- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 26-05-2022.

- EUR/USD remains on the front foot around weekly/monthly top, sidelined of late.

- Softer USD, risk-on mood underpin the bullish bias targeting 50-DMA, early April’s low.

- Shrinking Fed vs. ECB divergence appears the key catalyst to recall bulls, highlighting US PCE Price Index for April.

EUR/USD grinds higher around the weekly top, as well as monthly high, recently steady around 1.0735 as bulls await fresh clues during a lackluster Asian session on Friday. The major currency pair cheered broad US dollar weakness, as well as the market’s optimism, to portray the run-up.

That said, the US Dollar Index (DXY) fades the mid-week bounce off the monthly low, dropping back to 101.78 at the latest, as market participants welcomed the lack of uncertainty over the Fed’s next move with zeal.

While portraying the mood, Wall Street benchmarks portrayed the second day of gains whereas the US 10-year Treasury yields remained indecisive around 2.75%. Further, S&P 500 Futures begins Friday without any major surprises around 4,055, down 0.05% intraday at the latest.

Also favoring the greenback bears were fears of an economic slowdown amid the recent raft of downbeat data. The US preliminary Q1 2022 Annualized GDP eased to -1.5%, below -1.4% prior and -1.3% forecasts, whereas a slump in the US Pending Home Sales for April, to -3.9% versus -2.0% forecast, also weighed on the greenback.

On a different page, recently hawkish comments from the European Central Bank (ECB) officials and the Eurozone diplomats, shrugging off recession fears due to the Russia-Ukraine crisis. The bloc’s policymakers also teased rate hikes of late and cut the monetary policy divergence between the US Federal Reserve (Fed) and the ECB, which bolstered the EUR/USD prices.

To sum up, EUR/USD prices are likely to remain firmer as the ECB vs. Fed drama turned in favor of the bloc. However, today’s US inflation data is the Fed’s preferred gauge of price pressure and may change the show of appeared extreme, expected at 4.9% YoY versus 5.2% prior. Also important will be the Fedspeak and the geopolitical headlines concerning China and Russia.

Read: US Core PCE Preview: Why there is room for a dollar-lifting upside surprise

Technical analysis

Bullish MACD and RSI (14) back the clear break of a monthly horizontal hurdle to keep buyers hopeful of crossing the 50-DMA level surrounding 1.0750. However, lows marked during early April, near 1.0760, could probe the bulls before March’s low of 1.0806.

Alternatively, a fortnight-old support line, near 1.0650, could test the pullback moves before the aforementioned horizontal resistance-turned-support around 1.0640.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the second consecutive day by the end of Thursday’s North American session.

That said, the inflation gauge rose from 2.56% to 2.62% at the latest as traders await the Fed’s preferred inflation barometer, namely the US Core Personal Consumption Expenditure (PCE) Price Index for April, for better decision-making.

It’s worth noting that the recently downbeat US data and confirmations of the Fed’s 50 bps rate hikes in the next two meetings favored market sentiment and dragged the US dollar.

While portraying the mood, Wall Street benchmarks portrayed the second day of gains whereas the US 10-year Treasury yields remained indecisive around 2.75%. Further, S&P 500 Futures begins Friday without any major surprises around 4,055, down 0.05% intraday at the latest.

To sum up, the recently firmer inflation expectations may help the US dollar consolidate weekly losses amid the market’s anxiety ahead of the key data.

Read: US Core PCE Preview: Why there is room for a dollar-lifting upside surprise

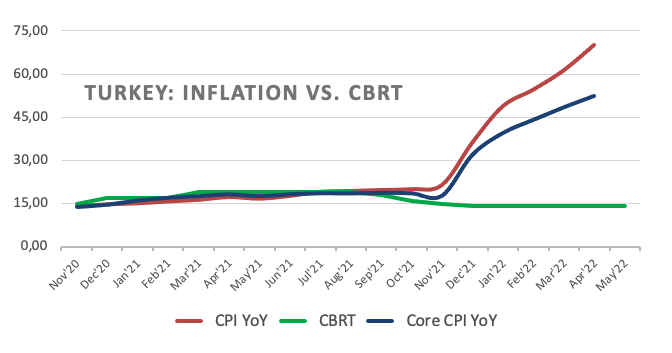

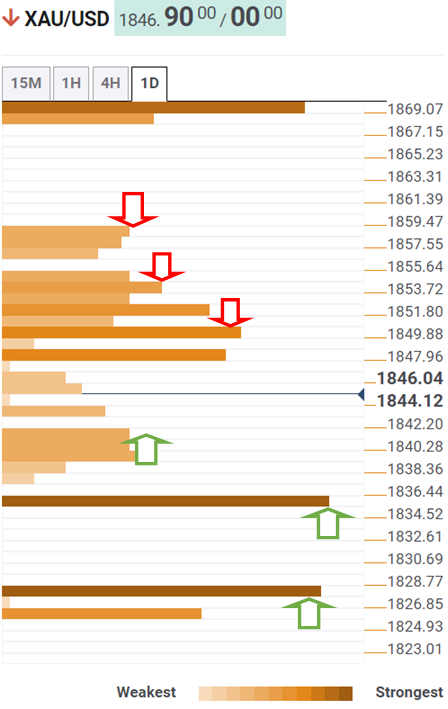

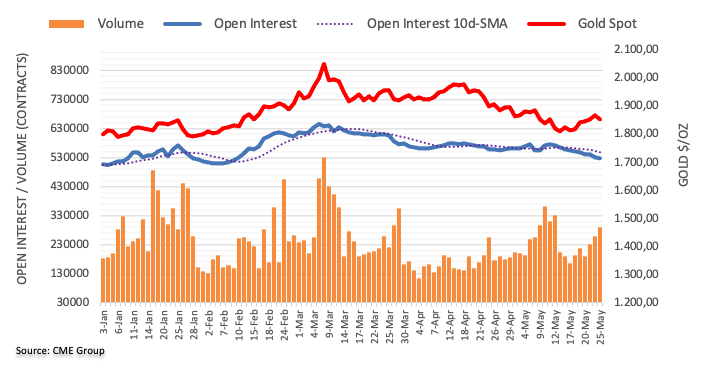

- Gold price has attracted bids to near $1,850.00 on broader weakness in the DXY.

- Poor GDP numbers and flat PCE figure has dented the demand for the DXY.

- In today’s session, US Core PCE and Michigan CSI are in focus.

Gold price (XAU/USD) witnessed a minor pullback towards $1,850.00 in its initial trading hours but has bounced back sharply. The precious metal is displaying a balance auction in a range of $1,840.76-1,856.35 from Wednesday amid the unavailability of any potential trigger that could provide a direction to the asset. Also, the release of the US Gross Domestic Product (GDP) numbers and Personal Consumption Expenditure (PCE) figures on Thursday failed to provide any meaningful move in the counter.

The annualized US GDP landed at -1.5%, lower than the estimates of -1.3% and the prior print of -1.4%. An underperformance on the GDP front didn’t bring a supportive move in the asset. Apart from that, the precious metal didn’t respond to the unchanged PCE numbers.

On the dollar front, the US dollar index (DXY) is established below 102.00. The DXY is expected to extend its losses after slipping below Tuesday’s low at 101.65. A firmer rebound in the positive market sentiment brought some significant offers to the counter.

On Friday, investors will keep the Core Personal Consumption Expenditure (PCE) Price Index on their radar, which may tumble to 4.9% against the prior print of 5.2%. Apart from that, Michigan Consumer Sentiment Index (CSI) will remain in focus, which is seen unchanged at 59.1.

