- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 01-06-2022.

- NZD/USD fades bounce off weekly low after two-day downtrend.

- New Zealand Q1 Terms of Trade Index matches 0.5% figures.

- Firmer US data, recession fears join sour sentiment to weigh on prices.

- US ADP Employment Change, Factory Orders and Aussie trade numbers will be eyed for immediate directions, risk catalysts are crucial.

NZD/USD renews intraday low to 0.6480 as bears keep reins for the third consecutive day to Thursday’s Asian session. In doing so, the Kiwi pair justifies the market’s risk-off mood, as well as a firmer US dollar, while paying a little heed to the upbeat trade data at home.

New Zealand’s Terms of Trade Index for the first quarter (Q1) of 2022 rose 0.5%, matching forecasts, while reversing the previous -1.0% figures.

It’s worth noting that the growing fears of recession, as well as faster monetary tightening by the global central banks, keep weighing on the NZD/USD prices. On the same line could be the latest trade/geopolitical tussles surrounding China and Russia.

Strong US data and Fed Beige Book raised concerns over economic growth and inflation in the US while Fed speakers renewed chatters surrounding a faster rate hike trajectory. That said, the US ISM Manufacturing PMI for April rose to 56.1 versus the 54.5 expected and the 55.4 prior. Further, the US JOLTs Job Openings eased below 11.8 prior readings but matched 11.4 market forecasts. Furthermore, the monthly release of the Fed Beige Book showed that the majority of districts indicated slight or modest growth while most informed of continued price rises. Also, three districts, out of 12, expressed concerns about a US recession.

St. Louis Federal Reserve Bank President James Bullard also raised concerns about the US recession as he repeated that a pace of 50 bps hike per meeting is a “good plan” for now. On the same line, Federal Reserve Bank of Richmond President Thomas Barkin mentioned, “You can't find a recession in the data or actions of business execs,'' speaking on Fox Business.

Recently, Reuters came out with the news suggesting the US readiness to implement a ban on Xinjiang goods whereas comments from China's Ambassador to Australia, Xiao Qian, hint at no relief to Aussie business houses from Beijing’s ban despite the change in government.

Against this backdrop, S&P 500 Futures drop 0.20% whereas the US 10-year Treasury yields retreat from a two-week high, down 1.2 basis points (bps) to 2.91% of late.

Looking forward, Australia’s trade figures for April and risk catalysts may offer immediate directions but major attention will be given to the US ADP Employment Change for May, expected 300K versus 247K prior.

Also read: US ADP Employment Change May Preview: The labor market recedes from center stage

Technical analysis

A three-week-old support line and 21-day EMA restrict short-term NZD/USD downside near 0.6470. Recovery moves, however, remain elusive until the quote rises past May’s high near 0.6570.

- GBP/USD remains depressed around two-week low, sidelined of late.

- Clear downside break of short-term key support, 200-SMA keep sellers hopeful.

- RSI conditions, 100-SMA restrict immediate downside ahead of the multi-month low marked in May.

GBP/USD licks its wounds around a fortnight low, after dropping the most in two weeks, as the 100-SMA probes the downturn during Thursday’s Asian session. Even so, the cable pair stays pressured around 1.2480-80 levels by the press time.

Although nearly oversold RSI (14) joins the 100-SMA to challenge the pair sellers around 1.2460, bearish MACD signals and sustained trading below 200-SMA keep sellers hopeful.

Also favoring the bears is the pair’s downside break of an ascending support line from May 13, now resistance around 1.2700.

It’s worth noting, however, that multiple supports around the 23.6% Fibonacci retracement (Fibo.) of April-May fall could challenge the GBP/USD bears around 1.2385, even if the quote drops below the 100-SMA level of 1.2460.

Following that, a broad one-month-old horizontal area surrounding 1.2275-55 will be a tough nut to crack for the pair sellers.

On the contrary, recovery moves could initially aim for the 200-SMA and May’s peak, respectively around 1.2550 and 1.2670, before targeting the support-turned-resistance line near 1.2700.

Should the GBP/USD bulls manage to keep reins past 1.2700, the 61.8% Fibonacci retracement level of 1.2765 will be in focus.

GBP/USD: Four-hour chart

Trend: Further weakness expected

- The USD/JPY gains some 2.45% in the week.

- Asian equity futures reflect a dampened market mood, though

- Fed officials backed 50 bps in the next couple of meetings and are set to tighten as needed.

The USD/JPY rallies past the 130.00 mark, a level last seen on May 12, when the major pulled back towards the 125.00 area, before resuming the ongoing uptrend as traders brace for a move towards a re-test of the YTD high at 131.34. At 130.19, the USD/JPY portrays the constant greenback strength amidst a risk-aversion environment.

Dampen market mood and fears of a US recession lifts the USD/JPY

Investors remain nervous, courtesy of global central banks’ tightening monetary conditions. Also, renewed fears of escalating the Russia-Ukraine conflict surfaced as the Russian military captured an industrial city in the Donbas region, while the US prepares to send additional weaponry to Ukraine.

Meanwhile, Asian equities are poised to a “flat” open, as shown by stock futures, recording minimal losses. The US Dollar Index, a gauge of the buck’s value, rose 0.75% on Wednesday, sitting at 102.542, a tailwind for the USD/JPY.

The yield on 10-year Treasuries spiked higher as traders raised bets on the path for rate hikes, and the Fed began its Quantitatitative Tightening (QT) process.

Positive ISM PMI and Fed speakers, boost the greenback

The US docket reported positive data, with May’s ISM Manufacturing PMI rising unexpectedly, lifting the USD/JPY towards a fresh three-week high. That, alongside Fed speakers crossing newswires, gave enough strength to lift the pair above 130.00. San Francisco Fed President Mary Daly and her colleague James Bullard both backed raising rates by 50 bps this month, while Richmond’s President Thomas Barkin said it made “perfect sense” to tighten policy.

An absent Japanese economic docket would keep USD/JPY traders leaning on US data. The US economic docket would feature the ADP May Employment report alongside Initial Jobless Claims for the week ending on May 28 and Factory Orders.

“US authorities are ready to implement a ban on imports from China's Xinjiang region when a law requiring it becomes enforceable later in June, a US Customs official said on Wednesday,” per Reuters. The news adds that a "very high" level of evidence would be required for an exemption, said the source mentioned.

Key quotes

The law includes a "rebuttable presumption" that all goods from Xinjiang, where Chinese authorities established detention camps for Uyghurs and other Muslim groups, are made with forced labor, and bars their import unless it can be proven otherwise.

China denies abuses in Xinjiang, a major cotton producer that also supplies much of the world's materials for solar panels, and says the law "slanders" the country's human rights situation.

Elsewhere, China's Ambassador to Australia, Xiao Qian, says Beijing is ready to talk to Australia’s new government without preconditions. The diplomat, however, mentioned that China's punitive trade sanctions will not be dropped while also saying, “This will not happen until there is an improvement in the “political relationship” between Canberra and Beijing.”

FX reaction

Forex markets failed to offer any immediate reaction to the news but the AUD/USD remains pressured around the 0.7170 level after reversing from a one-month high the previous day.

Read: AUD/USD bulls could be about to throw in the towel, but the 38.2% Fibo is key

- EUR/JPY is oscillating above 138.50, upside remains favored on ECB-BJ policy divergence.

- To fix the inflation mess, the ECB is left with no other choice than to end its low rates cycle.

- Upbeat Japan’s employment data failed to strengthen the yen bulls.

The EUR/JPY pair is juggling in a narrow range of 138.45-138.70 in the early Tokyo session. The cross has remained in the grip of the shared currency bulls for the last two weeks on expected divergence in the ECB-BOJ monetary policy stance as early as possible.

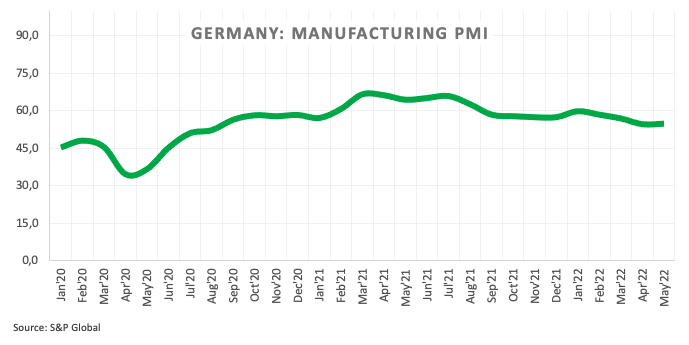

The European Central Bank (ECB) is qualified to announce a hawkish interest rate decision in its June monetary policy. Soaring inflation in eurozone amid rising prices of oil, food products, and other commodities are impacting the wallets of the households, and fixing the inflation mess is highly required.

One thing is worth noting that the eurozone has failed to keep the improvement in the employment data. The Unemployment Rate remained constant at 6.8%, lower than the market consensus of 6.7%. Despite a flat performance on the employment front, ending of the lower rate culture is highly needed to maintain harmony in the economy.

Going forward, investors will keep an eye on the eurozone Retail Sales, which are due on Friday. A preliminary estimate for the annual and monthly Retail Sales is 5.4% and 0.3% respectively. The economic data is expected to display an outperformance as the prior prints were 0.8% on annual basis and -0.3% on monthly basis.

On the Japanese yen front, the upbeat employment data failed to strengthen the yen bulls. The Jobs/Applicants ratio was improved to 1.23% vs. the former figure of 1.22%. Also, the Unemployment Rate jumped to 2.5% against the estimates and the prior print of 2.6%. The Bank of Japan (BOJ) will continue with its ultra-loose monetary policy as the growth forecasts are still lower than the pre-pandemic records.

