- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 31-05-2022.

- WTI extends pullback from multi-day high inside a bearish chart formation.

- 10-DMA adds strength to the wedge’s support, mid-May’s top restricts immediate downside.

- Bulls need validation from $116.00 to retake control.

WTI remains pressured around $113.80, after taking a U-turn from a nine-week high, as buyers fail to keep reins during Wednesday’s initial Asian session.

In doing so, the black gold remains depressed inside a one-month-old rising wedge bearish chart pattern.

Given the quote’s inability to close beyond late March’s swing high, not to forget the inability to defy the rising wedge formation, WTI crude oil prices are likely to stretch the latest weakness towards the March 24 swing high, close to $113.00.

However, the commodity’s further declines hinge on a clear break below $11.80, comprising the 10-DMA and support line of the wedge.

Should the quote drop below $111.80, the odds of its south-run towards April’s high surrounding $109.10 becomes imminent support whereas April month’s low near $92.65 appears the theoretical target.

Alternatively, a horizontal area from late March, around $116.00 limits the quote’s recovery moves ahead of the stated wedge’s resistance line, close to $117.20 by the press time.

In a case where WTI remains firmer past $117.20, the yearly peak of $126.51 will be in focus.

WTI: Daily chart

Trend: Further weakness expected

The latest BRC Shop Price Index jumped the most in over a decade, to 2.8% versus 2.7% prior, which in turn suggests that the food price inflation keeps pushing the Bank of England (BOE) towards tighter monetary policy.

“Shop prices accelerated in May at the fastest rate in more than a decade, according to new figures that reveal the pressure on retailers to pass on the cost of rising energy bills and the soaring price of imports,” said The Guardian following the data release.

The news also adds, “Fresh food prices were the most affected by rising costs, with farmers reporting that they were struggling to cope with the rising cost of labor since Brexit and the escalating price of fertilizer since Russia’s invasion of Ukraine.”

FX reaction

GBP/USD holds onto the day-start recovery moves around 1.2610 following the news suggesting further upside to track.

Read: GBP/USD picks up bids around 1.2600 as BOE, Brexit chatters join US dollar retreat

- USD/CAD is eyeing a re-test of its monthly lows at 1.2629 as investors await BOC monetary policy.

- The BOC is expected to elevate its interest rate by 50 bps.

- Oil prices faced selling pressure at around $120.00.

The USD/CAD pair is displaying a downside move in the Asian session, following the bearish sentiment on a broader note. The asset has recorded a five-day losing streak and its continuation looks likely if the asset drops below Tuesday’s low at 1.2629.

The loonie bulls are outperforming against the greenback as investors are awaiting the announcement of the interest rate decision by the Bank of Canada in the American session. As per the market consensus, an interest rate hike by 50 basis points (bps) is expected from the BOC. This will stretch the BOC’s interest rate officially to 1.5%. Canada’s annual inflation rate rose to 6.8% in April, which is compelling the BOC to continuously elevate the interest rates to avoid the inflation mess.

On the oil front, the black gold faced barricades around $120.00 and slipped to near $115.00, however, the overall trend is still bullish amid renewed supply concerns. The European Union (EU) Leaders Summit resulted in a prohibition of 90% of oil imports from Russia by the end of Calendar Year (CY) 2022. The announcement was highly expected by the market participants as Russia’s invasion of Ukraine was a punishable act and the EU wanted to isolate Russia badly.

On the dollar front, the US dollar index (DXY) witnessed a steep fall after failing to sustain above 102.00 on Tuesday. The asset displayed a reversal after hitting a fresh monthly low of 101.30 on expectations of a potential outcome from the Biden-Powell meeting to contain the price pressures. However, the unavailability of any material outcome brought offers in the DXY. This week, the US Nonfarm Payrolls (NFP) will be the key event for the FX domain. The US NFP is seen at 320k against the prior print of 428k.

Atlanta Fed President Raphael Bostic crossed wires during an interview with MarketWatch as he said that his suggestion that the central bank takes a September “pause” in its push to raise interest rates should not be construed in any way as a “Fed put,” or belief that the central bank would come to the rescue of markets.

Key quotes

The notion of any sort of “Fed put” was never a factor in his thinking.

I think it’s a good tale on some level for storybooks, but it’s not driving how I’m thinking about policy.

A pause might be a good idea because the market’s response to the Fed’s shift to raising rates “was far stronger than what we’ve historically seen.”

FX reaction

Following the news, S&P 500 Futures remain mildly bid and the EUR/USD pair consolidates recent losses around 1.0735.

- GBP/USD consolidates the first daily loss in five, mildly bid of late.

- DXY fades bounce off monthly low even as Yellen, Biden support Fed actions to tame inflation.

- Allegations on UK PM Johnson, NIP tussle and doubts over BOE’s performance probe cable buyers.

- US ISM PMIs, qualitative catalysts could determine short-term moves.

GBP/USD marches confidently above 1.2600 as it reverses the first daily loss in five during Wednesday’s quiet morning in Asia. That said, the cable refreshed daily top around 1.2610 by the press time.

The quote’s recent uptick could be linked to the US dollar’s failure to keep the bounce off one-month low, despite the increasing chatters surrounding inflation and the Fed’s prudent role.

Recently, US President Joe Biden praised the US Federal Reserve’s (Fed) task in controlling price increases, followed by comments from US Treasury Secretary Janet Yellen’s acceptance that she was wrong about inflation. “US Treasury Secretary Janet Yellen said on Tuesday that she was wrong in the past about the path inflation would take, but said taming price hikes is President Joe Biden's top priority and he supports the Federal Reserve's actions to achieve that,” said Reuters.

The US Dollar Index (DXY) flashed the first daily positive in four by the end of Tuesday’s trading, despite a pullback from 102.17. The greenback gauge recovered the previous day as the US traders cheered hawkish comments from Fed Board of Governors member Christopher Waller, as well as upbeat data at home.

Fed’s Waller said that he supports lifting interest rates by another 50 bps at the next several Fed meetings and that the policy rate should be above neutral by the end of the year to reduce demand, reported Reuters. On the other hand, the US Chicago Purchasing Managers’ Index and CB Consumer Confidence both rose past forecasts for May whereas the Dallas Fed Manufacturing Business Index dropped to the lowest levels in two years.

At home, agitations over UK PM Boris Johnson’s party during the covid-led lockdowns join the disappointment of British business leaders over the Northern Ireland Protocol (NIP) to weigh on the GBP/USD prices. On the same line are the doubts over the Bank of England’s (BOE) role in taming inflation. “In a downbeat assessment of the UK’s economic prospects, the impact of Brexit and the potential ‘politicization’ of monetary policy, the US investment bank (Bank of America) believes that investors will dump the pound after sustained weakness,” per The Times.

Looking forward, the US ISM Manufacturing PMI for May, expected 54.5 versus 55.4 prior, will decorate the calendar while Fedspeak and other risk catalysts may entertain GBP/USD traders.

Technical analysis

A daily closing below the 13-day-old rising trend line keeps GBP/USD sellers hopeful until the quote stays below 1.2690.

- The GBP/JPY extends its weekly gains up by 1.14%.

- Sentiment begins to shift positively, which could propel the GBP higher.

- GBP/JPY Price Forecast: Upward biased, but facing solid resistance around 162.18.

The British pound gains against the Japanese yen, albeit a risk-off market mood that usually benefits the Japanese yen, but the rally in the USD/JPY weighed on the JPY. At 162.31. the GBP/JPY gains some 0.20% as the Asian Pacific session begins.

Sentiment begins to shift positively but remains mixed

Asian equity futures fluctuate, portraying a mixed open. Meanwhile, US equities are rising, illustrating that month-end flows were the main reason for a dismal market mood. Sentiment-wise, any news from China regarding the coronavirus could shift market players’ mood. Additionally to the aforementioned, traders need to be aware of the release of China’s Caixin PMI for May, expected at 48, with April’s reading at 46.

The GBP/JPY Tuesday’s price action shows that the cross-currency opened near the 161.30s, 40 pips above the 160.94 daily low. However, the pair jumped as the JPY weakened, undermined by rising US Treasury yields, and underpinned the greenback. So, the GBP/JPY broke Tuesday’s early high at 161.95 and rallied 40 pips further, reaching a weekly high around 163.35.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY remains upward biased and poised for a re-test of April’s 28 daily high around 164.25. However, the cross-currency would face a wall of resistance levels on its way north. Nonetheless, the Relative Strength Index (RSI) above the 50-midline in the bullish territory has enough room to spare before reaching overbought conditions.

Therefore, the EUR/JPY first supply zone would be May 9 high at 162.18. Break above would expose May 5 daily high at 163.57, followed by May 2 cycle high at 163.89. Once cleared, the EUR/JPY could rally towards April’s 28 cycle high at 164.25.

On the flip side, the GBP/JPY first support would be the 50-DMA at 161.70. A breach of the latter would expose May 31 low at 160.94, followed by May 30 daily low at 160.25.

- EUR/USD is juggling around 1.0733 ahead of multiple economic events.

- An improvement is expected in the eurozone jobless rate at 6.7% vs. 6.8% earlier.

- ECB policymaker is expecting two consecutive rate hikes in June and September by 25 bps.

The EUR/USD pair is displaying back and forth moves in a narrow range of 1.0730-1.0740 in early Tokyo. The major displayed a sheer reversal on Tuesday after hitting a low of 1.0679. A firmer rebound in the shared currency bulls is backed by rising odds of a rate hike by the European Central Bank (ECB) in its June monetary policy.

Soaring inflation in the eurozone is demanding the deployment of quantitative measures, which will incorporate a ceiling on the inflationary pressures. On Tuesday, Eurostat reported the annual Harmonized Index of Consumer Prices (HICP) at 8.1% vs. the expectation of 7.7% and the prior print of 7.4%. A significant upside in the inflation numbers in Europe is compelling for an end of the lower rates cycle and rate hikes will be featured by the ECB in its upcoming monetary policy meetings.

