- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 02-06-2022.

- GBP/JPY picks up bids near one-month top, grinds higher after printing five-day uptrend.

- Market sentiment improves on softer data, preparations for NFP.

- Hawkish calls from the BOE, versus BOJ’s favor of easy money, underpin upside momentum.

- Off in the UK, a light calendar restricts moves but risk catalysts are the key to track for fresh impulses.

GBP/JPY picks up bids to refresh one-month top during Friday’s Asian session, rising for the sixth consecutive day despite grinding higher of late.

In doing so, the cross-currency pair struggles to justify upbeat sentiment and hawkish expectations from the Bank of England (BOE) amid the pre-NFP anxiety. It’s worth noting that a light calendar and holiday in the UK also restrict the GBP/JPY pair’s immediate moves.

Softer US data and downbeat Treasury yields previously favored the pair buyers. On the same line were the odds favoring more monetary policy divergence between the Bank of England (BOE) and the Bank of Japan (BOJ).

On Thursday, the US ADP Employment Change eased to 128K for May, versus 300K forecasts and a downwardly revised 202K previous reading. The Weekly US Initial Jobless Claims, on the other hand, dropped to 200K compared to 210K anticipated and 211K prior. Further, Nonfarm Productivity and Unit Labor Costs both improved in Q1, to -7.3% and 12.6% respectively, compared to -7.5% and 11.6% figures for market consensus. Furthermore, US Factory Orders for April softened to 0.3%, from a revised 1.8% in March and 0.7% forecast.

It’s worth noting that the Australia and New Zealand Banking Group (ANZ) highlights the difference between the currency BOE rate and the one per Taylor rule to suggest more work for the “Old Lady”. On the other hand, BOJ policymakers have been defending the easy money practices for a long with the recent tone shifting a bit but staying mostly in favor of no immediate change in policies.

Elsewhere, Tory critics, a UK Member of Parliament’s (MP), suggestion to rejoin the bloc and chatters over a no-confidence vote for UK Prime Minister (PM) Boris Johnson tried to weigh on the GBP/JPY prices.

Against this backdrop, the Wall Street benchmarks rose the most in a week whereas US Treasury yields remained pressured. At the latest, the S&P 500 Futures print mild gains while the US Treasury yields struggle around 2.92%, suggesting the market’s cautious optimism.

Technical analysis

Despite crossing the 200-SMA, around 161.50 by the press time, GBP/JPY buyers jostle with the 61.8% Fibonacci retracement of April-May downside, around 163.50, amid overbought RSI conditions.

Even if the quote rises past 163.50 immediate hurdle, highs marked during late April and March, respectively near 164.25 and 164.65, will challenge the pair’s further upside.

Hence, GBP/JPY runs out of steam despite the latest advances, suggesting a pullback from a multi-day high.

- The DXY has slipped sharply to near 101.70 as the risk-on impulse has diminished the DXY’s appeal.

- The US economy may have generated lower employment in May.

- A preliminary estimate of the ISM Services PMI is hinting at underperformance.

The US dollar index (DXY) surrendered its entire gains recorded on Wednesday as investors were expecting an aggressive stance on the monetary policy announcement by the Federal Reserve (Fed), which is scheduled in the third week of June. The DXY faced sufficient barricades around 102.50, therefore bears dragged the asset lower to near 101.70. A slippage in the DXY is indicating a rebound in the positive market sentiment, which will keep the DXY on the tenterhooks.

US NFP in focus

The investing community is entirely focused on the release of the US Nonfarm Payrolls (NFP). The downbeat disclosure of the US Employment Change by Automatic Data Processing (ADP) on Thursday, is advocating dismal NFP figures. The ADP reported the Employment Change at 128k, which displays sluggishness in employment generation by the US economy. It is highly expected that the NFP will showcase the similar pattern displayed by the ADP. The NFP is forecasted at 325k vs. 428k reported earlier.

Also, the Unemployment Rate is expected to diminish to 3.5% from the prior print of 3.6%.

US ISM Services PMI

In today’s session, investors’ focus will remain on the release of the ISM Services Purchase Managers Index (PMI). A preliminary estimate of the ISM Services PMI is hinting at underperformance. The economic catalyst is expected to land at 56.4 against the prior print of 57.1.

Key events next week: Goods and Services Trade Balance, Initial Jobless Claims, Consumer Price Index (CPI), Michigan Consumer Sentiment Index (CSI).

Major events next week: Reserve Bank of Australia (RBA) interest rate decision, European Central Bank (ECB) monetary policy announcement.

- GBP/USD remains sidelined after bouncing off the 21-DMA support.

- 10-DMA restricts immediate upside amid receding bullish bias of MACD signals.

- Descending trend line from February, 50-DMA stand tall to challenge further advances.

GBP/USD portrays the typical pre-NFP trading lull as buyers and sellers jostle around 1.2580 during Friday’s Asian session.

The cable pair reversed from a fortnight low the previous day while posting the biggest daily jump in two weeks. The recovery moves gained support from the 21-DMA, as well as bullish MACD signals.

However, recently smaller green bars on the MACD, the difference between the MACD line and signal line, join the 10-DMA level surrounding 1.2580 to challenge the GBP/USD pair’s immediate upside.

Even if the quote manages to cross the 1.2580 immediate hurdle, the latest swing high around 1.2670 precedes a convergence of the descending trend line from February 18 and 50-DMA, close to 1.2700-15, to challenge the pair buyers.

Meanwhile, the pair’s downside past 21-DMA support of 1.2460 will need validation from the 1.2410-2400 region, comprising levels marked since April 28, to recall GBP/USD bears.

Following that, the area surrounding the mid-1.2200s can act as the last defense for bulls before directing the prices down to May’s low of 1.2155.

GBP/USD: Daily chart

Trend: Pullback expected

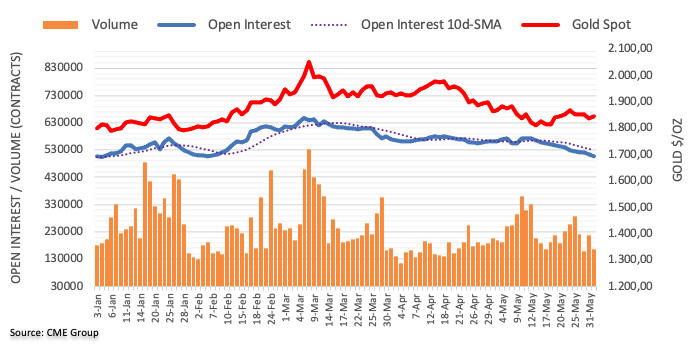

- Silver (XAG/USD) shed some weekly losses and is rallying almost 2.80% in the last couple of days.

- A risk-on market mood weighed on US Treasury yields and the US Dollar, lifting precious metals.

- Silver Price Forecast (XAG/USD): To extend its gains towards $23.00.

Silver (XAG/USD) is surging to fresh weekly highs above $22.00 amidst an upbeat market sentiment that weighed on the safe-haven US Dollar, also undermined by US Treasury yields, particularly the 10-year benchmark note rate, almost flat at 2.911%. At the time of writing, XAG/USD is trading at 22.38.

The market mood improved, as shown by US equities registering gains, while Asian stocks are set for a higher open. Investors set aside concerns about a possible US recession, spurred by the US Federal Reserve’s aggressive tightening path, while also assessing ongoing China’s coronavirus crisis, which has eased some restrictions, as it battles to fulfill the 5% growth target by the end of 2022.

Additionally to the abovementioned, the conflict between Ukraine-Russia, which has lasted for three months, has begun to weigh on food and commodity prices.

Elsewhere, the Fed speakers parade continued. Cleveland’s Fed President Loretta Mester said that she supports 50 bps increases in the next couple of meetings and added that the Fed is well-positioned to consider the appropriate pace for further rate hikes.

Mester added that she is unsure how high rates need to go, and a pause on the tightening cycle would depend on data. Nevertheless, she emphasized that the Fed would slam the brakes if inflation remains stubbornly high, and she still keeps 25 or 50 bps rate hikes, contrarily to a pause in September.

Earlier on Thursday, the Fed’s Vice-Chair Lael Brainard said that the central bank is getting mixed signals on the economy and that the number one challenge is bringing inflation down. When asked about a Fed pause, she said it is harder to say because the policy is not on a pre-set course via CNBC.

In the meantime, the US calendar would release the May Nonfarm Payrolls report, ISM Non-Manufacturing, and Composite PMIs, alongside additional Fed speakers, ahead of the blackout of the June Federal Reserve Open Market Committee meeting.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD surged sharply and broke on its way up the $22.00 mark. Additionally, the Relative Strength Index (RSI) entered positive territory due to the size of the move, meaning that the rally has some legs to go before turning south. Also, it’s worth noting that the XAG/USD’s first resistance level is the confluence of the 50-DMA and the May 5 high, up at $23.26-28, respectively. A breach of the latter could pave the way for further gains. XAG/USD’s next supply zone would be the 200-DMA at $23.51, followed by the 100-DMA above all the DMAs at $23.72.

Key Technical Levels

EUR/USD remains sidelined near 1.0750, after rising the most in a fortnight while bouncing off a two-week low.

In doing so, the major currency pair repeats the typical pre-NFP trading behavior amid a lack of major data/events. Also increasing the importance of Friday’s economic calendar is the US ISM Services PMI for May.

Also read: Nonfarm Payrolls Preview: It is all about the money, three scenarios for wage growth and the dollar

That said, one-month risk reversal (RR) for the EUR/USD, a gauge of calls to puts, rises the most in three days, by the end of Thursday’s North American trading session, per the latest options market data on Reuters.

The daily RR figures for June 02 jumped to +0.035 while snapping the previous two-day downtrend. However, the weekly figures print a bearish bias with a -0.175 level after rising for the two consecutive weeks the last.

Also read: EUR/USD Price Analysis: Bulls move in on a critical H4 resistanvce

- USD/JPY has climbed to near 130.00 despite weaker DXY.

- A poor US ADP Employment Change is advocating a dismal show from the US NFP.

- The Japanese docket will report its GDP numbers next week.

The USD/JPY pair is oscillating in a narrow range of 129.70-130.05 in the early Asian session. The asset has turned rangebound after a sheer upside move from the crucial support of 127.00. The asset ended its four-day winning streak on Thursday however, a minute downside closing doesn’t advocate any reversal. The upside momentum is still intact and is expected to accelerate at a quick pace.

