- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 06-06-2022.

- US Dollar Index grinds higher after positing the first weekly gain in three.

- US Treasury yields regain upside momentum following strong US NFP, hawkish Fedspeak.

- Increasing odds of September rate hike, mixed concerns allow DXY to stay firmer.

- Headlines from China, optimism ahead of ECB test greenback buyers before Thursday’s US CPI.

US Dollar Index (DXY) dribbles around mid-102.00s after a two-day uptrend, not to forget the first weekly jump in three, as traders seek fresh clues during Tuesday’s Asian session.

The greenback gauge’s latest run-up could be linked to the firmer Treasury yields. However, the market’s anxiety ahead of Thursday’s European Central Bank (ECB) monetary policy meeting and Friday’s US Consumer Price Index (CPI) for May seem to test the DXY bulls of late. Also challenging the greenback’s recovery are the recent positives from China.

Recently, China Securities Journal (CSJ) praised the country’s virus control and policy stimulus while expecting economic improvement in the second half (H2) of 2022. Previously, Beijing’s ability to overcome the pandemic and citing preparations to recover from the economic loss with faster unlocks joined US President Joe Biden’s likely easy stand for China, as far as showing readiness to remove Trump-era tariffs, seemed to have favored sentiment and tested the US dollar’s safe-haven appeal.

Even so, firmer US Nonfarm Payrolls (NFP) and the hawkish appearance of the Fedspeak’s last dose before the blackout norm favored the US Treasury yields to extend the first weekly gains in four, up by around 10 basis points (bps) to 3.04%. The same underpins the US Dollar Index run-up amid recently escalating hopes of a 0.5% rate hike during September, versus previously thin chatters surrounding the same.

That said, DXY traders should keep their eyes on the risk catalysts, as well as the US CPI and ECB, for clear directions. However, the US Goods and Services Trade Balance for the said month, forecast $-89.5B compared to $-109.8B previous readouts, can also direct short-term moves.

Technical analysis

Although the 50-DMA defends DXY bulls around 101.80, upside momentum needs validation from the 21-DMA surrounding 102.80 to aim for April’s top near 104.00.

- EUR/JPY has given an upside break of 140.96-141.16 range ahead of the ECB’s interest rate decision.

- To tame the roaring inflation, the ECB is likely to announce a rate hike.

- The eurozone GDP is seen unchanged while Japan’s annual GDP could tumble.

The EUR/JPY pair has imbalanced after displaying a balanced market profile in a narrow range of 140.96-141.16 in the Asian session. The cross is witnessing a sheer upside rally from the last week as investors are underpinning the shared currency bulls against the Japanese yen as a divergence in the European Central Bank (ECB) and Bank of Japan (BOJ) is expected to initiate sooner.

The ECB and BOJ have remained dedicated to an ultra-loose monetary policy in order to keep pushing the aggregate demand higher. Now, the ECB is expected to turn the wheel and may announce a rate hike on Thursday. Mounting price pressures amid ongoing tensions between Russia and Ukraine are forcing the ECB to dictate a rate hike in its monetary policy this week.

Apart from that, Eurostat will report the Gross Domestic Product (GDP) numbers on Wednesday. The quarterly and annualized figures are expected to remain unchanged at 0.3% and 5.1% respectively.

On the Tokyo front, the BOJ is gauging ways to elevate its inflation rate. The BOJ is continuously advocating a combination of wage hikes along with the price rise to keep inflation at desired levels. Going forward, investors’ focus will remain on the release of Wednesday’s GDP numbers. The annualized GDP is seen as stable at -1%, however, the quarterly GDP could tumble to -0.3% against the prior print of -0.2%.

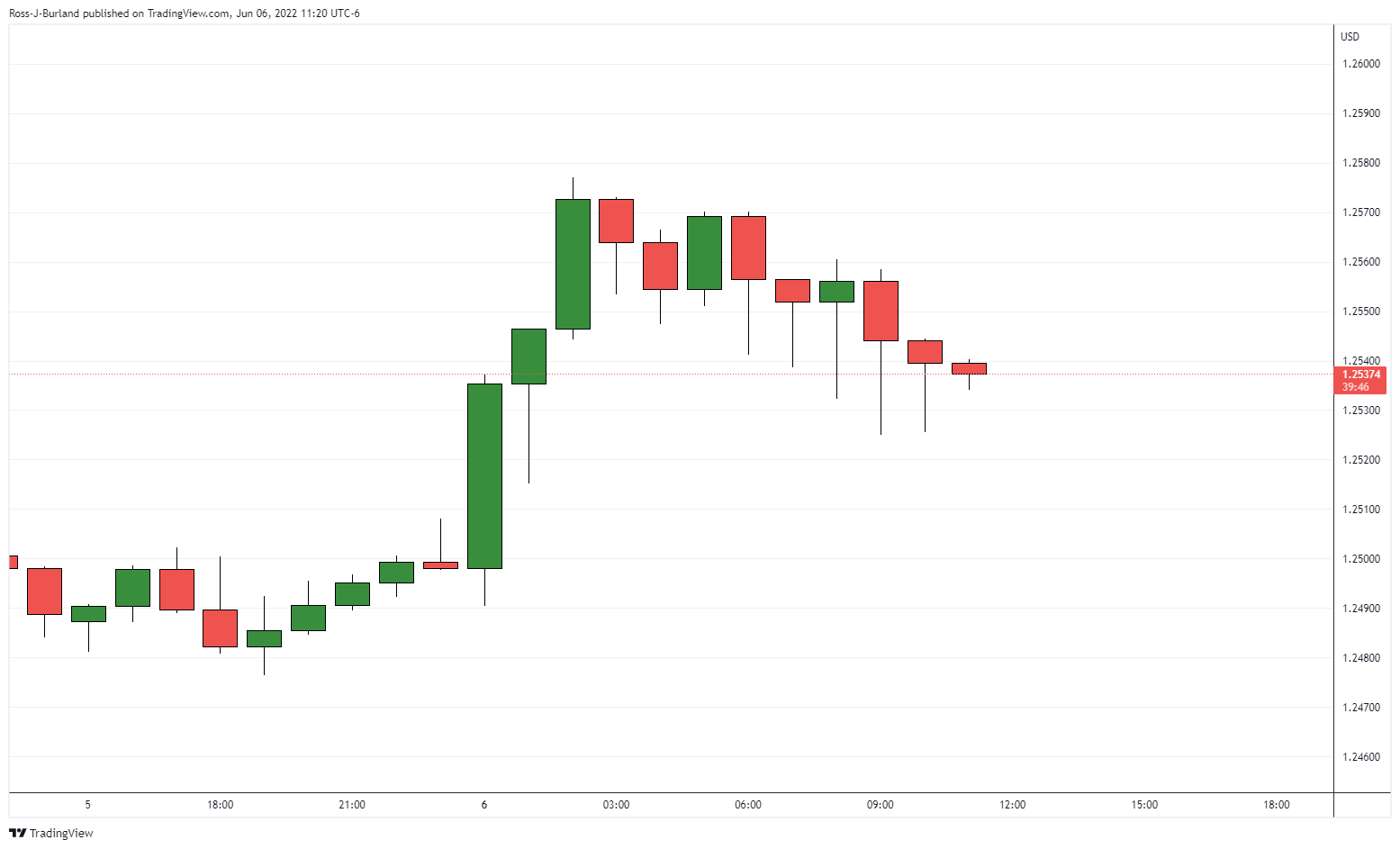

- USD/CAD struggles to defend buyers around seven-week low.

- Convergence of an ascending trend line from October 2021, support line of a three-week-old falling channel restricts immediate downside.

- RSI conditions challenge further downside, 200-DMA, bearish channel keep sellers hopeful.

USD/CAD pares a corrective pullback from a seven-week low of around 1.2580 during Tuesday’s Asian session.

In doing so, the Loonie pair portrays another failure to overcome the 61.8% Fibonacci retracement (Fibo.) of October 2021 to May 2022 upside, near 1.2590.

Also keeping USD/CAD bears hopeful are the bearish MACD signals and downward sloping RSI (14) line, not oversold.

It’s worth noting, however, that a limited downside gap for the RSI (14), before visiting the oversold territory, highlights the importance of the 1.2500 support confluence including an ascending support line from October 2021 and a lower line of a three-week-old descending trend channel.

Should the USD/CAD prices drop below 1.2500, the odds of its south-run towards the yearly low marked in April around 1.2400 can’t be ruled out.

On the contrary, the 200-DMA level surrounding 1.2665 restricts the pair’s recovery moves ahead of the stated channel’s upper line, near 1.2700 by the press time.

In a case where the USD/CAD pair remains firmer past 1.2700, it defies the bearish chart pattern and can brace for March’s high near 1.2900.

USD/CAD: Daily chart

Trend: Limited weakness expected

- NZD/USD is establishing below 0.6500 as investors are cautious over red-hot US inflation.

- The DXY is performing stronger on upbeat US NFP and higher forecasts for inflation.

- The RBNZ will reach its neutral rates faster than the other Western central banks.

