- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 31-01-2012.

The euro fell to its weakest level in almost a week versus the dollar as investors speculated European policy makers won’t be able to reach an agreement regarding Greece’s debt obligations. The euro weakened against the majority of its most- traded peers as Standard & Poor’s increased the number of Portuguese banks on “creditwatch negative.” Greece pledged a last-ditch effort to prevent the collapse of a second rescue package from creditors, aiming to complete talks this week on a financial lifeline that’s been in the works for six months.

The dollar and yen pared earlier losses as stocks fell after consumer confidence and business activity in the U.S. was weaker than forecast in January. The dollar gained against half its major counterparts after Institute for Supply Management-Chicago Inc. said today its business barometer decreased to 60.2 from 62.2 in December. Consumer confidence unexpectedly dropped in January as gas prices picked up and more Americans said jobs are hard to get.

European stocks rose, posting their best monthly start to a year since 1998, as most countries in the region agreed to tighter budget controls, outweighing worse- than-estimated economic data.

European Union leaders, meeting in Brussels yesterday, agreed on a fiscal-discipline treaty that allows for sanctions on high-deficit states and requires members to enact laws to limit budget shortfalls. Britain and the the Czech Republic refused to sign the pact.

The policy makers also decided to bring the region’s permanent bailout fund, the European Stability Mechanism, into operation on July 1, a year before schedule.

Greece aims to complete debt-swap talks with bondholders this week. Prime Minister Lucas Papademos told reporters after summit that he is “strongly committed” to reaching a deal.

German unemployment dropped more than economists forecast to a two-decade low in January. The number of people out of work fell a seasonally adjusted 34,000 to 2.85 million, the Federal Labor Agency said. That’s the biggest drop since March.

National benchmark indexes rose in 15 of the 18 western European markets today. The U.K.’s FTSE 100 climbed 0.2 percent, Germany’s DAX advanced 0.2 percent, and France’s CAC 40 gained 1 percent.

Oil gained after the December industrial output rose more than forecast in Japan, the third-biggest crude consumer. BP, Europe’s second-largest oil producer, gained 2.7 percent to 470.85 pence. Shell and Total SA gained 0.5 percent to 2,240.5 pence and 1.5 percent to 40.41 euros, respectively.

ThyssenKrupp, Germany’s largest steelmaker, rose 2.7 percent to 21.67 euros in Frankfurt after agreeing to sell its Inoxum stainless steel unit to Outokumpu Oyj. The deal valued the German company’s unit at about 2.7 billion euros. ThyssenKrupp will retain a 29.9 percent stake in the business, receive 1 billion euros in cash, and transfer liabilities of 422 million euros for Inoxum to Outokumpu. Outokumpu fell 15 percent to 6.27 euros in Helsinki.

ARM Holdings jumped 2 percent to 609.5 pence. The maker of processors for Apple Inc.’s iPads and iPhones said fourth- quarter revenue climbed 21 percent as the company increased the number of licenses sold for smartphones and tablet computers.

U.S. stocks reversed gains, sending the Standard & Poor’s 500 Index toward its longest decline since November, as reports showed consumer confidence trailed economists’ projections and business activity cooled.

Stocks erased gains as reports showed that consumer confidence unexpectedly dropped in January and a gauge of business activity fell, underscoring forecasts that the U.S. economy will cool after expanding at the fastest pace since the second quarter 2010. Earlier gains were triggered after most countries in Europe agreed to tighter budget controls and Greece made progress on debt talks.

Dow 12,607.44 -46.28 -0.37%, Nasdaq 2,807.60 -4.34 -0.15%, S&P 500 1,310.40 -2.61 -0.20%

Exxon Mobil dropped 2.1 percent to $83.66. Revenue rose 16 percent to $121.6 billion during the quarter, less than the $124.4 billion average of five analysts’ estimates compiled by Bloomberg.

UPS lost 1.1 percent to $75.34. The company reported sales of $14.17 billion, missing the average analyst estimate in a Bloomberg survey of $14.45 billion.

ADM sank 5 percent to $28.24. The company, led by Chairman and Chief Executive Officer Patricia Woertz, has missed analysts’ estimates for three straight quarters. Operating profit at the agricultural-services unit, the company’s largest segment by revenue in fiscal 2011, fell 63 percent to $158 million after U.S. grain exports declined because of a smaller domestic crop and “adequate” global supplies, ADM said.

RadioShack Corp. tumbled 30 percent to $7.18 after the consumer-electronics retailer suspended share repurchases and reported preliminary fourth-quarter earnings that trailed analysts’ estimates.

