- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 16-06-2022.

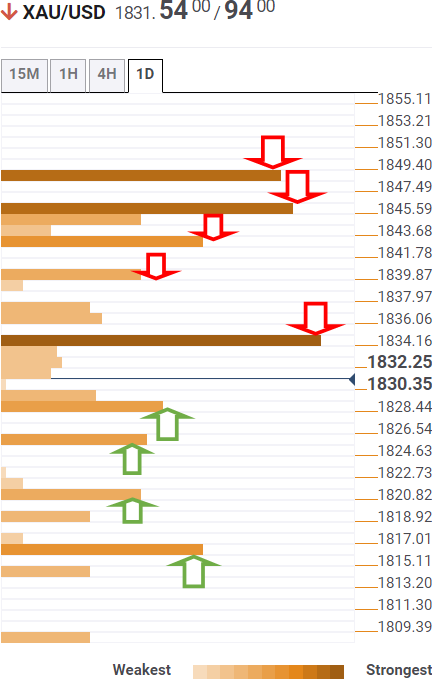

- Gold price is holding itself above the critical support of $1,850.00 amid weaker yields.

- The 10-year US Treasury yields have slipped below 3.20% on the bumper rate hike announcement by the Fed.

- Investors await Fed chair Jerome Powell’s speech in today’s session.

Gold price (XAU/USD) is going through a corrective move after a juggernaut rally to a high of $1,857.64, recorded in the early Asian session. The precious metal displayed a perpendicular upside move on Thursday after hitting a low of $1,815.66 as yields plunged. It s worth noting that this time the risk-aversion theme has underpinned the gold prices and other currencies, however, the US dollar index (DXY) and global equities are facing turmoil.

Investors doubt that the Federal Reserve (Fed) will stop the recession arrival, which has trimmed the DXY’s appeal and expectations of lower profits due to recession fears have brought an extreme sell-off in the global equities.

The 10-year US Treasury yields have plunged by 3.32% to near 3.19% and the ongoing price action is warranting more downside. Vulnerable yields will weaken the DXY further. The DXY is already balancing below 104.00 and is expected to continue its two-day losing streak after slipping below Thursday’s low at 103.42.

In today’s session, the speech from Fed chair Jerome Powell will remain the major event. Investors will get the ideology of the Fed behind a 75 basis point (bps) rate hike announcement. Along with this, guidance for July monetary policy will be of significant importance.

Gold technical analysis

On an hourly scale, gold prices are facing a hurdle around the critical resistance at $1,857.73. A sheer upside move is generally followed by a minor pullback. The precious metal is expected to witness a minor correction towards the 21-period Exponential Moving Average (EMA), which is placed at $1,842.35. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which underpins a bullish momentum. A minor correction could drag the RSI (14) below 60.00, however, a bullish momentum will remain intact.

Gold hourly chart

- GBP/USD bulls take a breather after two-day uptrend, pokes eight-day-old descending trend line.

- Clear break of 50-SMA joins bullish MACD signals, firmer RSI to keep buyers hopeful.

- 100-SMA, monthly resistance line lures bulls, sellers need validation from weekly support for fresh entry.

GBP/USD dribbles around 1.2350 amid Friday’s Asian session, after refreshing the weekly top during a two-day uptrend the previous day.

In doing so, the Cable pair jostles with an eight-day-old descending trend line resistance while keeping the latest upside break of the 50-SMA and the weekly horizontal resistance area, now support.

Other than the latest breakouts, the firmer RSI (14) conditions, not oversold, join the bullish MACD signals to keep GBP/USD buyers hopeful.

However, a clear upside break of the 1.2350 becomes necessary for the cable pair to aim for the immediate hurdles, namely the 100-SMA and a descending trend line from May 30, respectively around 1.2450 and 1.2530.

It’s worth noting that the clear upside break of 1.2530 won’t hesitate to propel the GBP/USD prices beyond the monthly high around 1.2600.

Alternatively, pullback moves remain elusive until the quote drops back below the 50-SMA level near 1.2325.

Also acting as short-term key support is the previous horizontal resistance area comprising multiple tops marked since Monday, near 1.2210-2200.

GBP/USD: Four-hour chart

Trend: Further upside expected

- USD/CHF consolidates the biggest daily fall in seven years within a tight range.

- Market sentiment dwindles amid a quiet Asian session.

- SNB’s surprise 0.50% rate hike propelled CHF, broad US dollar weakness strengthened bearish bias.

- Fed Monetary Policy report, Chairman Powell’s speech will be crucial for short-term directions, yields are important too.

USD/CHF traders lick their wounds around 0.9670 after posting the biggest daily slump since 2015, led by the SNB’s surprise rate hike. The Swiss currency (CHF) pair’s latest inaction could be linked to the traders’ wait for more clues during early Friday’s quiet Asian session.

It’s worth noting that a pause in the US Treasury yields’ weakness and mildly bid US stock futures seem to have favored the quote’s latest corrective pullback from a two-week low.

That said, the US benchmark 10-year Treasury yields dropped during the last two consecutive days to 3.195% at the latest. S&P 500 Futures, on the other hand, print 0.25% intraday gains after losing around 3.25% on Wall Street.

Aggressive momentary policy actions from the Swiss National Bank (SNB) and the downbeat US data weighed on the US bond coupons, as well as the USD/CHF prices the previous day. In doing so, the Treasury yields fail to pay respect to the US Federal Reserve’s (Fed) 0.75% rate hike, the biggest move since 1994.

It’s worth noting that the SNB surprised global markets with a 0.50% rate hike on Thursday. “It cannot be ruled out that further increases in the SNB policy rate will be necessary in the foreseeable future to stabilize inflation in the range consistent with price stability over the medium term,” mentioned the SNB Statement after the rate announcement. Additionally, SNB Chairman Thomas Jordan also said that the Swiss franc was no longer highly valued because of the recent depreciation, per Reuters. "Central bank is ready to intervene in markets to check excessive appreciation or weakening of the Swiss franc," added SNB’s Jordan.

On the other hand, the US Building Permits and Housing Starts eased in May to 1.695M and 1.549M respectively while the Initial Jobless Claims 4-week average inched up to 218.5K versus 215K expected during the period ended on June 10. Further, Philadelphia Fed Manufacturing Survey printed a negative figure of -3.3 for June, the first such contraction since May 2020.

Moving on, the US Industrial Production for May, expected at 0.4% versus 1.1% prior, will join the Fed’s bi-annual Monetary Policy Report and Powell’s speech to entertain USD/CHF traders. Should Fed’s Powell defend the latest moves, the USD bulls may return to the table.

Technical analysis

Despite the latest plunge, USD/CHF remains supported by an upward sloping trend line from late March, near 0.9635 by the press time, which in turn suggests a corrective pullback towards the 50-DMA level surrounding 0.9705.

- USD/CAD is sensing offers around 1.2950 as investors await a speech from Fed chair Jerome Powell.

- Oil prices are mildly offered after hitting a high of $118.00, an upside bias is still intact.

- The odds of a higher Canada CPI will restrict the loonie bulls.

The USD/CAD pair has witnessed a minor selling pressure around 1.2950 and has slipped a little lower for now. On a broader note, the greenback bulls are facing barricades in a range of 1.2974-1.2995 from the last three trading sessions.

Despite a broad-based weak performance by the greenback bulls in the last two trading sessions after the Federal Reserve (Fed) announced a rate hike by 75 basis points (bps), the asset has failed to display any meaningful downside move like the other risk-sensitive assets. One could state that the loonie bulls are also weak and have remained vulnerable. A vulnerable performance by the loonie bulls could bank upon higher expectations for Canada Consumer Price Index (CPI), which is due next week.

On an annual basis, Canada's inflation is seen at 7.5%, and a significant jump is expected against the prior print of 6.8%. While the core CPI that excludes oil and food prices is expected to land at 5.9% vs. 5.7% recorded earlier.

The oil prices are mildly offered after hitting a critical hurdle of $118.00. A bumper rate hike announcement by the Federal Reserve (Fed) has triggered recession fears which kept the oil prices on the tenterhooks.

Meanwhile, the US dollar index (DXY) is expected to remain on the sidelines as investors are awaiting the speech from Fed chair Jerome Powell. The speech may guide investors above the likely monetary policy action going further along with the rationale behind announcing the 75 bps rate hike.

“The Bank of Japan (BOJ) is likely to maintain ultra-low interest rates on Friday and stress its resolve to support a fragile economy with massive stimulus, a move that may further weaken the yen by highlighting a policy divergence with the rest of the world,” said Reuters ahead of Friday’s BOJ monetary policy announcement.

