- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 07-06-2022.

The Japanese Gross Domestic Product released by the Cabinet Office has been released as follows:

- Q1 Revised real gdp -0.1%QoQ (prelim -0.2%, Reuters poll -0.3%).

- Revised Real GDP annualised -0.5% (prelim, poll -1.0%).

- Revised Capex -0.7% QoQ (prelim +0.5%, poll +0.3%).

- Revised private consumption +0.1% QoQ (prelim -0.0%).

- Revised net external demand contribution to GDP -0.4 pct point (prelim -0.4 pct point).

- Revised domestic demand contribution +0.3 pct point (prelim +0.2 pct point).

The yen is on the backfoot but the data will have little impact. USD/JPY is higher in the session regardless by 0.18% so far at 132.80.

About the Gross Domestic

The GDP released by the Cabinet Office shows the monetary value of all the goods, services and structures produced in Japan within a given period of time. GDP is a gross measure of market activity because it indicates the pace at which the Japanese economy is growing or decreasing. A high reading or a better than expected number is seen as positive for the JPY, while a low reading is negative.

- AUD/JPY pauses seven-day uptrend around the highest levels since 2015.

- Overbought RSI, nearness to the bullish channel’s resistance challenge further upside.

- Sellers need clear break of 94.70 for entry.

AUD/JPY retreats to 96.00, after refreshing a seven-year high the previous day, as buyers take a breather inside the weekly ascending channel during Wednesday’s Asian session.

Also challenging the cross-currency pair’s further upside is the overbought RSI (14) and nearness of the quote to the stated bullish trend channel.

However, sellers may wait for a downside break of the April 2022 peak, near 95.75, to take fresh entries. Even so, a convergence of the channel’s support line and 21-SMA, around 94.70, appears a tough nut to crack for the AUD/JPY bears.

Should the quote drop below 91.60, the odds of its south-run to the 200-SMA level of 91.60 can’t be ruled out.

Alternatively, the aforementioned channel’s resistance line near 96.40 and the May 2015 peak of 97.30 are likely immediate hurdles for the AUD/JPY bulls to cross before eyeing the 100.00 psychological magnet.

Overall, AUD/JPY remains in a bullish trajectory but may witness a pullback.

AUD/JPY: Four-hour chart

Trend: Pullback expected

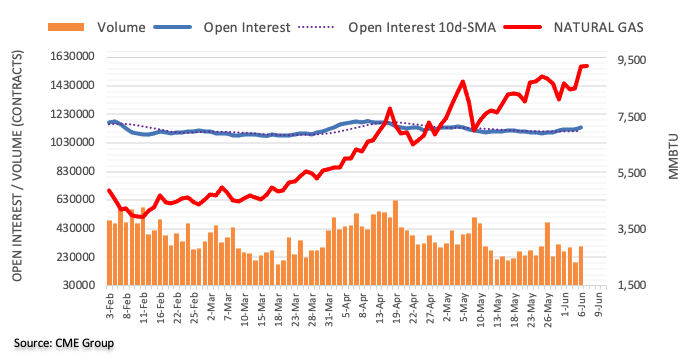

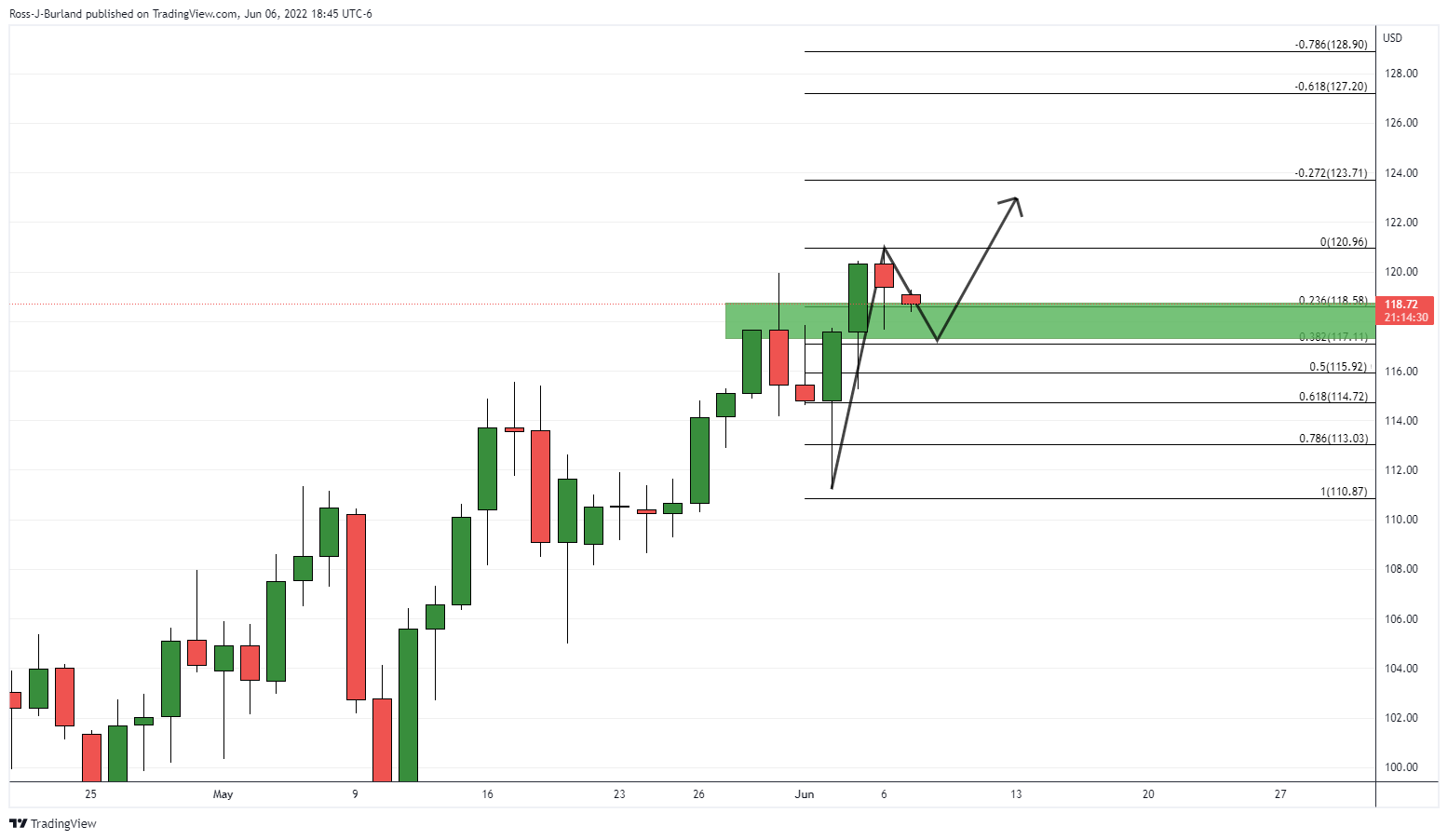

- Oil prices are trading back and forth around $118.00 as investors await a fresh trigger.

- Advancing odds of a demand recovery in China will keep bulls in the driving seat.

- The promise of pumping more oil by the OPEC+ is unable to offset the oil exports from Russia.

West Texas Intermediate (WTI), futures on NYMEX, has stretched its consolidation amid the unavailability of any potential trigger that could dictate direction to the oil investors. The oil prices have turned sideways towards $118.00 and are eyeing a potential catalyst as supply concerns are expected to drive the asset northwards.

Oil prices have witnessed a strong upside on expectations of a demand recovery in China. The Chinese administration has withdrawn lockdown curbs imposed on Shanghai and Beijing to contain the spread of the Covid-19. This has resumed the regular usage of oil for transportation and economic activities, which will restore the former demand grades going forward.

On the supply front, the American Petroleum Institute (API) has reported an unexpected increase in the oil stockpiles by 1.845 million barrels. However, it will have a minimal impact on the oil prices as supply concerns are galloping on a broader note. The OPEC+ has promised to pump more oil into the global supply to neutralize the shortage of oil supply due to the prohibition of oil imports from Russia by various Western leaders.

Considering the bulk oil exports from Russia and the promise of adding 648,000 barrels of oil by the OPEC+, the oil cartel is unable to fix the oil shortage. Also, the market participants cannot rely on additional oil promises from the OPEC+ as a majority of the oil-producing countries are operating at full capacity, which leaves less room for more oil production.

- EUR/USD struggles to defend the recovery from weekly low.

- US Treasury yields snapped six-day uptrend before the latest inaction, stock futures retreat on mixed clues.

- Recession fears joined market’s consolidation before the key data/events triggered previous rebound.

- Final readings of Eurozone Q1 2022 GDP may entertain traders ahead of ECB, US inflation.

EUR/USD retreats to 1.0700, following the rebound from a weekly low, as the pair traders search for fresh clues amid the market’s indecision. That said, the major currency pair remains sluggish during Wednesday’s Asian session after snapping a two-day downtrend.

The pair’s latest inaction could be linked to the steady US Treasury yields and the downbeat US stock futures, as well as an absence of major data/events during the quiet session. That said, the US 10-year Treasury bond yields drop back below 3.0%, steady at around 2.94 % by the press time, after posting the first daily loss in seven. Further, the S&P 500 Futures drop 0.15% intraday even if the Wall Street benchmarks closed in the positive territory for the last two days.