The NZD/USD pair is displaying back and forth moves in a narrow range of 0.6485-0.6495 as investing community is focusing on the release of the US Consumer Price Index (CPI) on Friday. The kiwi bulls witnessed extreme selling pressure after failing to sustain above the critical resistance of 0.6530 on Monday.

A preliminary estimate for the US CPI is 8.2%, a little lower than the prior print of 8.3%. Despite the two rate hike announcements of 25 basis points (bps) and 50 bps by the Federal Reserve (Fed) in March and May’s monetary policies, the agency has failed to bring significant slippage in the annual inflation rate. The US annual inflation rate is stabilizing above 8%, which will keep declining the worth of the wallets of the US households.

Meanwhile, the US dollar index (DXY) is gearing up for further upside as the optimism on upbeat US Nonfarm Payrolls (NFP) has not faded yet. The DXY is oscillating in a 102.37-102.43 range and an upside break is expected going forward. Last week, the US labor agency reported the additional jobs generated in May at 390k, much higher than the expectations of 325k. This has underpinned the greenback against the antipodean.

On the kiwi front, the pace of hiking interest rates by the Reserve Bank of New Zealand (RBNZ) is much faster than other Western leaders. Therefore, the RBNZ will reach neutral rates sooner than other major central banks. It would be worth seeing whether the quick rate hikes by the RBNZ will perform the required job effectively or not.

- The USD/CHF marches firmly towards a renewed test of the YTD high, near parity.

- A strong USD and improved sentiment, a tailwind for the USD/CHF.

- USD/CHF Price Forecast: To face solid resistance around 0.9760, if it’s broken, would exacerbate an upward move towards 0.9900 and beyond.

The USD/CHF soars above the 0.9700 mark for the first time since May 23, gaining 0.86% on Monday. At the time of writing, the USD/CHF is trading at 0.9709 recording minimal gains of 0.01%, as Tuesday’s Asian session begins amidst a positive market mood.

A strong USD and improved sentiment, a tailwind for the USD/CHF

A risk-on market mood persists as the Asian session starts. On Monday, reports from China that Beijing was ready to lift restrictions was cheered by investors. Global equities rallied, and the greenback rose, underpinned by high US Treasury yields, sending five and 10-year Treasury yields above the 3% threshold for the first time since May.

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of six G10 currencies, advances 0.24%, sitting at 102.412.

The abovementioned factors were the reasons for the USD/CHF rallying sharply. On Monday, the major opened around 0.9620s, dipped to the daily low at 0.9605 (the confluence of the 20, 50, and 100-hourly simple moving averages (SMAs)), and surged without looking back, breaking on its way north, the June MTD high at 0.9658, and the 0.9700 mark.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is upward biased, though it would face some solid resistance if the pair re-tests the YTD highs around the parity. The Relative Strenght Index (RSI), at 53.40, crossed above the 50-midline and is aiming higher, supporting the previously mentioned scenario.

If that scenario plays out, the USD/CHF first supply area would be the May 20 daily high at 0.9764. A breach of the latter would expose the May 19 high at 0.9885, followed by the YTD high at 1.0007.

"Chinese economy is expected to improve in H2 2022," said China Securities Journal (CSJ).

more to come

- EUR/USD remains pressured for the third consecutive day.

- Hawkish Fedspeak, upbeat NFP renews bets on faster Fed rate hikes.

- Euro traders turn cautious ahead of ECB, with eyes on receiving clues for July rate lift.

- German Factory Orders, US goods trade numbers will decorate the calendar.

EUR/USD holds lower grounds near 1.0680 during Tuesday’s Asian, after two consecutive days of downturn, as mixed sentiment and firmer yields favored bears ahead of this week’s key data/events. The major currency pair witnessed an upbeat start of the week before the US Treasury yields recalled the US dollar buyers.

Global markets witnessed a dull start to the key week with holidays in Germany, France, New Zealand and Switzerland. However, the risk markets improved during the early Monday before taking a U-turn as the US markets opened.

The earlier optimism could be linked to Beijing’s ability to overcome the pandemic and citing preparations to recover from the economic loss with faster unlocks. On the same line was news of US President Joe Biden’s likely easy stand for China, as far as showing readiness to remove Trump-era tariffs.

On the contrary, firmer US Nonfarm Payrolls (NFP) and the hawkish appearance of the Fedspeak’s last dose before the blackout norm favored the US Treasury yields to extend the first weekly gains in four, up by around 10 basis points (bps) to 3.04% at the end of Monday’s North American session.

Amid these plays, the Wall Street benchmarks closed with mild gains whereas the US Dollar Index (DXY) rose for two consecutive days, around 102.30 by the press time.

Looking forward, the return of full markets and German Factory Orders for April, expected 0.5% versus -4.7% prior, can entertain EUR/USD traders ahead of the US Goods and Services Trade Balance for the said month, forecast $-89.5B compared to $-109.8B previous readouts.

It should be noted, however, that major attention will be given to Thursday’s European Central Bank (ECB) monetary policy meeting and Friday’s US Consumer Price Index (CPI) for May.

Also read: US yields soar ahead of this weeks closely watched US bond auction, oil lower on rare supply good news

Technical analysis

A three-week-old ascending trend line, around 1.0680, challenges EUR/USD sellers before directing the bears to the previous weekly low surrounding 1.0630-25. Recovery moves, however, need validation from a one-week-long downward sloping resistance line, close to 1.0755 by the press time.

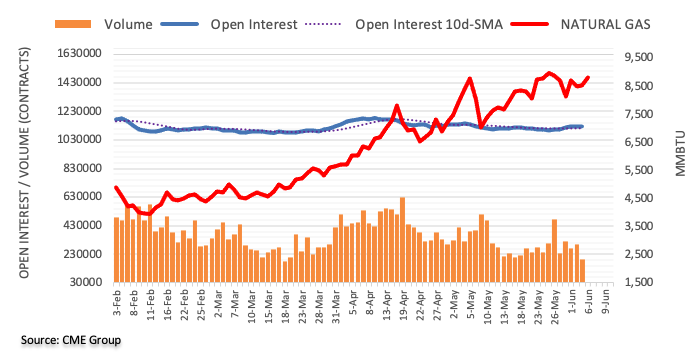

- Gold price is expected to register a vertical downside move after violating the critical support of $1,840.

- Higher-than-expected US NFP has bolstered gold bears as Fed’s rate hike announcement looks imminent.

- The Fed is highly focused to tame the inflation pressures.

Gold price (XAU/USD) is oscillating in a minor range of $1,840.70-1,842.60 in early Tokyo after an initiative selling structure. The precious metal witnessed a sheer downside move after experiencing a significant selling pressure from Monday’s high near $1,858.00. A pullback move towards $1,858.00 was capitalized by the market participants for initiating fresh shorts on the counter.

The deadly duo of upbeat US Nonfarm Payrolls (NFP) and higher expected US inflation is keeping the luster of the bright metal in check. Last week, the US economy reported the number of generated employment opportunities in May at 390k, significantly higher than the expectations of 325k. While the Unemployment Rate remained stable at 3.6%. A tight labor market in the US and its ability to multiply job opportunities has delighted Federal Reserve (Fed) policymakers. The agency could continue its rate hike announcements with affordable barricades.

The US Bureau of Labor Statistics is expected to report the annual inflation figure at 8.2, a little lower than the former figure of 8.3%. Mounting inflationary pressures are denting the real income of households and expectations of a consecutive jumbo rate hike by the Fed are soaring vigorously.

Gold technical analysis

On an hourly scale, Gold spot (XAU/USD) is on the verge of displaying a breakdown of an Inverted Flag, which will keep the gold bears on the driving seat. The 50- and 200-period Exponential Moving Averages (EMAs) are an inch far from displaying a death cross at $1.851.45. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which signals a continuation of the downside move by the precious metal further.

Gold hourly chart

- AUD/JPY grinds higher at six-week top after crossing a horizontal hurdle since late March.

- Bullish MACD, resistance break directs buyers towards the yearly peak but RSI has limited room before turning overbought.

- RBA is likely to hike the benchmark interest rate by 25 basis points (bps).

AUD/JPY edges higher around the highest levels since late April, after crossing the 2.5-month-old horizontal hurdle. That said, the cross-currency pair dribbles near 94.90 as traders prepare for the Reserve Bank of Australia’s (RBA) second rate hike, widely expected to be of 0.25%.

Also read:

In addition to the pair’s successful break of horizontal resistance, now support around 94.30-40, bullish MACD signals also keep AUD/JPY buyers hopeful.

However, the RSI (14) speedily approaches the overbought territory, suggesting limited upside room for the AUD/JPY prices.

Hence, the pair’s run-up beyond the yearly peak of 95.75 appears difficult, unless the RBA offers a major positive surprise.

Should the quote manage to rise past 95.75, its run-up towards the May 2015 high surrounding 97.30 can’t be ruled out.

Meanwhile, pullback moves need to break the 94.30 support to convince sellers. Even so, 50-DMA and an ascending support line from May 12, respectively around 92.10 and 91.60, could challenge the AUD/JPY bears.

Following that, the pair sellers may aim for the 90.00 psychological magnet ahead of challenging the 38.2% Fibonacci retracement of December 2021 to April 2022 upside, around 89.30.

