- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 14-06-2022.

- USD/CAD is hovering around 1.2950 as investors are sidelined ahead of the Fed’s interest rate meet.

- The BOC may elevate its interest rates to 3% to tame the soaring inflation.

- Oil prices have tumbled on advancing odds of a slump in the aggregate demand.

The USD/CAD pair is oscillating in a narrow range of 1.2944-1.2959 in the early Asian session after registering a fresh four-week high at 1.29751 on Tuesday. The asset has displayed a five-day winning streak and is expected to extend the same after violating Tuesday’s high at 1.2975.

An expectation of an aggressive hawkish monetary policy by the Federal Reserve (Fed) is strengthening the greenback bulls against loonie. The Fed is set to announce a strong rate hike after incorporating the sky-rocketing Consumer Price Index (CPI) and a tight labor market. Price pressures have reached the rooftop and are denting the paychecks of the households. Therefore, the market participants are expecting a rate hike by 75 basis points (bps) this time.

On the loonie front, research firm Fitch believes that the growth rate in Canada could decline to 2.2% in CY 2023 from 3.8% in CY2023. Also, the global rating giant has dictated that the Bank of Canada could accelerate its interest rates by 150 bps to 3%, which is beneficial for containing higher prices.

Meanwhile, oil prices have tumbled vigorously on soaring recession fears due to higher inflationary pressures. A liquidity shrinking program by the Fed is going to bring a serious drop in aggregate demand. This will eventually dampen the demand for oil in the global market and investors have started considering the same, which is capping the oil bulls. Investors should be aware of the fact that Canada is a leading exporter of oil to the US and lower oil prices result in lower fund flows into the US economy.

- WTI remains pressured around weekly low after breaking short-term key support lines.

- Downbeat RSI (14), not oversold, keeps oil bears hopeful.

- Clear downside break of $115.00 will confirm a ‘double top’ formation, which could facilitate further declines.

- Bulls remain cautious until witnessing a sustained run-up beyond 121.35.

WTI crude oil prices stay depressed at the weekly bottom, recently sidelined near $115.60-50, as sellers cheer a clear downside break of the short-term key support during Wednesday’s Asian session.

It’s worth noting that the black gold broke two support lines stretched from May but the 100-SMA challenges the bears. However, RSI (14) line joins the trend line breakdowns to keep the sellers hopeful.

In addition to the 100-SMA level near $115.30, Monday’s bottom surrounding $115.15 and the $115.00 threshold also challenge the commodity sellers.

Though, a sustained break of the $115.00 will confirm the double-top bearish chart pattern and direct the quote further south. In that case, the 200-SMA level of $110.86 and the monthly low near $110.00 could gain the market’s attention.

Following that, a downward trajectory towards May 19 swing low near $103.00 can’t be ruled out.

Alternatively, the monthly support-turned-resistance line near $115.85 appears the immediate hurdle to challenge the WTI rebound. After that, an upward sloping trend line from May 10, previous support around $116.55, will be crucial to watch for recovery moves.

Above all, the commodity buyers should wait for a clear upside break of the recent double tops before taking the driver’s seat, which in turn highlights $121.35 as the key level.

WTI: Four-hour chart

Trend: Further weakness expected

- NZD/USD struggles to extend the bounce off 25-month low after NZ data.

- New Zealand’s Q1 Current Account – GDP Ratio widened, Current Account deficit increased.

- Risk-off mood exerts additional downside pressure on the Antipodeans.

- China’s Industrial Production, Retail Sales may entertain traders ahead of FOMC.

NZD/USD fades bounce off a two-year low as it flirts with 0.6220-25 during Wednesday’s initial Asian session. The Kiwi pair’s latest inability to rebound could be linked to the downbeat New Zealand (NZ) data, as well as the market fears ahead of the Federal Open Market Committee (FOMC).

NZ Current Account – GDP Ratio dropped to -6.5% versus -6.3% expected and -5.8% prior. Further, the Current Account balance also depleted to $-6.143B compared to $-5.5B market forecasts and $-7.26B previous readings.

On the other hand, the US Producer Price Index (PPI) matched 0.8% MoM forecasts for May, also easing to 10.8% YoY figures versus 10.9% expected and prior readouts. The PPI ex Food & Energy, known as Core PPI, dropped below 8.6% YoY forecasts to 8.3%.

While portraying the mood, the US stock futures remain sluggish around the lowest levels since early 2021 while the Treasury bond yields dribble at the 11-year top near 3.5%, around 3.475% at the latest.

It should be noted that chatters surrounding China’s worsening virus conditions and the Sino-American tussles over Taiwan join the fears of the Fed’s aggressive rate hike to exert additional downside pressure on the NZD/USD prices.

Moving on, China’s monthly prints of Industrial Production and Retail Sales for May could entertain NZD/USD traders due to Auckland’s trade ties with Beijing. However, major attention will be given to the Fed’s ability to tame inflation and not disappoint the markets as it walks on a tight rope.

Read: Fed Preview: Powell to plunge markets or raise yields, a win-win for the dollar, five scenarios

Technical analysis

The late 2019 low surrounding 0.6200 precedes April 2020 peak near 0.6175 to restrict short-term NZD/USD downside amid oversold RSI conditions. The recovery moves, however, remain elusive until the quote crosses the immediate 0.6300 hurdle.

Confidence among Japanese manufacturers rose in June and was steady in the services sector as resilient demand helped firms withstand pressure from high raw material prices, a Reuters poll showed, in a sign of a gradual economic recovery.

Reuters Tankan strongly correlates with the Bank of Japan’s (BOJ) quarterly Tankan survey, which found sentiment among manufacturing and service-sector firms was expected to improve over the next three months, though companies reported pressure from rising costs aggravated by a weaker yen.

Key quotes

The monthly poll of 499 large and mid-sized firms, of which 238 responded between June 1-10, comes amid uncertainty over the economic outlook in Asia as a result of China’s heavy-handed approach to stamping out COVID-19 outbreaks.

The Reuters Tankan sentiment index for manufacturers rose to 9 in June from 5 in the previous month, driven by chemical firms as well as metal products and machinery makers. It was expected to rise further to 12 in September.

The service-sector index was flat from the previous month at 13 in June, though firms in the sector also said they were burdened by higher input costs, which have been made worse by a weakening of the yen.

USD/JPY struggles

The news fails to gain any major attention from markets as the USD/JPY struggles to extend the latest run-up towards 136.00.

Read: USD/JPY faces hurdles around 135.60 as DXY turns sideways, the spotlight is on Fed

- USD/JPY has failed to extend its upside above 135.60 as DXY is consolidating ahead of Fed’s policy.

- Higher price pressures are advocating a rate hike of 75 bps by the Fed.

- The BOJ is expected to stand with its prudent monetary policy to accelerate aggregate demand.

The USD/JPY pair has slipped below 135.30 after facing barricades around 135.60. On a broader note, the asset has remained in the grip of bulls therefore minor exhaustion doesn’t resemble a bearish reversal. It won’t be early to state that the asset is heading for a fresh new high ahead of the interest rate policy by the Federal Reserve (Fed).

The Fed is expected to dictate a rate hike by 75 basis points (bps). Fed chair Jerome Powell in his previous testimonies stated that a rate hike by 75 bps is not into consideration, which doesn’t rule out the odds of a 75 bps rate hike this time. The inflation situation has much worsened now as the annual figure has climbed to 8.6%, thanks to the advancing oil and food prices. To fix the inflation mess, the Fed will tighten its policy further and will elevate interest rates aggressively.

Meanwhile, the US dollar index (DXY) has turned sideways ahead of Fed’s policy and is expected to display a lackluster performance going forward. The DXY is hovering around 105.50 after registering a fresh 19-year high at 105.65.

On the Tokyo front, investors are awaiting the interest rate policy by the Bank of Japan (BOJ), which is due on Friday. The BOJ is expected to continue with its prudent monetary policy to keep flushing liquidity into the economy. The inflation rate in Japan has reached to its target but is majorly contributed by higher oil prices rather than a broad-based demand recovery.

- GBP/USD picks up bids to consolidate recent losses at multi-month low, snaps five-day uptrend.

- UK PM Johnson's eyes to repeal corporate tax raid, tells cabinet to ‘de-escalate’ protocol stand-off with Brussels.

- US Dollar cheers risk-off mood, strong Treasury yields ahead of the Fed’s verdict.

- Markets anticipate big moves, making it a source of disappointment and anxiety ahead of the Fed.

GBP/USD prints a corrective pullback from a 27-month low as traders brace for the key Fed meeting during the early Asian session on Wednesday. In addition to the market’s consolidation, positive news from UK Prime Minister (PM) Boris Johnson also underpins the cable pair’s latest rebound.