Key quotes

While a modest, technical tweak to its yield cap or guidance on the future policy path cannot be ruled out, the BOJ is seen sustaining its massive monetary support for now to ensure the economy is fully out of the doldrums.

At the two-day policy meeting ending on Friday, the BOJ is widely expected to maintain its -0.1% target for short-term rates and its pledge to guide the 10-year yield around 0%.

The central bank may also deepen its resolve to defend the 0.25% upper limit by targetting a wider range of debt maturities for its unlimited fixed-rate bond-buying operation, which currently covers only 10-year bonds, some analysts said.

The BOJ is caught in a dilemma. With Japan’s inflation well below that of Western economies, its focus is to support the stil-weak economy with low rates. But the dovish policy has triggered sharp yen falls, hurting an economy heavily reliant on fuel and raw material imports.

BOJ Governor Haruhiko Kuroda has repeatedly stressed the need to keep interest rates ultra-loose, and that the central bank won’t target exchange-rates in guiding policy.

Prime Minister Fumio Kishida appeared to defend Kuroda’s stance. In a news conference on Wednesday, Kishida said the BOJ will likely take into account various factors besides yen moves, such as the impact on small firms’ borrowing costs, in setting policy.

Kuroda is likely to warn against a weak yen at his post-meeting briefing, such as by highlighting the damage the currency’s sharp falls could inflict on the economy, analysts said.

USD/JPY pares recent losses

USD/JPY picks up bids to refresh intraday high around 132.70 by the press time. The yen pair’s latest gains could also be linked to the market’s consolidation amid a quiet Asian session on Friday.

Also read: USD/JPY stays defensive above 132.00 on softer yields, BOJ, Fed’s Powell eyed

- NZD/USD has remained flat despite a higher release of the NZ PMI at 52.9.

- The DXY is performing vulnerable after a 75 bps rate hike announcement by the Fed.

- Next week, the kiwi bulls will react to the interest rate decision by the PBOC.

The NZD/USD pair has not displayed any wild or one-sided moves after the release of the Business NZ PMI. Business NZ has reported the PMI at 52.9, higher than the expectations and the prior print of 52.7 and 51.2 respectively.

The kiwi bulls are performing strongly from the last two trading sessions despite the downbeat Gross Domestic Product (GDP) numbers. A country’s GDP data states its overall economic growth and possess significant importance. The GDP has tumbled to 1.2%, significantly lower than the estimates of 3.3% and the prior print of 3.1%on an annual basis. More adverse, the quarterly figures have shifted to negative territory. The quarterly GDP has landed at -0.2%, much lower than the consensus and the former figure of 0.6% and 3% respectively.

Next week, the kiwi dollar will be guided by the interest rate decision from the People Bank of China (PBOC). Officially, the one-year loan prime rate of the PBOC stands at 3.7% while the five-year rate is at 4.6%.

Meanwhile, the US dollar index (DXY) has recorded a two-day losing streak after the Federal Reserve (Fed) announced a rate hike by 75 basis points (bps). A 75 bps rate hike option gained popularity on the release of the four-decade-high US Consumer Price Index (CPI) at 8.6%. A tight labor market and firm growth prospects have supported the Federal Reserve (Fed) to announce an extremely tight policy. In today’s session, investors will keep an eye on the speech from Fed chair Jerome Powell, which will provide more insights of the monetary policy dictated on Wednesday.

- AUD/NZD struggles to extend the previous day’s bounce off short-term key support.

- Business NZ PMI rose to 52.9 in May versus 52.7 expected.

- Sluggish oscillators, upbeat NZ data favor sellers but 50-DMA adds to the downside filters.

- Bulls need to cross descending resistance line from early May for conviction.

AUD/NZD steadies around 1.1080, pausing the recovery from a three-month-old support line, after New Zealand (NZ) data came in firmer during early Friday.

That said, the Business NZ PMI rose past 52.7 forecasts and 51.2 prior, to 52.7 during May.

The firmer NZ data joins sluggish MACD and steady RSI to weigh on the AUD/NZD prices.

However, the 50-DMA level of 1.1005 acts as an extra challenge for the pair bears, in addition to the immediate support line near 1.1020.

Should the quote drops below 1.1005, the 1.1000 psychological magnet may act as an extra filter to the south before directing the quote towards late May’s swing low around 1.0920.

Alternatively, recovery moves could aim for 1.1125-30 ahead of challenging a downward sloping resistance line from May 04, close to 1.1175 by the press time.

In a case where the AUD/NZD prices rally beyond 1.1175, bulls can aim for 2017 peak surrounding 1.1290.

AUD/NZD: Daily chart

Trend: Further weakness expected

- The euro recovered some ground vs. the Japanese yen amidst the scenario of Japanese authorities intervening in the FX markets.

- EUR/JPY Price Analysis: The bounce at weekly lows might open the door for a re-test of 142.00.

The EUR/JPY is paring some of Thursday’s losses as the Asian session begins and is posting decent gains of 0.22%. At the time of writing, the EUR/JPY is trading at 139.62.

The market mood remains negative. On Wednesday afternoon, the US Federal Reserve hiked rates by 0.75%, opening the door for further hikes. Also, the Bank of England (BoE) and the Swiss National Bank (SNB) followed suit, hiking 0.25% and 0.50%, respectively. That, alongside dismal US housing data, reignited recession fears on the traders’ minds.

Reflecting the abovementioned were US equities tumbling between 3 and 5 percent. Asian futures are trading in the red, meaning bourses get ready for a lower open.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart illustrates the pair as upward biased. Even though Thursday’s price action recorded a fresh weekly low at around 137.84, the pair bounced off weekly lows and settled around the 139.40-60 area.

The EUR/JPY’s 4-hour chart illustrates that the pair broke below the bullish flag and aimed lower towards 137.84 weekly lows, at around the 200-4H simple moving average (SMA). Nevertheless, the EUR/JPY surged towards the 100-4H SMA at around 139.62, a difficult dynamic resistance level, on its way towards a re-test of June 12 highs at around 141.73.

Hence, the EUR/JPY is upward biased. That said, the EUR/JPY’s first resistance would be June 16 high at 139.95. Break above would expose the R1 daily pivot at 140.74. Once cleared, the EUR/JPY’s next resistance would be 50-4H SMA at 141.33, followed by the aforementioned June 12 high.

Key Technical Levels

President Joe Biden said a recession is "not inevitable" and he is confident the United States can overcome inflation, the Associated Press (AP) reported on Thursday, per Reuters.

US President Biden gave two main statements during the AP interview while saying, “First of all, it’s not inevitable,” Biden adds, “Secondly, we’re in a stronger position than any nation in the world to overcome this inflation.”

Market reaction

EUR/USD extends the latest pullback from the weekly high, after a three-day uptrend, towards 1.0540 following the news. However, the softer yields and downbeat US dollar probed the pair sellers by the press time.

Also read: EUR/USD Forecast: Potential gains limited by fear

- USD/JPY picks up bids to pare two-day losses ahead of the key events.

- Yields dropped amid mixed sentiment, softer data, US dollar failed to cheer risk-aversion.

- Central banks’ aggression contrast downbeat US data to challenge traders.

- BOJ is widely expected to keep monetary policy unchanged, Powell should defend the latest action to restrict volatile moves.

USD/JPY pares recent losses around a fortnight low, snapping a two-day downtrend, as yen buyers take a pause ahead of the Bank of Japan’s (BOJ) monetary policy report on early Friday morning in Asia. Also challenging the pair’s pullback moves could be the market’s cautious mood ahead of a speech from Fed Chairman Jerome Powell. That said, the major currency pair bounces off a fortnight low to refresh an intraday high around 132.40 by the press time.

While portraying the pre-event anxiety, the USD/JPY pair ignores downbeat Treasury yields that drowned the quote during the last two days.

The US benchmark 10-year Treasury yields dropped during the last two consecutive days to 3.195% at the latest. Aggressive momentary policy actions from the Swiss National Bank (SNB) and Bank of England (BOE) seem to join the downbeat US data to weigh on the US bond coupons. In doing so, the Treasury yields fail to pay respect to the US Federal Reserve’s (Fed) 0.75% rate hike, the biggest move since 1994.

That said, the US Building Permits and Housing Starts eased in May to 1.695M and 1.549M respectively while the Initial Jobless Claims 4-week average inched up to 218.5K versus 215K expected during the period ended on June 10. Further, Philadelphia Fed Manufacturing Survey printed a negative figure of -3.3 for June, the first such contraction since May 2020.