Despite the underperformance by the US dollar index (DXY) on Thursday after the release of the US Automatic Data Processing (ADP) Employment Change, the greenback bulls managed to outperform the Japanese yen. This indicates a compelling weakness in the Japanese yen.

The DXY slipped to near 101.70 after failing to sustain above 102.50 on poor ADP Employment Change numbers. The additional employment numbers landed at 128k, vigorously lower than the estimates of 300k. The release of the dismal ADP Employment Change numbers is indicating a disclosure of poor show from the US Nonfarm Payrolls (NFP). As per the market consensus, the US NFP is expected to report 325k job additions in the labor market. The consensus is already lower than the prior print of 428k and the 12-month average job additions of 551.6k. This may bring more offers into the DXY.

On the Japanese yen front, investors will keep an eye on the release of the Gross Domestic Product (GDP) numbers, which are due on Tuesday. The quarterly and annual GDP figures are expected to remain constant at -0.2% and -1% respectively.

- NZD/USD grinds higher around one-month high after rising the most in a fortnight.

- 50-EMA, bearish RSI divergence test buyers on their way to crossing May’s top.

- Convergence of 21-EMA and three-week-old rising trend line restricts immediate downside.

NZD/USD sits comfortably at its monthly peak, after taking the seat the previous day, as challenges to further upside emerge during Friday’s Asian session. That said, the Kiwi pair takes rounds to 0.6550-60 by the press time, following the run-up to 0.6565.

A sustained bounce off the 0.6480 confluence, comprising the 21-EMA and an upward sloping trend line from mid-May, joined bullish MACD signals to underpin the NZD/USD pair’s latest run-up.

However, the 50-EMA level surrounding 0.6570 and the RSI’s failures to march with the higher high, known as bearish divergence, challenge the pair’s latest upside moves.

In a case where the NZD/USD rises past the 0.6570 hurdle, it can extend the rally towards the 50% Fibonacci retracement (Fibo.) of April-May upside, near 0.6625, ahead of challenging the 100-EMA level surrounding 0.6655.

Alternatively, pullback moves may retest the 0.6500 round figure before the 0.6480 support convergence could challenge the bears.

It’s worth noting, however, that a clear downside break of 0.6480 won’t hesitate to drag the NZD/USD prices towards the 23.6% Fibo. level surrounding 0.6410.

NZD/USD: Daily chart

Trend: Pullback expected

- USD/CAD remains pressured around six-week low after the biggest daily fall since early May.

- Upbeat oil prices, softer US dollar and risk-on mood weighed on the Loonie prices.

- Hawkish BoC Speak adds to the bearish bias, Fed speakers couldn’t lift the USD.

- Monthly prints of US employment, services activity gauge will be important to watch amid firmer sentiment, softer USD.

USD/CAD holds lower ground near the lowest levels in six weeks, recently pressured near 1.2570 after posting the biggest daily fall in three weeks. That said, firmer prices of oil and hawkish comments from the Bank of Canada (BOC) policymaker join broad US dollar weakness to underpin the Loonie pair’s latest weakness ahead of the key US employment numbers for May. The quote, however, portrayed the pre-NFP trading lull during the early hours of Friday.

Bank of Canada (BoC) Deputy Governor Paul Beaudry on Thursday said that the BoC sees an increasing likelihood that it may need to raise its policy rate to 3% or higher, reported Reuters. It’s worth noting that the BOC raised interest rates by 50 basis points (bps) to 1.5% last Wednesday.

WTI crude oil, Canada’s biggest export item, rose the most in a week even as the oil ministers from OPEC+ nations agreed on Thursday to lift output by 648K barrels per day (BPD) in both July and August, versus 432BPD expected, according to sources speaking to Reuters. The reason for the black gold’s jump could be linked to the market’s doubts over OPEC+ ability to deliver the output, as well as the “sell the rumor, buy the fact” attitude.

Elsewhere, the US Dollar Index (DXY) dropped the most in a fortnight as market players took relief from softer US data, after two consecutive days of hawkish Fed scenario. On Thursday, the US ADP Employment Change eased to 128K for May, versus 300K forecasts and a downwardly revised 202K previous reading. The Weekly US Initial Jobless Claims, on the other hand, dropped to 200K compared to 210K anticipated and 211K prior. Further, Nonfarm Productivity and Unit Labor Costs both improved in Q1, to -7.3% and 12.6% respectively, compared to -7.5% and 11.6% figures for market consensus. Furthermore, US Factory Orders for April softened to 0.3%, from a revised 1.8% in March and 0.7% forecast.

Amid these plays, the Wall Street benchmarks rose the most in a week whereas US Treasury yields remained pressured.

Looking forward, USD/CAD traders need to pay attention to the risk catalysts ahead of the key US jobs report and ISM Services PMI for May. That being said, the latest comments from Canadian Prime Minister Justin Trudeau, disliking Chinese behavior with Canadian patrol planes, and joining the USTR statements over China trade, gain the attention of late.

Read: Nonfarm Payrolls Preview: It is all about the money, three scenarios for wage growth and the dollar

Technical analysis

A clear downside break of the two-month-old support line, now resistance around 1.2600, joins successful trading below the 200-DMA level of 1.2660 to keep USD/CAD bears hopeful of visiting the 78.6% Fibonacci retracement of October 2021 to May 2022 upside, near 1.2450.

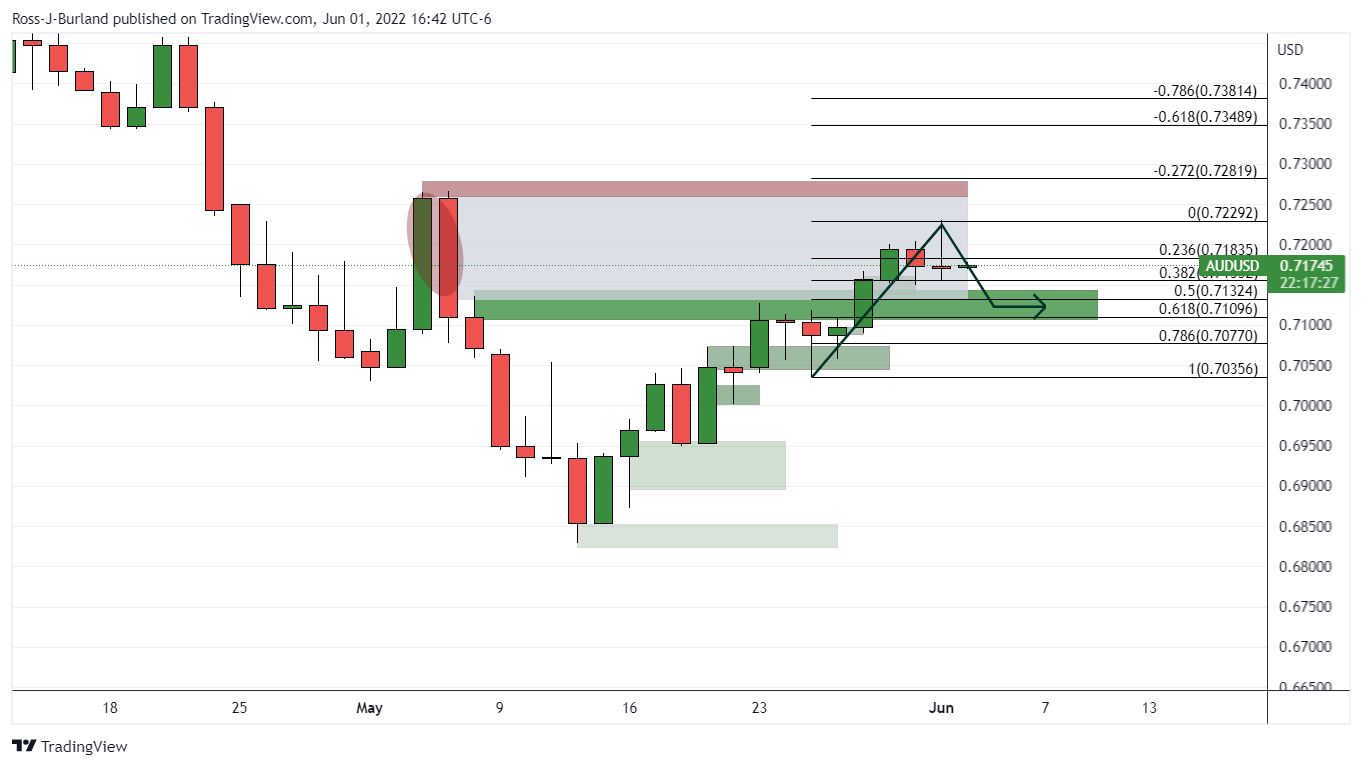

- AUD/USD is marching towards 0.7300 on expectations of poor US NFP and hawkish RBA.

- The US economy is expected to display dismal performance in employment generation.

- Investors should brace for a hawkish commentary from the RBA next week.

The AUD/USD pair is advancing firmly towards the round-level resistance of 0.7300 amid positive market sentiment. The aussie bulls have been a star performer on Thursday after scaling the asset comfortably above the critical resistance of 0.7200.

Sickness in the greenback bulls resulted in funds channelization into the risk-sensitive assets as investors dumped the US dollar on poor Automatic Data Processing (ADP) Employment Change numbers. The ADP Employment Change landed at 128k, significantly lower than the consensus of 300k. Poor employment additions renewed concerns of an imbalance in the US labor market, which may worsen the already complex situation for the Federal Reserve (Fed).

Taking into account, the negative cues from the ADP Employment Change, it will be justified to claim that the market participants could find an extreme deviation in the actual and expected figures of the US Nonfarm Payrolls (NFP). The US NFP is already seen lower at 325k, however, any below-expectations figure would insert more pressure on the US dollar index (DXY). The DXY has plunged to near 101.70 after failing to sustain above 102.50.

On the aussie front, investors are awaiting the announcement of the interest rate decision by the Reserve Bank of Australia (RBA). Inflationary pressures in the aussie zone are advancing further and to tame the soaring prices, the RBA is expected to dictate a tight stance along with a hawkish commentary.

Deputy USTR Bianchi: "All options are on the table" regarding tariff decisions on Chinese imports.

More to come

- The USD/CHF remains almost flat in the week, up by a minimal 0.06%.

- Sentiment remains positive as Asian equities prepare for a higher open, as shown by the futures market.

- USD/CHF Price Forecast: To extend its losses towards the 100-DMA at 0.9419.