Meanwhile, ECB Chief Economist Philip Lane has advocated two consecutive interest rate hikes by 25 basis points (bps) in June and September. This has bolstered the odds of a rebound in the ECB’s interest rate curve.

Going forward, investors will focus on the speech from ECB President Christine Lagarde and the release of the eurozone Unemployment Rate. Considering the galloping inflation levels, investors should brace for hawkish commentary from ECB’s Lagarde. While the eurozone Unemployment Rate is seen at 6.7% against the prior print of 6.8%.

On the dollar front, the US dollar index (DXY) is experiencing barricades around 101.80 ahead of the ISM Manufacturing PMI, which is seen lower at 54.5 against the former figure of 55.4.

"Inflation is number one concern for President Biden," US Treasury Secretary Janet Yellen said during early Wednesday morning in Asia.

More to come

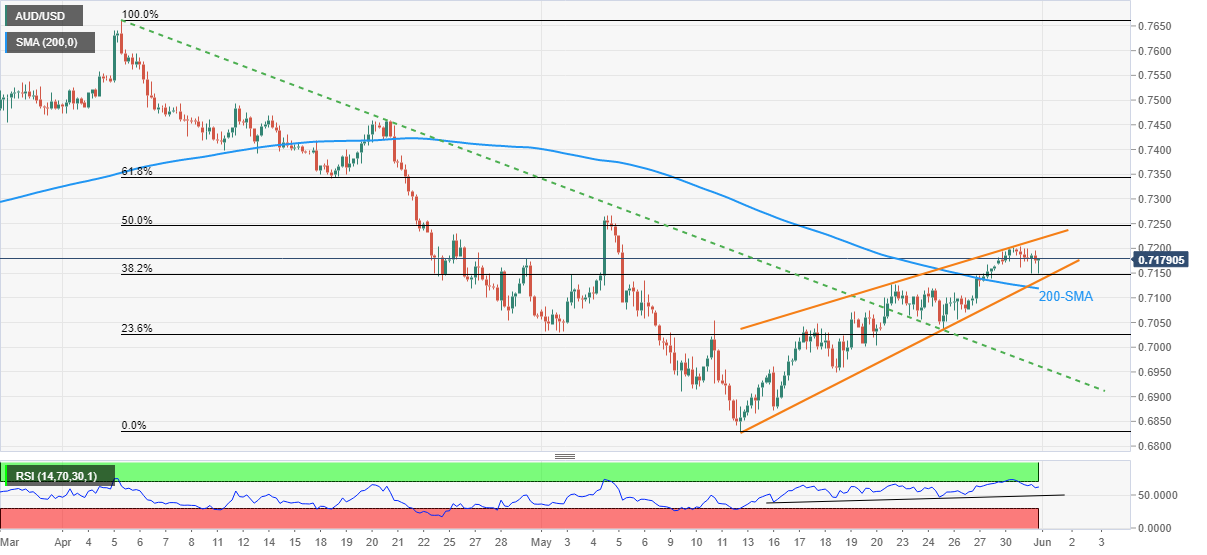

- AUD/USD consolidates pullback from three-week high, sidelined of late.

- Australia’s Q1 2022 GDP is estimated to have softened by 0.7% QoQ.

- Bearish chart pattern, RSI retreat keeps sellers hopeful.

- 200-SMA adds to the downside filters, recovery moves have multiple hurdle to tackle.

AUD/USD picks up bids to 0.7178 as bears lick their wounds after the quote’s U-turn from a three-week high. In doing so, the Aussie pair consolidates the first daily loss in four ahead of the key Australia Q1 Gross Domestic Product (GDP) release during Wednesday’s Asian session.

Also read:

The AUD/USD pair’s pullback the previous day portrays a rising wedge bearish chart pattern on the four-hour play. The downside bias also gains support from the RSI (14) retreat.

However, the 200-SMA offers an additional barrier to the south around 0.7120, in addition to the stated wedge’s support line near 0.7135.

Should the quote drops below 0.7120, theory backs bears to expect a fresh yearly high under the previous month’s trough of 0.6828. During the fall, the 23.6% Fibonacci retracement (Fibo.) of April-May fall, around 0.7030, as well as the 0.7000 psychological magnet may offer intermediate halts.

On the flip side, recovery moves need to reject the wedge formation, by crossing the 0.7220 immediate hurdle, to convince short-term buyers.

Even so, the 50% Fibo. level and the previous monthly high, respectively around 0.7245 and 0.7270, can challenge the upside momentum past-0.7220.

Overall, AUD/USD teases bears ahead of the key Aussie data but the downtrend requires strong disappointment from scheduled data and has multiple challenges.

AUD/USD: Four-hour chart

Trend: Grinds lower

- USD/JPY bulls in charge but a correction could be on the cards.

- The bulls are taking the lead on the back of Fed expectations.

USD/JPY has soared on the back of a stronger US dollar on Tuesday that rallied against its major trading partners early doors after the long Memorial Day holiday weekend. The data schedule is busy again this week, with the focus on Friday's May employment report. Investors moved away from risk following the US Federal Reserve Governor Christopher Waller's hawkish remarks the prior day.

Subsequently, global equities came under pressure on news of record-high inflation in Europe. The Euro Stoxx 50 and CAC 40 closed 1.4% lower, and the DAX slipped 1.3%. The FTSE 100 posted a modest 0.1% increase. The Dow Jones Industrial Average fell by 0.7% to 32,990.12, the S&P 500 dropped by 0.6% to 4,132.15, and the Nasdaq Composite was 0.4% in the red at 12,081.39. For the month, the S&P and the Dow closed little changed while the Nasdaq was 2.1% lower after registering a more than 13% retreat in April. The US 10-year yield rose 10.2 basis points to 2.85%.

The Fed official Waller advocated for the central bank to raise interest rates at every meeting until inflation is curbed. Specifically, Waller said “I support tightening policy by another 50 bp for several meetings. In particular, I am not taking 50 bp hikes off the table until I see inflation coming down closer to our 2% target.”

Consequently, the analysts at Brown Brothers Harriman explained that WIRP suggests 50 bp is fully priced in for June and July. ''However, a third 50 bp that was fully priced in for September is now about 50% priced in vs. 35% last week. After September, two more 25 bp hikes are fully priced in and a third is partially priced in that would take the Fed Funds ceiling to between 3.0-3.25%.''

What’s really changed is that rates are seen peaking in mid-2023 before falling in H2 23 and beyond, the analysts added. ''This would only happen if the US were to fall into recession next year and while it is possible, it is not our base case. This week’s data will be very important for near-term market expectations.''

The Nonfarm Payrolls and other important survey data will be reported. We get the regional Fed manufacturing surveys wrap-up and May ISM manufacturing PMI will be reported tomorrow and is expected at 54.5 vs. 55.4 in April.

We also have US President Joe Biden who said he and Jerome Powell will discuss inflation in a White House meeting Tuesday and pledged to give the Federal Reserve chair space to do his job.

- Biden and Powell to discuss inflation, US dollar on a knife's edge

USD/JPY technical analysis

The price is meeting a daily resistance area and could be on the verge of a bearish correction to the 38.2% Fibo that meets prior resistance that would be expected to act as a support.

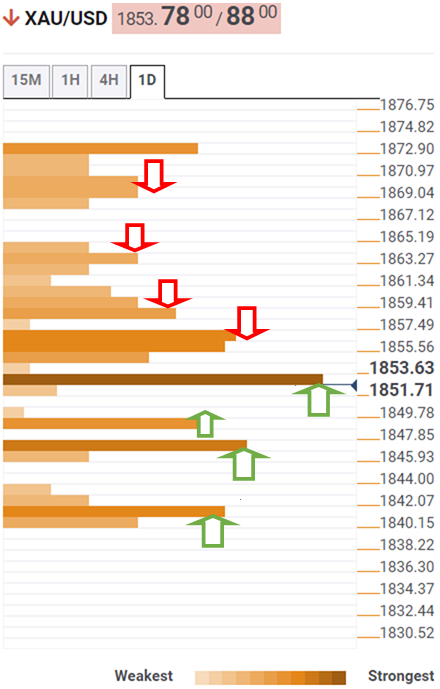

- Gold price is declining sharply on advancing hawkish Fed bets.

- Measures to contain inflationary pressures will absorb liquidity from the economy.

- Investors will keep an eye on the release of the ISM Manufacturing PMI.

Gold price (XAU/USD) has given a downside break from its previous consolidation formed in a $1,846.20-1,864.16 range in the New York session. The precious metal has turned extremely volatile as investors are bracing for a rise in the extent of the hawkish stance to be dictated by the Federal Reserve (Fed) in June.

Mounting inflationary pressures in the US economy have created havoc for the Fed and the US administration. To discuss the same, US President Joe Biden and Fed chair Jerome Powell conducted a meeting on Tuesday to discuss measures that could contain the soaring inflation. No matter what kind of measures the Fed will take to tame the price pressures, one thing is for sure the liquidity absorption program will get tightened further and the gold prices will remain on the tenterhooks.

Meanwhile, the US dollar index (DXY) is consolidating above 101.70 and is likely to witness an initiative buying action after a pullback. In today’s session, investors will focus on the ISM Manufacturing PMI, which is seen lower at 54.5 against the prior print of 55.4.

Gold technical analysis

A downside break of the Symmetrical Triangle on the hourly scale resulted in a volatility expansion that dragged the gold prices significantly lower. The breakdown of the precious metal will find a cushion at around $1,820.00. Declining 20- and 50-period Exponential Moving Averages (EMAs) at $1,846.00 and $1,850.00 are hinting at more downside. Along with this, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which adds to the downside filters.

