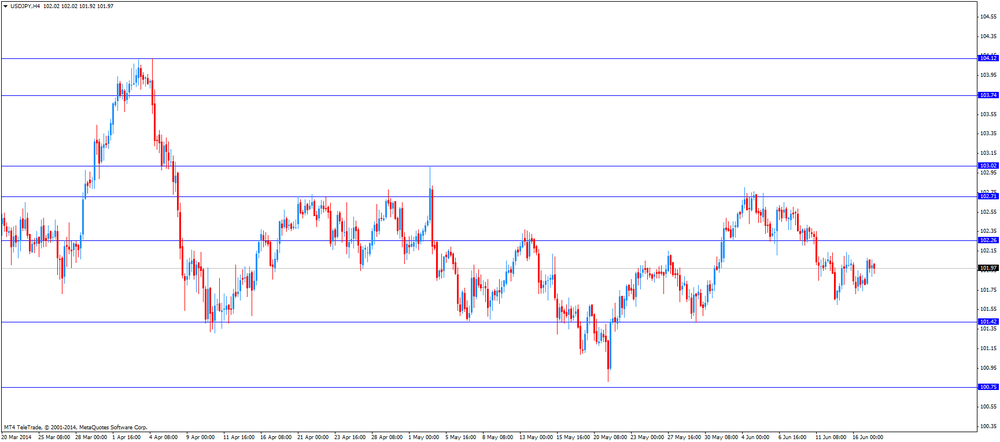

USD/JPY Y102,16 +0,34%

EUR/JPY Y138,38 +0,15%

GBP/JPY Y173,25 +0,23%

AUD/USD $0,9334 -0,69%

NZD/USD $0,8653 -0,27%

USD/CAD C$1,0857 +0,15%

00:00 Australia Conference Board Australia Leading Index April 0.0%

00:00 Australia Conference Board Australia Leading Index April 0.0%

00:30 Australia Leading Index April -0.5%

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 7.4

12:30 Canada Wholesale Sales, m/m April -0.4% +0.3%

12:30 U.S. Current account, bln Quarter I -81 -96

14:30 U.S. Crude Oil Inventories June -2.6

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 45

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I +0.9% +1.2%

22:45 New Zealand GDP y/y Quarter I +3.1%

The U.S.

dollar traded higher against the most major currencies after the

better-than-expected U.S. consumer inflation. The consumer price index in the

U.S. rose 0.4% in May, exceeding expectations for a 0.2% gain, after a 0.3%

increase in April. Food prices had shown the biggest increase since August

2011.

On a yearly

basis, the U.S. consumer price index increased 2.1% in May, after a 2.0% gain

in April. That was the biggest rise since October 2012. Analysts had expected

the consumer price index to remain unchanged at 2.0%.

The U.S.

core consumer prices excluding food and energy climbed 0.3% in May, slightly

exceeding expectations for a 0.2% rise, after a 0.2% increase in April. On a

yearly basis, the U.S. core consumer prices increased 2.0% in May, after a 1.8%

gain in April. That was the fastest pace since February 2013.

The higher

inflation could weigh on Federal Reserve’s decision when to raise short-term

interest rates.

There is a weakness

in the U.S. housing sector. The U.S. housing starts declined by 6.5% to a

seasonally adjusted 1.001 million units in May from 1.071 million in April.

Analysts had expected a decline of 3.7% to 1.034 million units.

The number

of building permits in the U.S. fell by 6.4% to a seasonally adjusted 991,000

units in May from 1.059 million units in April. Analysts had forecasted

building permits to decrease by 0.1% to 1.05 million units.

The euro

traded lower against the U.S. dollar after the weaker-than-expected ZEW

economic sentiment and the better-than-expected U.S. consumer inflation. The

German economic sentiment dropped by 3.3 points to 29.8 in June from 33.1 in

May. Analysts had expected an increase by 1.9 points to 35.0.

Eurozone’s

ZEW economic sentiment climbed to 58.4 in June from 55.2 in May, missing

expectations for a gain to 59.6.

The British

pound traded slightly lower against the U.S. dollar. The unexpected decline in inflation

in the U.K. and the stronger consumer inflation in the U.S. weighed on the

British currency. The annual rate of inflation declined 1.5% in May, after 1.8%

in April. That was the lowest level since October 2009. Analysts had expected

the annual inflation rate to decrease to 1.7%.

