- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 09-06-2022.

- USD/JPY grinds higher after refreshing the multi-year top during the five-day uptrend.

- Yields stay firmer around monthly peak amid hawkish hopes from global central banks.

- Inflation fears, growth concerns join BOJ vs. Fed battle to also propel the prices.

- Japan’s PPI in May eased on YoY basis but increased on MoM.

- US CPI, risk catalysts eyed for fresh impulse.

USD/JPY takes rounds to a two-decade high surrounding 134.50 during the initial Asian session on Friday. In doing so, the yen pair portrays the market’s cautious mood ahead of the key US inflation data. However, hopes of further monetary policy divergence between the US Federal Reserve (Fed) and the Bank of Japan (BOJ) keep the pair buyers hopeful.

That said, Japan’s Producer Price Index (PPI) for May eased to 9.1% YoY from 9.8% expected and revised down prior figure. Further, the MoM print also dropped to 0.0% versus 0.5% forecasts and 1.3% previous reading, revised from 1.2%.

Elsewhere, the US Jobless Claims rose past 210K forecasts to 229K for the week ended on June 3. Further, US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, remain steady at around 2.75% in the last two days by the end of Thursday’s North American session.

It’s worth noting that the growing concerns over the surging price pressure to challenge the global economic growth seem to have weighed on the market sentiment of late. The risk-aversion wave also gained support from the recent hawkish actions from the major central banks, except for the BOJ.

On Thursday, the European Central Bank (ECB) conveyed fears of inflation weighing on growth, via their forecasts. The bloc’s central bank also matched market consensus while announcing an end of Quantitative Easing from July 1 and 25 basis points (bps) of a rate hike on July 25, versus expectations of a 50 bps move. Alternatively, BOJ Governor Haruhiko Kuroda has been spotted favoring the easy money policies to defend the export-oriented economy.

It should be observed that the White House has already conveyed the risk of higher inflation ahead of today’s US Consumer Price Index (CPI) data while the World Bank (WB) and the Organisation for Economic Co-operation and Development (OECD) have raised concerns over the global recession. Also contributing to the risk-aversion is the return of activity restrictions and mass testing in China, due to the resurgence of covid cases.

Amid these plays, the Wall Street benchmarks dropped the heaviest in the week whereas the US 10-year Treasury yields also refreshed their monthly high before retreating to 3.04%, around 3.057% at the latest. Further, the US Dollar Index (DXY) also rallied the most in a week while cheering the greenback’s safe-haven status.

That said, USD/JPY traders will pay attention to the risk catalysts ahead of the US Consumer Price Index (CPI) release for May, expected to remain unchanged near 8.3% YoY.

Also read: US Consumer Price Index May Preview: Fed policy is set but there is room for surprise

Technical analysis

USD/JPY bulls may struggle as multiple tops marked around 135.15-20 during early 2002 joins overbought RSI (14). However, pullback moves remain elusive until staying beyond the six-week-old previous resistance line around 131.70-65.

- Oil prices have been less impacted due to renewed lockdown worries in China.

- The oil shortage due to the ban on Russian oil imports won’t get offset sooner.

- The rising demand for gasoline in the US economy in peak summers will strengthen the oil bulls further.

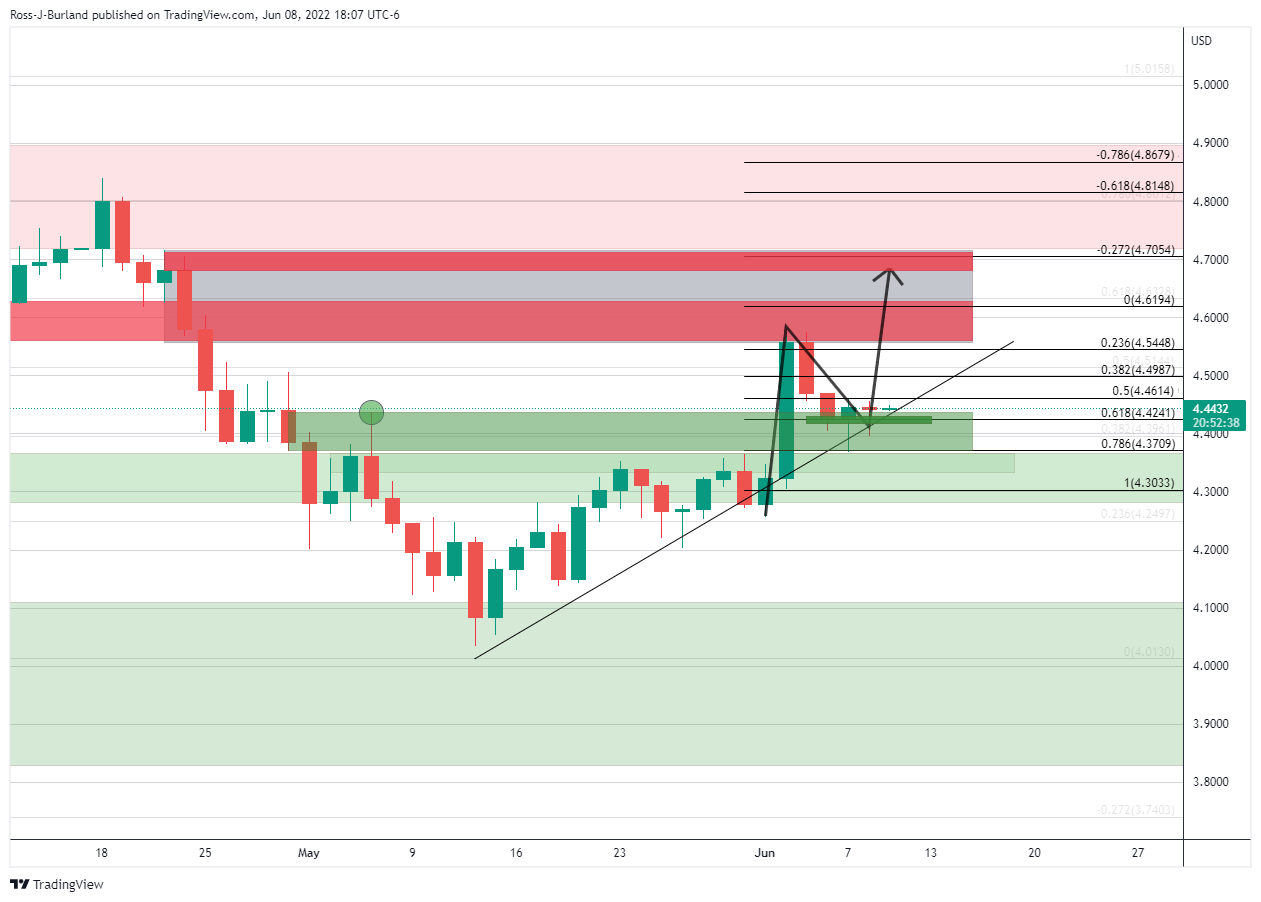

West Texas Intermediate (WTI), futures on NYMEX, is holding itself above $119.00 and has faced a minor time correction after a vertical upside move. The black gold is holding its gains despite the renewed fears of a lockdown in China to contain the spread of the Covid-19.

The Chinese economy was recovering from lockdown measures in Shanghai and Beijing after a two-month lockdown period. Restrictions on the execution of various economic activities were getting the traction again, however, the discovery of fresh Covid-19 cases has raised questions over the zero Covid-19 policy of China.

No doubt, the restrictive measures in the Chinese economy will trim the demand forecasts but the broader upside in the oil prices will remain intact. The oil shortage due to the embargo on oil imports from Russia won’t get offset sooner. Investors have started considering the fact that the imbalance in the demand-supply mechanism after a prohibition of oil from Moscow will persist longer.

The restrictions on oil imports from Russia have forced many refineries worldwide to shut down their operations after its invasion of Ukraine. Availability of less capacity due to less number of operating refineries will keep the oil bulls' momentum intact. The oil prices are set to recapture their all-time-high levels at $126.35.

Meanwhile, the rising demand for crude oil to manufacture gasoline due to peak summer in the US economy will keep the requirement for oil at elevated levels.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, take round to the monthly high surrounding 2.76%, steady around 2.75% in the last two days by the end of Thursday’s North American session.

Despite the steady inflation signals from the FRED data, markets fear a higher number from the US Consumer Price Index (CPI) release for May, up for publishing later on Friday, which in turn weigh on the market’s sentiment and underpin the US dollar’s safe-haven demand.

That said, the chatters surrounding strong inflation to weigh on growth and the White House’s fear of stronger CPI data add to the market’s risk-off mood.

The sour sentiment could be witnessed via the biggest daily slump in the Wall Street benchmarks for the week whereas the US 10-year Treasury yields also refreshed their monthly high before retreating to 3.04%. The US Dollar Index (DXY) also rallied the most in a week while cheering the greenback’s safe-haven status.

It’s worth noting, however, that the headlines US CPI is expected to remain unchanged near 8.3% YoY while the CPI ex Food & Energy, known as Core CPI, may soften to 5.9% from 6.2%.

Also read: US Consumer Price Index May Preview: Fed policy is set but there is room for surprise

- Silver remains pressured around one-week low, down for third consecutive day.

- Clear downside break of one-month-old ascending trend line, 21-DMA favor sellers.

- Five-week-long horizontal resistance appears a tough nut to crack for bulls.

Silver (XAG/USD) stays depressed around the weekly low near $21.60 during Friday’s Asian session, after breaking the short-term key supports the previous day.

However, the bright metal’s further downside hinges on its ability to conquer a three-week-old upward sloping trend line, around $21.55 by the press time.

Given the downbeat RSI (14) and a clear break of the previously important support levels, namely the 21-DMA and an ascending trend line from May 13, XAG/USD is likely to extend the latest weakness below the immediate support.

In doing so, the quote could challenge the $21.30 and $21.00 supports before directing the bears towards the last monthly low near $20.45.

Meanwhile, recovery moves may initially be challenged by the 21-DMA and the support-turned-resistance line from early May, respectively around $21.85 and $22.00.

Following that, a horizontal area comprising multiple levels marked since early May and the 50-DMA, close to $22.40-50 and $23.00 in that order, will be crucial for the silver buyers to tackle.

