- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 12-06-2022.

- GBP/JPY consolidates the biggest daily fall in a month, probes two-day downturn.

- Risk-off mood joins Brexit, UK political woes to exert additional downside pressure.

- BOE vs. BOJ divergence keep buyers hopeful as Japan policymakers showed readiness to intervene.

- UK’s monthly data, Brexit news will direct immediate moves, risk catalysts are the key.

GBP/JPY stays defensive around 165.60-55 during Monday’s Asian session, after falling the most in a month the previous day. The pair’s latest inaction could be linked to the market’s anxiety ahead of the key data/events lined up for publication. However, bears remain hopeful as sour sentiment joins Brexit woes.

The market’s risk-off mood gained strength on Friday after the US inflation data rose past market expectations and propelled the case of the Fed’s aggression. That said, the headline US Consumer Price Index (CPI) rose to 8.6% YoY versus 8.3% expected while the Core CPI jumped 6.0% YoY compared to the expected drop to 5.9% from 6.2% a month earlier. It’s worth noting that the record low of the University of Michigan Consumer Sentiment Index for June, to 50.2 versus revised down 58.1, couldn’t stop the US dollar bulls.

Additionally, weighing on the sentiment is a blast in covid numbers in Beijing, as well as an increase in Shanghai’s virus figures, not to forget the Sino-American tussles over Taiwan.

On the other hand, Japanese policymakers held a top-tier discussion over global markets and the yen on Friday. Following the meeting, Japan’s top currency diplomat Masato Kanda said, “We will take appropriate action if needed,” adding that “there are various options in mind.”

Also exerting downside pressure on the GBP/JPY prices are the latest Brexit woes and concerns over political instability in the UK, not to forget the lack of trust in the Bank of England’s (BOE) capacity to tame inflation and avoid recession.

Talking about the latest Brexit development, UK Foreign Secretary is up for presenting a Bill to edit a part of the Brexit deal, relating to the Northern Ireland Protocol (NIP), to the British House of Common on Monday. In addition to the European Union’s (EU) clear signals to retaliate against such moves by harsh measures, chatters that the European judges to be stripped of Northern Ireland protocol powers under new Brexit law, backed by the UK Telegraph, also amplify Brexit concerns.

Further, Tory rebels are trying hard to oust UK PM Boris Johnson and may use the latest Brexit bill for their purpose. However, a lack of clarity over the successor and Johnson’s Brexit aggression seem to help Johnson keep the throne, as per the market’s rumors.

Above all, BOE vs. BOJ divergence seems to defend the GBP/JPY prices ahead of today’s monthly Gross Domestic Product (GDP) for April, expected 0.2% versus -0.1% prior, as well as Manufacturing and Industrial Production data, not to forget the UK’s trade numbers for April. Should the scheduled data print expected improvement, the GBP/JPY pair may witness intermediate relief. Though, Brexit woes may reverse any corrective pullback on negative announcements.

Technical analysis

Failure to provide a daily closing beyond April’s high near 168.45 seems to direct GBP/JPY bears towards highs marked in March and late April, respectively around 164.65 and 164.25. However, a convergence of the 50-DMA, 20-DMA and monthly support line, near 162.70, appears a tough nut to crack for the pair sellers.

- USD/CAD bears could be on the prowl and eyes are on the downside.

- The W-formation is a compelling feature of the daily chart.

USD/CAD has extended its rally and is reaching prior highs that would be expected to act as a resistance and potentially lead to a significant correction of the bullish impulse. The following illustrates the prospects of a correction for the coming sessions that could target key areas of potential support.

USD/CAD daily chart

The price formation is an over-extended W-pattern, a reversion pattern that would be expected to see the USD/CAD slide back towards the neckline, or in this case, only as far as the structure near 1.2680 as the prior structure. Once the rally decelerates, the Fibonacci retracement tool can be drawn on the bullish impulse to compare to where the levels meet the structure for additional confluence. As it stands, based on the current range of the rally so far, the 50% mean reversion level meets with the structure between 1.2680 and 1.2650:

- Silver struggles to extend Friday’s recovery from one-month low.

- Bullish MACD signals, weekly resistance break keeps buyers hopeful.

- One-month-old horizontal support challenges bears amid steady RSI.

Silver (XAG/USD) prices retreat from $22.00 during Monday’s Asian session, following the rollercoaster ride that ended with the heaviest daily gains in a week.