It’s worth noting that the downbeat US data and yields weighed on the US Dollar Index (DXY) as it refreshed its weekly low with 103.41 before closing Thursday’s trading session around 103.83 during the second negative daily performance.

However, the Wall Street benchmarks failed to cheer the downbeat US dollar, neither they could benefit from the softer yields as fears of faster monetary policy tightening weigh on investor sentiment, which in turn allowed USD/JPY to remain depressed.

Looking forward, USD/JPY traders will pay attention to the BOJ monetary policy meeting even as the Japanese policymakers have clearly shown their intent to keep the easy money flowing until witnessing the 2.0% inflation on a successive basis. The reason making today’s BOJ interesting are the surprises from the Fed and the SNB, as well as the yen’s heavy weakness.

Also read: BOJ Preview: Slim chance for a tweak in YCC policy

Other than the BOJ, the US Industrial Production for May, expected at 0.4% versus 1.1% prior, will join the Fed’s bi-annual Monetary Policy Report and Powell’s speech to offer a busy end to the crucial week. Fed’s Powell need to defend the latest moves to recall the USD bulls.

Technical analysis

A sustained downside break of a fortnight-old ascending trend line directs USD/JPY towards the tops marked during late April and early May, surrounding 131.25-35. Alternatively, multiple supports around 133.50 guards immediate upside.

- AUD/USD is balancing above 0.7040 as DXY has turned bearish ahead of Fed Powell’s speech.

- The aussie bulls have ignored the subdued aussie jobless rate.

- Higher aussie Employment Change will provide more room for the RBA to stretch interest rates.

The AUD/USD pair has displayed a mild correction after hitting a fresh weekly high of 0.7070 in the late New York session. The aussie dollar is advancing gradually this week after sensing a responsive buying action near 0.6850 on Wednesday. The antipodean has ignored the mixed employment data and has got strengthened against the greenback.

The Australian Bureau of Statistics reported the Unemployment Rate at 3.9%, unchanged from the prior print but came higher than the expectation of 3.8%. However, the economy has managed to generate significant job opportunities in May. The Employment Change has landed at 60.6k, extremely higher than the expectations of 25k and the prior print of 4k.

An unchanged Unemployment Rate and higher job additions in the labor market will support the Reserve Bank of Australia (RBA) to tighten policy without any hesitation. A tight labor market delights the central bank in policy tightening measures as it feels the least slowdown worries. The RBA would be able to consider rate hike options beyond the 25 basis points (bps) rate.

Meanwhile, the US dollar index (DXY) extended its weakness on Thursday after slipping below the crucial support of 104.67. Falling US Treasury yields have brought a sell-off in the DXY. The 10-year US Treasury yields have eased 5.9% and have slipped to 3.19%. A 75 bps rate hike announcement by the Federal Reserve (Fed) has trimmed the DXY’s appeal vigorously. Going forward, investors’ focus will remain on the speech from Fed chair Jerome Powell, which is due on Friday. The speech is expected to dictate the rationale behind featuring a bumper rate hike.

- The EUR/USD shifted positively in the week and is gaining 0.34%.

- US recession fears shifted sentiment negatively, though boosted appetite for safe-haven peers, except for the US Dollar.

- EUR/USD Price Forecast: Failure at 1.0600 will pave the way for further losses.

EUR/USD soars sharply above the 1.0500 mark for the first time in the week and extends its gains for the third consecutive day after Fed Wednesday’s afternoon hike, that tumbled the major towards weekly lows around 1.0350, though staged a comeback and now is trading at weekly highs near 1.0601. At the time of writing, the EUR/USD is trading at 1.0552.

Risk aversion is the name of the game in the financial markets. US equities tumbled between 2.40% and 4.98%, while Asian stocks futures are set for a lower open. Weaker than expected US housing data reignited recession fears as more central banks were added to the list of the ones that are tightening monetary conditions. On Thursday, the Bank of England (BoE) raised rates by 25 bps, while the Swiss National Bank (SNB) surprised everybody by hiking 50 bps.

In the meantime, some ECB speakers crossed the wires, though they did not help the EUR/USD, which is rallying on the back of pure US Dollar weakness. The US Dollar Index, a measure of the buck’s value against a basket of six currencies, plunged 1%, down at 103.813, underpinned by falling US Treasury yields.

- Read also: EUR/USD climbs above the 1.0500 figure due to a softer US dollar

EUR/USD Price Forecast: Technical outlook

In the news piece mentioned above, I wrote, “The EUR/USD 1-hour chart depicts the pair trading above a double bottom neckline in the near term,” and added that the EUR/USD might pull back before reaching the double bottom target at 1.0550. The truth is that the EUR/USD extended its gains, fulfilled the double bottom target, and extended its gains towards 1.0600 before retreating towards the 1-hour chart double bottom target, at around 1.0550.

Despite Thursday’s late EUR/USD rally, the downward bias remains unless EUR bulls recover the 1.0800 mark. Also, the EUR/USD retracement from weekly highs around 1.0600 and the RSI shifting trendless at 4629 within negative territory could open the door for further losses.

Therefore, the EUR/USD first support would be 1.0500. Once cleared, the EUR7USD next support would be 1.0400, followed by the YTD Low at 1.0348

Key Technical Levels

- Gold is trimming weekly losses but remains down by 0.89%.

- Sentiment remains dismal, and the greenback fell, underpinned by plummeting US Treasury yields; gold rose.

- Gold Price Forecast (XAUUSD): Neutral-upwards above $1880; otherwise, would be exposed to selling pressure.

Gold spot (XAU/USD) remains steady above the 200-day moving average (DMA), which lies around $1843.19, as the Wall Street close approaches. Safe-haven demand and US dollar buyers taking profits weakened the greenback and lifted Gold prices, with XAU/USD trading at $1854.60, gaining 1.14%.

US equities remain on the backfoot, posting hefty losses. Risk aversion is keen late in the week after the US Federal Reserve raised rates by 75 bps on Wednesday afternoon, followed by Fed Chair Jerome Powell’s press conference.

Chair Jerome Powell said that he does not expect a move of 75 bps to be “common” but mentioned that the July meeting is open for a 50 or 75 bps rate hike. He also said that ongoing increases to the Federal funds rate (FFR) are appropriate and emphasized that inflation is extremely high.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, continues drifting lower, currently at 103.697, plunging 1.10%, underpinned by falling US Treasury yields

Besides the buck’s value and the US 10-year Treasury nominal yield, Gold traders need to be aware of real yields. The US 10-year Treasury Inflation-Protected Securities (TIPS) yield, a proxy for real yields, sits at 0.651%, down from daily highs at 0.893%.

Meanwhile, harmful US housing data shifted traders’ attention towards a recession scenario. Housing Starts in the US for May dropped by -14.4%, while Building Permits followed suit, edging lower by -7%. Furthermore, the Philadelphia Fed Manufacturing Index for June showed signs of a slowing US economy contracting by -3.3, much lower than estimations of 5.5.

Gold Price Forecast (XAUUSD): Technical outlook

Gold’s daily chart depicts the pair as neutral. On Thursday, Gold buyers reclaimed the 200-DMA, but to further cement the upward bias, they need a daily close above the June 13 high at $1878.65. Otherwise, XAUUSD would remain vulnerable to further selling pressure.

Upwards, the XAUUSD’s first resistance would be the 50-day moving average (DMA) at 1876.91. Break above would expose the aforementioned June 13 high, followed by the $1900 mark. On the other hand, XAUUSD’s first support would be June’s 16 low at $1814.68. A breach of the latter would expose the June 14 low at $1804.95, followed by the May 16 cycle low at $1786.50.

Key Technical Levels

What you need to take care of on Friday, June 17:

Central banks spurred panic, but the American dollar could not take advantage of the panic scenario, ending the day with losses against most major rivals.

The Switzerland National Bank surprised markets with an unexpected 50 bps hike, while the Bank of England moved as planned and made its fifth consecutive 25 bps hike. Two things we learned from this. On the one hand, the Fed is far more aggressive than any other central bank. On the other, global policymakers are much more scared about the economic situation than what they let see.

Stocks resumed their declines, with Wall Street plummeting to fresh 2022 lows. The DJIA and the S&P 500 traded at levels last seen in January 2021. The FTSE 100 also plummeted as the BOE’s decision fell short of the market’s expectations. Recession fears are behind stocks’ collapse.

Demand for government bonds sent yields to the lower end of their weekly range, which in turn undermined demand for the greenback. The yield on the 10-year Treasury note currently stands at around 3.30% after flirting with 3.50% earlier in the day. The dollar’s weakness may well be temporal if the demand for safety continues.