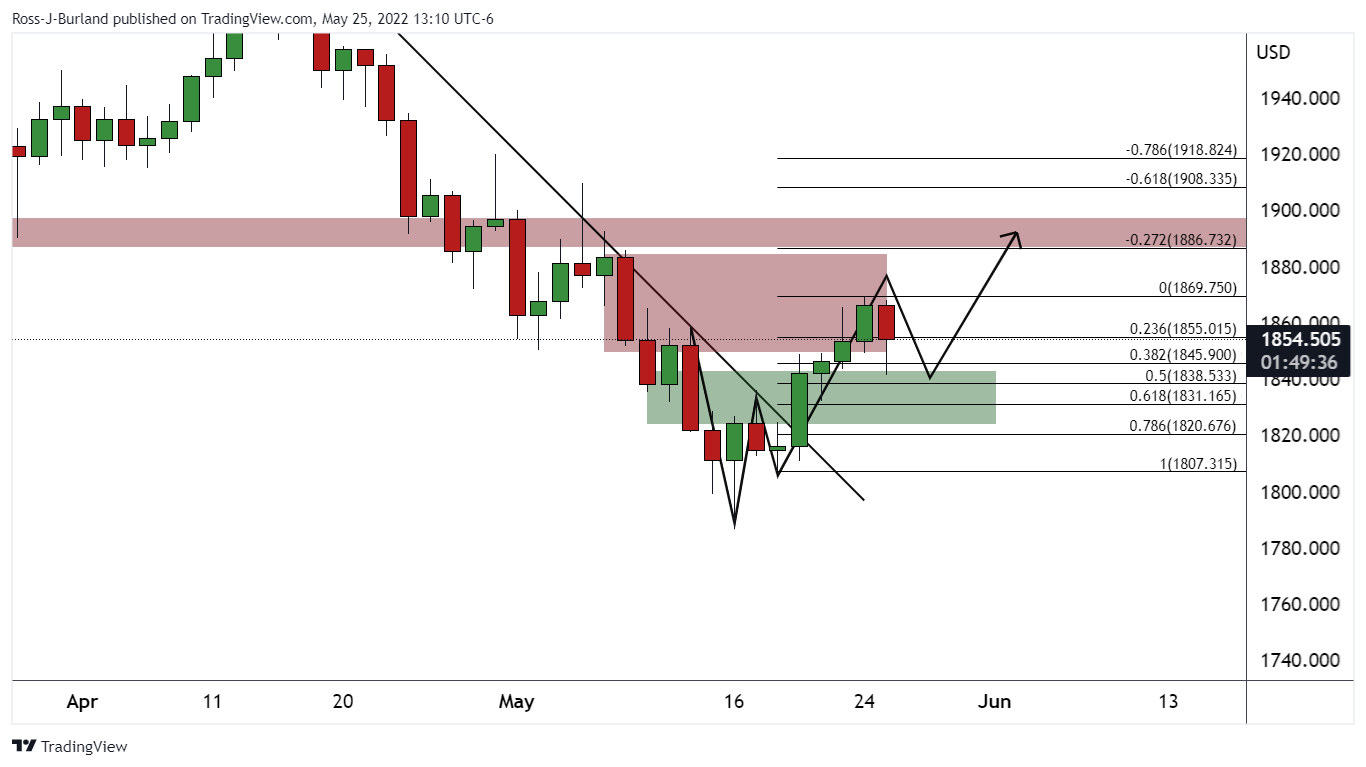

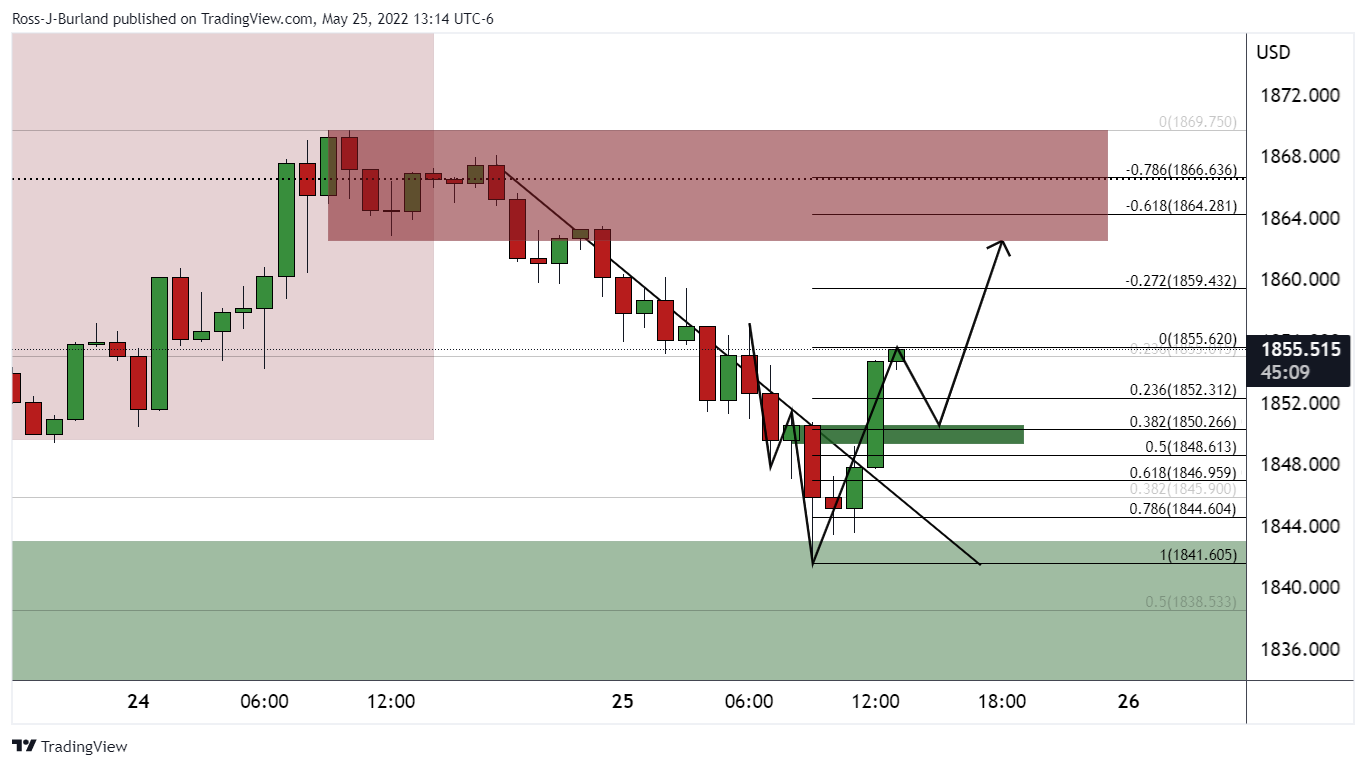

Gold technical analysis

On an hourly scale, gold prices are trading in a consolidation range of $1,840.76-1,856.35 near the upward sloping trendline placed from May 16 low at $1,786.94, adjoining May 19 low at $1,811.01. The 20- and 50-period Exponential Moving Averages (EMAs) have given a bearish crossover at $1,856.23, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a no trading zone.

Gold hourly chart

-637892043162561320.png)

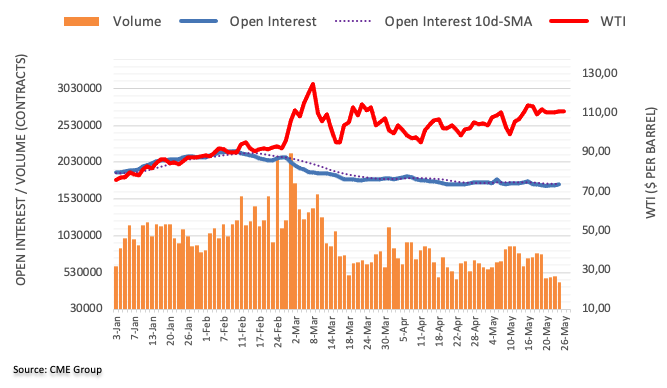

- WTI remains sidelined after rising the most in a fortnight.

- Break of two-month-old descending trend line, bullish MACD signals favor buyers.

- Rising wedge can test buyers on the way to late March swing high.

WTI struggles to extend the upside break of the key hurdle, grinds higher around the two-month top during Friday’s Asian session. That said, the black gold seesaws near $113.10 at the latest.

Given the firmer RSI (14), not overbought, joining the bullish MACD signals to back WTI’s latest breakout, the commodity prices are likely to extend the run-up.

However, a six-week-old rising wedge bearish chart pattern tests the upside momentum, with the formation’s resistance line near $114.90 acting as an immediate hurdle.

Also challenging the short-term WTI buyers is March’s high near $115.90, a break of which will allow the bulls to aim for the yearly top marked in March near $129.45.

Meanwhile, pullback moves remain elusive beyond the resistance-turned-support line from March 24, around $112.55 by the press time.

Following that, the 10-DMA and support line of the aforementioned wedge, respectively near $110.35 and $108.75, will be crucial to watch.

Should the quote drops past $108.75, it confirms the rising wedge and becomes vulnerable to testing April’s low near $92.65.

WTI: Daily chart

Trend: Further upside expected

“Chinese Premier Li Keqiang warned of dire consequences if officials don’t move decisively to prevent the economy from sliding further, saying a contraction in the second quarter must be avoided,” said Bloomberg.

The news also adds that Li’s comments at an emergency meeting Wednesday were more frank than the official readout published by state media.

Key quotes

He said China will pay a huge price with a long road to recovery if the economy can’t keep expanding at a certain rate.

That means growth must be positive in the second quarter, he said, according to the people, who declined to be identified in order to discuss official matters.

The remarks reinforce economists’ expectations that the government’s growth target this year of about 5.5% is increasingly out of reach.

Li listed a handful of objectives for local officials to focus on this year, including better balancing Covid controls and economic growth.

Li said the spike in the jobless rate -- it hit 6.1% in April, close to a record -- would bring about grave consequences.

Li also stressed the need to ensure grain output does not fall below last year’s levels, as such production is key to keeping inflation in check.

FX implications

The news seems to have a negative impression on the AUD/USD traders, due to Australia’s trade ties with China. Even so, the Aussie pair remains sidelined at around 0.7100 during the early Friday’s Asian session.

Read: AUD/USD bulls flirt with 0.7100 with eyes on Aussie Retail Sales, US PCE Inflation

- The EUR/JPY remains firm in the week, advancing 1.02%.

- On Thursday, BoJ Kuroda’s hawkish commentary did not weigh on the EUR/JPY.

- EUR/JPY Price Analysis: To fall towards 132.50 once the rising wedge break is achieved.

The EUR/JPY marches firmly inside a “rising wedge” above the 50-day moving average (DMA), advancing for the third day out of five, but remains below the weekly highs reached on May 23, at 136.79, and since then, the cross-currency has been unable to approach those levels. At 136.31, the EUR/JPY edges higher some 0.03% as the Asian Pacific session begins.

Sentiment-wise, investors’ spirits are upbeat after Wall Street registered hefty gains on Thursday, and Asian equity futures prepare to open higher. Wednesday’s release of the US Federal Reserve minutes did not change what Fed policymakers have expressed since May 5 and, in fact, reaffirmed that the US central bank would hike 0.50% in each of the June and July meetings.

Elsewhere, the EUR/JPY recovered from Wednesday’s losses, despite hawkish commentary from the Bank of Japan (BoJ) Governor Haruiko Kuroda, who said that “When debating exit strategy, key will be how to raise rates and reduce BOJ’s balance sheet.”

Also read: BOJ’s Kuroda: Don’t expect inflation to stay around 2% next year, and the year after

EUR/JPY Price Forecast: Technical outlook

EUR/JPY price action remains confined within the boundaries imposed by the “rising wedge” formed in the daily chart. Usually, the aforementioned chart pattern has a bearish bias. However, EUR/JPY traders need to be attentive to the cross-currency price action near the 50-day moving average (DMA) at 135.93, which could be difficult to break for EUR/JPY bears on their way to achieving a downward break of the pattern.

In the case of that event playing out, the EUR/JPY first support would be the 50-DMA at 135.93. A breach of the latter would send the cross towards the May 20 daily low at 134.58. Once cleared, the following support would be the confluence of the May 12 low and the 100-DMA around the 132.65-81 area.

Key Technical Level

- AUD/USD fails to cheer equity gains amid market’s indecision, growth fears.

- Softer US GDP, housing data join repetitive Fedspeak to underpin US dollar weakness.

- Market sentiment improves despite recession woes, known path for Fed, downbeat US data play their role.

- Australia’s Retail Sales for April may entertain intraday traders ahead of Fed’s preferred version of inflation.