“Boris Johnson wants to reverse Rishi Sunak’s planned multibillion-pound tax raid on business as he tries to firm up support on the Tory right in the aftermath of last week’s confidence vote,” said the UK Times.

News from the UK Telegraph saying, “Boris Johnson has told his Cabinet ministers to ‘de-escalate’ the war of words with Brussels over the Northern Ireland Protocol to avoid a trade war,” also should have helped the GBP/USD prices to rebound from a two-year low.

It’s worth noting that the downbeat UK data and concerns over the Bank of England’s (BOE) ability to tame the inflation without hurting the GDP seems to weigh on the GBP/USD prices.

On Tuesday, the UK’s employment numbers hint at the higher Unemployment Rate of 3.8% versus 3.6% expected for three months to April. Further, the Claimant Count Change improved to -19.7K from -49.4K expected and -65.5K prior

Elsewhere, the US Producer Price Index (PPI) matched 0.8% MoM forecasts for May, also easing to 10.8% YoY figures versus 10.9% expected and prior readouts. The PPI ex Food & Energy, known as Core PPI, dropped below 8.6% YoY forecasts to 8.3%.

Although the factory-gate inflation data eased, the fears of an aggressive Fed rate hike during today’s FOMC haven’t faded as the US 10-year Treasury yields refreshes the 11-year high to 3.497%, around 3.479% by the press time. With this, the Wall Street benchmarks witnessed another day of losses.

Moving on, GBP/USD may witness lackluster moves around the multi-month low as markets are likely to portray the pre-Fed anxiety.

Read: Federal Reserve Interest Rate Decision Preview: Damn the inflation, full speed ahead

Technical analysis

GBP/USD takes a U-turn from a six-month-old descending support line, around 1.1935 by the press time. Given the oversold RSI, as well as the likely USD retreat ahead of the Fed, the cable pair may witness a corrective pullback ahead of the key Federal Open Market Committee (FOMC).

Global rating giant Fitch affirmed Canada’s Long-Term Foreign-Currency and Local-Currency Issuer Default Ratings (IDR) at 'AA+' with a Stable Rating Outlook.

Fitch expects firm Canadian economic growth of 3.8% in 2022, decelerating to 2.2% in 2023.

“Fitch's baseline is that BOC will lift the overnight rate another 150bps to 3% by YE2022 and sustain it through YE2023, as it seeks to lower demand and stabilize inflation expectations amid strong price rises,” said the official update.

Key quotes (from Fitch)

Inflation has run thirteen months above the upper threshold of the inflation-control target range driven by supply-chain shocks and strong domestic demand.

The Canadian housing market is slowing after a period of rapidly rising house prices.

In Fitch's view, the seven largest Canadian banks are adequately capitalized to sustain rapidly increasing credit losses even under an unlikely severely adverse scenario.

The spring FY2022-2023 federal and provincial budgets place Canada's general government balance on a faster deficit reduction path than Fitch expected at its last review in June 2021.

Federal and provincial governments medium-term budgets together will keep the gross consolidated general government debt/GDP on a downward trajectory, despite increased monetary policy tightening (275 bps) during 2022 in the June baseline scenario.

In February, the governing minority Liberal Party signed a 'supply and confidence agreement' with the New Democratic Party (NDP), which assures the mutual policy support for confidence votes, including budget measures during 2022-2025.

USD/CAD eases from monthly top

Following the news, USD/CAD retreats from a monthly high surrounding 1.2975, also probing the five-day uptrend, at 1.2955 by the press time.

Also read: Canada's PM Trudeau: We're watching rising interest rates 'with concern'

- The shared currency is down almost 1% in the week.

- A risk-off market mood caused a bloodbath in equities, but the Asian stocks are poised for a higher open.

- EUR/USD Price Analysis: The pair would remain range-bound ahead of June’s Fed meeting.

The EUR/USD tanks for the third straight day as traders prepare for an aggressive rate hike by the Federal Reserve, with Wall Street’s expecting a 75 bps increase to the Federal Funds Rate (FFR) on Wednesday. The aforementioned shifted sentiment sour since late Monday and has carried on. At the time of writing, the EUR/USD is trading at 1.0420, set to range-bound ahead of the FOMC’s monetary policy decision.

Sentiment remains negative. US equities finished with hefty losses, while Asian stocks are set to open higher. US Treasury yields spiked, led by the US 10-year benchmark note coupon at 11-year highs above 3.49%, as bets that the Federal Reserve would hike more than 50 bps. The greenback followed suit and is rising, as depicted by the US Dollar Index, up 0.26%, at 105.477.

During the Tuesday trading session, the EUR/USD opened near the session’s lows around 1.0406 and edged higher as a reaction to German inflation data, printing a daily high around 1.0485. However, the EUR/USD erased those losses and settled near 1.0415.

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the EUR/USD is still downward pressured. Last Friday’s dip below the 50-day moving average (DMA) at 1.0687 exacerbated the downtrend since the major dropped almost 300 pips. Despite the size of the move, the Relative Strength Index (RSI) at 35.88 still has some room to spare before reaching oversold readings.

The EUR/USD in the near term would remain trapped in the 1.0400-1.0490 range, as it usually happens, ahead of the FOMC’s monetary policy meeting. Nevertheless, some levels could be tested into the FOMC meeting and after the decision is revealed. Upwards, the EUR/USD’s first resistance would be the daily pivot point at 1.0432. Break above would expose the 50-hour simple moving average (SMA) at 1.0443, followed by the R1 pivot point at 1.0468 and the June 14 high at 1.0484. On the flip side, the EUR/USD first support would be 1.0400. A breach of the latter would expose the S1 daily pivot at 1.0379, followed by the May 13 daily low at 1.0348.

Key Technical Levels

“US economy is in a transition,” said White House (WH) Economic Adviser Brian Deese during an interview with CNN on Tuesday.

The policymaker also signaled the WH's aim to ease the price pressure and the Federal deficit during the interview.

Market implications

Such comments from the key diplomat ahead of the Federal Open Market Committee (FOMC), up for Wednesday, exert additional pressure on the Fed to act, which in turn adds to the risk-off mood.

It’s worth noting that earlier in the day, National Economic Council Deputy Director Bharat Ramamurti also crossed wires and signaled inflation as the key problem.

Also read: WH Economic Adviser Ramamurti: Inflation is a global problem – Bloomberg

US Treasury Secretary Wally Adeyemo said on Tuesday that Russia's oil profits have likely risen despite lower crude exports, and the United States and its allies must find ways to reduce Moscow's oil revenue, possibly by capping prices, per Reuters.

Adeyemo told a U.S. Senate Appropriations subcommittee hearing.

Additional comments

US goal needs to be limiting the amount of revenue Russia earns from oil exports.

There are a number of options in terms of reducing Russia’s revenue.

There are things like introducing a price cap, such moves must be taken in cooperation with U.S. allies and partners.

Russian economy is 'getting smaller every day' due to sanctions.

Full US. trade embargo on Russia would have marginal impact on Russia's economy 'at best'.

Market implications

The news adds to the risk-off mood and weighs on the US equity benchmarks, as well as allowing the US Treasury yields to refresh an 11-year high of around 3.5%. However, major attention is on the Fed.

Read: Forex Today: Dollar retains its strength ahead of the Fed

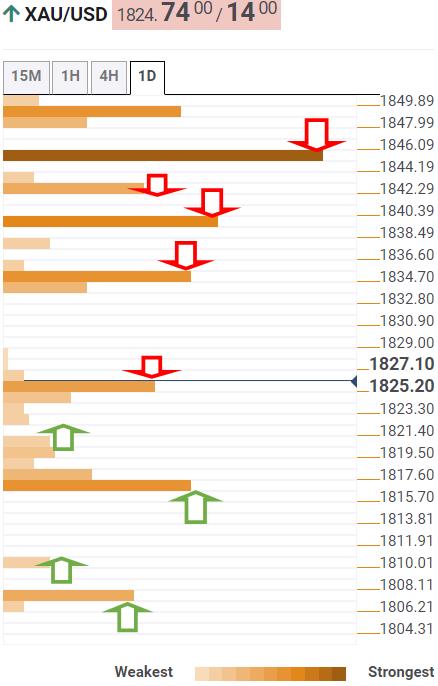

- Gold price is displaying a minor pause above $1,800.00 after a steep rally.

- A 75 bps rate hike by the Fed will have a significant impact on the inflationary pressures.

- The precious metal is declining towards $1,786.00 as the RSI (14) has shifted into a bearish range.

Gold price (XAU/USD) is displaying a minor pause above the psychological support of $1,800.00 after a perpendicular fall. The market participants have dumped the precious metal on expectations of an interest rate hike above 50 basis points (bps) figure this time.

