- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

U.S. authorities are afraid to make decisions before the election

Inflation is really a matter of concern

The influence of the Fed's actions on the labor market is only slightly

The March employment report does not change forecast

European stocks tumbled to a two- month low amid mounting concern about the region’s debt crisis and as a U.S. report showed employers in the world’s largest economy added fewer jobs in March than forecast.

Stocks dropped around the world after a report showed that American employers added 120,000 jobs in March, the fewest in five months and less than the median economist forecast of 205,000. The amount had exceeded 200,000 for three straight months.

Spain’s bond yields rose today, after surging the most since January last week, amid concern that the country may join Greece, Ireland and Portugal in requesting a bailout.

National benchmark indexes fell in every western-European market except Greece, where the ASE Index jumped 3.2 percent, and Iceland. France’s CAC 40 slid 3.1 percent, while the U.K.’s FTSE 100 decreased 2.2 percent and Germany’s DAX slipped 2.5 percent. Spain’s IBEX 35 plunged 3 percent to its lowest level since March 2009, while Italy’s FTSE MIB sank 5 percent.

Italian banks led a gauge of European lenders lower, with UniCredit, the country’s biggest bank, dropping 8.1 percent to 3.04 euros and Intesa Sanpaolo SpA falling 7.9 percent to 1.14 euros. Banca Popolare di Milano Scarl slumped 6.8 percent to 32.82 euro cents.

STMicroelectronics NV dropped 8.2 percent to 5.33 euros after the chipmaker cut its first-quarter gross-margin forecast. The company said that an arbitration panel ordered it to pay $59 million to NXP Semiconductors Netherlands NV, a supplier.

Elsewhere, Santander lost 3.9 percent to 5.20 euros, Banco Bilbao Vizcaya Argentaria SA slid 3.6 percent to 5.40 euros and Banco Popular Espanol SA retreated 3.5 percent to 2.50 euros.

Vedanta fell 6.5 percent to 1,155 pence as base metals declined in London and the company said fourth-quarter iron-ore sales fell to 5.2 million tonnes from 6.4 million tones a year earlier because of a continued mining ban in Karnataka, India.

EFG Eurobank Ergasias SA led a rally in Greek banks, surging 29 percent to 66.9 euro cents. National Bank of Greece SA, the Mediterranean nation’s largest lender, climbed 24 percent to 2.05 euros, while Piraeus Bank SA, Greece’s fourth-biggest lender, jumped 27 percent to 33.1 cents.

The yen rose for a fifth day versus the dollar and the euro after Federal Reserve Chairman Ben S. Bernanke said the U.S. recovery is far from complete, spurring demand for haven amid bets the central bank will add stimulus. The Japanese currency advanced against all of its 16 most- traded peers after the Bank of Japan refrained from easing monetary policy. The Bank of Japan kept its key rate between zero and 0.1 percent and left unchanged its 30 trillion-yen ($370 billion) asset-purchase fund. No board member proposed additional easing at the two-day meeting concluded today, the central bank said. The yen has weakened 4.2 percent against the dollar since the Bank of Japan set a 1 percent inflation goal on Feb. 14 and increased its planned purchases of government bonds.

The euro fell to the lowest level in a month against the yen before Italy auctions bonds this week amid concern the region’s debt crisis is spreading. Italy will sell 11 billion euros ($14.4 billion) of bills tomorrow, followed by an offering of debt due from 2015 to 2023. Spain’s 10-year yields jumped more than 40 basis points last week, the biggest surge since the five days ended Jan. 6, as Prime Minister Mariano Rajoy said the nation is in “extreme difficulty.” Spanish banks may need additional capital if the economy weakens more than expected, Bank of Spain Governor Miguel Angel Fernandez Ordonez said today at a conference in Madrid as he warned the recovery will be slow. Spanish lenders have made provisions of 112 billion euros in the four years through 2011, and that figure will rise to 147 billion euros once tighter rules approved in February have been implemented, Ordonez said today. If the economy recovers, that will be “more than enough,” he said.

U.S. stocks declined for a fifth straight day, giving the Standard & Poor’s 500 Index its longest losing streak since November, amid concern about Europe’s sovereign debt crisis and as commodities tumbled.