AUD/USD holds onto the recently sidelined moves around 0.7100 as bulls and bears jostle over mixed clues heading into the key data on Friday. Also restricting the Aussie prices are downbeat statistics at home and looming economic fears over the largest customer China, not to forget uncertainty in the markets.

Although the softer US data helped the AUD/USD pair to recover early losses on Thursday, the pair remains capped below 0.7100 as traders recollect downbeat figures at home. That said, Australia’s Private Capital Expenditure (CAPEX) for Q1 2022 dropped below 1.5% expected to -0.3%. On the other hand, the US preliminary Q1 2022 Annualized GDP eased to -1.5%, below -1.4% prior and -1.3% forecasts. Further, a slump in the US Pending Home Sales for April, to -3.9% versus -2.0% forecast also weighed on the greenback.

Elsewhere, market sentiment remained positive, as traders feel relieved in predicting the Fed’s next move with more accuracy, mainly supported by the repeated Fedspeak of 50 bps move and downbeat US data. It’s worth noting, however, that the looming fears of economic recession in the US and China probe the AUD/USD bulls due to trade ties with Beijing and also being a risk barometer pair.

Amid these plays, Wall Street benchmarks portrayed the second day of gains whereas the US 10-year Treasury yields remained indecisive around 2.75%. Further, S&P 500 Futures begins Friday without any major surprises around 4,055, down 0.05% intraday at the latest.

Moving on, Australia’s Retail Sales for April, expected 0.9% versus 1.6% prior, will offer immediate directions to the AUD/USD pair, especially after recently softer Aussie data. Also important will be the Fedspeak and the geopolitical headlines concerning China and Russia, not to forget the US Core Personal Consumption Expenditure (PCE) Price Index for April, expected at 4.9% YoY versus 5.2% prior.

Read: US Core PCE Preview: Why there is room for a dollar-lifting upside surprise

Should the scheduled Aussie figures came in softer, the bears may have an upper hand after multiple days of struggle for entry.

Technical analysis

AUD/USD buyers seem running out of fuel after rising to 0.7127 on Monday. Even so, a convergence of the 21-DMA and previous resistance line from early April, around 0.7030, becomes necessary for the bear’s entry.

- A formation of a Falling Channel is advocating the yen bulls.

- Investors should brace for a death cross formation, which will strengthen yen further.

- The RSI (14) is expected to weaken the greenback after a prompt action below 40.00.

The USD/JPY pair is attempting to rebound after a minor correction from 127.40 in early Tokyo. A rangebound move has been observed this week as the asset has remained in a bracket of 126.36-127.48. The volatility has been contracted sharply investors are bracing for wild moves going forward.

A Falling Channel chart formation on a four-hour scale is advocating the dominance of the yen bulls in the upcoming trading sessions. The upper boundary of the Rising Channel is placed from May 11 high at 130.81 while the lower boundary is plotted from May 4 low at 128.63. The asset is displaying back and forth moves in a 126.36-127.48 range near its crucial support at 126.97.

The 50- and 200-period Exponential Moving Averages (EMAs) are expected to display the death cross formation, which will strengthen the Japanese yen against the greenback further.

Meanwhile, the Relative Strength Index (RSI) is oscillating in a 40.00-60.00 range, which signals topsy-turvy moves in the asset. A decisive slippage below 40.00 will bring a prompt downside action into the asset.

Investors should tighten their shorts if the asset drops below Tuesday’s low at 126.36, which will drag the asset towards March 28 high at 125.10, followed by April 1 high at 123.04.

On the flip side, the greenback bulls could take the charge if the asset oversteps May 19 high at 128.95, which will drive the asset towards May 17 high at 129.78. A breach of the latter will expose the asset to recapture its multi-year high at 131.28.

USD/JPY four-hour chart

-637892013840381041.png)

- GBP/USD grinds higher at three-week top, eyes further gains.

- UK government announced multiple measures to help the most vulnerable households.

- US Dollar Index remains pressured around monthly low amid risk-on mood, downbeat US data.

- Fed’s preferred inflation gauge eyed for further USD weakness.

GBP/USD remains on the way to a monthly high, after rising for three consecutive days to a three-week top, as the UK’s aid package joins broad US dollar weakness. That said, the cable pair grinds higher around 1.2600 by the press time of early Friday morning in Asia.

UK’s Chancellor Rishi Sunak announced multiple measures to tame the cost of living on Thursday. The government’s temporary levy on energy profits and targeted support to the most vulnerable households in the UK are some of the measures that favored the cable bulls the previous day.

It’s worth noting that the recently hawkish BOE and comparatively less appreciation for the Fed’s 50 bps rate-hike plans also underpin the GBP/USD pair’s latest advances.

On the other hand, the US Dollar Index (DXY) reversed Wednesday’s rebound from the monthly low as the US preliminary Q1 2022 Annualized GDP eased below -1.4% prior and -1.3% forecasts to -1.5%. Further, a slump in the US Pending Home Sales for April, to -3.9% versus -2.0% forecast also weighed on the greenback.

Elsewhere, market sentiment remained positive, as traders feel relieved in predicting the Fed’s next move with more accuracy. Also, downbeat US data and an absence of major data played their roles to underpin the GBP/USD upside.

While portraying the mood, Wall Street benchmarks portrayed the second day of gains whereas the US 10-year Treasury yields remained indecisive around 2.75%.

Looking forward, Fedspeak and the geopolitical headlines concerning China and Russia will be crucial for short-term GBP/USD moves. Above all, the US Core Personal Consumption Expenditure (PCE) Price Index for April, expected at 4.9% YoY versus 5.2% prior, will be crucial amid the latest run of softer US data weighing on the greenback.

Read: US Core PCE Preview: Why there is room for a dollar-lifting upside surprise

Technical analysis

Sustained trading beyond the fortnight-old rising support line, near 1.2575, directs GBP/USD buyers towards the monthly high near 1.2640. However, bulls remain unconvinced below a downward sloping trend line from late February, around 1.2740.

- The AUD/JPY is recording gains of 0.17% during the week.

- Despite an upbeat market sentiment, the AUD/JPY failed to break above crucial resistance above 91.72.

- AUD/JPY Price Forecast: Range-bound in a congestion area, preceded by an uptrend; an upward break looms.

The AUD/JPY barely moves as the Asian Pacific session begins, though on Thursday ended recording minimal losses, despite an upbeat market mood, mainly ignored by FX traders, as the sentiment in the FX complex was mixed. At 90.25, the AUD/JPY posts minimal gains of 0.08%.

US equities finished with gains, between 1.61% and 2.68%, eyeing to end the week on a higher note. Meanwhile, Asian stock indexes are poised for a higher open. Now that the Federal Reserve has released its May Meeting Minutes, investors have become more confident that Fed officials have set the pace of rate hikes, as Fed speakers expressed since May 5.

AUD/JPY Price Forecast: Technical outlook

Turning to Price action, the AUD/JPY has failed to reclaim above the 50-day moving average (DMA) at 91.72, and the cross-currency weekly high is the May 23 daily peak at 91.04. AUD/JPY traders need to be aware that the pair is consolidating in the 89.08-91.15 range, but market mood and the lack of a catalyst keep the pair range-bound. Nevertheless, the previously-mentioned congestion area is preceded by an uptrend, meaning that an upside break would aim towards the measured distance of the high-low of that range, being 93.20, the measured target, short of the May 5 swing low at 94.02.

However, if that scenario is about to play out, as of today, the AUD/JPY’s first resistance would be the May 23 daily high at 91.04. Break above would expose the 50-DMA at 91.72. Once that supply zone is cleared, there’s nothing on the way up to the measured 93.20 targets.

Key Technical Levels

- EUR/USD's market structure is now bullishon the daily chart.

- EUR/USD's support near 1.0705 could offer a base from which bulls can engage in order to target the 1.08 areas.

As per the prior analysis, EUR/USD Price Analysis: Traders looking for a catalyst from the Fed, bulls on a knife's edge, the euro, following initial mitigation of some upside eventually melted to the downside into the targetted area of 1.0640.

EUR/USD prior analysis

''The bearish head and shoulders are a topping pattern that currently features in the 15-min time frame. A break of the neckline near 1.0725 could spell trouble for the committed bulls. A break of 1.0705 will likely open the way for further supply to mitigate the price imbalance towards a 38.2% Fibonacci retracement of the daily bullish breakout impulse near 1.0665 that guards a 50% mean reversion to 1.0640.''

Subsequent price action:

For the FOMC minutes, the pair was based at the targetted support area and there were prospects of a higher correction from support:

Immediately following the minutes the price indeed resumed the upside:

This now invalidates the immediate bearish outlook and leaves a bullish daily continuation on the map:

EUR/USD daily chart

The price broke the horizontal resistance that is now responding as a support zone on the retest. The bulls have committed to the course and a run into prior support and resistance between 1.0761 and 1.0936 could be in order with the 1.08 figure a key target.

EUR/USD H4 chart

The Information's neckline near 1.0705 could offer a base from which bulls can engage in order to target the 1.08 areas.

- NZD/USD is aiming to recapture 0.6500 as the risk-on impulse is dominating the FX domain.

- A spree of jumbo rate hikes by the RBNZ has triggered the recession fears.

- The DXY is expected to report more losses on weak economic data.

The NZD/USD pair is advancing gradually higher in the early Asian session after hitting a low of 0.6455 on Thursday. The pair is displaying a consolidation on a broader note and eventually a squeeze in volatility, which will be followed by a breakout in the same. The trading range in the asset after the monetary policy announcement by the Reserve Bank of New Zealand (RBNZ) has been 0.6437-0.6500.

It seems like a set trading range after the announcement of the interest rate decision by the RBNZ has puzzled the market participants as they are unable to decide whether to ditch kiwi bulls or not. The RBNZ featured a consecutive Official Cash Rate (OCR) hike by 50 basis points (bps) as the central bank is deploying all necessary measures to contain the soaring inflation. However, a spree of prompt actions by the RBNZ by stepping up their OCR has pressed the recession button. The continuation of an extreme hawkish monetary policy by the RBNZ will squeeze liquidity from the market swiftly and the unavailability of the dirt-cheap money will force the corporate to stick to multi-filtered investments.