The gold prices faced extreme selling pressure after a pullback move towards $1,830.00 on Tuesday, which dragged the bright metal sharply to near $1,800.00. The annual US inflation figure has risen to 8.6% on annual basis. It looks like the quantitative tightening yet done by the Federal Reserve (Fed) has failed to impact materially on the price pressures.

Meanwhile, the US dollar index (DXY) is oscillating around 105.50 and is expected to display more upside on expectations of an extreme hawkish tone by Fed chair Jerome Powell. The DXY is advancing firmly on a broader basis and has refreshed its 19-year high at 105.65. Also, the 10-year US Treasury yields have jumped to 3.8% as a big rate hike by the Fed is on the cards.

Gold technical analysis

On a four-hour scale, the gold prices are declining towards the potential support that is placed at $1,786.94. The 50- and 200-period Exponential Moving Averages (EMAs) at $1,842.80 and $1,859.90 respectively have turned lower again after remaining sideways, which signals an initiative selling structure. The Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which signals more pain ahead.

Gold four-hour chart

“Canadian Prime Minister (PM) Justin Trudeau on Tuesday said his government was watching rising interest rates ‘with concern,’ when asked about the impact higher borrowing costs are having on housing affordability in the country,” said Reuters on late Tuesday.

“We know full well that housing prices are a real concern, especially for middle-class Canadians hoping to buy their first home,” Canadian PM Trudeau spoke to Parliament by video conference after testing positive for COVID-19.

USD/CAD retreats below 1.3000

Following the news, USD/CAD eases from a monthly high surrounding 1.2975, also probing the five-day uptrend.

Also read: USD/CAD marches firmly to fresh multi-week highs around 1.2960s, ahead of FOMC, US Retail Sales

- AUD/USD is expected to continue its five-day losing streak after slipping below Tuesday’s low at 0.6850.

- Investors are cautious as the Fed is expected to elevate its interest rates by 75 bps.

- The Australian economy may have added 25k jobs to the labor force in May.

The AUD/USD pair has witnessed some bids around 0.6850 as the US dollar index (DXY) has entered into a pullback phase after an upside move. The asset displayed a steep fall on Tuesday after slipping below the critical support of 0.6911. A four-day losing streak was carry-forwarded on Tuesday as investors are uncertain over the interest rate decision by the Federal Reserve (Fed).

After the release of a higher print by the US Consumer Price Index (CPI), the market participants have turned more cautious amid advancing odds of a recession situation in the upcoming quarters. The Fed tightened its policy by elevating its interest rates by 75 basis points (bps) in total in its last two monetary policy meetings along with balance sheet reduction. Despite the restrictive quantitative measures, the US CPI landed above the expectations at 8.6%.

Taking into account, higher inflation and a tight labor market, the Fed is expected to dictate a 75 bps rate hike as stronger tightening measures would do the job more efficiently.

On the aussie front, investors are awaiting the release of the employment data. As per the market consensus, the Australian economy has 25k jobs in the labor market vs. 4k reported earlier. Also, the Unemployment Rate will slip to 3.8% from the prior print of 3.9%.

- The euro recovered some ground vs. the Japanese yen amidst the scenario of Japanese authorities intervening in the FX markets.

- EUR/JPY Price Analysis: The formation of a bearish flag pattern in the 1-hour chart would open the door for further losses.

The EUR/JPY is snaping three days of consecutive losses, courtesy of last Friday’s verbal intervention by Japanese authorities, which spurred a dip from YTD highs at around 144.18 to 139.38, almost a 500 pip fall. However, on Tuesday, the EUR/JPY is recovering and erases 150 pips of losses, gaining 1.06%, and is trading at 141.06, as the New York session winds down.

Sentiment remains negative. Expectations that the US Federal Reserve would hike 75 bps mounted. Banks in Wall Street updated their Fed calls on Tuesday after an article by the WSJ that stated that due to high inflationary indicators, the US central bank would “surprisingly” hike 75 bps.

The aforementioned triggered a bloodbath in global equities, which remain on the defensive. US Treasury yields remain elevated, and the greenback rose.

The EUR/JPY got a boost, despite a dismal than expected EU data. As expected, inflation in Germany rose by 7.9% YoY in May, alongside other inflationary numbers that came in line as estimated. However, the Zew Economic Sentiment Index in the Euro area and Germany missed expectations. Nevertheless, it was ignored by traders.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY’s daily chart depicts the cross-currency as upward biased, but the RSI, albeit in the bullish territory, is trendless. That said, the EUR/JPY might consolidate in the near term in the 139.40-141.00 area.

The EUR/JPY’s 1-hour chart illustrates that the pair is confined to an uptrend channel, forming a bearish flag. Nevertheless, a break above the bearish flag-top trendline, which confluences with the 200-hour simple moving average (SMA) at 141.34, would open the door for a test of June’s 12 high, which confluences with the 100-hour SMA and the R1 daily pivot point around 141.76. If that scenario is completed, the following resistance would be June’s 10 high at 142.79.

However, the EUR/JPY path of least resistance is downwards. The EUR/JPY’s first support would be the confluence of the 50-hour SMA and the daily pivot at around 140.54. Break below would expose the bottom trendline of the bearish flag around 140.30-40, followed by the S1 daily pivot at 140.00.

Key Technical Levels

- The USD/CHF extended its gains on Tuesday, up by 0.50% courtesy of expectations of the US Fed hiking 75 basis points.

- The major seesawed around a 160 pip range, with the USD taking the upper hand.

- USD/CHF Price Analysis: A daily close above the parity might open the door for a YTD high challenge at around 1.0064.

The USD/CHF climbs towards parity for the fifth time in the year, courtesy of a negative sentiment surrounding the financial markets, as traders prepare for an “aggressive” rate hike of the Federal Reserve on Wednesday, which could probably increase 75 bps, the Federal Funds Rate (FFR) to 1.75%. At 1.0015, the USD/CHF gains 0.45%.

The Swiss franc remains weak for the reasons above-mentioned. Additionally, another Covid-19 outbreak in China summed up the factors remaining in the backdrop, like global inflation and Russia’s invasion of Ukraine.

In the meantime, the US Dollar Index advanced 0.26% during the day, currently at 105.473, underpinned by high US Treasury yields. The US 10-year benchmark note yields 3.477%, gaining eleven basis points.

USD/CHF Price Analysis: Technical outlook

USD/CHF Tuesday’s price action witnessed a sharp U-turn. The major opened around 0.9970 and dipped sharply towards daily lows at 0.9874 before rallying to fresh monthly highs above the parity at 1.0037. That said, the USD/CHF remains upward biased in the near term.

Therefore, due to the upward bias of the pair, the USD/CHF first resistance would be the MTD high at 1.0037. A breach of the latter would expose the YTD high at 1.0064, followed by the 1.0100 figure, which, once cleared, would send the pair towards the May 2019 swing highs at around 1.0226.

Key Technical Levels

What you need to take care of on Wednesday, June 15:

The American dollar kept advancing on Tuesday, and retains its strength early Wednesday, as fear rules financial markets ahead of the US Federal Reserve decision.

Market players had long ago anticipated a 50 bps hike, but on Monday, market talks suggested the central bank may go for a steeper hike of 75 bps. Also, US policymakers will present fresh Economic Projections, which may lead to a sustained aggressive stance, should the new scenario hint at stagflation.

Across the pond, ECB’s member Klaas Knot hinted at more rate hikes in October and December, although sticking to a 25 bps move in September.

The UK released mixed employment data, as the jobless rate rose to 3.8% in April from 3.7% in the previous month, while the number of people claiming jobless benefits fell by 19.7K in May.

The EUR/USD pair hovers around 1.0400 while GBP/USD trades at its lowest since March 2020 at 1.1980. The AUD/USD pair extended its slump to 0.6850, while USD/CAD trades around 1.2955 as the poor performance of equities and plummeting gold and oil prices undermined demand for commodity-linked currencies.

Wall Street remained under selling pressure, although the Nasdaq Composite was able to post a modest gain of 0.10%.

US government bond yields continued to rally, with that on the 10-year Treasury note peaking at 3.489%, its highest in over a decade.

Like this article? Help us with some feedback by answering this survey:

- The NZD is nosediving during the week, almost 2.30%.

- The market sentiment dampened on expectations that the Fed may hike 0.75% in June, increasing investors’ appetite for safe-haven assets, thus boosting the greenback.

- US Wednesday calendar will be busy reporting Retail Sales and the FOMC’s monetary policy decision.

