- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-08-2022

- NZD/USD struggles to defend buyers inside monthly rising wedge bears formation.

- Steady RSI, receding bullish bias of MACD tease sellers.

- Previous resistance line from April adds to the downside filters.

- Bulls have a bumpy road to the north unless crossing 0.6565 hurdle.

NZD/USD retreats towards 0.6250, fading the bounce off 21-DMA inside a one-month-old rising wedge bearish pattern amid Thursday’s initial Asian session.

In addition to the latest failures to defend buyers, the steady RSI (14) and the receding bullish bias of the MACD also teases the NZD/USD sellers.

However, a clear downside break of the aforementioned rising wedge’s support line, at 0.6245 by the press time, appears necessary for the bears.

Even so, the 21-DMA and the resistance-turned-support line from April, respectively around 0.6215 and 0.6100, could challenge the NZD/USD downside momentum before highlighting the yearly low marked in July at around 0.6060.

Alternatively, recovery moves may aim for the 0.6300 round figure ahead of the stated wedge’s upper line, close to 0.6380 at the latest.

Following that, highs marked in mid-June and a two-month-old horizontal resistance line, near 0.6400 and 0.6570 in that order, will be crucial hurdles to watch.

To sum up, NZD/USD buyers have limited upside room while the sellers can easily retake control.

NZD/USD: Daily chart

Trend: Pullback expected

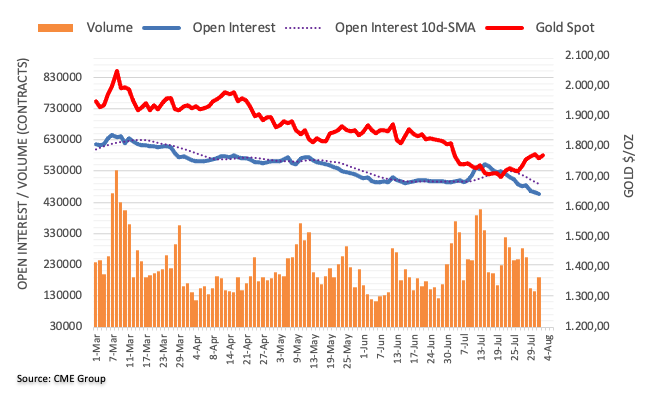

- Gold price is turning to a balanced auction profile ahead of US NFP data.

- Soaring interest rates and a halt in the recruitment process by US firms will weigh on job opportunities.

- A preliminary estimate for the US NFP is 250k, lower than the prior release of 372k.

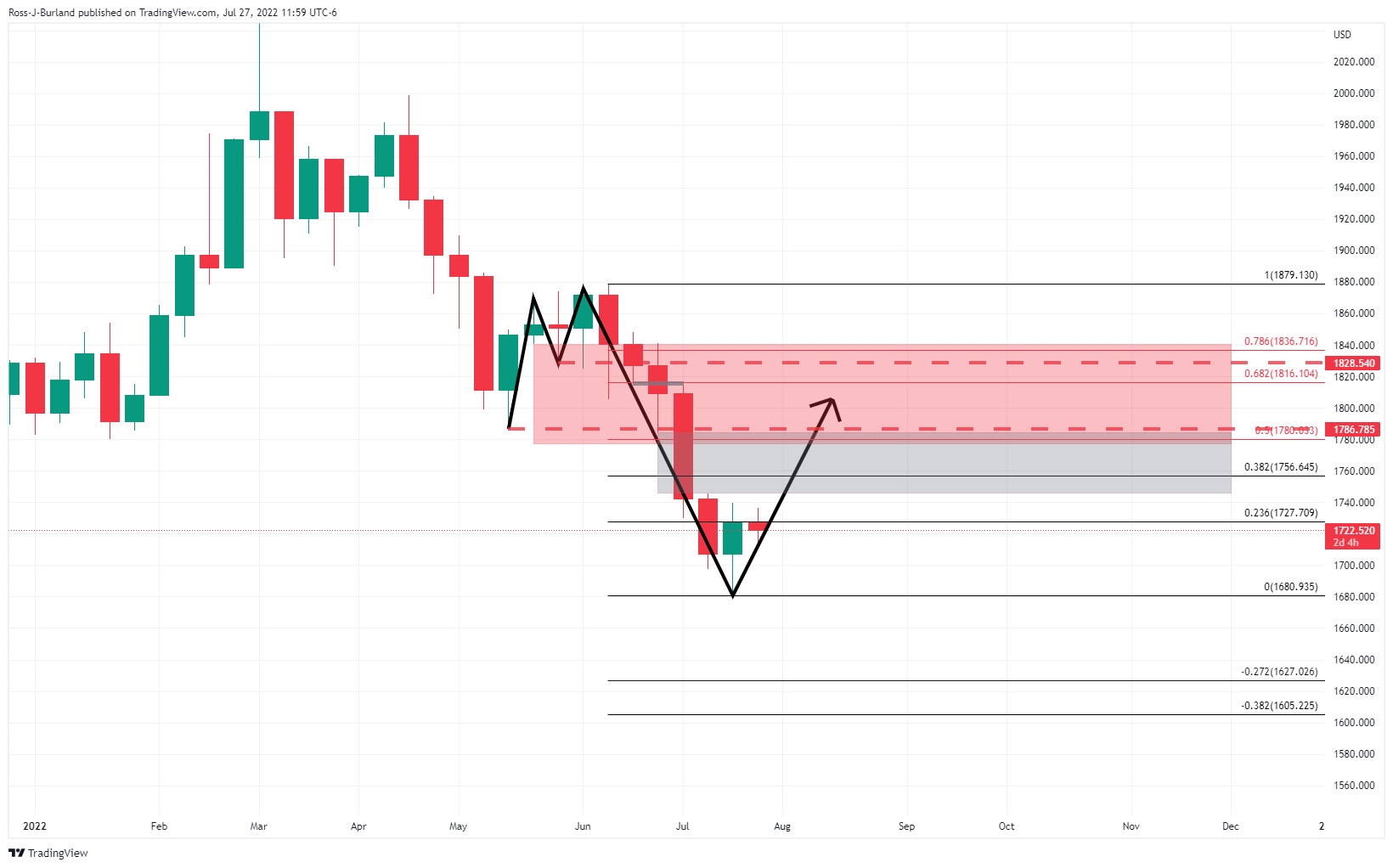

Gold price (XAU/USD) is displaying topsy-turvy moves above the immediate cushion of $1,760.00 in the early Asian session. Earlier, the precious metal displayed a responsive buying action after hitting a low of $1,756.00 on Wednesday. The bright metal defended its two-day low and has climbed to near $1,764.00. Going forward, the FX domain will prepare a base for the release of the US Nonfarm Payrolls (NFP), which will determine the further direction for the asset.

There is no denying the fact that rising interest rates by the Federal Reserve (Fed) have forced the corporate players to inculcate extra filters while scrutiny of the investment opportunities. Firms are doing a lot of brainstorming before investing costly dollars in projects. This has accelerated the odds of serious damage to the job creation process.

Apart from that, commentaries from giant techs discussing halting the recruitment process for the remaining year will result in a steep fall in employment opportunities. Therefore, investors have estimated 250k job additions in the labor market in the month of July against June’s print of 372k. A vulnerable figure from this number could drive gold prices significantly higher.

Gold technical analysis

On a four-hour scale, the gold prices will find significant bids near the lower portion of the Rising Channel placed from July 21 low at $1,681.87 while the upper portion is plotted from July 22 high at $1,739.37.

The gold prices are overlapping with the 200-period Exponential Moving Average (EMA) at $1,764.11, which indicates a make-or-break scenario for the gold bulls. While the 50-EMA at $1,752.16 is advancing will indicates an upside ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range, which indicates a consolidation ahead.

Gold four-hour chart

- AUD/JPY climbs almost 0.07% as the Asian session begins.

- An ascending wedge in the hourly chart might exert downward pressure on the pair.

- A break above 93.30 will find solid resistance around 93.70-85.

The AUD/JPY snaps four straight days of losses and escalates above the 100-day EMA at 92.73 as the Asian Pacific session begins. On Wednesday, the AUD/JPY started trading near the day’s lows at 91.72 before rallying towards the daily high at 93.225, for a gain of almost 150 pips. At the time of writing, the AUD/JPY is trading at 93.09.

AUD/JPY Price Analysis: Technical outlook

In the daily chart, the AUD/JPY trades within the boundaries of a descending channel and sits at the mid-central line, shy of the August 3 high at 93.22. Although the price is above the 100-day EMA, keeping the neutral-to-upwards bias intact, the Relative Strength Index (RSI) oscillates in bearish territory, signaling sellers could be leaning around the aforementioned area.

A break above 93.23 would pave the way for buyers to test the confluence of the 20 and 50-day EMAs around 93.73-82.

Otherwise, if AUD/JPY buyers struggle and the pair tumbles below 93.00, a fall towards the 100-day EMA at 92.73 is on the cards.

AUD/JPY 1-hour chart

In the near term, the AUD/JPY is neutral to downwards biased. Worth noting that although trending up for the last couple of days, price action formed an ascending-wedge, with bearish implications. Additionally, AUD/JPY sellers are lurking around solid resistance in the 93.31-93.60 area, a confluence of the August 1 high and the 200-hour EMA.