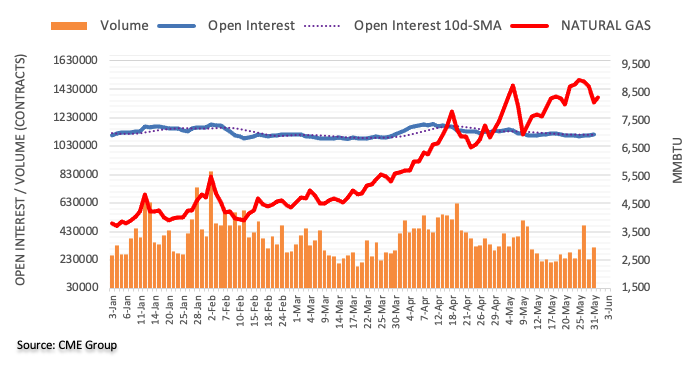

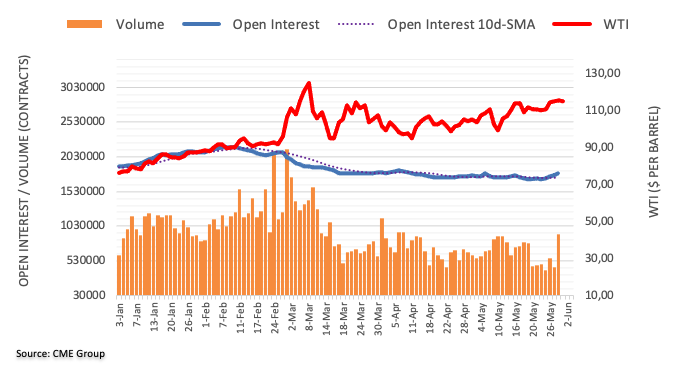

- WTI flirts with intraday low, prints three-day downtrend.

- Growing concerns over recession in the US and China weigh on energy demand outlook.

- Russia’s likely exit from OPEC+ could increase supply even as EU sanctions hurt the output.

- OPEC is likely to stick to current policy, risk flows, US data are also important to watch for fresh impulse.

WTI remains on the back foot for the third consecutive day, despite the latest bounce off intraday lows, as fears surrounding growth and Russia’s exit from OPEC+ weigh on the black gold. That said, the quote remains pressured at around $112.50 after dropping to $112.11 during the early hours of Thursday’s Asian session.

As bears cheer the gloomy outlook for demand and a boost to supplies of oil to extend pullback from a three-month high, they ignored the latest draw of API Weekly Crude Oil Stock for the week ended on May 27. That said, the industry stockpiles shrank by 1.181M versus the previous addition of 0.567M.

Strong US data and Fed Beige Book raised concerns over economic growth and inflation in the US. That said, the US ISM Manufacturing PMI for April rose to 56.1 versus the 54.5 expected and the 55.4 prior. Further, the US JOLTs Job Openings eased below 11.8 prior readings but matched 11.4 market forecasts. It’s worth noting that the monthly release of the Fed Beige Book showed that the majority of districts indicated slight or modest growth while most informed of continued price rises. Also, three districts, out of 12, expressed concerns about a US recession.

It’s worth noting that China’s successive contraction in manufacturing activities, as per the latest Caixin Manufacturing PMI, joins the hawkish path of the global central banks to also weigh on the black gold.

On Wednesday, the Bank of Canada (BOC) announced 50 basis points (bps) rate hike and the US is well on that path as St. Louis Federal Reserve Bank President James Bullard also raised concerns about the US recession as he repeated that a pace of 50 bps hike per meeting is a “good plan” for now. Further, Federal Reserve Bank of Richmond President Thomas Barkin mentioned, “You can't find a recession in the data or actions of business execs,'' speaking on Fox Business.

Elsewhere, speculations over Russia’s departure from OPEC+, comprising the Organization of the Petroleum Exporting Countries (OPEC) and Russia, triggered through a Wall Street Journal (WSJ) piece, also drowned the black gold. Further, chatters that the OPEC will keep its current policy of increasing output by 432,000 BPD, per Reuters, during today’s meeting exerts additional downside pressure on the WTI oil prices.

In addition to the aforementioned catalysts, today’s US ADP Employment Change for May, expected 300K versus 247K prior, will be eyed as well. Furthermore, the official weekly oil inventory data from the Energy Information Administration (EIA), expected -0.067M versus -1.1019M prior, will offer additional directions and should be watched carefully.

Technical analysis

Despite the latest pullback, WTI crude oil prices remain beyond three-week-old support and the 10-DMA level surrounding $112.00, which in turn keeps buyers hopeful. However, a clear upside break of March’s top surrounding $115.90 becomes necessary for the energy bulls to retake the control.

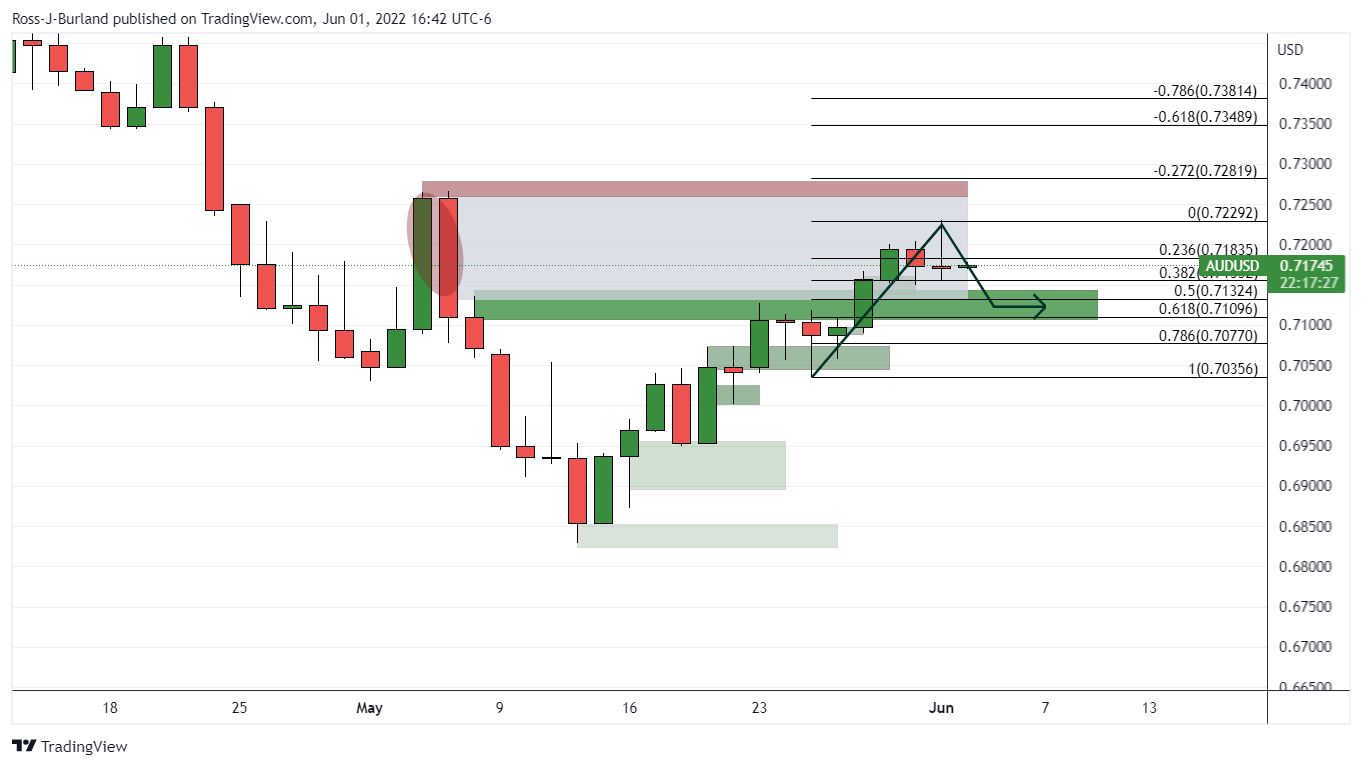

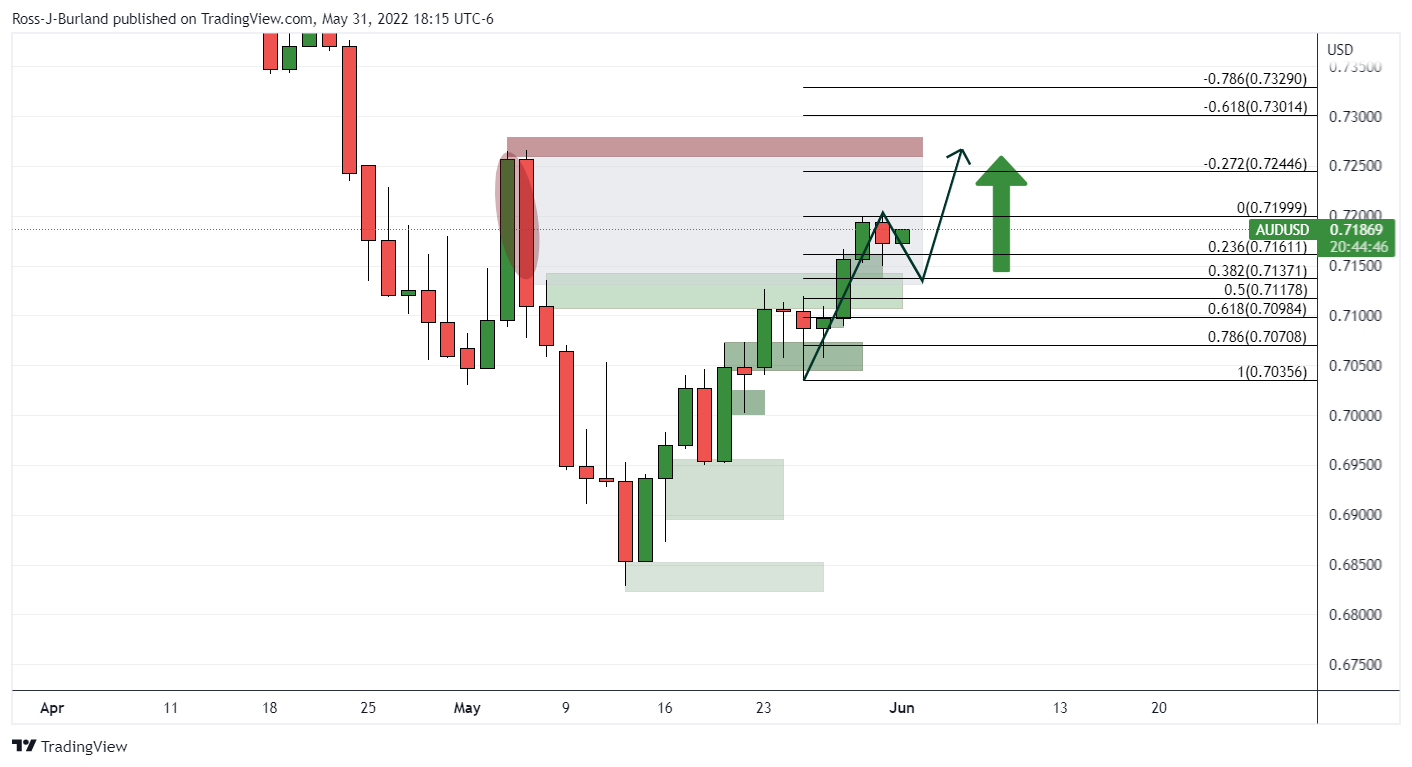

- AUD/USD is consolidating the recent volatility and has left a doji on the daily chart.