Investors awaited the start of the first-quarter earnings season. While S&P 500 per-share profit growth slowed to 0.8 percent during the first three months of the year from 4.9 percent in the fourth quarter and 15 percent in the three months ended in September, it will accelerate to 8.3 percent during all of 2012, according to analyst estimates.

Dow 12,769.06 -160.53 -1.24%, Nasdaq 3,003.81 -43.27 -1.42%, S&P 500 1,364.08 -18.12 -1.31%

Bank of America (ВАС) slipped 4.1 percent to $8.56. Caterpillar (САТ) fell 3.3 percent to $100.17.

Alcoa (AA) lost 2.8 percent to $9.33. It is scheduled to release first-quarter results after the market close. It will post a loss of 4 cents a share, according to the average of estimates.

Best Buy slumped 3.4 percent to $21.88 after also saying board member G. Mike Mikan is taking the position on an interim basis as the company focuses on smaller stores and Internet sales. The change was a “mutual agreement” that new leadership was needed, the Richfield, Minnesota-based company said today in a statement. A committee of directors has been created to search for a new CEO, the company said.

Supervalu Inc. surged 9 percent to $5.80. The supermarket and pharmacy chain forecast 2013 earnings excluding some items of at least $1.27 a share, beating the average analyst forecast of $1.19.

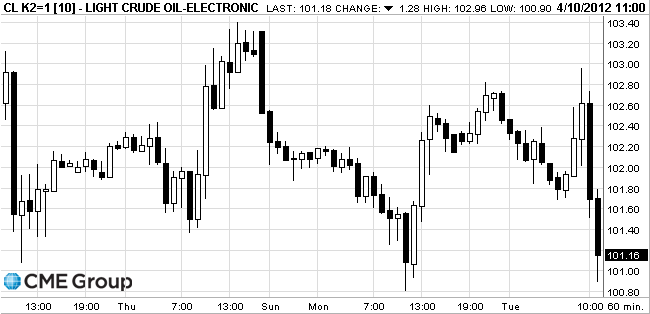

Oil prices down amid concerns of investors possible decrease in demand for China's "black gold" after the morning of publication of weak data on imports to China.

As it became known today, in the last month, China's trade surplus reflected surpluses.However, the decrease in imports suggests that the magnitude of decrease in activity in the 2 nd largest economy in the world can be very serious. The volume of imports rose by 5.3% against the projected 9%, while exports registered a rise of 8.9%, which together led to an increase in the trade surplus to $ 5.35 billion instead of the expected deficit of $ 3.15 billion

Also today it was announced that Tehran intends in the coming days to cut oil exports to several countries in Europe, reported Xinhua news agency on Tuesday, referring to the statement of Iranian oil minister Rostam Kassem. The minister also said that "Iran is not concerned about the introduction of the EU embargo on Iranian oil."

Earlier, Iran announced the termination of oil supplies in the UK, France and Greece, and threatened to reduce exports to Portugal, Spain, Italy, Germany and Holland.

The foreign ministers of 27 EU countries in late January approved an embargo on oil supplies from Iran. The new package of sanctions it is assumed that by July 1, all members of the EU, buying oil from Tehran will have to close down imports from that country. In response, Iranian officials have threatened to block the Strait of Hormuz - a key waterway for transporting Persian Gulf oil. U.S. responded by intensifying their naval presence in the Gulf. Iran, for its part, the Navy conducted exercises in the Strait of Hormuz.

Earlier today it was reported that Iran has enough funds to sustain a total embargo on oil sales for several years. So, at least, according to Iranian President Mahmoud Ahmadinejad.

Crude for May delivery fell to $100.90 on the New York Mercantile Exchange.

Gold prices are down against the dollar strengthening. Contrary to the expectations of experts, publication of data in the U.S. Labor Department last Friday, and the message about the end of the strike jewelers in India have contributed to an increase in gold prices.

Although demand in India - the world's largest gold market - and grew up after the strike, the dealers are surprised that demand is still relatively small.

