- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 08-06-2022.

- US Dollar Index struggles to extend latest recovery inside a bearish chart pattern.

- Bearish RSI divergence, pullbacks from 200-SMA also keep sellers hopeful.

- Bulls need validation from 103.00, downside break of 102.00 confirms rising wedge.

US Dollar Index (DXY) fades upside momentum inside a rising wedge bearish formation during Thursday’s Asian session. In doing so, the greenback gauge dribbles around 102.55, following the previous day’s bounce off the 50% Fibonacci retracement (Fibo.) of April-May upside.

In addition to the rising wedge, the quote’s multiple failures to cross the 200-SMA since late May joins the bearish RSI divergence to tease the sellers. It’s worth noting that the higher high in prices contrasts with the lower high in RSI (14) to portray the bearish divergence.

That said, the quote’s pullback moves remain elusive until it stays beyond the 50% Fibonacci retracement level of 102.30.

Also acting as the key downside hurdle is the confluence of the 50-SMA and the stated wedge’s support line, close to 102.00.

In a case where the US Dollar Index drops below 102.00, the odds of its south-run to May’s bottom surrounding 101.30 can’t be ruled out.

Alternatively, the 200-SMA and the wedge’s resistance line challenge recovery moves around 102.85.

Following that, the 103.00 threshold appears to challenge the DXY bulls before directing them towards April’s peak of 103.94.

DXY: Four-hour chart

Trend: Pullback expected

- AUD/JPY is expected to extend gains on RBA-BOJ policy divergence.

- The BOJ has restricted its yields to 0.25 to keep up the ultra-loose monetary policy.

- RBA’s 50 bps rate hike announcement may shrink its employment generation ability further.

The AUD/JPY pair is scaling firmly higher towards the round-level resistance of 97.00 on broad weakness in the Japanese yen. The risk barometer is expected to continue its three-day winning streak after overstepping Wednesday’s high at 96.88.

A divergence in the approach of the Bank of Japan (BOJ)’s monetary policy with its respective G-10 peers has brought an intense sell-off in yen. A gradual downside move in Tokyo was lucrative in fetching more business opportunities, however, investors are dumping yen, which has raised concerns. The ideology of restricting the 10-year benchmark Japanese yields at 0.25% is denting the yen’s demand.

It is worth noting that the Japanese economy has achieved the desired 2% inflation target. However, the context is boosted by higher oil prices rather than a broad-based recovery in the aggregate demand.

Meanwhile, the aussie has been underpinned amid a rate hike announcement by the Reserve Bank of Australia (RBA) on Wednesday. The RBA unexpectedly elevated its Official Cash Rate (OCR) by 50 basis points (bps), double the consensus of 25 bps. No wonder, the galloping price pressures forced the RBA to feature a jumbo rate hike but vulnerable employment opportunities may get dented further as the quantitative tightening will lose up the labor market. To be noted, the Australian economy added only 4k jobs in May, significantly lower than the expectations of 30k.

- During the week, the USD/JPY is recording gains of almost 3%.

- A risk-off market mood has not been an excuse for the buck to keep trending higher, underpinned by elevated US Treasury yields.

- USD/JPY Price Forecast: To consolidate before resuming upwards.

The Japanese yen continues weakening against the greenback as USD buyers mount against the weakest currency in the G10, also weighed by higher US Treasury yields, widening the bond spread between both countries. At 134.42, the USD/JPY lurks at the 135.00 psychological level, which analysts and former Japanese policymakers mentioned could trigger intervention in the Forex market.

At the time of writing, the US 10-year Treasury yield sits at 3.00%, flat in the day. Meanwhile, the US Dollar Index, a gauge of the greenback’s value, rises 0.21%, currently at 102.545, a tailwind for the USD/JPY.

Sentiment-wise, Asian equity futures are mixed, with Japanese and Australian stock exchanges ready to open with losses. Chinese markets are poised for a higher open. Concerns about central banks tightening monetary policy might spur an economic slowdown loom.

On Wednesday, the USD/JPY opened near the session’s lows around 132.50 and rallied nonstop until the North American open, when it dipped towards 133.60, before resuming above 134.00.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart depicts the pair as upward biased, despite the parabolic upward move, from 126.86 to 134.40s, reaching a 20-year high. However, USD/JPY traders need to be aware that the last leg-up was printed on weaker momentum, as the Relative Strength Index (RSI) begins to show a negative divergence between the major’s price action and the oscillator. Therefore, the USD/JPY might pull back before resuming the uptrend.

That said, the USD/JPY first support would be the psychological 134.00 mark. Break below would expose the June 8 low at 132.54, followed by the May 9 high at 131.34.

Key Technical Levels

- AUD/USD remains pressured, eyes the first weekly loss in four.

- US dollar benefits from concerns that higher inflation, faster monetary policy normalization to take a toll on economic growth.

- RBA’s rate hike, China’s post-covid unlock fail to impress bulls amid chatters over Fed’s moves, US CPI.

- China trade numbers for May to offer immediate directions ahead of ECB, US CPI.

AUD/USD holds lower ground near 0.7190, keeping the previous day’s losses in a tight range, as sour sentiment joins anxiety ahead of China’s trade numbers. Also exerting downside pressure on the Aussie pair are the recent losses on Wall Street and gold’s failures to impress bulls, not to forget broad US dollar strength.

That said, the Wall Street benchmarks snapped a two-day rebound and the US Dollar Index (DXY) regained upside momentum as it closed with 0.21% daily gains around 102.55 on Wednesday, after retreating from 102.77. Further portraying the risk-off mood is the 5.3 basis points (bps) of an addition to the US 10-year Treasury yields, to 3.027%.

The risk-aversion wave got appreciation after White House spokeswoman Karine Jean-Pierre said they expect the inflation numbers to be released at the end of the week to be elevated. Also supporting the forecasts are the recently firmer US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data. That said, the inflation precursor stays firmer around the one-month high of late.

On the same line, the Organisation for Economic Co-operation and Development (OECD) cuts the global growth outlook for 2022 while World Bank (WB) President David Malpass warned that faster-than-expected tightening could recall a debt crisis similar to the one seen in the 1980s.

It should be noted that the Reserve Bank of Australia’s (RBA) surprise 50 bps rate hike and China’s gradual economic transition after the covid-led lockdowns appear to fall short of convincing the AUD/USD pair buyers ahead of this week’s key data/events.

Among them, today’s China Trade Balance, Imports and Exports for May will be the first to direct the Aussie pair ahead of Friday’s inflation numbers from China and the US. Also important will be today’s monetary policy decision from the European Central Bank (ECB), due to its direct impact on the US dollar and the market sentiment.

Although likely improvement in China’s trade numbers may probe the AUD/USD bears, sour sentiment may keep exerting downside pressure on the risk barometer pair.

Technical analysis

AUD/USD fades bounce off yearly low marked in May amid a failure to cross the 200-DMA, around 0.7255 by the press time. The anticipated pullback moves, however, will need validation from the 21-DMA level surrounding 0.7100.

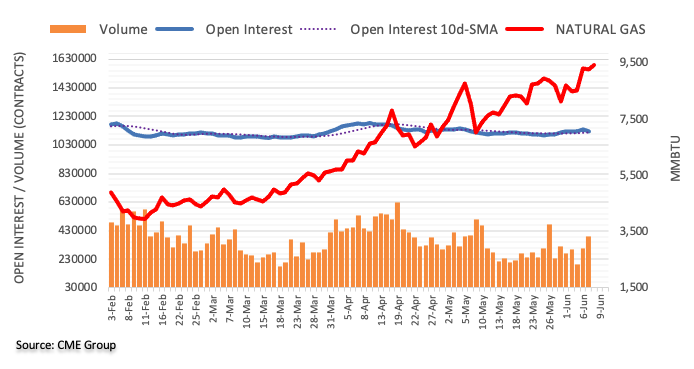

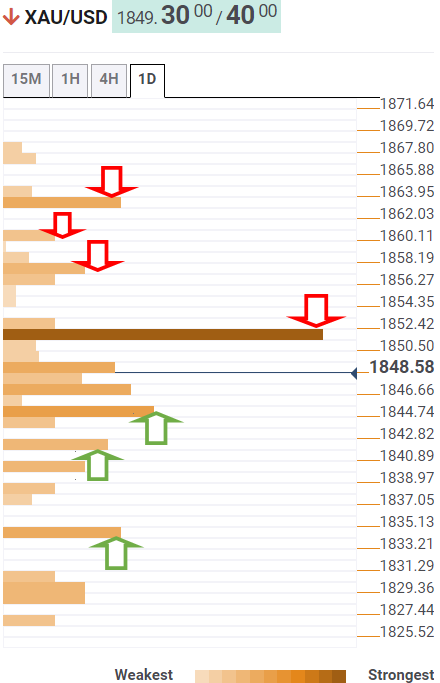

- Gold price has defended the crucial support of $1,850.00 but is still inside the woods.