- The price could be in for some sideways action as markets take a rest bite ahead of more critical US events.

At 0.7150, AUD/USD is flat on the day and trading in the middle of the overnight ranges. It has been a period of finding equilibrium while the US dollar bounces back to life, spurred on by fears of global inflation.

The dollar index DXY, which measures the currency against six major peers, climbed to 102.71 and stalled near there, extending Tuesday's gains. Equities fell and bond yields rose as strong US manufacturing and job openings data reinforced the need for aggressive Fed funds rate hikes. The US 10-year yield lifted 9.3bps to 2.937%. As such, the high beta currency was pressured before rebounding in the midday session of New York.

In data, the US May ISM manufacturing index surprised by rising to 56.1 (55.4 previously) – the consensus expectation was for a small decline. New orders improved, rising to 55.1 (53.5 previously), while prices paid eased slightly to 82.2 (84.6 previously). Analysts said the latter is still far too high to be comfortable for the Fed.

As for the Reserve Bank of Australia, the analysts said that yesterday's growth data for the first quarter for Australia has prompted them to look for a 40bp hike in the cash rate to 0.75% in June (previously expected 25bps).

''Not only did the data show a healthy 0.8% q/q lift in GDP (as expected), but based on our calculations, non-farm average hourly earnings lifted 5.3% y/y in Q1 – an acceleration from 3.3% previously. While these earnings data can be volatile and thrown around by compositional issues, the print was still much higher than we were expecting to see,'' the analysts explained.

''Combine that with the strongest quarterly increase in the household consumption deflator since 1990 (ex-GST), and we think it should convince Governor Lowe that “there is a very strong argument” to move in larger increments than the usual 25bps.''

AUD/USD technical analysis

Wednesday's doji is not so bullish but the restest of the 38.2% could encourage buying as bulls move in at a discount and see to a full-on mitigation of the price imbalance between the highs of the doji to towards the My 5 highs of 0.7266. Failing that, if the bulls throw in the towel, a deeper correction to the support area below would be likely ahead of US Nonfarm Payrolls on Friday.

- The US Dollar index continues its weekly rally, up by 0.89%.

- Risk-aversion and positive US ISM Manufacturing PMI boost the greenback and rallies vs. most G7 currencies.

- US Dollar Index Price Forecast (DXY): The bias remains intact, though a break above 103.000 might pave the way for further gains.

The US Dollar Index, a measure of the greenback’s value vs. a basket of six foreign currencies, climbs 0.75% due to a risk-aversion Wednesday trading session as the New York session wanes and Asia takes over. At the time of writing, the DXY sits at 102.549.

The market mood remains negative, with US bourses closing lower while Asian equity futures register losses. Stronger than expected ISM Manufacturing PMI data pressured the buck against major currencies, lifting the index. Additionally, US Treasury yields led by the 10-year benchmark note rose six bps and finished around 2.911%.

Fed speakers remain hawkish, underpinning the USD

Fed speakers crossed wires on Wednesday. The first in line was the San Francisco Fed President Mary Daly, who said that she sees a couple of 50 bps increases and added that they need expeditiously to get rates to neutral.

Late in the day, Richmond’s Fed President, Thomas Barkin, said that a recession couldn’t be found in the data or actions of business executives. At the same time, he added that a reduction in the balance sheet does a little more on top of rate hikes to tighten policy. Barkin added that comfortable with the path of rate hikes for the next couple of meetings while supporting more rate hikes.

Closing the parade was the St. Louis Fed President James Bullard. He said that “The current US macroeconomic situation is straining the Fed’s credibility with respect to its inflation target.” Furthermore, he added that the US labor markets and the US economy remain robust, but Russia’s invasion of Ukraine and a sharp slowdown in China means risk remains “substantial.”

US Dollar Index Price Forecast (DXY): Technical outlook

The DXY remains upward biased. On Tuesday, the index pierced the 50-day moving average (DMA) around 101.447 but bounced off and closed at 101.414, forming a “bullish-piercing” pattern.

Wednesday’s price action witnessed bulls entering the market, lifting the US Dollar Index above the 102.000 mark, achieving a daily close above the May 5 swing low at 102.352. Therefore, the DXY bias remains intact.

That said, the US Dollar Index’s first resistance would be 103.000. A breach of the latter would expose the May 19 high at 103.820, followed by the YTD high at 105.005.

- USD/CAD defends the bounce off six-week low, grinds higher of late.

- BOC announced 0.50% rate hike, showed readiness to "act more forcefully if needed".

- Upbeat US data, hawkish Fedspeak underpin DXY’s biggest daily gains in a month.

- US ADP Employment Change, Factory Orders and Fed/BOC speakers eyed ahead of the key US NFP.

USD/CAD stays defensive around a two-month low, following the first positive daily close in six, as softer oil prices and strong US dollar tease buyers. That said, the Loonie pair seesaws around 1.2655-60 during an inactive start to Thursday’s Asian session.

The quote dropped to the lowest levels since early April just after the Bank of Canada (BOC) announced 50 basis points (bps) of rate hikes, matching market consensus. However, the important was the policymakers’ preparedness for aggressive rate lifts if needed to achieve its 2.0% inflation target.

It’s worth noting, however, that fears of growth and inflation, not to forget hawkish comments from the Fed policymakers, bolstered the US Dollar Index (DXY) and poured cold water on the BOC’s strong rate hike. Also fueling the USD/CAD prices was a retreat in the WTI crude oil prices, Canada’s key export.

Strong US data and Fed Beige Book raised concerns over economic growth and inflation in the US while Fed speakers renewed chatters surrounding a faster rate hike trajectory. That said, the US ISM Manufacturing PMI for April rose to 56.1 versus the 54.5 expected and the 55.4 prior. Further, the US JOLTs Job Openings eased below 11.8 prior readings but matched 11.4 market forecasts. It’s worth noting that the monthly release of the Fed Beige Book showed that the majority of districts indicated slight or modest growth while most informed of continued price rises. Also, three districts, out of 12, expressed concerns about a US recession.

Elsewhere, St. Louis Federal Reserve Bank President James Bullard also raised concerns about the US recession as he repeated that a pace of 50 bps hike per meeting is a “good plan” for now. Further, Federal Reserve Bank of Richmond President Thomas Barkin mentioned, “You can't find a recession in the data or actions of business execs,'' speaking on Fox Business.

It’s worth noting that WTI crude oil prices dropped for the second consecutive day on Wednesday, extending pullback from a three-month high to near $113.50 at the latest, as firmer US dollar and recession fears. Also, downbeat PMI data from China and anxiety ahead of today’s Organization of the Petroleum Exporting Countries (OPEC) meeting weigh on the black gold prices.

Amid these plays, the Wall Street benchmarks closed for the second day in the red while the US 10-year Treasury yields printed a three-day uptrend while refreshing a fortnight high near 2.95%.

Moving on, US ADP Employment Change for May, expected 300K versus 247K prior, will be eyed closed due to being the early signal for Friday’s US Nonfarm Payrolls (NFP). Also important to watch is the US Factory Orders for May bearing forecasts of a 0.7% increase compared to 2.2% in previous readouts. At home, an anticipated recovery in Canada Building Permits, to 0.7% from -9.3% prior, may test the USD/CAD rebound.

Also read: US ADP Employment Change May Preview: The labor market recedes from center stage

Technical analysis

A daily closing below 200-DMA, around 1.2665 by the press time, keeps USD/CAD directed towards a two-month-old support line near 1.2600.

- EUR/USD is expected to decline towards 1.0627 as DXY rebounded on upbeat PMI data.

- Mounting inflationary pressures in eurozone are compelling for a rate hike announcement by the ECB.

- The annual eurozone Retail Sales may climb to 5.4%, higher than the former figure of 0.8%.

The EUR/USD pair is juggling around 1.0650 after a sheer downside move from 1.0730 on Thursday. A sluggish consolidation move is indicating the occurrence of an intensive selling action, which will expose the asset to more downside.

The pair has displayed a vulnerable performance in the last two trading sessions after a firmer rebound in the US dollar index (DXY). Rising odds of an extreme hawkish monetary policy dictation by the Federal Reserve (Fed) in its June monetary policy and the upbeat US ISM Manufacturing PMI were sufficient to bring bulls back into the counter. The US ISM PMI landed at 56.1, higher than the forecasts of 54.5 and the prior print of 55.4.

On the euro front, the chances of the first rate hike announcement by the European Central Bank (ECB) taking into account the inflationary pressures have been bolstered. The eurozone Harmonized Index of Consumer Prices (HICP) landed at 8.1% vs. the expectation of 7.7% and the prior print of 7.4%. A significant upside in the inflation numbers in Europe is compelling for an end of the lower rates cycle and the ECB will feature rate hikes in its upcoming monetary policy meetings.

Going forward, investors will focus on the release of the US Nonfarm Payrolls (NFP), which is seen at 325k against the prior print of 428k. Meanwhile, eurozone will report the Retail Sales on Friday. As per the market consensus, the annual Retail Sales are seen at 5.4% vs. 0.8% released last April.

