- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks climbed in the final hour of trading, trimming a third week of losses for the Stoxx Europe 600 Index, as a rebound in commodity companies offset renewed concern about the euro area.

Spain’s 10-year bonds dropped for a third day, pushing the yield on the country’s benchmark debt seven basis points higher to 5.76 percent, after an International Monetary Fund spokesman said the nation is facing “severe” challenges.

Italy’s 10-year yield rose seven basis points to 5.44 percent today, with the spread over bunds widening 12 basis points to 370 basis points. France’s 10-year bonds also slid as borrowing costs increased when the nation sold 8.4 billion euros of debt.

National benchmark indexes fell in nine of the 15 western- European markets trading today. France’s CAC 40 Index (CAC) added 0.2 percent and the U.K.’s FTSE 100 Index gained 0.4 percent. Germany’s DAX Index lost 0.1 percent.

Markets in Denmark, Norway and Iceland were closed for a holiday today. All Western-European markets are closed tomorrow for the Good Friday holiday.

Copper climbed in New York for the first time in three days as reports showing an improving labor market and rising consumer confidence added to signs of recovery in the U.S., the world’s second-biggest consumer of the metal.

Glencore, the largest publicly traded commodity supplier, rallied 5.8 percent to 411.8 pence, leading a rebound in commodity stocks. Xstrata Plc jumped 3.5 percent to 1,112 pence, BHP Billiton Ltd. climbed 1.6 percent to 1,907 pence and Vedanta Resources Plc gained 2.1 percent to 1,235 pence.

Banks still retreated. UniCredit, Italy’s biggest lender, slid 3.1 percent to 3.31 euros. Banca Popolare di Milano Scarl lost 4 percent to 35.2 euro cents, Commerzbank AG declined 1.9 percent to 1.9 percent to 1.75 euros and BNP Paribas SA dropped 1 percent to 32.88 euros.

Merck KGaA dropped 1.8 percent to 83.40 euros. The German drugmaker was cut to neutral from outperform at Exane BNP Paribas.

The euro fell to a three-week low against the dollar as Spanish and Italian bonds slumped and borrowing costs increased at a French auction, adding to concern the region’s debt crisis is spreading. The 17-nation currency dropped to a three-week low versus the yen as Spain’s 10-year bond yields increased to the biggest spread compared with German bunds since November amid investor concern that Spanish Prime Minister Mariano Rajoy may require international aid. Spain’s 10-year yields increased to 400 basis points, or 4.0 percentage points, more than similar-maturity bunds after demand declined at a Spanish debt sale yesterday. Italy’s 10- year yield increased 12 basis points to 5.48 percent. France auctioned 4.32 billion euros of 10-year debt today at an average yield of 2.98 percent, up from 2.91 percent at the previous offering on March 1. Borrowing costs for five-year and 15-year debt also increased.

The Swiss National Bank said it won’t allow the franc to go beyond 1.20 per euro after the currency rose past that level for the first time since the ceiling was put in place in September. The Swiss central bank set a limit of 1.20 francs per euro on Sept. 6 to protect exports after investors turned to the nation’s currency as a haven from Europe’s sovereign-debt crisis. The SNB won’t allow the franc to rise above the ceiling and is ready to buy foreign currencies in unlimited quantities, spokesman Walter Meier said by telephone today.

The pound strengthened for a second day versus the euro as the Bank of England left its bond-purchase target unchanged at 325 billion pounds ($515 billion) and its policy rate at 0.5 percent, as anticipated by surveys of economists.

U.S. stocks were little changed as renewed concern about Europe’s debt crisis offset a drop in jobless claims to a four-year low.

Equities trimmed early losses after Labor Department data showed unemployment claims in the U.S. fell 6,000 to 357,000 in the week ended March 31, the fewest since April 2008. The median forecast of 43 economists in a Bloomberg News survey estimated a decrease to 355,000. The number of people on unemployment benefit rolls also dropped, while those getting extended payments increased.

Stocks fell earlier as Spanish bonds declined for a third day today, pushing the spread between yields on 10-year Spanish and German debt to more than 400 basis points for the first time since Dec. 12.

Dow 13,060.22 -14.53 -0.11%, Nasdaq 3,081.00 +12.91 +0.42%, S&P 500 1,398.45 -0.51 -0.04%

The Morgan Stanley Cyclical Index lost 0.3 percent. Alcoa (АА) declined 1 percent to $9.71, while General Electric (GE) erased 0.9 percent to $19.56.