On Thursday, the USD/CHF slashed Wednesday’s gains and some more, down 0.50%, and breaching on its way south, the 50-day moving average (DMA) at 0.9594. At 0.9577, the USD/CHF reflects the US Dollar’s weakness amidst a positive market mood throughout the day.

During the New York session, stocks ended with gains. Despite the market’s rhetoric of investors’ fears about a US recession, China’s Covid-19 lockdowns, and Russia’s invasion of Ukraine, Asian equity futures are poised for a higher open. Also, a weaker than expected US Dollar, following Wednesday’s price action, when the greenback recaptured 102.000, gave back its gains, retracing 0.77%, sitting at 101.754.

That said, a headwind for the USD/CHF boosted the low-yielder Swiss franc. Furthermore, a stationary US 10-year Treasury yield at 2.911% fueled selling pressure on the USD/CHF, which fell below the 0.9600 mark.

USD/CHF Price Forecast: Technical outlook

From the daily chart perspective, the USD/CHF is consolidating with the short-term daily moving averages (DMAs), the 20 and 50 above the exchange rate, while the 100 and the 200-DMA remain below. Nevertheless, due to Wednesday’s rally towards 0.9652 and the Relative Strength Index (RSI) pushing lower, well within negative readings, a move towards the 100-DMA might be on the cards.

Therefore, the USD/CHF first support would be the April 20 high-turned-support at 0.9526. A breach of the latter would expose April 1, 2021, at 0.9472 high, followed by the 100-DMA at 0.9419.

Key Technical Levels

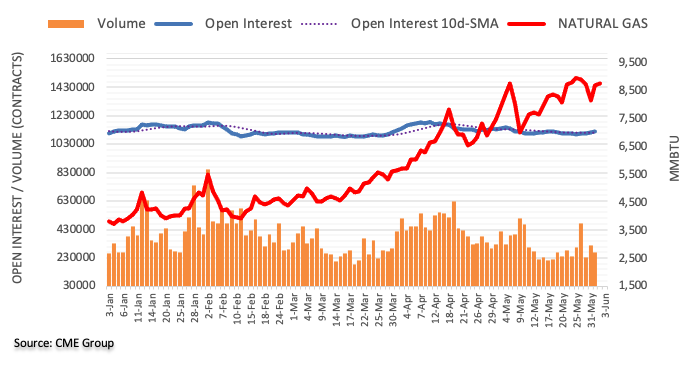

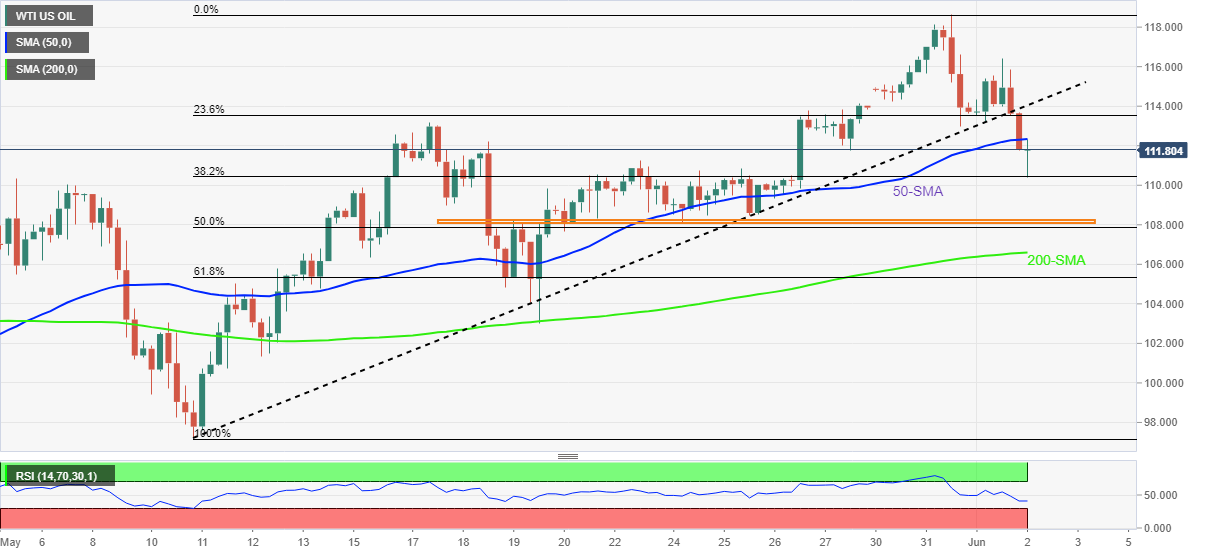

- WTI pushes higher on Thursday asOPEC+ agrees to increase its monthly oil quotas.

- US oil inventories fell by 5.1-million barrels last week, well above the 1.3-million-barrel fall.

At $117.53, West Texas Intermediate (WTI) crude is 2.37% higher on Thursday as US oil inventories fell more than expected last week. Traders were also taking into account that OPEC+ agreed to increase its monthly oil quotas that most of its members cannot meet.

Bulls moved in again when the Energy Information Administration reported US oil inventories fell by 5.1-million barrels last week, well above the 1.3-million-barrel fall that markets are positioning for ahead of the announcement. Meanwhile, analysts at TD Securities explained that the ''rumours that OPEC members are considering to exempt Russia from a production deal, which would open the door for the spare capacity 'Haves' to pump more oil to compensate for the 'Have-Nots', are a distraction from the insurance ban on Russian oil.''

OPEC+ on Thursday said it is raising quotas in July and August by 648,000 barrels per day, up from the 432,000 bpd in previous monthly hikes, to make up for lower Russian supply.

''While negotiations between Saudi Arabia and the Biden Administration would ultimately determine this course of action, it would represent a swift change in the geopolitical landscape in the Middle East, placing Riyadh at odds with Moscow. Ultimately, this is unlikely to occur in the immediate term, which suggests these rumours will prove to be a distraction from the EU's proposed insurance ban on shipping Russian oil to third countries,'' the analysts explained.

''We have reiterated that this could create a significant logistical bottleneck for Russian crude exports. This view fits with our return decomposition model, which highlights that energy supply risk continues to soar higher. In this context, we remain long Dec23 Brent crude in anticipation of a continued rise in supply risk premia.''

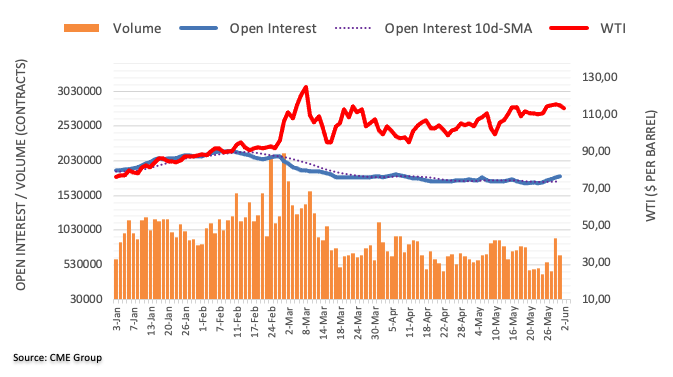

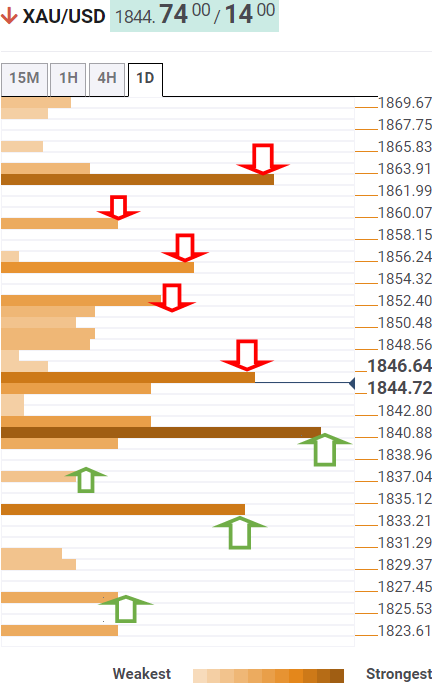

- Gold price has surpassed $1,870.00 on lower consensus for the US NFP.

- The US NFP is seen lower at 325k against the former print of 428k.

- The downbeat US ADP Employment Change has diminished the DXY’s appeal.

Gold price (XAU/USD) is balancing around $1,870.00 after a juggernaut rally on Thursday. Wednesday’s rebound from the low of $1,828.57 turned into a power-pack rally, which drove the gold prices firmly and refreshes three-week's high at $1,870.45. The precious metal is bided by the market participants on lower employment generation by the US economy in May.

The US Automatic Data Processing (ADP) Employment Change reported an addition of 128k jobs in May, less than half the expectations of 300k and lower than the prior print of 202k. Considering the downbeat ADP numbers, a downward shift in the US Nonfarm Payrolls (NFP) cannot be ruled out. As per the market consensus, the US NFP is seen at 325k, lower than the prior print of 428k. After the release of the downbeat ADP numbers, investors should brace for extreme volatility in the US dollar index (DXY), which will underpin the gold prices.

The US dollar index (DXY) has witnessed a steep fall after failing to sustain above the crucial resistance of 102.50. A sheer downside move has dragged the asset to near 101.70. Investors should be aware of the fact that and meaningful plunge in the US NFP will result in fresh monthly lows in the asset.

Gold technical analysis

An upside break of the 38.2% Fibonacci retracement at $1,867.65, which is placed from April 18 high at $1,998.43 to May 16 low at $1,786.94. The formation of the golden cross represented by the bullish crossover of the 50- and 200-period Exponential Moving Averages (EMAs) at $1,847.90, adds to the upside filters. The Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which signals more gains ahead.

Gold hourly chart

-637898034240387500.png)

- The AUD/JPY extends its weekly rally, up by 3.71%.

- Sentiment improved in the session, despite the economic backdrop, with investors’ fears about a possible global economic recession and a food crisis.

- AUD/JPY Price Forecast: Consolidates in the 94.00-40 range before pressuring the YTD high above 95.00.

The AUD/JPY advances nicely after reaching a daily low below the 93.00 mark, popping up to fresh six-week highs above the 94.00 figure, a level last seen on April 22, preparing for a re-test of the YTD highs. At 94.33, the AUD/JPY reflects an upbeat sentiment, with US equities finishing Thursday’s session with gains of 0.81% and 2.75%.