A break below the ascending-wedge bottom trendline will exacerbate a fall towards the daily pivot at 92.70. Once cleared, the cross could tumble towards the confluence of the S1 pivot and the 50-hour EMA at 92.05.

AUD/JPY Key Technical Levels

- USD/CAD holding up in the 1.2830s and a correction to mitigate the price imbalance between spot and 1.2865.

- Bears need a break of 1.2820 with the downside price imbalance between 1.2800 and 1.2780 then eyed.

As per the prior analysis, USD/CAD Price Analysis: Bulls eye 1.2880 but bears are lurking, the bulls have moved in for a deeper test of the bear's commitments but have since come under pressure. The focus is on the downside at this juncture for a daily extension.

USD/CAD daily chart, prior analysis

The daily chart's support structure near 1.2820 was pierced in a firm bearish impulse that took the price down to 1.2770 before it corrected at the start of the week. However, it was stated that ''so long as the 1.2900 area remains intact, the focus is on the downside with 1.26 and below eyed.''

USD/CAD H1 chart, prior analysis

Meanwhile, the near-term price action was corrective and bullish according to the analysis on the hourly chart. 1.2880 was residing in an area of the imbalance of price which was anticipated to mitigate in due course so long as 1.2820 held up against any bearish meanwhile pressures.

USD/CAD H1, live market

The price indeed moved in on the prior price imbalances and has since moved sideways in a bumpy ride and consolidative phase. There is little bias to go on although there has been a lower high of late printed. The price is holding up in the 1.2830s and a correction to mitigate the price imbalance between spot and 1.2865 could result in further supply in order to break down the support of 1.2820. In doing so, this will leave the price imbalance between 1.2800 and 1.2780 exposed.

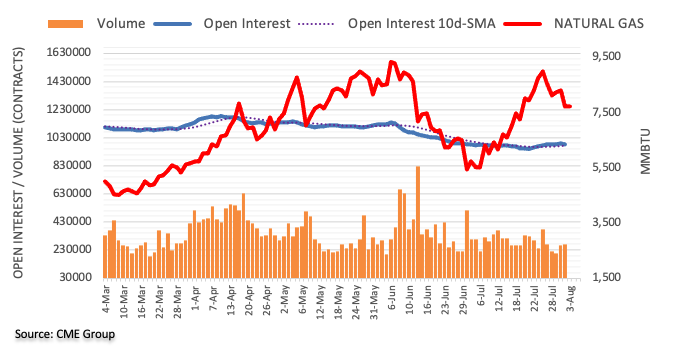

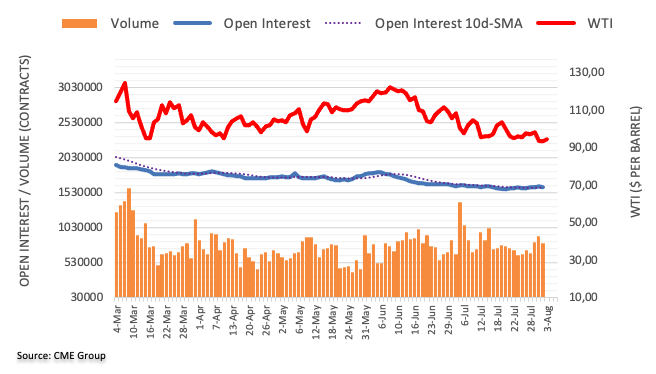

- WTI crude oil picks up bids to consolidate recent losses at three-week low.

- OPEC+ delivered 100,000 bpd output increase on Wednesday.

- EIA weekly inventories marked surprise build amid fall in exports, lower run of refiners.

- Risk catalysts will be crucial for near-term directions.

WTI crude oil traders lick their wounds near the lowest levels since three weeks, picking up bids to $90.50 during Thursday’s Asian session.

The black gold slumped to the multi-day low the previous day after the weekly stockpile data from the US Energy Information Administration (EIA) marked a notable increase in inventories. In doing so, the commodity prices failed to respect the Organization of the Petroleum Exporting Countries (OPEC) and allies, collectively known as OPEC+, verdict on the output increase.

Reuters cited multiple sources familiar with the matters while confirming that the OPEC+ leaders have agreed to raise the oil output by 100,000 barrels per day (bpd) in September. In a statement published following its meeting, OPEC said that insufficient investment will impact the availability of adequate oil supply to meet growing demand beyond 2023, as reported by Reuters.

Elsewhere, the EIA statement mentioned that the US crude oil inventories rose unexpectedly last week as exports fell and refiners lowered their runs, while gasoline stocks also posted a surprise build as demand slowed, per Reuters. “Crude inventories rose by 4.5 million barrels in the week to July 29 to 426.6 million barrels, the EIA said, compared with analysts' expectations in a Reuters poll for a 600,000-barrel drop,” stated the news.

It’s worth noting that the US-China tussles over Taiwan jostle with the recently hawkish Fedspeak and firmer US data, as well as recession fears to confuse the oil traders. As a result, the latest rebound in the black gold appears less convincing.

To sum up, the energy benchmark prices may remain depressed around the multi-day low despite the recent recovery.

Technical analysis

WTI’s corrective pullback needs validation from the 200-DMA resistance near $94.20, until then the odds of witnessing further downside towards the latest swing low, around $88.35, can’t be ruled out.

- USD/CHF has picked bids around 0.9600 after a healthy correction.

- The DXY surrendered gains after the release of the upbeat US ISM Services data.

- This week, the release of the US NFP will be the key event for the FX domain.

The USD/CHF pair has attempted a rebound after a corrective action towards the critical support of 0.9600. The asset is likely to display a sideways move for a while, however, the upside will remain favored as the Swiss Consumer Price Index (CPI) remained flat at 3.4%.

Investors were expecting an improvement in Swiss CPI to 3.5%, however, the data remained unchanged at 3.4%. Well, this doesn’t trim the odds of a rate hike by the Swiss National Bank (SNB) ahead, but hawkish guidance will get hurt badly.

Meanwhile, the US dollar index (DXY) surrendered its entire Wednesday’s gains after Wall Street capitalized on the upbeat US Institute of Supply Management (ISM) Services data. NASDAQ displayed 2.60% gains as US ISM Services New Orders Index gained to 59.9, solid than the former release of 55.6. This indicates that the demand for services will remain resilient going ahead. A firmer rebound in the risk-on impulse forced the DXY to surrender its intraday gains.

This week, investors’ entire focus will remain on the US Nonfarm Payrolls (NFP) data. As per the market estimates, the US economy has failed to outperform June’s job additions numbers and has added 250k jobs in the labor market in July. Also, the Unemployment Rate is seen flat at 3.6%. The commentary from big US corporate players indicated that the firms have halted their recruitment process for the remaining year, whose consequences will be displayed in the labor market data.

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, recovered to 2.50% after a two-day downtrend by the end of Wednesday’s North American session. With this, the inflation gauge reverses the pullback from the highest levels since June 27.

It’s worth noting that the market’s latest fears of inflation took clues from the US activity numbers for July. Recently, US ISM Services PMI for July rose to 56.7 from 55.3 prior and the market expectation of 53.5. On the other hand, the Final reading of the US S&P Global Services PMI for July dropped to 47.3, marking the first contraction in two years, from 52.7 in June and the flash estimate of 47.

Given the firmer inflation expectations and the US Fed policymakers’ determination for higher rates, the market sentiment could fade the latest optimism amid fears of the Fed’s aggression amid the economic slowdown chatters. Also challenging the latest cautious optimism is the US-China tussles over Taiwan.

However, major attention will be given to Friday’s US Nonfarm Payrolls (NFP) for fresh impulses, which in turn keeps the traders on their toes ahead of the release.

Also read: Forex Today: Wall Street saved the day

- GBP/JPY grinds higher during three-day rebound from a 10-week low.

- 50-EMA, fortnight-old horizontal hurdle guards immediate upside.

- Convergence of 61.8% Fibonacci retracement level, 200-EMA appears a tough nut to crack for the bulls.

- 20-EMA, weekly support line could challenge pullback moves.

GBP/JPY bulls struggle to keep reins around 162.60 as traders await the key Bank of England (BOE) Monetary Policy decisions during the Asian session on “Super Thursday”.

Also read: Bank of England Preview: Bailey to deal blow to pound with dovish hike, what to watch for

A convergence of the 50-EMA and a horizontal resistance from July 22 appears to challenge the pair buyers of late. However, steady RSI and bullish MACD signals hint at the quote’s further upside.

It’s worth noting that the GBP/JPY bull’s dominance beyond the 50-EMA level of 162.85 and the aforementioned horizontal resistance near 163.00-05 won’t be too long. That said, a convergence of the 200-EMA and the 61.8% Fibonacci retracement of July 27 to August 02 move, near 163.70, appears a tough nut to crack for the pair buyers.

Should the GBP/JPY prices rise beyond 163.70, the odds of witnessing a run-up towards the late July swing high of 165.28 can’t be ruled out.

Alternatively, pullback remains elusive until the quote stays above the weekly support line and the 20-EMA, respectively around 162.30 and 162.15.

Following that, the 23.6% Fibonacci retracement level could act as the last defense for the GBP/JPY bulls before directing them to the monthly low of 159.44.

GBP/JPY: Four-hour chart

Trend: Limited upside expected

- A bearish megaphone formation accelerates the odds of a downside bias.

