- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 30-01-2012.

EU promises to take action against youth unemployment, the credit flows

The yen strengthened against all of its major counterparts as concern increased that Greek bailout negotiations will hinder efforts to resolve the financial crisis, boosting demand for haven assets.

The euro fell below 100 yen for the first time in a week as European Union leaders met in Brussels, and Italy raised less than its maximum target at a bond sale after Fitch Ratings downgraded the nation last week. The dollar touched the weakest against the yen since Oct. 31, when it reached a record low. The Swiss franc strengthened to the highest level against the euro since September.

EU leaders met to put the finishing touches on a German-led deficit-control treaty and endorse the statutes of a 500 billion-euro ($656 billion) rescue fund to be set up this year. While Greece and its private creditors said Jan. 28 they expect to complete a debt-swap deal to reduce the nation’s obligations in coming days, it now requires 145 billion euros for the second bailout, 15 billion euros more than was agreed in October, Der Spiegel reported Jan. 28.

Euro-area leaders are mulling policy responses to states that are “off-track” in fulfilling budget pledges, including supplying external advisers with decision powers to states in difficulty, German Finance Ministry spokesman Martin Kotthaus said at a press conference in Berlin.

Italy sold 7.5 billion euros of debt due between 2016 and 2022 today, less than its maximum target of 8 billion euros. Fitch cut the ratings of Italy, Spain, Belgium, Slovenia and Cyprus on Jan. 27, saying they lack financing flexibility in the face of the regional debt crisis. Italy was reduced two levels to A- from A+, and Spain was lowered two grades to A from AA-.

European stocks dropped the most in six weeks as Portuguese bonds sank amid concern a meeting of the region’s leaders will fail to draw a line under the sovereign- debt crisis.

European Union leaders gathered in Brussels for their first summit of 2012 as a deteriorating economy and the struggle to complete a Greek debt write off risk sidetracking efforts to stamp out the financial crisis. EU chiefs are discussing a German-led deficit-control treaty and the statutes of a 500 billion-euro ($661 billion) rescue fund to be set up this year.

The yield on Portugal’s 10-year bonds surged 217 basis points to a euro-era record of 17.39 percent today. Portuguese credit-default swaps also rose to a record, implying a 71 percent chance the government will default.

Euro-area confidence in the economic outlook improved less than forecast in January. An index of executive and consumer sentiment in the 17-nation euro area rose to 93.4 from a revised 92.8 in December, the European Commission said today.

National benchmark indexes fell in every western European market today, except Greece and Iceland. The U.K.’s FTSE 100 lost 1.1 percent, Germany’s DAX slid 1 percent and France’s CAC 40 retreated 1.6 percent.

BNP Paribas tumbled 7.1 percent to 32.18 euros and Societe Generale plunged 6.5 percent to 19.71 euros. The proposed 0.1 percent French transaction tax will apply to share purchases, including high-frequency trading, and CDS transactions, from August. Sarkozy said he expects revenue of 1 billion euros from the tax.

Philips lost 2.2 percent to 15.24 euros as the world’s biggest lightbulb maker reported a 162 million-euro net loss in the fourth quarter. That was wider than analysts’ estimates for a loss of 25.8 million euros.

Hochtief sank 5.8 percent to 48.07 euros after saying it will report a wider loss for 2011 than it had previously anticipated because of additional charges in the fourth quarter at its Australian subsidiary and costs related to the departure of executives. The German builder said the net loss for 2011 will be about 160 million euros, compared with a previous estimate for a loss of about 100 million euros.

ThyssenKrupp AG and Salzgitter AG, Germany’s biggest steelmakers, fell 3.6 percent to 21.11 euros and 5.1 percent to 45.47 euros, respectively.

U.S. stocks fell, sending the Standard & Poor’s 500 Index toward its biggest drop in a month, as European leaders sparred with Greece over a rescue program.

European leaders won’t finalize Greece’s second aid program today because talks with banks over debt reduction aren’t completed, German Chancellor Angela Merkel said. Greek Finance Minister Evangelos Venizelos rejected reports of plans to appoint a commissioner, citing “national dignity.” U.S. consumer spending stalled in December, a report today showed.