Dismal market mood spurred by fears that the US Federal Reserve might raise rates by 75 bps, but it would trigger the US into a recession, has risk-sensitive currencies like the New Zealand dollar on the defensive. At the time of writing, the NZD/USD is down 0.69% daily, trading at 0.6211, at new 2-year lows.

Sentiment and safe-haven flows, a headwind for the NZD

Global equities are tumbling for the second consecutive day. In the meantime, the appetite for safe-haven peers has grown, as the US Dollar Index, a gauge of the greenback’s value vs. six currencies, advances 0.42%, currently at 105.636, at 20-year highs, a headwind for the NZD/USD.

Last Friday’s high US inflation report, topping at around 8.6% YoY, caused a reaction on Monday. Since the opening of the Asian session, the market mood shifted to risk-off, with US Treasury yields skyrocketing above the 3% threshold, and during the day, the 2s-10s yield curve inverted, a signal of a US recession. Also, the re-emergence of China’s Covid-19 outbreak added another piece to the already battered sentiment.

In the meantime, reports surfaced that the Fed might accelerate the pace of tightening and lift rates by 75 bps, loom. Most Wall Street analysts updated their calls for the Federal Funds Rate (FFR) to finish June at 1.75%, contrary to the 1.50% estimated on Monday.

That said, the NZD/USD extended its losses. So far is down 2.25% in the week, with just two trading days, almost matching last week’s losses.

Data-wise, the US economic docket featured prices paid by producers, which heightened at around 10.8% YoY, though they were ignored by traders, with their focus on the Fed. The CME FedWatch Tool reports that investors have priced in a 93.2% chance of a US Federal Reserve 0.75% rate hike in the June meeting.

In the week ahead, the New Zealand economic docket will reveal the Current Account for Q1, estimated at NZ$-5.5 billion. The US calendar will feature May’s Retail Sales, estimated to grow by 0.2% MoM, alongside the highlight of the week, the US Federal Reserve Open Market Committee (FOMC) interest rates decision.

Key Technical Levels

- The USD/CAD is gaining close to 1.50% during the week.

- Investors’ sentiment shifted sour on expectations of a higher than estimated FOMC rate hike; global equities fall.

- USD/CAD Price Forecast: The pair is upward biased, and a break above 1.3000 opens the door for a challenge of the YTD high at 1.3076.

The USD/CAD marches firmly and is reaching a new four-week high, extending its gains for the fifth consecutive day, with investors worried that the Federal Reserve might trigger the US economy into a recession as they tighten monetary policy to abate inflation. The USD/CAD is trading at 1.2962 at the time of writing, up by 0.49%.

Global equities remain under pressure, reflecting a dampened market mood. Consequently, demand for the greenback rose due to its safe-haven status. Reflection of that is the US Dollar Index, a basket of the performance of six currencies vs. the buck, advancing 0.15%, sitting at 105.360.

The USD/CAD remains upward pressured for the reason mentioned above. The US economic calendar reported prices paid by producers, which rose by 10.8% YoY, in line with estimations, triggering no action as traders’ focus is on the Fed. The CME FedWatch Tool reports that investors have priced in a 93.2% chance of a US Federal Reserve 0.75% rate hike in the June meeting.

Meanwhile, oil prices drop for the first time in the week. Western Texas Intermediate (WTI), the US crude oil benchmark, falls more than 1%, exchanging hands at $119.64 per barrel, a tailwind for the USD/CAD.

Data-wise, the Canadian economic docket reported factory sales, which climbed 1-7% in April, with sales volumes up 0.9%, adding evidence of firm economic activity in the second quarter.

In the week ahead, the Canadian economic docket will feature Housing Starts on Wednesday, estimated at 252.6K. On the US front, May’s Retail Sales are estimated to grow by 0.2% MoM, alongside the highlight of the week, the US Federal Reserve Open Market Committee (FOMC) interest rates decision.

USD/CAD Price Forecast: Technical outlook

The USD/CAD fourth-day rally lifted the major from 1.2550 to 1.2960s. After being above the exchange rate, the daily moving averages (DMAs) shifted the USD/CAD bias upwards during a high-volatility three-day trading session. The RSI is aiming higher, though shy of reaching overbought conditions, opening the door for further gains.

Therefore, the USD/CAD first resistance would be the 1.3000 mark. Break above would expose the YTD high at 1.3076, followed by November 13, 2020 swing high at 1.3172.

Key Technical Levels

- West Texas Intermediate traded as high as $123.66 a barrel before retreating.

- The sour tone of equities undermines demand for black gold.

- The OPEC+ downwardly revised Russian oil output for the year.

Crude oil prices are in retreat mode after reaching fresh three-month highs. The barrel of West Texas Intermediate hit an intraday high of $123.66, now trading at around $119.38. The initial rally came after the OPEC+ reported that it produced a total of 28.5 million barrels per day in May, down by 176K bpd compared to April.

The organism´s Monthly Oil Market Report also showed that members expect demand to keep rising, while downwardly revised Russian liquids output forecast by 250K bpd, which means they expect the country’s production to contract by 170 bpd on the year. Additionally, OPEC is hopeful that the Chinese decision to lift lockdown measures should increase imports from the country.

The commodity turned south with Wall Street’s opening, as US indexes extend their bearish route amid fears of a US recession and ahead of the US Federal Reserve monetary policy decision. The central bank has been widely anticipated to hike the benchmark rate by 50 bps, although the latest inflation figures pushed market players to lift their bets, now anticipating a 75 bps hike.

- Gold spot slides for the second consecutive day and extends its weekly losses to 3.12%.

- Higher US Treasury yields and real rates weigh on the appeal of the yellow metal.

- Gold Price Forecast (XAUUSD): Remains downward pressured, and a break of $1800 to open the door for a challenge of the YTD Low at around $1780.

Gold spot (XAUUSD) grinds lower in the midday of the North American session, down by 0.27%, as the US Dollar continues printing fresh 20-year highs on Tuesday, weighing on the non-yielding metal appeal as US Treasury yields rise. At the time of writing, XAU/USD is trading at $1812.24 a troy ounce.

In the meantime, the US Dollar Index, a measure of the greenback’s value vs. a basket of peers, rises by 0.16%, sitting at 105.379, underpinned by the yields of US Treasuries. Reflection of the aforementioned is the 10-year benchmark note rate at 3.439%, up 6.8 bps.

Risk-aversion extends for the second consecutive day, as reflected by the bloodbath in global equities. On Monday, near the Wall Street close, reports emerged that the US Federal Reserve might hike 75 bps the Federal Funds Rates (FFR) on Wednesday as a response to last Friday’s hot US CPI of around 8.6%. Traders are braced for an upward move, as shown by the CME FedWatch tool, which sits at a 96.1% chance of a 0.75% rate increase.

Therefore, Gold prices are due for a further correction lower. Commerzbank analysts, in a note, wrote, “Gold is facing headwind from the persistently firm US dollar and, above all, from the further rapid rises in bond yields. Yields on two-year US Treasuries have surged by around 30 basis points. Yields on ten-year US Treasuries climbed for a time above 3.4%, their highest level in more than eleven years. As a result, real interest rates have also picked up significantly and at 0.68% now find themselves at their highest level in over three years.”

At the time of publishing, the US 10-year Treasury Inflation-Protected Securities (TIPS), which are also a proxy for real rates, sit at 0.803%, extending its gains, spurring a fall in Gold spot (XAUUSD) towards a daily ow at $1807.65

Before Wall Street opened, the Producer Price Index (PPI) for May, rose by 10.8% YoY, in line with expectations, and up 0.5% from April. The market players’ reaction was muted as investors focused on Wednesday’s Retail Sales in advance of the Federal Reserve Open Market Committee (FOMC) monetary policy decision.

Gold Price Forecast (XAUUSD): Technical outlook

On Monday, XAU/USD prices collapsed sharply below the 200-day moving average (DMA) and broke below a 4-year-old upslope support trendline that passed around July 15, 2021, high at $1834, a significant support/resistance level for gold traders, exacerbating the fall towards the $1820 area.

That said, the XAU/USD first support level would be the May 18 low at $1807.23. Break below would expose the $1800 psychological level, which, if it gives way, XAU/USD bears could prepare an attack towards the YTD low at $1780.18.

Key Technical Levels

European Central Bank (ECB) Governing Council member Isabel Schnabel said on Tuesday that the monetary policy can and should respond to a disorderly repricing of risk premia, as reported by Reuters.

Additional takeaways

"We will react to new emergencies with existing and potentially new tools."

"Tools might again look different, with different conditions, duration and safeguards to remain firmly within our mandate."

"There can be no doubt that, if and when needed, we can and will design and deploy new instruments to secure monetary policy transmission."

"Flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardise the attainment of price stability."

"Monetary policy will need to respond to destabilising market dynamics."

