- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-10-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 (GMT) | Japan | Eco Watchers Survey: Current | September | 43.9 | |

| 05:00 (GMT) | Japan | Eco Watchers Survey: Outlook | September | 42.4 | |

| 05:45 (GMT) | Switzerland | Unemployment Rate (non s.a.) | September | 3.3% | 3.3% |

| 06:00 (GMT) | Germany | Current Account | August | 20.0 | |

| 06:00 (GMT) | Germany | Trade Balance (non s.a.), bln | August | 19.2 | |

| 09:30 (GMT) | Switzerland | SNB Chairman Jordan Speaks | |||

| 10:15 (GMT) | Eurozone | ECB's Yves Mersch Speaks | |||

| 11:30 (GMT) | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 12:15 (GMT) | Canada | Housing Starts | September | 262.4 | 240 |

| 12:30 (GMT) | U.S. | Continuing Jobless Claims | September | 11767 | 11400 |

| 12:30 (GMT) | U.S. | Initial Jobless Claims | October | 837 | 820 |

| 12:30 (GMT) | Canada | BOC Gov Tiff Macklem Speaks | |||

| 18:30 (GMT) | U.S. | Fed Barkin Speech | |||

| 22:00 (GMT) | U.S. | FOMC Member Kaplan Speak | |||

| 23:30 (GMT) | Japan | Labor Cash Earnings, YoY | August | -1.3% | |

| 23:30 (GMT) | Japan | Household spending Y/Y | August | -7.6% | -6.9% |

- Says he wouldn't overinterpret euro's appreciation

- Rise in infections still in line with ECB's baseline

- Rate cuts are possible, reversal rate has not yet been reached

- Sees no immediate need for more fiscal stimulus

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories rose

by 0.501 million barrels in the week ended October 2. Economists had forecast a

build of 0.400 million barrels.

At the same

time, gasoline stocks fell by 1.435 million barrels, while analysts had

expected a decline of 0.471 million barrels. Distillate stocks decreased by

0.962 million barrels, while analysts had forecast a drop of 0.995 million

barrels.

Meanwhile, oil

production in the U.S. increased by 300,000 barrels a day to 11.000 million

barrels a day.

U.S. crude oil

imports averaged 5.7 million barrels per day last week, increased by 0.6

million barrels per day from the previous week.

The Ivey

Business School Purchasing Managers Index (PMI), measuring Canada’s economic

activity, fell to 54.3 in September from 67.8 in August. The latest reading was

the lowest since May.

A reading above

50 signals expansion, while a reading below 50 indicates contraction.

Within

sub-indexes, the employment measure dropped to 53.8 in September from 56.1 in

the previous month, the inventories indicator declined to 44.1 from 50.9 and

the supplier deliveries gauge tumbled to 40.7 from 51.3. At the same time, the

prices index increased to 60.3 in September from 57.6 in August.

- UK's internal market bill is a safety net

- We reserve the right to ensure the integrity of UK be protected if no agreement reached

- EU has been constructive recently

- Believe progress can still be made in Joint Committee

- EU has recognized that exit summary declarations are not strictly necessary for the single market integrity

- Transition period should not be extended; time is running out

- We are working very hard to get an agreement with EU

- We will work as hard as we can to see if we can get a deal by October 15

- Obviously as we close on October 15, I will have to advise the PM on whether the conditions of the PM have been met

- The door will never be closed

- We have made quite good progress

- The landing zone is clear but not exactly pinned down

- We need to make progress where there are big gaps

- We await decisions from EU on many areas

- Realistic that we would only get an outline agreement on the main outstanding points

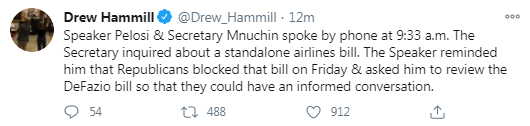

U.S. stock-index futures surged on Wednesday, rebounding from Tuesday’s slide after the U.S. president Donald Trump said he would support "standalone" relief bills for airlines, small businesses and citizens.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,422.82 | -10.91 | -0.05% |

