- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 05-06-2022.

- EUR/USD reverses pullback from a six-week-old resistance line.

- Sustained trading beyond 200-SMA, firmer RSI hints at further recovery.

- The previous support from mid-May also challenges bulls, 1.0460 appears a tough nut to crack for bears.

EUR/USD picks up bids to consolidate Friday’s losses as buyers eye another battle with the short-term key resistance line. That said, the major currency pair rises to 1.0727 during Monday’s initial Asian session.

The quote’s recent rebound takes clues from the steady RSI and improvement in the market’s risk appetite. However, the bulls need validation from a six-week-old downward sloping resistance line, around 1.0760 by the press time.

Even so, 50% Fibonacci retracement of the March-May downside, as well as the previous support line from May 13, respectively around 1.0770 and 1.0825, will challenge EUR/USD buyers.

Also acting as an upside filter is the 61.8% Fibonacci retracement level and a horizontal resistance area stretched from late March, close to 1.0870 and 1.0940 in that order.

Alternatively, pullback remains elusive until the quote stays beyond the 200-SMA level of 1.0611.

Additionally challenging the EUR/USD bears is the 1.0600 threshold and multiple supports marked since late April, surrounding 1.0470-60.

Overall, EUR/USD remains on the bull’s radar but needs validation for further upside momentum.

EUR/USD: Four-hour chart

Trend: Further recovery expected

- Copper bears dived in and have sent the bulls packing.

- A bid from the demand area could be on the cards for the foreseeable future.

As per last week's Copper Price Analysis, ''Dr Copper prescribes upbeat tone, marred by critical multi-timeframe supply zone,'' the price indeed hs deteriorated from the supply area with potential;y more to go for the week ahead.

Copper, prior analysis, daily and lower time frames

Copper live market, daily and H4 charts

Looking ahead, on the daily chart, we could start to see some accumulation start to come in. This would be expected to see the price supported in the demand area as illustrated below resulting in a subsequent bid making prospects for an upside continuation:

- AUD/USD holds lower ground within a choppy range after reversing from six-week high.

- Markets remain indecisive as US data, Fedspeak favor bears but China-linked news suggests improvement in sentiment.

- RBA is up for the second rate hike of 2022 to tame inflation.

- NFP’s surprise highlight this week’s US CPI for the pair bears.

AUD/USD struggles to overcome Friday’s losses, despite risk-positive news from China, as traders seem cautious ahead of this week’s monetary policy meeting by the Reserve Bank of Australia (RBA), as well as the US Consumer Price Index (CPI) for May. That said, the quote seesaws around 0.7210, staying inside an immediate 15-pip trading range near 0.7200 during the initial Asian session on Monday.

Beijing’s readiness to ease the virus-led activity controls joins the US preparations for announcing tariff relief for China to underpin the latest improvement in the market sentiment. While the same should have ideally favored the AUD/USD buyers, Friday’s upbeat US jobs report and hawkish Fedspeak challenge the pair’s upside momentum ahead of the key RBA and the US inflation data.

“Dine-in service in Beijing will resume on Monday, except for the Fengtai district and some parts of the Changping district, the Beijing Daily said. Restaurants and bars have been restricted to takeaway since early May,” reports Reuters.

Additionally, US Commerce Secretary Gina Raimondo said, per Reuters, “President Joe Biden has asked his team to look at the option of lifting some tariffs on China that were put into place by former President Donald Trump, to combat the current high inflation.”

On Friday, US Nonfarm Payrolls (NFP) came in 390K for May, more than 325K expected but lesser than the upwardly revised 428K previous readouts. Further, the Unemployment Rate remained unchanged at 3.6% versus expectations of a slight decline to 3.5%. Additionally, the US ISM Services PMI fell to 55.9 in May, versus 56.4 market consensus and 57.1 flashed in April.

Following the data, Cleveland Fed President Loretta Mester crossed wires while saying that the one problem that the Fed has is inflation. The policymakers also added that the risks of a recession have gone up.

While weighing these catalysts market sentiment remains sluggish and restricts AUD/USD moves, due to the pair’s risk-barometer status. That said, Wall Street benchmarks closed in the red and the US 10-year Treasury yields posted the first weekly gain in three at the latest whereas the S&P 500 Futures remain indecisive at around 4,100 by the press time.