Constellation Brands Inc. plunged 13 percent, the most in the S&P 500, to $21.37. The world’s largest wine company said comparable earnings per share may be $1.93 to $2.03. Analysts projected profit of $2.23, the average of 12 estimates in a Bloomberg survey.

Polycom Inc., a maker of videoconferencing equipment, slumped 18 percent to $15 after saying preliminary first-quarter earnings and revenue fell short of analysts’ expectations.

Bed Bath & Beyond rose 9.2 percent to $72.29 for the biggest increase in the S&P 500. The retail-chain operator posted a fourth-quarter profit of $1.48 a share, beating the average analyst estimate of $1.32.

PPG Industries Inc. climbed 2.8 percent to $96.52. The world’s second-biggest paint maker reported first-quarter profit that exceeded analysts’ estimates on increased demand from the aerospace and automotive markets.

Oil gained for the first time in three days as claims for U.S. unemployment benefits dropped to a four-year low and equities rose, raising hopes that demand in the world’s biggest user of oil will increase.

Prices increased after the Labor Department said jobless claims fell 6,000 to 357,000 in the week ended March 31 and extended the gain as equities erased losses. Oil declined earlier on renewed concern that the euro area has yet to contain its debt crisis.

The four-week moving average of jobless claims, a less volatile measure than the weekly figures, decreased to 361,750 last week from 366,000, according to the Labor Department.

U.S. consumer confidence climbed last week to the highest level in four years as brighter job prospects and an advancing stock market bolstered Americans’ view of the economy. The Standard & Poor’s 500 Index erased a loss of 0.4 percent.

Oil fell earlier after Spain Prime Minister Mariano Rajoy may require international aid. Spain, the euro region’s fourth- largest economy, is in “extreme difficulty,” Rajoy said yesterday, raising the likelihood of a bailout for the second time this week.

Crude for May delivery gained to $103.15 a barrel on the New York Mercantile Exchange. Oil tumbled yesterday after the Energy Department said U.S. stockpiles surged the most since 2008. Trading is closed tomorrow for Good Friday.

Brent oil for May settlement rose 68 cents, or 0.6 percent, to $123.02 a barrel on the London-based ICE Futures Europe exchange.

The price of gold rising on Thursday as part of correction after a significant decline on Wednesday amid growing investor confidence in the fact that the U.S. Federal Reserve will not take new measures to stimulate the national economy.

At the close of trading on Wednesday, the spot price of gold fell by 3.5% - to a minimum over the past three months, the mark of 1614.10 dollars per troy ounce.

The strong decline in demand for gold, traditionally considered a reliable asset, followed by the publication of minutes of meetings of the Federal Open Market Committee, the U.S. Federal Reserve, indicating that the regulator does not intend to take new stimulus measures as it believes that the macroeconomic indicators are improving in recent months.

April futures price of gold on COMEX today rose to $ 1633.2 an ounce.

Resistance 3:1414 (Apr 3 high)

Resistance 2:1403 (МА (200) for Н1)

Resistance 1:1398 (session high)

Current price: 1392,00

Support 1:1384 (session low)

Support 2:1380 (Apr 23 low, МА (200) for Н4)

Support 3:1360 (МА (55) for D1)

