- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-03-2013

Consumer price inflation in the Organization for Economic Cooperation and Development (OECD) area decelerated notably in January, and hit the lowest level in more than two years, latest data showed Tuesday.

Inflation as per the consumer price index dropped to1.7 percent in January from 1.9 percent in December. The latest figure was the lowest since November 2010.

Driving the easing of the headline inflation, energy prices rose at a notably slower rate of 1.8 percent year-on-year in January than 2.9 percent in December. Meanwhile, the growth in food prices remained unchanged at 2.1 percent.

Core inflation, excluding food and energy prices, stayed unchanged at 1.5 percent during the month, data showed.

Among member countries, annual inflation in Canada eased to 0.5 percent from 0.8 percent in December, while Germany's inflation dropped to 1.7 percent from 2 percent. Inflation in France slowed to 1.2 percent in January from 1.3 percent in the previous month, while Italian inflation dropped to 2.2 percent from 2.3 percent.

Japan continued to record deflation, with the index falling at a faster rate of 0.3 percent than 0.1 percent in December. In the United Kingdom, inflation stayed stable at 2.7 percent for the fourth consecutive month.

Month-on-month, the consumer price index for the OECD area edged up 0.1 percent in January, after holding flat in the previous month, data showed.

European stocks fell from a 4 1/2- year high, with the benchmark index reversing gains in the last hour of trading, as companies from Henkel AG to Legal & General Group Plc posted earnings.

National benchmark indexes dropped in 14 of the 18 western European markets. Germany’s DAX added 0.6 percent and France’s CAC 40 retreated 0.4 percent, while the U.K.’s FTSE 100 was little changed.

Sacyr slipped 3.6 percent to 1.65 euros after Goldman Sachs Group Inc. said it sold a 2.79 percent stake in the Spanish builder at 1.64 euros per share. The bank purchased the shares from Austral BV before reselling them to investors.

Axel Springer AG tumbled 5.9 percent to 34.13 euros after Europe’s largest newspaper publisher forecast lower profit in 2013 because of spending to accelerate its shift to digital publications amid a declining print business. The owner of Germany’s largest tabloid also reported a 5.8 percent increase in 2012 earnings before interest, taxes, depreciation and amortization.

Henkel rose 2.4 percent to 70.33 euros, the highest price since at least August 1992. The world’s biggest adhesives company reported a 4 percent increase in like-for-like revenue for the fourth-quarter, topping analyst estimates for a 3.2 percent gain. Henkel also forecast sales growth of as much as 5 percent and higher profitability this year.

Legal & General gained 3.3 pence to 166 pence, the highest price in almost six years, as the largest manager of U.K. pension assets raised its dividend 20 percent to 7.65 pence a share after demand for retirement products boosted sales, cash flow and profit.

Admiral Group Plc rallied 5.3 percent to 1,334 pence after the owner of the confused.com website reported a 15 percent increase in full-year pretax profit to 345 million pounds ($519 million). That beat the 331.7 million-pound average estimate of analysts.

Vodafone Group Plc rallied 6.8 percent to 180 pence, the biggest increase since February 2009, after people familiar with the situation said Verizon Communications is seeking to resolve its relationship with the U.K. company and has weighed options that range from ending its wireless venture with Vodafone to a full merger of the two phone companies. Vodafone owns a 45 percent stake in the Verizon Wireless subsidiary which is is worth about $115 billion, according to analysts.

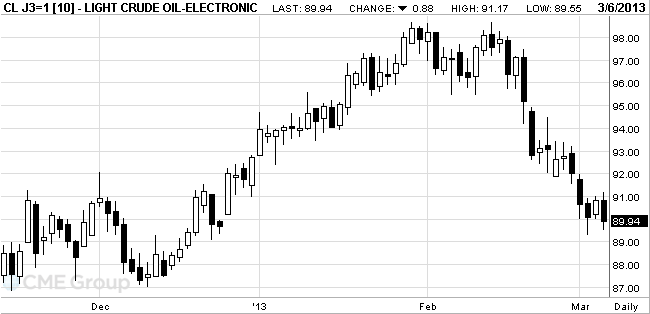

West Texas Intermediate oil fell for the fourth time in five days as a government report showed U.S. inventories increased more than expected last week.

