- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 03-06-2022.

- The EUR/USD is set to finish the week almost flat, though with a minimal loss,

- Risk-aversion boosted the appetite for the greenback, though it weighed on the EUR/USD.

- EUR/USD Price Forecast: To consolidate in the 1.0627-1.0787 range, but downside risks remain.

The EUR/USD edges lower as the New York session winds down, trimming some of Thursday’s gains, but remains above the 1.0700 threshold due to the 50-day moving average (DMA) acting as support around 1.0718. At the time of writing, the EUR/USD is trading at 1.0719.

Dampened sentiment weighed on the EUR, and the USD rose

US equities finished the session with hefty losses, between 1.05% and 2.47%. Positive US jobs report further cemented the case for a US Federal Reserve rate hike of 50 bps in the June meeting, despite worries that the US central bank could cause a recession.

On Friday, the EUR/USD opened near the session highs at around 1.0745 and edged up towards 1.0760, shy of the R1 daily pivot at 1.0782. However, traders dragged the EUR/USD below the daily pivot in the European session and pierced the 50-hour simple moving average (SMA) at 1.0712. Nevertheless, the EUR/USD seesawed on the release of the US Nonfarm Payrolls report to finally settling down at current price levels.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains downward biased, despite the major reaching a fresh weekly high at 1.0787. The Relative Strength Index (RSI), in bullish territory, begins to drift lower. Hence, the EUR/USD might consolidate between the 1.0627-1.0787 range before resuming downwards.

The EUR/USD 4-hour chart depicts the major range-bound. However, the pair is back above the 50-simple moving average (SMA) at 1.0716, consolidating near the daily pivot, which sits at 1.0714.

Upwards, the EUR/USD’s first resistance would be June 3 daily high at 1.0764. A breach of the latter would expose May’s 30 high at 1.0787, followed by the 1.0800 mark. On the other hand, the EUR/USD first support would be the 1.0700 figure. Break below would expose June’s 1 swing low at 1.0627, followed by the 200-SMA at 1.0618.

- The USD/CHF bounces off weekly lows and is back above 0.9600.

- Risk appetite remains dampened, US equities tumble, and the greenback rise, underpinned by elevated US Treasury yields.

- USD/CHF Price Forecast: The major is upward biased, though a daily close above 0.9660 would exacerbate a rally towards the 20-DMA.

On the week’s last trading day, the USD/CHF jumps from weekly lows erasing Thursday’s losses, gains 0.56% as the New York session wanes. At the time of writing, the USD/CHF is trading at 0.9626, reflecting a downbeat mood and a strong US Dollar, underpinned by high US Treasury yields.

Sentiment stills negative on investors’ US recession fears

Risk aversion dominates Friday’s trading session. US equities point to a lower close, losing between 0.83% and 2.36%, on the same narrative since the beginning of the week. Investors’ fears that an aggressive Federal Reserve might cause a recession lurks. Alongside supply chain disruptions, which worsened with China’s Covid-19 crisis, which seems to be left behind, and Russia’s invasion of Ukraine, remain issues that keep market players uneasy.

The USD/CHF Friday’s price action opened near 0.9570 and dipped towards the S1 daily pivot near 0.9552. Nevertheless, buyers entered the market around the European open and rallied sharply, though hesitated, at the time of the US Nonfarm Payrolls report release, though reached a daily high at 0.9642.

USD/CHF Price Forecast: Technical Outlook

The USD/CHF is upward biased, and in fact, buyers reclaimed the 50-day moving average (DMA) at 0.9595. Nevertheless, the Relative Strength Index (RSI), albeit pointing upwards, remains in bearish territory. If USD/CHF buyers would like to exacerbate a move towards the 20-DMA at 0.9757, they would need a daily close above June 1 high at 0.9660.

Therefore, the USD/CHF first resistance would be the previously mentioned 0.9660. A break above would expose the 0.9700 figure, followed by the confluence of the 20-DMA, and the May 20 high around the 0.9757-64 range

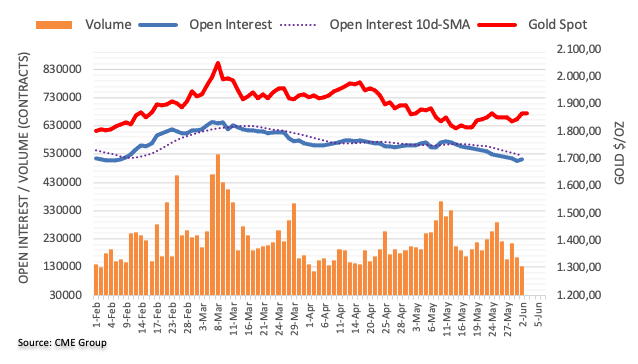

- The yellow metal would finish the week on the defensive, losing 0.28%.

- Sentiment remains negative, as US equities fall between 1.02% and 2.57%.

- Fed’s Mester supports 50 bps hikes in June and July; September is still open for 50 or 25 bps increases.

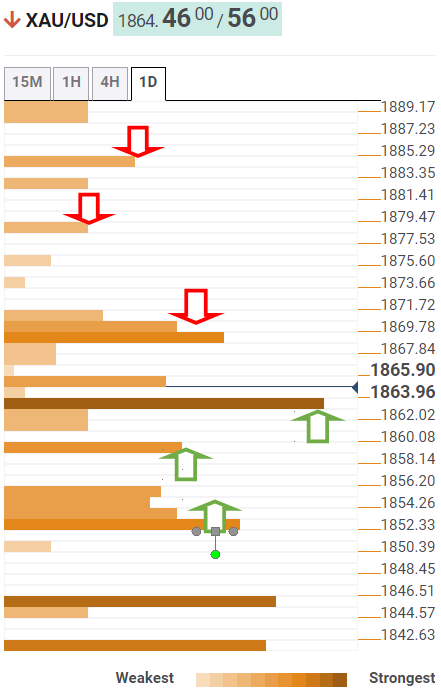

- Gold Price Forecast (XAU/USD): Failure at $1889.91, exacerbates a fall towards $1800.

Gold spot (XAU/USD) slumps from three-week highs near $1874 towards the confluence of the 20 and the 200-day moving averages (DMAs) around the $1840s region after the US Labor Department revealed that the US economy added more jobs than expected. At the time of writing, XAU/USD is trading at $1848.43, falling 1.06%.

Fed speakers to keep Gold prices on the defensive

In the meantime, Cleveland’s Fed Loretta Mester (2022 voter) is crossing the wires. She said that the one problem that the Fed has is inflation, and contrarily to what JP Morgan’s CEO Jamie Dimon said about a hurricane ahead in a Bloomberg article, Mester does not see it. Nevertheless, added that risks of recession have gone up.

Loretta Mester added that she supports 50 bps increases in June and July while not ruling it out in the September meeting, but it would be data-dependent. She said that if she sees compelling evidence of lower inflation, then a 25 bps hike in September would be appropriate.

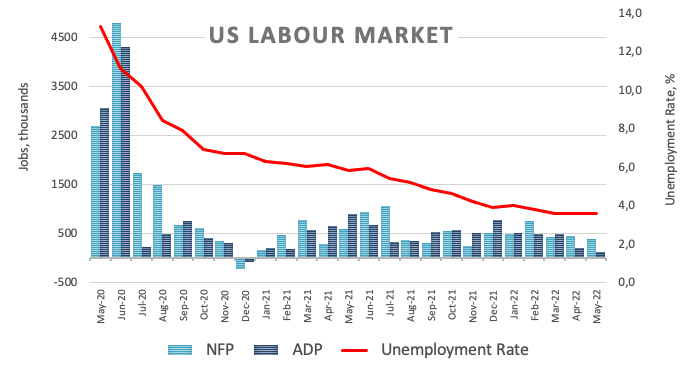

Earlier, the US Nonfarm Payrolls for May, illustrated that the economy added 390K new jobs, far more than the 318K foreseen. Nevertheless, financial analysts’ chatter about the US labor market still supports the view that the US Federal Reserve will tighten aggressively after receiving the green light.

Analysts at Commerzbank, in a note, wrote that “The labor market thus continues to be very robust. Due to the unchanged high demand for labor, there is still a risk of a wage-price spiral. Further sharp Fed rate hikes are likely.” They stated that they “maintain our forecast that the Fed will raise its key rate to 3.00% by the end of the year, i.e., by another 200 bps.”

In the US jobs report, Average Hourly Earnings on its YoY reading remained unchanged at 5.2%, reflecting the tight labor market though easing a little bit, worries of a wage-price spiral.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, is rising 0.42%, sitting at 102.187, a headwind for Gold prices. That, alongside the US 10-year Treasury yield aiming towards the 3% threshold, currently at 2.96%, will keep the non-yielding metal on the defensive.