- Sustenance of the US inflation above 8% will bolster the odds of a bumper rate hike by the Fed.

- The precious metal is expected to remain sideways on Ascending Triangle formation.

Gold price (XAU/USD) is bided strongly below the critical support of $1,850.00 as the US dollar index (DXY) is displaying back and forth moves. The precious metal witnessed barricades while attempting a break above $1,860.00 and slipped lower to $1,849.11.

The market participants need to understand the fact that trading sessions before a principal event bring wild moves in the respective counters. The investing community is awaiting the release of the US Consumer Price Index (CPI), which is due on Friday. Therefore, wild swings cannot be ruled out.

The US inflation is seen as stable at 8.3% on annual basis. The Federal Reserve (Fed) is featuring quantitative restricting measures for a longer period but is still far from achieving the desired outcome. The central bank has already announced two rate hikes by 25 basis points (bps) in March and 50 bps in May. Considering the galloping price pressures and upbeat employment data, which were released last week, a jumbo rate hike by the Fed looks real.

Gold technical analysis

On an hourly scale, the gold price is continued to trade in an Ascending Triangle whose upward sloping trendline is placed from May 16 low at $1,786.94 while the horizontal resistance is plotted from May 24 high at $1,869.69. The 50-period Exponential Moving Average (EMA) at $1,851.36 is overlapping with the gold prices, which signals a consolidation ahead. Meanwhile, the Relative Strength Index (RSI) (14) has faced a hurdle around 60.00 and has shifted back into the 40.00-60.00, which signals a continuation of a consolidation phase.

Gold hourly chart

- USD/CAD fades bounce off seven-week low, stays on the way to fifth weekly loss.

- Fears of faster monetary policy normalization to weigh on economic growth underpin US dollar gains ahead of Friday’s inflation data.

- Oil prices cheer China’s gradual recovery from covid, geopolitical concerns.

- OECD cuts global economic forecasts to challenge the market sentiment and probe pair bears.

USD/CAD teases a return to the bear’s area, after a brief journey with buyers, as the quote eases back towards the seven-week low during the inactive Asian session on Thursday. That said, the Loonie pair fades the previous day’s bounce off the multiday low of 1.2517, printing mild losses around 1.2550 by the press time.

The quote’s latest weakness could be linked to the recently steady US dollar and firmer prices of Canada’s key export item, namely the WTI crude oil.

That said, the black gold stays firmer around a three-month high amid hopes of more energy demand due to China’s unlocks of the covid-led activity restrictions. Also favoring the energy benchmark is the drawdown of crude in the Strategic Petroleum Reserve (SPR) and the Russia-Ukraine crisis. “US commercial crude oil inventories rose unexpectedly last week, while crude in the Strategic Petroleum Reserve fell by a record amount as refiners ramped up production to pre-pandemic levels, the Energy Information Administration said on Wednesday,” said Reuters.

On the other hand, the US Dollar Index (DXY) regained upside momentum as it closed with 0.21% daily gains around 102.55 on Wednesday, after retreating from 102.77. The greenback’s gains could be linked to the broad fears concerning growth and inflation.

The market pessimism gained momentum after White House spokeswoman Karine Jean-Pierre said they expect the inflation numbers to be released at the end of the week to be elevated. Also supporting the forecasts are the recently firmer US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data. That said, the inflation precursor stays firmer around the one-month high of late.

On the same line, the Organisation for Economic Co-operation and Development (OECD) cuts the global growth outlook for 2022 while World Bank (WB) President David Malpass warned that faster-than-expected tightening could recall a debt crisis similar to the one seen in the 1980s.

Amid these plays, the Wall Street benchmarks snapped a two-day rebound whereas the US 10-year Treasury yields rose 5.3 bps to 3.027%.

Looking forward, today’s monetary policy decision from the European Central Bank (ECB) appears the key event for markets, as well as for the USD/CAD traders due to its impact on the US dollar. However, major attention will be given to Friday’s US Consumer Price Index (CPI) for May and the Canadian employment report. That said, hawkish expectations from the ECB challenge the recent US dollar gains.

Technical analysis

Unless providing a daily closing beyond the monthly resistance line, around 1.2570 by the press time, USD/CAD prices are on the way to testing the late April swing low near 1.2460.

- The shared currency is registering gains of 3% in the week vs. the yen.

- Risk-aversion and ECB’s meeting to keep the pair in choppy trading.

- ECB Preview: Forecasts from eight major banks, ready for lift-off.

- EUR/JPY Price Forecast: A break above 144.14 to open the door towards 147.00s.

The shared currency moves to seven-year-highs around 144.25, spurred by a weaker Japanese yen, tumbling against most G8 currencies. At the time of writing, the EUR/JPY is trading at 143.84, recording minimal gains of 0.01% as the Asian Pacific session begins.

Risk-aversion and ECB’s meeting to keep the pair in choppy trading

Sentiment remains negative on concerns that central banks hiking rates will weigh on the economic growth. Reflecting that, are US equities snapping two days of gains. Asian equity futures fluctuate, reflecting a mixed mood, while EUR/JPY traders brace for the European Central Bank (ECB) monetary policy meeting on Thursday.

The European Central Bank (ECB) is set to announce the end of its APP program, though it would keep rates unchanged. Market players expect Mrs. Lagarde and Co. to lay the ground for a July lift-off while finishing the Quantitative Easing.

Still, investors’ only doubt is if the ECB would guide the markets regarding the pace of rate increases, as some ECB Governing Council (GC) members leaned toward 50 bps hikes, except for Mrs. Lagarde and the ECB’s Chief Economist Philip Lane.

In the meantime, money market futures have priced in around 132 bps of tightening this year, which would imply 25 bps hikes at the three of the four meetings after June, with one meeting expected to see a 50 bps rate raise.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY weekly chart depicts the cross-currency as upward biased, though it is about to face solid resistance, at around 144.16, January’s 2015 highs. It’s worth noting that the Relative Strength Index (RSI) just reached overbought conditions at 71, which means that the EUR/JPY might consolidate before resuming the uptrend.

Nevertheless, if the EUR/JPY aims higher, the first resistance would be 144.16. A breach of the latter would expose December 29, 2014, high at 147.22, followed by December 15, 2014, high at 148.23, and December 8, 2014, daily high near 149.78

- EUR/USD bears are lurking below a critical resistance.

- A break of 4-hour support could open the risk of a significant correction.

EUR/USD is displaying a bearish bias on the weekly chart which can be analysed on a lower time frame for prospects of a deeper correction in the days ahead. The following illustrates the market structure on a multi-timeframe basis:

EUR/USD weekly chart

This is a powerful reversion pattern and a move in to test the old support, or the nose of the W-formation, is a high probability.

EUR/USD lower time frames, H1 & H4

On the lower time frames is where the current market structure and the potential distribution schematic that can be analysed for a bearish trade set-up

A line chart shows the weekly W pattern more clearly:

H4 charts

Where there is less noise on the four-hour chart, zooming in on the near-term price action and structure, we can see an M-formation has developed. There are prospects of either some sideways consolidation between resistance and support before a breakout to the downside if we do not get that beforehand.

- Silver prices remain depressed below one-week-old descending trend line despite repeated bounces off 100-SMA.

- Sluggish RSI, MACD hints at the continuation of a slow grind to the south.

- 200-SMA adds to the upside filter, monthly low lures bears.

Silver Price (XAG/USD) holds lower ground near $22.00 during Thursday’s initial Asian session, following the biggest daily loss of the week.

In doing so, the bright metal approaches a short-term key support line while consolidating the weekly gains.

Also supporting the gradual weakness is the recently steady RSI (14), as well as sluggish MACD.

On breaking the aforementioned one-month-old support line, near $21.90 by the press time, the XAG/USD prices could drop towards the monthly low surrounding $21.40.

Following that, the 61.8% Fibonacci retracement of the May 13 to June 06 upside, around $21.25, will gain the market’s attention ahead of directing silver sellers towards the $21.00 threshold.

Meanwhile, the 200-SMA and a weekly resistance line restrict short-term upside moves of the silver prices, respectively around $22.15 and $22.20.

Also acting as an upside filter is the monthly peak of $22.51, a break of which could quickly propel the quote towards May’s top near $23.30.

Silver: Four-hour chart

Trend: Further weakness expected

- USD/CHF is advancing towards 0.9800 on a souring market mood.

- A higher seen US inflation event has trimmed the advocacy for the risk-sensitive currencies.

- A stable jobless rate has failed to cheer the Swiss franc bulls.

The USD/CHF pair has witnessed a firmer rebound at open from 0.9768 and is advancing towards the round-level resistance of 0.9800 on negative market sentiment. Uncertainty over the release of the US Consumer Price Index (CPI) on Friday has underpinned the risk-off impulse, which has improved the safe-haven’s appeal.