On a

monthly basis, inflation in the U.K. fell 0.1%, missing expectations for a 0.2%

gain, after a 0.4% increase.

The decline

was driven by falls in the price of bread, cereals and vegetables. Food prices

declined 0.6%.

Core

consumer price index excluding food costs in the U.K. climbed at annual rate by

1.6%, missing expectations for a 1.7% rise.

The Retail

Prices Index (RPI) decreased to 2.4% in May from 2.5% in April.

U.K. house

prices surged by 9.9% in the 12 months to April and reached a new high of

£260,000.

The Swiss

franc traded lower against the U.S. dollar. The producer & import prices in

Switzerland rose 0.1% in May, after a 0.3% decline in April. Analysts had

expected the producer & import prices to be flat.

On a

yearly, producer & import prices in Switzerland declined 0.8% in May,

meeting expectations, after a 1.2% fall.

The Canadian

dollar traded lower against the U.S. dollar in the absence of any major

economic reports in Canada. The better-than-expected U.S. consumer inflation

weighed on the Canadian dollar.

The New

Zealand dollar declined against the U.S dollar in the absence of any major

economic reports in New Zealand. Concerns over the violence in Iraq weighed on

the kiwi.

The

Australian dollar dropped against the U.S. dollar due to concerns over the

violence in Iraq and comments by the Reserve Bank of Australia.

The Reserve

Bank of Australia (RBA) released minutes from its latest meeting. The RBA said

that the current stimulus measures continue to be appropriate and the economic

growth is expected to remain slightly below trend. Australia’s central bank

added inflation in Australia is to remain within the target range of 2% to 3%.

New motor

vehicle sales in Australia increased 0.3% in May, after a flat reading in

April. On a yearly basis, new motor vehicle sales in Australia declined 2.0% in

May, after a 1.9% drop in April.

The

Japanese yen declined against the U.S. dollar in the absence of any major

economic reports in Japan. The better-than-expected U.S. consumer inflation

weighed on the yen.

The U.S. Labor

Department released the consumer price index. The index rose 0.4% in May,

exceeding expectations for a 0.2% gain, after a 0.3% increase in April. Food

prices had shown the biggest increase since August 2011.

On a yearly

basis, the U.S. consumer price index increased 2.1% in May, after a 2.0% gain

in April. That was the biggest rise since October 2012. Analysts had expected

the consumer price index to remain unchanged at 2.0%.

The U.S.

core consumer prices excluding food and energy climbed 0.3% in May, slightly

exceeding expectations for a 0.2% rise, after a 0.2% increase in April. On a yearly

basis, the U.S. core consumer prices increased 2.0% in May, after a 1.8% gain

in April. That was the fastest pace since February 2013.

The higher

inflation could weigh on Federal Reserve’s decision when to raise short-term

interest rates.

The U.S.

Commerce Department released the U.S. housing starts and building permits

figures. The U.S. housing starts declined by 6.5% to a seasonally adjusted

1.001 million units in May from 1.071 million in April. Analysts had expected a

decline of 3.7% to 1.034 million units.

Many

Americans are still struggling to afford new houses due to the high mortgage

rates. Single-family houses, the largest part of the housing market, declined

5.9% in May.

Apartments gained

9.4% over the past 12 months. It seems that more Americans prefer to rent a

house instead of owning homes.

The number

of building permits in the U.S. fell by 6.4% to a seasonally adjusted 991,000

units in May from 1.059 million units in April. Analysts had forecasted

building permits to decrease by 0.1% to 1.05 million units.

EUR/USD $1.3500, $1.3540/45, $1.3600

USD/JPY Y101.40/50, Y101.65

USD/CAD Cad1.0975/85, Cad1.1000

AUD/USD $0.9375, $0.9435

USD/CHF Chf0.8925, Chf0.8950, Chf0.9100

Economic

calendar (GMT0):