AUD/JPY: Daily chart

Trend: Limited upside expected

- The pound has found buyers at a 61.8% ratio as the UK PMs survive a confidence vote.

- For now, the PM is in office, but there are questions over his leadership on a poor outcome in the vote.

- A break of the 61.8% ratio could lead to a restest of the support structure ahead of a run below 1.2500 through to 1.2350.

At 1.2530, GBP/USD is starting out resting at hourly support on the Fibonacci scale, coming in close to the 61.8% golden ratio. This is following a slide overnight as UK political tensions combined with US dollar strength digs into long spot positioning

Sterling bulls moved in to support the currency around a confidence vote on Monday after a growing number of lawmakers in Boris Johnson's Conservative Party questioned the British leader's authority over the "partygate" scandal.

As Reuters reported, ''a majority of the 359 Conservative lawmakers - at least 180 - would have to vote against Johnson for him to be removed, a level some Conservatives have said might be difficult to reach given the lack of an obvious successor. A Reuters count showed at least 169 British lawmakers from Johnson's Conservative Party had publicly indicated support for him ahead of the vote.''

The outcome left the PM at the helm but the vote proves that he has little support from within his own party which hangs like danger on a rope over his leadership. Johnson won the support of 211 MPs but 41% of his party voted to get rid of him. It was the worst verdict on a sitting prime minister by their own party in recent times.

Meanwhile, the US dollar gained against a basket of major currencies on Monday as risk appetite waned from earlier levels. After touching a near 20-year high of 105.01 on May 13, the US dollar index (DXY) was pulling itself up in the bull's commitment from around the 102 level.

Friday's strong Nonfarm Payrolls report helped the currency to recover as traders now count down to the Federal Reserve's policy announcement on June 15, in which the central bank is widely expected to raise rates by 50 basis points. Ahead of that, investors will look to Friday's reading on Consumer Price Index for signs of how long the Fed may continue its rate hike path.

GBP/USD technical analysis

The price on the H4 chart is leaning bearish. A break of the 61.8% ratio could lead to a restest of the support structure. A break of there opens the prospects for a run below 1.2500 and towards 1.2350 for the days ahead.

- AUD/USD holds around the critical support of 0.7190 ahead of RBA’s policy.

- An announcement of a rate hike by 25 bps is expected from the RBA.

- The US inflation is expected to sustain above 8% despite continuous rate hikes by the Fed.

The AUD/USD pair is gauging acceptance near the crucial support of 0.7190 in the Asian session. Investors are awaiting the announcement of the interest rate decision by the Reserve Bank of Australia (RBA) for further guidance, which is due in the European session

Considering the inflationary pressures and subdued employment status in aussie region, RBA Governor Philip Lowe is expected to dictate a hawkish stance on the Official Cash Rate (OCR). As per the market consensus, a rate hike by 25 basis points (bps) should be featured by the RBA.

Taking into account the inflation rate of 5.1% recorded in the first quarter of CY 2022, the RBA should tighten the policy beyond the standard figure of 25 bps. However, the inability to generate sufficient employment opportunities could be dampened further by an extremely tight monetary policy. Therefore, an interest rate hike by a quarter to a percent looks optimal.

On the dollar front, the US dollar index (DXY) is juggling around 102.40 after a sheer upside move from Monday’s low at 101.85. Going forward, investors’ focus will remain on the US Consumer Price index (CPI) data. A preliminary estimate for the annual CPI figure is 8.2% against the prior print of 8.3%. It is worth noting that despite the continuous elevation of interest rates by the Federal Reserve (Fed), price pressures are holding themselves above the 8% figure, which raises concerns over the confidence of the consumers in the US economy.

- The GBP/JPY begins the week on a higher note, up by 1.15%.

- The GBP/JPY rallies courtesy of a positive mood and an ultra-dovish Bank of Japan (BoJ).

- GBP/JPY Price Forecast: The pair is upward biased and would climb towards 167.00, before consolidating.

GBP/JPY soars for the eighth straight day and registers a fresh five-week high, above the 165.00, a level last seen since April 25. At 165.24, the GBP/JPY rallies as the Asian Pacific session is about to begin, up by 1.13%, due to a positive market mood and the Japanese yen weakness.

Sentiment and an ultra-dovish Bank of Japan (BoJ), propelled the GBP/JPY up

Alongside the aforementioned, Beijing’s lifting of restrictions was cheered by market players. Also, Bank of Japan (BoJ) board members, led by Governor Haruiko Kuroda, reiterated the ultra-dovish stance and maintained a weak yen. He emphasized that the BOJ will be unwavering in its posture of maintaining monetary easing to ensure the recent rise in inflation expectations lead to a sustained price increase.

Hence, the GBP/JPY continued surging since May 12, when the GBP/JPY began its 900-plus pip rally from 155.50s towards 165.20s.

GBP/JPY Price Forecast: Technical outlook

The cross-currency pair is upward biased from the GBP/JPY’s daily chart perspective. Confirmation of the previously-mentioned is the daily moving averages (DMAs) below the exchange rate, alongside the RSI at bullish territory, aiming higher. Additionally, an inverted head-and-shoulders formed, which targets 167.00, as measured from the May 12 swing low 155.58, to the neckline around 162.20.

Therefore, If that scenario plays out, the GBP/JPY’s first resistance would be the June 6 high at 165.57. Break above would expose the 166.00 mark. Once cleared, the next supply zone would be the inverted head-and-shoulders target at 167.00.

- USD/JPY bulls run into resistance and the hourly retracement is underway.

- It is a big week or two on the calendar for the pair.

At 131.88, USD/JPY is higher towards the close on Wall Street by some 0.8%. The pair has rallied from a low of 130.42 to score a high of 132.01. There are no Japanese data scheduled for release on Monday nor has there been anything key in the way of data for the US at the start of the week. Nonetheless, there is a busy schedule ahead for the pair.

Japanese inflation data will be released on Friday while the Bank of Japan meets on June 16-17 and is expected to maintain its ultra-low interest rate regime to boost growth further. Meanwhile, the markets are digesting the May employment report that had been released on June 3 and will now look to the release of the May Consumer Price Index on June 10 ahead of the Federal Reserve later in the month.

The employment data were mixed, with a solid gain in payrolls, a steady Unemployment Rate near pre-COVID lows, but a smaller increase in hourly earnings. Overall, the Federal Open Market Committee is unlikely to be veered away from an expected 50-basis point rate increase at their meeting on June 15-16.

Additionally, while the release of the consumer price index on Friday is unlikely to switch the direction of the board member's thinking, it could still have an impact on the market as investors try to second guess the Fed's trajectory down the line for the future path of rate increases.

In other data this week, international trade for April will be released on Tuesday, while Wholesale Inventories for May on Wednesday followed by Initial Jobless claims on Thursday will be important as will the Preliminary Michigan Sentiment index for June on Friday.

We are in a blackout period ahead of the Fed, so there will be no Federal Reserve officials speaking.

USD/JPY technical analysis

What you need to take care of on Tuesday, June 7:

The market sentiment changed from optimism during Asian trading hours to pessimism during US ones. The early good mood was backed by hopes that the global economic situation would start improving after Beijing continued lifting coronavirus-related restrictions.

The sentiment turned south with Wall Street's open, as investors fear the US Federal Reserve will maintain its aggressive momentary policy, which will boost the chances of a recession in the country. The upbeat Nonfarm Payrolls report released last Friday underpinned such speculation.

US Treasury yields soared, with the yield on the 10-year note yielding as much as 3.04%.

The American dollar started the day on the back foot but strengthened in the second half of the day, ending the day with gains against all of its major rivals.

The EUR/USD pair is sub-1.0700, although action around it was limited by a holiday in Europe. GBP/USD trades around 1.2530 after UK Prime Minister Boris Johnson's confidence vote. 211 Conservatives voted in favor of Johnson, while 148 said they had lost confidence in the PM.

Commodity-linked currencies trimmed early gains and settled around their opening levels, with AUD/USD hovering around 0.7200 and USD/CAD trading around 1.2580.

Safe-haven assets were among the worst performers. Gold is down to trade around $1,841 a troy ounce, while USD/JPY reached a fresh multi-year high of 132.00, now a handful of pips below the level. The USD/CHF pair is up to 0.9705.

Crude oil prices edged lower, with WTI now trading at $118.20 a barrel.

The Reserve Bank of Australia takes centre stage as it will announce its monetary policy decision early on Tuesday.

Like this article? Help us with some feedback by answering this survey:

The ballot of the Uk's Primminster Confidence Vote was held on Monday after the threshold of 54 letters was submitted to the 1922 Committee of Tory backbenchers.

359 ballots cast, vote in favour in having confidence in favour was 211 vs.148 said, this is a majority of just 63, a disappointing result.

He is now immune for a year before another confidence vote can be called but his leadership is now in jeopardy giving Boris Johnson plenty of food for thought. Some speculate that he will resign, although he has previously said that he will not.

