- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 15-06-2022.

- EUR/USD is marching towards 1.0500 amid a positive market mood.

- A mega rate hike announcement by the Fed has strengthened the risk-sensitive currencies.

- The key agendas for the Eurogroup meeting will be sky-rocketing inflation and new oil suppliers.

The EUR/USD pair is oscillating in a narrow range of 1.0437-1.0453 in the early Tokyo session after a firmer upside move. A mega rate hike announcement by the Federal Reserve (Fed) has underpinned the risk-sensitive currencies and has diminished the safe-haven's appeal. A minor rangebound move is expected to be followed by an upside move, which will drive the asset towards the psychological resistance of 1.0500.

A two-day monetary policy meeting of the Fed policymakers turned out as a nightmare for the greenback. Taking into account the price pressures and tight labor market, the Fed has featured a 75 basis point (bps) interest rate hike. Higher-than-expected interest rate hike brought a sell-off in the yields and the US dollar index (DXY). Fed chair Jerome Powell in his press conference dictated that the US economy is very strong and well-positioned to handle a tighter policy.

The Fed believes that higher rate hikes would result in lower employment opportunities and an increase in the jobless rate. Price pressures are soaring sharply and in order to tame them, the Fed is ready to sacrifice the tight labor market. As per the dictations in the conference, Fed chair Jerome Powell is fine with the rising jobless rate to 4.1%, with a stipulation that the inflation should get cornered.

On the eurozone front, investors are focusing on the minutes from the Eurogroup meeting. The major agendas are expected to be gauging new oil suppliers after banning Russian oil imports. Also, mounting price pressures are a major worry for the responsible authorities. Therefore, some measures could be taken on the same.

- USD/CHF holds lower grounds after witnessing the Fed-inspired heavy daily losses.

- Fed’s 0.75% rate hike couldn’t impress USD bulls as Chairman Powell sounds normal.

- SNB is less likely to alter current interest rates but hints for September rate hike will be crucial to watch.

- SNB Monetary Policy Statement, Governor Macklem’s press conference will be eyed too.

USD/CHF remains depressed around mid-0.9900s, after posting the biggest daily loss in three weeks, as traders await the Swiss National Bank’s (SNB) monetary policy decision. The Swiss currency’s (CHF) inaction during Thursday’s Asian session could also be linked to a light calendar and fewer catalysts amid the post-Fed relaxation.

That said, the US Federal Reserve (Fed) announced the biggest interest rate hike since 1994 to battle inflation fears. The US central bank also revised up inflation forecasts for this year and the next while cutting down the inflation expectations. Further, the policymakers also signaled either a 50 bp or 75 bp rate hike in the next meeting. However, the Fed’s rejection of the odds of a 100 bp rate increase and Chairman Jerome Powell’s measured comments seem to have drowned the Treasury yields and the US dollar afterward.

It’s worth noting that the quarterly report of the Swiss State Secretariat for Economic Affairs (SECO) revised GDP forecasts to 2.6% versus 2.8% previous expectations for 2022 while also cutting down the 2023 GDP predictions to 1.9% from 2.0%. The SECO report also quoted government warning risks stemming from the war in Ukraine and food and energy inflation has increased.

On the other hand, US Retail Sales marked a contraction of 0.3% MoM versus an anticipated growth of 0.2% and downwardly revised 0.7% previous readings. Also, the NY Empire State Manufacturing Index dropped to -1.2 compared to 3.0 market consensus and -11.6 prior.

Looking forward, USD/CHF moves are likely to depend upon the SNB’s reaction to the latest inflation fears. The Swiss central bank isn’t expected to alter the benchmark rate, currently at -0.75%. However, signals for a September rate hike will be a welcome sign for the USD/CHF bears. “Twenty-four of 26 economists expect the SNB to keep its policy rate steady at minus 0.75%, the lowest in the world and the rate it has maintained since 2015,” said the latest Reuters poll on SNB.

Technical analysis

USD/CHF pulls back from the 1.0050 hurdle amid nearly overbought RSI conditions, suggesting further declines. However, a two-week-old support line, near 0.9930 by the press time, restricts the pair’s immediate downside.

- Silver struggles to extend Fed-inspired rally as bulls jostle with a short-term key resistance confluence.

- 10-DMA, weekly descending trend line restricts immediate upside.

- Sluggish MACD, RSI challenges further upside, bears need validation from monthly horizontal support.

Silver (XAG/USD) prices remain sidelined at around $21.70, following the biggest daily jump in over three months, as bulls struggle to cross the key hurdle during Thursday’s Asian session.

That said, bright metal rallied over 3.5% to post the biggest daily rise since early March after the US Federal Reserve’s (Fed) monetary policy decision. However, a convergence of 10-DMA and a downward sloping trend line from June 06 challenges the XAG/USD upside around $21.75.

Not only the $21.75 resistance confluence but sluggish MACD and steady RSI (14) also challenge the commodity’s immediate upside.

It’s worth noting that a quote’s run-up beyond the $21.75 hurdle enables the silver buyers to aim for a downward sloping resistance line from early May, around $22.25 by the press time, a break of which could direct the bulls to the 50-DMA resistance level of $22.71.

Alternatively, pullback moves need validation from a one-month-old horizontal support area surrounding $21.40-45.

Should the XAG/USD prices drop below $21.40, a fall towards the $21.00 threshold will be imminent before the monthly low and May’s bottom, respectively around $20.90 and $20.45 lures the metal sellers.

Silver: Daily chart

Trend: Pullback expected

- The GBP/JPY trims weekly losses though prevails down, losing 1.34%.

- The cross-currency is trading near the top of a bearish flag.

- GBP/JPY upward break above the bearish flag might send the cross towards 164.00.

The GBP/JPY is recovering some ground, following a 700 pip drop from YTD highs around 168.70s towards 161.30s, courtesy of constant verbal intervention by Japanese authorities, expressing that fundamentals need to reflect the yen value. At 163.19, the GBP/JPY jumped from weekly lows, gaining 0.20% as the Asian session kicked in.

Asian equity futures rise, depicting an upbeat market mood. Investors appear calmed that the US Fed raised rates 75 bps, though the US central bank put a lid on the size of subsequent movements to the Federal funds rate (FFR), easing tensions of aggressive increases.

GBP/JPY Price Forecast: Technical outlook

1-hour chart

Elsewhere, the GBP/JPY marches firmly within the boundaries of a bearish flag, as illustrated in the 1-hour chart. The cross-currency reclaimed the 50-simple moving average (SMA) at 162.63 and accelerates to the top of the bearish flag.

If the GBP/JPY breaks upwards, that would invalidate the bearish flag and open the door for further gains. The cross-currency first resistance would be the R1 daily pivot at 163.44. Once cleared, it would pave the way to the confluence of the 100-SMA and the R2 daily pivot at 164.01-05, followed by June’s 13 high at 164.32.

On the flip side, the GBP/JPY first support would be the confluence of the 50-SMA and the central pivot point at around 162.58-62. A breach of the latter would send the pair towards the bottom of the bearish flag around 162.20. Once broken, the following demand zone would be the S1 daily pivot at 162.00

Key Technical Levels

- AUD/NZD has reversed its intraday gains and has tumbled again to near 1.1150.

- The quarterly and annual GDP have landed at -0.2% and 1.2% respectively.

- This week, investors’ focus will remain on the aussie employment data.

The AUD/NZD pair has pared most of its gains recorded on the release of the downbeat Gross Domestic Product (GDP) data by Statistics New Zealand. A country’s GDP data states its overall economic growth and possess significant importance. The GDP has tumbled to 1.2%, significantly lower than the estimates of 3.3% and the prior print of 3.1%on an annual basis. More adverse, the quarterly figures have shifted to negative territory. The quarterly GDP has landed at -0.2%, much lower than the consensus and the former figure of 0.6% and 3% respectively.

A vulnerable performance by the kiwi economy on the economic growth front has weakened the kiwi dollar against aussie. The cross has confidently overstepped 1.1165 and is expected to extend further considering the upside momentum.

On the aussie front, investors are awaiting the release of the labor market data due in the Asian session. The Australian Bureau of Statistics is expected to report a significant improvement in the employment generation opportunities program. As per the market estimates, the Australian economy has added 25k in May, principally higher than the 4k job additions reported earlier. Also, the Unemployment Rate is expected to reduce to 3.8% from the prior print of 3.9%.

An upbeat employment data will delight the Reserve Bank of Australia (RBA) to tighten its policy further without much fear of a slowdown in employment opportunities. It is worth noting that the RBA elevated its Official Cash Rate (OCR) by 50 basis points (bps) in the first week of June and more rate hikes are expected going forward.

“Food price inflation in Britain is likely to peak at up to 15% this summer and high levels will persist into 2023, industry researcher the Institute of Grocery Distribution (IGD) said on Thursday,” per Reuters.

The news also mentioned that IGD predicted that the average monthly spend on groceries for a typical family of four would reach 439 pounds ($528) in January 2023, up from 396 pounds in January 2022.”

On a different path, the Financial Times (FT) said, “A sharp rise in the number of people dropping out of the UK workforce has been largely because of older workers choosing to retire early, according to new analysis by the Institute for Fiscal Studies.”

FT also adds, “Almost half a million fewer people were in paid work in first quarter than before pandemic.”

Furthermore, Reuters said that Brexit is no reason to radically alter British financial regulation and regulators should not be forced to water down rules to boost London’s competitiveness, or stray from global standards, a UK parliamentary committee report said on Thursday.