Hang Seng | 24,242.86 | +262.21 | +1.09% |

Shanghai | - | - | - |

S&P/ASX | 6,036.40 | +74.30 | +1.25% |

FTSE | 5,948.62 | -1.32 | -0.02% |

CAC | 4,878.66 | -16.80 | -0.34% |

DAX | 12,841.54 | -64.48 | -0.50% |

Crude oil | $39.70 | -2.39% | |

Gold | $1,892.50 | -0.85% |

- Stretched fiscal situation may hinder full recoveries from COVID

- Work-from-home trend could bring productivity gains in medium term

- Shift to online shopping could bring productivity gains too

- Administration is continuing to have conversations on stimulus that are not leading anywhere

- Democrats' proposals are too high for state and local governments

- He is not optimistic that there will be a compensative stimulus deal, but can do individual bills if House brings them up for a vote

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 164.28 | 2.05(1.26%) | 854 |

ALCOA INC. | AA | 11.92 | 0.25(2.14%) | 7491 |

ALTRIA GROUP INC. | MO | 39.95 | 0.35(0.88%) | 3771 |

Amazon.com Inc., NASDAQ | AMZN | 3,136.50 | 36.54(1.18%) | 72219 |

American Express Co | AXP | 103.35 | 1.59(1.56%) | 2033 |

Apple Inc. | AAPL | 114.49 | 1.33(1.18%) | 1655439 |

AT&T Inc | T | 28.98 | 0.27(0.94%) | 161809 |

Boeing Co | BA | 163.35 | 3.81(2.39%) | 441025 |

Caterpillar Inc | CAT | 153 | 1.47(0.97%) | 8267 |

Chevron Corp | CVX | 73.14 | 0.84(1.16%) | 75345 |

Cisco Systems Inc | CSCO | 38.78 | 0.21(0.54%) | 49877 |

Citigroup Inc., NYSE | C | 45.14 | 0.73(1.64%) | 62255 |

Exxon Mobil Corp | XOM | 33.69 | 0.30(0.90%) | 51204 |

Facebook, Inc. | FB | 260.15 | 1.49(0.58%) | 121816 |

FedEx Corporation, NYSE | FDX | 262.65 | 3.38(1.30%) | 10720 |

Ford Motor Co. | F | 7.13 | 0.15(2.15%) | 224047 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.14 | 0.42(2.67%) | 63549 |