GBP is unchanged on the vote within a corrective phase vs. the US dollar which is firm in the US session:

(GBP/USD four-hour chart)

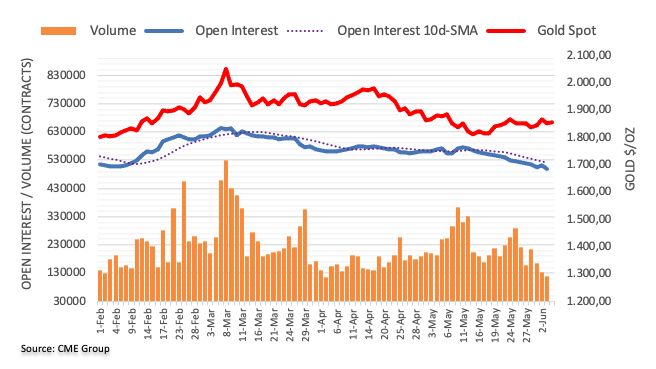

- Gold begins the week with losses of close to 0.50%.

- US Treasury yields and an upbeat sentiment weigh on the yellow metal.

- Gold Price Forecast (XAU/USD): Neutral biased, though a daily close below the 200-DMA might open the door for additional losses.

Gold spot (XAU/USD) is tumbling, weighed by rising US Treasury yields and an upbeat mood, as Federal Reserve officials begin their blackout period ahead of June’s monetary policy meeting. At $1842.02, the XAU/USD reflects the aforementioned, in a critical week regarding the US economic calendar, revealing inflation figures for May.

US Treasury yields and an upbeat sentiment weigh on the yellow metal

Sentiment remains positive courtesy of China’s easing of coronavirus restrictions and after an upbeat US employment report on Friday, as reflected by global equities registering gains. Also, China’s Caixin PMIs readings in Services and Composite, even though remaining in contractionary territory, were better than foreseen.

Hence, XAU/USD prices have been under pressure since the beginning of Monday’s trading session. Additional to US Treasury yields rallying, led by the 10-year benchmark note rate at 3.032%, almost ten bps up, the greenback remains positive in the day. The US Dollar Index climbs 0.27%, sitting at 102.448.

In the meantime, the last Fed speaker of the previous week, before the June meeting blackout, San Francisco’s Fed President Mary Daly, said that “I’m going to come into that September meeting, and if I don’t see compelling evidence (of lower inflation), then I could easily be a 50 bp in that meeting as well. There’s no reason we have to make that decision today, but my starting point will be do we need to do another 50 or not.”

She sounded more hawkish than foreseen, as some Fed policymakers expressed that the central bank might “pause” to assses economic conditions in September. For the new Fed Vice Chair Lael Brainard, that is not an option, as she pushed back on that last Thursday, saying that “it’s very hard to see the case for a pause.”

Therefore, the Federal Reserve is headed for back-to-back 50 bps rate hikes meetings in June and July. September is open, and we could see the first split in rate increases, some leaning towards 25 bps and the others remaining in the 50 bps pace unless the Fed’s Chair Jerome Powell convinces the committee.

The US economic docket would feature April’s Balance Trade, Initial Jobless Claims, the May Consumer Inflation report, and the UoM Consumer Confidence in the week ahead.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD remains upward biased though it is threatening to break below the 200-day moving average (DMA) at $1841.82, which would open the door for further losses. Additionally, in bearish territory, the Relative Strength Index (RSI) is aiming lower but far from reaching oversold conditions.

That said, the XAU/USD path of least resistance in the near term is neutral. Upwards, the XAU/USD’s first resistance would be the 200-DMA at $1841.82. Break above would expose the June 6 high at $1857.76, followed by the June 3 swing high at $1874, shy of March’s lows-turned-resistance at $1889.91. On the flip side, the XAU/USD’s first support would be June 1 low at $1828.33. A breach of the latter would expose the $1800 mark, followed by the May 16 cycle low at $1786.50.

- AUD/JPY awaits the outcome of the confidence vote of UK PM.

- The RBA will be the next major events for the cross.

At 94.83, AUD/JPY is higher on the day as risk sentiment largely stays on positive ground. The focus for the near term will also be on the Reserve Bank of Australia. AUD/JPY is 0.62% higher and has rallied from a low of 93.76 and has reached 94.99 the high of the day so far.

There were no major economic data released Monday and AUD/JPY is aligned to the stock market which in recent trade has started to tail off, dragging the cross in a meanwhile correction to the downside with it.

US stocks were drifting away from their earlier gains Monday that followed an overnight advance for Chinese technology stocks amid signs of easing regulatory scrutiny at home. The Dow Jones Industrial Average was fractionally higher, S&P 500 increased 11 points, or 0.27% and Nasdaq added 34 points or 0.38% by the time of writing.

In other world markets, Japan's Nikkei closed 0.6% higher, Hong Kong's Hang Seng gained 2.7%, and China's Shanghai Composite added 1.3% higher. Meanwhile, Germany's DAX index added 1.3% and the FTSE 100 rose 1.0% ahead of a scheduled no-confidence vote later Monday by members of the ruling Conservative party in parliament on Boris Johnson's continued tenure as UK prime minister. Results are due at 9 pm London time, at the top of the hour. The outcome could make for volatility in forex and AUD/JPY tends to move lower at times of risk-off.

RBA in focus

Looking ahead, there will still be considerable tension around the RBA decision on Tuesday. Analysts at Westpac expect a ''40bp increase in the cash rate to 0.75%, but forecasters are very divided – about half expect 25bp and the rest are split between 40bp and a handful for 50bp. Market pricing is skittish around +30-35bp.''

''The wording of the statement will also be closely noted, though there will not be new forecasts until August,'' the analysts argued. ''The RBA Board is unlikely to have been very surprised by the Q1 GDP data. Growth of 0.8%qtr, 3.3%yr seems decent at first glance but the details showed reliance on inventory build-up and consumers running down savings. Westpac looks for better data in Q2 and Q3 2022 but overall, Australia’s economic outlook appears weaker, especially around housing construction. We have lowered our forecast for the 2022 GDP growth rate from 4.5% to 4.0%, and 2023 from 2.5% to 2.0%.''

AUD/JPY technical analysis

The price is meeting a key resistance and the breakout area is illustrated as being either above or below the support and reistsnace structures.

- EUR/USD bulls have thrown in the towel on a longer-term basis.

- However, there could be some meanwhile upside in an immanent correction.

As per the prior multi-timeframe analysis, EUR/USD Price Analysis: Bulls take on bears in critical resistance area, the price is melting to the downside following a typical failure at resistance as follows:

EUR/USD prior analysis, daily and H4 charts

EUR/USD live market

As illustrated on these daily and 4-hour updates in the live market, the price has followed the projected trajectory to the downside.

At this juncture, some stalling in the downside has taken place but the bears remain in control. That being said, there are prospects of a retest of the prior support as follows:

A correction of this current bearish leg could currently target a 38.2% Fibonacci level that falls in based on the current lows of the impulse at 1.0710.

- The EUR/GBP begins the week with robust losses of 0.47%.

- Risk-appetite increases, weighing on the low-yielder euro and boosting risk-sensitive currencies.

- EUR/GBP Price Forecast: The daily chart depicts a bullish flag formed, eyeing a break above 0.8700.

The EUR/GBP slashes Friday’s gains on Monday and aims towards the 0.8500 mark after reaching a daily high near 0.8590s, though retracing on a buoyant market mood as global equities record gains. At the time of writing, the EUR/GBP is trading at 0.8530, losing 0.47%.

Upbeat sentiment weighed on the EUR/GBP

Positive news from China lifted investors’ spirits. Beijing relaxed Covid-19 restrictions, increasing the speculation that it would help abate the supply-chain pressures. However, the Ukraine-Russia conflict remains in the backdrop, and further escalation and extension of hostilities are set to keep global inflation high.

Meanwhile, the EUR/GBP cross-currency pair retreated from last week’s highs near 0.8580s, dipping towards the 0.8530 area, on an increased appetite for risk-sensitive currencies, like the British pound.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP remains upward biased, despite Monday’s retracement. However, the cross-currency would face solid resistance at around 0.8600, a level last traded on May 12, which sparked a correction towards highs of 0.8390s, before resuming the uptrend towards 0.8590s. EUR/GBP traders need to be aware that volatility shrank, and the EUR/GBP formed a bullish flag, which would open the door for further gains. Nevertheless, the cross would consolidate in the 0.8500-0.8600 area before aiming toward fresh YTD highs above 0.8700.

Therefore, the EUR/GBP's first resistance would be the YTD high at 0.8618. Break above would expose the September 29 high at 0.8658, followed by the 0.8700 mark, and then the April 21 swing high at 0.8719.

The Reserve Bank of Australia (RBA) is set to announce its next policy decision on Tuesday, June 7 at 04:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming central bank's decision.

The RBA is expected to hike the cash rate for a second consecutive month. Market participants are split on whether the central bank will pull the trigger by another 25 bps or if it will go with a 40 bps upswing.

ANZ

“We expect the RBA to raise the cash rate by 40 bp. The RBA could confound us all and decide to go by 50 bp, but we think the fact a 40 bp move was discussed in May makes it a more likely choice. More than 50 bp seems unlikely given that the RBA meets monthly. We can’t rule out the RBA sticking with a cautious approach and tightening by 25 bp, but with policy still exceptionally stimulatory we think a bigger move of 40 bp is more likely.”