Dow 12,582.69 -77.77 -0.61%, Nasdaq 2,805.08 -11.47 -0.41%, S&P 500 1,307.56 -8.77 -0.67%

American banks fell as a gauge of European lenders retreated 3.1 percent. Bank of America (ВАС) declined 3 percent to $7.07 after Goldman Sachs cut its recommendation for the shares to “neutral” from “buy.”

Halliburton (HAL) decreased 1.6 percent to $36.49. Alcoa (АА) slipped 1.4 percent to $10.28.

Wendy’s Co. fell 2.2 percent to $5.10. The operator of fast-food restaurants forecast adjusted earnings before interest, taxes, depreciation and amortization in 2012 of $345 million at most. That compares with the average analyst estimate in a Bloomberg survey of $353.1 million.

Staples Inc. declined 5.6 percent to $15.11. The world’s largest office products company was cut to “sell” from “neutral” by Goldman Sachs, which cited a “tough” outlook for the global printing segment.

Oil prices are falling amid fears of investors about the negative results of the EU summit.European heads of states will discuss a number of important issues including, inter alia, an agreement on fiscal stability in the EU.

In addition to the EU summit, the focus of markets continues to be the situation with the debts of Greece. Trying to avoid a default, the country is in talks with private creditors to write off the debt of some 100 billion euros, as well as the "troika" of international donors (European Commission, ECB and IMF) on a new 130-billion aid package in exchange for tight fiscal program. Pressure on lenders to Greece with the requirement to perform multiple indicators Failed budget program reached its peak this weekend, when the international press has been the proposal of Germany de facto deprive Athens control over their own policies.

In turn, Iran will limit the supply of oil in the country, threatening the Islamic republic with economic sanctions. This was stated by Minister of the country's oil Rustam Kashemi. Oil Minister said that the export restrictions will not cause serious harm to the economy of Iran.

Crude for March delivery fell 16 cents to $98.50 a barrel on the New York Mercantile Exchange. Prices have gained 0.6 percent this month. Brent oil for March settlement dropped 27 cents to $111.19 a barrel on the London-based ICE Futures Europe exchange.

Gold prices down on the background of decreasing willingness to take risks, while on a seven-week stay near the maximum.

Euro falls from a maximum of six weeks against the dollar and stock markets came underpressure, because Greece is not able to negotiate with creditors prior to EU summit, which starts on Monday.

Stocks ETF backed by gold funds last week increased by almost 200,000 ounces to 69.324 million ounces.

Cost of the February gold futures on the COMEX today declined to 1715.7 dollars per ounce.

EUR/USD $1.3000, $1.3075, $1.3100, $1.3225, $1.3250

USD/JPY Y76.80, Y77.00, Y77.15

AUD/USD $1.0700, $1.0375

EUR/CHF Chf1.2025

GBP/USD $1.5700, $1.5530, $1.5500

EUR/JPY Y101.00, Y100.00

U.S. stock futures fell amid concern about Europe’s debt crisis as Greece signaled opposition to economic oversight in exchange for aid.

Global Stocks:

Nikkei 8,793 -48.17 -0.54%

Hang Seng 20,160 -341.26 -1.66%

Shanghai Composite 2,285 -34.08 -1.47%

FTSE 5,666 -67.00 -1.17%

CAC 3,271 -48.12 -1.45%

DAX 6,425 -87.10 -1.34%

Crude oil: $98.68 (-0,9%).

Gold: $1724.70 (-0,4%).

Data:

10:00 Eurozone Business climate indicator January -0.31 -0.25 -0.12

10:00 Eurozone Economic sentiment index January 93.3 93.8 93.4

13:00 Germany CPI, m/m (preliminary) January +0.7% -0.4% -0.4%

13:00 Germany CPI, y/y (preliminary) January +2.1% +2.0% +2.0%

The euro fell for the first time in six days against the dollar as European Union leaders prepared to meet in Brussels amid concern Greek bailout negotiations will hinder efforts to resolve the financial crisis.

