- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 10-06-2022.

- On Friday, the USD/JPY climbs 0.11%, and in the week, 2.80%.

- Risk-aversion initially weighed on the USD, but late in the North American session, higher US Treasury yields lifted the USD/JPY.

- USD/JPY Price Analysis: The USD/JPY might retrace as intervention looms, towards 131.00s.

The USD/JPY is registering gains close to 2.80% during the week, and on Friday is edging up after reaching a daily low at 133.36, following the statement’s release by Japanese authorities, which acknowledged the yen weakness. The pair fell, though late as the New York session wanes, recovered, and the USD/JPY is trading at 134.43, up 0.11%.

Wall Street finished the last trading day of the week with losses between 2.53% and 3.56%, portraying the dismal market mood. Meanwhile, US Treasuries rose, with the 10-year benchmark note up at 3.163%, gaining 11 basis points. The greenback followed suit, with the US Dollar Index rallying towards 104.185, up by 0.85%.

USD/JPY Price Analysis: Technical outlook

The major’s daily chart illustrates that the uptrend remains intact, though the rally appears overextended. The top Bollinger band, at 134.62, would be a challenging resistance level to overcome. The Relative Strength Index (RSI) making lower higher-highs, contrary to the USD/JPY’s price action, might create a negative divergence. That said, the USD/JPY might pull back towards the 131.00 area as JPY’s weakness begins to gather Japanese authorities’ attention near the 135.00 mark.

Therefore, the USD/JPY’s first support would be June’s 9 daily low at 133.18. A breach of the latter would expose June’s 8 low at 132.54. Once cleared, the USD/JPY’s next demand zone would be May 9 high-turned-support at 131.34.

Key Technical Levels

- Financial Japanese authorities met regarding a weaker JPY and accorded to act if the yen continues weakening.

- Despite falling on threats of an FX intervention by Japan, the GBP/JPY gained 1.30% weekly.

- GBP/JPY Price Analysis: To continue falling towards 164.25 before resuming to the upside.

The GBP/JPY plunged on Friday and trimmed weekly gains of almost 4%, on an announcement by the Ministry of Finance and the Bank of Japan, regarding a weaker yen and said that Japan “will take appropriate measures when necessary while maintaining close communication with the monetary authorities of each country.” At 165.51, the GBP/JPY collapses 1.31% as the New York session winds down.

Japan’s authorities verbal intervention worked; the JPY strengthened

Negative sentiment weighed on global equities. US stocks fall off the cliff recording losses between 2% and 2.80%, as Wall Street head into the weekend. Worries that inflation might last longer than expected despite efforts of global central banks, which tighten monetary policy, kept investors’ flows flying toward safe-haven assets.

In the case of the GBP/JPY, traders braced for safety and booked profits, validating the words from government authorities in Japan. The GBP/JPY seesawed around 168.00 at the beginning of Friday’s Asian session and tumbled on the statement’s release, reaching a daily low of 165.16.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY retreated from fresh YTD highs printed on June 9 near 168.72 and fled towards the 23.6% Fibonacci retracement, drawn from the May 12 low towards June 9 high. Nevertheless, the GBP/JPY daily chart depicts the pair as upward biased, but Friday’s pullback might extend towards April’s 28 daily high at 164.25.

In the short-term, the GBP/JPY’s 4-hour chart cross probed the 50-simple moving average (SMA) but failed to break below it and bounced shy of the S2 daily pivot point at 165.68. Also, the Relative Strength Index (RSI), albeit in negative territory, shifted upwards, opening the door for a cross over the 50 mid-line.

Upwards, the GBP/JPY would face resistance at the S2 pivot at 165.68. Break above would expose the 166.00 barrier, followed by the S1 pivot level at 166.70. On the flip side, the GBP/JPY first support would be the 50-SMA at 165.05. Once cleared, it would open the door towards the S3 pivot level at 164.67, followed by the 164.00 mark.

- As investors expect an aggressive US Fed, USD/CHF rallies 0.80% post US hot inflation.

- Elevated US Treasury yields lifted the greenback and weighed on stocks.

- USD/CHF Price Forecast: The pair is upward biased and would aim towards parity if buyers achieve a daily close above 0.9885.

The USD/CHF rallies sharply following a US inflation report that showed CPI is approaching the 9% threshold, increasing the bets of a US Federal Reserve 50 bps hike added to the June and July’s penciled by the US central bank. At 0.9882, the USD/CHF approaches 0.9900 and opens the door for a parity challenge for the second time in the year.

US CPI increased, lifting US Treasury yields on US Fed hike expectations, and stocks fall

Reflection on US data is better illustrated by the equity markets. European bourses plunged and finished with losses, while US equities nosedive, slashing between 2.12% and 3% of their value. The US dollar rose while US Treasury yields skyrocketed, while the Treasury curve inverts.

The US Dollar Index, a measure of the buck’s value, is advancing 0.84%, sitting at 104.177, while the US 10-year benchmark note rises 21 basis points and is up at 3.154%.

On Friday, the USD/CHF opened around 0.9800 and dipped below the figure on the news from Japan, particularly BoJ’s and finance officials, unveiling a document threatening to intervene in the FX markets. The USD/CHF dipped towards daily’s low at 0.9766 but rallied on US data towards highs of 0.9890s

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains upward biased, though at the time of writing, retraced from daily highs near 0.9898. However, buyers are in control and would keep it if they achieve a daily close above the May 19 daily high at 0.9885. If that scenario plays out, the USD/CHF first resistance would be 0.9900. Break above would expose the May 18 high at 0.9984, followed by a challenge of the YTD high at 1.0007.

- The euro records substantial losses vs. the greenback, down 1.81% in the week.

- Stagflation looms as US inflation accelerates, and consumers’ pessimism increases.

- EUR/USD Price Forecast: Daily close below 1.0532 would send the major tumbling for a retest of YTD lows at around 1.0340.

The EUR/USD nosedives and approaches the 1.0500, a level not seen since mid-May, following a higher-than-expected US inflation report, which topped estimations and opened the door for an aggressive Fed tightening cycle. At 1.0521, the EUR/USD trades near three-week lows, down 0.82% during the North American session.

US inflation approaching 9% paves the way for an aggressive Fed

Risk-aversion struck the markets following the release of May’s Consumer Price Index (CPI), which is getting closer to hitting 9% YoY after stabilizing for two months at around 8.3%. In the same report, the core CPI, which excludes volatile items like food and energy, increased by 6% YoY, higher than the 5.9%.

The greenback is rising on expectations that the US Federal Reserve will keep hiking rates faster. Reflection of the previously-mentioned is the US 10-year Treasury yields, rising to 3.178%, up by 23 basis points, underpinning the buck. The US Dollar Index reclaimed the 104.000 mark and is gaining almost 2%.

Analysts at Capital Economics wrote, “The surge in energy prices this month means that headline inflation will remain close to 8.6% in June. Together with the continued strength of the latest activity data, that bolsters the argument of the hawks at the Fed to continue the series of 50bps rate hikes into September and beyond, or even to step up the size of rate hikes at coming meetings.”

“The bigger increases in core prices a year ago means that core inflation still edged down to 6.0%, from 6.2%, but there is very little in the details of this report to suggest that inflationary pressures are easing,” Capital Economics wrote.

Late in the day, the University of Michigan reported June’s consumer sentiment preliminary numbers. The survey plunged to 50.2, lower than the 58.4 in May, showing consumer pessimism. Additionally, inflation expectations uptick to 5.4% from 5.3% in the previous study.

Now with the ECB meeting in the rearview mirror and elevated inflation in the US, the scenario of the Fed hiking 50 bps in June, July, and September is on the cards. So in the near-term, additional USD strength is expected, opening the door for further losses and a retest of EUR/USD’s 2022 YTD lows.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains on the defensive, battling at May 20 daily lows at 1.0532. A daily close below the latter leaves the major vulnerable to further selling pressure. The RSI around 40, with enough room before reaching oversold conditions, reinforces the previously mentioned scenario.

Therefore, the EUR/USD first support would be 1.0500. Break below would expose the May 19 daily low at 1.0460. Once cleared, the EUR/USD might tumble to challenge the YTD low at 1.0340.