Gold production in China in February rose by 11 percent in January to 26.9 tons,according to the Ministry of Industry and Information Technology. China - the largest gold producer in the world and last year produced a record number.

May futures on the COMEX gold fell today to $ 1632.6 an ounce.

Resistance 3:1397 (Apr 5 high)

Resistance 2:1383 (Apr 9t high

Resistance 1:1377 (resistance line from Apr 2)

Current price: 1371,00

Support 1:1370 (Apr 9 low, session low)

Support 2:1364 (МА (55) for D1)

Support 3:1338 (low of March)

EUR/USD $1.3000, $1.3175, $1.3200, $1.3225

USD/JPY Y82.00, Y82.50

EUR/GBP stg0.8355

USD/CHF Chf0.9055

AUD/USD $1.0250, $1.0265, $1.0280, $1.0390

U.S. stock futures are mixed ahead of the start of the first-quarter earnings season.

Alcoa Inc. (AA) added 0.9% as it becomes the first company in the Dow Jones Industrial Average to report quarterly results.

Global Stocks:

Nikkei 9,538.02 -8.24 -0.09%

Hang Seng 20,356.24 -236.76 -1.15%

Shanghai Composite 2,305.86 +20.09 +0.88%

FTSE 5,671.31 -52.36 -0.91%

CAC 3,264.72 -55.09 -1.66%

DAX 6,708.02 -67.24 -0.99%

Crude oil $102.16 за баррель (-0.39%).

Gold $1645.50 (+0,10%).

EUR/USD

Offers $1.3280, $1.3240/50, $1.3205/20, $1.3180, $1.3165/70, $1.3145/50, $1.3115/25, $1.3095/100

Bids $1.3035/30, $1.3020, $1.3005/00, $1.2980/70

GBP/USD

Offers $1.6000/10, $1.5980/85, $1.5960/65, $1.5900/05, $1.5880, $1.5850

Bids $1.5805/00, $1.5780/70, $1.5750/40

USD/JPY

Offers Y83.00, Y82.75/80, Y82.50/55, Y82.30/35, Y81.85/90, Y81.60/65

Bids Y81.00, Y80.65/55, Y80.50, Y80.30/25, Y80.10/00

EUR/JPY

Offers Y108.10/20, Y107.60/65, Y107.45/50, Y107.15/20, Y106.95/00, Y106.75/80

Bids Y105.65/60, Y105.45/40, Y105.10/00, Y104.75/70, Y104.50

AUD/USD

Offers $1.0425/30, $1.0380/00, $1.0360/65, $1.0350

Bids $1.0265/55, $1.0230, $1.0200, $1.0150

EUR/GBP

Offers stg0.8320/25, stg0.8300, stg0.8280

Bids stg0.8235/30, stg0.8225/20, stg0.8200, stg0.8180

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y82.15 (МА (200) for Н1)

Resistance 1: Y81.90 (session high)

Current price: Y81.11

Support 1: Y81.10 (area of session low, 38,2 % FIBO Y76,00-Y84,20)

Support 2: Y80.60 (high of March)

Support 3: Y80.20 (Feb 29 low)

Resistance 3: Chf0.9340 (high of March)

Resistance 2: Chf0.9250 (Mar 16 high)

Resistance 1: Chf0.9210/20 (area of session high and Apr 5 and 9 highs)

Current price: Chf0.9195

Support 1: Chf0.9175 (high of Asian session)

Support 2: Chf0.9140 (earlier resistance, Mar 26 high, Apr 5 low, session low)

Support 3: Chf0.9090 (earlier resistance, Mar 29 high)

Resistance 3 : $1.5960 (61,8 % FIBO $1,6060-$ 1,5800)

Resistance 2 : $1.5930 (session high)

Resistance 1 : $1.5870/80 (area of broken earlier support line from Apr 5, 50,0 % FIBO of today's decrease)

Current price: $1.5826

Support 1 : $1.5800 (Mar 26 and Apr 5 lows, support line from Jan 13)

Support 2 : $1.5770 (Mar 22 low)

Support 3 : $1.5700/690 (area of Mar 16 low)

Resistance 3 : $1.3200 (area of МА (200) for Н1)