The common currency slid for a third day versus the yen as Italy raised less than its maximum target at a bond sale after Fitch Ratings downgraded the nation last week.

EU leaders will meet in Brussels today to put the finishing touches on a German-led deficit-control treaty and endorse the statutes of a 500 billion-euro rescue fund to be set up this year.

EUR/USD: the pair decreased, showed session low slightly above $1,3100.

GBP/USD: the pair has fallen in $1,5650 area, but slightly restored later.

USD/JPY: the pair was limited Y76.60-Y76,75.

US data starts at 1330GMT with personal income data, which is expected to rise 0.4% in December, as payrolls jumped 200,000, the average workweek grew by 0.1 hours, and hourly earnings rose 0.2%. The weekly MNI Capital Goods Index is due at 1430GMT, followed at 1530GMT by the weekly MNI Retail Trade Index. Also at 1530GMT, the Dallas Fed Manufacturing Outlook Survey is due. Late US data ses quarterly borrowing requirements at 2000GMT.

"We wonder whether the Fed is being too pessimistic in its unemployment projections because our analysis suggests the rate could decline significantly further over the next 12 months-much more than what is assumed in the Fed's forecasts. If this happens, the timing of the Fed's first rate hike will be brought forward from late 2014 into either early 2014 or possibly the second half of 2013."

EUR/USD

Offers $1.3300, $1.3260/80, $1.3200, $1.3180/85, $1.3150

Bids $1.3100/090, $1.3050/30, $1.3010/00, $1.2980

GBP/USD

Offers $1.5770/80, $1.5750, $1.5715/20

Bids $1.5650/40, $1.5610/00

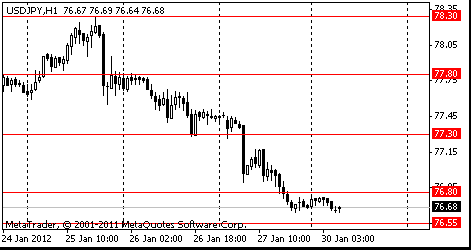

Resistance 3: Y78.50 (Jan 27 high)

Resistance 2: Y77.20 (hourly high on Jan 27, МА (200) for Н1)

Resistance 1: Y76.80 (session high)

Current price: Y76.67

Support 1:Y76.55 (Jan 17 low)

Support 2:Y76.00 (psychological level)

Support 3:Y75.60 (historic low)

Resistance 3: Chf0.9340 (Jan 25 high, 50.0 % FIBO Chf0.9570-Chf0.9120)

Resistance 2: Chf0.9290 (38,2 % FIBO Chf0.9570-Chf0.9120)

Resistance 1: Chf0.9230 (Jan 26-27 high, Jan 24 high, resistance line from Jan 17)

Current price: Chf0.9187

Support 1: Chf0.9160/50 (intraday low, Jan 26 low)

Support 2: Chf0.9120 (session low)

Support 3: Chf0.9060 (low of December)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5780 (high of December)

Resistance 1 : $1.5730 (session high, Jan 26-27 high)

Current price: $1.5692

Support 1 : $1.5660 (area of session low and support line from Jan 13)

Support 2 : $1.5640 (Jan 27 low)

Support 3 : $1.5540 (area of Jan 24-25 lows, 38,2 % FIBO $1,5230-$ 1,5730)

Resistance 3 : $1.3270 ( support line January'2011 broced earlier)

Resistance 2 : $1.3230/45 (session high, 38,2 % FIBO $1,4250-$ 1,2620)

Resistance 1 : $1.3155 (50.0 % of today's decrease)

Current price: $1.3121

Support 1 : $1.3080 (Jan 27 low)

Support 2 : $1.3040 (hourly low on Jan 25, earlier resistance)

Support 3 : $1.3000 (38,2 % FIBO $1,2620-$ 1,3230, МА (200) for Н1)

E3.574bln 2017; avg yield 5.39%, cover 1.297;

E2bln 2022;avg yield 6.08% (6.98%),cover 1.42 (1.36);

E746mln 2016; avg yield 4.79%, cover 1.87;

E1.155bln 2021; avg yield 5.74%, cover 1.50.