Gold hourly chart

-637896309575741347.png)

- The EUR/JPY moderately climbs some 0.07% as the Asin Pacific session begins.

- Sentiment remains negative, though the JPY weakened as other global central banks began tightening monetary conditions.

- EUR/JPY Price Forecast: To accelerate towards 140.00, once EUR/JPY bulls reclaim 139.00.

The EUR/JPY extends its rally for the fourth consecutive trading day due to a weaker Japanese yen, the weakest currency of Tuesday’s trading session in the FX complex. At 138.13, the EUR/JPY aims higher, and bulls have set their target around May 9 daily high at 138.32.

Sentiment remains negative, fundamentally for no reason than broad US dollar strength, courtesy of month-end flows. US equities closed with losses between 0.31% and 1.35%. China’s reported positive news related to May’s Covid-19 outbreak as Beijing and Shanghai prepares to lift some restrictions.

Of late, the EU Commission agreed to Russia’s oil embargo. Earlier, in the European session, inflation in the Euro area skyrocketed towards 8.1% YoY, higher than the 7.7% estimation

EUR/JPY Tuesday’s price action showed that the cross-currency dipped towards 136.80 daily lows, below the daily pivot point at 137.11, on pure JPY strength. Nevertheless, as Europan traders got to their desks, the EUR/JPY shifted gears and rallied more than 130 pips, reaching a daily high at 138.23, returning to current prices.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains upward biased and poised for a break of the May 9 138.31 cycle high. However, the cross-currency would face a wall of resistance levels on its way north. Nonetheless, the Relative Strength Index (RSI) is above the 50-midline in the bullish territory and has enough room to spare before reaching overbought conditions.

Therefore, the EUR/JPY first supply zone would be May 9 high at 138.31. Break above would expose April’s 25 daily high at 139.20, followed by April’s 22 cycle high at 139.48. Once cleared, the EUR/JPY could rally towards April’s 21 YTD high at 140.00.

Key Technical Levels

- NZD/USD pressured as US dollar battles back.

- The Aussie GDP data will be eyed and US events this week are key.

At 0.6517, NZD/USD is lower on the day, losing some 0.57% after falling from a high of 0.6563 to a low of 0.6482. We have seen a recovery in the greenback that was dragged higher by a rally in US bond yields. Equally, a weak open for key US equity indices weighed on the antipodean currencies.

''While the Kiwi recovered off lows below 0.65 as equities clawed back gains, it remains below levels prevailing yesterday. With no local data today, the immediate focus will be on Australian Gross Domestic Product data and more broadly on the state of global risk appetite,'' analysts at ANZ bank explained.

''As we noted yesterday, the medium-term outlook is complicated: NZ enjoys higher interest rates, but that’s offset by growing fears of a hard landing (here and, to complicate things, in the US too), and blockages in the FX forwards market that are suppressing carry. It all speaks to volatility and a period of range trading rather than the need to radically adjust levels.''

Meanwhile, investors moved away from risk following the US Federal Reserve Governor Christopher Waller's remarks the prior day who advocated for the central bank to raise interest rates at every meeting until inflation is curbed. Specifically, Waller said “I support tightening policy by another 50 bp for several meetings. In particular, I am not taking 50 bp hikes off the table until I see inflation coming down closer to our 2% target.”

This has left markets with the expectation of further rate increases in the forthcoming months. Analysts at Brown Brothers Harriman explained that WIRP suggests 50 bp is fully priced in for June and July. ''However, a third 50 bp that was fully priced in for September is now about 50% priced in vs. 35% last week. After September, two more 25 bp hikes are fully priced in and a third is partially priced in that would take the Fed Funds ceiling to between 3.0-3.25%.''

What’s really changed is that rates are seen peaking in mid-2023 before falling in H2 23 and beyond, the analysts added. ''This would only happen if the US were to fall into recession next year and while it is possible, it is not our base case. This week’s data will be very important for near-term market expectations.''

Looking ahead for the week, the US Nonfarm Payrolls and important survey data will be reported. We get the regional Fed manufacturing surveys wrap-up and May ISM manufacturing PMI will be reported tomorrow and is expected at 54.5 vs. 55.4 in April.

We also have US President Joe Biden who said he and Jerome Powell will discuss inflation in a White House meeting Tuesday and pledged to give the Federal Reserve chair space to do his job.

- Biden and Powell to discuss inflation, US dollar on a knife's edge

What you need to take care of on Wednesday, June 1:

The day will start with Australia releasing the Q1 Gross Domestic Product and the May AIG Manufacturing PMI. Disappointing readings could unleash risk aversion after poor Chinese data released early Tuesday.

EU inflation soared to a record high of 8.1% YoY in May, according to preliminary estimates, further fueling concerns about the future of major economies. Asian and European stocks edged lower. Wall Street aimed to trim early losses but gave up ahead of the close and ended the day also in the red.

Meanwhile, EU representatives reached a deal over the sixth package of sanctions on Russia. They agreed to ban 90% of the country's oil imports by the end of the year. Charles Michel, president of the European Council, said the move would immediately hit 75% of Russian oil imports. The embargo covers petroleum and derivatives brought in by sea, allowing a temporary exemption for imports delivered by pipeline.

Sanctions also include an asset freeze and travel ban on individuals and excluding the Russian biggest bank, Sberbank, from the SWIFT system. Finally, leaders agreed to provide Ukraine with a €9 billion tranche of assistance to support the war-torn country's economy.

Crude oil prices soared at the start of the day but were sharply down during US trading hours. The black gold was affected by headlines indicating that OPEC members are considering exempting Russia from their oil production deal. WTI traded as high as $119.96 a barrel but settled at around $115.20.

Gold was unable to take advantage of the dismal mood and finished the day in the red below $1,840 a troy ounce.

Across the FX board, there was little change. The American dollar appreciated during the first half of the day but gave up during the US session. The EUR/USD pair trades around 1.0730, while GBP/USD stands around 1.2600.

The USD/JPY pair advanced alongside US Treasury yields, now trading at around 128.60, but USD/CHF saw little action and is currently at 0.9590.

The AUD/USD pair eased at the end of the day, posting modest losses as per trading in the 0.7170 price zone. The Canadian dollar appreciated alongside oil, with USD/CAD down to 1.2640.

Like this article? Help us with some feedback by answering this survey:

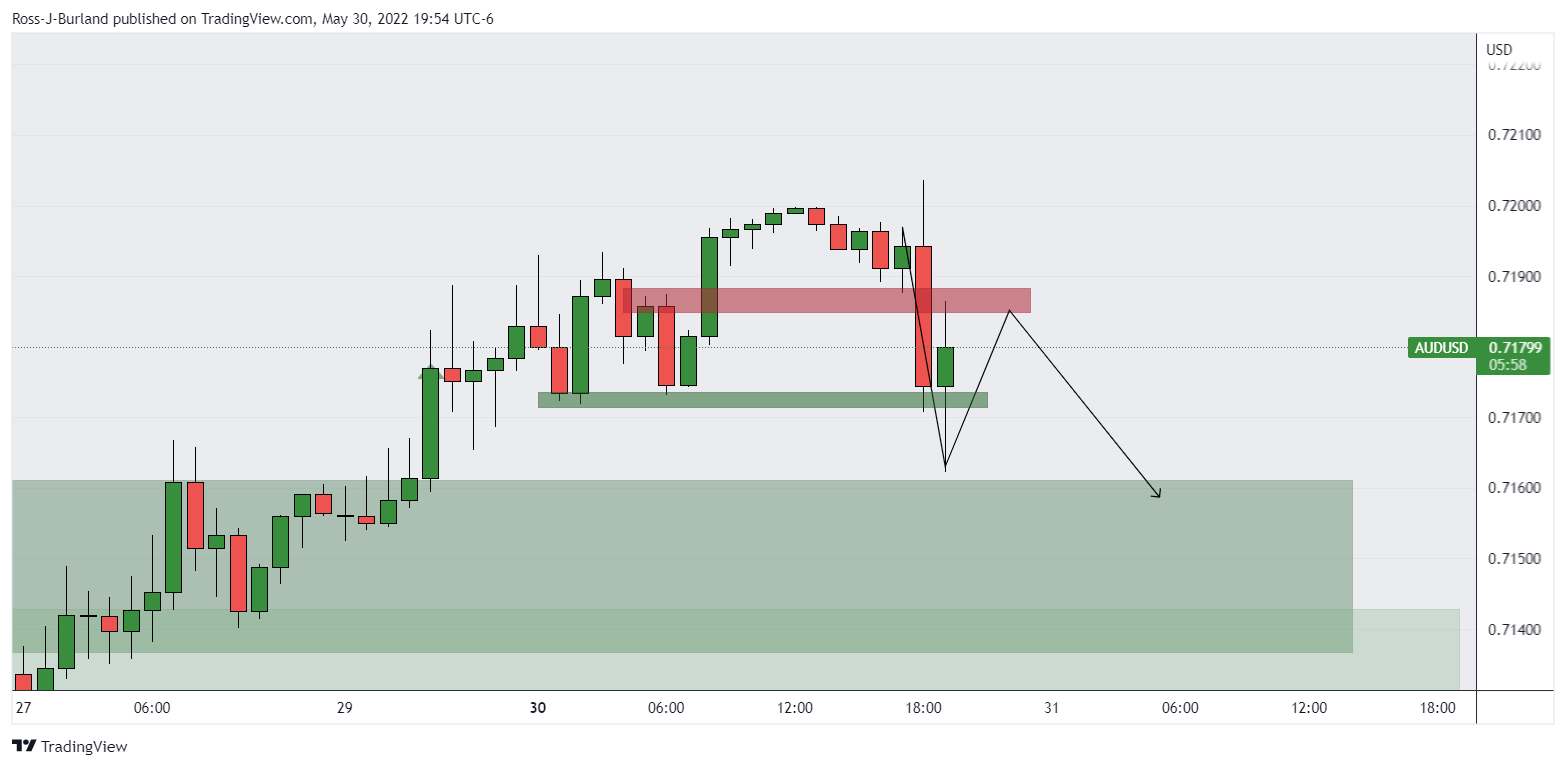

- The Australian dollar slides from weekly highs above 0.7200 amidst a sour trading day.