- The RSI (14) is attempting a downside break of 40.00, which will strengthen the greenback bulls.

- A bear cross, represented by the 20-and 50-period EMAs, adds to the downside filters.

The EUR/USD pair has turned sideways after a juggernaut rally from Wednesday’s low at around 1.0130. The asset is oscillating in a 1.0163-1.0172 range but is likely to behave volatile ahead. Also, the asset defended its weekly lows on Wednesday, which signals the availability of buying interest at lower levels.

On a four-hour scale, the asset is auctioning in a bearish megaphone chart pattern that indicates a volatility contraction but in a wider range. The upward sloping trendline of the above-mentioned chart pattern is placed from July 28 high at 1.0234 while the horizontal support is plotted from July 28 low at 1.0114.

A bear cross represented by 20-and 50-period Exponential Moving Averages (EMAs) at 1.0194 adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range. The momentum oscillator is attempting a break below 40.00, which will intensify the downside momentum.

A downside break of a two-week low at 1.0100 will drag the asset towards July 14 high and low at 1.0050 and 0.9952 respectively.

On the contrary, the shared currency bulls could defend the downside bias and send the asset towards July 1 low at 1.0366, followed by July 4 high at 1.0463, if the asset manages to overstep Tuesday’s high at 1.0294.

EUR/USD four-hour chart

-637951624092598936.png)

- AUD/USD fades bounces off seven-day low, sidelined of late.

- Firmer sentiment, US dollar weakness favored bulls but fears surrounding Fed’s aggression, Sino-American tension probe upside moves.

- Mixed Aussie data also played its role in challenging the bulls.

- Australia/US trade numbers for June, Fedspeak could direct intraday moves but risk catalysts are more important.

AUD/USD seesaws around mid-0.6900s, after bouncing off the weekly low, as traders await fresh clues during the initial Asian session on Thursday.

The Aussie pair’s earlier rebound could be linked to the firmer equities and softer US dollar while the latest inaction seems to portray the anxiety ahead of the key trade numbers from Australia and the US, not to forget traders’ confusion amid mixed signals.

Wall Street managed to post notable gains on strong earnings and the US dollar’s failure to remain firmer, mainly due to receding economic fears emanating from China. The reason could be linked to the strong China Caixin Manufacturing PMI.

However, downbeat Aussie data and the firmer US data challenged the AUD/USD bulls afterward. That said, Australia’s July AIG Performance of Construction Index fell to 45.3 from 46.2 whereas S&P Global Services PMI improved to 50.9 versus 50.4 prior. On the other hand, US ISM Services PMI for July rose to 56.7 from 55.3 prior and the market expectation of 53.5. On the other hand, the Final reading of the US S&P Global Services PMI for July dropped to 47.3, marking the first contraction in two years, from 52.7 in June and the flash estimate of 47.

Elsewhere, St. Louis Federal Reserve Bank President James Bullard said, “(There is) still some ways to go to get to a restrictive monetary policy." The policymaker adds that he still wants to get to 3.75 to 4% this year while showing a preference for the type of frontloading.

On a different page, the US-China tussles over Taiwan escalated and tamed the risk-on mood. On the same line was a cautious mood ahead of today’s trade numbers and Friday’s US employment data.

Amid these plays, the equities were firmer and the Treasury yields dropped, which in turn drowned the US dollar.

Moving on, Australia’s Trade Balance for June, expected 14,000M versus 15,965M prior, will be the immediate catalyst for the AUD/USD traders ahead of the US Good and Services Trade Balance for the said month, expected $-80.1B versus $-85.5B prior.

Technical analysis

Despite bouncing off the 21-DMA support surrounding 0.6890, AUD/USD bears remain hopeful until witnessing a clear upside break of the support-turned-resistance line from July 14, around 0.7000 by the press time.

“Foreign secretary Liz Truss, a frontrunner in the race to become the next British prime minister, said she would look to change the Bank of England’s mandate to ensure it controlled inflation,” said the Financial Times (FT) during early Thursday morning in Asia.

The news also mentioned, “Speaking at a hustings of Conservative party members in Cardiff on Wednesday, she argued that inflation had been caused by “huge” supply side shocks after the pandemic and the Ukraine war and said she wanted to review the mandate of the central bank, which has a target of maintaining 2 percent inflation.”

Additional quotes

The best way of dealing with inflation is monetary policy and what I have said is I want to change the Bank of England’s mandate to make sure in the future it matches some of the most effective central banks in the world at controlling inflation.

The last time the mandate was looked at was in 1997 under Gordon Brown. Things are very, very different now.

What is simply wrong at this time is to be putting taxes up on ordinary people when they’re struggling to pay their fuel bills, they’re struggling to pay their food bills.

Her campaign received a boost on Wednesday when former health secretary Sajid Javid offered his support. In a comment piece in the Times newspaper, Javid praised the foreign secretary’s ‘sharp focus and willingness to challenge the status quo’.

Recent YouGov polling has placed Truss firmly ahead in the leadership race, with 69 percent of members favoring the foreign secretary, compared with 31 percent backing former chancellor Rishi Sunak.

GBP/USD retreats towards 1.2100

The news appeared to have helped the GBP/USD bears in posting the three-day downtrend as the quote remains pressured around 1.2140 after two consecutive days of south-run.

- EUR/JPY rallied 0.50%, trimming its weekly losses to 0.09%.

- A risk-on impulse capped the EUR/JPY rally above 136.40.

- In the near term, the EUR/JPY is neutral-upward, but a break below 136.00 will expose the pair to selling pressure.

The EUR/JPY begins the Asian session slightly up, extending its gains to three days in a row. On Wednesday, the cross-currency hit a daily high at 136.42 but retraced and closed the trading session around 136.05, gaining 0.50%. At the time of writing, the EUR/JPY is trading at 136.09.

Investors sentiment is upbeat after snapping a two-day drop. US equities registered solid gains between 1.29% and 2.73%. Meanwhile, Asian stock markets prepare for a higher open, while the EUR/JPY sellers remain hopeful as the USD/JPY slides, thus strengthening the yen.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart illustrates a neutral bias. Though buyers regained some control in the last couple of days, resistance ahead with the 100-day EMA at 137.83 and July’s 8 low shifted resistance at 136.85 would be difficult hurdles to pass, as buyers target a re-test of the July 21 high at 142.32.

Upside, the EUR/JPY first resistance will be 136.42. Break above will pave the way for further gains ahead of the 100-day EMA. On the other hand, the EUR/JPY path of least resistance is downwards, further cemented by the RSI sitting in bearish territory, beginning to aim lower. So a breach below 136.00 could send the pair sliding towards 135.00.

EUR/JPY 1-hour chart

The EUR/JPY 1-hour chart is neutral-to-upward biased, but the cross faces resistance at a 13-day-old downslope resistance trendline near the exchange rate. Nevertheless, the Relative Strength Index (RSI) is in bullish territory but crossed under its RSI’s 7-hour SMA and is aiming lower, meaning a drop towards the confluence of the 20-hour EMA and the daily pivot point at 135.82 is on the cards.

Therefore, the EUR/JPY first support would be 135.82. Once cleared, sellers’ next support will be the confluence of the 50-hour EMA and the S1 pivot at 135.13, followed by the August 2 low at 134.82.

EUR/JPY Key Technical Level

- GBP/USD is struggling to surpass the immediate hurdle of 1.2150 after a pullback move.

- An expectation of a 50 bps rate hike by the BOE is not sufficient to offset the soaring inflation rate.

- The upbeat US ISM Services PMI data has improved the risk appetite of investors.

The GBP/USD pair is struggling to cross the immediate hurdle of 1.2150 after a minor pullback from 1.2100. The asset is likely to behave volatile as investors are awaiting the announcement of the interest rate decision by the Bank of England (BOE).

Considering the market expectations, the BOE will announce a rate hike by 50 basis points (bps). Featuring a rate hike by half of a percent by BOE Governor Andrew Bailey will push the interest rates to 1.75%. It is worth noting that price pressures in the UK area have climbed to 9.4%. Also, the inflation rate has not shown any sign of exhaustion yet, which indicates that the new normal 50 bps rate hike is not sufficient to offset the accelerating inflationary pressures.

Meanwhile, the US dollar index (DXY) surrendered its entire gains on Wednesday and settled flat despite the upbeat US Institute of Supply Management (ISM) Services data. The economic data landed at 56.7, higher than the estimates of 53.5 and the prior release of 55.3. Also, the US ISM Services New Orders Index was released at 59.9, lower than the consensus of 60.5 but remained solid than the former release of 55.6.

The upbeat US ISM Services economic data indicated that the demand is resilient and sent the tech stocks on fire. This tech-savvy index NASDAQ rose 2.59% and improved the risk appetite of investors swiftly.

Going forward, the US Nonfarm Payrolls (NFP) data will be the key event this week. A preliminary estimate for the employment generation is 250k, lower than the prior release of 372k.

- NZD/USD little changed compared to levels prevailing over employment data.

- Traders look to US Nonfarm Payrolls this Friday followed by US Consumer Price Index on August 10.

At 0.6270, NZD/USD is higher by some 0.34%, rising from a low of 0.6212 to a high of 0.6281. The kiwi has been pushed and pulled following the key second quarter Unemployment data that was released in the prior Asian session.

