- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 25-01-2012.

The dollar fell to the weakest level in a month against the euro after the Federal Reserve extended its pledge to hold its target for the federal funds rate low until late 2014 amid a “highly accommodative” monetary policy. The central bank had previously pledged to keep its rate target in place until mid-2013. Nine of 17 Federal Reserve officials expect borrowing costs will remain below 1 percent at the end of 2014, with six officials expecting zero rates to remain into 2015. The projections by Federal Open Market Committee participants, released for the first time today in Washington, provide an unprecedented look at policy makers’ plans for the path of the benchmark interest rate, which has remained near zero since December 2008. An increase in 2014 would mark the first rise in the fed funds rate since June 2006. Policy makers also lowered their estimates for growth and inflation in 2012, a move consistent with their statement earlier today that interest rates will remain “exceptionally low” through at least late 2014.

The yen fell against most its major counterparts after the Ministry of Finance said Japan’s exports dropped 8 percent in December from a year earlier. The median estimate of 27 economists surveyed by Bloomberg News was for a 7.4 percent decline. The Japanese currency is viewed as a safe haven because the nation’s trade surplus makes the currency attractive because it means the nation doesn’t have to rely on overseas lenders.

European stocks fell for a second day after Ericsson AB and Novartis AG posted earnings that missed analysts’ estimates. The U.K. economy shrank in the fourth quarter more than economists had forecast as manufacturers cut output and services stagnated, leaving Britain on the brink of another recession. Bank of England policy makers voted unanimously this month to keep their target for bond purchases unchanged, with some officials saying more stimulus is “likely” to be needed after the current program is complete.

The Federal Reserve will release rate forecasts for the first time today. Business and political leaders gathered in Davos, Switzerland, for the start of the World Economic Forum’s annual meeting.

National benchmark indexes fell in 12 of the 18 western- European markets today. The U.K.’s FTSE 100 Index slid 0.5 percent, France’s CAC 40 Index declined 0.3 percent and Germany’s DAX Index added less than 0.1 percent.

Ericsson, the world’s largest maker of wireless networks, plunged 14 percent after reporting fourth-quarter net income that missed analysts’ estimates.

Novartis, Europe’s biggest drugmaker by sales, declined 2.5 percent.

ARM Holdings Plc climbed 3 percent after Apple Inc. posted quarterly profit that more than doubled. ARM is the U.K. owner of chip technology used in Apple’s iPhone and iPad.

U.S. stocks rose, erasing an earlier loss in the Standard & Poor’s 500 Index, as the Federal Reserve said interest rates will remain low until late 2014 and Apple Inc. rallied after earnings more than doubled.

Federal Reserve officials said their benchmark interest rate will stay low until at least late 2014 and anticipate that unemployment will remain high and inflation “subdued.” The Fed extended its previous pledge to keep rates low at least until the middle of 2013 as inflation remains tame and more than two years of economic growth have failed to push unemployment below 8.5 percent.

Apple rallied 6 percent to $445.64. The gain gives Apple a market value of about $419 billion, higher than Exxon Mobil Corp.’s $414 billion. Quarterly profit more than doubled as surging demand for the iPhone and iPad cemented its role as the most valuable technology company and ramped up pressure on rivals Google Inc. and Samsung Electronics Co.

Textron Inc. added 16 percent, the most in the S&P 500, to $24.97. Chief Executive Officer Scott Donnelly is working to leverage the company’s businesses with measures such as having Cessna and Bell share overseas service centers and sales forces. Textron is winding down its finance unit, which struggled during the recession.

Xerox lost 8.6 percent to $7.93. The provider of printers and business services gave earnings forecasts that trailed some analysts’ estimates as companies curb spending. Xerox is relying on demand for business services to boost sales as a slowing global economy weighs on information-technology spending.

Nvidia declined 1.7 percent to $14.68. The company followed other PC chipmakers in reporting lower-than-anticipated sales, hurt by last year’s flooding in Thailand. The disaster shut down production of disk drives, leading to a decline in computer shipments.

