- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 13-06-2022.

- GBP/JPY is hovering around 163.00 ahead of the UK labor data.

- The show-stopper events this week will be interest rate policies from BOE and BOJ.

- A rate hike by 25 bps is expected by the BOE while the BOJ will stick to its ultra-loose policy.

The GBP/JPY pair is displaying back and forth moves in a narrow range of 162.83-163.24 in the Asian session. A lackluster performance in the cross is backed by uncertainty over the release of the UK Employment data. The asset has remained in the negative trajectory from the last week, however, a minor bounce has been witnessed on Monday after hitting a low of 162.25.

Investors are awaiting the release of the UK Employment data, which is expected to improve marginally. The Claimant Count Change is expected to shift lower to -42.5k against the prior print of -56.9k. Also, the Unemployment Rate is likely to fall to 3.6% from the former figure of 3.7%. An improvement in the labor market data will underpin the pound bulls against the Japanese yen for a limited horizon. However, the attention-seeking events will be the monetary policy announcement from the Bank of England and the Bank of Japan (BOJ).

As per the Reuters poll, a rate hike by 25 basis points (bps) is expected by the BOE, which will push the rates to 1.25%. Considering the momentum of price pressures in the UK zone, a rate hike is necessary, however, lower growth forecasts have left a little room for a quarter-to-a-percent bps only. Also, the economic activities in the UK area have underperformed in May. The Gross Domestic Product (GDP) slipped to -0.3% against the expectation of 0.2%. Also, the annual Manufacturing Production figure tumbled to 0.5 vs. 1.8% expected.

On the Japanese yen front, the BOJ is expected to stick to a prudent monetary policy despite advancing price pressures. The inflation rate in Japan's economy has increased above 2%, however, the price pressures are majorly dictated by soaring oil prices.

- USD/CAD probes four-day uptrend amid quiet markets in Asia.

- Chatters over Fed’s 75 bp rate hike in June joined fears of recession to weigh on market sentiment.

- US dollar, Treasury yields benefit from the rush to risk safety, oil prices remain sidelined.

- Risk catalysts are crucial for directions ahead of Wednesday’s FOMC.

USD/CAD flirts with monthly high as bulls take a breather following the four-day run-up during Tuesday’s Asian session. That said, the quote seesaws near 1.2900 by the press time as traders seek fresh clues.

Alike other major currency pairs, USD/CAD also portrayed the broad US dollar strength at the week’s start amid the market’s fears of faster/heavier rate hikes during this week’s Federal Open Market Committee (FOMC). The hawkish Fed expectations were joined by pessimism surrounding China to offer additional strength to the US dollar’s safe-haven demand.

The risk-aversion wave propelled the US Dollar Index (DXY) to rise to the fresh high since 2002 while also fuelling the US 10-year Treasury yields to the highest in over a decade. It should be noted that prices of crude oil, Canada’s main export, remain supported at around $120.00 as traders expect more stimulus from China and a supply crunch ahead.

It’s worth noting that major investment banks, including Goldman Sachs and JP Morgan, recently hiked their Fed rate expectations to include the odds of a 75 bp lift on Wednesday. Also, the US rate futures imply a 96% chance of the Fed raising rates by 75 bps at the June meeting.

Considering the recession fears joining the hawkish expectations from global central banks and inflation woes, not to forget China’s covid jitters, USD/CAD is likely to witness further upside. However, a market consolidation can’t be ruled out ahead of Wednesday’s Fed meeting.

Technical analysis

A three-month-old horizontal hurdle around 1.2900 appears to challenge the USD/CAD bulls. However, the pair’s sustained trading beyond the 50-DMA, at 1.2745 by the press time, keeps the buyers hopeful.

- The AUD/JPY recovered some ground as the Asian Pacific session began.

- The sentiment is still sour, with Asian futures poised to a lower open.

- AUD/JPY Price Forecast: In the near term might extend the pullback towards 92.40-50s before resuming the uptrend.

The AUD/JPY plunged 160 pips on Monday due to sour market sentiment, spurred by investors’ fears that the Federal Reserve could tighten monetary policy at a pace that the US economy might not survive a recession, as reflected by US Treasury yields, elevating to multi-year highs. At 93.14, the AUD/JPY records minimal gains of 0.16% as the Asian Pacific session begins.

Portraying the abovementioned were US equities registering huge losses. Asian futures are poised to a lower open, except for the Nikkei, which is up 0.09%. In the meantime, US Treasury yields, led by the 10-year benchmark note rate, finished at 3.362%, 11-year highs, up 20 bps in the day.

In the FX space, the greenback was the leading currency, except vs. the Japanese yen. On Friday, Japan’s government and the central bank said they were concerned by recent sharp falls in the yen in a rare joint statement, Reuters reported.

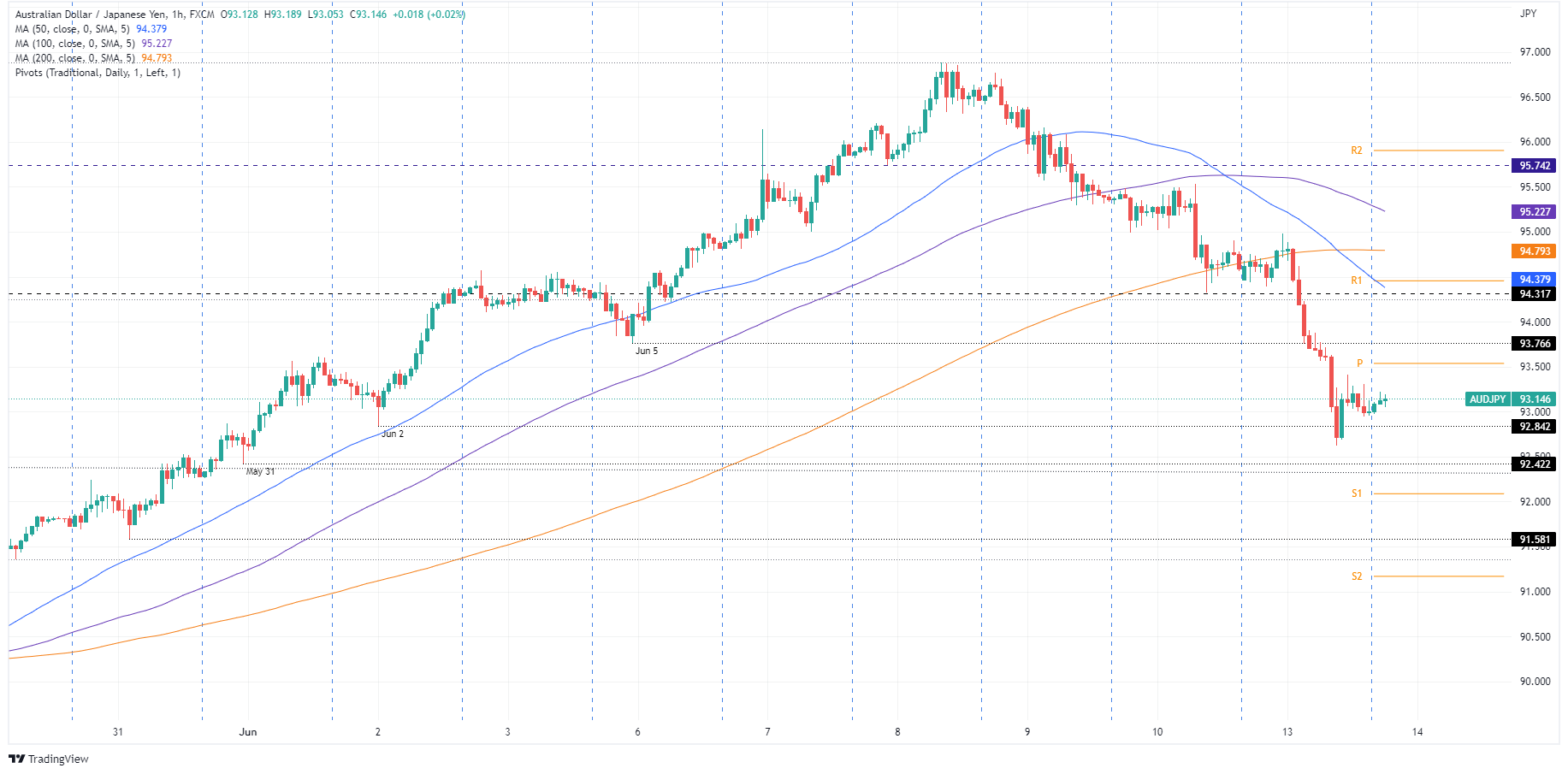

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is hovering around the 93.00 figure, for the first time, since June 2. Nevertheless, albeit falling more than 150 pips on Monday, the cross-currency keeps trading above the daily moving averages (DMAs), which remain below the spot price, with the 50-DMA being the closest to the exchange rate at 92.35.

The AUD/JPY 1-hour chart depicts the pair as downward biased. The 1-hour simple moving averages (SMAs) reside above the spot price, with the 50-hour SMA below the long-time frame ones, around 94.31. Additionally, once AUD/JPY’s price action broke below the June 5 daily low at 93.76, it opened the door for further losses.

Therefore, the AUD/JPY first support would be the 93.00 figure. Once cleared, the following support would be June 2 low at 92.84. A breach of the latter, an area full of sell stops, would send the pair towards the May 31 low at 92.42 before resuming to the upside, aligned with the daily chart overall bias.

Key Technical Levels

- EUR/USD has displayed a minute recovery after hitting a monthly low of 1.0400.

- Investors have started discounting a 75 bps rate hike from the fed.

- ECB Lagarde will dictate the roadmap for accelerating the rate cycle.

The EUR/USD pair is minutely bided around 1.0400 after a perpendicular downside move from the crucial resistance of 1.0650. The downside pressure is expected to force the asset to recapture its five-year low at 1.0389. The shared currency bulls have witnessed an extreme sell-off in the last two trading sessions after violating the consolidation formed in a narrow range of 1.0611-1.0642 last week.

The uncertainty over the announcement of the interest rate decision by the Federal Reserve (Fed), which is due on Wednesday, has set a negative undertone in the market. Risk-perceived currencies have witnessed a steep fall while the appeal of the US dollar index (DXY) is improved significantly.

As per the market consensus, the extent of a rate hike has surged to 75 basis points (bps) after the release of the US Consumer Price Index (CPI). The US inflation has landed at 8.6%, much higher than the prior print of 8.3% while the core CPI has climbed to 6% vs. 5.9% reported earlier. One can witness that higher oil and food prices have contributed majorly to the price pressures.