"We will not tolerate changes in financing conditions that go beyond fundamental factors and that threaten monetary policy transmission."

"We are therefore monitoring current market developments closely."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen posting modest recovery gains at 1.0430.

- The yield on the 10-year Treasury note soared to its highest in over a decade.

- Skyrocketing inflation is behind the market’s turmoil amid recession fears.

- USD/JPY is on its way to reaching fresh multi-decade highs beyond 135.20.

Risk aversion retains control of financial markets on Wednesday, as market participants speculate about the US Federal Reserve escalating quantitative tightening to fight stubbornly high inflation. The Consumer Price Index in the country soared to 8.6% YoY in May, the highest in over four decades.

At the same time, investors keep an eye on slowing economic growth, as economies keep struggling to stand back on its feet following the tough global measures imposed in March 2020, when the coronavirus pandemic stormed the world.

US government bond yields provide support to USD/JPY, as the 10-year Treasury note currently yields 3.44% after touching 3.456%, its highest in over a decade.

Levels to watch

The USD/JPY pair trades near a weekly high of 135.19, a level that was last seen in October 1998, and despite extreme overbought conditions in the daily chart, there are no signs of bullish exhaustion. The pair is gathering directional momentum in the near term, after consolidating around the current price zone since early June.

Beyond the mentioned weekly high, the next relevant resistance level is 136.90, October 1998 monthly high. A strong static support area comes around 133.30/40 where buyers have been appearing in the last few days.

National Economic Council Deputy Director Bharat Ramamurti told Bloomberg TV on Tuesday that inflation was a global problem but added that the United States was "well prepared."

Ramamurti further argued that oil refiners were to blame for high prices.

Market reaction

Markets remain risk-averse following these comments. As of writing, the S&P 500 Index was down 0.4% on a daily basis at 3,734. In the meantime, the US Dollar Index clings to modest daily gains and trades at its highest level since December 2002 at 105.40.

- The S&P 500 and the Dow Jones recorded losses in a risk-off market mood.

- The Nasdaq Composite is recovering some ground and remains above the 10,000 figure.

- Expectations of a bigger than foreseen Fed rate hike shifted sentiment sour, underpinned the greenback.

- US Treasury yields reach fresh multi-year highs, above the 3% threshold.

US stocks continue their rout, losing between 0.26% and 0.56%, except for the heavy tech Nasdaq Composite, which pares some of its losses, up by 0.25%.

US Fed expectations of a larger rate increase weighed on sentiment, US equities fell

The S&P 500 and the Dow Jones Industrial Average are slipping 0.26% and 0.56% each, sitting at 3,739.23 and 30,345.10, respectively, at the time of writing. Meanwhile, the Nasdaq Composite is rising 0.25%, up at 10,836.09.

In the meantime, the US Dollar Index advances to a fresh 20-year high at around 105.433, gaining 0.22%, on Tuesday. US Treasury yields remain elevated. The 10-year benchmark note rate is at 3.441%, up to six basis points, reflecting traders’ expectations of a 75 bps rate hike.

Investors’ mood remains negative, weighed by a WSJ news that revealed that US Fed officials might “surprise” the markets with a larger than expected 0.75% bps rate hike. Also, US economic data crossing the wires were mixed, led by the rise in the Producer Price Index, which showed that prices surged in May by 10.8% YoY, though lower than expected, indicating that it’s not slowing down, further cementing the Fed’s rate hike.

Later, the US IBD/TIPP Economism optimism for June dropped to 38.1 from 41.2 in May. Raghavan Mayur, president of TechnoMetrica, who directed the poll, wrote, “The June numbers are quite bleak. Most Americans (53%) feel we are now in a recession, and two-thirds (67%) feel the economy is not improving.

In terms of sector specifics, the leading gainers are Energy, up 1.9%, propelled by high oil prices, followed by Technology and Consumer Discretionary, each recording gains of 0.29% and 0.05%, respectively. Contrarily, Utilities, Consumer Staples, and Health are losing 3.04%, 1.68 %, and 1.2% each.

In the commodities complex, the US crude oil benchmark, WTI, is gaining 0.88%, trading at $122.00 BPD, while precious metals like gold (XAU/USD) are falling 0.99%, exchanging hands at $1813.45 a troy ounce, as US Treasury yields, keep rising to multi-year highs.

Key Technical Levels

The GBP/USD pair hit levels under 1.2000 for the first time since March 2020. The pound remains under pressure even as market participants expect a rate hike from the Bank of England on Thursday.

- EUR/USD drops back toward 1.0400 after being unable to hold above 1.0450.

- Euro posts strong gains versus the Swiss franc and the pound.

- FOMC meeting: Expectations of a 75 bps hike continue to rise.

The EUR/USD continue to pull back after the beginning of the American session and it is hovering around 1.0410, slight above Monday’s close. Earlier on Tuesday, the pair peaked at 1.0485 but then lost momentum as Wall Street turned to the downside and as US yields printed fresh highs.

After a positive opening, the Dow Jones is falling by 0.42% and the S&P 500 by 0.11%. The US 10-year bond yield stands at 3.45%, the highest since April 2011. The FOMC meets and will announce on Wednesday a rate hike. Speculations of a 75 basis points rate hike rose after CPI inflation data on Friday; the PPI numbers today came below expectation but did not alleviate tightening expectations.

“After yesterday's market carnage, the curve looks to have largely priced in this expectation. We are wary that the short EURUSD trade is a bit exhausted given the repricing in the FF curve (though this could remain fluid). EUR is also trading a bit better on the crosses ahead of the Fed decision. That suggests to us that we may see a sell the rumor, buy the fact dynamic into and out of the Fed”, explained analysts at TD Securities.

Dead cat bounce?

The EUR/USD is back near the daily low reached at 1.0396 during the Asian session. A break lower should trigger more losses targeting the YTD low at the 1.0350 zone. Below the next support might be located at 1.0300. The negative bias will likely persist until the FOMC statement. A recovery of the euro faces initial resistance at 1.0435 and above below the 1.0500 zone.

Technical levels

- The AUD/USD fell 0.54% on Tuesday, ahead of the US Fed meeting.

- Sentiment and US Federal Reserve expectations of a bigger than foreseen rate hike weighed on the AUD/USD.

- AUD/USD Price Analysis: Might re-test 0.6900 before challenging the YTD low at 0.6828.

The Australian dollar plunges to fresh four-week lows after news that the Federal Reserve would hike 75 bps in the June meeting, the largest since 1994, as US inflation hit 8.6%, showing signs of not abating in the near term. After reaching a daily high near 0.6970, the Aussie dollar collapsed and trades at 0.6894 at the time of writing.

AUD/USD falls on US Federal Reserve 75 bps hike expectations and negative sentiment

The AUD/USD fell on the back of a WSJ news piece that said that “a string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate.” The sentiment was already sour on Monday and carried on to Tuesday’s session, weighing on the AUD/USD, which has plummeted close to 3% in the first two days of the week.

Also, US data released on Tuesday saw the May prices paid by producers in the US rose by 0.8% MoM, aligned with expectations. On an annual basis, the figure downtick to 10.8%, from 10.9% estimations. The AUD/USD approached the 0.6900 figure on the PPI news but dipped towards 0.6880s before extending its losses to a new daily low at 0.6876.

Of late, the US IBD/TIPP Economism optimism for June dropped to 38.1 from 41.2 in May. Raghavan Mayur, president of TechnoMetrica, who directed the poll, wrote, “The June numbers are quite bleak. Most Americans (53%) feel we are now in a recession, and two-thirds (67%) feel the economy is not improving.”

Mayur added that “A full 90% are worried about inflation. Pain is particularly acute at the pump. Gasoline prices have taken over as the top economic issue for 59% of respondents, up from 47% last month. With more Americans cutting back on spending and the Personal Financial Outlook component hitting a record low, people are scared about what the coming months will hold.”

During the Asian session, the Australian NAB’s May business survey showed that business confidence and conditions fell, though they remained elevated compared to the trend. The report showed that total and retail prices continued in solid form, suggesting that upward pressure would keep mounting.

The Australian economic calendar will feature at around 12:30 GMT the Westpac Consumer Confidence for June. On the US front, May’s Retail Sales, alongside Imports and Exports Prices, would shed some light on the US economic outlook. Later at around 18:00 GMT, the Federal Reserve will reveal its monetary policy decision.

AUD/USD Price Analysis: Technical outlook

The AUD/USD is downward biased, reinforced by the break below the June 2 low at 0.7140, extending the pair losses towards the 0.7030s area. Nevertheless, on Monday, the major collapsed in tandem with most G8 currencies vs. the greenback on Federal Reserve news.