The annual US inflation is seen unchanged at 8.3% while the core CPI may slip to 5.9% against the prior print of 6.2%. Rising price pressures are tackled by restricted quantitative measures. The Federal Reserve (Fed) has already raised its interest rates by 25 basis points (bps) and 50 bps in March and May respectively. However, a minimal effect has been recorded on price pressures post the rate hike announcements. Adaptation of quick pace in quantitative tightening will trim the demand forecasts significantly, which has already shifted the risk-perceived assets on the tenterhooks.

Meanwhile, the US dollar index (DXY) has turned sideways in a 102.27-102.78 range ahead of the US inflation. Next week, the mega event of monetary policy announcement by the Fed will keep the DXY in the grip of bulls. As expected, the outcome of higher inflation will be joined by the upbeat US Nonfarm Payrolls (NFP) and will bolster the odds of a consecutive 50 bps rate hike announcement by the Fed.

On the Swiss franc front, stability in the jobless rate has failed to cheer the market participants. The Swiss State Secretariat of Economic Affairs has reported the Unemployment Rate at 2.2%. It looks like the Swiss franc bulls are not reacting much to the domestic data and are being guided by the US inflation event.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, regain upside momentum after a pullback from the highest levels since early May. With this, the inflation gauge remains around the highest levels since early May, at 2.75% by the end of Wednesday’s North American session.

The inflation gauge becomes more important considering this week’s US Consumer Price Index (CPI) for May, as well as an absence of the Fed policymakers’ speeches, due to the pre-Fed blackout norm.

Further increasing the importance of the precursor were the latest comments from White House spokeswoman Karine Jean-Pierre. The Diplomat said they expect the inflation numbers to be released at the end of the week to be elevated.

The inflation forecasts are also gaining momentum of late higher inflation pushes the global central bankers toward the faster monetary policy normalization amid fears of recession. Earlier in the week, World Bank (WB) President David Malpass warned that faster-than-expected tightening could push some countries into a debt crisis similar to the one seen in the 1980s.

Read: US economy slouches toward recession

- The 50- and 200-EMAs have turned sideways therefore a rangebound move cannot be ruled out.

- A Symmetrical Triangle formation signals a slippage in standard deviation, followed by an expansion in the same.

- Investors should brace for a rangebound move as the RSI (14) has shifted into a 40.00-60.00 range.

The AUD/USD pair is displaying topsy-turvy moves in a narrow range of 0.7187-0.7200. The unavailability of any potential trigger has turned the asset sideways. This week, the asset has auctioned in a range of 0.7157-0.7240, and a similar movement is expected further amid volatility contraction.

On an hourly scale, the asset is trading in a Symmetrical Triangle pattern that signals a slippage in volatility, followed by a breakout in the same. The ascending trendline of the above-mentioned chart pattern is placed from June 2 low at 0.7140 while the downward sloping trendline is plotted from Friday’s high at 0.7283.

The 50- and 200-period Exponential Moving Averages (EMAs) at 0.720 and 0.7187 respectively have turned flat, which signals a consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00 range, which bolsters the odds of a rangebound move ahead.

Should the asset oversteps June’s high at 0.7283, it will trigger the upside break of a Symmetrical Triangle, which will infuse fresh blood into the aussie bulls for an upside move towards the April 19 low at 0.7343, followed by the round-level resistance at 0.7400.

Alternatively, aussie bulls can lose their grip if the asset drops below June 2 low at 0.7140, which will drag the asset towards May 26 high at 0.7110. Breach of the latter will expose the asset to more downside towards May 18 high at 0.7048.

AUD/USD hourly chart

-637903211588562903.png)

- The GBP/JPY is registering weekly gains of almost 3%.

- Japanese yen weakness sounds the alarm of a possible intervention in the FX market.

- GBP/JPY traders need to know how the USD/JPY behaves around 135.00.

- GBP/JPY Price Forecast: Remains upward biased, and a break above 169.00 would open the door for 170.00; otherwise, a pullback towards 164.00s is on the cards.

The GBP/JPY soars to fresh six-year highs, despite a risk-off market mood, courtesy of the Bank of Japan’s (BoJ) pledging to keep its ultra-loose monetary policy posture, which also maintains the USD/JPY under pressure, reaching fresh 20-year highs. At the time of writing, the GBP/JPY is trading at 168.24, up almost 1%.

The Japanese yen would be under heavy pressure on Thursday. The USD/JPY is approaching the 135.00 mark, a price level mentioned by former Japanese officials as a line of the sand that could trigger an intervention by the Japanese Ministry of Finance in the Forex market.

Hiroshi Watanabe, a former currency chief in the Ministry of Finance until 2007, said that “Even 130, 135 is not so critically bad for the Japanese economy,” via Bloomberg. However, Watanabe added, “how long it’s going to stay there is quite important.”

In the meantime, Asian equity futures are mixed, carrying on Wall Street’s sentiment, with US stocks recording hefty losses.

Meanwhile, GBP/JPY Wednesday’s price action opened around 166.80s, and rallied steadily towards 168.50s, recording minor pullbacks on its way up,

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY had skyrocketed since May 25, when the cross soared 0.72%, beginning its 1024 pip rally towards printing a 7-year high above 168.50. It’s worth noting that the pair’s bias remains upward, but due to the steepness move of the cross and the Relative Strength Index (RSI) in overbought territory, it might pave the way for a pullback.

If the GBP/JPY heads for a pullback, the cross-currency first support would be June 8 daily low at 166.82. A breach of the latter would expose the 23.6% Fibonacci retracement at 165.49, followed by the 38.2% Fibonacci retracement at 163.62. On the other hand, if the GBP/JPY aims higher, the first resistance would be the 169.00 figure. A break above would expose February’s 2016 swing highs around 170.63. Once cleared, a GBP/JPYrally towards 175.01 is on the cards.

Key Technical Levels

- NZD/USD is meeting a key resistance area that is holding ahead of the ECB.

- The bias will be on the downside for the forseeible future for a potential lower low.

At 0.6445, NZD/USD has been in the hands of the bears mid-week and falling within the 0.64 area back towards the lows of the bearish daily cycle that began at the end of May when the bulls were capped on the last trading day of the month at 0.6563.

The commodity complex has struggled in June as investors were the complications of rising inflation, hawkish central banks, and dire geopolitics global growth prospects.

On Wednesday, equity markets traded slightly weaker in a familiar sour tone ahead of tonight’s European Central Bank meeting and key US events at the end of this week. The Federal Reserve is also just around the corner making for a nervous time in financial markets. The US 10-year auction hit a high yield of 3.03% on Wednesday, up from the 2.943% high in the previous auction. We have seen a subsequent rally in US yields and the 10-year now stands 1.54% higher on the day, supporting the greenback, and weighing on US stocks.

ECB in focus

''Both central banks will update their macroeconomic projections, and we expect that inflation forecasts will be raised, interest rate projections raised, and GDP forecasts cut,'' analysts at ANZ bank said in a note on Thursday morning. ''That is not a good combination for financial markets, and investors are likely to remain defensive as a result. We expect the ECB will err on the side of hawkishness as President Lagarde conveys the central bank’s determination to safeguard price stability. While she favors a gradual approach to normalizing policy, she cannot completely rule out the need for 50bps rate rises as the headline and core inflation pressures continue to intensify.''

As for the Reserve Bank of New Zealand, it has recently announced the balance sheet reduction plans whereby it will begin to sell its holdings of NZGBs from July 2022 and will sell NZD5bn per year in order of the maturity date. It will also sell until its holdings are reduced to zero.

NZD/USD techncial analysis

Meanwhile, from a technical standpoint, the price was meeting a key resistance area that is holding, so the bias will be on the downside for the foreseeable future for a potential lower low within the broader weekly bear trend:

What you need to take care of on Thursday, June 9:

Trading was choppy across the FX board, with most major pairs holding on to familiar levels, except for the USD/JPY pair, which surged to a fresh 20-year high of 134.47. The imbalance between the US Federal Reserve and the Bank of Japan boosted the pair as the BOJ reaffirmed its decision to maintain the ultra-loose monetary policy.

The American dollar suffered early in the US session as government bond yields eased, later recovering some ground amid falling US equities. Wall Street accelerated its decline in the final hours of trading after White House spokeswoman Karine Jean-Pierre said they expect the inflation numbers to be released at the end of week to be elevated.

The EUR/USD pair trades around 1.0710, while GBP/USD stands at 1.2540. The best performer was the Canadian dollar, as crude oil prices soared. The USD/CAD pair trades at around 1.2550 as WTI surged beyond $122.00 a barrel. AUD/USD gave up and settled just below 0.7200.