- The GBP/USD tanks close to 180 pips after elevated US inflation data.

- Consumer sentiment in the US has collapsed to a 5-decade low.

- GBP/USD Price Forecast: In the near term will test the YTD low at 1.2155.

The GBP/USD plummets following a hotter than expected US inflation report and extends its losses in the week, dropping from around 1.2500 to fresh three-week lows at around 1.2320s. At 1.2313, the GBP/USD remains on the defensive and would extend its downtrend towards the following week’s Fed monetary policy meeting.

The pound collapses on expectations of aggressive Fed rate hikes

On Friday, the US Bureau of Labor Statistics (BLS) reported that May’s Consumer Price Index (CPI) increased by 8.6% YoY, higher than the 8.3% estimation. Inflation excluding volatile items like food and energy, the so-called Core CPI, also uptick by 6%, smashing expectations. That would likely pressure the Federal Reserve to act aggressively and hike rates faster, despite spurring a recession.

Analysts at TD Securities said that US inflation data should be of “great concern for the Fed” as both readings showed no signs of peaking; instead, inflation is broadening, and they expect prices to rise further. They added, “We expect the Fed to maintain its aggressive tightening bias in the months ahead, look for the Committee to hike rates by 50bp both next week and in the July FOMC meeting, and believe a 50bp hike in September may not be out of the question.”

Later in the day, US consumer sentiment also printed a dismal reading, nosediving to a 50-year low reading, with the UoM survey sliding to 50.2 vs. 58.4 in May. The University of Michigan’s survey also collects inflation expectations, with prices expected to rise by 5.4% over the next year, higher than 5.3% in the previous study. Regarding price expectancy in the next five to 10 years, the poll shows an advance of 3.3%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is accelerating its downtrend and is testing the May 17 daily low at 1.2313. The Relative Strength Index (RSI) is aiming lower, and despite the GBP/USD’s aggressive drop, it still has enough room before reaching oversold readings.

The GBP/USD next support would be the figure at 1.2300. Once cleared, the next support would be 1.2200, followed by the YTD low at 1.2155.

Next week, the Bank of England will have its monetary policy meeting. Analysts at MUFG Bank consider it poses some upside risk for the pound but they warn any rally should be short-lived in light of the still unfavourable UK cyclical backdrop.

Key Quotes:

“The GBP has been consolidating at weaker levels after correcting lower in April and May. It has seen cable fluctuate around the 1.2500-level since late April while EUR/GBP has been trading just above the 0.8500-level over the same period. The recent pick-up in UK political uncertainty after Prime Boris Johnson faced and narrowly survived a vote of no confidence in parliament at the start of this week had only a limited and fleeting impact on GBP performance.”

“The weak outlook for UK growth combined with elevated inflation continues to be a negative mix for GBP performance, and is making it more difficult for the BoE to set monetary policy. We expect the BoE to continue tightening policy in the week ahead in response to the risk that elevated inflation could become more embedded without policy action.”

“We believe next week’s MPC meeting poses some upside risk for the GBP, but any rally should be short-lived in light of the still unfavourable UK cyclical backdrop.”

- Gold hits weekly highs despite higher yields.

- XAU/USD is testing the $1870 resistance area.

- DXY and US yields are at the highest level since May 9.

Despite higher US yields and a stronger dollar, gold prices are soaring on Friday. XAU/USD rebounded again at the $1830 but this time it broke $1850 and a few minutes later reach $1870.

Gold finally reacting to inflation?

After the US May CPI report, XAU/USD bottomed at $1824, the lowest level in three weeks as Treasury yields move higher. After moving sideways in a wide range, gold broke above $1850 and gained more strength.

Technical factors and probably the yellow metal finally reacting to inflation, are boosting gold. In the short term, bears appear to be capitulating. The rally in gold is taking place even as the dollar and US yields soar.

The DXY is up by 0.80%, at 104.15, the highest level since May 17. The US 10-year yield stands at 3.15% and the 30-year at 3.22%, both at the highest since May 9. At the same time, the Dow Jones and the S&P 500 are falling by more than 2%.

Usually, a context of higher yields, risk aversion and a stronger dollar is negative for gold. During the last hour, it has not been the case. From the daily low, XAU/USD has risen so far $45.

Form a technical perspective, if XAU/USD holds above $1870 it would point to more gains. The next strong barrier is seen at $1890. On the contrary, a reversal from current levels, back under $1850 would put gold back under pressure.

Technical levels

The annual inflation rate in the US rose to 8.6%, the highest level since December 1981 in May according to data released on Friday. The CPI rose 1% m/m, surpassing expectations. Until inflation is demonstrably on the downswing, analysts at Wells Fargo, expect the FOMC to fight back aggressively with tighter policy. They see likely 50 bps hikes next week, and again in July and September.

Key Quotes:

“Inflationary pressures were seen nearly everywhere. Energy prices surged, led by a 4.1% increase in gasoline prices, while grocery prices increased 1.4% and pushed the year-ago rate to a pace not seen since the 1970s.”

“Simply put, inflation remains far too high for the Federal Reserve's liking. It is true that there are still one-off factors putting upward pressure on inflation beyond the central bank's control. Tighter monetary policy will not help much with surging global commodity prices or structural changes in the way people spend and live in the post-pandemic economy.”

“Monthly core CPI inflation has been 0.5% or higher in seven of the past eight months. These monthly readings roughly translate to a 6%-7% pace of annualized core inflation. There was a period of time when top policymakers at the Fed would look through this, but we no longer believe that is the case. Until inflation is demonstrably on the downswing, we expect the FOMC to fight back with tighter policy.”

“Another 50 bps rate hike is all but assured at next week's FOMC meeting, and a couple more 50 bps hikes in July and September seem highly likely.”

- Silver climbs on Friday but is still down in the week by 0.24%.

- US inflation rebounded from April’s 8.3% dip and rose strongly.

- The UoM consumer sentiment is at a 50-year low; stagflation looms?

Silver (XAG/USD) advances after seesawing earlier in the day, reaching a three-week low at $21.27, but staged a recovery after the University of Michigan Consumer Sentiment slumped the most in 5 decades. At the time of writing, XAG/USD is trading at $21.82, erasing earlier losses and now gaining 0.57%.

In the meantime, the US Dollar is rallying to fresh three-week highs, at 104.174, gaining 1.96%. At the same time, the US 10-year Treasury yield is rallying to new four-week highs at 3.14%, up by twenty basis points.

US consumer sentiment plunges, and US inflation rose to 4-decades highs

US consumer sentiment plummeted the most in 5-decades, following an inflation report that in the previous two months before May reading fell though rebounded to 8.6% YoY.

The University of Michigan’s consumer sentiment dipped towards 50.2, from 58.4, the lowest slump in 52 years. Joanne Hsu, director of the survey, said, “Throughout the survey, consumers signaled strong concerns that inflation will continue to erode their incomes, and the factors they cited are unlikely to abate soon.”

“While consumer spending has remained robust so far, the broad deterioration of sentiment may lead them to cut back on spending and thereby slow down economic growth,” Hsu said.

Earlier in the day, the Department of Labor reported that the Consumer Price Index (CPI) for May rose by 8.6%, higher than the 8.3% expected, data showed on Friday. The so-called core CPI, which excludes food and energy prices, increased by 6% YoY, also above expectations.

That further reinforces the necessity for Fed’s aggressive action if they are going to tackle inflation down.

Commerzbank analysts, in a note, expressed that the Federal Reserve is behind the curve. They added, “It is becoming increasingly clear that the Fed was too late in raising interest rates. Everything therefore points to further significant rate hikes. We expect interest rate hikes of 50 basis points at each of the next three Fed meetings. At the end of the year, the key interest rate should stand at 3.00%, and at 3.50% in spring 2023. But even with this forecast, the risks are now clearly on the side of even stronger hikes.”

Key Technical Levels

The USD/JPY hit levels not seen since 2002 and then pulled back only modestly. Analysts at MUFG Bank point out that the USD/JPY move higher may slow down on an increased risk of intervention to curb yen’s weakness. They see short-term risks in USD/JPY to the upside.

