- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 27-01-2012.

The euro gained for a fifth day against the dollar, the longest streak in three months, after European Union Economic and Monetary Affairs Commissioner Olli Rehn said Greece was “close” to reaching agreement with its creditors. The 17-nation currency extended gains after a report showed U.S. consumer confidence this month was the highest in almost a year. The euro was supported as Italy sold bills, benefitting the European Central Bank’s efforts to fight the spread of the debt crisis by shoring up banks.

The Dollar Index headed for its second weekly decline after the Federal Reserve’s pledge to keep interest rates low for at least three more years. The dollar strengthened earlier after U.S. gross domestic product climbed at a 2.8 percent annual following a 1.8 percent gain in the prior quarter, Commerce Department figures showed today in Washington. The U.S. currency headed for a weekly loss against all 16 of its major counterparts as the Fed’s pledge to keep interest rates near zero percent until the end of 2014 spurred investors to search for yield. The Dollar Index, which tracks the U.S. currency against those of six trading partners, declined for a third day, dropping 0.5 percent to 78.977.

The yen rose against all its 16 most-traded counterparts. It added 0.8 percent to 81.67 versus the Australian dollar and jumped 0.7 percent to 63.19 against New Zealand’s currency as technical indicators showed the Japanese currency may have fallen too far, too quickly.

European stocks dropped from a five- month high as a report showed that the U.S. economy grew at a slower pace in the fourth quarter than economists had predicted.

A U.S. Commerce Department report today showed that the world’s largest economy expanded in the fourth quarter at a slower pace than economists had forecast. Gross domestic product, the value of all goods and services produced, grew at a 2.8 percent annual pace.

European Union Economic and Monetary Affairs Commissioner Olli Rehn said Greece’s government will probably reach an agreement on a debt swap with its private creditors this month.

The Institute of International Finance said that it made “some progress” at a meeting last night in Athens between managing director Charles Dallara and Greek Prime Minister Lucas Papademos. Talks continued today.

National benchmark indexes fell in every western European market except Iceland today. The U.K.’s FTSE 100 Index slid 1.1 percent, France’s CAC 40 Index declined 1.3 percent and Germany’s DAX Index lost 0.4 percent.

BP retreated 2.6 percent to 464.55 pence for the biggest drag on the Stoxx 600. A judge ruled that the U.K. oil company can’t collect from Transocean part of the $40 billion in cleanup costs and economic losses caused by the 2010 Gulf of Mexico spill. BP sued Transocean in April to recover a share of its damages and costs. The blowout of the Macondo well led to the world’s largest accidental oil spill.

Transocean advanced 0.9 percent to 43.83 Swiss francs.

BNP Paribas retreated 3.3 percent to 34.64 euros after JPMorgan downgraded France’s biggest bank to “neutral” from “overweight.” Credit Agricole SA dropped 1.6 percent to 4.94 euros.

Waertsilae Oyj, the world’s largest maker of ship motors and power plants, fell 5.3 percent to 25.54 euros after reporting fourth-quarter sales of 1.24 billion euros, missing the average analyst estimate of 1.38 billion euros. The company posted operating profit of 145 million euros, falling short of the average projection of 151 million euros.

U.S. stocks declined, erasing a weekly advance in the Standard & Poor’s 500 Index, after a report showed the world’s largest economy expanded less than forecast in the fourth quarter as consumers curbed spending.

Equities fell amid government data showing that gross domestic product, the value of all goods and services produced, climbed at a 2.8 percent annual rate following a 1.8 percent gain in the prior quarter. The median forecast of 79 economists surveyed by Bloomberg News called for a 3 percent increase. Growth excluding a jump in inventories was 0.8 percent.

Ford slumped 3.5 percent to $12.30. In the fourth quarter, the Dearborn, Michigan-based automaker was hamstrung by a weakening European market and flooding in Thailand that wiped out profits in its Asian operations, Chief Financial Officer Lewis Booth said today.

Chevron slid 2.9 percent to $103.54. Chief Executive Officer John Watson has been selling oil refineries and filling stations in Europe and Africa to focus on higher-profit crude production and gas-liquefaction projects.

Juniper Networks slid 3.3 percent to $21.64. The company forecast first-quarter sales and profit that missed estimates, a sign that Internet providers are limiting spending amid sluggish economic growth.

Offers eyed at $1.3210/15 area and stops above $1.3230.

Oil rose for a third day as gasoline jumped to the highest level since August on speculation that refinery outages and plant closures will reduce supplies of the motor fuel.

Crude gained as much as 0.9 percent as gasoline gained after refineries in Texas and Illinois reported plant upsets or unit repairs. Prices also increased on signs that Greece is near an agreement with its creditors.

Oil for March delivery rose to $100.63 a barrel on the New York Mercantile Exchange. Prices have climbed 1.5 percent this week and 17 percent in the past year.

