- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The U.S. dollar traded higher against the most major currencies. The U.S. currency recovered a part of its losses after the Fed's interest decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

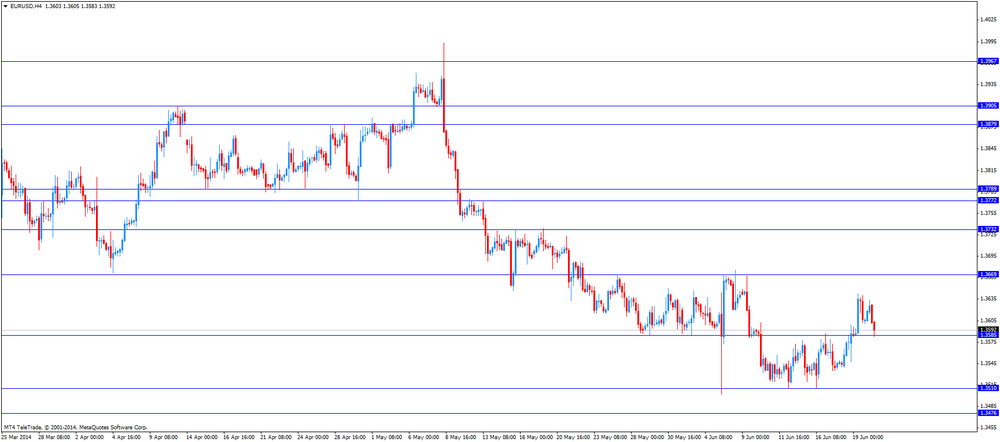

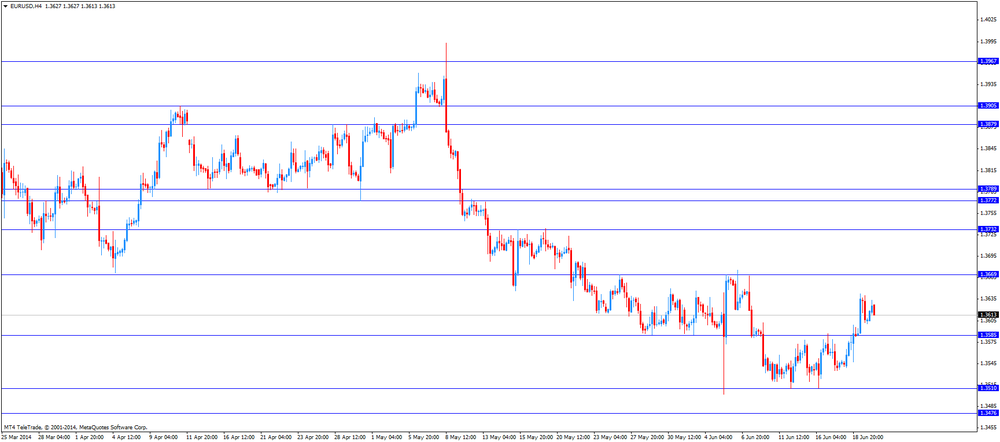

The euro traded lower against the U.S. dollar after of the consumer confidence in the Eurozone. Eurozone's consumer confidence dropped to -7.4 in June, missing expectations for an increase to -6, after -7 in May.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