''NZ’s Q2 unemployment rate may have come in a little higher than we (or the Reserve Bank of New Zealand) were expecting, but in our view that doesn’t matter for the monetary policy outlook,'' analysts at ANZ Bank said.

''Flat employment growth despite still-high demand for labour suggests the economy has run out of labour resource to keep growing, and with wage inflation running higher than anyone was expecting, these data suggest pipeline domestic Consumer Price Index inflation pressures are far too strong.''

''The risk of a wage-price spiral clearly isn’t any lower despite the small lift in the unemployment rate. In fact, with average hourly earnings growth at 7% YoY (vs CPI inflation at 7.3%), the RBNZ should be very worried about high domestic inflation sticking around long after global inflation (ie tradables) has slowed.''

US dollar mixed

Meanwhile, greenback has dropped from the 109 area down to a recent low of 105.97 over the course of two weeks. Nevertheless, a trio of Fed officials signalled on Tuesday the central bank remains "completely united" on increasing rates to a level that will put a dent in the highest US inflation since the 1980s. This has given the greenback a booster and lifted it to 106.819 over the course of the past few sessions.

San Francisco Fed President Mary Daly said on Wednesday that 50 basis points would be a reasonable thing to do in September. ''We have a lot in the pipeline in tightening but yet to see that in data showing a slowing of the economy, but if we see inflation roaring ahead undauntedly then perhaps 75 be more appropriate.'' US rate futures pared back 75bp view in Sept after Fed's Daly comments.

Looking ahead, the US Nonfarm Payrolls this Friday followed by Consumer Price Index on August 10 will help to iron out the creases in the greenback. The consensus for Nonfarm Payrolls is 250k. That is down from 372k in June. The Unemployment Rate is expected to fall in at 3.6%.

- Gold is holding up in the face of stronger stocks despite a firm US dollar.

- US yields slide into the closing hour of the US session.

Gold prices have been pushed and pulled on Wednesday, oscillating in and out of the hands of bulls and bears. At $1,765, the yellow metal is trading between $1,754.35 and $1,772.83, trading in the green by some 0.27%.

In futures, gold for December delivery closed down US$13.30 to settle at US$1,776.40 per ounce as US bond yields rose along with the greenback. While there is some relief over geopolitical worries that have eased since US House Speaker Nancy Pelosi ended her visit to Taiwan, there remains an underbelly of risk-off in markets with the Asian power boosting military activity around Taiwan to show its displeasure with Pelosi's move.

Earlier in the day, US Treasuries continued yesterday’s sell-off as markets are digesting the comments from Federal Reserve speakers that the central bank’s job on containing inflation isn’t done yet. ''The short covering rally is running out of steam. Fed Chair Powell catalyzed a short covering rally by tying another "unusually large" 75bp hike to data, which places a high bar for another jumbo-sized hike given the slowing trend in data,'' analysts at TD Securities said.

''However, on the other hand, we see risks that Fed speakers can push back against market expectations for an early Fed pivot. In that sense, the yellow metal may be hard pressed to receive another bullish catalyst that would spark a change in momentum trend signals and see CTAs cover their shorts.''

US yields give back gains

On the day, stronger US data also helped the move in US yields, bearish for gold since it offers no interest. However, the yield on the US 10-year note was last around 2.708%, down from the highs of 2.849% which enabled the yellow metal to climb in the remaining hour of the US forex session into the roll-overs. At the same time, equities pushed higher, helped by solid earnings results and stronger data. US factory orders for June were stronger than expected, rising 2% MoM vs. the expected: 1.2% and prior 1.8%. Durable goods orders also beat expectations, rising 2% vs. the expected 1.9% and previous 0.9%. Meanwhile, US Services ISM beat expectations, rising to 56.7 vs. the expected 53.5 vs. the previous 55.3. ''Taken together, the data may unwind some of the more negative sentiment that has surrounded the outlook for the US economy of late,'' analysts at ANZ Bank said.

Meanwhile, the analysts at TD Securities argued that ''gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold. We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and we expect the recent rally will ultimately fade.''

Gold technical analysis

As per the prior analysis, Gold Price Forecast: XAU/USD bulls are back in play, it was explained that the price was running higher in a correction of the weekly M-formation:

The grey area was a price imbalance that has now been mitigated by a 50% mean reversion:

There are prospects for further upside with the 68.2% Fibonacci meeting prior structure around $1,800. However, there is some mean while resistance to break on the 4-hour chart as follows:

- USD/JPY grinds higher though struggles around resistance at 134.00.

- US Treasury bond yields retrace from daily highs, putting a lid on the USD/JPY upward move.

- The USD/JPY is upward biased in the near term, but a break above the 200-hour EMA is needed to pave the way towards 136.50s.

The USD/JPY advances sharply during the North American session, underpinned by high US Treasury yields, up 0.66% on an upbeat sentiment trading day, courtesy of US House Speaker Pelosi leaving Taiwan, while US equities remain in the positive, bolstered by companies earnings. At the time of writing, the USD/JPY is trading at 133.95.

USD/JPY Price Analysis: Technical outlook

The USD/JPY is neutral-to-upward biased, but it’s facing solid resistance at134.57, the 50-day EMA. Even though buyers regained control, the Relative Strength Index (RSI) is still in negative territory, which means that sellers lost steam and could re-enter with confidence. Still, they will need a daily close below 134.00 to remain hopeful of lower prices.

USD/JPY 1-hour chart

In the hourly chart, the USD/JPY is neutral-to-upward biased. The hourly EMAs are located below the exchange rate, except for the 200-hour EMA at 134.58, which would be difficult resistance to hurdle. Nevertheless, price action in the last couple of days, breaking the August 1 daily high at 133.56, exacerbated the rally towards weekly highs at 134.54. That said, the USD/JPY in the near term is headed up.

Therefore, the USD/JPY’s first resistance would be the 200-hour EMA around 134.58. Break above will expose the R2 daily pivot at 135.00, followed by the July 27 daily high at 136.57. On the flip side, the USD/JPY first support would be the 20-hour EMA at 133.53. A breach of the latter will expose the 100-hour EMA at 132.78, followed by the 50-hour EMA at 132.40.

USD/JPY Price Analysis

What you need to take care of on Thursday, August 4:

Tensions eased a bit on Wednesday, pushing the greenback down across the FX board ahead of the US opening. The dollar, however, recovered its poise after the release of an upbeat ISM Services PMI, which indicated that the local economy remains resilient.

US indexes surged, capping the safe-haven dollar’s demand, partially helped by solid earnings reports and encouraging local data.

Meanwhile, different US Federal Reserve officials reinforce the market’s speculation the Fed is far from done with aggressive tightening, putting a 75 bps rate hike back on the table for September.

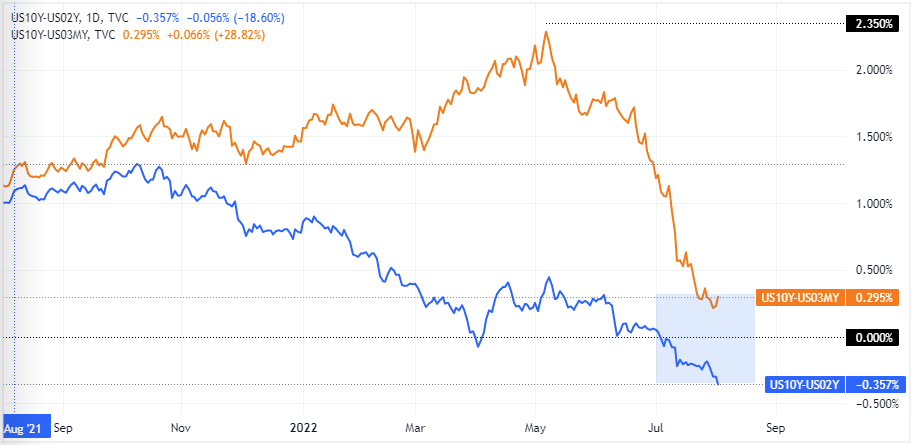

Recession fears maintain the US Treasury yield curve inverted, and the difference between the 2-year note and the 10-year note yields has widened to 36 bps. Nevertheless, Wall Street managed to post solid gains, helped by another batch of solid earnings reports.

The EUR/USD pair trades around 1.0160, as tepid European data undermined demand for the shared currency. The GBP/USD pair finished the day in the red at 1.2145.

Commodity-linked currencies, on the other hand, benefited from Wall Street’s strength. AUD/USD trades around 0.6950 while USD/CAD is marginally lower at 1.2840.

Gold price settled at $1,765 a troy ounce, while crude oil prices edged lower, as different OPEC+ sources suggest that they won’t increase output. Also, US weekly data showed slowing demand. WTI ended the day at $90.90 a barrel.

The Bank of England will announce its monetary policy decision on Thursday.

Bitcoin Price Prediction: A fundamental line in the sand

Like this article? Help us with some feedback by answering this survey:

Federal Reserve's Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, is speaking and has said that the Fed moved too slowly in 2021 in tackling high inflation.

He said wages are climbing and there is a risk that this goes into a wage-driven inflation story. he said the fed is laser-focused on getting inflation down.

He said concerning inflation is spreading and the Fed need to act with urgency. ''It is likely we raise rates and sit there, as 2023 rate cuts are a very unlikely scenario.

He says a soft landing is possible but he does not know how likely.