Meanwhile, the US dollar index (DXY) is expected to refresh its monthly lows amid positive market sentiment. The risk-on impulse has diminished the safe-haven’s appeal. The DXY has been hammered on Thursday on lower than expected Gross Domestic Product (GDP) numbers. The annualized GDP landed at -1.5% vs. -1.3% as expected. Also, the Personal Consumption Expenditure (PCE) prices remained stable at 7%.

Going forward, investors will focus on the Core PCE Price Index, which may tumble to 4.9% against the prior print of 5.2%. Apart from that, Michigan Consumer Sentiment Index (CSI) will hog the limelight, which is seen unchanged at 59.1.

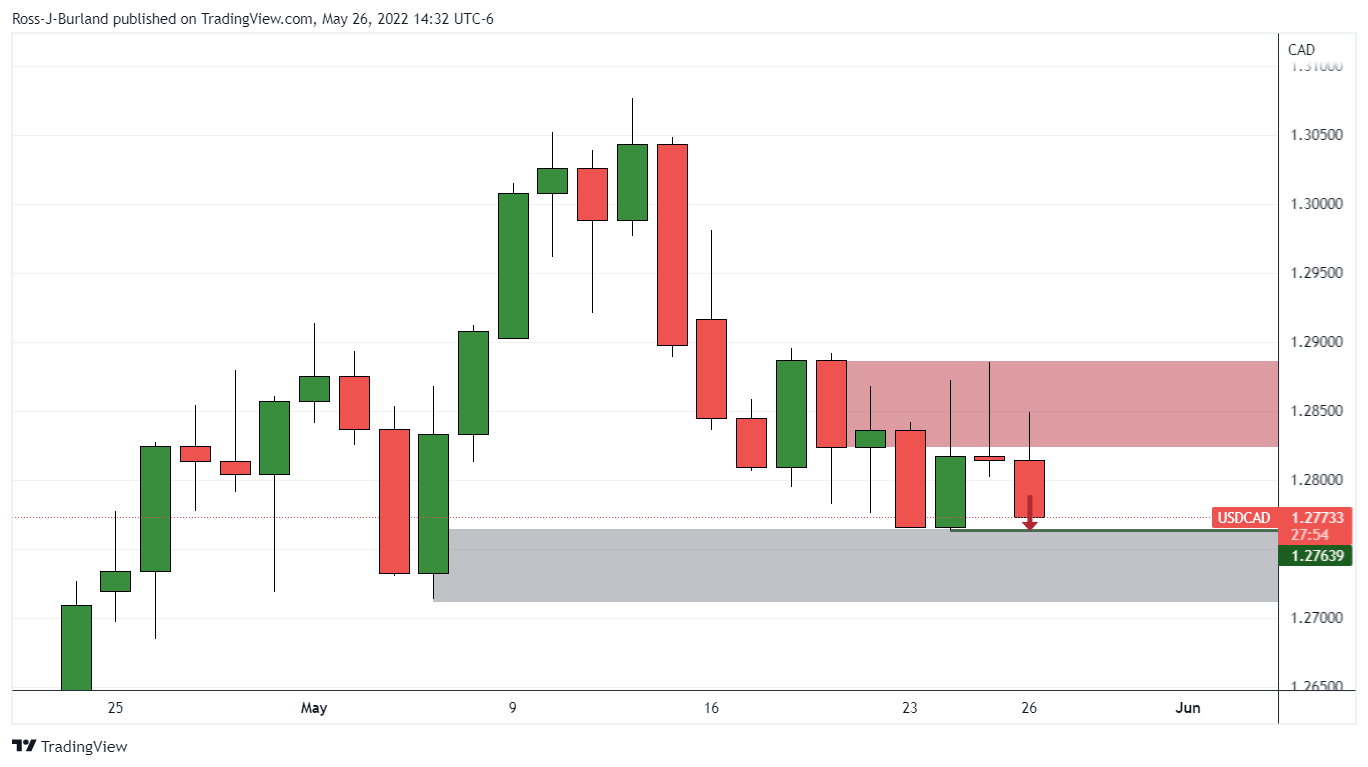

- USD/CAD is in the hands of the bears but a correction could be in the making.

- The daily chart remains bullish but the hourly bearish impulse may have run its course.

USD/CAD's bearish hourly impulse is starting to decelerate which could lead to a correction for the coming sessions to end the week. The following illustrates the market structure from both a daily and hourly perspective.

USD/CAD daily chart

The price is being rejected in the resistance zone and the bearish shooting star followed by the current bearish daily candle is bearish which likely leaves the prior lows vulnerable near 1.27639. However, a break of there opens the void in the price imbalance towards 1.2713 open for mitigation.

On the other hand, there are prospects building for a significant correction on the lower time frames:

USD/CAD H1

The price is moving in on the aforementioned lows whereby a correction to the upside could occur towards the 38.2% Fibonacci retracement of the bearish move that has a confluence with prior support. A downside continuation could then occur, if not from a higher ratio along the Fibo scale.

- The GBP/JPY is trading positive in the week by 0.27%.

- The Bank of Japan (BoJ) Governor Kuroda lifted the Japanese yen as he discussed an exit strategy to an accommodative policy stance.

- GBP/JPY Price Forecast: Failure at 161.00 might send the pair tumbling towards 158.20s.

The GBP/JPY barely edges higher in the day after seesawing in a wide 180 pip range and is set to finish Thursday’s session in the green, up just 0.04%. At the time of writing, the GBP/JPY is trading at 160.15.

US equities are recording gains as Wall Street is about to close, reflecting a risk-on mood. The GBP/JPY shifted gears, turned positive, and consolidated above the 160.00 mark, tested throughout the week. It’s worth noting that the Japanese yen got a lift from the Bank of Japan Kuroda, who talked about the exit strategy from an accommodative monetary stance to a restrictive one.

On Thursday, the GBP/JPY opened just above the 160.00 figure and bounced towards the daily high around 160.80. However, a raft of selling pressure dragged the pair towards the daily low at around 159.01, reached during the European session, followed by a recovery above the 160.00, where the cross-currency settled around.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY daily chart depicts the pair as upward biased. Nevertheless, failure to reclaim 161.00 would leave the cross-currency vulnerable to additional selling pressure. The RSI reinforces the previously-mentioned, with an almost horizontal slope and its reading in bearish territory.

That said, the GBP/JPY first support would be the 159.00 mark. Break below would expose the 100-DMA at 158.27, followed by the 200-DMA at 155.49.

Key Technical Levels

What you need to take care of on Friday, May 27:

Australian Retail Sales are coming up in Asia.

The American dollar attempted a modest recovery early on Thursday but finished the day with losses against most major rivals. Tepid US data and rallying equities helped particularly safe-haven rivals.

The US second estimate of the Q1 Gross Domestic Product, which growth was downwardly revised to -1.5%, worse than the previous estimate of -1.3% and missing the market's expectations of -1.4%.

The EUR/USD pair nears its weekly high at the end of the day, trading at around 1.0720. The GBP/USD pair hovers just below 1.2600. The Canadian dollar was among the strongest, with USD/CAD changing hands at 1.2770 as oil prices surged. WTI settled at $113.90 a barrel. The AUD/USD pair, on the other hand, remained steady in the 0.7090 region, unable to take advance of Wall Street´s rally.

Gold seesawed between gains and losses, ending the day little changed at around $1,852 a troy ounce.

Among US indexes, the Nasdaq Composite was the best performer, up roughly 3%. The S&P 500 and the Dow Jones Industrial Average added around 2% each.

Solana, Avalanche, Polkadot and NEAR Protocol at risk of a 40% flash crash

Like this article? Help us with some feedback by answering this survey:

- Gold bulls moving back in as the US dollar remains on the backfoot.

- This week's candle is bullish and the bulls have corrected to a 38.2% ratio milestone.

At $1,850, the gold price is losing around 0.18% on the day, falling from a high of $1,854.43, but has recovered from the day's lows of $1,840.75. The US dollar continues to struggle after the Federal Open Market Committee minutes. DXY is trading near the lows of the day at 101.768 dut the markets’ dovish take on the minutes.

Despite the minutes from the Federal Reserve's May meeting pointing to additional 50 basis point interest rate hikes in June and July, investors moved out of the greenback as observers considered the prospects for the Fed slowing the tightening cycle later in the year.

The minutes revealed that most participants at the Fed's May meeting judged 50 basis point hikes would likely be appropriate at the June and July policy meetings to combat inflation that they agreed had become a key threat to the economy's performance. Additionally, many of the board members believed that a fast pace of tightening would leave the central bank well-positioned later this year to assess the effects of policy firming.

No one really knows how far rates have to go

''We disagree with the market’s dovish take on the minutes,'' analysts at Brown Brothers Harriman argued.

''The dollar has softened after the FOMC minutes and US yields have fallen. To us, the views expressed in the minutes are about all they could say at the start of an aggressive tightening cycle where no one really knows how far rates have to go. The Fed is facing a very complicated situation and so is trying to burnish its hawkish credentials while trying not to pre-commit to any rate path. The minutes clearly reflect this balancing act.''

Earlier in the month, the dollar index had reached a nearly two-decade peak above 105, however, the signs that aggressive Fed action may already be slowing economic growth have prompted traders to scale back tightening bets, with Treasury yields also dropping from multi-year highs as well.

Meanwhile, to the contrary, data released on Thursday showed the number of Americans filing new claims for unemployment benefits fell last week, signalling continued tightness in the labour market. However, the decline partially unwound some of the prior week's surge, which had pushed claims to their highest level since January.

In other data on Thursday, the Commerce Department confirmed the economy contracted in the first quarter under the weight of a record trade deficit and a slightly slower pace of inventory accumulation compared to the fourth quarter. Real Gross Domestic Product fell at a 1.5% annualized pace in the March quarter, compared to a 1.4% drop initially projected, according to the second estimate from the Bureau of Economic Analysis.

Looking ahead, Friday's data schedule will include April personal income and spending data, with the Fed's preferred inflation measure, and the final reading for the May Michigan Sentiment index.

Besides data, there are fears about slowing growth in China and energy security risks in Europe could bolster safe-haven demand for the USD. ''In an environment in which the Fed and other central banks are removing liquidity, we expect higher levels of volatility in FX market,'' analysts at Rabobank argued.

