- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 09-02-2018.

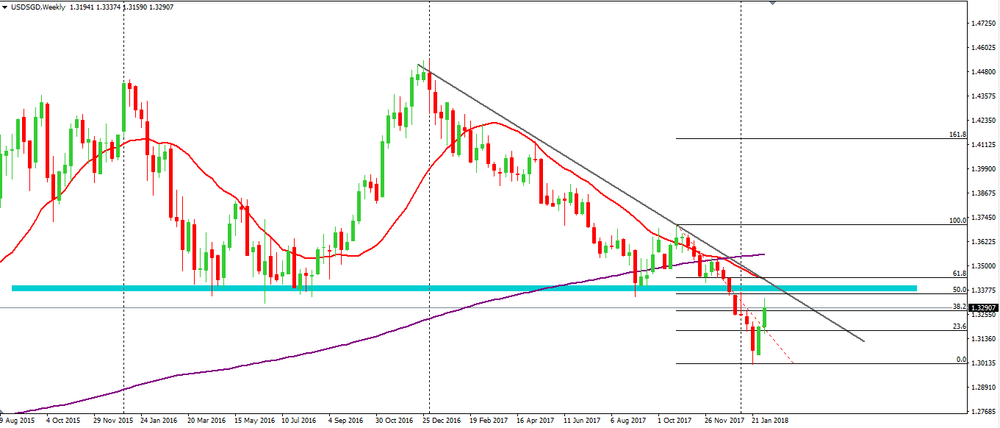

USD/SGD has been following a bearish trend for several weeks.

If we look on weekly time frame chart, we can see that the price is now moving close to the downside trend line and to the previous support.

Therefore, if the price starts to reject the blue zone (previous support level) then we can expect a further bearish movement close to the previous low and even lower.

Total inventories of merchant wholesalers, except manufacturers' sales branches and offices, after adjustment for seasonal variations but not for price changes, were $612.1 billion at the end of December, up 0.4 percent from the revised November level. Total inventories were up 3.4 percent from the revised December 2016 level. The November 2017 to December 2017 percent change was revised from the advance estimate of up 0.2 percent to up 0.4 percent.

The December inventories/sales ratio for merchant wholesalers, except manufacturers' sales branches and offices, based on seasonally adjusted data, was 1.22. The December 2016 ratio was 1.29.

Following two months of increases, employment fell by 88,000 in January. Part-time employment declined (-137,000), while full-time employment was up (+49,000). At the same time, the unemployment rate increased by 0.1 percentage points to 5.9%.

On a year-over-year basis, employment grew by 289,000 or 1.6%. Gains were driven by increases in full-time work (+414,000 or +2.8%), while there were fewer people working part time (-125,000 or -3.5%). Over the same period, hours worked rose by 2.8%.

n January, employment declined for core-aged women (25 to 54 years old), as well as people 55 and older and youth aged 15 to 24. There was little change for core-aged men.

The largest employment declines were in Ontario and Quebec. There were also decreases in New Brunswick and Manitoba.

-

There was no update from Britain on Brexit

-

UK withdrawal from EU, customs union would make border checks inevitable

-

There must be no ambiguity in UK deal on Irish border

-

Witnesses private investment jump but steep decline of public investments

The total UK trade (goods and services) deficit widened by £3.8 billion to £10.8 billion in the three months to December 2017; excluding erratic commodities, the deficit widened by £1.5 billion to £9.0 billion.

The £3.8 billion widening of the total trade (goods and services) deficit was due to a £3.3 billion widening of the trade in goods deficit and a £0.5 billion narrowing of the trade in services surplus; the trade deficit in fuels (oil) had the largest impact on the widening of the trade in goods deficit.

The widening of the trade in goods deficit was due mainly to a 3.8% (£2.1 billion) increase in imports from non-EU countries, alongside decreases in exports to the EU, in the three months to December 2017.

In the three months to December 2017, the Index of Production was estimated to have increased by 0.5% compared with the three months to September 2017, due to a rise of 1.3% in manufacturing; this was partially offset by a decrease of 4.7% in mining and quarrying, caused mainly by the shut-down of the Forties oil pipeline for a large part of December 2017.

Within manufacturing, 9 of the 13 manufacturing sub-sectors experienced growth; the largest contribution to quarterly growth came from basic metals and metal products, which increased by 5.7%.

Total production output increased by 2.3% for the three months to December 2017 compared with the same three months to December 2016; manufacturing provided the largest upward contribution with an increase of 3.4%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2403 (2689)

$1.2359 (1671)

$1.2307 (3148)

Price at time of writing this review: $1.2269

Support levels (open interest**, contracts):

$1.2234 (3748)

$1.2194 (6645)

$1.2147 (3311)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 128504 contracts (according to data from February, 8) with the maximum number of contracts with strike price $1,2200 (6645);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4153 (724)

$1.4105 (1126)

$1.4059 (738)

Price at time of writing this review: $1.3975

Support levels (open interest**, contracts):

$1.3876 (1643)

$1.3839 (1598)

$1.3795 (1064)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 44389 contracts, with the maximum number of contracts with strike price $1,3900 (3490);

- Overall open interest on the PUT options with the expiration date February, 9 is 41549 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.94 versus 0.91 from the previous trading day according to data from February, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Doubling of interest rates from 0.5 percent would not historically represent a big rise

-

Says now more confident wage growth is improving in UK

-

With U.S. economy at or beyond full employment, arrival of fiscal stimulus makes more rate hikes important

-

Says underlying inflation to reach 2.25 pct by mid-2020

-

Unemployment forecasts cut 0.25 point to 5.25 pct out to mid-2019, stays at 5.25 pct to mid-2020

-

Gdp growth seen at 3.25 pct end 2018, 3.25 pct end 2019, 3 pct mid-2020

-

Underlying inflation seen at 1.75 pct end 2018, 2 pct end 2019, 2.25 pct june 2020

-

Household income growth slow, if that persists it would constrain consumption

-

Recent new enterprise agreements to put downward pressure on wage growth for couple of years

-

Appreciating AUD would dampen domestic growth and inflation

-

Outlook for global growth positive despite volatility in equity markets

According to SECO surveys, at the end of January 2018, 149,161 unemployed people were enrolled in the Regional Employment Centers (RAV), 2,507 more than in the previous month. The unemployment rate remained at 3.3% in the month under review. Compared with the same month last year, unemployment fell by 15,305 (-9.3%). Youth unemployment in January 2018 Youth unemployment (15-24 year-olds) decreased by 135 (-0.8%) to 16,545. Compared to the same month of the previous year, this represents a decrease of 3,237 persons (-16.4%).

China's consumer and producer price inflation slowed in January, data from the National Bureau of Statistics cited by rttnews.

Consumer prices climbed 1.5 percent year-on-year in January, the weakest in four months, after rising 1.8 percent in December. The rate came in line with expectations.

Food prices fell 0.5 percent on year versus 0.4 percent drop a month ago. Meanwhile, non-food prices rose 2 percent following December's 2.4 percent rise.

Meanwhile, monthly inflation doubled to 0.6 percent from 0.3 percent in December.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.