Silver: Daily chart

Trend: Further downside expected

- The US Dollar Index (DXY) rose to fresh three-week highs, above 103.000.

- A negative sentiment boosted the US Dollar as investors scrambled toward safe-haven assets.

- US Dollar Index (DXY): To re-test the YTD highs in the medium-term.

The US Dollar Index, a measure of the greenback’s performance against a basket of six currencies, climbs sharply by 0.74% and is sitting at 103.306 at the time of writing, as the Asian Pacific session begins.

Risk-aversion is the name of the game in the financial markets. Another central bank, the ECB, decided to keep rates unchanged at -0.50% but signaled that it would begin to raise rates, starting as soon as July. The decision triggered an upward reaction in the EUR/USD but plummeted afterward, boosting the prospects of the greenback.

Therefore, risk appetite waned, as shown by global equities finishing Thursday’s session with losses. US Treasury yields are rising, led by the 10-year benchmark note rate, solid at 3.047%, underpinning the US Dollar.

The US economic calendar reported Initial Jobless Claims for the week ending on June 4, on Thursday. Albeit the reading rose by 229K more than the 210K, it was ignored by investors, as their focus is on the Consumer Price Index, expected to top 8.3% YoY expectations. Moreover, the University of Michigan Consumer Sentiment June’s preliminary number would give traders insight into US citizens regarding their current economic conditions.

US Dollar Index (DXY): Technical outlook

The US Dollar Index bottomed at the 50-day moving average (DMA) at around 101.297 on May 30. Since then, the index began trending higher, with a pair of pullbacks that were offset by upward days that lifted the DXY to fresh multi-week highs. That said, the US Dollar Index remains poised for further gains but would face some hurdles on its way north.

The US Dollar Index’s first resistance would be the May 19 high at 103.877. A breach of the latter would expose the May 17 daily high at 104.230, followed by the YTD high at 105.005.

- NZD/USD holds lower ground near a three-week low after falling the most since late May.

- New Zealand’s Manufacturing Sales slumped in Q1, Electronic Card Retail Sales also fell in May.

- Growth, inflation fears underpin US dollar’s safe-haven demand, China’s fresh covid woes exert additional downside pressure.

- China CPI/PPI and risk catalysts may offer intermediate moves but US CPI is the key.

NZD/USD bears keep reins, despite recent inaction, around a multi-day low of 0.6380 amid downbeat New Zealand and the US dollar’s upbeat performance ahead of the key catalysts. That said, the Kiwi dropped the most in nearly three weeks the previous day as risk-aversion drowned the Antipodeans.

New Zealand Q1 Manufacturing Sales turned negative to -3.5% versus the previous growth of 8.2%. Further, Electronic Card Retail Sales for May also disappointed the NZD/USD trades with 0.7% YoY growth compared to 2.1% prior. It’s worth noting, however, that the Kiwi pair failed to register any quick reaction to the downbeat data even if the prices remain pressured.

That said, the risk-off mood weighed on the Antipodeans the previous day as fears of inflation and growth accelerated after the European Central Bank (ECB) conveyed fears of inflation weighing on growth, via their forecasts. The bloc’s central bank also matched market consensus while announcing an end of Quantitative Easing from July 1 and 25 basis points (bps) of a rate hike on July 25, versus expectations of a 50 bps move.

Elsewhere, the White House has already conveyed the risk of higher inflation ahead of today’s US Consumer Price Index (CPI) data while the World Bank (WB) and the Organisation for Economic Co-operation and Development (OECD) have raised concerns over economic growth.

Furthermore, the resurgence of covid-led activity restrictions in Shanghai and Beijing joined no solution to the Russia-Ukraine crisis to exert additional downside pressure on the market’s sentiment.

The sour sentiment could be witnessed via the biggest daily slump in the Wall Street benchmarks for the week whereas the US 10-year Treasury yields also refreshed their monthly high before retreating to 3.04%. The US Dollar Index (DXY) also rallied the most in a week while cheering the greenback’s safe-haven status.

Looking forward, China’s CPI and Producer Price Index (PPI) data for May, expected 2.2% and 6.4% versus 2.1% and 8.0% in that order, will offer immediate directions to the NZD/USD traders ahead of the US CPI.

Also read: US CPI Preview: Soft core set to drive dollar down, and two other scenarios

Technical analysis

Not only a clear U-turn from the 0.6560 horizontal hurdle but a successful downside break of the 21-DMA, around 0.6440, also direct NZD/USD prices towards further south. That said, 0.6290 may attack short-term sellers before directing them to the yearly low marked in May at around 0.6215.

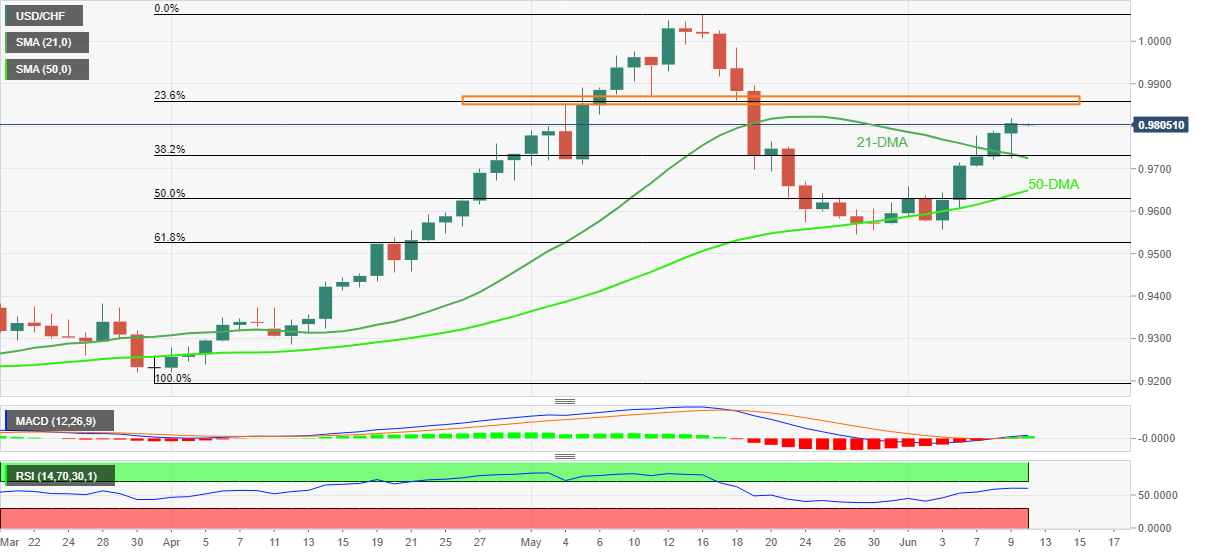

- USD/CHF remains sidelined near multi-day top, pausing five-day uptrend.

- Firmer MACD signals, RSI (14) joins successful break of 21-DMA to favor buyers.

- 50-DMA, May’s low act as the key support for bear’s conviction.

USD/CHF prices seesaw around 0.9800, after refreshing a three-week high during a five-day uptrend the previous day.

Even so, the Swiss currency (CHF) pair’s ability to stay beyond the 50-DMA and 21-DMA joins the recent bullish MACD signals, as well as firmer RSI (14), not overbought, to keep USD/CHF buyers hopeful.

That said, a five-week-old horizontal resistance area near 0.9855-75 appears a tough nut to crack for the USD/CHF bulls.

On the contrary, the 21-DMA and 50-DMA could restrict the quote’s immediate downside to around 0.9720 and 0.9650 respectively.

However, USD/CHF bears remain hopeful until the quote stays beyond May’s low of 0.9544.

Overall, USD/CHF has already signaled further upside but there is a little room on the north.

USD/CHF: Daily chart

Trend: Further upside expected

- EUR/JPY is juggling below 143.00 on stable interest rate policy by the ECB.

- The ECB has sounded hawkish on guidance amid higher inflation forecasts.

- Rising oil prices majorly contribute to a spurt in inflation levels in Japan.

The EUR/JPY pair is displaying back and forth moves below 143.00 and is expected to extend its losses as the European Central Bank (ECB) adopted a ‘neutral’ stance on the interest rates in its monetary policy meeting on Thursday. The ECB kept interest rates unchanged despite mounting inflationary pressures but dictated hawkish guidance for its July and September interest rate decisions.

A decision of keeping the interest rates at rock-bottom levels despite an inflation rate above 8% has depressed the shared currency bulls. The eurozone is facing extreme selling pressure from the market participants. It is worth noting that the price pressures are advancing majorly by higher food and energy prices, thanks to the military activities between Russia and Ukraine along with a disruptive supply chain.

As per the guidance, the ECB will end up its Asset Purchase Program (APP) on July 1 and will elevate the interest rates by 25 basis points (bps) in July and might be a higher than 50 bps rate hike announcement in September.

As per the statements, it looks like the ECB is moving toward the quantitative tightening process gradually so that the economy gets plenty of time to adjust to the turning wheel of the rate cycle.

On the Tokyo front, sustenance of ultra-loose monetary policy and capping of the bond yields at 0.25% against the hawkish G-10 is hurting the Japanese yen. The Bank of Japan (BOJ) is worried over lower demand levels despite the achievement of 2% inflation. The achievement of desired inflation levels is majorly contributed by higher fossil fuel prices.

- The European Central Bank (ECB) will begin hiking rates in July in small increments.

- ECB’s Lagarde: Conditions to begin raising rates have been met.

- Sentiment remains negative, as global equities recorded hefty losses.