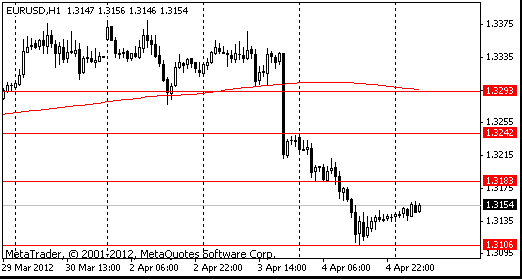

EUR/USD $1.3100, $1.3150, $1.3200

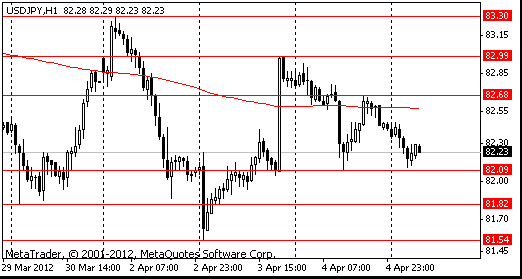

USD/JPY Y81.70, Y82.00, Y82.30, Y82.70, Y83.00

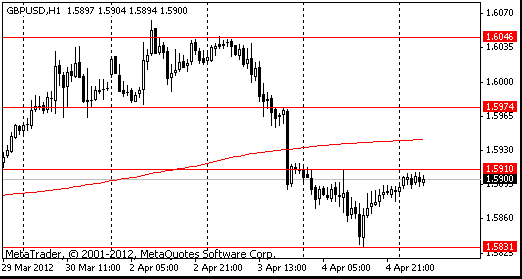

GBP/USD $1.5850, $1.5900, $1.6015

AUD/USD $1.0250, $1.0225

EUR/GBP stg0.8300

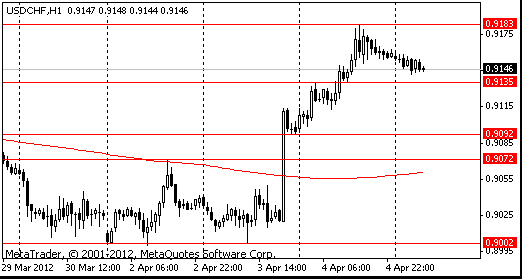

USD/CHF Chf0.9225, Chf0.9300

AUD/JPY Y85.00

U.S. stock futures fell as a decline in Spanish bonds boosted concern the euro area has yet to contain its debt crisis.

Global Stocks:

Nikkei 9,767.61 -52.38 -0.53%

Hang Seng 20,593 -197.98 -0.95%

Shanghai Composite 2,302.24 +39.45 +1.74%

FTSE 5,682.51 -21.26 -0.37%

CAC 3,296.92 -16.55 -0.50%

DAX 6,720.55 -63.51 -0.94%

Crude oil $101.48 (0.0%).

Gold $1624.80 (+0,7%).

Data:

07:00 Switzerland Foreign Currency Reserves March 224.9 237.5

07:15 Switzerland Consumer Price Index (MoM) March +0.3% +0.4% +0.6%

07:15 Switzerland Consumer Price Index (YoY) March -0.9% -1.1% -1.1%

08:30 United Kingdom Industrial Production (MoM) February -0.4% +0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) February -3.8% -2.1% -2.3%

08:30 United Kingdom Manufacturing Production (MoM) February +0.1% +0.2% -1.0%

08:30 United Kingdom Manufacturing Production (YoY) February +0.3% +0.1% -1.4%

10:00 Germany Industrial Production s.a. (MoM) February +1.6% -0.1% -1.3%

10:00 Germany Industrial Production (YoY) February +1.8% +0.3% -1.0%

11:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50% 0.50%

The euro weakened for a fourth day versus the dollar as Spanish and Italian bonds slumped and borrowing costs increased at a French auction, adding to concern the region’s debt crisis is spreading.

Spain’s 10-year yield rose as much as 15 basis points to 5.84 percent, the highest since Dec. 13 after demand declined at a Spanish debt sale yesterday. Italy’s 10-year yield increased 12 basis points to 5.48 percent.

France auctioned 4.32 billion euros of 10-year debt today at an average yield of 2.98 percent, up from 2.91 percent at the previous offering on March 1. Borrowing costs for five-year and 15-year debt also increased.

The Swiss franc rose beyond the central bank’s limit of 1.20 per euro for the first time since the ceiling was put in place in September as investors sought the safest assets.

The pound strengthened for a second day versus the euro as the Bank of England left its bond-purchase target unchanged at 325 billion pounds and its policy rate at 0.5 percent.

EUR/USD: the pair fell in $1,3040 area.

GBP/USD: the pair decreased in $1,5830 area, fell below МА (200) for D1 ($1,5845).

USD/JPY: the pair showed low below Y82,00, but returned above later.

The Canada Ivey Purchasing Managers Index is due at 1400GMT.