Although Friday’s corrective pullback from a one-month low enabled the bright metal to cross an immediate hurdle, now support around $21.85, the 200-SMA level near $22.10 seems to challenge bulls. Also challenging the quote’s upside momentum is the steady RSI (14) suggesting a continuation of a monthly trading range between 21.30 and 22.50.

That said, the metal’s latest weakness needs validation from the previous resistance line to retest the aforementioned trading range’s support, around $21.30.

Should XAG/USD bears conquer the $21.30 mark, a downward trajectory towards the $21.00 threshold and then to May’s low of $20.45 can’t be ruled out.

On the contrary, a sustained break of the 200-SMA level near $22.10 isn’t a strong welcome sign for the buyers as an upward sloping resistance line from May 27, near $22.55, could challenge the run-up.

In a case where silver prices rise beyond $22.55, early May’s swing high near $23.30 will gain the market’s attention.

Overall, silver prices are likely to witness a pullback towards testing the lower end of the immediate range.

Silver: Four-hour chart

Trend: Pullback expected

- USD/CHF is trading lackluster as investors await interest rate policy from the Fed and the SNB,

- The Fed is expected to sound extremely hawkish amid higher inflation.

- The SNB is expected to end its prudent monetary policy stance.

The USD/CHF pair is displaying back and forth moves in a narrow range of 0.9875-0.9893 in the early Tokyo session. The major displayed a juggernaut rally on Friday after sensing significant bids from 0.9766. A firmer responsive buying action was backed by soaring US inflation numbers.

The US Consumer Price Index (CPI) landed at 8.6%, vs. 8.3% as expected, and also the former figure on annual basis. While, the core CPI landed at 6%, higher than the forecasts of 5.9%. This has cleared the fact that higher food and energy prices are driving the price pressures and are required to tame sooner to safeguard the wallets of households from depreciation.

Therefore, the Federal Reserve (Fed) is expected to come forward with a higher rate hike announcement. Considering the tight labor market in the US and soaring inflationary pressures, the Fed is required to paddle up to their interest rates vigorously. The expectations of a 75 basis point (bps) rate hike are getting much air.

On the Swiss franc front, investors are awaiting the interest rate decision by the Swiss National Bank (SNB), which is due on Friday. The Swiss CPI has climbed above 2% in May, which could pause the SNB to continue with a neutral stance. However, a report from Citibank states that the Swiss central bank could raise interest rates next week”.

- AUD/USD refreshes three-week low during a four-day downtrend, pressured of late.

- Market sentiment roils after Friday’s US inflation propelled hawkish Fed bets, holiday in Australia restricts pair’s latest moves.

- China’s covid conditions, chatter over Sino-American jitters add to bearish bias.

- Aussie jobs report, RBA’s Q1 Bulletin may entertain traders but risk catalysts, Fed are crucial for fresh impulse.

AUD/USD holds lower ground near 0.7030, after refreshing the three-week low, as risk-aversion joins negative headlines from China to favor bears. In doing so, the Aussie pair drops during the fourth consecutive day even as Queen’s Birthday in Australia restricts the pair’s latest moves.

The risk barometer pair’s latest losses could be linked to the market’s increased fears over the Fed’s aggression amid skyrocketing US inflation. The sentiment worsened on Friday after the headline US Consumer Price Index (CPI) rose to 8.6% YoY versus 8.3% expected while the Core CPI jumped 6.0% YoY compared to the expected drop to 5.9% from 6.2% a month earlier. It’s worth noting that the record low of the University of Michigan Consumer Sentiment Index for June, to 50.2 versus revised down 58.1, couldn’t stop the US dollar bulls.

On the other hand, Beijing witnessed a jump in the covid numbers during the weekend and recalled some of the virus-led activity restrictions together with the mass testing. Shanghai is on the same line. Recently, Beijing’s local government spokesman Xu Heijian mentioned that a covid outbreak linked to a bar in Beijing is ferocious.

Also weighing on the market’s mood, as well as the AUD/USD prices are fresh fears of the US-China tussles over Taiwan. China’s Defense Minister Wei Fenghe crossed wires during the weekend stating that China's relationship with the US is at a crossroads. The policymaker also added that they will fight to the end if anyone attempts to secede Taiwan from China. “those who seek Taiwan independence will come to no good end,” said China’s Wei.

Against this backdrop, Wall Street slumped and the US Treasury yields rallied which in turn propelled the US dollar’s safe-haven demand. That said, the S&P 500 Futures drop 1.0% whereas the US 10-year Treasury bond yields remain mostly unchanged around 3.16% at the latest.