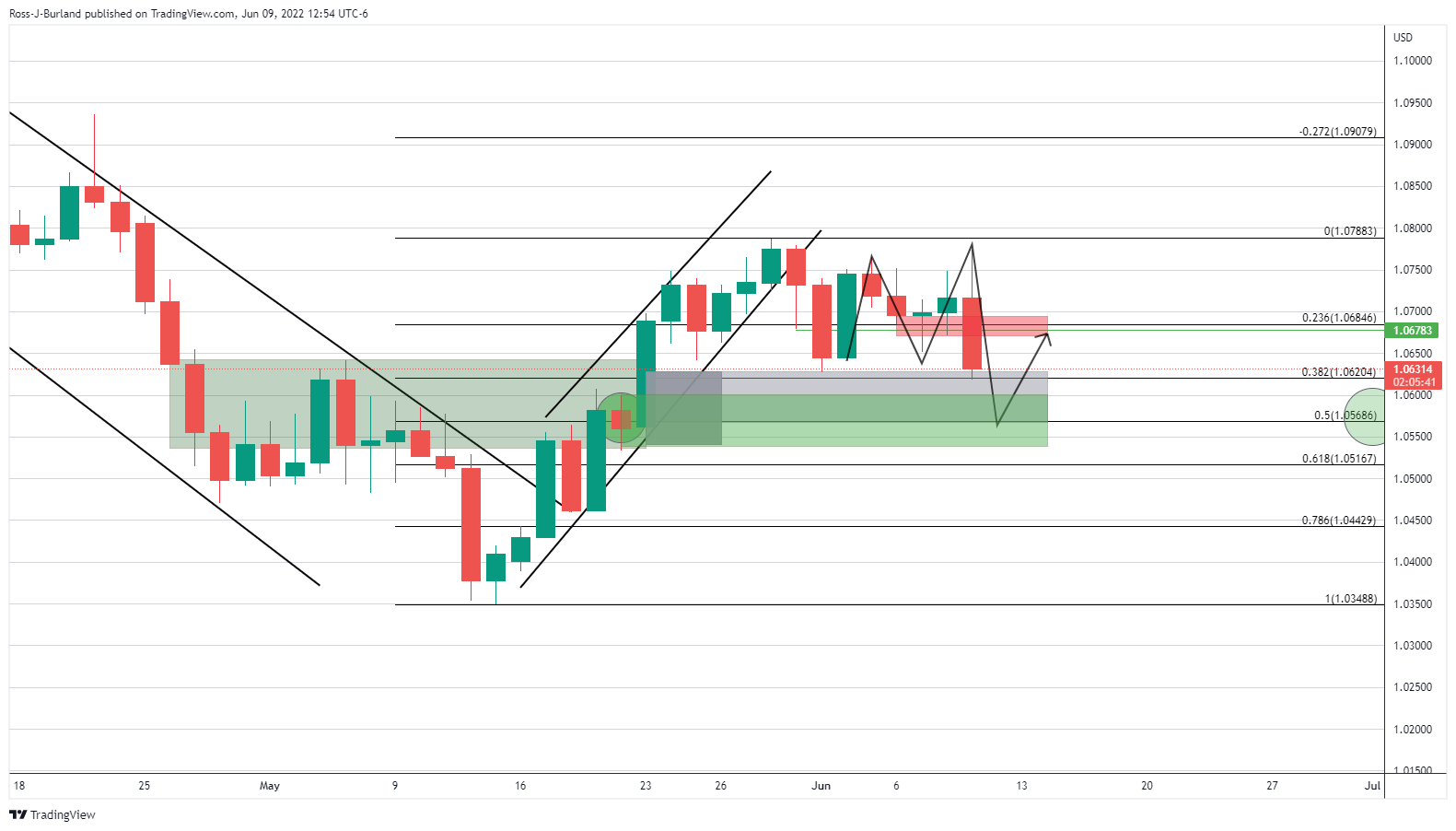

On Thursday, the EUR/USD plummeted 100 pips after the European Central Bank (ECB) decided that it would lift rates in the July meeting. However, it would do so in 25 bps increments, shifting from a hawkish decision to a dovish one, as perceived by investors, which sent the euro tumbling against the greenback. At 1.0614, the EUR/USD records minimal gains of 0.03% as the Asian session starts.

Summary of ECB’s decision; the greenback remains buoyant and weighs on the EUR/USD

Recapping the ECB’s decision, the Governing Council (GC) said it would raise rates by 25 bps at its July meeting and expects it to do it again in September. Although the market penciled in 25 bps for both reunions, the ECB opened the door for a higher increase in September. However, the GC emphasized that it would depend on the medium-term inflation outlook.

In the ECB’s press conference, the President, Mrs. Lagarde, stated that the decisions “were unanimously approved” and emphasized that conditions were met to begin raising rates.

In the same meeting, the ECB updated its forecasts, with growth estimated to finish at 2.8% vs. March’s 3.7%, while inflation estimations were revised to the upside, at 6.8% from 5.1% in March.

Elsewhere, risk-aversion continues ruling the markets. US equities finished with losses between 1.94% and 2.75%, and Asian futures followed suit. Market participants flew toward safe-haven assets in the FX space, the US Dollar. Reflection of the previously mentioned is the US Dollar Index, gaining 0.74%, sitting at 103.306.

On Friday, the Eurozone calendar will feature a speech of the ECB’s President Christine Lagarde. On the US docket, the May Consumer Price Index is expected to remain unchanged at 8.3% YoY. At the same time, the core CPI for the same period is estimated to rose by 5.9% YoY, lower than April’s 6.2%.

Also read: Forex Today: The financial world is in risk aversion mode

EUR/USD Price Forecast: Technical outlook

Thursday’s fall left the EUR/USD vulnerable to further selling pressure. On its way down, the pair broke a solid demand zone, the June 1 low at 1.0627, weekly low until June 9. The Relative Strength Index (RSI) at 45.81 further reinforces the EUR/USD’s downward bias as the RSI accelerates its downtrend.

Therefore, the EUR/USD favors the bears. That said, the major’s first support would be 1.0600. Break below would expose the May 19 low at 1.0460, followed by the YTD low at 1.0340.

- USD/CAD bulls take a breather after the biggest daily jump in 2022.

- BOC’s Macklem reiterated support for higher rates amid inflation fears.

- US dollar benefits from risk-aversion, oil prices ease.

- China/US CPI, Canada Employment data for May will be crucial for fresh impulse.

USD/CAD steadies around 1.2700, following the big leap to a two-week high, as markets turn cautious ahead of the key data/events scheduled for publishing on Friday. The Loonie pair rallied the most since November 2021 the previous day as inflation and growth fears roiled market sentiment, underpinning the US dollar. Also contributing to the pair’s run-up could be softer prices of Canada’s main export item, namely WTI crude oil, as well as the Bank of Canada’s (BOC) remarks.

That said, global markets witnessed heavy risk-aversion on Thursday after the European Central Bank (ECB) conveyed fears of inflation weighing on growth, via their forecasts. The bloc’s central bank also matched market consensus while announcing an end of Quantitative Easing from July 1 and 25 basis points (bps) of a rate hike on July 25, versus expectations of a 50 bps move.

At home, the Bank of Canada (BOC) released details of a bank stress test and conveyed challenges emanating from tighter monetary policies. Even so, BOC Governor Tiff Macklem was spotted favoring faster rate hikes by citing the overheating economy.

Elsewhere, the White House has already conveyed the risk of higher inflation ahead of today’s US Consumer Price Index (CPI) data while the World Bank (WB) and the Organisation for Economic Co-operation and Development (OECD) have raised concerns over economic growth.

Furthermore, the resurgence of covid-led activity restrictions in Shanghai and Beijing joined no solution to the Russia-Ukraine crisis to exert additional downside pressure on the market’s sentiment.

As a result, the Wall Street benchmarks posted the biggest daily loss in a week, down for the second consecutive day, whereas the US 10-year Treasury yields also refreshed their monthly high before retreating to 3.04%.

Moving on, China’s CPI and Producer Price Index (PPI) data for May, expected 2.2% and 6.4% versus 2.1% and 8.0% in that order, will offer immediate directions to the USD/CAD traders ahead of the US CPI data and Canada’s jobs report. Given the already known fears of higher inflation, a disappointment from the Canadian employment numbers becomes necessary for the pair buyers to keep reins.

Also read: US Consumer Price Index May Preview: Fed policy is set but there is room for surprise

Technical analysis

Despite a successful break of the 200-DMA and one-month-old descending trend line, respectively around 1.2660 and 1.2630, the USD/CAD buyers need validation from the convergence of 21-DMA and 50-DMA, near 1.2725-30, to extend the run-up.

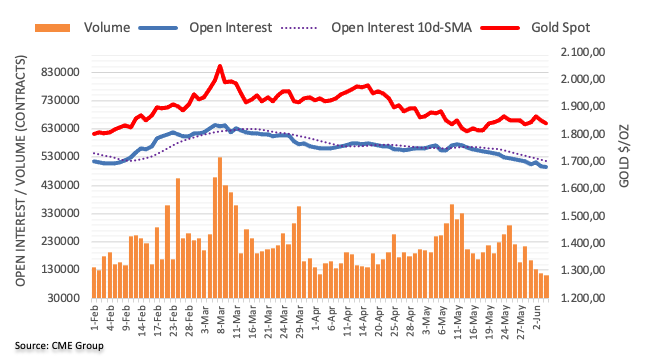

- Gold price is struggling at around $1,850.00 as stale US CPI forecasts support the DXY bulls.

- A slippage in the US CPI may not support the gold bulls while a higher CPI rate will strengthen the gold bears.

- The precious metal is still inside the woods and is expected to perform lackluster until the US inflation releases.

Gold price (XAU/USD) has witnessed a minor pullback after hitting a high near the critical hurdle of $1,850.00 on Thursday. The precious metal found significant offers amid improvement in the US dollar index (DXY)’s appeal and made a low of $1,840.10. However, a responsive buying action pushed the gold prices higher and at the press time, it is oscillating below $1,850.00.

Advancing uncertainty ahead of the US Inflation is responsible for wild moves in the FX domain. Doubtful breakouts and breakdowns have spooked the market participants. Market consensus is indicating a stable inflation rate at 8.3%, which states that two rate hikes announcements by the Federal Reserve (Fed) in March and May by 25 basis points (bps) and 50 bps have failed to perform their job seriously. A slippage in the core Consumer Price Index (CPI) is expected. The core CPI that excludes food and energy prices may shift lower to 5.9% vs. the prior print of 6.2%.

The price pressures are so high in the US economy that slippage in the US inflation may not support the gold’s appeal, however, a higher print will definitely trim the demand.

Gold technical analysis

On a four-hour scale, the gold price has bounced sharply after sensing a responsive buying action from the upward sloping trendline of the Ascending Triangle which is placed from the May 16 low at $1,786.94. While the horizontal resistance is plotted from May 24 high at $1,869.69. The 50-period Exponential Moving Average (EMA) at $1,850.66 is overlapping with the gold prices, which signals a consolidation ahead. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range and dictates that the precious metal needs a trigger for a decisive move.

