- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

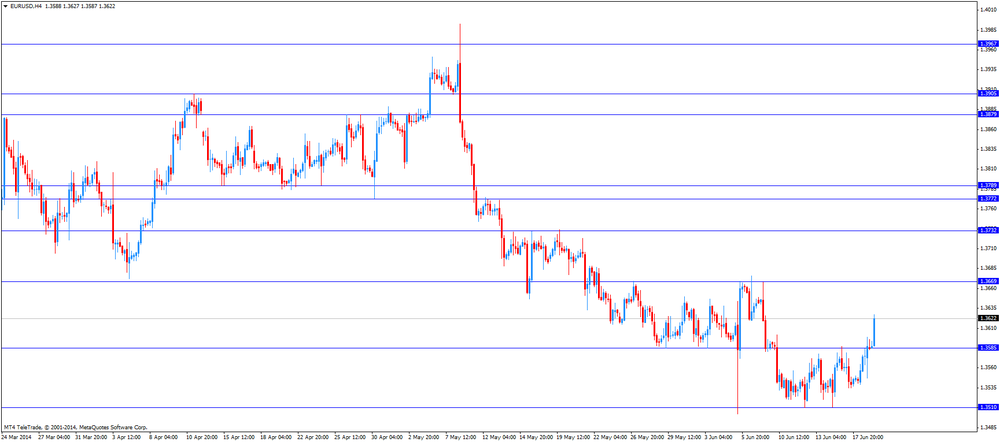

EUR/USD $1,3606 +0,14%

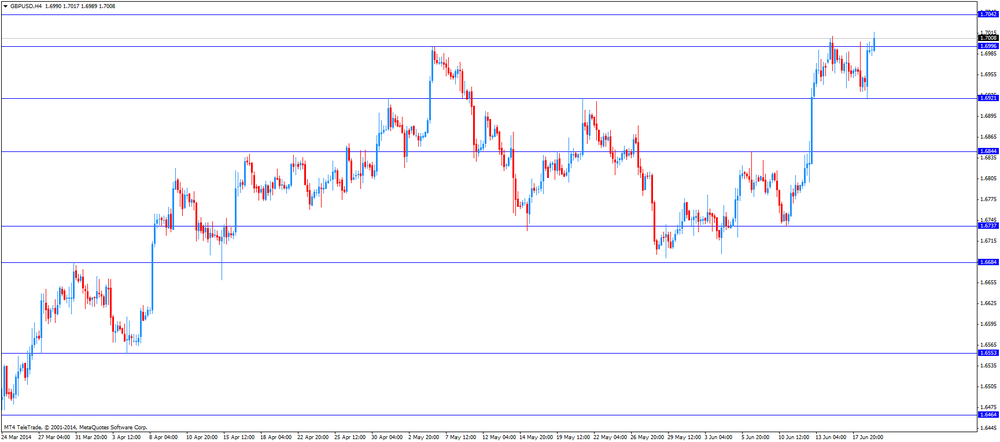

GBP/USD $1,7037 +0,28%

USD/CHF Chf0,8940 -0,23%

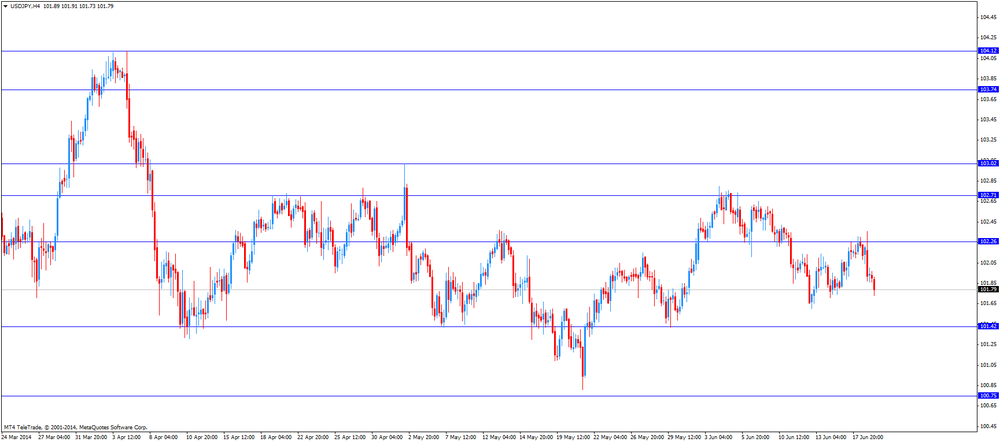

USD/JPY Y101,93 +0,01%

EUR/JPY Y138,69 +0,14%

GBP/JPY Y173,66 +0,29%

AUD/USD $0,9395 -0,01%

NZD/USD $0,8711 -0,18%

USD/CAD C$1,0818 -0,18%

06:00 Germany Producer Price Index (MoM) May -0.1% +0.2%

06:00 Germany Producer Price Index (YoY) May -0.9% -0.7%

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 Eurozone Current account, adjusted, bln April 18.8 19.4