The EUR/USD pair trades around 1.0570, while GBP/USD hovers around 1.2350. The AUD/USD pair surged to 0.7070, holding nearby, while the USD/CAD changes hands at 1.2920. Save-haven currencies were firmly up against the dollar, with USD/CHF down roughly 300 pips, now trading in the 0.9630 region. Ahead of the Bank of Japan monetary policy decision, the USD/JPY battles around 132.00.

Gold surged to a fresh 3-day high of $1,852.74 a troy ounce, holding nearby ahead of the Asian opening, while crude oil prices recovered some ground. WTI is now trading at $117.70 a barrel.

Like this article? Help us with some feedback by answering this survey:

- The Bank of England hiked 25 bps and initially tumbled the pound, though later rallied due to a weaker US dollar.

- The BoE decided not to give any forward guidance regarding the pace and time of monetary policy adjustments.

- Negative US housing data fueled speculations that the US might be headed into a recession.

The British pound is rallying sharply following a 25 bps rate hike by the Bank of England (BoE), which now plays catch up vs. the US Federal Reserve, with the former lifting rates to 1.25%, while the latter surpassing the BoE, with the Federal funds rate (FFR) at 1.75%. Nevertheless, despite the previously mentioned, the GBP/USD is up 1.47%, trading at 1.2352 at the time of writing.

Market sentiment remains negative, as portrayed by US equities recording losses between 2.70% and 5%. Fears that the Federal Reserve might trigger a recession after reacting late to high inflation figures loom.

The BoE hikes rates, though expect UK’s economy to contract

On Thursday, the Bank of England lifted rates by 0.25%, initially sending the GBP/USD towards daily lows at around 1.2050. Nevertheless, GBP/USD buyers lifted the pair around that area, which is rallying close to 200 pips in the day.

In its monetary policy statement, the BoE updated its projections about CPI and expects inflation to peak at 10% in Q4 of 2022. The Monetary Policy Committee (MPC) estimates inflation would tame at around the 2% target in two years as external factors dilute. Concerning UK’s growth, the bank expects a contraction in Q2, by -0.3%, weaker than anticipated in its May report.

It’s worth noting that the statement gave no forward guidance regarding further hikes in the near term. The BoE emphasized that the “scale, pace and timing will reflect the Committee’s assessment of the economic outlook and inflationary pressures.”

Despite the aforementioned, some banks in the street expect the BoE would lift the Bank’s Rate to 2.25%.

In the meantime, bad US housing economic data further raise speculations of a recession in the US. US House Starts shrank by -14.4%, while Building Permits followed suit, down -by 7%. Additionally, the Philadelphia Fed Manufacturing Index for June showed signs of a slowing US economy contracting by -3.3, much lower than estimations of 5.5.

Key Technical Levels

Citing an EU source familiar with the matter, Reuters reported on Thursday that European Central Bank President Christine Lagarde told the eurozone finance minister that fragmentation risk was a serious threat to the price stability mandate.

"Doubting our commitment would be a serious mistake," Lagarde reportedly added. "The goal of anti-fragmentation tool is not to close spreads, but to normalise spreads."

Market reaction

These comments were largely ignored by market participants and the EUR/USD pair was last seen rising 1.25% on the day at 1.0570.

- Negative divergence on the USD/JPY daily chart caused a drop of 200-pips, right above May 9 high at around 131.34.

- A risk-off market mood favors the Japanese yen, despite the Fed rate hike.

- A USD/JPY move above 133.00 opens the door towards 135.00, otherwise, a fall towards 131.00 is on the cards.

The USD/JPY extends its losses for the second consecutive day, despite a larger than initially expected 75 bps rate hike by the Federal Reserve, which initially boosted the greenback, with the USD/JPY jumping near 135.00, but gave way for JPY bulls, which since then, dragged the pair down below the 132.00 area. At the time of writing, the USD/JPY is trading at 132.06.

US equities remain on the backfoot as recession fears mount. In the meantime, the greenback remains on the defensive, as illustrated by the US Dollar Index (DXY), down 1.1%, at 103.698. US Treasury yields, led by the 10-year benchmark note, is down six basis points, yielding 3.330%.

Also read: USD/JPY Price Analysis: Hovers around 133.80s as a negative divergence emerges

USD/JPY Price Forecast: Technical outlook

Daily chart

In an article on June 15, a technical analysis piece on the USD/JPY, I wrote that “the last couple of cycle highs were recorded as the Relative Strenght Index (RSI) registered two peaks, but the second peak was lower than the previous one, meaning a negative divergence formed. That said, the USD/JPY might be headed for a pullback.”

That said, during Thursday’s trading session, the USD/JPY tanked 200 pips from the daily high at 134.67 towards the daily low at around 131.49, 15 pips above the May 9 daily high-turned-support at 131.34.

4-hour chart

The USD/JPY is neutral-upward biased, as illustrated by the 4-hour chart. Once the negative divergence tumbled the pair towards 131.40s, buying pressure lifted the pair back above the 132.00 mark. Nevertheless, a move of the Relative Strength Index (RSI) above the 50-midline, alongside a USD/JPY rally towards 133.00, is needed if USD/JPY bulls would like to remain in control.

Upwards, the USD/JPY’s first resistance would be the S2 daily pivot at 132.21. Break above would expose the S1 pivot point at 133.00, followed by the 50-simple moving average (SMA) at 133.84. On the flip side, the USD/JPY first support would be 132.00. A breach of the latter would send the pair towards the May 9 high at 131.34, followed by the 100-SMA at 131.21 and then the 200-SMA at 130.19

Key Technical Levels

- The greenback is under pressure as recession fears mount, as the Fed lifts rates to the 1.75% threshold.

- The US housing market started to weaken as Housing Starts shrank.

- Australia’s labor market strengthens and further cement a scenario of an RBA rate hike.

AUD/USD climbs during the North American session. Earlier, the major reached a daily high near 0.7035 though the rally was short-lived as traders recoiled its bullish bets, amidst a dampened market mood, with global equities falling. However, after reaching a daily low at around0.6940s, the AUD/USD bounced off that level and is gaining some 0.36%, trading at around 0.7025.

Harmful US economic data weighs on the buck

Of late, the AUD/USD pared some of its earlier losses on the back of worst-than-expected US economic data. US Housing Starts declined -by 14.4%, while Building Permits followed suit, down -by 7%. The Philadelphia Fed Manufacturing Index for June shrank for the first time, since May 2020, down -3.3 in June, against estimations of a 5.5 reading.

During the Asian session, Australia’s employment figures were better than expected. The Aussie economy added 61K new jobs to the economy, more than the 25K estimated, and the Unemployment rate held steadily around 3.9%.

Details of the report were also strong reinforcing market wagers the Reserve Bank of Australia (RBA) will deliver another half-point rate hike in July to reach 1.35%.

Analysts at ANZ said, “This continued strength in the labour market supports our view that the RBA will hike the cash rate a further 50bp in July.”

Elsewhere, US equities are plummeting, illustrating a gloomy market mood resulting from the Fed rate hike. On Wednesday, Fed Chair Jerome Powell said that although rate hikes of that size (75 bps) are not common, he reiterated that the July meeting is open for a move of that size or 50 bps.

Meanwhile, US Treasury yields, albeit heading down, remain steady above the 3% threshold. Contrarily the greenback remains soft, as illustrated by the US Dollar Index, at 103.699, down 1.10%.

Key Technical Levels

Italian Prime Minister Mario Draghi said on Thursday that the European Central Bank's (ECB) decision to hike the interest rate is inevitable, as reported by Reuters.

"ECB interest rise is bound to be more gradual than in the US," Draghi added and said that it was totally counterproductive for politicians to comment on the ECB's policy.

Market reaction

The shared currency continues to outperform its rivals on Thursday and the EUR/USD pair was last seen trading at its highest level in nearly a week at 1.0550, rising more than 1% on a daily basis.

The Bank of England announced on Thursday a new increase in the interest rate. It raised the key rate by 25 basis points to 1.25%, with three members voting for a 50 bps hike. Analysts from Rabobank expect one more 25 bps hike in August, before the Monetary Policy Committee (MPC) takes a pause and re-assesses.

Key Quotes:

“With GDP set to contract this quarter, the MPC is hiking into a slowdown. It risks inflicting a deeper recession on the economy; bringing down inflation creates a lot of collateral damage.”

“We expect one more 25 bps hike in August, before the MPC takes a pause and re-assesses. The risk is that the market will not allow the central bank to pause. In an environment where almost all other central banks are ramping up their hiking schedules, and where countries want stronger instead of weaker currencies in order to fend off imported inflation, the value of the currency increasingly becomes a risk factor.”