In the week ahead, the US Federal Reserve board members begin their blackout period on preparations for the June meeting. However, the US economic docket would keep investors’ eyes on the May inflation report alongside the UoM June’s Consumer Sentiment.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD remains under pressure after failing to break above March 29 swing low-turned-resistance at $1889.91. Hence, XAU/USD sellers entered the market and sent Gold prices sliding near the intersection of the 20 and 200-DMA near the $1841.65-$1842.51 area. Further exacerbating the pullback is the Relative Strength Index (RSI) in negative territory and aiming lower.

Therefore, XAU/USD’s first support would be the $1841-$1842 area. Break below would expose the June 1 cycle low at $1828.33, followed by the Bollinger band bottom line at $1809.93.

- The AUD/USD is ready to finish the week positive, up by 0.90%.

- The odds of a US Federal Reserve 0.50% rate hike in September lie at 80%.

- AUD/USD Price Forecast: Range-bound due to DMAs trendless and an RSI showing mixing signals.

The Australian dollar slumps during the last day of the week but remains stubbornly above the 0.7200 threshold as AUD/USD sellers mount a break to the figure. At 0.7210, the AUD/USD reflects the aforementioned, as risk-aversion rules the market, and the greenback got a boost on upbeat US data.

Risk-aversion and a strong US Dollar weigh on the AUD/USD

European stocks ended the week with losses. Equities are tumbling between 0.67% and 2.13% in the US after market players digested a stronger-than-expected jobs report, though financial analysts’ opinions reinforced the Federal Reserve tightening pace. Money market futures odds of the US central bank hiking 50 bps in September lie at 85%, while the June and July meetings are fully priced in.

The AUD/USD Friday’s price action shows the major failure to remain above the 200-day moving average (DMA), at 0.7256. Additionally, the AUD/USD slid below the crossing of the 50-DMA under the 100 one, further exacerbating a downward move. Also, the Relative Strength Index (RSI), albeit in bullish territory, the oscillator slope shifted downwards, aligned with the major’s price action.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is neutral biased, as the daily moving averages (DMAs) remain directionless. Nevertheless, traders need to be aware that although the AUD/USD broke above the May 5 0.7266 high, buyers could not hold to it, and sellers dragged the pair from above the 200-DMA, under the previously-mentioned, alongside the 50 and 100-DMAs.

However, the bias stays neutral due to the horizontal slope of the DMAs and the RSI showing mixing signals. Upwards, the AUD/USD’s first resistance would be the confluence of the 50 and 100-DMA around the 0.7226-28 region. Once broken, the following supply zone would be the 200-DMA at 0.7256, followed by the 0.7283 weekly high. On the other hand, the AUD/USD first support would be 0.7200. A breach of the latter would expose the June 2 swing low at 0.7140, followed by February 24 swing low at 0.7094.

- The GBP/USD prepares to finish the week with losses of almost 1%.

- A risk-off market mood and a robust US employment report weigh on the GBP/USD.

- GBP/USD Price Forecast: A daily close below 1.2500 would open the door for further losses.

The GBP/USD struggles at 1.2600 and slides sharply below the 1.2500 figure after upbeat US economic data boosted the greenback, while UK traders remain on holiday observing the Queen’s jubilee. At 1.2507, the GBP/USD records losses of 0.53% in the North American session.

Risk-aversion and a solid US NFP boost the buck

A risk-off market mood keeps market players uneasy. Albeit the US May, Nonfarm Payrolls report added 390K employees to the economy, better than the 318K expected, worries about the US getting into a recession courtesy of the Federal Reserve’s tightening pace lurks.

In the same report, Average Hourly Earnings stayed put at 5.2% on a yearly basis, still reflecting the tight labor market but easing worries of a wage-price spiral.

TD Securities analysts wrote in a note that “the May report supports the view that while the labor market remains firm, it continues to gradually slow. We think today’s report does not change the calculation for the Fed, supporting their inclination to front-load interest rate hikes until it reaches a more neutral stance by the fall.”

Later in the day, the Institute for Supply Management (ISM) unveiled that the Non-Manufacturing PMI increased by 55.9, lower than the 56.4 expected. The report portrays businesses’ resilience, after last week’s Q1 GDP contraction of 1.5%, according to the second estimate from the Bureau of Economic Analysis.

In the week ahead, the UK’s economic docket would feature May’s BRC Retail Sales, the Halifax House Price Index, and the GDP on a month-over-month and the 3-month average.

Across the pond, the Federal Reserve board members begin their blackout period on preparations for the June meeting. However, investors’ eyes would be on the inflation report alongside the UoM June’s Consumer Sentiment.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is still downward biased, as reflected by the daily chart. The daily moving averages (DMAs) above the exchange rate, alongside RSI’s readings turning bearish and with a downslope, opens the door for further losses. Nevertheless, if the GBP/USD is about to fall further, a break below the June 1 low at 1.2458 is required. Once cleared, the GBP/USD’s next support would be the May 17 daily low at 1.2313, followed by the YTD low at 1.2155.

- US dollar strengthens on Friday amid risk aversion and higher US yields.

- Positive employment report partially offset by a weaker reading of ISM Service PMI.

- EUR/USD flat for the week at around 1.0700.

The EUR/USD failed to recover the 1.0750 zone and pulled back during Friday’s American session toward the 1.0700 area. It is about to end at the same level it had a week ago after the US dollar recovered strength following NFP and the ISM Service PMI.

Yields, NFP and risk aversion

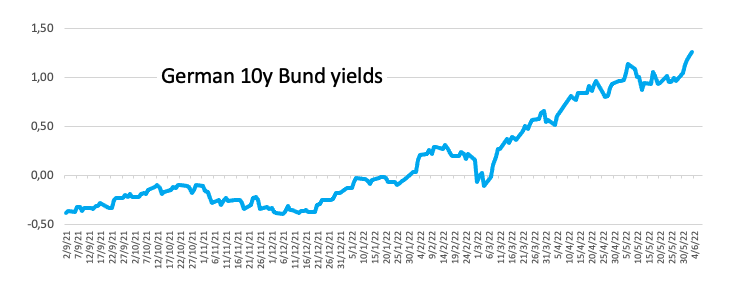

The employment report in the US came in modestly above expectations, but later the ISM Service PMI showed a larger-than-expected decline. Despite the numbers, US yields rose with the 10-year reaching 2.98%, the highest level since May 18. German yields are also higher, with the 10-year at 1.27%, level not seen since 2014, ahead of the European Central Bank meeting due next week.

US stocks are falling on Friday, the Dow Jones by 1.03%, the NASDAQ by 2.57% and the S&P 500 by 2.58%. The deterioration in market sentiment is offering support to the greenback. The DXY is up 0.45%, trimming more than half of Thursday’s losses.

Technical outlook

“The EUR/USD pair is trading just below the 50% retracement of its latest slide, measured between 1.1186 and 1.0348 at 1.0770. The weekly chart shows that the pair keeps developing well below all of its moving averages, with the 20 SMA maintaining its bearish slope below the longer ones,” explained Valeria Bednarik, Chief Analysts at FXStreet. She noted the bullish potential remains limited, “although the trend may gather momentum if the pair breaks above the 61.8% retracement at 1.0855. Steady gains above the latter could mean an extension towards the critical 1.1000 figure.”

Bednarik adds technical readings in the daily chart suggest upward exhaustion. A daily close clearly above 1.0775 should strengthen the euro, opening the doors to more gains. The 20-day SMA at 1.0610 is a critical support.

Technical levels

The employment report released on Friday showed a gain in payrolls of 390K, above the 325K of market consensus. According to analysts at Wells Fargo, the report “lands in a sweet spot for the Fed”. They point out that while the labor market remains clearly tight and is adding to inflationary pressures, improving labor supply is helping ease the upward pressure on wages while still allowing more workers to gain employment.

Key Quotes:

“May's downshift in hiring to its slowest pace in more than a year still leaves payrolls rising at a robust pace. Employers topped consensus expectations with 390K new jobs. The ongoing solid pace of hiring has been fueled not only by sky-high demand but by more workers returning to the labor force. The labor force participation rate rebounded a tick in May, helping to keep the unemployment rate steady at 3.6% and wages from accelerating further.”

“Age growth has shown some signs of slowing relative to the pace seen in the second half of last year, but at a 4.5% annualized pace, earnings are still growing at a rate inconsistent with the Fed's 2% inflation target.”

“There are a few glimmers that wage growth may ease a bit more in the months ahead, with small business compensation plans sliding to a 12-month low in May and a smattering of comments within the Fed's Beige Book signaling that wage increases are leveling off or edging down. But, any relief is unlikely to bring wage inflation back toward a rate in line with the Fed's 2% inflation target anytime soon given the utterly tight state of the market. This creates the circumstances with which Federal Reserve officials are likely to be unhappy. But businesses and households are no more pleased, as business margins are squeezed and workers see wage growth that struggles to keep up with inflation.”

- The USD/CAD to finish the week with losses of 1.09%, despite Friday's recovery.