OCBC

“We have expected the RBA to deliver a 40 bp hike at one of the upcoming meetings, which will bring the policy rate level back to a multiple of 25 bp. As the RBA is already behind the curve, this expected 40 bp hike will probably arrive sooner rather than later, at the June MPC meeting.”

Standard Chartered

“We expect the central bank to hike rates steadily by 25 bps through the year. The key question is whether the RBA may hike by more than 25 bps. We favour a 25 bps move as the May hike was already pre-emptive. In addition, the RBA has a meeting every month (except January), which offers more room for it to hike rates in a more calibrated manner, particularly considering that it has been cutting rates since 2011 and a more measured adjustment may avoid unlimited volatility for households and companies as they adjust to higher interest rates.”

Westpac

“Immediately following the Board’s decision to raise the cash rate by 25 basis points in May we argued that the correct policy decision for June 7 would be to raise the cash rate by a further 40 bps. By lifting the cash rate by 40 bps from 0.35% to 0.75%, the Board would be fully unwinding the emergency rate cuts we saw in 2020 during the Covid crisis. Clearly, that emergency has passed and there is no justification to maintain an extreme emergency policy stance. We believe that the Board will make that correct decision.”

Danske Bank

“We expect the RBA to continue its hiking cycle with another 25 bps hike, but following recent 50 bps hikes by the Fed, Bank of Canada and the RBNZ, risks are tilted towards a larger hike also in Australia.”

TDS

“The risks to inflation lean towards the upside and we expect the RBA to hike by 40bps to address this. With the economy on a stronger footing, we think the RBA can afford to take larger policy steps to tame inflation.”

UOB

“We recognise that a 40 bps hike at this meeting is a close call, but this is not our base case. We see the RBA hiking by 25 bps to 0.60% in June, and for now, another 65bps in the remainder of 2022, which would bring the OCR to 1.25% by year-end. Further out, we look for the OCR to rise over 2023 and 2024, reaching 2.50% by the end of our forecast period.”

SocGen

“We expect the RBA to increase the cash rate target from 0.35% to 0.60%. The RBA is likely to continue to say that it is committed to doing what is necessary to ensure that inflation returns to target over time, which suggests that the policymakers are in the process of monetary policy normalization. The RBA will likely maintain its upbeat outlook on economic growth and labour market, as well as reiterating its concerns about rising inflation that is increasingly driven by domestic capacity constraints.”

Britain’s prime minister, beset by a scandal over lockdown parties, faces a decisive vote on Monday evening London time.

Conservative lawmakers have handed out to the PM Boris Johnson a potentially lethal blow to his leadership as they have triggered a no-confidence vote which could force him from his position as leader of the government a little more than two years after his landslide election victory.

After some distraction with the Ukraine way and a distraction from UK politics, the claims that Mr Johnson misled Parliament about lockdown-breaking parties held at Downing Street at the height of a coronavirus pandemic have resurfaced again.

It is reported that at least 145 UK conservative lawmakers publicly back Boris Johnson as the confidence vote begins, a Reuters tally shows.

Tory MPs have two hours to cast their votes in Parliament, and the result will be announced an hour after that, at 9 p.m. local time.

Market implications

This is unsettling for UK markets and the British pound which is sinking vs. the US dollar and could turn out to be fragile vs. the euro depending on the outcome.

GBP/USD H1 chart

- The AUD/USD begins the week losing 0.10%, ahead of RBA’s decision and US inflation figures.

- An upbeat market mood was no excuse for the greenback to rise, propelled by the US 10-year yield above 3%.

- Reserve Bank of Australia Preview: Rate hikes are here to stay

- AUD/USD Price Forecast: Trendless ahead of the RBA’s meeting.

The Australian dollar slides below 0.7200, erasing earlier gains after reaching a daily high at 0.7231, despite an upbeat market mood ahead of the Reserve Bank of Australia (RBA) rate decision. At the time of writing, the AUD/USD is trading at 0.7197

A risk-on mood surrounds the financial markets. Global equities are registering gains, a consequence of China’s easing Covid-19 restrictions, and Caixin PMIs Services and Composite, which showed the world’s second-largest economy, appears to be founding a bottom despite slowing down.

Meanwhile, the US Dollar Index, a measurement of the greenback’s value, erases some earlier losses and remains to gain some 0.19%, sitting at 102.360, underpinned by elevated US Treasury yields. The 10-year benchmark note rate is at 3.025%, gains eight and a half bps, as investors assess the Federal Reserve’s pace of tightening.

The latter factor is the main reason for the AUD/USD fall. Despite the Reserve Bank of Australia (RBA) 25 bps hike, widely expected on Tuesday, June 7, market players had already priced in the increase. However, don’t discount the chance of a 40 bps rate hike.

TD Securities analysts wrote that “the risks to inflation lean towards the upside and we expect the RBA to hike by 40bps to address this. Average hourly earnings from the national accounts showed further gains in Q1 and points to an acceleration in wages growth which will pressure inflation higher.”

“With the economy on a stronger footing, we think the RBA can afford to take larger policy steps to tame inflation,” analysts noted.

Also read: Reserve Bank of Australia Preview: Rate hikes are here to stay

Additionally to the RBA monetary policy decision, the Australian economic calendar would feature the Building Permits and the AI Group Services Index.

In the case of the US, ISM PMIs were mixed but stayed above the 50-midline, displaying that the economy is cooling but not in recessionary territory. Additionally, May’s Nonfarm Payrolls report was better than foreseen, further cementing the case for the Federal Reserve hike in the June meeting.

AUD/USD Price Forecast: Technical outlook

The AUD/USD tumbled below the 200-DMA at 0.7255 after trading above it for just one trading session in the last week. It is worth noting that during the day, AUD/USD buyers lifted the pair towards the 100-DMA at 0.7227, though they did not have the force to break resistance, and the AUD/USD dipped towards the session lows at 0.7187. Since then, the major remains seesawing with no clear direction ahead of the RBA’s monetary policy meeting.

Upwards, the AUD/USD’s first resistance would be the 50-DMA at 0.7220. Once cleared, the next resistance would be the 100-DMA at 0.7227, followed by the trend-setter 200-DMA at 0.7255. On the other hand, the major’s first support would be June’s 2 low at 0.7140. Break below would expose February’s 24 daily low at 0.7094, closely followed by the 20-DMA at 0.7073.

Key Technical Levels

Analysts at Wells Fargo expect a more extended series of 50 basis points interest rate increases from the Bank of Canada (BoC) to be delivered at the July, September and October meeting. They see risks tilted towards a stronger Canadian dollar than their existing USD/CAD exchange rate target of 1.2500.

Key Quotes:

“The solid growth and rapid inflation trends prompted a second straight 50 bps rate hike from the Bank of Canada (BoC) at its June meeting, along with a forceful statement in which the central bank said it is willing to act more forcefully if needed.”

“We now expect a more extended series of 50 bps rate increases to be delivered at the July, September and October announcements. We see the BoC's policy rate ending 2022 at 3.25%, and peaking at 3.75% in 2023.”

“The solid Canadian growth outlook and aggressive central bank tightening means the outlook remains, in our view, for a resilient Canadian dollar. Indeed, given recent gains the Canadian dollar is already approaching our medium-term USD/CAD exchange rate target of CAD1.2500. We clearly see the risks as tilted towards further Canadian dollar gains over time, perhaps to the lower end of a CAD1.2000-1.2500 range.”

The pound is among the top perfomers on Monday and EUR/GBP dropped below 0.8550, on the day PM Boris Johson will face a confidence vote. According to analysts from Rabobank whether or not Johnson remains in his place, “GBP investors will be hoping it will clear the air and allow government to move on with the job in hand”.

Key Quotes:

“GBP is the best performing G10 currency on a 1 day view as the news of a confidence vote in PM Johnson gives way to hope that UK politics could be on the bring of pushing beyond scandal and distraction.”

“The Tory party did not perform well at last month’s local elections and there is speculation that two approaching by-elections could further highlight voter dissatisfaction with the government.”

“While the pound has found some support this morning on the hope that today’s confidence vote could clear the air and result in more directional leadership for the UK government, we see GBP as still undermined by UK fundamentals. Insofar as the UK has a current account deficit, the GBP is more likely to be sensitive to a perceived deterioration in economic fundamentals that it would be otherwise. EUR/GBP has never returned to its pre-Brexit referendum levels and the softer pound since mid-2016 tallies with the weak investment data in that period. We retain a 3 month forecast of EUR/GBP0.86.”

- US dollar rises across the board amid higher US yields.

- USD/JPY extends gains to levels not seen in two decades.

- Stocks trim gains on Wall Street; however, the yen remains under pressure.

The USD/JPY broke above 130.80 and jumped to 131.68, reaching levels not seen since April 2002. The pair remains near the top, holding onto important daily gains.

US Treasury yields wake up

The dollar rose across the board during the American session, ending hours of quiet trading. The DXY is up by 0.15% after trading most of the day in negative territory. The yen is among the worst performers.