08:30 United Kingdom PSNB, bln May 9.6 11.8

09:00 Eurozone ECOFIN Meetings

12:30 Canada Retail Sales, m/m April -0.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m April +0.1% +0.4%

12:30 Canada Consumer Price Index m/m May +0.3% +0.2%

12:30 Canada Consumer price index, y/y May +2.0% +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m May +0.2% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y May +1.4% +1.5%

14:00 Eurozone Consumer Confidence June -7 -6

The U.S. dollar traded slightly higher against the most major currencies after the better-than-expected U.S. economic data. The number of initial jobless claims in the week ending June 14 decreased by 6,000 to 312,000 from 318,000 in the previous week. The previous week's figure was revised down from 317,000. Analysts had expected a decline by 4,000 to 314,000.

The Philadelphia Fed Manufacturing index rose to 17.8 in June from 15.4 in May. Analysts had expected a fall to 14.3.

The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded higher against the U.S. dollar after the U.K. economic data. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance increased to 11% in June from 0% in May, exceeding expectations for a climb to 3%.

The Swiss franc traded mixed against the U.S. dollar. The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts. The SNB said the central bank will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

The New Zealand dollar traded mixed against the U.S dollar. New Zealand's gross domestic product increased 1.0% in the first quarter, missing expectations for a 1.2% gain, after a 1.0% rise in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised up from a 0.9% increase.

On a yearly basis, gross domestic product in New Zealand rose 3.8% in the first quarter, exceeding expectations for a 3.7% increase, after a 3.1% gain in the fourth quarter of 2013.

The Australian dollar traded lower against the U.S. dollar. Japanese life insurance firms and retail funds and Fed's interest rate decision supported the demand for the Australian dollar due to higher yields.

The Reserve Bank of Australia (RBA) released its June bulletin. The RBA said foreign property demand may have pushed up houses and the supply of dwellings in Australia. The RBA also said the growth in infrastructure investment in China could remain strong for some time, which will have a positive impact on Australian commodity exporters.

The RBA pointed out that the lower retail sales from May to mid June was driven by "the "significant downturn in consumer confidence".

The Japanese yen traded slightly lower against the U.S. dollar. Japan's all industry activity index declined 4.3% in April, after a 1.5% increase in March. Analysts had expected the index to fall 3.7%.

EUR/USD $1.3400, $1.3450, $1.3500, $1.3550, $1.3564/65, $1.3600, $1.3650

USD/JPY Y101.20/25, Y101.40, Y101.50, Y102.00, Y102.15, Y102.25, Y102.50, Y103.00

AUD/USD $0.9250, $0.9285, $0.9340/50, $0.9360

EUR/GBP stg0.7960, stg0.8010

USD/CHF Chf0.9000

NZD/USD $0.8625

Economic calendar (GMT0):

01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7% -4,3%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2% +3.9%

09:00 Eurozone Eurogroup Meetings

10:00 United Kingdom CBI industrial order books balance June 0 3 11

The U.S. dollar traded lower against the most major currencies. The Fed's interest decision on Wednesday still weighed on the U.S. currency. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

Investors had awaited Fed Chair Janet Yellen gave some hints when the Fed will start to rise its interest rate, but it didn't happen. Investors were disappointed. The U.S. currency suffered due to this disappointment by investors.

The number of initial jobless claims and the Philadelphia Fed Manufacturing index will be released later in the day. The number of initial jobless claims should decline by 1,000 to 316,000. The Philadelphia Fed Manufacturing index should decline to 14.3 in June from 15.4 in May.

The euro traded higher against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound climbed against the U.S. dollar after the U.K. economic data. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance increased to 11% in June from 0% in May, exceeding expectations for a climb to 3%.

The Swiss franc increased against the U.S. dollar. The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts. The SNB said the central bank will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

EUR/USD: the currency pair increased to $1.3643

GBP/USD: the currency pair rose to $1.7033

USD/JPY: the currency pair fell to Y101.73

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

EUR/USD

Offers $1.3695/00, $1.3670/80, $1.3650

Bids $1.3600, $1.3550, $1.3535, $1.3515/10, $1.3500

GBP/USD

Offers $1.7110/20, $1.7080/85, $1.7040/50

Bids $1.7000, $1.6950, $1.6910/00, $1.6885/80

AUD/USD

Offers $0.9550, $0.9500, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.20, Y138.00

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8120, stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

The Swiss National Bank (SNB) released its interest decision on Thursday:

- The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts;

- The SNB said the he Swiss franc is still high;

- The SNB will continue to enforce the minimum exchange rate with the utmost determination;

- The SNB could purchase foreign currency in unlimited quantities and could add further measures if required.