Key quotes

- Fed moved too slowly in 2021 in tackling high inflation.

- Inflation is dragging wages up rather than the other way around.

- Wages are climbing; risk this goes to a wage-driven inflation story.

- Concerning inflation is spreading; we need to act with urgency.

- We are laser-focused on getting inflation down.

- Very unlikely scenario Fed will cut rates next year.

- More likely scenario is we raise rates and then sit there.

- I am not sure what markets are looking at.

- Where will eventually be a tradeoff between employment and inflation.

- Best data we have says inflation expectations are still anchored.

- Will probably take several years to get inflation back to 2%.

- In a supply-constrained world we still need to get inflation down to 2%.

US dollar remains in bullish territory

The US dollar has been changing hands between bulls and bears on Wednesday but held on to most of the previous day's gains over worries related to China and Us relations and Federal Reserve officials' hints at aggressive rate hikes.

- EUR/USD remains pinned to the floor despite a pick-up in risk appetite.

- US dollar firm on Fed expectations and market caution surrounding China/US relations.

At 1.0151, EUR/USD is under pressure by 0.14% and has fallen from a high of 1.0210 to a low of 1.0122. On Wednesday, US stock futures rose as investor apprehension over hostile US-China relations subsided, yet the euro remains on the backfoot with the greenback firm due to US treasuries declining as a result of hawkish Federal Reserve comments.

Markets have been calmer since US House Speaker Nancy Pelosi returned from a trip to Taiwan that sparked a furious response from China. US stocks on Wall Street have advanced with government bond yields after a services gauge unexpectedly advanced and new orders for factory goods beat expectations. This has implied that the projected hike in interest rates this year may not necessarily coincide with an economy in recession, a relief for risk assets in general.

On Tuesday, risk-off tones had been spurred by Fed officials saying the central bank has some distance to go to contain inflation. This resulted in the two-year treasury yield surging through 3% as traders reduced their bets on policy easing in 2023. Nevertheless, the USD dollar index, which tracks the greenback against six major peers, has softened from a two-decade high in mid-July as investors reined in expectations of Fed rate hikes.

Fed speak conflicting

The US dollar has fallen from the 109 area down to a recent low of 105.97 over the course of two weeks. Nevertheless, a trio of Fed officials signalled on Tuesday the central bank remains "completely united" on increasing rates to a level that will put a dent in the highest US inflation since the 1980s. This has given the greenback a booster and lifted it to 106.819 over the course of the past few sessions.

Meanwhile, San Francisco Fed President Mary Daly said On Wednesday that 50 basis points would be a reasonable thing to do in September. ''We have a lot in the pipeline in tightening but yet to see that in data showing a slowing of the economy, but if we see inflation roaring ahead undauntedly then perhaps 75 be more appropriate.'' US rate futures pared back 75bp view in Sept after Fed's Daly comments.

Meanwhile, US Nonfarm Payrolls this Friday followed by Consumer Price Index on August 10 will help set the tone for the greenback. The consensus for Nonfarm Payrolls is 250k. That is down from 372k in June. The Unemployment Rate is expected to fall in at 3.6%.

EUR shorts packing up

As for positioning, speculators’ net EUR short positions have moved lower slightly ahead of the surge the previous week.

''Speculators have been edgy recently given concerns related to gas shortages in Europe during the winter and fears that industry may suffer rationing. This scenario could focus the market on fragmentation risks, though reassurances have been provided by the Brothers of Italy party that reformist policies would be retained if it did well in the election,'' analysts at Rabobank explained.

- Silver price clings to the $20.00 figure, despite a risk-on market mood.

- Upbeat US Non-Manufacturing PMI data keeps investors’ spirits high, that the US could dodge a recession.

- Fed officials emphasized their commitment to bringing inflation down.

Silver prices are pressing against the $20.00 figure after tumbling on Tuesday due to US dollar appreciation amidst a gloomy market mood spurred by geopolitical tensions between the US and China. Nevertheless, on Wednesday, the white metal stages a comeback, though it’s facing solid resistance with the 50-day EMA lingering around the $20.43 mark. At the time of writing, XAGUSD is trading at $20.00.

Silver recovers as US bond yields retrace from daily highs

Sentiment improved throughout the day. US equities rally propelled by company earnings, whilst safe-haven assets, particularly precious metals, are taking a breather, recovering from earlier losses, as US Treasury yields remain elevated on Fed’s hawkish commentary.

In the meantime, US economic data, with the July ISM Non-Manufacturing PMI, showed that businesses are holding the fort, with the index rising to 56.7, more than estimated and higher than June’s 55.9. That pares back expectations of a recessionary scenario, which augmented when the ISM Manufacturing PMI expanded at its slowest pace in two years.

Aside from this, the Fed parade continued. Earlier during the day, the uber-hawk St. Louis Fed President Bullard said that he wants to get rates by the end of the year, around 3.75-4.00%. He added that the Fed “is going to move inflation back to 2% over time.” Later, San Francisco’s Fed Daly said she’s open to lifting rates by 50 or 75 bps, but it would depend on inflation data.

The buck’s reaction to the abovementioned factors had been positive, as shown by the US Dollar Index, rising 0.14%, at 106.483. Lately, US Treasury bond yields are receding from daily highs, one of the reasons silver prices are recovering, with the 10-year bond rate at 2.763%, almost flat.

What to watch

The US economic docket will feature Thursday employment data led by Initial Jobless Claims, alongside other Fed policymakers taking the spotlight. Then, silver traders’ focus will move to Friday’s Nonfarm Payrolls report.

Silver (XAGUSD) Key Technical Levels

- USD/CAD is down on the day as risk bounces mid-week.

- US/China tensions are eyed. Fed speakers, commodities and US data events are in focus.

At 1.2850, USD/CAD is down 0.23%, falling from a high of 1.2891 to a low of 1.2832 so far on the day. The Canadian dollar is correcting Tuesday's fall that occurred at the start of the week due to investors being concerned over the rising tensions between the United States and China.

Risk has bounced, however, on Wednesday on a combination of dialled down Fed rate hike expectations and the fact that US House of Representatives Speaker Nancy Pelosi to Taiwan has not led to WW3.

During a historic trip to Taiwan Wednesday, Pelosi said her visit was intended to make it "unequivocally clear" that the United States would "not abandon" the democratically governed island. However, China responded to Pelosi's trip by launching military exercises, which China's Ministry of Defense said began on Wednesday with drills in both the seas and airspace surrounding Taiwan.

Frictions after the highest-level US visit to Taiwan in 25 years are likely to help support the safe-haven US dollar for now, which is presumed to weigh on the Canadian dollar, especially considering Canada is a major producer of commodities, including oil, so the currency tends to be sensitive to such tensions.

Fed speakers in play

Nevertheless, the USD dollar index, which tracks the greenback against six major peers, has softened from a two-decade high in mid-July as investors reined in expectations of Fed rate hikes. It has sunk from the 109 area down to a recent low of 105.97 over the course of two weeks. However, a trio of Fed officials signalled on Tuesday the central bank remains "completely united" on increasing rates to a level that will put a dent in the highest US inflation since the 1980s. This has given the greenback a booster and lifted it to 106.819 over the course of the past few sessions.

However, its comeback has been halted by less hawkish comments from San Francisco Fed President Mary Daly who said on Tuesday that a year-end Federal Reserve interest rate of 3.4% is a "reasonable place" to get to. Daly, in an interview with Reuters, also said she does not believe the US central bank has yet reached the threshold for its policy rate to be considered restrictive, seeing that as more at the 3% level than the Fed's current policy rate range of 2.25% to 2.50% after last week's meeting.

She added, however, that 50 basis points would be a reasonable thing to do in September. ''We have a lot in the pipeline in tightening but yet to see that in data showing a slowing of the economy, but if we see inflation roaring ahead undauntedly then perhaps 75 be more appropriate.'' US rate futures pared back 75bp view in Sept after Fed's Daly comments.

Meanwhile, US monthly jobs data due on Friday followed by Consumer Price Index on August 10 will help set the tone for the greenback. The consensus for Nonfarm Payrolls is 250k. That is down from 372k in June. The Unemployment Rate is expected to fall in at 3.6%.

As for positioning, speculators’ CAD net long positions strode higher but remain well below recent highs. The market is still quite confident in the Bank of Canada matching the Fed in terms of raising rates.

- USD/CHF buyers reclaim 0.9600 and lift the major to a daily high of 0.9651.

- Broad US dollar strength amidst an augmented risk appetite, tailwind for the USD/CHF.

- A trendline break in the hourly chart exacerbates the USD/CHF rally above 0.9600.

The USD/CHF rallies above the 100-day EMA and extended its gains to two straight days, up by more than a half percent, on risk-on impulse, as US bond yields rise, underpinned by Fed’s hawkish commentary. The greenback is also trading positive, as depicted by the US Dollar Index, climbing 0.18%, sitting at 106.546. At the time of writing, the USD/CHF is trading at 0.9625.

USD/CHF Price Analysis: Technical outlook

In yesterday’s article, I mentioned that “the USD/CHF edged higher, forming a bullish-engulfing chart pattern, a reversal pattern indicating buyers outweigh sellers, keeping risks skewed to the upside.” On Wednesday, the USD/CHF advanced sharply, cracking the 100-day EMA at 0.9626, as the major extended its gains towards the daily high at 0.9651. Although the USD/CHF is retracing, the major remains neutral-to-bullish biased. That said, USD/CHF traders should be aware of a move towards the confluence of the 50 and 20-day EMAs around 0.9674-77.

