- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 02-02-2012.

The euro fell against the majority of its most-traded counterparts as Greece struggles to reach an agreement with its bondholders on cutting the nation’s debt burden. Luxembourg Prime Minister Jean-Claude Juncker said steps to tackle the debt crisis adopted at a summit on Jan. 30 were “largely insufficient.” China’s Premier Wen Jiabao said his nation supports European efforts to stabilize the 17-nation currency. China is still researching the best way to participate in the European Financial Stability Facility, Wen said at a briefing with German Chancellor Angela Merkel in Beijing.

The dollar rose before a report tomorrow that may show employers boosted payrolls in January and the jobless rate held at an almost three-year low. Applications for unemployment insurance payments in the U.S. dropped by 12,000 to 367,000 in the week ended Jan. 28, Labor Department figures showed today in Washington. Fed Chairman Ben S. Bernanke said the economy has shown signs of improvement while remaining vulnerable to shocks, and he called on lawmakers to reduce the long-term U.S. budget deficit.

The yen rose to almost a postwar high against the dollar, prompting speculation Japan will intervene. Japanese Finance Minister Jun Azumi said he “can’t overlook” speculative moves in the foreign-exchange market and is ready take “decisive” actions if necessary.

The franc weakened against all except two of its 16 major counterparts amid talk of possible intervention by the Swiss National Bank. The SNB in September said it would cap the franc at 1.20 against the euro after it reached a euro-era record 1.00749 the previous month.

European stocks climbed for a third day as a report showed that U.S. jobless claims dropped more than economists had estimated and Glencore International Plc held talks to buy Xstrata Plc, boosting mining companies.

In the U.S., a Labor Department report showed that applications for unemployment benefits fell last week more than economists had predicted, indicating the labor market is improving in the world’s largest economy.

National benchmark indexes climbed in 14 of the 18 western- European (SXXP) markets today. The U.K.’s FTSE 100 Index added 0.1 percent. France’s CAC 40 Index gained 0.3 percent and Germany’s DAX Index advanced 0.6 percent.

Xstrata surged 9.9 percent to 1,230.5 pence after confirming that Glencore has held talks to buy the shares in the company that it doesn’t already own. Glencore’s shares soared 6.9 percent to 461.7 pence.

Novo Nordisk A/S rose 4.3 percent to 709.50 kroner after the world’s largest insulin maker posted net income that climbed to 4.69 billion kroner ($830 million) from 3.95 billion kroner a year earlier.

Benetton Group SpA surged 17 percent to 4.74 euros after the Benetton family, the company’s largest shareholder, said it will offer 276.6 million euros ($364 million) for the shares it doesn’t already own in the company. Edizione Holding SpA, which owns 67 percent of Benetton, will offer 4.60 euros a share, it said in a statement last night on the Italian bourse.

Unilever dropped 4.4 percent to 1,994 pence as the maker of Hellmann’s mayonnaise and Lynx deodorants said it expects difficult economic conditions and elevated commodity costs to persist this year.

Prepared to buy foreign currencies 'in unlimited quantities if necessary'

U.S. stocks swung between gains and losses as Merck & Co. led drugmakers lower after sales trailed forecasts and investors awaited tomorrow’s employment report to gauge the outlook for the economy. A report tomorrow may show that employment grew by 145,000 after rising by 200,000 in December, according to the median forecast of economists. The jobless rate may have held at an almost three-year low of 8.5 percent. Earlier today, Labor Department figures showed applications for unemployment insurance payments dropped by 12,000 to 367,000 in the week ended Jan. 28.

Merck lost 1.2 percent to $38.15. Revenue rose 1.7 percent to $12.3 billion, less than the analyst estimates of $12.5 billion.

Abercrombie & Fitch tumbled 12 percent to $41.31. The teen apparel chain reported preliminary fourth-quarter earnings that trailed analysts’ estimates as holiday promotions narrowed profit margins.