“The sterling effective exchange rate has fallen by 5% year-todate, with particular weakness against the US dollar. This could not only be attributed to a weakening growth and political outlook, but also to widening interest rate differentials with the United States. This places the central bank in a perilous spot: if it does too little, imported cost pressures keep flowing in, if it does too much, it will only intensify the recession.”

- Gold rises to the highest level in four days, eyes $1850.

- Silver erases losses, and approaches Wednesday's high near $21.90.

- US yields slide as demand for Treasuries picks up amid risk aversion.

Gold gained momentum boosted by a context of risk aversion and a weaker US dollar. XAU/USD rose from under $1820 to the $1850 area.

In Wall Street, stocks are falling sharply. The Dow Jones is losing 2.50% while the Nasdaq drops by more than 4%. Recession concerns are driving prices lower. At the same time, the demand for safe-haven assets boosted Treasuries. The US 10-year yield pulled back from 3.49% to 3.32%.

The US dollar is falling versus its G10 rivals, particularly against the Swiss franc and the yen. The DXY drops by 0.90%, and trades below 105.00.

The combination of lower yields and a weaker dollar pushed XAU/USD to the upside. The yellow metal trades at $1846, the highest level since Monday and is looking at the $1850. A break above could open the doors to more gains.

XAG/USD also hit multi-day highs at $21.89. Earlier on Thursday, bottomed at $21.35. On the contrary, cryprocurrencies remain under pressure. Bitcoin continues to trade dangerously close to the $20,000 level.

Technical levels

- Swiss franc among top performers after SNB surprise rate hike.

- USD/CHF extends slide amid risk aversion and a weaker dollar.

- EUR/CHF heads for the lowest close in two months.

The Swiss franc is having the best day in months on Thursday on the back of an unexpected rate hike from the Swiss National Bank. The USD/CHF dropped further during the American session and reached the lowest level in ten days, under 0.9700.

From a stronger CHF to a weaker USD

The Swiss franc jumped across the board earlier on Thursday following a 50 basis points rate hike from the Swiss National Bank from -0.75 to -0.25. Also, comments about the exchange rate, with references to the Swiss franc not being “highly valued”, triggered the CHF’s rally. “The updated forecasts don’t suggest any rush to tighten. However, the swaps market is pricing over 350 bp of tightening over the next 12 months that would see the policy rate peak near 3.25% vs. 1.25-1.50% at the start of this week,” explained analysts at BBH.

During the American session, the driver in the USD/CHF slide was a weaker US dollar. The greenback lost momentum despite risk aversion and amid a pullback in US yields. The USD/CHF is trading at 0.9680/85, at the lowest level in ten days, down more than 250 pips for the day. The move faces a support area at 0.9640 and then the May low at 0.9540.

The pair is back under the 20-day moving average and has made a sharp reversal after being rejected again from above 1.0000. The greenback needs to recover 0.9725 initially to alleviate the bearish pressure. Above the next resistance is seen at 0.9800 and 0.9870.

The EUR/CHF is falling more than 200 pips. It bottomed at 1.0127, the weakest since April 13 and then rebounded modestly to 1.0175. Below 1.0125, attention would turn to the April low of 1.0085.

Technical levels

"There is no need for Russia to cut its oil output," Russian Deputy Prime Minister Alexander Novak told RBC media on Thursday.

"OPEC+ role is on the rise due to uncertainties with demand and supply in China, Iran, Libya and Venezuela," Novak added. "We don't have plans to switch to an oil-for-roubles scheme."

Market reaction

Crude oil prices edged slightly lower following these comments. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $115.15, where it was down 0.6% on a daily basis.

- The shared currency remains trims some of its weekly losses but remains down 0.21%.

- Hawkish ECB speaking will keep the common currency supported.

- EUR/USD Price Forecast: A double bottom in the 1-hour chart targets 1.0550.

EUR/ÜSD advances above the 1.0400-1.0500 range, and it is trading with gains of 0.68% during the New York session, at around 1.0509 at the time of writing.

ECB speakers and negative US economic data, weighed on the USD

The shared currency is gaining traction as USD buyers book profits after the Federal Reserve’s 0.75% rate hike. Furthermore, worse-than-expected US economic data crossed the wires. US Home Sales for May dropped to their lowest level in a year, and Building Permits contracted by -7%. Additionally, the Federal Reserve Bank of Philadelphia Manufacturing Business Outlook Surve index shrank by -3.3 in June from 5.5 estimations.

ECB speakers have dominated the headlines. Francois Villeroy the Galhau was the first to hit the headlines, commenting that inflation remains higher and is broadening beyond energy prices. Later the ECB Vice-President Luis de Guindos said that inflation expectations in the Euro area were “quite anchored.”

The Bank of Italy President and ECB member Ignazio Visco said that he expects the ECB to hike rates in a gradual and sustained way after September. He added that normalization could continue to be gradual, which could mean 25 or 50 bps rate hikes.

In the meantime, US equities are plunging, depicting a negative market sentiment resulting from the Fed rate hike. On Wednesday, Fed Chair Jerome Powell said that although rate hikes of that size (75 bps) are not common, he reiterated that the July meeting is open for that jumbo rate hike or 50 bps.

Meanwhile, US Treasury yields, albeit heading down, remain steady above the 3% threshold. Contrarily the greenback remains soft, as illustrated by the US Dollar Index, at 104.316, down 0.51%.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart depicts the pair as downward biased unless it recovers the 1.0800 mark. Furthermore, the Relative Strenght Index at 43 remains in negative territory, despite Tuesday’s jump, which propelled the consolidation in the EUR/USD.

The EUR/USD 1-hour chart depicts the pair trading above a double bottom neckline in the near term. However, the last candle shows price exhaustion, and with the Relative Strength Index (RSI) at 67.66 accelerating toward overbought conditions, a pullback towards the neckline around 1.0470 is on the cards. That said, the EUR/USD will find some resistance levels at the R1 daily pivot at 1.0512, followed by the double bottom target at 1.0550.

- GBP/USD caught aggressive bids and rallied to a three-day high in the last hour.

- Softer US macro data weighed on the USD and prompted a short-covering move.

- Elevated US bond yields, the risk-off mood to limit the USD losses and cap the pair.

The GBP/USD pair witnessed a short-covering bounce on Thursday and rallied nearly 150 pips from the 1.2040 area, or the daily low touched in the aftermath of the Bank of England policy decision. The momentum pushed spot prices to a three-day high, around the 1.2280-1.2285 region during the early North American session.

The intraday US dollar positive move lost steam following the disappointing release of the US macro data, which, in turn, was seen as a key factor that offered support to the GBP/USD pair. The US Department of Commerce reported that Housing Starts declined by 14.4% and Building Permits fell by 7% in May. Adding to this, the Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity declined to -3.3 in June from 2.5 in May. The data added to worries about softening US economic growth and prompted some selling around the greenback.

That said, elevated US Treasury bond yields, bolstered by hawkish Fed expectations, should help limit any deeper USD pullback. Fed Chair Jerome Powell said on Wednesday the US central bank is “absolutely determined” to keep inflation expectations anchored to 2% and reaffirmed another big hike in July. Moreover, the so-called dot plot showed that the median year-end projection for the federal funds rate moved up to 3.4% from 1.9% in the March estimate and 3.8% in 2023. This, along with the risk-off impulse, could lend support to the safe-haven buck and cap the GBP/USD pair, at least for now.

Apart from this, expectations that the BoE would opt for a more gradual approach to raising interest rates amid recession fears could act as a headwind for the British pound. Bulls might also be reluctant to place aggressive bets amid the UK-EU impasse over the Northern Ireland Protocol of the Brexit agreement. The fundamental backdrop favours bearish traders, suggesting that any subsequent move up runs the risk of fizzling out rather quickly. Hence, it will be prudent to wait for strong follow-through buying before confirming that the GBP/USD pair has formed a near-term bottom.

Technical levels to watch

The Bank of Japan (BoJ) will announce its monetary policy decision on Friday, June 17 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks.

The BoJ to remain a dovish outlier by maintaining policy settings. What’s more, the central bank is unlikely to offer anything on FX but may tweak the yield curve control (YCC) cap.

ING

“No change is expected. Governor Kuroda and other members have publicly stated on several occasions that the BoJ will retain its current accommodative monetary policy stance, as the recent cost-push inflation will be temporary and that a weak yen benefits the economy as a whole. The current JPY weakness is expected to deepen with rate differentials widening.”

