- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 14-02-2018.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2450 +0,79%

GBP/USD $1,3997 +0,76%

USD/CHF Chf0,92913 -0,63%

USD/JPY Y107,01 -0,75%

EUR/JPY Y133,22 +0,05%

GBP/JPY Y149,785 +0,02%

AUD/USD $0,7924 +0,84%

NZD/USD $0,7364 +1,22%

USD/CAD C$1,24903 -0,81%

00:00 Australia Consumer Inflation Expectation February 3.7%

00:00 China Bank holiday

00:30 Australia New Motor Vehicle Sales (YoY) January 6.7%

00:30 Australia New Motor Vehicle Sales (MoM) January 4.5%

00:30 Australia Unemployment rate January 5.5% 5.3%

00:30 Australia Changing the number of employed January 34.7 25.5

04:30 Japan Industrial Production (MoM) (Finally) December 0.5% 2.7%

04:30 Japan Industrial Production (YoY) (Finally) December 3.6% 3.9%

10:00 Eurozone Trade balance unadjusted December 26.3 30.2

13:30 U.S. Continuing Jobless Claims February 1923 2006

13:30 U.S. NY Fed Empire State manufacturing index February 17.7 17.7

13:30 U.S. Philadelphia Fed Manufacturing Survey February 22.2 22.0

13:30 U.S. Initial Jobless Claims February 221 237

13:30 U.S. PPI excluding food and energy, Y/Y January 2.3% 2.5%

13:30 U.S. PPI, y/y January 2.6% 2.2%

13:30 U.S. PPI, m/m January -0.1% 0.4%

13:30 U.S. PPI excluding food and energy, m/m January -0.1% 0.3%

14:15 U.S. Capacity Utilization January 77.9% 78%

14:15 U.S. Industrial Production YoY January 3.6%

14:15 U.S. Industrial Production (MoM) January 0.9% 0.4%

15:00 U.S. NAHB Housing Market Index February 72 73

18:30 Canada Gov Council Member Schembri Speaks

21:00 U.S. Total Net TIC Flows December 33.8

21:00 U.S. Net Long-term TIC Flows December 57.5 50.3

21:30 New Zealand Business NZ PMI January 51.2

22:30 Australia RBA's Governor Philip Lowe Speaks

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.8 million barrels from the previous week. At 422.1 million barrels, U.S. crude oil inventories are in the lower half of the average range for this time of year.

Total motor gasoline inventories increased by 3.6 million barrels last week, and are in the upper half of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 0.5 million barrels last week and are in the middle of the average range for this time of year. Propane/propylene inventories decreased by 3.3 million barrels last week, and are in the middle of the average range. Total commercial petroleum inventories decreased by 2.7 million barrels last week.

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,902.2 billion, up 0.4 percent (±0.1 percent) from November 2017 and were up 3.2 percent (±0.3 percent) from December 2016.

The total business inventories/sales ratio based on seasonally adjusted data at the end of December was 1.33. The December 2016 ratio was 1.37.

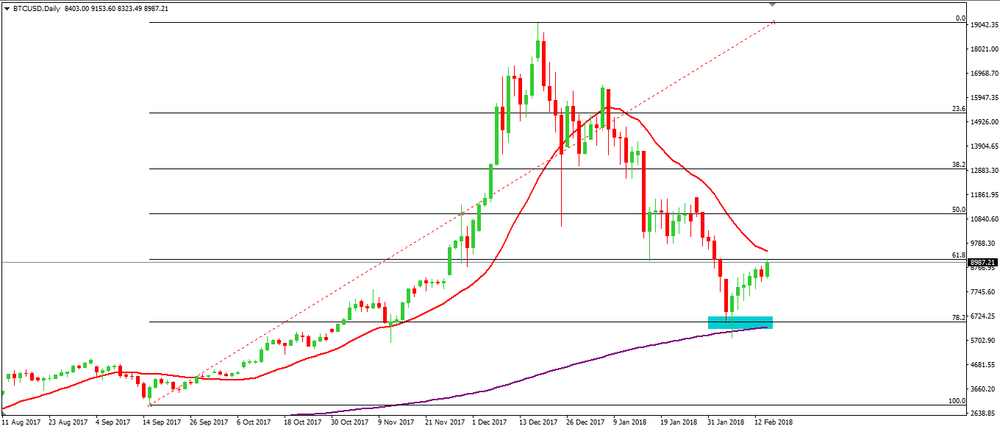

On daily time frame chart, we can see that the price is slowing down its last bearish movements.

If we look at Fibonacci levels we can see that the price has rejected the 78.2% fibs levels which can be an opportunity to Long entries in this crypto.

Therefore, we can expect a further appreciation by Bitcoin soon if the price remains above the 78.2% fibs levels.

Advance estimates of U.S. retail and food services sales for January 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $492.0 billion, a decrease of 0.3 percent from the previous month, but 3.6 percent above January 2017.

