- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 06-02-2012.

The euro rose, offsetting previously incurred losses against the background of EU President Van Rompuy and EU Commissioner for Greece of possible progress in talks on Greek debt. EU President said that "the crisis is not yet complete, but the worst part is over," adding that "the problem of U.S. debt on average more serious than in the euro area and euro area deficit is not dramatic".

Previously, the single currency fell against major currencies of the partner, after it became known that the Prime Minister of Greece Lucas Papademos appealed to the Ministry of Finance to prepare a report on options for action in case of default in the country. On Tuesday, leaders of political parties would meet again in an attempt to find a solution that will convince triple transfer the second tranche of aid for the troubled country. Earlier, Greece has the requirement to cut 15 thousand jobs in the public sector, it is necessary to improve performance.

The yen rose against most of its major peers even after Bank of Japan Governor Masaaki Shirakawa said the nation’s economic condition is “severe” because of deflation and the strong currency. The central bank is implementing monetary easing measures and will take appropriate steps as needed, he said in parliament in Tokyo today.

European stocks dropped, with the Stoxx Europe 600 Index trimming a six-month high, as Greece struggled to reach a deal with its international creditors.

Greece’s Prime Minister Lucas Papademos struck a tentative deal with the leaders of the three parties supporting his interim government to boost economic competitiveness and extend spending cuts. The politicians agreed in a five-hour meeting yesterday to make additional reductions this year equal to 1.5 percent of gross domestic product.

The policy makers meet tomorrow to work on the detail of plans for bank recapitalizations, ensuring the viability of pension funds and measures to reduce wage and non-wage costs to boost competitiveness.

The euro area’s debt crisis will cut China’s economic expansion almost in half if it worsens, a scenario that would warrant “significant” fiscal stimulus from the nation’s government, the International Monetary Fund said.

National benchmark indexes declined in 15 of the 18 western-European markets today. The U.K.’s FTSE 100 Index slipped 0.2 percent. France’s CAC 40 Index declined 0.7 percent, while Germany’s DAX Index fell less than 0.1 percent.

Copper declined on the London Metal Exchange after the IMF released its growth prediction for the world’s largest consumer of the metal. Vedanta, India’s biggest copper producer, slid 3.1 percent to 1,317 pence and Rio Tinto Group, the world’s third- largest mining company, fell 1.1 percent to 3,946 pence.

Glencore retreated 4.5 percent to 460.75 pence as the Financial Times reported that the company may offer an 8 percent premium over Xstrata’s closing share price on Feb. 1. The newspaper cited people familiar with the merger discussions. Xstrata declined 1.7 percent to 1,261.5 pence in London.

Societe Generale slid 2.9 percent to 23.55 euros, while Credit Agricole fell 2.7 percent to 5.18 euros.

The idea of appointment of Commissioner's budget for Greece is absurd

Out of Greece from the eurozone will only exacerbate the crisis

Companies, banks, law firms are studying the output of the euro in Greece

Internal devaluation is preferable to exit from the eurozone Greece

The ECB should play the role of lender of last chance

Diverging developments in EMU a problem

Don't consider public deficits as dramatic

We can overcome the debt crisis; have the tools to manage the debt crisis now

U.S. stocks declined, snapping a three-day rally for the Standard & Poor’s 500 Index, amid concern about Europe’s debt crisis as Greek leaders wrestled with spending cuts to get aid and avert a default.

European leaders stepped up pressure on Greek politicians to meet the conditions of a 130 billion-euro ($171 billion) bailout, saying time was running out. French President Nicolas Sarkozy met German Chancellor Angela Merkel in Paris today as Greece’s interim prime minister, Lucas Papademos, planned to confer with the so-called troika of international lenders in Athens. A gathering of Greek political leaders was delayed by a day until tomorrow as they struggled for a unified response.

