- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-10-2020

On Monday, at 00:30 GMT Australia will release the index of business sentiment from the National Australia Bank in September. At 01:00 GMT Australia will release data on inflation from MI for September. Then the focus will be on business activity indices in the services sector for September: at 07:50 GMT, France will report, at 07:55 GMT - Germany, at 08:00 GMT - the Eurozone, and at 08:30 GMT - the United Kingdom. At 09:00 GMT, the eurozone will announce changes in retail sales for August. At 13:45 GMT in the US, the Markit services PMI for September will be released, and at 14:00 GMT, the ISM Non-Manufacturing for September. At 21:00 GMT, New Zealand will publish an indicator of business environment sentiment from NZIER for the 3rd quarter. At 21:30 GMT Australia will present the index of activity in the construction sector from AiG in September.

On Tuesday, at 00:30 GMT, Australia will release the ANZ jobs index for September and report a change in the trade balance for August. At 03:30 GMT in Australia, the RBA interest rate decision will be announced. At 06:00 GMT, Germany will report changes in production orders for August. At 08:30 GMT, the UK will release the index of business activity in the construction sector for September. At 08:35 GMT ECB chief Lagarde will deliver a speech. At 12:30 GMT, Canada and the United States will announce changes in the trade balance for August. At 13:00 GMT ECB chief Lagarde will deliver a speech. At 14:00 GMT, the US will report changes in the level of vacancies and labor turnover for August. At 14:40 GMT, Fed chief Powell will deliver a speech. At 21:30 GMT, Australia will release the AIG services index for September.

On Wednesday, at 06:00 GMT, Germany will announce changes in industrial production for August. At 06:45 GMT, France will report a change in the trade balance for August. At 07:30 GMT, the UK will release the Halifax house price index for September. At 12:10 GMT ECB chief Lagarde will deliver a speech. At 14:00 GMT Canada will present the index of business activity managers from Ivey for September. At 14:30 GMT, the US will announce changes in oil reserves according to the Ministry of energy. At 18:00 GMT, in the US the Fed minutes will be published. At 19:00 GMT, the US will announce a change in the volume of consumer lending for August. At 23:50 GMT, Japan will report a change in the current account balance for August.

On Thursday, at 05:45 GMT, Switzerland will announce a change in the unemployment rate for September. At 06:00 GMT, Germany will report changes in the balance of payments and trade for August. At 09:30 GMT, the head of the SNB Jordan will make a speech. At 12:15 GMT, Canada will announce a change in the number of new foundations laid for September. At 12:30, the US will report a change in the number of initial applications for unemployment benefits. Also at 12:30 GMT Bank of Canada Governor Macklem will also deliver a speech. At 23:30 GMT, Japan will announce changes in the level of wages and household spending for August.

On Friday, at 00:30 GMT Australia will report changes in mortgage lending for August. Also at 00:30 GMT in Australia the RBA's financial stability report will be released. At 01:00 GMT Bank of Japan Governor Kuroda will deliver a speech. At 01:45 GMT China will publish the index of business activity in the services sector Caixin/Markit for September. At 06:00 GMT, the UK will announce changes in manufacturing production, industrial production, GDP and the overall trade balance for August. At 06:00 GMT, Japan will report a change in the volume of orders for equipment for September. At 06:45 GMT, France will announce changes in industrial production for August. At 12:30 GMT, Canada will report changes in the number of employees and the unemployment rate for September. At 13:00 GMT, the UK will release an estimate of the change in GDP from NIESR for the 3rd quarter. At 14:00 GMT the U.S. will report the change of wholesale trade for August. At 17:00 GMT, in the US, the Baker Hughes report on the number of active oil drilling rigs will be released

- Without further realism and flexibility from EU, risks being impossible to bridge

- Although differences remain in many areas of talks, the outlines of agreement are visible

- Encouraged that progress has been possible on law enforcement agreement and that there has been convergence on structure of overall partnership

- On level playing field, we continue to seek an agreement that ensures our ability to set our own laws in UK without constraints that go beyond those appropriate to free trade deal

The U.S.