Citigroup rose 1.3 percent to $31.99. Morgan Stanley advanced 0.8 percent to $19.54.

Gap rallied 9.3 percent, the biggest gain in the S&P 500, to $21.27. The company forecast fourth-quarter earnings to be at least 41 cents a share, exceeding the 35-cent estimate by analysts on average.

Green Mountain Coffee Roasters Inc. surged 22 percent to $65.19. The maker of Keurig brand single-cup pods and brewers reported profit that beat analysts’ estimates as sales rose.

World oil prices show mixed dynamics on the background of statistical data about the increase in stocks of raw materials in the U.S., as well as expectations about future government policy on China's fuel prices.

On Thursday, the markets continue to act out on the eve of the published data from the U.S. Department of Energy, under which commercial oil reserves in the country (excluding strategic reserves) for the week ended January 27 increased by 4.2 million barrels, or 1.2% - up to 338 9 million barrels. Experts expect growth stocks to only 2.6 million barrels - up to 337.4 million barrels.

Definite influence on the dynamics of quotations have news from China. According to the analytical agency C1 Energy, the cost of the basket of the three main grades (Brent, Dubai and Cinta), purchased by China, increased by 4.3% over the past three weeks. Such a rise in the basket was higher than projected by the authorities in the 4% mark. Against this background, as soon as the agency expects price correction in the fuel market by the state.

During the bidding investors paid attention to reporting the Anglo-Dutch Royal Dutch Shell in 2011. Net income rose in 2011 by 54% over the previous year - up to 30.92 billion dollars in diluted earnings per share amounted to 4.98 dollar against 3.28 dollar a year earlier.

Crude oil for March delivery fell to $95.81 a barrel on the New York Mercantile Exchange. Brent crude oil for March settlement climbed $0.35, or 0.31 percent, to $111.91 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise for third consecutive day against the background statistics on the number of applications for unemployment in the U.S., which turned out better than expected, reporting, corporate America, as well as continuing uncertainty about the debt problems of Greece.

The number of initial claims for unemployment benefits in the U.S. for the week ended January 28 fell by 12 000 - to 367 thousand. Published data were much better than analysts' expectations, projected to decline only 375 000.

On a positive financial results were seen for U.S. corporations in 2011. Thus, the net profit of the world's oldest pharmaceutical and chemical company Merck on the basis of 2011 increased by more than seven times and amounted to 6.2 billion dollars against 861 million dollars in 2010.

Net profit of the American Chemical giant Dow Chemical Company on the basis of 2011 grew by 18% - to 2.74 billion dollars.

In addition, investors continue to monitor the situation in Greece, where the government has still not reached an agreement with private creditors to write off part of the national debt.

Cost of the February gold futures on the COMEX today rose to 1761.1 dollars per ounce.

EUR/USD $1.3000, $1.3050-55, $1.3150, $1.3170, $1.3200, $1.3370

USD/JPY Y76.00, Y76.80, Y76.90

EUR/JPY Y102.00

GBP/USD $1.5850

USD/CHF Chf0.9200, Chf0.9125

AUD/USD $1.0675, $1.0700, $1.0750, $1.0800

EUR/CHF Chf1.2000, Chf1.2075, Chf1.2180

AUD/JPY Y81.30, Y81.45

USD/CAD C$0.9950

Data:

07:00 Switzerland Trade Balance December 3.00 2.85 2.00

09:30 United Kingdom PMI Construction January 53.2 53.0 51.4

10:00 Eurozone Producer Price Index, MoM December +0.2% -0.1% -0.2%

10:00 Eurozone Producer Price Index (YoY) December +5.3% +4.3% +4.3%

The euro weakened as Greece struggled to reach an agreement with bondholders on cutting the nation’s debt burden, stoking concern Europe’s crisis will deepen.

The common currency fell as Spanish bonds declined after the nation sold debt today.