Key Quotes:

“USD/JPY has corrected lower in part in reaction to a meeting today in Tokyo attended by MOF Vice Finance Minister Masato Kanda and the FSA Commissioner and two BoJ Executive Directors. The meeting was convened to discuss international financial markets and the statement that followed from that meeting clearly illustrated the heightened level of concern over the scale of yen depreciation. The statement referenced in particular the view in Tokyo that “current excessive moves aren’t aligned with fundamentals”. The statement also included that Tokyo officials “were watching FX with greater urgency”. Kanda-san’s position traditionally has the responsibility on FX policy and the meeting and Kanada-san’s attendance and comments certainly have elevated the risks of FX intervention to stem the depreciation of the yen.”

“The risks over the short-term is for USD/JPY to drift further higher. The CPI data and the Fed meeting next week will provide support for US yields, underlining the lack of change to the policy divergence driver, especially given Governor Kuroda’s speech this week. The threat of intervention is certainly now much higher following the statement today expressing concern, which may result in increased reluctance for speculative yen selling and result in non-dollar yen strength in circumstances of broader US dollar strength into the FOMC and BoJ meetings next week.”

Economic data released on Friday showed the jobs in Canada rose by 39,800 in May, surpassing expectations. Analysts at CIBC, consider that recent economic data means that the Bank of Canada could raise its interest rates a little higher.

Key Quotes:

“A further solid rise in employment, decline in the jobless rate and sharp acceleration in wage growth in May places more pressure on the Bank of Canada to continue raising interest rates aggressively. Employment rose by 40K, modestly ahead of the 27.5K expected by the consensus, which was enough to drive the unemployment rate down to a fresh record low of 5.1%. With wage growth now also accelerating, the Bank of Canada will feel increased pressure to continue raising interest rates to, and maybe now above, the mid-point of its neutral bound (2-3%).

“Continued solid momentum in the economy, combined with signals that inflationary pressures may be worsening rather than easing, means that the Bank of Canada could well raise interest rates a little higher than we had previously expected. We now see a peak of 2.75% (previously 2.5%) before the end of the year, although we still expect that growth and inflation will slow enough later in the year to prevent the Bank from having to take rates above the 3% upper bound of its neutral range.”

- US dollar rises across the board on risk aversion.

- US yields advance sharply after inflation data.

- USD/MXN heads for biggest weekly gain since March.

The USD/MXN is having the best day in weeks, boosted by a rally of the US dollar across the board. The pair jumped from under 19.70 to 19.96, hitting the highest level since May 19.

Following US inflation data, Wall Street resumed the decline, and US bond yields rose further. The Consumer Confidence report from the University of Michigan contributed to risk aversion. The Dow Jones is falling by more than 2%, and the Nasdaq tumbles by 3.40%.

Bullish outlook

The USD/MXN rose back above the 20-day Simple Moving Average. The daily chart shows bullish signs with the RSI moving north, far from overbought levels, and the Momentum above the 100 level.

If the pair holds above the 19.90 resistance area, a test of the 20.00 level seems likely. The bullish tone will remain in place while above 19.70. Under the mentioned level, the Mexican peso will recover strength, exposing the 19.50 area.

Technical levels

-637904708915707853.png)

- WTI prices have fallen back below $120 on Friday as China lockdown worries return and amid risk-off Wall Street flows.

- Oil now looks on course to close out the week in the red for the first time since early May.

- But WTI remains locked within an uptrend in play since April and dips remain subject to being bought.

Front-month WTI futures fell back below the $120 per barrel mark on Friday and now trade just over $2.0 on the day and around $3.50 lower versus earlier weekly peaks in the $123 area. Both Shanghai and Beijing were back in Covid-19 alert on Thursday as cases started rising again, while parts of Shanghai have gone back into lockdown and the city has restarted mass testing.

The recent negative news serves as a reminder that China’s zero-Covid-19 policy remains a major threat to oil demand in the country, with lockdowns there in March through to May having a chilling effect on regional oil consumption, and is being cited as one factor weighing on prices on the final trading day of the week.

A sharp deterioration in risk appetite on Wall Street after data showed headline US inflation hitting a fresh four-decade peak and a widely followed Consumer Sentiment survey’s headline index fell to a new record low (going all the way back to the 70s is also weighing on crude oil prices, which tend to be sensitive to macro risk appetite.

Friday’s tumble means that WTI is now trading lower on the week by about $2.50, the first weekly decline since early May. But the US benchmark for sweet light crude oil look still to very much be locked within an uptrend that has supported prices going all the way back to early April.

China lockdown risk aside, global demand is looking very strong right now at a time when OPEC+ output is struggling, mostly as a result of Western sanctions against Russia for its invasion of Ukraine. Another development that seemed to go under the radar a little this week is Iran’s decision to start removing nearly all of the monitoring equipment installed by the International Atomic Energy Agency as part of the 2015 nuclear pact. That dents the prospect of the US and Iran agreeing to return to the deal, making the removal of sanctions on Iranian crude oil exports less likely.

Against this backdrop, dips will probably continue to be bought into in the short term, aside from any significant worsening of the China lockdown situation once again. Specifically, any dips back to the 21DMA at $115 would be particularly attractive as this level has offered strong support twice since mid-May.

The University of Michigan's headline Consumer Sentiment Index slumped to 50.2 in June, its worst level since records began back in the 1970s, according to the preliminary release of the university's widely followed monthly consumer survey. That was a large miss on the expected slight decline to 58.0 from 58.4 in May.

The Consumer Expectations Index fell to 46.8 from 55.2 in May, well below the expected decline to 54.5 and also a new record low. Meanwhile, the Current Conditions Index fell to 55.4 from 63.3, well below the expected decline to 62.5, its worst level since May 1980. One-year inflation expectations rose to 5.4% from 5.3% in May, while five-year inflation expectations jumped to 3.3% from 3.0%.

Market Reaction

The latest weak consumer sentiment figures and rise in inflation expectations have exacerbated some of the moves triggered in wake of the hotter-than-expected US inflation data. Equity market downside has worsened and US bond yields are extending to the upside, which is dragging the US dollar higher with it as traders price in a more stagflationary US economy (weaker growth, but higher inflation and a still hawkish Fed).

- USD/JPY has pared earlier losses and is eyeing a test of multi-decade highs hit earlier in the week near 134.50.

- Yen strength after a joint Japanese government/BoJ statement of concern about currency weakness was short-lived.

- As US yields rise in wake of hotter-than-expected US CPI, USD/JPY remains at risk of further upside.

The yen’s earlier strength that at one point saw the currency recoup as much as 0.7% on the day versus the US dollar after Japan’s government and central bank issued a rare joint statement expressing concern about recent yen weakness has proven short-lived. USD/JPY is back to close to flat on the day and trading comfortably above the 134.00 level, not many pips below the multi-decade highs it reached near-134.50 earlier in the week.

Hotter than expected US Consumer Price Inflation data that saw the headline YoY inflation rate hit a new four-decade high in May and a smaller than expected decline in the YoY rate of core price pressures has resulted in the market rebuilding some Fed tightening bets, pushing US yields higher. USD/JPY, especially in wake of recent commentary from the BoJ, who are doubling down on their dovish policy of negative interest rates and yield curve control, is sensitive to higher a widening of US/Japan rate differentials.

Even though Japan’s top currency diplomat Masato Kanda on Friday told the Japanese press that the government will take action as needed to avoid disorderly currency market moves, a hint towards outright FX intervention (i.e. JPY buying), USD/JPY remains at risk of hitting fresh multi-decade highs before the week is out. The main focus next week will be on the Fed’s policy announcement on Wednesday.

- GBP/USD witnessed heavy selling for the third successive day amid broad-based USD strength.

- Stronger US CPI print for May reaffirmed hawkish Fed expectations and boosted the greenback.

- The risk-off impulse further underpinned the safe-haven buck and exerted pressure on the pair.

The GBP/USD pair extended this week's rejection slide from the 1.2600 neighbourhood and witnessed some follow-through selling for the third successive day on Friday. The intraday selling picked up pace during the early North American session and dragged spot prices to over a three-week low, below the 1.2400 round-figure mark.