Dow 12,828.14 -34.09 -0.27%, Nasdaq 2,902.63 -3.03 -0.10%, S&P 500 1,343.12 -1.78 -0.13%

Boeing (ВА) dropped 1.2 percent to $75.41. There is no “short- term safety concern” from the fault, which was caused by an incorrect assembly in a support structure within the plane’s aft fuselage, Scott Lefeber, a spokesman, said yesterday in a statement. The new checks add to the challenges in boosting output of the twin-engine 787, which entered service in 2011 after more than three years of delays.

Humana fell 6 percent to $84.73. The company says it may add about 40,000 more Medicare Advantage members in 2012 than previously expected. The increase will help overcome an anticipated increase in demand for medical services.

Micron retreated 2.6 percent to $7.74. The shares fell 3.1 percent to $7.70 in late trading Feb. 3, after having been halted at $7.95. Durcan, who joined Micron in 1984, had been scheduled to hand over his role as chief operating officer to Mark Adams in August. Adams, head of sales, was named company president.

Oil declined in New York on concern that Greece will fail to take sufficient steps to avert a default, threatening Europe’s economy and fuel consumption.

Futures dropped as much as 1.5 percent before a deadline for Greece to accept terms demanded by international lenders on a bailout package. Brent oil in London traded at the biggest premium to the American benchmark grade in 12 weeks as record- low temperatures in Europe bolstered fuel demand.

Greek Prime Minister Lucas Papademos struck a tentative deal with party leaders to extend spending cuts after euro-area finance chiefs told them an increase in the 130 billion-euro ($170 billion) aid package wasn’t forthcoming.

The economic expansion in China, the world’s biggest energy-consuming country, could be cut almost in half this year if Europe’s debt crisis worsens, the International Monetary Fund said. Crude oil for March delivery fell to $96.38 a barrel on the New York Mercantile Exchange. Prices are down 2 percent this year. Brent oil for March settlement gained 87 cents, or 0.8 percent, to $115.45 a barrel on the ICE Futures Europe exchange.

The second package of aid to Greece will be issued only if we prove the stability of finance

Gold becomes cheaper as the depreciation of the euro, pending approval of austerity measures in Greece, which had hoped for a second tranche of financial assistance.

Politicians in Greece agree on cost-saving measures necessary to obtain the second tranche of financial assistance, without which the country is threatened by default. Terms of credit must be agreed with the IMF and EU inspectors until the next meeting of eurozone finance ministers, said on Monday a representative of the Greek government.

From the beginning, gold has risen in price by nearly 10 percent, but Friday was the worst day for the market since the beginning of the year, as the hope for another round of easing monetary policy in the U.S. subsided after the publication of better-than-expected employment data.

Due to lower prices on Friday, the demand for physical markets in Asia. From the beginning, growing demand for gold coins and gold ETF-backed funds.

"The reserves of gold in the ETF funds rose last week to 20 tons, and in January, according to preliminary data, the net increase was 24.5 tonnes, after declining stocks in December. General fund reserves reached 2.404,6 tons and tons of only 1.3 below the peak reached in early December "- the report says Barclays Capital.

The cost of the February gold futures on the COMEX today fell to 1713.3 dollars per ounce.

EUR/USD $1.2800, $1.2900, $1.2960, $1.3000, $1.3050, $1.3080, $1.3100, $1.3140, $1.3200, $1.3250

USD/JPY Y76.25, Y76.35, Y76.50, Y77.00, Y77.50

AUD/USD $1.0575, $1.0600, $1.0700

EUR/CHF Chf1.2000, Chf1.1900

GBP/USD $1.5800, $1.5750, $1.5655-50, $1.5500

EUR/GBP stg0.8300

EUR/JPY Y100.75

NZD/USD $0.8200

Sees unempl rate below 8% by end of the yr.

Sees unempl rate below 8% by end of the yr.

Data:

08:00 United Kingdom Halifax house price index January -0.9% +0.1% +0.6%

08:00 United Kingdom Halifax house price index 3m Y/Y January -1.3% -1.8%

09:30 Eurozone Sentix Investor Confidence February -21.1 -11.1

11:00 Germany Factory Orders s.a. (MoM) December -4.9% +0.5% +1.7%

11:00 Germany Factory Orders n.s.a. (YoY) December -4.3% 0.0%

The euro slid the most in a week against the dollar and yen on concern Greece’s political leaders will fail to reach an agreement allowing the nation to receive a second bailout from international creditors.