Moving on, risk catalysts may entertain AUD/USD traders with the TD Securities Inflation for May acting as an immediate catalyst to watch. However, major attention will be given to how the RBA manages to announce a 0.25% rate hike and hints at more. Also important will be May’s CPI from the US and China.

Technical analysis

In addition to a pullback from the 200-DMA surrounding 0.7260, a clear downside break of a three-week-old ascending support line, now resistance around 0.7240, also keeps AUD/USD bears hopeful to retest 20-DMA support surrounding 0.7080.

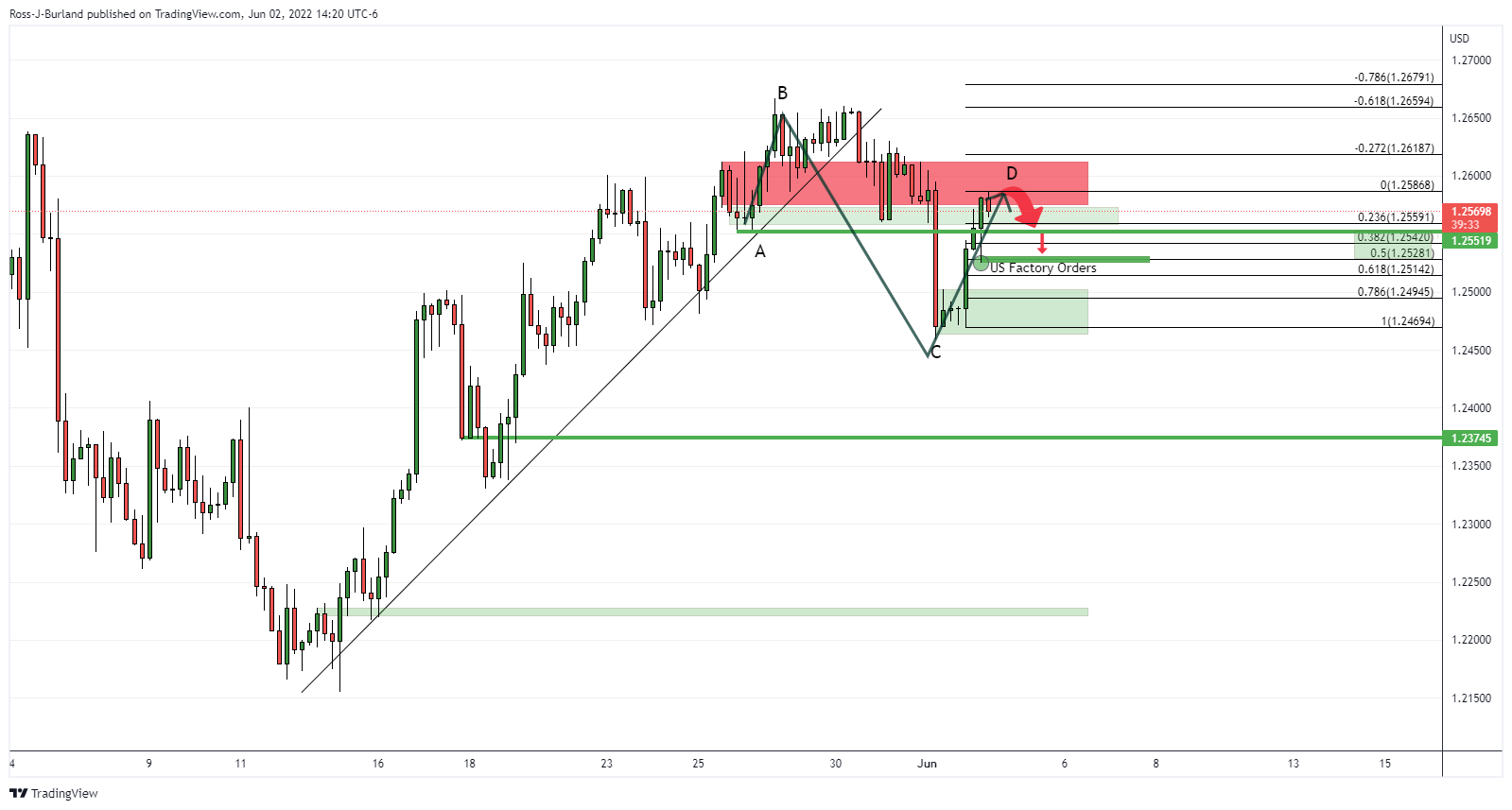

- GBP/USD bears take control and eye 1.2450s and below.