EUR/USD $1.3000, $1.3075, $1.3100, $1.3225, $1.3250

USD/JPY Y76.80, Y77.00, Y77.15

AUD/USD $1.0700, $1.0375

EUR/CHF Chf1.2025

GBP/USD $1.5700, $1.5530, $1.5500

EUR/JPY Y101.00, Y100.00

Asian stocks fell, with a regional benchmark index dropping from a three-month high, ahead of a European summit on the region’s debt crisis and after the U.S. economy expanded less than forecast, hurting the earnings outlook for exporters.

Nikkei 225 8,793 -48.17 -0.54%

Hang Seng 20,230 -271.88 -1.33%

S&P/ASX 200 4,273 -15.63 -0.36%

Shanghai Composite 2,285 -34.08 -1.47%

James Hardie Industries SE (JHX), a building materials supplier that counts the U.S. as its biggest market, fell 1.7 percent in Sydney.

Mitsubishi Electric Corp. slumped 15 percent after Japan barred the electronics maker from bidding on state contracts.

Advantest Corp. jumped 12 percent after the maker of memory-chip testers increased its dividend.

The euro declined against the dollar, snapping a five-day gain, before European Union leaders meet in Brussels to discuss the region’s debt crisis. EU leaders will meet in the Belgian capital today to put the finishing touches on a German-led deficit-control treaty and endorse the statutes of a 500 billion-euro ($659 billion) rescue fund to be set up this year. Greece and its creditors are “close” to an agreement on a debt exchange within a framework outlined by Luxembourg Prime Minister Jean-Claude Juncker, according to a Jan. 28 statement from the Institute of International Finance, which is negotiating on behalf of private bondholders. Italy is scheduled to sell debt maturing in 2016, 2017, 2021 and 2022 today. Fitch cut the ratings of Italy, Spain and three other euro-area countries on Jan. 27, saying they lack financing flexibility in the face of the regional debt crisis.

Italy, the euro area’s third-largest economy, was cut two levels to A- from A+. Spain was also lowered two grades, to A from AA-. Ratings on Belgium, Slovenia and Cyprus were also reduced, while Ireland’s was maintained.

The yen advanced for a third day versus the 17-nation euro as Italy prepares to sell bonds today after the country was downgraded by Fitch Ratings. Demand for the euro was supported amid speculation Greece and its private-sector creditors will reach an agreement on a debt-swap plan this week.

EUR/USD: during the Asian session the pair fell.

GBP/USD: during the Asian session the pair decreased below $1.5700.

USD/JPY: during the Asian session the pair was in range Y76.65-Y76.75.

EMU data sees the 1000GMT release of the January economic sentiment survey and business climate indicator. US data starts at 1330GMT with personal income data, which is expected to rise 0.4% in December, as payrolls jumped 200,000, the average workweek grew by 0.1 hours, and hourly earnings rose 0.2%. The weekly MNI Capital Goods Index is due at 1430GMT, followed at 1530GMT by the weekly MNI Retail Trade Index. Also at 1530GMT, the Dallas Fed Manufacturing Outlook Survey is due. Late US data ses quarterly borrowing requirements at 2000GMT.

On Monday the euro strengthened to an almost three-week high against the dollar as French Finance Minister Francois Baroin said negotiations between Greece and its private creditors are making “tangible progress.” The 17-nation currency gained versus 13 of its 16 major counterparts tracked by Bloomberg as European Union finance ministers gather in Brussels to discuss a Greek debt swap, budget rules and a financial firewall to protect indebted nations.

On Tuesday the dollar rose, reaching the highest level this year against the yen, as European policy makers and Greek bondholders failed to reach an agreement on a debt-swap plan for the indebted nation, spurring safety demand. The yen fell against 12 of 16 major peers tracked by Bloomberg after the Bank of Japan cut its economic growth forecast for next year. The euro reached the highest level in almost four weeks against the yen earlier after a report showed European services and manufacturing industries unexpectedly expanded in January.