Gold advanced for a second consecutive day, but gains were tepid. The bright metal is currently changing hands at $1,853 a troy ounce.

On Thursday, the focus will be on the European Central Bank. The ECB is set to announce the end of its stimulus program and keep key rates unchanged while hinting at a July lift-off, actually two steps behind most major central banks. European policymakers have been hinting at a 50 bps rate hike, but President Christine Lagarde inclines for a conservative 25 bps hike. Markets are choppy ahead of the event and ahead of fresh US inflation figures.

Bitcoin Price Prediction: BTC sets sight on $34,000

Like this article? Help us with some feedback by answering this survey:

- The gold price is correcting towards an hourly W-formation's support structure.

- Bulls are starting to move in the following break of the 38.2% Fibo.

At $1,853, the gold price has stuck to a tight range on Wednesday despite some higher volatility in the forex space during the US session. Bulls have been trying to move in on-resistance but are being pushed back by a rally in US yields and the US dollar. Consequently, gold is pulling back on the hourly chart into a potential support area close to a 50% retracement of Wednesday's hourly rally from $1,844.59 lows.

the US 10-year auction hit a high yield of 3.03% on Wednesday, up from the 2.943% high in the previous auction. We have seen a subsequent rally in US yields and the 10-year now stands 1.54% higher on the day, supporting the greenback, and weighing on US stocks and gold in a familiar synergy between the asset classes as the comparative daily chart illustrates below:

Meanwhile, traders will look ahead to key macro events later this week. These will include the European Central Bank tomorrow, Thursday, and US inflation data Friday.

''Core prices likely stayed strong in May, with the series registering a second consecutive 0.5% MoM increase. A drag on inflation recently, we now expect used vehicle prices to be a contributor, advancing for the first time in four months,'' analysts at TD Securities explained. ''We also look for continued momentum in airfares and shelter inflation. Our m/m forecasts imply 8.4%/5.9% YoY for total/core prices.''

As for the ECB, the analysts said unless the governor, Christine Lagarde, ''commits to a series of 50s, EUR/USD has limited room to gain, particularly with the Euribor curve trading where it is and US CPI due the next day. Risk/reward more favorable for EURUSD to trade lower. Long-term inflation forecast will be key.''

In turn, this could keep the US dollar elevated into the US inflation data on Friday and hold the yellow metal back within familiar sideways ranges. However, much will depend on the tone of the ECB. The analysts at TDS also argued that the ECB will ''announce that the APP will end within weeks, and send a strong signal that rate hikes are coming in July and September (October remains a more interesting meeting in this sense). Forecasts will show stronger inflation and weaker growth, highlighting the ECB's challenge going forward.''

Consequently gold could be attractive for its haven qualities. The weakening economic backdrop has enabled the precious metal to find some support from investors. The precious metal has recently pushed above $1,850, despite a stronger USD.

Gold technical analysis

The price is correcting towards the W-formation's support structures and through the Fibonacci retracement scale. Bulls are starting to move in following a break of the 38.2% Fibo but there is still some way to go until the bullish impulse's price imbalance from near the 50% mean reversion level is mitigated. This leaves prospects of a deeper correction, potentially as far as the 61.8% Fibo.

- Sterling clings to weekly gains of 0.42% amidst political turmoil and Brexit jitters.

- A risk-off mood, and high US bond yields, boosted the greenback and weighed on the GBP.

- GBP/USD Price Forecast: Still neutral-downwards, though a daily close below 1.2500 will send the pair tumbling towards 1.2400.

The GBP/USD remains in a consolidation phase, within the 1.2450-1.2670 area, below the 50-day moving average (DMA) at 1.2676, for the eighth consecutive trading day, as risk-aversion increased demand for the greenback. At 1.2539, the GBP/USD reflects the aforementioned in the New York session.

Risk-aversion and elevated US Treasury yields weighed on the GBP

Wall Street’s preparing to finish the day with losses as high US Treasury yields weigh on stocks. Also, underpin the greenback, as the US Dollar Index records gains of 0.18%, sitting at 102.517. In the bond market, the US 10-year T-note rate is rising five basis points, sitting at 3.029%. So, the leading causes of the GBP falling are those mentioned above, alongside UK’s ongoing economic slowdown, as the Bank of England (BoE) gets ready for another rate hike, despite the stagflation scenario.

On Wednesday, the GBP/USD achieved to open near the session’s highs, at 1.2597. Nevertheless, since the beginning of the trading day, the pound dipped towards the daily lows at around 1.2513, followed by a jump towards the 200-hour simple moving average (SMA) at 1.2565. Late in the New York session, cable settled at around the daily pivot, 1.2540s.

In the meantime, the OECD slashed the global economic outlook for 2022 and 2023. The organization expects the worldwide economy to grow 3.0% YoY in 2022, lower than the 4.5% estimated. Previous expectations were at 3.2% for 2023, though the OECD expects growth to hit 2.8% yearly.

The UK economic docket will feature no tier 1 economic data in the week ahead. Contrarily, the US calendar will unveil Initial Jobless Claims, the consumer inflation report, and the UoM consumer sentiment.

GBP/USD Price Forecast: Technical outlook

Despite the ongoing correction, which lifted the major from year-to-date lows at 1.2155 towards 1.2670s, the Sterling remains neutral-downward biased. Further confirming the previously mentioned is the Relative Strenght Index (RSI), at 48.76, even though in bearish territory, lacks the impetus to drag the GBP/USD lower.

In the near term, the GBP/USD’s first resistance would be the 50-day moving average (DMA) at 1.2675. On the other hand, the GBP/USD’s first demand zone would be 1.2500, followed by the June 7 swing low at 1.2430, followed by the 1.2400 figure.

- EUR/USD bulls are being beaten back as US yields pop.

- The focus will soon turn back to the ECB.

At 1.0720, EUR/USD is 0.2% higher on the day so far. The price has travelled up from a low of 1.0671 to reach a high of 1.0748 so far. However, the bears are moving in following the US 10-year auction that hit a high yield of 3.03% on Wednesday, up from the 2.943% high in the previous auction.

We have seen a subsequent rally in US yields and the 10-year now stands 1.54% higher on the day, supporting the greenback ahead of key macro events later this week. These will include the European Central Bank tomorrow, Thursday, and US inflation data Friday.

Meanwhile, the US dollar has caught a bid on the auction and rising yield, and the DXY index that measures the greenback vs.a basket of major rivals is currently up 0.17% to 102.50. The DXY has been trading between the lows and highs of the day, 102.269/102.776. US equities are also sinking in midday trade which tends to favour the greenback as follows:

(S&P 500 vs DXY daily chart)

ECB in focus

In a strongly-foreshadowed decision, analysts at TD Securities expect ''the ECB to announce that the APP will end within weeks, and send a strong signal that rate hikes are coming in July and September (October remains a more interesting meeting in this sense). Forecasts will show stronger inflation and weaker growth, highlighting the ECB's challenge going forward.''

Meanwhile, analysts at ABN Amro said ''we expect economic growth to slow considerably to clearly below trend rates from early next year. The economy has a number of cushions in the near term, such as continued post-Covid recovery in the services sector, significant household excess savings and unsatisfied demand for everything from industrial orders to employees.''

''However, these cushions will likely deflate next year, just as the impact of monetary tightening in the eurozone and globally feeds through. At the same time, the policy rate by then would be closer to more normal levels.''

As for trading the ECB, the analysts at TD Securities said ''unless Lagarde commits to a series of 50s, EUR/USD has limited room to gain, particularly with the euribor curve trading where it is and US CPI due the next day. Risk/reward more favourable for EURUSD to trade lower. Long-term inflation forecast will be key.''

- USD/CAD correcting the latest thrust to the downside from the channel lows.

- Bears are otherwise seeking to mitigate until 1.2458 which could be exploited.

At 1.2552, USD/CAD is higher by some 0.2% at the time of writing, recovering from fresh cycle lows posted earlier in the day of 1.2517 as the US dollar emerges as the top performer again vs commodity-FX for the US session so far.

DXY is up 0.17% to 102.50, trading between the lows and highs of the day, 102.269/102.776. US equities are sinking in midday trade and the US 1-year auction hit a high yield of 3.03% on Wednesday, up from the 2.943% high in the previous auction. We have seen a subsequent rally in US yields and the 10-year now stands 1.54% higher on the day, supporting the greenback ahead of key macro events, that include the European Central Bank, US inflation data Friday and Canadian central bank updates and jobs data.

Canada's employment report for May could help guide expectations for the pace of Bank of Canada interest rate hikes. However, the main focus will very much stay with this theme for the end of the week with the BoC's Financial Stability Report which is expected to shine a light on risks and vulnerabilities to the financial system. Analysts at TD Securities said that they ''do not expect any implications for the near-term policy outlook.''