Prices dropped as much as 1.3 percent after the Energy Information Administration, the Energy Department’s statistical arm, said supplies rose 3.83 million barrels in the week ended March 1. Analysts expected a gain of 788,000 barrels.

Oil stockpiles rose to 381.4 million barrels last week, the most since June 29, the EIA reported. Supplies at Cushing, Oklahoma, the delivery point for WTI, gained 257,000 barrels to 50.8 million.

Venezuelan President Hugo Chavez died yesterday, and an election must be held within 30 days. U.S. crude imports from Venezuela, OPEC’s fourth-largest producer, totaled 549,000 barrels in the week ended Feb. 22, down 44 percent from a year earlier, EIA data showed. U.S. domestic output rose to as much as 7.12 million barrels a day in February, the most since 1992.

Venezuela pumped 2.86 million barrels of oil a day last month, behind Saudi Arabia, Iraq and Kuwait in the 12-member Organization of Petroleum Exporting Countries, according to a survey of oil companies, producers and analysts.

WTI for April delivery declined to $89.55 a barrel on the New York Mercantile Exchange.

Brent for April settlement fell 94 cents, or 0.8 percent, to $110.67 on the London-based ICE Futures Europe exchange.

The price of gold has stabilized on hopes for the continuation of the ultrasoft policies of central banks and the increased interest in higher yielding assets.

Investors' attention turned to the stock market, when on the eve of the U.S., the Dow Jones reached a historic high, while European shares rose to its highest level since 2008.

According to analysts, the European Central Bank, the Bank of England and Bank of Japan this week the supersoft policy after assuring the Fed to continue the program of buying bonds.

South Korea's central bank bought 20 tonnes of gold in February, making the fifth purchase in less than two years, bringing the inventories to 104.4 tonnes. At the same time, the world's largest reserves of gold-exchange-traded fund (ETF) SPDR Gold Trust on Tuesday dropped to a 16-month low of 1.244,855 tons, indicating the sale of gold by investors.

April futures price of gold on COMEX today rose to 1584.30 dollars per ounce.

With orders for transportation equipment showing a substantial pullback, the Commerce Department released a report on Wednesday showing a notable drop in new orders for U.S. manufactured goods in the month of January.

The Commerce Department said factory orders fell by 2.0 percent in January following a revised 1.3 percent increase in December. Economists had expected orders to drop by about 2.2 percent compared to the 1.8 percent increase that had been reported for the previous month.

The drop by factory orders in January was largely due to a 19.8 percent decrease in orders for transportation equipment, which followed a 9.9 percent increase in December.

Excluding orders for transportation equipment, factory orders rose by 1.3 percent in January compared to a 0.1 percent drop in December.

The drop in orders for transportation equipment contributed to a 4.9 percent decrease in orders for durable goods, which was revised from the 5.2 percent decrease reported last week.

On the other hand, orders for non-durable goods increased by 0.6 percent in January after falling by 0.6 percent in December.

The report also showed that shipments of manufactured goods fell for the second consecutive month, dipping by 0.2 percent in January after edging down by less than a tenth of a percent in December.

A 1.2 percent decrease in shipments of durable goods was partly offset by a 0.6 percent increase in shipments of non-durable goods.

Additionally, the Commerce Department said inventories of manufactured goods rose by 0.5 percent in January after inching up by less than a tenth of a percent in the previous month.

With inventories rising and shipments falling, the inventories-to-shipments ratio crept up 1.28 in January from 1.27 in December.

U.S. stock-index futures advanced after a private jobs report showed companies took on more workers than estimated in February.