General Electric Co | GE | 6.26 | 0.09(1.46%) | 749046 |

General Motors Company, NYSE | GM | 30.84 | 0.44(1.45%) | 16399 |

Goldman Sachs | GS | 204.94 | 3.85(1.91%) | 7888 |

Google Inc. | GOOG | 1,459.50 | 6.06(0.42%) | 7901 |

Hewlett-Packard Co. | HPQ | 18.88 | -0.08(-0.44%) | 331 |

Home Depot Inc | HD | 281 | 4.53(1.64%) | 9696 |

Intel Corp | INTC | 51.74 | 0.37(0.72%) | 75359 |

International Business Machines Co... | IBM | 123 | 1.03(0.84%) | 1223 |

Johnson & Johnson | JNJ | 147 | 0.74(0.51%) | 4418 |

JPMorgan Chase and Co | JPM | 99.5 | 1.48(1.51%) | 26792 |

McDonald's Corp | MCD | 225.8 | 1.71(0.76%) | 4944 |

Merck & Co Inc | MRK | 80 | 0.37(0.46%) | 30150 |

Microsoft Corp | MSFT | 207.64 | 1.73(0.84%) | 168340 |

Nike | NKE | 128.85 | 1.20(0.94%) | 4441 |

Pfizer Inc | PFE | 36.36 | 0.19(0.53%) | 47216 |

Procter & Gamble Co | PG | 140.48 | 0.87(0.62%) | 1105 |

Starbucks Corporation, NASDAQ | SBUX | 88 | 0.99(1.14%) | 7676 |

Tesla Motors, Inc., NASDAQ | TSLA | 419.37 | 5.39(1.30%) | 594210 |

The Coca-Cola Co | KO | 49.24 | 0.30(0.61%) | 4582 |

Twitter, Inc., NYSE | TWTR | 46.07 | 0.47(1.03%) | 27278 |

Verizon Communications Inc | VZ | 59.79 | 0.33(0.56%) | 5026 |

Visa | V | 203 | 2.55(1.27%) | 9049 |

Wal-Mart Stores Inc | WMT | 141.55 | 0.92(0.65%) | 21041 |

Walt Disney Co | DIS | 121.9 | 0.97(0.80%) | 9459 |

Yandex N.V., NASDAQ | YNDX | 62.4 | 0.52(0.84%) | 3462 |

3M (MMM) upgraded to Hold from Underperform at Gordon Haskett; target $170

Netflix (NFLX) target raised to $650 from $600 at Pivotal Research Group

Amazon (AMZN) target raised to $3800 from $3675 at The Benchmark Company

FXStreet notes that the S&P 500 Index has achieved the Credit Suisse analyst team's target/resistance at 3429/44 and they continue to look for this to cap for now, with support seen at 3348, then 3327/23.

“The S&P 500 has extended its recovery to our recovery target zone, seen starting at the mid-September highs at 3425/29, and stretching up to the 61.8% retracement of the fall from September at 3444. This has capped as expected, with the subsequent sharp rejection resulting in the completion of a bearish ‘reversal day’ (although on relatively muted volume) and this should add weight to our scenario in looking for the unfolding of a lengthier consolidation phase.

“Big picture, we continue to view this as a temporary consolidation ahead of the core uptrend eventually resuming, with a clearer larger base now potentially forming.”

“Immediate support is seen from the lower end of the recent price gap at 3348/47, then, more importantly, the recent lows at 3327/23, which we continue to look to ideally hold. A break though would curtail thoughts of a larger base for now with support then seen next at 3298/93, then 3279.”

- ECB needs to maintain ample stimulus to reach goals

- Ambitious, coordinated fiscal stance remains critical

- Says she sees risk of more divergence in euro area after the coronavirus crisis

- Path of recovery remains a long, uncertain

- Consolidation would strengthen euro area banks

FXStreet notes that the ECB will boost its asset purchases in December, while yield curve control by the Federal Reserve now looks less likely. Economists at Nordea see a clear risk of EUR/USD trading above 1.25 in 2021 as USD weakness is likely to be broad-based against most peers.

“The USD level could be a focal point for the Federal Reserve during 2021 as the USD remains super strong compared to historical averages. A weak USD could be one way of helping inflation higher in the US, why the continued asset purchases from the Fed could work to weaken the USD over time. If we get a synchronized global recovery in 2021 as we anticipate, it usually also leads to a weaker USD against most peers.”

“The ECB has been decently firm in its defence of 1.20 in EUR/USD, why we don’t anticipate that the ECB will allow EUR/USD above such levels until the recovery is more profound than now.”

“The ECB decision to widen the PEPP in December should also work against the EUR in the short-run, why we keep a target of 1.15-1.17 in EUR/USD over the next one-two months before a substantial move higher during 2021.”

USD weakened against most other major currencies in the European session on Wednesday as tweets from the U.S. President Trump about standalone stimulus bills bolstered risk sentiment.

Just hours after ordering White House officials to halt stimulus negotiations with Democrats, the U.S. president Donald Trump tweeted that he would support standalone bills for airline and small business relief as well as for stimulus checks.

"The House & Senate should IMMEDIATELY Approve 25 Billion Dollars for Airline Payroll Support, & 135 Billion Dollars for Paycheck Protection Program for Small Business. Both of these will be fully paid for with unused funds from the Cares Act. Have this money. I will sign now!", Trump tweeted. "If I am sent a Stand Alone Bill for Stimulus Checks ($1,200), they will go out to our great people IMMEDIATELY. I am ready to sign right now. Are you listening Nancy?", he added in a separate tweet.

FXStreet reports that analysts at Credit Suisse note that EUR/USD has been capped at its 55-day average at 1.1792 and a close above here remains needed to suggest the corrective setback is over and broader uptrend resumed. On the flip side, support stays seen at 1.1695/85.

“The strong move higher in EUR/USD has been unable to clear on a closing basis its 55-day average, now at 1.1792, and whilst below here there can remain the risk the corrective phase still has further to run.”

“Support is seen at 1.1724/20 initially, below which can see a fallback to1.1695/85. Removal of this latter area though is needed to add weight to this risk to warn of a more meaningful move lower again for a move back to the 1.1612 recent low and bigger picture, we would still not rule out a move to 1.1495/85, although we would expect this to prove much better support if tested.”

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. rose 4.6 percent in the week ended October 2, following a 4.8

percent decline in the previous week.