UOB

“Although Japan’s inflation has climbed in recent months, BoJ Governor Kuroda does not see 2% inflation in Japan as sustainable ‘when it’s triggered by a rise in commodity prices and worsening trade factors’ with wage growth still absent. So, both Japan’s lacklustre economic recovery and the challenging growth outlook will imply the BoJ will not be tightening or signalling to do so anytime in 2022.”

Standard Chartered

“We expect the BoJ to keep the policy balance rate unchanged in June. Rising US and global bond yields have turned yield differentials further against the JPY, pushing the currency to multi-year lows. However, the BoJ does not see JPY weakness as detrimental to Japan’s economy; instead, a weak JPY is expected to support exports and improve firms’ profitability. While core CPI inflation has risen to over 2%, the BoJ sees the rise as transient as it is mainly driven by base effects. The central bank is likely to maintain its dovish stance, aiming to achieve sustainable CPI.”

Danske Bank

“The BoJ has made it very clear that they do not see the weak yen as a problem. With still modest inflation pressure, we expect no changes to the bank’s accommodative stance. In other words, the BoJ remains an outlier among advanced central banks.”

TDS

“BoJ likely to leave all policy levers unchanged. The central bank is leveraging a weak JPY to break the deflationary mindset, but pressure is growing to make a change to YCC in the coming months.”

SocGen

“We expect the BoJ to maintain its main monetary policy. Going forward, our main scenario is for the USD/JPY rate to stop exceeding 130 yen and for the core CPI to continue to be greater than 2.5% YoY. Therefore, we expect the BoJ to maintain its current policies – at least under Governor Kuroda.”

The Swiss National Bank (SNB) surprised the market with an unexpected 50 basis points (bps) rate hike. Subsequently, economists at Rabobank have lowered their one-month forecast for EUR/CHF to 1.02 from 1.03.

SNB would likely desire to move away from negative rates completely

“The news of a 50 bps move came as a big surprise to the vast majority of participants. That shock was evident in the knee-jerk plunge in EUR/CHF this morning – a move only softened by the warning from SNB President Jordan that FX intervention was still a policy option for the central bank.”

“Looking ahead, the SNB would likely desire to move away from negative rates completely (from the current level of -0.25 bps). Not only would this likely have to be preceded by an upward revision on inflation forecasts, but signs that EUR/CHF would not fall dramatically would also likely be a condition.”

“Any sniff of crisis in the Eurozone would likely send EUR/CHF sharply lower on safe-haven flows which could close the SNB’s window of opportunity for any further rate moves.”

“We have lowered our one-month forecast for EUR/CHF to 1.02 from 1.03 on account of today’s move.”

- Gold Price edged lower on Thursday and was pressured by more hawkish major central banks.

- But recession fears weighed on investors’ sentiment and limited losses for the safe-haven metal.

- Intraday USD selling revived demand for the XAUUSD, though the uptick lacked follow-through.

Gold Price struggled to capitalize on the previous day's goodish recovery move from a one-month low and came under some fresh selling pressure on Thursday. The XAUUSD remained depressed heading into the North American session, albeit managing to recover a major part of its intraday losses, and was last seen trading around the $1,830 region.

Gold Price weighed down by hawkish Central Banks

The Federal Reserve on Wednesday raised interest rates by 75 bps - the biggest hike since 1994 - and also indicated a faster policy tightening path to bring price pressures under control. In the post-meeting press conference, Fed Chair Jerome Powell reaffirmed the central bank will deliver another big hike in July. Moreover, the so-called dot plot showed that the median year-end projection for the federal funds rate moved up to 3.4% from 1.9% in the March estimate and 3.8% in 2023.

Also read: After Powell’s decision, the outlook for gold remains bearish

Adding to this, the Swiss National Bank surprised markets with a 50 bps rate hike this Thursday and also left the door open for further rate hikes to counter rising inflationary pressures. Separately, the Bank of England also decided to hike interest rates for the fifth consecutive time and said that it remains ready to act "forcefully" to curb soaring inflation. This, in turn, was seen as a key factor that continued acting as a headwind for the non-yielding yellow metal.

Gold bar

Risk-off mood offered support

The global risk sentiment took a hit amid doubts that major central banks can hike interest rates to curb inflation without impacting economic growth. Powell also projected a slowing economy and rising unemployment in the months to come amid concerns about the global supply chain disruptions caused by the Russia-Ukraine war and the latest COVID-19 lockdowns in China. The worsening global economic outlook tempered investors' appetite for riskier assets, which was evident from a sea of red across the equity markets. This, in turn, extended some support to the safe-haven precious metal.

Modest USD-selling helped limit losses

The US dollar struggled to preserve/capitalize on its intraday gains and witnessed some selling in reaction to disappointing US macro releases. The US Department of Labor reported that 229K individuals filed for unemployment insurance for the first time in the week ending June 11 and the previous week's reading was revised higher to 232K. Adding to this, data published by the US Department of Commerce revealed that Housing Starts in the US declined by 14.4% and Building Permits fell by 7% in May.

Furthermore, the Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity declined to -3.3 in June from 2.5 in May. The data added to worries about softening US economic growth and weighed on the buck, which, in turn, helped the dollar-denominated commodity to attract some buying at lower levels. That said, the intraday uptick lacked bullish conviction, warranting some caution before positioning for any further gains.

Gold Price technical outlook

Gold Price on Wednesday faced rejection near a technically significant 200-day SMA. The said barrier is currently pegged near the $1,842 region and should act as a pivotal point for short-term traders. Sustained strength beyond might trigger a short-covering move and lift the XAUUSD towards the $1,870 supply zone. Some follow-through buying above the monthly peak, around the $1,879 region, would shift the bias in favour of bullish traders and set the stage for a move towards reclaiming the $1,900 round figure.

On the flip side, the daily swing low, around the $1,815 region, now seems to protect the immediate downside ahead of the $1,805 area, or a one-month trough touched on Tuesday. Failure to defend the said support levels, leading to a subsequent break below the $1,800 mark, would be seen as a fresh trigger for bearish traders and expose the YTD low, around the $1,780 region.

-637909820257328331.png)

Bias remains bearish in the short term

A spread of over 200 bps in the 10-year Germany and Italy bond yield would be unjustified, European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday.

Additional takeaways

"Wage growth is contained so far."

"We're capable of sterilising liquidity without selling securities."

"Overly gradual monetary shift would compromise ECB credibility."

"Overly rapid policy normalisation would jeopardise financial stability."

"I think normalisation can continue to be gradual, it can mean 25 or 50 bps hikes."

"Fragmentation warrants concern."

"Spreads are not due to monetary policy normalisation."

"Today a spread of less than 150 bps would be justified, referring to Italy-Germany 10-year bond yield spread."

"Monetary policy normalisation and fighting fragmentation are complementary."

Market reaction

The EUR/USD pair extended its rebound after these comments and was last seen trading in positive territory above 1.0450.

European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that he expects the ECB to continue to hike the policy rate in a gradual and sustained way after September, as reported by Reuters.

Additional takeaways

"Future rate hikes after September will depend on new data and its impact on medium-term price stability prospects."

"Markets perceive a hawkish ECB stance which in my view is not appropriate."

ECB will continue to focus on economic developments, which are currently very uncertain."

"Convinced ECB's determination will help restore more order to markets."

"More orderly markets will help investors better assess the real conditions of our economy."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen losing 0.15% on a daily basis at 1.0428.

The S&P 500 has seen a near-term bounce post the FOMC as suspected, but this has been capped at resistance from the beginning of the gap lower from Monday at 3838. Analysts at Credit Suisse stay negative for 3666/63 next and eventually the 50% retracement of the 2020/2021 uptrend at 3505.

Initial resistance moves to 3815

“We look for 3838 to ideally continue to cap for a move below the current low at 3706 with support then seen next at 3666/63 ahead of potential trend channel support at 3637/33.”

“Big picture, we continue to look for a fall to our core objective at the 50% retracement at 3505, also the location of the 200-week average.”

“Resistance is seen moving to 3815 initially, with 3838 ideally capping. Above can see a deeper rebound toward the top of the price gap at 3900, but with fresh sellers expected here.”

- Philadelphia Fed Manufacturing Index fell into negative territory in June.

- US Dollar Index continues to fluctuate below 105.00 after this data.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity declined to -3.3 in June from 2.5 in May. This print missed the market expectation of 5.5 by a wide margin.

Additional takeaways

"The new orders index fell 35 points to -12.4, and the shipments index fell 25 points but remained positive at 10.8."

"On balance, the firms continued to report increases in employment, and the employment index moved up from 25.5 to 28.1."

"The indicators for prices paid and prices received continue to indicate widespread price increases but decreased this month. The prices paid index declined for the second consecutive month, down 14 points to 64.5."