During the day, investors set aside the market’s actual narrative. Fears about a possible US recession, triggered by the US Federal Reserve tightening conditions, China’s coronavirus outbreak and factory halts, slowing supply chains, and the war between Ukraine – Russia remain as a backdrop in the global economic outlook.

Elsewhere, the Japanese yen remained under heavy selling pressure, posting substantial losses vs. its fellow counterparts. The AUD/JPY is refreshing two-month highs, and with the Relative Strength Index (RSI) in bullish territory and accelerating to the upside, the AUD/JPY threatens to break above the previous YTD high at 95.74.

AUD/JPY Price Forecast: Technical outlook

Therefore, the AUD/JPY bulls regained control after a cross-currency correction to 87.30 and, at the time of writing, are headed towards reaching a daily close near the 94.50 area. That’s from the daily chart perspective.

Zooming into the 4-hour chart, the AUD/JPY appears to lose steam. The Relative Strength Index (RSI) is well within the overbought territory at 83.35, so the cross-currency might consolidate in the 94.00-40 area as AUD/JPY takes a breather.

Upwards, the AUD/JPY ceiling level would be 95.00. Break above would expose the YTD high at 95.74, followed by the psychological 96.00 mark. On the downside, the AUD/JPY's first support would be the May 4 high at 94.02. Latter’s breach would send the AUD/JPY correcting towards 93.56, followed by 92.84.

Key Technical Levels

- EUR/USD bulls run into the bear's lair, but a break of resistance will be highly positive.

- The bears will need to break the prior layer of H4 support.

EUR/USD was bid on the day as the greenback against six major currencies, was falling like a stone to 107.74 and lowing around 0.8% on the day, on pace to snap a two-day streak of gains. The dollar found no support from data showing US private payrolls increased far less than expected in May ahead of today's Nonfarm Payrolls. This leaves the technical outlook for the euro leaning bullish on a break of current resistance, but the bears could be lurking and the following illustrates both sides of the equation.

EUR/USD H4 chart

The price is moving in on a critical area of resistance and should this hold, then there will be significant bearish prospects for the foreseeable future the support structure gives out. Failing that, then the bullish scenario is as follows:

What you need to take care of on Friday, June 3:

The greenback changed course on Thursday and gave up all of its Wednesday gains and more. Easing government bond yields and tepid US employment-related figures put pressure on the American currency, later weighed by the positive tone of Wall Street.

Concerns related to economic growth and inflation remain the same, moreover after the EU Producer Price Index hit 37.2% in April, above the market’s expectations. Government bonds were up, with yields giving up some of their recent gains.

US indexes edged higher, even despite comments from Federal Reserve Vice-Chair Lael Brainard said that the central bank would hardly pause its current rate-hiking cycle amid record inflation levels. Cleveland Loretta Mester said that inflation has not yet peaked and that it’s too early to discuss a potential pause in the tightening path.

The EUR/USD pair trades near 1.0750, and not far from its weekly high at 1.0786. The GBP/USD pair is also up, trading at around 1.2560. Commodity-linked currencies soared. The AUD/USD pair is now hovering at around 0.7250, while USD/CAD trades at around 1.2570.

Gold soared, trading at its highest in near a month. It is currently changing hands at around $1,870 a troy ounce. Crude oil prices were also up, with WTI trading at $117.10 a barrel. The OPEC+ announce it would increase production by 648,000 barrels per day in July and August amid disruptions caused by Russia’s invasion of Ukraine.

The focus is now on the US Nonfarm Payrolls report.

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bears are moving in for the kill at what could be the end of the line for the bulls.

- The markets will now be looking at the US NFP data on Friday.

At 1.2570, GBP/USD is moving lower and way from the highs of the day near 1.2585. The pair is otherwise up by some 0.68% and had rallied from a low of 1.2469 as the US dollar retraced some of its Wednesday gains ahead of and during another busy data schedule.

The highlights on Thursday were the decline in weekly initial jobless claims, a small upward revision to Q1 productivity, and a smaller-than-expected 128,000 gain in ADP private payrolls, all of which, however, failed to support the greenback.

ADP said small businesses are struggling to keep up with larger businesses when competing for workers. The services sectors added 104,000 jobs, led by a 46,000 increase in education and health services workers. Initial jobless claims decreased by 11,000 to 200,000 in the week ended May 28, lowering the four-week moving average for the first time in nearly two months.

This data comes ahead of tomorrow's Nonfarm Payrolls where analysts at TD Securities explained they see Employment likely continuing to advance firmly in May but at a more moderate pace after consecutive job gains at +428k in March and April. ''Employment in the household survey likely rebounded after printing negative in April. We expect this to lead to a drop in the unemployment rate to a post-COVID low of 3.5%. We also look for wage growth to remain steady at 0.3% m/m (5.2% YoY).''

Recent comments from Federal Reserve officials point to an extremely high probability of a rate hike of 50 basis points at the June 14-15 Federal Open Market Committee meeting, so markets are pricing this in and it is unlikely to be swayed by the data.

There were no UK data on Thursday's schedule and markets were closed for both Thursday and Friday for the Queen's Jubilee. A further rate increase is expected at the Bank of England's next monetary policy meeting on June 16. In line with expectations, the BoE hiked the Bank Rate by another 25bp to 1.00%. at the start of last month. Attention was on forward guidance and not the rate hike itself which came in slightly dovish.

Analysts at Danske Bank, consequently, changed their Bank of England call now expecting three additional 25bp rate hikes (June, August and November vs. 25bp in August and November previously) ''recognising that the Bank of England is probably not ready to slow the rate hike pace just yet.''

''We still see risks skewed towards more rate hikes, as risk is that inflation continues to surprise to the upside.''

On Wednesday, the Bank of England Deputy Governor Jon Cunliffe said that the central bank was seeing evidence of a slowdown in the housing market.

"We see evidence of a slowdown in the housing market. There are some straws in the wind that show the market is starting to turn," Cunliffe said in an interview with ITV News.

"The Bank expects the economy, that’s already slowing, and we expect it to slow further, to slow quite a lot over next year or so. And I think that will have an impact on the housing market."

GBP/USD technical analysis

From a four hour perspective, the price is stalling on the bid into the remaining two hours of the candle. The price would be expected to be resisted by the opposing bearish structure and result in a near term correction towards prior lows that meets the 50% mean reversion level. Should the bears clear this support structure, then the downside is open toward the recent lows in the 1.2450s ahead of the 1.2370s and the 1.2220s.

This is inline with the daily chart's bearish bias as follows:

- The NZD/USD shifts to positive in the week, up by 0.34%.

- An upbeat market mood weighs on the greenback and boosts the NZD.

- Fed officials support 0.50% hikes in June and July but remain unsure about September.

- NZD/USD Price Forecast: A break above 0.6568 to open the door for further gains.

The NZD/USD soars in the New York session, pairing two days of consecutive losses, and is testing four-week highs, around 0.6560s, amidst an upbeat market sentiment session, as reflected by US equities registering gains. The NZD/USD is trading at 0.6555, near the daily highs, after reaching 0.6460 daily lows earlier in the European session.

On Thursday, sentiment improved, and equities recovered. The financial markets narrative stays the same. Worries about the US Federal Reserve tightening monetary policy and threatening to spur a recession in the US looms. JP Morgan’s CEO Jamie Dimon warned investors to prepare for an economic “hurricane” as the economy faces a combination of unprecedented challenges, according to Bloomberg.

Additionally to the abovementioned, the conflict between Ukraine-Russia, which has lasted for three months, has begun to weigh on food prices. Also, the latest China coronavirus outbreak, which triggered lockdowns for one month in Shanghai, now seemed controlled, could reappear on the scene.

Given the backdrop, the greenback remains on the defensive as the US Dollar Index shows, falling 0.77%, reversing Wednesday’s gains, sitting at 101.760. A tailwind for the NZD/USD, which fell for two consecutive days before retracing those losses, prepares to end the week on a higher note.

In the meantime, Fed officials continue to cross wires. Cleveland’s Fed President Loretta Mester supports 50 bps increases in the next couple of meetings and added that the Fed is well-positioned to consider the appropriate pace for further rate hikes.

Mester added that she is unsure how high rates need to go, and a pause on the tightening cycle would depend on data. Nevertheless, she emphasized that the Fed would slam the brakes if inflation remains stubbornly high, and she still keeps 25 or 50 bps rate hikes, contrarily to a pause in September.

Earlier on Thursday, the Fed’s Vice-Chairwoman Lael Brainard said that the central bank is getting mixed signals on the economy and that the number one challenge is bringing inflation down. When asked about a Fed pause, she said it is harder to say because the policy is not on a pre-set course via CNBC.

An absent New Zealand economic docket would leave NZD/USD traders leaning on US economic data.

In the meantime, the US calendar would release the May Nonfarm Payrolls report, ISM Non-Manufacturing, and Composite PMIs, alongside additional Fed speakers, ahead of the blackout of the June Federal Reserve Open Market Committee meeting.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is surging higher and is testing May’s 5 swing high at 0.6568. Additionally, the Relative Strength Index (RSI) aims higher in bullish territory, with enough room before reaching overbought conditions. Therefore, the NZD rally would keep going, and a break above 0.6568 might pave the way for further gains. The following supply zone would be the 50-DMA at 0.6607. Once cleared would expose the 100-DMA at 0.6674, followed by the 200-DMA at 0.6815.