- Sentiment remains negative as fears of a US recession mount.

- May’s US Nonfarm Payrolls crushed expectations and further cemented the case of an aggressive Fed.

- USD/CAD Price Forecast: To consolidate, unless the USD/CAD breaks below 1.2458, that would expose the YTD low around 1.2400.

The USD/CAD edges up during the New York session, though earlier seesawed between minimal gains/losses of 0.01-0.03%, but remains above the weekly low of 1.2551, amidst investors’ risk-off mood. At 1.2572, the USD/CAD remains steady after the Bank of Canada’s (BoC) 50 bps rate hike earlier in the week.

Upbeat US NFP lifts the greenback

Friday’s US calendar remains busy. Earlier, the US Nonfarm Payrolls for May, showed that the economy added 390K new jobs, far more than the 318K estimated. Financial analysts’ chatter about the US labor market still supports the view that the US Federal Reserve will tighten aggressively after receiving the green light.

Sources cited by Bloomberg commented that May’s solid job growth showed further evidence that the US economy was not in a recession in the spring. In the meantime, Average Hourly Earnings on its YoY reading remained unchanged at 5.2%, reflecting the tight labor market though easing worries of a wage-price spiral.

Of late, the Institute for Supply Management (ISM) unveiled that the Non-Manufacturing PMI increased by 55.9, lower than the 56.4 expected. It shows businesses’ resilience, after last week’s Q1 GDP contraction of 1.5%, according to the second estimate from the Bureau of Economic Analysis.

In the meantime, the USD/CAD was unchanged on the release, but of late, it regains some control and is aiming up toward the June 1 low at 1.2605. Also, it’s worth noting that oil prices remain high, a headwind for the USD/CAD. WTI is exchanging hands at $118.23 per barrel.

Meanwhile, the US Dollar Index, a measure of the buck’s value against six currencies, recovers some of Thursday’s losses, up by 0.36%, sitting at 102.106, boosted by US Treasury yields, particularly the 10-year benchmark note rate at 2.955%, gaining four bps.

Next week’s calendar, the Canadian docket, would feature the Balance of Trade, Ivey PMI, the Canadian employment report, and Bank of Canada speakers.

On the US front, the Federal Reserve officials begin their blackout period. However, investors’ eyes would be on the inflation report alongside the UoM June’s Consumer Sentiment.

USD/CAD Price Forecast: Technical outlook

From the daily chart perspective, the USD/CAD remains downward biased, but the RSI’s reading at 36.65, moving slightly up, suggests a correction might occur in the near term. Nevertheless, if the USD/CAD continues downwards and breaks below April’s 21 low at 1.2458, then a retest of the YTD lows at 1.2402 is on the cards.

Otherwise, the USD/CAD might head upwards to test the 1.2600. Failure of a daily close above the figure would keep the major in the 1.2550-1.2600 range.

Next week, the Reserve Bank of Australia will announce its decision on monetary policy. After GDP data on Wednesday, economists at ANZ Bank shifted their expectations and now see the RBA raising the cash rate by 40 basis points at the June meeting.

Key Quotes:

“From a policy perspective, there were two critical elements of the Q1 national accounts data. The first was the strong growth in average hourly earnings, calculated by the RBA as up 5.2% y/y. The second was that the broadest measure of consumer inflation (the household consumption deflator) had its highest quarterly increase since 1990 (outside the GST).”

“These suggest policy needs to lean more strongly against the broadening of inflation pressures. We think the strength of the price and wage measures in the GDP data should be enough to convince Governor Lowe that, “there is a very strong argument” to deviate from a regular 25bp move and lift the cash rate a bit, a little faster.”

“The RBA could confound us all and decide to go by 50bp, but we think the fact a 40bp move was discussed in May makes it a more likely choice. More than 50bp seems unlikely given that the RBA meets monthly. We can’t rule out the RBA sticking with a cautious approach and tightening by 25bp, but with policy still exceptionally stimulatory we think a bigger move of 40bp is more likely.”

- US dollar gains momentum across the board after the US employment report.

- Japanese yen under pressure even as Wall Street extends losses.

- USD/JPY heads for the highest weekly close since 2002.

The USD/JPY jumped following the release of the US employment report and recently rose further hitting a fresh three-week high at 130.73. It remains near the top, on its way to the highest weekly close since 2002.

Yields and dollar boost USD/JPY

The yen is among the worst performers on Friday despite the cautious tone in Wall Street. The Dow Jones is falling by 1.04% and the Nasdaq by 2.61%. Despite all the red, US yields are higher and the yen is sharply lower.

Economic data from the US came in mixed. Non-farm payrolls rose by 390K in May above the 325K of market consensus and the unemployment rate remained at 3.6% (consensus: 3.5%). “Improving labor supply and cooling wage growth are welcome signs for the Federal Reserve, but today's employment report is just one step along the rocky road to normalcy”, explained analysts at Wells Fargo.

A later report showed ISM Service PMI dropped from 57.1 to 55.9 in May, below the 56.4 expected. The greenback was unaffected, although US yields moved off daily highs.

Best week in months for USD/JPY

The USD/JPY is up more than 350 pips for the week so far and could post the highest weekly close since April, boosted by US yields.

“Fed policy is the determinant for the USD/JPY because the BoJ effectively has no policy. It is not at all clear that US rates can continue higher given the unsettled state of the US economy but the current spread is more than enough to provide the USD/JPY with support”, said Joseph Trevisani, Senior Analist at FXStreet.

Technical levels

- NZD/USD slid back to the low 0.6500s from earlier multi-week highs as the buck strengthened post-strong US jobs data.

- Attention turn to US CPI next week and evidence of a further easing of US price pressures could support NZD/USD.

NZD/USD slipped back from multi-week highs it hit earlier in the session in the upper 0.6500s as the US dollar strengthened across the board in wake of solid US labour market numbers for May, data which also seemed to weigh on broader risk appetite as traders priced in a marginally more hawkish Fed policy outlook, adding further headwinds for the risk-sensitive kiwi.

The pair was last trading around 0.6520, down around 0.6% on the session, putting it on course to end the week in the red by about 0.25%, though close to the middle of this week’s 0.6460-0.6575ish range. Robust US ISM Services PMI data didn’t have too much of a bearing on the price action, nor have recent comments from US President Joe Biden, who unsurprisingly attempted to spin the latest strong US jobs report in a politically favourable light.

Next week will be comparatively quiet in terms of economic events, aside from the release of US Consumer Price Inflation data for May on Thursday. This will be the week’s main event, as it will inform the debate on whether US inflation has peaked and on the outlook for Fed policy. Many think inflation will move lower in the coming months and further evidence that this is the case could spur renewed USD weakness, with NZD/USD perhaps having a shot at surpassing its 50DMA at 0.6600.

Gold remains on track to close the third straight week higher. However recent price action suggests that XAUUSD could find it difficult to make a decisive move in either direction unless it breaks out of the $1,840-$1875 range, FXStreet’s Eren Sengezer reports.

Gold Price defines breakout levels

“The Fibonacci 38.2% retracement of the latest downtrend seems to have formed stiff resistance at $1,875. With a daily close above that level, gold could target the $1,890/$1,900 area (100-day SMA, 50-day SMA, Fibonacci 50% retracement) and $1,915 (Fibonacci 61.8% retracement) afterwards.”

“$1,850 (Fibonacci 23.6% retracement) aligns as interim support before $1,840 (200-day SMA). In case the latter turns into resistance, this could be seen as a significant bearish development and attract sellers. In that scenario, additional losses toward $1,830 (June 1 low) could be witnessed.”

USD/JPY continues to trade above 130. However, economists at TD Securities expect the pair to face a tough resistance at cycle highs around 135.15.

USD/JPY is largely a function of US terminal rate expectations

“USD/JPY is largely a function of US terminal rate expectations, so until that debate is settled, it's going to be hard to sell.”

“We think the 131.35 cycle highs will be solid resistance as punching above might be harder to do without a major rethink on US terminal rates (that could come much later this year).”

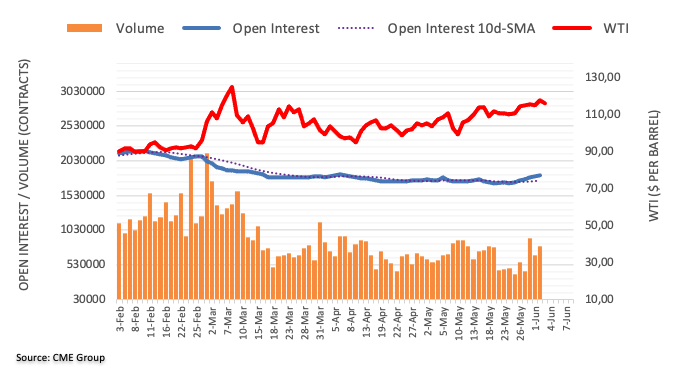

- WTI is holding near Thursday’s highs in the $117s despite risk-off Wall Street flows post-strong US jobs data.