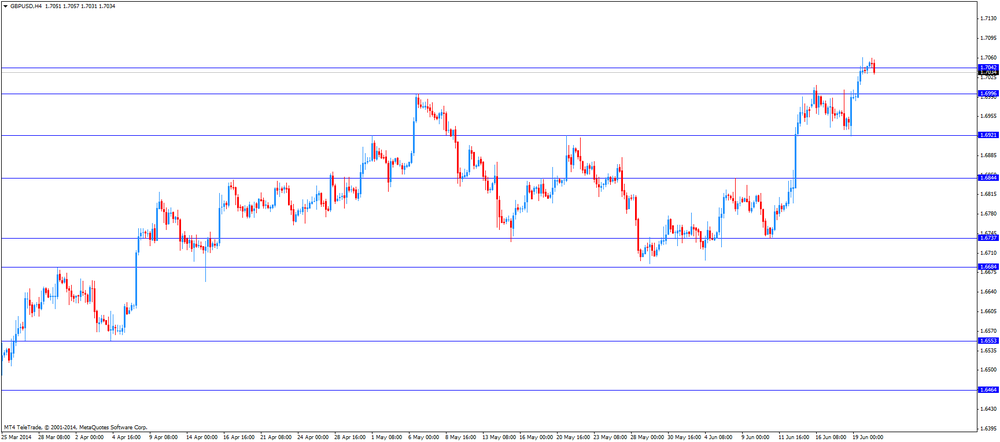

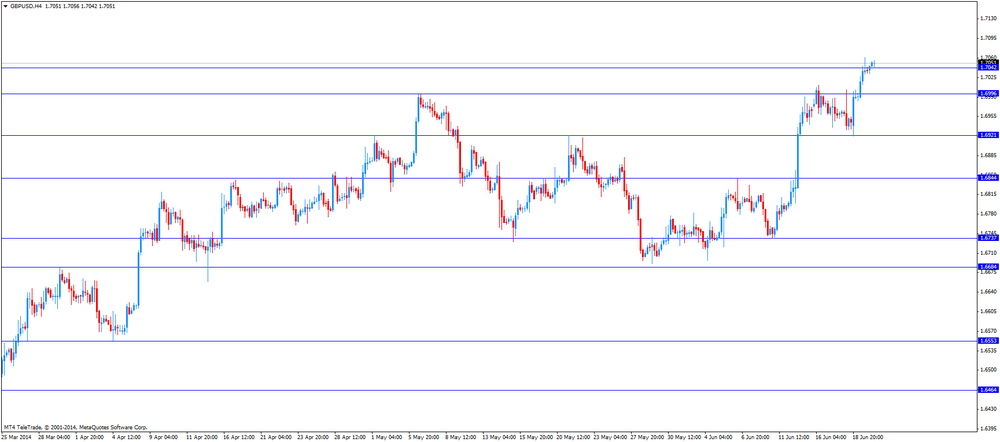

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian consumer inflation and retail sales. Retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall.

The Canadian core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

The consumer price inflation in Canada increased 0.5% in May, exceeding expectations for a 0.2% gain, after a 0.3% rise in April. On a yearly basis, the Canadian consumer price index increased 2.3% in May, beating expectations for a 2.1 gain, after a 2.0% rise in April.

The core consumer price index in Canada climbed 0.5% in May, beating expectations for a 0.2% rise, after a 0.2% gain in April. On a yearly basis, the Canadian core consumer price index rose 1.7% in May, exceeding expectations for a 1.5% increase, after a 1.4% rise in April.

The New Zealand dollar declined against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports in Australia.