The key drivers in price action are US yields. Treasuries are falling sharply, with the 10-year yield reaching 3.04%, the highest since May 12. Stock in Wall Street moved off highs. The S&P is up by just 0.22% after opening with a gain of more than 1%.

The Federal Reserve is likely to remain on its aggressive tightening path after Friday’s NFP. Job numbers came in slightly above expectations. The May CPI inflation report on Friday will be the highlight of the week of US data. Due to the media blackout ahead of the June 14/15 FOCM meeting, there are no Fed speakers this week.

If yields continue to move higher, the USD/JPY will likely follow. The next target could be seen at the 132.00 area. On a long term perspective, the next critical level is the 2002 high at 135.16. A decline back under 130.70 should alleviate the bullish momentum, suggesting some exhaustion.

Technical levels

- The USD/CAD begins the week on a lower note, down by 0.13%.

- The Canadian 10-year bond yield reached a 52-week high, a headwind for the USD/CAD.

- USD/CAD Price Forecast: To further extend its losses if it remains below 1.2700.

The USD/CAD slid to fresh two-month lows near 1.2535 in the North American session as sellers target a challenge to the YTD lows, while the 10-year Canadian bond rate rises to a 52-week high at 3.171%. However, at 1.2576, the USD/CAD recovers some ground, though stills reflects the market’s appetite for riskier assets while safe-haven peers fall.

Risk-on mood and a soft USD headwind for the USD/CAD

The sentiment is positive due to China’s easing of coronavirus restrictions and after an upbeat US employment report on Friday, as reflected by global equities registering gains. Furthermore, China’s Caixin Services and Composite PMIs, were better than expected, though they remain and contractionary territory but easied worries of the second-largest economy’s further slowdown. The Loonie rises as a consequence, despite WTI’s fall, by 0.05%, exchanging hands at $118.78 per barrel.

In the meantime, the US Dollar Index, a gauge of the buck’s value, remains above 102.000 but erases some of Friday’s gains, down 0.04%, sitting at 102.123. Contrarily to the aforementioned, US Treasury yields climb to a four-week-high, at 3.025%, as investors assess the Federal Reserve’s pace of tightening.

In the previously-mentioned, the San Francisco Fed President Mary Daly said that “I’m going to come into that September meeting and if I don’t see compelling evidence (of lower inflation), then I could easily be a 50 bp in that meeting as well. There’s no reason we have to make that decision today, but my starting point will be do we need to do another 50 or not.”

Last week, the Bank of Canada delivered a 50 bps rate hike as widely expected, lifting rates to the 1.50% threshold. Also, the statement was more hawkish than anticipated, according to TD Securities analysts on a note, as the central bank said it was “prepared to act more forcefully if needed.”

Data-wise, an absent Canadian and US economic docket keeps investors assessing last week’s data. On the Canadian front, Q1 GDP surprised to the downside, in part due to weaker exports. However, the S&P Global PMIs rose in the manufacturing index.

In the case of the US, ISM PMIs were mixed but stayed above the 50-midline, displaying that the economy is cooling but not in recessionary territory. Additionally, May’s Nonfarm Payrolls report was better than foreseen, further cementing the case for the Federal Reserve hike in the June meeting.

USD/CAD Price Forecast: Technical outlook

The USD/CAD tumbled below the 1.2540 mark, but in the last minutes, it bounced off two-month lows and trades above the June 2 lows at 1.2564. Despite the major’s uptick, USD/CAD traders need to be aware that the major’s bias is tilted to the downside, as the daily moving averages (DMAs) remain above the exchange rate, albeit directionless, and the RSI’s remain in negative territory, pushing lower.

Therefore, the USD/CAD first support would be June’s 6 low at 1.2535. Break below would expose the June 25 low at 1.2458, followed by the YTD low at 1.2402.

- US dollar soars boosted by Treasury yields.

- XAU/USD under pressure, likely to test 1840$.

- Wall Street posts gains, off highs.

Metals pulled back sharply during the American session amid a stronger US dollar and higher Treasury yields. Gold dropped to $1841, reaching the lowest level since Wednesday.

Gold resumes slide

XAU/USD reached a daily high after the beginning of the American session at $1857 and then turned to the downside, resuming the decline that started on Friday from levels above $1870.

Price remains near the lows, with gold under pressure, testing the $1840 support zone. A break lower could trigger more losses targeting the $1830 area (interim resistance at $1837). A recovery above $1850 could alleviate the bearish pressure.

The slide accelerated as US yields jump. The US 10-year yield rose from 2.94% to 3.04%, reaching the highest since May 12, and the 30-year yield hit 3.19%. Treasuries started to slide after the release of the US employment report on Friday. The figures reduced fear about a recession, leaving doors open to the Fed to tighten policy aggressively.

The key report for the week is US inflation on Friday. Next week will be the FOMC meeting, until then markets won’t hear Fed members (blackout period). CPI numbers will likely influence Fed expectations.

Technical levels

- WTI hit fresh three-month highs near $121 earlier in the session, but has since pulled back to the $118s.

- Oil prices were initially boosted on Monday amid a Saudi hike, China lockdown easing and following last week’s OPEC+ meeting.

Having at one point come within a whisker of hitting the $121 per barrel mark earlier in the day and, in doing, having hit fresh three-month highs, front-month WTI futures have waned in recent trade. WTI was last trading in the $118s and down about $1.50 on the session, with the boost from this weekend’s news about the Saudis upping their Official Selling Price (OSP) to large Asian customers having now faded.

But WTI is still trading more than $7.0 higher versus last week’s lows after OPEC+’s decision to increase the pace of output quota hikes in July and August to 648K barrels per month from 432K. That decision failed to weigh on prices in a lasting way given that the larger output quotas were spread evenly amongst OPEC+ members, many of whom will be unable to substantially lift output in practice (including Russia, who continue to face harsh Western sanctions).

JP Morgan said in a note on Monday that they only think OPEC+ will lift output by a net 160-170K barrels per day in July and August, far below the target announced by the cartel. More broadly, expectations for crude oil markets to remain very tight should keep WTI underpinned in the upper $110s and near $120 for now, especially in light of further announcements over the weekend that major Chinese cities will continue to roll back lockdowns, a boost to demand in the world’s second-largest oil-consuming nation.

- EUR/USD reverses the initial optimism and returns to 1.0720.

- The resistance line around 1.0790 caps the upside so far.

EUR/USD now trades slightly on the defensive, although it manages well to keep above the 1.0700 mark on Monday.

Surpassing the 3-month resistance line, today at around 1.0765, should see the downside pressure subsided and allow for a probable move to the May top at 1.0786 (May 30). Further up appears the weekly peak at 1.0936 (April 21).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1226.

EUR/USD daily chart

- Silver is higher on Monday in the $22.25 area, having set multi-week highs above $22.50 earlier in the day.

- But silver remains within recent intra-day ranges ahead of US CPI on Friday.

Spot silver (XAG/USD) prices, though trading with healthy on-the-day gains of around 1.5%, have remained largely stuck within recent intra-day ranges. XAG/USD just about managed to print fresh multi-week highs above the $22.50 per troy ounce mark earlier in the day but has since waned back to the $22.25 region, amid a broader lack of catalysts to spur cross-asset price action.

Last Friday’s US labour market report for May seemed not to shift the dial too much for markets, with silver still close to its pre-NFP levels. The data showed a slightly faster than expected pace of job gains in the US last month, but also showed wage pressures easing, as expected, contributing to the idea that price pressures in the US economy might be starting to ease.

The US inflation story (is it easing, how quickly is it easing and how will the Fed respond) remains in focus this week with the release of US Consumer Price Inflation (CPI) data out on Friday. After prices pressures showed signs of pulling back modestly from elevated levels in April, market participants will be looking to see if this trend continued last month.

If so, that takes the pressure off of the Fed to keep tightening monetary policy at a rapid pace. A downside surprise would, for example, make a 50 bps rate hike in September (50 bps hikes in June and July are currently seen as a done deal) much less likely. This could put the buck and long-term US bond yields under yet more pressure, which would give tailwinds for silver.

XAG/USD thus has a reasonably good chance of breaking out into the upper $22.50s and advancing on towards its 50 and 200-Day Moving Averages in the lower/mid-$23.00s later this week/next. However, the next few days are set to be very quiet, with not much by way of notable US data and no Fed speak, given policymakers have entered the so-called “blackout” ahead of next week’s Fed meeting. The ECB decision on Thursday will be worth watching, as the bank becomes incrementally more hawkish.

Senior Economist at UOB Group Alvin Liew assesses the latest Retail Sales figures in Singapore.

Key Quotes

“Singapore’s retail sales improved further with 12.1% y/y expansion in Apr (from 8.8% in Mar), against market expectations for a 10.4% y/y growth. Retail sales excluding motor vehicles rose even higher by 17.4% y/y (from 13.6% in Mar).”

“11 of the 14 main sub-indices of retail sales expanded on a y/y basis in Apr (up from 9 in Mar) with the strongest y/y growth recorded by wearing apparel & footwear (46.6% y/y) followed by food and alcohol (35.6% y/y), a testament to the easing of dine-in restrictions in the domestic market and the further relaxation of COVID-19 rules for travellers as borders reopen further.”