Oil prices fell after strong growth against a background of adverse macro USA. Support for oil have an EU summit outcome and expectation quick solution to the debt problems in Greece. Investors embraced a positive news from Europe on the outcome of EU summit.At a meeting in Brussels approved the strategy for economic growth and budget pact aimed at strengthening the financial stability of the eurozone. In addition, on the eve of Prime Minister of Greece Lucas Papadimos said that significant progress in the talks with lenders about restructuring the debt of the country and expressed hope that negotiations can be successfully completed before the end of the week. Markets also drew attention to the statement of EU president Herman Van Rompuy, who urged euro-zone finance ministers to take all necessary measures to implement agreements with banks and take a new facility in the amount of 130 billion euros, Greece promised that by the end of this week.

Published U.S. statistics disappointed investors. House price index from the S & P / Case-Shiller on an annualized basis for the results of November fell by 3.7% -3.2% when expectations. The index of consumer confidence in January was 61.1 points, 68.0 points expected, the previous value was revised from 64.5 points to 64.8 points. The Chicago index of business activity in January was 60.2 points, 63.0 points expected, the previous value of 62.2 points. Inhibit the growth of prices is also not fully met expectations quarterly results from the world's largest oil company Exxon Mobil.

The cost of the March futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to 101.29 dollars per barrel and then dropped to 98.27 dollars per barrel. Brent oil for March settlement rose 1.40 dollars to $112.15 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rise due to the weakening dollar and get ready to show in January, the strongest growth since August 2011.

The euro is rising against the dollar in the hope that Greece will be able to restructure debt and avoid default in March. Although this reduces the attractiveness of gold as a safe asset, concerns about Portugal and evidence of weak performance of the eurozone in the first quarter, support the market.

Yield on 10-year government bonds of Portugal close to 17 percent, from close to its highest level in history, 17.4 per cent of the eurozone. Investors fear that Lisbon is on the way in Athens.

Gold prices rise for four weeks, the growth began on the eve of Chinese New Year due to purchases in China.

Cost of the February gold futures on the COMEX today rose to 1747.7 dollars per ounce.

new orders -3.5 to 63.6;

employment -4.5 to 54.7 (lowest since Aug'11);

production -1.1 to 63.8;

prices paid -1.4 to 62.4.

EUR/USD $1.3000, $1.3100, $1.3200, $1.3265

USD/JPY Y77.00

AUD/USD $1.0700, $1.0575, $1.0550, $1.0525, $1.0465

EUR/CHF Chf1.2025, Chf1.2100

GBP/USD $1.5735

EUR/JPY Y100.00

EUR/GBP stg0.8400

NZD/USD $0.8225

Data:

07:00 Switzerland UBS Consumption Indicator December 0.81 0.92

07:00 Germany Retail sales, real adjusted December -0.9% +0.9% -1.4%

07:00 Germany Retail sales, real unadjusted, y/y December +0.8% +0.9% -0.9%

07:45 France Consumer spending December -0.1% +0.3% -0.7%

08:55 Germany Unemployment Change January -22 -8 -34

08:55 Germany Unemployment Rate s.a. January 6.8% 6.8% 6.7%

09:30 United Kingdom Net Lending to Individuals, bln December 1.0 1.2 0.4

10:00 Eurozone Unemployment Rate December 10.3% 10.4% 10.4%

The euro strengthened against the dollar after Greek Prime Minister Lucas Papademos said progress had been made in debt-swap talks with bondholders.

The common currency climbed for the first time in four days versus the yen after European chiefs meeting in Brussels yesterday agreed to accelerate the introduction of a permanent 500 billion-euro ($660 billion) rescue fund and signed a deficit-control treaty.

The dollar fell as stock gains damped demand for safer investments.

The euro is headed for its first monthly advance since October versus the dollar and the yen. The shared currency has appreciated 1.9 percent against the greenback, and risen 1.2 percent versus the yen.

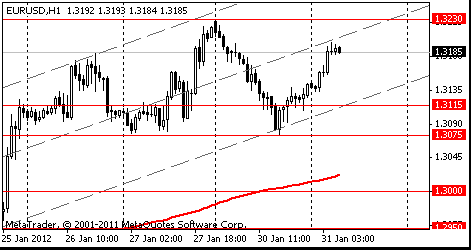

EUR/USD: during european session the pair showed high above $1,3200, but could not be kept and receded.