Offers above, as noted, said layered into $1.3100.

The Fed left interest rate range for the federal funds unchanged between 0.0% and 0.25%

Interest rates remain extremely low, at least until the end of 2014

The economy is growing at a moderate pace despite the slowdown in world economic growth

There is a further improvement in the labor market, but unemployment remains high

Investment companies slowed

The German reforms have improved the situation on the labor market

The implementation of structural reforms will lead to job growth

Struggle with deficiencies will take time

Some EU countries do not have competitive

Oil rose as a U.S. government report showed fuel demand increased last week and gasoline production dropped to the lowest level in almost two years.

Futures climbed as much as 0.6 percent after the Energy Department reported that total fuel consumption increased 7.5 percent to 19.2 million barrels a day in the week ended Jan. 20. Gasoline output tumbled 2.8 percent to 8.54 million barrels, the least since February 2010. Crude supplies rose 3.56 million barrels as fuel inventories dropped, the report showed.

Crude oil for March delivery rose 34 cents, or 0.3 percent, to $99.29 a barrel at 11:20 a.m. on the New York Mercantile Exchange. Futures traded at $97.70 a barrel before the release of the report at 10:30 a.m. in Washington. Prices are up 15 percent from a year earlier.

Brent oil for March settlement increased 52 cents, or 0.5 percent, to $110.55 a barrel on the London-based ICE Futures Europe exchange.

Gold prices are falling the second day in a row before the U.S. Federal Reserve decision on interest rates and long-term forecast of monetary policy.

Investors are waiting for long-term forecast the Fed's policy the United States, while analysts expect the central bank will not raise interest rates until at least 2014. If the central bank to convince the markets that interest rates remain at current levels for longer than expected, the dollar could fall, which will give impetus to the growth of gold.

Demand for gold in China is low, because the markets are closed for New Year celebrations of the lunar calendar, and buyers in India - the largest consumer of gold - are waiting for further price decrease with the increase in rupee against the dollar.

Stocks ETF backed by gold funds fell this week to 68.993 million ounces to 69.163 million last week.

Cost of the February gold futures on the COMEX today dropped to 1649.2 dollars per ounce.

EUR/USD $1.2850, $1.2900, $1.2950, $1.3000, $1.3050-60, $1.3100

USD/JPY Y77.50, Y77.75, Y78.00

AUD/USD $1.0500, $1.0475, $1.0400

EUR/GBP stg0.8300

GBP/USD $1.5500

Data:

09:00 Germany IFO - Business Climate January 107.2 107.7 108.3

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom GDP, q/q (preliminary) IV quarter +0.6% -0.1% -0.2%

09:30 United Kingdom GDP, y/y (preliminary) IV quarter +0.5% +0.8% +0.8%

09:30 United Kingdom Mortgage Approvals December 34.7 35.3 36.2

11:00 United Kingdom CBI industrial order books balance January -23 -19 -16

The euro fell after the European Central Bank was said to oppose restructuring its Greek bonds, adding to concern the nation will fail to win a deal to reduce its debt.

The yen slumped to the weakest level in almost two months against the U.S. currency after Japan reported its first annual trade deficit in 31 years, stoking concern the country’s fiscal health may deteriorate.

The dollar climbed before the Federal Open Market Committee’s first release of interest-rate forecasts. Australia’s currency climbed against the yen after the nation’s core inflation accelerated more than forecast.

EUR/USD: the pair showed low in area $1,2930. The rate receded later in $1,2950 area.

GBP/USD: the pair showed low in area $1,5530. The rate receded later in $1,5570 area.

USD/JPY: the pair become stronger above Y78.00.

At 1500GMT, NAR pending home sales are due along with the FHFA Home Price Index and also BLS Mass Layoffs data. This is followed at 1530GMT by the weekly EIA crude oil stocks data. At 1730GMT, the US Federal Open Market Committee decision is due. Also, this time around, from 1900GMT, the Federal Reserve will publish the FOMC participants federal funds rate projections for the first time, which will be ccompanied by updated quarterly economic assumptions. After this, at 1915GMT, Federal Reserve Chairman Ben Bernanke holds a news conference to provide additional context for the FOMC's policy decision.