The euro briefly erased losses after China’s Premier Wen Jiabao said his nation supports European efforts to stabilize the 17-nation currency.

Greece and its creditors are locked in talks over a debt- swap deal for the nation. Bondholders last week lowered their demands for an average coupon on the new debt they would get after European officials demanded they take steeper losses. The European Central Bank is likely to refuse to show its hand on how it will help cut Greece’s debt burden until the deal is reached, said economists from ING Group to Deutsche Bank.

EUR/USD: the pair fell below $1,3100.

GBP/USD: the pair decreased in $1,5810 area.

USD/JPY: movement of pair was limited Y76,05-Y76,18.

Challenger Layoffs starts UK data at 1230GMT, while at 1330GMT, the weekly jobless claims are expected to fall 7,000 to 370,000 in the January 28 week after see-sawing in recent weeks. The weekly Bloomberg Comfort Index is due at 1445GMT along with the ISM-New York Business Index. Weekly EIA Natural Gas Stocks data is due at 1530GMT. Late US data then sees the 2130GMT release of M2 Money Supply.

EUR/USD

Offers $1.3300, $1.3260/80, $1.3250

Bids $1.3080/70, $1.3055/50, $1.3020, $1.3010/995

GBP/USD

Offers $1.5950, $1.5930, $1.5900, $1.5890

Bids $1.5800/795, $1.5775/70, $1.5750, $1.5700, $1.5680/70

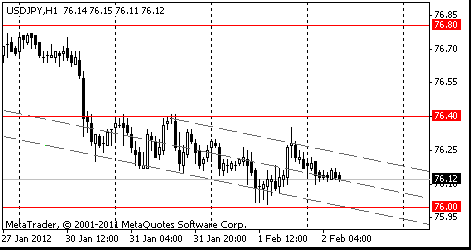

Resistance 3: Y77.20 (hourly high on Jan 27)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (Jan 31 high)

Current price: Y76.10

Support 1:Y76.00 (Feb 1 low)

Support 2:Y75.60 (historical low)

Support 3:Y75.00 (psychological level)

Resistance 3: Chf0.9290 (38,2 % FIBO Chf0.9570-Chf0.9120)

Resistance 2: Chf0.9250 (Feb 1 high)

Resistance 1: Chf0.9210 (session high, МА (200) for Н1)

Current price: Chf0.9193

Support 1: Chf0.9120 (area of Jan 27-31 and Feb 1 lows)

Support 2: Chf0.9060 (low of December)

Support 3: Chf0.9000 (psychological level)

Next storng support - $1.3020/00 area.

Resistance 3 : $1.5960 (МА (200) for D1) Resistance 2 : $1.5890 (area of Nov 18 and Feb 1 highs)

Resistance 1 : $1.5860 (session high) Current price: $1.5815 Support 1 : $1.5790 (Jan 31 high and support line from Jan 13)

Support 2 : $1.5700 (Feb 1 low) Support 3 : $1.5655/40 (Jan 27-30 low)

Resistance 3 : $1.3350 (МА (100) for D1)

Resistance 2 : $1.3230/45 (Jan 30 high, 38,2 % FIBO $1,4250-$ 1,2620)

Resistance 1 : $1.3190 (session hih, resistance line from Jan 27)

Current price: $1.3139

Support 1 : $1.3120 (session low)

Support 2 : $1.3090 (МА (200) for Н1)

Support 3 : $1.3020/00 (Feb 1 low, psychological level, 38,2 % FIBO $1,2620-$ 1,3230)

E1.011bln of 4.25% Oct 2018 OAT; avg yield 2.44%, cover 4.34;

E1.253bln of 2.50% Oct 2020 OAT; avg yield 2.91%, cover 3.99;

E5.698bln of new 3.00% Apr 2022 OAT; avg yield 3.13%, cover 1.71.