GBP/USD braces for BOE

Following the news, GBP/USD retreats to 1.2160, paring the post-Fed gains, as the cable traders await the Bank of England’s (BOE) monetary policy decision.

Also read: BOE Preview: Why GBP/USD set to suffer even in response to a 50 bps hike, a lose-lose event

- NZD/USD takes offers to refresh intraday low after NZ Q1 GDP disappoints.

- New Zealand Q1 GDP drops to -0.2% QoQ versus 0.6% expected.

- Fed’s rate hike, economic forecasts failed to impress USD bulls on Powell’s measured tone.

- Aussie data/events, risk catalysts can entertain intraday traders.

NZD/USD fails to hold the post-Fed gains as it slumps nearly 20 pips after New Zealand’s Q1 Gross Domestic Product (GDP) release on early Thursday morning in Asia. That said, the quote rose the most in a week the previous day before dropping back to 0.6265 at the latest.

New Zealand’s Q1 GDP dropped to -0.2% on QoQ compared to 0.6% market forecasts and 3.0% previous readings. Further details suggest the YoY figures easing to 1.2% versus 3.3% market consensus and 3.1% prior.

Ahead of the NZ GDP release, global rating agency Fitch mentioned that New Zealand's large banks are well-placed for rising interest rates, suggesting Fed-liked interest rate announcements, which in turn should have favored the NZD/USD buyers but could not. The reason could be linked to the market’s consolidation of the Fed-linked moves amid a quiet Asian session.

The US Federal Reserve (Fed) announced the biggest interest rate hike since 1994 to battle inflation fears. The US central bank also revised up inflation forecasts for this year and the next while cutting down the inflation expectations. However, the Fed’s rejection of the odds of a 100 bp rate increase and Chairman Jerome Powell’s measured comments seem to have drowned the Treasury yields and the US dollar afterward. The policymakers also signaled either a 50 bp or 75 bp rate hike in the next meeting.

Looking forward, NZD/USD traders will pay attention to Australia’s data/events including Consumer Inflation Expectations for June, the jobs report for May and the Reserve Bank of Australia’s (RBA) quarterly Bulletin. However, major attention will be given to the Asian market’s reaction to the Fed moves, as well as the US data/events.

Technical analysis

NZD/USD fades the bounce off yearly low below the two-week-old resistance line, around 0.6320 by the press time, which in turn suggests the quote’s further fall towards retesting the yearly bottom surrounding 0.6200.

New Zealand’s first quarter (Q1) 2022 Gross Domestic Product (GDP) dropped to -0.2% on QoQ compared to 0.6% market forecasts and 3.0% previous readings.

Further details suggest the YoY figures easing to 1.2% versus 3.3% market consensus and 3.1% prior.

Following the NZ GDP data release, NZD/USD refreshed intraday low to 0.6265 by flashing a 15-pip downside. That said, the pair rallied the most in two weeks the previous day after the Fed’s 75 bp rate hike.

About New Zealand GDP

The Gross Domestic Product (GDP), released by Statistics New Zealand, highlights the overall economic performance on a quarterly basis. The gauge has a significant influence on the Reserve Bank of New Zealand’s (RBNZ) monetary policy decision, in turn affecting the New Zealand dollar. A rise in the GDP rate signifies improvement in the economic conditions, which calls for tighter monetary policy, while a drop suggests deterioration in the activity. An above-forecast GDP reading is seen as NZD bullish.

- A swift move above the 20- and 50-EMAs has strengthened the pound bulls.

- The cable has attacked the formed inventory distribution, which supports the bullish reversal.

- A (60.00-80.00) bullish range shift by the RSI (14) adds to the upside filters.

The GBP/USD pair displayed a firmer rebound after hitting a low of 1.1933 on Wednesday. The asset witnessed a responsive buying action as the market participants found it a value bet and initiates significant longs, which drove it higher swiftly. The pound bulls have attacked the round-level barricade of 1.2200 and are expected to overstep the same for further upside.

The formation of a buying tail near the lowest prices dictates a firmer responsive buying, which states that the greenback bulls’ party is over now. An upside drive in cable has challenged the former inventory distribution, which placed in a narrow range of 1.2107-1.2208. A vertical upside move into the former balancing area strengthens a bullish reversal.

The pound bulls are auctioning above the 20- and 50-period Exponential Moving Averages (EMAs) at 1.2103 and 1.2113 respectively, which signals a short-term bullish trend.

Also, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which adds to the upside filters.

A minor pullback towards the 20-EMA at 1.2103 will be a bargain buy for the market participants, which will drive the asset towards Wednesday’s high at 1.2205. A breach of the latter will unleash the pound bulls for a quick upside move towards the round-level resistance at 1.2300.

On the flip side, the greenback bulls could regain strength if the asset drops below the psychological support of 1.2000. This will drag the asset towards Tuesday’s low at 1.1934, followed by the 26 March 2020 opening price at 1.1879.

GBP/USD hourly chart

-637909294092825886.png)

- AUD/USD remains sidelined after positing the biggest daily gains in six weeks.

- US Treasury yields, USD dropped after Fed matched wide market expectations by announcing 75 bp rate hike.

- Aussie employment numbers are expected to improve in May, Consumer Inflation Expectations, RBA Bulletin eyed as well.

AUD/USD grinds higher around 0.7000 as bulls take a breather following the Fed-inspired rally, the biggest daily jump since early May. That said, the Aussie pair’s inaction during the initial hours of Thursday morning in Asia could be linked to the cautious mood of traders ahead of Australia’s inflation expectations and employment numbers, as well as a light calendar by the press time.

Aussie bulls returned to the table after the US dollar failed to cheer the Fed’s 75 basis point (bp) rate hike. The pair’s gains could also be linked to the softer yields, firmer equities and upbeat gold prices, not to forget expectations of firmer jobs reports and RBA’s aggression.

The US Federal Reserve (Fed) announced the biggest interest rate hike since 1994 to battle inflation fears. The US central bank also revised up inflation forecasts for this year and the next while cutting down the inflation expectations. However, the Fed’s rejection of the odds of a 100 bp rate increase and Chairman Jerome Powell’s measured comments seem to have drowned the Treasury yields and the US dollar afterward. The policymakers also signaled either a 50 bp or 75 bp rate hike in the next meeting.

Following the Fed’s verdict, the US 10-year Treasury yields not only snapped the five-day uptrend but slumped the most since early March, by falling around 10 bps to 3.29%. The resulted in moves allowed Wall Street benchmarks to witness the biggest daily jump in over a week, as well as dragging the US Dollar Index (DXY) from a 20-year high to 104.87 at the latest.

It’s worth noting that the latest reaction to the Fed’s rate hike isn’t a signal for the AUD/USD pair’s trend reversal as the trader's eye monthly jobs report for May and Melbourne Institute’s Consumer Inflation Expectations for June. RBA’s Quarterly Bulletin will be important to watch too.

Forecasts suggest an improvement in the headline Employment Change by 25K versus 4K prior whereas the Unemployment Rate is expected to decline to 3.8% from the 3.9% forecast. Further, the Consumer Inflation Expectations were 5.0% at the latest.

“Despite the robust demand for labor as evinced by job vacancies, weekly payrolls remain weak; Westpac therefore anticipates employment to lift by 5k in May (vs. consensus +25k) with a clear risk of a negative print. A very small decline in participation should see the unemployment rate round down to 3.8%. MI inflation expectations should continue to hold at an elevated level in June,” said Westpac ahead of the release.

Technical analysis

Multiple levels marked since early May highlight 0.7030-35 as the immediate key hurdle to cross for the AUD/USD if bulls wish to keep the reins. Otherwise, a downside break of January’s low near 0.6965 could be enough to recall the bears.