EUR/USD

Offers $1.3120/30, $1.3100, $1.3075/85, $1.2995/005

Bids $1.2930/20, $1.2910/00, $1.2885/80, $1.2860/50

Resistance 3: Y79.50 (high of October) Resistance 2: Y79.00 (high of November) Resistance 1: Y78.20/30 (area of session high, high of December and МА (200) for D1) Current price: Y78.10 Support 1:Y77.80 (low of european session) Support 2:Y77.60 (session low) Support 3:Y77.30 (Jan 19-20 lows)

Resistance 3: Chf0.9400 (50,0 % FIBO Chf0,9570-Chf0,9230)

Resistance 2: Chf0.9380 (Jan 23 high)

Resistance 1: Chf0.9360 (38,2 % FIBO Chf0,9570-Chf0,9230)

Current price: Chf0.9329

Support 1: Chf0.9310 (Jan 24 high)

Support 2: Chf0.9270 (session low)

Support 3: Chf0.9230 (Jan 24 low)

- have not managed to stabilize situation in Greece;

- no point to pledge more money without tackling crisis cause;

- can only strengthen euro if we give more power to the EU;

- Eurobonds only possible after greater EU integration.

- have not managed to stabilize situation in Greece;

- no point to pledge more money without tackling crisis cause;

- can only strengthen euro if we give more power to the EU;

- Eurobonds only possible after greater EU integration.

Resistance 3 : $1.5670 (high of January)

Resistance 2 : $1.5620 (session high, Jan 24 high)

Resistance 1 : $1.5600 (intraday high)

Current price: $1.5578

Support 1 : $1.5530/15 (session low, Jan 23-24 lows, МА (200) for Н4)

Support 2 : $1.5475 (38,2 % FIBO $1,5230-$ 1,5620)

Support 3 : $1.5450 (Jan 20 low)

Resistance 3 : $1.3080 (high of January and Dec 26-28 highs)

Resistance 2 : $1.3050 (area of session high and Dec 23 high)

Resistance 1 : $1.3000 (intraday high)

Current price: $1.2968

Support 1 : $1.2950 (Jan 24 low)

Support 2 : $1.2895/80 (38,2 % FIBO $1.2620-$ 1.3060, Jan 20-23 lows)

Support 3 : $1.2840 (50,0 % FIBO $1.2620-$ 1.3060, Jan 19 low)

EUR/USD $1.2850, $1.2900, $1.2950, $1.3000, $1.3050-60, $1.3100

USD/JPY Y77.50, Y77.75, Y78.00

AUD/USD $1.0500, $1.0475, $1.0400

EUR/GBP stg0.8300

GBP/USD $1.5500

Asian stocks rose, with the regional benchmark index set for the highest close in almost three months, after the yen fell and Apple Inc. reported quarterly profit more than doubled, boosting the earnings outlook for Asian exporters.

Nikkei 225 8,884 +98.36 +1.12%

Hang Seng Closed

S&P/ASX 200 4,271 +47.11 +1.12%

Shanghai Composite Closed

Sony Corp. (6758), Japan’s No. 1 exporter of consumer electronics, advanced 4.8 percent. Hynix Semiconductor Inc. (000660) paced gains among suppliers to Apple after the world’s largest technology company gained in after-hours trading. Lynas Corp., an Australian rare- earths miner, rose 5.1 percent after selling a $225 million convertible bond to help fund a delayed refinery.

Yesterday the dollar rose, reaching the highest level this year against the yen, as European policy makers and Greek bondholders failed to reach an agreement on a debt-swap plan for the indebted nation, spurring safety demand.

The yen fell against 12 of 16 major peers tracked by Bloomberg after the Bank of Japan cut its economic growth forecast for next year.