On the euro front, investors are awaiting the speech from European Central Bank (ECB) President Christine Lagarde, which is due on Wednesday. ECB Lagarde is expected to dictate the roadmap of elevating the rate cycle for the first time from July. The price pressures in the eurozone have already jumped sharply above 8% and are needed to be tamed as early as possible by policy tightening measures.

“Business confidence fell to its lowest level in more than a year last month amid growing fears that inflation poses a long-term threat to company sales,” said the UK Times in its latest news during early Tuesday morning in Asia.

“Confidence among companies is now at levels last seen in April 2021, when coronavirus restrictions were beginning to relax, according to the index by BDO, the accounting and business advisory firm,” the news adds.

It’s worth noting that the sentiment gauge takes a weighted average of the UK’s main business surveys, covering responses from about 4,000 companies, per the UK Times.

Key findings

BDO’s optimism index fell for a second consecutive month in May, dropping by 4.82 points to 101.93. The 100 mark separates expectations for long-term growth from contraction.

The decline was driven by a fall in optimism in the services sector, which has been the hardest hit by falling consumer spending in light of the squeeze on household budgets.

The index for optimism in services fell by 5.35 points to 100.95 in May. Output also fell to its lowest level in more than a year, dropping by 1.86 points in May to 100.53.

The figures reflect official data on output published by the Office for National Statistics yesterday, which showed that the UK economy contracted for the second consecutive month in April, raising fears of an outright fall in output in the second quarter.

Also read: GBP/USD nosedives to a fresh two-year low around 1.2100s on expectations of a Fed 75 bps hike

- NZD/USD pauses seven-day downtrend near the monthly low.

- Nearly oversold RSI seems to underpin recovery moves but previous support from early May challenges rebound.

- 20-DMA, descending resistance line from April adds to the upside filters.

- Bearish MACD, key support break favor sellers eyeing 61.8% FE.

NZD/USD portrays a corrective pullback around a one-month low, snapping a seven-day downtrend, during Tuesday’s inactive Asian session. The kiwi pair refreshed the monthly low to 0.6246 before recently bouncing off to 0.6270.

The recovery moves seem to take clues from the nearly oversold RSI (14) line. However, the pair remains below the previous horizontal support line from May 10, broken the previous day, which in turn joins the bearish MACD signal to keep sellers hopeful.

Even if the quote rises past the 0.6300 immediate hurdle, the 20-DMA near 0.6442 and a 2.5-month-old downward sloping resistance line, near 0.6480, will be crucial for NZD/USD buyer’s return.

Also acting as an upside filter is the monthly high near 0.6580.

Alternatively, fresh declines could be aimed for the yearly low surrounding 0.6215 and may again portray indecision near the 0.6200 threshold.

It’s worth noting that multiple lows marked during March and April of 2020 could also challenge NZD/USD near around 0.6150 before directing them to the 61.8% Fibonacci Expansion (FE) of April-May moves, near 0.6070-65.

NZD/USD: Daily chart

Trend: Further weakness expected

- AUD/USD bears take a breather after the biggest daily fall in five weeks.

- Growing chatters over Fed’s 75 bp rate hike, China’s covid woes drowned riskier assets.

- DXY, Treasury yields cheered safe-haven demand by refreshing multi-year top.

- Australian markets will begin the week with housing, NAB sentiment data but risk catalysts are the key to fresh impulse.

AUD/USD licks its wounds near the recently flashed monthly low surrounding 0.6900, following the heaviest daily fall in five weeks, as Aussie traders return to the table after Monday’s holiday. That said, the quote seesaws near 0.6920-30 after refreshing the monthly low with 0.6910 the previous day.

Growing fears of the Fed’s aggression joined worsening covid conditions in China to underpin the latest risk-aversion wave. Also contributing to the AUD/USD pair’s weakness could be a light Aussie calendar due to the Queen’s Birthday.

Friday’s US inflation data propelled calls for faster/heavier rate increases and spread the market fears as hawkish central bank actions tease recession woes. The same pushed multiple analysts ranging from JP Morgan to Goldman Sachs to revise their Fed forecasts and include expectations of a 75 bp rate hike in June and July. “Our Fed forecast is being revised to include 75bps hikes in June and July,” said Goldman Sachs in its latest Fed forecasts per Reuters.

On the other hand, a fresh spike in China’s covid cases during the weekend again pushed Beijing and Shanghai towards the return of the activity restrictions. Given the dragon nation’s strong trading ties with Australia, coupled with the status of the world’s biggest industrial player, fears of China’s economic hardships weigh on the riskier assets like equities, commodities and Antipodeans.

Against this backdrop, the Wall Street benchmarks slumped to the yearly low marked in January while the US 10-year Treasury yields rose to the highest since May 2011, around 3.36% by the press time.

Considering the full steam risk-off mood, the AUD/USD prices are likely to witness further downside. However, the quarterly readings of Australia’s House Price Index for Q1, expected 1.4% versus 4.7% prior, will precede National Australia Bank’s Business Conditions and Business Confidence figures for May to direct intraday moves.

Technical analysis

A clear downside break of January’s low surrounding 0.6965 directs AUD/USD towards a yearly low of 0.6828.

- USD/CHF is marching towards 1.0000 on advancing hawkish Fed bets.

- The DXY is balancing above 105.00 amid a cautious market mood.

- A continuation of an accommodative stance is expected from the SNB.

The USD/CHF pair is displaying a minor cushion around 0.9960 as oscillators turned extremely oversold on small timeframes. The pair has remained in the grip of the bulls after overstepping the consolidation formed in a 0.9880-0.9900 in Monday’s Asian session and are expected to drive the asset towards the psychological resistance of 1.0000.

A broader strength in the US dollar index (DXY) ahead of the monetary policy announcement by the Federal Reserve (Fed) has infused fresh blood into the DXY-dominating FX pairs. The DXY has established above 105.00 as a higher US Consumer Price Index (CPI) figure has bolstered the odds of a more than 50 basis points (bps) interest rate hike on Wednesday.

As per the previous testimonies from Fed chair Jerome Powell, a 75 bps rate hike is not into consideration but the release of the US inflation at 8.6% on annual basis and the upbeat Nonfarm Payrolls (NFP) have featured its expectations. No doubt, a 75 bps rate hike announcement by the Fed will underpin recession fears in the US economy as extreme liquidity shrinkage from the economy will leave the corporate with fewer corpus to invest, which will result in lower employment generation.

On the Swiss franc front, investors are awaiting the interest rate decision by the Swiss National Bank (SNB), which is due on Friday. Investors are expecting an accommodative stance from the SNB as the inflation rate is still lower than the required levels in the Swiss economy. Although the inflation rate has moved above 2% but is majorly contributed by advancing oil prices.

“Our Fed forecast is being revised to include 75bps hikes in June and July,” said Goldman Sachs in its latest Fed forecasts per Reuters.

Key quotes

We anticipate two more rate increases in 2023 to 3.75-4%, followed by one cut in 2024 to 3.5-3.75%.

We anticipate a 50bp increase in September, followed by 25bp increases in November and December, for an unchanged terminal rate of 3.25-3.5%.

We expect the median dot to show 3.25-3.5% at end-2022.

FX implications

Recently growing chatters over a 75 bp rate hike by the Fed has been the key catalyst for the heavy risk-off mood. The same weighed down equities and propelled the US dollar, as well as Treasury bond yields of late.

Also read: Investors weigh the probabilities of three Fed scenarios: A 50bps, 75bps or even a 100bps hike

- A slippage below 61.8% Fibo retracement confirms more downside move.

- The 10- and 20-EMAs are scaling lower, which adds to the downside filters.

- A bearish range shift by the RSI (14) signals more downside ahead.

The GBP/USD pair has refreshed its two-year low after hitting a low of 1.2107 in the late New York session. The pound bulls have displayed a sheer downside move after violating its prolonged consolidation formed in a 1.2430-1.2600 range from the first day of June.

On the weekly scale, the cable has settled below the 61.8% Fibonacci retracement (which is placed from March 2020 low at 1.1412 to February 2021 high at 1.4243) at 1.2500. Also, the sustainability below the supply zone at 1.2140-1.2250 will remain a major hurdle for the pound bulls.

Declining 10- and 20-period Exponential moving Averages (EMAs) at 1.2528 and 1.2788 respectively adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which signals that the downside momentum is intact.

Should the asset displays a pullback move towards the above-mentioned supply zone, the greenback bulls will find it an optimal selling opportunity and will drag the asset towards the 18 May 2020 low at 1.2075. A breach of the latter will unleash the asset to find a cushion around the psychological support at 1.2000.

On the flip side, the pound bulls could regain strength if the asset oversteps May 27 high at 1.2667. An occurrence of the same will drive the asset to near 20-EMA at 1.2780, followed by 50% Fibo retracement at 1.2836.

GBP/USD weekly chart

-637907543631608113.png)

- Gold gets trashed as the US dollar rallies to fresh bull cycle highs.

- The Fed is causing angst in the financial markets, expected to hike by at least 50bps this week.

At $1,819.52, the gold price is down some 2.78% after falling from a high of $1,879 to a low of $1,819.10 as investors moved into the greenback with the fears of the recession taking hold.

The Federal Reserve this week is expected to hike which is pushing bond yields to the highest in more than a decade as the central bank is expected to raise interest rates by at least 50-basis points after inflation rose to a 40-year high of 8.6% in May.

Consequently, US equities were down sharply on Monday, with the S&P 500 on pace for its fourth straight decline. The benchmark index is more than 20% below its record closing high on Jan. 3 and such a drop would confirm the index is in a bear market, according to a commonly used definition.

The DXY index, which compares the greenback to a basket of rival currencies has moved as high as 105.285, the highest level since December 2002 which has seen the euro to 1.0403 the low and the yen 135.20.

-

Investors weigh the probabilities of three Fed scenarios: A 50bps, 75bps or even a 100bps hike

''Until evidence emerges that inflation is peaking and on a sustained downwards track, financial asset prices will remain under pressure,'' analysts at ANZ Bank argued.

Despite the hunt for safety, gold for August delivery closed down $29.10 to settle at $1,831.80 per ounce.

''While the strong inflation data immediately translated into higher gold prices, buying gold as an inflation hedge is only viable inasmuch as the higher inflation print is disregarded by monetary policy,'' analysts at TD Securities said.

''The next few Fed hikes are set in stone, which limits the relevance of imminent data releases to the left tail of Fed funds pricing, but the market has aggressively challenged the right tail — bringing 75bp hikes into scope.''