- OPEC+’s announcement of a faster pace of output quota hikes in July and August hasn’t dettered the bulls.

Front-month WTI futures held near Thursday’s highs on Friday, despite US equity markets trading with a downside bias on Fed tightening fears following robust US labour market data. WTI fell as low as $111 per barrel on Friday after OPEC+ confirmed that they will be increasing output quotas by a larger 648K barrel per day each month in July and August to address what they said was growing demand.

But WTI then saw a more than $6.0 intra-day rebound to the $117s, where WTI is still trading on Friday, as traders digested the details of OPEC+’s latest move. The quota hikes were spread evenly across producers, including Russia, rather than being allocated towards the nations who can actually increase output (like Saudi Arabia, the UAE and Iraq) and so analysts came to the conclusion that OPEC+ will not be able to live up to its pledged output hikes over the next few months.

In recent months, Russian output has been in sharp decline due to Western sanctions after its invasion of Ukraine in recent months, exacerbating a pre-existing OPEC+ output problem where smaller producers (mostly in Africa) were struggling to keep up with output quota hikes. In sum, the latest OPEC+ announcement has not deterred the crude oil bulls, who have also been bidding up prices as of late on expectations for rising demand in North America and Europe as the continents enter their peak summer driving season, and in China, where lockdowns are being eased as Covid-19 infections decline.

WTI bulls will likely eye a retest of earlier weekly highs in the $120 area as their next target. A break above this level next week would open the door to a run higher towards mid-March multi-year highs around $130 per barrel.

Gold Price retreated ahead of the weekend amid renewed dollar strength. Next week's European Central Bank (ECB) and US inflation report could ramp up XAUUSD volatility, FXStreet’s Eren Sengezer reports.

Gold Price eyes ECB meeting, US CPI as next catalysts

“The ECB is widely expected to hike its policy rate by 25 bps in July. In case the ECB reveals a hawkish rate outlook, XAUEUR could come under heavy bearish pressure and cause XAUUSD to edge lower as well. Nevertheless, the dollar’s market valuation would also be impacted in a negative way in that scenario and help gold limit its losses.”

“Next Friday, the BLS will release the May inflation data. On a yearly basis, the Consumer Price Index (CPI) is forecast to edge lower to 8.2% from 8.3% in April. The market reaction to the inflation data should be pretty straightforward with a lower than expected CPI print weighing on US T-bond yields and providing a boost to XAUUSD and vice versa.”

A 390K increase in Nonfarm Payrolls (NFP) marked another robust labour market outcome in the US in May. Will this data change the outlook for policy? Probably not, so economists at TD Securities would not expect this to be a game-changer for FX markets.

The better the data, the more difficult that a pause or reduced pace of tightening later this year becomes

“Payrolls rose a still robust 390K in May. The unemployment rate stayed unchanged at 3.6% for a second consecutive month. Average hourly earnings remained steady at 0.3% MoM, but they continued to fall on a YoY basis.”

“This report will do little to change the price action in the FX space, but it does mean that the better the data, the more difficult the proposition of slowing down the pace of hikes later this year becomes. What it does do however is at a minimum delay or even dent the premature prevailing bias to sell dollars.”

The headline ISM Services Purchasing Manager's Index (PMI) fell to 55.9 in May from 57.1 in April versus expectations for a slightly smaller decline to 56.4, according to the latest release by the Institute for Supply Management (ISM).

Subindices:

The Business Activity Index fell to 54.5 from 59.1 in April.

The Employment Index fell to 50.2 from 49.5 in April.

The New Orders Index rose to 57.6 from 54.6.

The Prices Paid Index fell to 82.1 from 84.6.

Market Reaction

FX markets did not seem to react to the latest ISM data, as investors continue to digest the ramifications of the earlier official US jobs report.

Lee Sue Ann, Economist at UOB Group, suggests the RBA would hike the OCR by 25 bps at the June 7 meeting.

Key Quotes

“We recognise that a 40bps hike at this meeting is a close call, but this is not our base case. We see the RBA hiking by 25bps to 0.60% in Jun, and for now, another 65bps in the remainder of 2022, which would bring the OCR to 1.25% by year-end.”

“Further out, we look for the OCR to rise over 2023 and 2024, reaching 2.50% by the end of our forecast period.”

- EUR/USD looks offered but keeps the trade above 1.0700.

- The 1.0790 region remains a tough barrier for bulls so far.

EUR/USD navigates within the daily range against the backdrop of fresh demand for the greenback.

The surpass of the 1.0780/90 band - where the 3-month resistance line and the May top coincide - should see the downside pressure alleviated and this could spark a fresh bout of strength in the near term. Against that, the next target of note then emerges at the weekly high at 1.0936 (April 21).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1232.

EUR/USD daily chart

Cable’s gains have been capped out around the 1.2590 area. Economists at Scotiabank expect a close below 1.26 to exert more downside pressure on the GBP/USD pair.

Resistance after the 1.26 figure area is located at 1.2630

“A failure to reclaim the 1.26 handle may give the GBP a more bearish feel to close out the week after it broke through its bullish trend from the mid-May lows on Tuesday.”

Support is the mid-1.25s area followed by 1.2525 and the big figure” zone; Wed’s low of 1.2459 follows.”

“Resistance after the 1.26 figure area is 1.2630 and the mid-1.26s.”

- DXY reclaims part of the ground lost on Thursday.

- The June high at 102.73 caps the upside so far.

DXY regains some composure and looks to extend the rebound further north of the 102.00 mark on Friday.

So far this week, bullish attempts appear limited by the June 1 top at 102.73. Beyond this area, there are no resistance levels of note until the 2022 high at 105.00 (March 13).

As long as the 3-month line near 101.00 holds the downside, extra gains in the dollar look likely in the short-term horizon.

Looking at the longer run, the outlook for the dollar is seen constructive while above the 200-day SMA at 96.98.

DXY daily chart

- Gold fell back into the $1850s, taking daily losses to more than 0.5% after data revealed robust US job gains.

- Wage pressures were also revealed to have eased, which might alleviate pressure on the Fed to tighten so aggressively.

- Ahead of US ISM Services PMI data and more Fed speak, XAU/USD is still trading higher on the week.

Spot gold (XAU/USD) prices fell in the immediate aftermath of the latest official US labour market report, which revealed 390K jobs were added in May, more than the expected 325K. Markets saw a “hawkish” reaction to the data (i.e. reacted to price in a more aggressive Fed tightening outlook), with US bond yields and the US dollar rising. The yield on the US 10-year note was last up about 6 bps and back near the 3.0% level.

XAU/USD fell back to the $1860 area from pre-data levels in the upper $1860s, meaning it now trades lower by about 0.5% on the day, having hit multi-week highs near $1875 earlier in the session. Still, the precious metal remains on course to post a modest weekly gain of about 0.3% after finding support earlier in the week upon a dip back to its 200-Day Moving Average in the $1840 area.

Given that the latest US jobs data also revealed an easing of US wage pressures last month, some gold bulls might see the latest pullback as an opportunity to add to long positions and target a retest of weekly highs. Indeed, analysts had billed the wage metrics in this month’s jobs report as the most important, given the Fed’s focus on inflation. Gold traders should look out for the upcoming release of US ISM Services PMI survey data for May at 1400GMT and remarks from Fed Vice Chair Lael Brainard shortly after.

Technical levels

- EUR/USD loses some ground and tests 1.0710 on Friday.

- US Non-farm Payrolls rose by 390K jobs in May.

- The unemployment stayed unchanged at 3.6%.

EUR/USD loses the grip further and revisits the low-1.0700s in the wake of the May’s Nonfarm Payrolls at the end of the week.

EUR/USD keeps targeting the 1.0800 area

EUR/USD corrects lower and gives aways some gains following Thursday’s strong advance after the US economy created 390K jobs during May, bettering expectations for a gain of 325K jobs. The April’s reading was revised to 436K (from 428K).

Further data showed the jobless rate stayed put at 3.6% and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.3% MoM and expanded 5.2% over the last twelve months. Another key gauge, the Participation Rate, improved a tad to 62.3%.

Later in the session, the final Services PMI is due seconded by the Non-Manufacturing PMI.

EUR/USD levels to watch

So far, spot is losing 0.27% at 1.0715 and a breach of 1.0627 (weekly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18). On the upside, the immediate up barrier lines up at 1.0786 (monthly high May 30) seconded by 1.0936 (weekly high April 21) and finally 1.0959 (100-day SMA).

- 390K jobs were added to the US economy in May, above the 325K expected.

- This seemed to initially boost the buck, though wage growth metrics eased, easing pressure on the Fed.

- Measures of labour market slack were mixed.