USD/CHF 1-hour chart

The USD/CHF is upward biased once the major broke solid resistance at a fifteen-day-old downslope trendline around 0.9559, putting a lid on Tuesday’s rally towards 0.9600. Additionally, the major reclaimed the 200-hour EMA at 0.9580, which exacerbated a jump above the 0.9600 area. That said, the USD/CHF first resistance would be the R2 daily pivot at 0.9644, shy of Wednesday’s daily high at 0.9651. Once cleared, the USD/CHF’s following resistance levels will be the July 22 daily high at 0.9704 and July 21 high at 0.9739.

USD/CHF Key Technical Levels

Analysts at CIBC consider that the decision of the Bank of Japan to continue with its easing policy will keep the yen limited. They forecast the USD/JPY at 135 by the end of the third quarter and at 132 by year-end.

Key Quotes:

“To no surprise, the BoJ maintained its commitment to broad monetary policy easing at its recent meeting. We would expect that any change in the policy environment is set to be left to Kuroda’s successor after Q1 2023.”

“The scale of holdings, amplified by recent measures to defend the 0.25% yield cap, may eventually prompt the BoJ to consider an adjustment in the YCC threshold. However, for now, we remain biased towards a perpetuation of easy policy, maintaining a broad defensive status for JPY.”

“BoJ policy inertia needs to be set against a downgrade in growth assumptions and an upgrade in the CPI profile. In terms of the former, the growth assumption for the current fiscal year was trimmed from 2.9% in April to 2.4% now.”

“Yet while inflationary pressures for the current year are revised up, core prices for fiscal year 2023 remain well below target at 1.4%, previously 1.2%. BoJ Governor Kuroda will likely see that tame underlying trend as justification for the BoJ to remain a broad central bank outlier, even if they face the inflation impetus of a modest further depreciation of the yen in the next few months. The lack of any further Fed tightening in 2023 should see the yen recover some lost ground next year.”

The AUD/USD pair is trading around 0.6935 on Wednesday, recovering after reaching weekly lows earlier at 0.6883. Analysts at CIBC expect the pair to re-test the July lows around 0.6600-0.6700.

Key Quotes:

“We have previously highlighted the growing headwinds to domestic and global activity through inflation and hawkish central bank responses that have pressured the AUD to lower levels. We see scope for further underperformance ahead, underscored by the procyclical and high-beta nature of the currency. A prominent illustration of the pro-cyclical exposure of the AUD is now developing via the path of weaker commodity prices.”

“Commodities are being pressured as a result of building concerns over global growth and demand. Correlations between AUD and global commodities including copper and iron ore remain significant. The correlation between the AUD and commodity and equity indices is similarly noteworthy.”

“The balance of current risks still points to further AUD weakness. We expect a re-test of spot toward lows of around 0.6600-0.6700 will be seen before a major low is recorded.”

- USD/MXN is correcting lower after Tuesday’s rally.

- Still looking at 20.80/21.00, but signals are mixed.

The USD/MXN is falling sharply, after having on Tuesday the best day in weeks. The pair peaked at 20.82 and then started to move to the downside. The 20.80 zone has become a strong barrier and a consolidation above should open the doors to 20.90. Above attention would turn to 21.00. A daily close above 21.00 would strengthen the bullish outlook.

If the bearish correction extends, a support area emerges at 20.45 and below at 20.25. A break under 20.25 would negate the bullish bias, exposing 20.00.

Technical indicators area mixed, with Momentum and the RSI moving around midlines, undecided. Price is near flats 20 and 200-day Simple Moving Averages.

USD/MXN Daily chart

-637951417509330986.png)

On the weekly chart, USD/MXN continues to be unable to post a close above 20.60 which should point to further gains in the medium term.

USD/MXN weekly chart

- GBP/USD falls for the second straight day, as sellers hold 1.2200, alongside a risk-on impulse.

- Broad US dollar strength keeps the greenback afloat against most G10 currencies.

- Fed officials hawkish commentary bolstered the buck, a headwind for GBP/USD.

- The Bank of England (BoE) is expected to hike rates on the August 4 interest rate decision.

The British pound losses ground and falls during Wednesday’s US session by almost 0.26%. Higher US Treasury yields, “hawkish” commentary by Fed officials, and an improvement in sentiment are headwinds for the GBP/USD.

The GBP/USD is trading at 1.2146, down after hitting a daily high at 1.2207, just above the 50-day EMA, but buyers unable to hold, left the major exposed to selling pressure, so the GBP/USD dived towards a daily low at 1.2100.

GBP/USD weighed by risk-on mood, buoyant US dollar

European and US equities are trading in the green. US data from the Institute for Supply Management revealed that July Non-Manufacturing activity, also known as Services PMI, surprisingly exceeded expectations, rose by 56.7, vs. estimations of 53.5, and higher than June’s 55.9. Data showed consumers shifting from goods to services, as the US ISM Manufacturing report depicted signs of slowing down.

Meanwhile, Fed officials remain crossing wires. San Francisco’s Fed Mary Daly commented that hiking 50 bps “would be reasonable to do in September,” but it would depend on data. She added that if inflation remains higher, a “75 bps hike would be more appropriate.” In the meantime, Richmond’s Fed President Thomas Barkin said that he said that recession fears are inconsistent with the labor market growing nearly 400K a month, with a 3.6% unemployment rate.

Earlier, the St. Louis Fed James Bullard commented that he wants to get the Federal funds rate (FFR) to 3.75-4.00% by year’s end while adding, “We’re going to move inflation back to 2% over time.”

On the UK side, final S&P Global Services and Composite PMIs for July. The former fell to 52.6 vs. 53.3 estimated, while the latter slid to 52.1 vs. 52.8 preliminary. UK’s stagflation fears keep rising while GBP/USD traders prepare for Thursday’s Bank of England (BoE) monetary policy decision, where the “old lady” is expected to raise rates by 50 bps to 1.75%.

What to watch

The UK economic docket will feature the BoE monetary policy decision alongside the S&P Global Construction PMI. Across the pond, the US calendar will feature Initial Jobless Claims, alongside further Fed officials crossing wires.

GBP/USD Key Technical Levels

Federal Reserve Bank of Richmond President Thomas Barkin reiterated on Wednesday that the Fed is committed to getting inflation under control and to returning it to the 2% target, as reported by Reuters.

Additional takeaways

"Fed may not get help from global events and supply chains but it has tools and credibility to deliver that outcome."

"Expecting inflation to come down but not immediately, not suddenly and not predictably."

"Seeing inflation coming down due to flattening demand, supply chain improvements and easing of commodity pressures."

"Recession fears a little inconsistent with monthly jobs growth of nearly 400,000, 3.6% unemployment rate."

"Returning to a normal environment doesn't have to require a calamitous decline in activity."

Market reaction

The dollar preserves its strength against its rivals with the US Dollar Index clinging to daily gains at 106.65.

"We have a lot in the pipeline in tightening but yet to see that in data showing a slowing of the economy," San Francisco Fed President Mary Daly said on Wednesday, as reported by Reuters.

Additional takeaways

"Consumers want to see directional improvement, not getting prices lower than they were some months ago."

"This is a journey, not going to happen overnight."

"I expect unemployment rate to rise a bit as we slow the economy."

"I don't see people experiencing recession right now."

"Not sure if jobs data due this week will show easing of hiring yet, still demand for workers outstripping supply."

"Haven't seen a single piece of data yet indicating we're near a pain point on joblessness."

"About 50% of the elevated inflation we're seeing is from demand factors, 50% from supply factors."

"Firms are reducing vacancies, not laying off workers en masse, supports optimism for soft landing."

"50 bps hike would be a reasonable thing to do in September but if we see inflation roaring ahead undauntedly then perhaps 75 bps hike would be more appropriate."

Market reaction

The US Dollar Index showed no immediate reaction to these remarks and was last seen rising 0.3% on the day at 106.65.

An unexpected rise in the July ISM Service PMI helped the US Dollar on Wednesday. The index showed a “broad pickup in the sector”, point out analysts at Wells Fargo. They consider the jump in new orders bodes well for coming demand, and an array of measures suggests supply chain pressures continue to ease.

Key Quotes:

“The ISM services index not only defied the consensus expectation for a decline but rose by the most in five months in July.”

“While the overall report indicates still solid activity in the sector, some selected industry comments from purchasing managers did point to a weakening economic environment and coming headwinds for sales. Growing fears of recession are likely weighing on optimism to some extent.”

“The employment component remained below the 50-threshold designating expansion from contraction, but it did improve 1.7 points last month to 49.1. This suggests the labor market is cooling, but not rapidly deteriorating as feared given increased concern of an imminent recession.”

“Given the uptick in current activity and new orders, service-providers are still finding it necessary to hire, even if the need for labor is not as great as it has been over the past two years.”

“We expect demand for labor is starting to ease more meaningfully as the labor market shows signs of cooling.”

- US dollar gains momentum versus G10 currencies.

- DXY up for the second day in a row.

- EUR/USD with bearish bias after being rejected from near 1.0300.

