- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 30-05-2022.

- The unavailability of any potential trigger in the kiwi docket has forced NZD/USD to struggle around 0.6560.

- The DXY is displaying a vulnerable performance on lower US NFP forecasts.

- RBNZ Adrian Orr hiked the OCR by 50 basis points in its last monetary policy meeting.

The NZD/USD pair is attempting to break the critical resistance of 0.6560 from the early New York session. A light economic calendar on the kiwi front has failed to provide any potential trigger to the antipodean. The asset has recorded a four-day winning streak and is expected to continue further, which looks possible after overstepping Monday’s high at 0.6560.

Broader weakness in the US dollar index (DXY) is driving the risk-sensitive dominating currencies higher. The DXY has remained vulnerable for the past two weeks as a rebound in the positive market sentiment trimmed the safe-haven's appeal. The DXY has printed a fresh monthly low at 101.30 however, a minor rebound has been witnessed in the early Tokyo, which will meet the responsive sellers.

This week, the entire investing community will focus on the US Nonfarm Payrolls (NFP). A preliminary estimate for the jobs additions in the nonfarm labor force is 320k in the month of May against the prior print of 428k. This will dampen the greenback further as the figure looks significantly lower. Also, the 12-month average of the US NFP has been recorded at 551.6k.

On the kiwi front, investors are still having the hangover of the hawkish monetary policy by the Reserve Bank of New Zealand (RBNZ). In order to tame the galloping inflation, RBNZ Governor Adrian Orr features a rate hike by 50 basis points (bps). Officially, the Official Cash Rate (OCR) has reached 2%. Going forward, the Caixin Manufacturing PMI data will be crucial for the kiwi dollar as the antipodean is a leading exporter to China. The economic data is seen at 47, higher than the prior print of 46.

- Silver takes offers to renew intraday low, extends Friday’s pullback from three-week high.

- Short-term support line, 200-HMA tests bears as RSI (14) approaches oversold territory.

- Recovery remains elusive unless crossing a two-day-old resistance line.

Silver (XAG/USD) prices keep the week-start pullback as bears attack short-term key support during Tuesday’s Asian session. That said, the bright metal drops to $21.92 by the press time.

An upward sloping trend line from May 19 precedes the 200-HMA to restrict XAG/USD weakness around $21.90-85.

It’s worth noting that the RSI (14) is speedily approaching the oversold region and hence tease the corrective pullback before further downside.

The same highlights the aforementioned $21.90-85 support, which if failed to trigger silver’s rebound could direct the metal towards $21.60.

Following that, the 61.8% Fibonacci retracement (Fibo.) of May 13-27, around $21.20, could challenge the XAG/USD bears.

Alternatively, recovery moves will need to cross a downward sloping resistance line from Friday, near $22.00, to convince buyers.

In a case where the silver bulls keep reins past $22.00, the recent high surrounding $22.45 and weekly resistance line around $22.50 may gain the market’s attention.

Silver: Hourly chart

Trend: Limited downside expected

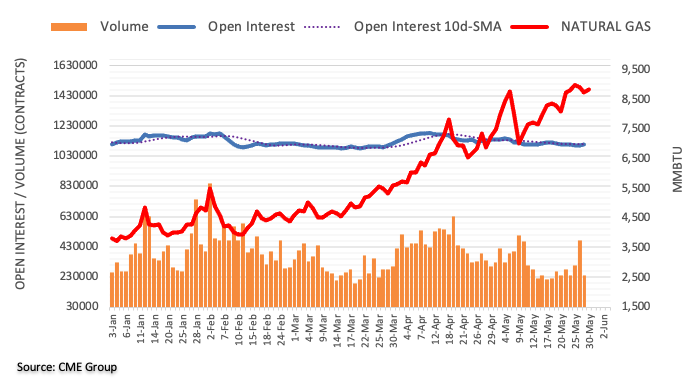

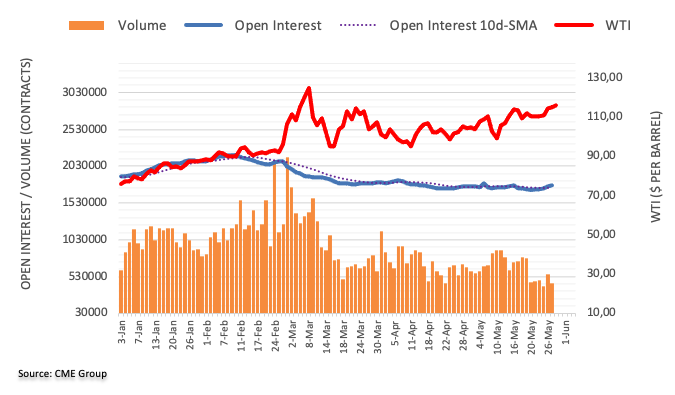

- WTI stays on the front foot around the highest levels in 12 weeks, up for the fifth consecutive day.

- EU Leaders release fresh sanctions for Russian oil imports, EC President Von der Leyen said oil coming through pipelines exempted.

- Risk-on mood, softer US dollar adds to the bullish momentum.

- China PMI and full markets eyed for fresh impulse.

WTI rises to the fresh high in three months, also printing a five-day uptrend, as the European Union (EU) leaders release details of sanctions on Russian oil imports during Tuesday’s Asian session. In doing so, the black gold rises to $116.41 before easing to around $116.20.

“EU agrees to ban 90% of Russian oil imports by end of 2022,” announced EU Council President Charles Michel. The EU, he says, ''agrees to de-swifting the largest Russian bank Sberbank, banning 3 more Russian state-owned broadcasters, and sanctioning individuals responsible for war crimes in Ukraine.''

It should be noted, however, that European Commission President Ursula von der Leyen mentioned that a ban on Russian oil exempts oil that comes through pipelines, which in turn triggered a pullback in oil prices after an initial rise.

Even so, the energy benchmark remains on the front foot as a softer US dollar and risk-on mood underpin the commodity’s run-up ahead of the key official PMI data from China. Also important to watch will be the return of full markets after Monday’s US Memorial Day holiday.

That said, the US Dollar Index (DXY) refreshed its monthly low to 101.29, before bouncing off to 101.34, on Monday as the latest PCE Core Price Index data, the Fed’s preferred gauge of inflation, came in softer and failed to favor some of the hawkish Fed members.

In addition to the EU sanctions and softer US dollar, China’s gradual opening up of the economy from the covid-led activity restrictions also underpin the risk-on mood and propel the WTI crude oil prices. While portraying the mood, the S&P 500 Futures rise 0.40% intraday by the press time.

Technical analysis

A clear upside break of the late March high surrounding $115.90 enables WTI bulls to aim for the $120.00 threshold ahead of challenging the yearly top surrounding $126.50.

- The AUD/JPY begins the week on the right foot, gaining 0.97%.

- Risk-on market mood and China’s possible lockdowns lifting, cheered by investors.

- AUD/JPY Price Forecast: To remain upward biased, but struggling around 92.00, might open the door for a pullback towards 90.00.

The Australian dollar is extending its rally for the third consecutive day as the Asian begins, after Monday’s thin liquidity trading session in the FX market, courtesy of US holidays, keeping the New York session closed. At the time of writing, the AUD/JPY is trading at 91.84, up by a minimal 0.10%.

Market players’ mood boosted the Aussie, weighed on safe-havens

Improvement in risk appetite is one of the factors that boosted the appeal of the Aussie dollar. It advanced against most G7 currencies as news of China’s reopening and support for Beijing business was cheered by investors. European bourses closed in the green, while US equity futures point to a higher open on Tuesday’s cash market session.

Diggin a little deep into China’s news, Shanghai port is now reported to be operating at a 95% capacity, which is upbeat news for supply chains.

Regarding the Japanese yen, the Bank of Japan (BoJ) Governor Kuroda repeated the commitment to monetary policy easing to help the economy recover from the Covid-19 slump while adding that rapid JPY moves are undesirable. However, Kuroda said that the FX market is regaining stability.

The Australian economic calendar would feature the ANZ-Roy Morgan Australian Consumer Confidence data, followed by Q1 GDP. Linked to the Australian data, China’s Caixin PMI will also be revealed. On the Japanese front, the docket would feature employment data, the Unemployment Rate, Retail Sales and Industrial Production.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY rallied in the last three trading days, almost 200 pips. Monday’s price action witnessed an AUD/JPY test of the 50-day moving average (DMA) at 91.84, but so far, AUD/JPY bulls struggled and failed to deliver a daily close above it, which would have opened the door for further gains.

AUD/JPY traders need to be aware that technical indicators aim higher, except for the RSI, which is almost horizontal, at 54.53, indicating the cross-currency pair could consolidate before resuming the uptrend.

The AUD/JPY’s first resistance would be the 50-DMA. Break above would expose the 93.00 mark before reaching the May 5 swing high at 94.02. On the flip side, the AUD/JPY first support would be May 30 low at 90.88. A breach of the latter to send the pair towards May 24 swing low at 89.23, followed by the 89.00 mark.