The common currency slid as Fitch Ratings said a Greek disorderly default “cannot be wholly discounted.”

The Dollar Index jumped before St. Louis Federal Reserve President James Bullard speaks amid speculation the U.S. central bank will avoid easing monetary policy further.

U.S. government data showed on Feb. 3 that nonfarm payrolls rose by 243,000 in January, surpassing the 140,000 increase estimated by economists. The benchmark yield on 10-year Treasuries jumped 10 basis points to 1.92 percent that day, the biggest gain since Dec. 20.

EUR/USD: during european session the pair decreased in $1,3040 area.

GBP/USD: the pair showed low in $1,5730 area. Later the rate restored

USD/JPY: the pair was limited Y76,55-Y76,80.

GBP/USD

Offers $1.5950, $1.5930, $1.5900, $1.5890, $1.5850, $1.5800, $1.5775/85

Bids $1.5720/00, $1.5680/70, $1.5655/40

EUR/USD

Offers $1.3250, $1.3200/20, $1.3150, $1.3120-30, $1.3095/100

Bids $1.3030, $1.3010/995

Resistance 3: Y77.50 (Jan 27 high)

Resistance 2: Y77.20 (hourly high on Jan 27)

Resistance 1: Y76.80 (session high, Jan 30 high)

Current price: Y76.58

Support 1:Y76.50 (session low)

Support 2:Y76.00 (Feb 1 low)

Support 3:Y75.60 (historical low)

Resistance 3: Chf0.9340 (50,0 % FIBO Chf0.9570-Chf0.9120, Jan 25 high)

Resistance 2: Chf0.9290 (38,2 % FIBO Chf0.9570-Chf0.9120)

Resistance 1: Chf0.9260 (session high)

Current price: Chf0.9239

Support 1: Chf0.9190 (session low, МА (200) for Н1)

Support 2: Chf0.9120 (area of Jan 27-31 and Feb 1 lows)

Support 3: Chf0.9060 (low of December)

Resistance 2 : $1.5890 (area of Nov 18 and Feb 1 highs)

Resistance 2 : $1.5860 (Feb 2-3 high)

Resistance 1 : $1.5860 (session high, Feb 2 high)

Current price: $1.5760

Support 1 : $1.5730 (session low)

Support 2 : $1.5700 (Feb 1 low)

Support 3 : $1.5650/40 (Jan 27-30 lows, 38.2 % FIBO $1,5230-$ 1,5890)

Resistance 3 : $1.3230/45 (Jan 30 high, 38,2 % FIBO $1,4250-$ 1,2620)

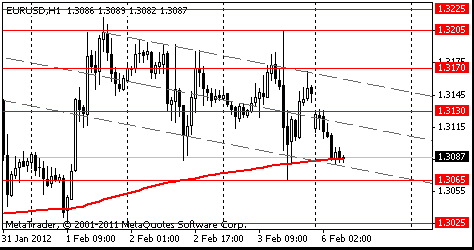

Resistance 2 : $1.3170 (resistance line from Jan 27)

Resistance 1 : $1.3100 (intraday high)

Current price: $1.3066

Support 1 : $1.3020/00 (session low, Feb 1 low, psychological level, 38,2 % FIBO $1,2620-$ 1,3230)

Support 2 : $1.2930 (50,0 % FIBO $1,2620-$ 1,3230, Jan 25 low)

Support 3 : $1.2860 (61,8 % FIBO $1,2620-$ 1,3230)