EUR/USD

Offers $1.3220, $1.3210, $1.3180/200, $1.3120/25, $1.3095/110

Bids $1.3050, $1.3035/30, $1.3020, $1.3005/00, $1.2980/70

GBP/USD

Offers $1.6000/15, $1.5980/85, $1.5950/60, $1.5910/20, $1.5880/85

Bids $1.5805/00, $1.5780/70, $1.5750/40

AUD/USD

Offers $1.0425/30, $1.0380/00, $1.0350, $1.0325/30, $1.0315/20

Bids $1.0250, $1.0230, $1.0210/00, $1.0150

EUR/JPY

Offers Y108.85/90, Y108.60/65, Y108.10/20, Y107.60/65

Bids Y106.70/60, Y106.50, Y106.00, Y105.65/60

Resistance 3: Y83.00 (Apr 3 high)

Resistance 2: Y82.55 (МА (200) for Н1)

Resistance 1: Y82.10 (earlier support, Apr 4 low)

Current price: Y81.85

Support 1: Y81.55 (Apr 3 low)

Support 2: Y81.10 (38,2 % FIBO Y76,00-Y84,20)

Support 3: Y80.60 (low of March)

Resistance 3: Chf0.9340 (high of March)

Resistance 2: Chf0.9250 (Mar 16 high)

Resistance 1: Chf0.9210 (session high)

Current price: Chf0.9189

Support 1: Chf0.9140 (earlier resistance, session low, Mar 26 high)

Support 2: Chf0.9090 (earlier resistance, Mar 29 high )

Support 3: Chf0.9050 (area МА (200) for Н1 and resistance line from Mar 26)

Resistance 3 : $1.5940 (МА (200) for Н1)

Resistance 2 : $1.5910 (area of session high and Apr 4 high)

Resistance 1 : $1.5840 (earlier support, area of Mar 28 and Apr 4 lows)

Current price: $1.5821

Support 1 : $1.5800 (Mar 26 low)

Support 2 : $1.5780/70 (support line from Jan 13, Mar 22 low)

Support 3 : $1.5700 (psychological level)

Resistance 3 : $1.3250 (Apr 4 high, Mar 29 low)

Resistance 2 : $1.3170 (session high)

Resistance 1 : $1.3100 (Apr 4 low)

Current price: $1.3069

Support 1 : $1.3050 (Mar 16 low)

Support 2 : $1.3000 (low of March)

Support 3 : $1.2975 (low of February)

EUR/USD $1.3100, $1.3150, $1.3200

USD/JPY Y81.70, Y82.00, Y82.30, Y82.70, Y83.00

GBP/USD $1.5850, $1.5900, $1.6015

AUD/USD $1.0250, $1.0225

EUR/GBP stg0.8300

USD/CHF Chf0.9225, Chf0.9300

AUD/JPY Y85.00

Most Asian shares fell, with the regional benchmark index headed for its biggest two-day decline in a month, after Spain struggled to sell bonds, renewing concern Europe won’t be able to contain its debt crisis.

Nikkei 225 9,767.61 -52.38 -0.53%

Hang Seng 20,593 -197.98 -0.95%

S&P/ASX 200 4,319.85 -14.02 -0.32%

Shanghai Composite 2,302.24 +39.45 +1.74%

Hutchison Whampoa Ltd. and other companies that do business in Europe slid after demand fell at a Spanish government bond auction, sparking concern about the region’s sovereign-debt crisis.

Industrial & Commercial Bank of China Ltd. dropped 2 percent after Premier Wen Jiabao said China needs to break the “monopoly” of a few big lenders.

Soho China Ltd. rose 2.5 percent, leading gains among mainland developers after Credit Agricole SA said China is “almost guaranteed” to ease monetary policy further this month.

The euro fell toward a three-week low versus the yen before a report today that may show German industrial production declined, backing the case for the European Central Bank to avoid raising interest rates. Germany’s industrial production probably decreased 0.5 percent in February from the previous month, when it gained 1.6 percent, according to the median estimate of economists in a Bloomberg News survey before the Economy Ministry releases the figure.

The 17-nation currency was near a three-week low against the dollar before France auctions bonds due from 2017 to 2041 today amid concern Europe’s prolonged debt crisis will weigh on the economy. Investor demand for the debt of Spain, the euro area’s fourth-largest economy, slumped yesterday, with the country selling 2.59 billion euros ($3.4 billion) of bonds, less than its maximum target of 3.5 billion euros. Prime Minister Mariano Rajoy said Spain’s situation is one of “extreme difficulty” and signaled that his budget cuts are less painful than a bailout would be.

The Australian and New Zealand dollars strengthened against most of their 16 major counterparts before U.S. data tomorrow that may point to an improvement in the labor market. Employment in the U.S. probably rose by 205,000 in March, according to the median estimate of economists before tomorrow’s government report. That would be the fourth straight month with jobs growth above 200,000.