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales

(MoM) May 0.0% 0.3%

01:30 Australia New Motor Vehicle Sales

(YoY) May -1.9% -2.0%

05:45 Switzerland SECO Economic Forecasts Quarter III

07:15 Switzerland Producer & Import Prices,

m/m May -0.3%

0.0% +0.1%

07:15 Switzerland Producer & Import Prices,

y/y May -1.2%

-0.8% -0.8%

08:30 United Kingdom Retail Price Index, m/m May +0.4%

+0.2% +0.1%

08:30 United Kingdom Retail prices, Y/Y May +2.5%

+2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y

May +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) May

-1.1% +0.1% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May

-5.5% -4.1% -5.0%

08:30 United Kingdom Producer Price Index - Output (MoM) May

0.0% +0.1% 0.0%

08:30 United Kingdom Producer Price Index - Output (YoY) May

+0.6% +0.8% +1.0%

08:30 United Kingdom HICP, m/m

May +0.4% +0.2%

-0.1%

08:30 United Kingdom HICP, Y/Y

May +1.8% +1.7%

+1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y May +2.0% +1.6%

09:00 Eurozone ZEW Economic Sentiment June 55.2 59.6 58.4

09:00 Germany ZEW Survey - Economic Sentiment June 33.1 35.2 29.8

The U.S.

dollar traded slightly lower against the most major currencies ahead of the

release of consumer price index in the U.S. The lowering forecast of the U.S.

economic growth by the International Monetary Fund (IMF) still weighed on the

U.S. The IMF expects the U.S. economy to grow 2% in 2014, down from its

forecast of 2.8% in April.

The

consumer price index in the U.S. should climb 0.2% in May, after a 0.3%

increase. The core consumer price index in the U.S. should remain unchanged at

2.0% in May.

The euro

traded mixed against the U.S. dollar after the weaker-than-expected ZEW

economic sentiment. The German economic sentiment dropped by 3.3 points to 29.8

in June from 33.1 in May. Analysts had expected an increase by 1.9 points to

35.0.

Eurozone’s

ZEW economic sentiment climbed to 58.4 in June from 55.2 in May, missing

expectations for a gain to 59.6.

The British

pound traded slightly higher against the U.S. dollar. The annual rate of

inflation declined 1.5% in May, after 1.8% in April. That was the lowest level

since October 2009. Analysts had expected the annual inflation rate to decrease

to 1.7%.

On a

monthly basis, inflation in the U.K. fell 0.1%, missing expectations for a 0.2%

gain, after a 0.4% increase.

The decline

was driven by falls in the price of bread, cereals and vegetables. Food prices

declined 0.6%.

Core

consumer price index excluding food costs in the U.K. climbed at annual rate by

1.6%, missing expectations for a 1.7% rise.

The Retail

Prices Index (RPI) decreased to 2.4% in May from 2.5% in April.

U.K. house

prices surged by 9.9% in the 12 months to April and reached a new high of

£260,000.

The Swiss

franc traded mixed against the U.S. dollar. The producer & import prices in

Switzerland rose 0.1% in May, after a 0.3% decline in April. Analysts had

expected the producer & import prices to be flat.

On a

yearly, producer & import prices in Switzerland declined 0.8% in May,

meeting expectations, after a 1.2% fall.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair increased to $1.6989

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 U.S. Building Permits, mln May 1.08 1.07

12:30 U.S. Housing Starts, mln

May 1.07 1.04

12:30 U.S. CPI, m/m

May +0.3% +0.2%

12:30 U.S. CPI, Y/Y

May +2.0% +2.0%

12:30 U.S. CPI excluding food and

energy, m/m May +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May +1.8% +1.8%