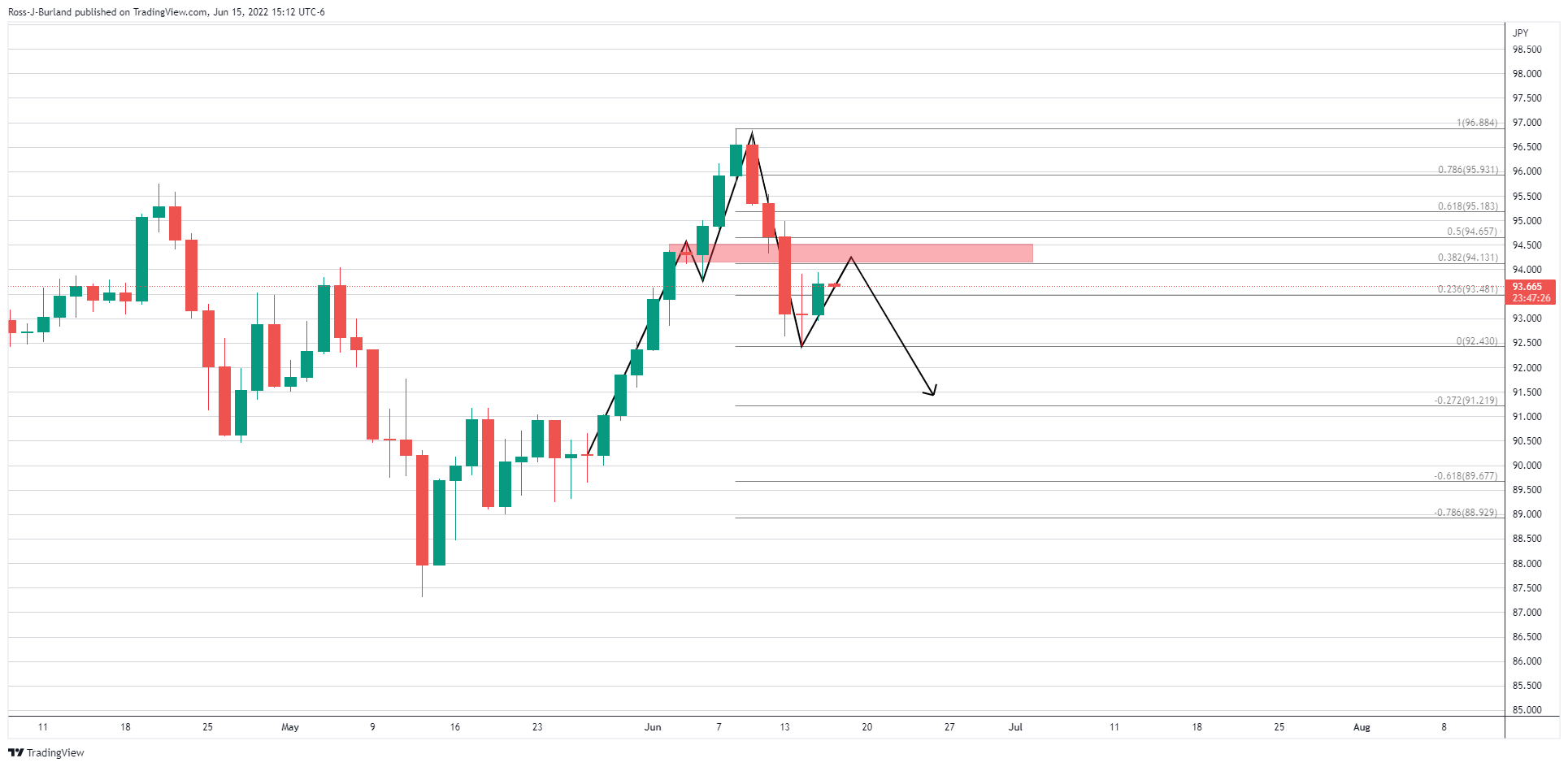

- The USD/JPY is erasing its previous weekly gains and is losing 0.40%.

- A hawkish Fed hiked 75 bps in a dovish way.

- USD/JPY Price Forecast: Headed for a pullback before resuming the overall uptrend.

USD/JPY slides for the first time in the week, following a hawkish rate by the Fed, though smoothed it later by Fed’s Chairman Jerome Powell, who said that moves of that size, he does not expect them to be “common,” in response to that, the USD/JPY plunged close to 80 pips in just 10 minutes, giving way for a break below 134.00. At the time of writing, the USD/JPY is trading at 133.82, barely up 0.02% as the Asian session begins.

US equities finished Wednesday’s session with gains, reflecting a relief rally, while Asian stocks prepare for a higher open. The greenback remains on the defensive, as illustrated by the US Dollar Index (DXY) down 0.57%, trading at 104.874. US Treasury yields edged lower but stayed above the 3% threshold.

USD/JPY Price Forecast: Technical outlook

Daily chart

The USD/JPY daily chart depicts the pair as upward biased. Nevertheless, the last couple of cycle highs were recorded as the Relative Strenght Index (RSI) registered two peaks, but the second peak was lower than the previous one, meaning a negative divergence formed. That said, the USD/JPY might be headed for a pullback, targeting the May 9 daily high-turned-support at 131.34.

4-hour chart

The USD/JPY 4-hour chart illustrates the pair as upward biased. However, the negative divergence between price action and the RSI mentioned in the paragraph above is further reinforced in the present time frame. With that said, the USD/JPY first support would be the 50-simple moving average (SMA) in the 4-hour chart at 133.62. A breach of the latter would expose the S1 daily pivot at 133.00, followed by the S2 pivot point at 132.21.

Key Technical Levels

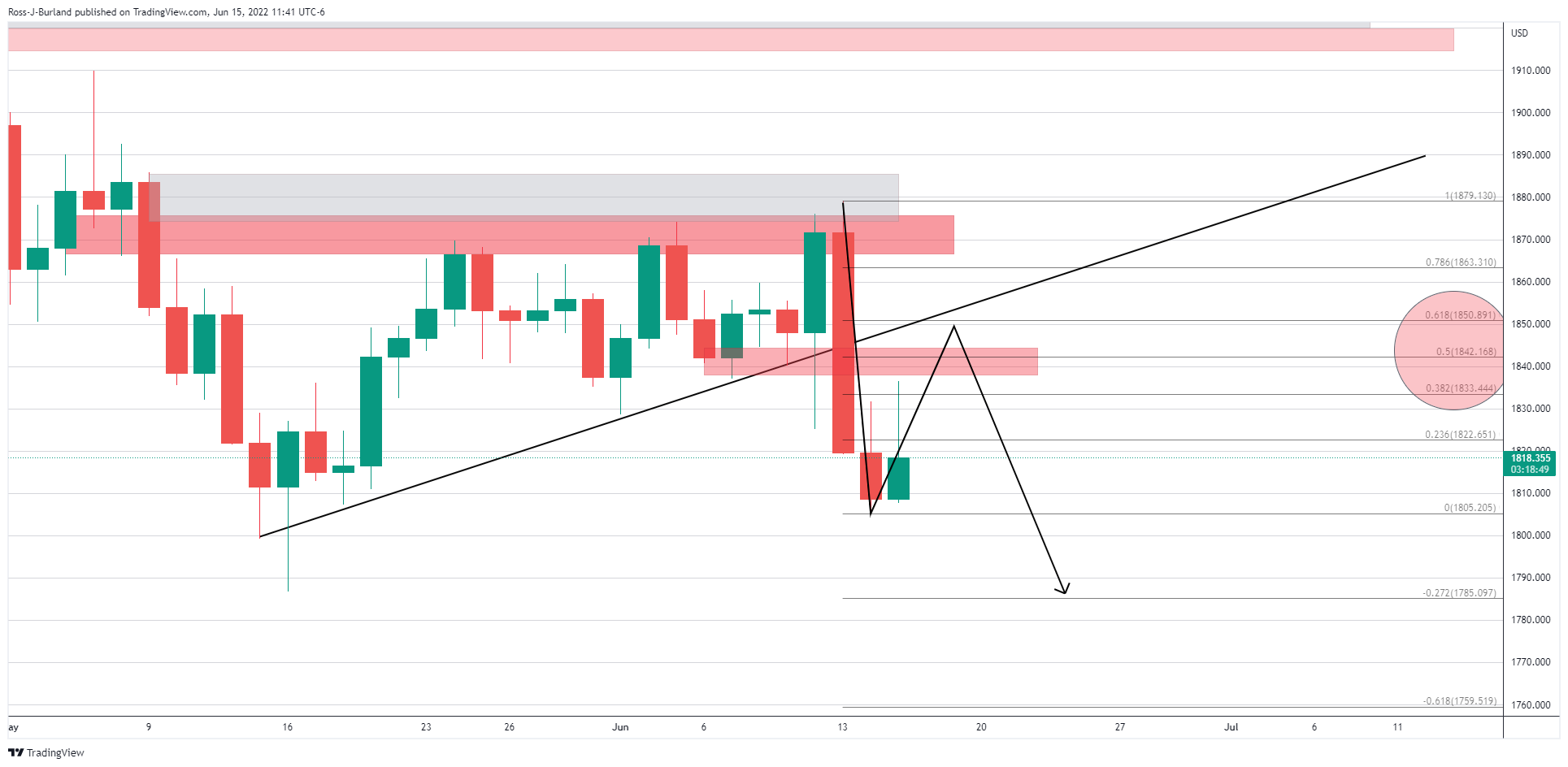

- Gold price is holding itself above $1,830.00 despite a 75 bps rate hike by the Fed.

- Solid economic growth in the US economy has facilitated the Fed to announce a 75 bps rate hike.

- The 10-year US Treasury yields have eased 5.50% on a mega rate hike by the Fed.

Gold price (XAU/USD) has witnessed a firmer rebound after hitting a low of $1,815.00 in the late New York session as the Federal Reserve (Fed) dictated a 75 basis point (bps) rate hike after its two-day policy discussion meeting. Fed chair Jerome Powell went beyond his words, took 75 bps into the consideration, and featured the same in the monetary policy decision.

As per the market consensus, a rate hike by 50 bps was expected, however, fresh prints of the US Consumer Price Index (CPI) reported last week, forced the Fed policymakers to move beyond the estimates and elevate the interest rates vigorously. Although various economies are facing the headwinds of higher inflation, their unsteady economic strength and inability to generate significant job opportunities are not providing them much room to stretch their benchmark rates. As per Fed Powell’s speech, the US economy is very strong and is well-positioned to handle tighter monetary policy.

Meanwhile, the 10-year US Treasury yields have plunged 5.50% and have settled at 3.9% on Wednesday. The US dollar index (DXY) has surrendered the psychological support of 105.00 and has slipped to near 104.60. A significant fall in the DXY and yields has supported the gold prices.

Gold technical analysis

The gold prices are attempting to balance above the supply zone placed in a narrow range of $1,831.70-1,833.88 on an hourly scale. The gold bulls have attacked the 200-period Exponential Moving Average (EMA) at $1,839.18 and a violation of the same will strengthen the precious metal. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which adds to the upside filters.