Commerce Department reported on Friday that the value of new factory orders rose

0.7 percent m-o-m in August, following a revised 6.5 percent m-o-m climb in July

(originally a 6.4 percent m-o-m surge). That marked the fourth consecutive

month of gains in factory orders.

Economists had

forecast a 1.0 percent m-o-m increase.

According to

the report, orders for transportation equipment increased 0.4 percent

m-o-m in August, slowing from +35.3 percent m-o-m in July. Gains also occurred

in orders for machinery (+1.5 percent m-o-m), primary metals (+1.6 percent

m-o-m) and computers and electronic products (+1.2 percent m-o-m). These

increases, however, were partially offset by declines in new orders for

electrical equipment, appliances, and components (-0.8 percent m-o-m) and

fabricated metal products (-1.2 percent m-o-m).

Meanwhile, total

factory orders excluding transportation, a volatile part of the overall

reading, also rose 0.7 percent m-o-m in August (compared to an upwardly revised

2.4 percent m-o-m advance in July), while orders for nondefense capital goods

excluding aircraft, a measure of business spending plans, increased 0.9 percent

m-o-m instead of advancing 1.8 percent m-o-m as reported last month. The report

also showed that shipments of core capital goods jumped 1.5 percent m-o-m in August, as previously

reported.

- Brexit negotiations still have lack of progress on climate change or carbon pricing

- Wie will continue to maintain calm and respectable attitude and we will remain united and determined until the end of these negotiations

The final

reading for the September Reuters/Michigan index of consumer sentiment came in

at 80.4 compared to a preliminary reading of 78.9 and the August final reading

of 74.1. This was the highest reading since March.

Economists had

forecast the index to be revised up to 79.

According to

the report, the index of the current economic conditions jumped 5.9 percent

m-o-m to 87.8 from August’s final reading of 82.9.

Meanwhile, the

index of consumer expectations climbed 10.4 percent m-o-m to 75.6 from August’s

final reading of 68.5.

Richard Curtin,

the Surveys of Consumers chief economist, noted that consumer sentiment

continued to improve in late September, mainly due to a more optimistic outlook

for the national economy. “While consumers have anticipated gains in the

national economy ever since the April shutdown, the September survey recorded a

significant increase in the proportion that expected a reestablishment of good

times financially in the overall economy. The recent gains are encouraging even

though they were largely due to upper income households,” he said.

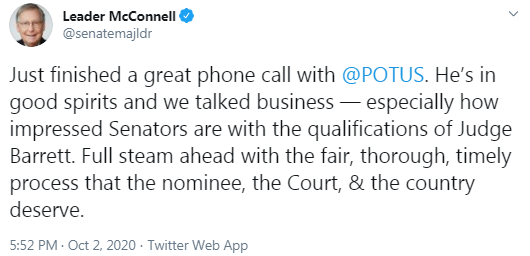

- Believes that President Trump's COVID-19 case changes the dynamic on stimulus

- Get money into the hands of people most likely to spend it, and you’ll see a multiplier effect throughout the broader economy

- Many jobs lost during the pandemic will not return

- Fed will accept periods of above 2% inflation after long periods of sub-2%

U.S. stock-index futures tumbled on Friday after the U.S. President Donald Trump announced that he and his wife had tested positive for COVID-19, while the U.S. jobs data showed that employment growth slowed more than forecast in September.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,029.90 | -155.22 | -0.67% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 5,791.50 | -81.40 | -1.39% |

FTSE | 5,836.30 | -43.15 | -0.73% |

CAC | 4,784.34 | -39.70 | -0.82% |

DAX | 12,589.76 | -141.01 | -1.11% |

Crude oil | $37.06 | -4.29% | |

Gold | $1,913.60 | -0.14% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 157.01 | -1.78(-1.12%) | 7015 |