Global Stocks:

Nikkei 11,932.27 +248.82 +2.13%Hang Seng 22,777.84 +217.34 +0.96%

Shanghai Composite 2,347.18 +20.87 +0.90%

FTSE 6,456.83 +24.88 +0.39%

CAC 3,796.24 +9.05 +0.24%

DAX 7,957.36 +87.05 +1.11%

Crude oil $90.65 -0.19%

Gold $1575.70 +0.05%

Downgrade:

Apple (AAPL) was downgraded to Sell from Buy at Berenberg

Other:

Apple (AAPL) target was lovered to $530 from $575 at Barclays

EUR/USD $1.3000, $1.3025, $1.3150, $1.3200

USD/JPY Y92.50, Y93.00, Y93.50, Y93.55

GBP/USD $1.5000

EUR/GBP stg0.8650

AUD/USD $1.0150, $1.0200, $1.0290Data

00:30 Australia Gross Domestic Product (QoQ) Quarter IV +0.5% +0.6% +0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter IV +3.1% +3.0% +3.1%

08:00 United Kingdom Halifax house price index February -0.2% +0.4% +0.5%

08:00 United Kingdom Halifax house price index 3m Y/Y February +1.3% +1.9%

09:45 United Kingdom BOE Gov King Speaks

09:45 United Kingdom BOE Executive Director Andrew Bailey Speaks

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV -0.6% -0.6% -0.6%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV -0.9% -0.9% -0.9%

The euro fell slightly after the data, which were presented by the Statistics agency Eurostat showed that the fourth quarter GDP in the euro area fell by 0.6%, compared with a fall of 0.1% in the third quarter. Note that this was the largest reduction rate from the first quarter of 2009, but, despite this, fully consistent with the projections of experts. The report also showed, that the costs of household final consumption decreased by the end of last quarter, by 0.4%, while government spending fell by 0.1%. Meanwhile, we note that the volume of investments has decreased even more rapidly, thus showing decline of 1.1%. It also became known that the volume of exports and imports decreased by 0.9% compared to the previous quarter.

The Swiss franc and the Japanese yen weakened, as many market participants are awaiting publication of a national report on U.S. employment from ADP, which is expected to show that the company increased the number of people employed in the last month, though at a slower pace than in January .

Franc fell against all 16 major currencies after the Dow Jones moved yesterday to a record high amid optimism that the world's largest economy is gaining momentum.

Australia's currency strengthened against the dollar, recording a session with the second increase in a row, as a government report showed that the seasonally adjusted gross domestic product of Australia increased in the fourth quarter by 0.6 percent. Note that this increase is fully consistent with the average forecast of most economists, but was slightly less than the revised upwards the figure for the previous quarter of 0.7 percent expansion. Recall that according to initial estimates of growth in the third quarter was 0.5 percent. In addition, it was reported that the volume of trade fell by 2.7 percent, while real gross domestic income remained unchanged.

The pound weakened against most currencies, which is associated with the beginning of the two-day meeting of the Bank of England, which will deal with the question regarding the additional stimulus. Note that some economists predict that the central bank will increase the asset purchase program to the level of 400 billion pounds ($ 604 billion) from the current 375 billion pounds.

EUR / USD: during the European session the pair fell to the low of $ 1.3022

GBP / USD: during the European session the pair fell to the low of $ 1.5061

USD / JPY: during the European session, the pair rose to Y93.50

At 13:15 GMT the U.S. will announce the change in the number of employees from ADP in February. At 14:00 GMT we will know the decision of the Bank of Canada Interest Rate for March, and will cover the application of the Bank of Canada in March. At 15:00 GMT in Canada comes from the Ivey PMI index for February, and the U.S. will announce the change in the volume of industrial orders in January. At 19:00 GMT the U.S. will publish economic survey of the Fed's regions "Beige Book."