Therefore, the AUD/USD might re-test the 0.6900 before resuming the uptrend. Then the AUD/USD first support would be the May 16 low at 0.6872. A breach of the latter would expose the May 13 daily low at 0.6853, followed by the YTD low at 0.6828.

- Technical factors and a weaker pound boost EUR/GBP to highest since May 2021.

- Cross breaks multi-day range and soars.

- UK data below expectations, BoE decision on Thursday.

The EUR/GBP broke a multi-day range and jumped to 0.8681, reaching the highest level since May 2021. The cross is rising almost a hundred pips on Tuesday, rising for the third consecutive day. The euro is also rising versus the Swiss franc on Tuesday. EUR/CHF climbed above 1.0420 reaching the highest level since June 9.

The break of the critical resistance area of 0.8600 and also above 0.8650, boosted the euro further to the upside. The next level to watch now is 0.8700. The bullish tone in EUR/GBP will remain in place while above 0.8600.

Economic data from the UK came in below expectations with the unemployment rate rising unexpectedly to 3.8%. The figures contributed weakening the pound ahead of the Bank of England (BoE) on Thursday.

The central bank is expected to raise the key rate by 25 basis points to 1.25%. “There won’t be updated macro forecasts until the next meeting on August 4. WIRP suggests around 35% odds of a 50 bp move, down from over 50% at the start of this week. However, odds of 50 bp moves at the August 4 and November 3 meetings have risen,” explained analysts at Brown Brothers Harriman. The pound remains under pressure despite tightening expectations.

Technical levels

- NZD/USD is eyeing a test of yearly lows in the low-0.6200s having erased earlier session gains.

- The buck remains in the ascendency ahead of Wednesday’s expected 75 bps rate hike from the Fed.

- NZD/USD has now dropped over 5.0% in the last eight sessions, with recession fears and China lockdowns woes also weighing.

One day out from what is now expected to be a 75 bps rate hike from the Fed plus a new hawkish spin on longer-term interest rate guidance in face of the recent rise in US price pressures (as per last Friday’s US Consumer Price Inflation figures), the US dollar is back in the ascendency. NZD/USD has subsequently reversed earlier session gains that saw the pair attempt to claw its way back to the 0.6300 level and has fallen to test its earlier annual lows in the 0.6220s.

At current levels, the pair is trading lower by about 0.5% and is on course for an eighth successive session in the red during which time it has shed over 5.0% and fallen back from above 0.6550. While inflation’s failure to subside as hoped and the subsequent build-up of Fed tightening bets is one of the key reasons for recent downside, it should also be noted that NZD/USD is also vulnerable to broader macro risk appetite given the kiwi’s status as highly risk-sensitive.

Recession fears have been amping up in recent days, not least in wake of last Friday’s record bad US Consumer Sentiment data from the University of Michigan. Given New Zealand is a small open economy, it (and its currency) is seen as exposed to global growth conditions. China lockdown fears are also hurting the kiwi given its importance as a regional trade partner, as China continues to struggle to stamp out Covid-19 cases.

The US Federal Reserve will announce its monetary policy decision on Wednesday, June 15 at 18:00 GMT and as we get closer to the release time, here are the expectations as forecast by analysts and researchers of 12 major banks.

The world's most powerful central bank is expected to go off-script and hike by 75 basis points (bps) in June. What’s more, markets fully price in another 75 bps rate increase in July.

Commerzbank

“The Fed is likely to raise its key interest rate by 50 bps, as it did at its last meeting. we continue to expect the Fed to raise key rates by 50 bps in September as well, moving to smaller steps of 25 bps only thereafter. In spring 2023, the key rate would then be 3.50%.”

ANZ

“We expect the Fed will raise rates by 50 bps and reiterate guidance that it intends to return rates to neutral quickly. We also expect it to maintain its guidance that rates will rise by 50 bps in July to 2.0%. The Fed will remain open to raising rates by 50 bps in September, with post-summer policy moves contingent on inflation and labour market data. We maintain our target of 3.75% fed funds by mid-2023. We expect the Fed to lower its 2022 GDP forecast and make a modest upward revision to its 2022 and 2023 inflation profiles. The median fed funds profile over the forecast horizon is set to move higher.”

UOB

“Given the clear indications for ongoing hikes to combat inflation spelled out in the May FOMC minutes but no intentions of cranking up the size of the hikes, we are comfortable maintaining our FFTR forecast for another 50 bps each in the Jun and July FOMC. We continue to expect 25 bps in every remaining meeting of this year. This will bring the FFTR higher to the range of 2.50-2.75% by end of 2022, a range largely viewed as the range for neutral stance.”

Westpac

“The second of three consecutive 50 bps increases in the fed funds rate is expected to be delivered, taking the cash rate to 1.375%, on the way to 1.875% in July. These moves have been well telegraphed by the Committee. What comes next is less certain, however, and is likely to be the focus of questioning by the journalists at Chair Powell’s post-meeting press conference. We are likely to see a more balanced assessment of the risks pertaining to inflation and growth through Q3, culminating in the throttling back of rate hikes to a 25 bps pace from September. This shift will be all the more apparent in Q4 as the FOMC ends the tightening cycle at 2.625% in December.”

Danske Bank

“We expect the Fed to hike by another 50 bps and signal that at least one more 50 bps rate hike is likely in July. With still high underlying inflation pressure and high labour demand, risk is skewed towards the Fed signalling that more 50 bps is needed, not least after Fed’s Waller opened the door for continuing with larger 50 bps rate hikes in the autumn.”

TDS

“We are now looking for the Fed to lift rates by 75 bps despite giving clear prior guidance of 50 bps increases for the June and July FOMC. According to media outlets (highly unusual for the Fed), the FOMC is now leaning toward a more front-loaded hiking cycle after another hot CPI and inflation expectations showing signs of de-anchoring. We believe this shows the Fed is more determined to do what it takes to end the inflation overshoot as rapidly as possible even if that raises the chance of a hard landing in 2023. We also expect the Fed to tighten policy by 75 bps in July and then, after reaching neutral, to slow the pace to 50 bps in September and November. We pencil in two further 25 bps increases for the December and February meetings to reach a terminal rate of at least 3.75%-4.00%.”

RBC Economics

“The Fed is widely expected to hike its target rate by another 50 bps, taking it into the 1% range. And it’s not done yet. We expect another 50 bps hike at the next meeting in July on the way up to a 2.75% to 3% range by the end of the year. Slower growth in the economy is expected to follow against the risk that more aggressive rate hikes than we expect will be needed to tame inflation pressures that continue to stoke recession fears. Markets will be watching updated policy rate expectations from FOMC members. As of March, most members did not expect to hike rates above 3%, but that share likely moved higher.”

NBF

“The Fed is all but guaranteed to deliver a second consecutive 50 bps rate hike, bringing the target range for the federal funds rate to 1.25%-1.50%. We’ll be looking for the Fed and Chair Powell to guide markets towards another 50 bps hike at the subsequent July meeting. Thereafter the trajectory becomes less clear. Fortunately, we’re also set to receive fresh guidance on the medium-term policy path as the FOMC is set to release an updated Summary of Economic Projections. As a reminder, the Fed’s previous dot plot (released in March) signaled an expected fed funds target of 1.75%-2% in December. That’s surely to rise but the question is by how much. The market is priced for a 3% policy rate target by year-end, while we’re looking for a slightly less aggressive 2.5%.”

CIBC

“The funds rate is far enough below its final destination that the Fed could opt for a 75 bps move, but we favour a 50 bps hike as more likely given the risks of a financial market overreaction to a larger move.”

ING

“The Fed is widely expected to raise interest rates by 50 bps and confirm that a further 50 bps hike in July is the most likely path ahead. However, there is a debate as to what happens after July. We remain optimistic about near-term growth and we also think inflation will be sticky given ongoing geopolitical strife, supply chain issues, and labour market shortages. As such, a September hike is still our base case, but there is a growing chance the Bank switches to 25 bps moves at that meeting and beyond. We expect the Fed funds rate to peak at around 3% in early 2023.”

Nordea

“We change our Fed call to include a 75 bps hike. Rate markets are prepared for such a message but stock markets could have more downside in store for them. Higher USD rates and more risk-off will be in favour of the USD, which could strengthen somewhat more against the other G10 currencies. However, if the Fed does not hike by 75 bps on Wednesday rates will fall, stock should rally and the USD will likely weaken against most G10 currencies.”