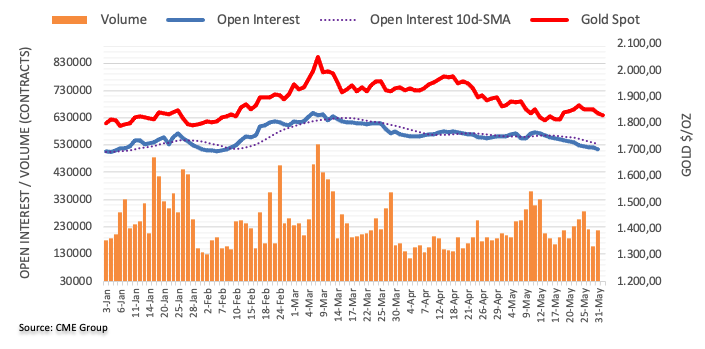

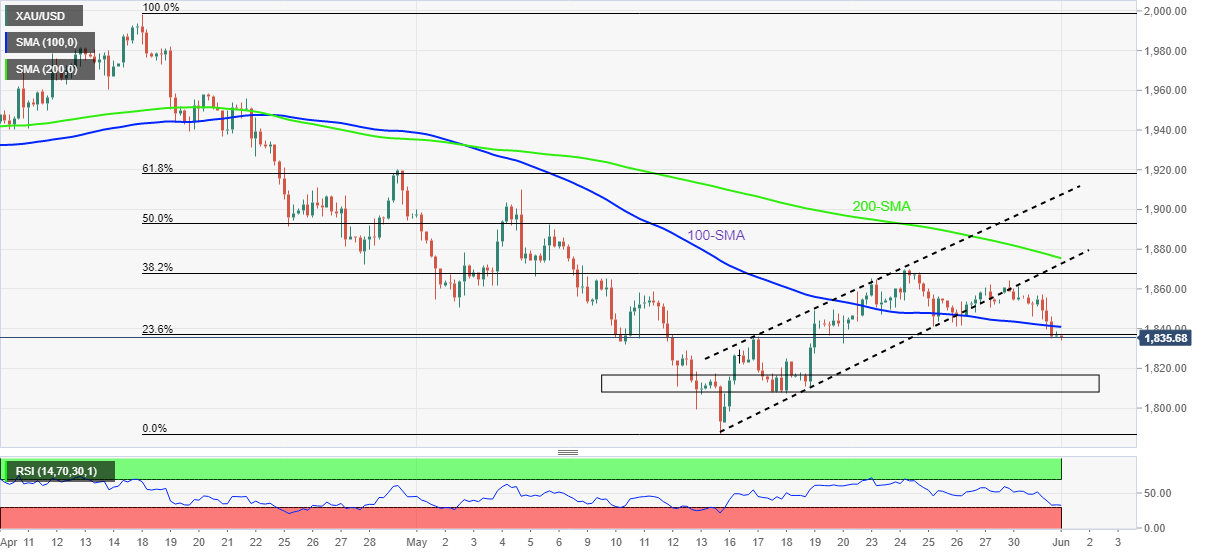

- Gold price is facing resistance around $1,850.00 on upbeat US ISM Manufacturing PMI data.

- A parallel upside move in the DXY and the golf prices is indicating an improvement in the safe-haven appeal.

- The US NFP will be the major event this week, which is expected to land at 325k.

Gold price (XAU/USD) is displaying some signs of exhaustion after a pullback move to its crucial resistance at $1,850.00. The precious metal and the US dollar index (DXY) have displayed a rare parallel upside move as both assets were advancing north on Wednesday. An initiative selling action could be observed in the gold prices amid lack of positive triggers.

Outperformance from the economic data

On Wednesday, the Institute for Supply Management (ISM) reported the Manufacturing PMI at 56.1, higher than the forecasts of 54.5 and the prior print of 55.4. An outperformance from the US economy on Manufacturing PMI despite rising inflationary pressures spurted a rally in the DXY. The DXY moved sharply higher after an upside break of the consolidation formed in a range of 101.80-102.05. Currently, the asset is balancing around 102.60.

US NFP in focus

This week, the entire investing community will focus on the release of the US Nonfarm Payrolls (NFP), which is due on Friday. A preliminary estimate for the additional jobs created in April is 325k, against the prior print of 428k. Also, the average monthly NFP figure is 551.6k from the last 12-months. More than 100k fall in job openings from a month and 200k fall in relation to the 12-month average figure indicates that the Federal Reserve (Fed) is required to focus again on balancing the labor market.

Gold technical analysis

On an hourly scale, the gold price is facing barricades around the ascending trendline of the Symmetrical Triangle, which is placed from May 20 low at $1,832.41 while the descending trendline is plotted from May 24 high at $1,869.75. The Relative Strength Index (RSI) (14) has displayed a sheer upside move from the bearish range of 20.00-40.00 to the bullish range of 60.00-80.00, which indicates a firmer reversal in the counter.

Gold hourly chart

-637897171556838165.png)

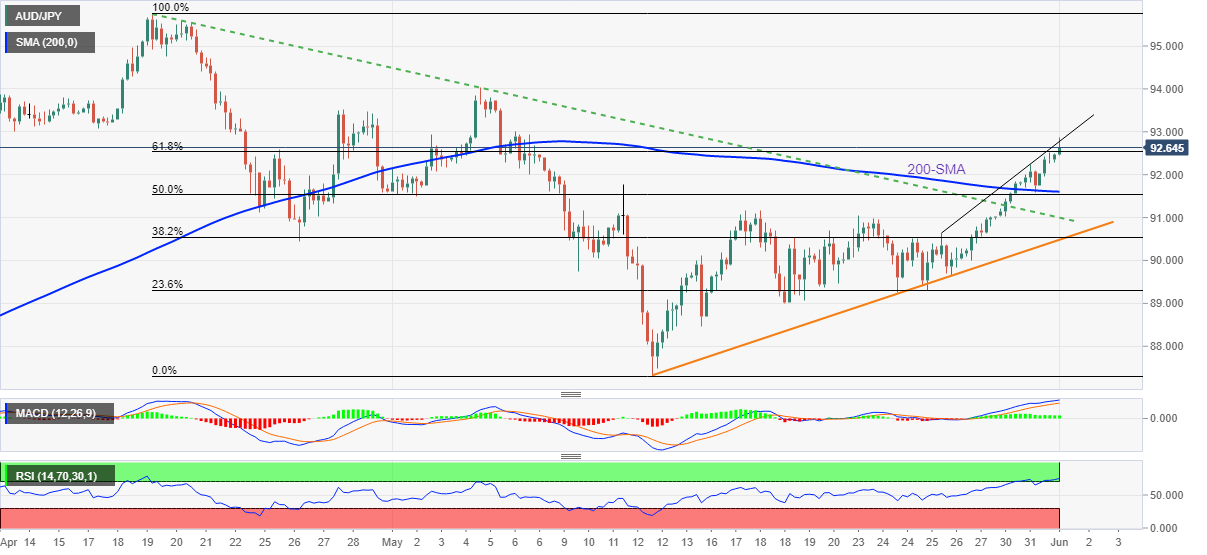

- The AUD/JPY rallies, albeit in a risk-off mood, as global equities are trading with losses.

- The sentiment is downbeat on investors’ worries about the US entering a recession and the Ukraine-Russia conflict escalation.

- AUD/JPY Price Forecast: The cross-currency is upward biased and will face solid resistance around 94.00.

The Australian dollar rallies against the Japanese yen, despite a risk-off market sentiment, reflected by global equities falling on Wednesday, courtesy of fears that the US Federal Reserve might cause a recession in the US and Russia’s advancement in Ukraine. At the time of writing, the AUD/JPY is trading at 93.37, a level last seen on May 5.

Since the beginning of Wednesday’s Asian session, positive data boosted the Aussie. Australia’s Q1 GDP rose by 0.75% QoQ and 3.3% YoY, beating the market expectations of 0.6% and 2.9%, respectively. Also, the China Caixin PMI for May rose by 48.1, vs. 48.0 expected, showing the resilience of the second-largest economy.

The AUD/JPY Wednesday’s open was 92.28, and the cross-currency rallied sharply, almost non-stop, though it dipped briefly towards 92.40 but kept upswing until reaching a daily high at 93.61.

AUD/JPY Price Forecast: Technical outlook

From a daily chart perspective, the AUD/JPY is upward biased after reclaiming the 50-day moving average (DMA) around 91.89. Also, the Relative Strength Index (RSI) in bullish territory aims higher, with enough room before entering the overbought zone.

In the meantime, the AUD/JPY 4-hour chart shows the pair with the same bias as the daily chart, but it’s worth noting that the AUD/JPY will face a solid resistance area around May 4 high at 94.02. Why is that level so important? Because it’s the pivot high of the downtrend that began in early May, towards May 12 swing low at 87.30, for a 670 pip fall.

If AUD/JPY bulls break above the May 4 high, that will open the door for further gains. The AUD/JPY first resistance would be 94.50, followed by the 95.00 figure. A breach of the latter would expose the YTD high at 95.74.

Key Technical Levels

- The outlook will be bullish ahead if buyers can breach the resistance of 0.6564.

- The downside will be opened if the price breaks below 0.6417.

As per the prior analysis, NZD/USD Price Analysis: Bulls need to break a key weekly level at this juncture, it was stated that the bulls need a clean break of the resistance or they will risk facing a firm move by the bears. Indeed, the bears have played their hand since the analysis and the price is being forced lower to test a potential support structure. The following illustrates the state of play on a multi-timeframe basis:

NZD/USD prior analysis

''The prior resistance on the daily and 4-hour charts that have a confluence with the daily Fibonacci scale would be expected to act as a support structure for the coming sessions.''

NZD/USD live market

As illustrated, the price has indeed moved towards the support area, so the question is whether the bulls will commit here to throw in the towel, pressured by the bears.

If the bears over-power the bulls, following some initial resistance from the bulls, then the case of a bearish head and shoulders could be made:

The price imbalance between the prior lows of 0.6417 to the 18 and 19 May support near 0.6290 will be vulnerable to mitigation.

This scenario would coincide with the weekly outlook as follows:

Or, if the bulls do maintain control, the outlook could be very bullish ahead if they can breach the resistance of 0.6564:

Joe Biden is laser-focused on knocking down sky-high gasoline prices, but he has a limited influence to do that and the US President said he cannot take immediate action to bring them down. Biden officials have been openly pleading with Big Oil to pump more despite his campaign efforts to address climate change. Yet, Biden has been draining oil from the SPR at a record pace, urging US oil and gas companies to pump more oil and trying to persuade OPEC to add supply.

