- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 08-02-2018.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2246 -0,15%

GBP/USD $1,3911 +0,22%

USD/CHF Chf0,93597 -0,76%

USD/JPY Y108,75 -0,53%

EUR/JPY Y133,18 -0,68%

GBP/JPY Y151,277 -0,32%

AUD/USD $0,7780 -0,51%

NZD/USD $0,7217 -0,23%

USD/CAD C$1,26012 +0,29%

00:30 Australia Home Loans December 2.1% -1.1%

00:30 Australia RBA Monetary Policy Statement

01:30 China PPI y/y January 4.9% 4.4%

01:30 China CPI y/y January 1.8% 1.5%

04:30 Japan Tertiary Industry Index December 1.1% 0%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.3% 3.4%

07:45 France Industrial Production, m/m December -0.5% 0.1%

09:30 United Kingdom Industrial Production (MoM) December 0.4% -0.9%

09:30 United Kingdom Industrial Production (YoY) December 2.5% 0.3%

09:30 United Kingdom Manufacturing Production (YoY) December 3.5% 1.2%

09:30 United Kingdom Manufacturing Production (MoM) December 0.4% 0.3%

09:30 United Kingdom Total Trade Balance December -2.804 -3.84

13:00 United Kingdom NIESR GDP Estimate January 0.6% 0.3%

13:30 Canada Unemployment rate January 5.7% 5.8%

13:30 Canada Employment January 78.6 10

15:00 U.S. Wholesale Inventories December 0.8% 0.2%

18:00 U.S. Baker Hughes Oil Rig Count February 765

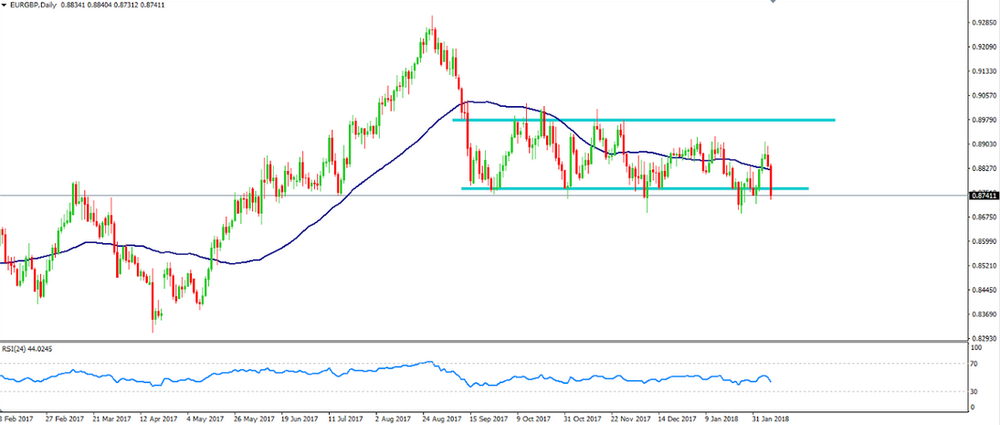

EUR/GBP is in a crucial zone which will help us understand whether the price could start a new bearish movement or a bullish movement.

On daily time frame chart, we can see that the price is stuck in the range between 0.897 - 0.877 which we can call consolidation zone.

Our suggestion is to wait for a clear price's reaction close to the bottom of the consolidation zone which is a support level as well in order to understand which trend it might start follow.

-

Small bump to U.S. GDP in 2018 from recent tax reform, adding about 0.2 pct point going forward

-

He's concerned about rising federal debt level from tax reform

In December, new house prices in Canada were unchanged for the first time since April 2015. Buyers in 15 of the 27 census metropolitan areas (CMAs) surveyed saw no price change. Increases in 8 surveyed CMAs across the country were offset by declines in the remaining 4.

In the Greater Golden Horseshoe, prices for new houses were unchanged in four of the six surveyed CMAs. Guelph posted the lone increase (+0.1%). Builders in Toronto, Canada's largest CMA, have not seen increases in prices in six of the previous seven months. In the neighbouring CMA of Hamilton prices fell 0.1% in December, following four months of no change.

In the week ending February 3, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 9,000 from the previous week's unrevised level of 230,000. The 4-week moving average was 224,500, a decrease of 10,000 from the previous week's unrevised average of 234,500. This is the lowest level for this average since March 10, 1973 when it was 222,000.

-

Bank of England MPC says appropriate to set monetary policy so inflation returns to target "at a more conventional horizon"

-

Inflation in three years' time at 2.11 pct (nov forecast 2.15 pct), based on market interest rates

-

Inflation in two years' time at 2.16 pct (nov forecast 2.21 pct), based on market interest rates

-

Inflation report shows unemployment rate at 4.1 pct in two years' time (nov 4.2 pct), based on market rates

-

Brexit uncertainty weighing on uk business investment

-

Estimates overall slack within economy is "very small" at just under 0.25 pct of gdp

-

Policy statement makes no direct reference to appropriateness of current market expectations about interest rates

-

Policymakers vote 9-0 to maintain corporate bond purchase target at 10 bln stg (poll 10 bln stg)

-

Mpc says if economy grows as expected, policy will need to be tightened somewhat earlier and somewhat more than expected in november

-

Inflation in one year's time at 2.28 pct (nov forecast 2.37 pct), based on market interest rates

-

Some flattening of the yield curve doesn't worry me

-

Highly vigilant about market volatility

-

Market volatility will not in itself cause change in my views

EUR/USD

Resistance levels (open interest**, contracts)

$1.2409 (2790)

$1.2370 (1452)

$1.2324 (3148)

Price at time of writing this review: $1.2280

Support levels (open interest**, contracts):

$1.2232 (4247)

$1.2191 (6878)

$1.2145 (3487)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 132852 contracts (according to data from February, 7) with the maximum number of contracts with strike price $1,2200 (6878);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4108 (1245)

$1.4023 (1977)

$1.3960 (2720)

Price at time of writing this review: $1.3893

Support levels (open interest**, contracts):

$1.3839 (1252)

$1.3774 (1003)

$1.3690 (1209)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 43942 contracts, with the maximum number of contracts with strike price $1,3600 (3442);

- Overall open interest on the PUT options with the expiration date February, 9 is 40006 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.91 versus 0.90 from the previous trading day according to data from February, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Says not actively monitoring crypocurrency markets, considers it a very small market

-

Next interest rate move could be up or it could be down

-

Sees annual CPI 1.7 pct by march 2019 (pvs 2.0 pct)

-

Domestic economic growth is projected to strengthen

-

NZD has firmed, assume it will ease in the period ahead

-

Future headline inflation expected to tend upwards towards the midpoint of the target band

-

Longer-term inflation expectations remain well anchored at around 2 percent

-

Numerous uncertainties remain and monetary policy may need to adjust accordingly

-

Labour market conditions continue to tighten

-

GDP growth in second half is expected to strenghthen

Germany exported goods to the value of 1,279.4 billion euros and imported goods to the value of 1,034.6 billion euros in 2017. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 6.3% and imports by 8.3% in 2017 compared with 2016. In 2017, export and import levels were higher than the previous all-time highs recorded in 2016. At the time, goods to the value of 1,203.8 billion euros were exported and goods to the value of 954.9 billion euros were imported.

The foreign trade balance showed a surplus of 244.9 billion euros in 2017. In 2016, the surplus of the foreign trade balance reached an all-time high (248.9 billion euros).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.