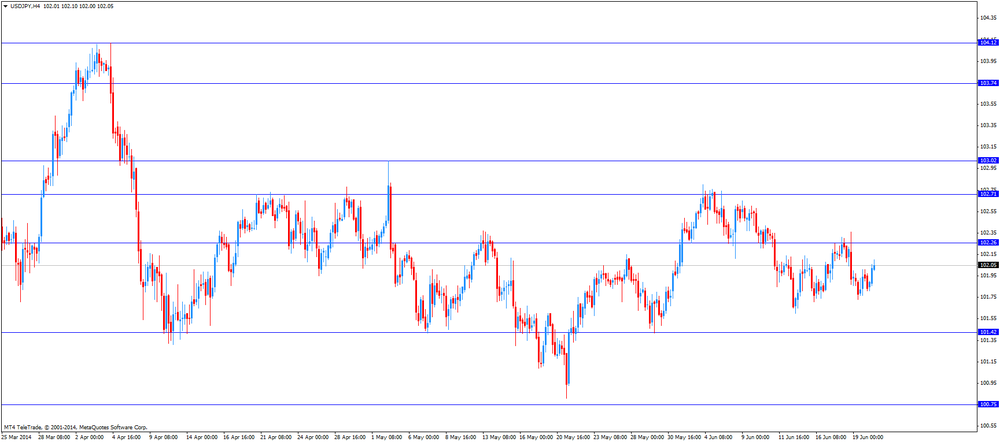

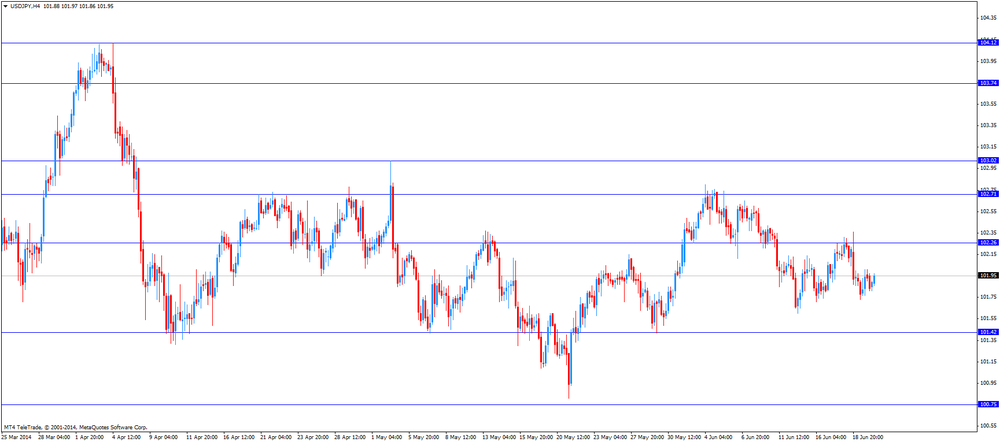

The Japanese yen decreased against the U.S. dollar. The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday that Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached. He added that the BoJ could make adjustments to hit the 2% target if required.

Mr. Kuroda pointed out the BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario.

Statistics Canada released retail sales. The retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall. That was the first increase in 5 months.

Motor vehicle and parts sales increased 2.4%. That was the biggest gain.

The Canadian Core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

EUR/USD $1.3500, $1.3550, $1.3570, $1.3590, $1.3600, $1.3625/30, $1.3635, $1.3650, $1.3670, $1.3700

USD/JPY Y101.00, Y101.20, Y101.50, Y101.70, Y102.00

GBP/USD $1.6925

USD/CAD Cad1.0820, Cad1.0835, Cad1.0840, Cad1.0850

USD/CHF Chf0.8920, Chf0.8925, Chf0.9025

EUR/CHF Chf1.2160, Chf1.2210

NZD/USD NZ$0.8755

Retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall.

The Canadian core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

The consumer price inflation in Canada increased 0.5% in May, exceeding expectations for a 0.2% gain, after a 0.3% rise in April.

The core consumer price index in Canada climbed 0.5% in May, beating expectations for a 0.2% rise, after a 0.2% gain in April.

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3600, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85

Bids $1.7000, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9500, $0.9450, $0.9440

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.75/80, Y102.50

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40, stg0.8000

Bids stg0.7950, stg0.7900

Economic calendar (GMT0):

06:00 Germany Producer Price Index (MoM) May -0.1% +0.2% -0.2%

06:00 Germany Producer Price Index (YoY) May -0.9% -0.7% -0.8%

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 Eurozone Current account, adjusted, bln April 18.8 19.4 21.5

08:30 United Kingdom PSNB, bln May 9.6 11.8 11.5

09:00 Eurozone ECOFIN Meetings

The U.S. dollar traded higher against the most major currencies. The Fed's interest decision on Wednesday still weighed on the U.S. currency. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The euro declined against the U.S. dollar ahead of the consumer confidence in the Eurozone. Eurozone's consumer confidence should increase to -6 in June, after -7 in May.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian consumer inflation and retail sales. The consumer price index in Canada should climb 0.2% in May, after a 0.3% gain in April. The Canadian core consumer price index should increase 0.2% in May.