ALCOA INC. | AA | 11.14 | -0.25(-2.19%) | 49699 |

ALTRIA GROUP INC. | MO | 38.46 | -0.46(-1.18%) | 26158 |

Amazon.com Inc., NASDAQ | AMZN | 3,151.25 | -70.01(-2.17%) | 125707 |

American Express Co | AXP | 99.03 | -2.30(-2.27%) | 17216 |

AMERICAN INTERNATIONAL GROUP | AIG | 27.54 | -0.18(-0.65%) | 5945 |

Apple Inc. | AAPL | 113.36 | -3.43(-2.94%) | 3677293 |

AT&T Inc | T | 28.26 | -0.23(-0.81%) | 161303 |

Boeing Co | BA | 162.25 | -5.61(-3.34%) | 461001 |

Caterpillar Inc | CAT | 144.71 | -2.00(-1.36%) | 10030 |

Chevron Corp | CVX | 69.11 | -1.31(-1.86%) | 59499 |

Cisco Systems Inc | CSCO | 38.27 | -0.53(-1.37%) | 97792 |

Citigroup Inc., NYSE | C | 42.65 | -0.79(-1.82%) | 86222 |

Deere & Company, NYSE | DE | 215.01 | -4.03(-1.84%) | 824 |

E. I. du Pont de Nemours and Co | DD | 53.53 | -1.00(-1.83%) | 3220 |

Exxon Mobil Corp | XOM | 32.35 | -0.78(-2.35%) | 211194 |

Facebook, Inc. | FB | 260.98 | -5.65(-2.12%) | 205371 |

FedEx Corporation, NYSE | FDX | 250.05 | -4.03(-1.59%) | 18570 |

Ford Motor Co. | F | 6.62 | -0.13(-1.93%) | 312593 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.25 | -0.30(-1.93%) | 63770 |

General Electric Co | GE | 6.1 | -0.14(-2.24%) | 1088553 |

General Motors Company, NYSE | GM | 29.7 | -0.68(-2.24%) | 61041 |

Goldman Sachs | GS | 195 | -3.55(-1.79%) | 20523 |

Google Inc. | GOOG | 1,464.00 | -26.09(-1.75%) | 14239 |

Hewlett-Packard Co. | HPQ | 18.7 | -0.30(-1.58%) | 3162 |

Home Depot Inc | HD | 273 | -4.62(-1.66%) | 12812 |

HONEYWELL INTERNATIONAL INC. | HON | 160.89 | -2.79(-1.70%) | 4135 |

Intel Corp | INTC | 51.21 | -1.03(-1.97%) | 202818 |

International Business Machines Co... | IBM | 119.36 | -1.73(-1.43%) | 16147 |

International Paper Company | IP | 39.1 | -0.85(-2.13%) | 837 |

Johnson & Johnson | JNJ | 146.15 | -1.17(-0.79%) | 11844 |

JPMorgan Chase and Co | JPM | 95.22 | -1.75(-1.80%) | 82920 |

McDonald's Corp | MCD | 218 | -1.59(-0.72%) | 5569 |

Merck & Co Inc | MRK | 81.29 | -0.35(-0.43%) | 10807 |

Microsoft Corp | MSFT | 208.05 | -4.41(-2.08%) | 416867 |

Nike | NKE | 124.19 | -2.45(-1.93%) | 13869 |

Pfizer Inc | PFE | 36.03 | -0.34(-0.93%) | 117886 |

Procter & Gamble Co | PG | 138.48 | -0.76(-0.55%) | 4489 |

Starbucks Corporation, NASDAQ | SBUX | 85.2 | -1.54(-1.78%) | 22012 |

Tesla Motors, Inc., NASDAQ | TSLA | 429.23 | -18.93(-4.22%) | 2995518 |

The Coca-Cola Co | KO | 48.6 | -0.58(-1.18%) | 45686 |

Travelers Companies Inc | TRV | 106.35 | -1.46(-1.35%) | 1775 |

Twitter, Inc., NYSE | TWTR | 45.6 | -1.10(-2.36%) | 224499 |

UnitedHealth Group Inc | UNH | 309.97 | -3.10(-0.99%) | 10568 |

Verizon Communications Inc | VZ | 59.1 | -0.35(-0.59%) | 16406 |

Visa | V | 199.81 | -3.54(-1.74%) | 21595 |

Wal-Mart Stores Inc | WMT | 141 | -2.08(-1.45%) | 85979 |

Walt Disney Co | DIS | 121.02 | -2.29(-1.86%) | 76853 |

Yandex N.V., NASDAQ | YNDX | 62.12 | -1.44(-2.27%) | 7355 |

Walmart (WMT) upgraded to Buy from Hold at DZ Bank; target $157.50

The U.S. Labor

Department announced on Friday that nonfarm payrolls rose by 661,000 in September