The US economy added 390,000 jobs in May, according to the latest Non-farm Payrolls (NFP) report released by the US Bureau of Labour Statistics on Friday. That was above the median economist forecast for a gain of 325,000 jobs, though slightly lower versus April's 436,000 gain (revised up from 428,000). The headline job gain was driven by a 333,000 gain in private sector employment, which was slightly above the 325,000 estimate. 18,000 of these were factory jobs, 59,000 of these goods-producing jobs, 36,000 of these construction jobs and 274,000 private service-producing jobs. Retail jobs fell by 60,700, while government jobs rose by 57,000.

Despite the headline NFP beat, the Unemployment Rate remained steady at 3.6% versus an expected drop to 3.5%, while the U6 Underemployment Rate rose to 7.1% from 7.0% a month earlier. Average hours worked per week remained unchanged at 34.6 hours. The Labour Force Participation Rate rose slightly to 62.3% from 62.2% a month earlier, which explained why the unemployment rate failed to decline as expected.

Average Hourly Earnings growth came in at 5.2% YoY in May, in line with expectations and below last month's 5.6% reading. However, the MoM rate of Average Hourly Earnings growth was lower than expected at 0.3%, in line with April's reading and below expectations for a rise to 0.4%.

Market Reaction

The immediate market reaction has been for the US dollar to strengthen as a result of the stronger headline NFP number. But traders should be aware that sellers might soon come in, given the easing wage growth metrics that may be interpreted as taking some pressure off of the Fed to hike interest rates so aggressively. For now, the DXY is at session highs back to the north of the 102.00 mark.

- EUR/JPY pushes higher and visits the boundaries of 140.00.

- Beyond 140.00 the cross should challenge 141.05.

EUR/JPY keeps the rally well and sound and trades at shouting distance from the YTD peak at 140.00 (April 21).

The surpass of the 2002 peak should motivate the cross to shift its attention to the June 2015 high at 141.05.

In the meantime, while above the 2-month support line near 135.30, the short-term outlook for the cross should remain bullish.

EUR/JPY daily chart

- Silver hit multi-week highs near $22.50 on Friday ahead of the release of US jobs data at 1230GMT.

- If the data confirms a slowing of job gains/easing wage pressures, XAG/USD could rally towards $23.00.

Even though the US dollar is ever-so-slightly firmer in the run-up to the release of the official US labour market report at 1230GMT, the risk-off mood to broader markets has helped spot silver (XAG/USD) prices hit fresh multi-week highs near the $22.50 per troy ounce mark on Friday. Analysts expect the upcoming US jobs data to reveal a slowdown in the pace of job gains in the US and, perhaps more importantly, an easing of wage growth.

If the data confirms expectations, then this will (at the margin) ease the pressure faced by the Fed to continue tightening its monetary policy settings aggressively beyond September (two 50 bps hikes in June and July are seen as a certainty, given recent Fed communications). Precious metals like it when the Fed is less hawkish/outright more dovish, as this tends to weigh on US bond yields and the US dollar, lowering the opportunity cost of holding non-yielding assets and making USD-denominated commodities cheaper for international buyers.

A convincing break above late-May highs in the mid-$22.00s would open the door to an extension of gains towards $23.00 and the 50/200-Day Moving Averages, both of which reside in the mid-$23.00s. Note that US ISM Services PMI data for May will be released at 1400GMT, which will also be in focus as a timely update on the health of the dominant US service sector. Just as with the jobs data, signs of a slowdown would be greeted positively by silver investors who want to see a less aggressive Fed.

- AUD/USD has dropped back from six-week highs to the 0.7240s as risk appetite sours pre-US jobs data release.

- But the pair is holding onto substantial gains on the week amid a cocktail of bullish tailwinds.

AUD/USD has pulled back from the six-week highs it hit earlier in the session in the 0.7280s and is now trading about 0.3% lower on the day in the run-up to the release of key US official jobs data for May, with the Aussie one of the G10 underperformers as broader macro risk appetite takes a (modest) turn for the worse. But at current levels just below the 0.7250 mark, the pair is still trading with solid gains of about 1.2% this week.

That is mostly as a result of Aussie-specific tailwinds as a result of US dollar flows (indeed, the DXY is slightly north of positive on the week at the time of writing). Stronger than expected Q1 GDP data and robust monthly trade figures released this week came on the heels of recent hotter than expected Aussie Consumer Price Inflation numbers that have spurred bets that the RBA is going to quicken the pace of rate hikes at upcoming meetings.

Most analysts are betting the central bank lifts interest rates by 40 bps next Tuesday. Meanwhile, analysts are also citing this week’s easing of lockdowns in China as lifting spirits – China is Australia’s largest trade partner and export destination.

Upcoming US jobs data could trigger some volatility, but if the wage growth metrics signal an easing of wage pressures, AUD/USD may have an opportunity to recover back towards session highs near 0.7300 as markets pare their hawkish Fed bets. Attention will then turn to US ISM Services PMI survey data released at 1400GMT for a timely insight into the health of the dominant US services sector.

- GBP/USD is trading subdued above 1.2550 amid holiday-thinned trade head of the release of key US jobs data.

- Evidence of cooling of US wage pressures could hit the buck and help GBP/USD challenge weekly highs.

- But the differential between US/UK growth and Fed/BoE tightening expectations makes a longer-lasting rebound more difficult.

With FX markets in wait-and-see mode ahead of the release of official US labour market data for the month of May at 1230GMT and with volumes further hampered amid a second day of market closures in the UK (London being the world’s top FX trading hotspot) as celebrations for the Queen’s platinum jubilee continue, GBP/USD is trading in subdued fashion and flat on the day just above the 1.2550 level.

That leaves the pair about equidistant between earlier weekly highs in the mid-1.2600s and Wednesday’s lows in the mid-1.2400s, as well as equidistant between the 21-Day Moving Average to the downside near 1.2450 and the 50DMA to the upside just above 1.2700. FX market volatility is expected to pick up if there is a significant deviation from expectations in the upcoming US jobs data release.

Analysts have highlighted wage growth metrics as the most important for traders to watch, given the ongoing debate about the state of inflation in the US (has it peaked yet?) and associated discussion about the outlook for the Fed policy outlook. Fed Vice Chair Lael Brainard set a high bar on Thursday for a pause in rate hikes in September following two 50 bps moves in June and July, though a slowdown to 25 bps moves is likely is the Fed does deem inflationary pressures to have eased.

In that regard, any evidence of easing wage pressures (which often then lead to inflation) could see the US dollar weaken and GBP/USD challenge weekly highs once again. But amid the relatively more optimistic story regarding US growth versus UK, and continued expectations for the Fed to be far more hawkish than the BoE in the quarters ahead, the outlook for a sustained GBP/USD rebound, say back into the 1.2800 area of above, doesn’t look great for now.

US ISM Services PMI survey data for May is slated for release at 1400GMT (after the jobs data at 1230GMT) and should highlight robust continued growth in the dominant US service sector. Fed speak will then be back in focus from 1430GMT with more remarks from Brainard.

UOB Group’s Economist Ho Woei Chen, CFA, assesses the recently announced measures to support growth in the Chinese economy.

Key Takeaways

“China’s State Council has announced a set of 33 measures to support businesses, stabilise industries and supply chains, boost consumer spending and investments.”

“We estimate that the quantifiable measures in the policy package may be worth around 2% of GDP and partially mitigate the economic impact from the Covid-19 curbs in Apr-May. Shanghai accounts for 3.8% of China’s GDP and around 20% of total trade and thus the containment curbs and spill-over effects are likely to have cost around 1% of China’s GDP.”

“The worst is probably behind us (as seen in the rebound in May PMIs) but risks remain elevated due to China’s zero-covid strategy, weak outlook in the domestic real estate market, Russia-Ukraine conflict, sustained commodity prices and the withdrawal of monetary policy accommodation by the global central banks.”

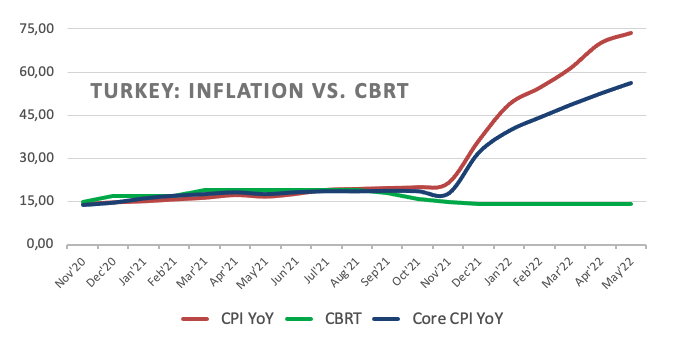

- USD/TRY advances to new peaks around 16.50.

- The lira comes under pressure following inflation data.

- US Nonfarm Payrolls comes next in the calendar.

Further depreciation of the Turkish currency lifts USD/TRY to fresh YTD tops around 16.50 on Friday.

USD/TRY up post-CPI, looks to US NFP

USD/TRY advances uninterruptedly since Monday and its seems to have accelerated the upside after inflation figures ran at the fastest pace in the last 24 years in May.