Brent oil for March settlement gained 56 cents, or 0.5 percent, to $111.35 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise due to the depreciation of the dollar against the euro after reports the U.S. Federal Reserve's intention to continue an extremely loose monetary policy.

The dollar fell 0.3 percent against the euro, which reached a five-week, on Thursday to a maximum of U.S. currency. The dollar index fell by 0.19% to reach 79.36 points.

Activity in the physical market is weak, since China and other major Asian markets closed for New Year celebrations of the lunar calendar.

Cost of the February gold futures on the COMEX today rose to 1733.1 dollars per ounce.

current conds 84.2 vs 82.6p;

expectations 69.1 vs 68.4p;

1y infl expectations 3.3%;

5y infl expectations 2.7%.

EUR/USD $1.3000, $1.3075, $1.3100, $1.3160, $1.3200, $1.3225

USD/JPY Y76.00, Y77.00, Y77.30, Y77.50-55, Y77.65, Y78.00

AUD/USD $1.0620, $1.0470, $1.0450, $1.0445

EUR/CHF Chf1.2150

GBP/USD $1.5675, $1.5520, $1.5500, $1.5425

USD/CHF Chf0.9200, Chf0.9250

Data:

08:00 Switzerland KOF Leading Indicator January 0.01 -0.06 -0.17

The euro strengthened after borrowing costs fell at an Italian bill sale, boosting optimism the region’s debt crisis is easing.

The common currency headed for a second weekly gain versus the dollar and yen after European Union Economic and Monetary Affairs Commissioner Olli Rehn said Greece was “close” to reaching agreement with its creditors over a debt swap.

The dollar weakened before a U.S. report that economists said will show economic growth accelerated, supporting demand for higher-yielding assets.

EUR/USD: the pair has grown in $1,3150 area.

GBP/USD: the pair has grown above $1,5700.

USD/JPY: the pair has fallen below Y77.00.

US data starts at 1300GMT with the latest Building Permits Revision. US data continues at 1330GMT with Q4 GDP. Then, at 1455GMT, the Michigan Sentiment Index is expected to be unrevised from the 74.0 preliminary estimate. At 1500GMT, New York Fed President William Dudley delivers a regional economic press briefing on recession, federal stimulus and regional schools.

EUR/JPY

Offers Y102.50/55, Y102.35.40, Y102.20/25, Y101.90/95

Bids Y100.70/65, Y100.05/00

Resistance 3: Y78.20/30 (area of Jan 25 high, high of December and МА (200) for D1)

Resistance 2: Y78.50 (session high)

Resistance 1: Y77.20 (hourly high, МА (200) for Н1)

Current price: Y76.97

Support 1:Y76.85 (session low and Jan 23 low)

Support 2:Y76.55 (Jan 17 low)

Support 3:Y75.60 (historic low)

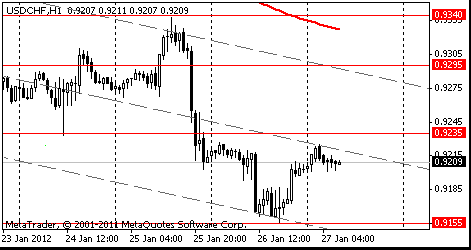

Resistance 3: Chf0.9290 (МА (200) for Н1)

Resistance 2: Chf0.9260 (resistance line from Jan 17)

Resistance 1: Chf0.9230 (session hugh, Jan 26 high and Jan 24 low)

Current price: Chf0.9187

Support 1: Chf0.9160 (Jan 26 low)

Support 2: Chf0.9060 (low of December)

Support 3: Chf0.8960 (61,8 % FIBO Chf0,8570-Chf0,9600)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5780 (high of December)

Resistance 1 : $1.5730 (Jan 26 high)

Current price: $1.5700

Support 1 : $1.5660 (session low)

Support 2 : $1.5630 (Jan 24 high, support line from Jan 13)

Support 3 : $1.5540 (area of Jan 24-25 lows, 38,2 % FIBO $1,5230-$ 1,5730)

Resistance 3 : $1.3260 (support line from Jan'2011 broken earlier)

Resistance 2 : $1.3200 (Dec 21 high)

Resistance 1 : $1.3185 (Jan 26 high)

Current price: $1.3140

Support 1 : $1.3120 (high of asian session, support line from Jan 25)

Support 2 : $1.3080 (session low)

Support 3 : $1.3040 (hourly low on Jan 25, earlier resistance)

growth depends on oil price, sov debt crisis outcome;

- growth still very dependent on how world unfolds;

- U.S. econ still faces tremendous challenges;

- people in u.s. have too much debt, unemployment high.

growth depends on oil price, sov debt crisis outcome;

- growth still very dependent on how world unfolds;

- U.S. econ still faces tremendous challenges;

- people in u.s. have too much debt, unemployment high.