Gold four-hour chart

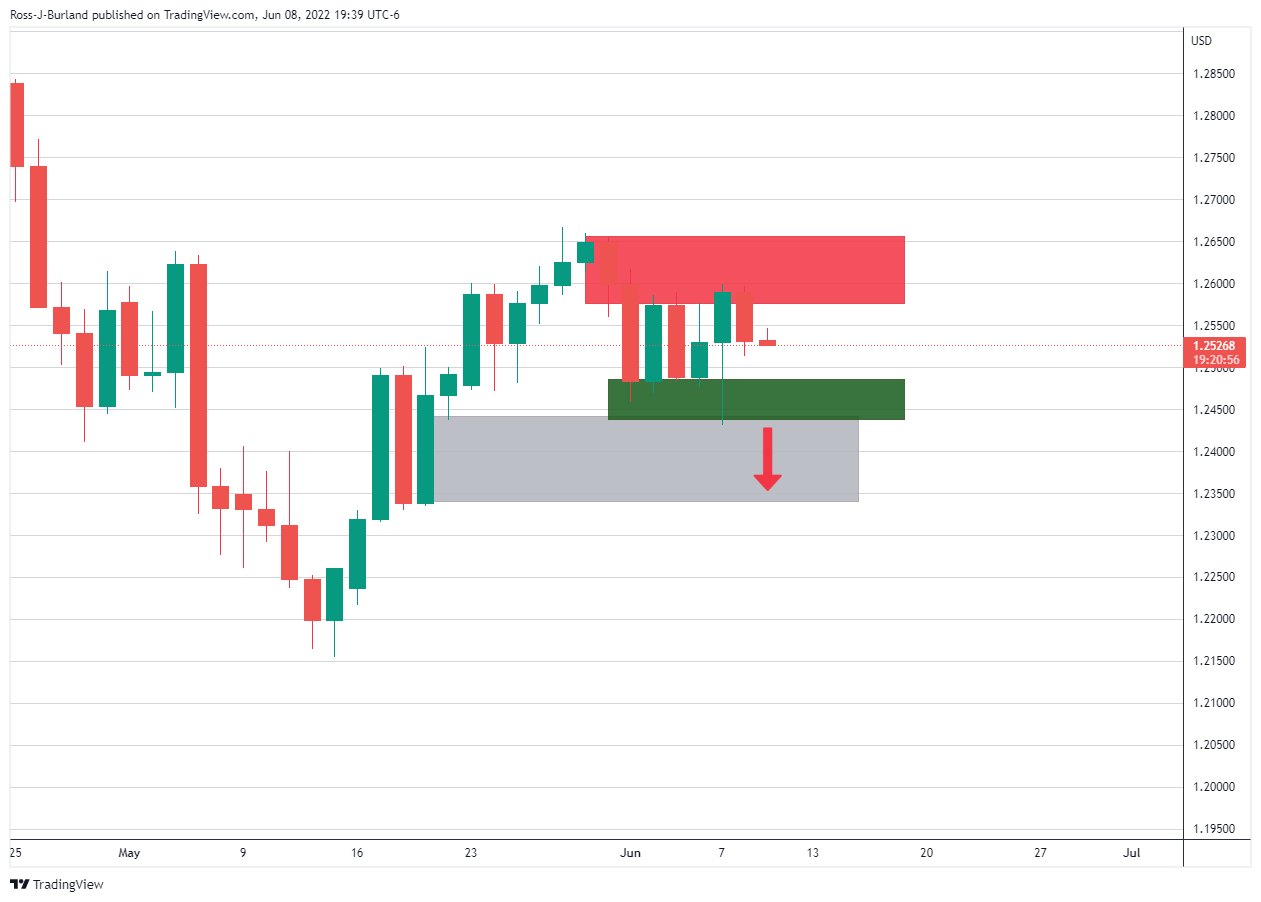

- The price is stuck below the hourly chart's resistance near 1.2550.

- If the bears break the support of 1.2430 then there is a price imbalance to 1.2390 and then 1.2330.

GBP/USD is making tracks to the downside and the bears will be seeking a continuation of the weekly chart as illustrated below. However, the price is trapped between daily resistance and support structure as the following shows.

GBP/USD weekly chart

The price has made a 50% mean reversion on the weekly chart and the bears are moving in again. This could be the last stop before a downside continuation for the weeks ahead.

GBP/USD daily chart

On the daily chart, however, the price is trapped between resistance and support. A break either way will open the risk of a price imbalance mitigation for the days ahead.

GBP/USD H1 chart

The price will now need to hold below the hourly chart's resistance near 1.2550. If the bears break the support of 1.2430 then there is a price imbalance to 1.2390 and then 1.2330.

- The AUD/JPY retreated from multi-year highs but remained up by 1.12% in the week.

- Wall Street’s finished with hefty losses, and Asian futures are poised to a lower open.

- AUD/JPY Price Forecast: The pullback from around 97.00 might go as lower as 94.00, before re-testing YTD highs.

AUD/JPY plunged more than 1% on Thursday, courtesy of a downbeat sentiment and appetite for safe-haven assets, as worldwide central banks shifted to a restrictive monetary policy, which caused a jump in bond yields. At 95.33, the AUD/JPY is retreating from multi-year highs, down 0.05% as Friday’s Asian session begins.

Sentiment remains negative; safe-haven peers gained

US equities finished Thursday’s session with losses, between 1.94% and 2.75%. Worries about global central banks restricting access to money might cause an economic slowdown and keeps market players uneasy, flying towards safe-haven assets. On Thursday, the European Central Bank (ECB) announced that it would hike rates in July at a slower rhythm than expected by some ECB hawks.

Recapping the AUD/JPY Thursday’s price action, the cross opened near the daily highs at around 96.80 and fell as soon as Tokyo’s session began. The AUD/JPY dipped towards a fresh two-day low at 95.29 and broke the 1-hour 50 and 100-simple moving averages (SMAs), each sitting at 96.07 and 95.46, respectively.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY daily chart depicts the pair as upward biased. Thursday’s pullback might extend towards the May 5 high at 94.02, as the Relative Strenght Index (RSI) at 64.17 is aiming lower. Nevertheless, once that area is tested, the AUD/JPY might resume its uptrend.

If that scenario plays out, the AUD/JPY first support would be the 95.00 psychological level. Once cleared, the following support would be the June 7 low at 94.80, followed by the above-mentioned 94.02. Once there, the AUD/JPY buyers could resume the uptrend and challenge the YTD high near 97.00.

Speaking at a New York event, US Treasury Secretary Janet Yellen explained that she does not think the US is going to have a recession.

Key comments

Expects growth to slow down, but consumer spending is very strong, and investment spending is solid.

Believes there is a path through this that entails a soft landing.

It's unlikely that gasoline prices will fall anytime soon.

Inflation clearly a major problem.

Would not change policies if she could go back in time.

Amazing how pessimistic households are given job gains.

Earlier in the week, Yellen told Congress that the US is facing “unacceptable levels of inflation” on Tuesday as the treasury secretary defended herself from criticism of her previous comments that rising prices were “transitory”.

In response to a question about how she had initially framed inflation, Yellen said: “When I said that inflation would be transitory, what I was not anticipating was a scenario in which we would end up contending with multiple variants of Covid that would be scrambling our economy and global supply chains.

- AUD/USD bears are testing commitments of a key support area on the daily chart.

- US CPI data will be the focus for the end of the week.

At 0.7098, AUD/USD is down over 1.25% on the day and is moving in hard on the next critical support area after breaking the prior higher lows of the rising daily trend. This leaves the focus on the downside although a meanwhile correction could be on the cards. With that being said, the markets are risk-off with Wall Street's benchmarks closing in the red on Thursday ahead of Friday's important inflation data.

Both US and European markets were a sea of red after the European Central Bank signalled it would hike interest rates next month for the first time since 2011. Consequently, eurozone borrowing costs hit an eight-year high when the ECB said inflation would remain "undesirably elevated" for some time. However, the ECB's steps to tackle inflation are not as hawkish as its counterparts at the Federal Reserve nor the Reserve Bank of Australia which earlier this week hiked more than expected.

Nevertheless, the mood was soured due to inflation concerns and the S&P 500 dropped 2.4%, putting it on track for its ninth losing week in the last 10, with losses accelerating late in the day ahead of a highly anticipated report in US Consumer Price Index report that is due Friday morning in the North American session.

Central Bank observers now expect the Federal Reserve to hike rates by 50 basis points next week, especially if U.S. CPI data on Friday confirms an elevated inflation reading.

The consensus forecast calls for a year-over-year inflation increase of 8.3%, unchanged from April. However, we could see more USD resilience in the very short-term ''especially if US core CPI surprises to the upside,'' analysts at TD Securities argued.

''Tactically, we see growing signs of an adverse risk backdrop in the coming weeks, as US real rates and equity correlations wane further and the USD peels away from relative US equity performance.''

A stronger CPI ''reading could put downward pressure on risky assets as investors look for the Fed to remain aggressive in its fight against inflation.''

That exposes US equities for which high beta currencies, such as the Aussie, would come under further pressure.

The Fed is scheduled to announce its next policy statement on Wednesday. A rate hike of at least 50 basis points from the central bank is already being priced in, according to CME's FedWatch Tool.

Meanwhile, as for the RBA, its to hike rates by 50 bps this month rather than 25 bps took the market by surprise, in a move that was described by the RBA Governor Phillip Lowe as “doing what is necessary” to ensure that inflation in Australia returns to target over time.

''A faster trajectory in RBA rate rises is a currency supportive factor,'' analysts at Rabobank said.''However, many other central banks are also hiking aggressively and this will dampen the impact on interest rate differentials. Moreover, the RBA’s sensitivity to growth risks, such as those that might stem from China’s zero Covid policy, is a potential headwind for the AUD.''

''On the upside,'' the analysts argue, ''the Australian economy should draw protection from a currently strong labour market, a high level of household savings and a healthy financial system. Pandemic savings in Australia are estimated to be in the region of AUD270 bln.''