Market reaction

The US Dollar Index stays below 105.00 after this data and Wall Street's main indexes remain on track to open sharply lower.

The Bank of England's MPC voted 6-3 to raise Bank Rate by 25 bps to 1.25%. GBP has initially fallen back against both EUR and USD, reflecting the disappointment on the BoE move. In the view of economists at TD Securities, the pound is likely at the whims of risk sentiment.

Three members voted for a 50 bps rise

“The BoE voted to raise Bank Rate by 25 bps to 1.25%. Three members dissented for a stronger 50 bps hike, the same as at May's meeting.”

“GBP initially gave back some early gains on the announcement, reflecting the disappointment with the BoE's 25bps move. Nevertheless, the door remains open for further hikes, which has likely limited GBP's sell-off.”

“The sheer pessimism built into GBP remains the one source of support with positioning and valuations stretched.”

- Housing Starts in the US declined sharply in May.

- US Dollar Index continues to edge lower after dropping below 105.00.

The data published by the US Department of Commerce revealed on Thursday that Housing Starts in the US declined by 14.4% on a monthly basis in May following April's increase of 5.5%. In the same period, Building Permits fell by 7%.

Underlying details of the publication showed that Housing Permits decreased by 7%.

Market reaction

The dollar weakens modestly against its major rivals in the early American session on Thursday with the US Dollar Index posting small losses near 104.80. Meanwhile, US stock index futures were last seen losing between 1.6% and 2.1%.

A choppy session has seen EUR/USD fall to retest and again hold for now the YTD and 2017 lows at 1.0350/41. Economists at Credit Suisse continue to look for an eventual break below here for a fall to parity.

Initial resistance aligns at 1.0470

“Whilst we see scope for further consolidation above the YTD and 2017 lows at 1.0350/41, our core bias stays negative for an eventual clear and sustained break lower. We would expect this to then act as the catalyst for a resumption of the core downtrend with support seen next at 1.0281 then 1.0217/09, which we look to hold at first.”

“Big picture, we maintain our core negative outlook for an eventual sustained break lower for an eventual fall to parity/0.99.”

“Resistance is seen at 1.0470 initially, with a break above 1.0508 needed to clear the way for a recovery back to the 13-day exponential average at 1.0554, which we look to prove tougher resistance.”

“A sustained close above the 55-day average at 1.0672 is needed to warn of a potentially more important low.”

EUR/CHF has plummeted aggressively lower. A close below the 1.0189/69 support would open the door for a fall below parity and a move to Credit Suisse’s core medium-term objective at 0.9839/30

Scope for near-term ranging on quick return above 1.0339

“A sustained close below the key medium-term support at late April lows at 1.0189/69 would trigger a larger bearish ‘triangle’ continuation pattern to significantly reinforce our core bearish view.”

“Below 1.0189/69 support is seen at 1.0133 and then at 1.0086, which we expect to eventually break to open a move to parity, ahead of our long -held core objective at 0.9839/30.”

“We note that the potential ‘measured triangle objective’ is seen at 0.9609/00.

“A quick return above 1.0339 would negate the potential triangle formation and see scope for near-term ranging to occur.”

- Initial Jobless Claims declined by 3,000 in the week ending June 11.

- US Dollar Index retreats below 105.00 in the early American session.

There were 229,000 initial jobless claims in the week ending June 11, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 232,000 (revised from 229,000).

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 0.9% and the 4-week moving average was 218,500, an increase of 2,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending June 4 was 1,312,000, an increase of 3,000 from the previous week's revised level," the DOL said.

Market reaction

The greenback stays on the back foot after this report and the US Dollar Index was last seen posting small daily losses at 104.82.

Following his meeting with Saudi Arabia's energy minister, Russian Deputy Prime Minister Alexander Novak said on Thursday that they have discussed forecasts on oil prices.

"It is important to continue joint work at OPEC+ to avoid collapse on the oil market," Novak added and noted that the oil market is currently balanced while acknowledging that there were lots of uncertainties.

Market reaction

Crude oil prices showed no immediate reaction to these comments and the barrel of West Texas Intermediate (WTI) was last seen trading at $113.50, where it was down 2% on a daily basis.

- USD/CAD finds support from USD rebound, WTI weakness.

- The pair sights a potential bull pennant on the 4H chart.

- 50 and 100 SMAs bullish crossover backs the upswing.

USD/CAD is holding higher ground near the mid-1.2900s, as bulls continue to capitalize on the risk-off flows-driven renewed US dollar upswing.

Meanwhile, the 1% drop in WTI prices, amid risk-aversion and a potential increase in the Russian oil output, weighs negatively on the resource-linked Canadian dollar. Therefore, USD/CAD cheers the oil price weakness heading into a bunch of the US housing and jobs data. Investors also look forward to the Canadian Wholesale Sales data for fresh trading cues.

From a short-term technical perspective, USD/CAD is poised for the additional upside as bulls have spotted a bull pennant formation on the four-hour chart, which will be confirmed on a sustained break above the falling trendline resistance at 1.2947.

On an upside break validation, the pair could advance to retest the 1.3000 supply zone, above which the 1.3050 psychological level could be tested.

The 14-day Relative Strength Index (RSI) is turning lower but holds well above the midline, supporting the case for the upside.

Adding credence to the bullish potential, a 50 and 100-Simple Moving Averages (SMA) bullish crossover, confirmed on Wednesday, remains in play.

USD/CAD: Four-hour chart

On the other side, the bullish 21 SMA at 1.2913 will limit any pullback, a break below which will open floors towards the rising trendline support at 1.2882.

A four-hourly candlestick closing below the latter will lead to the pattern failure, exposing the further downside towards the horizontal 200 SMA at 1.2796.

USD/CAD: Additional levels to consider

- GBP/JPY witnessed aggressive intraday selling on Thursday and dived to over a three-week low.

- The risk-off impulse benefitted the safe-haven JPY amid some repositioning trade ahead of BoJ.

- The British pound lost ground after the BoE announced the expected 25 bps interest rate hike.

The GBP/JPY cross attracted some intraday selling near the 163.75-163.80 region on Thursday and dived to its lowest level since May 27 after the Bank of England announced its policy decision. The cross, however, quickly recovered over 100 pips and was last seen trading above the 161.00 round figure.

The US central bank projected a slowdown in economic growth and rising unemployment in the months to come on Wednesday. The Fed's gloomy outlook added to market concerns that a more aggressive move by major central banks to curb inflation would pose challenges to the global economic recovery.

Apart from this, the global supply chain disruptions caused by the Russia-Ukraine war and the latest COVID-19 lockdowns in China further fueled recession fears. This, in turn, took its toll on the risk sentiment, which boosted demand for traditional safe-haven assets and benefitted the Japanese yen.

This, along with some repositioning trade ahead of the Bank of Japan meeting on Friday, forced investors to lighten their bearish bets around the JPY. This was seen as a key factor that exerted some downward pressure on the GBP/JPY cross, which lost additional ground after the BoE announcement.

As was widely anticipated, the UK central bank decided to hike interest rates for the fifth consecutive time to curb soaring inflation. The nine-member Monetary Policy Committee (MPC) voted 6-3 for the 25 bps hike in the bank rate from 1.0% to 1.25%, with the minority voting for a 50 bps increase.

In the accompanying policy statement, the BoE noted that it was ready to act "forcefully" to stamp out dangers posed by the persistent rise in inflationary pressures. This suggested that the central bank would opt for a more gradual approach amid recession fears and weighed on the British pound.

Despite the negative factors, the GBP/JPY cross showed some resilience near the 160.00 psychological mark and found some support just ahead of the 100-day SMA. This warrants caution before positioning for an extension of the recent sharp pullback from a multi-year peak touched earlier this month.

Technical levels to watch

- EUR/USD is struggling to extend the recovery above 1.0400.

- The US dollar remains choppy despite risk-aversion at full speed.

- ECB officials said to want new policy instrument ready by the July meeting

EUR/USD is attacking 1.0400, unable to sustain the recovery near the 1.0425 region, as EUR bulls remain unimpressed by the latest European Central Bank (ECB) news.

Reuters reported that European Central Bank (ECB) officials are said to want a new instrument, which will be used to counter the fragmentation issue, ready by the July Governing Council meeting.

Further, the upside attempts in the pair remain elusive, as the risk-on market profile keeps the sentiment around the US dollar buoyed. The rebound in the longer-dated US Treasury yields on the 75 bps Fed rate hike is also underpinning the dollar demand.

Meanwhile, investors assess the cautious policy guidance adopted by the Bank of England (BOE) this Thursday after it hiked rates by 25 bps, as expected. The GBP/USD slump-induced support received by EUR/GBP is cushioning the losses in the shared currency against the dollar, as of writing.