Moving on, holidays in Australia may restrict AUD/USD moves during the Asian session but the risk-aversion wave can keep exerting downside pressure on the quote. That said, Wednesday’s Fed decision and Thursday’s Aussie employment data for May will be crucial for the pair traders amid hawkish concerns from the RBA.

Technical analysis

Unless providing a daily close beyond the 20-DMA surrounding 0.7125, AUD/USD remains on the way to a broad horizontal support zone stretched from January, around 0.6955-70.

- USD/JPY has registered a fresh two-decade high at 134.70 as investors see extreme hawkish Fed policy.

- Soaring inflation and the upbeat NFPs have opened doors for a 75 bps rate hike by the Fed.

- The BOJ is expected to keep policy unchanged and end the prudent monetary policy approach.

The USD/JPY pair has surpassed the last week's high at 134.55 and has registered a fresh two-decade high at 134.70 at open. The asset witnessed some offers while attempting to record a fresh new two-decade high earlier.

Higher odds of a jumbo rate hike by the Federal Reserve (Fed) in its monetary policy to be announced on Wednesday have bolstered the US dollar index (DXY). The DXY has crossed the last week’s high at 104.21 and is expected to print more gains as higher US Consumer Price Index (CPI) numbers have raised odds of a 75 basis point (bps) interest rate hike by the Fed.

The US Bureau of Labor Statistics has reported the US Consumer Price Index (CPI) at 8.6% on annual basis, much higher than the estimates of 8.3%. Also, the US Nonfarm Payrolls (NFP) were upbeat as the US economy added 390K jobs in May. Higher inflation and US NFP have opened the doors for the 75 bps rate hike announcement by the Fed. Although Fed Chair Jerome Powell stated that a 75 bps rate hike is not into our consideration, but considering the fresh inflationary pressures and the upbeat NFPs, the Fed may be required to consider a bumper rate hike announcement.

On the Tokyo front, the Bank of Japan (BOJ) will announce the interest rate decision on Friday. As per the market consensus, the BOJ is expected to maintain the status quo and will keep the interest rates unchanged. Although, a prudent monetary policy may be concluded this time and the BOJ would shift to a neutral stance on the monetary policy.

- USD/CAD remains on the front for the fourth consecutive day, hovers around multi-day top marked on Friday.

- Strong Canada jobs report couldn’t supersede hot inflation data from the US as hawkish Fed bets increase.

- China’s worsening covid conditions add to the risk-off mood as market’s anxiety escalates ahead of the key data/events.

USD/CAD grinds higher around a fortnight top, up for the fourth consecutive day, as softer oil prices join the strong US dollar to favor bulls. That said, the Loonie pair stays firmer around 1.2800 during Monday’s initial Asian session.

Although Canada’s upbeat job numbers battled strongly with the US inflation data, the Fed-linked chatters kept the USD/CAD bulls on the throne. On Friday, the headline US Consumer Price Index (CPI) rose to 8.6% YoY versus 8.3% expected while the Core CPI jumped 6.0% YoY compared to the expected drop to 5.9% from 6.2% a month earlier. It’s worth noting that Canada’s Employment Change rose past 30K forecast to 39K while the Unemployment Rate dropped from 5.2% to 5.1%.

On the other hand, the University of Michigan Consumer Sentiment Index for June also refreshed the record to 50.2 versus revised down 58.1 but couldn’t derail the US dollar bulls.

Elsewhere, WTI crude oil prices printed the bearish Doji candlestick at a three-month high amid the market’s fears of a slowdown in the demand, mainly due to China’s covid conditions and growing monetary policy aggression of the major central banks. Also weighing on the black gold is the US dollar strength that has an inverse relationship with the oil prices.

Given the stronger US data increasing the odds of the Fed’s faster/heavier rate hikes, the market’s rush towards the risk-safety escalates ahead of Wednesday’s Fed meeting.

While the Fed is likely to keep USD/CAD bulls on the radar, any disappointment won’t be taken lightly and can trigger volatility in the markets. Hence, USD/CAD needs more care during this week.

Technical analysis

Successful break of the one-month-old descending trend line and the 50-DMA, respectively around 1.2470 and 1.2600, direct USD/CAD prices towards the yearly high marked in May, near 1.3075. That said, multiple hurdles marked during late May, around 1.2880-90, could offer an intermediate halt during the anticipated run-up.