Indeed, inflation results showed the CPI rise at a monthly 2.98% in May and 73.50% vs. the same month of 2021. In addition, Producer Prices gained 8.76% inter-month and 132.16% from a year earlier.

If (and it is a big “if”) there is a silver lining following the CPI release, is that consumer prices rose less than initially estimated and at a slower pace than in previous months, hinting at the idea that inflation pressures might be running out of steam.

The deteriorated geopolitical landscape following the Russian invasion of Ukraine in combination with soaring energy prices and the depreciation of the lira were behind the May’s uptick in the CPI.

On another front, the pair should remain focused on the upcoming publication of the US Nonfarm Payrolls regarding the dollar’s near-term price action.

What to look for around TRY

USD/TRY keeps the underlying upside bias well and sound and looks to consolidate the recent surpass of the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Inflation Rate, Producer Prices (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.27% at 16.5025 and faces the next up barrier at 16.5029 (2022 high May 26) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the flip side, a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

- USD/CAD tracks the dollar price action ahead of the critical US data.

- Falling WTI prices keep the downside checked in the major.

- Bears eye daily closing below the horizontal trendline support at 1.2567.

USD/CAD is nursing Thursday’s heavy losses while wavering near five-week lows of 1.2556, as it tracks the subdued price action in the US dollar across the board.

The dollar is trading listlessly in multi-day lows against its major peers, as traders remain on the sidelines ahead of the all-important US Nonfarm Payrolls data. A lack of momentum around the US Treasury yields is offering little help to the dollar bulls.

Meanwhile, the downside in the pair remains cushioned, courtesy of the renewed weakness in WTI price. The black gold is shedding over 1.50% on the day, currently trading at $114.25. Oil prices are reeling from the OPEC+ decision to ramp up output by 648K barrels this month to help make up for the Russian oil deficit.

From a short-term technical perspective, USD/CAD is testing the crucial daily support line, going back to the April 22 low of 1.2567.

Daily closing below the latter is needed to yield a downside break of the trendline support, which will kick in a fresh downswing towards the 1.2500 level.

The April 21 low of 1.2458 will then come to the rescue of bulls.

The 14-day Relative Strength Index (RSI) is trading listlessly just above the oversold territory, allowing more room for declines.

USD/CAD: Daily chart

On the other side, bulls will need acceptance above 1.2600 to initiate any meaningful recovery.

Further up, a rebound towards the horizontal 200-Daily Moving Average (DMA) at 1.2662.

USD/CAD: Additional levels to consider

Economist at UOB Group Enrico Tanuwidjaja reviews the latest inflation figures in Indonesia.

Key Takeaways

“May’s headline inflation jumped to 3.6% y/y in May vs 3.5% in Apr, while core inflation stayed the course at 2.6%.”

“Significant increases in cooking oil, meat, egg, fresh fish and red onion, as well as overall transportation prices, especially air transport costs, drove inflation higher in May.”

“Going forward, we expect the headline inflation to continue rising together with core inflation as domestic demand recovers, thus we keep our inflation forecast average of 3.3% in 2022.”

- EUR/USD hovers around the mid-1.0700s on Friday.

- German 10y bund yields now target the 1.30% level.

- US Nonfarm Payrolls take centre stage later in the NA session.

Price action around EUR/USD falls in line with the generalized side-lined mood in the rest of the global markets at the end of the week.

EUR/USD stays vigilant near 1.0750

EUR/USD trades within a tight range around 1.0750 amidst the prevailing cautious mood among market participants ahead of the key releases due later in the US calendar.

In the meantime, markets continue to bet on potential rate hikes by the ECB and currently price in a 50 bps hike at the October meeting.

In the German money markets, the 10y bund yields extend further the march north and have already left behind the 1.25% mark, an area last traded back in May 2014.

In the euro calendar, the German trade surplus widened to €3.5B in April and the Services PMI eased to 55.0 in May. In the broader Euroland, Retail Sales contracted 1.3% MoM in April and expanded 3.9% from the year earlier, while the final Services PMI receded to 56.1 during last month.

Other than the Nonfarm Payrolls, the US docket will see the Unemployment Rate, the ISM Non-Manufacturing and the final Services PMI.

What to look for around EUR

EUR/USD met quite a solid resistance near 1.0800 so far this week on the back of supportive ECB-speak, which continued to point at an initial rate hike as soon as in July, while the consensus view that the bond-purchase programme should end at some point in early Q3 has also lent legs to the European currency.

In addition, the renewed selling bias in the greenback has also collaborated with the multi-cent upside in the pair, as investors appear to have already pencilled in a couple of 50 bps rate hikes at the June and July gatherings.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, elevated inflation and a decent pace of the economic recovery in the euro bloc are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany Unemployment Change, Unemployment Rate, EMU Flash Inflation Rate (Tuesday) – Germany Retail Sales, Final Manufacturing PMI, EMU Final Manufacturing PMI, ECB Lagarde (Wednesday) – Germany Balance of Trade, Final Services PMI, EMU Retail Sales, Final Services PMI (Friday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro area. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is gaining 0.01% at 1.0746 and faces the immediate up barrier at 1.0786 (monthly high May 30) seconded by 1.0936 (weekly high April 21) and finally 1.0959 (100-day SMA). On the other hand, a breach of 1.0627 (weekly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18).

FX option expiries for June 3 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0500 946m

- 1.0700 793m

- USD/JPY: USD amounts

- 131.90 575m

- 125.00 514m

- AUD/USD: AUD amounts

- 0.7150 556m

- 0.7100 455m

- USD/CAD: USD amounts

- 1.2630 1.4b

- 1.2700 782m

- 1.2600 460m

- Gold Price is off monthly top but the bullish potential remains intact.

- The US dollar index is set for the third straight weekly loss.

- XAU bulls could likely regain control amid mixed markets.

Gold Price is consolidating this week’s rebound to one-month highs above $1,870 on Friday, as bulls take a breather amid mixed markets. A sense of caution prevails, in the face of the recent series of disappointing US economic data, which has tempered the Fed tightening expectations. The US Treasury yields are stabilizing after the previous retreat, capping the upside in the yellow metal. Traders refrain from placing any directional bets on XAUUSD, as they await the critical US NFP data for fresh trading opportunities.

Also read: Gold Price Forecast: Will XAUUSD extend the upside break on US NFP?

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the Gold Price is keeping its range below a stack of healthy resistance levels around $1,870, which is the convergence of the previous day’s high, the previous week’s high and the SMA5 four-hour.

The next stop for bulls is seen at the pivot point one-day R1 at $1,878, above which the confluence of the pivot point one-week R2 and Bollinger Band one-day Upper around $1,882 will come into the picture.

On the flip side, if the corrective mode extends, then sellers could gear up for a sustained break below strong support at $1,862. At that level, the Fibonacci 61.8% one-month, Fibonacci 23.6% one-week and the Fibonacci 38.2% one-day coincide.

The additional declines will call for a test of the Fibonacci 38.2% one-week at $1,859.

Powerful support of around $1,854 is likely to limit the bearish pressure on XAU bulls. That level is the intersection of the SMA5 one-day, SMA50 four-hour and the Fibonacci 61.8% one-day.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

According to FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang, a deeper decline in USD/CNH should meet decent support around 6.5940.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘is likely to edge higher but is unlikely to break the resistance at 6.7350’. USD subsequently rose to 6.7150 before staging a surprisingly sharp sell-off to a low of 6.6543. USD extended its decline during early Asian and while further USD weakness is not ruled out, the major support at 6.5940 is likely out of reach for now (there is another support at 6.6100). Resistance is at 6.6500 followed by 6.6700.”

Next 1-3 weeks: “On Monday (30 May, spot at 6.7200), we highlighted that the outlook for USD is mixed and we expected USD to trade within a broad range of 6.6500/6.8000. USD traded well within the expected range for a few days but dropped below 6.6500 during early Asian hours today. The break of the solid support coupled with the rapid improvement in downward momentum has shifted the risk to the downside. However, USD already declined a fair bit and any further weakness could be limited to a test of the next solid support at 6.5940. Overall, USD is expected to trade on its back-foot unless it can move above 6.6850 (‘strong resistance’ level).”

- Eurozone Retail Sales fell by 1.3% MoM in April vs. 0.3% expected.

- Retail Sales in the bloc arrived at 3.9% YoY in April vs. 5.4% expected.

Eurozone’s Retail Sales dropped by 1.3% MoM in April versus 0.3% expected and 0.3% last, the official figures released by Eurostat showed on Friday.

On an annualized basis, the bloc’s Retail Sales came in at 3.9% in April versus 1.6% recorded in March and 5.4% estimated.

FX implications

The euro is holding higher ground, unfazed by the downbeat Eurozone Retail Sales data.

At the time of writing, the major is trading at 1.0752, higher by 0.07% on the day.