EUR/USD $1.3000, $1.3050-55, $1.3150, $1.3170, $1.3200, $1.3370

USD/JPY Y76.00, Y76.80, Y76.90

EUR/JPY Y102.00

GBP/USD $1.5850

USD/CHF Chf0.9200, Chf0.9125

AUD/USD $1.0675, $1.0700, $1.0750, $1.0800

EUR/CHF Chf1.2000, Chf1.2075, Chf1.2180

AUD/JPY Y81.30, Y81.45

USD/CAD C$0.9950

Tesoro sold E4.56bln vs target E3.5bln-E4.5bln

Sold E2.522bln of 4.00% July 2015 Bono, cover 1.63 vs 1.797 previous,at avg yield 2.861% vs 3.384% previous

Sold E984mln of 4.25% Oct 2016 Bono, cover 3.57 vs 1.71 previous, at avg yield 3.455% vs 3.912% previous

Sold E1.054bln of 3.80% Jan 2017 Obligacion, cover 2.70., at avg yield 3.565%

00:30 Australia Building Permits, m/m December +8.4% +2.3% -1.0%

00:30 Australia Building Permits, y/y December -18.9% -22.1% -24.5%

00:30 Australia Trade Balance December 1.38 1.23 1.71

The dollar weakened against most of its 16 major counterparts as Asian stocks extended a global rally ahead of U.S. data that may show an improving job market, curbing demand for refuge assets. Applications for unemployment payments in the U.S. probably fell to 371,000 in the week ended Jan. 28 from 377,000 the previous week, according to the median estimate of economists in a Bloomberg News survey. The Labor Department will release the figures today.

The 17-nation euro held yesterday’s gain versus the greenback after German Chancellor Angela Merkel said Europe must be united in protecting stability in the currency.

The Australian and New Zealand dollars maintained two-day gains as Asian equities extended a global stocks rally, spurring investor appetite for higher- yielding assets.

Australia’s currency earlier reached a five-month high after a report showed the nation’s trade surplus increased, exceeding analyst projections. The so-called Aussie and kiwi also rose after data yesterday showed manufacturing in China and the U.S. expanded, while a similar European gauge topped an initial reading. Demand for New Zealand’s dollar was limited after whole-milk powder prices fell for the fourth-straight auction, according to Fonterra Cooperative Group Ltd. (FCG).

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair decreased.

USD/JPY: during the Asian session the pair was under pressure.

Core-European data for Thursday includes German car registrations data and then, at 0900GMT, machine orders, which are followed by EMU PPI data at 1000GMT. Challenger Layoffs starts UK data at 1230GMT, while at 1330GMT, the weekly jobless claims are expected to fall 7,000 to 370,000 in the January 28 week after see-sawing in recent weeks. The weekly Bloomberg Comfort Index is due at 1445GMT along with the ISM-New York Business Index. Weekly EIA Natural Gas Stocks data is due at 1530GMT. Late US data then sees the 2130GMT release of M2 Money Supply.

Yesterday the euro rose against the dollar for the first time in three days as a purchasing managers’ index of manufacturing output in the region beat analysts’ estimates, adding to signs Europe’s economy is stabilizing. The euro reversed an earlier decline after Markit Economics said its manufacturing gauge based on a survey of purchasing managers in the euro region rose to 48.8 in January from 46.9 in December. In Germany, the output gauge reached the highest in six months. The euro appreciated 1 percent against the dollar last month as Italian and Spanish bonds outperformed their German counterparts amid speculation policy makers are bringing the region’s debt crisis under control. European economic confidence increased in January and German unemployment dropped more than economists estimated from the previous month. In discussions late last week in Athens, bondholders negotiating a debt swap with Greece lowered their demands for an average coupon on the new 30-year securities they would receive to as little as 3.6 percent from 4.25 percent after European officials demanded they take steeper losses, people familiar with the matter said at the time.