Gold hourly chart

- AUD/JPY bears are in control of the longer-term time frames.

- The bulls, on the other hand, could be on the verge of a break of key short-term resistance.

As per the hourly chart, despite the better mood in financial markets and a relief rally in US stocks, the bulls are not out of the woods yet, and may not find their way out according to the higher time frames.

The following illustrates this in a top-down analysis as follows:

AUD/JPY daily chart

The trend is down and will remain so until the resistance highlighted above is cleared. A retest of the structure and a 38.2% Fibonacci retracement, however, is not out of the question.

AUD/JPY H4 chart

The 4-hour chart's price inefficiency between resistance levels is a compelling feature that could offer an opportunity for bulls to scalp towards the 94.40s on a break of near-term resistance of 93.90.

AUD/JPY H1 chart

The hourly time frame shows that the price is accumulating and with a break of the aforementioned resistance levels, then the bulls could be in the running for a retest of 95.10 and 95.80 thereafter.

What you need to take care of on Thursday, June 16:

Central banks are in the eye of the storm amid global stubbornly high inflation. The US Federal Reserve was the star of the day. The central bank hiked rates by 75 bps, the most significant hike since 1994, but dismissed the chances of a 100 bps hike. Chief Powell said it was the current pace of hikes is appropriate and that it could be either 50 or 75 bps in the next meeting, adding they are “front-loading.”

Overall, chief Powell managed to cool down market fears. US government bond yields sharply retreated, with that on the 10-year Treasury note currently at 3.29%. Wall Street, on the other hand, managed to end the day with gains. The Nasdaq Composite was the best performer, up 2.5%, while the DJIA added 1% and the S&P 500 recovered 1.46%.

US policymakers revised PCE inflation to 5.2% for this year, from 4.3% previously. Also seen at 2.6% in 2023, 2.2% in 2024. Growth for this year, on the other hand, has been downwardly revised to 1.7% from 2.8%.

Earlier in the day, the European Central Bank called for an emergency reunion. The ECB decided that it would apply flexibility in reinvesting redemptions coming due in the pandemic emergency purchase programme (PEPP) portfolio, concerned about the bonds’ sell-off over the last few days.

Also, Japanese Prime Minister Fumio Kishida noted that he expects the Bank of Japan to continue efforts to meet the price target. The BOJ is having a monetary policy meeting at the end of the week.

Meanwhile, the EU has announced new legal action against the UK government over its plans to scrap parts of the Northern Ireland Protocol. The UK aimed to change trade, tax and governance arrangements that disrupted trade in the kingdom. UK Prime Minister Boris Johnson’s spokesman said afterwards that the UK is disappointed with the EU bringing legal action over the Brexit deal.

The EUR/USD pair bottomed at 1.0358, ending the day around 1.0450. GBP/USD was also able to recover and settled in the 1.2170 area. Commodity-linked currencies were able to advance against the greenback amid stocks’ rallies. AUD/USD trades around 0.7000, while USD/CAD hovers around 1.2900. The USD/JPY pair, in the meantime, pressures the base of its latest range, trading at 133.70.

Gold closed the day with gains at $1,834 a troy ounce, while crude oil prices kept retreating. The barrel of WTI now changes hands at $116.00.

Like this article? Help us with some feedback by answering this survey:

- S&P 500 closes 1.46% higher post less hawkish Fed.

- However, analysts argue that financial asset prices will remain under pressure.

US stocks closed higher Wednesday after the Federal Reserve approved its biggest interest-rate increase in nearly 30 years. However, the relief came in the words of the chairman, Jerome Powell, when speaking at the post-meeting press conference.

He said that he does not expect 75bps moves to be common, which was the magnitude that they were hiked by on Wednesday. However, he did say that it may be necessary to raise rates by that magnitude again at the next meeting at the end of July if inflation has not moderated.

Powell said that front-loading rate increases over the next few meetings would give the FOMC more flexibility later in the year to slow down the pace of tightening if conditions allow it.

The Summary of Economic Projections now suggests another 175 basis points of increase by the end of 2022 to a median of around 3.4% and another 25 to 50 basis points of increase in 2023 to 3.8% before easing back to 3.4% in 2023. These levels are well above the 2.5% neutral rate.

- Fed swaps price 75bp rate hike for July; 140bp over July/Sept.

- US rate futures price in 93.4% chance of 75 bps hike in July; 55% probability of 50 bps rise in September after Fed decision - CME's FEDWATCH.

However, the expectations for overall PCE inflation were revised and are now sharply higher and the rates are expected to remain above the 2% target at least through that period. At the same time, expectations show slower growth and higher unemployment rates over the next three years than in the March SEP update.

Nevertheless, US stocks have breathed a sigh of relief, but ''until evidence emerges that inflation is peaking and on a sustained downwards track, financial asset prices will remain under pressure,'' analysts at ANZ Bank argued.

- The US central bank raised rates by 75 bps, to 1.75%.

- Fed Chair Jerome Powell opened the door for 50 or 75 bps increases in the July meeting.

- The Federal Reserve would begin cutting rates in 2024, according to the Fed’s SEP.

The NZD/USD advanced after the Federal Reserve hiked 75 bps, the biggest rate increase since 1994, which sent the NZD/USD towards the daily low of around 0.6214. However, Fed Chair Powell shifted less hawkish than expected, so the New Zealand dollar got bid and is rallying above 0.6300, gaining 1.55%, during the day.

Sentiment remains positive, as traders have already priced in the expectations of a higher-than-expected rate increase. US equities record gains between 1.41% and 2.73%. In the FX space, the greenback is getting battered. Portraying the previously-mentioned is the US Dollar Index, falling 0.52%, back below the 105.000 figure.

In his press conference, Jerome Powell, the Federal Reserve Chair, said that “Clearly, today’s 75 basis point increase is an unusually large one and I do not expect moves of this size to be common.” However, he kept the door open for the July meeting, stating that 50 or 75 rate hikes are in play.

Recap of the FOMC’s statement

The Federal Reserve decision did not catch the markets off guard. The US central bank reiterated its commitment to reach the 2% target and reiterated that “inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.”

Concerning the US economic outlook, the board added that activity picked up after the Q1 negative reading. Regarding the reduction of the balance sheet, also known as Quantitative Tightening (QT), the plan started as revealed in May.

The aftermath of the monetary policy decision and Chair Powell’s press conference leaves a weaker US Dollar. US Treasury yields fell more than 10 basis points, from 2s-to-30s. The 10-year benchmark note yields 3.297%, almost 20 bps off highs.

The Federal Reserve Chair Jerome Powell reiterated at the press conference that ongoing increases are appropriate and emphasized that the labor market is extremely high and inflation too. Powell commented that when May inflation surprised to the upside alongside inflation expectations elevating, the FOMC decided that 75 bps was warranted in response.

Furthermore, in the same meeting, the Federal Reserve Open Market Committee (FOMC) unveiled the Summary of Economic Projections (SEP), which showed that the Fed reduced its expectations for growth from 2.8% in March to 1.7%, while the unemployment rate would uptick to 3.7% from 3.5% projected in March.

Concerning their inflation outlook, Fed policymakers estimate the Core PCE at 4.3%, more than the 4.1% foreseen in March. Regarding interest rates, the Federal Funds Rate by the end of 2022 is forecasted to increase by 3.4%, 150 bps more elevated than the 1.9% projected in March. Also, the FOMC expects rates to peak at around 3.8% in 2023, and they expect a rate cut by 2024.

Late in the day, the New Zealand economic docket will feature the Gross Domestic Product Growth Rates in the first quarter on a QoQ and YoY reading.

Key Technical Levels

- AUD/USD bulls turn it up on the back of a less hawkish Fed outlook.

- The technicals now lean bullish, at least for the near term.

AUD/USD is recovering on the back of a risk rally and relief that the Federal Reserve's chairman, Jerome Powell, is arguing the case for less aggressive tightening. This leads the technicals into a bullish outlook as per the following analysis below:

AUD/USD daily chart

From a daily perspective, the price is attempting to reach into the 0.7050s in a correction of the last leg of the M-formation's bearish impulse. This aligns with a 50% mean reversion.

AUD/USD hourly chart

The bulls have cracked a number of hourly resistances in the move out of the downtrend and are un the runnings for higher corrective highs in the coming sessions.

The Federal Reserve raise the key interest rate by 75 basis points on Wednesday, the biggest move since 1994. According to analysts at Wells Fargo, the action demonstrates FOMC’s growing concern over inflation as well as its increased commitment to restore price stability.

Key Quotes:

“The statement and updated Summary of Economic Projections (SEP) showed the FOMC is prepared to continue to tighten policy at a historically aggressive pace. The median estimate for the fed funds rate at year-end rose to 3.375%, implying another 175 bps of tightening before the year is over.”

“Despite aiming to move policy into restrictive territory by year-end, the SEP continues to paint a rather optimistic picture of the economy ahead. GDP growth next year is expected to slow only slightly below trend, while inflation falls back to 2-3% and the unemployment rate rises modestly enough to where it remains within its "longer-run" neutral range. In our view, it will take a more material slowdown in economic growth to bring core inflation back to the FOMC's 2% target and more damage is likely to be inflicted to the labor market (or greater weakening in the labor market is likely to ensue).”

“Today's hike boosts the Fed's credibility and demonstrates that the door is open for similar adjustments at future meetings. This suggests to us a much more sensitive reaction function from the FOMC, and similar upside inflation surprises in the future very well may be met with equally aggressive upside surprises for the federal funds rate.”