- There is a price imbalance towards the 1.2330s for the medium term.

GBP/USD was under pressure at the end of the week and has fallen towards a key area of support on the four-hour charts, in line with the bearish bias from a daily perspective. The following illustrates the market structure across the said time frames and prospects for further downside.

GBP/USD prior analysis

From a four hour perspective, the price was stalling on the bid into the remaining two hours of the candle. The price was anticipated to be resisted by the opposing bearish structure and result in a near term correction towards prior lows that meets the 50% mean reversion level:

Point A's support was cleared to confirm the downside prospects below the 50% mean reversion to open prospects of a run towards the 1.2450s ahead of the 1.2370s and the 1.2220s.

This was in line with the daily chart's bearish bias as follows:

GBP/USD live market, H4 & daily charts

The price is moving in on a demand area on the 4-hour chart and a meanwhile correction could be in store for the immediate future if not a downside continuation. A 38.2% Fibonacci correction could be on the cards.

If the bears break the support near 1.2450, this could be the last defence before a daily continuation as illustrated above.

- NZD/USD consolidates recent losses after reversing from five-week high.

- Friday’s US NFP, comments from Fed’s Mester favored greenback bulls.

- New Zealand markets are off due to Queen’s Birthday, US CPI, RBA and ECB are this week’s key events.

NZD/USD picks up bids to pare recent losses around 0.6510 during Monday’s quiet Asian morning. The Kiwi pair’s latest gains could be linked to upbeat news concerning China, as well as an off in the New Zealand market.

News from China’s local media, suggesting a further easing of activity controls on Beijing, seems to underpin the latest rebound in NZD/USD prices. Beijing is up for further easing of covid-linked activity controls from Monday after witnessing a sustained fall in the virus numbers, following Shanghai’s ease of lockdown measures late in May. “Dine-in service in Beijing will resume on Monday, except for the Fengtai district and some parts of the Changping district, the Beijing Daily said. Restaurants and bars have been restricted to takeaway since early May,” reports Reuters.

On the same line are Sunday’s risk-positive comments from US Commerce Secretary Gina Raimondo. The diplomat said, per Reuters, “President Joe Biden has asked his team to look at the option of lifting some tariffs on China that were put into place by former President Donald Trump, to combat the current high inflation.”

It’s worth noting, however, that fears of the Fed’s aggression keep NZD/USD prices in check, especially after Friday’s surprise from the US employment data and hawkish Fedspeak. US Nonfarm Payrolls (NFP) came in 390K for May, more than 325K expected but lesser than the upwardly revised 428K previous readouts. Further, the Unemployment Rate remained unchanged at 3.6% versus expectations of a slight decline to 3.5%. Additionally, the US ISM Services PMI fell to 55.9 in May, versus 56.4 market consensus and 57.1 flashed in April.

Elsewhere, Fed’s Mester said, per Reuters, “The one problem that the Fed has is inflation.” The policymakers also added that the risks of a recession have gone up, said the news. Loretta Mester also mentioned that she supports 50 bps increases in June and July while not ruling it out in the September meeting, but it would be data-dependent. She said that if she sees compelling evidence of lower inflation, then a 25 bps hike in September would be appropriate.

Against this backdrop, Wall Street benchmarks closed in the red whereas the US 10-year Treasury yields posted the first weekly gain in three. That said, S&P 500 Futures remain indecisive around 4,100 by the press time.

It should be observed that the Reserve Bank of New Zealand (RBNZ) has already announced two 125 bps worth of rate hikes during 2022 and hence may wait for the Fed’s next step, which in turn highlights this week’s inflation data from the US and China for fresh impulse. Additionally, monetary policy meeting by the Reserve Bank of Australia (RBA) will also be important for NZD/USD due to New Zealand’s trade ties with Australia.

Technical analysis

NZD/USD portrays traders’ indecision unless crossing the area between the 50-day EMA and the 21-day EMA, respectively around 0.6550 and 0.6480. Given the recently sluggish RSI and receding bullish bias of MACD, sellers are likely to retake control.

- Gold posted two consecutive weekly losses amid indecision over Fed’s next move.

- Yields snapped three-week downtrend as hawkish Fedspeak, upbeat US data hint at Fed’s aggression.