- Sentiment shifted negatively as month-end flows boosted the greenback, and US Treasury yields rose.

- AUD/USD Price Forecast: A daily close below 0.7200 to open the door for further losses.

AUD/USD slumps in the North American session, dropping from weekly highs above 0.7200, spurred by a risk-off market mood, on May’s last trading day. At 0.7178, the AUD/USD reflects the greenback’s strength, benefitted by month-end flows and higher US Treasury yields.

US equities remain trading with losses, between 0.46% and 1.80%. Sentiment shifted sour as the Eurozone reported inflation for May, which increased by 8.1% YoY, higher than the 7.8% foreseen, triggering worries about elevated prices and a global stagflation scenario.

In the Asian session, positive news from China showed that May PMIs came better than expected. The Manufacturing PMI printed a solid 49.6, higher than the 49.0 expected. The Non-Manufacturing PMI index rose by 47.8 vs. 45.5 estimations. The previously mentioned, alongside some restrictions lifted in Beijing and Shanghai, paint a hopeful scenario for the second-largest economy and Australia’s largest trading partner.

Chinese data boosted the AUD/USD, which was suffering under some selling pressure, though in the end, it failed to cling to the 0.7200 mark.

On Monday, Fed’s Governor Christopher Waller said he wants to keep hiking rates in 50 bps size until inflation is moving back towards the 2% target. Specifically, he said, “I support tightening policy by another 50 bps for several meetings. In particular, I am not taking 50 bps hikes off the table until I see inflation coming down closer to our 2% target.”

In the day ahead, the Australian economic docket would feature the GDP for Q1. Along with China’s Caixin Manufacturing PMI for May, that data could influence the AUD/USD direction. On the US front, the US economic calendar would feature the US ISM Manufacturing and Non-Manufacturing PMIs, US employment data, led by the Nonfarm Payrolls, and the ADP and JOLTs openings report.

AUD/USD Price Forecast: Technical outlook

The AUD/USD daily chart depicts the pair as neutral-downward biased. Above the 0.7200 mark, AUD/USD buyers would face a firm supply area in the 0.7229-56 region, the confluence of the 50, 100, and the 200-day moving averages (DMAs), a reason for the pair’s dip below 0.7200, as AUD/USD bears stepped in.

If the AUD/USD records a daily close below the 0.7200 mark, that will open the door for further weakness. That said, the AUD/USD first support would be the May 30 low at 0.7152. Once that hurdle cleared, the AUD/USD would tumble towards 0.7100, followed by the 50-day moving average (DMA) at 0.7050.

On the other hand, the AUD/USD first resistance would be 0.7200. A breach of the latter would expose the major to the 0.7229.56 area, the confluence of the above-mentioned DMAs.

- Gold is on the verge of a test of critical daily support, resisted at a weekly 38.2% Fibonacci.

- Forthcoming events on the Us economic calendar will be key.

At $1,839.80, the gold price is down by some 0.85% on the day as the US dollar attempts to correct from the lowest levels since the last trading week of April. Gold prices are headed for a second consecutive month of declines as rising US Treasury yields discourage investors from the non-yeilding asset, despite concerns over surging inflation.

The 10-year yield is currently trading near 2.82%, up from last week’s low near 2.70% but still well below the May 9 peak near 3.20%. Elsewhere, the 2-year yield is trading near 2.54%, up from last week’s low near 2.44% but still well below the May 4 peak near 2.85%. US gold futures (GCv1) settled down 0.5% at $1,848.4 and the spot gold price is following in tow.

Investors' nerves were shaken up by the US Federal Reserve Governor Christopher Waller who on Monday advocated for the central bank to raise interest rates at every meeting until inflation is curbed. Specifically, Waller said “I support tightening policy by another 50 bp for several meetings. In particular, I am not taking 50 bp hikes off the table until I see inflation coming down closer to our 2% target.”

This has left markets with the expectation of further rate increases in the forthcoming months. Analysts at Brown Brothers Harriman explained that WIRP suggests 50 bp is fully priced in for June and July. ''However, a third 50 bp that was fully priced in for September is now about 50% priced in vs. 35% last week. After September, two more 25 bp hikes are fully priced in and a third is partially priced in that would take the Fed Funds ceiling to between 3.0-3.25%.''

What’s really changed is that rates are seen peaking in mid-2023 before falling in H2 23 and beyond, the analysts added. ''This would only happen if the US were to fall into recession next year and while it is possible, it is not our base case. This week’s data will be very important for near-term market expectations.''

The US Nonfarm Payrolls is critical at the last trading of this week, but before then, ahead of the jobs report, important survey data will be reported. Chicago PMI will be reported today and is expected at 55.1 vs. 56.4 in April. The regional Fed manufacturing surveys wrap up with Dallas today, which is expected at 1.5 vs. 1.1 in April. May ISM manufacturing PMI will be reported tomorrow and is expected at 54.5 vs. 55.4 in April.

In the immediate future, US President Joe Biden said he and Jerome Powell will discuss inflation in a White House meeting Tuesday, and pledged to give the Federal Reserve chair space to do his job.

- Biden and Powell to discuss inflation, US dollar on a knife's edge

The outcome of the meeting will be important for the gold price. While gold is viewed as a hedge against inflation, rising US interest rates increase the opportunity cost of holding non-yielding bullion and boost the dollar in which gold is priced.

''The world is chasing the same narrative: quantitative tightening is going to sap liquidity at a fast clip, while the Fed hikes into a slowing growth profile in a grand battle against inflation,'' analysts at TD Securities argued, ''and yet,'' they said, ''consensus positioning in gold remains to the long-side, keeping precious metals prices resilient.''

Gold technical analysis

The gold price is meeting resistance n the weekly chart at a key 38.2% Fibonacci retracement level as follows:

However, from a daily perspective, the price is forming an M-formation while on the way to completing the test of the neckline of the prior W-formation.

Gold, daily chart

This makes for prospects of some meanwhile consolidation in the days ahead, with the price potentially trapped between the two opposing necklines acting as support and resistance.

The Wall Street Journal reports that while there are no formal plans to push for OPEC to increase output, some members are planning for it. This has seen the oil market sell-off:

WTI H1 chart

The OPEC+ group of producers continues to underproduce, which had taken the sting out of the highly anticipated 430k bpd output hike this month.

''Following a decade of underinvestment, the world's spare capacity is left in the hands of a few Gulf nations,'' analysts at TD Securities said. ''With few able to ramp up production, deal compliance has already risen to a massive 220% last month, and Russian output is likely to continue to suffer in coming months. The insurance and re-insurance of Russian cargoes will likely also become an operational bottleneck driving Russian production lower.''

- GBP/USD bulls seeking a higher high on the daily chart.

- The 4-hour time frame is offering some bullish structure.

GBP/USD has been in the hands of the bulls in the New York session and has broken a key level of resistance on the four-hour time frame. The following illustrates the progress that the bulls have been making at the start of the week below a key counter trendline.

GBP/USD H4 chart

The price broke below counter-trendline support but the tweezer bottom is encouraging for the bulls. A break of resistance and subsequent retest of the counter trendline will leave prospects of an inverse head and shoulders, a bullish reversal pattern, usually most effective at the end of a trend, however. Nonetheless, potentially bullish for the days ahead.

GBP/USD daily chart

Meanwhile, the daily chart is promising given the support structures that have been formed on the breaks of resistance.

DXY H4 chart

From a US dollar perspective, the bearish W-formation is drawing in the price towards the neckline of the pattern.

If this were to give out as a failed support structure, then this will likely give way to further downside and aid the GBP bulls in their quest for higher highs.

- The USD/CHF climbs and reduces Monday’s losses, up by 0.02%.

- Sentiment remains dampened, courtesy of the buoyant greenback.

- USD/CHF Price Forecast: The 1-hour chart price action and oscillators suggest a downward move.

The USD/CHF snaps three consecutive days of losses and jumps from weekly lows near 0.9550s, after a long three-day weekend in the US, in the observance of Memorial Day. At the time of writing, the USD/CHF is trading at 0.9572, reflecting the broad US Dollar strength.

The market sentiment remains negative, as shown by global equities falling. In the meantime, the US Dollar Index is up by 0.38%, sitting at 101.753, underpinned by US Treasury yields. The 10-year US Treasury yield raises four bps and parks around 2.846%.

USD/CHF Tuesday’s price action showed that the USD/CHF opened near the daily’s pivot point and rallied shy of the R2 pivot point, at 0.9620. Then the major dropped towards the central daily pivot point, where it currently stands.

USD/CHF Price Analysis: Technical outlook

The 1-hour chart depicts the USD/CHF trading within the narrow Bollinger band’s range, meaning that volatility is constrained. The 20, 50, and 100-hour simple moving averages (SMAs) lie within the 0.9571-91 range, while the 200-hour SMA sits comfortably around 0.9636, and the Relative Strength Index (RSI) is below the 50-midline at 43.28, aiming lower. Therefore, the USD/CHF in the near term is downward biased.

That said, the USD/CHF first support would be the Bollinger’s band lower band at 0.9570. A breach of the latter would expose the confluence of the May 22 low and the S1 daily pivot at 0.9544, followed by the April 20 high-turned-support at 0.9536.