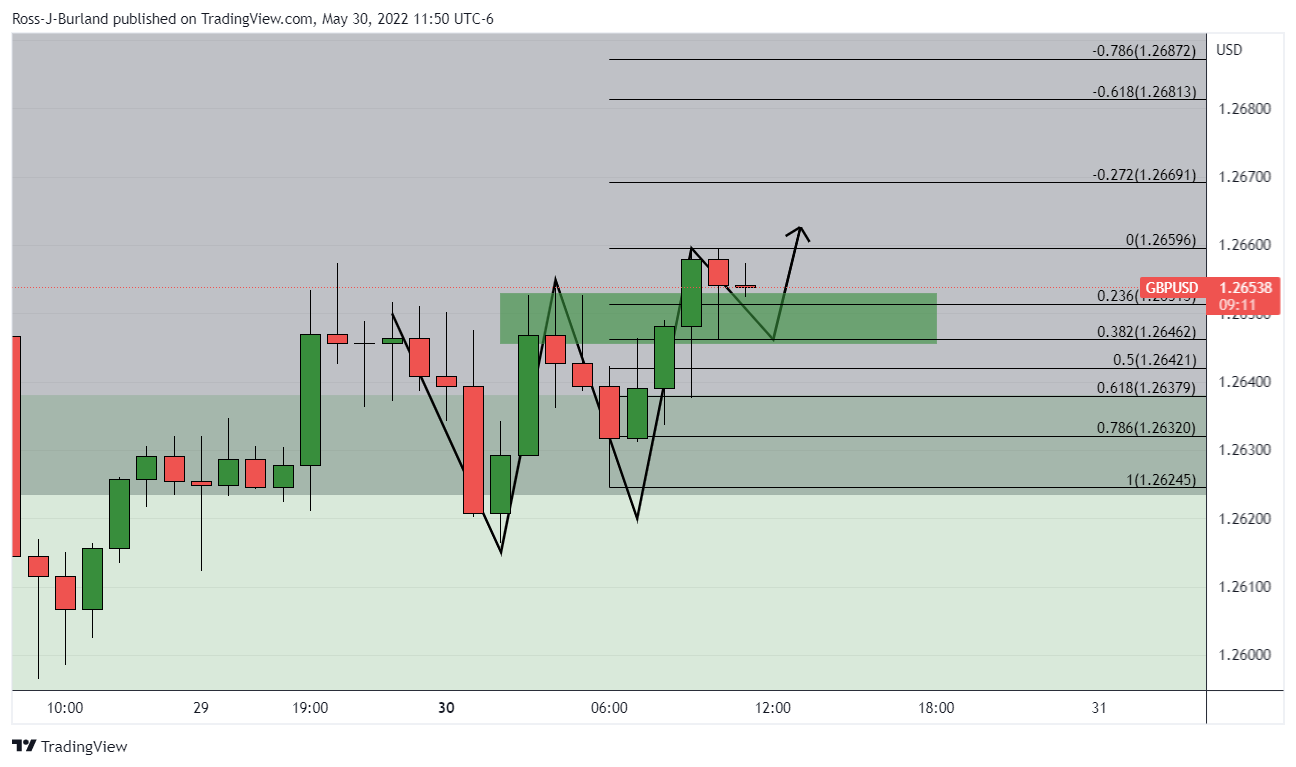

- The formation of a Rising Channel is advocating pound bulls.

- A break above the 200-EMA for the first time in the past three months adds to the upside filters.

- The RSI (14) is established in a 60.00-80.00 range, which signals more gains ahead.

The GBP/USD pair is witnessing topsy-turvy moves in a narrow range of 1.2649-1.2655 in the early Tokyo session. A four-day winning streak has been displayed by cable and its continuation is expected once it will overstep Monday’s high at 1.2660.

The formation of a Rising Channel on a four-hour scale has underpinned the pound bulls against the greenback. The lower boundary of the above-mentioned chart pattern is placed from May 13 low at 1.2155 while the upper boundary is plotted from May 11 high at 1.2400.

The asset has climbed above the 200-period Exponential Moving Average (EMA) for the first time in the past three months. The 200-EMA is hovering a little above 1.2600. Also, the 50-EMA at 1.2552 is advancing sharply higher, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which signals a continuation of bullish momentum, however, a slight pullback cannot be ruled out.

A minor pullback move towards the round-level support of 1.2600 will call for a responsive buying action by the market participants, which will send the asset towards Monday’s high at 1.2659. A breach of the latter will drive the asset towards the round-level resistance at 1.2700.

On the flip side, the pound bulls could lose their grip if the asset drops below the psychological support of 1.2500. This will drag the asset towards May 24 low at 1.2471, followed by May 11 high at 1.2400.

GBP/USD four-hour chart

-637895486419297270.png)

- USD/CAD dribbles around five-week low, probes four-day downtrend.

- 61.8% Fibonacci retracement level, 200-DMA tests bearish commitments.

- RSI, MACD signals hint at the further downside, 100-DMA guards recovery moves.

USD/CAD seesaw around the key 1.2660-55 support confluence as bears take a breather after refreshing the multi-day low. In doing so, the Loonie pair tests the bears ahead of the key Q1 2022 Canada GDP, pausing the consecutive declines for the last four days.

Not only the pre-data consolidation but a convergence of the 200-DMA and 61.8% Fibonacci retracement (Fibo.) of April-May upside, around 1.2660-55, also challenge the USD/CAD bears.

Should the quote conquer the 1.2655 support, the odds of witnessing a gradual south-run towards the 1.2600 and 1.2500 thresholds appear more lucrative.

However, April’s low surrounding 1.2400 could tests the USD/CAD sellers afterward.

Meanwhile, the 100-DMA level of 1.2700 tests the USD/CAD buyers ahead of a downward sloping trend line from early May, close to 1.2800 by the press time.

Even if the USD/CAD crosses the 1.2800 hurdle, bulls remain skeptical until witnessing a clear break of the 23.6% Fibo. level surrounding 1.2920.

USD/CAD: Daily chart

Trend: Further weakness expected

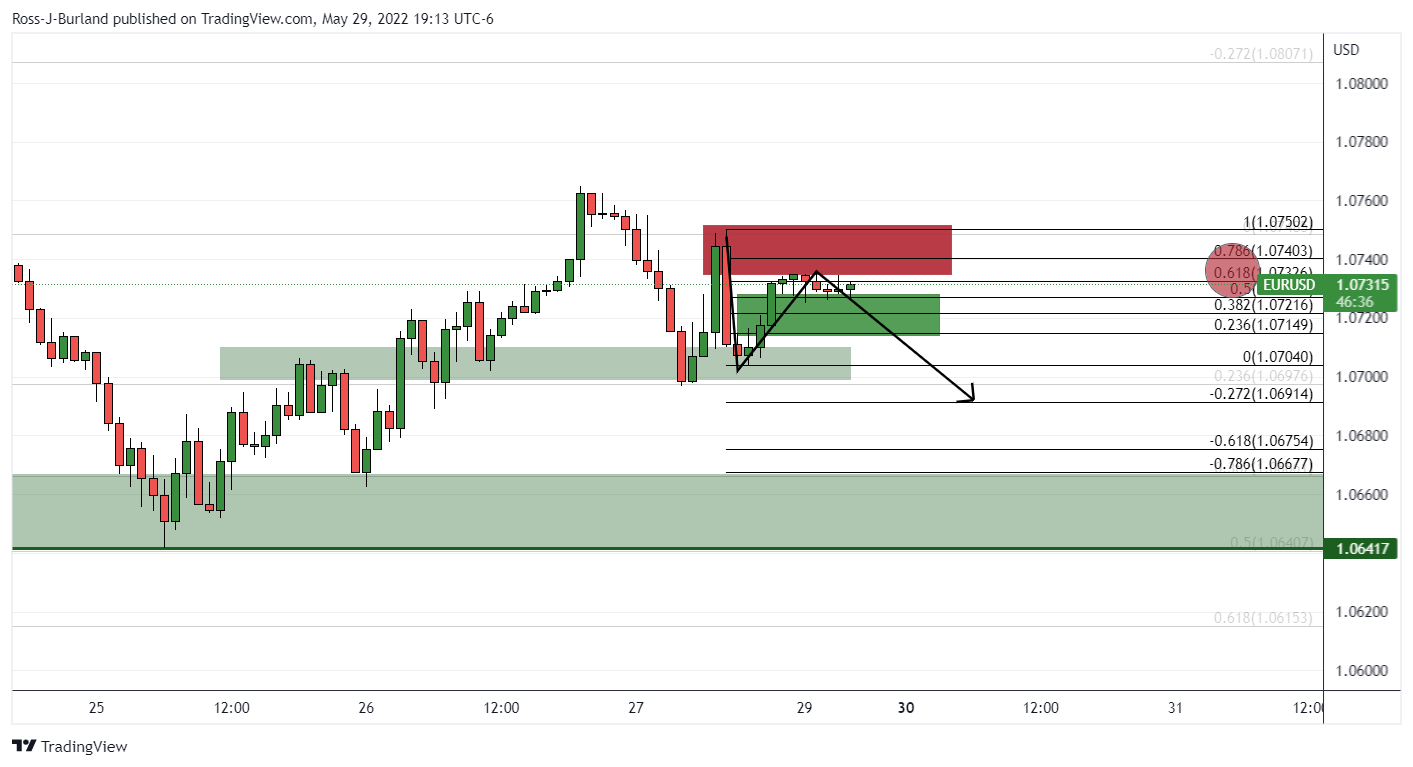

- EUR/USD retreats from monthly top, probes three-day uptrend.

- Market sentiment improved on China news, easing bets on Fed’s aggressive rate hikes.

- Germany’s inflation gauge refreshed multi-year high in April, EU Consumer Confidence edged up in May.

- Strong inflation numbers can add strength to hawkish ECBSpeak, supporting further upside of the pair.

EUR/USD bulls appear to turn cautious at a monthly high, pausing a three-day uptrend, as traders await the Eurozone inflation data, as well as full markets. That said, the major currency pair eases from the multi-day peak of 1.0786 to 1.0777 by the press time of the early Asian session on Tuesday. Even so, the quote remains on the bull’s radar amid broadly softer US dollar and upbeat concerns surrounding the bloc.