''We will be watching for any new detail on high-leverage borrowers or mortgage delinquencies, but expect an overall message that the financial system remains resilient amid a rising interest rate environment.''

We'll also hear from Governor Macklem on Thursday. Last week, the BoC hiked its benchmark rate by half a percentage point for a second straight time to tackle soaring inflation. in this regard, Reuters reported that ''prices in Canada are rising at their quickest pace in 31 years, but that is not yet feeding into a wage spiral, Canada's budgetary watchdog said on Tuesday, with inflation still expected to return to target in coming years.''

USD/CAD technical analysis

The price is correcting the latest thrust to the downside from the channel lows. However, there is still a price imbalance that the bears are seeking to mitigate until April 21 lows, 1.2458, which could be exploited. With that being said, the price is headed towards a long term support area. Should the bulls commit to the correction, a break of resistance and if the 61.8% Fibonacci fails to draw in supply, then there will be prospects of a deeper correction towards 1.26 the figure and possibly beyond.

- The Australian dollar extends its losses vs. the greenback, down by 0.12%.

- The RBA’s unexpected 0.50% rate hike lifted the major; a negative sentiment erased the AUD/USD gains.

- Investors’ focus turns to the US CPI and UoM Consumer Sentiment data.

- AUD/USD Price Forecast: A daily close below 0.7200 might send the pair tumbling towards 0.7100.

The AUD/USD trims some of its Tuesday’s gains after the Reserve Bank of Australia (RBA) surprisingly hiked rates by 50 bps. Nevertheless, investors’ negative sentiment is weighing on high beta currencies, like the Australian dollar, with the major drifting below the 100-day moving average (DMA). At 0.7199, the AUD/USD is 30 pips short of the latter in the North American session.

The Australian dollar edges down despite RBA’s rate hike

Recapping the RBA decision, the central bank said that inflation is higher than expected, that the labor market is tight, and that the economy is solid. According to the RBA, it was necessary to reduce the monetary stimulus introduced when the Covid-19 global pandemic hit and emphasized the need for additional rate increases over the following months.

Analysts at Commerzbank wrote that the “RBA’s restrictive approach should support AUD, but as long as the economic development in China remains unclear, AUD gains are likely to remain limited.”

In the meantime, European equities ended Wednesday’s session with losses, while US equities remain in the red. Higher US Treasury yields weigh on stocks and underpin the greenback. The US 10-year Treasury yield sits at 3.007%, up almost three basis points, while the US Dollar Index, a measure of the buck’s value against a basket of rivals, edges up by 0.10%, at 102.436.

The factors mentioned above weighed on the AUD/USD, which failed to sustain the rally provided by the RBA’s hike. On Wednesday, the AUD/USD retreated from daily highs at around 0.7234 and is back below the 0.7200 figure, a reflection of a risk-off mood.

Elsewhere, the OECD is the following international organization that shrank the expectations for a higher global economic growth rate. By 2022, the OECD estimates growth at 3.0%, lower than the 4.5% estimated, and by 2023, it will hit 2.8% YoY, less than the 3.2% foreseen.

In the week ahead, the US calendar will feature Initial Jobless Claims for the week ending on June 4, followed by consumer inflation data, alongside the University of Michigan’s Consumer Sentiment.

AUD/USD Price Forecast: Technical outlook

During the day, the AUD/USD broke below the 100-DMA at 0.7228 and edged towards the 50-DMA at 0.7208. At the time of writing, selling pressure on the AUD/USD tumbled the pair below 0.7200. At the same time, the Relative Strength Index (RSI) is aiming downwards, and albeit in a bullish territory at 54.28, its slope signals weak demand on the pair.

Therefore, the AUD/USD would resume its downtrend. That said, the major’s first support would be the June 7 low at 0.7157. Break below would expose the June 2 daily low at 0.7140, followed by the May 27 daily low at 0.7089.

US dollar strength will continue over the remainder of 2022 and over the course of 2023 according to analysts at Wells Fargo. They point out that despite more aggressive monetary tightening from central banks across the world, they believe the Federal Reserve will lead tightening and will continue to push the dollar higher against G10 and emerging market currencies.

Key Quotes:

“Slower global growth underpins our view for a stronger U.S. dollar over the second half of this year and into 2023. In our view, declining growth prospects should attract capital flows to dollar-denominated assets, given the dollar's safe-haven qualities. But, perhaps more inspiring for the dollar's prospects is a hawkish Federal Reserve and the outlook for tighter Fed monetary policy.”

“As of now, we forecast more Fed tightening than financial markets have priced and for most foreign central banks to lag behind the Fed. While the ECB should begin raising interest rates in July and major central banks, such as the Reserve Bank of Australia, become more hawkish, the combination of higher U.S. rates and a smaller Fed balance sheet should result in dollar strength against most G10 currencies.”

“Emerging market currencies are likely to be the most sensitive against this backdrop. We expect emerging market currencies, particularly in Latin America, to weaken over the foreseeable future as growth concerns build and political risk weighs on sentiment.”

Analysts at Rabobank expect the USD/JPY pair to remain around current levels on a one to three month view. They consider the pair could pullback toward 130 around year end.

Key Quotes:

“It can be inferred that if and when wages and prices do rise the BoJ will be able to change the tone of monetary policy. Meanwhile the BoJ is maintaining extremely accommodative policy suggesting that USD/JPY remains exposed to the interest rate differentials between treasuries and JGBs.”

“Although we expect USD/JPY to remain elevated around current levels on a 1 to 3 month view we see scope for USD/JPY to edge back to 130 around year end.”

“Japan’s history of weak wage inflation and the low acceptance of price rises in the country mean that Kuroda’s hopes of hitting the 2% CPI inflation target in a sustainable way are by no way guaranteed. If it is assumed that BoJ policies remain accommodative USD/JPY may be at risk of further gains. Softer yields in the US may be necessary to bring the currency pair down to lower levels.”

- The USD/CHF is registering gains of 1.33% during the week.

- Fragile market sentiment keeps investors flowing towards and outwards of safe-haven peers, like the US dollar.

- USD/CHF Price Forecast: Range-bound in a 30 pip range, at around 0.9735-65 area.

The USD/CHF climbs for the fourth consecutive day but retraces from weekly highs around 0.9780s, though it remains up by 0.30%. At the time of writing, the USD/CHF is trading at 0.9751.

Factors like a dismal market mood boost appetite for the greenback. Reflecting the previously mentioned are European and US equities, falling except for the Nasdaq 100, undermined by rising global bond yields. The US 10-year Treasury yield climbs three and a half basis points above 3.014%.

The US Dollar Index, which measures the buck’s performance vs. a basket of six currencies, remains flat during the day at 102.336.

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains upward biased after the 500 pip pullback from YTD highs at 1.0007, which bounced short of the 61.8% Fibonacci retracement at 0.9532. However, in the last couple of trading days, USD/CHF traders, unable to break above the May 20 high at 0.9764, would keep the USD/CHF in a 30-pip narrow range, with the 38.2% Fibonacci retracement at 0.9735 on the bottom, and 0.9764 on top.

Upwards, the USD/CHF first resistance would be 0.9764, the top of the range. Break above would expose the major to further upward pressure and send it towards the 23..6% Fibonacci retracement at 0.9861. Once cleared, a test of the YTD high at 1.0007 is on the cards. Otherwise, the USD/CHF first support would be the psychological 0.9700 figure. A breach of the latter would expose the 50% Fibonacci retracement at 0.9633, followed by the 50-day moving average (DMA) at 0.9621.

Key Technical Levels

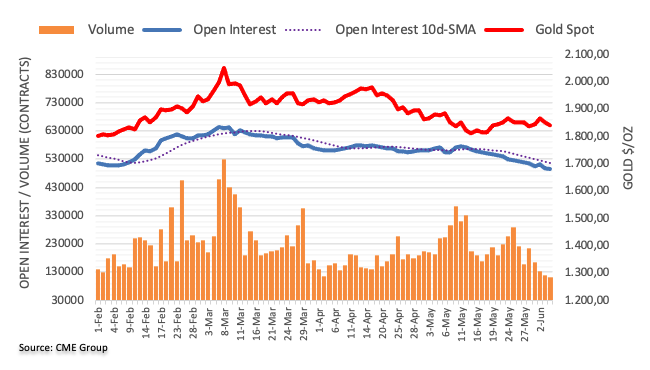

- Gold gains momentum despite higher yields.

- XAU/USD remains sideways, looking at the $1860 resistance.

The US dollar pulled back during the American session boosting XAU/USD that climbed to $1859.70, reaching the highest level in three days. The yellow metal is facing resistance around the $1860 area.

Dollar down, gold slightly higher

On a quiet session, the DXY turned negative in American hours, sliding back to the 102.30 area. US yields are modestly higher with the 10-year at 3.01% and the 30-year at 3.16%. Also Eurozone yields are higher ahead of the European Central Bank meeting on Thursday.