According to

the report, refinance applications surged 8.2 percent, while applications to

purchase a home decreased 1.5 percent.

Meanwhile, the

average fixed 30-year mortgage rate dropped from 3.05 percent to record-low 3.01

percent.

“There are

signs that demand is waning at the entry-level portion of the market because of

supply and affordability hurdles, as well as the adverse economic impact the

pandemic is having on hourly workers and low- and moderate-income households,” noted

Joel Kan, an MBA economist. “As a result, the lower price tiers are seeing

slower growth, which is contributing to the rising trend in average loan

balances.”

FXStreet reports that FX Strategists at UOB Group forecast USD/JPY to keep the side-lined trading between 105.00 and 106.00 in the next weeks.

24-hour view: “...USD traded in a relatively quiet manner between 105.45 and 105.78 before closing largely unchanged at 105.62 (-0.09%). The price action offers no fresh clues and USD could continue to trade sideways for now, likely holding within a 105.40/105.80 range.”

Next 1-3 weeks: “Last Friday (02 Oct, spot t 105.55), we indicated that USD ‘is likely to trade between 105.00 and 106.00 for now’. USD subsequently dropped to a low of 104.92 before rebounding quickly and closed slightly lower at 105.33 (-0.16%). Momentum indicators are still mostly ‘neutral’ and the price actions indicate that USD could trade between 105.00 and 106.00 for a while more. Looking forward, USD has to post a daily closing out of the 105.00/106.00 range before a more sustained directional movement can be expected.”

FXStreet notes that the Reserve Bank of Australia decision on Tuesday, October 6 has reinforced the possibility of an easing announcement at the upcoming 3 November rate decision: with several speeches by RBA officials keeping policy expectations in focus between now and the decision, analysts at Credit Suisse see the pre-US elections AUD/USD 0.70 target as still intact.

“The fact that the RBA opted to wait at the 6 Oct meeting reduces to some extent the potential for AUD to trade idiosyncratically later in the year, as investor willingness to take directional views around the decision will be understandably curtailed by the coincident timing of one of the biggest risk events of the year. Nevertheless, in the weeks leading up to the election, we still see potential for RBA expectations to weigh on AUD, especially if the upcoming speeches were to focus more on the possibility of a more structured extension of QE purchases. As such, we remain focused on 0.70 as our tactical AUD/USD pre-election target.”

“The announcement of the 2020-21 budget by the Morrison administration is a less clear FX driver than the RBA decision, but on the margin is likely to be seen as a long-term positive in our view.”

"Ministers, scientists and officials are deeply concerned about the rate at which Covid-19 is increasing in the north west, north east and Yorkshire/Humberside: they believe the daily quantum of infection is doubling every five to seven days in large chunks of northern England," the ITV reported. "Ministers are therefore feeling their way towards imposing more severe restrictions on socialising in those areas. They are likely to impose closure of all hospitality venues - pubs and restaurants - for a period. These new restrictions are most likely to be announced on Monday, although they could come earlier."

- UK stance on state aid in Brexit talks is "very problematic"

- Level playing field is "really serious issue"

- EU's Brexit negotiator Barnier won't enter tunnel without UK state aid move

- Gap on fisheries is "really, really wide"

- UK should not underestimate how strongly EU feels on fishing issue

- A landing zone on fishing is hard to envisage

- No back room talks about extending Brexit transition period

FXStreet reports that FX Strategists at UOB Group still believe USD/CNH could drop and test the 6.7000 area in the next weeks.

Next 1-3 weeks: “Our latest narrative was from last Friday (02 Oct, spot at 6.7600) wherein USD ‘could weaken further but the major support at 6.7165 could be out of reach this time round’. In other words, we did not anticipate the sudden surge in downward momentum as USD plunged to a low of 6.7135 yesterday (05 Oct). From here, further weakness appears likely and the focus now is at the round-number support level of 6.7000. On the upside, the ‘strong resistance’ level has moved lower to 6.7700 from 6.8250.”

CNBC reports that according to Barclays Wealth Chief Investment Officer Will Hobbs, U.S. tech megastocks spearheaded a global market sell-off in September, and a key underlying factor could have been a move higher in real interest rates,

Hobbs suggested that a move higher in real interest rates, particularly in the U.S., had coincided with the sharp downturn for Silicon Valley.