Key Technical Levels

President Joe Biden will meet with Federal Reserve Chair Jerome Powell at the Oval office to discuss the state of the American and global economy and address inflation.

Watch live

Meanwhile, Biden has crossed the wires and stated that he congratulates Powell on his confirmation and says they will discuss inflation.

Key quotes

- Says we need to transition from recovery to steady growth.

- Says he respects Fed's independence.

- Says his job is to give fed officials space to do their job.

- Says Powell has noted fed had a laser focus on inflation.

- Says he looks forward to leadership at the Fed.

Market implications

The US dollar is bid on Tuesday as Treasury yields climb and worries over a further acceleration in global inflation kept investors' risk appetite low key.

Hawkish comments from a Federal Reserve official spooked investors. Fed Governor Christopher Waller said the Fed should be prepared to raise interest rates by a half percentage point at every meeting from now on until inflation is decisively curbed.

Today's meeting will give further insight into the path of the Fed, inflation and growth so it will be keenly eyed by traders. The greenback is on a knife's edge on the four-hour chart:

The price of DXY, an index that measures the greenback vs. a basket of currencies is heading towards a key area of support , a break of which will be bearish for the near term.

- The shared currency gives back Monday’s gains, courtesy of overall buck strength and high US Treasury yields.

- The EUR/USD reached new weekly lows below 1.0700 despite the EU inflation breaking above the 8% threshold.

- EUR/USD Price Forecast: The major is tilted to the downside; solid resistance lies around highs of 1.0700s near 1.0800 looms.

The euro slides in the North American session but bounced off daily’s lows in a high volatility trading session that witnessed the EUR/USD rallying near 1.0780 and falling to 1.0678, but at the time of writing is stabilizing. At 1.0726, the EUR/USD is trading below the 20-DMA and down 0.41%.

The EUR/USD falls due to overall US Dollar strength and a risk-off market

Global equities remain trading with losses, illustrating a dampened mood. Due to month-end flows, the greenback remains buoyant, also underpinned by high US Treasury yields. The US Dollar Index, a measure of the buck’s value, gains 0.44%, up at 101.812, after briefly piercing the 102.00 mark. The US 10-year Treasury yield advances four bps, sitting at 2.842%.

The above-mentioned weighed on the EUR/USD. In the European session, the Euro area reported that inflation in the EU accelerated to 8.1% in May, up from 7.4% in April, while price pressures continued to broaden, indicating that’s not just energy lifting the headline reading.

Over the last couple of weeks, some ECB officials have been expressing the need to normalize the EU monetary policy. ECB’s President Christine Lagarde said that the central bank might raise rates in July and September by 25 bps once the QE is finalized. Some of the ECB hawks showed discomfort regarding the previously mentioned and have continued commenting about moving fast amid increasing fears that inflation will get out of control.

On Monday, Federal Reserve Governor Christopher Waller said that he supports 50 bps for “several meetings,” and he’s not taking 50 bps off the table until inflation closes to the 2% target. Furthermore, inflation is “stubbornly high,” and the Fed would need to be prepared to do more, Waller said. It’s worth noting that regarding the balance sheet reduction, he noted that it’s equivalent to a couple of 25 bps rate hikes.

The US calendar featured the May CB Consumer Confidence, which rose by 106.4, better than the 103.9 expected. The report showed that inflation expectations for one year are at 7.4%, lower than April’s 7.5%. Furthermore, Housing data was mixed but near the estimations, while the Fed Regional banks continued releasing their Manufacturing Indexes ahead of June’s 1 ISM Manufacturing PMI. Chicago’s PMI for May rose by 60.3, higher than the 55 expected, but the Dallas Fed Index contracted to -7.3, lower than April’s reading.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart depicts the pair as neutral-downward biased, despite rallying since the second half of May, from YTD lows near 1.0300, towards 1.0780s. In fact, the upward move caused the Relative Strength Index (RSI) to jump over the 50-midline, but of late, in the last two trading days, is poised to the downside, at 55.17.

Therefore, the EUR/USD path of least resistance is tilted to the downside. The EUR/USD first support would be 1.0700. Break below would expose the May 31 low at 1.0678, followed by the May 25 cycle low at 1.0641, and then the May 23 daily low at 1.0556.

- After hitting the highest level since March 2020, the Mexican peso reversed sharply.

- US dollar recovers ground on Tuesday as the rally in Wall Street ends.

- USD/MXN volatile, without clear signs.

With a 0.82% gain, the USD/MXN is having the best day in three weeks. On Monday, it bottomed at 19.41, the lowest since March 2020; since then it rebounded by 1.50%. The sharp reversal increases the risks of higher volatility and gains ahead.

Has it bottomed?

USD/MXN ended Monday with a small loss and far from the bottom, and above 19.50; all signs of exhaustion to the downside. On Tuesday, the pair continued to rebound and accelerated during the American session, reaching at 19.73, the highest since Friday.

The reversal, if sustained, could mean the end of the recent rally of the Mexican peso unless USD/MXN drops back under 19.50. A likely scenario is for the pair to start a short-term consolidation phase, trading back in the 19.50/19.75 range. A break higher would turn the attention to 19.90.

Volatility has increased during the last sessions, as the USD/MXN broke key support levels. Such price action could persist, also fueled by significant fluctuations in Wall Street.

From a fundamental perspective, analysts at Standard Chartered Global Research, consider that a hawkish Bank of Mexico should support the Mexican peso in the near term. “Given high inflation prints near-term and strong conviction among most board members to accelerate the hiking pace, we now expect Banxico to raise the policy rate by 75bps to 7.75% at its June meeting (we previously expected a 25bps move to 7.25%); this would take the ex-ante real rate close to the upper level of the estimated real neutral rate range (1.8-3.4%).”

Technical levels

Data released on Tuesday showed that Canadian GDP rose below expectations during the first quarter. On Wednesday, the Bank of Canada (BoC) will announce its monetary policy decision. Analysts at CIBC point out that despite GDP figures, the central bank is still for a 50bp rate hike.

Key Quotes:

“Statisticians threw the Bank of Canada a soft curveball a day before it's policy decision, with GDP growth in Q1 coming in shy of previously released industry data and consensus expectations. However, the modest disappointment is unlikely to deter the Bank from hitting a double (50bp hike) at tomorrow's meeting, with economic growth over the first half of the year as a whole still tracking close to its April MPR projections, and inflation well ahead of previous expectations.”

“There were a lot of moving parts in today's report, but through all of the noise little has really changed for the Bank of Canada. The growth rate in Q1, while disappointing relative to heightened expectations, was still in line with the April MPR projections. For Q2, growth appears to be tracking in the 4.5-5% range, which would be only modestly below the 6% projected by the Bank in that previous MPR. As such, there is little to deter the Bank from another 50bp hike tomorrow, and likely a further outsized move in July. We forecast a deceleration in growth and inflation in the second half of the year, which will be the catalyst for the Bank to slow and then ultimately pause this rate hike cycle.

- Canadian Q1 GDP below expectations, still BoC 50 bp rate hike expected.

- Loonie is among the top performers of the American session.

- USD/CAD breaks range and tumbles to fresh lows.

The USD/CAD broke below 1.2650 and fell to 1.2628, reaching a fresh monthly low. The pair resumed the downside despite the Canadian GDP reading coming below expectations and ahead of Wednesday’s Bank of Canada meeting.

The loonie rose across the board during the last hours as the GDP report did not affect rate hike expectations from the BoC. The Canadian economy, measured by the GDP, rose by 3.1% during the first quarter (annualized), below the 5.4% of market consensus. Analysts at RBC Economics explained growth was supported by “robust household consumption and business investment that offset a sizable decline in net trade. Consumption expenditure increased 3.4% from the prior quarter despite a soft start to the quarter in January”.

On Wednesday, the Bank of Canada is expected to announce a 50 bp rate hike. “A strong economy, booming jobs market, and elevated inflation argue for another ‘forceful’ 50bp hike. And the BoC is unlikely to stop there, with a red hot housing market and support from rising commodity prices suggesting it may be even more aggressive than the Fed this year”, said analysts at ING.

The USD/CAD is falling despite the recovery of the US dollar. The DXY is having the best day in almost two weeks as US yields move higher. A deterioration in market sentiment is also helping the greenback. The Dow Joines is falling by 0.78% and the Nasdaq drops by 0.71%.

If USD/CAD rises back above 1.2650 the loonie will likely lose momentum favoring a return to the 1.2685/1.2650 range. Below the daily low, attention would turn to 1.2600. Ahead of the BoC meeting, volatility is set to remain elevated.

- The bright metal falls due to high US Treasury yields and broad US Dollar strength.

- US 10-year inflation expectations rose to 2.63%, keeping US bond yields up.

- Gold Price Forecast (XAU/USD): Seesawing around the 20 and 200-DMA’s but poised for a break below the 200-DMA.

Gold spot (XAU/USD) snaps two days of gains and retraces towards the 20-DMA after bouncing off the 200-DMA amidst a sour sentiment trading session as US traders come back from a three-day weekend and are propelling up the greenback and US Treasury yields. At $1842.36, XAU/USD remains on the defensive, almost 0.50% down.

Buoyant US dollar and higher US Treasury yields weigh on Gold Prices

Investors’ mood shifted negatively, as witnessed by global equities falling. The US Dollar Index, a gauge of the greenback’s value vs. a basket of rivals, advances 0.50%, sitting at 101.811, underpinned by elevated yields on US Treasuries. The 10-year benchmark note rate is gaining five bps, up at 2.868%.

The factors mentioned above, alongside fears of inflation anchored above the US Federal Reserve 2% target, caused a shift towards safe-haven assets. Meanwhile, 10-year breakeven inflation expectations are rising up to 2.63%, signaling that investors are not sure about buying the dip.