- EUR/USD bears have stayed in control and eye 1.04 the figure.

- The FOMC is in focus for the week ahead following the data on Friday.

At 1.0517, EUR/USD is down some 0.1% at the start of the week suffering from a firm US dollar as the DXY eeks out a fresh high for the month of June. Financial markets reeled in response to higher-than-expected US inflation data for May and record low consumer confidence – with rising inflation expectations giving the greenback the edge as investors moved out of risk.

The market is now pricing in a peak in fed funds above 3.5%, analysts at ANZ Bank noted when explaining that the May Consumer Price Index rose 1.0% MoM to hit 8.6% YoY, its highest level since December 1981 (exp: 8.3%).

''US inflation is proving stubbornly persistent around multi-decade highs, and there was nothing in the data to indicate either headline or underlying inflation pressures are moderating.''

''Underscoring concerns about the economy,'' the analysts said, ''Michigan Consumer Confidence slumped to a record low of 50.2 (exp: 58.1, prev: 58.4) as cost of living concerns weighed on sentiment. Inflation is weighing heavily on consumers, the principal engine of economic growth. The preliminary data for June also showed 1-year ahead inflation expectations rising unexpectedly to 5.4% (exp: 5.3%). 5-year ahead inflation expectations rose to 3.3% – the highest reading since 2008. No comfort for the Fed here, then.''

This latest data comes ahead of the Federal Open Market Committee meeting the markets are priced for a 50bps rate hike and more to come, potentially extending beyond September. ''As inflation stays high, the FOMC’s estimates of the neutral fed funds rate is under upward pressure, and the risks to energy prices lie to the topside, meaning inflation may not have peaked yet,'' the analysts at ANZ Bank added. ''Recession risks are rising as the challenge facing the Fed intensifies. These are of course global themes, but the Fed is by far the most important central bank for global markets.''

Meanwhile, the European Central Bank intends to end QE by 1 July and hike policy rates by 25bp in connection with the July meeting, according to its latest statement released last week. The door for hiking by 50bp in September has been left ajar also and will be a strong possibility "if the medium-term inflation outlook persists or deteriorates".

''We now expect the ECB to hike by 25bp in July, 50bp in September and 25bp on each of the following meetings until March 2023 when the hiking cycle is likely to end, in our view. We see risks as skewed towards more 50bp rate hikes,'' analysts at Danske Bank said.