EUR/USD

Offers $1.3140, $1.3115/25, $1.3100, $1.3080/85

Bids $1.3010/00, $1.2980-60,$1.2950, $1.2920, $1.2900, $1.2880, $1.2865-50

GBP/USD

Offers $1.5300, $1.5270, $1.5240/50, $1.5220/25, $1.5180/85, $1.5130/35, $1.5100/10

Bids $1.5035/30, $1.5000, $1.4985/80

AUD/USD

Offers $1.0375/80, $1.0340/50, $1.0330

Bids $1.0220/15, $1.0200, $1.0160/50, $1.0120/15, $1.0050, $1.0020, $1.0000

EUR/GBP

Offers stg0.8720/25, stg0.8695/700, stg0.8660/65, stg0.8650

Bids stg0.8575/70, stg0.8555/50, stg0.8520, stg0.8505/00

EUR/JPY

Offers Y122.10, Y122.08

Bids Y121.35/25, Y121.00, Y120.80, Y120.00

USD/JPY

Offers Y94.50, Y94.30/35, Y94.00, Y93.70/75, Y92.50/60

Bids Y92.95/90, Y92.65/60, Y92.45/40, Y92.20/10, Y92.00European stocks rose, climbing to the highest level in the last 4.5 years, after the company reported better-than-expected results of its activities.

Stoxx Europe 600 Index added 0.2 percent, reaching 294.79.

Note that today is expected to publish the reports of eight other companies that are in the Stoxx 600 today. Of those that reported their results, about 48% higher than analysts' estimates for earnings.

Cost Henkel AG rose 2.7% to 70.54 euros, registering with the highest value, at least since August 1992, after the company reported a 4 percent increase in revenue for the fourth quarter, topping analysts' estimates at 3.2%. We also note that Henkel forecast sales growth of as much as 5 percent, as well as higher yield this year.

Shares of Legal & General Group Plc rose 0.7% to 163.8 pence as the biggest asset manager UK pension dividends per share increased by 20% to 7.65 pence, citing increased demand for pension products, as well as increasing cash flow and earnings.

The cost of Admiral Group Plc rose 4.3% to 1,322 pence after the owner of the site confused.com reported an increase in profit before tax for the previous year by 15% to 345 million pounds, compared with forecasts for the level of 331.7 million .

Shares of Sacyr (SYV) fell 3.5% to 1.65 euros after Goldman Sachs Group said it sold 2.79% stake in the Spanish builder to 1.64 euros per share. Note that the bank acquired the shares from the Austral BV before reselling them to investors.

To date:

FTSE 100 6,441.73 +9.78 +0.15%

CAC 40 3,793.66 +6.47 +0.17%

DAX 7,939.48 +69.17 +0.88%

EUR/USD $1.3000, $1.3025, $1.3150, $1.3200

USD/JPY Y92.50, Y93.00, Y93.50, Y93.55

GBP/USD $1.5000

EUR/GBP stg0.8650

AUD/USD $1.0150, $1.0200, $1.0290

Asian stocks climbed, with the regional benchmark index touching the highest level since August 2011, after U.S. shares surged to a record as the service industry expanded at the fastest pace in a year and investors bet central banks will continue stimulus measures.

Nikkei 225 11,932.27 +248.82 +2.13%

Hang Seng 22,777.84 +217.34 +0.96%

S&P/ASX 200 5,116.79 +41.43 +0.82%

Shanghai Composite 2,347.18 +20.87 +0.90%

Toyota Motor Corp., a carmaker that gets 25 percent of its sales in North America, rose 2 percent in Tokyo.

Sharp Corp. jumped 14 percent as the unprofitable Japanese television maker is said to be in talks to secure investment from Samsung Electronics Co.

ZTE Corp. surged 7.1 percent in Hong Kong after China’s second-largest mobile-phone equipment maker said it’s collaborating with Intel Corp. on next-generation smartphones.The Dollar Index traded at almost its highest level in six months as service industries in the U.S. expanded in February at the fastest pace in a year, adding to signs of economic acceleration.

The U.S. currency was supported after the Institute for Supply Management’s non-manufacturing index exceeded forecasts, fueling speculation the Federal Reserve may have scope to reduce monetary stimulus earlier than projected.