The oil markets were paying attention to Biden's plans in March when he announced a record-setting release of 180 million barrels of oil from the SPR following the disruptions caused by Russia's invasion of Ukraine. However, the relief proved to be temporary and the price of oil is back on the rise:

WTI daily chart

- GBP/USD bulls correcting the avalanche from early NY trade's business.

- US dollar firmer in risk-off tones in the financial markets.

- BoE eyed for later this month, rate hike expected.

At 1.2493, GBP/USD is down over 0.8% on the day and has fallen from a high of 1.2616 to a low of 1.2458. The US dollar has come back into vogue over the last few sessions amid a rise in US yields. The risk sentiment has been on tenterhooks and the pound typically trades as a high beat to the performance of global stocks, regarded as a risky currency due to the twin deficits.

Stocks fell broadly midday Wednesday on worries over aggressive tightening risks. Asian exchanges traded choppily overnight, while European bourses edged lower on the continent. In the US, the US 10-year yield rose more than 9 basis points to 2.939% after the Institute for Supply Management's manufacturing index unexpectedly rose in May, climbing to 56.1 last month from 55.4 in April. The Dow Jones Industrial Average fell by 1.3% to 32,584 and the S&P 500 declined to a low of 4,073.85. This all occurred at the same time that the pound collapsed at the start of the New York session, losing some 140 pips in morning trade.

In line with expectations, the Bank of England (BoE) hiked the Bank Rate by another 25bp to 1.00%. at the start of last month. As expected, attention was on forward guidance and not the rate hike itself which came in slightly dovish. Analysts at Danske Bank, consequently, changed their Bank of England call now expecting three additional 25bp rate hikes (June, August and November vs. 25bp in August and November previously) ''recognising that the Bank of England is probably not ready to slow the rate hike pace just yet.''

''We still see risks skewed towards more rate hikes, as risk is that inflation continues to surprise to the upside.''

On Wednesday, the Bank of England Deputy Governor Jon Cunliffe speaking on Wednesday who said that the central bank was seeing evidence of a slowdown in the housing market.

"We see evidence of a slowdown in the housing market. There are some straws in the wind that show the market is starting to turn," Cunliffe said in an interview with ITV News.

"The Bank expects the economy, that’s already slowing, and we expect it to slow further, to slow quite a lot over next year or so. And I think that will have an impact on the housing market."

GBP/USD technical analysis

Cable has started to rebound and a 50% mean reversion to restest old support at 1.2524, from May 25 trade, could be on the cards. This would be mitigating some of the price imbalance left behind following the recent bearish impulse:

What you need to take care of on Thursday, June 2:

The American dollar surged during US trading hours as stocks fell and yields advanced. The catalyst was a mixture of upbeat US data boosting the greenback and concerns about a soon-to-come recession.

The focus remained on inflation and growth and whether policymakers would tighten monetary policies further. The latest taking action was the Bank of Canada, which lifted interest rates by 50 bps to 1.5% on Wednesday. Policymakers noted that they are prepared to “act more forcefully if needed” to achieve their 2% inflation target.

Late on Tuesday, Atlanta Fed President Raphael Bostic clarified a potential pause in rate hikes in September should not be understood as the central bank coming to the rescue of markets. On the contrary, he said that by September, some of the uncertainty over the economy could be resolved, and therefore, there could be a “significant reduction in inflation” this year. James Bullard, on the other hand, noted that it’s too early to say inflation has peaked, adding that a pace of 50 bps hike per meeting is a “good plan” for now.

The US ISM Manufacturing PMI rose to 56.1 in May from 55.4 in the previous month, surpassing the market’s expectations. The unexpected increase in activity boosted the dollar while affecting demand for Treasuries. But yields also rose on the back of lingering inflation concerns and rate hikes speculation, with that on the 10-year Treasury note reaching an intraday high of 2.95%.

The US Fed Beige Book brought up some interesting points. All the twelve districts reported continued economic growth, but the majority indicated slight or modest growth. Also, most districts informed of continued price rises, while three districts expressed concerns about a US recession.

Commodity-linked currencies were the best performers against the greenback, as the AUD/USD pair retained gains and settled at around 0.7190, while USD/CAD flirted with 1.2600 before bouncing to the current 1.2630 price zone.

The Japanese yen was the worst performer, as USD/JPY soared to 130.18, holding nearby early on Thursday.

The EUR/USD pair edged sharply lower, ending the day in the 1.0650 price zone, while the GBP/USD settled just below 1.2500.

The focus now shifts to US employment-related data ahead of the Nonfarm Payrolls report to be out on Friday.

Like this article? Help us with some feedback by answering this survey:

Federal Reserve's Tom Barkin has stated that ''you can't find a recession in the data or actions of business execs,'' speaking on Fox Business.

Key quotes

- It's time to normalize.

- Reduction in balance sheet does a little more on top of rate hikes to tighten policy.

- Perfectly comfortable with path of rate hikes for the next couple meetings.

- The stronger the economy, and inflation, the better the case is to do more on rates.

US dollar update

Today, the US dollar is lifted by higher Treasury yields as global inflation worries flared anew. The dollar index (DXY), which measures the currency against six major peers, is rising by 0.8% % to 102.59 at the time of print, extending Tuesday's gains.

The price is falling towards prior areas of the structure that could be expected to act as a support area in the coming sessions if reached. These happen to align with the key Fibonacci's namely the 38.2% and 61.8% ratios.

- The USD/CHF extends its rally to two consecutive days, up by 0.57%.

- Risk-aversion bosts the appeal for the greenback, while safe-haven peers remain on the defensive.

- USD/CHF Price Forecast: Bulls keeping the major above 0.9600 would open the door for further gains.

The USD/CHF advances for the second consecutive day though faltering of breaking above June 5, 2020, at 0.9652, but positive in the week, trimming some of last week’s losses by 0.57%. At the time of writing, the USD/CHF is trading at 0.9625, gaining 0.35%.

Sentiment remains negative. Hostilities in the Ukraine-Russia conflict escalated, with the Russian military advancing in an industrial city, via Reuters. Meanwhile, broad US Dollar strength and investors worry that the US Federal Reserve tightening monetary policy conditions could bring the economy into a recession, boosts the USD/CHF.

The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, edges higher by 0.75%, and sits at 102.530. At the same time, US Treasury yields advanced, led by the 10-year benchmark note rate up by nine bps up at 2.937%.

The USD/CHF Wednesday’s price action shows that bulls get some momentum back, lifting the pair from below the 50-day moving average (DMA) at 0.9583, and reaching a daily high at 0.9658. Nevertheless, they lacked the strength to keep the pace but kept the USD/CHF above the 0.9600 mark.

USD/CHF Price Forecast: Technical outlook

The USD/CHF 1-hour chart depicts the pair forming a “saucer-bottom,” a bullish chart pattern. However, the Relative Strength Index (RSI) at 55.62 aims lower, meaning the major is consolidating before resuming upwards. Further confirming the uptrend are the hourly simple moving averages (SMAs), sitting below the exchange rate.

Therefore, the USD/CHF bias is upwards. That said, the USD/CHF first resistance would be the Bollinger band top band at 0.9641. Break above would expose the June 1 high at 0.9658, followed by the R3 daily pivot point at 0.9676.

Key Technical Levels

Reuters recently reported on the Bank of England Deputy Governor Jon Cunliffe speaking on Wednesday who said that the central bank was seeing evidence of a slowdown in the housing market.

"We see evidence of a slowdown in the housing market. There are some straws in the wind that show the market is starting to turn," Cunliffe said in an interview with ITV News.

"The Bank expects the economy, that’s already slowing, and we expect it to slow further, to slow quite a lot over next year or so. And I think that will have an impact on the housing market."

Key notes

- Says we see evidence of a slowdown in the housing market.

- Says we have to ensure that the inflation we are seeing in the economy now doesn’t become the new normal.

- Says interest rates may well have to rise further.

- Says I don’t think we’re heading back to the interest rates of the 1990s.

- Says I am certainly not predicting a crash in house prices.

GBP/USD update

GBP/USD is starting to correct higher and 50% mean reversion to restest old support at 1.2524, May 25, could be on the cards which would be mitigating some of the price imbalance left behind following the recent bearish impulse:

The Federal Reserve's Beige Book report is out and states that the US economy continued to grow in recent weeks, with most Federal Reserve districts "indicating slight to modest growth," down from the "moderate" activity reported in the April.

Effects of higher interest rates and inflation are beginning to show up. Four districts noted that the pace of growth had slowed since the prior period. "Retail contacts noted some softening as consumers faced higher prices, and residential real estate contacts observed weakness as buyers faced high prices and rising interest rates," the report said.

Perhaps more notable, eight of the Fed's 12 districts said expectations of future growth had diminished. Contacts in three of those districts specifically voiced concerns about a recession.

Key notes

- More than half of the districts cited some customer pushback on higher prices.

- Contacts in 2 districts noted rapid price increases continuing; 3 observed it had moderated somewhat.

- While firms generally anticipate wages to rise further over next year, one district indicated firms' expected wage growth has fallen 2 consecutive quarters.

- More than half of the districts cited some customer pushback on higher prices.

- Contacts in 2 districts noted rapid price increases continuing; 3 observed it had moderated somewhat.

- While firms generally anticipate wages to rise further over next year, one district indicated firms' expected wage growth has fallen 2 consecutive quarters.

US dollar update

Meanwhile, the US dollar is higher, lifted by higher Treasury yields as global inflation worries flared anew. The dollar index (DXY), which measures the currency against six major peers, is rising by 0.77% to 102.567 at the time of print, extending Tuesday's gains.

The DXY is reaching into an area of daily resistance where a correction could be on the cards on this hourly chart where the 61.8% ratio meets prior resistance.

- Silver cuts some of its weekly losses but stays losing 1%.

- Risk-aversion underpins the non-yielding metal, alongside the US Dollar

- Positive US economic data keep the greenback tilted to the upside.

- Fed policymakers see 50 bps rate hikes in June and July.

- Silver Price Forecast (XAG/USD): Tilted downwards, though a break above $22.44, would open the door towards the 50-DMA.

Silver (XAG/USD) snaps two days of losses and rallies above 1.50% in the day amidst a risk-off trading session, courtesy of increasing worries that restrictive monetary policies would threaten to bring the US economy into a recession. At $21.86, XAG/USD is bouncing from weekly lows at around $21.43 as XAG bulls prepare to re-test the $22.00 mark.