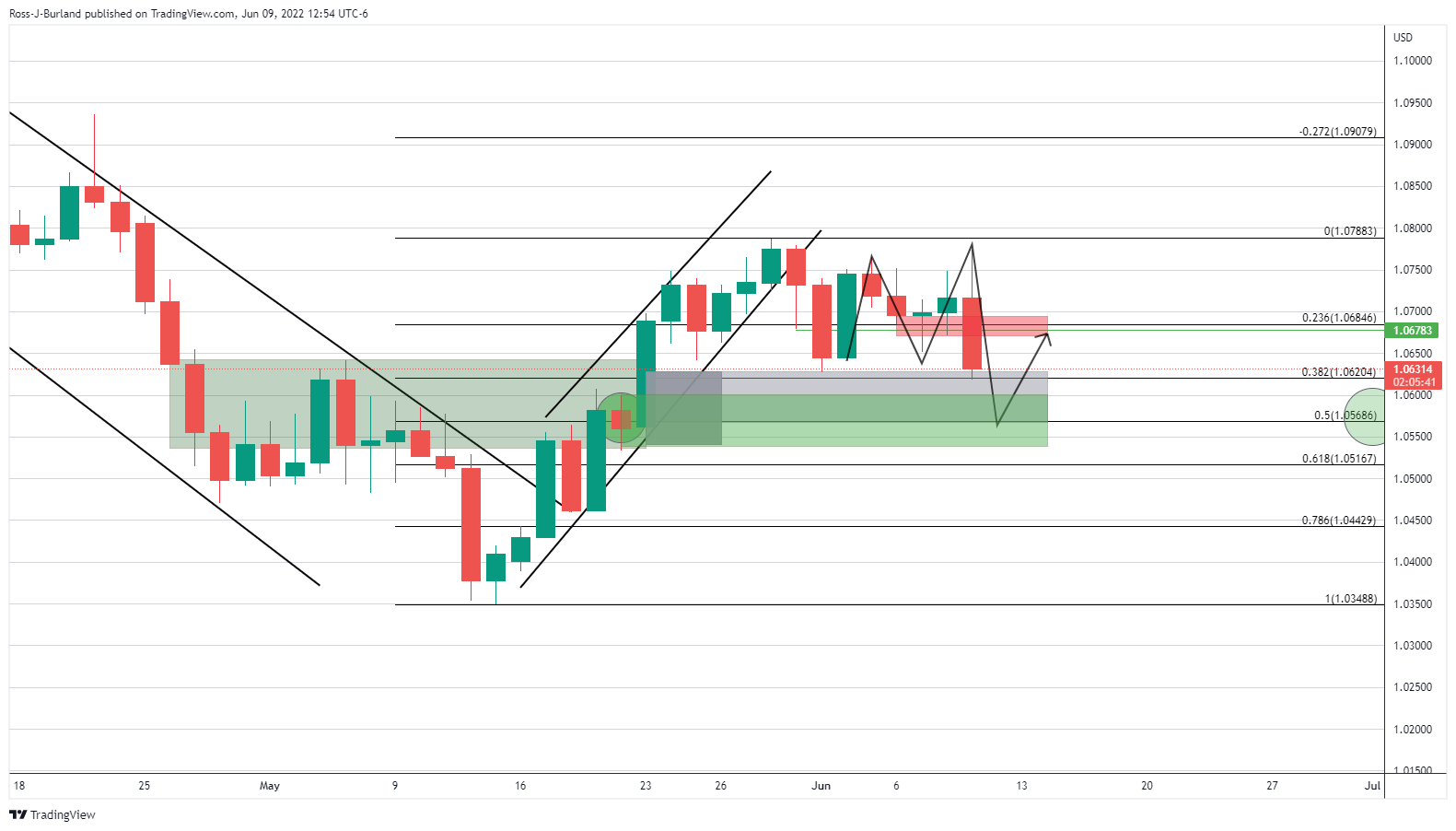

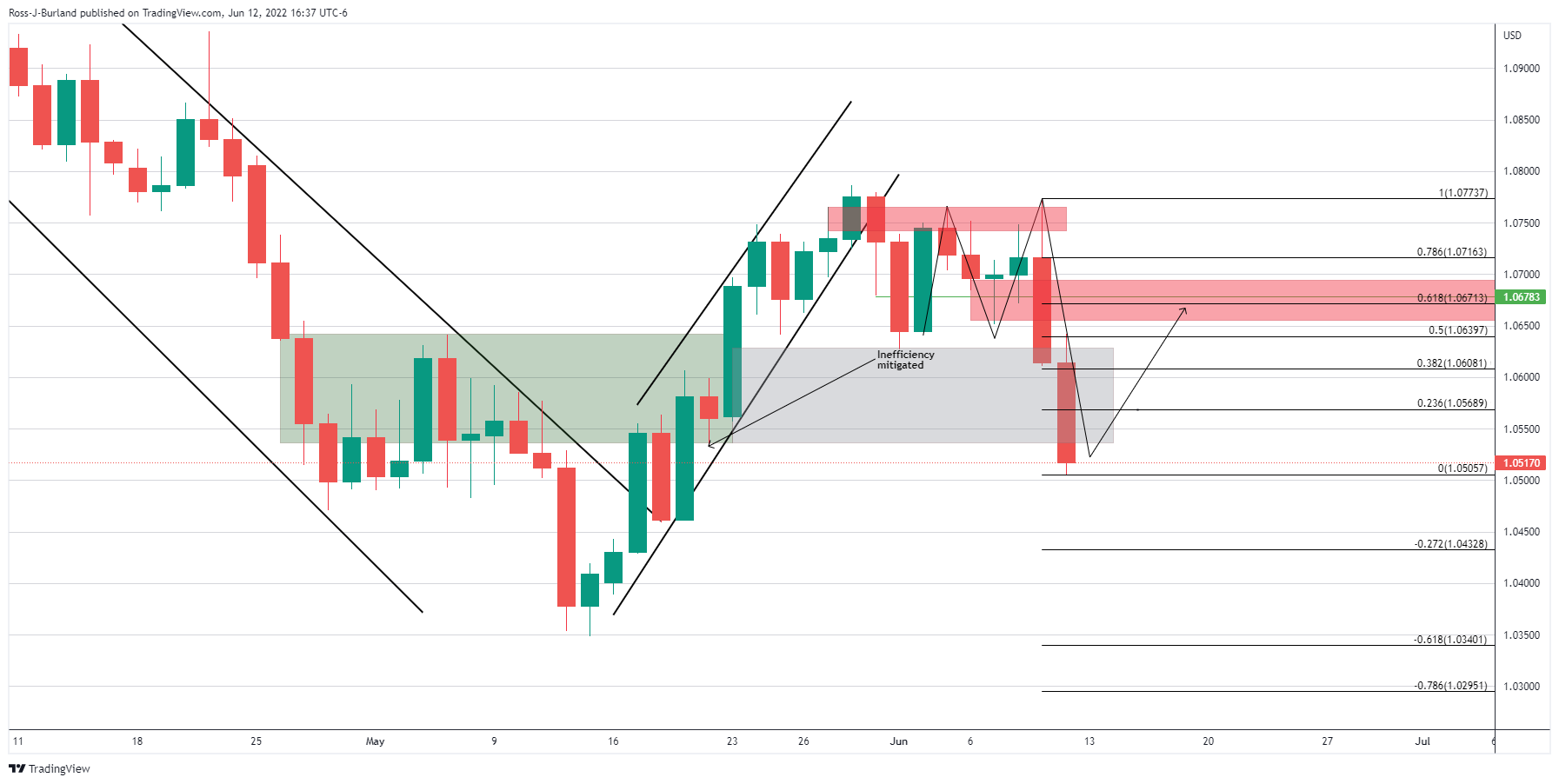

EUR/USD technical analysis

As per the prior analysis, EUR/USD Price Analysis: Bears march the bulls back to the edge of the abyss, the price came under pressure and sank deeper on the weekly chart to test the support of the W-formation, mitigating the price imbalances on the lower time frames. It was explained that from a daily perspective, there was an M-formation being formed from Thursday's price action.

However, the analysis also stated that ''while this too is a reversion pattern, there is a price imbalance between June 1's low and May 20 lows of 1.0532 that the bears are embarking on. Mitigation of this price area, around 80 pips to the downside, could play out over the course of the next sessions if bears stay in control.'' And,'' from an hourly perspective, the price is testing the mitigation area, but the drop could be ripe for a meanwhile correction.''

EUR/USD prior analysis, weekly, daily & hourly charts:

EUR/USD live charts:

The hourly chart above represents the mitigation of the daily price imbalance below:

We can now be in anticipation of a correction of the bearish impulse which could target as high as the neckline o the M-formation near a 61.8% ratio. However, from a weekly perspective, the bearish impulse was strong and there is an inefficiency in the price below the neckline of the W-formation to the lows of mid-May between 1.04 the figure and 1.0350:

- GBP/USD takes offers to renew one-month low, dropped the most in five weeks the previous day.

- Strong US inflation data bolstered risk-aversion wave underpinning the US dollar’s safe-haven demand.

- Brexit, UK politics and China’s covid conditions exert additional downside pressure.