EUR/USD $1.2800, $1.2900, $1.2960, $1.3000, $1.3050, $1.3080, $1.3100, $1.3140, $1.3200, $1.3250

USD/JPY Y76.25, Y76.35, Y76.50, Y77.00, Y77.50

AUD/USD $1.0575, $1.0600, $1.0700

EUR/CHF Chf1.2000, Chf1.1900

GBP/USD $1.5800, $1.5750, $1.5655-50, $1.5500

EUR/GBP stg0.8300

EUR/JPY Y100.75

NZD/USD $0.8200

00:30 Australia Retail sales (MoM) December 0.0% -0.1%

00:30 Australia Retail Sales Y/Y December +3.1% +3.0%

The euro weakened against almost all of its 16 major counterparts before Greek leaders respond today to demands by international creditors on economic measures. Greek political-party leaders must provide a first response to demands by the European Union, European Central Bank and International Monetary Fund on economic measures, including wage cuts, by 11 a.m. local time today, a spokesman for the biggest party, Pasok, told reporters in Athens. The 17-nation currency slid versus the dollar with France set to sell as much as 8.5 billion euros ($11 billion) of bills today.

The dollar extended its gain versus the yen to a third day before St. Louis Federal Reserve President James Bullard speaks amid speculation the U.S. central bank will avoid easing monetary policy further.

The Australian dollar, known as the Aussie, fell against 10 of its 16 major peers after the Bureau of Statistics said the country’s retail sales fell 0.1 percent in December from a month earlier. Economists had estimated a 0.2 percent gain. The Reserve Bank of Australia will lower the benchmark interest rate to 4 percent from 4.25 percent in a meeting tomorrow, another survey of economists shows..

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair weakened.

USD/JPY: during the Asian session the pair gain.

It is a queit day for data in Europe Monday, so traders eyes will once again be on debt/bailout talks from Greece. The data that is due is the Eurozone Sentix investor confidence data, expected at 0900GMT. In the US, St. Louis Federal Reserve Bank Pres. Charles Bullard speaks to the Union Leage Club of Chicago on 'Inflation Targeting" at 1355GMT. At 1430GMT, US MNI Capital Goods Index is released, followed by Retail Trade Index at 1530GMT. At 1430GMT, the US auctions 3-mos, 6-mos paper. Dallas Federal Reserve Bank Pres. Richard Fisher speaks to the Institute of International Finance in Washington at 1715GMT.

On Monday the yen strengthened against all of its major counterparts as concern increased that Greek bailout negotiations will hinder efforts to resolve the financial crisis, boosting demand for haven assets. The euro fell below 100 yen for the first time in a week as European Union leaders met in Brussels, and Italy raised less than its maximum target at a bond sale after Fitch Ratings downgraded the nation last week. The dollar touched the weakest against the yen since Oct. 31, when it reached a record low. The Swiss franc strengthened to the highest level against the euro since September.

On Tuesday the euro fell to its weakest level in almost a week versus the dollar as investors speculated European policy makers won’t be able to reach an agreement regarding Greece’s debt obligations. The euro weakened against the majority of its most- traded peers as Standard & Poor’s increased the number of Portuguese banks on “creditwatch negative.” Greece pledged a last-ditch effort to prevent the collapse of a second rescue package from creditors, aiming to complete talks this week on a financial lifeline that’s been in the works for six months.

On Wednesday the euro rose against the dollar for the first time in three days as a purchasing managers’ index of manufacturing output in the region beat analysts’ estimates, adding to signs Europe’s economy is stabilizing. The euro reversed an earlier decline after Markit Economics said its manufacturing gauge based on a survey of purchasing managers in the euro region rose to 48.8 in January from 46.9 in December. In Germany, the output gauge reached the highest in six months. The greenback fell versus 14 of its 16 most-traded peers after manufacturing in China and the U.S. also rose, damping demand for safer assets. The official Chinese purchasing managers’ index increased to 50.5 from 50.3 in December, though the data may have been distorted by a week long holiday. U.S. manufacturing expanded at the fastest pace since June. The Institute for Supply Management’s manufacturing index rose to 54.1 in January from 53.1 in December, the group said today. Companies in the U.S. added 170,000 workers in January, reflecting job gains in services and at small businesses, according to a private report based on payrolls.