“One of the theories around the current context for markets is that a lot of it is quite dependent on ever-lower real interest rates, because if you think about the valuation of some of these tech titans, think about the shape of their cash flows, they’re sort of like long-duration bonds,” Hobbs said, adding that investors could to some extent project cash flows like annuity revenues.

He argued that much of the popularity of tech growth stocks, those which generate substantial and consistent cash flows while increasing earnings and revenue at a greater pace than their peers, was down to the fact that real interest rates had been steadily falling in recent years.

Although the conditions for a sustainable rise in real interest rates are not present yet, Hobbs suggested that a move higher should not be ruled out given the unprecedented policy environment created by central banks around the world.

Reuters reports that Japan's government upgraded its assessment of the economy on Wednesday for the first time since May 2019 after a key indicator improved for August.

The index of coincident economic indicators rose a preliminary 1.1 points from the previous month to 79.4 in August, the Cabinet Office said.

Based on the index data, the Cabinet Office said that showed economic activity in the world's third-largest economy had stopped contracting, an upgrade from its previous view that the economy was "worsening" in July.

"There is a possibility that the index will grow further this year as there is room for exports, notably auto shipments, and consumer spending to recover," said Koya Miyamae, senior economist at SMBC Nikko Securities.

"The economy overall has been picking up after hitting the bottom around May and a gradual recovery is expected to continue."

FXStreet reports that the EUR/CHF pair will target the June peak at 1.0915 on a break of the 1.0877 recent high, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, reports.

“The July, August and September lows down to 1.0712 have held and while intact scope for recovery to the 1.0850/60 region remains, this is long-term Fibonacci resistance.”

“A close above the 1.0850/60 area and preferably above the 1.0877 recent high is needed to target the 1.0915 June high and the 1.1058 October 2019 high.”

According to the report from Istat, in August 2020 estimates for seasonally adjusted index of retail trade were nearly at pre-pandemic levels, as value rose by 8.2% and volume increased by 11.2% in the month on month series.

In the three months to August 2020, both value and volume showed a strong growth (+22.8% and +22.4% respectively) due to monthly rises in June and August when compared with steep decline occurred over lockdown in March and April.

Compared with August 2019, value of sales was up 0.8% in August 2020, this is the first year on year increase since February 2020, the volume remained unchanged instead.

After decreasing in the previous months, in August 2020 large-scale distribution slightly rose by 0.4%, while small-scale distribution was still negative, dropping by 0.5%. Non-store retail sales were down 3.3% when compared with August 2019.

Online sales strongly grew by 36.8% in the year on year series.

FXStreet reports that economists at MUFG Bank see downside risks for stocks and upside risks for the greenback as the US stimulus hopes fade while Fed concerns rise.

“The prospects of a deal were already diminishing simply given the fact that Republicans themselves in the Senate are divided on the size of another stimulus package. A piecemeal deal that focuses on the areas that please President Trump most and does not address the main concerns of the Democrats will never get through the House and hence, despite this backtrack from Trump offering hope, we see the prospect of a deal diminishing further. So we are somewhat surprised by the level of hope the markets appear to be clinging on to and continue to see downside risks for equities and upside risks for the US dollar.”

“The lack of progress on a deal is all the more alarming when we hear the clarity from the Fed on the need for additional support.”

“Ideally, the Fed would have preferred to have upped QE on the back of additional fiscal stimulus in order to keep yields in check. That would have been a powerful overall policy stimulus, helping drive inflation expectations higher and real yields and the dollar lower. But now the risk is that the Fed is forced into additional QE as a counter to the poor fiscal policy outlook. If that’s what happens, it will not have the same impact on lifting inflation expectations or weakening the US dollar.”

CNBC reports that Finance Minister Mathias Cormann said that after providing initial support for an economy reeling from the coronavirus pandemic, the Australian government is now focusing on the strength of recovery.

“Having provided the initial crisis support to cushion the blow on the economy, on jobs and on working families, what we’re doing now is invest in the strength of our economic recovery moving forward,” Cormann told CNBC.

“Yes, it is a sizeable deficit in an Australian context, but we went into this crisis in a comparatively stronger fiscal position,” he said, adding that even after the planned expenditure and fiscal support measures announced, Australia’s debt position as a share of GDP remains substantially lower than other advanced economies.