Tuesday’s downside in the US Treasury bond yields could be linked to the recession fears emanating from the faster monetary policy normalization by the major central banks. The fears grew on a comment from World Bank (WB) President David Malpass who warned that faster-than-expected tightening could push some countries into a debt crisis similar to the one seen in the 1980s.

Also exerting downside pressure on the bond coupons were comments from US Treasury Secretary Janet Yellen and hopes of faster economic recovery in China, both of which favor risk appetite. On Tuesday, US Treasury Secretary Yellen testified on the Fiscal Year 2023 Budget before the Senate Finance Committee while saying that the US economy faces challenges from "unacceptable levels of inflation", as well as headwinds from supply chain snags. The policymaker added, “An appropriate budget is needed to complement Fed’s actions to tame inflation without harming the labor market.”

On the other hand, a record monthly drop in the US trade deficit, down 19.1% to USD87.1bn for April, as well as Germany’s downbeat Factory Orders for April, challenges EUR/USD buyers. Furthermore, news that Ukraine failed to secure an agreement with Russia or Turkey also weighed on the market sentiment and paused the US dollar weakness. “Kyiv says it has not yet reached any agreement with Russia or Turkey to allow the safe passage of its grain ships in the Black Sea, injecting skepticism into a push by the U.N. to create a vital food corridor,” said Politico.

Above all, the market’s anxiety ahead of Thursday’s European Central Bank (ECB) meeting and the US Consumer Price Index (CPI) for May seems to challenge the EUR/USD traders. That said, today’s final readings of the Eurozone Q1 2022 GDP, expected to confirm the earlier forecasts of 0.3% QoQ growth, could offer intermediate clues.

Technical analysis

Despite the latest run-up from the monthly horizontal support around 1.0640, EUR/USD prices remain below 50-day EMA resistance, near 1.0735 by the press time, which in turn keeps sellers hopeful amid the receding bullish bias of the MACD.

“The strength of the economy is continuing to be reflected in the Crown accounts and shows New Zealand is well-positioned to support New Zealanders to manage the impacts of the challenging global economic environment,” said New Zealand Finance Minister (FinMin) Grant Robertson.

“For the ten months to the end of April, the Operating Balance before Gains and Losses (OBEGAL) deficit was $9.4 billion, $3.2 billion below that forecast in May's Budget 2022,” adds the policymaker on early Wednesday morning in Asia.

Key quotes

We know this is a difficult time for families and business who are doing it tough in the face of rising costs. But we face these pressures with record low unemployment, good growth levels, and lower debt than most as we look to secure our economic future.

Under the old debt measure, which looks through the variability created by the inclusion of the NZ Super Fund, net core Crown debt stood at 37.5 percent of GDP, $1.13 billion above forecast

Our economy has come through the Covid shock better than almost anywhere else. The economy is bigger than before the pandemic, unemployment is at a record low and exports are growing.

The recovery is gaining momentum and the easing of restrictions and opening up to skilled workers and tourists will help business and the economy rebuild.

2022 continues to be a challenging year for many New Zealanders facing the impact of global inflation and our resilience will continue to be tested. Nevertheless, our fiscal position is strong and our debt is substantially below most other nations.

Monetary policy is supporting fiscal policy. It was preferable to have temporary and target support.

FX reaction

NZD/USD fails to cheer the news as it retreats from 0.6500, taking rounds to 0.6490 by the press time.

Read: NZD/USD bulls face-off with bears and meet an important area of resistance

- USD/JPY is auctioning rangebound as investors await Japan’s GDP numbers.

- A subdued performance is expected from Japan’s GDP.

- This week the investing community is focusing on the US inflation as it will dictate the likely action by the Fed.

The USD/JPY pair is oscillating in a narrow range of 132.33-133.01 as investors are awaiting the release of the Gross Domestic Product (GDP) numbers by the Japanese Cabinet Office in the Asian session. The asset has remained stronger in the last two trading weeks after sensing a rebound near the round-level support of 127.00.

The uncertainty over the release of Japan's GDP has sidelined the market participants. A preliminary estimate for the quarterly GDP is -0.3% vs. the prior print of -0.2%. While the annualized GDP is expected to remain unchanged at -1%. A higher-than-expected GDP figure is going to strengthen the Japanese bulls.

Meanwhile, the US dollar index (DXY) is expected to register more downside amid an improvement in the risk appetite of investors. A round in the positive market sentiment has underpinned the risk-sensitive currencies and eventually has diminished the DXY’s appeal.

This week, the major event is the US Consumer Price Index (CPI), which will release on Friday. The annual US CPI figure is seen at 8.3%, similar to its previous print while the core CPI could trim to 5.9%. The deadly duo of the upbeat US Nonfarm Payrolls (NFP) and elevated inflationary pressures are bolstering the odds of an extreme hawkish stance by the Federal Reserve (Fed) in its monetary policy announcement next week. It is worth noting that the US economy reported the US NFP at 390k, much higher than the forecasts of 325k.

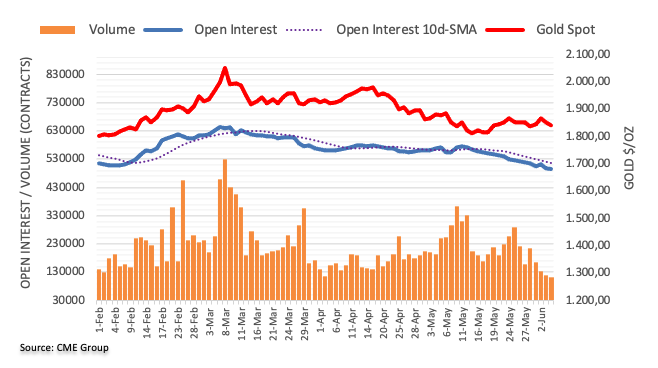

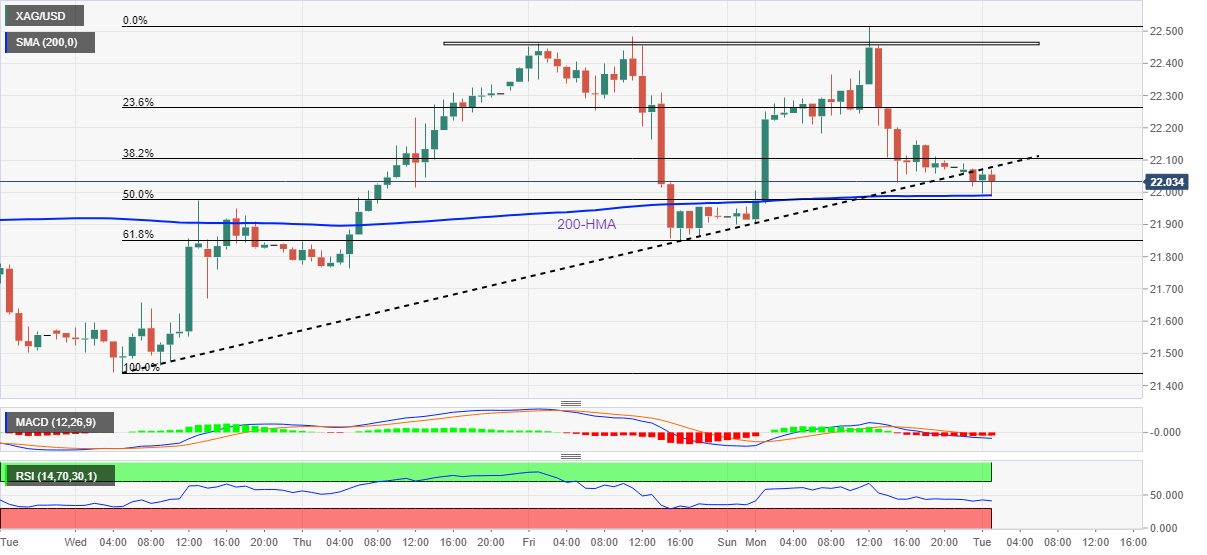

- Silver is recording gains of 1.43% in the week.

- The sentiment is mixed as the Asian session begins, US Treasury yields, and the greenback fall.

- US Treasury Secretary Yellen blames inflation on Russia’s invasion of Ukraine, though she recognized that inflation was not “transitory.”

- Silver Price Forecast (XAG/USD): Break above $22.50 to open the door towards $23.20s.

Silver (XAG/USD) records decent gains of 0.08%, as the Asian session begins, after Tuesday’s trading session when the white metal recorded gains of 0.70%. The XAG/USD is trading at $22.23 at the time of writing.

Asian equity futures are mixed ahead of Wednesday’s trading day. Wall Street finished with decent gains in choppy trading conditions, boosted by falling US Treasury yields and a softer US Dollar. The US 10-year benchmark note rate finished at 2.979%, below the 3% threshold, and the US Dollar Index, a gauge of the buck’s value, edges down 0.08%, sitting at 102.331.

In the commodities complex, XAG/USD benefitted from a soft greenback. It’s worth noting that precious metals rose in tandem, propelled by the factors above-mentioned.

Investors’ focus begins to shift towards Friday’s release of US inflation figures. Last week’s May Nonfarm Payrolls report showed that the US economy is far from slowing, despite the Q1 GDP contraction. Also, ISM PMIs, even though they slowed a tone, remain in expansionary territory.