The white metal prices are rallying, despite higher US Treasury yields. The rate of the US 10-year T-note is advancing almost ten bps and sits at 2.949%, failing to undermine precious metals. Nevertheless, global equities fall, attributed to higher global bond yields.

Sentiment remains dismal courtesy of the increase of hostilities in the Ukraine-Russia war. Russia’s military advanced in an industrial city, according to Reuters. Meanwhile, the US is preparing to send additional military equipment to Ukraine.

In the meantime, the greenback continues its recovery during the New York session. The US Dollar Index, a measurement of the buck’s value against a basket of six currencies, climbs 0.77%, and sits at 102.557, a level last seen on May 23.

Data-wise, a busy US economic docket featured May’s US ISM Manufacturing PMI, JOLTs openings, and some Fed speakers. The ISM Manufacturing PMI came at 56.1 vs. 55.4 in April, while expectations were near 54.5. Meanwhile, the US JOLTs report showed that openings in April dropped from 11.9 million in March to 11.4 million, a relief for employers who struggle to contract or keep workers.

The St. Louis Fed President James Bullard said that “The current US macroeconomic situation is straining the Fed’s credibility with respect to its inflation target.” Furthermore, he added that the US labor markets and the US economy remain robust, but Russia’s invasion of Ukraine and a sharp slowdown in China means risk remains “substantial.”

Earlier in the day, the San Francisco Fed President, Mary Daly, said that she sees a couple of 50 bps rate hikes and emphasized the Fed’s need to get expeditiously to neutral. She added that the central bank needs to be prepared to do whatever it takes to tame inflation, though it needs to be ready to stop hiking rates if needed.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains tilted to the downside, further confirmed by the daily moving averages (DMAs), residing above the spot price. If XAG/USD bulls would like to regain control, they would need a break above May’s 27 high at $22.46. Once cleared, that could pave the way for a test of the 50-DMA at $23.38. Otherwise, XAG/USD would remain vulnerable to further selling pressure, as sellers would look for rallies to enter at a better price. In that case, the XAG/USD first support would be June 1 low at $21.43. Break below would expose May’s 19 swing low at $21.28, followed by the YTD low at $20.45.

Key Technical Levels

St. Louis Federal Reserve Bank President James Bullard has crossed the wires in recent trade with comments continuing to come out.

He has explained that inflation at levels last seen in the 1970s and early 1980s is putting the US central bank's credibility at risk and has been reiterating his call for the Fed to follow through on promised rate hikes to bring down inflation, and inflation expectations.

"The current US macroeconomic situation is straining the Fed's credibility with respect to its inflation target," Bullard said in slides prepared for a presentation to the Economic Club of Memphis.

Reuters is reporting on his statements and explained that ''inflation is at more than three times the Fed's 2% target, pushed up by the collision of strong consumer demand and constrained supply of labor and parts.''

''In response, the Fed has raised interest rates by three-quarters of a percentage point this year - a pace critics say is far too timid to bring inflation under control quickly.

But on Wednesday Bullard laid out the case - as he has many times previously - that the Fed has actually tightened monetary policy far more than its actual rate hikes suggest.''

"The Fed still has to follow through to ratify the forward guidance previously given, but the effects on the economy and on inflation are already taking hold," Bullard said.

The US central bank's reduction of its massive balance sheet - a process known as "quantitative tightening" - has already been "partially successful" in pushing up longer-term borrowing costs, he said.

"We'll have to see how this plays out in the months ahead," Bullard added in a virtual appearance before the Economic Club of Memphis. The Fed began trimming its balance sheet this month.

Key notes

- Current US macro situation 'straining' Fed's credibility on inflation.

- Inflation expectations could become unmoored without credible fed action.

- Fed has taken important steps to return inflation to 2%, including rate hikes and promises of more.

- Fed must follow through on forward guidance with rate hikes.

- Effects of Fed's forward guidance on rates already taking hold on economy, inflation.

- Labor markets robust, expect continued GDP growth in 2022, risks remain substantial.

More comments:

- Not advisable to move too quickly in central banking.

- Have already announced we'll raise rates by 50 bps per meeting, that's a good path.

- Want to get to higher policy rate expeditiously.

- If unable to bring inflation under control, could be in for a very long haul.

- Hopeful to bring inflation down to 2% 'very soon'.

- Have hope that special factors driving inflation will abate.

- If pandemic had ended cleanly in 2021 Fed would have acted more quickly.

- I dont think the signals for the need to raise rates were really there until the fall of 2021.

- hopefully will be able to bring inflation down in quarters, years ahead.

- If war remains contained as it is today, i don't see it as a direct drag on US economy.

- QT has been partially successful so far in pushing up on long-term rates.

Market implications

Fed policymakers next meet June 14-15, and the markets have been trying to second guess the central banks next move and the move after that. The sentiment is fickle and the US dollar has been subsequently pushed and pulled in the last week or so along with US yields. Markets have been concerned that the US is headed to a recession, but Bullard says he is sceptical about recession probabilities, which is likely plus for the greenback, vs the likes of the euro.

Today, the US dollar is higher, lifted by higher Treasury yields as global inflation worries flared anew. The dollar index (DXY), which measures the currency against six major peers, is rising by 0.8% % to 102.59 at the time of print, extending Tuesday's gains.

Analysts at MUFG Bank explained that the weakness seen in the Turkish lira is starting to stand out again amongst Emerging Market currencies. They see the USD/TRY moving to the upside over the next months, forecasting it at 18.000 by year-end.

Key Quotes:

“The lira has resumed its slide against the US dollar bringing an abrupt end to the recent period of relative stability from mid-March to early May. Turkey’s weak economic fundamentals have been exacerbated by the negative fallout from the Ukraine invasion leaving the lira even more vulnerable to another sharp adjustment lower.”

“Headline inflation had already surged to 70.0% in April, with PPI elevated at 122%. There has been no indication that the CBRT is willing to act to tightening policy to dampen upside inflation risks. The sharp rise in inflation has resulted in the CBRT’s real policy rate moving deeply into negative territory. The lira is now very vulnerable to a further sharp adjustment lower. It stands in contrast to the hawkish shift taking place globally.”

“Turkey has limited scope to support the lira through intervention reinforcing the bearish trend. The sharp depreciation of the lira in May will bring into focus the unsustainable FX-protected deposit account scheme that will increase costs for the government as the lira weakens and will prove counter-productive in only fuelling heavier lira selling. We have therefore lowered our TRY forecasts notably through to Q1 2023.”

The nearly half-million decline in job openings in April reported on Wednesday, offers further evidence that labor shortages are no longer worsening according to analysts at Wells Fargo. They warn that the 11.4 million job openings at the end of April follows an upwardly revised figure of 11.9 million for March and underscores that the Federal Reserve still has significant work ahead balancing the labor market, inflationary pressures and wages.

Key Quotes:

“Bringing the opening rate back down to Earth has been floated as one means in which the labor market could cool without payrolls going into reverse. The job opening rate fell to 7.0% as labor shortages appear to no longer be worsening. However, the drop came from an upwardly revised 7.3% in March, underscoring that the Fed continues to play catch up and has significant work ahead in generating a more balanced labor market that relieves the inflationary pressures stemming from wages.”

“Job openings are not alone in signaling the labor market has approached a turning point. Small business hiring plans the past few months have fallen to the lowest levels since February 2021, job postings from Indeed have been on a downward slide since December, and consumers' own views of the labor market have more recently rolled over.”

“We look for Friday's jobs report to show payroll gains downshifting from the 428K monthly pace of March and April to 325K in May as demand for workers has started to ease.”

“We look for the unemployment rate to press even lower, including a tick down to 3.5% in the May jobs report. Voluntary turnover and thereby wage growth is likely to remain historically strong as a result, keeping the heat turned up on inflation.”

- The AUD/USD trims its gains but stays positive in the week, by 0.17%.

- Positive Australian Q1 GDP and China’s Caixin PMI data boosted sentiment in the Asian session.

- The greenback rallied due to US ISM Manufacturing surprising to the upside, and job openings dropped.

- AUD/USD Price Forecast: Failure to reclaim the 100-DMA opened the door for further losses.

The Australian dollar retreats from weekly highs around 0.7230 and drops 70 pips during Wednesday’s North American session, towards daily lows near 0.7160s. At 0.7170, the AUD/USD is set to extend its losses as sellers prepare to break below the 0.7149 weekly high, aiming to drag the major towards 0.7100.

Negative sentiment and a strong US Dollar weigh on the AUD/USD

A dampened market sentiment, as portrayed by global equities, keeps the AUD/USD extending its losses. Albeit positive data from Australia regarding Q1 GDP, which recovered 0.75% QoQ (3.3% YoY), and China’s Caixin PMI for May aligned with expectations, worries about the US Federal Reserve tightening monetary conditions, could tip the economy into recession.

The market reaction was muted, though, in the middle of the European session, the AUD/USD jumped towards weekly highs around 0.7230s and retreated following the release of upbeat US economic data.

Regarding the US economic docket, the May ISM Manufacturing PMI advanced in May as new orders, and output growth quickened, suggesting that demand remains solid. The reading rose to 56.1 vs. 55.4 in April, while estimations were around 54.5. Meanwhile, the US JOLTs report showed that openings in April fell from 11.9 million in March to 11.4 million, offering some relief for employers who struggle to contract or keep workers.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of six peers, rallies 0.79%, up at 102.584, underpinned by higher US Treasury yields. The 10-year benchmark note rate climbs close to 10 bps and begins June at around 2.944%.

Later in the day, the San Francisco Fed’s President Mary Daly crossed wires and said that she sees a couple of 50 bps hikes and reinforced the need to get rates to neutral expeditiously and would like to be around 2.5% by the end of 2022.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased. Failure to reclaim the 100-day moving average (DMA) at 0.7228 spurred a dip below the 0.7200 mark. Also, the Relative Strength Index (RSI), at 54.63, is in bullish territory but begins to aim lower, indicating that some selling pressure could accelerate the fall towards 0.7100.

Therefore, the AUD/USD first support would be the 0.7150 figure. Break below would expose the May 27 low at 0.7089, followed by the 20-DMA at 0.7039. Once cleared, a move towards the 0.7000 psychological figure is on the cards.