When asked if businesses, as they face global uncertainties, would take up the government’s offer and kickstart their investment process, Cormann was optimistic. He said Australia’s economic fundamentals were strong before the pandemic hit and that the country is in Asia Pacific, a part of the world that is set to generate most of the global economic growth in decades to come.

According to the report from Halifax Bank of Scotland, on a monthly basis, house prices in September were 1.6% higher than in August

In the latest quarter (July to September) house prices were 3.3% higher than in the preceding three months (April to June).

House prices in September were 7.3% higher than in the same month a year earlier – the strongest growth since June 2016.

Russell Galley, Managing Director, Halifax, said: “The average UK house price is now approaching £250,000 after September saw a third consecutive month of substantial gains. The annual rate of change will naturally draw attention, with the increase of 7.3% the strongest since mid-2016. Context is important with the annual comparison, however, as September 2019 saw political uncertainty weigh on the market. Few would dispute that the performance of the housing market has been extremely strong since lockdown restrictions began to ease in May. It is highly unlikely that the housing market will continue to remain immune to the economic impact of the pandemic. The release of pent up demand and indeed the stamp duty holiday can only be temporary fillips and their impact will inevitably start to wane. And as employment support measures are gradually scaled back beyond the end of October, the spectre of increased unemployment over the winter will come into sharper relief.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 05:00 | Japan | Coincident Index | August | 78.3 | 79.4 | |

| 05:00 | Japan | Leading Economic Index | August | 86.7 | 88.8 | |

| 06:00 | Germany | Industrial Production s.a. (MoM) | August | 1.4% | 1.5% | -0.2% |

| 06:45 | France | Trade Balance, bln | August | -7 | -7.7 | |

| 07:00 | Switzerland | Foreign Currency Reserves | September | 848.3 | 873.5 |

During today's Asian trading, the dollar fell slightly against the euro and rose moderately against the yen on news of the suspension of discussions on new measures to support the US economy. At the same time, the dollar fell against the pound and the australian dollar.

On Tuesday evening, Donald Trump announced on Twitter his decision not to negotiate a new economic stimulus package before the presidential election scheduled for November 3.

Earlier on Tuesday, US Fed Chairman Jerome Powell warned of risks to the country's economy due to the lack of new stimulus. "Insufficient support will lead to a weak recovery and create unnecessary difficulties for households and businesses," he said.

On Wednesday, traders are waiting for the publication of the minutes of the September meeting of the Federal open market Committee (FOMC) of the US Fed

The pound rose against the dollar and the euro. Traders continue to monitor the negotiations between London and Brussels. The European Union is ready to continue negotiations in November and December, or even allow British Prime Minister Boris Johnson to interrupt the discussions, rather than compromise, a senior EU diplomat said. Johnson is already softening his demands, saying that October 15, when the EU summit begins, is the deadline not for concluding an agreement, but for determining whether it is possible.

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, expects further GBP/USD losses to 1.2445 after seeing failure at the 1.3000/70 zone.

“GBP/USD has tested and seen initial failure at 1.3008, the mid-September high. The market charted an outside day to the downside and although we are unable to rule out a slightly deeper move to 1.3070, this seems less likely.”

“Should the market fail in the 1.3000/70 zone as expected, we should see further losses to 1.2445 and then 1.2250/00.”

“Only above the 1.3080 level would somewhat neutralise our outlook.”

FXStreet reports that the analysts at Bank of America Global Research upgraded their end-2020 price target for NZD/USD to 0.6400.

"The NZD is likely to be driven by external factors, particularly the coronavirus situation and global recession. China remains New Zealand's largest trading partner and the first order impact on tourism, and to a lesser extent education services, has been evident.

"We revise up our end-2020 target for NZD/USD to 0.64 (from 0.62) but continue to expect depreciation into year-end given the RBNZ remains among the most dovish G10 central banks, as well as our stronger USD forecast.”

According to the report from the Federal Statistical Office (Destatis), in August 2020, production in industry was down by 0.2% on the previous month on a price, seasonally and calendar adjusted basis. Economists had expected a 1.5% increase.

Compared with August 2019, the decrease in calendar adjusted production in industry amounted to 9.6%.