Meanwhile, US Treasury Secretary Janet Yellen said that inflation is likely to stay high on Tuesday in an appearance with lawmakers. While Republicans blamed the US President Biden’s American Rescue Plan (ARP), Yellen said that “we’re seeing high inflation in almost all developed countries worldwide, and they have very different fiscal policies.” She added that Russia’s invasion of Ukraine is having an impact on energy and food prices globally.

Elsewhere the World Bank cut the 2022 global growth forecast to 2.9% from 4.1% in January and reported that growth in developed countries might slow down to 2.6%.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains downward biased, as shown by the daily moving averages (DMAs). But, the correction from year-to-date lows near $20.40s to $22.50s might open the door for further gains, targeting the confluence of the 50-day moving average (DMA) and the February 11 daily low-turned-resistance at $23.08.

Therefore, the XAG/USD’s first resistance would be the June 6 daily high at $22.51. Breach of the latter would expose the confluence mentioned above at around $23.08. Once cleared, XAG/USD’s next supply zone would be the May 5 daily high at $23.28.

Key Technical Levels

- GBP/USD grinds higher after staging notable rebound from three-week low.

- Bullish MACD signals, break of two-month-old resistance favor buyers.

- May’s peak, 50-DMA test upside momentum, sellers await 20-DMA breakdown.

GBP/USD holds onto the short-term key resistance break as bulls attack 1.2600 during Wednesday’s Asian session.

In doing so, the cable pair also cheers the clear recovery from the 20-DMA amid bullish MACD signals.

However, last month's top and the 50-DMA, respectively around 1.2665 and 1.2680, challenge the GBP/USD pair buyers before giving them control.

Following that, a run-up towards 61.8% Fibonacci retracement (Fibo.) of March-May downside, near 1.2860, will gain the market’s attention.

Alternatively, pullback moves may initially aim for the previous resistance line from mid-May, around 1.2560, a break of which can direct GBP/USD sellers towards the 20-DMA support near 1.2500.

Should the cable pair closed beneath the 20-DMA support, the odds of witnessing a downside move towards the 1.2400 round figure can’t be ruled out.

GBP/USD: Daily chart

Trend: Further upside expected

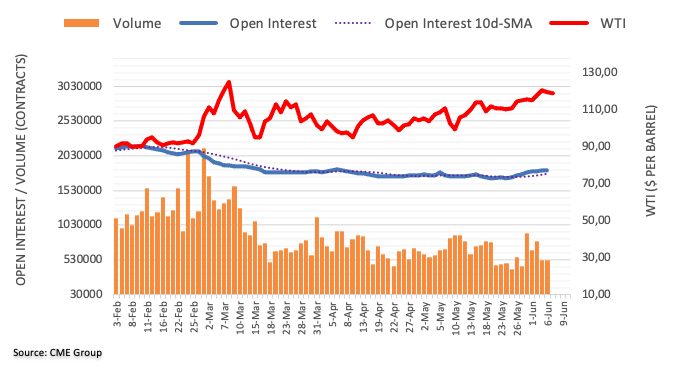

- Gold price is holding itself above $1,850.00 as investors ignored uncertainty ahead of the US inflation.

- The DXY has witnessed a decent sell-off which could drag the asset towards 102.00.

- Higher inflation and upbeat NFP will compel the fed to feature a bumper rate hike.

Gold price (XAU/USD) has displayed a minor correction after recording a high around $1,856.00 on Tuesday but is holding strongly above the crucial resistance of $1,850.00 as the US dollar index (DXY) has slipped sharply. The precious metal has been advancing higher gradually after hitting a low of $1,837.06 and is expected to extend gains if the bright metal oversteps Tuesday’s high at $1,855.64.

The DXY surrendered the majority of its gains recorded on Tuesday after failing to cross the critical barricade of 102.83. A rebound in the risk-on impulse after investors ignored the uncertainty ahead of the US inflation strengthened the risk-perceived currencies and the precious metal. The US Consumer Price Index (CPI) is expected to remain unchanged at 8.3% while the core CPI that doesn’t include food and energy prices may slip to 5.9% vs. the prior print of 6.2%.

The sustainability of the US inflation above 8% is going to put forward complications for the Federal Reserve (Fed). The Fed is going to dictate its monetary policy next week and elevated inflation along with the upbeat US Nonfarm Payrolls (NFP) will compel a rate hike decision.

Gold technical analysis

On an hourly scale, the gold price is oscillating in a wider range of $1,828.98-1,874.16 for a prolonged period. The precious metal is forming a Darvas Box chart pattern that signals a slippage in volatility followed by a breakout in the same. A 50-period Exponential Moving Average (EMA) at $1,849.74 is overlapping to the prices, which signals a rangebound move going forward.

Meanwhile, the Relative Strength Index (RSI) is struggling to enter into the bullish range of 60.00-80.00. An establishment in the same will strengthen the gold bulls.

Gold hourly chart

- The RBA has left the bulls in the driving seat ahead of key Us inflation data later this week and the Fed the following.

- A break of 0.7300 should lead to mitigation of the price imbalance between recent highs and potentially as far as 0.7450.

At 0.7233, AUD/USD has failed to make a higher high in the bullish cycle on a daily basis but it may have just picked up enough demand to see the bulls equipped enough to break beyond 0.7280 in the coming days. The Reserve Bank of Australia has put its peddle to the metal which could be the deciding factor in the battle between the bulls and the bears at this juncture.

The Reserve Bank of Australia's statement says explicitly that, “the Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.” The stronger language that had been set out in May suggests at least another 50bp increase is on the cards over the next few months, analysts at ANZ Bank argued. ''We think August, after the Q2 CPI print and a couple more employment reports. For July we’ve pencilled in a 25bp move at this stage, with 50bp clearly being a live option.''

However, the analysts also warned that Australians’ consumer confidence dropped 4.1% last week, to its lowest level since mid-August 2020. ''This most likely reflected cost-of-living concerns as inflation expectations rose to 5.7%, its highest weekly reading since early April. Consumers are especially pessimistic about the current economic outlook and their current financial circumstances.''

Meanwhile, there is little reason for the Fed to ease up anytime soon, as analysts at RBC Economics argued. ''With the US economy running hot, the Fed is moving “expeditiously” to a more neutral policy stance.''

The analysts there explained that the Fed's Chair Jerome Powell noted broad consensus on the committee that 50 bp hikes should be on the table at upcoming meetings—we’re with the market in thinking such moves are a virtual lock in June and July. ''We look for the Fed to revert to 25 bp hikes in September though it could continue with larger increments—a number of policymakers think front-loading hikes will put the committee in a better position later this year to evaluate the impact of tightening and assess whether more is needed.''

Markets will now look to this week's US inflation data to see if the dynamics there will offer anything to sway sentiment one way or the other, in the absence of Fed speakers this week. The date will be key to that assessment with the Fed wanting to see clear evidence that inflation is moving toward its 2% target before easing up on rate hikes.

AUD/USD technical analysis

The price has picked up demand at old resistance and that could carry the bulls through the overhead daily resistance in the coming days. A break of 0.7300 should lead to mitigation of the price imbalance between recent highs and potentially as far as 0.7450.

- USD/CAD stays pressured towards refreshing multi-day low after dropping the most in a week.

- US Treasury yields drowned on fears that tighter monetary policy will weigh on growth.

- Mixed data, hopes from US budget also underpinned market’s consolidation.

- Light calendar emphasizes on risk catalysts ahead of the key data/events.

USD/CAD holds lower ground near 1.2530 as bears cheer softer US dollar while ignoring inactive oil prices during Wednesday’s early Asian session. The Loonie pair’s latest weakness could be linked to the retreat in the US Treasury yields as markets brace for this week’s key data/events.

US Dollar Index (DXY) snapped two-day rebound while reversing from a fortnight high, around 102.30 at the latest, as the US 10-year Treasury yields drop back below 3.0% while positing the first daily loss in seven.

The retreat in the US Treasury bond yields could be linked to the recession fears emanating from the faster monetary policy normalization by the major central banks. The fears grew on comment from World Bank (WB) President David Malpass who warned that faster-than-expected tightening could push some countries into a debt crisis similar to the one seen in the 1980s.

It’s worth noting that a record monthly drop in the US trade deficit, down 19.1% to USD87.1bn for April, joined Canada’s mixed Ivey PMI for April and softer trade numbers, to also push the Bank of Canada (BOC) and the Fed towards more tightening. The same amplified growth fears and helped in the US bond market consolidation ahead of the US Consumer Price Index (CPI), as well as Canada’s jobs report, up for publishing on Friday.

Elsewhere, prices of Canada’s main export item, WTI crude oil couldn’t much cheer the US dollar weakness as the black gold dribbled around $120.00, mildly offered by the press time, on fears of softer energy demand, amid recession woes, as well as downbeat API data. That said, the weekly prints of the American Petroleum Institute’s (API) Crude Oil Stock data for the period ended on June 3 flashed an addition of 1. 845M barrels versus the previous contraction of 1.181M.

Amid these plays, the Wall Street benchmarks another positive daily close and exerted downside pressure on the US dollar’s safe-haven demand.

Considering the market’s consolidation ahead of Friday’s key data/events, the USD/CAD bears are likely to keep reins until the shift in the market sentiment trigger a corrective pullback from the multi-day low.

Technical analysis

A clear downside break of the 61.8% Fibonacci retracement (Fibo.) of October 2021 to May 2022 upside, around 1.2590, directs USD/CAD prices towards a seven-month-old support line near 1.2500.

- USD/CHF is attempting a recovery after a downside move to near 0.9720.