Total sales for the November 2017 through January 2018 period were up 4.9 percent from the same period a year ago. The November 2017 to December 2017 percent change was revised from up 0.4 percent to virtually unchanged. Retail trade sales were down 0.3 percent from December 2017, but 3.9 percent above last year. Nonstore Retailers were up 10.2 percent (±1.4 percent) from January 2017, while Gasoline Stations were up 9.0 percent (±1.6 percent) from last year.

The Consumer Price Index for increased 0.5 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.1 percent before seasonal adjustment.

The seasonally adjusted increase in the all items index was broad-based, with increases in the indexes for gasoline, shelter, apparel, medical care, and food all contributing. The energy index rose 3.0 percent in January, with the increase in the gasoline index more than offsetting declines in other energy

component indexes. The food index rose 0.2 percent with the indexes for food at home and food away from home both rising.

The index for all items less food and energy increased 0.3 percent in January. Along with shelter, apparel, and medical care, the indexes for motor vehicle

insurance, personal care, and used cars and trucks also rose in January. The indexes for airline fares and new vehicles were among those that declined over the month.

-

SNB does not plan the issue of a digital currency

-

Growth in activity had held steady at a modest pace

-

Strong growth in inbound tourist spending, though there were some signs of a softening in discretionary spend by domestic

-

Banks' risk appetite towards construction and retail had fallen slightly

-

Fall in sterling has led to some, albeit still limited, switching from overseas to cheaper domestically produced goods

In December 2017 compared with November 2017, seasonally adjusted industrial production rose by 0.4% in the euro area (EA19) and by 0.3% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2017, industrial production rose by 1.3% in the euro area and by 1.2% in the EU28. In December 2017 compared with December 2016, industrial production increased by 5.2% in the euro area and by 4.8% in the EU28. The average industrial production for the year 2017, compared with 2016, rose by 3.0% in the euro area and by 3.3% in the EU28.

Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and the EU28 during the fourth quarter of 2017, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2017, GDP grew by 0.7% in both zones. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 2.7% in the euro area and by 2.6% in the EU28 in the fourth quarter of 2017, after +2.8% in both zones in the previous quarter.

During the fourth quarter of 2017, GDP in the United States increased by 0.6% compared with the previous quarter (after +0.8% in the third quarter of 2017). Compared with the same quarter of the previous year, GDP grew by 2.5% (after +2.3% in the previous quarter). Over the whole year 2017, GDP grew by 2.5% in both zones.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2461 (4471)

$1.2444 (2578)

$1.2410 (913)

Price at time of writing this review: $1.2372

Support levels (open interest**, contracts):

$1.2319 (973)

$1.2300 (2429)

$1.2277 (5247)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 126388 contracts (according to data from February, 13) with the maximum number of contracts with strike price $1,2400 (5247);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4028 (3319)

$1.4005 (1749)

$1.3968 (1164)

Price at time of writing this review: $1.3895

Support levels (open interest**, contracts):

$1.3840 (1537)

$1.3809 (1778)

$1.3765 (2032)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 43742 contracts, with the maximum number of contracts with strike price $1,3900 (3319);

- Overall open interest on the PUT options with the expiration date March, 9 is 43109 contracts, with the maximum number of contracts with strike price $1,3850 (2206);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Japan's gross domestic product added a seasonally adjusted 0.1 percent on quarter in the fourth quarter of 2017, the Cabinet Office said in Wednesday's preliminary reading, cited by rttnews.

That was shy of expectations for a gain of 0.2 percent and down from 0.6 percent in the third quarter.

On an annualized basis, GDP gained 0.4 percent - again missing expectations for 1.0 percent and down from the downwardly revised 2.2 percent increase in the three months prior (originally 2.5 percent).

Nominal GDP was flat on quarter, missing forecasts for a gain of 0.4 percent and down from 0.6 percent in the third quarter.

The German economy continued to grow at the end of 2017. In the fourth quarter of 2017, the gross domestic product (GDP) rose 0.6% on the previous quarter after adjustment for price, seasonal and calendar variations. The economic situation in Germany in 2017 thus was characterised by steady and strong growth (+0.9% in the first quarter, +0.6% in the second quarter and +0.7% in the third quarter). The Federal Statistical Office (Destatis) also reports that this results in a 2.2% increase (calendar-adjusted: +2.5%) for the whole year of 2017. The provisional annual GDP result released in January has been confirmed.

Consumer prices in Germany rose by 1.6% in January 2018 compared with January 2017. The inflation rate - measured by the consumer price index - thus decreased slightly at the beginning of the year (December 2017: +1.7%, November 2017: +1.8%). Compared with December 2017, the consumer price index fell by 0.7% in January 2018, which was largely due to seasonal influences. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 January 2018.

Energy prices, which in January 2018 were by 0.9% higher than a year earlier, had a downward effect on the overall inflation rate. Also, the increase in energy prices slowed again (December 2017: +1.3%; November 2017: +3.7%). From January 2017 to January 2018, prices rose especially for heating oil (+5.5%). Price increases were also recorded for electricity (+1.6) and charges for central and district heating (+1.5%). In contrast, the prices of gas (-1.3%) and motor fuels (-0.5%) were down on the same month a year earlier. Excluding energy prices, the inflation rate would have been slightly higher (+1.7%) in January 2018.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.