While the market’s anxiety ahead of the key data and the US traders’ return probes the EUR/USD bulls of late, the currency pair is far from welcoming bears. The rose to the highest levels since April 25 the previous day, also rising for the third consecutive day, as the US dollar weakness joined optimism surrounding the European Central Bank’s (ECB) rush toward a rate hike in July.

The US Dollar Index (DXY) refreshed its monthly low to 101.29, before bouncing off to 101.34, during the US Memorial Day Holiday. The greenback’s fall could be linked to the recently easing odds of the Federal Reserve’s (Fed) aggressive rate hikes, considering the downbeat inflation and growth numbers.

On the other hand, the first readings of Germany’s annual inflation, per the Harmonised Index of Consumer Prices (HICP), rose to 8.7% in May versus 8.0% expected and 7.8% prior. It’s worth noting that the Eurozone Consumer Confidence also increased to 105.0 in May from a revised down 104.9 figures for April.

It’s worth noting that firmer inflation data from the bloc back the recently hawkish comments suggesting a July rate hike from the ECB policymakers. The same contradicts the US conditions where the latest PCE Core Price Index data, the Fed’s preferred gauge of inflation, came in softer and failed to favor some of the hawkish Fed members. On Monday, Fed Board of Governors member Christopher Waller said that he supports lifting interest rates by another 50 bps at the next several Fed meetings and that the policy rate should be above neutral by the end of the year to reduce demand, reported Reuters.

Other than the US dollar weakness and upbeat concerns for the Euro, China’s gradual opening up of the economy from the covid-led activity restrictions also underpin the risk-on mood and propel the EUR/USD prices.

Moving on, Eurozone HICP YoY is expected to refresh multi-year high with 7.7% figures versus 7.4% prior whereas the HICP-X F, E, A, T, also known as core inflation, bears the consensus of reprinting 3.5% YoY figures. Additionally, Chicago Purchasing Managers’ Index and Dallas Fed Manufacturing Business Index for May could also entertain EUR/USD traders.

Given the upbeat expectations from the Eurozone data, the major currency pair may witness further upside. However, the US traders’ reaction to the latest market sentiment should be observed.

Technical analysis

A daily closing beyond the 50-DMA, around 1.0740 by the press time, directs EUR/USD towards a downward sloping trend line from February 10, close to 1.0800.

- USD/CHF has attracted some bids near 0.9564, investors should brace for a responsive selling action.

- A preliminary estimate for the annual GDP is 4.4% against the prior print of 3.7%.

- The US NFP may slip to 320k, significantly lower than the 12-month average of 551.6k.

The USD/CHF pair has bounced back from 0.9564 after consolidating in a narrow range of 0.9568-0.9580 in the late New York session. A V-shape downfall after failing to sustain above 1.0000 has pushed the asset lower to 0.9545. On Monday, the asset displayed reluctance while attempting an upside move above 0.9600, which indicates that the party of the Swiss franc bulls is yet not over and more downside would be recorded by the market participants.

The greenback is underperforming against the Swiss franc as investors are expecting an outperformance in the Swiss Gross Domestic Product (GDP) numbers. The quarterly GDP is likely to land at 0.4% vs. 0.3% the former figure. While the preliminary estimate for the yearly figure is 4.4% against the prior print of 3.7%. Later this week, the Swiss Federal Statistical Office may report the Consumer Price Index (CPI) figure at 2.6%, an elevation from the prior print of 2.5%.

Meanwhile, the US dollar front (DXY) has refreshed it's monthly low at 101.30. A minor bounce has been witnessed in the asset, although it looks less confident and will invite a responsive selling action by the market participants ahead. The DXY is going through an intense selling pressure as a lower forecast of the US Nonfarm payrolls (NFP) at 320k is expected to compel the Federal Reserve (Fed) to trim its extreme hawkish tone for June monetary policy.

“I welcome the EUCO agreement tonight on oil sanctions against Russia. This will effectively cut around 90% of oil imports from Russia to the EU by the end of the year,” tweeted European Commission President Ursula von der Leyen after sanctions on Russia were unveiled.

Also read: EU diplomat: EU agrees to ban 90% of Russian oil imports by end of 2022

Key quotes

Ban on Russian oil exempts oil that comes through pipelines.

This allows dependent states, which is Hungary almost exclusively, to continue importing.

Shipped (sea-borne oil imports) Russian oil, accounting for 2/3 of EU imports, will be banned.

Germany and Poland will stop oil imports via the Druzhba pipeline by the end of the year.

Market reaction

After the news, WTI reverses the recent uptick to the highest levels since early March by declining to $115.90. Even so, the black gold remains 0.18% up intraday during the early hours of Tuesday’s Asian session.

- The British pound appreciates vs. the Japanese yen, spurred by an upbeat sentiment.

- The mood improved as China’s Covid-19 Covid-19 restrictions might ease as cases dropped.

- GBP/JPY Price Analysis: To aim upward, unless bulls battle at around 161.50, which would send the pair tumbling towards 160.00.

The British pound extends its gains against the low-yielder Japanese yen for four days, courtesy of a positive market sentiment that witnessed flows towards the equity markets. At the time of writing, the GBP/JPY is trading at 161.46, up by some 0.63%.

Asian and European stocks recorded gains, while US equities rose. Safe-haven peers remain downward pressured, particularly the Japanese yen and the greenback, a tailwind for the GBP/JPY. Meanwhile, at the Euro area summit, the EU Commission failed to deliver the sixth tranche of sanctions to Russia on disagreements regarding the Russian oil embargo.

Elsewhere, it is worth noticing that the week began in a positive mood due to China’s Covid-19 improvements. A Beijing city official said they would no longer require working from home, while Shanghai is set to remove restrictions on Wednesday, June 1.

GBP/JPY Price Analysis: Technical outlook

GBP/JPY Monday’s price action lifted the pair towards the May 17 high at 161.85 but failed to conquer that level. However, it’s worth noting that the Relative Strength Index (RSI,) albeit in the bullish territory, is directionless, and if the cross-currency pair is aiming for a break above May 9, swing high at 162.18, it would need to overcome some hurdles on its way north.

With that said, the GBP/JPY’s first resistance is the 161.50 mark. Break above would expose the May 17high at 161.85, followed by 162.00, and then the May 9 swing high at 162.18.

Otherwise, the GBP/JPY’s failure at 161.50 would open the door for further downside action. The GBP/JPY first support would be the 161.00 mark. A breach of the latter would expose the May 30 low at 160.25, followed by May 20 low at 158.72.

Key Technical Levels

EU leaders are meeting for an off-schedule summit and some progress with regard to Russian sanctions is being made. The EU Council President Michel says they have an agreement to ban the export of Russian oil to the EU. The EU, he says, ''agrees to de-swifting the largest Russian bank Sberbank, banning 3 more Russian state-owned broadcasters, and sanctioning individuals responsible for war crimes in Ukraine.''

To date, Hungary has blocked EU-wide energy sanctions, but this meeting may have provided a platform for a breakthrough. The New York Times said the embargo was in draft agreement leaders were set to adopt Monday.

The Times said the measure will ban all Russian oil transported to the European Union by tankers, but permit crude arriving by pipeline. That would still outright ban two-thirds of all oil imported into the bloc from Russia, based on a draft seen by the Times.

In March, leaders asked the Commission to present proposals at this meeting on how to deal with rising food prices, defence gaps, decoupling electricity and gas prices, as well as reducing Russian energy dependence.

Oil prices were unchanged in early Asian trade despite the prospects of an agreement.

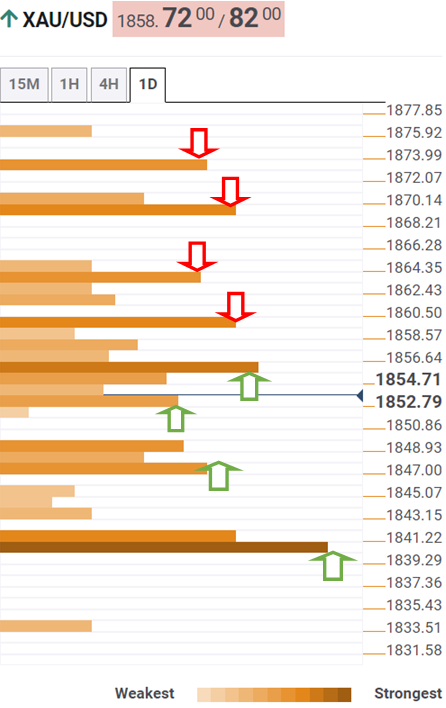

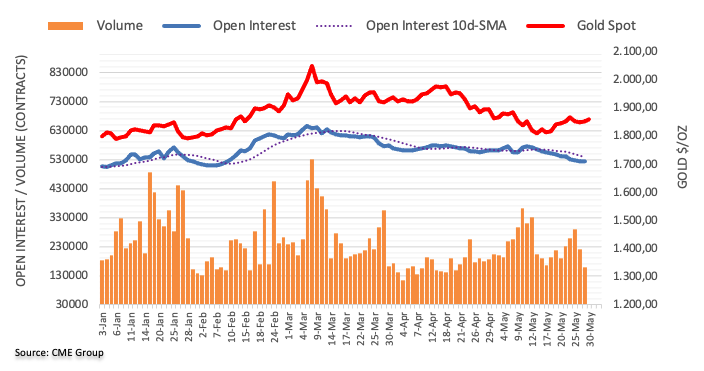

- Gold price is oscillating in a $1,850-1,864.23 range ahead of the US NFP.

- An estimation of the US NFP is significantly lower than the 12-month average figure.

- The momentum oscillator RSI (14) is indicating more consolidation ahead.