The Institute of Supply Management’s non-manufacturing index increased to 56 last month from 55.2 in January, the Tempe, Arizona-based group said. Economists projected the guage would be little changed at 55, according to the median estimate. Readings above 50 signal expansion.

Australia’s currency climbed versus the dollar as the central bank kept interest rates on hold. Governor Glenn Stevens said in a statement that growth in 2012 was led by “very large increases in capital spending in the resources sector,” while reiterating that the inflation outlook “would afford scope to ease policy further, should that be necessary.”

The euro exchange rate fluctuates against the dollar after data showed that business activity in the euro area services sector declined in February compared with January, adding evidence that the region's economy will continue to be liquefied in the first three months of the year, which could be the fourth quarterly drop in a row. In addition, it was reported that retail sales rose by 1.2% on a monthly basis, fully compensate for the decline of 0.8% in December, which was revised from 0.9% decline.

The pound rose against the dollar before the euro after a report showed that the UK services sector expanded in February, showing a more rapid pace than analysts had forecast that downgraded the speculation as to whether the Bank of England will increase the incentive program.

The focus of investors are the most important meeting of the European Central Bank and the Bank of England, which will be held later in the week.

Asian stocks climbed, with the regional benchmark index rising after two days of losses, amid speculation central bankers will continue stimulus measures and as China maintained its economic-growth target for 2013.

Nikkei 225 11,683.45 +31.16 +0.27%

Hang Seng 22,560.5 +22.69 +0.10%

S&P/ASX 200 5,075.36 +64.84 +1.29%

Shanghai Composite 2,326.31 +52.90 +2.33%

James Hardie Industries SE, a building-materials supplier that gets two-thirds of its sales from the U.S., rose 3.9 percent in Sydney.

SK Hynix Inc., the world’s second-largest maker of computer memory chips, added 3.9 percent in Seoul after Kiwoom Securities Co. said chip prices will continue to gain this month.

Fast Retailing Co., Asia’s biggest clothier, jumped 5.5 percent in Tokyo after reporting same-store sales at its Uniqlo outlets in Japan increased last month.

European stocks rose, with the Stoxx Europe 600 Index rallying to a 4 1/2-year high, amid speculation that central banks around the world will continue with measures to support economic recovery.

Federal Reserve Vice Chairman Janet Yellen said yesterday the U.S. central bank should press on with its $85-billion monthly bond purchases. Yellen echoed Chairman Ben S. Bernanke’s comment last week that the benefits of the Fed’s low interest rates and $3.1 trillion balance sheet outweigh any risk of financial instability.

In Asia, Kikuo Iwata, a nominee for deputy governor at the Bank of Japan, said the monetary authority should buy longer- term bonds to help it achieve a 2 percent inflation target.

China plans to raise its budget deficit by 50 percent this year as the government cuts taxes and boosts measures to support consumer demand in the world’s second-biggest economy. Premier Wen Jiabao set a growth target of 7.5 percent for 2013.

In the euro area, officials indicated that budget policies may be eased after a backlash against austerity plans.

Economic strains may “justify in a certain number of cases reviewing deadlines for the correction of excessive deficits,” European Union Economic and Monetary Commissioner Olli Rehn told reporters late yesterday.

National benchmark indexes climbed in all of the 18 western European markets except Greece. France’s CAC 40 rose 2.1 percent. The U.K.’s FTSE 100 gained 1.4 percent. Germany’s DAX added 2.3 percent.

Standard Chartered climbed 3.2 percent to 1,837.5 pence, the highest price since December 2010. Britain’s second-largest lender by market value said pretax profit rose to $6.88 billion from $6.78 billion a year earlier. That beat the $6.84 billion estimate of analysts.

Serco rallied 8.9 percent to 630.5 pence, the biggest jump since September 2003. The U.K. services company that operates prisons and London’s Docklands Light Railway posted 6 percent growth in adjusted pretax profit and increased the dividend 20 percent to 10.1 pence.