Resistance 2 : $1.3150 (session high)

Resistance 1 : $1.3100 (area of low of Asian session)

Current price: $1.3066

Support 1 : $1.3030 (Apr 5 and 9 lows)

Support 2 : $1.3000 (low of March)

Support 3 : $1.2975 (low of February)

EUR/USD $1.3000, $1.3175, $1.3200, $1.3225

USD/JPY Y82.00, Y82.50

EUR/GBP stg0.8355

USD/CHF Chf0.9055

AUD/USD $1.0250, $1.0265, $1.0280, $1.0390

Asian stocks slipped, with the region’s benchmark dropping for a fifth day as markets opened from a holiday, after the Bank of Japan didn’t add to monetary stimulus and China reported an unexpected trade surplus.

Nikkei 225 9,538.02 -8.24 -0.09%

Hang Seng 20,356.24 -236.76 -1.15%

S&P/ASX 200 4,292.26 -27.58 -0.64%

Shanghai Composite 2,305.86 +20.09 +0.88%

Sony Corp., which yesterday said it will cut 10,000 jobs, extended declines as the yen rose after the Bank of Japan’s decision to leave its stimulus measures unchanged.

China Resources Land Ltd. and other mainland developers dropped after better-than-expected Chinese exports and a report yesterday that inflation accelerated gave policy makers less room to ease monetary policy.

BHP Billiton Ltd., the world’s biggest miner, dropped 0.6 percent after crude prices fell.

01:00 China Trade Balance, bln March -31.5 -3.0 +5.4

01:30 Australia ANZ Job Advertisements (MoM) March +3.3% +1.0%

01:30 Australia National Australia Bank's Business Confidence March 1 3

03:30 Japan BoJ Interest Rate Decision - 0.10% 0.10% 0.10%

05:00 Japan BoJ Monetary Policy Statement -

06:00 Japan Prelim Machine Tool Orders, y/y March -8.6% +2.4%

The most-accurate foreign-exchange forecasters say the euro will slide as austerity-driven spending cuts from Spain to Italy reignite debt turmoil and drag the region into recession.

The yen remained lower against all of its 16 major counterparts as speculation persisted that the Bank of Japan (8301) will add to monetary easing later this month. The Japanese currency pared declines after the BOJ kept policy unchanged today.

The dollar fell against most of its peers after Federal Reserve Chairman Ben S. Bernanke said the U.S. economy is far from a complete recovery, spurring speculation the Fed will increase stimulus measures. The U.S. economy is still “far from having fully recovered” from the effects of the global financial crisis, Bernanke said yesterday. A Labor Department report on April 6 showed hiring by American employers in March amounted to 120,000, trailing the most-pessimistic forecast in a Bloomberg survey.

The Australian and New Zealand dollars erased gains versus the yen after the Bank of Japan (8301) declined to boost stimulus measures and a Chinese official said the global environment remains “grim.” China’s trade surplus was $5.35 billion, the customs bureau said in a statement on its website today. Exports rose 8.9 percent from a year earlier, while inbound shipments increased 5.3 percent. The median estimate in a Bloomberg News survey of economists was for a $3.15 billion trade deficit. Australian business confidence rebounded to 3 last month from a five-month low of 1 in February, a National Australia Bank Ltd. (NAB) survey of about 400 companies taken March 26-30 and released in Sydney today showed.

EUR/USD: during the Asian session the pair updated yesterday's high.

GBP/USD: during the Asian session the pair gain to $1.5930.

USD/JPY: during the Asian session the pair fell to yesterday's low.

European data also starts at 0600GMT with German trade data. This is followed at 0630GMT by the France BoF business survey and at 0645GMT by France industrial output data. At 0730GMT, ECB Governing Council member Miguel Fernandez Ordonez is due to give an opening speech entitled "The New Reality Of The Spanish Banking System", in Madrid. The EMU and UK OECD leading indicator data is due from 1000GMT, while at the same time the UK Conference Board Leading Indicator data is also due.