Gold price (XAU/USD) is consolidating below the critical resistance of $1,860.00 after a sheer upside move from the low of $1,786.78, recorded on May 16. The precious metal has turned sideways as investors are awaiting the release of the US Nonfarm Payrolls (NFP), which are due on Friday. The US NFP is a major catalyst that guides the preparation of the monetary policy statement, which is dictated by the Federal Reserve (Fed).

As per the market consensus, the US NFP is expected to land at 320k against the prior print of 428k. The labor market in the US economy is extremely tight and continuous additions of jobs are indicating the healthy progress of the economy. On an average basis, the US economy has been adding 551.6k jobs to its labor force over the past year. This time, the forecast of 320k is significantly lower than the average additions, which signals that the employment curve is advancing but at a diminishing rate.

On the dollar front, the US dollar index (DXY) has comfortably established below 102.00. The asset has registered a fresh monthly low at 101.30. This week, ISM Manufacturing PMI data also holds significant importance. The economic catalyst is seen at 54.5 against the prior print of 55.4.

Gold technical analysis

On an hourly scale, the gold price is forming a Symmetrical Triangle that signals a slippage in the volatility followed by a breakout in the same. Considering the price action, an upside break of the above-mentioned chart pattern looks likely. The 20-period Exponential Moving Average (EMA) at $1,856.90 is overlapping with the gold prices, which signals an ongoing consolidation phase. Apart from that, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which signals the continuation of a rangebound move.

Gold hourly chart

-637895444042424121.png)

- AUD/USD bulls stay in the driver's seat and eye a strong move through the 0.72s.

- Bulls are now in the clear and target 0.7260.

At 0.71944, AUD/USD is testing through a key resistance area on the daily chart following a solid start to the week so far. The Aussie has been underpinned by risk assets that have been in demand as investors get incentivised by the gradual easing of the lockdown in China. Moreover, the pricing of a Fed pause allows interest to return to FX carry trades which is supporting the antipodeans. The greenback has dipped in reflection of speculation that the Fed may take a pause in its rate hiking cycle in September.

Equity markets trended up overnight but gains, particularly in Europe, which too was supportive of the high beta AUD. However, it was a slow day in New York with the Memorial Day holiday in the US which meant no new data was released from there.

With a focus on the Chinese easing of lockdowns, analysts at ANZ Bank explained in a note that they are starting to ease as COVID-19 cases fall. ''This will help boost economic activity, not only in China, but also in the countries which rely on China for trade. China is expected to release additional fuel into the global market to help clear its stockpiles,'' the analysts said.

''Beijing has also announced measures to try to stimulate economic activity through additional government spending on infrastructure, speeding up approvals for property purchases, making it cheaper for consumers to purchase cars, subsiding wages in certain industries, and reducing taxes.''

Meanwhile, there will be attention paid to today's data release in PMIs from China. ''Both PMIs are likely to remain in contraction,'' analysts at TD Securities said. ''Partial easing in lockdown measures will help reduce some negative sentiment in manufacturing. However, weaker export trends, lacklustre demand for loans, and soft infrastructure spending suggest manufacturing will not move back to expansion quickly. Services recovery is likely to be even slower amid constrained consumer activity.''

AUD/USD technical analysis

As per the pre-open analysis at the start of this week, AUD/USD Price Analysis: Bulls move into a critical area on H4 charts, eye a run to the 0.7250/60s the bulls stay with the course as illustrated:

AUD/USD pre-open analysis

It was explained that the price had been respecting the support structures ''in its pursuit of the price imbalance between recent highs and the May 4 highs at 0.7266. The price would be expected to mitigate this area of imbalance with relative ease.''

AUD/USD live update

- The price is in the hands of the bulls, but potentially only momentarily.

- The W-formation is being printed, a reversion pattern that could prove to be the determining factor.

As per the prior series of analyses, USD/JPY Price Analysis: Bulls meeting tough resistance from bears despite bull flag, and, USD/JPY Price Analysis: Bears have taken control, eye weekly 38.2% Fibo near 125.00, the price has continued on its southerly trajectory. There are a few hurdles left to cross until the bears reach the 38.2% target, with 127.30 and 126.80 key in this regard.

USD/JPY weekly chart, prior analysis

USD/JPY live market

The bears are giving some ground back to the bulls at this juncture. However, the daily chart's structure leans bearish still, as follows:

The price is in the hands of the bulls, but potentially only momentarily according to the current W-formation that is being printed. This is a reversion pattern and while a move into resistance is on the cards, the pull of the neckline could prove to be the determining factor that results in a downside continuation for the days ahead.

Reserve Bank of New Zealand Deputy Governor/General Manager Financial Stability Hawkesby has crossed the wires stating that the central bank needs to tighten conditions past neutral of 2% and reduce stimulus. He forecasts a period of subdued consumption. He also said the risk of a recession is a possibility.

Meanwhile, the NZD was boosted by the RBNZ's hawkish Statement when it raised rates by 50bp to 2%, indicating more hikes to come.

''The Kiwi is a touch stronger this morning, but it looks more like currency at the upper end of trading ranges than a currency on the verge of a major breakout, the analysts at ANZ Bank argued,'' in line with the following analysis:

-

NZD/USD Price Analysis: Bulls need to break a key weekly level at this juncture

- The weekly correction into the 38.2% Fibonacci has a confluence with the May swing lows.

- A firm break through the resistance will be needed if the bulls are going to stay in control towards 0.6720.

The NZ dollar is attracting a bid as the US dollar nurses last week's losses and continues to bleed out on Monday. As measured by the DXY index vs. a basket of major currency rivals, the greenback is headed for its first monthly drop in five months. Investors have scaled back bets that rising US rates will send the greenback higher within the bull cycle as fears of a global recession have receded a little.

On the charts, this gives the kiwi bulls an opportunity to take on the prior daily resistance as follows:

However, the bulls need a clean break of the resistance or they will risk facing a firm move by the bears:

The prior resistance on the daily and 4-hour charts that have a confluence with the daily Fibonacci scale would be expected to act as a support structure for the coming sessions.

From a weekly perspective, however, the bulls will be cautious around such a key weekly level as this:

The correction into the 38.2% Fibonacci that has a confluence with the May swing lows could offer a firm area of resistance and consequently push the bulls back. In doing so, this could embolden the bears and lead to a downside continuation for the forthcoming weeks.

On the other hand, a firm break through the resistance will leave the bulls in good stead for a deeper correction towards 0.6720 and the prior support structure that has a confluence with the 61.8% golden ratio.

What you need to take care of on Tuesday, May 31:

The greenback remained under pressure in the first trading day of the week, falling against most major rivals. The USD/JPY pair, however, edged higher amid the better tone of stocks markets.

The better mood was triggered by China, as Shanghai announced it would start lifting covid-related restrictions this week as planned. Businesses will return to normal after over a month of lockdown. Asian and European indexes advanced, while US markets were closed due to the celebration of Memorial Day.

EU representatives are still discussing the sixth package of sanctions on Russia, with rumours hinting at a potential announcement this week, that would not include banning oil imports coming from pipelines.

The EUR/USD pair managed to reach a fresh May high of 1.0786, despite German inflation reaching fresh multi-decade highs in May, according to preliminary estimates. The EU will publish its own estimates on Tuesday. GBP/USD settled around 1.2650.

The Canadian dollar was among the top performers. USD/CAD trades around 1.2660, helped by higher oil prices, as WTI futures trade at $117.00 a barrel. AUD/USD is near 0.7200, despite gold remained lifeless. The bright metal currently changes hands at $1,855 a troy ounce.

Little happened during US trading hours amid the aforementioned holiday. However, the week will be fulfilled with growth, employment and inflation data from major economies. EU inflation, AUS GDP and the US Nonfarm Payrolls report are among the most relevant.

Dogecoin price is positioned for a charge back to $0.11

Like this article? Help us with some feedback by answering this survey:

- Silver begins the week on the wrong foot, down 0.57%.

- Sentiment-wise, the market is positive, as reflected by global equities up.

- Silver Price Forecast (XAG/USD): Fluctuating around $21.50-22.50.

Silver (XAG/USD) grinds lower during Monday’s North American session, albeit the US Dollar trading softer in a shorter than usual trading session, as US markets remain closed in the observance the Memorial Day. At the time of writing, the XAG/USD is trading at $21.97, off the $22.00 mark.

A risk-on market mood keeps flowing towards stocks, thus weighing on safe-haven assets like silver. Asian and European equities finished with gains, while US futures rose. The greenback is softer during the day, as illustrated by the US Dollar Index, down 0.31%, sitting at 101.323.

Fed speaking crossed the wires. In Frankfurt, Federal Reserve Governor Christopher Waller said that he advocates 50 bps rate hikes on the table “until we see substantial reductions in inflation. Until we get that, I don’t see the point of stopping.” He added that he supports 50 bps at “several” meetings.

Silver traders need to be aware that on Tuesday, US President Joe Biden and Federal Reserve Chair Jerome Powell will meet for discussions in the White House on the state of the American and global economy.

Monday’s absent US economic calendar would keep traders leaning towards market sentiment. In the week ahead, the US docket would feature May’s ISM Manufacturing and Non-Manufacturing PMIs, the CB Consumer Confidence, and US employment data, led by the Nonfarm Payrolls, ADP report, and Initial Jobless Claims.

Silver Price Forecast (XAG/USD): Technical outlook

On Friday, Silver (XAG/USD) reached a two-week high at around $22.46, and since then, XAG/USD bulls have failed to keep prices above $22.00. That said, the white metal remains to trade in the $21.50-22.50 range, unable to register a successful upward/downward break beyond the boundaries.