Analysts at MUFG Bank, point out that capital outflows from South Korea’s equities market eased in May, helping the won that appreciated versus the dollar. They forecast USD/KRW at 1230.00 by the end of the second quarter, and at 1210.00 by the end of 2022.

Key Quotes:

“KRW’s rebound in May was attributed to capital inflows, with foreign investors buying about a net USD 135mn of Korea equities in the month after a net selling of more than USD 4.9bn in April.”

“As the country’s economy continued to show resilience, improved sentiment helped to support the currency.”

“Amid growing concerns that inflationary pressures could hamper economic growth, the finance ministry on 30th May rolled out a set of measures to tame inflation and stabilize living conditions, including the removal of import duties on key foodstuffs. We expect those measures to help to boost confidence in Korean economy, which in turn will attract renewed capital inflows and support the currency. Having said that, external factors including China’s Covid situation and geopolictical tensions will keep the KRW volatile. Looking ahead, the US dollar’s movement will continue to play a key role in KRW’s movements in the near-term.”

The Bank of Canada, as expected, increased the key interest rate by 50 basis points. Analysts at CIBC, see another 50 basis point hike in July before a slow down in September to a 25bp hike.

Key Quotes:

“Today’s half point rate hike wasn’t a half measure in the Bank of Canada’s battle against inflation, because in short order, we’ll likely see another move of the same magnitude. The 50 basis point move, taking the overnight rate to 1.5%, was well telegraphed, as was the Bank of Canada’s well-reasoned decision to further reduce monetary stimulus. This was yet another larger-than-normal hike, so to justify it, Macklem’s team couldn’t mince words about their concern over inflationary pressures.”

“There was no announced change to its plans for quantitative tightening, which will let its bond holdings roll off with maturities.”

“Our call for another 50 basis point hike in July would fit the definition for the forceful measures it has talked about. There was, however, a threat to act “more forcefully if needed”, and no counterbalancing hint of a potential need to slow the pace of hikes. That runs counter to our forecast that we’ll see signs of a growth deceleration by early fall, allowing the BoC to slow to a 25 bp hike in September, and then a pause before a final quarter point to 2.5% in early 2023.”

“But with another half point hike on tap for July, likely with more stern language from the Bank of Canada, we expect more of May’s flight-to-safety rally in bonds to be reversed over the summer if equities can even manage to level off.”

Analysts at MUFG Bank forecast the Indian rupee will weaken gradually versus the US dollar over the next months. They see USD/INR at 78.500 by the end of the second quarter and at 79.500 by year-end.

Key Quotes:

“The Indian rupee plunged to a new record low of 77.928 against the US dollar in May on the back of mounting investor concerns over both global and domestic growth and inflation. That led to a greater amount of net foreign institutional investment outflows from Indian equities to the tune of USD 4.6bn between 2nd and 25th May based on latest available data versus a net outflow of USD 3.8bn for the entire month of April.”

“The launch of India’s largest IPO in early May did little to boost the rupee, particularly in view of a lukewarm reception from foreign investors. With India’s IPO pipeline drying up amid the challenging global risk environment, inflows into India’s capital markets are expected to dwindle which would lead to greater amounts of net portfolio outflows and have a negative impact on the rupee.”

“The impact of higher oil prices is starting to be evident on India’s trade, with a wider trade deficit seen in April at USD 20.1bn from March’s USD 18.5bn. This trend is likely to persist in the year ahead, leading to wider current account deficits and adding further downward pressure on the rupee.”

- Stocks reverse in Wall Street, Dow Jones down by more than 1%.

- US economic data surpass expectations.

- XAU/USD faces resistance around the $1850 area.

Gold prices bounced from multi-day lows under $1830 to the $1850 area after the beginning of the American session and despite higher US yields. XAU/USD holds near daily highs even as Wall Street extends losses and as the US dollar strengthens.

Earlier on Wednesday gold prices rose sharply finding resistance under $1850. After a pullback to $1838 following the release of better-than-expected US economic, prices turned again to the upside. As of writing, XAU/USD stands at $1849, fresh daily high.

The positive momentum for gold remains intact even despite the negative context for the metal. The US 10-year yield stands at weekly highs at 2.93%. The US dollar trades at daily highs across the board. The DXY is up by 0.80% above 102.55.

The positive US ISM Manufacturing report triggered a decline in equity prices as the figures reinforced expectations of aggressive monetary policy tightening from the Federal Reserve.

Silver is rising by 1.45%, erasing most of Tuesday’s losses. XAG/USD bottomed at $21.44 during the European session and recently peaked at $21.97.

Wednesday’s rally in metal could turn into a reversal if gold manages to break and hold above $1850 and silver does the same with $22.00.

Technical levels

Data released on Wednesday showed an unexpected acceleration in the US ISM Manufacturing PMI Index in May from 55.4 to 56.1. According to analysts at Wells Fargo, the report offers a mixed read on the state of the industry. “Orders and order backlogs are growing at a faster pace. Meanwhile, supplier deliveries are getting better but only incrementally, and inflation pressure is fading but not materially.”

Key Quotes:

“Swooning financial markets and a Federal Reserve bent on raising rates did little to slow activity in the manufacturing sector in May. The ISM manufacturing index rose to 56.1 signaling an even faster pace of expansion than a month earlier. The challenges confronting U.S. industry have not changed: material and input components remain in short supply as do skilled workers.”

“High demand and limited supply are keeping pressure on inflation. The prices paid component held above 80 for the third straight month. While that is blisteringly hot, the 82.2 reading in May is down a couple notches from 84.6 in April.”

“The May employment report is due out on Friday morning and our forecast is for nonfarm payrolls to increase by 325K jobs. Manufacturers have added jobs for 12-straight months, and we see no reason for any sustained disruption to that in a period when orders are still pouring in.”

“With inventories gradually being rebuilt there is some evidence that parts of the supply chain are functioning again.”

- The USD/CAD remains lower in the week, so far down 0.48%.

- The Bank of Canada raised rates and laid the ground for additional hikes.

- May’s US ISM Manufacturing surprised to the upside while price pressures have eased.

The USD/CAD is rising on Wednesday despite a negative knee-jerk reaction to the Bank of Canada's (BoC) decision to hike the overnight rate by 50 bps, lifting it to the 1.50% threshold. USD/CAD soon found its feet, however, and has rallied to 1.2663, snapping a five day losing streak, amidst a dismal market mood, with global equities falling – both factors more supportive of its USD side of the pair.

The USD/CAD dollar jerked lower to a daily low near 1.2600

The BoC lifted rates by 0.50%, using as backdrop high global inflation, driven by elevated energy prices, courtesy of the Russian invasion of Ukraine, China’s Covid-19 related lockdowns, and ongoing supply disruptions. The BoC emphasized that the war “increased uncertainty and put further upward pressure on energy and agricultural commodities prices.”

Regardings Canada’s outlook, the BoC mentioned that Canada’s CPI, at around 6.8% YoY in April, would likely move higher in the near term before showing signs of easing. The central bank noted that inflation continues to broaden, meaning that inflation has nowhere to go but up. The BoC Governing Council added that interest rates would need to rise further and that the central bank’s assessment would guide the pace of hikes. The BoC said it is prepared “to act more forcefully if needed to meet its commitment to achieving the 2% inflation target.”

Market’s reaction

The USD/CAD 1-hour chart shows the pair seesawed in a 44 pip range, between 1.2600-44, with the 20-period simple moving average (SMA) at 1.2644, where it found sellers that put a lid on the USD/CAD's upward reaction. To the downside, USD/CAD found a floor and buying pressure lifted the pair around 1.2600, so that’s the major’s key support level in the near term.

Elsewhere, the US docket revealed the ISM Manufacturing PMI for May, which surprisingly rose to 56.1 in May, from 55.4 in April and beating market forecasts of 54.5. New orders, production, and inventories witnessed jumps while price pressures eased for the second month, from 82.2 vs. 84.6.

USD/CAD Price Forecast: Technical outlook

Overall, the USD/CAD remains pressured to the downside, but USD/CAD buyers are lifting the pair above the 200-day moving average (DMA), which lies at 1.2659. Nevertheless, it’s worth noting that although they are lifting the major upwards, aiming towards 1.2700, solid ceiling levels loom ahead at around 1.2700.

If USD/CAD reaches 1.2700, its first line of resistance would be the 100 DMA at 1.2695. A break above that would send the pair towards the 50 DMA at 1.2708, followed by the May 27 high at 1.2783.

On the other hand, the USD/CAD's first support would be the 200 DMA. A breach of the latter would expose the Bollinger's bottom band at 1.2607.

- US dollar gains momentum amid risk aversion and higher US yields.

- April ISM Manufacturing PMI rises unexpectedly.

- EUR/USD approaches support area of 1.0640.

The EUR/USD broke to the downside after trading for hours in the range between 1.0730-1.0700 and dropped to 1.0650, hitting the highest level since May 25. The pair remains under pressure as the US dollar benefits from higher US yields and risk aversion.

Stocks and Treasuries slide

After a positive opening, equity prices in Wall Street reversed sharply following the release of US data. The better-than-expected figures keep the Federal Reserve on track for aggressive rate hikes.

The ISM Manufacturing PMI rose in May to 56.1 from 55.4 in April, above the 54.5 of market consensus. The unexpected increase in activity boosted the dollar and weakened the demand for Treasuries. The US 10-year yield jumped from 2.84% to 2.93%, the highest level since May 22 and the 30-year climbed to the weekly high at 3.08%.

In Wall Street, the Dow Jones is falling by 0.75% and the Nasdaq drops 0.43%. The negative turn in equity prices boosted further the dollar. The DXY is up by 0.70%, hovering around 102.50, the highest in a week.

From a technical perspective, the area between 1.0640/50 is a strong support; below the next target stands at 1.0605. If EUR/USD manages to hold above 1.0650, the euro could rebound initially to 1.0700. Above the next resistance is seen at 1.0735.

Technical levels

- WTI is a little higher on the day in the $116s, though still below Tuesday’s near-$120 highs.

- The WSJ speculated that Russia might leave OPEC+ and some other OPEC+ might up output.

- For now, Russia/OPEC+ supply woes, tight global markets, rising summer demand in the US/Europe are keeping prices supported.