Gold technical analysis

The bulls have failed to maintain control of the gold price as it crumbles below a 78.6% Fibonacci of a fake-out bullish impulse:

However, the price is now moving in on resistance and should bulls commit near $1,850, there will be prospects of a move beyond resistance which could be the foundations of a bullish close to the week.

Gold weekly chart

This week's candle is bullish and the bulls have corrected to a 38.2% ratio milestone with prospects of a 50% mean reversion in due course.

- The AUD/USD remains positive in the week, up by 0.70%.

- China’s Premier Li Keqiang warned that the economy could not achieve its goals, weighing on the AUD/USD.

- AUD/USD Price Forecast: Tilted to the downside and might have peaked around 0.7100.

The AUD/USD is almost flat during the North American session after trading in a 0.7057 low to 0.7109 high trading range, amid a risk-on market mood that keeps US equities buoyant while safe-haven assets retraced. At 0.7090, the AUD/USD is poised to finish the day with minimal gains.

Sentiment remains positive after Wednesday’s release of the Federal Reserve’s May meeting minutes. The US central bank stated that all participants agreed to rate raises of 50 bps in the next couple of meetings and mentioned that they need to move “expeditiously” to a neutral posture. Also, officials said they would remain focused on inflationary pressures, much In line with the Fed speaking rhetoric, since May 5.

Meanwhile, the US Dollar Index slumps some 0.20% during the North American session, sitting at 101.877, opening the door for a fall towards April 21 daily low at 99.818. US Treasury yields recovered some ground, led by the 10-year benchmark note, which appears to have bottomed just shy of the 50-day moving average (DMA), and is gaining two basis points, sitting at 2.768%.

During the Asian session, China’s Premier Li Keqiang sound the alarm about the slowing economy. He made comments to local officials in an emergency meeting. He said that growth risks were slipping below a “reasonable” range and warned that China would face a much longer road to recovery if the economy doesn’t keep expanding at a certain rate.

Those remarks put a lid on the AUD/USD, which was headed to record a fresh weekly high above the current one at 0.7127, eyeing a test of March’s 15 swing low at 0.7165.

Regarding US macroeconomic data, the docket featured Gross Domestic Product (GDP) preliminary figures for the first quarter, which showed a contraction of 1.5% YoY, much larger than the -1.3% expected. Trade dynamics weighed on the readings, as Exports fell at a 5.4% pace in Q1, while Imports skyrocketed 18.3%. Nonetheless, consumer spending increased by 3.1% vs. estimations of 2.7% YoY. Also, the Labor Department reported Initial Jobless Claims for the week that ended on May 20, which rose 210K, lower than the 215K foreseen.

The Australian economic docket would feature Retail Sales on its preliminary reading, foreseen at 0.9% MoM on Friday. On the US front, the economic docket would reveal the Fed’s favorite measurement for Inflation, the Personal Consumption Expenditure (PCE), foreseen at 6.4%, triple the US central bank objective.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased in the mid to long term. In the short term, the 20-day moving average (DMA), spotted at 0.7034, suggests the major is trending higher, but it’s worth noting that the four-day rally was capped at the 0.7100 figure, meaning that it might be ending. Further confirmation was provided by oscillators, which are trending lower within a bearish territory.

That said, the AUD/USD first support would be the 20-DMA at 0.7034. A break below would expose the May 18 cycle low at 0.69490, followed by the YTD low at 0.6828.

Key Technical Levels

- GBP/USD bulls stay in the driving seat as US dollar remains soft.

- Higher levels of volatility could keep USD underpinned.

At 1.2580, GBP/USD is flat in midday trade on Wall Street. The pair has moved within a range of between 1.2551 and 1.2620 so far. Sterling, among the rest of the G7 block, has benefitted from a softer US dollar in the closing stages of the month.

Comments from FOMC officials this week have turned slightly dovish and the focus turned to other central banks, such as the European central bank, the Reserve bank of New Zealand and meetings on the horizon, such as the Bank of England in June.

The greenback hit a one-month low at 101.64 on Tuesday after European Central Bank chief Christine Lagarde flagged an end to negative interest rates in the eurozone in the third quarter. The governor's remarks implied an increase of at least 50 basis points in the deposit rate and fueled speculation of bigger hikes this summer.

Elsewhere, the RBNZ became the latest central bank to raise interest rates by half a point. While that move was expected, it also provided hawkish guidance on its policy path, noting a larger and earlier hike reduced the risk of inflation becoming persistent.

As for the BoE, some commentators have concluded that the committee may be forced to be more aggressive on rate hikes than had previously been thought likely. ''Textbooks suggest that the prospect of a more aggressive interest rate cycle from the BoE is a positive near term factor for the pound,'' analysts at Rabobank said. ''However,'' the analysts argued, ''insofar as this would increase the likelihood of a hard landing for the UK, upside potential for GBP on more rate rises could turn out to be limited.''

Nevertheless, the current inflation focus of the BoE and the growth concerns in the US have enabled cable to recover from the lows this week. The greenback declined against its major trading partners early Thursday ahead of an update to the first quarter Gross Domestic Product and the PCE price index that was unrevised at a 7% rise in the first quarter, while the measure excluding food and energy rose 5.1%, compared with a 5.2% gain in the initial estimate.

The US economy contracted more than initially feared in the first quarter due to downward revisions to inventories and residential investment. Consumer spending came in stronger than previously expected, government data showed Thursday. Real GDP dropped at a 1.5% annualized pace in the March quarter, compared to a 1.4% drop initially projected, according to the second estimate from the Bureau of Economic Analysis.

Looking ahead, Friday's data schedule will include April personal income and spending data, with the Fed's preferred inflation measure, and the final reading for the May Michigan Sentiment index.

Besides data, there are fears about slowing growth in China and energy security risks in Europe could bolster safe haven demand for the USD. ''In an environment in which the Fed and other central banks are removing liquidity, we expect higher levels of volatility in FX market. We see risk that GBP/USD could again re-visit it recent lows in the coming months,'' analysts at Rabobank argued.

- The USD/CHF continues extending its two-week rally, gaining 1.53%.

- Risk appetite increased and weighed on the USD/CHF, falling 0.15%.

- USD/CHF Price Forecast: In the short-term, to persist downward biased.

The USD/CHF records minimal losses for the third day in the week, though it clings above the 0.9600 mark, just above the 50-day moving average (DMA) at 0.9562. At the time of writing, the USD/CHF is trading at 0.9596.

A risk-on market mood keeps the greenback on the defensive. European bourses finished Thursday’s session with gains, while US equities are gaining. The US Dollar Index, a measure of the buck’s value vs. a group of peers, is falling 0.10%, sitting at 101.970.

Elsewhere, the USD/CHF appears to found its feet after dropping from YTD highs at 1.0000 towards 0.9600. For two consecutive days, the major has been trading within the 0.9573-0.9642 band, unable to break above/below the range, despite some US economic data that investors ignored.

From a technical analysis perspective, the USD/CHF remains in an uptrend, and it’s worth noting that the price action of the last three days formed a “bullish-harami,” a reversal candle-chart pattern.

During the day, the USD/CHF began trading near 0.9606 and so far has seesawed around the 0.9585-0.9632 range. Of late, it stabilized around 0.9600 as market players prepare for Friday’s Personal Consumption Expenditure (PCE), the Federal Reserve’s preferred measure for inflation.

USD/CHF Price Forecast: Technical outlook

Volatility in the USD/CHF shrank, as shown by the Bollinger bands, in the 4-hour chart, depicting a trading range of 0.9579-0.9669. However, a continuation to the downside remains in play in the short term, as the 20, 50, 100, and 200-4H simple moving averages (SMAs) reside above the spot price, leaving the major vulnerable to additional selling pressure.

That said, the USD/CHF first support would be Bollinger’s bottom band at 0.9579. Break below would expose the June 30, 2020 highs at 0.9533, followed by March 16 swing high-turned-support at 0.9460.

Key Technical Levels

- US dollar remains weak, but losses are limited.

- Wall Street rises sharply, US yields at fresh 2-day highs.

- EUR/USD short-term outlook is bullish, and faces resistance at 1.0730 and 1.0750.

The EUR/USD rose further during the American session and printed a fresh daily high at 1.0729. It then pulled back, staying above 1.0700. The euro is holding onto important weekly gains.

Bullish but capped under 1.0750

The recovery of EUR/USD appears to be resuming after a pullback from the 1.0750 area to 1.0640. The euro remains below the recent top but the chart still shows some positive momentum. A break of 1.0730 should clear the way for a test of 1.0750. The next resistance stands at 1.0765. A deli back below 1.0700 would alleviate the pressure. And under 1.0645, the pair could drop to test the important support area of 1.0600.

The move higher on Thursday is being driven by a weaker US dollar and risk appetite, the day after the FOMC minutes. The DXY is falling 0.12%, under 102.00. Equity prices in the US are up considerably. The Dow Jones gains 1.72% and the Nasdaq 2.87%.

The improvement in market sentiment is keeping the dollar on the defensive. At the same time, US yields are reacting. The US 10-year rose to 2.78% and the 30-year to 3.02%, both at 2-day highs.

Economic data from the US came in mixed on Thursday. The second reading of Q1 GDP showed a negative revision from -1.4% to -1.5%. Initial Jobless Claims dropped more than expected to 210K while Continuing Claims rose to 1.34 million above the 1.31 million of market consensus. The Kansas Fed Manufacturing Index declined unexpectedly in May to 19 from 28, against an expectation of 37. On Friday, Personal Income and Spending data are due in the US, including the Core PCE.

Ahead of a long weekend in the US, the EUR/USD is holding into important weekly gains as it continues to rebound from multi-year lows. During the last two weeks, it gains more than 300 pips. “EUR/USD looks to have stalled at the top of a potential 1.02-1.08 trading range this summer and we could quite easily see a near-term move back towards the 1.0500/1.0550 area as the Fed cycle is repriced higher”, explained analysts at ING.

Technical levels

- Silver prices remains under pressure and falls 0.23% on Thursday.

- An upbeat sentiment and elevated US Treasury yields a headwind for XAG/USD.

- Silver Price Forecast (XAG/USD): To remain sideways amid the lack of a catalyst.