after a downwardly revised 1,489,000 advance in the prior month (originally a

gain of 1,371,000), reflecting the continued resumption of economic activity

that had been curtailed due to the coronavirus pandemic and efforts to contain

it.

According to

the report, employment rose sharply in leisure and hospitality (+318,000 jobs),

in retail trade (+142,000), in health care and social assistance (+108,000),

and in professional and business services (+89,000), but declined significantly

in government (-216,000 jobs), mainly in state and local government education.

The

unemployment rate fell to 7.9 percent in September from 8.4 percent in August.

Economists had

forecast the nonfarm payrolls to increase by 850,000 and the jobless rate to

drop to 8.2 percent.

The labor force

participation rate decreased by 0.3 percentage point in September to 61.4

percent, while hourly earnings for private-sector workers edged up 0.1 percent

m-o-m (or $0.02) to $29.47, following a revised 0.3 percent m-o-m increase in August

(originally a gain of 0.4 percent m-o-m). Economists had forecast the average

hourly earnings to increase 0.2 percent m-o-m in September. Over the year,

average hourly earnings increased by 4.7 percent in September, following a

revised 4.6 percent rise in August (originally an increase of 4.7 percent).

The average

workweek increased by 0.1 hour to 34.7 hours in September, exceeding

economists' forecast for 34.6 hours.

NFXStreet reports that analysts at Credit Suisse note that USD/CAD maintains a base to suggest further corrective strength, with key resistance seen at 1.3421 while key support stays at 1.3247/41.

“USD/CAD saw a sharp rejection from price resistance at 1.3421 and the 61.8% retracement of the June/September fall at 1.3440 earlier in the week, which increases the risk of an earlier than anticipated resumption of the core bear trend.”

“Whilst above the ‘neckline’ to the base at 1.3247/41, we remain biased for further corrective strength, with resistance seen initially at the aforementioned 1.3421 and 1.3340. Removal of here would expose the late July highs at 1.3451/60 next, ahead of the “measured base objective” and 200-day average at 1.3496/3529, where we would look for a cap for the medium-term downtrend to then reassert itself."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Eurozone | Harmonized CPI | September | -0.4% | 0.1% | |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | September | -0.2% | -0.2% | -0.3% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | September | 0.4% | 0.5% | 0.2% |

GBP rose against most other major currencies in the European session on Friday as market participants cheered the announcement about Boris Johnson’s intervention in trade talks with the EU.

The UK PM Boris Johnson's spokesman announced the prime minister's "intervention" in Brexit talks. The UK's PM is set to hold talks with European Commission (EC) president Ursula von der Leyen tomorrow afternoon "to take stock of negotiations and discuss next steps". It will be the first time Johnson gets involved in talks since June.

Market participants reacted positively to this announcement, as they believe that the talks between Johnson and von der Leyen may spur a breakthrough in Brexit trade negotiations.

However, the UK's housing secretary Robert Jenrick said it is too early to say what tomorrow's talks between the UK's PM and EC president may mean, adding that there are still some very significant issues to be resolved.

Media also reported that the EU's sources expect that there will be more talks between the UK and the EU negotiators before the next EU summit, set to be held on October 15-16, since they are not going to reach any firm compromise at the last scheduled round of trade negotiations, ending this week.

Investors are also awaiting statements from the UK and the EU chief Brexit negotiators David Frost and Michel Barnier, who are to meet today on the final day of the formal talks.

FXStreet notes that NZD/USD stays positive for a sixth consecutive day and probes one week high around 0.6650. Economists at Westpac see potential for further gains above 0.6655.