''On the other hand.'' the analysts warned, ''there is uncertainty about the hit to consumers from higher mortgage rates, increased fuel prices and the broad hit to real incomes.''

''Bearing in mind the positive impact on Australian terms of trade as a result of higher commodity prices, we see scope for AUD/USD to be moderately higher vs the USD at year-end.''

AUD/USD technical analysis

The price is meeting a support area following the break of prior support and falling outside of the rising trendline support. The M-formation is a reversion pattern which could draw in the price towards the old support and neckline of the pattern. This too has a confluence with the 38.2% Fibonacci retracement level.

What you need to take care of on Friday, June 10:

The American dollar soared on Thursday as fears took over financial markets. The catalyst was the European Central Bank, as Lagarde & Co. reaffirmed their commitment to raise rates in July, although they anticipated a 25 bps move. Investors were hoping for a 50 bps hike amid inflationary pressures. She added that more hikes are likely in the near future, although the scale of each increment would depend on the medium-term inflation outlook.

Additionally, the central bank upwardly revised the annual inflation forecast, now seen at 6.8% for this year, then decreasing to 3.5% in 2023 and to 2.1% in 2024. On the other hand, growth has been slashed to 2.8% in 2022 and to 2.1% for the next two years.

The EUR/USD pair plummeted, now trading near the 1.0600 price zone.

The GBP/USD pair fell sub-1.2500, affected by risk aversion but with the Pound was also hurt by comments from UK Prime Minister Boris Johnson, who said that the kingdom is in a better position than in the past when the nation has faced economic difficulties, although he added that there is no quick fix to the situation in Ukraine, one of the reasons of mounting price pressures.

The Bank of Canada published a bank stress test, revealing that major banks would incur huge financial losses but would remain resilient in the event of a large and lasting economic shock. The document also showed that monetary policy tightening would put the financial system's resilience to the test and may exacerbate current financial vulnerabilities. The USD/CAD pair is at1.2700 back from an intraday low of 1.2517. Softer crude oil prices weighed on the CAD as the black gold settled at $ 121.10 a barrel.

The AUD/USD gave up to Wall Street's sell-off and finished the day just below the 0.7100 threshold. Gold weakened within range, now trading at around $1.847 a troy ounce.

USD/CHF and USD/JPY edged higher amid the dollar's strength and higher US government bond yields. The 10-year T note yielded as much as 3.073%, a multi-week high.

US indexes closed dip in the red, with the Nasdaq Composite being the worst performer, down 2.50%.

The focus will be on US inflation on Friday, as the country will release the May Consumer Price Index, foreseen stable at 8.3% YoY. However, the White House warned on Wednesday that the government expects inflation numbers to be "elevated."

Like this article? Help us with some feedback by answering this survey:

- The NZD/USD slumps to fresh three-week lows, despite the RBNZ’s beginning of its QT program.

- US initial Jobless Claims rose more than expected, but market players are focused on US inflation data.

- The RBNZ will begin its Quantitative Tightening (QT) program at an NZ $5 billion rate.

The New Zealand dollar slides for the fifth consecutive day after reaching a daily high at 0.6461. However, the NZD/USD is dipping below the 0.6400 figure amidst a risk-off market mood. At the time of writing, the NZD/USD is trading at 0.6385, down by 0.86%.

Risk-aversion and a firm US Dollar, a headwind for the NZD/USD

On Thursday, the European Central Bank (ECB) kept rates unchanged but laid the ground for a lift-off. Worries that more central banks will begin tightening monetary conditions shift the market mood towards risk-off. That said, the NZD/USD fell as investors sought safe-haven assets in the FX complex, boosting the greenback.

Before Wall Street opened, the US Department of Labor reported that Initial Jobless Claims for the week ending on June 4 increased to 229K, higher than the foreseen 210K. Albeit a negative report, the market mainly ignored it, as they are focused on Friday’s US inflation report.

The May Consumer Price Index (CPI) is expected to print 8.3% YoY, in line with the previous two readings. Meanwhile, the core CPI is estimated to hit 5.9% YoY. Late in the day, the University of Michigan would release the preliminary reading for June of its Consumer Sentiment report, which would give investors a guide on how US citizens deal with the current economic outlook.

During the Thursday Asian session, the Reserve Bank of New Zealand is getting ready to unwind its pandemic stimulus program and will begin selling its securities back to the Treasury Department debt office at a rate of NZ $5 billion. The following RBNZ monetary policy will be on July 15, in which market players expect another 50 bps rate hike to leave the Overnight Cash Rate at 2.50%.

Key Technical Levels

- EUR/USD bears are in control and the price is at the edge of the abyss.

- The 50% mean reversion weekly target is vulnerable.

As per the pre-ECB analysis from Thursday's Asian morning session, EUR/USD Price Analysis: Bears are stalling bullish advances at key resistance, 50% mean reversion eyed, the euro has come under immense selling pressure and moved in on a critical area of price imbalance which leaves the 50% target vulnerable.

EUR/USD weekly chart, prior analysis

The W-formation was spotted on the weekly chart, a reversion pattern that leaves the 50% mean reversion target vulnerable for the time ahead.

EUR/USD live market, weekly, daily & H1 charts

The price extended the correction towards the target as illustrated above.

From a daily perspective, there is an M-formation being formed from Thursday's price action. However, while this too is a reversion pattern, there is a price imbalance between June 1's low and May 20 lows of 1.0532 that the bears are embarking on. Mitigation of this price area, around 80 pips to the downside, could play out over the course of the next sessions if bears stay in control.

From an hourly perspective, the price is testing the mitigation area, but the drop could be ripe for a meanwhile correction:

- USD/JPY dips towards 134.00 as buyers book profits ahead of Friday’s US CPI.

- Sentiment remains negative as US equities record losses.

- USD/JPY Price Forecast: The major is upward biased, but negative divergence in the weekly/daily chart might open the door for a pullback towards 131.00.

The USD/JPY retreats from 2-decade highs around 134.55 but is trimming substantial losses, and albeit losing 0.09%, is preparing for a test of the 135.00 figure. At the time of writing, the USD/JPY is trading at 134.20, a signal that traders are booking profits ahead of the release of US inflation data on Friday.

USD/JPY falls as bulls take profits

A dismal market mood keeps global equities pressured. In the FX space, the safe-haven currencies are rising. The USD/JPY is dropping, as above-mentioned by profit-taking and the closeness of the 135.00 mark, seen by some Japanese officials as a line of the sand to intervene in the FX markets.

In the meantime, the US Dollar remains bid, gaining 0.59% as portrayed by the US Dollar Index. The DXY is sitting at 103.151, underpinned by the US 10-year benchmark note rate parked around 3.033%.

Elsewhere, the USD/JPY topped around 134.50 and edged lower, breaking demand zones on its way south, like the daily pivot point at 133.74 and stopped shy of the S1 pivot point, at 133.01.

USD/JPY Price Forecast: Technical outlook

The USD/JPY monthly chart depicts the pair as upward biased, but RSI readings at 83 suggest the major might be about to peak soon. However, a rally towards 2002’s yearly high at 135.16 is on the cards. If the USD/JPY clears that hurdle, then a move towards the August 1998 high at 147.67 is on the cards.

The USD/JPY weekly chart illustrates the formation of a negative divergence between price action and the Relative Strength Index (RSI). If that scenario plays out, the USD/JPY could fall towards 131.34.

The USD/JPY daily chart portrays the pair as in a strong uptrend, recording gains of more than 700 pips in the last ten trading days. Nevertheless, the USD/JPY lost 0.19% in one of those ten days and at the time of writing, is down by 0.04%. Also, a negative divergence between price action and the RSI formed and might open the door for a pullback.

That said, the USD/JPY’s first support would be the June 7 low at 132.54. A breach of the latter would expose the June 6 low at 131.84, followed by the May 9 swing high-turned-support at 131.34.

- The gold price is picking up a safe-haven bid amid global inflation concerns and risk-off markets.

- XAU/USD is rounding off a correction in the 38.2% Fibonacci retracement area.

At $1,850, the gold price is bouncing back from a low of $1,840.10 and has recovered to a high of $1,844.41 so far on the day as investors fear worsening inflation risks. The US Treasury's 30-year auction hit a high yield of 3.185% on Thursday, up from the 2.997% high in the previous auction and the US 10-year yield climbed to a fresh high of 3.07% intraday.

Gold is firmer despite a strong US dollar. The DXY index that measures the US dollar vs. a basket of currencies has rallied from a low of 102.152 to score a high of 103.23 so far on Thursday while the euro and US stocks gave up earlier gains after the latest policy announcement by the European Central Bank (ECB) that revised up its inflation projections "significantly" and unveiled plans for an interest rate hike in July.

ECB: Lower growth, higher inflation

The euro has dropped like a stone, falling over 0.8% already while the Dow Jones Industrial Average fell 0.45% after midday with the S&P 500 down 0.66% and the Nasdaq Composite 0.8% lower. Consequently, gold is enjoying a safe-haven bid.

The ECB announced the end of QE and signalled a 25bp rate hike in July while its forward guidance also set out the prospect of sustained rate hikes, even opening the door for larger steps.

''If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting,'' the central bank said.

''This means that the ECB will only refrain from a 50bp step if the inflation outlook improves, which makes the larger hike look very likely,'' analysts at ABN Amro explained.

However, a concern in markets came from the lack of any details for a plan about dealing with fragmentation concerns. The ECB has warned that the divergence between borrowing costs for different European countries hampers the execution of its monetary policy. Traders, as well as being concerned about lower growth but much higher inflation, took that as a green light to sell the euro and this pushed the greenback towards its second straight weekly gain and biggest weekly gain in five.

The ECB significantly lowered its forecast for Gross Domestic Product growth and raised its forecasts for inflation in 2022-2024. Headline inflation now is projected to be 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024 on average (up from 5.1%, 2.1% and 1.9%, respectively). The central bank’s forecasts for GDP growth during the entire period 2022-2024 have been revised lower by 1.1 percentage points in total. The forecast for 2022 now is 2.8% (was 3.7%), for 2023 2.1% (was 2.8%) and for 2024 2.1% (was 1.6%).