Elsewhere, China’s released its official PMIs for Mat, which increased by 49.6 from 47.4 in April, signaling a minimal recovery after May’s Covid-19 lockdowns. Additionally, reports on Monday’s Asian session said that Shanghai and Beijing would ease some of their restrictions to boost economic growth.

In the meantime, the US economic calendar released Housing data, which came mixed but close to forecasts. The highlight was May’s CB Consumer Confidence, which came at 106.4, better than the 103.9 expected. The report showed that inflation expectations for one year are at 7.4%, lower than April’s 7.5%.

Additionally, the Fed Regional banks keep releasing their Manufacturing Indexes ahead of June’s 1 ISM Manufacturing PMI. Chicago’s PMI for May rose by 60.3, higher than the 55 expected, but the Dallas Fed Index contracted to -7.3, lower than April’s reading.

Gold Price Forecast (XAU/USD): Technical outlook

Gold’s Tuesday price action witnessed a test of the 200-DMA at $1840.86, quickly rejected, as depicted by the candlestick. However, gold bears appear to be leaning towards the 20-DMA at $1846.76, maintaining the spot price seesawing in the $5 range. It’s worth noting that the Relative Strenght Index (RSI) is at 43.06, in bearish territory, aiming lower, meanings that gold seems poised to break to the downside.

Therefore, the XAU/USD path of least resistance is tilted to the downside. The XAU/USD’s first support would be the 200-DMA at $1840.86. Break below would expose the 4-year-old upslope trendline around $1830-34, which, once cleared, would send gold tumbling towards the Bollinger’s band bottom band at $1805.44.

- NZD/USD has slipped back towards 0.6500 on Tuesday amid a stronger buck plus risk-off trading conditions.

- Downbeat New Zealand business survey data for May has also weighed on the kiwi and triggered stagflation fears.

Month-end buying in the US dollar combined with downbeat New Zealand business survey data and a risk-off tone to US trade as market participants there returned from a long weekend weighed heavily on NZD/USD on Tuesday. The pair dropped back to probe the 0.6500 level, having been as high as the 0.6560s as recently as Monday, where it currently trades lower on the day by about 0.7%.

Regarding the downbeat New Zealand data, the headline ANZ Business Outlook Index for May dropped to -55.6% from -42.0% a month earlier, while the ANZ Own Activity Index dropped to -4.7% from 8.0% previously. That marked the worst reading since April 2020, when much of the global economy was under lockdown due to the initial spread of Covid-19.

The data triggered fears that New Zealand's economy might be headed towards/already in stagflation. Meanwhile, remarks from the RBNZ’s Deputy Governor that the central bank needs to keep decreasing stimulus and tighten conditions beyond the neutral rate of 2.0% added to concerns about the outlook for the economy. Tighter financial conditions tend to boost a currency, but not if they risk sending the economy into recession.

US data in the form of robust Chicago PMI and CB Consumer Confidence survey data for May have likely helped the US dollar hold onto earlier session gains. But tier one US data releases later this week in the form of ISM Manufacturing PMI and the official labour market report, also for May, will be more important. Despite Tuesday’s losses, NZD/USD still looks on course to end the month just shy of 1.0% higher.

The Bank of Canada (BoC) is set to announce its interest rate decision on Wednesday, May 1 at 14:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of six major banks, regarding the upcoming announcement.

The BoC is set to deliver another 50-basis point hike raising the Overnight Rate to 1.50% with a hawkish policy statement.

TDS

“We look for the BoC to deliver another 50bp hike in June to bring the overnight rate to 1.50%. With little uncertainty around the decision itself, the focus will shift to the policy statement where we expect a hawkish tone. The Bank will note that growth and inflation are both tracking above the April MPR, and repeat that rates will need to rise further. Global factors remain a crucial driver of the loonie, likely limiting the impact of the BoC's anticipated 50bp rate hike. As a result, we expect USD/CAD to maintain the 1.26-1.30 range through the summer months but will look to fade extremes.”

ING

“A strong economy, booming jobs market, and elevated inflation argue for another ‘forceful’ 50bp hike. And the BoC is unlikely to stop there, with a red hot housing market and support from rising commodity prices suggesting it may be even more aggressive than the Fed this year. We expect CAD to benefit from BoC tightening in the medium-term.”

RBC Economics

“The overnight interest rate is widely expected to rise by another 50 bps to 1.5% as the BoC continues its efforts to fight inflation. The hike will build on the BoC’s 50 bp increase in April and 25 bp rise in March – with more increases likely in the months ahead.”

NBF

“The BoC is widely expected to follow April’s 50 basis point rate hike – which was the first in over twenty years – with another half-percentage-point hike, bringing the overnight target to 1.5%. With the announcement of QT already behind us and now underway, the focus will remain squarely on the Bank’s guidance for its key interest rate. For now, the BoC appears set to quickly move towards its 2-3% neutral range (implying a third straight 50 bp move in July) but thereafter, the outlook is murkier. That said, we don’t expect the Bank to show its cards on Wednesday. Instead, look for the Governing Council to retain flexibility.”

CIBC

“The BoC will have to sound hawkish. After all, non-standard 50bp hikes don’t happen every day, particularly back-to-back. Moreover, inflation has continued to surprise to the upside. However, any admission that the housing market is already responding to higher interest rates should also be seen as an admission that excess demand is about to become less excessive. That is one of the key reasons why we think that, after another 50bp hike in July, the pace of hikes will slow down, and the Bank won’t need to take rates any higher than the 2.5% mid-point of its neutral band to achieve 2% inflation sometime in 2023.”

Citibank

“We expect a 50bp rate hike from the BoC taking the policy rate to 1.5%.”

Banco de México (Banxico) raised the policy rate by 50bps in May. Economists at Standard Chartered now expect Banxico to raise the policy rate by 75bps in June (versus 25bps prior). In their view, hawkish Banxico should support the Mexican peso in the near-term.

Banxico to raise the policy rate by 75bps in June

“The increasing possibility of a 75bps rate hike from Banxico in June should exert downward pressure on USD/MXN.”

“In the near-term, with broad FX volatility declining, high carry should continue to support the peso. However, MXN has shown a rising correlation to US equities, which warrants caution given shaky risk sentiment.”

“Despite vulnerability to broader market moves, we think MXN benefits from attractive underlying macro fundamentals. Mexico’s external vulnerabilities are limited, with low foreign positioning in fixed income and a current account bolstered by record remittances.”

“Over the medium-term, anaemic domestic growth and a lack of structural reforms will remain a headwind, while the potential for a US slowdown is a key risk to watch.”

EUR/GBP has broken over the resistance line drawn from April highs and is comfortably above the 40-week moving average of 0.8442 as a sign of budding recovery. Hawkish European Central Bank (ECB) rhetoric also adds fuel to the upmove, Benjamin Wong, Strategist at DBS Bank reports.

ECB's hawkish rhetoric paves the way for recovery

“EUR/GBP is now comfortably above the 40-week moving average at 0.8442 and trying to sustain gains over a minor intermediate dropped-down resistance line from 0.8719, the late April highs. The moving average convergence divergence (MACD) signal is grinding out a nascent buy signal, so all looks good for a budding recovery.”

“ECB hawkish rhetoric is driving the cart. The next ECB policy meeting scheduled for 9 June is watching out for signs of a July policy lift-off. Given that inflation has nudged to 8.1% in May for the eurozone, Klass Knot (a noted hawk, President of the Dutch central bank) has remarked a 50 bps rate hike is not off the table.”

“EUR/GBP has edged higher and paved cloud support at 0.8358 on the daily Ichimoku charts. Nonetheless, the cross still has hurdles to clear. 0.8618 the mid-May spike high and 0.8659 are intermittent resistance levels to break.”

- WTI nearly hit $120 on Tuesday amid a cocktail of bullish catalysts, though has since dropped back towards $118.

- The EU agreed to phase out 90% of Russian oil import by the year’s end.

- China lockdown easing/Covid-19 infection decline and the incoming peak driving season in North America and Europe are further bullish drivers.

A cocktail of bullish factors supported global oil prices on Tuesday, with front-month WTI futures coming within a whisker of hitting the $120 per barrel mark earlier in the session before backing off somewhat following a risk-averse start to the final trading day on Wall Street of the month. At current levels just above $118, WTI is still trading with gains of around $0.50, having on Monday broken above key support in the form of the late March highs in the $116s.

Market commentators cited expectations for rising demand in the coming months as North America and Europe enter the peak summer driving season plus positive developments regarding the Covid-19 situation in China (lockdown easing continues as new infections in the country fell back under 100 for the first time since early March). Probably the most important development underpinning prices right now, however, is the news early on Tuesday that EU 27 leaders came to an agreement on a Russian oil embargo.

Seaborne crude oil imports from Russia will be completely phased out within the next six months and, while oil delivered via pipeline is exempt from sanctions to placate land-locked Hungary, other EU nations that import a lot of Russian crude oil via pipeline have pledged to end purchases by the end of the year. In sum, the bloc will have phased out 90% of its purchases of Russian crude by the end of the year, a devasting blow to the Russian energy industry.

OPEC+ are scheduled to meet later in the week and sources on Monday said that, despite the EU’s (widely anticipated) ban on Russian oil imports, they would stick to their existing policy of steady 432K barrel per day increases in output quotas each month. The group's slow approach to increasing output at a time when many of its smaller producers are struggling to keep up and Russian output is collapsing from pre-Ukraine invasion levels has contributed to a significant tightening of global oil markets.

Highlighting this tightness, commodity analysts on Tuesday pointed to a continued steepening of the current contango of the oil futures curve. The premium to buy Brent crude futures for delivery in August versus six months later rose to a fresh nine-week high of near $15.

- Silver prices are under pressure on Tuesday, though have recovered substantially from earlier session lows.