Yesterday the euro rose against the U.S. dollar against the announcement of the fact that Spain will cut costs further E10 billion in the focus of market participants are data on the trade balance of Germany, which will be published tomorrow. The data may show a fall in exports in February. According to a preliminary survey of economists, exports from the eurozone's largest economy, Germany is likely to decline by 1.2% in February compared with the previous month, when the index grew by 2.4%.

The Canadian dollar rose against its U.S. counterpart after the Bank of Canada said that the spring survey of business sector reflects the optimism. For example, sales growth will be stronger in the next 12 months - 58% of the companies (19% - no change, 23% expect a decrease). Inflation expectations do not exceed the target range of securities, while rose against higher oil prices.

The yen rose against all of its major peers as data showing Japan returned to a current-account surplus and tensions over a North Korean rocket launch bolstered the allure of the currency as an investment haven. The yen has weakened almost 5 percent against the dollar since the Bank of Japan set a 1 percent inflation goal on Feb. 14 and increased its planned purchases of government bonds. The BOJ starts a two-day policy meeting.

EUR/USD: yesterday the pair rose, closed day above $1.3100.

GBP/USD: yesterday the pair gain to $1.5900.

USD/JPY: yesterday the pair traded in range Y81.20-Y81.65.

European data also starts at 0600GMT with German trade data. This is followed at 0630GMT by the France BoF business survey and at 0645GMT by France industrial output data. At 0730GMT, ECB Governing Council member Miguel Fernandez Ordonez is due to give an opening speech entitled "The New Reality Of The Spanish Banking System", in Madrid. The EMU and UK OECD leading indicator data is due from 1000GMT, while at the same time the UK Conference Board Leading Indicator data is also due.

Asian stocks fell for a fourth day, the longest losing streak on the regional benchmark since November, as a weaker-than-expected U.S. jobs report cast doubt on the strength of the recovery in the world’s biggest economy.

Nikkei 225 9,546.26 -142.19 -1.47%

Hang Seng 20,593 -197.98 -0.95%

S&P/ASX 200 4,319.85 -14.02 -0.32%

Shanghai Composite 2,285.78 -20.78 -0.90%

Toyota Motor Corp. fell 1.5 percent in Tokyo after U.S. payrolls grew at the slowest pace in five months and the yen rose against the dollar, damping the outlook for export earnings.

Samsung Electronics Co. slid 1.4 percent after Apple Inc. asked a U.S. court to block sales of products it said “slavishly copy” the iPhone and the iPad.

HTC Corp. dropped 6.2 percent in Taiwan after the smartphone maker posted its biggest drop in profit since listing a decade ago.

European stock markets closed in observance of Easter Monday.

U.S. stocks fell, dragging the Standard & Poor’s 500 Index lower following its worst week of 2012, after employers added fewer jobs than forecast in March.

Equities slumped last week after the Federal Reserve signaled it will refrain from further monetary stimulus and concern about Europe intensified. The U.S. Labor Department said April 6 that employers added 120,000 jobs, the fewest in five months and less than the median economist forecast of 205,000. The amount had exceeded 200,000 for three straight months.

Dow 12,929.59 -130.55 -1.00%, Nasdaq 3,047.08 -33.42 -1.08%, S&P 500 1,382.20 -15.88 -1.14%

Caterpillar (САТ), the world’s largest construction and mining-equipment manufacturer, retreated 2.2 percent to $103.57, while General Electric (GE), the maker of jet engines and power generation equipment, declined 1.5 percent to $19.20.Bank of America (ВАС) lost 3.3 percent to $8.93, the biggest retreat in the Dow. Citigroup erased 2.4 percent to $33.97.

Alcoa (АА) slipped 0.3 percent to $9.60. The largest U.S. aluminum producer is scheduled to disclose first-quarter results after the close of trading tomorrow, the first company in the Dow average to report.

AOL soared the most since at least November 2009, adding 43 percent to $26.40. The Internet company, under shareholder pressure to make strategic changes as revenue declines, agreed to sell and license more than 800 patents to Microsoft in a deal worth $1.06 billion. Microsoft fell 1.3 percent to $31.10.