Despite the move in yields, gold is rising although gains seem limited for the moment while unable to break above $1860. A break above would expose the strong barrier of $1870. The following resistance is the $1890 area, a horizontal level and also the confluence of the 55 and 100-day Simple Moving Averages.

If price fails to rise above $1860, a retreat back to the $1850 area seems likely. The immediate support might be seen at $1840 followed by the weekly low at $1836 and then $1827 (June 1 low).

On a wider perspective, XAU/USD continues to move sideways between $1835 and $1870. During the next sessions volatility could pick up considering the ECB meeting on Thursday, US inflation data on Friday, and the FOMC meeting next week.

Technical levels

- Euro rises across the board as EZ yields move higher.

- ECB meeting on Thursday likely to trigger volatility.

- EUR/GBP sideways, without a clear direction.

The EUR/GBP is rising on Wednesday, on the back of a stronger euro across the board. The cross rose from under 0.8500 and peaked at 0.8563. It then pulled back finding support at 0.8550.

The euro gained momentum as German bond yields rose above 1.35% for the first time since 2014. The move takes place ahead of the European Central Bank on Thursday. The central bank is expected to announce the end of the purchase program and to suggest rate hikes at the next meetings.

Analysts at Brown Brothers Harriman point out ECB tightening expectations have picked up ahead of Thursday’s decision. “WIRP suggests liftoff July 21 remains fully priced in. However, markets are now pricing in a potential 50 bp move at either the September 8 or October 27 meetings, followed by a 25 bp hike December 15 that would take the policy rate to 0.75% by year-end, up from 0.5% previously.”

The ECB meeting, the political drama in the UK and a plan from PM Johnson to rewrite parts of the Brexit, warrant volatility ahead for the EUR/GBP cross over the next sessions.

Above 0.8500, below 0.8600

The EUR/GBP is moving in a wide range since late May, finding resistance below 0.8600 and being rejected from under 0.8500. A daily close clearly above 0.8600 should open the doors to more gains, initially to test May’s high at 0.8618. On the flip side, a consolidation below 0.8500 would weaken the euro, leaving the cross vulnerable to a decline to 0.8400.

Technical levels

- Silver is trading positive during the week, up by 1.12%.

- On Wednesday, high US Treasury yields and a solid greenback weigh on silver

- Silver Price Forecast (XAG/USD): Remains range-bound, trading between $21.28-$22.50 in the last month.

Silver (XAG/USD) slides from June 7 highs at around $22.28, courtesy of higher US Treasury yields and a steady greenback amidst a risk-off market mood, which has investors scrambling to safe-haven assets, but the precious metals complex. At $22.18, XAG/USD grinds lower by 0.39% at the time of writing.

Higher US Treasury yields and a solid greenback weigh on silver

The US Dollar Index, a gauge of the buck’s value vs. a basket of its rivals, is almost flat in the day, though slightly positive, at 102.342, recovering from earlier losses that dragged prices towards 102.269. The US 10-year benchmark note rate sits at 3%, gaining two-basis points, a headwind for silver prices.

European and US equities are falling, reflecting a dismal sentiment, weighed by rising bond yields. Investors assess global central banks tightening monetary conditions. As of Thursday, the European Central Bank (ECB) will be the next in line; though it is expected to hold rates unchanged, an announcement of the end of the APP can lay the ground for the first-rate hike in the July meeting.

Elsewhere, the OECD is the following international organization that shrank the expectations for a higher global economic growth rate. By 2022, the OECD estimates growth at 3.0%, lower than the 4.5% estimated, and by 2023, it will hit 2.8% YoY, less than the 3.2% foreseen.

In the meantime, XAG/USD prices remain on the defensive after opening above $22.20. As soon as Wednesday’s Asian session kicked in, prices fell, though the non-yielding metal reclaimed $22.00 after reaching a daily low near $21.80.

In the week ahead, the US calendar will feature Initial Jobless Claims for the week ending on June 4, followed by consumer inflation data, alongside the University of Michigan’s Consumer Sentiment.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains ina a choppy trading range since May 19. Pressured by a fragile mood and elevated US Treasury yields, silver traders could not break above/below the $21.28-$22.50 range. The Relative Strength Index (RSI) at 48.63 is trendless, portraying silver’s price behavior.

Upwards the XAG/USD’s first resistance would be the June 6, high at $22.51. Break above would expose the 50-day moving average (DMA) at $23.08, followed by the May 5 swing high at $23.28. On the flip side, the XAG/USD’s first support would be $22.00. Once cleared, the following demand area would be the June 1 swing low at $21.43, followed by the May 19 low at $21.28.

- WTI has recovered back above $120 after the latest US EIA inventory report showed gasoline stocks falling unexpectedly.

- Prices remain well supported against the backdrop of strong and rising demand plus OPEC+/Russia supply woes.

- Bulls will continue to target a test of $130 for the weeks ahead.

Despite just-released weekly US EIA crude oil inventory data confirming that, as Tuesday’s Private weekly API inventory report had implied, headlines US crude oil stocks rose unexpectedly last week, the data still showed a decline in gasoline inventories, suggesting demand in the US remains robust. This helped front-month WTI futures move back from close to session lows in the mid-$119s per barrel back to the low-$120s, leaving prices not far below the multi-month peaks they hit earlier in the session in the low-$121s.

Traders also cited reports of a potential halt to production in Norway amid threats of strike action amongst oil workers there as offering some modest support. Crude oil prices have been trading with an upwards trajectory in recent sessions and weeks, with demand in North America and Europe rising as peak summer driving season hits and in China as Beijing and Shanghai reopen with Covid-19 now seemingly under control there. Against the backdrop of strong and recovering demand, global oil markets are very tight right now.

Reuters reported on Wednesday that refinery margins for diesel are at record highs in Asia and most global refineries are running at close to full capacity, as Russian exports of refined products falls amid Western sanctions over its war in Ukraine. Analysts view OPEC+’s decision last week to increase output quotas by 648K barrels per day in July and August as insufficient to make up for the loss of Russian output this summer, given that these output hikes were evenly spread across OPEC+ producers, many of whom aren’t able to actually increase output.

“Unless new Middle East capacity comes online more quickly than we expect or China decides to lift its products export caps, the shortage of (refined) products will only get worse as demand for transport fuels picks up during the northern hemisphere summer,” JP Morgan said in a note on Wednesday. Separately, the CEO of Trafigura said that oil could hit $150 this year against the current backdrop.

Give all of the above, it seems more likely than not that WTI continues its recent upwards trajectory that has seen it rally more than $16 per barrel since the start of May. Oil bulls will continue to target a test of March’s near $130 highs in the coming weeks.

GBP/USD is offered after choppy price action to test 1.26 on Tuesday. While below the 1.26 level, the cable remains vulnerable, economists at Scotiabank report.

Initial support aligns at the 1.25 figure zone

“GBP price action has been choppy since the start of the month but generally confined to 1.26 on the top and the high 1.24s on the bottom – aside from yesterday’s low of 1.2431.”

“The pound plumbing new lows since its May rally yesterday and lengthy sideways trading point to weakness ahead – especially if the GBP again fails at making a push above 1.26.”

“Support is the 1.25 figure zone followed ~1.2480 and yesterday’s low.”

The European Central Bank (ECB) will announce its decision on monetary policy on Thursday, June 9 at 11:45 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of eight major banks.

The ECB is set to announce the end of its QE program and keep key rates unchanged while hinting at a July lift-off. In the opinion of FXStreet’s Yohay Elam, the ECB will most likely opt for what it already signaled – a 25 bps hike in July.

SocGen

“The June ECB meeting should align with the views we’ve heard over the past month, signalling an end to net APP purchases by early July (or end June) and a rate hike in July. We wonder though: if there was sufficient conviction to signal rate hikes already in early May, why not end QE and raise rates in June? With inflation expectations above 2.2% since early March and market rate expectations well-ahead, why the foot-dragging? Clearly, forward guidance is a difficult habit to shake, reflecting fears of adverse market reactions, but it now seems to be a hindrance to data-dependency and timely action. With the PMIs holding up well in May and inflation next week expected to break new records (7.9%), the outlook may soon demand more action. A discussion on 50bp hikes and QT, for which there is a clear need for early signalling, seems all but premature. The risk of lasting indirect and second-round inflation effects is now so high that it threatens to de-anchor inflation expectations and the ECB’s credibility. This holds true even if growth turns out weaker than expected over the coming quarters. Allowing a gradual reduction in the APP reinvestments could thus help anchor expectations and reduce the need for steeper rate hikes. We expect little help from the upcoming bank TLTRO repayments (around €200bn in June and €450bn over the coming year) and believe a new (limited) TLTRO will be needed in 2023 to smoothen the run-down. A too reactive ECB thus risks higher inflation expectations and more aggressive rate hikes later.”