The corona crisis has affected the development in manufacturing for several months now. Compared with February 2020, the month before restrictions were imposed due to the corona pandemic in Germany, new orders in July 2020 were 10.8 % lower in seasonally and calendar adjusted terms.

In August 2020, production in industry excluding energy and construction was down by 0.7%. Within industry, the production of intermediate goods showed an increase by 3.3%. The production of consumer goods decreased by 1.3% and the production of capital goods by 3.6%. Outside industry, energy production was up by 6.7% in August 2020 and the production in construction decreased by 0.3%.

Production in the automotive industry - the largest branch of manufacturing - fell by 12.5% on the previous month in August, following an increase of 8.9% in July. This means that it was by just under 25% below the level of February 2020.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1858 (3130)

$1.1820 (2365)

$1.1778 (611)

Price at time of writing this review: $1.1739

Support levels (open interest**, contracts):

$1.1692 (2647)

$1.1648 (2718)

$1.1599 (3464)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 9 is 70482 contracts (according to data from October, 6) with the maximum number of contracts with strike price $1,1900 (4980);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3152 (1542)

$1.3059 (376)

$1.2982 (855)

Price at time of writing this review: $1.2897

Support levels (open interest**, contracts):

$1.2820 (921)

$1.2783 (1082)

$1.2741 (835)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 16270 contracts, with the maximum number of contracts with strike price $1,3150 (1542);

- Overall open interest on the PUT options with the expiration date October, 9 is 18561 contracts, with the maximum number of contracts with strike price $1,3150 (2620);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 41.52 | 1.37 |

| Silver | 22.94 | -5.83 |

| Gold | 1877.37 | -1.87 |

| Palladium | 2337.24 | -0.99 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 121.59 | 23433.73 | 0.52 |

| Hang Seng | 212.87 | 23980.65 | 0.9 |

| KOSPI | 7.9 | 2365.9 | 0.34 |

| ASX 200 | 20.5 | 5962.1 | 0.35 |

| FTSE 100 | 7 | 5949.94 | 0.12 |

| DAX | 77.71 | 12906.02 | 0.61 |

| CAC 40 | 23.59 | 4895.46 | 0.48 |

| Dow Jones | -375.88 | 27772.76 | -1.34 |

| S&P 500 | -47.65 | 3360.95 | -1.4 |

| NASDAQ Composite | -177.89 | 11154.6 | -1.57 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 (GMT) | Japan | Coincident Index | August | 78.3 | |

| 05:00 (GMT) | Japan | Leading Economic Index | August | 86.7 | |

| 06:00 (GMT) | Germany | Industrial Production s.a. (MoM) | August | 1.2% | 1.5% |

| 06:45 (GMT) | France | Trade Balance, bln | August | -6.99 | |

| 07:00 (GMT) | Switzerland | Foreign Currency Reserves | September | 848.3 | |

| 07:30 (GMT) | United Kingdom | Halifax house price index | September | 1.6% | |

| 07:30 (GMT) | United Kingdom | Halifax house price index 3m Y/Y | September | 5.2% | |

| 12:10 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 14:00 (GMT) | U.S. | Fed Barkin Speech | |||

| 14:00 (GMT) | Canada | Ivey Purchasing Managers Index | September | 67.8 | |

| 14:30 (GMT) | U.S. | Crude Oil Inventories | October | -1.98 | 0.4 |

| 18:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 18:00 (GMT) | U.S. | FOMC meeting minutes | |||

| 18:15 (GMT) | U.S. | FOMC Member Kashkari Speaks | |||

| 19:00 (GMT) | U.S. | Consumer Credit | August | 12.25 | 14 |

| 19:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 20:30 (GMT) | U.S. | FOMC Member Charles Evans Speaks | |||

| 23:50 (GMT) | Japan | Current Account, bln | August | 1468.3 | 1983.7 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71003 | -1.09 |

| EURJPY | 123.908 | -0.51 |

| EURUSD | 1.17318 | -0.41 |

| GBPJPY | 135.974 | -0.84 |

| GBPUSD | 1.28736 | -0.76 |

| NZDUSD | 0.65826 | -0.83 |

| USDCAD | 1.33118 | 0.41 |

| USDCHF | 0.91802 | 0.31 |

| USDJPY | 105.611 | -0.09 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.