The retail sales in Canada should rise 0.4% in April, after a 0.1% decline in March.

EUR/USD: the currency pair declined to $1.3583

GBP/USD: the currency pair decreased to $1.7031

USD/JPY: the currency pair was up to Y102.10

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m April -0.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m April +0.1% +0.4%

12:30 Canada Consumer Price Index m / m May +0.3% +0.2%

12:30 Canada Consumer price index, y/y May +2.0% +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m May +0.2% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y May +1.4% +1.5%

14:00 Eurozone Consumer Confidence June -7 -6

The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday:

- Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached;

- The BoJ could make adjustments to hit the 2% target if required;

- Japan's economy is expected to continue a moderate recovery;

- The BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario;

- The annual consumer inflation should accelerate in or after October;

- The 2% target should be reached during fiscal 2015.

EUR/USD $1.3500, $1.3550, $1.3570, $1.3590, $1.3600, $1.3625/30, $1.3635, $1.3650, $1.3670, $1.3700

USD/JPY Y101.00, Y101.20, Y101.50, Y101.70, Y102.00

GBP/USD $1.6925

USD/CAD Cad1.0820, Cad1.0835, Cad1.0840, Cad1.0850

USD/CHF Chf0.8920, Chf0.8925, Chf0.9025

EUR/CHF Chf1.2160, Chf1.2210

NZD/USD NZ$0.8755

Economic calendar (GMT0):

06:00 Germany Producer Price Index (MoM) May -0.1% +0.2% -0.2%

06:00 Germany Producer Price Index (YoY) May -0.9% -0.7% -0.8%

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 Eurozone Current account, adjusted, bln April 18.8 19.4 21.5

08:30 United Kingdom PSNB, bln May 9.6 11.8 11.5

The U.S. dollar traded slightly lower against the most major currencies. The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

Escalating violence in Iraq also weighed on the U.S. currency.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded mixed against the U.S. dollar. The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday that Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached. He added that the BoJ could make adjustments to hit the 2% target if required.

Mr. Kuroda pointed out the BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario.

EUR/USD: the currency pair increased to $1.3625

GBP/USD: the currency pair climbed to $1.7050

USD/JPY: the currency pair declined to Y101.80

The most important news that are expected (GMT0):

09:00 Eurozone ECOFIN Meetings

12:30 Canada Retail Sales, m/m April -0.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m April +0.1% +0.4%

12:30 Canada Consumer Price Index m / m May +0.3% +0.2%

12:30 Canada Consumer price index, y/y May +2.0% +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m May +0.2% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y May +1.4% +1.5%

14:00 Eurozone Consumer Confidence June -7 -6

EUR / USD

Resistance levels (open interest**, contracts)

$1.3687 (2397)

$1.3661 (3456)

$1.3642 (1808)

Price at time of writing this review: $ 1.3630

Support levels (open interest**, contracts):

$1.3605 (1774)

$1.3574 (1176)

$1.3550 (4014)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30662 contracts, with the maximum number of contracts with strike price $1,3700 (3893);

- Overall open interest on the PUT options with the expiration date July, 3 is 42496 contracts, with the maximum number of contracts with strike price $1,3550 (5057);

- The ratio of PUT/CALL was 1.39 versus 1.41 from the previous trading day according to data from June, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2222)

$1.7103 (2488)

Price at time of writing this review: $1.7048

Support levels (open interest**, contracts):

$1.6995 (1023)

$1.6898 (1180)

$1.6799 (1672)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 19326 contracts, with the maximum number of contracts with strike price $1,7100 (2488);

- Overall open interest on the PUT options with the expiration date July, 3 is 23176 contracts, with the maximum number of contracts with strike price $1,6700 (2252);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from June, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.