Fed Chair Jerome Powell said in his post-Fed meeting press conference that the worst mistake that the Fed could make would be to fail to get inflation back down, reported Reuters. "We need to restore price stability," Powell reiterated, adding that the Fed wants to get the job done.

Additional Remarks:

- "We are not seeing a wage-price spiral."

- "We think the public believes we'll get back down to 2%."

- "It's key that we sustain confidence in the Fed's ability to get inflation down."

- "Clearly inflation is incredibly unpopular and painful."

- "It will take some time to get inflation back down."

- "We need to make sure the public has the confidence we have the tools, and they do work, to get inflation down."

- "I think our projections meet the test of a softish landing."

- "I think we can get a softish landing."

- "But events have raised the degree of difficulty."

- "There is a much bigger chance that it will now depend on factors outside our control."

- "We just don't know if we can."

- "Fluctuations in commodity prices could take the possibility of a softish landing out of our hands."

- "If we see data going in a different direction and we will adapt policy."

- "This is a highly uncertain environment."

- "We are determined and resolved but flexible."

- "You couldn't get this kind of inflation without a change on the supply side."

- "On QT, I have no reason to think it will lead to liquidity issues."

- "We are watching to see how much rate rises will affect residential investment, house prices."

- "House prices might keep going up for a while due to supply constraints."

- "Prices in housing may keep going up for a while even when rates are going up."

- US dollar tumbles during Powell’s press conference after Fed rate hike.

- EUR/USD back in recent range, looking now at 1.0500.

- Wall Street adds to gains, and Treasury yields decline.

The EUR/USD bounced from near the May low and jumped back above 1.0450. As Powell’s press conference ends, the pair is hovering around 1.0460, almost 70 pips above the level it had before the FOMC statement.

A weaker dollar boosted the EUR/USD from the four-week low at 1.0357. It is back in the weekly familiar range. A break above 1.0500 should strengthen the recovery of the euro. On the flip side, under 1.0390 a new test of the year-to-date low at 1.0345/50 seems likely.

Fed moves, traders sell the fact

At the end of the June meeting, the Federal Reserve decided to raise its target interest range by 75 basis points, the biggest move since 1994. In the statement, the Fed mentioned that more rate hikes are coming and warned about the increasing risks of a recession.

Fed Chair Powell mentioned he does not expect 75bp rake hikes to be common. He said the pace of rate hikes will depend on incoming data. Inflation developments warranted a bigger hike at the June meeting, Powell commented.

The dollar turned lower after his comments while Wall Street indices rose sharply. The Dow Jones is up by 1.27% and the Nasdaq gains 2.80%. Treasuries recovered with the US 10-year yield falling to 3.33%.

The improvement in risk sentiment and lower US yields pushed the dollar to the downside across the board. The DXY is falling 0.70%, the worst day in almost a month. The rally of the dollar is being challenged at the moment.

Technical levels

Fed Chair Jerome Powell said in his usual post-Fed meeting press conference that if the Fed can bring inflation down whilst the unemployment rate only rises to 4.1%, that would be a successful outcome, as that is still a historically low level, reported Reuters. The Fed does not seek to put people out of work, of course, Powell continued, but it is not possible to sustain the current strong labour market in the absence of price stability.

The Fed is not trying to induce a recession, Powell noted, restating the Fed's goal to get inflation back to 2.0% whilst maintaining a strong labour market. The pathway to achieving this has become more challenging, Powell conceded, noting that the Fed will get rates up to where ever they need to be in the coming months.

The Fed is watching consumer spending very closely, Powell added, noting that while the Fed is seeing shifts in consumption, overall spending remains very strong. Consumer are spending and there is no sign of a broader slowdown in the economy, he continued, adding that the Fed sees the economy slowing a bit but still at healthy growth levels.

- The US Federal Reserve decided to hike 75 bps, greatly influenced by last Friday’s hot 8.6% CPI reading.

- Fed Chair Powell does not expect moves of 75 bps to be common; the USD/CAD plunged from 1.2995 to 1.2915 as a reaction.

- The US central bank expects to cut rates by 40 bps in 2024.

The USD/CAD is erasing earlier gains after the Federal Reserve released its monetary policy statement and peaked at 1.2995. However, is nosediving once the Federal Reserve Chair Jerome Powell, at his presser, stated that he does not expect moves of 75 bps to be common but opened the door for the July meeting of raising rates in the 50-75 bps range. At the time of writing, the USD/CAD is seesawing in the 1.2920-40 range.

The Federal Reserve Chair Jerome Powell reiterated at the press conference that ongoing increases are appropriate and emphasized that the labor market is extremely high and inflation too. Powell commented that when May inflation surprised to the upside alongside inflation expectations elevating, the FOMC decided that 75 bps was warranted in response.

Summary of the FOMC monetary policy statement

The Fed reiterated that it is committed to returning inflation to its 2% target. They added that economic activity picked up after the negative print in the first quarter. Furthermore, the Fed would continue to reduce its balance sheet as planned in the May meeting.

The FOMC added that “inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.”

Additionally, in the same meeting, the Federal Reserve Open Market Committee (FOMC) unveiled the Summary of Economic Projections (SEP), which showed that the Fed reduced its expectations for growth from 2.8% in March to 1.7%, while the unemployment rate would uptick to 3.7% from 3.5% projected in March.

Concerning their outlook about inflation, Fed policymakers estimate the Core PCE at 4.3%, more than the 4.1% foreseen in March, while the Federal Funds Rate by the end of 2022 is estimated to increase to 3.4%, 150 bps more elevated than the 1.9% projected in March.

It’s worth noting that the Federal Reserve expects another 50 bps hike in 2023, and then in 2024 would be the first-rate cut

USD/CAD 1-hour chart

Key Technical Levels

Fed Chair Jerome Powell said on Wednesday in his post-Fed meeting press conference that if the Fed doesn't see progress on inflation, it will react, reported Reuters. However, Powell said that soon enough there will be some progress on bringing inflation back down and that he thinks the Fed's guidance is still credible.

Additional Remarks:

- "It is unusual to get data late during the Fed's blackout period."

- "We won't declare victory until we really see compelling evidence inflation is coming down."

- "We are going to be careful about declaring victory."

- "Our policy will be sensitive and flexible."

- "I do think our goal is to bring inflation down to 2% while the labor market remains firm."

- "What is becoming clear is many factors we don't control will play a large part in if that happens."

- "We can't control supply-side issues."

- "There is a path for us to keep a firm labor market, but it's not getting easier."

- The Fed is causing volatility in financial markets and GBP/USD bulls need to get above the resistance of 1.2125.

- 1.2100 area would be expected to act as support in the near term.

At 1.2137, GBP/USD is bid and has tallied over 1.2% of gains on the day in a short squeeze that has come about during the Federal Reserve's chairman's comments in the press conference that has followed today's interest rate hike of 75bps.

In what has been the biggest hike since 1994, the Fed has raised the benchmark interest to leave the target range standing at 1.50% - 1.75%. This was in line with expectations and as a consequence, there had been a slow reaction in financial markets.

- Fed swaps price 75bp rate hike for July; 140bp over July/Sept.

- US rate futures price in 93.4% chance of 75 bps hike in July; 55% probability of 50 bps rise in September after Fed decision - CME's FEDWATCH.

However, during the presser, chairman Jerome Powell pushed back against the market's aggressive expectations of a series of big interest rate hikes. Powell said either 50bps or 75bps are most likely at the next meeting but that he does not expect 75bps moves to be common. Consequently, the USD dollar and short-term rates have eased back from their initial post-Fed rate hike highs on the day and this has given sterling bulls and the US stocks some relief.

GBP/USD technical analysis

The price is carving out a channel to the upside and the bulls will need to get above the resistance of 1.1225 to open risk towards 1.22 the figure. 1.2100 area would be expected to act as support in the near term.

Fed Chair Jerome Powell on Wednesday said in the post-Fed meeting press conference that demand in the US economy is still very hot and the Fed would like to see this moderate, reported Reuters.

Additional Remarks:

- "We'd like to see labor market in better balance."

- "The neutral rate is pretty low these days."

- "We are not going to be model driven."

- "The data shows that inflation expectations are still in place where short-term inflation is high but comes down sharply over the medium term."

- "Last week's University of Michigan inflation reading was quite eye-catching."

- "We also noticed the Fed's inflation expectations have moved up."

- "We felt we had to take that seriously."

- "Inflation expectations were a factor in today's decision."

- "We will react to incoming data."

- "We don't know how restrictive we need to be."

The US economy is very strong and is well positioned to handle tighter monetary policy, Fed Chair Jerome Powell stated on Wednesday in the post-Fed meeting press conference.

Additional Remarks:

- "We will do all we can to achieve our dual goals."

- "We always aim to provide as much clarity as we can about our intentions."

- "In the current circumstances, we think it helpful to provide more clarity than usual on policy."

- "When I offered guidance of 50 bps hike at the last meeting, I said that if data came in worse than expected, we would consider a more aggressive move."

- "The CPI data and inflation expectations data last week made us realize 75 bps was the way to go."

- "We want to see a series of declining monthly inflation readings."

- "We had expected to see inflation flattening out by now."

- "But inflation surprised to the upside."

- "We thought strong action was needed at this meeting."

- "We decided we needed to do more frontloading."

- "The next meeting could well be a decision between 50 bps and 75 bps."