- The US Inflation will dominate the FX domain despite an unchanged forecast at 8.3%.

- The Swiss docket will report the Unemployment Rate, which is seen at 2.2%.

The USD/CHF pair is finding bids around 0.9720 as the asset has displayed some signs of exhaustion in the downside move. On a broader note, the greenback bulls have remained stronger over the last week, however, profit-booking near 0.9779 brought a minor correction in the asset.

Going forward, the asset is likely to dance to the tunes of the US Inflation, which is due on Friday. As per the market consensus, the US Consumer Price Index (CPI) is seen unchanged at 8.3% on annual basis. The sustainability of the price pressures above 8% is a nightmare for US households as elevated inflation is dampening the paychecks. However, the annual core CPI is expected to drop to 5.9% from the prior print of 6.2%, which may bring some relief to the Federal Reserve (Fed).

Meanwhile, the US dollar index (DXY) is displaying a balanced market profile in a 102.26-102.35 range after a vertical downside move. It is worth noting that the correction in the USD/CHF pair is lower in comparison with the fall in the DXY, which signals that the Swiss franc bulls are also weak.

On the Swiss franc front, investors are focusing on the Unemployment Rate, which is due in the European session. The jobless rate is seen stable at 2.2% on monthly basis. The Swiss National Bank (SNB) is continued with its prudent monetary policy amid lower inflation levels and is expected to continue dedicating to the same till it finds a significant change in the economic catalysts.

- On Tuesday, the GBP/JPY reached the inverted head-and-shoulders chart pattern at 167.00.

- GBP/JPY Price Forecast: A negative divergence in the 1-hour chart might open the door for a pullback towards 165.50.

The GBP/JPY rallied during the North American session and reached a fresh-seven-week high above 167.00 for the first time since April 18, though as Wall Street’s closed, the cross-pair retraced towards the high 166.90s. At the time of writing, the GBP/JPY is trading at 166.97.

US equities finished the session in an upbeat mood. UK political turmoil, alongside global central bank tightening conditions, keeps investors uneasy. In fact, the Reserve Bank of Australia (RBA) added its name to the list of central banks, hiking 0.50%, leaving the ECB, the BoJ, and the Swiss National Bank (SNB), behind.

On Monday, UK Prime Minister Boris Johnson achieved a victory on the no-confidence vote. Nevertheless, his position weakened, leaving it exposed after the party-gate on his office, despite Covid-19 restrictions, in 2020. The GBP rallied as a relief to the news, though a slowing economic outlook in the UK puts the stagflation scenario on the table.

On Tuesday, the GBP/JPY opened near the day’s lows, below the 165.50 mark, and began its uptrend. Towards fresh weekly highs. Once European traders got to their desks, the GBP/JPY corrected just above the daily lows and rallied sharply towards 167.00.

- Also read: GBP/JPY Price Analysis: An inverted head-and-shoulders targeting 167.00

GBP/JPY Price Forecast: Technical outlook

On Monday, I wrote a note about an inverted hammer in the daily chart. On Tuesday, the inverted head-and-shoulders target was fulfilled as the GBP/JPY reached a daily high at 167.00, and the next target on the upside would be the YTD high at 168.43. Nevertheless, the Relative Strength Index (RSI) is closing sharply towards overbought conditions, at 68.48, opening the door for consolidation before the uptrend continues.

The GBP/JPY 1-hour chart shows the cross is topping in the near term, confirmed by the RSI. Also, the GBP/JPY price action printed a series of successive higher-highs, but on a weaker momentum, as RSI edges lower, meaning a negative divergence looms. Hence, the GBP/JPY might be headed to the downside.

That said, the GBP/JPY first support would be the daily pivot at 166.38. Break below would expose the S1 daily pivot at 165.66, followed by the S2 pivot at 164.45.

Key Technical Levels

- NZD/USD bulls fly into a wall of resistance.

- Bears could be lurking and eager for a discount.

At 0.6490, NZD/USD is holding on to bullish territory but looking over the abyss following Monday's roller-coaster ride where the price fell to a low of 0.6422 in mid-day Asia trade. The bird is not airborne again but is up against four-hour resistance around 0.65 the figure.

''The bounce off overnight lows looks to have been courtesy of broad USD weakness as bond yields there slip back below 3%,'' analysts at ANZ Bank noted. As measured by the 10-year Treasury yield, US yields are falling on the second day of trade this week, down from the 3.062% highs to lows of 2.963%. Consequently, the greenback was dropping to the lows of the day near 102.26 at the time of writing, as measured by the US dollar index (DXY), vs. a basket of six currencies.

''There is no local data today, and the Kiwi is likely to continue to dance to a global beat, and it’s arguable that the greatest source of downside is USD weakness, whereas domestic factors (hard landing etc) appear to pose more downside risks,'' the analysts at ANZ Bank said.

In prior notes, the analysts explained that ''higher rates are helping the Kiwi (that’s evident in NZD/AUD) but it’s likely that the May MPS marked peak RBNZ ‘hawkish surprise’. It’s hard to see future MPSs being so hawkish relative to market expectations; that makes us more cautious than otherwise on the NZD’s prospects. Fears of a hard landing here also continue to percolate; that’s another potential NZD headwind.''

NZD/USD technical analysis

The price is meeting a key resistance area and if this were to hold, the bias will be on the downside again for a potential lower low within the broader bear trend.

- The EUR/USD remains almost flat in the week, though losing 0.09%.

- Sentiment remains positive, though the EUR/USD remains in choppy trading ahead of ECB’s decision and US inflation numbers.

- EUR/USD Price Forecast: To resume downwards if the major breaks below 1.0700.

EUR/USD pares some of Monday’s losses and tests the 50-day moving average (DMA) to the upside on Tuesday during the North American session. At 1.0709, the EUR/USD exchanges hands on top of the previously-mentioned DMA at the time of writing.

A positive mood and a weaker US Dollar lift the EUR/USD

US equities are trading with gains as Wall Street’s closing looms, reflecting Investors’ positive mood. Market players’ worries about elevated prices and the Federal Reserve’s tightening conditions eased. Consequently, US Treasury yields fell, underpinning the greenback, a tailwind for the EUR/USD.

The US 10-year Treasury yield pares Monday’s gains and loses six basis points, down at 2.981%. In the meantime, the US Dollar Index, a measure of the buck’s value, grinds lower some 0.10%, sitting at 102.302.

Data-wise, the Eurozone economic docket featured the S&P Global Construction PMI for the fourth largest economies in the block, alongside the Euro area figures. The readings were mixed, though they failed to trigger a reaction in the pair. Later in the week, the European Central Bank (ECB) monetary policy lurks. The ECB President Lagarde & Co. are expected to hold rates unchanged, though market players await forward guidance regarding the APP and signals that the bank would shift policy to normal.

Meanwhile, 10-year bond yield spreads across the Euro area began to widen. Greece and Italy spread have hit the 3.87% and 3.42% threshold, respectively,

The US economic docket featured the Trade Balance, which helped ease the deficit, narrowing the most in almost nine and half years in April, as exports bounced to a record high of $252.6 billion vs. March’s $244.1 billion.

Ahead of the week, Initial Jobless Claims, inflation figures, and Consumer confidence would give GBP/USD traders the current status of the US economy.

EUR/USD Price Forecast: Technical outlook

The EUR/USD has a downward bias, despite the major’s correcting from YTD lows around 1.0300s to 1.0780s. Also, EUR/USD traders pushed the pair near the 50-day moving average (DMA) at 1.0705, though a daily close below would exacerbate a move towards the June 1 swing low at 1.0627, as the first target.

The daily moving averages (DMAs) above the spot price have a downward slope. The Relative Strenght Index (RSI), albeit at bullish territory at 53, aims lower, meaning that selling pressure begins to mount in the pair.

The EUR/USD first support would be 1.0700. Break below would expose the June 1 low at 1.0627, followed by the May 20 daily low at 1.0532, and the May 19 low at 1.0460.

- The price is running into monthly resistance but prior highs near 102.80 will be eyed if the bulls stay with the course.

- The yen is suffering a central bank divergence blow and a potential paradigm shift.

At 95.89, AUD/JPY is strong and rising over 1% on the day following a surprise move and hawkishness from the Reserve Bank of Australia. AUD/JPY rallied to a high of 96.14 on the back of the RBA's rate hike and the statement that ays explicitly that, “the Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.” The stronger language that had been set out in May suggests at least another 50bp increase is on the cards over the next few months, analysts at ANZ Bank argued.

By contrast, the weakening trend in the yen has reasserted itself while the monetary policy divergences will continue to widen and that should lead to continued yen weakness, as analysts at Brown Brothers Harriman pointed out. ''Governor Kuroda walked back his comments yesterday regarding greater tolerance on the part of consumers to accept higher prices, noting 'I didn’t necessarily say it in an appropriate way.' Officials have the tricky task of explaining exactly why exiting years of deflation should be welcome. April leading and coincident indexes were also reported.''

As a consequence USD/JPY is trading at a new high for this cycle near 133 which has helped to elevate the Aussie/yen cross further. ''We maintain our long-standing target of the January 2002 high near 135.15,'' the analysts argued.