Demand for the South Pacific currencies was also bolstered as Asian stocks pared declines. The so-called Aussie was within 0.2 percent of a six-month low versus the New Zealand dollar as swaps traders increased bets the Reserve Bank of Australia will cut interest rates next month. Financial markets in both countries will be closed from tomorrow for holidays and will reopen on April 10.

EUR/USD: during the Asian session the pair traded in a range $1.3135-$1.3160.

GBP/USD: during the Asian session the pair traded in a range $1.5890-$1.5910.

USD/JPY: during the Asian session the pair fell to a yesterday's low.

Events for Thursday start at 0700GMT when the Swiss National Bank publishes the 2011 Annual Report. Swiss CPI is also due Thursday. Core-European data sees just the 1000GMT release of German industrial output data. It is a busy day for the UK, starting at 0830GMT with the data highlight of the week, February industrial production. The data is followed at 1000GMT by UK New car and CV registrations. The National Institute (NIESR) will release its estimate of Q1 GDP later in the session, at 1400GMT. The MPC will announce its April policy decision at 1100GMT. The expectation is that there will be no change either to Bank Rate or to the current 325 billion stock of QE in light of the data flow, which has offered some patchy backing to the idea of a moderate underlying recovery. The Canada Ivey Purchasing Managers Index is due at 1400GMT. US data starts at 1130GMT with Challenger Layoffs data, which is followed at 1230GMT by the weekly initial jobless claims, which are expected to remain relatively unchanged at 360,000 in the March 31 week after hitting a four-year low in the previous week. At 1310GMT, St. Louis Federal Reserve Bank President James Bullard speaks to the 13th Annual InvestMidwest Venture Capital Forum.

Yesterday the euro lost the most in almost a month against the dollar after demand declined at a Spanish bond auction, adding to concern the region is struggling to overcome its sovereign-debt crisis. Spain sold 2.59 billion euros of bonds today, less than its maximum target of 3.5 billion euros, the central bank said. Demand for notes maturing in 2015 was 2.41 times the amount allotted, down from 4.96 at the previous sale of the maturity in March. It also sold securities due in 2016 and 2020. The 17-nation currency weakened after the European Central Bank kept its benchmark rate at a record low and President Mario Draghi said the economic outlook remained subject to “downside risks.”

Sterling rallied as U.K. services growth accelerated last month and house prices increased. The pound rose against most of its major peers before the Bank of England meets. Sterling gained 0.6 percent to 82.68 pence per euro after a gauge of U.K. services activity based on a survey of purchasing managers increased to 55.3 from 53.8 in February. A separate report showed house prices climbed 2.2 percent in March from the previous month, Lloyds Banking Group Plc’s Halifax division said.

The yen and dollar strengthened versus all their most- traded counterparts amid demand for the relative safety of the nations’ debt.

EUR/USD: yesterday the pair fell to a figure to $1.3100.

GBP/USD: yesterday the pair fell, however restored the lost positions later.

USD/JPY: yesterday the pair fell having come nearer to Y82.00.

Events for Thursday start at 0700GMT when the Swiss National Bank publishes the 2011 Annual Report. Swiss CPI is also due Thursday. Core-European data sees just the 1000GMT release of German industrial output data. It is a busy day for the UK, starting at 0830GMT with the data highlight of the week, February industrial production. The data is followed at 1000GMT by UK New car and CV registrations. The National Institute (NIESR) will release its estimate of Q1 GDP later in the session, at 1400GMT. The MPC will announce its April policy decision at 1100GMT. The expectation is that there will be no change either to Bank Rate or to the current 325 billion stock of QE in light of the data flow, which has offered some patchy backing to the idea of a moderate underlying recovery. The Canada Ivey Purchasing Managers Index is due at 1400GMT. US data starts at 1130GMT with Challenger Layoffs data, which is followed at 1230GMT by the weekly initial jobless claims, which are expected to remain relatively unchanged at 360,000 in the March 31 week after hitting a four-year low in the previous week. At 1310GMT, St. Louis Federal Reserve Bank President James Bullard speaks to the 13th Annual InvestMidwest Venture Capital Forum.