- "It is desirable to be up to neutral on interest rates."

- "That would get us to a more normal range, and then would have optionality."

- "The Summary of Economic Projections really says that we want to see policy at modestly restrictive level at end of this year."

- "That is generally a range of 3 to 3.5%."

- "For much of the yield curve now, real rates are positive, but that's not true for the short end."

- Federal Reserve raises key rate by 75 bps.

- US dollar rises but then plummets at the beginning of Powell’s press conference.

The USD/JPY dropped below 134.00 and hit a fresh daily low at 133.78 as Fed Chair Powell delivered initial remarks at the press conference following the FOMC meeting. The central bank raised the key interest rate by 75 basis points.

The dollar initially appreciated across the board but then reversed sharply, erasing gains in a few minutes. Stocks rebounded sharply and printed fresh highs while at the same time, US yields turned to the downside.

The Federal Reserve raised its target rate by 75 basis points, the biggest move since 1994. In the statement, the Fed mentioned that more interest rates are coming and warned there are increasing risks of a recession.

Chair Powell does not expect 75bp rake hikes to be common. The pace of rate hikes will depend on incoming data. He sees that inflation developments warranted a bigger hike at the June meeting. The dollar turned lower after his comments. The conference is taking place and remains a source of volatility.

Vulnerable while under 134.50

The USD/JPY four-hour chart is biased to the downside. A consolidation in USD/JPY below 133.50 would point to an extension of the correction, with the next support seen at 132.90. On the upside, immediate resistance is located at 134.40/50 and above at 135.00.

Technical levels

The Fed continues to see upside risks to inflation, Fed Chair Jerome Powell noted in the opening statement of his post-Fed meeting press conference. Supply chain constraints have been longer than anticipated and price pressures have broadened, with Covid-19 disruptions in China likely to make things worse ahead.

The Fed is highly attentive to the risks of high inflation and is strongly committed to bringing it down, Powell continued, noting that the Fed's policy will continue to be adaptive ahead. Since the Fed's May meeting, inflation has surprised to the upside, he continued, with indicators of inflation expectations also rising. As a result, the Fed decided a larger interest rate hike was warranted, Powell stated.

This continues the approach of expeditiously raising interest rates and will help to ensure longer-term inflation expectations remain well anchored, Powell explained. The Fed's projections are not a plan, as no one knows with any certainty where the economy will be in one year's time, Powell remarked.

Nonetheless, the Fed will in the coming months be looking for compelling evidence that inflation is coming down and the pace of rate hikes will depend on this incoming data, Powell said, noting that he does not expect moves of 75 bps to be common. At the Fed's next meeting, a 50 or 75 bps rate hike is likely, he noted, saying that the Fed needs to be nimble given that there could be further surprises in store for inflation.

- The US Federal Reserve hiked rates by 75 bps.

- The AUD/USD spiked to fresh highs as a reaction, then tumbled towards the 1-hour 50-SMA.

- The US Federal Reserve Chairman Jerome Powell’s press conference is to begin.

On Wednesday, the US Federal Reserve raised rates by 0.75%, not as initially expected by market participants, as Federal Reserve Chairman Jerome Powell discounted a hike of that size. Nevertheless, the article published on Monday about the possibility of the Fed raising rates by the abovementioned size proved true. At the time of writing, the AUD/USD seesaws around the 0.6915-70 range as a reaction to the Fed’s monetary policy meeting.

Summary of the FOMC monetary policy statement

The FOMC stated its commitment to return inflation to the 2 percent target. They added that “inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.”

Regarding the US economic outlook, the Fed noted that the economic activity picked up after the negative reading in Q1. They added that the Fed would continue reducing its holdings, so the Quantitative Tightening (QT) began.

Also, in the same meeting, the Federal Reserve Open Market Committee revealed the Summary of Economic Projections (SEP), which showed that the Fed reduced its expectations for growth from 2.8% to 1.7%, while the unemployment rate would uptick to 3.7% from 3.5% projected in March.

Regarding their outlook about inflation, Fed officials expect the Core PCE at 4.3%, higher than the 4.1%, while the Federal Funds Rate by the end of 2022 is expected at 3.4%, 150 bps more elevated than the 1.9% projected in March.

It’s worth noting that the Federal Reserve expects another 50 bps hike in 2023, and then in 2024 would be the first-rate cut. Nevertheless, contrary to what the Bank of England (BoE) said in their last meeting, slashing growth to negative territory, the Fed appears optimistic.

AUD/USD 1-Hour Chart

Key Technical Levels

Fed Chair Jerome Powell said in the opening statement of his usual post-Fed meeting press conference that the Fed is moving expeditiously to lift interest rates and that the Fed has resolve to restore price stability, reported Reuters. The US economy has been through a lot and is resilient, Powell continued, noting that it is essential to bring inflation down. The current picture is that the labour market is extremely tight and inflation is too high, he stated.

Powell said the Fed thinks that ongoing interest rate increases are appropriate and that the Fed is also in the process of significantly reducing the size of its balance sheet. Activity in the housing sector appears to be softening, he continued, noting that the recent tightening of financial conditions ought to temper demand.

The labour market has remained extremely tight and wage growth elevated, Powell stated, while labour supply has remained subdued and demand for labour strong. The Fed expects supply and demand conditions in the labour market to come into better balance and then temper wage gains, the Fed Chair noted.

- Gold is under pressure as the US dollar firms on the back of the Fed.

- The Fed raised as expected and now markets are tuned into the Chairman's presser.

The gold price has made little of a reaction to what was a well-telegraphed move from the Federal Reserve on Wednesday. The central bank has raised the benchmark interest rate by 75bps so to leave the target range standing at 1.50% - 1.75%. This was in line with expectations and as a consequence, there has been a mooted reaction in financial markets so far following plenty of positioning and volatility ahead of the event.

The lift was the biggest hike since 1994 and the statement signals that there will be more o the same to come in the foreseeable future.

- Fed swaps price 75bp rate hike for July; 140bp over July/Sept.

- US rate futures price in 93.4% chance of 75 bps hike in July; 55% probability of 50 bps rise in September after Fed decision - CME's FEDWATCH.

As such, the greenback and front-end yields are bid following the decision and statement. Now markets await to hear from Fed's chairman, Jerome Powell which is where the meat on the bone for markets could be.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Gold technical analysis

From a technical perspective, the daily chart is poised for further downside while below the 61.8% ratio's confluence with the counter trendline.

On the hourly chart, the breakout points are illustrated as follows:

The W-formation is a reversion pattern that would be expected to keep the price hamstringed to the neckline and potentially see the bears take over.

- Federal Reserve hikes rates by 75bps.

- US dollar rises across the board, DXY at fresh cycle highs.

- US yields move higher, 10-year back above 3.40%.

The EUR/USD dropped to 1.0353 after the decision of the Federal Reserve. The US central bank raised interest rates and boosted the greenback. The pair is approaching the five-year low it reached in May at the 1.0350 area. A larger decline would see the lowest prices for the euro since 2002.

The EUR/USD remains under pressure, seeing strong support ahead around 1.0350 and resistance at 1.0400.

After its two-day meeting, the Federal Reserve raised rates by 75 basis points, the largest hike since 1994. In the statement it mentioned that more interest rates are coming and increasing risk of a recession. Attention now turns to Jerome Powell's press conference.

The US dollar gained momentum across the board after the release of the FOMC statement. The DXY hit fresh multi-year highs above 105.70. US stocks trimmed gains and hits fresh lows, although still holding in positive territory for the day.

Technical levels

The US Federal Reserve on Wednesday announced that it had lifted interest rates by 75 bps to 1.50-1.75%, as expected. The vote split was 10 to one, with Esther George favouring a 50 bps rate hike. The US central bank said in its statement that it anticipates ongoing increases to interest rates to be appropriate, noting that it is strongly committed to returning inflation to 2.0%.

The Fed released its quarterly economic projections. It now sees PCE inflation ending 2022 at 5.2%, up from 4.3% in March, ending 2023 at 2.6%, at 2.2% in 2024 and then back to 2.0% in the long run. The Fed said it sees US real GDP growth at 1.7% in 2022, down from 2.8% in its March forecasts, then growing at a pace of 1.7% in 2023 and 1.9% in 2024, before then growing at a long-run rate of 1.8%.

The Fed also released its latest dot-plot, which shows where policymakers expect rates to be at the end of 2022, 2023 and 2024. The median view amongst Fed members is that interest rates ill end 2022 at 3.4%, well up from the last dot-plot back in March, when the median view was 1.9%. Rates are then seen ending 2023 at 3.8%, before dropping back to 3.4% by the end of 2024. The Fed's long-run view of interest rates was lifted slightly to 2.5% from 2.4% back in March.

Click here for real-time coverage of the Fed's policy announcement.

Market Reaction

The dollar saw kneejerk upside in wake of the Fed's 75 bps rate hike and hawkish new set of economic forecasts (which see much higher inflation) and dot-plot rate guidance. Some analysts had been still thinking the Fed might lift interest rates by 50 bps, so these dovish bets being priced out is the reason for the kneejerk rally.

The DXY momentarily hit fresh multi-decade highs near 105.80, but has since fallen back to close to 105.60.

- The GBP/USD remains negative in the week, down by 1.76%.

- An upbeat market sentiment ahead of the US central bank decision keeps equities in the green.

- Mixed US economic data, mainly ignored by investors, ahead of the Fed decision.