“We keep the view that domestic retail sales will continue to stay supported in 2022, in line with the positive economic outlook, re-opening trends and tightening labour market. On the external front, we expect that domestic retailers will likely see some support as borders continue to reopen, complementing the recovery in domestic activities but the downside to growth and upside to inflation outlook brought on by a protracted Russia-Ukraine conflict, will dampen the recovery in consumption demand while the region’s transition to the endemic state and increase in private spending could help offset some of those negative impact. Barring the re-emergence of fresh COVID-19-related risks in Singapore and around the region, we expect retail sales to expand by 6.0% in 2022.”

- DXY comes down and retests the 102.00 zone on Monday.

- Immediately to the downside emerges the 55-day SMA.

DXY fades part of Friday’s advance amidst the better mood in the risk-associated universe.

While gains in the dollar appears capped by the 102.70/75 area, the resumption of the downtrend could revisit the interim support at the 55-day SMA at 101.44 ahead of the May low near 101.30 (May 30).

As long as the 3-month line around 101.00 holds the downside, the outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen constructive while above the 200-day SMA at 97.03.

DXY daily chart

- GBP/Usd rebounded from a key area of support in the upper 1.2400s to the mid 1.2500s on Monday.

- Sterling is outperforming despite UK PM Johnson’s looming no-confidence vote that could unseat his premiership.

- The week will otherwise be quiet until Friday’s US CPI data release.

Despite UK PM Boris Johnson’s looming confidence vote later on Monday evening UK time, it's all cheer for sterling at the start of the new week, with the currency outperforming its G10 peers as UK markets reopen following a long week of celebrations for the Queen’s Platinum Jubilee. Yield differentials appear to be one factor behind sterling’s outperformance, with UK 2-year yields last up nearly 7 bps on the day as UK bond markets reopen for the first time since last Wednesday.

GBP/USD was last trading with gains of about 0.5% on the day close to the 1.2550 level, having rebounded from a strong area of support in the 1.2460-80 region (last week’s lows and the 21-Day Moving Average). Analysts are framing a potential defeat for Johnson later in the day as a potential positive, or at least not a negative, for sterling, given the PM’s waning authority in recent months amid the ongoing “partygate” scandal where the PM and his staff incurred a number of policy fines over breaching lockdown rules.

Aside from UK political machinations, things are set to be quiet for GBP/USD traders until Friday, when US Consumer Price Inflation data for May is set for release. Until then, there is a chance FX markets remain locked within recent ranges, suggesting GBP/USD remaining between the mid-1.2400s to upper 1.2600s. However, should Friday’s US inflation data then point to a further easing of price pressures, some analysts expect USD weakness to come back to the fore.

Easing US price pressures would come as a welcome development for the Fed, not only reducing the chance of what would be a fourth consecutive 50 bps rate hike in September (50 bps hikes in June and July are seen as a done deal) but also reducing the pressure on the Fed to keep aggressively lifting rates in Q4 2022 and 2023. A less hawkish Fed outlook would undermine the US dollar as well as boost risk appetite, a bullish combination for GBP/USD. If the bullish scenario unfolds, traders will be looking to resistance in the 1.2700 area, including from the 50DMA.

- Gold Price is fluctuating in a tight range near $1,850 on Monday.

- 10-year US T-bond yield stays flat following last week's rally.

- Strong near-term support seems to have formed at $1,840.

Gold Price moves sideways near $1,850 at the start of the week following the sharp drop witnessed on Friday. Trading conditions remain thin due to the Whit Monday holiday in Europe. The US economic docket will not be offering any high-impact data releases and XAUUSD is likely to continue to fluctuate between key technical levels.

Rising US yields limit gold's upside

The US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls in the US rose by 390,000 in May, surpassing the market expectation for an increase of 325,000. Further details of the report showed that the Labor Force Participation Rate improved modestly to 62.3% and the annual wage inflation edged lower to 5.2% as expected. The US Treasury bond yields shot higher on the upbeat US jobs report and forced gold to erase its weekly gains. The benchmark 10-year yield rose more than 7% last week and snapped a three-week losing streak. At the time of press, the 10-year yield was moving up and down in a narrow channel near 2.95%.

Also read: Gold Price Forecast: XAUUSD has room to recover before the next downswing kicks in.

Gold Price could react to ECB, US inflation data

Later in the week, the European Central Bank (ECB) is widely expected to keep policy rates unchanged. The bank is set to hike its policy rate by 25 basis points in July with the Asset Purchase Programme (APP) coming to an end in July. According to Bloomberg, some policymakers want ECB President Christine Lagarde to deliver a convincing message that borrowing costs of vulnerable countries will be contained and fragmentation will not be allowed. A strong reaction in XAUEUR to ECB's policy announcements could impact XAUUSD's movements in the second half of the week.

The most important data release of the week will be the May inflation report from the US on Friday. The Consumer Price Index (CPI) and the Core CPI are forecast to decline to 8.2% and 5.9%, respectively, on a yearly basis. With the NFP data confirming that labor market conditions remain tight in the US, stronger-than-expected CPI figures are likely to trigger another leg higher in US yields and make it difficult for gold to find demand. On the other hand, a retreat in consumer inflation could cause investors to start pricing in a pause in Fed rate hikes in September and help XAUUSD push higher.

Chart illustrating rising inflation

Ahead of the above-mentioned key events, XAUUSD could have a hard time making a decisive move in either direction. The market mood seems to have turned upbeat at the beginning of the week. In case risk flows continue to dominate the markets, the dollar could lose interest and help gold hold its ground. In that scenario, however, US yields could gain traction and not allow gold to turn north.

Gold Price technical outlook

Gold Price seems to have gone into a consolidation phase on Monday with the Relative Strength Index (RSI) indicator on the daily chart extending its sideways grind near 50. The Fibonacci 23.6% retracement of the latest downtrend forms interim support at $1,850. If this level turns into resistance, XAUUSD could decline toward $1,840, where the 200-day SMA is located. A daily close below that level could be seen as a significant bearish development and open the door for additional losses.

On the upside, $1,875 (Fibonacci 38.2% retracement) aligns as first resistance ahead of the $1,890/$1,900 area (100-day SMA, 50-day SMA, Fibonacci 50% retracement) and $1,915 (Fibonacci 61.8% retracement) afterwards.

Until a fundamental catalyst triggers a strong market reaction, it wouldn't be surprising to see XAUUSD continue to fluctuate in the $1,875-$1,840 range.

Gold Price: Great trading idea ahead on metal market

- EUR/USD is trading in calm fashion in the low 1.0700s as traders eye this week’s ECB meeting and US CPI.

- A hawkish ECB/easing of US price pressures combo could see the pair push above 1.0800.

EUR/USD is trading just north of flat in the 1.0725 area, in quiet trade ahead of what will ultimately be a busy week for the pair. The European Central Bank (ECB) announces policy in June and is expected to solidify expectations for interest rates going positive by the end of Q3, with traders set to scrutinise President Christine Lagarde’s tone on the prospect of further tightening as markets guage the outlook for 2023. Meanwhile, US Consumer Price Inflation data for May is set for release on Friday and could impact expectations for Fed policy.

But the first three days of the week are set to be much quieter in terms of central bank events and economic data, meaning EUR/USD is likely to take its cue more from things like risk sentiment/geopolitical developments etc. That would suggest that the pair may well remain stuck within recent low-1.0600s to upper-1.0700s ranges, with the 50-Day Moving Average likely to act as a magnet, as has more or less been the case over the past few days.

Some strategists think that the case for a push above 1.0800 and to its highest levels since mid-April is on the cards for EUR/USD later this week/next week, should the ECB come across as hawkish and US inflation show signs of easing. On the latter, growing momentum behind the peak US inflation narrative and, thus, peak Fed hawkishness, has been a major driver of the recent rebound from last month’s lows under 1.0400.

Quek Ser Leang at UOB Group’s ‘Global Economics & Markets Research’ noted that extra weakness below 14,410 in USD/IDR looks out of favour.

Key Quotes

“We highlighted last Monday (30 May, spot at 14,540) that USD/IDR ‘is likely to break the major support near 14,500’. We added, ‘the next support at 14,448 is unlikely to come into the picture’. The subsequent weakness exceeded our expectations as USD/IDR plummeted to a low of 14,415 last Friday. While the rapid drop appears to be overdone, USD/IDR could dip below the major support at 14,410.”

“In view of the oversold conditions, a sustained decline below this level is unlikely. Resistance is at 14,500 but only a break of 14,570 would indicate that the current weakness has stabilized.”

- EUR/JPY clinches new 2022 highs past 140.00.

- The continuation of the uptrend could see 141.05 retested.

EUR/JPY prints new cycle highs past the 140.00 mark at the beginning of the week.

The cross has quickly left behind the 140.00 hurdle and advanced to as high as the 140.60/65 band on Monday, opening the door at the same time for extra gains to, initially, the June 2015 peak at 141.05.

In the meantime, while above the 2-month support line near 135.50, the short-term outlook for the cross should remain bullish.

EUR/JPY daily chart

USD/MYR is expected to navigate within the 4.3700-4.4000 range for the time being, comments Quek Ser Leang at UOB Group’s ‘Global Economics & Markets Research’.