Upwards, the XAGU/USD’s first resistance would be $22.00. A breach of the latter would send XAG/USD towards May 27 high at $22.46. Once cleared, the following supply zone would be February 11 low-turned-resistance at $22.86, followed by February 15 low at $23.08.

On the flip side, the xAG/USD first support would be May 26 low at $21.72. Break below would expose May 13 swing low at $21.28, followed b the YTD low at $20.45.

Key Technical Levels

- A soft US dollar at the start of the week is keeping the euro bulls in charge.

- EUR/USD bulls are looking for 1.0760 to hold as critical support in order to target the 1.08 territories.

As per the prior analysis, EUR/USD Price Analysis: Bulls are up against pressures in a key support zone, the price had been testing a key support area on the four-hour charts within what could have been the makings of a fresh daily bullish impulse. The prospects have played out at the start of the week as the US dollar continues to slide. The following illustrates the bullish bias the price moves into a key area on the daily chart as the bulls penetrate critical resistance.

EUR/USD, before and after analysis, daily and H4 charts

(Before)

It was stated that ''the price broke the horizontal resistance that is now responding as a support zone on the retest. The bulls have committed to the course and a run into prior support and resistance between 1.0761 and 1.0936 could be in order with the 1.08 figure a key target.''

(After)

The price has indeed moved higher and is now up against a potentially firmer layer of resistance.

Meanwhile, in the following four-hour prior analysis, the W-formation was identified and the price has moved in accordance with this reversion pattern as follows:

(Before)

(After)

The price moved higher, respecting the W-formation's neckline support and printed another W-formation, again respecting the neckline support before extending into the target area with 1.08 eyed for the sessions ahead. The bulls could be encouraged should 1.0760 hold as the next level of support.

- EUR/JPY bulls regain control and get ready to aim towards 138.00.

- Sentiment has improved as China is about to ease some Covid-19 restrictions in Beijing and Shanghai.

- EUR/JPY Price Analysis: The upside break of the rising wedge and the RSI in bullish territory exerts upward pressure on the cross-currency pair.

The EUR/JPY breaks above the top of a rising wedge, invalidate the chart pattern, and records a three-week high, around the 137.50s area, courtesy of an improved market mood and weaker safe-haven currencies. At 137.55, the EUR/JPY trades near-daily highs in the North American session.

The EUR/JPY lifts on positive mood, expectations of a less aggressive US Fed

Asian and European equities closed in the green. As Wall Street is closed, US stock futures trade in the green. Worries about China’s coronavirus outbreak ease as Beijing and Shanghai get ready to relax some restrictions on Wednesday, aiming to boost the economic activity in the second-largest economy. Alongside the previously-mentioned expectations, some central banks, particularly the US Federal Reserve, might slow the rate hikes as investors scaled back aggressive bets on the Fed’s tightening.

Elsewhere, the EUR/JPY Monday’s price action opened near the daily lows around 136.30s and rallied near 100 pips, breaking on its way north the rising’s wedge top-trendline, around 137.00, as EUR/JPY bulls aim towards 138.00 and beyond.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY registered an upside break of the rising wedge, exposing the cross-currency for further gains. EUR/JPY bulls regained control, as shown by the daily moving averages (DMAs), sitting beneath the exchange rate, and the Relative Strength Index (RSI), which was aiming lower, when the EUR/USD retraced from the May 9 high at 138.32 towards May 12 low at 132.89, is now in a bullish territory at 57.13.

With that said, the EUR/JPY’s first resistance would be the 138.00 mark. Break above would expose the May 9 high at 138.32. Once cleared, the EUR/JPY following supply zone would be the YTD high at 140.00.

- GBP/USD is attempting to move higher into a bullish area on the daily chart.

- The softness in the US dollar at the start of the week is underpinning the upside bias.

At 1.2655, GBP/USD is 0.18% higher having risen from a low of 1.2616 to score a high of 1.2660 so far on the day. It is a holiday-shortened week and Monday's ranges are narrow making for a slow start to the week for G10 FX.

That being said, risk assets remain in demand as investors continue to cheer the gradual easing of the lockdown in China. Additionally, the pricing of a Fed pause allows interest to return to FX carry trades which is weighing on the greenback and enabling the pound to move higher. USD has dipped in reflection of speculation that the Fed may take a pause in its rate hiking cycle in September.

Last week's £15bn fiscal stimulus provided some support to sterling which is lingering at the start of the week also. Equally, the backbone of a strong UK labour and inflation data has switched the focus of the market back to price pressures from growth concerns. The Bank of England meets this month and there is speculation of a more hawkish reaction from the Old Lady. Nevertheless, ''signs of weakness in the UK April Gross Domestic Product data, due in the middle of June, or a softening in consumer sentiment surveys are likely to undermine the pound,'' analysts at Rabobank said.

''Simultaneously, fears about slowing growth in China and energy security risks in Europe could bolster safe-haven demand for the USD. In an environment in which the Fed and other central banks are removing liquidity, we expect higher levels of volatility in FX market. We see risk that GBP/USD could again re-visit its recent lows in the coming months.''

GBP/USD technical analysis

The price is breaking to the upside and moving in on an area of price imbalance for which mitigation thereof leaves the 1.30 figure vulnerable for the foreseeable future so long as 1.2600 holds on any forthcoming retests.

GBP/USD H1 chart

From a 1-hour perspective, the W-formation is a reversion pattern. The price has already retraced to retest the neckline in a 38.2% Fibonacci correction which has mitigated the price imbalance and therefore puts the ball back into the bull's court. However, a more complete correction over the coming candles could be in order but an interruption in a bullish close at the top of this hour would be reinforcing the upside bias.

- The AUD/USD begins the week on the right foot, gaining some 0.57%.

- An upbeat market mood, a weaker greenback, and expectations of a less aggressive Fed, propelled the major near the 0.7200 mark.

- AUD/USD Price Forecast: Once cleared 0.7200, the major would face a raft of supply zone; otherwise, a fall towards the 20-DMA is on the cards.

The Australian dollar marches firmly in the day, despite a thin liquidity trading session, as the US equities and bond markets remain close in the observation of the Memorial Day and would resume operations on Tuesday. At the time of writing, the AUD/USD is trading at around 0.7196, shy of the 0.7200 mark.

Positive sentiment and a weaker USD lift the AUD/USD

A risk-on mood trading session keeps the greenback on the defensive. China’s positive news regarding the Covid-19 outbreak seems to be controlled as Beijing and Shanghai get ready to ease some restrictions, aiming to propel the Chinese economy, battered by lockdowns that halted factory operations.

Alongside being boosted by market sentiment, the AUD/USD benefitted from a weaker US Dollar. Last week, the Core PCE, the Fed’s favorite gauge of inflation, although it came higher, easied from 5.1% YoY highs to 4.9%. Market players took advantage and lifted high-beta currencies and riskier assets as they began to price in a less “aggressive” approach by the US Federal Reserve.

Earlier in the day, US Federal Reserve Governor Christopher Waller said that he supports 50 bps for “several meetings,” and he’s not taking 50 bps off the table until inflation closes to the 2% target. Waller added that the balance sheet reduction it’s equivalent to a couple of 25 bps rate hikes.

Furthermore, Waller added that inflation is “stubbornly high,” and the Fed would need to be prepared to do more.

Events in the week ahead

The Australian economic calendar would feature S&P Global Manufacturing PMI, the GDP, and the Retail Sales Final.

Regarding the GDP report, analysts at Westpac noted, “We anticipate that the Australian economy will experience a robust expansion in 2022 as it reopens from the delta lockdowns of 2021, with most of the growth concentrated in Q2 & Q3. Output growth for the year is a forecast 4.5%. Growth will be centered on, but not confined to, the consumer, with consumption increasing in the order of 6% over the year – which directly adds 3.3ppts to activity.”

On the US front, the economic docket would unveil the US ISM Manufacturing and Non-Manufacturing PMIs, US employment data, led by the Nonfarm Payrolls, and the ADP and JOLTs openings report.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is neutral-upward biased in the near term, distancing from the 20-day moving average (DMA) at 0.7046 and aiming toward the 0.7200 mark. However, once cleared, the major would face a wall of resistance levels, led by the 100, 50, and 200-DMAs, each at 0.7229, 0.7249, and 0.7257, reséctively.

Upwards, the AUD/USD first resistance would be 0.7200. Once cleared, the following supply zone would be the first of the above-mentioned DMAs. Once all those supply zones are removed, the next resistance would be 0.7300.

On the other hand, the AUD/USD's first support would be May 27 daily low at 0.7089. A breach of the latter would expose May 26 low at 0.7057, followed by the 20-DMA at 0.7046.

- Canadian dollar among top performers during the American session.

- USD/CAD drops below the 200-day Simple Moving Average.

- Canadian Q1 GDP on Tuesday, BOC on Wednesday, and NPF on Friday.

The USD/CAD continued to decline during the American session and printed a fresh one-month low at 1.2649. It is hovering near the lows, holding onto daily losses, about to post the fourth consecutive decline.

The combination of an improvement in market sentiment, higher crude oil prices and a weaker dollar during Memorial Day, pushed USD/CAD further to the downside ahead of the Canadian Q1 GDP reading on Tuesday. The dollar continues to correct lower amid easing expectation about Federal Reserve’s monetary tightening.

The pair fell under the 200-day Simple Moving Average (1.2660) for the first time since April 22. The short-term outlook remains bearish with technical indicators at oversold territory.