“The recent 3c downward correction appears complete, and a rise towards the top of the range at 0.6800 is now in progress.”

“We still expect risk sentiment to remain elevated into year-end... and the USD to resume its weakening trend. That should see NZD/USD above 0.67 by year-end.”

FXStreet reports that gold is consolidating as expected after achieving the Credit Suisse flagged $2075 base case objective in August and whilst the bank maintains its long-term bullish view, their strategists think new highs are not likely until next year.

“Gold extends its correction following the move to our base case objective of $2075/80 in August for a fall to just shy of support at $1837 – the 23.6% retracement of 2020. We look for this to continue to hold to maintain the sideways range for now ahead of an eventual move above $1993 for a fresh look at $2075. An eventual move above here stays looked for a resumption of the core bull trend with resistance seen next at $2175, then $2300.”

“Below $1837 can see a deeper setback to $1765, potentially $1726 – the 38.2% retracement of the entire 2018/2020 bull trend and rising 200-day average.”

- Says prices falling because of energy, demand, German VAT

- Hopes to finish strategy review by the middle of next year

Down from -12.8% q-o-q and -17.7% y-o-y in previous estimate

eFXdata reports that Societe Generale Research flags a scope for EUR/USD break lower during this month.

"Recovery Fund concerns can hold the euro down, and the prospect of easier fiscal policy in the US doesn’t suggest that we’ll see any further narrowing in Bund/Treasury yields, now or for the foreseeable future. With a bullish consensus, it’s disturbingly easy to name a series of reasons for the euro to be weaker. On a positive note, even in Spain the second wave of the pandemic continues to be much less economically damaging than the first. But still, if we break outside a EUR/USD 1.16-1.19 range in October, suspect it will be to test 1.15," SocGen adds.

FXStreet reports that China recovery progress and the market’s risk appetite will push-and-pull USD/CNY, which is likely to move within the 6.70-6.90 range in the short-term, according to economists ta MUFG Bank

“Autumn has arrived, and the challenges ahead are heavy, but the most challenging time is over. Currently, some countries are struggling to balance COVID-19 countermeasures and everyday activities. China’s COVID-19 situation and economic environment have been continuously improving since this summer.”

“On the one hand, the market is more optimistic about China’s economic prospects. On the other hand, however, the fog on the RMB’s path has become denser as the global risk-on sentiment cooled off toward the end of September.”

“We forecast the USD/CNY is likely to trade between 6.70 and 6.90 in the near-term.”

According to a flash estimate from Eurostat,, euro area annual inflation is expected to be -0.3% in September 2020, down from -0.2% in August. Economists had expected a 0.2% decrease

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in September (1.8%, compared with 1.7% in August), followed by services (0.5%, compared with 0.7% in August), non-energy industrial goods (-0.3%, compared with -0.1% in August) and energy (-8.2%, compared with -7.8% in August).

CNBC reports that an investment strategist told that investors should look at Asia instead of the U.S. when it comes to stocks and bonds.

“Given the election risk in U.S. and more expensive valuations, I think the Asian markets look more interesting – (there is) strong economic recovery, strong earnings and much cheaper valuations compared to the U.S. equity market,” said Suresh Tantia of Credit Suisse.

Economic data from China has been “quite encouraging,” and the coronavirus pandemic is largely under control in other North Asian markets such as South Korea, Taiwan and Hong Kong, he said.

“That has allowed the economic recovery to continue,” he told CNBC.

Fixed income assets are also more attractive in Asia because spreads are still “much higher” than in the U.S., Tantia said.

“Asian (investment grade) bonds are offering yield of around 3%, compared to 2% yield in the U.S. We think there is slightly higher yield for similar rated companies in Asia,” he said.

Tantia also said the last quarter of 2020 is likely to be “choppy” for markets, but that investors should buy on dips.

Reuters reports that the EU’s financial services chief designate said that the flow of financial services between the European Union and Britain will be less fluid from January whatever happens in talks on a future free trade deal, on Friday.

Britain left the EU last January and unfettered access to the single market under transition arrangements ends on Dec. 31.