The greenback fell versus 14 of its 16 most-traded peers after manufacturing in China and the U.S. also rose, damping demand for safer assets. The official Chinese purchasing managers’ index increased to 50.5 from 50.3 in December, though the data may have been distorted by a weeklong holiday. U.S. manufacturing expanded at the fastest pace since June. The Institute for Supply Management’s manufacturing index rose to 54.1 in January from 53.1 in December, the group said today. Companies in the U.S. added 170,000 workers in January, reflecting job gains in services and at small businesses, according to a private report based on payrolls.

The yen appreciated for a fifth day against its U.S. counterpart, adding to speculation Japan’s central bank may sell the currency to stem its appreciation.

Switzerland’s franc climbed to a four-month high against the euro, approaching the Swiss National Bank’s ceiling.

EUR/USD: yesterday the pair has grown on a floor of a figure and closed day above $1.3100.

GBP/USD: yesterday the pair rose, updated monthly high.

USD/JPY: yesterday the pair decreased, updated a monthly low.

Core-European data for Thursday includes German car registrations data and then, at 0900GMT, machine orders, which are followed by EMU PPI data at 1000GMT. Challenger Layoffs starts UK data at 1230GMT, while at 1330GMT, the weekly jobless claims are expected to fall 7,000 to 370,000 in the January 28 week after see-sawing in recent weeks. The weekly Bloomberg Comfort Index is due at 1445GMT along with the ISM-New York Business Index. Weekly EIA Natural Gas Stocks data is due at 1530GMT. Late US data then sees the 2130GMT release of M2 Money Supply.

Asian stocks fell, erasing gains, amid speculation that an unexpected expansion in China’s manufacturing reduces the need for easier monetary policy and as weaker economic reports in the U.S. dimmed the earnings outlook for exporters.

Nikkei 225 8,810 +7.28 +0.08%

Hang Seng 20,335 -55.44 -0.27%

S&P/ASX 200 4,226 -37.02 -0.87%

Shanghai Composite 2,268 -24.53 -1.07%

Industrial & Commercial Bank of China Ltd., the world’s biggest lender, slid 0.9 percent in Hong Kong.

Li & Fung Ltd., the supplier of toys and clothes to retailers including Wal-Mart Stores Inc., fell 1.5 percent.

Sumitomo Heavy Industries Ltd. sank 9.6 percent in Tokyo after the machinery maker cut its full-year profit forecast by 28 percent. Shipping stocks gained on speculation rising cargo rates will help shore up earnings.

European stocks advanced to a six- month high, with the Stoxx Europe 600 Index extending its best start to a year since 1998, as gauges of manufacturing increased from America to the euro area to China.

The Institute for Supply Management’s U.S. manufacturing index rose to 54.1 in January from 53.1 in December, the Tempe, Arizona-based group’s data showed today. Chinese manufacturing rose last month as the world’s second-biggest economy withstood weaker exports driven by the euro-area debt crisis and a government-induced property slowdown.

Greek bondholders may get a sweetener tied to a revival in economic growth that would ease the impact of accepting a lower interest rate on new bonds, people with knowledge of the talks said.

National benchmark indexes rose in 17 of the 18 western European markets. France’s CAC 40 added 2.1 percent. The U.K.’s FTSE 100 climbed 1.9 percent and Germany’s DAX jumped 2.4 percent.

Banks and carmakers led gains.

Banco Santander SA, Spain’s biggest lender, advanced 3.6 percent to 6.16 euros. Credit Agricole SA, France’s third-largest bank, rallied 7.4 percent to 5.06 euros.

BP Plc, Europe’s second-biggest oil company, gained 2.6 percent to 483 pence.

ICAP jumped 7.7 percent to 362 pence. The world’s largest broker of inter-bank transactions said pretax profit for the year ending March 31 will be at the “upper end” of the current range of analyst estimates of 336 million pounds ($528 million) to 358 million pounds. ICAP had said in November it expected full-year profit to be within analysts’ projections at that time of 358 million pounds to 390 million pounds.