22:45 New Zealand Current Account

Quarter I -1.43 1.42

23:50 Japan Monetary Policy Meeting

Minutes

23:50 Japan Adjusted Merchandise Trade

Balance, bln May -808.9 -1100

EUR/USD

Offers $1.3630-50, $1.3610/15, $1.3600

Bids $1.3550, $1.3535, $1.3515/10, $1.3500, $1.3485/80

GBP/USD

Offers $1.7080/85, $1.7040/50, $1.7015-20, $1.6995/00

Bids $1.6930/20, $1.6910/00, $1.6885/80, $1.6820, $1.6800

AUD/USD

Offers $0.9500, $0.9450

Bids $0.9320, $0.9300, $0.9280

EUR/JPY

Offers Y139.20, Y139.00, Y138.80

Bids Y138.00, Y137.50, Y137.20, Y137.00

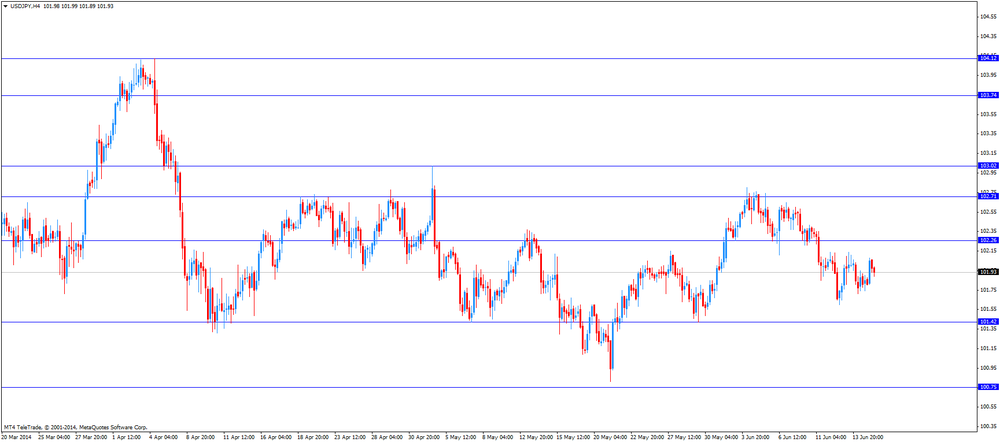

USD/JPY

Offers Y102.50

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

The Office

for National Statistics released inflation in the U.K. The annual rate of

inflation declined 1.5% in May, after 1.8% in April. That was the lowest level

since October 2009. Analysts had expected the annual inflation rate to decrease

to 1.7%.

On a

monthly basis, inflation in the U.K. fell 0.1%, missing expectations for a 0.2%

gain, after a 0.4% increase.

The decline

was driven by falls in the price of bread, cereals and vegetables. Food prices declined

0.6%.

Core consumer

price index excluding food costs in the U.K. climbed at annual rate by 1.6%, missing

expectations for a 1.7% rise.

The Retail

Prices Index (RPI) decreased to 2.4% in May from 2.5% in April.

U.K. house

prices surged by 9.9% in the 12 months to April and reached a new high of

£260,000.

The ZEW

Centre for Economic Research released its index for Germany and the Eurozone.

The German economic sentiment dropped by 3.3 points to 29.8 in June from 33.1

in May. Analysts had expected an increase by 1.9 points to 35.0.

Eurozone’s ZEW

economic sentiment climbed to 58.4 in June from 55.2 in May, missing

expectations for a gain to 59.6.

EUR/USD $1.3500, $1.3540/45, $1.3600

USD/JPY Y101.40/50, Y101.65

USD/CAD Cad1.0975/85, Cad1.1000

AUD/USD $0.9375, $0.9435

USD/CHF Chf0.8925, Chf0.8950, Chf0.9100

Economic

calendar (GMT0):

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) May 0.0% 0.3%

01:30 Australia New Motor Vehicle Sales (YoY) May -1.9% -2.0%

05:45 Switzerland SECO Economic Forecasts Quarter III

07:15 Switzerland Producer & Import Prices, m/m May -0.3% 0.0% +0.1%

07:15 Switzerland Producer & Import Prices, y/y May -1.2% -0.8% -0.8%

08:30 United Kingdom Retail Price Index, m/m May +0.4% +0.2% +0.1%

08:30 United Kingdom Retail prices, Y/Y May +2.5% +2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y May +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) May -1.1% +0.1% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -5.5% -4.1% -5.0%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.0% +0.1% 0.0%

08:30 United Kingdom Producer Price Index - Output (YoY) May +0.6% +0.8% +1.0%

08:30 United Kingdom HICP, m/m May +0.4% +0.2% -0.1%

08:30 United Kingdom HICP, Y/Y May +1.8% +1.7% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y May +2.0% +1.6%

The U.S.

dollar traded higher against the most major currencies. The demand for the U.S.

currency was supported by the violence in Iraq and the yesterday’s better-than

expected economic data.

Concerns

over the violence in Iraq and the resulting possible impact of higher oil

prices on global economic growth weighed on the risk-related currencies.

The NAHB

housing market index in the U.S. increased to 49 in June from 45 in May,

exceeding expectations for a gain to 47.