''In turn, the trading bias is still to the downside, but participants are still looking for catalysts to flush out the massive amount of complacent length. We see risks that technical breakdown could be the catalyst,'' the analysts said:

- Firstly, the bar for CTA liquidation is growing thin, as we estimate that a break below $1810/oz would catalyze a substantial selling program from systematic trend followers.

- Secondly, prices have managed to break below the bull-market defining uptrend from 2019, which may catalyze additional liquidations from the complacent bulls at prop-shops.

- Thirdly, a growing valuation gap between gold and real rates might eventually exacerbate the repricing lower in the yellow metal, despite it being attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive complacent length in the yellow metal which has kept the prices elevated.

- On Monday, the GBP/USD plunged nearly 200-pips, losing almost 1.50%.

- US Federal Reserve expectations of a 75 bps rate hike at the Wednesday meeting keep mounting.

- The UK April’s Gross Domestic Product (GDP) shrank for the second straight month.

The GBP/USD tanked to fresh two-year lows around 1.21054 but slightly recovered as investors assessed the news that the US Federal Reserve might hike 75 bps on a news piece published by the WSJ. Additionally, the UK’s GDP in a monthly reading contracted, by 0.3%, fueling expectations that the UK is headed into a recession as the Bank of England hikes rates again. At the time of writing, the GBP/USD is trading at 1.2129.

The greenback benefits from risk-aversion and US Fed rate hikes expectations

Concerns that the US Federal Reserve would tighten more than 50 bps following a worse-than-expected US inflation report shifted sentiment sour. Reflection of the previously mentioned is US equities tumbling between 2.80% and 4.81%. Contrarily, US Treasury yields rose, while the greenback gained more than 1%, reaching a two-decade high, around 105.285.

A Wall Street Journal news piece stated, “A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week,” further weighed on sentiment.

Elsewhere, China’s coronavirus headlines weighed on the already battered mood. According to Reuters, a Covid-19 outbreak linked to a bar, traced by authorities, with millions facing mandatory testing and thousands under targeted lockdowns. The re-emergence of infections raises worries about China’s economic outlook.

Earlier in the European session, the Office of National Statistics (ONS) reported that Gross Domestic Product (GDP) fell by 0.3% in April; but the 3-months to April 2022 rose by 0.2%. Services fell by 0.3%, and it was the main contributor to GDP’s fall, reflecting a decrease of 5.6% in human health and social work. Production fell by 0.6%, attributed to a fall in manufacturing of 1% on the month, as businesses continue to report the impact of price increases and supply chain shortages.

Monday’s GBP/USD price action witnessed the ongoing Sterling weakness. A weaker than expected GDP maintains investors’ expectations that the Bank of England would continue hiking rates, despite the current economic outlook. Therefore, despite the BoE’s rising rates, the GBP/USD is headed to the downside and, during the day, dropped nearly 200 pips as sellers prepare for a test of the 1.2000 figure.

An absent US economic docket left GBP/USD traders adrift to the market sentiment that ultimately benefitted the USD, a headwind for the GBP/USD.

Key Technical Levels

- The Fed is going to be the key driver in the coming days and central bank watchers are on high alert.

- There are bets being laid against a 50bps hike, and some investment banks see prospects of even a 100bps hike.

- Markets are being roiled by the prospects of a recession with the S&P 500 entering an official bear market.

Typically, during the Federal Reserve's blackout period, financial news agencies, such as the Wall Street Journal fill the void with opinion pieces such as the following:

''A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week,'' a Wall Street Journal piece opened within an article that has been circulating throughout the start of the week.

''Before officials began their pre-meeting quiet period on June 4, they had signalled they were prepared to raise interest rates by a half percentage point this week and again at their meeting in July,'' the article continues. ''But they also had said their outlook depended on the economy evolving as they expected. Last week’s inflation report from the Labor Department showed a bigger jump in prices in May than officials had anticipated.''

As stated within the following article, EUR/USD bears plough through corrective territories and eye 1.0400 as traders lay odds of just a 50bp hike, ''the US Consumer Price Index increased a bigger-than-expected 8.6% last month, the largest year-on-year increase since December 1981, data showed on Friday, so investors hopeful that inflation has peaked were disappointed. This has left investors on alert that the Federal Reserve may tighten policy for too long and cause a sharp economic slowdown.''

This has led to recession fears which are tilting the US stock market into a confirmed bear market. US equities tumbled on Monday, with the S&P 500 on pace for its fourth straight decline. The benchmark index is more than 20% below its record closing high on Jan. 3 and such a drop would confirm the index is in a bear market, according to a commonly used definition.

Meanwhile, the US dollar index, DXY, which compares the greenback to a basket of rival currencies has ticked as high as 105.285, the highest level since December 2002 which has seen the euro to 1.0403 the low and the yen 135.20.

''Until evidence emerges that inflation is peaking and on a sustained downwards track, financial asset prices will remain under pressure,'' analysts at ANZ Bank argued.

A 75bps hike, is it possible?

In the prior euro article, it was reported that the analysts at Brown Brothers Harriman noted that some banks are raising their Fed calls for a 75 bp move, one for as early as this week.

Is it possible?

''Sure,'' the analysts say, but they think it's very unlikely as there is going to be a very high bar after the Fed already flagged 50 bp moves for June and July.''

Have things really worsened that much? They say ''not really.''

''Looking ahead, the swaps market is now pricing in a terminal rate near 4.0%, a new high and up from around 3.0% at the start of this month. This was the risk if inflation were to remain persistent and that's what we are seeing.''

''When all is said and done, we believe monetary policy divergences remain the dominant driver for FX. As the US economic outlook remains the best relative to its DM peers, the dollar uptrend remains intact,'' analysts at Brown Brothers Harriman argued.

Meanwhile, analysts at Rabobank said the expectation is Wednesday’s meeting will still be the pre-flagged 50bps move. ''However, we are starting to hear whispers of a 75bps hike, and this weekend saw the first suggestion of 100bps and the Fed opening the door to inter-meeting hikes of indeterminate size,'' they explained.

JP Morgan economists see the Fed hiking 75bps and Standard Charted predicts a 10% chance of a 100 bps hike.

However, the last two months of wage data have been showing signs of slowing, which could be a factor that persuades the Fed to stick to a 50bps tightening path.

Markets currently price 80% odds of a half-point increase and 20% odds for 75 basis points, (FEDBETS).

Meanwhile, taking the euro as a gauge of what is to come in the following sessions ahead of the FOMC, we are at a crossroads in forex:

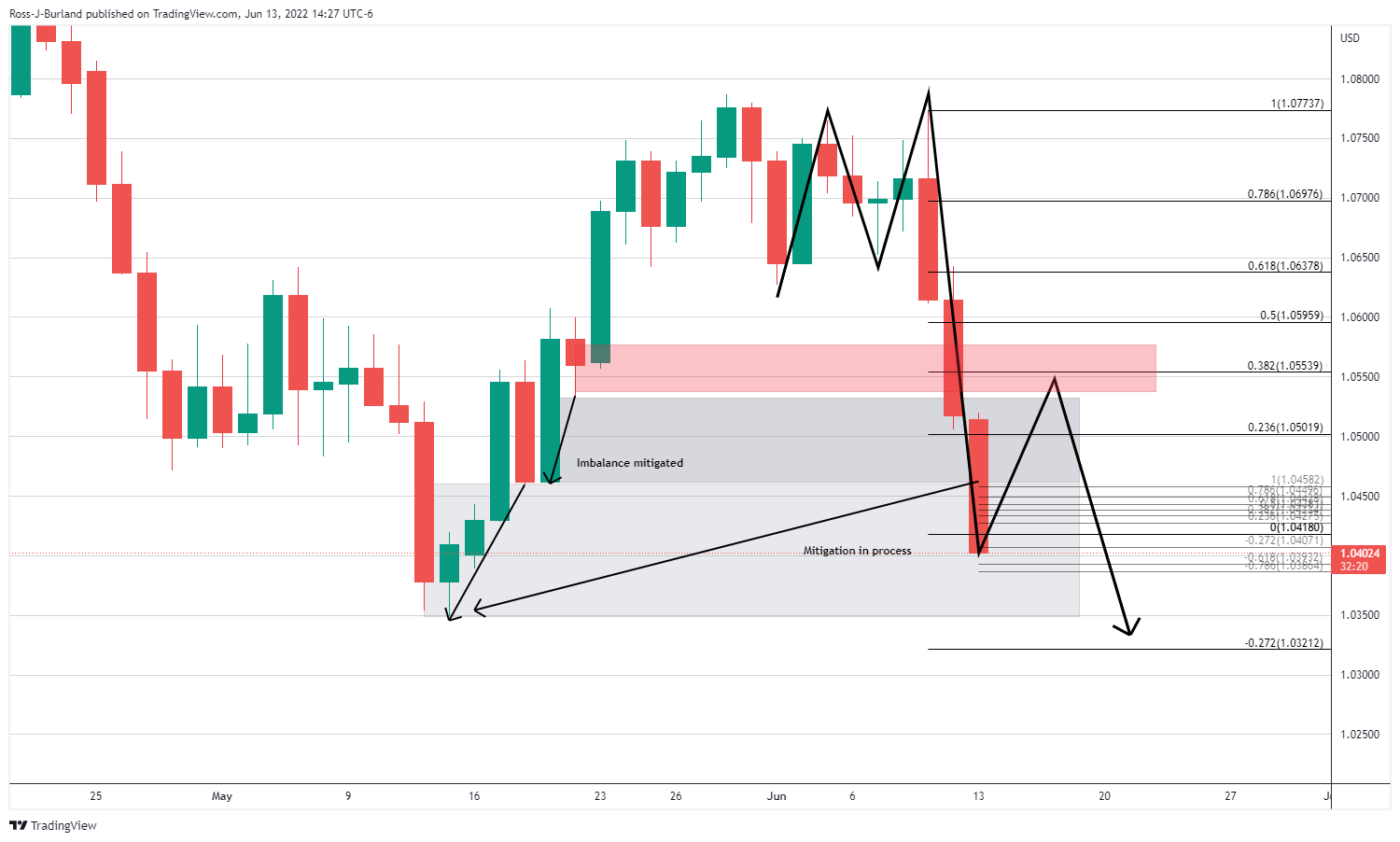

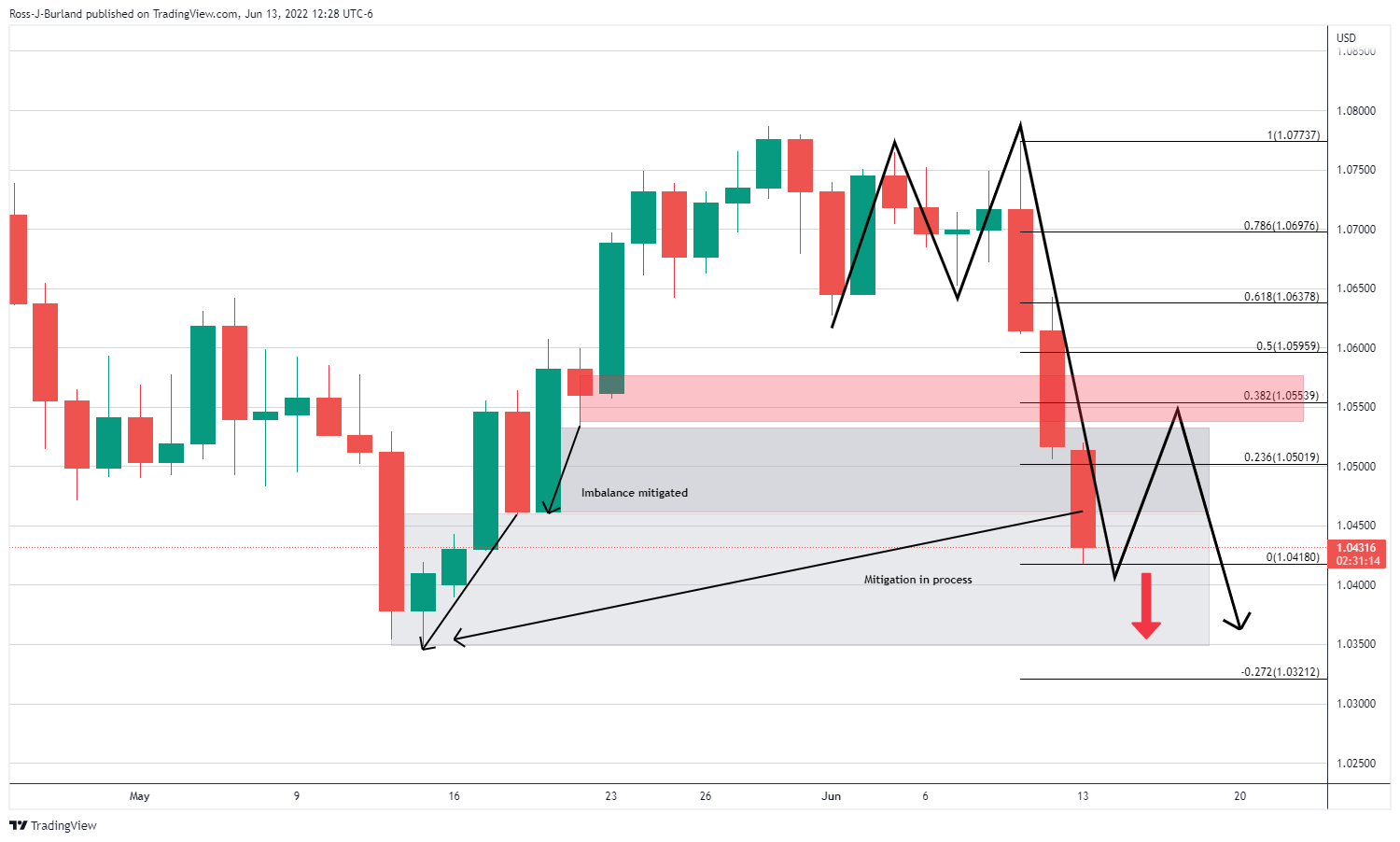

EUR/USD technical analysis

The price is moving in to take out the 1.04 figure with 1.0399 bid seen at some brokers already. According to the above chart, there is still more to come if the price is going to even out the bid from the May 22 lows of 1.0348. However, an hourly correction is more than likely before a break of 1.0390 is seen as the price meets the point of control of the 12-16 May correction on the 4-hour chart as follows:

What you need to take care of on Tuesday, June 14:

Financial markets started the week in risk-off mode, a follow-through of Friday’s negative sentiment after the US reported inflation kept rising in May to reach a multi-decade high. Market participants are looking for a potential 75 bps rate hike as the US Federal Reserve meets this week.

The macroeconomic calendar remained empty, which exacerbated risk-related trading. Wall Street remained pressured while heading into the close, with the three major indexes settling at their lowest since last January. The

The EUR/USD pair trades near the 1.0400 level, while the GBP/USD pair bottomed at a 2-year low of 1.2106, holding near-by at the time being. Commodity-linked currencies also collapsed. AUD/USD trades around 0.6920, while USD/CAD soared to 1.2890. The USD/JPY pair closed the day with a third consecutive doji at around 134.30.

Gold edged lower, with XAU/USD now changing hands at around $1,823 a troy ounce. Crude oil prices continued to advance, with WTI now trading at $120.70 a barrel.

The yield on the US 10-year Treasury note finished the day at 3.37% after peaking at 3.44%, its highest since before the pandemic.

The US Federal Reserve will be the first but not the only central bank to announce its monetary policy decision. The Switzerland National Bank, the Bank of England and the Bank of Japan will also announce their decisions in the upcoming days.

If the US Federal Reserve steps up its bet, it won’t take long until the rest follow such a lead. In the meantime, financial markets will see the decision as mounting concerns about a possible recession, which will translate into more panic selling.

Like this article? Help us with some feedback by answering this survey:

- The New Zealand dollar remains on the defensive, losing 1.69%.

- US hot inflation, and the Federal Reserve meeting, weighed on the market mood and boosted the greenback.

- Tuesday’s US Producer Price Index for May might attract investors’ attention as the Fed monetary policy meeting looms.

The NZD/USD nosedives near 90 pips in a risk-aversion trading day courtesy of May’s US Consumer Price Index, hitting 8.6%, sparking fears that the US Federal Reserve would tight more aggressively than they had, which would drag the US into a recession. At 0.6251, the NZD/USD is trading at fresh four-week lows as sellers begin to target the YTD lows at 0.6216.

Dismal sentiment dominates the financial markets

Dampened market mood keeps investors seeking a flight to safe-haven assets. Wall Street is going into a blood bath, losing between 2.66% and 4.84%. On Tuesday, the US Federal Reserve will begin its two-day monetary policy meeting and is widely expected to hike rates by at least 0.50%. That, alongside the above-mentioned and the re-emergence of a China’s coronavirus outbreak, keeps investors uneasy.

Just crossing the wires, the WSJ reported a news piece that said, “A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week.”

Market’s reaction

The NZD/USD dipped from 0.6280s to 0.6240s in a matter of 15 minutes. In the meantime, the US Dollar Index reacted upwards and jumped from 104.9325 towards 105.285, at new 2-decade highs, up by 1.03%. The US 10-year Treasury yield jumped to fresh 11-year-highs and is closing to the February 2011 highs at around 3.737%.

Later in the Asian session, the New Zealand calendar will reveal May’s Food Inflation. The US economic docket will unveil the Producer Price Index (PPI) for May, which is expected to rise to 10.9% YoY, lower than April’s 11%. However, due to the jump in the CPI, it could smash the expectations, opening the door for a 75 bps rate hike by the Fed.

Key Technical Levels

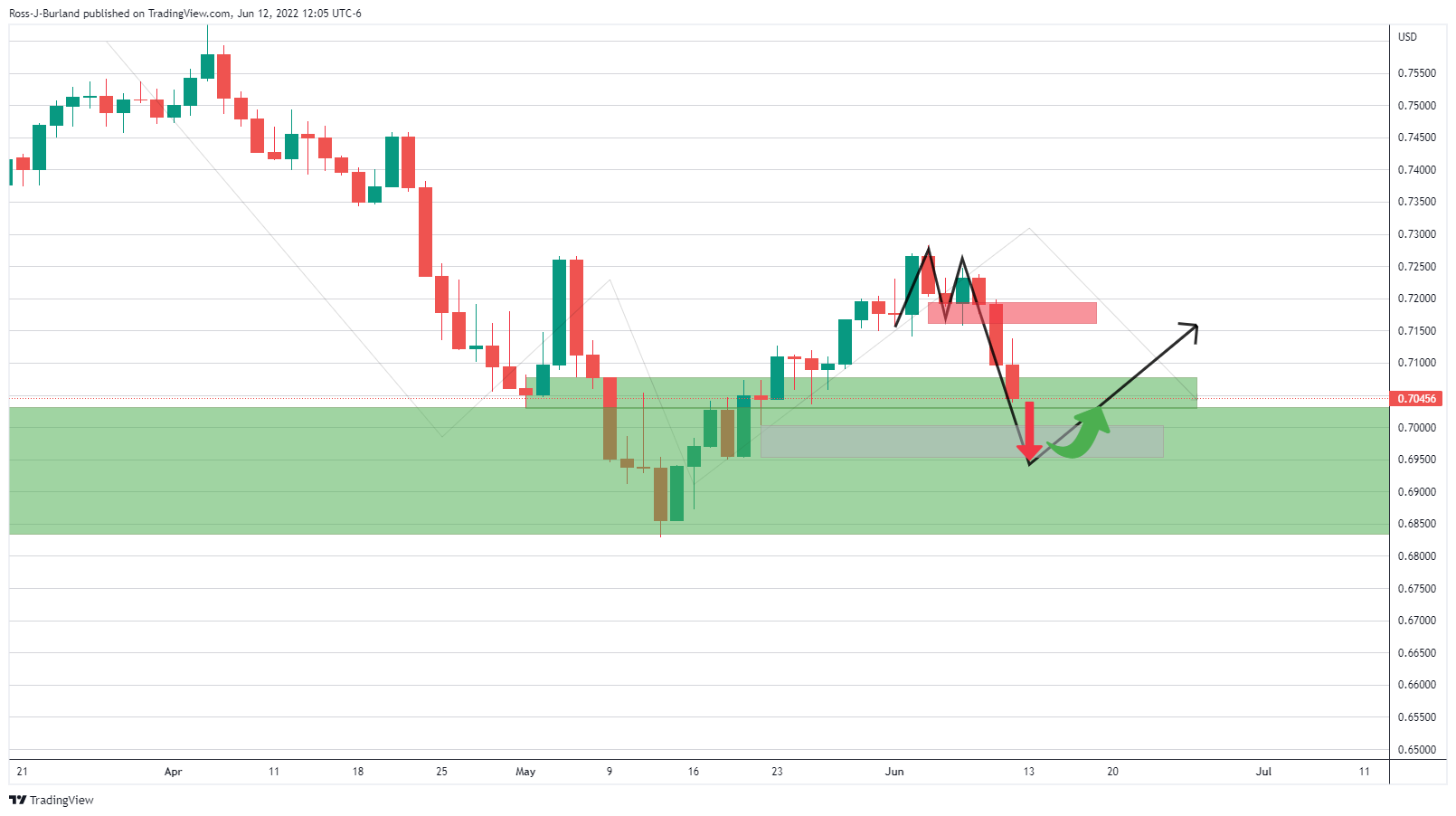

- A retracement to the 38.2% Fibo that aligns with old support near 0.7050 could play out.