Meanwhile, historically, the yen's correlation to stock markets has been negative as it tends to benefit from risk-off tones, but since April of this year, that correlation to the S&P 500 has broken down as follows and instead, the DXY is picking up the flack:

The indicator at the top is a trend bias indicator based on the strength of the US dollar. In this scenario, it is indicated that the S&P 500 is destined to move lower. Meanwhile, the JXY index that measures the yen vs. a basket of currencies is moving lower, despite this while the greenback's trend is bullish. Whether this is a paradigm shift or just a brief irregularity will be important for the direction of AUD/JPY, as historically, the pair has been regarded as the forex risk barometer.

If the yen continues to decouple from risk, then the AUD/JPY cross will more likely depend on the RBA and central bank divergences. The Bank of Japan is committed to conducting fixed-rate operations, which will be expected to keep this sharp Japanese yen depreciation going for the time to come which could expose a much higher level in AUD/JPY. After all, the BoJ’s efforts to anchor the yield target around 0% is more important to it than the cost of living and the central bank has made it clear that it firmly believes that higher yields would impose bigger costs on the economy more than FX depreciation.

AUD/JPY technical analysis

The price is running into resistance but following a restest of prior highs that could be expected to act as support, should the bulls commit, then the monthly highs near 102.80 will be eyed.

What you need to take care of on Wednesday, June 8:

Risk aversion was once again the main theme, although the dollar edged lower against its major rivals in the last trading session of the day. Lower US Treasury yields undermined demand for the greenback, as the 10-y note yields 2.97%, after peaking earlier in the day at 3.06%.

The World Bank lowered this year's global GDP forecast to 2.9% from 4.1%. WB President David Malpass warned that faster-than-expected tightening could push some countries into a debt crisis similar to the one seen in the 1980s. Malpass added that new energy and food production is imperative for Europe and the world, as it would help reduce prices and inflation expectations.

The EUR/USD pair recovered from a fresh weekly low of 1.0651 to end the day a few pips above 1.0700. The GBP/USD suffered an early knee-jerk and bottomed at 1.2429, but later recovered to end the day near 1.2590.

US Treasury Secretary Janet Yellen testified on the Fiscal Year 2023 Budget before the Senate Finance Committee. She said that the US economy faces challenges from "unacceptable levels of inflation", as well as headwinds from supply chain snags. An appropriate budget is needed to complement Fed’s actions to tame inflation without harming the labor market.

Wall Street managed to revert its negative tone and posted gains in the last hours of trading, helping mostly commodity-linked currencies. The AUD/USD pair is currently in the 0.7230 price zone, while USD/CAD trades around 1.2520, holding at its lowest in seven weeks.

The USD/JPY pair kept advancing, reaching a fresh multi-year high of 132.99 to end the day at 132.55. USD/CHF posted modest intraday gains to settle around 0.9722.

Weaker US government bond yields pushed XAUUSD higher. The bright metal changes hands at $1,855 a troy ounce. Crude oil prices, on the other hand, benefited from the positive tone of Wall Street, with WTI at $120.20 a barrel.

Markets’ volatility reflects uncertainty about the economic future amid fears aggressive quantitative tightening will provoke recessions among major economies.

Top 3 Crypto Price Prediction Bitcoin, Ethereum, Ripple: Crypto’s manipulation proves decentralization is a myth

Like this article? Help us with some feedback by answering this survey:

- The shared currency is climbing in the week by 1.17%.

- Market players’ sentiment turned positive, though it could fluctuate at anytime.

- EUR/JPY Price Forecast: Consolidating, but subject to mean reversion due to the size and speed of the rally; might fall to the 140.00s before resuming upwards.

The EUR/JPY is soaring to 7-year highs, to a level last seen in January 2015, at around 142.06, though the euro bulls are taking a breather as the EUR/JPY remains positive below the 142.00 mark. At 141.88, the EUR/JPY reflects investors’ mixed mood as US equities fluctuate.

Investors’ mood is fragile, fluctuating between positive/negative. Of late, US equities shrugged off worries of the global central bank tightening monetary conditions and the possibility of the US reaching a recession.

Tuesday’s EUR/JPY price action witnessed the cross-currency opening around 141.00. Through the end of the Asian-beginning of the European session, the EUR/JPY rallied sharply towards the 7-year high at 142.06, retreating later to the R1 daily pivot point at 141.50.

EUR/JPY Price Forecast: Technical outlook

From the EUR/JPY daily chart perspective, the cross is upward biased. However, the Bollinger’s band, alongside the Relative Strenght Index (RSI) shows that volatility has increased sharply. In fact, the EUR/JPY is in overbought territory, as shown by the RSI above 70, opening the door for a mean-reversion move before resuming the ongoing bias.

In the near-term, the EUR/JPY 1-hour chart depicts the cross consolidating in the high 141.00s, near the 142.00 area, forming a top that could evolve to a double-top chart pattern. Also, the EUR/JPY exerts pressure on the 20-hour simple moving average (SMA), which, once cleared, would send the EUR/JPY falling towards the 50-hour SMA at 140.94. A break below would expose the 100-hour SMA at 140.07.

Key Technical Levels

- Gold is trapped below a critical 4-hour resistance and moving sideways out of the daily trendline resistance.

- The weekly chart's bias is to the downside and critical US inflation data and central bank meetings could be the catalyst.

At $1,850.06, the gold price is 0.45% higher and trading between a low of $1,837.06 and a high of $1,853.63 on the day so far. The markets are somewhat volatile as traders weigh the fickle outlooks for global growth, the latest of which comes from the World Bank.

''Global economic growth will likely lose momentum this year, with the Ukraine war, soaring inflation and rising interest rates threatening what is now considered a precarious recovery," the World Bank stated on Tuesday. It expects Real Gross Domestic Product to rise just 2.9% in 2022, significantly lower than a 4.1% rise previously projected in January. The US economy is expected to expand 2.5% this year, down 1.2 percentage points from the prior forecast.

Meanwhile, the US dollar climbed to a two-week high while on the back of rising US Treasury yields that had supported the greenback. However, as measured by the 10-year Treasury yield, they are falling on the second day of trade this week, down from the 3.062% highs to lows of 2.963%. Consequently, the greenback is dropping to the lows of the day near 102.30 at the time of writing, as measured by the US dollar index (DXY), vs. a basket of six currencies.

The lower yields and greenback are supporting the gold price that was already being boosted by the mounting inflation concerns. While the yellow metal yields little compared to bonds, it benefits from the safe-haven bids for the precious metals. The surprise 50-basis-point rate increase in Australia was the catalyst at the start of the day which has jolted the financial markets into a risk-off mode amid concerns over policy tightening ahead of a European Central Bank meeting this week.

The Reserve Bank of Australia's statement says explicitly that, “the Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead.” The stronger language that had been set out in May suggests at least another 50bp increase is on the cards over the next few months, analysts at ANZ Bank argued.

However, whether the precious metal can continue to benefit in a straight line in such a hawkish environment is questionable. As authors at Reuters pointed out, ''although gold is considered a hedge against higher inflation, interest rate hikes remain a potential headwind since that translates into a higher opportunity cost of holding non-yielding bullion.''

In this regard, analysts at TD Securities said in a note that "the gap between gold and real rates may be attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive amount of complacent length being held in gold, keeping the yellow metal's prices elevated."

Meanwhile, besides the ECB this week, traders will be looking to the US inflation data due Friday for clues on the Federal Reserve's interest rate hike trajectory. We are in a blackout period in terms of Fed speakers, so the data will be important ahead of the Federal Open Market Committee meeting on June 14-15 where another 50 basis points of rate hikes are currently being priced in.

Gold technical analysis

On the daily chart above, the gold price is bouncing around along a support structure but the price is yet to convince to the upside following a break of resistance when it moved out from beneath the daily dynamic trendline resistance.

On the 4-hour chart, the price needs to break this meanwhile resistance if the bulls are going to enjoy a spell of fresh air out of the consolidation phase with prospects of a bullish continuation and meaningful correction of the broader downtrend, as per the weekly chart below:

- The GBP/USD remains positive on the week, up by 0.82%.

- The UK Prime Minister Boris Johnson won a no-confidence vote, and the GBP reacted positively.

- The World Bank reduces the global economic growth from 4.1%.

- UK’s PMI remains in expansionary territory, showing the economy is slowing.

- The US Trad deficit narrowed the most in nearly 9 ½ years.

The British pound climbs for the second straight day amidst two days of a volatile trading session, courtesy of political issues, mainly the Boris Johnson no-confidence vote on Monday. At the time of writing, the GBP/USD is trading at 1.2593, gaining 0.54%.

UK’s PM Boris Johson to remain as Prime Minister, the GBP/USD edges up

So far, the GBP/USD remains buoyant, courtesy of Boris Johnson’s victory, although by a tight margin, spurred a brief relief rally on the pound. Also, falling US Treasury yields narrow the spread between the 10-year US and UK bond yields. However, the sentiment shifted negative, as European bourses closed with losses, while US equities showed some weakness, except for the Russell 2000, up by 0.53%.

After Wall Street opened, the World Bank lowered the global growth forecast to 2.9% from 4.1% in January. World Bank President David Malpass said that “the risks of stagflation, the Russo-Ukraine war, and lockdowns in China have been hammering growth and that a recession will be hard to avoid for many countries. Meanwhile, though global inflation is expected to moderate next year, it will likely remain above target in many economies.“

Worth noting that in the Asian session, the Reserve Bank of Australia (RBA) hiked rates by 0.50%, adding to the list of “aggressive” central banks.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. six peers, records minimal losses of 0.01%, sitting at 102.401, a tailwind for the GBP/USD.