ABN Amro

“We expect the Fed to deliver its second 50 bps rate hike, taking the target range for the fed funds rate to 1.25-1.50%. However, we also see a significant risk that the Fed makes an even bigger move in rates of 75 bps, given the upside surprise in the May CPI reading on Friday. We expect month-on-month inflation readings to remain far above the Fed’s target over the coming months, and somewhat above target later in the year, and this should keep the Fed hiking at a 50 bps pace for all remaining meetings of 2022, and likely once more in 2023. We expect the upper bound of the fed funds rate to peak at 4% by February. We suspect the median projected peak in the fed funds rate will fall somewhat short of our expectation of 4%, but be well above the current consensus expectation, i.e. perhaps signalling an upper bound of 3.75%. Should the Committee deliver a 75 bps hike, it is possible that its projected peak might be even higher than our new base case. At the press conference, we expect Chair Powell to continue to be incrementally more hawkish in the face of the mounting inflation challenge, perhaps flagging the risk to markets that the Fed has to move even more aggressively than the June projections might suggest. We also expect him to continue to emphasise the priority the Fed places on achieving price stability, even if this comes at the expense of a near-term rise in unemployment. The Fed will want to ensure there is no doubt among market participants over its resolve to fight inflation.”

- WTI has broken to fresh multi-month highs in the $123s on Tuesday, in keeping with the recent bullish trend.

- OPEC supply woes were in focus after the cartel said output fell in May (versus the planned hike).

- Traders will be watching the China lockdown situation and macro reaction to this Wednesday’s Fed meeting.

In fitting with the recent bullish trend, oil prices broke higher on Tuesday, with front-month WTI futures rallying into the $123s per barrel, where they trade up more than $2 on the day and nearly $6 higher versus Monday’s lows near $118. Concerns about a tight global oil market as demand in the northern hemisphere continues to rise during peak summer driving season, but supply fails to keep up, is keeping prices supported in the face of downside in risk assets such as stocks and other economically sensitive commodities.

OPEC said on Tuesday that its output fell by 176,000 barrels per day in May, a large miss on the output hike that had been targeted under its deal with OPEC+ members. Smaller (mainly African producers) continue to struggle to lift output as much as permitted under the supply pact. Meanwhile, non-OPEC but OPEC+ member nation Russia, the world’s third-largest oil producer, continues to see its output fall as a result of Western sanctions over its invasion of Ukraine.

WTI bulls continue to eye a test of early March highs in the $130 area, which looks likely given the bullish technicals, where dips have been consistently bought into since mid-April. The main threat to higher prices right now is if major Chinese cities go back into another strict lockdown like a few months ago, which would hit demand in the world’s second-largest oil-consuming nation. Wednesday’s Fed meeting also risks triggering fresh downside in global risk assets/upside in the US dollar, though oil has been resilient to these headwinds in recent weeks. US weekly Private API crude oil inventory data out at 20:30 GMT is also worth a watch.

- USD/CAD turned positive for the fifth straight day and shot to a near one-month high.

- The technical set-up favours bullish traders and supports prospects for additional gains.

- Any meaningful pullback below the 1.2865 zone would be seen as a buying opportunity.

The USD/CAD pair attracted some dip-buying near the 1.2865 area, the 61.8% Fibonacci retracement level of the 1.3077-1.2518 fall and turned positive for the fifth successive day on Tuesday. The momentum lifted spot prices to a near one-month high, closer to mid-1.2900s during the early North American session.

The US dollar reversed modest intraday losses and inched back closer to a nearly two-decade high touched the previous day. This was seen as a key factor that acted as a tailwind for the USD/CAD pair. Bulls seemed rather unaffected by a fresh leg up in crude oil prices, which tend to underpin the commodity-linked loonie.

The emergence of fresh buying near the previous resistance breakpoint now turned support, and some follow-through strength beyond the 1.2900 mark favours bullish traders. Given that oscillators on the daily chart have been gaining positive traction, the USD/CAD pair seems all set to prolong a one-week-old appreciating move.

Spot prices might now aim to surpass an intermediate hurdle near the 1.2980 region and reclaim the key 1.3000 psychological mark. The upward trajectory could further get extended and allow the USD/CAD pair to challenge the YTD peak, around the 1.3075 region touched on May 12, though the pre-Fed anxiety might cap the upside.

On the flip side, the 1.2870-65 region now becomes immediate strong support to defend. Any further pullback is likely to find decent support near the 1.2820 horizontal zone. This is closely followed by the 1.2800 round-figure mark, which coincides with the 50% Fibo. level and should now act as a strong base for the USD/CAD pair.

A convincing break below could make the pair vulnerable to weaken further below the 1.2760 support zone and drop to the 38.2% Fibo. level, around the 1.2730 area. Some follow-through selling, leading to a subsequent break through the 1.2700 mark, would negate the near-term positive bias and shift the bias in favour of bearish traders.

USD/CAD daily chart

-637908111624293884.png)

Key levels to watch

- Gold Price staged modest recovery from a near one-month low touched earlier this Tuesday.

- Aggressive Fed rate hike bets underpinned the USD and kept a lid on any meaningful upside.

- Recession fears extended some support ahead of the crucial FOMC decision on Wednesday.

Gold Price attracted some buying near the $1,810 region, or a near one-month low set earlier this Tuesday, albeit struggled to capitalize on the attempted recovery move. The XAUUSD seesawed between tepid gains/minor losses heading into the North American session and was last seen trading in neutral territory, just below the $1,820 level.

Gold Price weighed down by Fed rate hike bets

Investors seem convinced that the Federal Reserve will get more aggressive to combat stubbornly high inflation, which surged to over a four-decade high in May. In fact, the markets are now pricing in a 175 bps of tightening over the next three meetings, implying at least one 75 bps rate hike by the September meeting. Moreover, investors now expect the officials to raise rates to nearly 4% by next spring, up from last month’s expected to peak at around 3%, which, in turn, acted as a headwind for the non-yielding gold.

Bullish USD further undermined XAUUSD

The US dollar quickly reversed modest intraday losses and stood tall near a two-decade peak touched the previous day amid elevated US Treasury bond yields. This was seen as another factor that kept a lid on any meaningful upside for the dollar-denominated commodity. Expectations that the US central bank would tighten its monetary policy at a faster pace pushed the US government bond yields to their highest levels in more than a decade on Monday. This, in turn, continued lending some support to the greenback.

USD and Gold

Gloomy economic outlook helped limit losses

The prospect of a more aggressive policy tightening by the Fed and other major central banks has reignited fears of a global recession. Apart from this, worries about the supply chain disruptions caused by the Russia-Ukraine war and the latest COVID-19 outbreak in China capped the initial optimistic move in the equity markets. This, in turn, was seen as the only factor that helped limit deeper losses for Gold Price, at least for the time being.

Focus remains on FOMC

Market participants keenly await the outcome of a two-day FOMC monetary policy meeting, scheduled to be announced during the US session on Wednesday. A 75 bps hike would be the biggest since 1994 and would send shockwaves across asset classes. This should be enough to provide a fresh lift to the USD and exert downward pressure on the XAUUSD. Traders, however, seemed reluctant to place aggressive bets and preferred to wait on the sidelines heading into the key central bank event risk.

According to Yohay Elam, Senior Analyst at FXStreet: “A "buy the dip" in stocks has now turned into one for the US dollar. The Fed decision on June 15 will likely include several gut-wrenching twists, and I think the dollar would be able to stomach every move and come out on top.”

Gold Price technical outlook

Gold Price now seem to have found acceptance below a technically significant 200-day SMA and seems vulnerable to weakening further. The negative outlook is reinforced by the fact that oscillators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. Some follow-through selling below the daily swing low, around the $1,810 area, will reaffirm the bearish bias and drag the XAUUSD further below the $1,800 mark. Bears might eventually aim to test the May monthly low, around the $1,786 region, which is closely followed by the YTD low, near the $1,780 zone.

On the flip side, the $1,831-$1,832 region now seems to act as an immediate resistance ahead of the $1,842 area (200-DMA). Sustained strength beyond might trigger a short-covering rally back towards the $1,870 supply zone. Some follow-through buying above the monthly peak, around the $1,879 region, would shift the bias in favour of bullish traders and set the stage for a move towards reclaiming the $1,900 round figure.

-637908082417963111.png)

Expect volatility with the Fed decision

USD/CAD has surged above the 1.29 level. Economists at Scotiabank expect the pair to test the 1.2945 mark next.

Scant signs from the charts that the USD rally is slowing

“There is scant sign from the charts that the USD rally is slowing, let alone reversing.”

“The strong rise in the USD overcame 1.29 easily to put 1.2945 (76.4% Fibonacci of the 1.3077/1.2518 decline) on the radar for today. Above there, the May peak is the only thing standing between current levels and the 1.33+ zone.”

“Intraday support is 1.2890/00.”

EUR/USD has bounced back from sub-1.04 levels. However, the pair has struggled to surpass the 1.0485 mark, that stands as key resistance, economists at Scotiabank report.