The US dollar added to its intraday gains and shot to the highest level since May 19 in reaction to stronger-than-expected US consumer inflation figures. In fact, the headline US CPI climbed 1.0% MoM in May as against 0.7% expected and the yearly rate jumped to a fresh 40-year high level of 8.6%. Adding to this, core inflation, which excludes food and energy prices, rose 0.6% MoM and 6.0% YoY, surpassing consensus estimates for a reading of 0.5% and 5.9%, respectively.

The data lifted bets for a more aggressive policy tightening by the Fed, which was evident from a sharp spike in the shorter-dated US bond yields. Moreover, the markets are now pricing in a 50 bps rate hike each in June, July and September meetings. This, along with the worsening global economic outlook, triggered a fresh wave of the global risk-aversion trade, which further benefitted the safe-haven buck and contributed to the heavily offered tone surrounding the GBP/USD pair.

From a technical perspective, the intraday break through the previous weekly low, around the 1.2430 area, was seen as a fresh trigger for bearish traders. The subsequent slide and acceptance below the 1.2400 mark might have already set the stage for additional losses towards the 1.2330-1.2325 support. The downward trajectory could further get extended towards the 1.2300 round figure en-route the 1.2240 zone before the GBP/USD pair eventually drops to sub-1.2200 levels.

Technical levels to watch

- EUR/USD drops sharply to the 1.0520 area on Friday.

- Further downside could see the 2022 low revisited.

EUR/USD adds to Thursday’s losses and prints new multi-week lows near 1.0520 at the end of the week.

The inability of spot to surpass the 4-month resistance line near 1.0730, the lack of surprise from the ECB and May’s US CPI were just too much for the European currency.

Against that, the continuation of the pullback could open the door to a probable visit to the 2022 low near 1.0350 (May 13).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1202.

EUR/USD daily chart

NZD/USD is showing further weakness below 0.6568/76. Economists at Credit Suisse look for a further downside to develop from here.

Further downside

“NZD/USD is showing further weakness following its rejection of the May highs at 0.6568/76. We thus stay with our tactically negative position, supported by the falling 55-day and 200-day moving averages, as well as by daily MACD momentum turning lower. “

“Immediate support moves to 0.6378/62 and then further below to 0.6310/6288, which we expect to eventually break and enable a retest of major retracement support and the YTD low at 0.6230/13.”

“A sustained close above the May highs and the 55-day moving average at 0.6568/86 would negate our tactically bearish view and indicate yet another mean-reversion within the broader 2021/22 downtrend, similar to the July/Oct 2021 and Jan/April 2022 recoveries. However, this is not our base case.”

USD/CAD has pushed higher to a fresh two-week high. Economists at Scotiabank expect the pair to extend its gains back to the 1.2775/1.2875 range.

Drop back under 1.2685 to relieve near-term upside pressure

“A high close on the week for the USD will confirm a bullish outside range week which will ease downward pressure on the USD.”

“We note that shorter-term trend momentum indicators have flipped to more USD-supportive readings now.”

“The charts suggest some risk of USD gains extending back to the 1.2775/1.2875 range.”

“A drop back under 1.2685 will relieve near-term upside pressure on the USD but technically safer ground for the CAD remains distant (low 1.26s).”

- NZD/USD slipped to fresh multi-week lows under 0.6400 on Friday after hot US CPI data.

- The annual rate of headline inflation hit a fresh four-decade high.

- In response, risk appetite soured, US yields rose and the buck strengthened as traders upped Fed tightening bets.

NZD/USD hit fresh multi-week lows under the 0.6400 level on Friday after a hotter-than-expected US Consumer Price Inflation report for May injected a dose of strength into the US dollar. The headline annual pace of inflation unexpectedly rose to 8.6% from 8.3%, marking a new four-decade high, while the annual pace of core inflation fell less than expected.

The data triggered a hawkish market reaction as traders rebuilt Fed tightening bets (having pared back on them recently in anticipation the data would show inflation in the US having “peaked”). US 2-year yields were last trading 10 bps higher on the session, a reflection of this.

Fed tightening fears are weighing on sentiment, with major US equity index futures coming under selling pressure in pre-market trade and risk sending NZD/USD from current levels in the 0.6380s, where the pair still trades flat on the day, into the red. From a technical standpoint, the fact that the pair tested its 21-Day Moving Average at 0.6440 earlier in the session but was rejected suggests a negative short-term trading bias. The door is open for a drop lower towards 0.6300.

Economist at UOB Group Enrico Tanuwidjaja evaluates the Consumer Confidence gauge in Indonesia.

Key Takeaways

“Indonesia’s Consumer Confidence Index rose to an all-time high of 128.9 in May, up by 15.8pts from Apr’s 113.1.”

“The Current Economic Condition Index improved to 116.4 in May from Apr’s 98.9.”

“Consumer sentiment generally remains upbeat on the economy in the next 6 months, supported by an increase in the 6-month ahead Index to 141.5 in May from 127.2 in Apr.”

- EUR/USD loses further ground and revisits 1.0520.

- The US Dollar Index stays bid and approaches 104.00.

- US CPI rose at the fastest pace in the last 40 years in May.

The European currency comes under further pressure and motivates EUR/USD to slip back to the 1.0520 region on Friday, or new 3-week lows.

EUR/USD weaker post-US CPI

EUR/USD sheds further ground after the greenback saw its upside exacerbated in response to higher-than-expected US inflation figures measured by the CPI for the month of May.

Indeed, the headline CPI rose 1.0% MoM in May and 8.6% over the last twelve months. The Core CPI, in the meantime, went up by 6.0% from a year earlier.

The release of US inflation figures reaffirmed the idea of an aggressive tightening by the Federal Reserve in the near-term horizon, with a 50 bps rate hike already priced in at the June and July gatherings.

Furthermore, Fed Funds futures now point to nearly 3.00% by end of 2022.

Later in the NA session, the flash US Consumer Sentiment is due.

What to look for around EUR

EUR/USD came under extra pressure in response to the multi-decade highs in US inflation recorded in May.

The resumption of the selling bias in the pair followed the accelerated inflows into the greenback on the back of now firmer conviction of a tighter Fed policy in coming months.

EUR/USD remains far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is losing 0.69% at 1.0542 and a breach of 1.0521 (monthly low June 10) would target 1.0500 (round level) en route to 1.0459 (low May 18). On the other hand, immediate up barrier emerges at 1.0786 (monthly high May 30) seconded by 1.0925 (100-day SMA) and finally 1.0936 (weekly high April 21).

- Gold prices saw a choppy reaction to the latest hotter-than-expected US CPI data.

- XAU/USD was last trading just above $1840 versus initial post-data lows around $1825.

- Prices are currently higher versus pre-data levels, but at risk of falling given strength in US yields and USD.

Spot gold (XAU/USD) prices saw a choppy reaction in wake of the just-released US Consumer Price Inflation (CPI) data for May, which came in above expectations across the board. As a result, the kneejerk reaction for gold was to dip to fresh session lows in the $1825 area, though prices have now swung higher once again to trade closer to $1840, above pre-data levels. However, XAU/USD still trades with on-the-day losses of about 0.3%.

The move higher versus pre-data levels in spot gold might reflect a combination of safe-haven demand as US equities come under pressure as markets rebuild Fed tightening bets and fears about inflation after the headline CPI rate jumped to 8.6%, a new four-decade high. Gold is seen by many investors as a hedge against inflation.

But the move higher cuts against moves seen in US bond and currency markets. US yields, particularly at the short-end, have spiked to reflect a build-up of Fed tightening bets and this is also boosting the buck. Gold has a negative correlation to both yields and the dollar. Perhaps that means that gold’s next stop will be a retest of session lows in the mid-$1820s rather than a retest of session highs in the upper-$1840s.

- The USD strengthened across the board and pushed USD/CAD to a fresh two-week high.

- Stronger US CPI reaffirmed hawkish Fed expectations and provided a strong lift to the buck.

- Better-than-expected Canadian CPI did little to benefit the loonie or hinder the move up.

The USD/CAD pair added to its intraday gains and shot to a fresh two-week peak, around the 1.2770 region in reaction to stronger US consumer inflation figures.