- XAG/USD dipped as low as under $21.50 before recovering closer to $22.00 amid the stronger dollar/higher US yields.

Though spot silver (XAG/USD) prices are still trading lower by about 0.3% on the day, they have erased the lion’s share of earlier losses and are back to trading in the $21.90s per troy ounce, more than 2.0% above earlier session lows under $21.50. That means spot prices continue to trade relatively close to their 21DMA (in the $21.80s) and only a little over 2.0% below last week’s highs near $22.50.

Month-end strength in the US dollar plus a month-end rebound in US bond yields, which some say is also being boosted by hawkish remarks from Fed Board of Governors member Christopher Waller on Monday, are the primary factors weighing on silver and precious metals more broadly on Tuesday. Recent US data in the form of housing figures, Chicago PMI and CB Consumer Conference numbers haven’t factored much into the equation.

Silver continues to trade about 7.0% above mid-month lows in the mid-$20s and, as Wall Street chatter about US inflation/Fed hawkishness having peaked builds, the prospects for a more lasting rebound are improving. But, for now, price action seems content in remaining glued to the 21DMA and ahead of key US data releases later in the week, this is likely to remain the case.

The Conference Board's measure of Consumer Confidence fell to 106.4 in May from 108.6 in April (revised higher from 107.3), smaller than the expected drop to 103.9, data released on Tuesday revealed. That is consistent with a level of consumer confidence that remains still well above post-pandemic lows, but, owing to sky-high inflation, remains substantially below pre-pandemic levels around 130.

The Consumer Present Situation Index fell to 149.6 in May from 152.9 in April, while the Consumer Expectations Index fell to 77.5 from 79.0. The widely watched Jobs Hard-to-get Index rose a little to 12.5 in May from 10.1 in April, indicative of modest deterioration in labour market conditions.

According to the latest release by ISM-Chicago, Inc, the Chicago PMI rose to 60.3 in May versus an expected drop to 55 from 56.4 in April. The latest numbers are in fitting with a gradually slowing, but still robust pace of growth in the US midway through the second quarter of 2022.

European Central Bank (ECB) Governing Council member Pablo Hernandez de Cos said on Monday that if inflationary pressures persist, they are likely to feed into wage negotiations and trigger second-round and indirect effects on inflation, reported Reuters. These second-round effects have not yet materialised, with the latest data on wage settlements pointing to employees bearing a considerable loss of purchasing power in recent quarters.

The natural rate of interest is relatively low in the euro area, de Cos continued, hovering around or slightly above 1.0% and this would suggest that, until these levels are reached, the ECB's monetary policy stance will continue to be expansionary, at least from a long-term perspective.

In order for us to adopt a gradual normalisation approach, it is essential that inflation expectations remain anchored at the 2.0% target, he added. Moreover, it is not optimal to pre-commit to any specific interest rate path, much less in the current uncertain context.

- USD/JPY caught aggressive bids on Tuesday and shot to a near two-week high.

- Resurgent USD demand was seen as a key factor that provided a strong boost.

- The set-up favours bullish traders and supports prospects for additional gains.

The USD/JPY pair built on the previous day's positive move and gained strong follow-through traction for the second successive day on Tuesday. The momentum pushed spot prices to a nearly two-week high, around the 128.70-128.75 region during the early North American session and was exclusively sponsored by resurgent US dollar demand.

Fed Governor Christopher Waller on Monday backed a 50 bps rate hike for several meetings until inflation eases back toward the central bank’s goal. The remarks triggered a sharp spike in the US Treasury bond yields, which, in turn, assisted the USD to make a solid comeback from over a one-month low touched the previous day.

From a technical perspective, the strong move up confirmed a breakout through a multi-day-old trading range resistance. The said barrier coincided with the top end of a descending channel extending from a two-decade high touched earlier this month and the 38.2% Fibonacci retracement level of the 121.28-131.35 rally.

Given that technical indicators on the daily chart have again started moving in the positive territory, the USD/JPY pair seems all set to surpass the 23.6% Fibo. and reclaim the 129.00 mark. Some follow-through buying should push spot prices to the 130.00 round figure with some intermediate resistance near the 129.60-129.70 area.

On the flip side, any meaningful pullback below the 127.60-127.55 confluence resistance breakpoint might now be seen as a buying opportunity and remain limited near the 127.10-127.00 region. This is followed by the monthly swing low, around the 126.35 region, which coincides with the 50% Fibo. level and should act as a pivotal point.

Failure to defend the said support levels would negate any near-term positive bias and make the USD/JPY pair vulnerable. The downward trajectory could then drag spot prices below the 126.00 round figure, towards testing the 125.65 support. The next relevant support is pegged near the 61.8% Fibo. level, around the 125.00 psychological mark.

USD/JPY daily chart

-637896011778240961.png)

Key levels to watch

The CAD has backed off the 1.2660 area that provided support for the USD on Monday. Analysts at Scotiabank highlight the key levels to watch regarding the USD/CAD pair.

Resistance stretches from 1.2690 to 1.2715

“We spot support intraday at 1.2655/60 and resistance at 1.2690, although resistance likely extends up to the 1.2715 area, the early May low.”

“USD weakness through the mid-1.26s target losses to the mid-1.25s and potentially opens the door to a drop back to the Apr low at 1.2405.”

Today’s EUR decline may merely be corrective in nature as it nears the 1.08 level. Economists at Scotiabank believe that the EUR/USD pair could climb as high as 1.10 in the medium-term.

Some market participants are betting on a 50bps hike this year

“The EUR is still maintaining a higher highs and higher lows pattern that supports a breakthrough 1.08 in the near-term. A stretch of trading where it fails to break through the figure opens up a correction, however.”

“Continued inflation beats and a resilient Eurozone economy in the face of high energy prices may continue to bolster 50bps hike bets. This could see the EUR strengthen to 1.10 in the medium-term, something that seemed very unlikely a few weeks ago.”

The relief rally in copper is running out of steam. Economists at TD Securities expect the metal to dip under key support levels.

Copper appears to be in a more precarious position than its peers

“The metals complex is vulnerable to further weakening in the coming months, which fits with our view that the trading regime in base metals has morphed into a sell-rallies regime.”

“Copper appears to be in a more precarious position than its peers given its lower energy intensity, but CTA trend followers could now add to their shorts below $9,505/t.”

“A set-up is forming for copper prices to ultimately break below the support levels which have held since early-2021.”

- USD/TRY resumes the upside beyond 16.40.

- Turkey GDP expanded more than expected in Q1.

- Investors remain cautious ahead of upcoming CPI figures.

The Turkish lira loses ground for the second session in a row and sponsors the move higher in USD/TRY to the area past 16.40 on Tuesday.

USD/TRY up on dollar’s recovery

USD/TRY saw its upside accelerated so far on Tuesday in response to the rebound in the demand for the greenback, which managed to trim part of the recent losses vs. its main peers.

The move higher in the pair is so far accompanied by the recovery in US yields in the belly and the long end of the curve, while the Turkey 10y bond yields keep the range around 23.00%.

Further out, the lira is expected to keep the cautious note ahead of the publication of key inflation figures tracked by the CPI later in the week.

In the domestic calendar, better-than-expected GDP figures showed the economy expanded at an annualized 7.3% in Q1, while Trade Balance results saw the deficit shrink to $6.11B in April.

What to look for around TRY

USD/TRY keeps the underlying upside bias well and sound and looks to consolidate the recent surpass of the 16.00 yardstick for the first time since late December 2021.

So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Q1 GDP, Trade Balance (Tuesday) – Manufacturing PMI (Wednesday) – Inflation Rate, Producer Prices (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.03% at 16.3812 and faces the next up barrier at 16.4554 (2022 high May 26) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the flip side, a breach of 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

USD/TRY is set to move higher. Economists at Danske Bank 20.00 in a year.

‘Perfect storm’ looming for Turkey and lira

“The rising stagflation fears combined with tightening financial conditions, negative terms of trade shock, and no signs of a turnaround in domestic economic policies indicate further weakness for the lira.”

“We see USD/TRY at 20 in 12M.”

“Risks are tilted towards even further TRY weakness as the intervention policies, which have supported the currency over the past months, begin to lose steam.”