Support past 1.04 does not come in until the mid-1.03s

“The EUR’s daily gains stalled around 1.0485, that stands as key resistance ahead of the 1.05 zone, that triggered fresh selling.”

“Support past ~1.0420 and the big figure area does not come in until the mid-1.03s that marked the EUR’s low in mid-May – and could prevent losses to its 2017 low of 1.0341.”

Gold lost more than 2% on Monday and posted its largest one-day drop since March. The yellow metal could suffer a substantial drop fueled by a hawkish Federal Reserve, economists at TD Securities report.

XAUUSD trades below the bull-market defining uptrend

“The composition of gold markets has changed in the aftermath of the pandemic, leaving proprietary traders as the dominant speculative force. This cohort holds a massive amount of complacent length in gold, acquired during the pandemic. Under the weight of a hawkish Fed, these positions are incredibly vulnerable and pose a risk for a substantial correction in gold as a result. With XAUUSD now trading below their bull-market defining uptrend, a technical breakdown could be the catalyst needed to squeeze this cohort.”

“Prices have broken below the threshold for CTA liquidations, which we expect will result in substantial selling flow from systematic trend followers.”

“The growing valuation gap between gold and real rates might eventually exacerbate the repricing lower in the yellow metal, despite it being attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive complacent length in the yellow metal which has kept the prices elevated.”

- GBP/USD remained under pressure on Tuesday, hitting fresh annual lows under 1.2100 though recently bouncing a little post-soft US PPI data.

- The pair has dropped hard this week with soft UK data weighing on BoE tightening bets as Fed tightening bets rise.

- The Fed and BoE’s policy announcements on Wednesday and Thursday are this week’s key events.

The pound remains under pressure on Tuesday, with GBP/USD dipping to fresh annual lows under 1.2100 to print lows in the 1.2070s, after the latest monthly UK labour market data release revealed the unemployment rate rose for the first time since 2020 in the three months to April. The pair was last trading lower by about 0.3% just under 1.2100, after finding support in the form of the May 2020 lows in the 1.2070s. Slightly weaker than expected US Producer Price Index data has helped it recover from lows in recent trade.

GBP/USD decline on Tuesday comes after the pair fell just under 1.5% on Monday as a result of safe-haven demand for the US dollar and after monthly GDP data showed the UK economy shrank in April. This week’s poor UK data has compounded fears about the UK economy being in or close to recession, with growth in the UK seen as likely to be amongst the weakest in the G20 this year. Fears about UK economic weakness go hand in hand with decreasing confidence about how much more monetary tightening the BoE can get away with, just as the Fed and ECB look likely to pivot in a more hawkish direction, hence sterling underperformance.

Indeed, the BoE is likely to only deliver a meager 25 bps rate hike on Thursday versus a 75 bps hike from the Fed on Wednesday. These two central bank meetings will be the main events of the week and GBP/USD risks falling under 1.20 if the divergence between the two’s monetary stance (the Fed being more hawkish and BoE less) is greater than expected. Wednesday’s US Retail Sales data will also be crucial in the context of recession fears, which have had an important impact on macro sentiment in recent sessions (also weighing heavily on sterling).

Another theme to watch this week is rising UK/EU tensions over the former’s proposal to unilaterally alter the Northern Ireland Protocol, which some think puts the post-Brexit trade deal and London’s financial equivalence with the EU at risk. This risk has also been weighing on sterling as of late.

The annual pace of producer price inflation in the US according to the Producer Price Index (PPI) fell slightly to 10.8% from 10.9% a month earlier, a tad below expectations for it to remain unchanged at 10.9%. MoM, PPI showed prices rising 0.8% in May, in line with expected, but up from 0.4% a month earlier (revised lower from 0.5%).

The Core PPI showed the annual inflation rate at 8.3%, below the expected 8.6%, while the MoM gain in Core PPI was 0.5%, below the expected 0.6%, but still up from last month's 0.2%.

Market Reaction

The US dollar has been pulling back a tad in wake of slightly weaker than expected PPI data, recently dipping back below 105.00, but still remains at fairly elevated levels.

- EUR/USD has recovered to the 1.0450 area on Tuesday after briefly dipping under 1.0400 and eyeing annual lows on Monday.

- Hawkish ECB speak might be helping for now, but most traders will refrain from placing big bets pre-Fed.

- The potential for further risk-off flows means the pair remains at risk of hitting fresh annual lows.

After dipping briefly below 1.0400 on Monday and eyeing a test of previous annual lows in the 1.0350 region as the broader Dollar Index (DXY) hit fresh multi-year highs, EUR/USD has mounted a reasonable recovery on Tuesday. The pair was last trading in the 1.0450 region, higher by about 0.4% on the day, despite slightly softer than expected German ZEW Economic Sentiment survey data for June released during the European morning.

The euro seems to be benefitting from hawkish ECB speak, with Dutch central bank head and ECB governing council member Klaas Knot having earlier hinted at the prospect of a larger than 25 bps rate hike from the ECB next month “if conditions remain the same as today”. Indeed, with markets having moved to swiftly price in an additional 25 bps of tightening from the Fed at this Wednesday since last Friday’s hot US inflation figures, there is no reason they won’t move to price a 50 bps hike from the ECB next month.

In terms of calendar events for the remainder of the day, US Producer Price Inflation (PPI) data at 1230GMT will be worth watching in the context of ongoing concerns about persistently high inflation. Meanwhile, a speech from influential ECB policymaker Isabel Schnabel at 1700GMT on the topic of Eurozone fragmentation will be interesting in the context of the recent rise in the German-Italian yield spread (which surpasses 250 bps on Monday).

Ahead of key macro events later this week, traders would be wise not to chase any big moves in either direction. The prospect of renewed downside in risk assets on central bank tightening fears, which tends to weigh on EUR/USD (because the buck is seen as a safe-haven currency) could yet send the pair to fresh annual lows under 1.0350.

- Silver struggled to preserve/capitalize on its modest recovery gains from a one-month low.

- The technical set-up favours bearish traders and supports prospects for additional losses.

- Sustained move beyond the $22.00 mark is needed to negate the near-term negative bias.

Silver surrendered a major part of its intraday gains and retreated to the lower boundary of the daily trading range during the first half of the European session. The white metal was last seen trading just above the $21.00 mark, well within the striking distance of a nearly one-month low touched the previous day.

Given the overnight break through the 61.8% Fibonacci retracement level of the $20.46-$22.52 bounce, acceptance below the $21.00 handle would be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone.

The technical set-up supports prospects for an extension of the recent decline from the $22.50 region, or a one-month high touched on June 6. Hence, a subsequent fall back towards challenging the YTD low, around the $20.45 area touched on May 13, now looks like a distinct possibility amid the emergence of some US dollar dip-buying.

On the flip side, the daily swing high, around the $21.35-$21.40 region, now seems to act as immediate resistance ahead of the 50% Fibo. level. Any further move up might still be seen as a selling opportunity and remain capped near the $22.00 confluence hurdle, comprising 200-period SMA on the 4-hour chart and the 23.6% Fibo. level.

That said, some follow-through buying would negate the near-term negative outlook and shift the bias in favour of bullish traders. The XAG/USD might then surpass an intermediate resistance near the $22.30 area and test the $22.50-$22.60 supply zone.

Silver 4-hour chart

-637907995167330829.png)

Key levels to watch

In his first appearance after the 50 bps June interest rate hike, Reserve Bank of Australia (RBA) Governor Dr. Phillip Lowe warned that Australians should be ready for significant interest rate hikes in the balance of this year.

Key quotes

“The RBA would do "what's necessary" to get inflation back to between 2 to 3 percent.”

"It's unclear at the moment how far interest rates will need to go up to get that."

"I'm confident that inflation will come down over time but we'll have to have higher interest rates to get that outcome."

it was "reasonable" to think interest rates would reach about 2.5 percent at some point.”

"I say that because the midpoint of our inflation target is 2.5 percent, so an interest rate of 2.5 percent in inflation-adjusted terms is really an interest rate of zero, which in historical terms is a very low number.”

"How fast we get to 2.5 percent, indeed whether we get to 2.5 percent, is going to be determined by events."

- GBP/USD struggled to preserve its modest recovery gains amid the emergence of USD dip-buying.

- Recession fears kept a lid on the optimistic move in the markets and benefitted the safe-haven buck.

- Fed rate hike bets favour the USD bulls and support prospects for additional losses for the major.

The GBP/USD pair surrendered modest intraday recovery gains and dropped to the lower boundary of its daily trading range during the first half of the European session. The pair was last seen hovering around the 1.2115-1.2110 area, just a few pips above a two-year low touched the previous day.