- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-03-2013

The euro exchange rate fluctuates against the dollar amid insolvency Italian politicians to form a coalition. Exert pressure on the currency upcoming data on Italy's GDP for the fourth quarter, which will show that the region's economy declined in the fourth quarter of 2012.

Market participants expect the news from the meeting in Brussels, the finance ministers of the euro area, as well as a busy week of meetings of central banks. The finance ministers of the euro area meet to discuss whether to give Portugal and Ireland more time to repay loans received under the assistance programs. It is expected that, following last week's inconclusive election in Italy will also discuss the political uncertainty in the country.

With regard to regional statistics, it was mixed. Eurozone confidence among investors decreased significantly in March, topping with analysts' forecasts, and recorded the first decline in six months. Sentix investor confidence indicator fell this month to the level of -10.6, which is the lowest level since December 2012. At the same time, the annual rate of producer price inflation slowed in January to the level of 1.9%, compared with 2.1% the previous month, which fully corresponded to the experts.

The yen rose against all but one of its 16 major counterparts after the Chinese CSI 300 Index fell to the lowest in two years. In addition, the yen strengthened even after the candidate to be the next Governor of the Bank of Japan Haruhiko Kuroda, has promised a more loose monetary policy to overcome deflation in the economy. Kuroda, submitted to Prime Abe said in parliament that the Bank of Japan will do everything possible to end the 15-year period of deflation in Japan.

The pound strengthened against the euro and the dollar amid concern that the formation of the Government of Italy may be delayed, and will have a negative impact on the recovery of 17 countries the currency bloc. In addition, a report released today showed that house prices in the UK rose in February, registering the first increase in nine months. Also today it was announced that the business activity index fell to the end of last month to the level of 46.8, up from 48.7 in January. Note that according to the average analyst estimate the value of this indicator would grow to the level of 49.2. Recall that the value of the indicator below 50 suggests contraction in the sector. The report also said that total production has fallen sharply, demonstrating the highest rate of decline over the past 3 years. Meanwhile, it was reported that the number of new orders declined, while accelerating its pace, while the so-sector employment showed a slight increase.

European stocks were little changed as utility shares rallied, offsetting HSBC Holdings Plc’s biggest retreat since July and a survey that showed China’s services industries slowed last month.

China’s government intensified its three-year campaign to cool the real estate market, ordering larger deposits and stricter enforcement of sales taxes. The People’s Bank of China’s regional branches may implement the measures in conjunction with the price-control targets of local governments, the country’s cabinet said in a statement.

In Rome, a senior aide to Democratic Party leader Pier Luigi Bersani said the country will need to hold another election if the center left fails to build a coalition commanding a majority of seats in the Senate.

The finance ministers of the 17-member euro area meet in Brussels today to discuss the planned bailout for Cyprus.

National benchmark indexes dropped in 12 of the 18 western- European markets. The U.K.’s FTSE 100 slipped 0.5 percent, France’s CAC 40 rose 0.3 percent and Germany’s DAX retreated 0.2 percent. Greece’s ASE Index lost 2.1 percent after Russell Investments reclassified the country as an emerging market.

HSBC dropped 2.5 percent to 710 pence after saying pretax earnings fell 5.6 percent in 2012 because of a record settlement for anti-money-laundering sanctions in the U.S. and a charge to revalue its own debt. Profit of $20.65 billion trailed the $23.49 billion estimate of 26 analysts surveyed by Bloomberg. The lender took a $5.2 billion charge for revaluing its debt.

Anglo American Plc retreated 2.7 percent to 1,849 pence after Nomura Holdings Inc. downgraded the stock to reduce, a rating similar to sell, from neutral. The brokerage said that analysts need to lower their estimates for the company’s earnings this year.

Debenhams slumped 15 percent to 80.7 pence, for the biggest tumble on the Stoxx 600. The second-largest U.K. department store forecast that pretax profit for the first half of the year will decline to 120 million pounds ($181 million) after snow disrupted sales. Comparable revenue dropped 10 percent from Jan. 14 to Jan. 27, the retailer said.