“Under all circumstances, deal or no deal, trading in financial services will be different and less fluid as of the first of January next year,” Mairead McGuinness told the European Parliament.

If confirmed by the parliament, McGuinness will lead the European Commission’s work that will decide how much EU access the City of London will have from January.

FXStreet reports that USD/CNH carries the potential to debilitate to the 6.7165 level in the next weeks, suggested FX Strategists at UOB Group.

Next 1-3 weeks: “The sharp drop in USD that sent it to a fresh 17-month low (6.7302) came as a surprise. While the longer-term outlook for USD still appears weak, the sharp decline over the past couple of days appears to be running ahead of itself. That said, USD is expected to stay under pressure unless it can move above 6.8250 (‘strong resistance’ level). Overall, while USD could weaken further, the major support at 6.7165 could be out of reach this time round.”

RTTNews reports that data from the Cabinet Office showed that Japan's consumer confidence improved to the highest level in seven months in September.

On a seasonally adjusted basis, the consumer confidence index increased to 32.7 in September from 29.3 in August.

Among the four sub-indexes of the consumer confidence index, the index reflecting households' willingness to buy durable consumer goods rose to 34.9 in September, and the index for overall livelihood increased to 35.1.

The indicators measuring the income growth increased to 34.8 and employment grew to 26.0.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | August | 3.2% | -4.2% | -4% |

| 05:00 | Japan | Consumer Confidence | September | 29.3 | 32.7 |

During today's Asian trading, the US dollar began to fall sharply against the yen after US President Donald Trump announced that the results of tests for COVID-19 taken from him and his wife showed a positive result.

The ICE index, which tracks the dynamics of the US dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.02%.

Investors continue to monitor the process of adopting a new package of measures to support the US economy. The U.S. house of representatives on Thursday approved a $2.2 trillion stimulus package proposed by Democrats, despite a lack of agreement with the administration of Donald Trump.

Meanwhile, data from the Japanese Ministry of internal Affairs and communications showed that unemployment in Japan rose to 3% in August from 2.9% a month earlier and reached the highest level since may 2017. The indicator coincided with analysts ' expectations.

Today, investors are waiting for the publication of preliminary data on changes in consumer prices in the Euro zone in September, as well as data from the US Department of labor on the unemployment rate in the country in September.

Reuters reports that ECB board member Fabio Panetta said that the European Central Bank must prepare to issue a digital euro to complement banknotes "if and when" it becomes necessary.

Major central banks are studying the creation of officially sanctioned digital currencies to address demand for electronic means of payment and fend off competition from Bitcoin and other crypto tokens.

In a study published on Friday, the ECB said a digital euro could help in scenarios where citizens abandoned cash, foreign forms of electronic money took over, or other means of payments became unavailable.

"We should be ready to issue a digital euro if and when developments around us make it necessary," Panetta said in a blog post accompanying the study. "This means that we already need to be preparing for it."

FXStreet reports that in opinion of FX Strategists at UOB Group, the short-term stance in AUD/USD remains positive.

24-hour view: “Yesterday, we held the view that AUD ‘could grind higher towards 0.7195 and that the next resistance at 0.7230 is likely out of reach’. AUD subsequently rose to a high of 0.7209 before pulling back. Upward pressure is beginning to ease and AUD is unlikely to strengthen further. That said, it is premature to expect a significant pull-back. All in, AUD could drift lower but any weakness is viewed as part of 0.7140/0.7205 range.”

eFXdata reports that CIBC Research discusses EUR/USD outlook and adopts a neutral bias on the pair going into year-end.

"The combination of an earlier re-opening and a less dovish central bank compared to the Fed, led to an aggressive expansion in EUR longs over the summer. Speculative positioning reached all-time extremes into the end of August, with the position extension coinciding with the change in Fed policy to average inflation targeting. An unwinding of such positions, triggered by global risk aversion that favours the greenback, alongside eurozone data that added up to an easing the eurozone surprise index, has put a temporary stall into the euro’s march stronger. We expect EURUSD to remain near 1.17 into year-end," CIBC notes.