- NFP’s surprise highlights US inflation, ECB meeting as key events, China’s easing of covid-led restrictions keep buyers hopeful.

- Gold Price defines breakout levels ahead of ECB meeting, US CPI

Gold Price (XAU/USD) licks US NFP-led wounds around mid-$1,800s during the initial Asian session on Monday, with eyes on this week’s US Consumer Price Index (CPI). The metal’s corrective pullback could also be linked to the risk-positive headlines concerning China’s covid conditions and the US-China trade relations.

Beijing is up for further easing of covid-linked activity controls from Monday after witnessing a sustained fall in the virus numbers, following Shanghai’s ease of lockdown measures late in May. “Dine-in service in Beijing will resume on Monday, except for the Fengtai district and some parts of the Changping district, the Beijing Daily said. Restaurants and bars have been restricted to takeaway since early May,” reports Reuters.

Elsewhere, chatters over the US lifting of some tariffs on China, mainly announced during Donald Trump’s reign, also underpin the gold price recovery. “US Commerce Secretary Gina Raimondo said on Sunday that President Joe Biden has asked his team to look at the option of lifting some tariffs on China that were put into place by former President Donald Trump, to combat the current high inflation,” per Reuters.

It should be noted that gold prices dropped around 1.0% on Friday after the US Nonfarm Payrolls (NFP) surprised markets. Also exerting downside pressure on the bullion were the hawkish comments from Cleveland Fed President Loretta Mester.

That said, US Nonfarm Payrolls (NFP) came in 390K for May, more than 325K expected but lesser than the upwardly revised 428K previous readouts. Further, the Unemployment Rate remained unchanged at 3.6% versus expectations of a slight decline to 3.5%. Additionally, the US ISM Services PMI fell to 55.9 in May, versus 56.4 market consensus and 57.1 flashed in April.

On the other hand, Fed’s Mester said, per Reuters, “The one problem that the Fed has is inflation.” The policymakers also added that the risks of a recession have gone up, said the news. Loretta Mester also mentioned that she supports 50 bps increases in June and July while not ruling it out in the September meeting, but it would be data-dependent. She said that if she sees compelling evidence of lower inflation, then a 25 bps hike in September would be appropriate.

Amid these plays, Wall Street benchmarks closed in the red whereas the US 10-year Treasury yields posted the first weekly gain in three.

Moving on, the monetary policy meeting of the European Central Bank (ECB) and the US Consumer Price Index (CPI) are the key data/events for the week amid chatters of central bankers’ aggression in taming the price pressure, which in turn could weigh on gold prices.

Technical analysis

Gold’s pullback from 200-SMA, coupled with the steady RSI, hints at the quote’s further weakness toward the key $1,836-35 short-term support confluence, including the 23.6% Fibonacci retracement of the April-May fall, as well as a three-week-old rising support line.

It should be noted, however, that a clear break of $1,835 won’t hesitate to drag the precious metal towards May’s low surrounding $1,786, with the $1,800 threshold likely acting as an intermediate halt.

Alternatively, a clear upside break of the 200-SMA, near $1,865 now, could propel the quote towards a horizontal area established in late April at around $1,915.

During the rise, the $1,900 round figure may probe the XAU/USD buyers while the April-end swing high near $1,920 might offer an additional filter to the north before welcoming the bulls.

Gold: Four-hour chart

Trend: Further weakness expected

- USD/JPY sits at daily resistance, consolidating Friday's rally.

- The US dollar turned heavily bid on Friday following NFP.

At 103.86, USD/JPY is starting out the week where Friday left off, in the green. The US dollar ended last week firmly bid following a tight US labour market. Investors got back behind the Federal Reserve trade in anticipation of an aggressive path of interest rate hikes.

The US Nonfarm Payrolls increased by 390,000 jobs last month, the Labor Department said in its closely watched employment report on Friday, way exceeding the forecasts or around 325,000 jobs in May.

''The May report supports the view that while the labour market remains firm, it continues to gradually slow,'' analysts at TD Securities said. ''We think today's report does not change the calculation for the Fed, supporting their inclination to front-load interest rate hikes until it reaches a more neutral stance by the fall.''

''This report will do little to change the price action in the FX space, but it does mean that the better the data, the more difficult that a pause or reduced pace of tightening later this year becomes. The upcoming US CPI report and MoM reading will be far more important for broad USD dynamics.

