- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 21-05-2012.

weaken the nation’s foreign-exchange rates. BOJ officials will gather for a two-day meeting starting tomorrow. The central bank expanded its asset-purchase program in February and April. Last week, two bond-buying operations failed to attract the central bank’s target for sell offers.

The euro erased losses against the dollar as German Finance Minister Wolfgang Schaeuble said Germany and France will do “everything necessary” to keep Greece in the shared currency. German Finance Minister Wolfgang Schaeuble met with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare for a summit meeting in Brussels on May 23.

EUR/USD $1.2700, $1.2780, $1.2800, $1.2900.

USD/JPY Y79.50, Y79.75, Y80.00

GBP/USD $1.5785, $1.5880, $1.5900

EUR/GBP stg0.8000

Data:

05:45 Switzerland SECO Consumer Climate Quarter I -19 -18 -8

The yen declined on speculation the Bank of Japan (8301) will add to stimulus measures this week to support growth and weaken the nation’s foreign-exchange rates.

Japan’s currency slid as speculation European officials may step up efforts to tackle the debt crisis damped demand for haven assets.

The euro fell before German and French officials meet today to discuss ways to contain Europe’s financial turmoil.

Australia’s dollar snapped a six-day drop against the greenback and an index of implied volatility fell.

EUR/USD: the pair returned to area of session low $1,2750.

GBP/USD: the most part of the European session the pair was limited $1,5790-$ 1,5840.

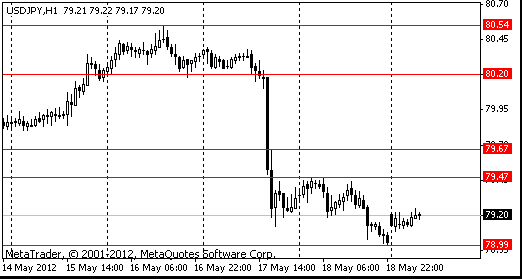

USD/JPY: the pair receded in Y79.20 area after showed session high at Y79.45.

EUR/USD

Offers $1.2860/80, $1.2850, $1.2820, $1.2810/15

Bids $1.2750, $1.2710/00, $1.2640

GBP/USD

Offers $1.6000, $1.5950/55, $1.5900/10, $1.5880, $1.5840/60

Bids $1.5780/70, $1.5755/50, $1.5720, $1.5700

AUD/USD

Offers $0.9980/85, $0.9960/65, $0.9950, $0.9920/25, $0.9895/00, $0.9875/80

Bids $0.9825/20, $0.9805/00, $0.9780/60, $0.9750, $0.9700, $0.9665/60

USD/JPY

Offers Y80.35/40, Y80.15/20, Y80.00, Y79.60/65, Y79.50

Bids Y78.80, Y78.55/50, Y78.00

EUR/JPY

Offers Y102.70/75, Y102.50, Y102.30/40, Y102.00, Y101.65/70

Bids Y101.00, Y100.90/85, Y100.50, Y100.00, Y99.80

EUR/GBP

Offers stg0.8140/50, stg0.8120, stg0.8090/100

Bids stg0.8050/40, stg0.8025/20, stg0.8000, stg0.7980, stg0.7965/60, stg0.7950

Resistance 3: Y80.55/60 (area of high of May)

Resistance 2: Y79.80 (МА (200) for Н1)

Resistance 1: Y79.50 (session high, May 18 high)

Current price: Y79.28

Support 1: Y79.00 (session high)

Support 2: Y78.55 (МА (200) for D1)

Support 3: Y78.20 (earlier resistance, area of high of December’2011 and January’2012)

Resistance 3: Chf0.9600 (area of high of January)

Resistance 2: Chf0.9500 (May 18 high)

Resistance 1: Chf0.9420 (session high)

Current price: Chf0.9404

Support 1: Chf0.9370 (area of session low and МА (200) for Н1)

Support 2: Chf0.9330 (May 15 low, 38,2 % FIBO Chf0,9040-Chf0,9500)

Support 3: Chf0.9300 (earlier resistance, area of May 9-11 highs)

Комментарии: пара не сумела закрепится выше линии сопротивления от ноября 2010 года и отступила (для ее преодоления паре необходимо было прошлую неделю выше уровня Chf0,9440, однако сил покупателей было не достаточно и пара завершили неделю на отметке Chf0,9397).