- Plans to edit NIP will be presented in UK’s House of Commons, British monthly data, BOE and Fed are important too.

GBP/USD stands on slippery ground as it takes offers to renew monthly low around 1.2300, after falling the most in five weeks. With this, the cable pair begins the week on the negative side after declining for the four consecutive days in the last.

The quote’s latest weakness portrays a blend of risk-aversion and Brexit woes, not to forget anxiety ahead of the key data/events scheduled for publication during this week, starting from today’s monthly economics from the UK.

The risk-off mood intensified on Friday after the US inflation data rose past market expectations and propelled the case of the Fed’s aggression. That said, the headline US Consumer Price Index (CPI) rose to 8.6% YoY versus 8.3% expected while the Core CPI jumped 6.0% YoY compared to the expected drop to 5.9% from 6.2% a month earlier. Alternatively, the record low of the University of Michigan Consumer Sentiment Index for June, to 50.2 versus revised down 58.1, added to the market's risk-off mood and favored the USD.

It should be noted that the Brexit woes and political instability in the UK join the lack of trust in the Bank of England (BOE) to exert additional downside pressure on the GBP/USD prices.

UK Foreign Secretary is up for presenting a Bill to edit a part of the Brexit deal, relating to the Northern Ireland Protocol (NIP), to the British House of Common on Monday. In addition to the European Union’s (EU) clear signals to retaliate against such moves by harsh measures, chatters that the European judges to be stripped of Northern Ireland protocol powers under new Brexit law, backed by the UK Telegraph, also amplify Brexit concerns.