CNBC reports that President Donald Trump said he and first lady Melania Trump have tested positive for coronavirus, plunging the United States into further upheaval and uncertainty just over a month away from Election Day.

In a tweet early Friday morning, Trump said: “We will begin our quarantine and recovery process immediately. We will get through this TOGETHER!”

RTTNews reports that according to the report from Australian Bureau of Statistics, the total value of retail sales in Australia was down a seasonally adjusted 4.0 percent on month in August, coming in at A$29.481 billion. That beat forecasts for a drop of 4.2 percent.

Australian Bureau of Statistics said that food retailing fell 0.2 percent in August as sales fell 2.9 percent for liquor retailing, rose 0.1 percent for supermarket and grocery stores and rose 0.5 percent for other specialized food retailing.

Household goods retailing fell 6.0 percent as sales fell 7.7 percent for electrical and electronic goods retailing, fell 6.1 percent for hardware, building and garden supplies retailing and fell 3.3 percent for furniture, floor coverings, houseware and textile goods retailing.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1831 (2156)

$1.1802 (306)

$1.1783 (659)

Price at time of writing this review: $1.1712

Support levels (open interest**, contracts):

$1.1680 (4528)

$1.1641 (1797)

$1.1595 (3609)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 9 is 67945 contracts (according to data from October, 1) with the maximum number of contracts with strike price $1,1900 (4610);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3042 (365)

$1.2982 (299)

$1.2930 (232)

Price at time of writing this review: $1.2860

Support levels (open interest**, contracts):

$1.2754 (1076)

$1.2717 (843)

$1.2651 (257)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 15500 contracts, with the maximum number of contracts with strike price $1,3150 (1205);

- Overall open interest on the PUT options with the expiration date October, 9 is 20443 contracts, with the maximum number of contracts with strike price $1,3150 (2620);

- The ratio of PUT/CALL was 1.32 versus 1.19 from the previous trading day according to data from October, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 40.29 | -2.94 |

| Silver | 23.74 | 2.28 |

| Gold | 1905.698 | 1.07 |

| Palladium | 2321.71 | 0.72 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 0 | 23185.12 | 0 |

| ASX 200 | 57 | 5872.9 | 0.98 |

| FTSE 100 | 13.35 | 5879.45 | 0.23 |

| DAX | -29.96 | 12730.77 | -0.23 |

| CAC 40 | 20.6 | 4824.04 | 0.43 |

| Dow Jones | 35.2 | 27816.9 | 0.13 |

| S&P 500 | 17.8 | 3380.8 | 0.53 |

| NASDAQ Composite | 159 | 11326.51 | 1.42 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | August | 3.2% | -4.2% |

| 05:00 | Japan | Consumer Confidence | September | 29.3 | |

| 12:30 | U.S. | Average workweek | September | 34.6 | 34.6 |

| 12:30 | U.S. | Government Payrolls | September | 344 | |

| 12:30 | U.S. | Manufacturing Payrolls | September | 29 | 35 |

| 12:30 | U.S. | Labor Force Participation Rate | September | 61.7% | |

| 12:30 | U.S. | Private Nonfarm Payrolls | September | 1027 | 850 |

| 12:30 | U.S. | Average hourly earnings | September | 0.4% | 0.2% |

| 12:30 | U.S. | Unemployment Rate | September | 8.4% | 8.2% |

| 12:30 | U.S. | Nonfarm Payrolls | September | 1371 | 850 |

| 14:00 | U.S. | Factory Orders | August | 6.4% | 1% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | September | 74.1 | 79 |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | October | 183 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71835 | 0.33 |

| EURJPY | 123.922 | 0.27 |

| EURUSD | 1.1741 | 0.16 |

| GBPJPY | 135.912 | -0.17 |

| GBPUSD | 1.28764 | -0.29 |

| NZDUSD | 0.66483 | 0.54 |

| USDCAD | 1.32748 | -0.32 |

| USDCHF | 0.91783 | -0.25 |

| USDJPY | 105.519 | 0.09 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.