Silver (XAG/USD) retraces for the second straight day on rising US Treasury yields led by the 10-year benchmark note, which was parked around 2.750% for the last two days, but shows signs of life advancing two-basis points, a headwind for precious metals. At $21.94, XAG/USD retraces from weekly highs at around $22.00 and remains range-bound, with just one day left in the week.

The rise of US Treasury yields begins to weigh on the bright metal after being stationary for two days. At the same time, European and US equities are recording solid gains, reflecting an increase for riskier assets, another factor influencing the fall of precious metals.

The US Dollar Index, which measures the greenback’s value vs. a basket of six currencies, loses 0.22% and sits at 101.843.

The awaited Federal Reserve’s last meeting minutes were revealed and reinforced what Fed policymakers have said since May 5. The minutes showed that all the board members agreed to 50 bps increases for the next couple of meetings and emphasized the need to move “expeditiously.” Officials stated that moving to a neutral stance was appropriate and added that they are focused on inflationary pressures.

Meanwhile, the US docket featured preliminary readings of the US GDP Q1 for 2022 reported a contraction of 1.5% YoY. The report blamed the drop on trade dynamics, with US Exports falling at an annual pace of 5.4% in the first quarter while imports increased 18.3%. However, estimates showed healthy growth in consumer spending of 3.1% vs. forecasts of 2.7% YoY. Additionally, the US Department of Labor reported that Initial Jobless Claims for the week ending on May 20 fell to 210K against a 215K expectations.

On Friday, the US docket would unveil the Fed’s favorite measurement for Inflation, the Personal Consumption Expenditure (PCE), foreseen at 6.4%, triple the US central bank objective.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remails downward biased after failing to trade above the February 3 swing low-turned-resistance at $22.00. Nonetheless, Silver prices are range-bound and would keep trading within the $21.28-$22.00 area unless a catalyst triggers a break above/below the boundaries.

Upwards, the XAG/USD first supply level would be $22.00. Once cleared, the following resistance would be the May 24 weekly high at $22.20, followed by the February 11 cycle low-turned-resistance at 22.86. On the other hand, the XAG/USD first support would be the weekly low at $21.67. Break below would expose the May 19 swing low at $21.28, followed by the $21.00 barrier.

Key Technical Levels

A new estimate of US Q1 GDP growth revised the original contraction of 1.4% to 1.5%. According to analysts at Wells Fargo, the economy continues to plow ahead, despite the modest contraction in real GDP growth observed during the first quarter.

Key Quotes:

“Revised data that were released this morning showed that U.S. real GDP contracted at an annualized rate of 1.5% in Q1-2022. The outturn represents a slight downward revision to the “advance” estimate of -1.4% that was reported last month.

“The revised data continue to show that two volatile spending components, namely inventories and net exports, were largely responsible for the contraction in real GDP that occurred in the first quarter. Specifically, the downshift in stock building in Q1 subtracted 1.1 percentage points off the overall rate of GDP growth while net exports made a negative contribution to growth that was worth 3.2 percentage points.”

“Today's release also gave us the first look at real gross domestic income (GDI) in Q1-2022. In theory, growth in GDI should be identical to growth in GDP. In practice, however, the two measures are rarely identical due to data errors and omissions. In that regard, real GDI grew at an annualized rate of 2.1% in Q1. This growth in the income side of the national income and product accounts (NIPA) is more in line with the “core” parts of the spending side.”

“Real personal consumption expenditures grew at an annualized rate of 3.1% in Q1 while fixed investment spending rose 6.8%. In short, the economy continues to plow ahead, despite the modest contraction in real GDP growth in the first quarter.”

Next week, the Bank of Canada (BoC) will have its monetary policy meeting. Market consensus is for another 50 basis points rate hike to 1.50%. According to analysts from TD Securities, global factors remain a crucial driver of the Canadian dollar, likely limiting the impact of the rate hike from the BoC.

Key Quotes:

“We look for the Bank to deliver another 50bp hike in June to bring the overnight rate to 1.50%. With little uncertainty around the decision itself, the focus will shift to the policy statement where we expect a hawkish tone. The Bank will note that growth and inflation are both tracking above the April MPR, and repeat that rates will need to rise further.”

“Global factors remain a crucial driver of the loonie, likely limiting the impact of the BoC's anticipated 50bp rate hike. As a result, we expect USD/CAD to maintain the 1.26-1.30 range through the summer months but will look to fade extremes. For now, CAD is more attractive to trade tactically on the crosses where we remain short versus NOK and like scaling into short exposure versus AUD.”

“A 50bp move is broadly expected, but the accompanying tone could impact front-end rates on the margin. A hawkish statement would reinforce the index-related flattening which we see as the dominant event in CAD markets on June 1.”

Data released on Thursday showed retail sales in Canada stagnated in March against expectations of a 1.4% increase. Analysts at CIBC, point out the headline number disappointed but the details of the report were stronger with growth in ten out of 11 subsectors.

Key Quotes:

“Headline retail sales disappointed in March, but the details of the report were stronger with growth in 10 out of 11 subsectors. Nominal retail sales were flat in March, much weaker than the consensus and advance estimate for 1.4% growth, as lower sales of motor vehicles offset gains elsewhere.”

“Excluding auto sales, receipts were up by a healthy 2.4%, but some of those gains would be driven mainly by higher prices. In volume terms, overall retail sales were down 1%.”

“The advance estimate for April suggests that sales grew 0.8%, which, given continued inflationary pressures, would not be very impressive in volume terms.”

“Motor vehicle sales look to have limited overall spending on goods in Q1, despite decent contributions from other goods consumption. The April advanced estimate from this release, combined with previously released data for manufacturing sales (+1.6%) and wholesale trade (+0.2%), suggests little help in real terms from these sectors for monthly GDP, which will rely on the continued growth in services. Overall, the impact of surging inflation on household disposable incomes will likely be a stronger headwind to sales volumes in Q2.”

- Mexican peso rises versus the US dollar for the third time in a row.

- USD/MXN stays bearish, looking at 2022 lows near 19.70.

- The 19.90 area is not the immediate resistance.

The USD/MXN keeps a bearish tone and continues to move lower at a slow pace, as equity markets recover. A few minutes ago, the Bank of Mexico released the minutes of its latest board meeting. The central bank could act more forcefully to curb inflation according to the document. Members noted inflation expectations have increased significantly.

The move lower in USD/MXN faces a strong barrier around 19.70/75 that contains many horizontal support levels and the 2022 low. A consolidation below should open the doors to a slide to the next critical support at 19.50/55.

If the pair remains above 19.75, the odds of a rebound will increase. A recovery to 19.90 should be seen as a modest correction, keeping the bearish tone intact. Above, at 20.10 awaits the 20-day Simple Moving Average. A daily close above should negate the bearish short-term outlook.

Technical indicators continue to favor the downside in USD/MXN. The RSI is still above 30, but it is flattening; Momentum remains below 100, now again pointing south.

USD/MXN daily chart

-637891756426703409.png)

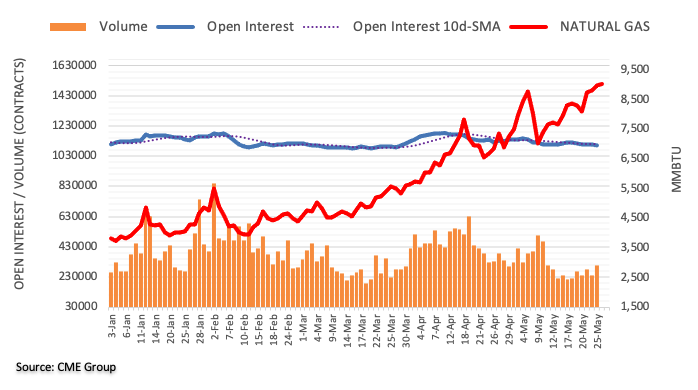

- WTI has managed a bullish break after three days of consolidating around $110 and is looking to test last week’s highs.

- Traders are citing a combination of factors, including US demand, EU/Russia sanctions and OPEC+ production woes as supportive.

Oil prices broke out of a three-day consolidation pattern on Thursday, with front-month WTI futures leaping into the $114s per barrel from earlier session lows closer to $110. The more than $3.50 gain seen on Thursday is the largest move of the week yet, with WTI now eyeing a test of last earlier monthly highs in the $115s, plus the late March highs in the $116s. There wasn’t one specific catalyst/fundamental development to drive the upside. Rather, the gains really got going upon the open of the COMEX crude oil pit from 13:00 GMT, after which time its not uncommon to see a spike in volumes.

Market commentators/commodity analysts cited a combination of bullish factors as supporting prices on Thursday. Firstly, there is a lot of chatter about rising demand in the US as the peak driving season approaches (most define peak US driving season as starting with the coming Memorial Day weekend and going into September). So far, despite high prices, gasoline demand and vehicle miles traveled has remained robust.

Secondly, various EU officials have pushed back against recent pessimism being expressed by Hungarian officials about how soon a deal on an EU embargo on Russian oil imports can be reached. European Council President Charles Michel on Wednesday said he was confident a deal could be struck between the EU/Hungary prior to the upcoming EU Council Summit on 30 May. German Finance Minister Robert Habeck also said a deal could be struck in the coming days, or else Germany would look to “other instruments”.

Moreover, OPEC+ and its production woes have been in focus. Sources told Reuters on Thursday that, as expected, the group will proceed with its usual policy of lifting output quotas by 432,000 barrels per day (BPD) each month. The cartel has been unable to meet these output hike targets for months, initially owing to the struggles faced by smaller OPEC producers (mainly in Africa), but now more recently as Russian output drops due to Western sanctions following its invasion of Ukraine.

A recent Reuters report said OPEC+ missed its output target by 2.6M BPD in April, with Russia accounting for half of the miss. Production woes are only expected to have worsened in May. Finally, macro flows are also helping crude oil prices on Thursday, with gains being seen on Wall Street as traders pare back on hawkish Fed bets in wake of Wednesday’s Fed meeting minutes and Thursday’s underwhelming US GDP figures. Bulls will be confident that WTI’s pattern of printing higher highs and lower lows that has been in play over the past few weeks will continue, meaning a likely break higher towards $120 before some likely profit-taking.