Core prices likely stayed strong in May, with the series registering a second consecutive 0.5% MoM increase. A drag on inflation recently, we now expect used vehicle prices to be a contributor, advancing for the first time in four months. We also look for continued momentum in airfares and shelter inflation. Our MoM forecasts imply 8.4%/5.9% YoY for total/core prices.''

Meanwhile, JPY's net short positions have fallen for a second week, though they remain elevated. Data show that Japan has held a current account surplus for two consecutive months. Stronger inflation data in Japan keeps traders watchful for a change of tact at the Bank of Japan with respect to its YCC policy.

''The BoJ currently appears steadfast that it will not budge from its YCC control policy that is aimed at preventing the 10 year,'' analysts at Rabobank had previously argued.

''JGB yield from moving beyond 0.25%. However, if US yields push higher and encourage further upside in USD/JPY, the costs of this policy in terms of currency weakness could prove to be greater than the benefits. This explains why the market is likely to continue to suspect that the BoJ could do a policy U-turn in the coming months.''

''A policy change could take the shape of widening the fluctuation band for the 10-year yield or targeting a different maturity with YCC. Whether or not the BoJ is forced to make a policy change will likely depend on the direction of US yields which will have a bearing on USD/JPY as well the build-up of domestic pressure.''

- EUR/USD starts flat in the open, licking wounds from Friday's sell-off.

- The ECB will be a key focus for the week ahead.

At 1.0721, EUR/USD is flat at the start of the day ahead of what could be a busy week with the European Central Bank taking place and with plenty of ground to make back following Friday's whitewash.

A tight US labour market sent the US dollar higher against a basket of currencies on Friday as investors increased their stakes on the Federal Reserve in anticipation of an aggressive path of interest rate hikes.

Nonfarm Payrolls increased by 390,000 jobs last month, the Labor Department said in its closely watched employment report on Friday, way exceeding the forecasts or around 325,000 jobs in May. The US Dollar Currency Index (DXY), which tracks the greenback against six other major currencies, was 0.4% higher at 102.16 after rising as high as 102.22 following the jobs report. For the week, the index was up around 0.5%.

''The May report supports the view that while the labour market remains firm, it continues to gradually slow,'' analysts at TD Securities said. ''We think today's report does not change the calculation for the Fed, supporting their inclination to front-load interest rate hikes until it reaches a more neutral stance by the fall.''

''This report will do little to change the price action in the FX space, but it does mean that the better the data, the more difficult that a pause or reduced pace of tightening later this year becomes. The upcoming US CPI report and MoM reading will be far more important for broad USD dynamics.

Core prices likely stayed strong in May, with the series registering a second consecutive 0.5% MoM increase. A drag on inflation recently, we now expect used vehicle prices to be a contributor, advancing for the first time in four months. We also look for continued momentum in airfares and shelter inflation. Our MoM forecasts imply 8.4%/5.9% YoY for total/core prices.''

ECB in focus

This backdrop is problematic for currencies that do not have aggressive hikers (like the yen), while it means less of an issue for those that do (like the EUR), the analysts argued ahead of this week's ECB meeting.

''We expect the ECB to announce that the APP will end within weeks, and send a strong signal that rate hikes are coming in July and September (October remains a more interesting meeting in this sense),'' the analysts said. ''Forecasts will show stronger inflation and weaker growth, highlighting the ECB's challenge going forward.''

- AUD/USD bulls seeking a break towards 0.7350 with daily resistance eyed.

- H4 support is critical within the M-formation structure.

As per last week's pre-open analysis, AUD/USD Price Analysis: Bulls move into a critical area on H4 charts, eye a run to the 0.7250/60ss, where it was explained that the price was in ''pursuit of the price imbalance between recent highs and the May 4 highs at 0.7266,'' the bulls indeed met the target.

AUD/USD prior analysis

AUD/USD live market

The price has mitigated that imbalance as projected and is now forming an M-formation on the 4-hour time frame. For the open, the focus is between the neckline near 0.7250 and support neat 0.7180. A break below there will be bearish and will open prospects of a run to 0.7150. A break of resistance, on the other hand, will reveal the 0.7350s as the next key resistance area as per the daily chart:

The volume profile is illiquid between resistance and 0.7350.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.