US inflation in focus

Meanwhile, traders will get a look at the latest reading on US inflation on Friday in the form of the May Consumer Price Index (CPI). The consensus forecast calls for a year-over-year inflation increase of 8.3%, unchanged from April. However, we could see more USD resilience in the very short-term ''especially if US core CPI surprises to the upside,'' analysts at TD Securities argued.

''Tactically, we see growing signs of an adverse risk backdrop in the coming weeks, as US real rates and equity correlations wane further and the USD peels away from relative US equity performance.''

A stronger CPI ''reading could put downward pressure on risky assets as investors look for the Fed to remain aggressive in its fight against inflation.''

The Fed is scheduled to announce its next policy statement on Wednesday. A rate hike of at least 50 basis points from the central bank is already being priced in, according to CME's FedWatch Tool.

Meanwhile, the analysts at TD Securities argued that ''a growing valuation gap between gold and real rates might eventually exacerbate the repricing lower in the yellow metal, despite it being attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive complacent length in the yellow metal which has kept the prices elevated.''

Gold technical analysis

The gold price is rounding off a correction in the 38.2% Fibonacci retracement area and a subsequent series of offers could see the bulls off, sending the price significantly lower in the coming days. A snowball effect would likely squeeze length and result in a downside continuation on the weekly chart. On the other hand, should the bulls manage to stay the course, the daily chart's prospects opens the risk towards $1,920 (weekly 61.8% Fibo):

- The British pound clings to weekly gains of 0.24%, ahead of next week’s key events.

- Sentiment remains dismal, a headwind for the GBP/USD.

- GBP/USD Price Forecast: Buyers’ failure to recapture 1.2600 might open the door for selling pressure.

The British pound is sliding for the second consecutive day, after reaching a daily high near 1.2560, retreated and eyes for a re-test of the 1.2500 figure. At 1.2509, the GBP/USD falls courtesy of a dismal market mood, influenced by the ECB, which is preparing to lift off rates, although it would be done “gradually,” as ECB’s President Mrs. Lagarde acknowledged.

Sentiment, high US Treasury yields, and a strong USD weigh on the GBP/USD

Also, a risk-off mood keeps high-beta currencies, like the GBP, pressured. In the FX space, safe-haven peers led by the greenback rise, despite a higher reading in unemployment claims. The Initial Jobless Claims for the week ending on June 4 increased by 229K, worse than the 210K foreseen. The report shows that while the labor market remains tight, data indicates that there has been an uptick in layoffs.

Despite being a negative report, the buck remains in the driver’s seat, boosted by higher US Treasury yields. The 10-year US Treasury yield is rising two and a half basis points, at 3.051%, underpinning the greenback. The US Dollar Index, a measure of the US Dollar value vs. a basket of six currencies, advances close to 0.50% and is back above the 103.000 mark, which was last reached on May 23.

Aside from this, UK Prime Minister Boris Johnson said that its the time to cut taxes in the UK while announcing a house-buying scheme, aiming to give people an opportunity to buy a house.

In the week ahead, the US Consumer Price Index (CPI) May report looms. The headline figure expectation on an annual basis is 8.3%. The so-called core CPI, which excludes food and energy, is foreseen at 5.9% YoY. Additionally, the University of Michigan Consumer Sentiment report will shed some light on how households feel about the US economy, alongside inflation expectations for five years.

GBP/USD Price Forecast: Technical outlook

The GBP/USD daily chart depicts the pair remains downward pressured, though consolidating in a wide 1.2450-1.2600 range. The daily moving averages (DMAs) stay above the exchange rate and accelerate downwards. It’s worth noting that the Relative Strength Index (RSI), pushed to positive territory, though of late, is back below the 50 mid-line, which exacerbated the GBP/USD fall in the last two days.

Hence, the GBP/USD bias favors sellers. The GBP/USD first support would be the 1.2500 figure. A breach of the latter will send the pair towards challenging the June 7 swing low at 1.2430. Once cleared, the next demand level would be May 17, 1.2313 daily low, followed by the YTD Low at 1.2155.

On Thursday, as expected the European Central Bank (ECB) kept rates unchanged, confirmed it would end the purchase program (APP) in July and said it intends to raise interest rates in July by 25bps. Analysts at Wells Fargo point out that market participants and the ECB are unlikely to contemplate multiple 50bps rate hikes and see the ECB moving more gradually than the Federal Reserve, indeed expecting a softer EUR/USD.

Key Quotes:

“We acknowledge a larger move in September is not yet a done deal, and with ultimately depend on the inflation and activity data in the interim, but we are leaning in the direction of a larger increase at that September meeting. By December however, we see a greater chance that headline inflation will begin to recede even if energy prices simply stabilize, and that high energy prices will begin to weigh more noticeably on economic activity.”

“We expect the ECB to increase its Deposit Rate by 25 bps in July, 50 bps in September, and by 25 bps at each of the meetings in December 2022, March 2023 and June 2023, which would lift the Deposit Rate to +0.50% by the end of 2022, and +1.00% by mid-2023.”

“We believe it is unlikely the European Central Bank, or market participants, will contemplate multiple 50 bps rate hikes, and the ECB is still projected to raise interest rates much more gradually than the Federal Reserve over the medium-term. Thus, we do not expect today's announcement to be very supportive of the euro over time, and indeed still see a weaker euro versus the U.S. dollar over the medium-term.”

- Swiss franc rises across the board after the ECB meeting.

- Euro under pressure even as ECB announces it “intends to raise rates in July”.

- EUR/CHF off lows, still down by more than 50 pips.

The EUR/CHF reversed sharply on Thursday, falling 150 pips from the daily high to a three-day low in a few minutes on the back of the European Central Bank meeting.

EUR/CHF rejected from above 1.0500

After the ECB released the statement the EUR/CHF peaked at 1.0513. But again, as it happened in May, the euro was rejected and started to decline. It continues to face a strong resistance around 1.0500. On the flip side, on a closing basis, key support levels are seen at the 1.0400 zone and below at 1.0250.

The downside accelerated on Thursday after Lagarde’s press conference. The cross bottomed at 1.0370 and then rebounded. As of writing, it trades at 1.0415/20, off lows but still down more than 50 pips. It is the first daily decline after rising during five consecutive days.

The ECB announced the end of net purchases under the APP programme on 1 July and that they intend to raise interest rates by 25bp in July. For September, the ECB kept the door open to a larger hike depending on data. The euro weakened even as German bond yields soared to the highest level since 2014.

“The SNB (Swiss National Bank) has sent out initial signals that it, too, is prepared to raise interest rates in the foreseeable future. First, however, it is likely to be the ECB's turn, which should support EUR/CHF. But only moderately, because the SNB is also likely to initiate the interest rate turnaround in September”, explained analysts at Commerzbank.

Technical levels

The European Central Bank held its meeting on Thursday. It announced the end of the purchase program (APP) by July 1st, kept interest rates unchanged as expected, and said it intends to raise rates in July by 25bp. Analysts at Danks Banks point out risks are still skewed for more than one 50bp rate hike, but with the current very uncertain outlook, we expect the economic outlook will dampen the medium inflation pressure, paving the way for ‘only’ 25bp hike. They still see the EUR/USD pair moving toward 1.00.

Key Quotes:

“For EUR/USD, ECB is provided some well-sought after clarity as to the entire likely policy path in to and including Q4. Further, this guidance appear quite in line with the market’s view. We are seeing a mild widening of credit spreads (higher Italian rates vs Germany) and during the press conference, and EUR/USD unwound some of the initial strength – likely due to the credit/risk aversion channel. This is well in line with the observation that FX strength upon hawkish central banks has faded rather fast and we have recently seen that in SEK, AUD and Eastern Europe. Also, EUR strength on ECB guidance has faded multiple events in the last 3-6 months.”

“In our view, this ECB meeting confirms our view that rate hikes are a global phenomenon intended to make markets rotate towards less risky positions and a lower EUR/USD spot is part of such a rotation. For Europe, widening spreads is also crucial to why EUR/USD heads south as we price in higher rates. Looking ahead, we continue to see EUR/USD towards 1.00 in 12m.”

- Euro under pressure after ECE meeting and despite higher yields.

- US dollar gains momentum as market sentiment deteriorates.

- EUR/USD falls to test 20-day Simple Moving Average.

The EUR/USD dropped further during the American session and bottomed at 1.0643 reaching the lowest level in a week amid a stronger US dollar on the back of risk aversion triggered by higher yields.

Euro unable to benefit from ECB shift

The euro peaked versus the US dollar on Thursday at 1.0773, the highest level in a week following the European Central Bank announcement. The central bank, as expected, kept interest rates unchanged and said it intends to raise rates at the July meeting by 25 bps.

“We adopt the ECB's implied near-term profile, and now expect a 25bps hike in July and a 50bps hike in September. Beyond that, we look for a further 50bps hike in October before the ECB slows the pace to 25bps hikes in December, February, and March. This would take the depo rate to 1.50%, which we believe is the ECB's estimate of its neutral rate”, explained analysts at TD Securities.

During Lagarde’s press conference the euro lost momentum even as German bond yields hit fresh multi-year highs at 1.46%. EUR/CHF tumbled from above 1.0500 to 1.0370 and EUR/GBP hit level under 0.8500.

In the US, Initial Jobless Claims rose more than expected, to the highest level in 20 weeks. On Friday, May’s CPI is due and next week is the FOMC meeting.

Testing the 20-day SMA

The slide of the EUR/USD so far found support around the 1.0635 zone. It is a relevant area that also contains the 20-day Simple Moving Average. A daily close below should weaken the outlook for the euro, exposing the next support level at 1.0585 followed by 1.0520.

If the pair remains above 1.0640 it will likely continue to trade in the range 1.0640/1.0750. A break above the upper limit should clear the way for an extension of the recovery.

Technical levels

- The USD/CAD recovers some ground and is positive in the week, up by 0.42%.

- BoC’s Macklem said that the Canadian economy is overheating and needs higher rates.

- USD/CAD Price Forecast: A break above 1.2700 would give control to buyers; otherwise, further downside is expected.

The USD/CAD rebounds from weekly lows at around 1.2510s and advances firmly during the North American session amidst a risk-off market mood that boosted the greenback and safe-haven currencies in the FX space. At 1.2647, the USD/CAD records gains of 0.71% at the time of writing.