GDP, BoC and NFP

On Tuesday, Canada's Q1 GDP is due. Analysts at Wells Fargo expect the report to confirm a solid start for the economy in 2022. “The consensus anticipates Q1 growth of 5.5% quarter-over-quarter annualized, which would be only a modest slowing from the 6.7% pace of growth in Q4, and also stronger than the 3% pace of growth forecast by the Bank of Canada in its latest economic projections. Given sturdy activity trends, and with inflation also moving higher, the Q1 GDP report will almost certainly leave the Bank of Canada on course to raise its policy rate another 50 bps to 1.50% its monetary policy announcement” on Wednesday.

In the US, the key report will be the official employment report on Friday. Market consensus is for an increase in payrolls of 320K and a decline in the unemployment rate from 7% to 6.9%.

Technical levels

- Gold begins the week on a positive tone, up by some 0.20%.

- Holiday in the US to keep prices within a tighter range amid a busy US economic calendar week.

- Fed’s Waller support 50 bps hikes for “several meetings.”

- Gold Price Forecast (XAU/USD): Steady above the 50-DMA, but it needs a break above $1871 to aim towards $1889.91.

Gold spot (XAU/USD) advances during the New York session amid thin liquidity conditions, courtesy of the observation of the Memorial Day in the US, meaning stocks and bonds would not trade until Tuesday. At $1856.05, XAU/USD reflects decent demand for the non-yielding metal at the time of writing.

Sentiment has improved since Monday’s Asian open. China reported the fewest coronavirus cases in almost three months. Shanghai and Beijing are preparing to ease some strict measures, moving to stimulate the economy, which has been hit severely by the Covid-19 zero-tolerance restrictions. Meanwhile, inflation worries are back, as Germany reported high inflationary readings at all-time-highs, at 8.7% YoY, sparking renewed fears of elevated prices and an aggressive approach of the ECB.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, is losing traction and aims towards April’s 21 low at 99.818, down 0.24% in the day. Meanwhile, the US 10-year T-note rate remains parked at Friday’s close of 2.743%.

Of late, Fed’s Governor Christopher Waller crossed wires. He said he supports 50 bps for “several meetings,” and he’s not taking 50 bps off the table until inflation closes to the 2% target. Furthermore, inflation is “stubbornly high,” and the Fed would need to be prepared to do more, Waller said. It’s worth noting that regarding the balance sheet reduction, he noted that it’s equivalent to a couple of 25 bps rate hikes.

An absent US economic docket would keep Gold traders leaning on market sentiment and the economic data revealed in the week ahead. The US economic calendar would feature the US ISM Manufacturing and Non-Manufacturing PMIs, US employment data, led by the Nonfarm Payrolls, and the ADP and JOLTs openings report.

Gold Price Forecast (XAU/USD): Technical outlook

The bright metal has an upward bias, taking advantage of recent US Dollar weakness in the last couple of weeks. Once gold traders reclaimed the 20-day moving average (DMA) last Friday, the XAU/USD fluctuated in the $1840-67 range, unable to break above $1870. Break above the latter would send gold for a re-test of March’s lows at around 1889.91, which also intersects with the bottom Bollinger’s band, followed by $1900.

Key Technical Levels

- Mexican peso accelerates versus the US dollar at the beginning of the week.

- USD/MXN breaks 19.70 and then 19.50, two critical support areas.

- Improvement in risk sentiment boosts demand for emerging market currencies.

The USD/MXN is falling for the fifth consecutive day on Monday. It reached 19.41, the lowest level since March 2020. It is hovering slightly below 19.50, trimming losses.

Global equity markets are rising on Monday, extending last week’s rally. The fact that major Chinese cities began to relax COVID controls over the weekend helped risk sentiment. Commodity and crude oil prices are higher on Monday.

Emerging market currencies are up versus the dollar, also supported by higher interest rates. The best performer on Monday are the Russian ruble (USD/RUB down 6.15%) and the Korean won (USD/KRW falls 1.75%).

Key data ahead

Activity in the US is limited on Monday due to Memorial Day. The key report of the week will be on Friday with the Non-farm payroll report.

In Mexico, the most important event will be Banxico’s quarterly inflation report on Wednesday. “Given recent comments and decisions, we expect the report to tilt hawkish. At the May meeting, it hiked rates 50 bp to 7.0% by a 4-1 vote, with Deputy Governor Espinosa dissenting in favor of a 75 bp hike. However, the minutes showed that two more policymakers were open to a larger move”, explained analysts at Brown Brother Harriman. They point out the next meeting “will be a very close call between 50 and 75 bp and will depend on how the data come in.”

Technical levels

Fed Board of Governors member Christopher Waller said on Monday that he supports lifting interest rates by another 50 bps at the next several Fed meetings and that the policy rate should be above neutral by the end of the year to reduce demand, reported Reuters.

Waller said he is not taking 50 bps rate hikes off of the table until inflation comes down closer to the Fed's 2.0% target and that, if inflation is stubbornly high, he is prepared to do more. Reductions in the size of the Fed's balance sheet are equivalent to a couple of additional 25 bps rate hikes, he noted.

Additional Remarks:

"I am optimistic that the strong US labor market can handle higher rates without a significant increase in unemployment."

"I don't know how soon supply constraints will ease."

Inflation remains alarmingly high.

Longer-run inflation expectations have moved up to a level consistent with underlying inflation a little above 2%.

Core inflation is not coming down enough to the Fed's 2% goal anytime soon.

The economy continues to power along at a healthy pace.

I don't expect the Q1 drop in output to be repeated.

- EUR/USD hit fresh monthly highs in the 1.0770s on Monday as the buck continued to ease.

- Spicey German and Spanish HICP numbers also helped to underpin the euro by shoring up ECB tightening expectations.

- More Eurozone inflation data is out on Tuesday ahead of a busy week of tier one US data releases.

Whilst spicey German and Spanish HICP inflation numbers helping things for the euro, a positive tone to risk appetite and a subsequent continued broad weakening of the US dollar saw EUR/USD push convincingly above its 50-Day Moving Average for the first time since mid-February on Monday. The pair was last trading in the 1.0760s, up about 0.3% on the day in US holiday-thinned trade and at monthly highs.

Indeed, the pair looks set to close the month about 2.2% higher, which would mark its best one-month performance in over a year. EUR/USD’s rebound is even more impressive when viewed in the context of where it started – at rock bottom mid-month lows in the mid-1.0300s. The pair has bounced over 4.0% since May 13, driven by a combination of USD long-position squaring and a closing of the divergence in Fed/ECB policy tightening expectations.

In the past few weeks, US inflation data (both CPI and Core PCE) has added fuel to the idea that US inflation has now peaked, which eases the pressure on the Fed to tighten so aggressively in H2 2022 and 2023. Meanwhile, communication from the ECB has continued to get more hawkish, and in the wake of Monday’s hot inflation data, some are even talking about a hike being brought forward to next week’s meeting.

Focus remains on Eurozone inflation on Tuesday with the preliminary May numbers being released out of France and the Eurozone as a whole. Then there is a barrage of tier one US data scheduled for the rest of the week, culminating in the official May labour market report on Friday.

If the wage growth component of the labour market report shows signs of easing, this could further contribute to the peak inflation narrative and underpin further upside in EUR/USD. But the pair has run into an important area of resistance, with the March low around 1.0800 notable.

The eurozone will release its May Harmonised Index of Consumer Prices (HICP) report on Tuesday, May 31 at 09:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of four major banks regarding the upcoming EU inflation print.

Expectations are for HICP to rise further to 7.7% YoY in April (prev. 7.4%), with the core metric (ex-food and energy) seen rising to 3.5% YoY.

Commerzbank

“The rate is likely to have jumped from 7.4% to 8.0% in May. The decline in energy prices in April did not continue. More had to be paid again for all types of energy in May. The YoY rate of change is likely to have risen from 37.5% to 39%. This alone increases the inflation rate in May by 0.15 percentage points. The inflation rate excluding energy, food, alcohol and tobacco is likely to have risen further from 3.5% in April to 3.8% in May. The jump in food prices is even greater. Here, the YoY rate is likely to have climbed from 6.3% to 7.3%, which in itself pushes up the inflation rate by 0.2 percentage points.”

SocGen

“We expect euro area HICP to have increased by 0.5 pp to 7.9% YoY in May, with core inflation remaining at 3.5% YoY.”

Wells Fargo

“For May, headline inflation is expected to quicken further to a new record high of 7.7% year-over-year. Meanwhile, core CPI inflation is expected to remain steady at 3.5% YoY. We believe these inflation trends will leave the European Central Bank on course to begin raising interest rates at the July announcement, and we anticipate a 25 bps increase in the Deposit Rate to -0.25% at that meeting.”

TDS

“Euro area headline HICP inflation will likely reach new serie high in May (7.8%), with a rebound in fuel prices and continued acceleration in food inflation likely being the main drivers. However, we look for EZ core inflation to soften 0.1ppts to 3.4% YoY due to weakness in the non-energy industrial goods component.”

- USD/TRY fades Friday’s downtick and retests 16.40.

- Turkey 10y bond yields hover around 23.00%.

- Markets’ attention shifts to the CPI release on Friday.

The Turkish currency gives away part of Friday’s gains and pushes USD/TRY to the upper end of the range around 16.40 on Monday.

USD/TRY now looks to CPI

USD/TRY resumes the upside and leaves the May’s rally well on track to challenge the so far 2022 highs near 16.50 recorded on May 26. It is worth recalling that the pair closed with losses in just four sessions since the beginning of the month and the lira has so far shed nearly 24% in that same period.

The lira, in the meantime, remains well under pressure on the back of the deteriorated geopolitical background, elevated energy prices and high domestic inflation. On the latter, investors are expected to shift their attention to the publication of inflation figures for the month of May due later in the week.