Resistance 3 : $1.5990 (intraday high on May 16, МА (200) for Н1)

Resistance 2 : $1.5930 (May 17 high)

Resistance 1 : $1.5870 (session high, May 18 high, МА (200) and МА (100) for D1)

Current price: $1.5818

Support 1 : $1.5730 (May 18 low)

Support 2 : $1.5700 (psychological level)

Support 3 : $1.5600 (psychological level, low of March)

Resistance 3 : $1.2900 (May 14 high)

Resistance 2 : $1.2870 (May 15 high)

Resistance 1 : $1.2820 (area of session high and МА (200) for Н1)

Current price: $1.2772

Support 1 : $1.2750 (earlier resistance, area of session low and May 16-17 highs)

Support 2 : $1.2640 (May 18 low)

Support 3 : $1.2620 (low of January)

EUR/USD $1.2700, $1.2780, $1.2800, $1.2900.

USD/JPY Y79.50, Y79.75, Y80.00

GBP/USD $1.5785, $1.5880, $1.5900

EUR/GBP stg0.8000

00:00 Canada Bank holiday -

04:30 Japan All Industry Activity Index, m/m March -0.1% 0.0% -0.3%

05:00 Japan Leading Economic Index March 96.6 96.4

05:00 Japan Coincident Index - 96.5 96.7

The yen dropped versus all of its major counterparts amid speculation the Bank of Japan will add to stimulus measures this week to support growth and weaken the nation’s currency. BOJ officials will gather for a two-day meeting starting tomorrow. The central bank expanded its asset-purchase program in February and April. Last week, two bond-buying operations failed to attract the central bank’s target for sell offers.

The yen trimmed its gain from last week against the U.S. dollar before a May 23 report that may show Japan had a trade deficit for a second-straight month. Japan probably had a trade shortfall of 470.8 billion yen ($5.9 billion) last month after a revised deficit of 84.5 billion yen in March, according to the median estimate of economists in a Bloomberg News survey before the data is released May 23.

Demand for the euro was limited ahead of data forecast to show consumer confidence in the 17-nation currency bloc dropped to a four-month low in May amid concern the debt crisis is worsening. An index of consumer sentiment in Europe probably dropped to minus 20.5 this month from minus 19.9 in April, a survey showed before the Brussels-based European Commission reports the figure tomorrow. That would be the lowest level since January.

Spain is scheduled to sell three- and six-month bills tomorrow. The nation revised its 2011 budget shortfall to 8.9 percent of gross domestic product from 8.5 percent previously, the Budget Ministry said in a statement e-mailed on May 18.

The Dollar remained lower after a one-day decline as Asian stocks advanced, curbing demand for the relative safety of the U.S. currency. The Group of Eight nations pushed for Greece, which will be holding its second national vote in six weeks, to stay in the euro area, leaders said at a weekend gathering at U.S. President Barack Obama’s retreat outside Washington.

EUR/USD: the pair gain above $1.2800, however receded later.

GBP/USD: the pair rose to Friday’s high, however receded later.

USD/JPY: the pair has slightly grown.

At 0700GMT, Bank of England MPC Member Adam Posen speaks at the Tokyo Conference on Global Financial Regulatory Issues. Ahead of that, at 0915GMT, Atlanta Fed President Dennis Lockhart speaks at the Tokyo seminar on "limits of monetary policy: what more can central bankers do to stabilize global economy and underpin global growth?".

On Monday the euro dropped to its lowest level in almost four months against the dollar as a leadership vacuum in Greece prompted European officials to weigh prospects for the currency union’s first Alexis Tsipras, who heads Greece’s anti-bailout Syriza party, wouldn’t attend a meeting called by President Karolos Papoulias today, the Athens-based party said in a statement. Syriza rejected a unity government last week following inconclusive elections on May 6. Greece may face another vote unless leaders can agree on a new coalition.