Oil prices have stabilised pulling back slightly from multi-week highs hit on Tuesday. Front-month WTI futures were last trading higher by just under $1.0 on Wednesday in the $116s per barrel, having slipped back after coming close to hitting $120 on Tuesday. The pullback was sparked by a WSJ report that some OPEC+ producers are exploring the idea of excluding Russia from the OPEC+ production pact as a result of the impact of Western sanctions over Russia’s invasion of Ukraine.

The report said that while there has not yet been a push by the rest of OPEC+ to make up for the recent fall in Russian output, some Gulf nations had begun planning to increase output in the coming months. Against the backdrop of a very tight global crude oil market as North America and Europe head into peak driving season, additional supply from OPEC+ members would be welcomed by major oil-consuming nations.

Further tightening the market in the near term is the reopening of the Chinese economy as Covid-19 infections fall and lockdowns ease. Indeed, lockdowns in Chinese megacity and financial hub Shanghai have now ended after two months. For these reasons, as well as the anticipation that Russia’s oil production woes might worsen in the months ahead after the EU agreed to phase out 90% of their imports from the nation by the end of this year, many oil bulls remain confident that prices are set to remain elevated in the near future.

Indeed, WTI marked a sixth successive monthly gain on Tuesday after posting a more than $11 gain in May to close the month in the $115s. Over the course of these six months, WTI has leapt by around $50 per barrel. That is the best winning streak in more than a decade. A significant easing of global oil supply woes plus a further slowdown in global growth will likely be needed in order to see this bull run snapped and WTI fall sustainably back below $100 per barrel.

There were 11.4 million job openings in the US at the end of April, the latest JOLTs survey released on Wednesday showed. That was a decline from March's record-high number of 11.8 million job openings, but in line with consensus forecasts. The data shows that the demand for labour remained very healthy at the start of Q2 2022, as evidenced by the fact that there is still well over one job opening per unemployed person in the US at the moment.

Market Reaction

The robust JOLTs data, alongside a stronger than expected ISM Manufacturing PMI report, has given the buck a boost in recent trade.

- Headline ISM Manufacturing PMI unexpectedly rose to 56.1 from 55.4 in May.

- The strong data boosted the buck across the board.

The headline ISM Manufacturing Purchasing Manager's Index (PMI) rose to 56.1 in May from 55.4 in March versus expectations for a small decline to 54.5, according to the latest release by the Institute for Supply Management (ISM).

Subindices:

The Prices Paid Index fell slightly to 82.2 in May from 84.6 in April.

The New Orders Index rose to 55.1 from 53.5.

The Employment Index fell to 49.6 from 50.9, the first drop back below 50 since August 2021.

Market Reaction

The stronger than expected US economic data which alludes to a pick up in growth in May versus expectations for a moderation in growth has lifted the US dollar, with the DXY jumping from under 102.10 to session highs in the 102.30s in recent trade.

The Bank of Canada (BoC) lifted interest rates by 50 bps from 1.0% to 1.50% on Wednesday, a move that had been expected by most analysts, with a minority calling for a larger 75 bps hike.

According to the BoC's latest statement on monetary policy, the bank is prepared to "act more forcefully if needed" to achieve its 2.0% inflation target, in light of the risk of elevated inflation becoming more entrenched having risen. Moreover, the BoC said that inflation will likely move even higher in the near term before beginning to ease. The bank said it continues to judge that interest rates will need to rise further.

Regarding the economy, the BoC said that Canadian economic activity is strong and the economy is clearly operating in excess demand. Q2 growth is expected to be solid given robust consumer spending, as well as given expectations of strengthening exports. Moreover, activity in the Canadian housing market is moderating from exceptionally high levels.

The BoC said it plans to continue its policy of quantitative tightening and said that the Ukraine war has increased uncertainty and is putting further upwards pressure on prices for energy and agricultural commodities.

Market Reaction

The loonie saw some kneejerk weakness given the fact that money markets had been pricing in some probability of a more hawkish 75 bps rate hike. USD/CAD was last trading in the 1.2640s, about 20 pips higher versus pre-BoC announcement levels, though still flat on the day.

- A combination of supporting factors pushed USD/JPY to a two-week high on Wednesday.

- The technical set-up favours bullish traders and supports prospects for additional gains.

- Any meaningful pullback could be seen as a buying opportunity near the 129.00 mark.

The USD/JPY pair gained positive traction for the third successive day and climbed to a two-week high, around the 129.60 region on Wednesday. The risk-on impulse undermined the safe-haven JPY and acted as a tailwind amid modest US dollar strength.

From a technical perspective, the overnight move up confirmed a breakout through a descending trend-line extending from a two-decade high touched in May. The said resistance coincided with the 38.2% Fibonacci retracement level of the 121.28-131.35 rally.

The subsequent move beyond the 23.6% Fibo. level and the 129.00 round-figure mark could be seen as a fresh trigger for bulls. Given that oscillators on the daily chart have again started gaining traction, the set-up supports prospects for additional gains.

Hence, some follow-through strength, back towards reclaiming the 130.00 psychological mark, now looks like a distinct possibility. The momentum could get extended and push spot prices to the next relevant hurdle near mid-130.00s en-route the 130.80 area.

On the flip side, any meaningful pullback could be seen as a buying opportunity near the 129.00 mark. This, in turn, should help limit the downside near the daily swing low, around the 128.60 region. The latter should act as strong support for the USD/JPY pair.

Failure to defend the aforementioned support levels might prompt some technical selling and make the USD/JPY pair vulnerable to retesting sub-128.00 levels. The downfall trajectory could eventually drag spot prices towards the 127.40-127.35 confluence resistance breakpoint.

USD/JPY daily chart

-637896883087651105.png)

Key levels to watch

- GBP/USD recently fell to fresh session lows under the 1.2550 level amid focus on the weakening UK economy.

- Upcoming US data on Wednesday (ISM Manufacturing PMI) and Friday (jobs) will be worth watching and could spur fresh downside.

- A widening Fed/BoE policy and UK/US growth differentials suggests further downside is possible, with technicals also taking a bearish turn.

GBP/USD is on the back foot on Tuesday ahead of the release of key US data, despite US yields easing back from earlier session highs and US equities trading in the green, both factors that might normally lift the pair. Cable was last trading at session lows underneath the 1.2550 level and eyeing a run lower towards its 21-Day Moving Average in the mid-1.2400s, with the pair seemingly instead being driven by concerns about the weakening UK economy once again.

Final UK Manufacturing PMI data for May showed that manufacturing activity in the UK expanded at its weakest pace rate since January 2021, as producers of consumer goods struggled amid the worst cost-of-living crunch in multiple decades. Meanwhile, though the latest Nationwide house price data showed another jump in prices last month, a slowdown in the market is expected, the mortgage lender said.

At 1400GMT, US ISM Manufacturing PMI survey data for May is slated for release and should paint a comparatively more constructive picture of the health of the US economy, which could add further downside to GBP/USD. But the key data out this week will be Friday’s US labour market report. Any signs of easing inflation pressures from this week’s data might be a negative for the buck as it eases pressure on the Fed to tighten so aggressively.

However, the Fed is still set to be substantially more hawkish in the coming quarters than the BoE, with the UK’s economic outlook much more fragile than in the US. Technical selling might also be at play on Wednesday, with GBP/USD looking like it has broken the bullish uptrend of the last few weeks. That potentially means that, in the weeks ahead, a retest of May’s sub-1.2200 lows is on the cards.

- EUR/USD appears under pressure in the low-1.0700s.

- The resistance line around 1.0790 caps the upside so far.

EUR/USD remains slightly on the defensive, although it manages well to keep the trade above the 1.0700 m ark so far on Wednesday.

The surpass of the 3-month resistance line, today around 1.0790, should see the downside pressure subsided and this could spark a fresh bout of strength in the near term. Against that, the next target of note then emerges at the weekly high at 1.0936 (April 21).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1242.

EUR/USD daily chart

GBP/USD remains depressed below the 1.26 mark. Economists at Scotiabank highlight the key levels to watch on the cable.

The mid-1.25 area stands as support

“The pound’s failure to extend its rally past the mid-1.26s over the past few days and a break under its upward-sloping trendline since mid-May leaves the GBP-bullish picture looking weaker, but with a still broadly positive trajectory.”

“Resistance is ~1.2630 followed by firmer at 1.2660/70 (the Fri and Mon highs) and then the big figure.”

“The mid-1.25 area is support followed by the big figure zone.”

EUR/USD holds 1.07. A break below here would point to a possible reversal of some of the recent gains, according to economists at Scotiabank.

Resistance stands at 1.0740/50

“The low 1.07s and the figure area remain key support for the currency followed by yesterday’s intraday low of 1.0680 and the mid-1.06s.”

“A daily close under 1.07 would point to a possible reversal of some of the EUR’s recent gains.”

“Resistance stands at 1.0740/50 ahead of the Monday high of 1.0787.”

S&P 500 maintains a bullish “Marubozu” breakout above key resistance at 4091/28. Thus, analysst at Cerdit Suisse stay biased towards a deeper corrective move higher, with next key resistance at 4278/4314.

Short-term support at 4091/51 expected to hold

“S&P 500 posted a bullish “Marubozu” breakout on Friday above the price high and gap at 4091/4128, which confirms a short-term base to signal a more profound recovery, supported by the turn higher in daily MACD momentum.”

“We expect the market to extend the recovery to the 63-day average at 4272/4314, where we would be alert to a potential cap. At most, we can see the recovery extending towards the 200-day average and potential downtrend from the 2022 high at 4453/4510, however we have more confidence in a cap here.”

“We view this short-term recovery as corrective in nature, with the medium-term picture still pointing towards an eventual turn back lower. For now though, near-term support is seen at the recent ‘breakaway gap’ at 4091/51, which we look to hold to maintain the near-term upward pressure.”

- DXY adds to the weekly rebound on Wednesday.

- A sustainable breakout of 102.00 remains elusive so far.

DXY adds to Tuesday’s advance, although the bullish attempt ran out of steam around 102.10 so far midweek.

The upside momentum in the index seems to lack strength so far, and the inability to spark a more serious rebound could prompt sellers to return to the market and shift the focus to a potential test of the 55-day SMA, today at 101.22.