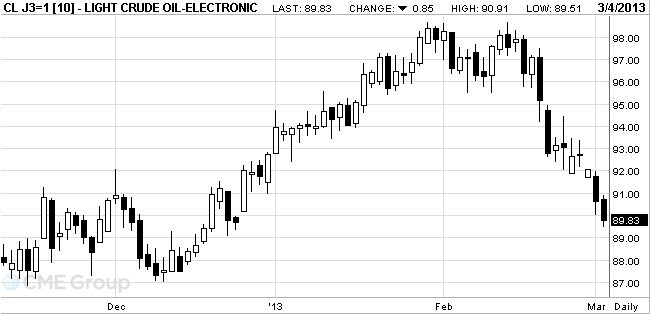

West Texas Intermediate crude fell below $90 a barrel for the first time in more than two months as service industries in China expanded at the slowest pace in five months in February.

Prices declined for a third day as the expansion of the non-manufacturing industry in China, the world’s second-largest oil-consuming country after the U.S., was the slowest since September after a gauge of new orders declined. Measures released March 1 pointed to manufacturing growth cooling. Money managers cut bets on rising oil prices in the week ended Feb. 26, according to data from the Commodity Futures Trading Commission.

China’s non-manufacturing Purchasing Managers’ Index fell to 54.5 in February from 56.2 in January, the Beijing-based National Bureau of Statistics and China Federation of Logistics and Purchasing said in a weekend statement. The index’s reading has been above 50, which indicates expansion, for at least two years.

A gauge of new orders declined 1.9 points from January to 51.8, the weakest reading since October. The federation’s manufacturing PMI released March 1 dropped to 50.1, the weakest level in five months.

WTI for April delivery slid to $89.51 a barrel on the New York Mercantile Exchange.

Brent for April settlement dropped 60 cents to $109.80 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rose slightly from week low with the support of shopping at the market of Asia, but strong U.S. economic performance reduces the appeal of gold as a safe investment.

Investors are waiting to see how the U.S. economy will affect begun on Friday $ 85-billion reduction in public spending. Meanwhile, released last week, the February data on production, car sales and consumer sentiment in the U.S. pointed to faster economic growth.

Stocks of the world's largest gold-exchange-traded fund (ETF) SPDR Gold Trust on Friday fell to a seven-month low 1.254,885 tons, down ninth consecutive session. Improving forecasts for the world economy has increased the appetite for risk and attract investors to higher-yielding markets such as stocks.

Sales of gold coins in the United States rose sharply in February, while sales of silver coins were the highest for February since 1986.

April futures price of gold on COMEX today is trading in the range of 1571.60 - 1584.30 dollars per ounce.

U.S. stock-index futures declined as growth slowed in China’s services industry and American lawmakers signaled federal spending cuts will continue for weeks before they can reach a budget resolution.

Global Stocks:

Nikkei 11,652.29 +45.91 +0.40%Hang Seng 22,537.81 -342.41 -1.50%

Shanghai Composite 2,273.4 -86.10 -3.65%

FTSE 6,357.33 -21.27 -0.33%

CAC 3,713.41 +13.50 +0.36%

DAX 7,695.34 -12.82 -0.17%

Crude oil $90.60 -0.09%

Gold $1576.80 +0.29%

EUR/USD $1.3000, $1.3025, $1.3050, $1.3100

USD/JPY Y92.00, Y92.50, Y93.00, Y93.75, Y94.00GBP/USD $1.4900, $1.5050

EUR/GBP stg0.8700Data

00:30 Australia Building Permits, m/m January -4.4% +2.8% -2.4%

00:30 Australia Building Permits, y/y January +9.3% +8.1% +9.9%

00:30 Australia ANZ Job Advertisements (MoM) February -0.9% +3.0%

00:30 Australia Company Operating Profits Quarter IV -2.9% -0.9% -1.0%

09:00 Eurozone Eurogroup Meetings March

09:30 Eurozone Sentix Investor Confidence March -3.9 -4.5 -10.6

09:30 United Kingdom PMI Construction February 48.7 49.2 46.8

10:00 Eurozone Producer Price Index, MoM January -0.2% +0.5% +0.6%

10:00 Eurozone Producer Price Index (YoY) January +2.1% +1.9% +1.9%

13:00 U.S. FOMC Member Yellen Speaks March

The euro fell, approaching its lowest level in nearly three months against the dollar, which was associated with the failure to form a coalition of Italian politics. Meanwhile, the pressure on the currency to provide data on the upcoming Italian GDP for the fourth quarter, which will show that the region's economy declined in the fourth quarter of 2012.