EUR/USD $1.3000, $1.3075, $1.3100, $1.3160, $1.3200, $1.3225

USD/JPY Y76.00, Y77.00, Y77.30, Y77.50-55, Y77.65, Y78.00

AUD/USD $1.0620, $1.0470, $1.0450, $1.0445

EUR/CHF Chf1.2150

GBP/USD $1.5675, $1.5520, $1.5500, $1.5425

USD/CHF Chf0.9200, Chf0.9250

Asian stocks swung between gains and losses as rising commodity prices pushed energy and mining shares higher, while the yen’s rise weighed on Japanese exporters.

Nikkei 225 8,841 -8.25 -0.09%

Hang Seng 20,502 +62.53 +0.31%

S&P/ASX 200 4,288 +17.03 +0.40%

Shanghai Composite Closed

Woodside Petroleum Ltd. (WPL), an Australian oil and gas producer, added 1.5 percent.

Honda Motor Co., Japan’s second-largest carmaker by market value, dropped 1.9 percent after Prime Minister Yoshihiko Noda call for “bold” action failed to stem the yen’s appreciation.

NEC Corp. slid 7.1 percent in Tokyo after the electronics maker forecast its third loss in four years.

Hong Kong-based GCL-Poly Energy Holdings Ltd. led gains among solar panel makers in on speculation the market in China and Germany will expand.

Yesterday the dollar weakened versus all its 16 most-traded counterparts as the Federal Reserve’s pledge to keep interest rates at a record low for longer than originally forecast spurred investors to seek higher yields.

The U.S. currency touched a five-week low against the euro after policy makers said yesterday the benchmark interest rate would stay low until at least late 2014 from mid-2013 and as Italian yields fell to a six-week low. The euro rallied earlier as Italian 10-year yields fell below 6 percent for the first time since Dec. 8. The nation sold its maximum target at an auction of zero-coupon and inflation- linked debt.

The Canadian dollar strengthened to parity with the greenback for the first time since November. Goldman Sachs Group Inc. recommended its clients buy the Canadian dollar versus the greenback, saying the Fed’s pledge to keep rates low reaffirms a dollar “weakening trend.”

The Australian dollar climbed for a second day versus the greenback after Alexei Ulyukayev, first deputy chairman of Russia’s central bank, said his nation may start buying the Aussie as a reserve currency as soon as early February.

EUR/USD: yesterday the pair rose, showed new month's high, however has lost the positions later.

GBP/USD: yesterday the pair rose, showed new month's high.

USD/JPY: yesterday the pair fell.

On Friday in Davos, French Finance Minister Francois Baroin, Spanish Economic Affairs Minister Luis de Guindos Jurado and EU Economic Affairs Commissioner Olli Rehn participate in a panel debate on the future of the Eurozone. Then, at 1030GMT, US Treasury Secretary Timothy Geithner is due to speak on priorities for the US economy, in Davos, while at 1230GMT, he will be interviewed by CNN's Fareed Zakaria. At 1315GMT, ECB President Mario Draghi is due to speak on Europe's economic outlook, in Davos. US data starts at 1300GMT with the latest Building Permits Revision. US data continues at 1330GMT with Q4 GDP. Then, at 1455GMT, the Michigan Sentiment Index is expected to be unrevised from the 74.0 preliminary estimate. At 1500GMT, New York Fed President William Dudley delivers a regional economic press briefing on recession, federal stimulus and regional schools.

Asian stocks rose, with the regional benchmark index set for the highest close in almost three months, after the yen fell and Apple Inc. reported quarterly profit more than doubled, boosting the earnings outlook for Asian exporters.

Li & Fung Ltd., a supplier of toys and clothes to Wal-Mart Stores Inc., advanced 3.4 percent in Hong Kong.

Cnooc Ltd. (883) and other energy companies advanced after oil and metal prices climbed.

Franshion Properties China Ltd. (817) led gains among Chinese developers on speculation the mainland will ease lending.

Tokyo Electric Power Co. rose 5.4 percent after a report the company will accept public funds to avoid bankruptcy.

European stocks advanced, climbing 20 percent from the September low and entering a bull market, after the U.S. Federal Reserve signaled it may keep interest rates low through 2014 and a report said Greece’s creditors will make a new offer for a debt-swap deal.

U.S. policy makers are “prepared to provide further monetary accommodation if employment is not making sufficient progress towards our assessment of its maximum level, or if inflation shows signs of moving further below its mandate- consistent rate,” Bernanke said yesterday after European markets closed. Bond buying is “an option that’s certainly on the table,” he added. The Fed also extended its pledge to keep interest rates low through at least late 2014.

Orders for U.S durable goods rose 3 percent in December. Orders advanced for a third month boosted by demand for aircraft, autos and business equipment.