About Eurozone Retail Sales

The Retail Sales released by Eurostat are a measure of changes in sales of the Eurozone retail sector. It shows the performance of the retail sector in the short term. Percent changes reflect the rate of changes of such sales. The changes are widely followed as an indicator of consumer spending. Usually, the positive economic growth anticipates "Bullish" for the EUR, while a low reading is seen as negative, or bearish, for the EUR.

EUR/USD has gathered bullish momentum in the second half of the week. The US Bureau of Labor Statistics will release the May jobs report later in the day. EUR/USD – which has gathered bullish momentum in the second half of the week – could test 1.08 on disappointing US employment data, FXStreet’s Eren Sengezer reports.

Souring market mood could limit euro's upside in the near term

“A disappointing Nonfarm Payrolls (NFP) growth in May could put the dollar under strong selling pressure. It's worth noting, however, that wage inflation, as measured by the Average Hourly Earnings, is one of the key data points for the Fed when conducting its monetary policy. Strong wage growth could support the greenback even if the NFP falls short of estimates.”

“If safe-haven flows start dominating the markets in the second half of the day, EUR/USD could find it difficult to continue to push higher and vice versa.”

“In case EUR/USD rises above 1.0780, buyers could show interest and lift EUR/USD to 1.08 (psychological level) and 1.0830 (former support, static level).”

“1.0720 (50-period and 20-period SMAs on the four-hour chart) forms first support ahead of 1.07 (psychological level) and 1.0680 (Fibonacci 23.6% retracement).”

See – NFP Preview: Forecasts from 11 major banks, strength continues

Gold climbed noticeably on Thursday for the second day running. A downbeat Nonfarm Payrolls print could mean more upside potential for the yellow metal, economists at Commerzbank report.

Gold is being lent tailwind by the US dollar

“Gold is being lent tailwind by the US dollar, which has been prone to weakness over the past two days, thereby more than offsetting the higher bond yields.”

“The ADP’s employment figures for the US proved disappointing yesterday, showing a mere 120K jobs created in May and a downward revision of the previous month’s figure. If this picture is repeated in today’s official labor market data, gold is likely to build on its gains because this would presumably prompt the market to lower its expectations as regards US Fed rate hikes.”

See – NFP Preview: Forecasts from 11 major banks, strength continues

- GBP/USD is trading lackluster as investors have reduced volume ahead of the US NFP.

- Poor ADP Employment Change numbers have trimmed the forecasts of the payrolls data.

- The BOE needs to continue elevating its interest rates aggressively to contain the runaway inflation.

The GBP/USD pair is auctioning back and forth in a 1.2565-1.2590 range. It looks like a lackluster Asian session is carry-forwarding to the European shift and all eyes are set on the event of the US Nonfarm Payrolls (NFP).

The US economy will report the NFPSs, Unemployment Rate, and ISM Services PMI on Friday. The market participants have lowered the consensus for the payroll data. Earlier, the expectations for the employment generation figures were 325k. Now, the dismal Automatic Data Processing (ADP) Employment Change has lowered the forecasts significantly to 225k, as per Reuters. The Unemployment Rate is expected to decline to 3.5% from the prior print of 3.6%. The entire employment data signals that a tight labor market will continue its dominance, however, the rate of employment generation will diminish vigorously.

Apart from the employment data, investors will focus on the ISM Services PMI data. A preliminary estimate of the ISM Services PMI is hinting at underperformance. The economic catalyst is expected to land at 56.4 against the prior print of 57.1.

Meanwhile, the pound bulls pushed cable higher on Thursday amid a rebound in the positive market sentiment. Risk-perceived currencies gained a lot of traction. A light economic calendar on the pound front will provide more power to the chatters over inflationary pressures and interest rates in the UK. The Bank of England (BOE) is expected to continue dictating bumper rate hikes as it seems the only measure to tame the runaway inflation. Investors should be informed that the inflation rate in the UK is stable above 9%.

- DXY trades without a clear direction near 101.70.

- Activity in US yields remain muted and near Thursday’s close.

- US Nonfarm Payrolls, Unemployment Rate next of note in the docket.

The greenback alternates gains with losses around the 101.70 region when measured by the US Dollar Index (DXY) on Friday.

US Dollar Index remains vigilant ahead of Payrolls

Market participants remain vigilant ahead of the publication of the key May’s Nonfarm Payrolls later on Friday, motivating the index to hover around the 101.70 zone amidst the generalized lack of direction in the global markets.

Activity in the US cash markets show the same performance so far, with yields along the curve looking consolidative in the upper end of the weekly range.

As indicated, Nonfarm Payrolls for the month of May are due later in the NA session seconded by the Unemployment Rate and the ISM Non-Manufacturing. Additionally, the final Services PMI is also due followed by the speech by FOMC’s Governor L.Brainard (permanent voter, centrist).

What to look for around USD

The dollar came under pressure in the past session and returned to the area below the 102.00 mark against a cautious backdrop ahead of the release of May’s labour market figures.

Renewed weakness in the dollar came in response to the rising perception that inflation might have peaked in April, which in turn supports the idea that the Fed may not need to be as aggressive as market participants expect when it comes to raising the Fed Funds rates.

In the meantime, the Fed’s divergence vs. most of its G10 peers coupled with bouts of geopolitical effervescence, higher US yields and a potential “hard landing” of the US economy are all factors still supportive of a stronger dollar in the next months.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Final Services PMI, ISM Non-Manufacturing (Friday).

Eminent issues on the back boiler: Powell’s “softish” landing… what does that mean? Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.01% at 101.72 and faces the next contention at 101.36 (55-day SMA) followed by 101.29 (monthly low May 30) and then 99.81 (weekly low April 21). On the upside, a break above 102.73 (weekly/monthly high June 1) would open the door to 105.00 (2022 high May 13) and finally 105.63 (high December 11 2002).

Here is what you need to know on Friday, June 3:

Following Wednesday's decisive rebound, the US Dollar Index lost its traction and erased a large portion of its weekly gains on Thursday. Markets remain relatively quiet early Friday as investors await the US Nonfarm Payrolls (NFP) data for May. US stock index futures trade flat after having recorded strong gains on Thursday and the benchmark 10-year US Treasury bond yield continues to move sideways near 2.9%. The European economic docket will feature the April Retail Sales report. Ahead of the weekend, the ISM Services PMI report from the US will be looked upon for fresh impetus as well.

Nonfarm Payrolls Preview: It is all about the money, three scenarios for wage growth and the dollar.

The data published by the ADP showed on Thursday that private-sector employment in the US rose by only 128,000 in May. This marked the lowers print since the beginning of the coronavirus pandemic and missed the market expectation of 300,000 by a wide margin, triggering a fresh dollar selloff.

Lael Brainard, Vice Chairwoman of the US Federal Reserve, told CNBC on Thursday that it was very hard to see the case for a pause in rate hikes in September. “We’re certainly going to do what is necessary to bring inflation back down,” Brainard added and reiterated that the economy still has a lot of momentum. Nevertheless, these hawkish remarks failed to help the dollar gather strength against its rivals.

Markets expect NFP to rise by 325,000 in May following April's increase of 428,000. Analysts at Goldman Sachs, however, said that they expect a 225,000 growth. "Job growth tends to slow during the spring hiring season when the labour market is tight—particularly in May before the arrival of the youth summer workforce—and all four Big Data employment indicators we track suggest a below-consensus report," analysts explained.

Meanwhile, OPEC and its allies decided to ramp up oil production by nearly 650,000 barrels per day in July and August, compared to the 400,000 barrels per day increase planned initially. The group, however, refrained from excluding Russia from future quotas. Crude oil prices jumped in the second half of the day on Thursday and the barrel of West Texas Intermediate gained nearly 2.5% before going into a consolidation phase near $117.00 early Friday.

EUR/USD consolidates its gains near 1.0750 following Wednesday's sharp upsurge. Retail Sales in the euro area are forecast to rebound in April following the 0.4% contraction recorded in March.

GBP/USD erased a large portion of its weekly losses on Thursday but seems to have lost its bullish momentum before testing 1.2600. UK markets will remain closed on Friday and the dollar's reaction to the US data could drive the pair's action.

Gold extended its rebound amid broad dollar weakness and broke above $1,860 on Thursday. At the time of press, XAU/USD was moving sideways at around $1,865.

US May Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises.

For the second straight day, USD/JPY trades within a touching distance of 113.00. Bank of Japan Governor Haruhiko Kuroda reiterated earlier in the day that they must maintain an easy policy to create an economic environment where wages can rise more.

In the opinion of FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang, USD/JPY could edge higher and revisit the mid-130.00s in the next weeks.

Key Quotes

24-hour view: “We highlighted yesterday that ‘further USD strength is not ruled out but in view of the deeply overbought conditions, the pace of advance is likely to be slower and a clear break of the next major resistance at 130.50 is unlikely’. USD subsequently rose to 130.23, dipped to 129.50 before trading sideways for the rest of the sessions. The price actions appear to be part of a consolidation and USD is likely to trade sideways between 129.40 and 130.20.”