We also add that the final negotiations between Republicans and Democrats on the budget sequestration ended on Saturday, and, unfortunately, a long-awaited compromise policy is not found, Obama signed a bill to reduce government spending by $ 85 billion by the end of this year. President immediately tried to convince some of the apocalypse will happen after that.

The yen rose against all but one of its 16 major counterparts after the Chinese CSI 300 Index fell to the lowest in two years. In addition, the yen strengthened even after the candidate to be the next Governor of the Bank of Japan Haruhiko Kuroda, has promised a more loose monetary policy to overcome deflation in the economy. Kuroda, submitted to Prime Abe said in parliament that the Bank of Japan will do everything possible to end the 15-year period of deflation in Japan. However, the currency could not hold the earned position, dropping to their lowest levels of the session.

The Australian dollar fell to near an eight-month low against the U.S. dollar, as the data presented today showed that the number of permits issued for the construction or reconstruction of homes and apartments fell in January by 2.4%, compared with a revised downward fall by 1 , 7% in December. Note that according to the average forecast in January the value of this index should increase by 2.8%.

The pound strengthened against the euro amid concern that the formation of the Government of Italy may be delayed, and will have a negative impact on the recovery of 17 countries the currency bloc. In addition, a report released today showed that house prices in the UK rose in February, registering the first increase in nine months. Also today it was announced that the business activity index fell to the end of last month to the level of 46.8, up from 48.7 in January. Note that according to the average analyst estimate the value of this indicator would grow to the level of 49.2. Recall that the value of the indicator below 50 suggests contraction in the sector. The report also said that total production has fallen sharply, demonstrating the highest rate of decline over the past 3 years. Meanwhile, it was reported that the number of new orders declined, while accelerating its pace, while the so-sector employment showed a slight increase.

EUR / USD: during the European session the pair fell to the low of $ 1.2980

GBP / USD: during the European session the pair trade the range $ 1.4995-$ 1.5060

USD / JPY: during the European session, the pair rose to Y93.69

At 18:15 GMT the U.S. with an address by a member of the Federal Open Market Jerome Powell. At 22:30 GMT Australia will index services from AIG in February.

EUR/USD

Offers $1.3100, $1.3080, $1.3040/50

Bids $1.2980-60, $1.2950, $1.2920, $1.2900, $1.2880, $1.2865-50

GBP/USD

Offers $1.5100/05, $1.5080

Bids $1.5000, $1.4985/80, $1.4965/60, $1.4950

AUD/USD

Offers $1.0290/3.00, $1.0280, $1.0240/60

Bids $1.0100, $1.0050, $1.0020, $1.0000

EUR/GBP

Offers stg0.8720/25, stg0.8695/700

Ордера на покупку stg0.8610/00, stg0.8575/70, stg0.8555/50, stg0.8520, stg0.8505/00

EUR/JPY

Offers Y122.10-20, Y122.00, Y121.99

Bids Y121.00, Y120.80, Y120.00

USD/JPY

Offers Y94.95/00, Y94.75/80, Y94.50, Y94.30/35, Y94.00, Y93.70/75

Bids Y9310/00, Y92.85/80, Y92.65/60, Y92.45/40, Y92.10/00

European stocks were down, which was associated with the fall of Asian stocks, as well as information from China. According to the statement, which was presented today by the State Council, China will increase the down payments and interest rates on second mortgages in the cities, where there was an overgrowth of prices, and ordered to strict compliance sales taxes against the three-year campaign to cool the property market. In addition, the State Council said that the regional offices of the People's Bank of China may implement measures under the price control objectives of local government. Meanwhile, the statement says that the city faced with a relatively large pressure from rising house prices, should tighten restrictions on housing sales.

Cost HSBC fell 3.1% to 705.5 pence, while showing the largest drop in eight months after Europe's largest lender reported a profit before tax declined by 5.6% in 2012 due to a record settlement to combat money laundering in the United States. As it became known, the profit was $ 20.650 billion, compared with forecasts of $ 23.490 billion

Shares of Anglo American Plc (AAL) fell 3.4% to 1,836 pence after Nomura Holdings downgraded the shares to 'sell' from 'neutral'.

Debenhams price fell by 11% to 84 pence, showing the biggest drop in the Stoxx 600. The second-largest seller of Great Britain said that the forecast profit before tax for the first half of this year will fall to 120 million pounds.