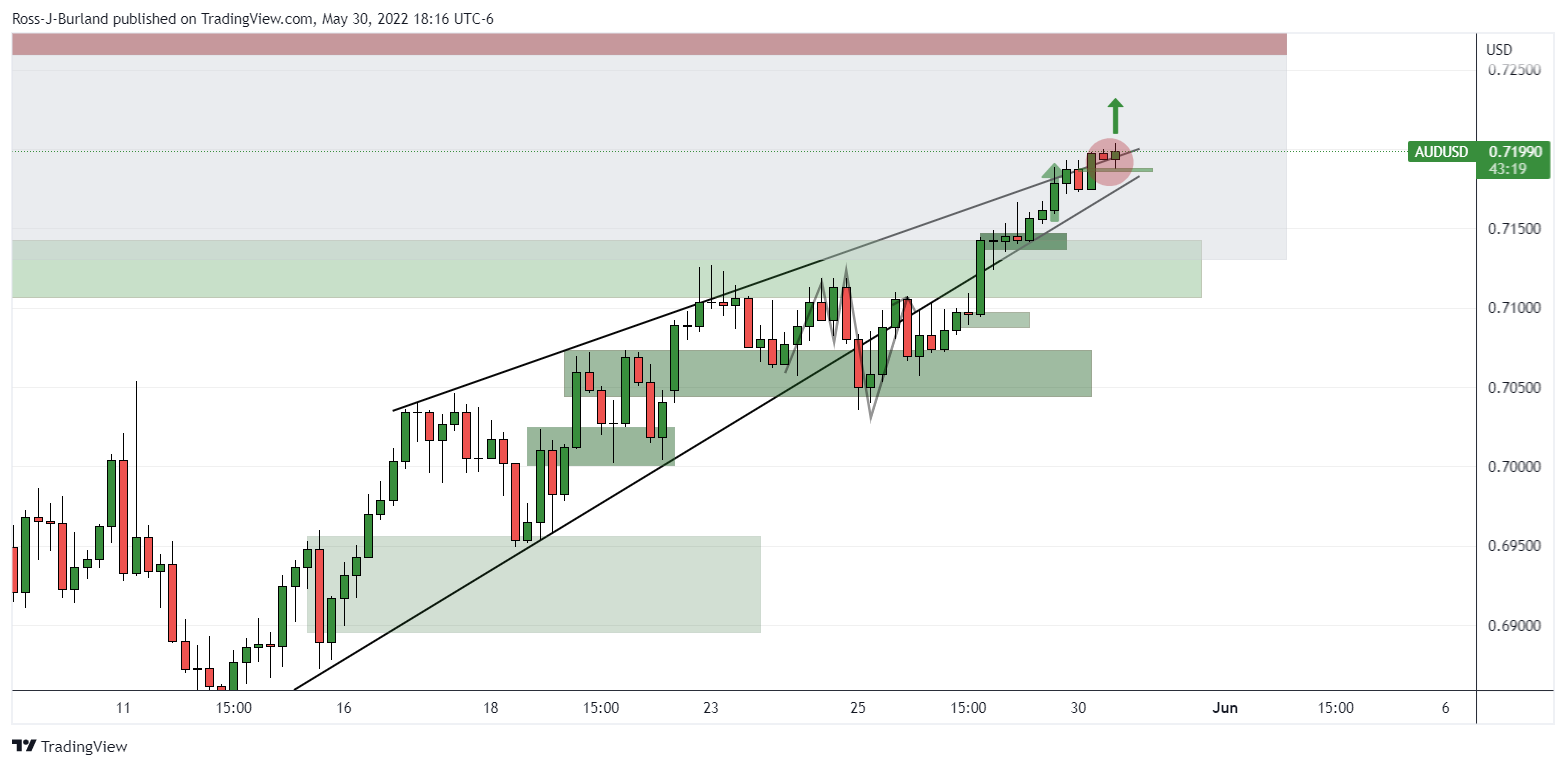

- AUD/USD pulled back from a three-and-half-week high touched earlier this Tuesday.

- The risk-off impulse weighed on the risk-sensitive aussie amid resurgent USD demand.

- A sustained break below 0.7100 is needed to support prospects for additional losses.

The AUD/USD pair witnessed a modest pullback from a three-and-half-week high, levels just above the 0.7200 mark touched earlier this Tuesday and eroded a major part of the overnight gains. The pair maintained its offered tone through the early North American session and dropped to a fresh daily low, closer to mid-0.7100s in the last hour.

The overnight hawkish comments by Fed Governor Christopher Waller, along with a sharp spike in the US Treasury bond yields, assisted the US dollar to stage a solid rebound from over a one-month low. Apart from this, the worsening global economic outlook and the risk-on impulse further boost the safe-haven greenback and exerted some downward pressure on the risk-sensitive aussie.

Despite the negative factors, the AUD/USD pair, so far, has managed to hold its neck above the 38.2% Fibonacci retracement level of the 0.7662-0.6829 downfall. This is followed by the 0.7130 confluence support, comprising the 200-period SMA on the 4-hour chart and the lower boundary of an ascending channel extending from the YTD low touched earlier this month.

Given that technical indicators on daily/4-hour charts are still holding in the positive territory, the set-up favours bullish traders and supports prospects for the emergence of some dip-buying. That said, a convincing breakthrough the aforementioned confluence support will negate the positive outlook and shift the bias in favour of bearish traders, prompting some technical selling.

Some follow-through selling below the 0.7100 mark will reaffirm the bearish bias and drag spot prices to the 23.6% Fibo. level support, near the 0.7025-0.7020 region. The next relevant support is pegged near the 0.7000 psychological mark, below which the AUD/USD pair could slide to the 0.6940 area en-route the 0.6900 mark and the 0.6830-0.6825 region, or the YTD low.

On the flip side, a sustained move beyond the 0.7200 round figure is likely to confront resistance near the 100-day SMA, around the 0.7235-0.7245 region. The said barrier coincides with the 50% Fibo. level and is closely followed by the 200-day SMA, near the 0.7260 zone, which if cleared would be seen as a fresh trigger for bullish traders and pave the way for further gains.

AUD/USD 4-hour chart

-637895979162651610.png)

Key levels to watch

- USD/CAD hit session highs in the upper 1.2600s in wake of underwhelming Canadian GDP figures.

- Focus now turns to upcoming tier two US data, the Biden/Powell meeting, and whether month-end USD strength can continue.

The Canadian dollar, which had been holding up relatively well versus a strengthening US dollar, has been on the back foot in recent trade in wake of a worse than expected Canadian GDP data release. Granted, the MoM pace of growth in March was stronger than expected at 0.7%, but GDP growth as a whole for the first quarter was much lower than expected, coming in at an annualised quarterly pace of 3.1% versus expectations for 5.4%.

That has been enough to send USD/CAD to fresh session highs in the 1.2680s, with the pair now trading with gains of about 0.2% on the day. Previously, higher oil prices as a result of the EU’s agreement on Tuesday quickly phase out all imports of seaborne Russian crude oil had been weighing on the pair.

Looking ahead, attention turns to various tier two US data releases including some home price figures, the May Chicago PMI survey and the May CB Consumer Confidence survey, as well as a meeting between Fed Chair Jerome Powell and US President Joe Biden. Traders will be assessing whether month-end USD strength can continue as US markets reopen following the long weekend, or whether the recent trend of weakening as a result of easing US inflation concerns/Fed tightening bets starts to weigh once again.

- Real GDP expanded at a pace of 0.7% MoM in March, above expectations.

- However, the annualised quarterly pace of growth in Q1 was below expectations.

- The loonie seemed to weaken a tad initially in response to the data.

Canadian real GDP expanded at a pace of 0.7% MoM in March, according to the latest data release by Statistics Canada on Tuesday. That was above the median economist forecast for a 0.5% MoM pace of expansion but down from February's 0.9% MoM growth rate.

Meanwhile, the annualised quarterly pace of GDP growth in Q1 in Canada came in at 3.1%, well below the median economist forecast for a growth rate of 5.4% and down from Q4 2021's annualised quarterly growth rate of 6.6%.

Market Reaction

The loonie seemed to weaken a tad initially in response to the data.

Vice Chairman of the Swiss National Bank (SNB) Martin Schlegel said on Monday that while inflation in Switzerland is low relative to other countries, it is not irrelevant, reported Reuters. Moreover, Schelgel said that the high nominal value of the franc has dampened inflation in Switzerland and the nominal value has risen, but in real terms, it has been flat.

In a set of slides shown by the Vice Chairman, it said the SNB will maintain expansive monetary policy in order to secure price stability and support the domestic economy. Schlegel said that he thinks energy prices won't rise as quickly as they have recently and supply chain problems won't persist.

Consensus positioning in gold remains on the long-side, keeping precious metals prices resilient. What is keeping gold bugs from capitulating? Strategists at TD Securities provide the answer.

CTA flows are immense

“CTA trend follower flows help to explain stubbornly elevated positioning levels, but prices are now challenging the threshold that would imply a sustained downtrend forming in coming months, suggesting the bar for additional liquidations from this cohort is low.”

“While CTA flows are immense, the pandemic has reinvigorated discretionary trading in gold, leaving 'Other Reportables' to play a larger role in speculative markets. This cohort has yet to capitulate, and without conviction that the Fed could blink, represents the greatest risk for a liquidation vacuum as we exit the pandemic-regime.”

Slovak central bank Governor and European Central Bank (ECB) Governing Council member Peter Kazimir said on Monday that he expects a 25 bps rate hike in July and is open to discussing a 50 bps move, perhaps for September, amid record-high Eurozone inflation, reported Reuters. The neutral rate in the Eurozone is closer to 2.0% than 1.0%, he opined, meaning it will take around 200 bps of tightening to get interest rates back to neutral.

Lifting interest rates back to neutral may not be enough to contain inflation, he warned, noting that inflation will stay over the bank's target in 2024 and possibly return in 2025. Moreover, Kazimir warned that a short recession in some Eurozone countries is possible this year, but a recession for the entire bloc is unlikely. Finally, Kazimir noted that inflation is broadening, but not yet de-anchoring.

- GBP/USD met with a fresh supply on Tuesday and snapped four straight days of the winning streak.

- Rebounding US bond yields, the risk-off impulse boosted the safe-haven USD and exerted pressure.

- The gloomy outlook for the UK economy supports prospects for additional losses amid Brexit woes.

The GBP/USD pair witnessed some selling on Tuesday and snapped a four-day winning streak amid resurgent US dollar demand. The intraday pullback from the vicinity of over a one-month high extended through the mid-European session and dragged spot prices to a fresh daily low, around the 1.2585 region.

The overnight hawkish comments by Fed Governor Christopher Waller triggered a fresh leg up in the US Treasury bond yields, which, in turn, assisted the USD to make a solid comeback. Speaking at an event in Frankfurt, Waller backed a 50 bps rate hike for several meetings until inflation eases back toward the central bank’s goal. This, along with the risk-off impulse, offered additional support to the safe-haven buck and exerted downward pressure on the GBP/USD pair.

The market sentiment remains fragile amid doubts that central banks can hike interest rates to curb inflation without impacting economic growth. The worries resurfaced following the release of official Chinese PMIs, which showed that business activity in both manufacturing and services sectors contracted in May. Furthermore, concerns that the global supply chain disruption would push consumer prices even higher, tempered investors' appetite for riskier assets.