Renault SA jumped 4.9 percent to 34.18 euros. Renault- Nissan 2011 global sales rose 10 percent to a record, driven by emerging markets and the U.S., the company said.

U.S. stocks advanced, snapping a four-day decline in the Standard & Poor’s 500 Index, amid signs that manufacturing across the world is strengthening.

Equities rallied after data showing manufacturing in the U.S. grew at the fastest pace in seven months. Factory indexes in China improved and a U.K. manufacturing gauge jumped to an eight-month high. In Germany, output grew for the first time since September. Manufacturing contracted less than initially estimated in the euro region. A spokesman said Greece expects to complete talks on a private sector debt swap and a second international financing deal for the country in the next days.

Dow 12,716.46 +83.55 +0.66%, Nasdaq 2,848.27 +34.43 +1.22%, S&P 500 1,324.08 +11.67 +0.89%

Bank of America Corp. (ВАС) added 3.2 percent, the most in the Dow, to $7.36. Citigroup Inc. advanced 2.9 percent to $31.60.

Morgan Stanley climbed 4 percent to $19.39. Facebook will file plans with regulators today to raise $5 billion, though the amount may increase, two people said. Morgan Stanley stands to earn a larger share of the fees collected by securities firms for arranging the IPO.

Whirlpool surged 13 percent to $61.64 after also reporting a 20 percent gain in fourth-quarter profit. Cost reductions and price increases “positively impacted” the results last quarter, the company said today in a statement.

Resistance 3: Y77.30 (Jan 20 high)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (Jan 31 high)

The current price: Y76.11

Support 1: Y76.00 (Feb 1 low)

Support 2: Y75.60 (Oct 31 low)

Support 3: Y75.00 (psychological level)

Resistance 3: Chf0.9250 (Feb 1 high)

Resistance 2: Chf0.9225 (Jan 31 high)

Resistance 1: Chf0.9180 (middle line from Jan 27)

The current price: Chf0.9153

Support 1: Chf0.9115 (Feb 1 low)

Support 2: Chf0.9065 (Nov 30 low)

Support 3: Chf0.9020 (Nov 10 low)

Resistance 3 : $1.3290/00 (138.2 % FIBO $1.3025-$1.3215)

Resistance 2 : $1.3260 (123.6 % FIBO $1.3025-$1.3215)

Resistance 1 : $1.3215 (Feb 1 high)

The current price: $1.3166

Support 1 : $1.3115 (middle line from Jan 30)

Support 2 : $1.3075 (Jan 30 low, MA (233) H1)

Support 3 : $1.3025 (Feb 1 low)

Change % Change Last

Oil $97.44 -0.17 -0.17%

Gold $1,744.90 -2.20 -0.13%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3160 +0,59%

GBP/USD $1,5831 +0,47%

USD/CHF Chf0,9155 -0,49%

USD/JPY Y76,17 -0,11%

EUR/JPY Y100,24 +0,47%

GBP/JPY Y120,64 +0,40%

AUD/USD $1,0703 +0,78%

NZD/USD $0,8323 +0,70%

USD/CAD C$0,9984 -0,40%

00:30 Australia Building Permits, m/m December +8.4% +2.3%

00:30 Australia Building Permits, y/y December -18.9% -22.1%

00:30 Australia Trade Balance December 1.38 1.23

07:00 Switzerland Trade Balance December 3.00 2.85

09:30 United Kingdom PMI Construction January 53.2 53.0

10:00 Eurozone Producer Price Index, MoM December +0.2% -0.1%

10:00 Eurozone Producer Price Index (YoY) December +5.3% +4.3%

13:30 U.S. Initial Jobless Claims 28/01/2012 377 371

14:00 U.S. FOMC Member Charles Evans Speaks 0

15:00 U.S. Fed Chairman Bernanke Speaks 0

22:30 Australia AIG Services Index January 49.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.