- However, the 4-hour chart shows no sign of deceleration so far and exposes 0.6890 first.

As per the pre-open analysis of AUD/USD, AUD/USD Price Analysis: There's something here for both the bulls and bears, the price has moved in to mitigate an inefficiency that was highlighted as follows:

The grey area marked the price imbalance between 0.6952 and 0.7000 from where there were prospects of a bullish correction. However, as seen in the following chart, the bears are relentless and taking on a fresh area of inefficiency in price:

With that being said, overstretched impulses will need to correct at some point, the question, for now, is when will the bears start to take profits?

In coming to the end of Wall Street, as the clock ticks down to the Fed this Wednesday, speculators might be inclined to cash in now:

A retracement to the 38.2% Fibo that aligns with old support near 0.7050 could play out. However, the 4-hour chart shows no sign of deceleration so far and exposes 0.6890 first:

- Wall Street collapses, remains in a bear market, and the USD rises.

- High inflation might trigger an aggressive US Federal Reserve reaction to tame inflation, despite increasing fears of a US recession.

- USD/CAD Price Forecast: Will face solid resistance at around 1.2880-1.2900.

The USD/CAD gained traction on Monday and extended its rally to three consecutive days, even though it retreated after reaching a daily high near 1.2880s. At the time of writing, the USD/CAD is trading at 1.2864, up by 0.60%.

High inflation in the US increases the odds of an aggressive Fed

US equities reflect a dampened market mood, so the USD/CAD edged higher. Wall Street’s stock indexes record losses between 2.08% and 4.37%, while US Treasury yields skyrocket on fears that an aggressive Federal Reserve tightening cycle might cause a recession in 2023. Last Friday’s inflation report weighed on investors as they reshuffled their portfolios, dumping riskier assets for safe-haven currencies. That boosted the greenback, with the US Dollar Index (DXY) gaining close to 0.70%, sitting at 104.893. Earlier, the DXY reached a multi-year high of around 105.065.

Besides the aforementioned, China’s coronavirus fears are back. A dozen Covid cases linked to a Beijing bar have triggered a race for millions of people facing mandatory testing and thousands under targeted lockdowns via Reuters. The re-emergence of infections is raising concerns about the economic outlook of the second-largest economy.

In the meantime, crude oil prices extend their gains. WTI, the US crude oil benchmark, rose 0.27%, exchanging hands at $121.06 per barrel but fails to lift the Canadian dollar, which is dragged down by global risk aversion.

The lack of economic data in the US and Canadian calendar left the USD/CAD adrift to a market sentiment play. The Canadian docket will feature New Motor Vehicle Sales and Manufacturing sales on Tuesday. On the US front, prices paid by producers for May will be revealed. An uptick on the latter could shift Fed officials towards a higher rate hike, though the baseline scenario remains 50 bps increases.

USD/CAD Price Forecast: Technical outlook

The USD/CAD witnessed a jump from around 1.2550 to 1.2880s in a three-day rally. On its way north, the major broke above the daily moving averages (DMAs), shifting from a neutral-downward bias to a neutral-upwards. Nevertheless, the USD/CAD will face a solid resistance at around 1.2885, the May 25 high, which, if broken, would pave the way for further gains.

If that scenario plays out, the USD/CAD first resistance would be 1.2900. Break above would expose December 20, 2021, daily high at 1.2964, followed by a test of the psychological 1.3000.

- EUR/USD bears stay the course and continue to eye a test of 1.04 the figure.

- The US dollar has climbed to score fresh bull cycle highs ahead of the Fed.

At 1.0448, the euro is still trailing to the US dollar by some 0.65% despite the recent bid in mid-day New York trade. The pair corrected from a low of 1.0418 but fell from a high of 1.0520 at the start of the week. The safe-haven dollar has gained to new two-decade highs versus major rival currencies as measured by the DXY index. The US dollar index (DXY), which measures the currency against six major peers including the yen, ticked as high as 105.065, the highest level since December 2002.

The US consumer price index increased a bigger-than-expected 8.6% last month, the largest year-on-year increase since December 1981, data showed on Friday, so investors hopeful that inflation has peaked were disappointed. This has left investors on alert that the Federal Reserve may tighten policy for too long and cause a sharp economic slowdown.

Fears of a global economic slowdown and bets on steep interest rate hikes by the Fed which have weighed on risk sentiment, sending stocks lower and bond yields higher on the back of red-hot inflation. The 10-year US Treasury yield has climbed to a fresh high of 3.354%, putting it in line with late April 2022 levels.

The moves come as traders are starting to ramp up bets that the Federal Reserve will potentially hike interest rates by 75 basis points on Wednesday. However, the last two months of wage data have been showing signs of slowing, which could be a factor that persuades the Fed to stick to a 50bps tightening path. Markets currently price 80% odds of a half-point increase and 20% odds for 75 basis points, (FEDBETS).

A 75bps hike, is it possible?

Analysts at Brown Brothers Harriman note that some banks are raising their Fed calls for a 75 bp move, one for as early as this week.

Is it possible?

''Sure,'' the analysts say, but they think it's very unlikely as there is going to be a very high bar after the Fed already flagged 50 bp moves for June and July.''

Have things really worsened that much? They say ''not really.''

''Looking ahead, the swaps market is now pricing in a terminal rate near 4.0%, a new high and up from around 3.0% at the start of this month. This was the risk if inflation were to remain persistent and that's what we are seeing.''

''When all is said and done, we believe monetary policy divergences remain the dominant driver for FX. As the U.S. economic outlook remains the best relative to its DM peers, the dollar uptrend remains intact,'' analysts at Brown Brothers Harriman argued.

ECB risks skewed towards more 50bp rate hikes

Meanwhile, the 2-year differential between the US and Germany has recovered to 210 bp after falling to 197 bp last week, the lowest since the end of February, the analysts at BBH noted.

The European Central Bank has been more hawkish of late and it intends to end QE by 1 July and hike policy rates by 25bp in connection with the July meeting, according to its latest statement released last week. The door for hiking by 50bp in September has been left ajar also and will be a strong possibility "if the medium-term inflation outlook persists or deteriorates".

''We now expect the ECB to hike by 25bp in July, 50bp in September and 25bp on each of the following meetings until March 2023 when the hiking cycle is likely to end, in our view. We see risks as skewed towards more 50bp rate hikes,'' analysts at Danske Bank said.

EUR/USD technical analysis

The momentum is strong in the US dollar which is driving the euro to the edge of the abyss, mitigating longer-term price imbalances along the way as follows:

However, there are prospects of a bullish correction in the M formation's last bearish leg which exposes the 38.2% Fibonacci area near 1.0550:

From a 1-hour perspective, however, the price action and structure remain bearish while below the 78.6% Fibo and the market is in the throes of a fresh bearish impulse towards 1.04 the figure following a failed correction.

- The USD/JPY reached a 24-year high above 135.00 but retreated on fears of Japanese intervention in the FX markets.

- A dismal market mood boosts safe-haven peers, thus favoring the JPY, as USD/JPY traders booked profits.

- The Fed and the Bank of Japan will unveil their monetary policy decisions in the week.

The USD/JPY plunges close to 200 pips after breaking above the 135.15 January 2002 high, as speculations of Japanese authorities’ intervention in the FX market emerged last Friday. At 134.18, the USD/JPY retreated from daily highs at around 135.19, despìte US Treasury yields extending their gains towards multi-year highs.

US bond yields rise, but the USD/JPY remains heavy during the day

Global equities remain under pressure as investors assess the almost 9% inflation in the US. Negative sentiment favors safe-haven peers and, in the case of the USD/JPY, the yen. However, during the day, the major weakened to a 24-year, though retreated on a verbal intervention expression by Japanese authorities on Friday, which said, “It’s important that currency rates move in a stable way, reflecting fundamentals. But there have recently been sharp yen declines, which we are concerned about.”

In the meantime, the US Dollar Index, a gauge of the buck’s value against its peers, is advancing 0.64% at 104.857 after reaching a 20-year high at around 105.065.

Central bank divergence between the Fed and the BoJ’s had been the main drivers of the USD/JPY in the year. Also, the positive correlation of the pair with the US 10-year Treasury yield triggered a USD/JPY rally, from 116.00 to 135.00.

Earlier, the short-end of the yield curve, the 2s-10s, inverted during the day on concerns that a higher Federal Funds Rate (FFR) might trigger a recession, as the US central bank battles inflation readings near 9%, not seen since 1981. Also, it is worth noting that some Wall Street’sbanks increased their calls for a potential 75 bps increase, even a 100 bps increase.

Reflection of the aforementioned is the US 10-year benchmark note rate, up at 3.343%, gaining almost 20 bps.

Fed’s and BoJ’s monetary policy decisions, the spotlight on the calendar

A busy US economic docket would keep USD/JPY traders entertained. On Tuesday, the Federal Reserve June meeting begins, and on Wednesday, they will unveil its decision. Later on, the Fed Chair Jerome Powell will high the stand.

Meanwhile, the Japanese docket would feature the Industrial Production, Machinery Orders, and the Balance of Trade. By Friday, the Bank of Japan will reveal its monetary policy, widely expected to hold rates negative at -0.10%.

Key Technical Levels

- Risk aversion intensifies across financial markets.

- Treasuries also decline, US yields at multi-year highs.

- USD/MXN break key resistance levels, tests 20.45/50 area.

The USD/MXN is rising sharply on Monday as global markets tumble. The pair jumped from below 20.00 to 20.50, hitting the highest level since May 2. It is having the biggest daily gain in months boosted by risk aversion.

Latin American currencies are the worst performers on Monday. The USD/CLP (Chilean peso) gains 2.50%, followed by the USD/BRL (Brazilian real) up 2.25% and the USD/COP (Colombian peso) rises 2.20%. The USD/MXN rises by 2.30% and is about to post the highest close in a month.

The rally is testing the 20.45/50 resistance area. It is a zone that capped the upside in April and May. A break higher should trigger more gains targeting initially the 20.70 area. While under 20.45, losses in USD/MXN seem limited, with the new support levels seen at 20.15 and 20.00.