Deutsche Bank

“Our previous baseline was to expect back-to-back 25 bp hikes from July. We now expect one of the two hikes in Q3 to be a 50 bp hike – September is more likely than July. Hikes of 25 bp in July and 50 bp in September mean the deposit rate will rise above zero in three months. We believe the ECB is continuing to underestimate inflation and we expect support for a 50 bp hike will increase as the summer progresses. On 9 June, we expect the ECB to confirm that APP net purchases will cease at the end of June. Other issues: (1) staff forecasts: inflation to rise to 2% in 2024, satisfying the liftoff criteria; (2) rates guidance: expect the three liftoff conditions to be replaced with language similar to Lagarde's normalisation blog; and (3) TLTRO: expiry of TLTRO discount to be confirmed and ECB to pledge smooth transmission of the hiking cycle through the banking system.”

Nordea

“The ECB is set to confirm that it plans to end asset purchases very early in July and hike rates by 25 bp later that month. While the door is not totally shut for a 50 bp move in July, it would be quite surprising for the ECB to start its hiking cycle with such a big step, especially as Lagarde recently signalled the ECB’s first moves would take place gradually. Given the ECB’s gradual shift towards a more hawkish stance and the market’s receptiveness to such comments, we see risks tilted towards a hawkish interpretation of the ECB’s message, i.e. higher rates and a stronger EUR. The ECB staff forecasts are set to show clear downward revisions to GDP growth but see core inflation above the target also longer out.”

TDS

“We expect the ECB to announce that the APP will end within weeks, and send a strong signal that rate hikes are coming in July and September. Forecasts will show stronger inflation and weaker growth, highlighting the ECB's challenge going forward. With the Euribor curve already reflecting the ECB's most likely scenario for tightening, scope for EUR/USD gains remain limited from here.”

Danske Bank

“This ECB meeting is set to be the formal end of ECB net asset purchases and a clear signal to hike rates in July, although without specific guidance of the size of the first-rate hike. We expect ECB net purchases to end on 1 July, thereby in line with previous guidance for Q3. With inflation pressures continuing to build and the economic backdrop still supported by services, we do not expect the inflation problem to solve itself in the near future. On the other hand, inflation expectations should gradually decline to the 2% mark in late 2024/early 2025, which leaves a narrow window for ECB to hike between now and the coming 12M. Market focus will be on the discussion if a 50bp hike is possible, and if so when, as well as any hints about tools that ECB may take to address fragmentation. We expect ECB to hike 25 bp each meeting until Mar23, but risks are clearly skewed for a 50 bp rate hike in H2 this year (July or Sep most likely).”

Commerzbank

“The ECB Council is expected to decide to end its net asset purchases at the beginning of the third quarter. We also expect it to signal the end of the negative deposit rate by September.”

Rabobank

“A further deterioration of the inflation outlook warrants immediate action, while recent data on the economy remain solid enough to facilitate some tightening. Inflation data have increased the odds of a 50 bp hike. We believe it is unlikely to become the ECB’s base case already, but we would not want to position against this risk. If the ECB does go for a 50 bp hike, we prefer July over September or later. We expect the ECB to terminate APP this month, with zero net purchases from July. Sequencing prevents hiking policy rates this month, but July is all but a done deal. We expect the ECB to confirm that the TLTRO-III discount will not be extended after June. The ECB is not in a hurry to drain liquidity from the system.”

BofA

“We expect the ECB to leave the door open to 50bp in July and September by signalling that negative rates will end during the third quarter (rather than at the end of the third quarter). We have recently changed our ECB call and now expect a total of 150bp throughout 2022. For now, while we reassess our growth forecast and wait for this week's meeting, we think they are likely to be stopped out in 2023. Being forced by persistent inflation surprises, we expect the ECB to begin its hawkish pivot with the end of QE this week and the first hike, possibly by 50bp, in July. We expect this pivot to start supporting the EUR, but we are also cautious as a number of things still weigh on the currency. Assuming our call turns out right, any EUR strength should be temporary.”

EUR/USD has oscillated around the 1.07 level since the start of the month. A disappointing European Central Bank (ECB) decision at its meeting on Thursday could pave the way for a fall below 1.06 during the week ahead, economists at Scotiabank report.

Lagarde unlikely to fan the flames of 50 bps hike bets

“The bloc’s economy expanded by 0.6% QoQ, double the initial estimate, lifting Eurozone yields ahead of tomorrow’s ECB decision. Implied pricing for the bank’s Sep meeting rose by 5bps to near 75bps – implying nearly a full 50bps hike at one of the Jul or Sep meetings.”

“We think Lagarde is unlikely to fan the flames of 50 bps hike bets as the ECB sticks to a gradual forward guidance approach.”

“A disappointing ECB decision, a US inflation beat, and a hawkish Fed next week could combine to pull the EUR firmly below 1.06 in the space of a week.”

Uncertainty about the Bank of England ‘s (BoE's) future course is hig. Economists at Commerbank expect the “Old Lady” to disappoint market expectations. Thus, EUR/GBP is set to trend higher until the end of the year.

Market expectations could be disappointed

“The BoE is continuing its gradual tightening of monetary policy. However, it is likely to act less restrictively than expected by the market. The pound should suffer increasingly from this.”

“Another factor weighing on the pound is that the ECB is also likely to start its monetary policy U-turn in July. We therefore see EUR/GBP higher until the end of the year.”

“Next year, we see scope for lower levels in EUR/GBP because the BoE is likely to continue its rate hike cycle somewhat longer than the ECB.”

- USD/CAD witnessed fresh selling on Wednesday and dropped to its lowest level since April 21.

- Bullish oil prices underpinned the loonie and acted as a headwind amid a modest USD pullback.

- Sustained weakness below the 1.2500 mark would pave the way for additional near-term losses.

The USD/CAD pair struggled to preserve its modest intraday recovery gains and met with a fresh supply near the 1.2560 area on Wednesday. The intraday downfall dragged spot prices to the lowest level since April 21, around the 1.2520 region during the early North American session.

Despite rising US Treasury bond yields and the prevalent cautious mood, the safe-haven US dollar failed to capitalize on its early move up amid a goodish pickup in demand for the shared currency. Apart from this, bullish crude oil prices underpinned the commodity-linked loonie and exerted some downward pressure on the USD/CAD pair.

From a technical perspective, last week's sustained break below the very important 200-day SMA was seen as a fresh trigger for bearish traders. Moreover, the USD/CAD pair's inability to gain any meaningful traction and the emergence of fresh selling at higher levels supports prospects for an extension of a near one-month-old bearish trend.

Some follow-through selling below the 1.2500 psychological mark will reaffirm the negative bias and drag the USD/CAD pair to the next relevant support near the 1.2450 region. The downward trajectory could further get extended and allow bearish traders to challenge the YTD low, around the 1.2400 mark touched on April 5.

On the flip side, the 1.2560 region, or the daily swing high, now seems to have emerged as an immediate hurdle. Any subsequent move up might now be seen as a selling opportunity near the 1.2600 mark. This, in turn, should cap the upside for the USD/CAD pair near the 200-DMA support breakpoint, currently around the 1.2660 area.

USD/CAD daily chart

-637902937299939190.png)

Key levels to watch

- Gold Price reversed an intraday dip to the $1,845 area amid the prevalent cautious mood.

- Expectations for more aggressive central banks and a stronger USD should cap the upside.

- The market focus remains glued to the ECB meeting on Thursday and the US CPI on Friday.

Gold Price struggled to capitalize on the previous day's goodish bounce from the $1,837 area - levels just below the very important 200-day SMA - and edged lower on Wednesday. The early downtick, however, was bought into near the $1,845 region amid the prevalent cautious mood, which tends to benefit the traditional safe-haven precious metal. The XAUUSD was last seen trading just above the $1,850 level, nearly unchanged for the day heading into the North American session.

Gold Price benefits from worsening global economic outlook

The market sentiment remains fragile amid concerns that a more aggressive move by major central banks to constrain inflation could pose challenges to global economic growth. Adding to this, the World Bank slashed its 2022 global growth forecast on Tuesday to 2.9% and tempered investors' appetite for perceived riskier assets. This was evident from a generally weaker tone around the equity markets, which could drive some haven flow towards the XAUUSD. Despite the supporting factors, any meaningful upside still seems elusive, warranting caution before placing aggressive bullish bets.

Also read: Gold Price Forecast: Bull-bear tug-of-war around $1,850 extends, all eyes on US inflation.