Economic data: UK’s data boost the pound, and the US Trade deficit shrinks

The UK economic docket featured the S&P Global/CIPS UK Services and Composite PMIs indices. The Services rose by 53.4, higher than expected but trailed the 58.9 April’s reading. Composite rose by 53.1, showing that activity is slowing, meaning that the UK stagflationary scenario looms.

Earlier, UK Retail Sales shrank by 1.5% YoY, vs. a -1.70% a year before. Helen Dickinson, BRC’s CEO, said, “Sales continued to see declines as the cost-of-living crunch squeezed consumer demand. Higher value items, such as furniture and electronics, took the biggest hit as shoppers reconsidered major purchases during this difficult time.”

The US economic docket featured the Trade Balance, which showed that the deficit narrowed by the most in almost nine and half years in April, as exports jumped to a record high of $252.6 billion vs. March’s $244.1 billion. Late in the week ahead, Initial Jobless Claims, inflation figures, and Consumer confidence would give GBP/USD traders the current status of the US economy.

Key Technical Levels

The Reserve Bank of Australia (RBA) rose rates by 50 bps on Tuesday to 0.85%. Analysts at Wells Fargo expect the RBA to deliver another 50 bps rate hike in July to help tame inflation, before reverting to the more typical 25 bps increments in August, November, and December, which would bring the Cash Rate to 2.10% at the end of 2022. They expect the Australian dollar to soften against the US dollar over the medium-term as the RBA will still lag behind the Federal Reserve.

Key Quotes:

“The Australian economy has shown solid economic trends this year, including resilient growth and a tight labor market. Underlying inflation has also accelerated above the Reserve Bank of Australia's (RBA) medium-term target. We expect inflation to remain elevated in the coming quarters and see potential for wage growth to quicken as well.”

“Even with this series of steady monetary tightening, we expect that RBA rate hikes will still lag behind the Federal Reserve's and fall short of the tightening currently priced in by market participants. As a result, we expect the Australian dollar to soften against the U.S. dollar over the medium-term.”

“We forecast the AUD/USD exchange rate to reach 0.6900 by the end of 2022. That said, in our view the risks could be tilted toward less weakness in Australia's currency than we currently anticipate, as inflation pressures could lead the Australian dollar to experience a more gradual pace of depreciation than our base case forecast currently projects.”

- Outlook continues to favor the Mexican peso in the short term.

- Losses are limited while above 19.50.

- Immediate resistance levels at 19.60 and 19.72.

The USD/MXN keeps a bearish tone in the short-term. The downside remains limited by the 19.50 support area. A consolidation below the mentioned zone would expose last week’s low at 19.41 and below the next support area at 19.30.

So far during the current week, USD/MXN is moving sideways, consolidating between 19.50 and 19.60. If the dollar manages to rise and hold above 19.60 it could head to test the next significant barrier around 19.71.

A daily close above 19.75 would alleviate the bearish pressure and if the recovery extends above 19.82, the outlook should change to neutral, increasing the odds of a recovery toward 20.00.

Technical indicators in the short-term are starting to favor the upside. The daily RSI is moving slowly away from 30 while Momentum (still under 100) is moving north.

USD/MXN daily chart

-637902163660326713.png)

Data released on Tuesday in Canada showed the merchandise trade surplus narrowed from CAD 2.28 billion in March to CAD 1.50 billion in April, significantly below expectations. Analysts at the National Bank of Canada explained export growth moderated in April, partially due to a decline in energy exports. They added that in volume terms, exports remained 11.9% below their level in December 2019.

Key Quotes:

“Although the trade surplus narrowed in April, Canada’s international merchandise balance nonetheless remained in positive territory, and that for a tenth time in the past eleven months.”

“After two solid increases in February (+5.1%) and March (+7.8%), imports expanded at a more modest pace. In fact, they would have been down had it not been for price increases in several categories including energy products. On the exports side, the consumer goods segment was an important contributor as shipments of packaged seafood products soared 52.4%. This increase was due not only to the sharp increase in the price of crab, but also to a shift in the fishing season for this crustacean to earlier dates.”

“After reaching unprecedented highs in the previous three months, exports of energy products were down 0.9% in April, the result of planned shutdowns for maintenance in the Alberta oil sands. This decline was partly responsible for the slight drop in the trade surplus with the United States, the main buyer of Canadian energy products.”

- The USD/JPY continues extending its weekly gains to 1.29%.

- A risk-on mood, and high US Treasury yields, boost the USD/JPY.

- The BoJ to keep the ultraloose monetary policy stance, despite yen weakness.

- USD/JPY Price Forecast: To retreat towards 132.00, as bulls prepare an attack towards 135.16

The USD/JPY rallied for the third straight day and reached a 20-year high at 133.00, a level last seen in April of 2002, amidst an upbeat market mood and also propelled by higher US Treasury yields. Nevertheless, the USD/JPY is retreating towards 132.50 at the time of writing, up by 0.49%.

Upbeat sentiment and elevated US Treasury yields tailwind for the USD/JPY

The market sentiment is mixed, as European bourses edge down, while in the States, equities are rising. In the meantime, the US 10-year Treasury yield is below the 3% threshold, post-Monday jump, down seven bps, sitting at 2.974%.

Tuesday’s overnight session witnessed the Reserve Bank of Australia (RBA) adding its name to the list of global central banks, surprisingly hiking 50 bps, its overnight cash rate. The Central Bank said they would do “what is necessary” to tame inflation. So a scenario with higher yields, and a global economic slowdown, put the stagflation outlook on the table.

Earlier, the World Bank lowered the global growth forecast to 2.9% from 4.1% in January. World Bank President David Malpass said that the risks of stagflation, the Russo-Ukraine war, and lockdowns in China have been hammering growth and that a recession will be hard to avoid for many countries. Meanwhile, though global inflation is expected to moderate next year, it will likely remain above target in many economies.“

In the meantime, during the Asia session, the Japanese docket reported weaker than expected data, particularly household spending. The reading rose by -1.7% YoY vs. -0.6% estimated. With no wage pressures in the near future, the Bank of Japan (BoJ) made it clear to maintain its loose policy stance.

The monetary policy divergences will continue to widen, leading to continued yen weakness. Governor Kuroda walked back his comments yesterday regarding greater tolerance on the part of consumers to accept higher prices, noting, “I didn’t necessarily say it in an appropriate way.” Officials have the tricky task of explaining exactly why exiting years of deflation should be welcome. April leading and coincident indexes were also reported.

The US economic docket is absent, though on Thursday will feature the Initial Jobless Claims and Continuing claims. By Friday, US inflationary readings alongside Consumer Confidence would shed some light on the current economic conditions.

Therefore, the USD/JPY remains upward biased, pressured by higher US Treasury yields. The spread between both countries’ 2-year yields continues to widen, so USD/JPY traders could expect additional buying pressure unless Japanese authorities threaten to make verbal interventions or do intervene in the FX market.

USD/JPY Price Forecast: Technical outlook

The USD/JPY retreats from the 133.00 figure, eyeing to form an “inverted hammer” candlestick. Also, the Relative Strength Index (RSI) at 71 in the overbought territory might deter USD/JPY buyers from increasing or opening fresh longs positions due to the overextended price action. Due to increased volatility in the pair, the USD/JPY might be subject to a mean reversion move.

Therefore, using the Bollinger’s band indicator, a move towards the top band around 131.97 lurks as USD/JPY bulls take a breather before pushing towards the January 2002 high around 135.16.

That said, the USD/JPY first support would be the June 6 high at 132.01. Break below would expose the previously-mentioned band at 131.97.

Data released on Tuesday showed a reduction in April in the trade deficit from a record figure in March. Analysts at Wells Fargo, point out that real net exports were a significant drag on the headline rate of GDP growth in the first quarter, they look for them to make a modestly positive contribution to overall GDP growth in the second quarter.

Key Quotes:

“The U.S. deficit in international trade in goods and services, which plunged to an all-time record of $107.7 billion in March, rebounded to "only" $87.1 billion in April. The international trade data have been unusually volatile in recent months due to the distortions of the lingering pandemic and supply chain bottlenecks.”

“The GDP data for the first quarter showed that real exports of goods and services declined at an annualized rate of 5.4% while real imports jumped 18.3%. Consequently, real net exports sliced 3.2 percentage points from the headline GDP growth rate. Indeed, the 1.5% drop in real GDP in Q1 was due in large part to this marked deterioration in real net exports. Today's data showed that the real trade deficit narrowed considerably in April from its nosedive in March and has more or less returned to its level in the first two months of the year.·

“We look for real net exports to make a modest positive contribution to overall GDP growth in the second quarter. Indeed, we do not expect the negative GDP growth print in Q1 to be repeated in Q2-2022.”

- US dollar turns negative as risk sentiment improves.

- CAD is the top performer among commodity currencies.

- USD/CAD heads for the lowest close since April 20.

The USD/CAD is falling on Tuesday and recently hit a fresh daily low at 1.2539. A weaker US dollar pushed the pair further lower during the American session.

Resumes the decline?

A sudden improvement in risk sentiment boosted US stocks indices that turned positive in a few minutes. The Dow Jones is up 0.21% after rebounding 300 points. At the same time US yields extended the decline. The US 10-year yield fell to 2.96%, far from the recent high of 3.06%.

The combination of lower US yields and risk appetite weighed on the US dollar. The DXY erased all gains and as of writing, it trades at 102.35 (daily low) down 0.07%.