If the current mood in financial markets persists, the Mexican peso will likely remain under pressure. A recovery could limit the upside.

The economic calendar is clear in Mexico for the current week. The key event will be the Federal Reserve meeting. On Wednesday the FOMC will announce its decision. A 50bps rate hike is expected, although some analysts consider the possibility of a larger hike after the latest CPI numbers.

Technical levels

- Friday’s US hot inflation reading triggered a flight to safe-haven currencies like the greenback, and precious metals fell.

- The 2s-10s US Treasury yield curve inverted during the day as a recessionary scenario looms.

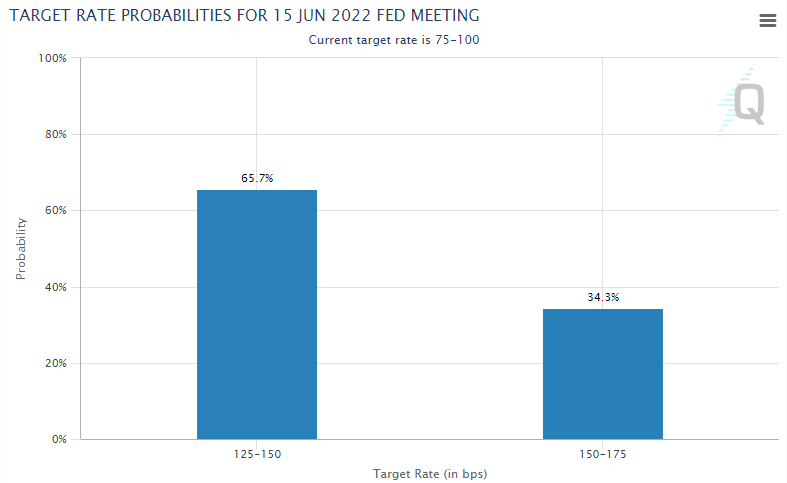

- The CME FedWatch Tool shows that the odds of a 75 bps increase in the June meeting lie around 34%.

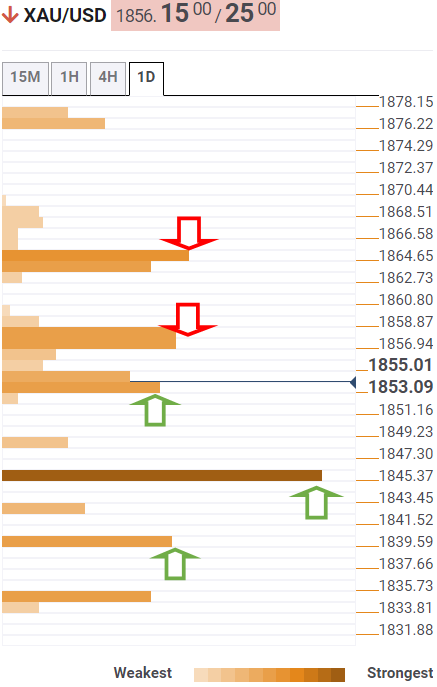

- Gold Price Forecast (XAU/USD): A daily close at around $1820 to open the door towards $1800.

Gold spot (XAU/USD) slides to a new monthly low near the $1820 figure on Monday, as US Treasury yields skyrocket, propelled by Friday’s hotter than expected US inflation numbers, ahead of the US Federal Reserve June meeting, in which investors have priced in a 50 bps increase. At the time of writing, XAU/USD is trading at $1826.60, down near 2.20%.

Pessimistic sentiment triggered a flight to safe-haven assets, except Gold

Risk-aversion dominates Monday’s session. European and US equities are plunging as a recession looms, spurred by global central banks, which forecasted inflation as transitory, falling behind the curve. Market participants are flying toward safe-haven assets, as reflected by the greenback. The US Dollar Index, a measure of the greenback’s value vs. six currencies, advances 0.80%, trading at fresh 2-decade highs around 105.027.

In the meantime, Gold remains trading heavy after reaching a daily high near $1880, weighed by higher US Treasury yields. The 10-year benchmark note rate jumped to multiyear-highs, to levels last seen in 2011, at around the 3.314% threshold, up by 15 bps.

Meanwhile, the short-end of the yield curve, the 2s-10s, inverted during the day on concerns that a higher Federal Funds Rate (FFR) might trigger a recession, as the US central bank battles inflation readings near 9%, not seen since 1981.

Elsewhere, some commercial banks around the globe begin to price in a 75 bps rate hike on Wednesday, like Barclays. However, most analysts expect the Fed to hike 50 bps as they aim to keep its credibility intact, though it could open the door for higher rate increases in July and September.

The CME FedWatcht Tool shows the odds of a 75 bps rate hike at 34.3% while fully pricing in a 50 bps increase.

With no data in the US economic docket to be released, all eyes are set on the Fed monetary policy decision and Chair Jerome Powell’s post-meeting press conference. Traders must know that the Summary of Economic Projections (SEP) will also be unveiled. Expectations are mounting that officials would update inflation estimations to the upside and growth to the downside.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is trading below the 200-DMA, for the second time, in the last couple of trading sessions. In fact, it also broke a 4-year-old upslope trendline that, if confirmed by a daily close, would pave the way for further losses. Therefore, in the short term, XAU/USD is headed to the downside.

Gold’s first support would be May’s 18 low at $1807.23. A breach of the latter would expose the $1800 figure, which, once cleared, could send XAU/USD tumbling towards the YTD low at $1780.18.

- Euro under pressure, yen soars on risk aversion.

- Dow Jones tumbles 2.60%, US yields print multi-year highs.

- EUR/JPY drops almost 500 pips in three days.

The decline of EUR/JPY from multi-year highs gained speed on Monday and tumbled under 140.00. From last week highs, it has fallen 500 pips

Reversal points to more losses

The EUR/JPY is trading around at 139.48, the lowest level in ten days. It is falling for the third consecutive day, making a sharp reversal that started last week from levels above 144.00.

The cross is holding under 140.00, a relevant support area. A daily close below the next key support at 139.00/10 should open the doors to more losses, targeting 138.40, the 20-day simple moving average.

The slide in EUR/JPY takes place amid risk aversion and despite higher US yields. The yen is among the top performers unaffected by the fact that the US 10-year yield hits the highest level in a decade above 3.30%.

On Wall Street, the Dow Jones is falling by 2.80% and the S&P 500 drops 3.79%. Markets look in panic mode at the beginning of the Federal Reserve’s week. Concerns about the global economic outlook and monetary tightening across the globe weigh on investors. The central bank is seen raising rates by 50 bps, although after Friday’s CPI data some analysts consider it could raise by 75 bps.

Technical levels

Gold bugs beware – a technical breakdown could be the catalyst needed to squeeze a massive amount of complacent length in the yellow metal, according to strategists at TD Securities.

Growing valuation gap between gold and real rates to exacerbate the repricing lower

“The trading bias is still to the downside, but participants are still looking for catalysts to flush out the massive amount of complacent length. We see risks that technical breakdown could be the catalyst. The bar for CTA liquidation is growing thin, as we estimate that a break below $1,810 would catalyze a substantial selling program from systematic trend followers.”

“Prices have managed to break below the bull-market defining uptrend from 2019, which may catalyze additional liquidations from the complacent bulls at prop-shops.”

“A growing valuation gap between gold and real rates might eventually exacerbate the repricing lower in the yellow metal, despite it being attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive complacent length in the yellow metal which has kept the prices elevated.”

- AUD/USD cratered into the low-0.6900s on Monday, down over 1.5% on the day and over 4.0% lower in four days.

- The pair is being battered by risk-off flows as markets price a more hawkish Fed and potential recession.

- China lockdown fears are also hurting the pair, with bears eyeing a near-term test of support in the low-0.6800s.

AUD/USD cratered on Monday in tandem with a collapse in US and global stock market sentiment as investors upped their bets on both Fed tightening (in wake of last Friday’s US inflation data) and a US recession (in wake of last Friday’s US Consumer Sentiment figures). The pair was last trading to the south of the 0.6950 level, having shed over 1.5% on Monday, taking its string of losses in the last four sessions to over 4.0%.

The risk-sensitive Aussie is also feeling the pain of renewed fears about lockdowns in China as Beijing and Shanghai both reinstate restrictions to contain new Covid-19 outbreaks. China is Australia’s largest trade partner and is the main export destination for many of the country’s industrial/energy coming.

Anyone who bet on near-term Aussie upside in wake of last week’s larger-than-expected RBA rate hike has likely already been stopped out. That should deter traders from betting on a substantial rebound in the pair should this Thursday’s Australia labour market report come in better than expected. Indeed, the Aussie is this week set to continue to trade as a function of broader risk appetite and USD flows.

As risk appetite craters on central bank tightening and recession fears and the US dollar benefits from the hawkish Fed and its status as a safe-haven currency (it is the world’s reserve currency, after all), AUD/USD next stop is likely the May lows in the mid-0.6800s. If it can break below 0.6800, there isn't much to stop a run all the way lower to around the 2019 lows in the upper-0.6600s. The main macro events of the week will be Tuesday’s US Retail Sales report for May and Wednesday’s Fed meeting, where some are calling the bank to invoke a Volcker moment and surprise with a larger 75 or 100 bps rate hike.

- WTI is a little lower but still trading near $120, weighed slightly amid risk-off conditions and China lockdown worries.

- Weak US data, a surprisingly hawkish Fed and tough restrictions in China could combine to send WTI towards its 21DMA.

Though still a little lower on the day, oil prices pared the bulk of earlier session losses on Monday, despite steep downside in global risk assets as investors fretted about last Friday’s hotter than expected US inflation and its implications for Fed monetary policymaking, as well as increasing signs that the US economy might be headed for recession. Front-month WTI futures were last trading a few cents in the red in the $120 per barrel area, having bounced from earlier session lows near $118.

Traders cited China Covid-19 developments, after Beijing and Shanghai both moved to reimpose restrictions as Covid-19 infections rose once again, as weighing on the price action, as well as the market’s risk-off mode that has seen the US dollar strengthen. A strong buck means USD-denominated commodities are more expensive for international buyers.

But the bounce from mid-session lows suggests that appetite to buy the dip remains strong, for now. Indeed, global oil markets are still very tight as demand in the northern hemisphere rises towards its summer peak and OPEC+ supply woes show no signs of abating, with Russian output still languishing in the face of strict Western sanctions and as smaller (mainly African) producers struggle amid a lack of investment and amid instability.