Key Technical Levels

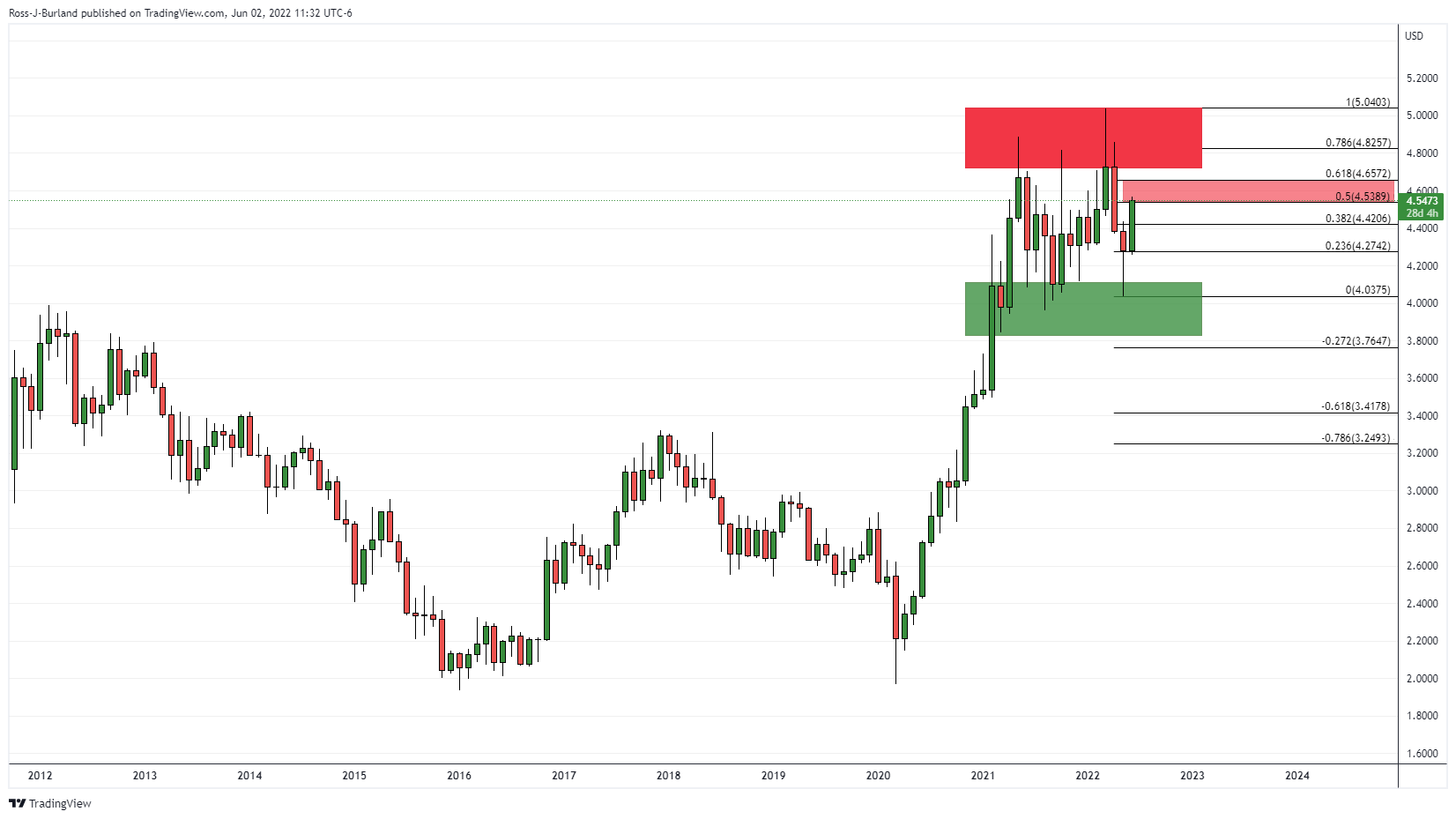

- On the hourly time frame, the rally is parabolic and likely in need of a meanwhile correction in the coming hours.

- There is a case for the move back towards the prior highs near 4.4370.

There has been a more positive outlook for China with restrictions being eased which has been supporting base metals as bargain hunters pile in, encouraged also by positive economic data elsewhere, such as in the US and eurozone. US manufacturing activity unexpectedly advanced in May, with the ISM factory index rising to 56.1 from 55.4. The euro area PMI ticked up to 54.6 in May versus a flash reading of 54.4.

Copper has been leading the sector higher, with CFD's trading higher by over 5% on the day so far. the contract is nearly 13% up from the May 12 lows after reaching a high of 4.567.

''With restrictions in Shanghai being to ease, the worst of the recent economic weakness may be behind it. Chinese officials are also ramping up efforts to boost economic activity,'' analysts at ANZ Bank argued.

From a technical standpoint, however, there could be a correction in store on the near term charts. However, there is also the case for a much longer-term negative outlook on the charts as well and the following illustrates the market structure on a multi-time-frame basis:

Copper monthly chart

For just over a year, the price has been consolidating the 2020 bull rally. In the past weeks, the price has made a strong 50% mean reversion. This could signify more to go on the upside given the strength of the correction.

Copper weekly chart

The weekly chart is more interesting. The price made a jolt through the highs of resistance from the middle of the range but quickly reverted lower and continued lower to meet the support of the channel. The bears are in control overall. This could mean that the current bullish correction is about to meet committed bears as it moved in on the neckline of the M-formation. This is an area that would be expected to act as resistance on initial tests. If it does and the best commit, a case for the downside will start to build again. 4.2780s will be key in protecting against a downside continuation and a fresh low below the channel's support for the weeks ahead.

Copper daily chart

The extended W-formation on the daily chart is a bearish feature should the price fail to break above the resistance at 4.6215 for the days ahead, as illustrated above. The 61.8% ratio that has a confluence with prior wick highs could be targeted near 4.4370.

Copper hourly chart

On the hourly time frame, the rally is parabolic, besides a brief stall at 4.5330 and likely in need of a meanwhile correction in the coming hours. If the bears manage to break below the potential support structure where the bulls paused for breath previously within this rally, then that will reinforce the case for the move back towards the prior highs:

- boarThe GBP/JPY is registering solid gains of almost 1.80% in the week.

- An upbeat market mood increased appetite for riskier assets, and safe-haven peers fell.

- GBP/JPY Price Forecast: To test April’s 28 swings high above 164.00.

The British pound is rallying to fresh multi-week highs on Thursday, up by 1.78% and aiming towards 164.00 amidst an improved market sentiment. US equities rebound from earlier losses, and safe-haven peers are downward pressured. At 163.34, the GBP/JPY climbs sharply for the seventh straight day.

The GBP/JPY rises on a weaker JPY

The cable remains strong during the day, albeit the UK is on holiday to observe the Queen’s Jubilee. The UK’s high inflation of around 9%, about to print double digits, and slowing economic growth, would keep the GBP vulnerable to further selling pressure. Nevertheless, it got a hand from the JPY, affected by the ultra-dovish Bank of Japan’s (BoJ) monetary policy stance, despite country inflation hitting 2%.

In the Asian session, the BoJ board member Adachi said that attempting to strengthen a weaker yen by tightening monetary policy would squeeze corporate funding. Adachi commented that if the Fed’s hiking cycle cools the US economy, then there is a risk that could reverse the depreciation of the Japanese yen.

In the meantime, an absent UK economic docket left GBP/JPY traders leaning towards a pure market sentiment play. Regarding the Japanese calendar, around 12:30 GMT, Jibun Bank Services and Composite PMIs would shed some light regarding the Japanese economy.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY Thursday’s price action shows the resilience of GBP bulls, which pushed Sterling for the seventh straight session towards new daily highs. In fact, the cross-currency is trading at four-week highs whatsoever would be facing solid resistance, which is to blame for the fall from 164.25 to 155.58.

The above-mentioned would signal that the GBP/JPY is about to peak. Nevertheless, the Relative Strenght Index (RSI) at 58.90 aims higher, so a move towards April’s 28 high at 164.25 is on the cards.

Therefore, the GBP/JPY’s first resistance would be the May 5 daily high at 163.57. A breach of the latter would expose the May 2 high at 163.89, followed by 164.00 and then the above-mentioned 164.25, April’s 28 high.

- The USD/JPY retreats from weekly highs above 130.00 and falls below the 20-hour SMA, eyeing 129.50.

- Risk appetite has improved but remains fragile and could shift at any time.

- USD/JPY Price Forecast: Range-bound but slightly tilted to the downside in the 1-hour chart.

The USD/JPY retraces from three-weekly highs, and bears drag prices down the 130.00 mark, eyeing to push the pair towards the 20-day moving average (DMA) around 128.66, amidst a risk-off session on Thursday. At the time of writing, the USD/JPY is trading at 129.79, posting decent losses of 0.23%.

Besides US Dollar weakness boosting the yen, unchanged US Treasury yields add their part to the USD/JPY drop. The 10-year benchmark note rate sits at 2.919%, flat in the session.

Sentiment has improved in the North American session, as US equities record gains. The US Dollar Index, as above-mentioned, is pairing Wednesday’s losses, down 0.64%, sitting at 101.894. Mixed US economic data weighed some on the mood, but the markets lack a clear direction ahead of Friday’s Nonfarm Payrolls report.

Elsewhere, the USD/JPY retraced from weekly highs at 130.24, but the drop was capped near the 50-hour simple moving average (SMA) at 129.54, then climbed towards the 20-hour SMA at 129.92, settling down near 129.75.

USD/JPY Price Forecast: Technical outlook

From a daily chart perspective, the USD/JPY, although in an uptrend, is consolidating in the high 129.00s. The Relative Strength Index (RSI) is in bullish territory but aims lower, so buying pressure is easing.

The USD/JPY hourly chart depicts the major is trapped within the 20 and 50-hour SMAs. Furthermore, the RSI shifted gears, below the 50-midline, with a downward slope, as the USD/JPY is edging towards the daily pivot at 129.62. Nevertheless, the USD/JPY needs to break below the current daily low at 129.51 to pave the way for further downside action.

If that scenario plays out, the USD/JPY first resistance would be the S1 daily pivot at 129.05, which once cleared would expose the May 31 high at 128.89. A breach of the latter would expose the 100-hour SMA at 128.55.

Key Technical Levels

The US official employment report will be released on Friday. Analysts at TD Securities look for a slowdown in payroll in May to 300K, the lowest number since April. They consider the impact on the greenback to be limited. Martet consensus is for an increase of 325K in payrolls.

Key Quotes:

“We look for payrolls to have slowed to a still-solid pace in May, posting their smallest net job gain since April 2021. Indeed, we pencil in an increase of 300k, which is a whisker below consensus expectations at 325k. Despite this loss of momentum, we look for the unemployment rate to decline a tenth to 3.5% in May. We also forecast average hourly earnings to have advanced again at a 0.3% m/m pace.”

“We expect the USD to trade in line with the direction and magnitude of any surprise in the data given its recent correlation flip. We think the m/m AHE (Average Hourly Earnings) will be rather important as well, given concerns about a wage spiral. That said, we think USD moves will be limited with next week's CPI report but expect EURUSD and USDJPY to be particular sensitive given terminal rate correlations.

“We believe the Treasury market reaction to payrolls is likely to be asymmetric. A weaker report will likely trigger a notable bull steepening after investors recently increased pricing for the terminal Fed funds rate to 3.2% from a low of just 2.9% last week.”