The Swiss National Bank president Thomas Jordan said on Thursday:

- The Swiss economy is facing an "extremely challenging" climate with weak growth in the euro area and a hesitant global recovery;

- The SNB expect the moderate recovery in Switzerland;

- The SNB will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

The Office for National Statistics (ONS) released the retail sales. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The ONS pointed out the decline would have been even bigger had it not been for strong sales in sports stores driven by football shirt sales ahead of the World Cup.

A drop in prices in stores could not help to increase the retail sales volume.

The Federal Reserve released its interest decision in Wednesday:

- The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent;

- The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends;

- The Fed lowered its forecast for economic growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously;

- The Fed expect its interest rate to reach 1.2% by the end of 2015 and 2.5% by the end of 2016.

Fed Chair Janet Yellen said at the press conference on Wednesday:

- The U.S. economy will continue to expand at a moderate pace;

- The U.S. economy is continuing to make progress towards the Fed's targets of full employment and 2% inflation.

EUR/USD $1.3400, $1.3450, $1.3500, $1.3550, $1.3600

AUD/USD $0.9250, $0.9285, $0.9340/50, $0.9360

Economic

calendar (GMT0):

01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7% -4,3%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2% +3.9%

09:00 Eurozone Eurogroup Meetings

The U.S.

dollar dropped against the most major currencies after the Fed’s interest

decision on Wednesday. The Fed cut its monthly asset purchases by another $10

billion to $35 billion and kept the Federal Funds Target Rate between zero and

0.25 percent. Market participants had expected this decision. The Fed pointed

out that interest rates will remain unchanged for a considerable time after the

Fed’s asset purchase program ends.

Investors

had awaited Fed Chair Janet Yellen gave some hints when the Fed will start to

rise its interest rate, but it didn’t happen. Investors were disappointed. The

U.S. currency suffered due to this disappointment by investors.

The Fed lowered

its forecast for economic growth this year to a range of 2.1% to 2.3% from 2.8

to 3.0% previously.

The Fed expect

its interest rate to reach 1.2% by the end of 2015 and 2.5% by the end of 2016.

The New

Zealand dollar traded lower against the U.S dollar due to the slower than

expected economic growth in New Zealand. New Zealand’s gross domestic product

increased 1.0% in the first quarter, missing expectations for a 1.2% gain,

after a 1.0% rise in the fourth quarter of 2013. The fourth quarter of 2013

figure was revised up from a 0.9% increase.

On a yearly

basis, gross domestic product in New Zealand rose 3.8% in the first quarter,

exceeding expectations for a 3.7% increase, after a 3.1% gain in the fourth

quarter of 2013.

The

Australian dollar climbed against the U.S. dollar after the Fed’s interest

decision. Japanese life insurance firms and retail funds also supported the

demand for the Australian dollar due to higher yields.

The Reserve

Bank of Australia (RBA) released its June bulletin. The RBA said foreign property

demand may have pushed up houses and the supply of dwellings in Australia. The

RBA also said the growth in infrastructure investment in China could remain

strong for some time, which will have a positive impact on Australian commodity

exporters.

The RBA

pointed out that the lower retail sales from May to mid June was driven by “the

“significant downturn in consumer confidence”.

The

Japanese yen climbed against the U.S. dollar after the Fed’s interest decision.

Japan’s all industry activity index declined 4.3% in April, after a 1.5% increase

in March. Analysts had expected the index to fall 3.7%.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

10:00 United Kingdom CBI industrial order books balance June 0 3

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

EUR / USD

Resistance levels (open interest**, contracts)

$1.3677 (2191)

$1.3645 (3496)

$1.3620 (1819)

Price at time of writing this review: $ 1.3591

Support levels (open interest**, contracts):

$1.3559 (1774)

$1.3536 (1008)

$1.3493 (5033)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 29935 contracts, with the maximum number of contracts with strike price $1,3700 (3728);

- Overall open interest on the PUT options with the expiration date July, 3 is 42215 contracts, with the maximum number of contracts with strike price $1,3550 (5033);

- The ratio of PUT/CALL was 1.41 versus 1.43 from the previous trading day according to data from June, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1762)

$1.7102 (1852)

$1.7005 (2184)

Price at time of writing this review: $1.6991

Support levels (open interest**, contracts):

$1.6895 (1232)

$1.6798 (1707)

$1.6699 (2081)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 18623 contracts, with the maximum number of contracts with strike price $1,7000 (2184);

- Overall open interest on the PUT options with the expiration date July, 3 is 22336 contracts, with the maximum number of contracts with strike price $1,6750 (2293);

- The ratio of PUT/CALL was 1.20 versus 1.22 from the previous trading day according to data from June, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.