Elevated US Treasury yields, a buoyant US dollar, and falling oil prices weigh on the CAD

On Thursday, the USD/CAD is pushing upwards, spurred by higher US Treasury yields. The 10-year benchmark note sits at 3.055%, up by two basis points, and underpins the buck. The US Dollar Index, a gauge of the greenback’s value, sits at 102.977, gaining almost 0.50%, a tailwind for the USD/CAD.

Falling crude oil prices also weigh on the Loonie. Western Texas Intermediate (WTI), the US crude oil benchmark, is at $121.83 per barrel, losing 0.27%.

Meanwhile, US economic data showed that Jobless Claims for the week ending on June 4 rose to 229K, higher than the 210K expected. Sources cited by Bloomberg said, “However, while we think labor markets are still currently quite tight, we can’t totally dismiss the notion that the rise in claims is a sign of a modest rise in layoffs.”

In the meantime, the Bank of Canada (BoC) Governor Tiff Macklem is crossing wires. When asked if households could handle a larger than 50 bps increase, he said the bank needs to take a larger step. He added that the chances of rates going above 3% have risen, meaning that the BoC would need more or bigger rate increases.

Macklem added that the Canadian economy is overheating and needs higher rates.

On Friday, the Canadian economic docket will reveal employment data. At the same time, the US calendar will announce US inflationary figures, with the Consumer Price Index (CPI) expected to rise to 8.3%. Excluding volatile items, ais expected at 5.2%. Also, later in the day, the UoM Consumer Sentiment will shed some light on how households feel about the US economy, alongside inflation expectations for five years.

USD/CAD Price Forecast: Technical outlook

The USD/CAD is neutral-downward biased, despite the two-day rally of almost 130 pips. The thesis is reinforced by the Relative Strength Index (RSI), at 45.18, is aiming higher, but unless it crosses bullish territory, it might shift downwards. Additionally, if the daily moving averages (DMAs) remain above the exchange rate, that would favor sellers, giving them better price entries.

If the USD/CAD is to shift to a neutral bias, buyers need to lift the pair to move above the 1.2658-1.2700 confluence of the 200 and the 100-DMA. Once cleared, that would pave the way for further gains. Otherwise, the USD/CAD first support would be 1.2600. Break below would expose the June 8 swing low at 1.2517, followed by the June 25 swing low at 1.2458.

- AUD/USD slumped to the low-0.7100s from near 0.7200 on Thursday as risk appetite worsened after a hawkish ECB announcement.

- That meant fresh weekly lows for the pair that failed to derive a lasting boost from this week’s RBA surprise.

- Having now snapped a medium-term uptrend, the pair is eyeing a test of its 21DMA.

The Australian dollar turned sharply lower on Thursday as broader market risk appetite took a turn for the worse in wake of the ECB’s hawkish policy announcement (which weighed on European equities) and amid a fall in industrial metal prices, with Bloomberg’s Industrial Metal Subindex last down around 2.0% on the day as traders watch Covid-19 updates in China.

As a result, AUD/USD has slumped nearly 1.0% from the upper 0.7100s to fresh weekly lows around the 0.7120 mark and is eyeing a test of its 21-Day Moving Average around the 0.7100 level. Tuesday’s post-larger than expected RBA rate hike and more hawkish than expected RBA rate guidance upside in the Aussie has proven short-lived.

Technicians will likely view the recent drop in AUD/USD as signaling the end of a bull run that had seen the pair rally over 6.5% from multi-year lows in low-0.68s to last week’s highs in the upper 0.7200s. Ahead, the main event for the remainder of the week will be Friday’s US Consumer Price Inflation report.

If the data reveals US price pressures to have eased in May, then that could provide AUD/USD with some respite via 1) a weaker US dollar as traders pare back their Fed tightening bets ahead of next week’s meeting and 2) via a likely improvement in risk appetite as inflation fears ebb.

AUD/USD bulls will be hoping for US inflation to trend lower from here on out, meaning a lasting drop in the buck and improvement in risk appetite, which could see AUD/USD resume its recent uptrend. But for now, traders will likely want to keep their powder dry.

- Gold Price witnessed some selling on Thursday amid a further rise in the US bond yields.

- Hawkish central banks further contributed to driving flows away from the commodity.

- A softer risk tone, modest USD downtick extended some support and helped limit losses.

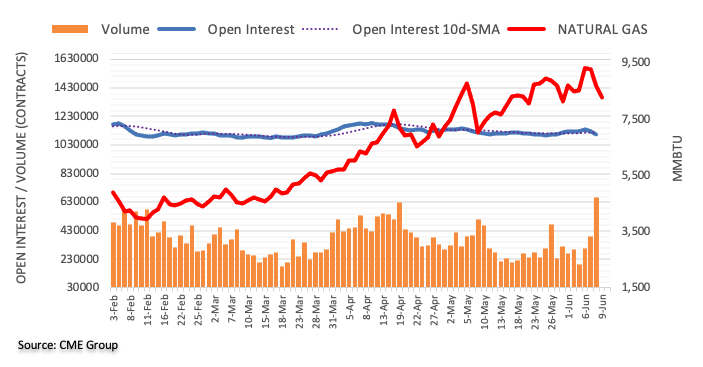

Gold Price edged lower on Thursday and was last seen trading around the $1,848-$1,847 region, just above the very important 200-day SMA support. Elevated US Treasury bond yields, bolstered by hawkish Fed expectations, turned out to be a key factor that weighed on the XAUUSD. That said, some intraday US dollar selling, along with a generally weaker risk tone, helped limit deeper losses for the XAUUSD, at least for the time being.

Gold Price weighed down by hawkish central banks

Following a brief retracement during the early part of the week, the 10-year US bond yield climbed back above the 3.0% threshold amid concerns about rising inflation. Crude oil prices climbed to their highest levels since early March amid an improving demand outlook. Apart from this, the global supply-chain disruptions caused by the Russia-Ukraine war and the COVID-19 lockdowns in China could put upward pressure on already high consumer prices. This might force the US central bank to tighten its monetary policy at a faster pace, which remained supportive of the recent rally in the US bond yields.

The European Central Bank also hinted that it intends to raise interest rates by 25 bps in July and left the door open for a potential 50 bps hike in September. In the monetary policy statement, the ECB said that if the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting. This comes on the back of a 50 bps rate hike by the Reserve Bank of Australia and the Reserve Bank of India on Tuesday and Wednesday, respectively, which continued acting as a headwind for the non-yielding yellow metal.

Subdued USD demand, softer risk tone lend support

Meanwhile, the post-ECB buying around the shared currency weighed on the greenback and held back traders from placing aggressive bearish bets around the dollar-denominated XAUUSD. Meanwhile, doubts that major central banks can hike interest rates to curb inflation without impacting economic growth continued weighing on investors' sentiment. This was evident from the prevalent cautious mood around the equity markets, which could further lend some support to the safe-haven precious metal. Investors might also prefer to wait on the sidelines ahead of the US consumer inflation figures, scheduled for release on Friday.

Focus remains on US CPI

The US inflation report would determine the Fed's policy tightening path and influence the near-term USD price dynamics. This, in turn, should provide a fresh directional impetus to the XAUUSD, which is often considered a hedge against inflation. According to Joseph Trevisani, Senior Analyst at FXStreet: Even though Fed policy for at least the next two meetings will not be affected by the CPI results for May or June, there is considerable room for a market response depending on the deviation from forecasts. Market risk lies primarily with a higher than predicted inflation number. There are good reasons to suspect that a portion of the May oil and gas price increases were not captured in the analysts surveys that produce the forecasts.

Inflation fears

Gold Price technical outlook

Gold Price continued showing some resilience near a technically significant 200-day SMA. The said support, currently near the $1,842-$1,841 region, should act as a pivotal point, which if broken decisively could drag the XAUUSD to the $1,830 region. The downward trajectory could further get extended towards the $1,810-$1,808 intermediate support en-route the $1,800 round-figure mark.

On the flip side, the weekly high, around the $1,860 region touched on Wednesday, now seems to act as an immediate strong barrier ahead of the $1,870 supply zone. Sustained strength beyond the latter would negate any near-term bearish bias and lift the XAUUSD to the $1,885-$1,886 area. Bulls might eventually aim back to reclaim the $1,900 mark for the first time since early May.

-637903789782795367.png)

Gold Price draws support from worsening economic outlook

The Bank of Canada said on Thursday that it is paying particular attention to the fact that a greater number of Canadian households are carrying high levels of mortgage debt, reported Reuters.

Additional Takeaways:

Financial system vulnerabilities have become more complex, and risks have become more elevated.

Vulnerabilities associated with elevated house prices increased further over the past year and evidence implies that the overall proportion of highly indebted households likely surpassed its pre-pandemic peak in 2021.

It is too early to tell whether the recent decrease in housing resale activity and prices will be temporary or the beginning of a substantial correction.

Those who entered the housing market over the last year would be more exposed in event of a significant price correction.

Vulnerabilities associated with elevated household indebtedness and high house prices increase the downside risks to future GDP growth.

The tightening of monetary policy globally will test the resilience of the financial system and could worsen existing financial vulnerabilities.

Effects on the real economy could be significant if a trigger event occurs, even as systemically important financial institutions remain resilient.

Stress-testing exercises showed major banks would suffer significant financial losses but remain resilient in case of a large and persistent economic shock.

Market participants' confidence in the resilience of the Canadian financial system has hit its highest level reported.

Publicly traded non-financial businesses are generally in good financial shape and appear well-positioned to handle higher rates.

Fragile liquidity in fixed-income markets remains an ongoing structural vulnerability while the risk of a quick repricing of assets exposed to climate change has increased.

New outbreaks of Covid-19 in China and associated lockdowns are another source of concern to the global economy and inflation.

The risk of a further disorderly repricing of risk remains, which could lead to much tighter financial conditions globally and in Canada.

- Silver fell to fresh weekly lows under its 21DMA after a hawkish ECB announcement but remains within recent ranges.

- XAG/USD was last trading near $21.80, down 1.0% as focus turns to Friday’s US CPI and next week’s Fed meeting.