The euro reached the highest level in almost four weeks against the yen earlier after a report showed European services and manufacturing industries unexpectedly expanded in January.

The pound rose against most peers after a report showed the budget deficit shrank in December more than predicted.

EUR/USD: yesterday the pair was under pressure, however was restored later.

GBP/USD: yesterday the pair has grown on a floor of a figure.

USD/JPY: yesterday the pair gain and showed new high of 2012.

On Wednesday UK data at 0930GMT includes the first estimate of Q4 GDP as well as BBA Lending data and the latest Index of Services, while at the same time the latest bank of England MPC meeting minutes are due along with the BoE Agents Report. Main European data stats at 0900GMT with the German IFO business survey. In Davos, Swiss Finance Minister Eveline Widmer-Schlumf is due to speak at 1600GMT, followed at 1630GMT by German chancellor Angela Merkel. US data starts at 1200GMT with the weekly MBA mortgage applications data. At 1500GMT, NAR pending home sales are due along with the FHFA Home Price Index and also BLS Mass Layoffs data. This is followed at 1530GMT by the weekly EIA crude oil stocks data. At 1730GMT, the US Federal Open Market Committee decision is due. Also, this time around, from 1900GMT, the Federal Reserve will publish the FOMC participants federal funds rate projections for the first time, which will be ccompanied by updated quarterly economic assumptions. After this, at 1915GMT, Federal Reserve Chairman Ben Bernanke holds a news conference to provide additional context for the FOMC's policy decision.

Asia’s benchmark stock index maintained gains for a sixth day after a stalemate emerged between European policy makers and Greek bondholders.

Nintendo Co. (7974), a Japanese maker of video-game players that gets 34 percent of its sales in Europe, rose 1.5 percent.

Mirabela Nickel Ltd. (MBN), an Australian nickel producer, slumped 13 percent after analysts cut their recommendations on the stock.

Elpida Memory Inc. (6665) advanced 4.6 percent after a newspaper reported the chipmaker is in merger talks with Micron Technology Inc. and Nanya Technology Corp. (2408)

European stocks declined from a five-month high as the region’s finance ministers failed to agree on a debt-swap deal for Greece and called for a greater contribution from bondholders.

The region’s finance ministers, meeting in Brussels yesterday, balked at putting up more public money for Greece, calling on bondholders to provide greater debt relief in order to point the way out of the two-year-old debt crisis.

National benchmark indexes fell in 14 of the 18 western European markets. France’s CAC 40 lost 0.5 percent, as did the U.K.’s FTSE 100. Germany’s DAX retreated 0.3 percent.

A gauge of banking shares fell 1 percent. Societe Generale retreated 5.4 percent to 21.57 euros. Credit Agricole lost 4.1 percent to 5 euros. Societe Generale, France’s second-largest lender, and Credit Agricole had their ratings downgraded to A from A+, with a stable outlook, S&P said yesterday.

Petroplus sank 84 percent to 24 centimes, its biggest decline and the lowest price since it issued shares to the public in November 2006. The company said it plans to file for insolvency in Switzerland and other jurisdictions. The Swiss refiner that has been trying to avoid bankruptcy had about $1 billion in credit lines suspended last month, preventing it from supplying its plants with crude.

Siemens declined 1.3 percent to 77.39 euros. The company said achieving its full-year goals has become harder to reach after profitability at its four divisions slipped as the debt crisis weighs on the economy.

U.S. stocks retreated, ending a five-day advance in the Standard & Poor’s 500 Index, amid a stalemate between European finance ministers and Greek bondholders over how to resolve the nation’s debt crisis.

Global stocks slumped as European finance ministers pushed bondholders to provide greater debt relief for Greece, spurring concern the nation may fail to make a March 20 bond payment. The International Monetary Fund cut its forecast for the global economy. President Barack Obama tonight will lay out what he calls a “blueprint” for revitalizing the economy in his third State of the Union address before a joint session of Congress. The Federal Reserve began a two-day policy meeting.

Travelers Cos., the only insurer in the Dow Jones Industrial Average, sank 3.8 percent as earnings fell.