The EUR/USD is falling for the second day in a row, and recently printed a fresh six-day low at 1.0121. From Tuesday’s high it has fallen almost 175 pips amid a recovery of the US dollar.

The greenback is rising again on Wednesday, particularly versus G10 currencies as US yields climb further. The 10-year Treasury yield hit 2.85%, the highest level since July 22, before pulling back to 2.79%.

Economic data from the US contribute to the move higher of the USD. The ISM Service PMI rose unexpectedly in July to 56.7 from 55.3, against the market consensus of 53.5. The key report will be on Friday with the non-farm payrolls.

An improvement in risk sentiment limits the upside of the dollar. In Wall Street, the Dow Jones is up by 0.92% and the Nasdaq soars 1.82%. Stocks are breaking a two-day negative streak.

Looking at crucial support

The slide in EUR/USD pushed the price under the 20-day Simple Moving Average (1.0155). Now it is moving closer to the critical short-term support area around 1.0100, a consolidation below should open the doors to more losses.

On the upside, now 1.0150 is the immediate resistance followed by 1.0210 (20-SMA in four hours). As long as below 1.0300, gains seem limited for the pair.

Technical levels

San Francisco Fed President Mary Daly said on Wednesday that they are not yet done with the fight against high inflation, as reported by Reuters.

Additional takeaways

"We are committed to get it down closer to our 2% target."

"Markets are ahead of themselves in expecting rate cuts next year."

"We are united in delivering on both sides of our mandate."

"In my book, 3.4% is a reasonable place for us to get to on rates by year-end."

"June Fed projections remain a reasonable guide for rate path."

"What happens at remaining meetings this year depends on incoming data."

"The early glimmers of progress on inflation really need to show through in the data."

"I am optimistic we can get inflation down with a rate path that does not trigger a deep recession."

"Nothing in the lines of sight right now that indicates the soft landing outcome is not possible."

"I do not think we should ratchet up rates fast and high only to lower rates a few months after that."

"That would be hard on families and businesses."

"Holding rates high for a while could be longer than the period the markets had begun to price in for rate cuts."

Market reaction

The US Dollar Index clings to daily gains after these comments and was last seen rising 0.32% on the day at 106.68.

- Gold price recedes from $1770s as US bond yields climb.

- Overall US dollar strength and a risk-on impulse, headwinds for gold.

- Gold Price Forecast (XAUUSD): Sellers’ failure at $1787 sent the pair stumbling towards the $1750 area.

Gold price slides from around $1770s highs due to high US Treasury yields spurred by Fed policymakers reiterating that they are not done hiking rates, despite the ongoing slowdown in the US economy. Nevertheless, money market futures are still pricing in a 50 bps rate hike in September, while odds of a 75 bps increase lie at 80%. At the time of writing, XAUUSD is trading at $1757.36.

XAUUSD drops as sentiment improves, and Fed commentary

Global equities remain firm one hour after the New York ringing bell. The US House Speaker Nancy Pelosi’s trip to Taiwan finished without casualties yet. July’s US ISM Non-Manufacturing PMIs surprised economists, beating expectations, with the index increasing by 56.7 from 55.3 in June, data showed Wednesday. The services reports contradict Monday’s Manufacturing report, which showed production is slowing its pace, so demand for goods is down due to consumers’ shift to services.

Fed speakers pushed vs. dovish tilt

Since Tuesday, Fed officials reiterated the Fed’s commitment to bring inflation to the 2% target, led by San Francisco Fed Daly, saying that “we are still resolute and completely united” in getting inflation down. Following suit, Cleveland’s Fed Mester said that she needs to see “compelling evidence” of prices getting lower, while Chicago’s Evans commented that “50 bps are reasonable” and added that 75 bps might be needed as data comes out.

On Wednesday, the St. Louis Fed President Bullard said the Q2 slowdown was more concerning than Q1. By the year’s end, Bullard wants to lift the Federal funds rate (FFR) to 3.75-4.00%.

Meanwhile, US Treasury yields are rising sharply, led by 2s, while the US 10-year benchmark note coupon is yielding just 2.801%, compared with the former at 3.151%. So the US 2s-10s yield curve inversion further deepened to -0.346%, as investors have positioned ahead of an impending US recession.

US 2s-10s yield curve inversion

Underpinned by firm US bond yields, the greenback is rising, as shown by the US Dollar Index, gaining 0.34%, at 106.711. The buck has recovered some strength in the last few days, bolstered by safe-haven flows amidst geopolitical jitters.

What to watch

The US calendar will feature Initial Jobless Claims, alongside further Fed officials crossing wires.

Gold Price Forecast (XAUUSD): Technical outlook

Still, XAUUSD is neutral-to-downward biased. Buyers’ failure to crack the May 16 low-turned-resistance at $1787.03 was a solid ceiling level as sellers stepped in, dragging prices to their daily low at $1755.00. However, the XAUUSD downtrend could be capped around the 20-day EMA at $1731.65.

Therefore, XAUUSD’s first support would be the July 29 low at 1752.27. Once cleared, gold will dive to the 20-day EMA. Otherwise, if gold buyers stepped in, their first resistance would be $1772.77.

- US ISM Services PMI came in higher than expected in July.

- Price pressures in the service sector eased modestly.

- US Dollar Index continues to push higher after the data.

The business activity in the US service sector expanded at a more robust pace in July than in June with the ISM Services PMI rising to 56.7 from 55.3. This reading came in better than the market expectation of 53.5.

Further details of the publication revealed that the Prices Paid Index declined to 72.3 from 80.1, compared to the market forecast of 81.6, and the Employment Index improved to 49.1 from 47.4.

Commenting on the survey, "the slight increase in services sector growth was due to an increase in business activity and new orders," noted Anthony Nieves, Chair of the Institute for Supply Management (ISM) Services Business Survey Committee. "Availability issues with overland trucking, a restricted labor pool, various material shortages and inflation continue to be impediments for the services sector."

Market reaction

The US Dollar Index gained traction after this report and was last seen rising 0.25% on the day at 106.60.

- USD/JPY gains positive traction for the second straight day and inches closer to the weekly high.

- The widening US-Japan yields differential, and the risk-on impulse undermine the safe-haven JPY.

- Bulls now seem to wait for sustained strength beyond the 134.00 mark before placing fresh bets.

The USD/JPY pair catches fresh bids near the 132.30-132.25 region and steadily climbs back closer to the weekly high set earlier this Wednesday. The pair is currently trading around the 133.65-133.70 area, up nearly 0.40% for the day and is supported by a combination of factors.

A further rise in the US Treasury bond yields, bolstered by the overnight hawkish remarks by several Fed officials, widens the US-Japan rate differential. This, along with the risk-on impulse, undermines the safe-haven Japanese yen and pushes the USD/JPY higher for the second successive day.

Looking at the broader picture, the post-FOMC sharp downfall stalled on Tuesday near the 130.40-130.35 confluence support. The mentioned area comprises the 100-day SMA and the 50% Fibonacci retracement level of the April-July rally, which should now act as a pivotal point for the USD/JPY pair.

Bullish traders, meanwhile, might wait for some follow-through buying beyond the 134.00 mark before positioning for any further gains. The USD/JPY pair could then climb to the 134.75 intermediate hurdle en-route to the 135.00 psychological mark and the 23.6% Fibo. level, around the 135.15 region.

On the flip side, the 38.2% Fibo. level, around the 132.50 area, now seems to protect the immediate downside ahead of the 132.00 round figure and the 131.65-131.60 region. Failure to defend the said support levels could make the USD/JPY pair vulnerable to sliding back below the 131.00 mark.

The downward trajectory could further get extended towards the 130.40-130.35 confluence support. A convincing break below the latter would be seen as a fresh trigger for bears and set the stage for an extension of the recent corrective slide from the 24-year peak touched on July 14.

USD/JPY daily chart

-637951317212664641.png)

Key levels to watch

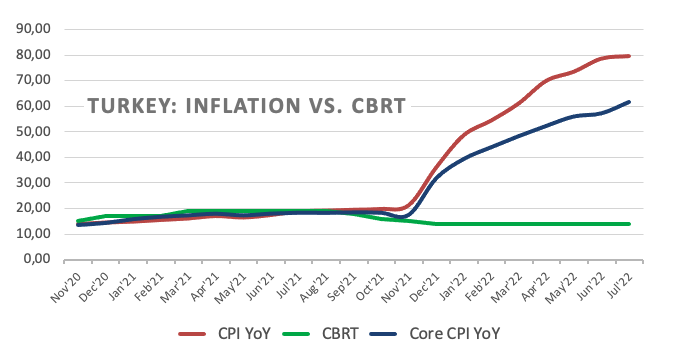

- USD/TRY clinches new 2022 highs just below 18.00.

- Türkiye inflation extended the upside in July at 79.60% YoY.

- Producer Prices also came on the strong side in July.

The Turkish lira extends the weekly depreciation vs. the greenback and lifts USD/TRY to new YTD tops around 17.97 on Wednesday.

USD/TRY up on elevated July CPI

USD/TRY adds to Tuesday’s gains and trades at shouting distance from the key hurdle at the 18.00 mark midweek.

The selling bias in the lira intensified after inflation figures tracked by the CPI rose 79.60% in the year to July, the fastest pace in the last 24 years. The CPI print, however, was lower than what consensus was expecting and remained propped up by elevated energy and commodity prices.

