- Analytics

- News and Tools

- Market News

- GBP/USD gets a pick-me-up after last week’s heavy selling

GBP/USD gets a pick-me-up after last week’s heavy selling

- GBP/USD recovers after steep sell-off takes it to 1.2600s.

- Brighter UK retail sales data helps improve the outlook for the Pound Sterling.

- BoE and Fed divergence on interest rate outlook, however, is a depresser for the pair.

GBP/USD saw a fillip on Monday, rising by almost four tenths of a percent to the mid 1.2600s on a mixture of better-than-expected UK retail sales data, profit taking after the recent steep sell-off and the US Dollar (USD) being broadly sold following intervention by authorities to prop up their currencies in Asia.

GBP/USD gets some support by UK retail sales

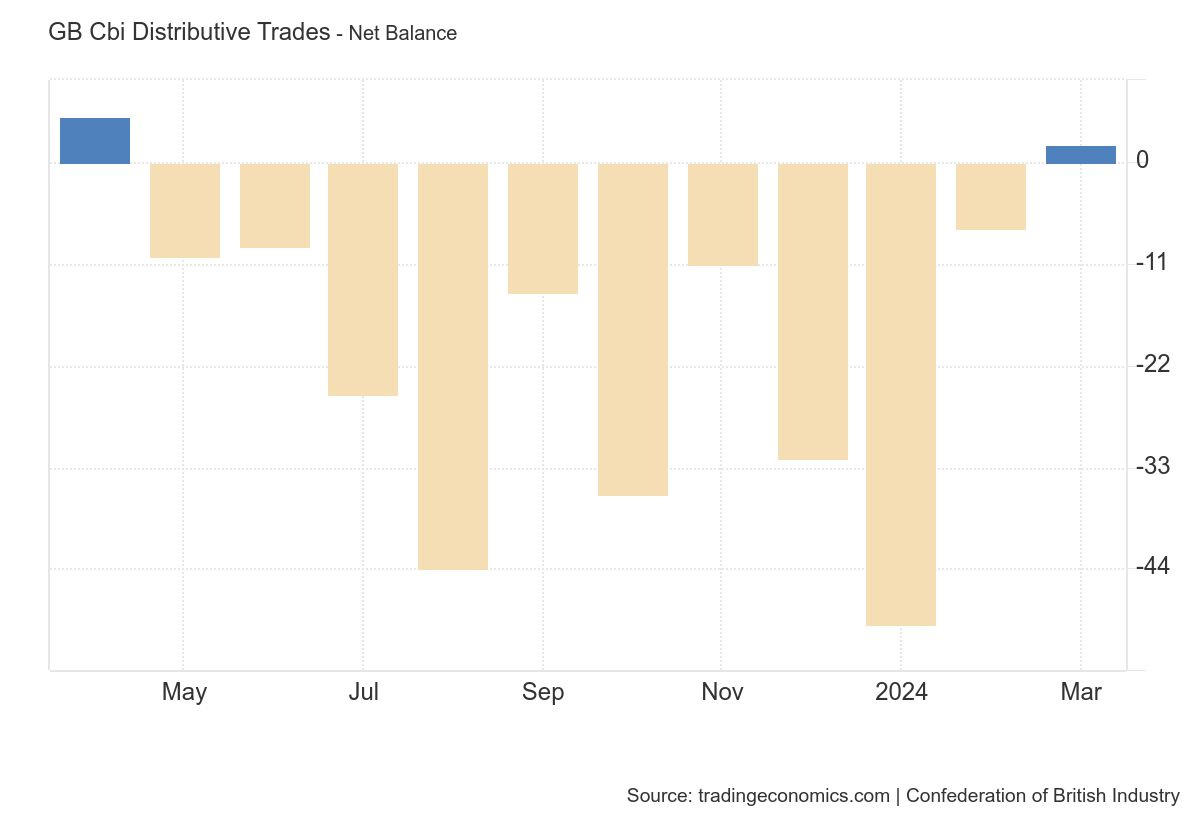

GBP/USD got some relief from the CBI Distributive Trades Survey figures showed the monthly retail sales balance climbed to plus two points in March from a reading of minus seven points a year ago, in March 2023.

The positive data published by the Confederation of British Industry (CBI), came after ten months of declines, suggesting the retail climate in the UK was improving.

The data comes after official UK Retail Sales volumes data from the Office of National Statistics (ONS) beat expectations in February and were revised up in January.

The data indicates Q1 will probably be stronger for the UK economy than had previously been predicted which is likely to help underpin the Pound Sterling (GBP).

"Retail sales volumes are on track to rebound strongly in Q1, helping the economy leave last year’s recession behind, as falling inflation boosts consumer spending power," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics, as quoted by Poundsterlinglive.com.

The data was all the more impressive given February was the wettest since 1836, added Wood.

Even if Retail Sales remain flat in March, they will still show a 1.7% gain quarter-on-quarter, according to the economist.

The data suggests the UK economy could be turning around after falling into a technical recession in Q4 and that the Bank of England (BoE) will not be in such a hurry to lower interest rates as may currently be expected. Maintaining higher interest rates would be positive for GBP as higher interest rates attract greater inflows of foreign capital.

GBP/USD suffers from diverging interest rate expectations

GBP/USD weakened substantially following the March BoE policy meeting on Thursday after it was revealed that the last remaining member of the board of governors holding out for interest rate hikes, Catherine Mann, had shifted allegiance. This left zero members voting for a rate hike, eight for leaving rates unchanged and one for cutting rates. It was viewed as indicative of a decisive shift in the BoE and a canary-in-the-coalmine warning of rate cuts on the horizon.

The US Dollar, meanwhile, has been supported by expectations shifting in the opposite direction – that of holding interest rates at their current elevated level, as US inflation data continues to surprise to the upside. Although the Federal Reserve (Fed) stuck to its earlier view that it would cut rates three times in 2024 at the March meeting, it revised up most of its economic metrics such as GDP, suggesting a risk it might not follow through with the cuts.

On Monday, Atlanta Federal Reserve President Raphael Bostic said he advocated a slow approach to lowering interest rates and only expected the Fed to make one rate cut in 2024.

Federal Reserve Governor Lisa Cook also urged caution, arguing that the Fed needed to take a “careful approach” to easing over time to “ensure inflation returns sustainably to 2.0%.”

The rate-setter who was previously in favor of rate hikes in the UK, Catherine Mann, but who chose to change her mind at the last BoE meeting, is currently speaking although she has not been reported as saying anything market moving at time of publication.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.