McDonald’s Corp. slid 2.2 percent as the restaurant chain said foreign-currency fluctuations will cut 2012 profit.

Verizon Communications Inc. lost 1.6 percent after the phone company reported a loss.

EMC Corp. advanced 7.3 percent to $25.14 after reporting a 32 percent increase in fourth-quarter earnings as data growth spurs demand for its products and software from majority-owned

Resistance 3: Chf0.9410 (Jan 19 high)

Resistance 2: Chf0.9380 (Jan 23 high, MA (233) H1)

Resistance 1: Chf0.9310 (Jan 24 high)

The current price: Chf0.9286

Support 1: Chf0.9235/50 (area of Jan 23-24 lows)

Support 2: Chf0.9180 (Dec 9 low)

Support 3: Chf0.9140 (Nov 29 low)

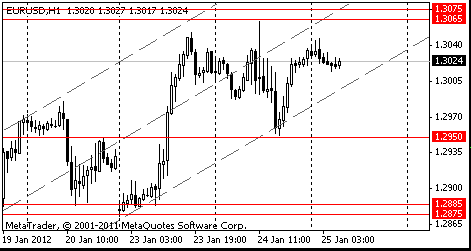

Resistance 3 : $1.3200 (Dec 21 high)

Resistance 2 : $1.3130 (Dec 20 high)

Resistance 1 : $1.3065/75 (area of Jan 3-4 and 24 highs)

The current price: $1.3024

Support 1 : $1.2950 (Jan 24 low)

Support 2 : $1.2875/85 (area of Jan 20-23 lows)

Support 3 : $1.2840 (Jan 19 low)

Change % Change Last

Oil $99.09 +0.14 +0.14%

Gold $1,665.50 +1.00 +0.06%

Change % Change Last

Nikkei 225 8,785 +19.43 +0.22%

Hang Seng Closed

S&P/ASX 200 4,224 -0.88 -0.02%

Shanghai Composite Closed

FTSE 100 5,752 -30.66 -0.53%CAC 40 3,323 -15.77 -0.47%

DAX 6,419 -17.40 -0.27%

Dow 12,675.75 -33.07 -0.26%

Nasdaq 2,786.64 +2.47 +0.09%

S&P 500 1,314.63 -1.37 -0.10%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3035 +0,17%

GBP/USD $1,5624 +0,38%

USD/CHF Chf0,9274 -0,03%

USD/JPY Y77,65 +0,81%

EUR/JPY Y101,24 +1,02%

GBP/JPY Y121,34 +1,22%

AUD/USD $1,0493 -0,29%

NZD/USD $0,8118 +0,23%

USD/CAD C$1,0087 +0,05%

00:00 China Bank holiday 0

00:30 Australia CPI, q/q IV quarter +0.6% +0.2%

00:30 Australia CPI, y/y IV quarter +3.5% +3.3%

02:00 U.S. President Obama Speaks 0

05:00 Japan BoJ monthly economic report 0

08:00 Canada BOC Gov Carney Speaks 0

09:00 Germany IFO - Business Climate January 107.2 107.7

09:00 Switzerland World Economic Forum Annual Meetings 0

09:30 United Kingdom Bank of England Minutes 0

09:30 United Kingdom GDP, q/q (preliminary) IV quarter +0.6% -0.1%

09:30 United Kingdom GDP, y/y (preliminary) IV quarter +0.5% +0.8%

09:30 United Kingdom Mortgage Approvals December 34.7 35.3

11:00 United Kingdom CBI industrial order books balance January -23 -19

13:15 Eurozone ECB President Mario Draghi Speaks 0

15:00 U.S. Pending Home Sales (MoM) December +7.3% -0.3%

15:30 U.S. EIA Crude Oil Stocks change 20/01/12 -3.4

19:15 U.S. Fed Interest Rate Decision 0 0.25% 0.25%

20:00 New Zealand RBNZ Interest Rate Decision 0 2.50% 2.50%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.