Elsewhere, Tory rebels are trying hard to oust UK PM Boris Johnson and may use the latest Brexit bill for their purpose. However, a lack of clarity over the successor and Johnson’s Brexit aggression seem to help Johnson keep the throne, as per the market’s rumors.

Elsewhere, a blast in covid numbers in Beijing, as well as an increase in Shanghai’s virus figures, recall the COVID-19-linked activity restriction in China, which in turn weighed on the market sentiment and increase the US dollar’s safe-haven demand.

Amid these plays, the Wall Street benchmarks slumped and the US Treasury yields rallied, enabling the US dollar’s safe-haven demand.

Looking forward, the market’s fears of Brexit and doubts over the BOE’s ability to counter the inflation woes, due to the alleged late policy response, could keep the GBP/USD prices directed towards the south.

For the day, UK’s monthly Gross Domestic Product (GDP) for April, expected 0.2% versus -0.1% prior, will join Manufacturing and Industrial Production data, as well as the UK’s trade numbers for the said month, to offer immediate directions. Should the scheduled data print expected improvement, the GBP/USD pair may witness intermediate relief. Though, Brexit woes may reverse any corrective pullback on negative announcements.

Technical analysis

A sustained downside break of the 1.5-month-old horizontal support around 1.2400-2410 joins bearish MACD signals and an absence of the oversold RSI to direct GBP/USD bears towards the 2022 low near 1.2155. That said, 1.2250 may act as immediate support.

Meanwhile, recovery moves above 1.2410 need validation from a descending trend line from February and the 50-DMA, respectively around 1.2545 and 1.2620, to recall the buyers.

- Gold price is expected to balance above $1,870.00 despite higher rate hike expectations.

- Higher addition in US CPI than Core CPI has indicated that US inflation is major contributed by food and oil.

- Investors should brace for an extreme hawkish stance by the Fed this week.

Gold price (XAU/USD) is oscillating in a narrow range of $1,868.92-1,879.25 in the early Asian session despite mounting bets on an extreme hawkish stance to be dictated by the Federal Reserve (Fed) this week. The precious metal displayed a juggernaut upside move after the release of the US Consumer Price Index (CPI) on Friday. The bright metal moved higher from $1,828.99 to $1,879.25 swiftly.

The US Bureau of Labor Statistics reported the US CPI at 8.6%, much higher than the prior print and forecasts of 8.3%. Also, the core CPI that doesn’t include food and oil prices rose to 6% from the expectations of 5.9%. It is worth noting that the contribution from the food and oil process in making the inflation situation more horrible is much higher. The core CPI that excludes oil and food is jumped lower than the plain-vanilla CPI in terms of percent-wise growth.

A higher-than-expected US inflation along with better-than-expected US Nonfarm Payrolls (NFPs) are compelling for a rate hike announcement by the Federal Reserve (Fed), which is due on Wednesday.

Gold technical analysis

On a four-hour scale, the gold price is on the verge of delivering an upside break of its prolonged consolidation formed in a range of $1,825.10-1,876.01. A firmer responsive buying action reported last week from $1,825.10 has strengthened the bullish momentum. The precious metal is auctioning higher from the 50-period Exponential Moving Average (EMA) at $1,853.15. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which adds to the upside filters.