Shares of Kuehne & Nagel International AG fell 5.2% to 100.50 francs. Largest sea freight forwarder in the world, said the chief executive Reinhard Lange to resign for health reasons. Meanwhile, it was reported that profits for the year 2012 did not meet analysts' expectations. Full year profit fell 19% to 485 million Swiss francs ($ 515 million), compared with forecasts at 523 million francs.EUR/USD $1.3000, $1.3025, $1.3050, $1.3100

USD/JPY Y92.00, Y92.50, Y93.00, Y93.75, Y94.00

GBP/USD $1.4900, $1.5050

EUR/GBP stg0.8700

Asian stocks dropped, with the regional benchmark index heading for its second day of decline, after China tightened mortgage rules to cool the property market. Japanese shares pared gains.

Nikkei 225 11,652.29 +45.91 +0.40%

Hang Seng 22,537.81 -342.41 -1.50%

S&P/ASX 200 5,010.52 -75.61 -1.49%

Shanghai Composite 2,273.4 -86.10 -3.65%

China Resources Land Ltd., a state-owned developer, slumped 9.3 percent in Hong Kong, pacing declines among Chinese real- estate companies.

Noble Group Ltd., Asia’s biggest commodity trader by sales, dropped 2.6 percent in Singapore after Citigroup Inc. downgraded its rating.

Mitsubishi Estate Co., Japan’s No. 1 developer by market value, rose 3.6 percent after Bank of Japan nominee Haruhiko Kuroda said he will do whatever it takes to end deflation.

The euro fell sharply against the dollar, dropping below the level at the time of $ 1.30, which was the first time in two months after a report published showed that activity in the manufacturing sector continued to decline, while the unemployment rate has reached a record high. Note that the EU statistical agency Eurostat reported that the unemployment rate in the euro area in January was 11.9%. This is the highest value for the 17 countries in the currency bloc to start keeping statistics in 1995. Value is higher than the January December, which, after an upward revision was 11.8%. Meanwhile, according to preliminary data, Eurostat, annual inflation in the euro area in February was 1.8% versus 2.0% in January. This is the lowest level since August 2010. Inflation is currently below the target level of the European Central Bank, which is just below 2.0%. In addition, note that the single currency is now on his way to his fourth consecutive weekly decline against the dollar, which is the length of the strip loss since June.

The dollar index rose to its highest level since August, as the inability of the U.S. government to avoid automatic budget cuts, known as sequestration, encouraged investors to look for safer assets.

However, the euro to recover most of its losses against the dollar amid comments of U.S. President Obama. Obama said that until recently, tried to prevent the suspension of the government, as evidenced by his willingness to accept a program to reduce budget spending billions of dollars, which automatically goes into effect, even though he did his best to prevent automatic spending cuts to save jobs place and avoid the negative effect on the economic recovery. Obama said that it was rebuffed congressional Republicans agree on a balanced budget by raising taxes on further spending cuts to avoid automatic sequestration. Obama also warned that the impact of automatic cuts would have a negative impact felt by ordinary citizens, and that will force Republicans to change their point of view.

The pound fell substantially after the data presented Markit, showed that the purchasing managers' index (PMI) for the manufacturing of Great Britain in February fell to 47.9, below the key 50 level that separates growth territory from the territory of contraction. Economists had expected a slight improvement to 51.0. Activity in the UK manufacturing sector declined in February, as the decreased amount of new foreign and domestic orders, and the company reduced staff at the fastest pace in more than three years. This renewed expectations that the Bank of England may resume quantitative easing program in one form or another, at its meeting on monetary policy, which will be held on Thursday.

Asian stocks rose, with the regional benchmark index heading for its biggest weekly advance in two months. Japanese shares rallied after a drop in consumer prices stoked speculation the Bank of Japan will add to monetary easing to beat deflation.

Nikkei 225 11,606.38 +47.02 +0.41%

Hang Seng 22,880.22 -140.05 -0.61%

S&P/ASX 200 5,086.13 -17.95 -0.35%

Shanghai Composite 2,359.51 -6.09 -0.26%

Mitsubishi Estate Co. jumped 6.1 percent, pacing gains among Japanese developers.