The European Central Bank (ECB) will have its monetary policy meeting next week. Analysts at Danske Bank point out the meeting is set to be the formal end of the net asset purchases and a clear signal to hike interest rates in July. They don’t see the ECB helping the euro and still look for EUR/USD to fall to 1.00 over the next twelve months.

Key Quotes:

“Next week’s ECB meeting is set to be the formal end of ECB net asset purchases and a clear signal to hike rates in July, although without a specific guidance of the size of the first rate hike. We expect ECB net purchases to end on the 1 July, thereby in line with previous guidance for Q3.”

“Market focus will be on the discussion if a 50bp hike is possible, and if so when, as well as to any hints about tools that ECB may take to address fragmentation. We expect ECB to hike 25bp each meeting until Mar23, but risks are clearly skewed for a 50bp rate hike in H2 this year (July or Sep most likely).”

“The ECB’s stance has been well communicated ahead of the meeting, including the release of Lagarde’s blog post. As such, the market is well ahead of the view that rate hikes are likely at most, if not all, meetings going in to H2 and excess liquidity will fall. At present, we view it hard for ECB to surprise on the hawkish side versus those market expectations. If any, we might see some pushback against recession risks and/or confidence in inflation turning around ‘sooner than later.’ Both may well give a bit of downside to EUR/USD spot at the meeting, maybe in the scope of some 50-100pips given EUR/USD has seen a short-term uptick to 1.07 recently.”

“We continue to forecast EUR/USD towards 1.00 over the coming 12M.”

- The AUD/USD is the strongest currency in the North American session, and the greenback trades soft.

- European and US equities reflect a mixed mood; in the FX space, safe-haven peers fall.

- Fed’s Brainard: Not so sure about pausing in September because she does not have a clear sense of how the economy would be.

- AUD/USD Price Forecast: Eyeing a break of the 200-DMA around 0.7256.

For the third straight day, the Australian dollar is rallying in the North American session amidst a mixed market mood, as European and US equity indices fluctuate and the greenback falls. At 0.7253, the AUD/USD is testing the 20-day moving average (DMA) at 0.7225, though up in the day by 1.17%.

On Thursday, the market mood improved some, though it lifted the spirits in the FX space. Risk-sensitive currencies, like the AUD, are rising against most G7 peers. In the US, mixed economic data keeps investors unease after the ADP Employment Change for May, which showed that private hiring increased by just 128K vs. 300K estimated.

The ADP chief economist Nela Richardson said, “Under a tight labor market and elevated inflation, monthly job gains are closer to pre-pandemic levels.” She added that “The job growth rate of hiring has tempered across all industries, while small businesses remain a source of concern as they struggle to keep up with larger firms that have been booming as of late.”

However, the positive news is that Initial Jobless Claims for the week ending on May 28 rose by 200K, lower than the 210K foreseen. Mixed signals in the labor market keep market players guessing what would happen on Friday’s Nonfarm Payrolls estimated at 325K.

At the same time, Factory Orders for April rose by 0.3% MoM, lower than the 0.7% expected.

Talking about Fed officials crossing wires, now is the turn of the Vice-Chairwoman Lael Brainard. She said that the central bank is getting mixed signals on the economy, and the number one challenge is bringing inflation down. When asked about a Fed pause, she said it is harder to say because the policy is not on a pre-set course via CNBC.

AUD/USD Price Forecast: Technical outlook

Thursday’s price action portrays the AUD/USD as upward biased. At the time of writing, is trading above the 50-DMA and 100-DMA, each at 0.7231 and 0.7247, respectively, and eyes to challenge the 200-DMA at 0.7256. Worth noting that the Relative Strength Index (RSI) is still bullish, above the 50-midline, aiming higher and with enough room to spare before reaching overbought conditions.

Hence, the AUD/USD’s first resistance would be the 200-DMA at 0.7256. Break above would expose the 0.7300 figure that, once cleared, would send the pair climbing towards April’s 22 high at 0.7376, followed by the 0.7400 mark.

Key Technical Levels

- Canadian dollar outperforms on hawkish BoC.

- US dollar is under pressure across the board, DXY drops 0.60%.

- USD/CAD heads for the fourth weekly decline in a row.

After taking a pause following the rate hike from the Bank of Canada on Wednesday, the USD/CAD resumed the downside on Thursday and broke below 1.2600, to the lowest level in six weeks.

The pair bottomed at 1.2581 and it is hovering around 1.2590, holding onto important weekly losses. The loonie is headed toward the fourth weekly gain in a row and has turned positive for the current year.

The decline is being driven by a weaker US dollar on Thursday. The DXY is falling by 0.60%. Equity markets are mixed while US yields are flat. Economic data from the US came in mixed, with a lower-than-expected reading of the ADP employment report ahead of tomorrow’s NFP.

The loonie was also helped by hawkish commentaries from Bank of Canada (BoC) Deputy Governor Paul Beaudry. On Thursday he said that the BoC sees an increasing likelihood that it may need to raise its policy interest rate to 3% or higher.

The USD/CAD looks oversold but no signs of a correction or consolidation are seen at the moment. The next support level might be located at 1.2570 followed by the 1.2535 area. On the upside, resistance levels lie at 1.2630 and 1.2670. The dollar needs to rise and hold above 1.2685 to alleviate the negative pressure.

Technical levels

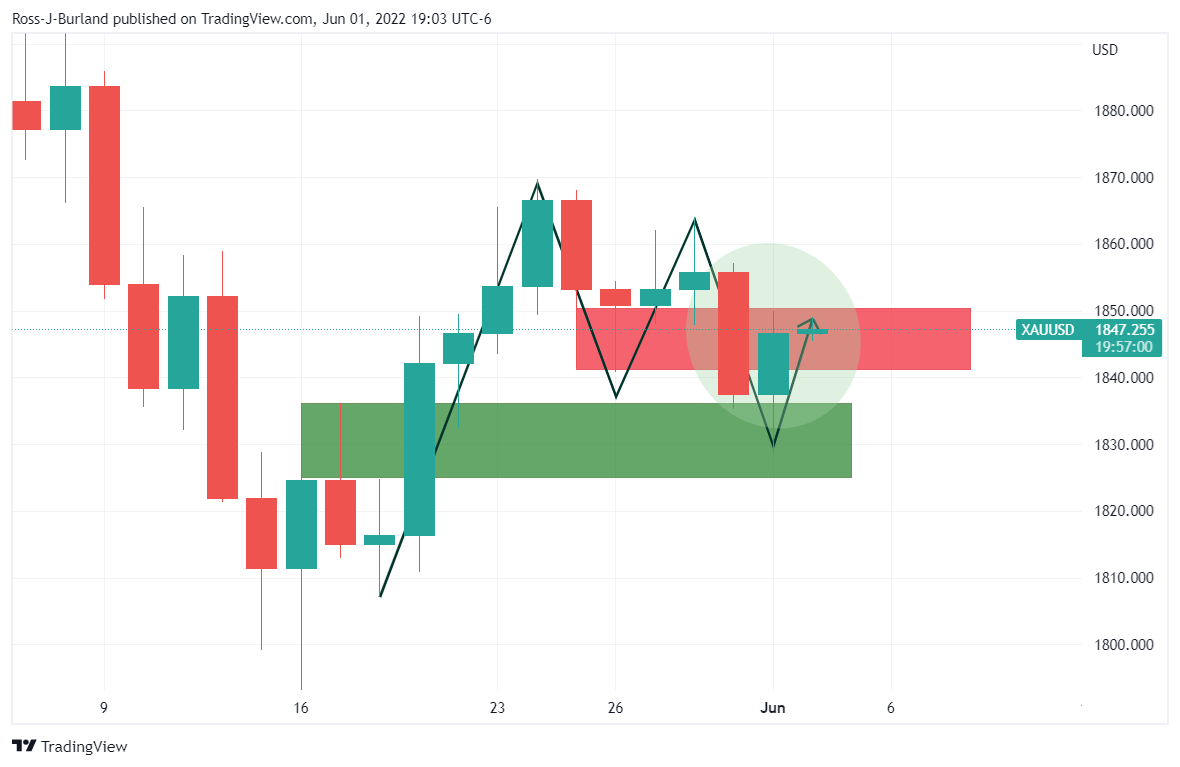

- Gold prices rallied over 1.0% into the upper $1870 and towards multi-week highs on Thursday as the buck/US yields softened.

- But any bullish breakout towards $1900 will probably have to wait until after Friday’s official US jobs report.

Spot gold (XAU/USD) prices rallied more than 1.0% on Thursday from the low $1840s per troy ounce to the upper $1860s and are currently probing late May highs just under $1870. An upside break would open the door, technically speaking to a run higher towards the 50-Day Moving Average, which is close to the $1900 level.

Thursday’s gains come as US yields and the US dollar back off from weekly highs, giving precious metals markets some tailwinds, and despite mixed tier two US labour market data (Q1 Unit Labour Cost was revised higher, May ADP Employment Change missed expectations and weekly jobless claims was decent). But any bullish breakout will likely have to wait until after Friday’s official US jobs report.

Gold bulls should beware of the risk that the report comes in stronger than expected and/or shows a further acceleration of US wage pressures. In this scenario, markets would likely rush to price in a more hawkish Fed policy path, which could push yields and the buck higher and weigh on gold. For now, Gold will probably remain rangebound in the mid-$1800s.

Bank of Canada (BoC) Deputy Governor Paul Beaudry on Thursday said that the BoC sees an increasing likelihood that it may need to raise its policy rate to 3% or higher, reported Reuters.

Additional Remarks:

The risk is now greater that inflation expectations could de-anchor and high inflation could become entrenched.

In deliberations ahead of the 1 June 50 bps rate hike, the BoC noted price pressures are broadening and inflation is likely to go higher still before easing.

The BoC must be - and will be - resolute in bringing inflation back down and will prevent high inflation from becoming entrenched.

The BoC expects strong growth and low unemployment to continue, while interest rate increases will take time to have their full impact.

The Canadian economy is moving further into excess demand and the economic rebound has been much faster than the BoC anticipated.

The more significant of the two forces driving Canadian inflation is largely international and is more complicated for monetary policy to tackle.

Normally, inflationary shocks linked to external supply disruptions don't persist for long, so the BoC typically does not react to such shocks.