The British pound gained some ground on Wednesday and trimmed five days of consecutive losses after reaching a 2-year low at around 1.1935. However, the GBP/USD stages a recovery and is back above the 1.2000 mark, trading at 1.2092, up by 0.81% at the time of writing.

Positive sentiment and lower US Treasury yields, a tailwind for GBP/USD

The pullback in US Treasury yields weighed on the greenback against the pound. The US 10-year Treasury yield is sliding five bps, at 3.418%. Meanwhile, the US Dollar Index, a measure of the buck’s value against some peers, records minimal losses of 0.06%, down at 105.411.

Sentiment remains positive, with US equities trading in the green. In the meantime, the US economic docket featured May’s US Retail Sales, which missed monthly expectations and decreased by -0.3% MoM, lower than April’s downward revision to 0.7%. However, excluding autos and gas, it rose 0.1% MoM but trailed the previous month’s figure. At the same time, June’s NY Empire State Manufacturing Index rose to -1.2, worse than estimations but better than the -11.6 May reading.

Despite the ongoing correction, analysts at Scotiabank expected cable to fall below 1.2000. They wrote in a note that “In addition to the UK’s economic weakness, EU-UK tensions over No10’s push to unilaterally re-write the Northern Ireland Protocol and Sturgeon’s push for a Scottish independence vote next year are weighing on GBP sentiment.”

“We think the BoE will deliver a less hawkish message than markets are expecting tomorrow that combined with a large hike from the Fed today risks losses extending a few cents below 1.20 in coming weeks,” Scotiabank analysts said.

Key Technical Levels

- Gold is poised for another downside but a short squeeze is not off the table.

- The Fed at the top of the hour is expected to seal the deal one way or another.

As per the pre-open analysis on gold for the week, Gold, Chart of the Week: XAU/USD bulls need to commit or face an avalanche of supply, where the bears committed to below $1,885, the downside risk to May 16 lows at $1,786 and beyond have been opened.

The W-formation's neckline failed to support and as such, the price has broken not only that horizontal support but also the dynamic trendline support as follows:

With the price embedded deeply below resistances, the bulls have a tall order if they are going to break out o the bear's cage. The path of least resistance is to the downside. With that being said, volatility could see retests of resistance, where the 61.8% Fibo aligned with the counter trendline will be the last defence on the upside. A sell-the-news rally could catalyze a counter-intuitive knee-jerk reaction in gold.

Analysts at TD Securities said, ''with markets already nearly fully pricing in two consecutive 75bp hikes, gold and risk markets alike could be set-up for a short-squeeze, which has typically served to shake weak shorts out of the markets and spark some optimism that the worst is over, which ultimately sets the market up for the next leg lower thereafter.''

The Fed's communication will be key in this regard, no matter if today they hike by 50 or 75bps. A 100bp hike would be a catalyst for huge volatility but the yellow metal should ultimately succumb to the Fed's fight against inflation.

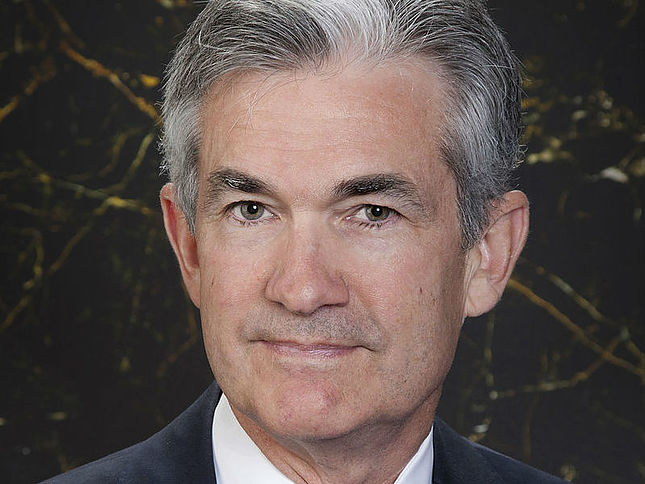

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

- The USD/CHF extends its weekly rally and is up by 1.60%.

- Risk appetite is back as stocks rally, and safe-haven peers suffer.

- USD/CHF Price Forecast: Might test new YTD highs, otherwise, would be vulnerable to selling pressure.

The USD/CHF clings to parity for the second consecutive day, trading at 1.0028, recording minimum gains of 0.11%, ahead of the US Fed monetary policy decision.

Positive sentiment is weighing on safe-haven peers, in this case, the Swiss franc. European and US stocks are recovering, but the correction could be short-lived unless Fed Chair Powell & Co disappoints investors. In the meantime, the greenback remains in the driver’s seat.

The US Dollar Index, a gauge of the buck’s value against a basket of six currencies, edges up 0.04% and clings to 105.516. Contrarily, US Treasury yields are under pressure. The 10-year benchmark note rate falls eight basis points, yielding 3.395%.

In the meantime, the USD/CHF Wednesday’s price action remained choppy, but in the mid-European session, the major dropped below the parity and printed a daily low at 0.9961, just below the daily pivot point. Nevertheless, the pair jumped above 1.000 and may remain around that level into Fed’s decision.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts the pair as upward biased, but it appears the price is overextended. For USD/CHF bulls is crucial a break to new year-to-date highs above 1.0064 because failure to do that would leave the major exposed to selling pressure and could form a double top.

The USD/CHF 1-hour chart illustrates that the major is battling near this week’s highs around 1.0037. It’s worth noting that the 50-hour simple moving average (SMA) at around 0.9971 was tested earlier during the day but acted as a dynamic support level.

If the USD/CHF is headed towards new YTD highs, the first resistance would be 1.0064. A breach of the latter would expose the R1 daily pivot at 1.0080, followed by the 1.0100 figure. On the other hand, failure to conquer new highs, the USD/CHF first support would be the parity (1.0000). Break below would expose the daily pivot point at 0.9980, followed by the confluence of the 100-hour SMA and the S1 pivot point at 0.9910.

Key Technical Levels

- The AUD/USD is trimming some weekly losses but is still down by 1.30%

- Sentiment shifted positive but will remain fragile as the Fed’s decision lurks.

- US Retail Sales dropped more than expected, though it would not change June’s Fed decision.

- AUD/USD Price Forecast: Despite being in a correction, the path of least resistance is downwards.

The Australian dollar stages a comeback vs. the greenback, climbing close to 70 pips on Wednesday amidst an upbeat market mood, ahead of the Federal Reserve monetary policy decision. After reaching a weekly low near 0.6850, the AUD/USD bounces off those lows and is trading at 0.6950 during the North American session.

An upbeat market lifts the AUD/USD; the Fed is next

European and US equities record gains, portraying the market’s risk-on impulse. Nevertheless, the greenback stays in positive territory, up by 0.05%, at 105.525, erasing earlier losses that witnessed the DXY dipping below the 105.000 mark. US Treasury yields dropped, as traders prepared for the FOMC’s decision. Contrarily, the US 10-year Treasury yield slides eight basis points, settling at around 3.395%.

Data-wise, in the North American session, May’s US Retail Sales missed monthly expectations and decreased by -0.3% MoM, lower than April’s downward revision to 0.7%. However, excluding autos and gas, it rose 0.1% MoM but trailed the previous month’s figure. At the same time, June’s NY Empire State Manufacturing Index rose to -1.2, worse than estimations but better than the -11.6 May reading.

During the Asian session, Australia’s Westpac Consumer Confidence Index for June rose by 86.4, lower than the 90.4 expected. “The survey detail shows a clear picture of a slump in sentiment being driven by rising inflation; an associated lift in interest rates; and a loss of confidence around the economic outlook, both here and abroad,” according to the report. Later in the day, the Fair Work Commission granted a $40 per week or 5.2% increase in Australia’s minimum wage.

AUD/USD Price Forecast: Technical outlook

AUD/USD Wednesday’s correction could be short-lived unless the Fed disappoints the market. The major is still downward biased, with the daily moving averages (DMAs) above the exchange rate, positioned in a bearish order, with the short-term below the longer-term ones. Also, the Relative Strength Index (RSI) jumped but will keep bulls unhopeful because it remains in negative territory. Therefore, the AUD/USD path of least resistance is downwards.

That said, the major’s first support would be 0.6900. Break below will send the pair towards June 14 low at 0.6850, which, once cleared, could pave the way and tumble the AUD/USD to the YTD low at 0.6828.

European Central Bank President Christine Lagarde said on Wednesday that crises are never the same twice and that they must have the courage to act when facts are not clear, as reported by Reuters.

"We cannot just be bold, we must be consistent too," Lagarde added and said that they must be true to the spirit not just the letter of the mandate.

Market reaction

The shared currency stays on the back foot following these comments and the EUR/USD pair was last seen losing 0.27% on a daily basis at 1.0387.

- Euro under pressure after ECB emergency meeting.

- US dollar mixed ahead of the Fed’s decision.

- FOMC statement to be released at 18:00 GMT.

The EUR/USD is falling on Wednesday, trading at daily lows near 1.0380 ahead of the Fed’s decision. The US dollar is posting mixed results while the euro is falling across the board weakened after the European Central Bank emergency meeting.

Eyes on the Fed

In a few minutes, at 18:00 GMT the Fed will announce its decision. A rate hike is expected. Analysts consider the central bank could raise interest rates by 50 or 75bps. The decision, the statement and the staff macroeconomic projections will likely trigger sharp moves across financial markets.