- The NZD/USD retraces from weekly highs at 0.6518, although the RBNZ hiked rates on Wednesday.

- Fed minutes confirmed that all participants agreed to 50 bps increases for the June and July meetings.

- NZD/USD Price Forecast: A “bearish-harami” in the daily chart looms, once confirmed, might pave the way for a re-test of the 20-DMA at 0.6385.

The NZD/USD runs to resistance and fails to extend Wednesday’s gains after the Reserve Bank of New Zealand (RBNZ) hiked rates by 0.50%, lifting the Overnight Cash Rates (OCR) to 2%. At 0.6460, the NZD/USD is retracing from weekly highs above 0.6500, despite an upbeat market mood.

Global equities are rising, depicting a positive market sentiment. In the FX complex, the mood is mixed as the gainers fluctuate between safe-haven peers and risk-sensitive currencies. The New Zealand dollar is the weakest currency as the North American session begins, with no fundamental reason supporting the move.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, is losing traction and is back beneath the 102.000 mark, down 0.12% at 101.956. At the same time, US Treasury yields, led by the 10-year benchmark note, is flat, sitting at 2.754%, a reflection of market players backpedaling an aggressive Fed, as preliminary readings of the US GDP Q1 for 2022 reported a contraction of 1.5% YoY.

Additionally, the US Department of Labor reported that Initial Jobless Claims for the week ending on May 20 fell to 210K against a 215K expectations.

On Wednesday, the US Federal Reserve’s Open Market Committee released the May meeting minutes, which delivered already known news, though confirmed policymakers’ stance of raising rates by 50 bps on each of its June and July meetings. Furthermore, the Fed agreed that they needed to move “expeditiously” to a neutral posture and that a “restrictive” approach was appropriate. Also added that some members emphasized that they were and will be focused on inflationary pressures and noted that prices are skewed to the upside.

For the remainder of the week, the NZ docket would feature the ANZ Roy Morgan Consumer Confidence for May, foreseen at 83. On the US front, the Personal Consumption Expenditure (PCE) is widely expected, as it’s the Federal Reserve’s favorite gauge of inflation.

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart shows that the pair remains downwards, despite that NZD/USD buyers lifted the major above the 20-day moving average (DMA) on May 23, a signal that consolidated the pair. However, failure to trade above 0.6568 would not shift the bias to neutral-downwards and even could expose the NZD/USD to further selling pressure, as it is forming a “bearish-harami” pattern.

If the latter scenario plays out, the NZD/USD first support would be the May 25 swing low at 0.6417. A break below would expose the May 19 cycle low at 0.6290, followed by the YTD low at 0.6145. Otherwise, if NZD/USD bulls push the exchange rate above 0.6568, that would open the door for further gains, though the major would face some supply zones. The NZD/USD’s first resistance would be the 50-DMA at 0.6647. Once cleared, the immediate supply level would be the 100-DMA at 0.6688, followed by April 20 swing high at 0.6813.

Key Technival Levels

- Gold is holding above its 200DMA in the $1850 area and is back to nearly flat on the week.

- Traders are weighing the tailwinds of a softer USD/US yields versus strong US equities as key Friday inflation data looms.

Spot gold (XAU/USD) is for now holding just above its 200-Day Moving Average at $1839 and trading near the $1850 level, though still with a slight downside bias on the day, despite Thursday’s worse than expected US GDP figures and Wednesday’s not as hawkish as feared Fed minutes release. Indeed, in wake of the weak data and modest paring back of hawkish Fed bets, the US dollar is a tad weaker and US yields are nudging lower, a combination that would normally be a tailwind for gold.

But US equities are rallying, with the S&P 500 last trading up around 1.4% on the day and eyeing a test of its 21-Day Moving Average for the first time since mid-April. On the week, the index is trading with gains of more than 3.0% and this appears to be weighing on the safe-haven precious metal. Traders are attributing stock market gains to weak GDP data reducing the need for aggressive Fed tightening and to strong earnings from a few US companies, including retail giant Macy’s.

Either way, the better tone to risk appetite is for now keeping XAU/USD on the back foot. Having been as high as the $1870 level earlier in the week, spot gold’s gains on the week have been eroded back to only about 0.2% from around 1.2%. But the recent pullback towards the 200DMA might prove a good opportunity for the gold bulls to add to long positions if they think that hawkish Fed bets will continue to be pared in the weeks ahead and, as a result, the buck and US yields continue softening. If it contributes to the strengthening narrative that US inflation has peaked, Friday’s US April Core PCE report could lead to a further reduction of Fed tightening bets and gold could well end the week back at highs in the $1870 area.

- A combination of factors attracted fresh selling around USD/CAD on Thursday.

- Rising oil prices underpinned the loonie and exerted pressure amid a weaker USD.

- Sustained break below the 50% Fibo. level will set the stage for additional losses.

The USD/CAD pair surrendered its modest intraday gains and dropped to a fresh daily low, around the 1.2800 mark during the early North American session.

The risk-on impulse - as depicted by strong rally in the equity markets - weighed on aven US dollar amid speculations that the Fed could pause the rate hike cycle later this year. On the other hand, a goodish pickup in crude oil prices underpinned the commodity-linked loonie and attracted some intraday selling around the USD/CAD pair.

From a technical perspective, spot prices, so far, have been struggling to find acceptance above the 38.2% Fibonacci retracement level of the 1.2459-1.3077 strong move up. Apart from this, repeated failures ahead of the 1.2900 mark favour bearish traders and supports prospects for an extension of the recent pullback from the YTD peak.

That said, it will still be prudent to wait for some follow-through selling below the 50% Fibo. level, around the 1.2770-1.2765 region, before positioning for any further downfall. The USD/CAD pair might then accelerate the fall towards the 1.2720-1.2715 intermediate support before eventually dropping to sub-1.2700 levels, or the 61.8% Fibo. level.

On the flip side, the daily swing high, around mid-1.2800s, which coincides with the 38.2% Fibo., now seems to act as an immediate hurdle ahead of the weekly high, around the 1.2885 region. Some follow-through buying, leading to a subsequent move beyond the 1.2900 mark will negate the bearish outlook and prompt a short-covering rally.

The momentum might then push spot prices beyond the 1.2930 zone, or the 23.6% Fibo. level, and allow the USD/CAD pair to aim back to reclaim the 1.3000 psychological mark. The next relevant resistance is pegged near the recent daily closing high, around the 1.3045-1.3050 region, ahead of the YTD peak, around the 1.3075 area.

USD/CAD daily chart

-637891702833735548.png)

Key levels to watch

- EUR/USD reverses the initial pullback and regains 1.0700 and above.

- Immediately to the upside now comes the 55-day SMA at 1.0774.

EUR/USD regains part of the ground lost on Wednesday and manages to reclaim the area above the 1.0700 figure on Thursday.

Considering the pair’s current price action, the continuation of the rebound looks likely in the very near-term at least. That said, the next up barrier now appears at the 55-day SMA, today at 1.0774 prior to the 3-month resistance line near 1.0820.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

The daily RSI around 55 also indicates that extra upside could still be in store for the pair until it reaches the overbought territory (>70).

EUR/USD daily chart

- USD/JPY recovered a major part of its intraday losses, though lacked follow-through buying.

- The risk-on impulse undermined the safe-haven JPY and extended some support to the pair.

- Subdued USD price action did little to provide any impetus and kept a lid on any further gains.

The USD/JPY pair attracted some dip-buying in the vicinity of mid-126.00s on Thursday and recovered a part of its early lost ground. The intraday uptick pushed spot prices back above the 127.00 mark during the early North American session, though lacked any follow-through.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - undermined the safe-haven Japanese yen and was seen as a key factor that extended some support to the USD/JPY pair. That said, concerns about softening global economic growth kept a lid on the optimistic move, which, along with subdued US dollar demand acted as a headwind for the major.

Speculations that the Fed could pause the rate hike cycle later this year dragged the yield on the benchmark 10-year US government bond to a fresh six-week low. This, in turn, failed to assist the USD to capitalize on the overnight bounce from the monthly low. Even the mixed US macro data also did little to impress the USD bulls or provide any impetus to the USD/JPY pair.

The Prelim US GDP report showed that the world's largest economy contracted by a 1.5% annualized pace during the first quarter of 2022 as against the advance estimate for a 1.4% decline. The slight disappointment from the backwards-looking data, to some extent, was offset by better-than-expected US Weekly Initial Jobless Claims, which fell to 210K last week from the 218K previous.

Thursday's US economic docket also features the release of Pending Home Sales, though is unlikely to influence the buck or produce any meaningful trading opportunities around the USD/JPY pair. Meanwhile, spot prices, so far, have managed to hold above the monthly low. This, in turn, makes it prudent to wait for some follow-through selling before positioning for any further losses.

Technical levels to watch

USD/CAD is little changed on the session. Looking ahead, economists at Scotiabank expect the pair to tick down towards the low 1.27s.

More range trading in the short-run

“We look for the CAD to pick up a little more support in the short run if the data run continues to support the impression that the domestic economy is running ahead of BoC expectations, which will keep policymakers on a relatively aggressive tightening path in the next few months.”

“The underlying momentum signals on the shorter-term studies remain mixed, suggesting more range trading in the short run.”

“We still view broader risks as being tilted to the downside (low 1.27s at least), on the basis of bearish, longer term (weekly) price signals.”

“Intraday weakness below minor trend support at 1.2810 would suggest a run to 1.2765.”

Gold Price is back in the red, falling for the second straight day. A hawkish Federal Reserve (Fed) is set to weigh on the yellow metal, with little demand for gold ahead, economists at TD Securities report.

The world is chasing the same Fed narrative

“Quantitative tightening is going to sap liquidity at a fast clip, while the Fed hikes into slowing growth – and everyone knows it. This leaves positioning analytics as a critical source of information for price action in the coming months.”

“Trend followers have completed their buying program and still remain long, which argues for additional downside on the horizon as momentum persists to the downside, with the macro narrative sapping investment demand for gold.”

“Without conviction that the Fed could blink, there are few participants remaining to buy gold, which still leaves a liquidation vacuum as the playbook in gold.”