The BoC opted against raising rates in 2021 because of what it saw as temporary inflationary shocks from abroad and because the economy was still operating well below its capacity for most of the year.

The Boc also chose not to raise rates in 2021 because premature tightening could have made it harder for people who lost jobs during the pandemic to find work.

The risk of leaving rates low was that higher inflation could start to become entrenched and the risk seemed appropriate at the time, given the slack in the economy at the time.

In July, the BoC will provide an initial analysis of its inflation forecast errors.

The US Bureau of Labor Statistics (BLS) will release the May jobs report on Friday, June 3 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 11 major banks regarding the upcoming employment data.

After an increase of 428K jobs in April, May's report is set to show a somewhat lower advance of 325K while a low unemployment rate of 3.6% is set to make way to an even lower level of 3.5%.

Commerzbank

“In May, we expect another noticeable increase in employment, even though the various negative factors suggest that the momentum is slowing. We forecast job growth of 300K, roughly lower than in April.”

Westpac

“US employment growth looks to be losing momentum but is currently still robust (370K), consistent with a further decline in the unemployment rate. Ahead, we believe employment growth will slow further, as tightening takes effect, and that participation will strengthen, making the unemployment rate of 3.5% expected from this month a likely low for the cycle. Given the tight state of the labour market, hourly earnings will continue to be bid higher, though not as aggressively as in 2021 and at less than the rate of inflation. As a result, real incomes are set to continue falling through 2022.”

TDS

“Employment likely continued to advance firmly in May (300K) but at a more moderate pace after consecutive job gains at 428K in March and April. Employment in the household survey likely rebounded after printing negative in April. We expect this to lead to a drop in the unemployment rate to a post-COVID low of 3.5%. We also look for wage growth to remain steady at 0.3% MoM (5.2% YoY).”

SocGen

“We expect 440K NFP reading in May. Expectations are for moderation but we still see strong hiring in retail franchises. This includes restaurants and hotel chains that are still struggling to find employees and return to normal operations. In April, the unemployment rate held steady at 3.6%, as expected. We look for a modest decline to 3.5% in May. Labor force participation should rise slightly from the lower April pace of 62.2 (which had been a drop from 62.4 in March). Overall, as the unemployment rate dips further below the long-term normal level (4.0% according to the Federal Reserve and 4.4% according to the Congressional Budget Office), each decline should be more challenging. Wages are moderating slightly, but we view the pace of above 4% as still too high and adding to inflation and profit margin concerns. Workers should enjoy a wage that is above inflation as long as labor productivity is positive.”

NBF

“Hiring should have continued at a strong pace in the month given the very high number of vacancies. Layoffs, meanwhile, could have stayed roughly stable judging from previously released data on initial jobless claims. All told, payrolls may have increased by 325K. The household survey is expected to show a similar gain, a development which could leave the unemployment rate unchanged at 3.6%, assuming a one-tick increase in the participation rate to 62.3%.”

CIBC

“Overall, headcounts likely increased by 300K, which would still be enough to push the unemployment rate down to 3.5%. With hiring likely tilted towards lower value-added services, wage growth likely slowed to 0.3% on the month. We’re below the consensus which could see the USD and bond yields fall.”

Danske Bank

“We expect another strong US jobs report with 400K new jobs in May.”

Deutsche Bank

“We project gains of 325K vs last month's 428K reading that came in above the median estimate of 380K on Bloomberg.”

ING

“US jobs report should be firm (320K). Once again the main constraint will be a lack of worker supply with nearly two vacancies for every unemployed American (we will get an update on vacancies in next Wednesday’s JOLTS report). This means wages will continue to be bid higher and the unemployment rate will likely fall to 3.5%.”

Wells Fargo

“We forecast NFP to rise 325K in May and look for the unemployment rate to decline to 3.5%. A 325K increase, should it occur, would mark a moderation from the job gains seen over the past couple of months. Regional Fed employment indices improved in May, but at a cooling pace. The job openings rate has also appeared to top out and small business hiring plans have softened. With job openings more smoothly translating into new hires, stiff competition for workers will presumably improve and help quell wage pressures. We forecast average hourly earnings to rise 0.4% MoM in May.”

Citibank

“We continue to expect that monthly job gains are likely to slow over the coming months as labor supply shortages limit the pace of hiring, with 315K payrolls added in May and some further slowing back towards a pre-pandemic pace of ~150K-250K over the coming months.”

Vice Chairwoman of the US Federal Reserve Lael Brainard said on Thursday that the Fed is seeing mixed signals on the economy, but the number one priority remains getting inflation down, reported Reuters citing an interview on CNBC. Brainard added that she does expect to see some cooling of the economy over time, and that she does expect to see some moderation and a better balance in the labour market.

Regarding moderation of inflation and the economy, Brainard warned that it too early to say that the Fed is seeing this, and that she wants to see a consistent string of data showing this is the case. There's a fair amount of uncertainty, she continued, though she added that its clear that the Fed needs to get inflation down.

There is a path to do this with a growing economy and moderating labour market, she continued, adding also that there is a path to see demand cooling, inflation coming down and the labour market still strong. Economists refer to this as a "soft landing".

The economy has a lot of momentum, Brainard added, noting that the Fed is going to do what is necessary to bring inflation back down. Businesses, households and balance sheets are starting this process from a very healthy position, she continued.

Financial conditions have tightened quite a lot and are a lot tighter than pre-pandemic levels, Brainard observed. While the Fed cannot affect supply shocks, Brainard said the central bank has confidence that it has the tools to start cooling demand, adding that monetary policy transmission is already working.

Brainard noted that market expectations for 50 bps rate hikes at the next two meetings seem like a reasonable path, before adding that, regarding September's meeting, its harder to say, as she does not have a clear sense of where the economy will be in September. If inflation hasn't sufficiently decelerated, it may be appropriate for another 50 bps rate hike, she said.

Conversely, if demand does moderate and inflation decelerates then the pace of hikes could slow to that prices by markets (25 bps per meeting). It is important to keep in mind that while the Fed is raising interest rates, it is also shrinking its balance sheet, Brainard added, and this is also tightening financial conditions.

Quantitative Tightening might be worth another 2-3 rate hikes, she stated and the Fed takes this into account when assessing financial conditions.

- EUR/USD is trading higher by about 0.5% on Thursday as US yields ease amid mixed US jobs data pre-Friday’s NFP.

- The pair has rebounded back to around 1.0700, though remains capped under its 50DMA.

- Buck bulls may come back if Friday’s US jobs data reveals hotter than expected wage growth.

EUR/USD rebounded on Thursday, though was unable to break back above the 1.0700 level or its 50-Day Moving Average just above it at 1.0723 and has since pulled back to change hands just below 1.0700. The pair is nonetheless still trading with on-the-day gains of about 0.5%, as the US dollar eases across the board amid a pullback from earlier weekly highs in US yields.

The buck had been given a boost on Wednesday following stronger than expected US ISM Manufacturing PMI numbers for May, whilst a barrage of employment data on Thursday (Q1 Unit Labour Cost, May ADP Employment Change and weekly jobless claims) failed to spur a similar reaction. That perhaps isn’t too surprising given the upcoming release of the official US labour market report for May on Friday, which is deterring currency market participants from placing any big dollar bets based on labour market considerations for now.

EUR/USD is now back to trading with only very slight losses on the week, with the pair also still deriving support from hot Eurozone inflation figures that showed price pressures reaching record highs last month. The latest inflation data means that a 50 bps rate hike from the ECB at its July meeting is on the table, with some even going so far as to bet that the ECB might break from its recent guidance and lift interest rates even sooner than the July meeting (i.e. this month?).

Hot Eurozone inflation, a hawkish ECB plus a growing sense since April US Consumer Price Inflation (CPI) and Core PCE data was released last month that US inflation might have now peaked, reducing the pressure on the Fed to tighten so aggressively in H2 2022 and 2023, have been key factors supporting EUR/USD in recent weeks. As of Thursday, the pair is trading nearly 3.5% higher versus mid-May lows in the mid-1.0300s.

But there is a risk that Friday’s US jobs report rekindles some USD strength, if it shows US wage growth picking up once again. Labour market developments that raise the risks of high US inflation becoming embedded (such as rapid wage growth) will encourage the Fed to remove their foot from the monetary accelerator and onto the break at a faster pace. In this scenario, the EUR/USD bears will be eyeing a drop back towards the 21DMA around 1.0600.

A more consistently hawkish-sounding European Central Bank (ECB) and China reopening, has neutralised the US Dollar Index (DXY) upside. However, it is still too early to call a long-term DXY peak, in the opinion of economists at Westpac.

More hawkish ECB countering the Fed for now

“China reopening hopes, rate hike rethink in the US and a decidedly more hawkish ECB have neutralised USD upside recently.”

“The greater risk is surely that the ECB does not deliver against rate expectations than the Fed.”

“DXY could ease back as far as 100 near-term, but it’s still too early to call a peak in the multi-month bull trend.”

EUR/USD has recovered around half of Wednesday’s decline. The pair needs to close above the 1.07 to improve its technical outlook, economists at Scotiabank report.

Support aligns at 1.0680

“A firm break past 1.07 to close above it on the day would add some bullishness back into the EUR technical picture.”

“Support is 1.0680 followed by the 1.0640/60 zone and yesterday’s low of 1.0627.”

The loonie rebounds after dipping to the upper 1.26s against the US dollar. Economists at Scotiabank expect the USD/CAD pair to witness additional losses towards the 1.25 zone.

Spreads to support gains

“We think yield spreads can move a bit further in the CAD’s favour in the coming weeks as a result, helping support CAD gains towards the 1.25 area.”

“The USD’s rebound from yesterday’s low just ahead of 1.26 formed a bullish signal on the short-term chart (bull ‘hammer’) but the lack of upside follow-through demand over the past few hours along with a fairly firm rejection of the 1.2690 resistance zone suggest that the broader trend lower remains intact.”

“A break under 1.2600/10 targets a drop to 1.2550.”

- EUR/USD reclaims ground lost and advances beyond 1.0700.

- The 1.0780/90 band emerges as a key resistance area.

EUR/USD retakes the area above the 1.0700 yardstick and reverses two consecutive daily pullbacks.

The surpass of the 1.0780/90 region, where the May high and the 3-month resistance line are located, should alleviate the downside pressure and allow a potential move to he weekly peak at 1.0936 (April 21).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1237.