Meanwhile, the prospect of a return by the US and Iran to compliance with the 2015 nuclear pact which could set the stage for well over 1 million barrels per day in Iranian exports to return to global markets appeared to have been dealt a death blow last week. Amid a spat with global nuclear watchdog the International Atomic Energy Agency (IAEA), Iran is set to remove nearly all equipment that had been used by the organisation to monitor its nuclear activities.

But traders should be aware that amid the risk that 1) the China lockdown worsens, threatening oil demand in the country, 2) further US data this week points to a recession and 3) the Fed on Wednesday delivers a hawkish surprise as inflation continues to surprise to the upside, oil might be in for a rough time. A test of the 21-Day Moving Average in the mid-$115s seems a solid possibility.

- Silver met with an aggressive supply near the $22.00 confluence resistance on Monday.

- The technical set-up favours bearish traders and supports prospects for further losses.

- Sustained strength beyond the $22.00 mark is needed to negate the bearish outlook.

Silver extended its rejection slide from the $22.00 confluence hurdle and dropped to a near one-month low, around the $21.20 region during the early North American session on Monday.

The latter coincides with the 61.8% Fibonacci retracement level of the $20.46-$22.52 bounce and acceptance below would be seen as a fresh trigger for bearish traders. Meanwhile, Technical indicators on daily/4-hourly charts are holding deep in the bearish territory and are still far from being in the oversold zone.

The technical set-up seems tilted firmly in favour of bearish traders and supports prospects for an extension of the ongoing depreciating move for the XAG/USD. Hence, a subsequent slide below the $21.00 mark, towards challenging the YTD low around the $20.45 area touched on May 13, now looks like a distinct possibility.

On the flip side, attempted recovery might now confront resistance near the 50% Fibo. level, around mid-$21.00s. Any further move up might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the $22.00 mark, comprising 200-period SMA on the 4-hour chart and the 23.6% Fibo. level.

A convincing break through the aforementioned barrier would negate the near-term negative bias and shift the bias in favour of bullish traders. The XAG/USD might then surpass an intermediate resistance near the $22.30 area and test the $22.50-$22.60 supply zone. Some follow-through buying should pave the way for additional gains.

Silver 4-hour chart

-637907246110784329.png)

Key levels to watch

GBP/USD has dropped below 1.22 after disappointing GDP data ahead of the Bank of England’s (BoE) decision on Thursday. A cautious stance from the “Old Lady” could send cable to new lows for the year, economists at Scotiabank report.

BoE may allude to an eventual pause in rate hikes

“Further to the USD rally on Fed bets and the weak market's mood, UK April GDP disappointed economists’ expectations in data published this morning. The country’s economy surprisingly contracted by 0.3% MoM against a median forecast for a slight 0.1% expansion.”

“The poor GDP showing makes the BoE’s decision even more difficult. We think odds have risen that the bank alludes to an eventual pause in rate hikes – perhaps as soon as August, but more likely in September or November.”

“OIS markets still seeing two 50 bps hikes across the four BoE meetings between now and November are in for a severe disappointment and the GBP is at clear risk of plumbing new lows for the year (and since mid-2020) under the mid-1.21s if the BoE delivers a cautious message this week.”

The CAD is trading defensively against the strengthening USD. Economists at Scotiabank expect the loonie to continue at the mercy of the current US dollar’s force.

The risk of a push on to 1.2950/1.30 has risen

“The CAD slide looks excessive from our point of view, given the strength of the domestic economy, the BoC’s own hawkish intent, and yield premiums over the USD for the CAD but that will not help the CAD resist the USD’s general advance for the moment.”

“With spot already reaching the 1.2865 area (61.8% Fib of the May/ Jun USD decline), the risk of a push on to 1.2950/1.30 has risen.”

“USD support is 1.2815/25.”

GBP/USD has fallen aggressively. Analysts at Credit Suisse stay tactically bearish, with next key supports at 1.2157/50, then 1.2072, which is certainly not viewed as a floor.

Resistance moves to 1.2431/39

“Next key support is seen at the recent lows at 1.2167/57, which we expect to be broken fairly imminently, with short-term daily MACD momentum turning lower from neutral levels. Thereafter, we continue to look for an eventual fall to our 1.2072/17 target zone – the May 2020 low and 78.6% retracement of the entire 2020/2021 uptrend.”

“Given the very strong downtrend, the 1.2072/17 area is not viewed as a floor and we certainly do not rule out an eventual move to 1.15/1.14, which is the bottom of the six-year range.”

“Near-term resistance moves lower to 1.2300/01 initially, above which would trigger a move to the recent minor breakdown point at 1.2431/39, which we look to cap. Above here would open up more important medium-term resistance at 1.2668/76, where we would have even more confidence in a ceiling if reached.”

EUR/USD drops to mid-1.04s. Economists at Scotiabank expect the pair to extend its decline toward the year-to-date low of 1.0350.

EUR/USD ends its two-week consolidation period

“Risk-off sentiment, widening core-periphery spreads, a more hawkish Fed, and Eurozone growth concerns will likely offset augmented ECB hike bets in the near-term and keep the EUR on the backfoot as the current leg lower eyes the year-to-date low of 1.0350.”

“The EUR’s steep three-cent-plus drop from above the mid-1.07s last Thursday has wiped out a sizable share of its H2-May gains, ending its two-week consolidation period with a sharp slide that points it towards its year-to-date low of 1.0350.”

- Gold has slumped back to test its 200DMA in the low-$1840s having at one point tested its 50DMA near $1880.

- Fed tightening bets have amped up since last Friday’s hot US CPI, hurting gold via higher yields/a stronger buck.

- The Fed policy announcement on Wednesday is this week’s main event.

With investors having had a little more time to digest the implications of last Friday’s hotter than forecast May US Consumer Price Inflation (CPI) data and record weak June US Consumer Sentiment figures, spot gold (XAU/USD) prices have experienced an about-face on Monday. Prices were last trading in the low-$1840s and near the 200-Day Moving Average (at $1842), having reversed more than $30 lower versus earlier session highs near $1880, where the 50DMA came into play as resistance.

Whilst calls for the US to be already in, or on the brink of, recession from analysts on Wall Street are growing louder, something that might normally support safe-haven gold, calls for even faster and more aggressive Fed tightening with CPI at four-decade highs are also growing louder. Some banks have warned that there is a non-negligible chance that the Fed might opt to shock the market with a 75 or even 100 bps rate hike at its policy announcement on Wednesday.

Whilst a 50 bps rate hike remains the market’s base case scenario, bets are rising for the Fed to have taken interest rates well into restrictive territory (i.e. the upper 3.0s%) by this time next year. These renewed hawkish bets on Monday are pressuring US bonds, which pushes yields higher and benefitting the US dollar, thus creating an unfavourable backdrop for gold prices.

A rise in yields hurts demand for gold as it represents a rise in the opportunity cost of holding non-yielding assets (like precious metals). Meanwhile, a stronger buck makes USD-denominated commodities (like XAU/USD) more expensive for international buyers, reducing demand. For now, growth/recession fears might be enough to keep gold supported near its 200DMA in the $1840s. US May Retail Sales data out Tuesday might highlight such fears.

But if the Fed does deliver a big hawkish shock (i.e. a larger than 50 bps rate hike), a test of annual lows under $1800 is on the cards. However, with most analysts now of the opinion that a recession is coming sooner rather than later, gold’s long-term outlook doesn’t look to bad. Looking at the Fed funds futures curve, markets very much remain of the opinion that after some aggressive near-term hiking from the Fed coupled with a recession over the next 12 or so months, US inflation should come eventually come under control, giving the Fed the space to then cut interest rates in the longer-term (which gold bulls want).

The S&P 500 has seen a further sharp fall and gap lower following the CPI release on Friday. Economists at Credit Suisse look for a clear and sustained break below support at 3815 for a fall to the 50% retracement of the 2020/2021 uptrend at 3505.

Resistance moves to 3943 initially

“We look for a conclusive and sustained move below 3815. This should then see the risk stay directly bearish with support seen next at the March 2021 lows at 3730/23 and eventually our core objective at the 50% retracement at 3505, also the location of the 200-week average.”

“Resistance is seen moving to 3943 initially, then the price gap from Friday, starting at 3974 and stretching up to 4017/18, which we look to ideally cap further strength.”

GBP/USD has tumbled back below the 1.22 area. Economists at Rabobank expect the pair to extend its fall to 1.20 over the coming months.

Brexit carries a long-lasting impact on GBP

“We continue to see risk of GBP/USD dipping to 1.20 on a three-month view. This forecast assumes the greenback retains broad-based strength.”

“In a report published last June, the Bank of England identified two factors which were holding back investment. These were covid and Brexit-related uncertainties. The former has mostly passed. The latter is likely continuing to have an impact.”

- Gold Price turned south following the impressive upsurge witnessed last Friday.

- Investors grow increasingly concerned over the US economy tipping into recession.

- A daily close below $1,840 could open the door for additional losses ahead of Fed meeting.

Gold Price reversed its direction at the start of the week and erased all the gains it recorded last Friday. The risk-averse market environment is helping the dollar outperform its rivals on Monday and making it difficult for XAUUSD to shake off the bearish pressure.

Technicals paint a mixed picture

The near-term technical outlook suggests that buyers remain on the sidelines despite Friday's impressive upsurge. The 200-day SMA forms significant support at $1,840 and sellers could look to dominate XAUUSD's action if that level fails ahead of the FOMC's policy announcements on Wednesday.

Gold Price looks fragile on hawkish Fed bets

Markets are pricing in a more-than-50% probability of the Federal Reserve hiking its policy rate by a total of 125 basis points (bps) in the next two meetings, the CME Group's FedWatch Tool shows on Monday. By September, there is an 80% chance that the Fed will raise its rate by at least 175 bps from the 0.75%-1% range where it stands today.

Friday's inflation data from the US seems to have caused markets to reconsider the Fed's rate outlook. The US Bureau of Labor Statistics announced that the Consumer Price Index (CPI) jumped to a fresh multi-decade high of 8.6% on a yearly basis in May, compared to the market expectation of 8.3%. Additionally, the Core CPI, which excludes volatile food and energy prices, rose by 0.6% on a monthly basis.

US CPI data revived inflation fears

Although US bond yields surged higher with the initial reaction to the inflation data, gold managed to find demand ahead of the weekend. Commenting on the market reaction, "both 10-year yields – relevant to gold – and those on two-year notes, which are best for gauging how markets expect the Fed to act, advanced," noted FXStreet Analyst Yohay Elam. "However, those on two yields rose at a much faster pace. If they surpass the 10-year yield – yield curve inversion – it has historically tended to reflect fears of a brewing recession. If the US economy shrinks, the Fed would eventually have to cut interest rates and therefore, long-term yields such as 10-year ones would have to fall. That is what pushed gold higher."