Spot silver (XAG/USD) was trading with a negative bias at weekly lows in the $21.80 per troy ounce area on Thursday, down around 1.0% on the day, in wake of a hawkish ECB policy announcement that saw the bank signal a 25 bps rate hike next month plus the end of QE and a possible 50 bps hike in September depending on the development of the outlook for inflation.

But that still leaves XAG/USD well within recent ranges and support in the form of the 21-Day Moving Average at $21.80 continues to hold. Silver is thus currently close to the middle of a $21.50-$22.50ish range that has been in play since the end of May and traders will be looking to Friday’s US Consumer Price Inflation data and next Wednesday’s Fed meeting to see whether things get shaken up.

Silver bulls will be hoping for Friday’s inflation data to surprise to the downside and reinforce the idea that US inflation has now peaked, thus likely resulting in some further paring back of Fed tightening bets. This would weigh on US yields and the buck, both of which are typically positive for precious metals.

Meanwhile, the Fed is widely expected to raise interest rates by 50 bps at next week’s meeting (and again in July), so this shouldn’t come as a surprise to hurt silver. What will be more important is Fed Chair Jerome Powell’s commentary in the post-meeting press conference on the outlook for rate hikes beyond July.

If he starts sounding a little more confident that inflation is going to fall back from current elevated levels/concerned about the weakening US economy, then that, if CPI also surprised to the downside, could help XAG/USD rally into the $23.00-$23.50 area, where it would run into resistance in the form of its 50 and 200-Day Moving Averages.

- EUR/USD could not sustain the uptick beyond 1.0770.

- Next on the downside emerges the June low around 1.0630.

EUR/USD’s ECB-induced bullish attempt ran out of steam in the 1.0770 region on Thursday.

The inability of spot to surpass the 4-month resistance line near 1.0740 carries the potential to spark a corrective leg lower sooner rather than later. That said, there is an initial support at the so far June low at 1.0627 (June 1).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1209.

EUR/USD daily chart

In response to a question about whether the European Central Bank's (ECB) commitment to prevent fragmentation in the Eurozone is enough to prevent it, President Christine Lagarde gave an unconvincing response, where she essentially just repeated the commitment the ECB made to prevent fragmentation that might impair the transmission of its monetary policy. Various commentators on Twitter accused Lagarde of not wanting to admit that the ECB hasn't yet created an actual monetary policy tool to prevent transmission.

Market Reaction

The ECB's hawkish policy announcement on Thursday in which they highlighted a 25 bps hike in July and a likely 50 bps hike in September appears to have sparked fears of Eurozone economic fragmentation, as represented by the underperformance of so-called peripheral Eurozone bonds versus core bonds. For example, whilst German 10-year yields were last trading around 7 bps higher in the 1.40% area, Italian 10-year yields had jumped around 20 bps in wake of the ECB from around 3.45% to 3.65%.

- EUR/USD fades the post-ECB uptick to the 1.0770/75 band.

- The ECB plans to hike rates by 25 bps in July.

- A larger rate hike depends on the progress of inflation.

EUR/USD advanced to multi-day highs past 1.0770, although that move rapidly fizzled out and motivated spot to slip back below the 1.0700 mark on Thursday.

EUR/USD looks offered, as investors digest Lagarde’s presser

EUR/USD now looks volatile after hitting tops in the 1.0770 region on Thursday.

Indeed, sellers seem to be gaining ground following the press conference by Chair Lagarde and after the ECB left its interest rates unchanged at its meeting.

Actually, Lagarde suggested that the outlook for the future has worsened, while near-term activity is expected be negatively affected by higher energy costs and price increases has spread across other sectors. She also added that risks to inflation remain tilted to the upside.

Lagarde said that the policy decision was unanimous and the bank intends to raise rates by 25 bps in July, while a larger hike will be dependent on how inflation evolves in the next months.

What to look for around EUR

EUR/USD continues to trade in a side-lined mood near 1.0700 for the time being.

The pair’s recent multi-week recovery has been on the back of supportive ECB-speak, which continued to point at an initial rate hike as soon as in July, while the consensus view that the bond-purchase programme should end at some point in early Q3 has also lent legs to the European currency.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: ECB Interest Rate Decision (Thursday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is losing 0.04% at 1.0712 and a breach of 1.0627 (monthly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18). On the other hand, immediate up barrier emerges at 1.0786 (monthly high May 30) seconded by 1.0933 (100-day SMA) and finally 1.0936 (weekly high April 21).

When questioned on why the European Central Bank (ECB) has signalled its intention to raise interest rates by 25 bps in July and not by 50, President Christine Lagarde said that it is good practise to start an interest rate hiking cycle with an incremental increase that is sizeable, but not excessive, as per a tweet by Bloomberg's Jonathon Ferro.

European Central Bank (ECB) President Christine Lagarde said on Thursday in the Q&A section of her post-ECB meeting press conference that the ECB needs to ensure that fragmentation doesn't prevent the transmission of its monetary policy, reported Reuters. If necessary, the ECB can deploy new instruments to tackle fragmentation, she added.

On a separate note, Lagarde warned that when the ECB revisits its inflation forecasts in September, if the ECB staff see 2024 inflation coming in at 2.1% or higher, then a larger than 25 bps rate hike is likely at that meeting. Meanwhile, Lagarde noted that the ECB deliberately didn't discuss the neutral rate of interest on Thursday.

European Central Bank (ECB) President Christine Lagarde said on Thursday in the opening remarks of her post-meeting press conference that inflationary pressures have broadened and remain undesirably high, which is a major challenge, reported Reuters. Moreover, price pressures are becoming more widespread across sectors, she added.

Near-term economic activity is to be dampened by high energy costs, she noted, noting that the war in Ukraine and recent lockdowns in China have made supply chain snags worse. Wage growth has started to pick up, Lagarde continued, and the initial signs of inflation expectations above target warrant monitoring. The war in Ukraine is a big downside risk to economic growth, while risks to inflation are primarily tilted towards the upside.

- Weekly initial jobless claims rose to 229K, above expected.

- Currency markets did not react, given they are more focused on the ECB right now.

There were 229,000 initial jobless claims in the week ending on 4 June, above the prior week's reading of 202,000 and expectations for a rise to 210,000. That pushed the four-week average higher to 215,000 from 207,000 a week earlier.

Continued jobless claims in the US in the week ending 28 May remained unchanged versus one week earlier at 1.306M, almost bang in line with market expectations. That meant the insured unemployment rate remained unchanged at 0.9%.

Market Reaction

Currency markets did not react to the latest US weekly jobless claims figures and are instead much more focused on the ECB right now.

The Reserve Bank of Australia’s (RBA’s) aggressive hike did not help the aussie much, with equities fragile. Post-FOMC next week, once the dust settles, economists at Westpac expect to see the AUD/USD a little softer, near 0.7100.

RBA cash rate pricing is aggressive

“Aggressive market pricing for RBA tightening reinforces the aussie’s fundamentals and should limit the scale of pullbacks for months to come. A previously very shaky support pillar has been shored up.”

“FOMC meetings often deliver volatility, but when the dust settles, we should see AUD/USD at the lower end of recent ranges, near 0.7100, with risks lower until the global mood brightens.”

The overall burden of taxes in the UK is high and must come down, UK PM Boris Johnson said on Thursday in a speech, reported Reuters. The time has come for the government to enact supply-side reforms, he continued, noting that it is time to start cutting taxes and regulations.

Boris had previously said that the UK's position is better than in the past when the nation has faced economic difficulties and that the UK government has the fiscal firepower to help, and it will.

As broadly expected, the ECB left rates unchanged today. What’s more, the European Central Bank (ECB) has signaled its intent to raise rates by 25 bps in July but left the door open to a 50 bps move in September. Still, economists at TD Securities do not believe that the EUR/USD is ready to push higher.

EUR/USD is at risk of returning to sub-1.07 If Lagarde cannot sound more hawkish

“ECB institutionalized dovishness wins out by essentially saying that it ‘intends to’ hike by 25 bps in July.”

The ECB did throw a bone to the hawks by opening the door to a 50 bps hike in September if high inflation is sustained. But, with the ECB still focusing on ‘gradualism’ and a small upgrade to 2024 inflation (to 2.1%), we do not get the sense that EUR/USD is ready to push higher, particularly with the risk of a stronger US core CPI read tomorrow (on a MoM basis).”

“If Lagarde cannot sound more hawkish in the press conference, EUR/USD is at risk of returning to sub-1.07.”

UK PM Boris Johnson said on Thursday in a speech that the UK's position is better than in the past when the nation has faced economic difficulties, reported Reuters. However, the price of oil, gas, grain and feed looks likely to remain high, he added, noting that there is no quick fix to the situation in Ukraine. But the economic consequences of the war in Ukraine will abate over time, he said.

The UK has the fiscal firepower to help, and it will, Boris said. The government will help the British people for as long as it takes, he continued, caveating that no government can afford to shield everyone from the rising cost of living. When facing inflation, "you can't just pay people more", as this risks an inflationary spiral, he cautioned, adding that the only cure for this is higher interest rates.

Lee Sue Ann, Economist at UOB Group, sees the BoJ sticking to its ultra-accommodative policy stance at the June 17 meeting.

Key Quotes

“Although Japan’s inflation has climbed in recent months, BOJ Governor Kuroda does not see 2% inflation in Japan as sustainable ‘when it’s triggered by a rise in commodity prices and worsening trade factors’ with wage growth still absent.”

“So, both Japan’s lacklustre economic recovery and the challenging growth outlook will imply the BOJ will not be tightening or signalling to do so anytime in 2022.”

- EUR/USD advances on a firmer note to 1.0750.

- ECB left its key rates unchanged, matching expectations.

- Investors now look to Lagarde’s press conference.

The buying bias in the single currency gathers extra steam and lifts EUR/USD back to the 1.0750 region, or 3-day highs, in the wake of the ECB interest rate decision.

EUR/USD now focuses on Lagarde

EUR/USD now adds to the weekly recovery after the ECB left intact the interest rate on the main refinancing operations, the interest rate on the marginal lending facility and the deposit facility at 0.00%, 0.25% and 0 -0.50%, respectively.

In its statement, the ECB plans to end the net asset purchase under the APP in July and hike rates by 25 bps later in the same month. If the inflation outlook worsens, then a larger hike in September could be on the cards.