The headline US CPI climbed 1.0% MoM in May as against 0.7% expected and the yearly rate jumped to a fresh 40-year high level of 8.6%. Adding to this, core inflation, which excludes food and energy prices, rose 0.6% MoM and 6.0% YoY, surpassing consensus estimates for a reading of 0.5% and 5.9%, respectively.

The data reaffirmed market bets that the Fed would need to tighten its policy at a faster pace to curb soaring inflation. In fact, the markets are now pricing in about 215 bps of cumulative hikes in 2022, with 50 bps hikes each in June, July and September meetings. This, in turn, boosted the US dollar and the USD/CAD pair.

On the other hand, the Canadian dollar failed to gain any meaningful traction following the release of better-than-expected domestic employment data. Statistics Canada reported that the number of employed people rose 39.8K in May (30K anticipated) and the unemployment rate edged lower to 5.1% from the 5.1% in the previous month.

With the latest leg up, the USD/CAD pair has now rallied nearly 250 pips from its lowest level since April 21, around the 1.2520-1.2515 region touched on Wednesday and seems poised to appreciate further. Hence, a subsequent move towards the 1.2800 mark, en-route the 1.2825-1.2830 supply zone, now looks like a distinct possibility.

Technical levels to watch

- AUD/USD turned lower for the third straight day in reaction to stronger US inflation figures.

- The latest US CPI report reaffirmed hawkish Fed expectations and boosted the greenback.

- The risk-off impulse further underpinned the buck and weighed on the risk-sensitive aussie.

The AUD/USD pair witnessed aggressive selling during the early North American session and turned lower for the third successive day in reaction to stronger US consumer inflation figures. The pair was last seen trading around the 0.7080-0.7075 region, or over a two-week low, down 0.25% for the day.

According to the data released this Friday, the headline US CPI rose to 1.0% MoM in May as against 0.7% expected and the yearly rate unexpectedly jumped to a fresh 40-year high level of 8.6%. Adding to this, core inflation, which excludes food and energy prices, came in at 0.6% MoM and 6.0% YoY rate versus consensus estimates for a reading of 0.5% and 5.9%, respectively.

The data reaffirmed market bets that the Fed would need to tighten its monetary policy at a faster pace to curb soaring inflation. This was reinforced by a fresh leg up in the US Treasury bond yields, which, along with a steep fall in the equity markets, pushed the safe-haven US dollar to a fresh three-week high and exerted heavy downward pressure on the AUD/USD pair.

Given the overnight break below the 0.7150 horizontal support, the emergence of fresh selling on Friday favours bearish traders and supports prospects for further losses. Hence, some follow-through weakness, towards testing the 0.7000 psychological mark, now looks like a distinct possibility. The downward trajectory could further get extended towards the 0.6945 support zone.

Technical levels to watch

- Canada added 39.8K jobs in May, more than expected.

- The loonie strengthened against most of its peers in wake of the robust data.

The Canadian economy added 38,900 jobs in May, according to the latest data released by Statistics Canada on Friday. That was above expectations for a 30,000 rise and above last month's 15,300 reading.

The gain in full-time employment was a robust 135,400 while part-time employment fell by 95,800. Meanwhile, the unemployment rate fell unexpectedly to 5.1% in May from 5.2% a month earlier. The participation rate was unchanged at 65.3%.

Market Reaction

The loonie saw immediate strength versus the majority of its major G10 peers in wake of the robust labour market data, which supports the case for aggressive BoC tightening.

- US CPI rose to 8.6% YoY in May, higher than expected.

- Markets saw a hawkish reaction to the data.

The annual pace of inflation in the US rose to 8.6% in May according to the latest Consumer Price Index data released by the US Bureau of Labour Statistics on Friday. That was above the expected reading of 8.3%. MoM, the headline inflation rate was 1.0%, well above the expected rise to 0.7% from 0.3% back in April.

Core measures of the CPI also came in hotter than expected. YoY, core prices were up 6.0%, above the expected drop to 5.9% from 6.2% a month earlier. MoM, the rise in core prices was also higher than expected at 0.6% and unchanged versus one month ago, versus expectations for a drop to 0.5%.

Market Reaction

In response to the hotter-than-forecast US inflation figures, markets saw an immediate hawkish reaction, with the US dollar and US yields spiking, while US equity index futures and rate-sensitive assets like gold and crypto came under pressure.

- DXY adds to the weekly rebound above 103.00 on Friday.

- Further gains face an interim hurdle at the Fibo level at 104.21.

DXY keeps the march north unabated and extends the recover to the 103.70 zone at the end of the week.

Considering the ongoing price action, further gains now look probable. Against that, the next interim barrier comes at the Fibo level (of the 105.00-101.29 drop) at 104.21ahead of the 2022 peak at 105.00 recorded on May 13.

As long as the 3-month line around 101.30 holds the downside, the near-term outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen bullish while above the 200-day SMA at 97.24.

DXY daily chart

Gold has been in the range of $1,800-1,850 since mid-May. Strategists at ANZ Bank expect the yellow metal to confirm an upside move on a break past $1,900.

XAUUSD is consolidating, the range looks indecisive

“The current price range of $1,800-1,900 will not provide any clear direction until prices break either side of the range.”

“A convincing break of above $1,900, which is also a trend break-out, will be required before a short-term bullish outlook can be called. Once this level breaks, prices could touch the previous highs of $1,950 and $2,000.”

“Key supports are at $1,800 and $1,760.”

Economist at UOB Group Ho Woei Chen, CFA, comments on the latest trade balance figures in China.

Key Takeaways

“In USD-terms, China’s exports expanded 16.9% y/y (Bloomberg est: 8.0% y/y; Apr: 3.9% y/y) in May and while imports also came in above expectation, the outperformance was less as it rose by 4.1% y/y (Bloomberg est: 2.8% y/y; Apr: 0.0% y/y).”

“Stronger-than-expected rebound in China’s trade in May confirms that the economy has bottomed out and we should expect the recovery to continue into Jun as Shanghai’s easing COVID measures will provide a temporary boost to trade flows.”

“However, the high comparison base and increasing headwinds to global economic growth due to factors such as higher commodity prices and an acceleration in central banks’ tightening as well as logistics challenges, are likely to lead to a moderation in China’s trade growth in 2H22. Domestically, there are also concerns of a recurrence of widespread COVID lockdowns as China stays on its dynamic zero-COVID policy which may encourage further diversification of supply-chain to the ASEAN region.”

“The main upside to the outlook is a potential lowering of Trump era’s tariffs on US$300 bn of Chinese goods as the Biden administration looks to ease inflationary pressures in the US.”

- USD/CHF scaled higher for the sixth straight day and shot to over a three-week high on Friday.

- Elevated US Treasury bond yields continued underpinning the USD and remained supportive.

- A softer risk tone could drive haven flows towards the CHF and keep a lid on any further gains.

- The market focus will remain glued to the release of the US consumer inflation figures for May.

The USD/CHF pair attracted some dip-buying near the 0.9765 region on Friday and turned positive for the sixth successive day. The momentum pushed spot prices to over a three-week high, around the 0.9840 region heading into the North American session.

The US dollar quickly reversed modest intraday losses and shot to its highest level since May 19 amid a fresh leg up in the shorter-dated US bond yields. In fact, the 2-year Treasury note rose to the highest level since November 2018 amid expectations that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation.

Hence, the market focus would remain glued to the release of the crucial US CPI report, due in a short while from now, which is expected to show that the headline inflation held steady at the 8.3% YoY rate in May. Meanwhile, core inflation, which excludes food and energy prices, is projected to edge down to 5.9% YoY versus 6.2% in April.

Investors, however, remain concerned that the global supply chain disruption caused by the Russia-Ukraine war and COVID-19 restriction in China would push consumer prices even higher. This, in turn, points to the risk of stronger print, which would be enough to boost the USD and set the stage for additional gains for the USD/CHF pair.

That said, the worsening global economic outlook continued weighing on investors' sentiment and led to a further decline in the equity markets. This could drive some haven flows towards the Swiss franc and cap gains for the USD/CHF pair. Nevertheless, the fundamental backdrop favours bullish traders and supports prospects for an extension of the ongoing move up.

Technical levels to watch

- GBP/USD hit multi-week lows on Friday in the low 1.2400s, with bears eyeing a push lower into the 1.2300s.