Meanwhile, China's zero-COVID policy continues to cloud gold's demand outlook. Beijing officials announced over the weekend that the city's most populous district, Chaoyang, will go into mass testing because of a "ferocious" coronavirus outbreak. Moreover, Shanghai will reportedly conduct a fresh round of testing for most of its 25 million residents. These developments coupled with growing recession fears caused safe-haven flows to dominate the financial markets on Monday.

Gold Price technical outlook

Gold Price was last seen testing the 200-day SMA at $1,840. In case XAUUSD makes a daily close below that level and starts using it as resistance, it could fall toward $1,825 (June 10 low) and $1,810 (the end-point of the latest downtrend) afterwards.

On the upside, $1,850 (Fibonacci 23.6% retracement) aligns as interim resistance ahead of $1,875 (Fibonacci 38.2% retracement) and $1,890 (100-day SMA).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart retreated below 50, confirming the bearish tilt in the near-term technical outlook.

Gold Price report for the week ahead

USD/JPY strength has stalled for now exactly below the 135.20 highs of 2002. But weakness stays seen as corrective ahead of a sustained break higher, with scope for 150 over the longer-term, analysts at Credit Suisse report.

Key 135.20 high of 2002 to cap in the short-term

“We look for the 135.02/135.20 highs of 2002 to cap at first for a fresh phase of consolidation. However, with a multi-year ‘secular’ base completed earlier this year, we ultimately expect 135.20 to be decisively cleared in due course, with resistance then seen next at 135.85/87, ahead of 136.81/84 and then 137.21.”

“Our ultimate objective stays seen in the 147.62/153.01 zone.”

“Near-term support at 133.38/20 is now increasingly important, as a break below here can see a pullback to 132.62, then 132.34 and likely gap and 13-day exponential moving average support at 131.87/62, but with fresh buyers expected here if reached.”

- USD/CAD gained traction for the fourth successive day and climbed to over a two-week high.

- Retreating oil prices undermined the loonie and remained supportive amid a stronger USD.

- Sustained move beyond the 61.8% Fibo. level will set the stage for further near-term gains.

The USD/CAD pair built on last week's solid rebound from the 1.2520-1.2515 region, or its lowest level since April 21 and scaled higher for the fourth successive day on Monday. The momentum lifted spot prices to a two-and-half-week high, though stalled near the 1.2865-1.2870 resistance zone.

Oil prices retreated further from a three-month peak touched last week and undermined the commodity-linked loonie. On the other hand, the prospects for a more aggressive Fed rate hike moves to combat stubbornly high inflation, along with the risk-off mood, benefitted the safe-haven US dollar. The combination of factors continued acting as a tailwind for the USD/CAD pair and remained supportive of the strong move up.

Bulls, however, struggled to capitalize on the move or make it through the 1.2865-1.2870 supply zone, which coincides with the 61.8% Fibonacci retracement level of the 1.3077-1.2518 downfall. The mentioned barrier should now act as a pivotal point, which if cleared decisively would set the stage for a further near-term appreciating move. The USD/CAD pair might then accelerate the momentum towards reclaiming the 1.2900 round figure.

The upward trajectory could further get extended towards the 1.2920-1.2925 intermediate resistance en-route the 1.2960 region, above which bulls could aim to conquer the 1.3000 psychological mark. Some follow-through buying has the potential to push the USD/CAD pair towards the YTD peak, around the 1.3075 area touched in May.

On the flip side, the 50% Fibo. level, near the 1.2800 mark, seems to protect the immediate downside. Any subsequent slide could be seen as a buying opportunity near the 1.2760 region, which should limit the downside near the 1.2730 area, or the 38.2% Fibo. level. The latter should act as a strong base for the USD/CAD pair.

USD/CAD daily chart

-637907213459108101.png)

Key levels to watch

Economists at Nordea believe the Federal Reserve will hike by 50 bps, but uncertainty is very high. If they are right, the USD could weaken in favour of other G10 currencies.

USD could strengthen on a 75 bps hike from the Fed

“We believe the Fed will hike by 50 bps this week but we admit that the uncertainty is very high. If we are right, we will likely see the USD weaken again in favour of other G10 currencies such as EUR, NOK, SEK, DKK, etc over the short-term.

“If we are wrong, the USD could strengthen somewhat more against the rest of G10 currencies.”

“From a technical standpoint, the USD is close to being overbought against most G10 currencies currently.”

The euro is trading heavily near 1.0450. A break below 1.0350 would open up additional losses toward parity, economists at BBH report.

Fragmentation fears have risen in the wake of the ECB decision

“The break below 1.0515 sets up a test of the May 13 low near 1.0350 and after that, we have to start talking about parity.”

“We think the rising risks of fragmentation are a major factor behind subsequent euro weakness. Markets were very disappointed by the lack of any concrete measures to address peripheral spreads, which are making new cycle highs as a result. Reports had hinted at some sort of new emergency bond-buying program but all we got was a pledge to use PEPP reinvestments to address the issue. That wasn't enough and so the euro is plumbing new depths.”

- EUR/USD has slid into the mid-1.0400s as the buck benefits from safe-haven demand and hawkish Fed bets.

- Some are eyeing a test of annual lows in the mid-1.0300 against an increasingly bearish backdrop.

- The main event of the week will be Wednesday’s Fed meeting, plus US Retail Sales and PPI data.

Though ECB policymakers continue to endorse the hawkish rate guidance unveiled by President Christine Lagarde following last week's policy announcement and has markets betting on a 25 bps rate hike next month followed by a 50 bps move in September, the euro bulls are nowhere to be seen. Indeed, EUR/USD has on Monday slumped back to its lowest levels since 17 May just above 1.0450, down a further 0.6% on the day following drops of closer to 1.0% each last Thursday and Friday.

EUR/USD downside over the past few days is a story of US dollar strength, with the buck benefitting from a combination of markets amping up Fed tightening bets and pushing US bond yields higher, while risk assets crumble, spurring demand for the world’s reserve currency as a safe-haven. Regarding the former, US 10-year yields rocketed to fresh multi-year highs on Monday above 3.25%, spurred as market participants bet that the Fed might even opt to go with a 75 or 100 bps rate hike in wake of last Friday’s hotter-than-expected US inflation data.

Traders will recall that data last Friday revealed the headline rate of annual US inflation according to the Consumer Price Index (CPI) to have risen to 8.6%, a new four-decade high. Meanwhile, data released by the University of Michigan later in the day showed Consumer Sentiment at a record low (going back to the 1970s) in June, sparking calls that the US economy might already be in, or at least imminently headed towards, a recession.

Given that high and rising US inflation precludes the Fed from easing to support growth (for the time being), the buck is able to garner safe-haven demand as a result of US growth fears. Punchy geopolitics-related headlines have also been in focus over the weekend, with China flexing about how it is ready to start a war against Taiwan if it declares independence and Russia seemingly gaining further ground in Ukraine. Meanwhile, Covid-19 infections in Beijing are on the rise again as officials there initiate further rounds of mass testing, highlighting the ongoing China lockdown risk.

US data this week (May Retail Sales & Producer Price Inflation plus June Philly Fed Manufacturing Index) is likely to reinforce that the economy is looking increasingly stagflationary, whilst the main event state-side will of course be Wednesday’s Fed policy announcement. The only data of note out of the Eurozone will be German ZEW figures for May on Tuesday. Against the current macro backdrop of risk-off flows and an increasingly hawkish Fed, a test of earlier annual lows in the mid-1.0300s seems very much on the table.

- GBP/USD witnessed selling for the fourth straight day and dropped back closer to the YTD low.

- Disappointing UK macro data fueled recession fears and weighed heavily on the British pound.

- Aggressive Fed rate hike bets and the risk-off mood benefitted the USD and added to the selling.

The GBP/USD pair added to its heavy intraday losses and weakened further below the 1.2200 round-figure mark heading into the North American session. The pair was last seen trading around the 1.2160-1.2165 region, just a few pips above the YTD low touched on May 12.

The monthly UK GDP report released earlier this month showed that the economy contracted by 0.3% in April, marking the first

back-to-back decline since the start of the coronavirus pandemic. Adding to this, the UK Industrial and Manufacturing Production slumped for the second straight month. The lacklustre macro data fuelled fears that Britain could be headed for a recession and clouded the outlook for the Bank of England. This, along with Brexit woes and UK political jitters, took its toll on the British pound.

In the latest Brexit-related developments, the UK government will publish plans to scrap parts of the post-Brexit deal concerning the Northern Ireland Protocol. This would set the stage for a further deterioration in post-Brexit UK-EU relations and possibly spark a trade war in the middle of the cost-of-living crisis. Apart from this, the uncertainty over Boris Johnson’s future as the UK Prime Minister further undermined sterling and dragged the GBP/USD pair lower for the fourth straight day amid broad-based US dollar strength.

The red-hot US consumer inflation data released on Friday fueled speculations that the Fed would tighten its policy at a faster pace and opened the door for a jumbo 75 bps rate hike. This, in turn, pushed the yield on the 2-year Treasury note - seen as a proxy for the Fed's policy rate - to 3% for the first time since 2008. Adding to this, the yield on the benchmark 10-year US government bond shot to the highest level since 2018 and underpinned the buck.

Meanwhile, the prospects for a more aggressive move by major central banks, along with the worsening global economic outlook, continued weighing heavily on investors' sentiment. This was evident from an extended selloff in the equity markets, which provided an additional boost to the greenback's relative safe-haven status. The combination of factors exerted downward pressure on the GBP/USD pair and took along short-term trading stops near the 1.2200 mark.

Some follow-through selling below the YTD low, around the 1.2155 region would be seen as a fresh trigger for bearish traders and set the stage for additional losses. That said, traders might refrain from placing aggressive bets ahead of the key central bank event risks later this week. The Fed is due to announce its policy decision on Wednesday and the BoE meeting is scheduled on Thursday. The outcome should provide a fresh directional impetus to the GBP/USD pair.

Technical levels to watch

Cable remains soft below 1.22 and is set to test the May 13 low near 1.2155. Economists at BBH believe that the GBP/USD pair could nosedive as low as 1.1410.

Brexit remains in the headlines

“GBP/USD is nearing a test of the May 13 low near 1.2155. After that is the May 2020 low near 1.2075 but we continue to target the March 2020 low near 1.1410.”

“A potential trade war with its largest trading partner as the economy is already contracting is yet another reason we remain negative on sterling.”