GBP/USD has struggled to hold its push above 1.26. Economists at Scotiabank expect cable to face more selling pressure above this level.

Dip under the daily low of 1.2550 to open up the big figure area

“The pound is not out of the woods yet, as it will likely continue to face selling pressure above 1.26 ahead of resistance at the early-May high of 1.2638.”

“Losses below the intraday low of ~1.2550 are followed by support at the big figure area and yesterday’s low of 1.2481.”

OPEC+ is set to stick to its current policy of raising output by 432K barrels per day (BPD) each month when it meeting again on 2 June, six sources told Reuters on Thursday. "Why change what works perfectly?" one of the sources said to Reuters, adding that "we will announce that we are going to increase our production by 432,000 bpd even if we are no longer able to do so".

Western nations have been putting pressure on Saudi Arabia and the UAE, the only OPEC+ nations with any real spare capacity to actually significantly ramp up oil output in the near term, to go beyond the current steady increases to output. That's partially because many of the smaller OPEC nations have been struggling to keep up with recent hikes to their output quotas, meaning that OPEC+ hasn't actually been lifting output by 432K BPD in recent quarters.

Sanctions on Russia since its invasion of Ukraine have substantially worsened the OPEC+ output picture. OPEC+ undershot its output quota by 2.6M BPD in April, a recent Reuters report showed, with Russia accounting for half of that miss. Things are expected to have gotten worse this month.

EUR/USD challenges 1.07. However, the shared currency may need a catalyst to extend gains, economists at Scotiabank report.

Further EUR upside currently looks limited

“Price action over the past few days suggests a stalling in the EUR’s recovery from the mid 1.03s since mid-May.”

“Daly gains were limited to ~1.0720 and price action showed limited signs of aiming for a push to key 1.0750 resistance (with the 50-day MA also standing at 1.0755).”

“The 1.07 zone, the intraday low of 1.0664, and the mid 1.06s area stand as support.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the recently published inflation figures in Malaysia

Key Takeaways

“Headline inflation reverted higher to 2.3% y/y in Apr after moderating for its fourth straight month to 2.2% in Mar. The reading matched our estimate and Bloomberg consensus. It was largely lifted by costlier food & non-alcoholic beverages, transportation, recreation services & culture, expenditure in restaurant & café, as well as education.”

“Overall price pressure is expected to pick up on the back of persistent global supply shortages, higher commodity prices, the lapse of favourable base effects, and currency weakness. Recovering domestic economic activities and higher private-sector wages amid ongoing labour shortages are also posing upside risks to inflation. Taking these factors and the government’s short-term measures to tackle the rising costs of living and supply shortage issues into considerations, we maintain our 2022 full-year headline inflation forecast at 3.0% (BNM est: 2.2%-3.2%, 2021: 2.5%).”

- AUD/USD extended its sideways price moves and remained well within the weekly trading range.

- The gloomy global economic outlook was seen as a key factor that capped the risk-sensitive aussie.

- Weaker US GPD print prompted some USD selling and helped limit any deeper losses for the major.

The AUD/USD pair continued with its struggle to gain any meaningful traction and remained confined in a range held since the beginning of the currency week. Spot prices remained on the defensive below the 0.7100 mark through the North American session and had a rather muted reaction to the US macro releases.

The Prelim US GDP report showed that the world's largest economy contracted by a 1.5% annualized pace during the first quarter of 2022. The reading was weaker than the advance estimate for a 1.4% decline and the 1.3% fall anticipated, which, in turn, prompted fresh US dollar selling and extended some support to the AUD/USD pair.

Apart from this, speculations that the Fed could pause the rate hike cycle later this year, along with a generally positive tone around the equity markets, weighed on the safe-haven greenback. That said, concerns about the worsening global economic outlook kept a lid on the optimistic move and acted as a headwind for the risk-sensitive aussie.

From a technical perspective, the one-week-old trading range constitutes the formation of a rectangle on short-term charts and points to indecision over the near-term trajectory for the AUD/USD pair. This comes despite the Reserve Bank of Australia's hawkish signal that a bigger interest rate hike is still possible in June and favours bearish traders.

The price action seems to suggest that the recent strong recovery move from the YTD low has run its course and the path of least resistance for the AUD/USD pair is to the downside. That said, sustained strength beyond the 0.7125 region will negate any near-term negative outlook and pave the way for a further appreciating move.

Technical levels to watch

- DXY appears consolidative in the lower end of the range.

- Extra losses could see the monthly low near 101.60 retested.

The index trades without a clear direction and keeps hovering around the 102.00 neighbourhood on Thursday.

DXY remains under pressure and extra losses should not be ruled out for the time being. That said, a breakdown of the May low at 101.64 (May 24) could pave the way for a visit to the temporary 55-day SMA, today at 101.03 in the short-term horizon.

Looking at the broader picture, the current bullish stance in the index remains supported by the 3-month line around 100.50, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 96.72.

DXY daily chart

According to the latest global growth outlook from Moody's, G20 economies will grow at a pace of 3.1% in 2022, down from a growth rate of 5.9% in 2021, reported Reuters.

Additional Takeaways:

The post-pandemic economic recovery faces a complex set of challenges.

"We expect headline inflation rates to ease through next year."

Many risks add to macroeconomic uncertainty including escalation of the Russo-Ukraine conflict and a larger-than-expected slowdown to China's growth.

Many risks add to macroeconomic uncertainty including extended supply-chain disruptions and new virus waves.

"We expect global economic growth to further slow to 2.9% in 2023."

There are multiple risks that could further dampen growth.

"We forecast that advanced economies will grow 2.6% in 2022 and emerging market countries will grow 3.8%."

Although expect headline inflation rates to ease through next year, price levels remain high and will weigh on consumer demand.

"Except for Russia, we do not expect a recession in any G20 country in 2022 or 2023."

"We forecast that global monetary and financial conditions will be quite tight by end of this year and in 2023, meaning inflation rates are bound to fall."

There were 210,000 initial jobless claims in the US in the week ending on 21 May, according to the latest data from the US Labour Department released on Thursday. That was a little below the expected drop to 215,000 from 218,000 a week earlier.

Continued Claims, meanwhile, rose to 1.346 million in the week ending on 14 May, above expectations for a drop to 1.31 million from 1.315 million a week earlier. The Insured Unemployment rate thus rose back to 1.0% from 0.9%.

Market Reaction

Markets did not react to the latest weekly jobless claims figures, with more focus on the GDP data that was released at the same time.

- Headlines Retail Sales growth missed expectations in March but Core sales were robust.

- The loonie did not react to the latest Canadian Retail Sales figures.

Retail Sales in Canada remains unchanged in March versus a month earlier, the latest report from Statistics Canada on Thursday showed. That was a miss on expectations for a MoM growth rate of 1.4%. That marked a slowdown after February's growth rate of 0.2%. Statistics Canada also released its preliminary estimate for Retail Sales growth in April, which it expects to come in at 0.8% MoM.

Despite the weaker than anticipated headline figures, Core Retail Sales grew at a robust pace of 2.4% MoM in March, a little above the expected growth rate of 2.0%.

Market Reaction

The loonie did not react to the latest Canadian Retail Sales figures.

- US GDP growth was even worse than initially though in Q1 according to the latest estimate, dropping at a 1.5% annualised pace.

- Markets did not react to the latest US GDP data.

According to a second estimate by the US Bureau of Economic Analysis, the annualised pace of real GDP growth in Q1 2022 came in at -1.5%, below the first estimate of -1.4% and the market's expectation for a growth rate of -1.3%, data on Thursday showed. Nonetheless, the latest GDP estimate still showed healthy growth in consumer spending of 3.1% in Q1 (on an annualised basis) versus the prior estimate of 2.7%, plus robust business investment growth of 9.2% (unchanged from the first estimate.

The data also still showed that the drop in GDP is largely explained by trade dynamics, with US exports in Q1 dropping at an annualised pace of 5.4% (versus the prior estimate of 5.9%), while imports rose by 18.3% (versus the prior estimate of 17.7%). A deterioration in the trade balance, as suggested by these figures, suggests that the economic activity being conducted to satisfy domestic consumption is being shifted abroad.

In terms of Q1 inflationary measures; the second estimate of the GDP deflator was raised to 8.1% versus the first estimate of 8.0%. Meanwhile, the PCE Price Index showed inflationary pressures up 6.3% YoY in Q1, in line with the first estimate.

Market Reaction

Markets did not react much to the latest US GDP figures, despite the miss on expectations on the headline growth number.

- GBP/USD has pulled back from a fiscal stimulus inspired jump above 1.2600 ahead of US data/amid Brexit headlines.

- The pair is back to trading in the 1.2560s, despite Sunak’s announcement of significant further aid for low-income households.

GBP/USD jumped momentarily to fresh near three-week peaks above 1.2600 in earlier trade as sterling got a boost on reports alleging that UK Chancellor of the Exchequer Rishi Sunak could be about to announce significant further targetted support for UK consumers suffering amid the worst cost-of-living crisis in the UK in decades. In a recent announcement, Sunak appeared to exceed these expectations, announcing a new combination of grants and one-off energy-related payments that would take the total support fiscal aid dished out to consumers since the start of the cost-of-living crisis to around £37 billion.

Despite this, GBP/USD has waned back from earlier session highs and now back to trading slightly in the red in the 1.2560s. Currency traders may have been inclined to book some sterling profits ahead of a test of monthly highs in the 1.2630s prior to the upcoming release of the second estimate of US Q1 GDP growth and weekly jobless claims figures at 1230GMT. In the absence of any surprises, the buck may once again fall under modest selling pressure, as focus returns to the Fed in wake of Wednesday’s release of the minutes from the latest meeting.

To recap, while the minutes showed a strong backing on the FOMC for 50 bps rate hikes at the Fed’s next two meetings, there were no standout hawkish surprises. Indeed, analysts said that the tone of the minutes lent itself towards FOMC members favouring a pause or slowdown in rate hikes once rates have reached the neutral level later in the year (inflation allowing), where the Fed could then reassess the need for further tightening. Long-term US bond yields have been dropping as of late as US recession fears rise and hawkish Fed bets are pared back and should this trend continue, GBP/USD can get back above 1.2600.