Rate hike bets, stronger US dollar to cap Gold Price

Investors remain concerned that the global supply chain disruption caused by the Russia-Ukraine war could push consumer prices even higher. This might force the Federal Reserve to tighten its monetary policy at a faster pace, which, in turn, could trigger a fresh leg up in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond has shot back above the 3.0% threshold and helped revive the USD demand. The European Central Bank (ECB) is also expected to join its global peers and hike interest rates to tamp down inflation. This might further contribute to capping the non-yielding yellow metal ahead of the key ECB monetary policy meeting on Thursday and the US consumer inflation figures on Friday.

Rising inflation fuels rate hike bets

Previewing the upcoming US Consumer Price Index (CPI) data, "there are signs of easing price pressures," FXStreet Analyst Yohay Elam said. "Most importantly, wages advanced by only 0.3% in both April and May, a total of 0.6%, while expectations imply an accumulated gain of 1.1% in Core CPI. Such a mismatch cannot be ruled out, but seems unlikely." In case inflation figures come in softer than expected, investors could see that as a development that could allow the Fed to pause rate hikes in September. In that scenario, US T-bond yields could retreat and help gold gain traction.

Gold Price technical outlook

Gold Price, so far, has managed to defend a technically significant 200-day SMA support, which is currently pegged near the $1,842-$1,841 region. This area should now act as a pivotal point, which if broken decisively could drag the XAUUSD towards the $1,830 intermediate support en-route to the $1,810-$1,808 area and the $1,800 round-figure mark.

On the flip side, momentum beyond the $1,857-$1,857 region is likely to confront resistance near the $1,870 supply zone. Sustained strength beyond would negate any near-term bearish bias and lift the XAUUSD to the next relevant hurdle near the $1,885-$1,886 area. The momentum could further get extended and allow bulls to aim back to reclaim the $1,900 mark for the first time since early May.

-637902916840739663.png)

Gold Price could be headed lower

- EUR/USD adds to Tuesday’s small gains and flirts with 1.0750.

- Extra upside looks likely on a breakout of 1.0750.

EUR/USD’s recovery picks up extra pace and challenges the 1.0750 region on Wednesday.

If the rebound surpasses the 4-month resistance line near 1.0750, the downside pressure is expected to lose traction and allow for the continuation of the move to the may high at 1.0786 (May 30). Up from here comes the weekly high at 1.0936 (April 21), an area reinforced by the 100-day SMA.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1215.

EUR/USD daily chart

- USD/JPY hit fresh multi-decade highs near 134.50 but has since backed off towards 134.00.

- But the pair is still over 1.0% higher on the day with BoJ dovishness and rising global yields in focus.

- The pair is now up around 4.5% on the month and over 6.0% since late May lows in the 126s.

USD/JPY extended on its Asia Pacific/early European session gains in the lead up to the US open, printing fresh multi-decade highs just below 134.50 in the process. Analysts have been citing the BoJ’s persistently dovish stance relative to its increasingly hawkish G10 peers, with the ECB the latest major bank to shift in recent weeks towards signaling a series of rate hikes, as weighing on the yen on Wednesday, as well as upside in global yields.

The BoJ’s policy of capping 10-year Japanese yields at no more than 25 bps above zero means that the yen is sensitive to rate differentials, hence, Wednesday’s bounce in US 10-year yields back above 3.0% is lifting USD/JPY. However, since the US open, the pair has fallen back slightly to just above the 134 level, where it continues to hold onto gains of around 1.2% on the day.

That takes the pair’s gains on the week to over 2.5%, since the start of the month to nearly 4.5% and since last month’s sub-126.50 lows printed on 24 May to the north of 6.0%. Many traders will be skeptical as to how much further the latest rally has to run and will be feeling increasingly reluctant to keep chasing the pair higher.

If Friday’s US Consumer Price Inflation data shows an easing of US price pressures and results in some buck weakness as markets pare back on Fed tightening bets, profit-taking could see USD/JPY swiftly drop back to support in the low 131s. But so long as the BoJ refuses to budge from its ultra-dovish policy stance, the outlook for sustained yen strength isn’t great.

On Wednesday, the BoJ’s Governor pushed back against the idea that the central bank should do something about yen weakness. He told the Japanese parliament that FX policy was not the authority of the BoJ and said that a weaker yen would be positive for the economy, so long as moves lower are gradual.

Lee Sue Ann, Economist at UOB Group, assesses the latest RBA event.

Key Takeaways

“The Reserve Bank of Australia (RBA) announced a bigger-than-expected increase in the cash rate target by 50bps to 0.85%. It also increased the interest rate on Exchange Settlement balances by 50bps to 0.75%. Once again, the RBA cited strong inflationary pressures and a resilient economy.”

“The RBA has now embarked on a more aggressive front-loading hiking cycle. Today’s move more than fully unwinds the emergency rate cuts that took place in 2020 amid the COVID-19 pandemic, and it is also the first rate hike under new Prime Minister Anthony Albanese.”

“We continue to expect a series of rate hikes over the coming months. We now see the RBA hiking by another 90bps in the remainder of 2022 to bring the cash rate target to 1.75% by year-end (compared to 1.25% previously), before continuing to rise more gradually over 2023. We retain the same peak of 2.50%, but now expect this to be reached sooner (around mid-2023) than previously forecast (around end-2023).”

- GBP/USD fell back to the mid-1.2500s but remains well within recent ranges as last week’s lows/the 21DMA offer support.

- UK PM Johnson’s no-confidence vote survival has been a key talking point this week, but hasn’t impacted sterling much.

- Currency markets are likely to remain subdued pre-US CPI on Friday.

Broad US dollar strength amid a rise in yields state-side has seen GBP/USD pull back to the 1.2550 are on Wednesday, where the pair is trading lower by about 0.3% on the day. However, the pair continues to trade nearly 1.0% higher versus the multi-week lows it posted on Tuesday in the 1.2430 area and is currently about 0.5% higher on the week.

Support in the form of last week’s lows in the mid-1.2400s and the 21-Day Moving Average in the 1.2480s has supported GBP/USD well so far this week and kept the pair trading well within recent ranges. Though UK politics has been a big talking point, with UK PM Boris Johnson surviving a Conservative Party vote of no-confidence on Monday, it does not seem to have shifted the dial much for the pair.

Though he held on to his position as party leader and PM, Johnson’s authority has arguably been weakened by a larger than expected rebellion by his MPs. Some FX analysts have said this might be a positive for sterling if recent events encourage the PM to bring forward tax cuts/increase fiscal stimulus, as this could modestly boost the weakening outlook for the UK economy.

UK households are facing the worst cost-of-living squeeze in more than a generation, with the government announcing back in May that support this year for low-income households would be increased to the tune of over £30 billion. Further stimulus measures might encourage the BoE to revise higher their very pessimistic growth forecasts for this year and next, thus encouraging a little more monetary tightening.

In the meantime, GBP/USD looks set to continue ranging between the mid-1.2400s to 1.2600 area as traders await the release of US Consumer Price Inflation (CPI) figures on Friday. If that data shows a further easing of US price pressures in May, then this could result in some paring back of Fed tightening bets and could perhaps help the pair test 1.2600 once again.

- DXY trades in a volatile fashion around 102.40/50 on Wednesday.

- So far, gains remain capped by the weekly high near 102.80.

DXY keeps the erratic performance above the 102.00 mark so far this week.

Considering the ongoing price action, further consolidation should not be ruled out, while occasional bullish attempts appear limited by the weekly highs in the 102.80/85 band. A Fibo level (of the mid May-late May sell-off) at 102.71 also underpins this region.

As long as the 3-month line around 101.15 holds the downside, the near-term outlook for the index should remain constructive.

Looking at the longer run, the outlook for the dollar is seen bullish while above the 200-day SMA at 97.13.

DXY daily chart

Economist at UOB Group Lee Sue Ann suggests the ECB will refrain from acting on rates at the June 9 event.

Key Takeaways

“There is an increasing sense of urgency among the hawks within the ECB’s governing council as surging inflation warrant higher interest rates in the Eurozone.”

“We might see the start of policy normalization as early as Jul, though the process will be gradual. We will be revising our forecasts following the ECB meeting in Jun.”

S&P 500 remains above support from its recent price gap and near-term range lows at 4077/57. Thus, economists at Credit Suisse continue to look for a deeper recovery with resistance seen at the 38.2% retracement of the 2022 fall at 4195, then the 63-day average at 4263.

Near-term support moves to 4138/33

“We remain biased to a deeper corrective recovery/consolidation. Above the near-term range high at 4178 is needed to add weight to our view for a test of the 38.2% retracement of the entire 2022 fall at 4195.

“Whilst we would expect a cap at 4195 at first, a break can see strength extend to the key 63-day average at 4263, where we would be alert to a fresh cap. At most, we can see the recovery extending towards the 200-day average and potential downtrend from the 2022 high at 4447/89, however, we have more confidence in a cap here if reached.”

“Near-term support moves to 4138/33, then 4110. Below 4080/58 is needed though to see the risk turn lower again with support then seen next at 3985.”