On Tuesday the euro fell to the lowest in almost four months versus the dollar as talks to form a Greek government failed, fueling concern the nation may leave the shared currency and boosting investor demand for safety. Greek President Karolos Papoulias’ meeting in Athens with political leaders failed to produce a government after an inconclusive May 6 vote. He called for a meeting to form a caretaker government to lead the country until the vote. A second election threatened to extend the country’s political gridlock and reignited speculation Greece will renege on its pledges to cut spending, required by the terms of its 240 billion euros ($306 billion) in bailouts. It added to bets Europe’s sovereign-debt crisis will worsen.

On Wednesday the euro fell to a four-month low against the dollar after the European Central Bank said it will temporarily stop lending to some Greek banks and as the nation’s leaders prepare for a second election.

The euro dropped for a fourth day versus the greenback as the ECB said it will push the responsibility for lending onto Greece’s central bank until the banks have sufficiently boosted their capital.

The pound fell the most in a month against the dollar as the Bank of England said U.K. growth will stay “subdued” in the near term.

On Thursday the yen extended its gain against the dollar after data showed U.S. jobless claims for unemployment benefits were unchanged last week and another report showed Philadelphia- area manufacturing decreased in May. The euro fell to a four-month low as Spain’s borrowing costs rose at an auction, stoking concern that the region’s financial contagion is spreading from Greece. Europe’s shared currency declined against most of its major counterparts as the European Central Bank said it will temporarily stop lending to some Greek banks.

On Friday the euro touched a four-month low against the dollar as German Finance Minister Wolfgang Schaeuble said financial-market turmoil may last another two years, adding to concern Europe’s crisis is worsening. The 17-nation currency reversed its losses as a technical indicator signaled its recent decline came too fast. The euro was headed for a fourth weekly decline versus the yen before a meeting of Group of Eight nations’ leaders beginning. German Chancellor Angela Merkel and fellow European leaders will face pressure from their G-8 counterparts to do more to quell the turmoil after speculation Greece will exit the euro wiped almost $4 trillion from global stock markets this month. Fitch lowered Greece’s ranking to CCC from B-, saying the strong showing of “anti-austerity” parties in elections on May 6 and subsequent failure to form a government underscored the lack of public and political support for the country’s bailout from the European Union and International Monetary Fund.

Moody’s yesterday lowered the credit ratings of Spain’s biggest banks including Banco Santander SA (SAN) and Banco Bilbao Vizcaya Argentaria SA, citing economic weakness and the government’s mounting budget strain.

Resistance 3: Y80.20 (May 16 low)

Resistance 2: Y79.65 (May 14 low)

Resistance 1: Y79.45 (May 18 high)

The current price: Y79.20

Support 1: Y79.00 (May 18 low)

Support 2: Y78.70 (Feb 15 high)

Support 3: Y78.15 (Feb 15 low)

Resistance 3: Chf0.9525 (Jan 16 low)

Resistance 2: Chf0.9500 (May 18 high)

Resistance 1: Chf0.9420 (session high)

The current price: Chf0.9393

Support 1: Chf0.9370 (session low)

Support 2: Chf0.9330 (May 15 low)

Support 3: Chf0.9305 (May 14 low)

Resistance 3 : $1.5930 (May 17 high)

Resistance 2 : $1.5885 (May 16 low)

Resistance 1 : $1.5840 (session high)

The current price: $1.5839

Support 1 : $1.5795 (session low)

Support 2 : $1.5730 (Mar 18 low)

Support 3 : $1.5695 (Mar 16 low)

Resistance 3 : $1.2905 (May 11 low, May 14 high)

Resistance 2 : $1.2870 (May 15 high)

Resistance 1 : $1.2810 (session high)

The current price: $1.2788

Support 1 : $1.2750 (session low)

Support 2 : $1.2640 (Jan 18 low)

Support 3 : $1.2625 (low of Jan)

00:00 Canada Bank holiday -

04:30 Japan All Industry Activity Index, m/m March -0.1% 0.0%

05:00 Japan Leading Economic Index March 96.6

05:00 Japan Coincident Index - 96.5

05:45 Switzerland SECO Consumer Climate Quarter I -19 -18

07:00 United Kingdom MPC Member Posen Speaks -

09:15 U.S. FOMC Member Dennis Lockhart Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.