In Greece, private creditors will submit a new offer with an average interest rate of 3.75 percent on bonds issued as part of a debt restructure, Kathimerini reported, without saying where it got the information.

BHP Billiton, the world’s largest mining company, advanced 3.3 percent to 2,199.5 pence. Rio Tinto Group, the third biggest, rose 4.9 percent to 3,893 pence. Anglo American Plc, the third-largest copper producer, climbed 3.1 percent to 2,737 pence after saying iron-ore output increased 5 percent in the fourth quarter, while copper volumes jumped 10 percent.

European steelmakers rallied. ThyssenKrupp AG gained 4.5 percent to 22.14 euros. ArcelorMittal added 3.8 percent to 16.72 euros. Salzgitter AG advanced 6.8 percent to 48.67 euros.

Nokia climbed 2.7 percent to 4.17 euros after selling more smartphones last quarter than projected. Nokia sold 19.6 million smartphones that can handle tasks such as video calls and showing movies, the Espoo, Finland-based company said today. Analysts had predicted sales of 18.5 million smartphones.

U.S. stocks fell, reversing a rally that sent the Dow Jones Industrial Average toward its highest level since 2008 earlier today, as banks tumbled and a report showed that sales of new homes unexpectedly declined.

Equities reversed gains today after a report showed that sales of new U.S. homes unexpectedly declined in December for the first time in four months, capping the slowest year on record for builders. Claims for U.S. jobless benefits rose last week, displaying the usual volatility around holidays that has masked an improvement in the labor market. Orders for U.S. durable goods advanced more than forecast in December.

Wells Fargo lost 3.8 percent to $29.05. Fifth Third Bancorp slid 3 percent to $13.08.

AT&T lost 2.5 percent to $29.45, the biggest decline in the Dow. The carrier projected “mid-single-digit or better earnings growth” for 2012. Analysts predicted 11 percent on average. AT&T also reported a fourth-quarter net loss of $6.68 billion because of a pretax charge of about $4 billion for the failed takeover of T-Mobile USA, and expenses for revaluing benefit plans and other assets.

Caterpillar Inc. (CAT) rallied 2.1 percent, the biggest gain in the Dow, to $111.31. The largest construction and mining- equipment maker posted fourth-quarter earnings and forecast full-year profit that topped analysts’ estimates as demand rose for shovels and trucks.

Greece Is A Special Case

- Everything Currently Suggests Rescue Funds Are Sufficient

Resistance 3: Chf0.9340 (Jan 25 high)

Resistance 2: Chf0.9295 (resistance line from Jan 23)

Resistance 1: Chf0.9235 (middle line from Jan 23)

The current price: Chf0.9209

Support 1: Chf0.9140/55 (Nov 29 and Jan 26 highs)

Support 2: Chf0.9110 (Nov 29 high)

Support 3: Chf0.9065 (Nov 30 high)

Resistance 3 : $1.3360 (high of the European session on Dec 12)

Resistance 2 : $1.3235 (Dec 13 high)

Resistance 1 : $1.3185/00 (Dec 21 and Jan 26 highs)

The current price: $1.3104

Support 1 : $1.3075 (session low)

Support 2 : $1.2985 (support line from Jan 23)

Support 3 : $1.2875/85 (area of Jan 20-23 lows)

Change % Change Last

Oil $99.77 +0.07 +0.07%

Gold $1,721.50 -5.20 -0.30%

Change % Change Last

Nikkei 225 8,849 -34.22 -0.39%

Hang Seng 20,439 +328.77 +1.63%

S&P/ASX 200 Closed

Shanghai Composite Closed

FTSE 100 5,795 +72.20 +1.26%CAC 40 3,363 +50.75 +1.53%

DAX 6,540 +118.00 +1.84%

Dow 12,734.63 -22.33 -0.18%

Nasdaq 2,805.28 -13.03 -0.46%

S&P 500 1,318.45 -7.61 -0.57%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3108 +0,02%

GBP/USD $1,5688 +0,07%

USD/CHF Chf0,9203 -0,12%

USD/JPY Y77,45 -0,43%

EUR/JPY Y101,51 -0,40%

GBP/JPY Y121,49 -0,22%

AUD/USD $1,0630 +0,32%

NZD/USD $0,8212 +0,56%

USD/CAD C$1,0015 -0,28%

00:00 China Bank holiday 0

09:00 Switzerland World Economic Forum Annual Meetings 0

10:30 Switzerland KOF Leading Indicator January 0.01 -0.06

13:30 U.S. GDP, y/y IV quarter +1.8% +3.1%

13:30 U.S. PCE price index, q/q IV quarter +1.7% +2.5%

13:30 U.S. PCE price index ex food, energy, q/q IV quarter +2.1% +1.0%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index January 74.2 74.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.