EUR/USD daily chart

GBP/USD has rebounded to the mid-1.25s on Thursday. In the opinion of economists at Westpac, surprisingly firm business reports may support the pound, but it remains vulnerable as it consolidates.

Pressure on PM Johnson is likely to resume

“BoE releases its latest inflation expectations survey at the end of next week. It is likely to be well above the peak of its data history (4.4% in 2008) and a spike to 5.0% or more will cement further BoE rate hikes but will also increase the risk of a cost-of-living induced recession. Countering that risk have been a series of persistently firm business-related surveys.”

“There are two by-elections likely towards the end of June which will be seen as key tests of Johnson’s and Conservative support. A constant flow of dissent could lead to a full leadership challenge should those Tory seats be lost.”

“Despite the prospect of higher rates, GBP remains vulnerable to retesting its recent lows.”

Bounce in Treasury yields helped USD/JPY back above 130. In the view of economists at Westpac, risks over the week ahead look to be for a run at the early May high of 131.35.

Tight correlation between USD/JPY and the 10 year US-JP yield spread

“The correlation between USD/JPY and the 10-year US-JP yield spread has been tight in recent months. And with BoJ officials this week once again dismissing talk of e.g. widening the 0% +/-0.25% yield target on the 10yr JGB, this spread remains overwhelmingly driven by the 10yr Treasury yield.”

“With USD/JPY back above 130 for the first time since 12 May, risks over the week ahead look to be for a run at the early May high of 131.35.”

OPEC+ nations agreed on Thursday to lift output by 648K barrels per day (BPD) in both July and August, according to sources speaking to Reuters, in line with the recommendation made by the group's Joint Ministerial Monitoring Committee earlier in the day.

The aussie has outperformed most of the G10 over the week. The Reserve Bank of Australia (RBA) could underpin the AUD on a 40 basis point rate hike, economists at Westpac report.

AUD’s ranges to move lower over June

“The fragile foundations of global equities leaves us skeptical of the sustainability of the aussie’s probes above 0.72.”

“If the RBA delivers the 40bp hike to 0.75% that we expect and remains upbeat on the growth outlook, AUD/USD should be able to hold in the 0.71 to low 0.72 area but with ranges to move lower over June.”

- DXY comes under pressure after two daily gains in a row.

- The leg lower could revisit the 101.30 region near term.

DXY reverses the recent upside and retests the 102.00 neighbourhood on Thursday.

The inability of the dollar to spark a more serious rebound could prompt sellers to return to the market and shift the focus to a potential test of the Mat low at 101.29 (May 30), which is also underpinned by the proximity of the 55-day SMA, today at 101.31.

As long as the 3-month line around 100.90 holds the downside, the outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen constructive while above the 200-day SMA at 96.94.

DXY daily chart

- Silver prices are holding onto gains in wake of a barrage of US labour market data.

- XAG/USD was last up around 1.3% in the $22.10 area and eyeing a test of last week’s highs.

- Focus is now turning to Friday’s official labour market report.

A barrage of US labour market data in recent trade gave mixed signals, with ADP’s estimate of employment change for May missing consensus and adding some downside risks to the market’s expectations for a 325K gain in non-farm payrolls in May on Friday, while the second estimate of Q1 Unit Labour Costs saw an upward revision to 12.6% QoQ from an already spicey 11.6%. Weekly jobless claims data was also robust, but the net impact has been that the US dollar has fallen to fresh session lows in recent trade as US yields continue to trade with losses on the day.

This has created a favourable backdrop for spot silver (XAG/USD) prices, which were last trading up about 30 cents or roughly 1.3% on the day in the $22.10 area per troy ounce. That marks a more than 3.0% bounce from Wednesday’s sub-$21.50 lows, with the bulls now eyeing a test of last week’s highs just under $22.50.

However, any bullish breakout in silver will have to wait until after Friday’s official US labour market report is released. If job gains do underwhelm, thus indicating a weaker-than-expected economy and less pressure on the Fed to tighten monetary policy so aggressively, that could provide impetus to the bulls. A break above resistance in the $22.50 area would open the door to a run higher towards $23.00 and resistance in the mid-$23.00s.

Note that traders will also be closely watching Friday’s US wage growth metrics and if these surprise on the upside, that would come as a worry to the Fed (and markets), as everyone has been hoping that inflation might have now peaked. In this case, a dip back below the 21-Day Moving Average (at $21,76), which XAG/USD has been pivoting either side of in recent weeks, is on the cards, plus a test of earlier weekly lows in the mid-$21.00s.

- Gold Price preserves its bullish momentum following Wednesday's rebound.

- Mixed data releases from the US weigh on the greenback on Thursday.

- 10-year US Treasury bond yield settles around 2.9% ahead of US jobs report.

Gold Price extended its recovery beyond $1,850 on Thursday after having registered daily gains on Wednesday. XAUUSD paid no attention to rising US Treasury bond yields mid-week and took advantage of the broad-based selling pressure surrounding the euro and the British pound.

Dollar rally loses its steam

The fact that gold managed to reclaim the critical 200-day SMA shows that buyers remain interested. Friday's May jobs report from the US could ramp up the market volatility ahead of the weekend. Meanwhile, the renewed dollar weakness on Thursday amid mixed data releases from the US help XAU/USD keep its footing.

Also read: Gold Price Forecast: XAUUSD in search of a clear direction, awaits NFP.

The monthly report published by the ADP showed on Thursday that private-sector employment in the United States rose by 128,000 in May, compared to the market forecast of 300,000. April's reading of 247,000 got revised lower to 202,000, Commenting on the data, “the job growth rate of hiring has tempered across all industries, while small businesses remain a source of concern as they struggle to keep up with larger firms that have been booming as of late," said Nela Richardson, chief economist at ADP. On the other hand, the US Bureau of Labor Statistics (BLS) reported that Unit Labor Costs increased by 12.6% in the first quarter following the 11.6% jump recorded in the previous quarter.

Gold Price ignores rising US yields for now

Comments from Fed officials provided a boost to the US Treasury bond yields on Wednesday and the dollar outperformed its rivals. St. Louis Federal Reserve Bank President James Bullard said on Wednesday that he was sceptical about recession probabilities. On a similar note, Richmond Fed President Thomas Barkin told Fox Business that the latest data or the actions of business executives were not suggesting that the economy was moving toward a recession. In addition to these remarks, the Fed's balance sheet reduction started on June 1st, allowing the 10-year yield to climb to the 2.9% area.

Federal Reserve building in Washington, D.C.

Nevertheless, XAUUSD stayed relatively resilient despite rising yields. XAUEUR and XAUGBP pairs both gained more than 1% on Wednesday, revealing that gold was able to capture some of the capital outflows out of the euro and the British pound. The European Central Bank (ECB) and the Bank of England (BOE) face a tough balancing act as the worsening economic outlook alongside high inflation causes policymakers to reassess how they should approach policy tightening moving forward.

The BLS will release the Nonfarm Payrolls (NFP) data for May on Friday. Markets expect payrolls to rise by 325,000 following April's increase of 428,000. Unless the headline NFP print offers a big negative surprise, investors are likely to react to the wage inflation data. On a yearly basis, Average Hourly Earnings are forecast to arrive at 5.2%, down from 5.5% recorded in April. The Fed grows increasingly concerned about wage growth feeding into consumer inflation. In case the US job report shows an improvement in the Labor Force Participation Rate and a retreat in wage inflation, the dollar could come under selling pressure and open the door for additional gold gains and vice versa.

Gold Price technical outlook

Gold Price dropped below the key 200-day SMA, which is currently located at $1,840, on Wednesday but managed to close the day above that level. XAUUSD faces next resistance at $1,865 (static level) ahead of $1,875 (Fibonacci 38.2% retracement of the latest downtrend) and $1,890 (100-day SMA).

On the downside, a daily close below $1,840 could be seen as a significant bearish development and attract sellers. In that case, additional losses toward $1,830 (June 1 low) and $1,810 (the end-point of the downtrend) could be witnessed.

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart recovered toward 50, suggesting that gold sellers remain on the sidelines for the time being.

Gold Price correction looks completed

- Unit Labour Cost growth was revised higher to 12.6% QoQ from 11.6% for Q1 2022.

- The DXY saw some initial strength though this has now been pared.

The second estimate of Unit Labour Cost growth in the first quarter of 2022 was revised higher to 12.6% QoQ from an initial estimate of 11.6%, according to the latest data released by the Bureau of Labour Statistics and Department of Labour released on Thursday.

Market Reaction

In wake of data showing that wage pressures were even higher than expected in the first quarter of this year, the DXY saw some initial upside, though has since pared most of this back and continues to trade close to lows of the day.

Weekly initial jobless claims in the US fell to 200,000 in the week ending 28 May, below the expected drop to 210,000 from 211,000 a week earlier, data released by the US Labour Department on Thursday showed. That meant the four-week average number of claims fell to 206,500.

Meanwhile, Continued Claims fell to 1.309 million in the week ending on 21 May, from 1.343 million a week prior, larger than the expected drop to 1.325 million. That meant the insured unemployment rate fell back to 0.9% from 1.0% a week earlier.

Market Reaction

There wasn't really any market reaction specifically to the latest weekly jobless claims data.

- ADP's estimate of US private sector employment change was a gain of 128K in May, below expectations.

- The buck weakened as a result, with the DXY edging to fresh session lows.

Private sector employment in the US rose by 128,000 in May according to US payroll company ADP's latest estimate of employment change released on Thursday. That was below expectations for 300,000 rise and lower than April's 247,000 gain.

Market Reaction

Though ADP has a patchy record in recent months in terms of predicting the official non-farm payroll change number, which is set to be released on Friday, the downbeat data has nonetheless weighed slightly on the US dollar in recent trade. The DXY dropped a couple of pips to hit fresh session lows in just above 102.10 in recent trade, but has since bounced a little.

- Better risk appetite has seen GBP/USD rebound to the mid-1.2500s on Thursday despite UK market closures.

- But the pair remains at risk of further downside if upcoming US data points to further economic strength there.

Despite the closure of UK markets for the rest of the week amid public holidays to commemorate the Queen’s platinum jubilee as head of state, and the lower than unusual trading in volumes in global FX markets as a result, sterling is one of the better performing G10 currencies on Thursday. A rebound in global risk appetite after yesterday’s more risk-off session, as evidenced in US equities trading higher in the pre-markets, seems to be the main culprit behind GBP/USD’s 0.5% rally on Thursday from the 1.2460s to current levels near 1.2550.