Key Quotes

“USD/MYR traded between 4.3630 and 4.3930 last week before closing at 4.3870 on Friday (Malaysia market is closed for holiday today).”

“The price actions appear to be part of consolidation phase and USD is likely to trade 4.3700 and 4.4000 fop this week.”

Conservative lawmaker and Britain's 'anti-corruption champion' John Penrose announced on Monday that he resigned from his role, as reported by Reuters.

"I’m sorry to have to resign as the PM’s Anti-Corruption Tsar but, after his reply last week about the Ministerial Code, it’s pretty clear he has broken it," Penrose stated on Twitter. "That’s a resigning matter for me, and it should be for the PM too."

Latest from lawmakers on the upcoming confidence vote

- UK Foreign Minister Truss says she backs PM Johnson in the confidence vote.

- UK Finance Minister Sunak says he backs PM Johnson in the confidence vote.

- UK's Gove says he backs PM Johnson in the confidence vote.

- Former UK Foreign Minister Jeremy Hunt says he will be voting for a change at the confidence vote in PM Johnson.

Market reaction

These headlines don't seem to be having a significant impact on the British pound's performance against its rivals. As of writing, the GBP/USD pair was up 0.5% on the day at 1.2550.

- AUD/USD rises above 0.7200 but bulls struggle to take on the further upside.

- China’s reopening news, the US dollar pullback underpin the aussie.

- The pair challenges critical daily resistance, with all eyes on Tuesday’s RBA.

AUD/USD is looking to extend the swift recovery beyond the 0.7230 supply zone, as bulls refrain from placing fresh bets ahead of Tuesday’s Reserve Bank of Australia’s (RBA) rate hike decision.

The aussie is taking advantage of the broad US dollar retreat, as well as, the optimism over the covid lockdown reopening of Chinese cities. The further upside, however, appears capped amid holiday-thinned market conditions and pre-RBA anxiety. A lack of significant US economic releases also keeps buyers a bit tied down.

From a short-term technical perspective, AUD/USD is finding strong hindrance near the 0.7230 area, as it is the confluence zone of the bearish 50- and horizontal 100-Daily Moving Averages (DMA).

AUD bulls are struggling also due to the 50-DMA and 100-DMA bearish crossover over in play, which got confirmed last Friday.

Only a daily closing above the aforesaid resistance will power bulls once again towards the flattish 200-DMA at 0.7258.

Up next, the 0.7300 round figure will be back on buyers’ radars.

The 14-day Relative Strength Index (RSI) is inching slightly higher above the midline, supporting the case for more gains.

AUD/USD: Daily chart

Alternatively, if the price fails to find acceptance above the 0.7230 barrier, then a pullback towards the daily lows of 0.7220 cannot be ruled out.

Sellers will then look out for the 0.7200 demand area, below which a test of the June 2 low of 0.7140 will be challenged.

AUD/USD: Additional levels to consider

- Gold Price is erasing early gains, as the US Treasury yields turn positive.

- Risk-on flows dominate, with the US dollar reversing the post-NFP upside.

- Impending bear cross on the daily chart warrants caution for XAU bulls.

Gold Price is fading its early rebound towards $1,860, with bears now testing the $1,850 level amid mixed factors in play.

The Asian recovery in the bright metal was driven by a minor pullback in the US Treasury yields, as the dust settled over the upbeat US labor market report released on Friday. Soaring oil prices on Saudi Arabia’s price hike also underpinned the inflation-hedge gold.

Although, the yields are flipping back into the positive territory amid the return of risk flows, which dull the safe-haven appeal of the US government bonds. This, in turn, caps the renewed upside in the non-yielding gold. Markets assess the Fed tightening outlook amid a tighter labor market and potential peak inflation.

Meanwhile, the US dollar is feeling the pull of gravity amid reduced demand for safety, keeping the downside cushion in the metal, for now. To add, most of the major European markets are on a holiday, keeping the volatility high and gold traders on their toes.

All eyes remain on the Wall Street open for fresh cues on risk sentiment, as the US economic docket remains data-empty and the Fed policymaker enter the ‘blackout period’.

Gold Price: Daily chart

The bearish 50-Daily Moving Average (DMA) is set to cross the horizontal 100-DMA for the downside. If that happens, it will confirm a bear cross, reviving the selling interest in the metal.

With strong support at $1842, the confluence of the bearish 21-DMA and horizontal 200-DMA will be put at risk. Acceptance below the latter on a daily closing basis will call for a test of the previous week’s low of $1,829.

Also read: Gold Price Forecast: XAUUSD has room to recover before the next downswing kicks in

If buyers manage to extend control, then a retest of the $1,860 level will be in the offing. The next significant bullish target is aligned at the end of May highs around $1,870.

Gold Price: Additional levels to consider

Quek Ser Leang at UOB Group’s ‘Global Economics & Markets Research’ suggests USD/THB could keep the 34.15-34.65 range well in place in the near term.

Key Quotes

“We highlighted last Monday (30 May, spot at 34.05) that ‘a break of 34.00 could potentially trigger a rapid decline to 33.81’. However, USD/THB did not break 34.00 as it rebounded strongly from 34.05.”

“Downward momentum is waning and the solid support at 34.00 is not expected to come under threat. For this week, USD/THB is likely to trade within a range of 34.15/34.65.”

- GBP/USD reverses NFP-led losses, as UK confidence vote in PM Johnson eyed.

- Risk-on market mood, USD retreat help cable stage a solid turnaround.

- A ballot will be held between 1700 and 1900 GMT later this Monday.

GBP/USD is trading strongly bid above 1.2550 so far this Monday, looking to retest the 1.2600 level ahead of the UK’s vote of confidence in PM Boris Johnson.

In doing so, cable has reversed most of Friday’s US NFP-led losses, as the US dollar retreats across the board amid the return of risk flows and holiday-thinned light trading.

The US Treasury yields hold the pullback, as investors reassess the Fed tightening outlook after the payrolls came in stronger than expected at 390K in May. The pause in the yields rally also adds to the weight on the buck.

The main catalyst behind the pound’s advance this morning, however, is the UK political headlines. GBP bulls cheer the news that a vote of confidence in the UK PM Boris Johnson will be held later in the day between 1700GMT- 1900GMT. The ballot will be immediately counted subsequently.

A spokesperson for Johnson's Downing Street office said, "the PM welcomes the opportunity to make his case to MPs (members of parliament) and will remind them that when they're united and focused on the issues that matter to voters there is no more formidable political force."

Markets believe that the vote will end months of speculation and allow the Johnson government to focus on other political and economic priorities if Johnson wins the vote of confidence.

This political scenario has come into being after a growing number of lawmakers in the governing Conservative Party questioned the British leader's flagging authority over the "partygate" scandal.

Meanwhile, a public holiday in most of the major European economies and a data-light US calendar will keep the focus on this UK political in the day ahead.

GBP/USD: Technical levels

- EUR/USD posts decent gains and trades near 1.0750.

- German 10-year bund yields target the 1.30% region on Monday.

- The dollar looks offered amidst firm appetite for riskier assets.

The European currency trades in an upbeat mood and pushes EUR/USD back to the mid-1.0700s at the beginning of the week.

EUR/USD bolstered by risk appetite trends

EUR/USD leaves behind Friday’s downtick and looks to resume the upside in a context dominated by the re-emergence of the selling pressure around the greenback.

Indeed, yields on both sides of the Atlantic move higher, with the German 10y bund yields flirting with the 1.30% level for the first time since April 2014 and its US counterpart slowly approaching the key 3.00% barrier.

The euro docket is empty on Monday and only a short-term bill auction is due later in the NA session.

What to look for around EUR

The recent upside momentum in EUR/USD has been capped by the 3-month resistance line around 1.0770.

The pair’s recovery since mid-May has been on the back of supportive ECB-speak, which continued to point at an initial rate hike as soon as in July, while the consensus view that the bond-purchase programme should end at some point in early Q3 has also lent legs to the European currency.

Renewed selling of the greenback has also contributed as investors appear to have already priced in a couple of 50 bps rate hikes at the Fed’s June and July gatherings.

EUR/USD is still far from exiting the woods, however, and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, nevertheless, higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany Construction PMI (Tuesday) – Advanced EMU Q1 GDP Growth Rate (Wednesday) – ECB Interest Rate Decision (Thursday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is gaining 0.24% at 1.0743 and faces the immediate up barrier at 1.0786 (monthly high May 30) seconded by 1.0936 (weekly high April 21) and finally 1.0959 (100-day SMA). On the other hand, a breach of 1.0627 (monthly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18).

FX Strategists at UOB Group Quek Ser Leang and Peter Chia see USD/CNH facing a tough support around the 6.5940 level in the near term.

Key Quotes

24-hour view: “Last Friday, we held the view that ‘further USD weakness is not ruled but the major support at 6.5940 is likely out of reach for now’. USD did not threaten the 6.5940 support as it dropped to 6.6170 before snapping back up to end the day little changed at 6.6558 (+0.02%). Downward pressure has dissipated and the current movement is likely part of a consolidation phase. For today, USD is likely to trade between 6.6320 and 6.6720.”