Asian stocks slid, with the benchmark index snapping a three-day winning streak amid market holidays across the region, after the Federal Reserve damped expectations for more monetary stimulus, sending commodity prices down and weighing on shares of resource companies. Shares extended declines after Japan’s Nikkei 225 Stock Average slipped below the key level of 10,000 for the first time in two weeks, triggering a deeper selloff.

Nikkei 225 9,819.99 -230.40 -2.29%

Hang Seng 20,790.98 +268.72 +1.31%

S&P/ASX 200 4,333.86 -3.17 -0.07%

Shanghai Composite Closed

BHP Billiton Ltd., Australia’s biggest oil producer, sank 1.5 percent in Sydney after crude prices fell.

Fast Retailing Co., Japan’s top clothier, plunged 5 percent after sales at its Uniqlo stores disappointed investors.

SK Telecom Co. slid 3.5 percent in Seoul after Posco sold shares of the mobile carrier at a discount.

European stocks fell for a second day after Spain sold fewer bonds than its maximum target and the Federal Reserve damped expectations of more monetary stimulus for the U.S.

Spain sold 2.6 billion euros ($3.4 billion) of bonds, near the minimum target, and borrowing costs rose in its first auction since the country said public debt will surge to a record this year. The Treasury had set a range of 2.5 billion euros to 3.5 billion euros for the sale.

The European Central Bank left its benchmark interest rate unchanged at a record low of 1 percent. The euro-area’s economic outlook remains subject to “downside risks,” President Mario Draghi said at a press conference in Frankfurt.

Euro-area retail sales declined 0.1 percent from January, when they rose a revised 1.1 percent, the European Union’s statistics office in Luxembourg said today. Euro-area services and manufacturing output contracted for a second month in March. A composite index based on a survey of purchasing managers in both industries dropped to 49.1 from 49.3 in February, London-based Markit Economics said today. That’s above an initial estimate of 48.7 on March 22. A reading below 50 indicates contraction. In Germany, factory orders rose 0.3 percent in February, the Economy Ministry in Berlin said today.

National benchmark indexes fell in all of the 18 western European markets, led by Sweden’s OMX 30 Index, which tumbled 3.6 percent. France’s CAC 40 Index dropped 2.8 percent, the U.K.’s FTSE 100 Index slipped 2.5 percent and Germany’s DAX Index retreated 3 percent.

Volvo lost 4.8 percent to 93.65 kronor after ACT Research said preliminary Class 8 truck orders in North America for March were 20,000 units, the second consecutive month that orders came in “below expectations.”

U.S. sales of cars and light trucks rose to a 14.4 million seasonally adjusted annual rate, falling short of the 14.5 million median estimate of analysts.

Peugeot SA plunged 5.6 percent to 10.80 euros, Renault SA slipped 4.5 percent to 37.27 euros, and Porsche SE retreated 2.3 percent to 43.50 euros.

BTG gained 2.6 percent to 347.10 pence after the company said sales for the year ended March 31 would reach as much as 195 million pounds ($309 million), more than previously forecast, because of higher-than-expected royalties from two drugs.

Ferrovial SA, Spain’s largest builder by market value, added 2.2 percent to 8.41 euros after Bank of America reiterated its buy recommendation on the shares and said Spain’s new tax rules won’t hurt the company.

U.S. stocks fell, with the Standard & Poor’s 500 Index posting this year’s second-biggest decline, as SanDisk Corp.’s lower forecast dragged down technology shares and the Federal Reserve signaled it may refrain from more monetary stimulus.

Stocks extended losses today after a report showed service industries in the U.S. expanded less than forecast in March as orders grew at the slowest pace in three months. The Institute for Supply Management’s non-manufacturing index dropped to 56 from a one-year high of 57.3 in February. Readings above 50 signal expansion, and economists projected 56.8 for the gauge, according to the median estimate.

Employment increased by 209,000 for the month after a revised 230,000 gain in February, figures from ADP Employer Services showed today.

Dow 13,074.75 -124.80 -0.95%, Nasdaq 3,068.09 -45.48 -1.46%, S&P 500 1,398.96 -14.42 -1.02%

Alcoa Inc. (АА) lost 2.5 percent, pacing declines among material companies, as investors sold shares of companies most- tied to the economy after a report on U.S. service industries missed estimates.

SanDisk sank 11 percent, the most in the S&P 500, to $44.51 after predicting revenue in the quarter that ended April 1 of about $1.2 billion. That compared with an earlier forecast for sales of $1.3 billion to $1.35 billion. Gross margin, a measure of profitability, will be less than the company’s previous prediction of 39 percent to 42 percent, SanDisk said.