In addition, the Core CPI rose 61.69% YoY and Producer Prices surged 144.61% over the last twelve months.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy prices, which appear directly correlated to developments from the war in Ukraine, the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Wednesday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.08% at 17.9425 and faces the immediate target at 17.9658 (2022 high August 3) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 17.0474 (55-day SMA) and finally 16.0365 (monthly low June 27).

- US S&P Global Services PMI fell into contraction territory in July.

- US Dollar Index continues to fluctuate above 106.00 after the data.

The business activity in the US service sector declined for the first time in over two years in July with the S&P Global Services PMI dropping to 47.3 from 52.7 in June. This reading came in slightly better than the market expectation and the flash estimate of 47.

Further details of the publication revealed that the Composite PMI fell to 47.7 in July from 52.3 in June.

Commenting on the survey's findings, "US economic conditions worsened markedly in July, with business activity falling across both the manufacturing and service sectors," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "Excluding pandemic lockdown months, the overall fall in output was the largest recorded since the global financial crisis and signals a strong likelihood that the economy will contract for a third consecutive quarter."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen trading flat on the day at 106.30.

In a statement published following its meeting, OPEC said that insufficient investment will impact the availability of adequate oil supply to meet growing demand beyond 2023, as reported by Reuters.

"The severely limited availability of excess capacity necessitates utilizing it with great caution in response to severe supply disruptions," the group added.

Market reaction

Crude oil prices turned south and erased a large portion of the daily gains. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $94.60, where it was down 0.85% on a daily basis.

- GBP/USD gains some positive traction on Wednesday, though lacks follow-through.

- The risk-on impulse is undermining the safe-haven USD and offering some support.

- Rising US bond yields help limit the USD losses and keep a lid on any further gains.

- Investors also seem reluctant ahead of the BoE on Thursday and the NFP on Friday.

The GBP/USD pair defends support marked by the lower end of a nearly three-week-old ascending channel and attract some buying near the 1.2135 region on Wednesday.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - undermines the safe-haven US dollar and offers some support to the GBP/USD pair. That said, a further rise in the US Treasury bond yields, bolstered by hawkish comments by several Fed officials on Tuesday, helps limit losses for the greenback.

The GBP/USD pair, meanwhile, struggles to find acceptance above the 1.2200 round figure and remains at the mercy of the USD price dynamics. Traders now look forward to the US ISM Services PMI for a fresh impetus, though the focus would be on the Bank of England meeting on Thursday and the US monthly jobs report (NFP) on Friday.

In the meantime, the ascending trend-channel support, near the 1.2135 area, might continue to protect the immediate downside. A convincing break below could prompt some technical selling and drag the GBP/USD pair further towards testing the 1.2100 mark. This is closely followed by the 200-period SMA on the 4-hour chart.

Some follow-through selling below the latter would be seen as a fresh trigger for bearish traders and make the GBP/USD pair vulnerable. The downfall could then accelerate towards the 1.2030-1.2025 intermediate support en-route the 1.2000 psychological mark and the next relevant support near the 1.1975-1.1970 horizontal zone.

On the flip side, the 1.2200 mark now seems to act as an immediate hurdle, above which the GBP/USD could climb back to the 1.2250 resistance. Sustained strength beyond the latter should pave the way for an extension of the recent recovery from the lowest level since March 2020 and allow spot prices to aim to conquer the 1.2300 level.

GBP/USD 4-hour chart

-637951295022889255.png)

Key levels to watch

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 14:00 GMT this Wednesday. The gauge is expected to drop to 53.5 in July from 55.3 in the previous month. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is expected to rise to 81.6 from 80.1 in June.

According to Eren Sengezer, European Session Lead Analyst at FXStreet: “Markets should pay close attention to the Employment component as well. Ahead of Friday’s jobs report, a print below 50 would point to a contraction in the service sector employment and put additional weight on the USD’s shoulders.”

How Could it Affect EUR/USD?

Ahead of the key release, the risk-on impulse in the equity markets was seen undermining the safe-haven US dollar. A weaker-than-expected US macro data could exert additional downward pressure on the buck. That said, a further rise in the US Treasury bond yields, bolstered by the overnight hawkish comments by several Fed officials, should limit deeper USD losses.

Conversely, a stronger print would be enough to provide a modest lift to the greenback and prompt fresh selling around the EUR/USD pair. The immediate market reaction, however, is more likely to be short-lived as investors might prefer to wait on the sidelines ahead of the US monthly jobs report (NFP) on Friday. Nevertheless, a significant divergence from the expected reading would still influence the USD and produce some meaningful trading opportunities around the EUR/USD pair.

Eren Sengezer, meanwhile, outlined important technical levels to trade the major: “EUR/USD faces immediate resistance at 1.0200 (psychological level, 50-period SMA on the four-hour chart). As long as this level stays intact, buyers could opt to remain on the sidelines. In case the pair reclaims that level and starts using it as support, additional gains toward 1.0230 (Fibonacci 38.2% retracement level of the latest downtrend), 1.0275 (200-period SMA) and 1.0300 (Fibonacci 50% retracement) could be witnessed.”

“On the downside, 1.0150 (Fibonacci 23.6% retracement) aligns as first support ahead of 1.0100 (psychological level, static level). A four-hour close below the latter could be seen as a significant bearish development and trigger another leg lower toward parity,” Eren added further.

Key Notes

• US July ISM Services PMI Preview: Inflation component holds the key

• EUR/USD Forecast: Euro to have a tough time regathering recovery momentum

• EUR/USD Price Analysis: Next on the upside comes 1.0300

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

- EUR/USD resumes the upside and advances above 1.0200.

- The next target emerges at the August top near 1.0300.

EUR/USD regains buying interest and reclaims part of the ground lost following Tuesday’s sell-off to the 1.0160 zone.

The continuation of the recovery is predicted to target the August high at 1.0293 (August 2). Above the latter spot could accelerate its losses to the next hurdle at the 55-day SMA, today at 1.0417.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0941.

EUR/USD daily chart

Citing a source familiar with the matter, Reuters reported on Wednesday that the Organization of the Petroleum Exporting Countries (OPEC) and allies, collectively known as OPEC+, have agreed to raise the oil output by 100,000 barres per day in September.

Market reaction

Crude oil prices gained traction on this headline. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $96.30, where it was up 2.6% on a daily basis. Meanwhile, the barrel of Brent was up 2% at $101.90.

- USD/CAD witnesses an intraday turnaround from a one-week high touched earlier this Wednesday.

- A pickup in crude oil prices underpins the loonie and exerts pressure amid modest USD weakness.

- Rising US bond yields could lend some support to the USD and limit any further losses for the pair.

The USD/CAD pair attracts some selling in the vicinity of the 1.2900 mark on Wednesday and stalls this week's recovery move from its lowest level since June 10. The pair continues losing ground through the mid-European session and drops to the 1.2835 region in the last hour, snapping a two-day winning streak to a one-week high.

The US dollar struggles to capitalize on the overnight bounce from a multi-week low and meets with a fresh supply, which, in turn, exerts some downward pressure on the USD/CAD pair. A goodish recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - is weighing on the safe-haven greenback.

Apart from this, a goodish pickup in crude oil prices undermines the commodity-linked loonie and also contributes to the offered tone surrounding the USD/CAD pair. Expectations that OPEC+ producers would keep output steady - amid fears that a slowdown in global growth will hit fuel demand - turn out to be a key factor boosting crude oil prices.

That said, indications that the current tight supply is abating could act as a headwind for crude oil prices. Apart from this, some follow-through rise in the US Treasury bond yields, bolstered by the overnight hawkish comments by several Fed officials, could revive the USD demand and help limit any further losses for the USD/CAD pair.

Investors might also refrain from placing aggressive bets and prefer to wait on the sidelines ahead of this week's important macro releases. The closely-watched monthly employment details from the US and Canada are scheduled on Friday. The NFP report, especially, would influence the USD and provide a fresh directional impetus to the USD/CAD pair.

In the meantime, traders on Wednesday would take cues from the US ISM Services PMI. This, along with the US bond yields and the broader risk sentiment, would drive the USD demand. Traders would further take cues from the headlines coming out of the OPEC+ meeting and oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

Win Thin, Global Head of Currency Strategy at BBH, maintains the medium-term bullish outlook for the US dollar amid more hawkish remarks by Fed officials on Tuesday.

Key Quotes:

“The dollar outlook has improved as the Fed pushes back against the perceived pivot. DXY traded as high as 106.549 today but has since fallen back to trade near 106.20.

Clean break above 106.518 would set up a test of the July 27 high near 107.246.”

“We maintain our strong dollar call as Fed officials are making it clear that markets misread the Fed’s commitment to lowering inflation. However, the greenback is unlikely to get much more traction in the absence of strong economic data. This week’s U.S. data will be key for the medium-term dollar outlook.”

“It should leave no doubt as to the Fed's intent to keep hiking rates until inflation comes down, no matter the cost to growth and employment. The full court press by the Fed is likely to continue today. Bullard, Harker, Daly, Barkin, and Kashkari all speak and likely to maintain the hawkish tone established yesterday.”

“While yields are sharply higher, the needle hasn't moved much in terms of Fed expectations, as the swaps market still sees a terminal Fed Funds rate of 3.5% Eventually, we think this will adjust higher to something closer to Evans' 3.75-4.0% call.”