Attention now turns towards a slew of second-tier US economic releases and the Wall Street open for fresh trading impetus on EUR/USD.

EUR/USD technical levels to consider

European Central Bank (ECB) officials reportedly want the new instrument that will be used to battle against fragmentation to be ready by the July Governing Council meeting.

Under the new anti-crisis tool, the ECB is said to offset bond-buying and policymakers are worried that market stress may hinder the monetary policy.

Market reaction

The shared currency is struggling to find demand following this headline. As of writing, the EUR/USD pair was trading at 1.0412, where it was down 0.26% on a daily basis.

- GBP/USD met with a fresh supply after the BoE hiked interest rates by 25 bps, as expected.

- Rising US bond yields, the risk-off impulse underpinned the USD and further exerted pressure.

- A break below the 1.2000 mark is needed to confirm a fresh breakdown and any further losses.

The GBP/USD pair witnessed some selling during the mid-European session and dropped to a fresh daily low, around the mid-1.2000s after the Bank of England announced its policy decision.

As was widely expected, the UK central bank decided to hike interest rates for the fifth consecutive time to curb soaring inflation. The nine-member Monetary Policy Committee (MPC) voted 6-3 for the 25 bps hike in the bank rate from 1.0% to 1.25%, with the minority voting for a 50 bps increase.

In the accompanying policy statement, the BoE noted that it was ready to act "forcefully" to stamp out dangers posed by the persistent rise in inflationary pressures. This suggested that the central bank would opt for a more gradual approach amid recession fears and weighed on the British pound.

On the other hand, a combination of factors assisted the US dollar to regain positive traction and reversed the post-FOMC losses. A fresh leg up in the US Treasury bond yields, along with the risk-off impulse, underpinned the safe-haven buck. This exerted additional pressure on the GBP/USD pair.

With the latest leg down, spot prices have eroded a part of the overnight goodish recovery gains. That said, the lack of a significant selling warrants caution for bearish traders. Hence, it will be prudent to wait for a sustained break below the 1.2000 psychological mark before positioning for further losses.

Technical levels to watch

- EUR/GBP gained nearly 100 pips with the initial reaction to BOE policy decisions.

- BOE hiked its policy rate by 25 bps to 1.25% as expected.

- Three BOE policymakers voted for a 50 bps hike.

EUR/GBP rose sharply and touched a daily high of 0.8630 in the European trading hours on Thursday before retreating slightly. The pair was last seen trading at 0.8620, where it was up 0.55% on a daily basis.

The Bank of England (BOE) announced on Thursday that it hiked its policy rate by 25 basis points to 1.25%. Some experts were expecting the BOE to raise its rate by 50 bps. Three policymakers voted for a 50 bps hike but failed to help the British pound find demand.

In its policy statement, the BOE said that it expects Consumer Price Index (CPI) inflation to be over 9% over the next few months before reaching 11% in October. "BOE will act forcefully in response, if necessary," the publication further read.

Reflecting the negative impact of the BOE's policy announcements on the GBP, the GBP/USD pair is down more than 1% on the day at around 1.2050.

Technical levels to consider

The Bank of England (BoE) announced its monetary policy decision this Thursday and hiked rates for the fifth consecutive time to curb soaring inflation. The nine-member Monetary Policy Committee (MPC) voted 6-3 for the 25 bps hike in the bank rate to 1.25%, with the minority - Catherine Mann, Jonathan Haskel and Michael Saunders - voting for a 50 bps increase. The UK benchmark rate is now at its highest since January 2009.

In the accompanying monetary policy statement, the BoE noted that the path for interest rates had risen materially since the May meeting, even though there had been relatively little news since then. The BoE further said that it was ready to act "forcefully" to stamp out dangers posed by an inflation rate heading above 11%.

Market Reaction

The latest monetary policy update by the UK central bank, however, failed to impress the GBP bulls. In fact, the GBP/USD pair dropped back below the 1.2100 round-figure mark after the announcement and was last seen hovering near the daily low.

- USD/JPY came under some fresh selling pressure on Thursday and dived to over a one-week low.

- The downward trajectory confirmed a bearish break below the ascending trend-channel support.

- A subsequent fall below the 200-hour SMA might have already set the stage for additional losses.

The USD/JPY pair witnessed aggressive selling near the 134.65-134.70 region on Thursday and extended the previous day's retracement slide from a 24-year peak. This marked the second successive day of decline and dragged spot prices to a one-and-half-week low, around the 132.30 region during the early part of the European session.

The risk-off impulse - as depicted by a sea of red across the equity markets - boosted demand for the traditional safe-haven assets. This, along with some repositioning trade ahead of the Bank of Japan meeting on Friday, forced investors to lighten their bearish bets around the JPY and exerted heavy downward pressure on the USD/JPY pair.

From a technical perspective, the sharp intraday decline on Thursday confirmed a breakdown through the lower end of a one-week-old ascending trend channel. Subsequent fall below the 200-hour SMA support, around the 133.75 region, and the 23.6% Fibonacci retracement level of the 126.55-135.60 rally could be seen as a fresh trigger for bearish traders.

That said, a big divergence in the monetary policy stance adopted by the BoJ and the Federal Reserve held back traders from positioning for any deeper losses. Apart from this, the emergence of fresh US dollar buying assisted the USD/JPY pair to quickly rebound around 80-85 pips from the daily low and climb back above the 133.00 mark.

This makes it prudent to wait for some follow-through selling below the 132.30 zone before confirming that the USD/JPY pair has formed a near-term top and positioning for deeper losses. Spot prices might then decline further below the 38.2% Fibo. level, around the 132.00 mark, and accelerate the slide towards testing sub-131.00 levels.

On the flip side, recovery back above the 133.40-133.45 region (23.6% Fibo.) might now confront stiff resistance near the 133.75 region (200-hour SMA). This is closely followed by the 134.00 mark and the ascending channel support breakpoint, which should act as a pivotal point and help determine the next leg of a directional move for the USD/JPY pair.

Sustaiend strength beyond the aforementioned levels would suggest that the correct fall has run its course and shift the bias back in favour of bullish traders. The USD/JPY pair might then surpass the daily high, around the 134.65-134.70 region, and aim to reclaim the 135.00 psychological mark before climbing further to the 135.45-135.50 supply zone.

USD/JPY 1-hour chart

-637909717808078769.png)

Key levels to watch

Russian chief negotiator said on Thursday that Russia is ready to hold peace talks with Ukraine but added that they are yet to receive a response to their proposals from Kyiv, as reported by Reuters.

Market reaction

These comments don't seem to be having a noticeable impact on risk sentiment during the European trading hours. As of writing, the Euro Stoxx 600 Index was down 2.2% on a daily basis. Additionally, US stock index futures were losing between 2% and 2.8%, suggesting that Wall Street's main indexes are likely to open deep in negative territory.

BoE Monetary Policy Decision – Overview

The Bank of England (BoE) is scheduled to announce its monetary policy decision this Thursday at 11:00 GMT and looks poised to hike rates for the fifth consecutive time to rein in soaring inflation. It is worth mentioning that the headline UK CPI surged to a 40-year high of 9% in April, fueling concerns about a major cost of living crisis in the country. Moreover, the BoE inflation to rise above 10% later this year.

That said, the incoming UK macro data, especially the latest GDP report that showed that the economy contracted by 0.3% in April, suggests that the BoE may opt for a cautious approach to raising interest rates. Hence, the market focus will remain glued to the MPC vote distribution and the accompanying monetary policy statement. In absence of the post-meeting press conference, the central bank’s forward guidance will be closely examined.

As Yohay Elam, Senior Analyst at FXStreet, notes: “The Bank of England is between the rock of elevated inflation and a hard place – potentially being the first developed economy to experience a cost-induced recession. I see the BOE's move as a dovish hike, a bearish outcome for the pound.”

How could it affect GBP/USD?

Heading into the key central bank event risk, the GBP/USD pair continued with its struggle to find acceptance above the 1.2200 mark and edged lower on Thursday amid resurgent US dollar demand. According to Yohay Elam, the British pound is unlikely to gain any meaningful traction and is more likely to fall even further.

“A faster rate increase would likely have two drivers. First, the BOE would try to catch up with other central banks such as US Federal Reserve. Markets would see through that and dismiss it as being disingenuous. Secondly and more importantly, it would be an attempt to crush inflation while the BOE has room to move – before the recession strikes. In other words, it would be seen as increasing borrowing costs now to have more room to cut them later down the line,” Yohay explained.