On Thursday the euro fell against the majority of its most-traded counterparts as Greece struggles to reach an agreement with its bondholders on cutting the nation’s debt burden. Luxembourg Prime Minister Jean-Claude Juncker said steps to tackle the debt crisis adopted at a summit on Jan. 30 were “largely insufficient.” China’s Premier Wen Jiabao said his nation supports European efforts to stabilize the 17-nation currency. China is still researching the best way to participate in the European Financial Stability Facility, Wen said at a briefing with German Chancellor Angela Merkel in Beijing. The dollar rose before a report that may show employers boosted payrolls in January and the jobless rate held at an almost three-year low. Applications for unemployment insurance payments in the U.S. dropped by 12,000 to 367,000 in the week ended Jan. 28, Labor Department figures showed today in Washington. Fed Chairman Ben S. Bernanke said the economy has shown signs of improvement while remaining vulnerable to shocks, and he called on lawmakers to reduce the long-term U.S. budget deficit.

On Friday the dollar gained, recovering from an almost postwar low against the yen, after U.S. employers added more jobs than forecast, damping speculation the Federal Reserve will add another round of asset purchases to spur growth. Nonfarm payrolls rose by 243,000, after a revised 203,000 gain in December, the Labor Department reported today in Washington. The unemployment rate fell to 8.3 percent. Data this year have signaled the U.S. economy is recovering at a quickening pace. Manufacturing grew in January at the fastest pace in seven months, the Institute for Supply Management reported Feb. 1. Consumer confidence rose last month to the highest level in almost a year, according to a Thomson Reuters/University of Michigan index published Jan. 27. The Japanese currency dropped, after trading within one yen of its post-World War II high versus the dollar, reducing speculation the nation will intervene in the currency market to stem its appreciation. Japan’s Finance Minister Jun Azumi has said he will take decisive steps against one-sided moves in the yen if needed. The currency’s level doesn’t reflect economic fundamentals, and falling U.S. interest rates are increasing speculative yen buying, he told reporters in Tokyo.

Resistance 3: Y78.30 (Jan 25 high)

Resistance 2: Y77.45 (61.8% FIBO Y76.00-Y78.30)

Resistance 1: Y77.15 (50.0% FIBO Y76.00-Y78.30)

The current price: Y76.74

Support 1: Y76.45 (session low)

Support 2: Y76.00 (Feb 1 low)

Support 3: Y75.60 (Oct 31 low)

Resistance 3 : $1.5880 (Feb 1 high)

Resistance 2 : $1.5860 (Feb 3 high)

Resistance 1 : $1.5830 (session high)

The current price: $1.5773

Support 1 : $1.5750 (Feb 3 low)

Support 2 : $1.5705 (Feb 1 low, MA(233) H1)

Support 3 : $1.5640/50 (area of Jan 27-30 lows)

Resistance 3 : $1.3205 (Feb 3 high)

Resistance 2 : $1.3170 (resistance line from Feb 1)

Resistance 1 : $1.3130 (session high)

The current price: $1.3087

Support 1 : $1.3065 (Feb 3 low)

Support 2 : $1.3025 (Feb 1 low)

Support 3 : $1.3000 (38.2% FIBO $1.3225-$1.2625)

00:30 Australia ANZ Job Advertisements (MoM) January -0.9%

00:30 Australia Retail sales (MoM) December 0.0%

00:30 Australia Retail Sales Y/Y December +3.1%

08:00 United Kingdom Halifax house price index January -0.9% +0.1%

08:00 United Kingdom Halifax house price index 3m Y/Y January -1.3%

08:00 Switzerland Foreign Currency Reserves January 254.2

09:30 Eurozone Sentix Investor Confidence February -21.1

11:00 Germany Factory Orders s.a. (MoM) December -4.8% +0.5%

11:00 Germany Factory Orders n.s.a. (YoY) December -4.3%

15:00 Canada Ivey Purchasing Managers Index January 63.5 57.8

17:15 U.S. FOMC Member Richard Fisher Speaks 0

21:45 New Zealand Private Sector Labor Costs (ex. overtime), q/q IV quarter +0.5% +0.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.