Gold four-hour chart

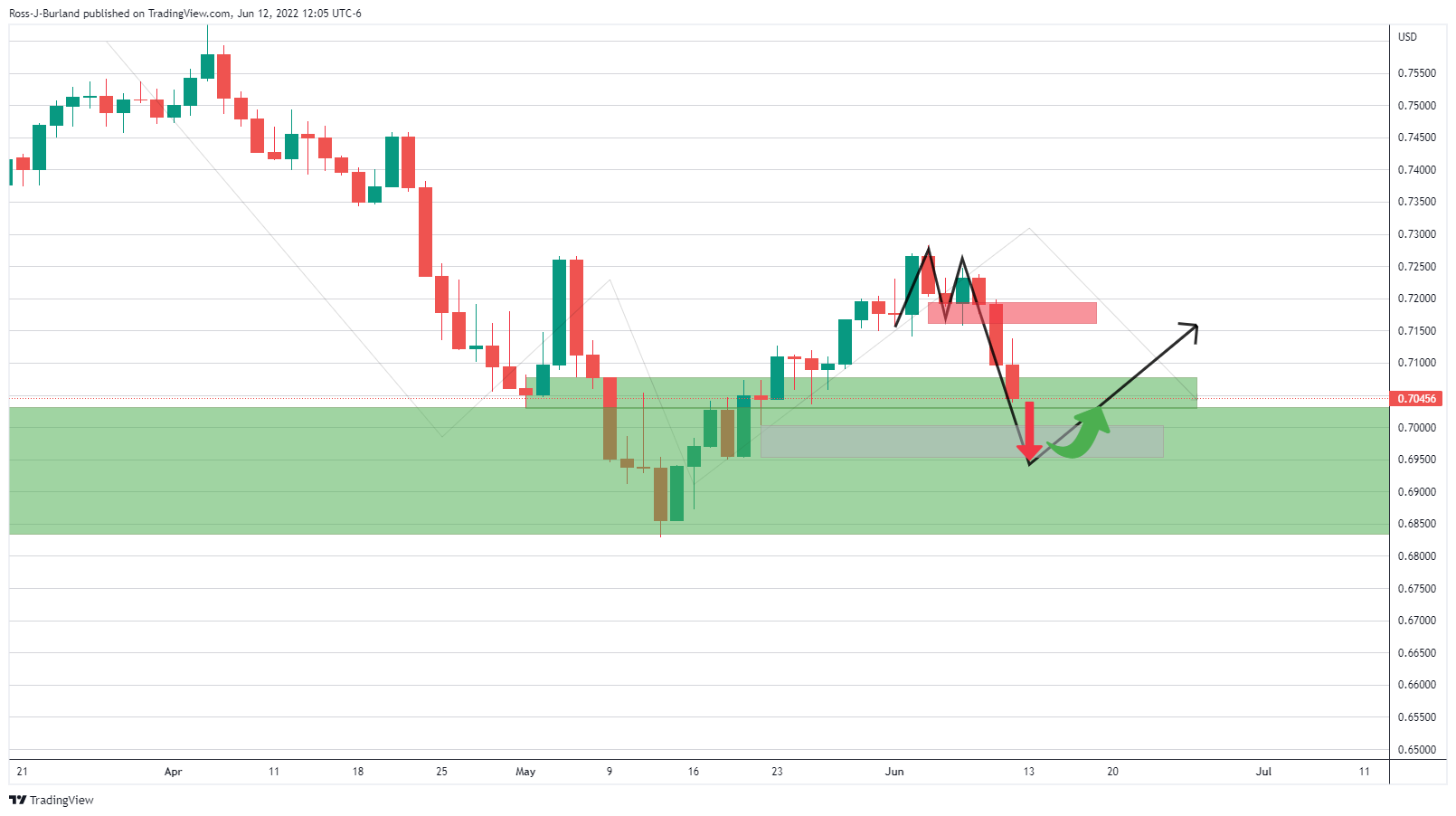

- AUD/USD bears are in control but the bulls could be preparing to move in.

- However, the price imbalance to the downside is compelling towards 0.6950.

AUD/USD has been in the hands of the bears due to a strong US dollar and risk-off markets with Wall Street 5% down on the week. The price, however, is now entering a weekly demand area and there are prospects of a bullish correction. With that being said, there is a price imbalance on the daily chart that could be vulnerable, exposing 0.6950.

AUD/USD weekly chart

The bulls could be about to move in from a weekly demand area following the completion of the W-formation and subsequent retest of the neckline, as illustrated in the above chart.

AUD/USD daily chart

From a daily perspective, however, the price could be expected to revisit the neckline of the M-formation, in line with the weekly outlook. However, mitigation of a price inefficiency below could be on the cards as well:

China is witnessing a massive surge in COVID cases which could be a weight for the open following Friday's bearish close on Wall Street and a higher US inflation reading that is likely to weigh on risky assets.

The weekend news that fresh COVID curbs were imposed in Beijing could spark fresh anxiety, despite China's infection rate being low by global standards. The nation maintains a zero-COVID policy even as other countries try to live with the virus.

In total, mainland China reported 210 new coronavirus cases for Friday, of which 79 were symptomatic and 131 were asymptomatic, the National Health Commission said.

That was up from 151 new cases a day earlier, 45 of them symptomatic and 106 asymptomatic.

As of Friday, mainland China had confirmed 224,659 cases with symptoms.

"The recent outbreak … is strongly explosive in nature and widespread in scope," Xu Hejian, A spokesperson of the Beijing municipal government said in a news briefing.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.