Economic data from Canada showed an unexpected reduction in the trade surplus in April due to imports rising more than exports, and the May Ivey PMI rose from 66.3 to 72.0.

The USD/CAD holds a bearish intraday bias and is looking at the June low at 1.2534. A break lower could trigger more losses to the 1.2500 area. Below the next level is 1.2465, with a daily close below suggesting more losses ahead.

On the upside, 1.2575 is again a resistance level to consider, followed by the 1.2610/15 area. While under 1.2615, the pair will hold a bearish/neutral outlook in the short term. Above 1.2615, the dollar could recover further toward 1.2680.

Technical levels

In the view of economists at Rabobank, the US is likely to avoid a recession this year. However, a recession seems inevitable in 2023.

The inevitable recession

“In the US, a recession seems difficult to avoid. Either the exogenous supply shocks are going to bring down business activity or the Fed’s response to high and persistent inflation is going to do the job.”

The timing of the recession will depend on whether it “is caused by exogenous or endogenous factors. Given the strong labor market and robust consumption and investment at the moment, we think that the endogenous will be decisive. This means it is more likely going to be the recession of 2023 rather than the recession of 2022.”

- NZD/USD has recovered from earlier session lows in the 0.6420 area as risk appetite improved since the US open.

- The pair, now trading closer to 0.6475, is likely to trading between in 21 & 50DMAs pre-release of US CPI.

The kiwi failed to emulate the upside seen in its Aussie counterpart in wake of a larger than expected rate hike from the RBA and was instead one of the worse G10 performers of the day. NZD/USD dropped as low as the 0.6420s, weighed amid a risk-off feel to broader macro trading conditions after major US retailer Target released downbeat guidance, sparking fresh fears about slowing US growth.

The downbeat tone to trade prior to the US open initially weighed most heavily on the G10 currencies with the thinnest liquidity conditions (like the kiwi). However, an improvement in sentiment that has seen US equities nearly recover back to flat has helped bring NZD/USD back from lows. The pair is now trading close to 0.6475, where it still admittedly trades lower by about 0.2% on the day.

Dip-buying ahead of the 21-Day Moving Average at 0.6420 also seemed to support the kiwi on Tuesday. Subject to risk appetite conditions, the pair is likely to now remain trapped between its 21DMA and 50DMA (around 0.6580) in the run-up to Friday’s US Consumer Price Inflation data release.

Analysts suspect that if the data shows US price pressures to have eased more than expected in May, the dollar will likely weaken significantly and risk assets (like the kiwi) will rally. In such a scenario, NZD/USD might be able to test the upper 0.6500s/muster a breakout into the 0.6600s (and to its highest levels since April).

- WTI has rebounded from session lows under $118 to closer to $120 despite a risk-off Wall Street open.

- Various themes are being cited as supporting prices and encouraging dip-buying as bulls eye a break towards March highs.

Oil prices have rebounded in recent trade despite a relatively risk-off open on Wall Street after major US retailer Target gave downbeat pre-market open guidance. Front-month WTI futures were last trading higher by a little over 50 cents near the $120 per barrel mark, around $2.0 higher versus earlier session lows under the $118 level.

For now, WTI prices have remained within this week’s ranges, but the bulls will no doubt be eyeing a test of Monday’s multi-week highs near the $121 level, against the backdrop of numerous supportive crude oil-related themes. Strong demand for refined products (petrol and diesel), as evidenced by still very solid refining margins, plus evidence of strong global demand in the form of Saudi Arabia upping the Official Selling Price of its benchmark Arab light crude oil to Asia customers to a $6.50 premium over Oman/Dubai prices are being cited by analysts as supportive.

Meanwhile, themes that were in focus last week, including the reopening of Shanghai and Beijing after months of lockdowns to contain Covid-19 and OPEC+’s underwhelming output hike guidance for July and August outlined last week are also being cited. Thus, the fundamental backdrop for crude oil markets remains bullish, hence why it shouldn’t be surprising to continue seeing WTI dips being bought into.

Since mid-May, WTI has found strong support at its 21-Day Moving Average on two occasions and the technical bullish trend looks very much still in play. In the next few weeks, many might expect WTI prices to return to multi-year highs printed back in March in the $130 area. In the more immediate future, US crude oil inventory data in the form of the latest weekly Private API report at 2030GMT will be in focus as another timely indicator of the health of US demand. The US Energy Information Agency (EIA) will also be releasing its monthly oil market report at 1600GMT which will provide oil traders with some commentary to scrutinize.

- USD/TRY prints fresh YTD highs near 16.80.

- The strong recovery in the dollar pushes spot higher.

- Turkey Treasury Cash Balance results come later.

The broad-based strong note in the greenback motivates USD/TRY to advance further and clock new 2022 highs in the vicinity of 16.80 on Tuesday.

USD/TRY: Next on the upside comes the all-time high past 18.00

USD/TRY adds to the positive start of the trading week and navigates the 16.70/80 band, or new YTD peaks, so far this year.

The move higher in the pair remains well underpinned by the bullish momentum around the greenback ahead of the FOMC gathering next week. Indeed, the better performance in the US dollar weigh on the risk complex and prop up outflows from the EM FX space and the rest of the dollar-denominated assets.

In the Turkish calendar, the Treasury Cash Balance for the month of May are due later in the session.

What to look for around TRY

USD/TRY keeps the underlying upside bias well and sound and now approaches the 17.00 neighbourhood, an area last traded back in December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Unemployment Rate (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 1.14% at 16.7521 and faces the next up barrier at 16.7713 (2022 high June 7) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the flip side, a breach of 16.3136 (monthly low June 3) would aim to 16.1431 (low May 27) and finally 15.6684 (low May 23).

- USD/CHF shot to a nearly three-week high on Tuesday amid broad-based USD strength.

- The risk-off mood underpinned the safe-haven CHF and capped any meaningful upside.

- Acceptance above the 0.9745-0.9750 confluence supports prospects for additional gains.

The USD/CHF pair gained strong follow-through traction for the third successive day on Tuesday and shot to a nearly three-week high during the early North American session. The pair was last seen trading around the 0.9765-0.9770 region, up over 0.60% for the day.

The recent surge in the US Treasury bond yields continued lending support to the US dollar, which, in turn, was seen as a key factor that acted as a tailwind for the USD/CHF pair. Bulls seemed unaffected by a softer risk tone, which tends to benefit the safe-haven Swiss franc.

The momentum pushed spot prices through the 0.9745-0.9750 confluence hurdle, comprising 200-period SMA on the 4-hour chart and the 38.2 Fibonacci retracement level of the 1.0064-0.9545 downfall. This might have already set the stage for a further near-term appreciating move.

Given that oscillators on the daily chart have just started gaining positive traction, the USD/CHF pair seems poised to reclaim the 0.9800 mark. The said handle coincides with the 50% Fibo. level, which if cleared decisively would be seen as a fresh trigger for bullish traders.

The USD/CHF pair might then accelerate the upward trajectory towards testing the 61.8% Fibo., around the 0.9870 region en-route the next relevant barrier near the 0.9900 mark and the 0.9925-0.9930 area.

On the flip side, pullback below the 0.9750-0.9745 confluence resistance breakpoint might now be seen as a buying opportunity and remain limited near the 0.9720-0.9715 region. This is followed by the 0.9700 mark, which if broken might shift the bias in favour of bearish traders.

USD/CHF 4-hour chart

Key levels to watch

US Treasury Secretary Janet Yellen said in the pre-released version a Congressional testimony that the US economy faces challenges from "unacceptable levels of inflation", as well as headwinds from supply chain snags, reported Reuters on Tuesday. An appropriate budgetary stance is needed to compliment the Fed's actions to dampen inflation without undermining the strength of the labour market, she added.

Yellen said she is keenly focused on moving forward with the US proposal on a deal for global corporate tax reform and says that US President Joe Biden's budget suggests "smart, fiscally responsible investments" that will cut the deficit. The US economy is entering a transition from recovery to stable and steady growth, she noted.

The World Bank lowered its forecast for global growth in 2022 on Tuesday to 2.9% from their 4.1% estimate put out in January, Reuters reported. The World Bank said that the Ukraine war will reduce per capita income in developing economies by 5.0% from their pre-Covid-19 trend.

World Bank President David Malpass said that the risks of stagflation, the Russo-Ukraine war, and lockdowns in China have been hammering growth and that a recession will be hard to avoid for many countries. Meanwhile, though global inflation is expected to moderate next year, it will likely remain above target in many economies.

The World Bank lowered its forecast for growth in advanced economies to 2.6% in 2022 versus its estimate back in January of 3.8% and lowered its estimate for emerging economies to 3.4% from 6.6% back in January. The bank warned that it sees a real threat that faster than expected tightening of financial conditions could push some countries into the kind of debt crisis that was seen back in the 1980s.

Senior Economist at UOB Group Alvin Liew assesses the latest Nonfarm Payrolls figures released on Friday.

Key Takeaways

“The US economy added another 390,000 jobs in May while the unemployment rate stayed at 3.6%, unchanged since Mar. Wage growth continued but the pace slowed for the second straight month to 0.3% m/m, 5.2% y/y. Despite hiring challenges, some signs of weakness emerged such as the jump in those employed part-time for economic reasons and the dip in retail employment.”