NY Fed

Empire State manufacturing index increased to 19.3 in June from 19.0 in May,

exceeding expectations from a decline to 15.2.

The New

Zealand dollar declined against the U.S dollar in the absence of any major economic

reports in New Zealand. Concerns over the violence in Iraq weighed on the kiwi.

The

Australian dollar dropped against the U.S. dollar due to concerns over the

violence in Iraq and comments by the Reserve Bank of Australia.

The Reserve

Bank of Australia (RBA) released minutes from its latest meeting. The RBA said

that the current stimulus measures continue to be appropriate and the economic

growth is expected to remain slightly below trend. Australia’s central bank

added inflation in Australia is to remain within the target range of 2% to 3%.

New motor

vehicle sales in Australia increased 0.3% in May, after a flat reading in

April. On a yearly basis, new motor vehicle sales in Australia declined 2.0% in

May, after a 1.9% drop in April.

The

Japanese yen traded lower against the U.S. dollar in the absence of any major economic

reports in Japan.

EUR/USD:

the currency pair declined to $1.3560

GBP/USD:

the currency pair decreased to $1.6960

USD/JPY:

the currency pair increased to Y102.10

The most

important news that are expected (GMT0):

12:30 U.S. Building Permits, mln May 1.08 1.07

12:30 U.S. Housing Starts, mln May 1.07 1.04

12:30 U.S. CPI, m/m May +0.3% +0.2%

12:30 U.S. CPI, Y/Y May +2.0% +2.0%

12:30 U.S. CPI excluding food and energy, m/m May +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May +1.8% +1.8%

22:45 New Zealand Current Account Quarter I -1.43 1.42

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Adjusted Merchandise Trade Balance, bln May -808.9 -1100

EUR / USD

Resistance levels (open interest**, contracts)

$1.3655 (3053)

$1.3630 (1779)

$1.3597 (71)

Price at time of writing this review: $ 1.3558

Support levels (open interest**, contracts):

$1.3537 (1013)

$1.3517 (3650)

$1.3492 (4506)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 28911 contracts, with the maximum number of contracts with strike price $1,3700 (3645);

- Overall open interest on the PUT options with the expiration date July, 3 is 41226 contracts, with the maximum number of contracts with strike price $1,3500 (4793);

- The ratio of PUT/CALL was 1.43 versus 1.44 from the previous trading day according to data from June, 16

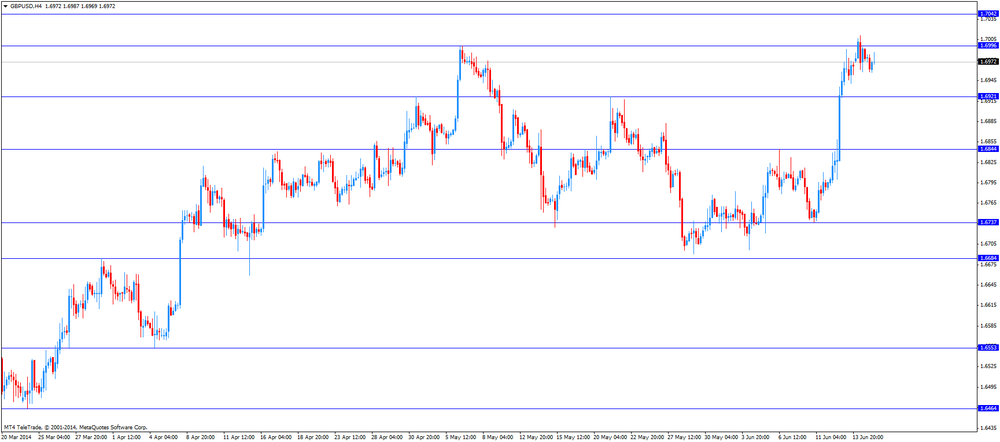

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1427)

$1.7103 (1729)

$1.7006 (2172)

Price at time of writing this review: $1.6972

Support levels (open interest**, contracts):

$1.6895 (977)

$1.6798 (1558)

$1.6699 (1931)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 17812 contracts, with the maximum number of contracts with strike price $1,7000 (2172);

- Overall open interest on the PUT options with the expiration date July, 3 is 21450 contracts, with the maximum number of contracts with strike price $1,6750 (2253);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from June, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.