The US dollar is mixed ahead of the meeting. The DXY is hovering around 105.50, up 0.05%. US yields are modestly lower on Wednesday, with the 10-year yield at 3.38%.

The euro is among the worst-performing currencies weakened after an emergent meeting from the European Central Bank. The Governing Council discussed policies to address widening spreads. The ECB said it will use PEPP reinvestments with flexibility and that it is working on an “anti-fragmentation” instrument. “We do not think today’s message will be enough to soothe markets and expect further volatility and higher spreads ahead”, say Jan von Gerich, Chief Analyst at Nordea Research.

The EUR/USD awaits the outcome of the two-day Fed meeting trading at daily lows and looking at the May bottom of 1.0345/50. The mentioned area is a key support that if broken could open the doors to 1.0300 and below. Also, the area could trigger a rebound. Resistance levels might be located at 1.0420 and then 1.0490/1.0500.

Technical levels

- Euro weaker and EZ yields lower after ECB emergency meeting.

- Pound steady ahead of the BoE meeting.

- EUR/GBP looks to more gain while above 0.8600.

The EUR/GBP turned to the downside in Wednesday after hitting at 0.8720, the highest level since February 2021. The euro retreated to as low as 0.8613 following the European Central Bank emergency meeting.

EUR/GBP still bullish despite retreat

The ECB surprised market participants with an emergency meeting although the outcome showed no majors surprises. The central bank “decided that it will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to preserving the functioning of the monetary policy transmission mechanism” and also “decided to mandate the relevant Eurosystem Committees together with the ECB services to accelerate the completion of the design of a new anti-fragmentation instrument for consideration by the Governing Council.”

Analysts at Rabobank point out the ECB strengthened its commitment to contain Eurozone spreads. “However, the statement leaves much uncertainty over how powerful the ECB’s intervention will actually be. We expect more clarity in July.” Stocks markets in Europe rose on the back of the meeting and Eurozone bonds rose sharply. The 10-year Italian yield is at 3.90%, falling 8.50%.

On Thursday will be the turn of the Bank of England. The consensus if for a rate hike of 25bps. Economists at TD Securities expected the BoE to continue with a cautious message. “But with 4 votes to hike by 50bps, we think the meeting will mark a slightly hawkish pivot, and we look for further 25bps hikes through year-end.”

In a few hours, on Wednesday the Federal Reserve announce its decision that could trigger volatility. Ahead of the FOMC statement, EUR/GBP is hovering around 0.8620/25, away from the top but still above the 0.8600 key level. The outlook is biased to the upside while above 0.8550.

Technical levels

- US stocks are climbing ahead of the Federal Reserve monetary policy decisions, expected to hike 75 bps.

- The Nasdaq Composite leads the pack, followed by the S&P 500 and the Dow Jones.

- The US Dollar Index falls, weighed by the drop of US Treasury yields.

US equities recovered some ground after a string of five days of losses and are gaining between 1.05% and 1.54% on Wednesday as investors expect the Federal Reserve’s monetary policy decision, with the majority of estimates around a 75 bps rate hike.

Risk appetite increased, but for how long?

The S&P 500 is rising 1.12% currently at 3,776.07, followed closely by the heavy-tech Nasdaq Composite, jumping 1.31% at 11459.56. At the bottom of the pile is the Dow Jones Industrial Average, which is up by 0.95% sitting at 30,654.16

US Retail Sales recorded their first drop in five months, decreasing 0.3% MoM; excluding autos and gas, uptick by 0.1%. It’s worth noting that April’s figures were revised down but stayed positive. Meanwhile, comparing numbers on an annual basis, Retail Sales jumped to 8.1%, higher than April’s 7.8%.

In the meantime, the US Dollar Index retreats from the fresh 20-year high and sits around 105.318, down 0.15%. US Treasury yields remain elevated but tumbled. The US 10-year note yields 3.398%, down eight basis points.

The market sentiment is positive but remains fragile. While Wall Street adjusted their forecasts to 75 bps, some voices suggest the Fed would need to move by 1% so that they can restore the central bank’s “credibility.” However, a move of that size would turn the mood sour, and equities could continue sliding.

In terms of sector specifics, the leading gainers are Consumer Discretionary, up 1.75%, followed by Real Estate and Technology, each recording gains of 1.34% and 1.27%, respectively. The main losers are Energy, Materials, and Consumer Staples, losing 1.45%, 0.05%, and 0.01% each.

In the commodities complex, the US crude oil benchmark, WTI, is losing 0.94%, trading at $117.90 BPD, while precious metals like gold (XAU/USD) is gaining 0.70%, exchanging hands at $1820.86 a troy ounce, as US Treasury yields, fall ahead of the FOMC’s decision.

S&P 500 Daily Chart

Key Technical Levels

- WTI recently fell to fresh session lows and is eyeing a test of its 21DMA pre-Fed rate announcement.

- Commentary about a weak outlook for demand growth and China lockdowns is being cited as weighing.

- But oil markets look set to remain right for the rest of the year amid OPEC+ output woes.

Front-month WTI futures recently fell to fresh weekly lows in the $116s and are currently trading with losses on the day of just over $2.0 as traders brace for what could be the largest rate hike from the Fed in 28 years later in the session. The American benchmark for sweet light crude oil is looking to test its 21-Day Moving Average, which currently sits just above $116, suggesting that, for now, though WTI is trading nearly $6.0 below earlier weekly highs, the bullish trend remains intact.

In terms of fundamental catalysts, some are citing downbeat commentary from the International Energy Agency (IEA), who on Wednesday said that higher oil prices and a worsening economic outlook are dimming the outlook for crude oil demand. Various Chinese cities have been moving to reimpose restrictions this week as the nation continues to struggle in its efforts to stamp out Covid-19. Meanwhile, the latest US Retail Sales figures have pumped recession calls.

All of this might be weighing on oil on an intra-day basis, but WTI continues to derive support from expectations for tight oil market conditions to persist for the near future. OPEC said earlier in the week that output fell in May despite the cartel aiming for to increase production, as some of its smaller members struggle to lift output. Libya is currently in a political crisis that has currently halted around 1M barrels per day in output. Meanwhile, Russian output also remains under pressure from Western sanctions over its invasion of Ukraine.

One commodity strategist said that the recent drop in OPEC+ output means that oil markets are likely to remain in a deficit of around 1.5M barrels per day for the remainder of the year. That means further drawdown on already heavily drained oil reserves, supporting the case for oil prices to remain supported well within triple-digit territory.

- USD/JPY corrected sharply from over a two-decade high touched earlier this Wednesday.

- Overbought RSI prompted some profit-taking ahead of the highly-anticipated FOMC decision.

- The technical set-up still favours bulls and supports prospects for the emergence of dip-buying.

The USD/JPY pair witnessed a corrective pullback from a 24-year top touched earlier this Wednesday, though the downfall stalled near the 134.30 area. The pair quickly recovered a few pips from the daily low and was last seen trading just above mid-134.00s, still down 0.70% for the day.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - undermined the safe-haven Japanese yen. Apart from this, the emergence of some US dollar dip-buying, bolstered by hawkish Fed expectations, turned out to be key factors that extended support to the USD/JPY pair.

From a technical perspective, perspective, the recent move up witnessed over the past one week or so has been along an upward-sloping trend channel and favours bullish traders. That said, the overbought RSI (14) on the daily chart prompted some profit-taking ahead of the highly-anticipated FOMC decision.

Nevertheless, the set-up supports prospects for the emergence of some dip-buying and warrants some caution before positioning for deeper losses. That said, some follow-through selling might still drag the USD/JPY pair towards testing the trend-channel support, currently near the 134.00-133.90 area.

A convincing break below would suggest that the USD/JPY pair has formed a near-term top and prompt aggressive long-unwinding trade.

On the flip side, immediate resistance is pegged near the 135.10-135.15 region ahead of a multi-year high, around the 135.55-135.60 area. The latter coincides with the top boundary of the aforementioned trend channel, which if cleared decisively would be seen as a fresh trigger for bullish traders.

The USD/JPY pair might then aim to reclaim the 136.00 round-figure mark and prolong the upward trajectory towards the next relevant hurdle near the mid-136.00s.

USD/JPY 1-hour chart

-637908984598974561.png)

Key levels to watch

The Bank of England (BoE) is set to announce its policy decision on Thursday, June 16 at 11:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of nine major banks.

The BoE is likely to hike the key rate by another 25 bps to 1.25%. A surprise 50 bps hike cannot be ruled out if the “Old Lady” prioritizes inflation control.

UOB

“Previously, we had held a cautious view of the BoE pausing once the policy rate reaches 1.00%. However, the last voting outcome by the MPC has turned out a little less dovish than our expectations, and we thus now look for another 25 bps hike in June. As for asset sales, we will likely have to wait until at least then for some guidance, though we expect sales to begin in 4Q22 at GBP5 bn a month.”

TDS

“We expect the MPC to announce a 25 bps hike in Bank Rate. Guidance is likely to be left broadly unchanged but multiple votes for a 50 bps hike imply a hawkish shift. We now expect sequential 25 bps hikes through the end of 2022, with Bank Rate reaching 2.25% by year-end.”

Danske Bank

“We expect the BoE to hike the Bank Rate by another 25 bps to 1.25% but simultaneously still sending slightly mixed signals by repeating that ‘some degree of further tightening in monetary policy may still be appropriate in the coming months’.”

Deutsche Bank

“We expect a 25 bps hike this week and have updated their terminal rate forecast from 1.75% to 2.5%.”

Nordea