- Near-term focus is on the upcoming US CPI release and whether it will impact Fed tightening expectations.

GBP/USD broke out to fresh multi-week lows in the 1.2420 area on Friday amid mixed FX market conditions and somewhat risk-averse pre-US inflation data trading conditions. The pair was last trading with losses of roughly 0.5% on the day, with bears eyeing a push lower into the 1.2300s in the week ahead should fears about the weakening UK economy linger.

According to a REC survey cited by Reuters on Friday, UK employers hired staff at the slowest pace since early 2021 in May, with the hiring pace having now declined for a sixth successive month. Sterling also has domestic politics to worry about, with the UK government reiterating its intention to pass legislation that would unilaterally amend the Northern Ireland Protocol (putting the UK’s free trade deal with the EU at risk) and with UK PM Boris Johnson’s authority having been weakened after a no-confidence vote on Monday that saw a larger than expected rebellion from his own MPs.

In the near-term, focus will be on US Consumer Price Inflation data scheduled for 1230GMT and analysts think that the data might ease inflation worries, which could (at the margin) relieve some pressure being felt by the Fed to tighten monetary policy so quickly in the quarters ahead. This could provide GBP/USD with some short-term support. But given Fed/BoE policy divergence and a comparatively weak UK growth story, traders may be inclined to sell any sterling rallies.

- EUR/JPY adds to Thursday’s losses and breaches 142.00.

- The next support of note comes at 140.00.

EUR/JPY extends the rejection from recent peaks past the 144.00 mark at the end of the week.

Overbought conditions and renewed demand for the Japanese yen now force the cross to shed further ground and re-shift its attention to the 140.00 neighbourhood, which emerges as the next magnet for bears in the short-term horizon.

So far, while above the 3-month support line near 136.20, the near-term outlook for the cross should remain bullish.

EUR/JPY daily chart

Latvian central bank head and European Central Bank governing council member Martins Kazaks on Friday said that inflation in the Eurozone is unacceptably high and that when the ECB talks about being gradual with policy tightening, it does not mean slow, reported Reuters. The ECB will do what it can to return inflation to 2.0%, he continued.

His remarks come after the ECB formally announced plans to end its QE program at the start of July and then hike interest rates by 25 bps at the July meeting. The bank also signaled that if inflation fails to sufficiently abate in the months ahead, a larger than 25 bps rate hike is on the table for September (i.e. a 50 bps hike).

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment details for May later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 30K jobs during the reported month, up from the 15.3K rise reported in April. Meanwhile, the unemployment rate is expected to hold steady at 5.2% in May.

Analysts at RBC Economics sounded less optimistic and offered a brief preview of the report: “We expect a gain of 15K jobs – matching the increase in April. Employment growth has slowed dramatically in recent months, but not due to any shortfall in labour demand. Canada's number of job openings was still running ~70% above pre-pandemic levels in May. But the number of workers available for hire is now minimal, with the unemployment rate at 5.2% in April, its lowest level since at least 1976. And labour shortages are widespread by sector. That means additional demand for workers from now on will show up more in wage growth than in employment counts.”

How could the data affect USD/CAD?

The data is likely to be overshadowed by the simultaneous release of the crucial US consumer inflation figures, which would determine the Fed's monetary policy tightening path. That said, a significant divergence from the expected readings should influence the Canadian dollar and provide some meaningful impetus to the USD/CAD pair. Heading into the key data risks, the pair shot to a fresh two-week high, closer to mid-1.2700s amid modest US dollar strength. Bulls seemed rather unaffected by an uptick in crude oil prices, which tend to benefit the commodity-linked loonie.

Some follow-through buying beyond the 1.2765-1.2770 region should allow bulls to reclaim the 1.2800 mark. The said handle coincides with the 50% Fibonacci retracement level of the 1.3077-1.2518 downfall, which if cleared decisively will suggest that the USD/CAD pair has formed a near-term bottom and pave the way for additional gains. Spot prices could then accelerate the momentum further towards the next relevant hurdle near the 1.2765-1.2770 supply zone en-route the 1.2800 round figure.

On the flip side, the 1.2700 mark now seems to protect the immediate downside ahead of the 1.2655 confluence support, comprising the very important 200-day SMA and the 23.6% Fibo. level. Failure to defend the said support could drag the USD/CAD pair back towards the 1.2600 round figure en-route the 1.2520-1.2515 support, or the monthly low touched earlier this week.

Key Notes

• Canadian Employment Preview: Forecast from four major banks, additional jobs gain in May

• USD/CAD Analysis: Bulls likely to seize control above 1.2700, US CPI/Canadian jobs data eyed

• USD/CAD: Limited appreciation potential for the loonie in the medium-term – Commerzbank

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

US CPI Overview

Friday's US economic docket highlights the release of the critical US consumer inflation figures for May, scheduled later during the early North American session at 12:30 GMT. The headline CPI is anticipated to rise by 0.7% during the reported month, up sharply from the 0.3% in April. The yearly rate, however, is expected to hold steady at 8.3% in May. Meanwhile, core inflation, which excludes food and energy prices, is projected to rise 0.5% MoM and come in at a 5.9% YoY as compared to 0.6% and 6.2%, respectively, in April.

Analysts at Nordea offered a brief preview of the report and explained: “Headline inflation is likely to stay flat printing at 8.3% YoY, while core inflation will fall towards 6.1% YoY with a slight risk to the downside. The primary driver of headline inflation will be energy prices, which are poised to show a large contribution to YoY headline CPI on the back of a 9% gasoline price increase in May. Another contributing factor will be service inflation, which has accelerated on a month-on-month basis and will start contributing more and more to the YoY numbers. Today’s inflation problem began as a surge in goods prices during the pandemic, but it has now turned into sticky and broad-based service inflation, which really highlights the Fed’s delay in withdrawing accommodative policy.”

How Could it Affect EUR/USD?

Ahead of the key release, the US dollar continued drawing support from the recent run-up in the US Treasury bond yields and was further underpinned by a generally weaker risk tone. Stronger-than-expected US CPI print would reaffirm market bets that the Fed would need to tighten its monetary policy at a faster pace to curb soaring inflation. This, in turn, would push the US bond yields higher, along with the greenback. Conversely, the reaction to a softer reading is more likely to remain muted amid concerns about the worsening global economic outlook, which should continue to act as a tailwind for the safe-haven buck. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the EUR/USD pair: “The 200-period SMA on the four-hour chart forms dynamic support at 1.0600. In case the pair falls below that level and starts using it as resistance, it could target 1.0570 (Fibonacci 50% retracement of the latest uptrend) and 1.0520 (Fibonacci 61.8% retracement) next.”

“On the upside, 1.0650 (static level) aligns as first resistance ahead of 1.0680 (Fibonacci 23.6% retracement) and 1.0700 (psychological level, 100-period SMA). Meanwhile, the Relative Strength Index (RSI) indicator on the four-hour chart stays near 40, suggesting that there is more room on the downside before the pair turns technically oversold,” Eren added further.

Key Notes

• US Consumer Price Index May Preview: Fed policy is set but there is room for surprise

• US CPI Preview: Soft core set to drive dollar down, and two other scenarios

• EUR/USD Forecast: Sellers could attack 1.0600 on hot US inflation data

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of the USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group comment on the release of the labour market figures in the Malaysian economy.

Key Takeaways

“The transition into endemicity with a full reopening of the economy and country borders on 1 Apr provided a big boost to Malaysia’s labour market during the month. The national unemployment rate dropped below 4.0% for the first time since Mar 2020 to 3.9% in Apr (Mar: 4.1%), while the labour force participation rate hit an all-time high of 69.4% (Mar: 69.2%).”

“Total employment also recorded the largest gain in six months by 84.1k or 0.5% m/m to a fresh high of 15.85mn (Mar: +38.5k or +0.2% m/m to 15.77mn). This robust improvement was primarily driven by persistent hiring in services, manufacturing and constructions sectors, as well as the resumption of employment in the agriculture sector for the first time in 23 months. The mining & quarrying sector was the only laggard, which still posted a reduction in employment for the 21th straight month.”