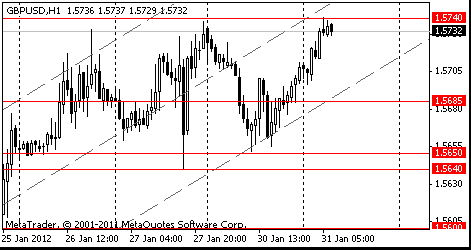

GBP/USD: the pair showed high in $1,5790 area, but decreased later.

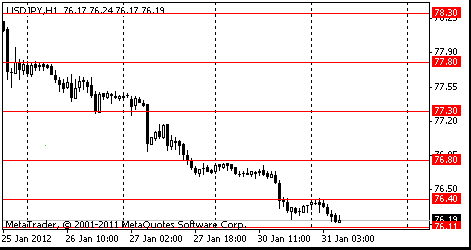

USD/JPY: the pair was limited Y76.20-Y76,40.

At 1400GMT the S&P/Case-Shiller Home Price Index is due and then at 1445GMT the Chicago PMI. At 1500GMT, consumer confidence is expected to rise to a reading of 68.0 in January after the solid jump in December to the strongest reading since April.

EUR/USD

Offers $1.3300, $1.3260/80, $1.3215

Bids $1.3160/50, $1.3110/00, $1.3070, $1.3050/30, $1.3010/00

Resistance 3: Y77.20 (hourly high on Jan 27, МА (200) for Н1)

Resistance 2: Y76.80 (Jan 30 high)

опротивление 1: Y76.40 (session high)

Current price: Y76.39

Support 1:Y76.20 (session low)

Support 2:Y76.00 (psychological level)

Support 3:Y75.60 (historical low)

Resistance 3: Chf0.9230 (Jan 26-27 highs, Jan 24 low)

Resistance 2: Chf0.9190 (resistance line from Jan 17)

Resistance 1: Chf0.9160 (intraday high)

Current price: Chf0.9132

Support 1: Chf0.9120 (session low and Jan 30 low)

Support 2: Chf0.9060 (low of December)

Support 3: Chf0.9000 (psychological level)

Resistance 3 : $1.5960 (МА (200) for Н1)

Resistance 2 : $1.5890 (Nov 18 high)

Resistance 1 : $1.5790 (session high)

Current price: $1.5784

Support 1 : $1.5720/10 (area of low of european session and support line from Jan 13)

Support 2 : $1.5655/40 (Jan 27-30 lows)

Support 3 : $1.5580 (38,2 % FIBO $1,5230-$ 1,5790)

Resistance 3 : $1.3360 (МА (100) for D1)

Resistance 2 : $1.3270 (support line punched earlier from Jan'2011)

Resistance 1 : $1.3230/45 (session high, 38,2 % FIBO $1,4250-$ 1,2620)

Current price: $1.3187

Support 1 : $1.3160 (intraday low)

Support 2 : $1.3080 (Jan 27-30 lows)

Support 3 : $1.3040 (hourly low on Jan 25, earlier resistance)

EUR/USD $1.3000, $1.3100, $1.3200, $1.3265

USD/JPY Y77.00

AUD/USD $1.0700, $1.0575, $1.0550, $1.0525, $1.0465

EUR/CHF Chf1.2025, Chf1.2100

GBP/USD $1.5735

EUR/JPY Y100.00

EUR/GBP stg0.8400

NZD/USD $0.8225

The yen strengthened against all of its major counterparts as concern increased that Greek bailout negotiations will hinder efforts to resolve the financial crisis, boosting demand for haven assets.

The euro fell below 100 yen for the first time in a week as European Union leaders met in Brussels, and Italy raised less than its maximum target at a bond sale after Fitch Ratings downgraded the nation last week. The dollar touched the weakest against the yen since Oct. 31, when it reached a record low. The Swiss franc strengthened to the highest level against the euro since September.

EU leaders met to put the finishing touches on a German-led deficit-control treaty and endorse the statutes of a 500 billion-euro ($656 billion) rescue fund to be set up this year. While Greece and its private creditors said Jan. 28 they expect to complete a debt-swap deal to reduce the nation’s obligations in coming days, it now requires 145 billion euros for the second bailout, 15 billion euros more than was agreed in October, Der Spiegel reported Jan. 28.

Italy sold 7.5 billion euros of debt due between 2016 and 2022 today, less than its maximum target of 8 billion euros. Fitch cut the ratings of Italy, Spain, Belgium, Slovenia and Cyprus on Jan. 27, saying they lack financing flexibility in the face of the regional debt crisis. Italy was reduced two levels to A- from A+, and Spain was lowered two grades to A from AA-.

EUR/USD: yesterday the pair fell, but closed day above $1.3100.