Bank of America (ВАС) slumped 3.1 percent to $9.20 while JPMorgan (JPM) declined 2.2 percent to $44.41.

General Electric Co. (GE), the maker of jet engines, power generation equipment, health-care imaging equipment and locomotives, fell 1.1 percent to $19.74. Moody’s Investors Service cut its credit rating by two steps, citing “heightened risk” from the company’s finance unit.

Resistance 3: Y83.40 (Mar 27 high)

Resistance 2: Y83.00 (Apr 3 high)

Resistance 1: Y82.70 (high of the American session on Apr 4)

The current price: Y82.23

Support 1: Y82.10 (Apr 4 low)

Support 2: Y81.85 (Mar 29-30 low)

Support 3: Y81.55 (Apr 3 low)

Resistance 3: Chf0.9335 (Mar 15 high)

Resistance 2: Chf0.9255 (Mar 16 high)

Resistance 1: Chf0.9185 (Apr 4 high)

The current price: Chf0.9146

Support 1: Chf0.9135 (high of the Asian session on Apr 4)

Support 2: Chf0.9090 (Apr 4 low)

Support 3: Chf0.9070 (Apr 2 high)

Resistance 3 : $1.6045 (Apr 3 high)

Resistance 2 : $1.5975 (high of the American session on Apr 3)

Resistance 1 : $1.5910 (Apr 4 high)

The current price: $1.5900

Support 1 : $1.5830 (Apr 4 low)

Support 2 : $1.5800 (Mar 26 low)

Support 3 : $1.5770 (Mar 22 low)

Resistance 3 : $1.3300 (MA(233) H1)

Resistance 2 : $1.3240 (Apr 4 high)

Resistance 1 : $1.3185 (low of the Asian session on Apr 4)

The current price: $1.3154

Support 1 : $1.3105 (session low)

Support 2 : $1.3045 (Mar 16 low)

Support 3 : $1.3000 (psychological mark)

Change % Change Last

Oil $101.96 +0.49 +0.48%

Gold $1,619.90 +5.80 +0.36%

Change % Change Last

Nikkei 225 9,819.99 -230.40 -2.29%

Hang Seng 20,790.98 +268.72 +1.31%

S&P/ASX 200 4,333.86 -3.17 -0.07%

Shanghai Composite Closed

FTSE 100 5,703.77 -134.57 -2.30%

CAC 40 3,313.47 -93.31 -2.74%

DAX 6,784.06 -198.22 -2.84%

Dow 13,074.75 -124.80 -0.95%

Nasdaq 3,068.09 -45.48 -1.46%

S&P 500 1,398.96 -14.42 -1.02%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3139 -0,72%

GBP/USD $1,5889 -0,14%

USD/CHF Chf0,9159 +0,70%

USD/JPY Y82,42 -0,47%

EUR/JPY Y108,30 -1,19%

GBP/JPY Y130,94 -0,61%

AUD/USD $1,0262 -0,64%

NZD/USD $0,8143 -0,63%

USD/CAD C$0,9962 +0,54%

07:00 Switzerland Foreign Currency Reserves March 224.9

07:15 Switzerland Consumer Price Index (MoM) March +0.3% +0.4%

07:15 Switzerland Consumer Price Index (YoY) March -0.9% -1.1%

08:30 United Kingdom Industrial Production (MoM) February -0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) February -3.8% -2.1%

08:30 United Kingdom Manufacturing Production (MoM) February +0.1% +0.2%

08:30 United Kingdom Manufacturing Production (YoY) February +0.3% +0.1%

10:00 Germany Industrial Production s.a. (MoM) February +1.6% -0.1%

10:00 Germany Industrial Production (YoY) February +1.8% +0.3%

11:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement 0

12:30 Canada Building Permits (MoM) February -12.3% +2.2%

12:30 Canada Employment March -2.8 +12.6

12:30 Canada Unemployment rate March 7.4% 7.5%

12:30 U.S. Initial Jobless Claims 31.03.2012 359 355

13:10 U.S. FOMC Member James Bullard Speaks 0

14:00 Canada Ivey Purchasing Managers Index March 66.5 64.8

14:00 United Kingdom NIESR GDP Estimate March +0.1%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.