What to look for around TRY

Despite Friday’s daily pullback, USD/TRY keeps the underlying upside bias well and sound and looks to consolidate the recent surpass of the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Q1 GDP, Trade Balance (Tuesday) – Manufacturing PMI (Wednesday) – Inflation Rate, Producer Prices (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 1.33% at 16.3837 and faces the next up barrier at 16.4554 (2022 high May 26) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the flip side, a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

- Gold traded with upside on Monday as the US dollar continued to fade despite holiday-thinned trading conditions.

- XAU/USD was last changing hands near $1860 and eyeing recent highs having found decent support at its 21 and 200DMAs.

- Should market participants continue to pare Fed tightening bets, gold could reclaim $1900, even if risk appetite also rebounds.

Spot gold (XAU/USD) prices are trading with an upside bias in quiet, US holiday-thinned trade and eyeing a test of last week’s highs around $1870 per troy ounce. At current levels around $1860, XAU/USD is about 0.4% higher, having found support earlier in the session at the 21-Day Moving Average (at $1849.25) and amid continued technical buying after spot prices found solid support at the 200DMA (at $1840) last week.

Gold’s advances on Monday come despite a positive tone to global macro trade and are being driven by a continued weakening to fresh monthly lows in the US dollar. In wake of US Consumer Price Inflation data released earlier in the month and Core PCE inflation data released last week, market participants have become less worried about inflation in the US and, as a result, Fed tightening bets have seen a modest pullback (i.e. for H2 2022 and 2023).

US bond markets are closed on Monday, but price action in gold and USD markets suggests that yields will probably open the week lower, a continuation of the weakening trend that has, in tandem with the recent weakening of the US dollar, boosted XAU/USD by over 4.0% from sub-$1790 mid-month lows. US data will be in focus this week with various tier one releases including the May ISM Manufacturing PMI survey and official May labour market report all out later in the week.

Analysts argued that should the trends of easing US inflation fears, easing Fed tightening bets and subsequently, more downside in US yields and the buck continue, that could be a bullish medium-term driver for gold, even if it also boosts risk appetite (i.e. US equities). With XAU/USD having found such strong support at its 21 and 200DMAs, the outlook for further upside towards the 50DMA near $1900 looks good.

- The risk-on mood undermined the safe-haven JPY and assisted USD/JPY to gain positive traction.

- The upside seems limited amid the prevalent USD selling bias, warranting some caution for bulls.

- The Fed’s expected rate hike path and the recent slump in the US bond yields weighed on the USD.

The USD/JPY pair gained some positive traction on Monday and broke out of a multi-day-old trading range amid the risk-on mood, which tends to undermine the safe-haven Japanese yen. The intraday buying interest picked up pace during the early North American session and lifted spot prices to a four-day high, around the 127.80-127.85 region.

Investors turned optimistic amid hopes that the easing of COVID-19 lockdowns in China could boost the global economy, which was evident from a generally positive tone around the equity markets. Apart from this, a big divergence in the monetary policy stance adopted by the Fed and the Bank of Japan weighed on the JPY and lifted the USD/JPY pair.

That said, the prevalent US dollar selling bias might hold back traders from placing aggressive bullish bets and keep a lid on any further gains for the USD/JPY pair. Traders continue to cut their long US dollar positions amid speculations that the Fed Fed could pause the rate hike cycle after two 50 bps hikes each in June and July.

The prospects for an eventual slowdown of the Fed's policy tightening was evident from the recent slump in the US Treasury bond yields to a multi-week high. This might act as a headwind for the greenback and cap any meaningful upside for the USD/JPY pair amid relatively lighter trading volumes on the back of the Memorial Day holiday in the US.

Investors might also prefer to wait on the sidelines ahead of important US macro releases scheduled at the beginning of a new month, including the closely watched US monthly jobs report (NFP) on Friday. Hence, it will be prudent to wait for strong follow-through buying before confirming that the USD/JPY pair has formed a strong near-term base.

Technical levels to watch

- EUR/USD pushes higher and reaches new May tops at 1.0780.

- Next on the upside comes the 3-month resistance line near 1.0800.

EUR/USD keeps the upside well and sound and prints new monthly highs around 1.0780 on Monday.

Considering the ongoing pair’s performance, the continuation of the rebound looks likely in the very near term at least. That said, the next up barrier now appears at the 3-month resistance line near 1.0800.

The breakout of this area should mitigate the selling pressure and allow for a probable move to the weekly high at 1.0936 (April 21).

EUR/USD daily chart

Hungarian Prime Minister Viktor Orban on Monday said that things are not looking good with respect to the EU's proposed ban on Russian oil imports, reported Reuters. The exemption of oil pipeline shipments would be a good solution, he stated, adding that Hungary also needs some guarantees in case of any potential halt to Russian oil shipments by pipeline. 4

There is no compromise at the moment at all, Orban said, adding that "we" are in a difficult situation given the "irresponsible behaviour of the (European) Commission". The Hungarian position remains that solutions are needed before sanctions, Orban added, noting that now is the time to come up with the solution.

Orban's remarks come after European Commission President Ursula von der Leyen earlier said that EU 27 nations are not yet there an agreement on a new Russia sanctions package. All issues regarding the sanctions have been solved except the issue of crude oil via pipelines, she added.

- NZD/USD came within a whisker of monthly highs in the mid-0.6500s in US holiday-thinned trade.

- USD long position squaring has continued to weigh on the buck, as NZD/USD traders brace for a busy data week.

NZD/USD came within a whisker of printing fresh highs for the month as recent downside in the US dollar extended on Monday, reaching into the upper 0.6550s before backing off to current levels in the 0.6530s. That means the pair is back to trading roughly flat on the day, which isn’t too surprising given a lack of trading volumes amid US market closures for the Memorial Day public holiday. Comments from the chief economist at the RBNZ on Monday, who cautioned that the bank’s recently unveiled hawkish rate guidance could be tempered if the economy underperforms expectations, were largely ignored.

Data released by the US Commodity Futures & Exchange Commission last Friday revealed that in the week ending last Tuesday, investors had continued to pare back on USD long positions and recent price action suggests this trend has continued, to the benefit of NZD/USD. The pair is now trading an impressive more than 5.0% above mid-month lows in the low 0.6200 area, with some traders citing an easing of expectations for Fed tightening in the latter part of 2022 and 2023 as inflation data increasingly shows signs of moderation (such as last week’s Core PCE numbers).

The rest of the week is set to be a busy one for NZD/USD traders given a barrage of upcoming tier one US data releases. May Conference Board Consumer Confidence survey data is out on Tuesday, May ISM Manufacturing PMI survey data and April JOLTs Job Openings data is out on Wednesday, May ADP Private Employment Change data is out on Thursday, while the official May labor market report is out on Friday.

NZD/USD is testing the price high at 0.6556/68. As analysts at Credit Suisse note, this area has to hold to avoid a lengthier reversion back higher.

Break below 0.6421/15, then 0.6310/6288 to shift risk back lower again

“With the daily and weekly MACD still negative and with the moving averages still falling, we retain our bearish view and look for a turn back lower again, with immediate support now seen at 0.6522/21.”

“A break below 0.6421/15 and then below 0.6310/6288 is needed to shift the short-term risk back lower again and pave the way for a move to the YTD low and major retracement support at 0.6231/13.”

“A sustained break above 0.6556/68 would signal another lengthy reversion within the 2021/22 downtrend, similar to the July/Oct 2021 and Jan/April 2022 recoveries, with next key resistance seen at the 55-day moving average at 0.6656/93. However, this is not our base case.”

USD/CHF has reached major support at 0.9576/44. Economists at Credit Suisse look for the market to turn back higher from here, ahead of the development of a broader range.

0.9472/60 expected to hold additional weakness

“Our view remains that the USD/CHF should see some stabilization around the 0.9576/44 area, setting it to trade in a ~9500 to parity range. We look for an eventual turn back higher toward the top of the highlighted range and see resistance at 0.9633/45 initially.”

“A close above the price high at 0.9766 is needed to relieve the immediate weakness and to confirm our view of a swing higher within our anticipated range, although we think that it is unlikely that market will break the YTD high at 1.0061/64.”

“Should weakness extend below 0.9517, we would look for the breakout point to the April/May surge at 0.9472/60 to serve as a floor to maintain our base case of broader trading range.”

EUR/GBP stays trapped below key resistance at 0.8616/21. Nevertheless, trend-following indicators are turning higher and analysts at Credit Suisse stay firmly bullish.

Support at 0.8393 set to hold

“EUR/GBP maintains a large ‘diamond bottom’ base and whilst weekly MACD did not confirm a positive cross last week, this remains very close, with medium-term moving averages also close to a bullish cross higher.”

“Our bias remains for an eventual closing break above 0.8618/21, with next resistance at 0.8654/59 and beyond.”

“First support is seen at 0.8434/32, then the 55-day average just below 0.8416/0.8393, with fresh buyers expected here if reached.”

- A combination of factors dragged USD/CAD to over a one-month-low on Monday.

- Bullish oil prices underpinned the loonie and exerted pressure amid a weaker USD.

- The Fed’s expected rate hike path, the risk-on mood weighed heavily on the buck.

The USD/CAD pair witnessed heavy selling for the third successive day on Monday and continued losing ground through the mid-European session. The downward trajectory dragged spot prices to the 1.2675 region, or its lowest level since April 22 and was sponsored by a combination of factors.

Expectations of demand recovery in China, along with global supply concerns amid the impending European Union embargo on Russian oil imports pushed the black liquid to over a two-month high. This, in turn, underpinned the commodity-linked loonie and dragged the USD/CAD pair lower for the third successive day amid sustained US dollar selling bias.