“Although the labour market continued to show signs of strength, the recovery is facing significant headwinds due to factors such as global recession fears, elevated business costs, prolonged supply chain bottlenecks, and China’s economic slowdown. Hence, a full labour market recovery back to pre-pandemic levels is still unlikely for now. We maintain our outlook for the unemployment rate to ease further but remain above the pre-pandemic levels at 3.6% by end-2022 (BNM est: ~4.0%, end2021: 4.2%, end-2019: 3.3%).”

The Central Bank of Russia announced on Friday that it cut its policy rate by 150 basis points to 9.5% from 11%. In its policy statement, the central bank noted that it will consider the necessity of key rate reductions at its upcoming meetings.

Additional takeaways per Reuters

"According to the Bank of Russia’s forecast, given the current monetary policy stance, annual inflation will total 14.0–17.0% in 2022, decline to 5.0–7.0% in 2023 and return to 4% in 2024."

"This comes as a result of ruble exchange rate movements and the tailing-off of the surge in consumer demand in the context of a marked decline in inflation expectations of households and businesses."

"Moving forward, in its key rate decision-making the Bank of Russia will take into account actual and expected inflation dynamics relative to the target and economic transformation processes, as well as risks posed by domestic and external conditions and the reaction of financial markets."

"Monetary conditions are overall tight, having softened unevenly across various segments of the financial market."

"High-frequency indicators point to a halt in the decline in business activity in May after it dropped sharply in April."

"Enterprises are still struggling to fix production and logistics."

"Consumer activity in real terms is on the decline as households show a high propensity to save and real incomes shrink."

"The external environment for the Russian economy remains challenging and significantly constrains economic activity."

Market reaction

The USD/RUB pair is down more than 3% at 57.3250 following this announcement.

- Gold Price is extending a two-day bearish momentum on Friday.

- The US dollar reigns supreme as risk-aversion remains at full steam.

- XAUUSD appears vulnerable, with all eyes on next week’s Fed decision.

Gold Price is trading with size-able losses on the final trading day of the week, as investors continue to seek refuge in the safe-haven US dollar amid persistent fears over rising inflation and a potential recession. Central banks tightening worldwide to quell inflation have re-ignited growth fears. The yellow metal is leaning bearish, despite a minor pullback in the US Treasury yields, as hot inflation and pre-Fed meeting anxiety keep the sentiment around the dollar underpinned.

Also read: Gold Price Forecast: XAUUSD at a critical juncture, US inflation holds the key

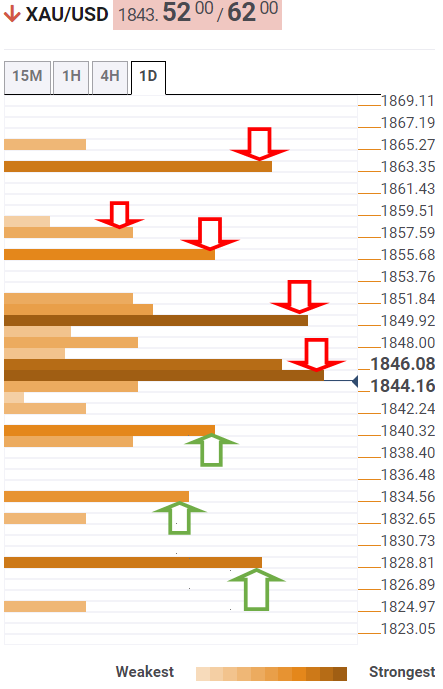

Gold Price: Key levels to watch

The Technical Confluence Detector shows that Gold Price is teasing the crucial SMA200 one-day support at $1,842.

A sustained move below the latter will put the previous day’s low of $1,840 at risk. At that level, the pivot point one-day S1 and Fibonacci 23.6% one-week merge.

The next relevant downside target is seen at $1,833; the confluence of the Fibonacci 38.2% one-month and the pivot point one-day S2.

The line in the sand for gold buyers is aligned at the intersection of the previous week’s low and the pivot point one-week S1 at $1,829.

On the upside, powerful resistance appears around the $1,845 region, where the SMA5 four-hour, Fibonacci 38.2% one-day and one-week coincide.

Further up, bulls will challenge the SMA5 one-day, Fibonacci 61.8% one-day and SMA10 one-day convergence at $1,850.

Acceptance above the latter will open doors for a fresh advance towards the previous day’s high of $1,855, above which the Fibonacci 61.8% one-week at $1,857 will be probed.

The meeting point of the Fibonacci 61.8% one-month and the pivot point one-day R2 at $1,863 will be a tough nut to crack for XAU bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- EUR/USD remains under pressure and breaches 1.0600.

- The greenback extends Thursday’s ECB-led recovery.

- Chair Lagarde, US CPI, Consumer Sentiment next on tap.

The selling pressure remains well and sound around the European currency and forces EUR/USD to break below the 1.0600 mark to clinch new 2-week lows.

EUR/USD weaker post-ECB, looks to US CPI

EUR/USD adds to Thursday’s post-ECB slump and breaches the 1.0600 support, as sentiment remains sour and the rebound in the greenback picks up extra pace.

So far, Friday’s pullback in the pair comes pari passu with the knee-jerk in the German 10y Bund yields, while the US cash markets also see a modest decline in the 10y and 30y bond yields.

Investors, in the meantime, keep selling the euro after the ECB’s event came short of hawkish expectations on Thursday despite the central bank announced a 25 bps rate hike in July and left the door open to a probable 50 bps move at the September meeting (depending on the inflation outlook).

Earlier in the session, ECB’s Holzmann suggested that the neutral rate could be around 1.5%, a view shared by his colleague Villeroy; while member Nagel stressed that a resolute action by the central bank is needed to tackle inflation in the region.

Absent releases of note in the domestic calendar, the release of US inflation figures for the month of May will take centre stage later in the NA session seconded by the U-Mich preliminary print for the current month.

What to look for around EUR

EUR/USD came under renewed and unexpected downside pressure following the ECB gathering on Thursday.

The resumption of the selling bias came in response to accelerated inflows into the greenback, particularly exacerbated after the ECB sounded less hawkish than expected at its meeting, despite confirming a rate hike next month as well as the end of the net asset purchases under the APP.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is losing 0.12% at 1.0601 and a breach of 1.0590 (monthly low June 10) would target 1.0532 (low May 20) en route to 1.0459 (low May 18). On the other hand, immediate up barrier emerges at 1.0786 (monthly high May 30) seconded by 1.0925 (100-day SMA) and finally 1.0936 (weekly high April 21).

- USD/CAD scaled higher for the third straight day and shot to a fresh two-week high on Friday.

- Softer oil prices undermined the loonie and extended support, despite subdued USD demand.

- Traders await the US CPI report and Canadian monthly jobs data for a fresh directional impetus.

The USD/CAD pair built on the previous day's strong move-up and gained some follow-through traction for the third successive day on Friday. The momentum lifted spot prices to a fresh two-week high, around the 1.2720-1.2725 region during the first half of the European session.

The new mini-lockdown in Shanghai - China’s biggest city and a global financial hub - renewed worries about fuel demand and dragged crude oil prices away from a three-month high touched on Wednesday. This, in turn, undermined the commodity-linked loonie and was seen as a key factor that assisted the USD/CAD pair to prolong this week's goodish rebound from its lowest level since April 21.

On the other hand, the US dollar was seen consolidating near a three-week top and failed to provide any meaningful impetus to the USD/CAD pair. That said, elevated US Treasury bond yields, along with the prevalent cautious market mood, acted as a tailwind for the safe-haven buck. The yield on the benchmark 10-year US government bond held steady above 3.0% amid hawkish Fed expectations.

Investors remain concerned that the global supply chain disruption caused by the Russia-Ukraine war and COVID-19 restriction in China would push consumer prices even higher. This might force the US central bank to tighten its monetary policy at a faster pace, which remained supportive of the recent runup in the US bond yields. Hence, the focus will remain on the US consumer inflation figures.

The crucial US CPI report should play a key role in determining the Fed's policy tightening path and influence the near-term USD price dynamics. Investors will also take cues from the simultaneous release of the monthly Canadian employment details later during the early North American session. Apart from this, oil price dynamics would provide a fresh directional impetus to the USD/CAD pair.