Sony Corp., the maker of Bravia televisions and PlayStation game consoles, rose 3.9 percent after selling a building in Tokyo for 111.1 billion yen ($1.2 billion).

Golden Agri-Resources Ltd. dropped 3.1 percent in Singapore after the world’s second-largest palm-oil producer reported fourth-quarter profit declined 93 percent.

European (SXXP) stocks declined, following nine months of gains for the Stoxx Europe 600 Index, as measures of manufacturing in the U.K. and China dropped, while a report showed euro-area unemployment has climbed to a record.

The Stoxx 600 retreated 0.3 percent to 289.02 at the close in London, paring an earlier slide of as much as 1.1 percent.

China’s manufacturing growth unexpectedly slowed last month. The country’s official purchasing managers’ index slipped to 50.1 in February from 50.4 in January, the National Bureau of Statistics and China Federation of Logistics and Purchasing said today in Beijing. The reading compared with the 50.5 median estimate in a Bloomberg News survey of 31 economists. A number above 50 means that activity increased.

European stocks pared their decline after the Institute for Supply Management’s U.S. factory index increased to 54.2 last month from 53.1 a month earlier. Economists had projected the gauge would decline to 52.5, according to the median forecast in a Bloomberg survey.

National benchmark indexes dropped in 11 of the 18 western- European markets.

FTSE 100 6,378.6 +17.79 +0.28% CAC 40 3,699.91 -23.09 -0.62% DAX 7,708.16 -33.54 -0.43%

Rio Tinto retreated 2.8 percent to 3,442 pence as a gauge of mining companies posted the largest decline of the 19 industry groups in the Stoxx 600.

Kazakhmys Plc (KAZ) slumped 4.7 percent to 590 pence. Liberum Capital Ltd. downgraded Kazakhstan’s biggest copper producer to hold from buy, citing higher unit costs at its businesses.

Glencore International Plc (GLEN) dropped 2.7 percent to 377 pence. The largest publicly traded commodities supplier said it will miss its March 15 deadline to complete the $33 billion takeover of Xstrata Plc. Glencore said that it needs approval from China before it can conclude the deal. Xstrata slid 3.1 percent to 1,127 pence.

Belgacom plunged 5.6 percent to 20.21 euros after Belgium’s largest phone company forecast earnings before interest, taxes, depreciation and amortization of 1.69 billion euros ($2.2 billion) to 1.73 billion euros for 2013. The average analyst estimate had predicted Ebitda of 1.75 billion euros this year.

Vopak tumbled 11 percent to 48.90 euros, falling the most since November 2008. The world’s largest oil and chemical storage company reported an 8.5 percent drop in full-year operating profit to 536 million euros.

Deutsche Bank AG lost 4.3 percent to 33.57 euros. Germany’s largest bank was downgraded to sell from neutral at Goldman Sachs Group Inc.

U.S. stocks rose, erasing earlier losses in the Standard & Poor’s 500 Index, as better-than- estimated data on consumer confidence and manufacturing offset concerns about federal spending cuts. For the week DOW index rose 0,53%, Nasdaq rose 0,17%, S&P gained 0.05%.

“The sequester panic, if this was 18 months ago, we could have seen multi-hundred point swings in the market,” Kevin Divney, chief investment officer at Beaconcrest Capital Management in Boston, said in a phone interview. “What has happened is that the policy makers have lost credibility with the stock market.”

President Barack Obama met with congressional leaders today as no one predicted a breakthrough to avert $85 billion in federal spending cuts set to start before midnight. Democrats and Republicans are in a standoff over how to replace the cuts totaling $1.2 trillion over nine years. Obama said the spending cuts will cause “ripple effects” throughout the economy and jobs will be lost.

Manufacturing Expands

American factories expanded in February at the fastest pace in almost two years. The Institute for Supply Management’s factory index rose to 54.2, the highest reading since June 2011, the Tempe, Arizona-based group said today.

Consumer spending in the U.S. rose in January even as incomes dropped by the most in 20 years, showing households were weathering the payroll-tax increase by socking away less money in the bank. Outside the U.S., data showed China’s manufacturing slowed for a second month while factory output in the euro area contracted for the 19th straight month.

“A couple economic data points are reminding the market that the sequestration is an issue,” Andres Garcia-Amaya, New York-based global market strategist at JPMorgan Chase & Co.’s mutual funds unit, which oversees $400 billion in assets, said in a phone interview. “It’s an issue that was known, but the underlying fundamental data continued to improve slightly.”