Expectations that the Fed Fed could pause the rate hike cycle after two 50 bps hikes each in June and July forced traders to continue cutting their long US dollar positions. The prospects for an eventual slowdown of the Fed's policy tightening was evident from the recent slump in the US Treasury bond yields to a multi-week high, which weighed on the buck.

Apart from this, the prevalent risk-on environment further dented demand for the safe-haven greenback and exerted additional downward pressure on the USD/CAD pair. Investors turned optimistic amid hopes that the easing of COVID-19 lockdowns in China could boost the global economy, which was evident from a generally positive tone around the equity markets.

With the latest leg down, the USD/CAD pair broke through the 1.2700 confluence support comprising 100-day SMA and the 61.8% Fibonacci retracement level of the 1.2459-1.3077 strong move up. The subsequent slide could be seen as a fresh trigger for bearish traders and supports prospects for an extension of the recent pullback from the YTD peak touched earlier this month.

That said, relatively lighter trading volumes on the back of the Memorial Day holiday in the US warrant some caution before placing aggressive bearish bets. Hence, any further downfall is more likely to find decent support near a technically significant 200-day SMA, currently around the 1.2660-1.2655 region, which should now act as a pivotal point.

Technical levels to watch

EUR/USD has reached the resistance zone at 1.0770/0835. Analysts at Credit Suisse look for a turn back lower from here, for a move to 1.0608/0599 initially, then 1.0350/41 and eventually beyond.

Resistance at 1.0835 expected to cap

“EUR/USD is still capped at 1.0770/0835. With five different resistances in this zone, we expect this area to act as a very tough barrier and we look for the medium-term downtrend to reassert itself from here.”

“Support stays at 1.0642, below which would now confirm a very small intraday ‘wedge top’ to confirm that the risks have turned lower again, with next support at 1.0608/0599, with scope then for a retest of 1.0350/41. Ultimately, we look for an eventual fall to parity/0.99, with the market still in a clear medium-term downtrend.”

“Above 1.0835 is not our base case, however, it would trigger a deeper-than-expected recovery, with the next level at 1.0923/37.”

Canada's Current Account for Q1 rose to C$5.0B from -C$0.1B in Q4 2021, bigger than the expected jump to C$3.2B, data released by Statistics Canada on Monday revealed. Positive moves in global commodity markets helped boost Canadian exports last quarter, and will likely do the same in Q2.

AUD/USD continues to recover. Nonetheless, analysts at Credit Suisse still anticipate that resistance at 0.7258/67 will cap the advance.

Bearish whilst below 0.7258/67

“We remain with our view that the recent recovery is corrective, with a major resistance zone at 0.7258/67 still set to cap the market.”

“We look for an eventual turn back lower again, with support seen at 0.7088/70 initially and further below at 0.6956/48, a break below which is needed to shift the short-term risk lower again and open the door to retest the YTD low at 0.6827, ahead of our medium-term objective at 0.6758.”

“Should the level at 0.7258/67 break, this would neutralize our bearish medium-term view and confirm a mean-reversion back in the broader range. However, this is not our base case.”

- AUD/USD gained follow-through traction on Monday and climbed to a fresh multi-week top.

- Sustained move beyond the 0.7145 confluence hurdle supports prospects for further gains.

- Weakness below the 0.7100 mark could be seen as a buying opportunity and remain limited.

The AUD/USD pair prolonged its strong recovery momentum from the YTD low and kicked off the new week on a positive note amid the prevalent US dollar selling. Expectations that the Fed could pause the current rate hike cycle later this year dragged the USD Index to a fresh monthly low.

Apart from this, the ongoing risk-on rally across the global equity markets further undermined the safe-haven buck. This, along with the Reserve Bank of Australia's hawkish signal that a bigger interest rate hike is still possible in June, offered additional support to the risk-sensitive aussie.

The combination of factors assisted the AUD/USD pair to capitalize on Friday's move beyond the 0.7145 confluence hurdle. The said barrier comprised the 200-period SMA on the 4-hour chart and the 38.2% Fibonacci retracement level of the 0.7662-0.6829 fall, which should now act as a pivotal point.

Looking at the broader picture, the recent appreciating move witnessed over the past two and half weeks or so has been along an upward sloping channel. This points to a well-established short-term bullish trend and should allow the AUD/USD pair to climb further beyond the 0.7200 round figure.

The subsequent strength, however, is likely to confront resistance near the 100-day SMA, around the 0.7235-0.7245 region. The said barrier coincides with the 50% Fibo. level and is followed by the 200-day SMA, near the 0.7260 zone, which if cleared would be seen as a fresh trigger for bulls.

On the flip side, the 0.7145 confluence resistance breakpoint now seems to protect the immediate downside ahead of the 0.7100 mark. Any further decline might still be seen as a buying opportunity and remain limited near the 23.6% Fibo. level support, near the 0.7025-0.7020 region.

Some follow-through selling, leading to a subsequent break through the 0.7000 psychological mark, will shift the bias in favour of bearish traders. The AUD/USD pair could then fall to the 0.6940 area en-route the 0.6900 mark and the 0.6830-0.6825 region, or the YTD low touched earlier this month.

AUD/USD 4-hour chart

-637895091387266217.png)

Key levels to watch

Leaders of EU 27 nations aim to reach a political agreement on an oil ban on Monday, an EU official said according to Bloomberg. The official added that there is agreement on the two phases of implementation of the import ban, but that implementation dates remain under discussion.

The more optimistic (on the chances of a deal being reached) remarks from an EU official comes after more pessimistic remarks from the Estonian PM, who said that it is not realistic to expect an agreement on a sixth package of sanctions against Russia today.

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest interest rate decision by the BoK.

Key Takeaways

“Bank of Korea (BOK) raised its benchmark base rate by 25 bps to 1.75% at its scheduled meeting today (26 May). All analysts polled by Bloomberg including UOB had expected the hike.”

“The key takeaway from the revisions to the growth and inflation forecasts as well as comments from BOK is that inflation is a much bigger concern than growth risks in the near-term. Governor Rhee was explicit on the need to tighten monetary policy further and to get real interest rates to a neutral level.”

“Given the persistent upside risks to inflation, we are raising our call for BOK’s tightening as we now expect the central bank to hike by 25 bps at each of the three subsequent meetings in Jul, Aug and Oct before stopping at its last meeting this year in Nov. This will bring the benchmark rate to 2.50% by end-2022 (vs. our previous forecast of 2.00%). We believe the BOK will stay on hold thereafter as inflation starts to moderate.”

- DXY remains under pressure well below 102.00.

- Immediately to the downside comes the 55-day SMA.

The index accelerates losses and clinches new multi-week lows in the 101.30 region on Monday.

DXY remains under pressure and extra losses should not be ruled out for the time being. That said, further decline is expected to target the temporary 55-day SMA, today at 101.10, ahead of the 3-month line around 100.60.

Looking at the longer run, the outlook for the dollar is seen constructive while above the 200-day SMA at 96.80.

DXY daily chart

Dollar Index Spot

- GBP/USD is consolidating in fairly quiet trade close to one-month highs in the mid-1.2600s.

- Volumes this week are set to be dampened by US (Monday) and UK (Thursday & Friday) public holidays.

- But a barrage of upcoming US data means the prospect for volatility remains elevated.

Trading conditions are quiet on Monday amid a lack of US market participants given market closures there for the Memorial Day public holiday. GBP/USD is nonetheless trading close to the one-month highs it printed last Friday in the 1.2670 area at just below 1.2650 amid an upbeat tone to risk appetite at the start of the week. The pair is on course to have rallied around 4.0% from mid-month lows in the mid-1.2100s, a move which analysts are mostly putting down to the weakening of the US dollar, which has continued this Monday.

That means the pair is on course to post a monthly gain of about 0.6%, it's first monthly gain of the year. Still, analysts remain cautious on the prospects for a more meaningful rebound in the pair given the divergence between the outlooks for the US and UK economies and associated divergence between the outlook for Fed and BoE policy. Both remain in the US dollar’s favour, analysts argue, suggesting that a return to recent lows is perhaps more likely that a move back above the 1.30 mark.

Indeed, data released by the US Commodity Futures Trading Commission (CFTC) last Friday showed that, as of last Tuesday, investors continued to add to net sterling short positions, despite the rebound from mid-month lows. That suggests a continued appetite to sell the rally.

GBP/USD trading volumes are expected to pick up on Tuesday with the return of US market participants, but will likely then die down again from Thursday into the end of the week, given the closure of UK markets for a long public holiday weekend for the British Queen’s Platinum Jubilee celebration. That doesn’t mean there won’t be volatility. Indeed, traders are bracing for a barrage of US data set to be released this week.

May Conference Board Consumer Confidence survey data is out on Tuesday, May ISM Manufacturing PMI survey data and April JOLTs Job Openings data is out on Wednesday, May ADP Private Employment Change data is out on Thursday, while the official May labor market report is out on Friday. After its prolonged recent decline, USD bulls may be looking for an opportunity to reload on long positions

.

Sellers could push USD/IDR below the 14,500 region in the near term, suggested FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“Our expectations for USD/IDR to ‘trade sideways’ last week were incorrect as it took out the rising trend-line support and plummeted last Friday. USD/IDR extended its decline today and USD/IDR is likely to break the major support near 14,500.”

“For this week, the next support at 14,448 is unlikely to come into the picture.”

- EUR/JPY adds to recent gains and trespasses the 137.00 hurdle.

- While above the 2-month support line, further gains are likely.

EUR/JPY extends the march north for the third session in a row beyond the 137.00 barrier at the beginning of the week.

The cross surpassed the 136.80 region and in doing so it opened the door to extra gains to, initially, the May high at 138.31 (May 9) prior to the 2022 high at 140.00 (April 21).