Technical levels to watch

Keeping prices in check will be an uphill battle if there is hesitation in tackling record euro-zone inflation, Bloomberg reported, citing comments from European Central Bank (ECB) Governing Council member Madis Muller noted in a blog post on Friday.

Key quotes

“Inflation is spreading from energy to other goods and services, with Russia’s war in Ukraine driving up food and raw-materials costs.”

“Loose ECB monetary policy is largely not to blame for elevated inflation, and that the full impact of its decisions this week will only be seen in a few years.”

These comments come a day after the ECB pledged to raise interest rates for the first time since 2011 at its July policy meeting.

Market reaction

EUR/USD is uninspired by the latest ECB-speak, turning back in the red near 1.0600.

The results of the Bank of England/ Ipsos latest quarterly survey of public attitudes to inflation showed that they see inflation rising to 4.6% in the next 12 months vs. 4.3% expected in February 2022.

Key takeaways

“Asked about expectations of inflation in the longer term, say in five years’ time, respondents gave a median answer of 3.5%, up from 3.3% in February 2022.”

“By a margin of 66% to 9%, survey respondents believed that the economy would end up weaker rather than stronger if prices started to rise faster, compared with 59% to 7% in February 2022.“

“When asked about the future path of interest rates, 15% said they expected rates to stay about the same over the next twelve months, compared with 16% in February 2022. 70% of respondents expected rates to rise over the next 12 months, up from 65% in February 2022.”

Market reaction

GBP/USD is holding the lower ground, unfazed by the above survey findings. At the press time, cable is trading at 1.2480, losing 0.08% on the day.

Economist at UOB Group Enrico Tanuwidjaja reviews the latest monetary policy meeting by the BoT.

Key Takeaways

“As widely expected, the Bank of Thailand (BOT) kept rates unchanged at its Jun MPC decision today despite soaring inflation in May.”

“BOT kept rates unchanged at 0.50% in order to ensure a steadier recovery as tourism picked up pace, supporting domestic economic recovery.”

“We revise the timing of our forecast for BOT to hike rates by 25bps to 0.75% at its Nov MPC meeting, from previous projection of first lift-off in Jun.”

EUR/USD has failed to stage a meaningful rebound after having lost more than 100 pips on Thursday. The pair stays within a touching distance of 1.06 and a hot inflation report from the US could cause it to suffer additional losses ahead of the weekend, FXStreet’s Eren Sengezer reports.

Sellers could attack 1.06 on hot US inflation data

“The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data. On a yearly basis, the CPI is expected to stay unchanged at 8.3% in May. The Core CPI, which strips volatile food and energy prices, is forecast to decline to 5.9% from 6.2% in April.”

“Stronger-than-expected CPI readings could remind investors of the policy divergence with the Fed and trigger another leg lower in EUR/USD. On the other hand, a soft inflation report should cause investors to book their profits ahead of the weekend and help EUR/USD stage a rebound.”

“In case the pair falls below 1.06 and starts using it as resistance, it could target 1.0570 (Fibonacci 50% retracement of the latest uptrend) and 1.0520 (Fibonacci 61.8% retracement) next.”

“On the upside, 1.0650 (static level) aligns as first resistance ahead of 1.0680 (Fibonacci 23.6% retracement) and 1.07 (psychological level, 100-period SMA).”

See – US CPI Preview: Forecasts from eight major banks, inflation peaked but faces challenges to moderate

- DXY wobbles around the 103.30 region.

- US yields show a mixed performance on Friday.

- Markets’ attention will be on the US CPI release.

The greenback, when tracked by the US Dollar Index (DXY), exchanges gains with losses in the 103.30 region at the end of the week.

US Dollar Index capped by 103.35/40

The index trades in an erratic fashion on Friday following Thursday’s strong advance to the area beyond 103.00 the figure.

Indeed, the intense sell-off in the risk complex gathered extra steam after the ECB did not sound as hawkish as many were expecting at its event on Thursday, lending extra wings to the buck and propelling the index to fresh multi-week highs past the 103.00 yardstick.

In the US cash markets, yields in the belly and the long end of the curve appear to be taking a breather on Friday vs. the continuation of the uptrend in the short end.

In the US data space, it will be all about inflation later in the session with the publication of May’s CPI figures.

What to look for around USD

The index reclaimed the 103.00 mark and beyond after the ECB failed to surprise market participants on Thursday.

The dollar, in the meantime, appears supported in the short term following the resumption of the selling bias in the risk-associated space, while the Fed’s divergence vs. most of its G10 peers coupled with bouts of geopolitical effervescence, higher US yields and a potential “hard landing” of the US economy are all factors still supportive of a stronger dollar in the next months.

Key events in the US this week: Inflation Rate, Flash Consumer Sentiment, Monthly Budget Statement (Friday).

Eminent issues on the back boiler: Powell’s “softish” landing… what does that mean? Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is gaining 0.01% at 103.32 and a break above 103.36 (monthly high June 9) would open the door to 105.00 (2022 high May 13) and finally 105.63 (high December 11 2002). On the other hand, the next contention emerges at 101.75 (55-day SMA) followed by 101.64 (monthly low June 3) and then 101.29 (monthly low May 30).

“Even if we had started with a 50 bps rate hike it might have an effect on credibility but it would have raised expectations of bigger rate rises afterwards, “European Central Bank (ECB) Governing Council member Robert Holzmann said on Friday.

Holzmann added, “financial markets reacted very well to yesterday’s announcement.”

Also read: ECB's Holzmann: September rate hike will be at least 25 basis points

Market reaction

EUR/USD was last seen trading at 1.0615, almost unchanged on the day.

- Silver remained depressed near the weekly low touched the previous day.

- The set-up favours bearish traders and supports prospects for further losses.

- Sustained move beyond the $22.00 mark is needed to negate the bearish bias.

Silver oscillated in a range, just above mid-$21.00s through the first half of the European session and consolidated the previous day's decline to over a one-week low.

Given the recent failures near the 200-period SMA on the 4-hour chart, acceptance below the $22.00 round-figure mark could be seen as a fresh trigger for bearish traders. Moreover, technical indicators on hourly/daily charts are holding in the bearish territory and add credence to the near-term negative outlook for the XAG/USD.

Some follow-through selling below the $21.50-$21.45 area would reaffirm the bearish bias and pave the way for additional losses. The XAG/USD could then fall to the $21.00 mark with some intermediate support near the $21.30 zone. The downward trajectory could get extended towards the YTD low, around the $20.45 region touched on May 13.

On the flip side, any attempted recovery move might now confront stiff resistance near the $21.90-$22.00 support breakpoint. The said region also marks a confluence barrier comprising the 200-period SMA on the 4-hour chart and the $20.46-$22.52 corrective bounce, which should now act as a key pivotal point for short-term traders.

Sustained strength beyond might trigger a short-covering move and lift spot prices back towards the monthly peak, around the mid-$22.00s touched earlier this week. The momentum could then allow bulls to reclaim the $23.00 round-figure mark and lift the XAG/USD further towards the next relevant hurdle near the $23.30 region.

Silver 4-hour chart

-637904474303309920.png)

Key levels to watch

Following the meeting between the Japanese financial authorities, the country’s top currency diplomat Masato Kanda said that he “cannot disclose what was discussed.”

But he said that “we will take appropriate action if needed,” adding that “there are various options in mind.”

Earlier this Friday, the Bank of Japan (BOJ), the Ministry of Finance (MOF) and the Financial Services Authority (FSA) released a joint statement after their high-level talks.

Key takeaways

It is important for currency market to move stably reflecting fundamentals

Rapid swings are undesirable.

Rapid yen weakening is seen recently in the currency market, concerned about it.

Government, BOJ will watch closely moves in the currency market.

Will watch for impact on the economy and prices with a sense of urgency.

Will respond appropriately as needed in the currency market based on G7 agreement.

Market reaction

Japanese verbal intervention combined with a pause in the US dollar advance has dragged USD/JPY sharply lower.

The pair is now trading 0.46% lower at 133.70.

According to FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang, USD/CNH could now attempt a move to the 6.7440 region in the next weeks.

Key Quotes