Federal Reserve Bank of Chicago President Charles Evans said the Fed should press on with $85 billion in monthly bond buying, warning that a premature withdrawal of stimulus risks hobbling the recovery.

“We need to be careful not to undermine our own policies and remove accommodation prematurely, as the Japanese did,” Evans said yesterday in a speech in Des Moines, Iowa.

Most components of DOW index closed in plus (18 of 30). Shares of Wal-Mart Stores Inc. (WMT, +1.51%) advanced more than other components. Shares of Alcoa, Inc. (AA, -1.12%) fell more than other components

Sectors of the S&P closed trading mixed. Most growts showed healthcare sector (+0.5%). Most fell showed sector of conglomerates (-0.8%).

On result of yesterdays session:

Dow +35.17 14,089.66 +0.25%

Nasdaq +9.55 3,169.74 +0.30%

S&P +3.53 1,518.21 +0.23%

00:30 Australia Building Permits, m/m January -4.4% +2.8% -2.4%

00:30 Australia Building Permits, y/y January +9.3% +8.1% +9.9%

00:30 Australia ANZ Job Advertisements (MoM) February -0.9% +3.0%

00:30 Australia Company Operating Profits Quarter IV -2.9% -0.9% -1.0%

Japan’s currency rose versus the euro as Asian stocks extended a global rout before data this week forecast to show Europe’s economy contracted.

The yen gained even after the nominee to become the next Bank of Japan governor pledged more monetary easing to defeat deflation. Haruhiko Kuroda, Abe’s pick to run the central bank, said in parliament today that the BOJ will do whatever is needed to end 15 years of deflation, including an early start to open- ended asset purchases. The BOJ announced those steps in January, deferring them till next year.

The euro traded 0.4 percent from the lowest in almost three months against the greenback as Italy edged closer to a new election. In Rome, a top aide to Democratic Party leader Pier Luigi Bersani said the country may need to hold another election this year after last week’s vote ended in a four-way split. The electorate revolted against German-inspired austerity measures, handing the party of comedian-turned-politician Beppe Grillo more than 25 percent of the vote with its anti-spending cut message and a call for a referendum on euro membership.

Australia’s dollar sank to a five-month low after building approvals declined. The number of permits granted to build or renovate houses and apartments declined 2.4 percent from December, when they fell a revised 1.7 percent, the Bureau of Statistics said in Sydney today. The median economist forecast was for a 2.8 percent gain.

EUR/USD: during the Asian session, the pair traded in the range of $1.3000-30.

GBP/USD: during the Asian session, the pair traded in the range of $1.5020-40.

USD/JPY: during the Asian session, the pair traded in the range of Y93.25-70.

Eurozone PPI data due up at 1000GMT in an otherwise data light morning. However, the week ahead provides interest with central bank decisions due from the RBA, BOC, ECB, BOE and BOJ, though no change expected in policy from any of them (ECB Draghi will outline key elements of the quarterly staff projections). US employment report Friday to end the week. Sterling was seen under pressure Friday following the release of weak manufacturing PMI data. This will turn attention onto services PMI data Tuesday, a weak reading here expected to put the market on a QE extension footing. BOE rate decision due this week (Thursday), but despite the recent 6-3 split at the last meeting to keep QE unchanged, most expect rates and QE to again hold steady (despite BOE King's vote for stg25bln extension last meeting).

00:30 Australia Building Permits, m/m January -4.4% +2.8%

00:30 Australia Building Permits, y/y January +9.3% +8.1%

00:30 Australia ANZ Job Advertisements (MoM) February -0.9%

00:30 Australia Company Operating Profits Quarter IV -2.9% -0.9%

09:00 Eurozone Eurogroup Meetings March

09:30 Eurozone Sentix Investor Confidence March -3.9 -4.5

09:30 United Kingdom PMI Construction February 48.7 49.2

10:00 Eurozone Producer Price Index, MoM January -0.2% +0.5%

10:00 Eurozone Producer Price Index (YoY) January +2.1% +1.9%

13:00 U.S. FOMC Member Yellen Speaks March

18:15 U.S. FOMC Member Jerome Powell Speaks March

22:30 Australia AIG Services Index February 45.3© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.