GBP/USD: yesterday the pair fell, but closed day above $1.5700.

USD/JPY: yesterday the pair decreased on a floor of a figure.

European data for Tuesday starts at 0700GMT with the German ILO measure of employment along with December and 2011 retail sales data. France data at 0745GMT includes consumer spending, PPI and also housing starts/permits data for December. The main German unemployment data is due at 0855GMT and is expected to see a jobless change of -10k, leaving the unemployment rate unchanged at 6.8%. EMU unemployment data is also due, at 1000GMT. The weekly US ICSC Mall Sales is due at 1145GMT, followed at 1330GMT by the Employment Cost Index. This is followed at 1355GMT by the weekly Redbook Chain Story sales, at 1400GMT by the S&P/Case-Shiller Home Price Index and then at 1445GMT by the Chicago PMI. At 1500GMT, consumer confidence is expected to rise to a reading of 68.0 in January after the solid jump in December to the strongest reading since April.

Resistance 3: Y77.30 (Jan 20 high)

Resistance 2: Y76.80 (Jan 30 high)

Resistance 1: Y76.40 (session high)

The current price: Y76.19

Support 1: Y76.10 (Sep 21 low)

Support 2: Y75.60 (Oct 31 low)

Support 3: Y75.00 (psychological level)

Resistance 3 : $1.5815 (Nov 16-17 high)

Resistance 2 : $1.5770 (Dec 21 high)

Resistance 1 : $1.5740 (session high)

The current price: $1.5732

Support 1 : $1.5685 (support line from Jan 18)

Support 2 : $1.5640/50 (area of Jan 27-30 low)

Support 3 : $1.5600 (MA (233) H1)

Resistance 3 : $1.3360 (high of the European session on Dec 12)

Resistance 2 : $1.3300 (resistance line from Jan 17)

Resistance 1 : $1.3230 (Jan 30 high)

The current price: $1.3185

Support 1 : $1.3115 (support line from Jan 17)

Support 2 : $1.3075 (Jan 27-30 low)

Support 3 : $1.3000 (38.2 FIBO $1.3230-$1.2625)

Change % Change Last

Oil $98.88 +0.10 +0.10%

Gold $1,727.90 -3.10 -0.18%

Change % Change Last

Nikkei 225 8,793 -48.17 -0.54%

Hang Seng 20,230 -271.88 -1.33%

S&P/ASX 200 4,273 -15.63 -0.36%

Shanghai Composite 2,285 -34.08 -1.47%

FTSE 100 5,795 +72.20 +1.26%CAC 40 3,363 +50.75 +1.53%

DAX 6,540 +118.00 +1.84%

Dow 12,653.72 -6.74 -0.05%

Nasdaq 2,811.94 -4.61 -0.16%

S&P 500 1,313.02 -3.31 -0.25%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3143 -0,57%

GBP/USD $1,5708 -0,14%

USD/CHF Chf0,9169 +0,50%

USD/JPY Y76,34 -0,45%

EUR/JPY Y100,33 -1,01%

GBP/JPY Y119,90 -0,58%

AUD/USD $1,0597 -0,56%

NZD/USD $0,8191 -0,61%

USD/CAD C$1,0013 -0,04%

00:01 United Kingdom Gfk Consumer Confidence January -33 -31

00:30 Australia National Australia Bank's Business Confidence December 2

00:30 Australia Private Sector Credit, m/m December +0.3% +0.4%

00:30 Australia Private Sector Credit, y/y December +3.5% +3.6%

05:00 Japan Housing Starts, y/y December -0.3% -1.4%

07:00 Switzerland UBS Consumption Indicator December 0.81

07:00 Germany Retail sales, real adjusted December -0.9% +0.9%

07:00 Germany Retail sales, real unadjusted, y/y December +0.8% +0.9%

07:45 France Consumer spending December -0.1% +0.3%

08:55 Germany Unemployment Change January -22 -8

08:55 Germany Unemployment Rate s.a. January 6.8% 6.8%

09:30 United Kingdom Net Lending to Individuals, bln December 1.0 1.2

10:00 Eurozone Unemployment Rate December 10.3% 10.4%

13:30 Canada GDP (m/m) November 0.0% +0.2%

13:30 Canada Raw Material Price Index December +3.8% +0.2%

13:30 Canada Industrial product prices, m/m December +0.2% +0.1%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y November -3.4% -3.2%

14:45 U.S. Chicago Purchasing Managers' Index January 62.5 63.2

15:00 U.S. Consumer confidence January 64.5 68.4

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.