“Notwithstanding those tentative signs of moderation, the overall US employment and wage gains in 2022 to date will anchor the Fed’s confidence in the labor market and keep them on the path to hike in clips of 50bps in Jun and Jul amidst on-going inflation.”

The GBP/USD pair once again fell below 1.25. Economists at Scotiabank note that cable needs to surpass the mid-1.25s in order to improve its outlook.

Recent price action is suggestive of a reversal of GBP May gains

“The decline to a fourteen-session low is signaling greater downward pressure than in recent declines under 1.25.”

“The pound’s daily low of 1.2431 stands as key support after ~1.2480, with the mid-1.24s also standing as a psychological floor.”

“We think the GBP will need to firm up past the mid-1.25s shortly and then push past 1.26 to improve its fate as recent price action is suggestive of a reversal of its May gains.”

USD/CAD is back to the high 1.25s. Economists at Scotiabank expect the pair to fall towards the 1.25 region again on a break under the 1.2585 mark.

Resistance aligns at 1.2630

“Intraday price action rather suggests a stall in the USD move higher, rather than an outright reversal at this point; we see intraday support at 1.2585 and resistance at 1.2630 for early trading.”

“A push back below 1.2585 should see the USD slip back to the low 1.25s again.”

“We continue to anticipate a drop in the USD to the Apr low around 1.24 following last week’s loss of retracement support at 1.2565.”

- EUR/USD remains on the defensive well below 1.0700.

- Immediately on the downside emerges the 1.0627 support.

EUR/USD comes under further downside pressure and extends the recent breakdown of the 1.0700 key support.

The current bearish move carries the potential to extend further and revisits the June low at 1.0627 (June 1) ahead of 1.0532 (low May 20). The RSI around 50 has still plenty of room to drop before entering the oversold territory.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1220.

EUR/USD daily chart

- Silver fell below $22.00 on Tuesday but remained within recent ranges as traders eye upcoming US CPI data on Friday.

- Further evidence of slowing US inflation coupled with growing fears about US growth add upside risks to precious metals.

- Silver bulls are eyeing a break above $22.50 resistance and a push towards $23.00.

Spot silver (XAG/USD) slipped back below the $22.00 per troy ounce level in quiet trading conditions on Tuesday and was last trading lower by about 0.5% in the $21.90s but still within recent intra-day ranges. Just released US trade data showed the country’s deficit shrinking a little more than expected in April, and this didn’t impact broader market sentiment. Ahead, traders will be watching a speech from US Treasury Secretary Janet Yellen at 1400GMT, but the remainder of the session looks set to remain quiet.

Most XAG/USD traders likely expect the pair to remain stuck within recent $21.50-$22.50ish ranges ahead of this Friday’s US Consumer Price Inflation report, with the 21-Day Moving Average at $21.74 likely to offer some short-term support. Traders are on the lookout for fresh signs that US inflation (and perhaps also Fed hawkishness might have peaked) might have peaked, which could weigh on the US dollar and US yields in the short term.

Given the negative relationship precious metals have to yields and the buck, this could give silver a boost and any US CPI-inspired break above resistance at $22.50 could see silver extend upside towards $23.00 and the 50DMA just above it. A worsening US growth story further adds to the potential upside risks for precious metals, amid a potential increase in the bid for safe havens.

Krone’s losses are likely to have been exaggerated and have already been partially corrected, in the opinion of economists at Commerzbank. They expect the EUR/NOK pair to fall below 10 again.

NOK losses overdone

“Inflation in Norway surprised to the upside again in April, so the Norges Bank may not only raise the key rate again in June but could also raise the interest rate path. Moreover, krone's losses in May seem overdone. EUR/NOK should therefore fall below the 10 mark again. However, NOK upside potential is still limited, as the ECB will also start raising interest rates in July.”

“Next year, NOK could gain a little more ground against the euro. Although the ECB is also likely to raise its key rate again, Norges Bank will remain the comparatively more active central bank. In addition, high energy prices should tend to support the NOK.”

- Gold Price continues to trade above key support level.

- 10-year US T-bond yield edges lower following Monday's upsurge.

- Sellers could take action if XAUUSD breaks below $1,840.

Gold Price registered daily losses on Monday but managed to erase a portion of its losses on Tuesday. The recent price action, however, doesn't point to a buildup of bullish momentum. Nevertheless, the significant technical support that aligns at $1,840 stays intact for the time being, causing sellers to remain on the sidelines.

US T-bond yields retreat

Following the previous week's rally, the benchmark 10-year US Treasury bond yield pushed push higher on Monday and broke above the key 3% level. In the absence of high-impact macroeconomic data releases, the upbeat US jobs report allowed yields to continue to rise. According to the CME Group FedWatch Tool, the probability of the Fed hiking its policy rate by a total of 125 basis points in the next two meetings rose to 15% from 4% last week. With safe-haven flows dominating the financial markets on Tuesday, yields edge lower and help XAUUSD stage a recovery.

Also read: Gold Price Forecast: Bearish technical structure suggests more pain ahead.

Gold Price ignores US data

The data published by the US Census Bureau revealed on Tuesday that the goods and services deficit of the United States narrowed by $20.6 billion to $87.1 billion in April. During that period, exports rose by $8.5 billion to $252.6 billion, while imports declined by $12.1 billion to $339.7 billion. These figures triggered little to no market reaction and gold continued to fluctuate in its daily range.

Earlier in the day, the monthly report published by the People's Bank of China (PBOC) showed that China's gold reserves remained steady at 62.64 million fine troy ounces at the end of May. The value of China's gold reserves, however, declined to $115.18 billion at the end of May from $119.73 billion at the end of April. Last week, Bloomberg reported that India's gold reserves increased by 9.4% on a yearly basis to 760.4 in the year ended March.

Gold bars

Meanwhile, investors gear up for this week's key events and data releases. The European Central Bank will announce its policy decision on Thursday and the US Bureau of Labor Statistics will publish the Consumer Price Index (CPI) data on Friday. Although the US Federal Reserve uses the Personal Consumption Expenditures (PCE) Price Index as its preferred gauge of inflation, the CPI reading is likely to trigger a significant market reaction. Analysts expect the CPI to tick down to 8.2% in May from 8.3% in April. A stronger-than-forecast print should provide a boost to yields and weigh on XAUUSD and vice versa.

Gold Price technical outlook

Gold Price continues to trade above the 200-day SMA, which is currently located at $1,840. When gold made a daily close below that level on May 31, it managed to reclaim it the next day. Hence, sellers might want to wait for a confirmation that $1,840 turned into resistance before taking action. In that scenario, $1,830 (static level) aligns as interim support ahead of $1,810 (the end-point of the latest downtrend) and $1,800 (psychological level).

On the other hand, $1,850 (Fibonacci 23.6% retracement) forms initial resistance. A daily close above that level could be seen as a bullish development and open the door for an extended rebound toward $1,874 (Fibonacci 38.2% retracement) and $1,890 (50-day SMA, 100-day SMA).

Gold Price at lower trend line

What's driving that gap between gold and real rates? The DKW model helps to address this question. Strategists at TD Securities conclude that the gap between gold and real rates may be attributed to an undue rise in real rates given quantitative tightening and the still-massive amount of complacent length being held in gold.

Residual rise in real rates could be partially attributable to quantitative tightening

“The DKW model highlights that TIPS liquidity premium may have overwhelmingly driven real rates over the past months, as quantitative easing likely created a scarcity of these assets. Today, quantitative tightening is now weighing on this liquidity premia as the market is left to absorb additional supply. In turn, the residual rise in real rates above what would otherwise be expected given gold prices could be partially attributable to quantitative tightening.”

“We see evidence that gold markets are hosting a massive amount of complacent length. While the war in Ukraine helped to send the bears packing, the fading of geopolitical risk premia across global assets hasn't seen this cohort of discretionary traders liquidate their length.”

“The gap between gold and real rates may be attributed to both an undue rise in real rates given quantitative tightening, and to the still-massive amount of complacent length being held in gold, keeping the yellow metal's prices elevated.”

USD/JPY is trading at a new high for this cycle near 133. Economists at TD Securities expect the pair to reach the 135 level.

MOF to note its discomfort with the currency's weakness

“The USD/JPY pair has demonstrated the capacity to make new multi-year highs despite what many believe to be a range-bound Treasury market. We view this as a significant technical development and it will not be long before the MOF will note its discomfort with the currency's weakness (not like they will do anything about it).

“135 marks the next major level for USD/JPY.”

Economist at UOB Group Ho Woei Chen, CFA, comments on the probable further tightening by the BoK in the next month.

Key Takeaways

“South Korea’s headline inflation is at a fresh 14-year high and more than double of the Bank of Korea’s (BOK) 2% target for three consecutive months. Core inflation (excluding agricultural products & oils) is above 4% for the first time since May 2009. The strong sequential gains suggest that the inflation risk remains to the upside.”

“This puts the BOK on track to continue raising interest rates and we reiterate our forecast for the central bank to hike by 25 bps at each of the three subsequent meetings in Jul, Aug and Oct before stopping at its last meeting this year in Nov.”

“The outlook for South Korea’s economy continues to be fortified by optimism from easing COVID restrictions, fiscal expansion and strong exports.”

- AUD/USD struggled to capitalize on a hawkish RBA-inspired intraday bullish spike.

- A softer risk tone, elevated US bond yields underpinned the USD and capped gains.

- The market focus will remain glued to the US consumer inflation figures on Friday.