Apple Inc. advanced 0.4 percent to $636.23. The world’s most valuable company erased an earlier decline of as much as 1.3 percent. The Cupertino, California-based company was cut to neutral from buy by BTIG LLC, which said investors should “take a breather” on expected strength this quarter.

Resistance 3: Y83.00 (Apr 3 high)

Resistance 2: Y82.55 (Apr 6 high)

Resistance 1: Y81.85 (session high)

The current price: Y81.53

Support 1: Y81.20 (Apr 9 low)

Support 2: Y80.55 (Mar 7 low)

Support 3: Y80.00 (Feb 28 low)

Resistance 3: Chf0.9255 (Mar 16 high)

Resistance 2: Chf0.9220 (Apr 5 high)

Resistance 1: Chf0.9175 (session high)

The current price: Chf0.9155

Support 1: Chf0.9140 (Apr 5 low)

Support 2: Chf0.9095 (Apr 4 low)

Support 3: Chf0.9070 (Apr 2 high)

Resistance 3 : $1.6045 (Apr 3 high)

Resistance 2 : $1.5975 (high of the American session on Apr 3)

Resistance 1 : $1.5935 (50.0% FIBO $1.5805-$1.6065)

The current price: $1.5926

Support 1 : $1.5885 (session low)

Support 2 : $1.5835 (Apr 9 low)

Support 3 : $1.5805 (Apr 5 low)

Resistance 3 : $1.3250 (61.8% FIBO $1.3030-$1.3380)

Resistance 2 : $1.3210 (high of the European session on Apr 4)

Resistance 1 : $1.3165 (Apr 5 high)

The current price: $1.3131

Support 1 : $1.3100 (session low)

Support 2 : $1.3030 (Apr 9 low)

Support 3 : $1.3000 (psychological level)

Change % Change Last

Oil $102.25 -0.21 -0.20%

Gold $1,642.30 -1.60 -0.10%

Change % Change Last

Nikkei 225 9,546.26 -142.19 -1.47%

Hang Seng closed

S&P/ASX 200 closed

Shanghai Composite 2,285.78 -20.78 -0.90%

FTSE 100 closed

CAC 40 closed

DAX closed

Dow 12,929.59 -130.55 -1.00%

Nasdaq 3,047.08 -33.42 -1.08%

S&P 500 1,382.20 -15.88 -1.14%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3109 +0,11%

GBP/USD $1,5896 +0,14%

USD/CHF Chf0,9166 -0,07%

USD/JPY Y81,56 -0,09%

EUR/JPY Y106,91 +0,07%

GBP/JPY Y129,63 +0,07%

AUD/USD $1,0308 +0,04%

NZD/USD $0,8215 +0,27%

USD/CAD C$0,9969 +0,01%

01:00 China Trade Balance, bln March -31.5 -3.0

01:30 Australia ANZ Job Advertisements (MoM) March +3.3%

01:30 Australia National Australia Bank's Business Confidence March 1

05:00 Japan BoJ Interest Rate Decision - 0.10% 0.10%

05:00 Japan BoJ Monetary Policy Statement -

05:45 Switzerland Unemployment Rate March 3.1% 3.1%

06:00 Germany Trade Balance February 14.2 13.6

06:00 Japan Prelim Machine Tool Orders, y/y March -8.6%

06:45 France Industrial Production, m/m February +0.3% +0.2%

06:45 France Industrial Production, y/y February -1.5% -1.4%

07:00 Japan BOJ Press Conference -

08:30 Eurozone Sentix Investor Confidence April -8.2 -7.4

14:00 U.S. Wholesale Inventories February +0.4% +0.5%

16:30 U.S. FOMC Member Richard Fisher Speaks -

16:45 U.S. FOMC Member Dennis Lockhart Speaks -

18:30 U.S. FOMC Member Narayana Kocherlakota -

21:00 New Zealand REINZ Housing Price Index, m/m March +0.8%

22:00 New Zealand NZIER Business Confidence Quarter I 0

23:01 United Kingdom RICS House Price Balance March -13%

23:50 Japan Core Machinery Orders February +3.4% -0.7%

23:50 Japan Core Machinery Orders, y/y February +5.7% +3.0%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.