Next 1-3 weeks: “Our update from yesterday (02 Jun, spot at 130.05) still stands. As highlighted, while USD could continue to strengthen, overbought conditions suggest a slower pace of advance. The next resistance is at 130.50 followed by 130.80. Overall, only a break of 129.00 (no change in ‘strong support’ level from yesterday) would indicate that the USD strength that started earlier this week has run its course.”

- NZD/USD is juggling a 10-pips range as investors’ focus is shifted to the US NFP.

- Investors should brace for volatility in the DXY on lower forecasts of NFPs.

- The RBNZ will reach neutral rates sooner than other Western leaders.

The NZD/USD pair is displaying a balanced profile in a narrow range of 0.6551-0.6561 in the early European session. The anxiety over the release of the US Nonfarm Payrolls (NFP) has sidelined the market participants. The boring activity could be the optimal tag to define the current performance of the FX domain.

As per the market consensus, 325k fresh payrolls are expected to release by the US Bureau of Labor Statistics for May. However, the payroll data from the Automatic Data Processing (ADP) Employment Change has trimmed the forecasts for NFPs significantly.

The ADP Employment Change has reported that the US economy has managed to add 128k jobs in the labor market. Therefore, expectations of 325k additional jobs in May would be meaningless. One more thing, investors should consider is the former and 10-month average NFP print. In April, the NFP landed at 428k while the 12-month average NFP is 551.6k. A serious plunge in the NFP for May is going to hurt the US dollar index (DXY) principally.

On the kiwi front, the pace of hiking interest rates by the Reserve Bank of New Zealand (RBNZ) is much faster than other Western leaders. Therefore, the RBNZ will reach neutral rates sooner than other major central banks. It would be worth seeing whether the quick rate hikes by the RBNZ will perform the required job effectively or not.

"New Australian Prime Minister Anthony Albanese has made a submission to the country’s labor watchdog, proposing to lift minimum wages by more than the inflation rate in a bid to fulfill one of his key election promises," said Bloomberg on early Friday morning in Europe.

The news quotes Aussie PM Albanese’s statement published recently as, “High and rising inflation and weak wages growth are reducing real wages across the economy and creating cost-of-living pressures for Australia’s low-paid workers.”

Key quotes (Source: Bloomberg)

The government does not want to see Australian workers go backwards; in particular, those workers on low rates of pay who are experiencing the worst impacts of inflation and have the least capacity to draw on savings.

Australia’s Fair Work Commission will announce its annual wage review later this month. The current national minimum wage is A$20.33 ($14.06) per hour. During his pre-election campaign last month, Albanese had said a 5.1% increase would be equal to just $1 an hour or “two cups a coffee” a day.

Albanese said an increase in minimum wages would also complement his government’s effort to help close the national gender pay gap of 22.8%.

AUD/USD remains unmoved amid pre-NFP trading lull

Markets paid a little heed to the news as AUD/USD stays sidelined near 0.7255-50, recently bouncing off daily lows. The reason could be well-linked to the anxiety ahead of the key US jobs report.

Read: AUD/USD retreats from monthly top to 0.7250 on mixed Aussie data, sentiment ahead of US NFP

In China, the zero-covid strategy has caused the economy to slump. Economists at Commerzbank expect the renminbi to remain under pressure and forecast the USD/CNY pair at 6.70 by end-2022.

CNY weakness expected

“The current weakness and the structural problems of the Chinese economy argue for devaluation pressure on the renminbi. In addition, significant rate hikes are on the horizon for the Federal Reserve, while the Chinese central bank should rather ease monetary policy.”

“We forecast 6.70 for USD/CNY at the end of 2022 and 6.80 for USD/CNY at year-end 2023.”

Open interest in natural gas futures markets reversed four consecutive daily advances and went down by just 975 contracts on Thursday according to preliminary readings from CME Group. On the other hand, volume rose by around 30.1K contracts, extending at the same time the erratic performance seen as of late.

Natural Gas keeps targeting $9.50

Prices of natural gas remained choppy so far this week. Thursday’s pullback was amidst a small downtick in open interest, leaving the perspective of further downside diminished for the time being. On the upside, traders continue to target the 2022 high around $9.50 mark per MMBtu.

Sustained inflation is raising recession concerns, which should benefit gold, according to economists at ANZ Bank. In their view, XAUUSD could reach the $1,950 mark.

Heightened geopolitical risks should protect the yellow metal

“Supply-driven inflation looks difficult to slow by rate hikes alone and this should keep real rates conducive for gold prices. Signs of slowing global economic growth and heightened geopolitical risks should also protect the price.”

“We expect gold to find a floor at around $1,800, with upside potential of $1,950.”

- USD/JPY extends rebound from daily low, reverses pullback from three-week top.

- Mixed concerns, pre-NFP anxiety restrict market moves.

- BOJ’s Kuroda reiterates his strong support for easy money, Japan PMI came in firmer.

- Downbeat signals for US NFP weigh on prices, Biden’s speech, ISM Services PMI also become important.

USD/JPY picks up bids towards intraday high during the sluggish Friday morning in Europe as traders await the key US data/events. Also restricting the yen pair’s immediate moves is the lack of major data/events amid the Asian session, as well as holidays in the UK and China.

The market’s pre-NFP caution appears at a peak this time as the recent downbeat signals for today’s US employment report for May contrast the hawkish Fedspeak.

That said, the US ADP Employment Change eased to 128K for May, versus 300K forecasts and a downwardly revised 202K previous reading. The Weekly US Initial Jobless Claims, on the other hand, dropped to 200K compared to 210K anticipated and 211K prior. Further, Nonfarm Productivity and Unit Labor Costs both improved in Q1, to -7.3% and 12.6% respectively, compared to -7.5% and 11.6% figures for market consensus.

On the contrary, Federal Reserve Vice-Chair Lael Brainard and Cleveland Fed President Loretta Mester repeated the statements suggesting higher odds favoring the Fed’s aggression in rate hikes.

It should be observed that the contrast between the risk-negative headlines concerning China and BOJ Governor Haruhiko Kuroda’s latest comments also challenge the USD/JPY moves.

Deputy US Trade Representative (USTR) Sarah Bianchi seemed to have offered the latest challenge to market sentiment, as well as to the bright metal, as the diplomat said, “USTR is seeking a 'strategic realignment' with China, tariff structure that 'makes sense'.” The mood was challenged by statements like, “‘All options are on the table’ regarding tariff decisions on Chinese imports.” USTR Bianchi also suggested faster trade talks with Taiwan which may not be liked by China and hence challenge the bullion prices. On the same line were statements from China’s Foreign Ministry spokesman Zhao Lijian who conveyed dislike for the US’ law banning imports from Xinjiang.

Alternatively, Mr. Kuroda said, “Must maintain easy policy to create economic environment where wages can rise more.”

Amid these plays, the S&P 500 Futures print mild gains but the US 10-year Treasury yields remain unchanged at around 2.915% by the press time.

Moving on, the pre-NFP anxiety and an absence of the British traders may restrict USD/JPY moves. That said, US NFP for May, expected to ease to 325K versus 428K prior, as well as the US ISM Services PMI for May, likely to retreat from 57.1 to 56.4, will be crucial for clear directions. Also important to track will be US President Joe Biden’s speech.

Technical analysis

USD/JPY bounces off the 50-HMA inside an immediate bullish pennant chart formation.

In addition to the 50-HMA and bullish pennant, RSI conditions also suggest the USD/JPY pair’s further upside. However, a clear break of the 130.00 hurdle becomes necessary for the bulls to retake control.

On the contrary, the 50-HMA and the support line of the pennant pattern, respectively near 129.75 and 129.70, could challenge the pair’s pullback moves.

The Swiss National Bank (SNB) could wait to raise interest rates until September. In this case, CHF’s appreciation pressure should be softened, economists at Commerzbank report.

SNB assumes that elevated inflation is merely temporary

“So far, the SNB assumes that elevated inflation is merely temporary and that it will return to the target corridor in the medium term. If Governing Board members stick to the assessment that this is only temporary, this rather suggests that they will wait a while longer before raising their key rate.”

“The SNB could let the ECB take the first step and then follow suit in September – also in order not to exert additional appreciation pressure on the franc.”

Further upside could push AUD/USD to the 0.7340 region in the next weeks, suggested FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “We expected AUD to ‘consolidate and trade between 0.7150 and 0.7210’ yesterday. We did not expect the burst in volatility as AUD dropped to 0.7141 before lifting off and surged to a high of 0.7270. In view of the solid upward momentum, further AUD strength would not be surprising. That said, a sustained rise above 0.7300 is unlikely (next resistance is at 0.7340). Support is at 0.7245 followed by 0.7225.”