On Wednesday the dollar fell to the weakest level in a month against the euro after the Federal Reserve extended its pledge to hold its target for the federal funds rate low until late 2014 amid a “highly accommodative” monetary policy. The central bank had previously pledged to keep its rate target in place until mid-2013. Nine of 17 Federal Reserve officials expect borrowing costs will remain below 1 percent at the end of 2014, with six officials expecting zero rates to remain into 2015.

On Thursday the dollar weakened versus all its 16 most-traded counterparts as the Federal Reserve’s pledge to keep interest rates at a record low for longer than originally forecast spurred investors to seek higher yields. The U.S. currency touched a five-week low against the euro after policy makers said yesterday the benchmark interest rate would stay low until at least late 2014 from mid-2013 and as Italian yields fell to a six-week low. The euro rallied earlier as Italian 10-year yields fell below 6 percent for the first time since Dec. 8. The nation sold its maximum target at an auction of zero-coupon and inflation- linked debt.

On Friday the euro gained for a fifth day against the dollar, the longest streak in three months, after European Union Economic and Monetary Affairs Commissioner Olli Rehn said Greece was “close” to reaching agreement with its creditors. The 17-nation currency extended gains after a report showed U.S. consumer confidence this month was the highest in almost a year. The euro was supported as Italy sold bills, benefitting the European Central Bank’s efforts to fight the spread of the debt crisis by shoring up banks.

Resistance 3: Y77.80 (Jan 26 high)

Resistance 2: Y77.30 (Jan 20 high)

Resistance 1: Y76.80 (session high)

The current price: Y76.68

Support 1: Y76.55 (Jan 17 low)

Support 2: Y76.10 (Sep 21 low)

Support 3: Y75.60 (Oct 31 low)

Resistance 3: Chf0.9290 (high of the Asian session on Jan 25, MA(233) H1)

Resistance 2: Chf0.9225 (Jan 26-27 high)

Resistance 1: Chf0.9175 (middle line from Jan 17)

The current price: Chf0.9150

Support 1: Chf0.9120 (session low)

Support 2: Chf0.9065 (Nov 30 low)

Support 3: Chf0.9020 (Nov 10 low)

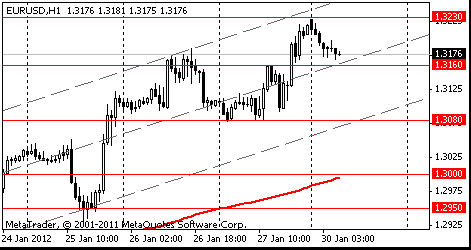

Resistance 3 : $1.3430 (Dec 9 high)

Resistance 2 : $1.3360 (high of the European session on Dec 12)

Resistance 1 : $1.3230 (session high)

The current price: $1.3176

Support 1 : $1.3160 (middle line from Jan 17)

Support 2 : $1.3080 (Jan 27 low, support line from Jan 17)

Support 3 : $1.3000 (MA (233) H1, 38.2 FIBO $1.3230-$1.2625)

09:00 Eurozone EU Economic Summit 0

10:00 Eurozone Business climate indicator January -0.31 -0.25

10:00 Eurozone Economic sentiment index January 93.3 93.8

13:00 Germany CPI, m/m (preliminary) January +0.7% -0.4%

13:00 Germany CPI, y/y (preliminary) January +2.1% +2.0%

13:30 U.S. Personal Income, m/m December +0.1% +0.3%

13:30 U.S. Personal spending December +0.1% +0.2%

13:30 U.S. PCE price index ex food, energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7%

21:45 New Zealand Building Permits, m/m December -6.4% +8.0%

23:30 Japan Unemployment Rate December 4.5% 4.5%

23:30 Japan Household spending Y/Y December -3.2% -0.1%

23:50 Japan Industrial Production (MoM) (preliminary) December -2.6% +2.6%

23:50 Japan Industrial Production (YoY) (preliminary) December -4.2% -5.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.