Roche Holding AG, the world’s largest maker of cancer drugs, gained 1.4 percent to 218.30 Swiss francs, the highest price since October 2007. The company obtained European Union approval for its breast-cancer drug Perjeta. Separately, Chief Executive Officer Severin Schwan confirmed the company’s 2013 sales and earnings forecasts and said he expects Roche will be able to raise its dividend for this year.

Deutsche Post AG increased 5.8 percent to 17.99 euros, the highest price since June 2008. Europe’s biggest postal service said fourth-quarter net income totaled 542 million euros ($707 million), topping the average 482 million-euro analyst forecast. The company said it expects 2013 earnings before interest and taxes in the range of 2.70 billion euros to 2.95 billion euros. That compared with the average analyst estimate calling for 2.87 billion euros.

The Dow Jones Industrial Average climbed to a record, erasing losses from the financial crisis, as China vowed to maintain its growth target and investors bet central banks will continue stimulus measures.

The bull market in U.S. equities enters its fifth year this month. The S&P 500 has surged 128 percent from a 12-year low in 2009 as companies reported better-than-estimated earnings and the Federal Reserve embarked on three rounds of bond purchases to stimulate the economy.

Stimulus Measures

U.S. stock indexes advanced this week amid optimism the Fed will maintain stimulus measures to support the economic recovery. Fed Vice Chairman Janet Yellen said yesterday the U.S. central bank should press on with $85 billion in monthly bond buying while tracking possible costs and risks from the unprecedented program.

Global equities also rose today as China pledged to support economic expansion. The nation will keep its growth target at 7.5 percent for this year and plans a 10 percent jump in fiscal spending, the government said during the start of the National People’s Congress today.

The Institute for Supply Management’s index of U.S. non- manufacturing businesses, which covers about 90 percent of the economy, rose to 56 in February from the prior month’s 55.2, the Tempe, Arizona-based group said today. Readings above 50 signal expansion. The ISM services survey covers industries ranging from utilities and retailing to housing, health care and finance.

All 10 groups in the Standard & Poor’s 500 Index and 27 out of 30 stocks in the Dow rose. Apple Inc. rallied 2.6 percent for its first gain in five days. Qualcomm Inc. jumped 2 percent as it increased its dividend by 40 percent and set up a $5 billion share buyback plan. J.C. Penney Co. sank 11 percent after its second-biggest shareholder sold part of its stake.

At the close:

S&P 500 1,539.79 +14.59 +0.96%

NASDAQ 3,224.13 +42.10 +1.32%

Dow 14,253.77 +125.95 +0.89%

00:30 Australia Gross Domestic Product (QoQ) Quarter IV +0.5% +0.6% +0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter IV +3.1% +3.0% +3.1%

The dollar fell for a second day against most of its 16 major counterparts before a private jobs report in the U.S. forecast to show companies added positions. U.S. companies took on more workers last month after adding the most jobs in almost a year in January, figures from the Roseland, New Jersey-based ADP Research Institute will probably show today. The Dollar Index declined for a third day before the Federal Reserve releases its Beige Book report.

The euro was little changed against the yen for a third session before European Central Bank President Mario Draghi and his board meet tomorrow. The ECB will probably maintain its benchmark rate at 0.75 percent this week, according to a Bloomberg survey. The central bank will also update its December economic forecasts.

The euro area’s gross domestic product probably fell 0.6 percent in the fourth quarter from the previous three-month period, according to the median estimate of economists surveyed by Bloomberg before the data today. The European Commission sees inflation at 1.8 percent this year and 1.5 percent in 2014.

Australia’s dollar gained after the nation’s statistics bureau said GDP expanded 0.6 percent in the fourth quarter and revised growth for the previous three months up to 0.7 percent from 0.5 percent previously.

EUR / USD: during the Asian session, the pair rose to $ 1.3070.

GBP / USD: during the Asian session, the pair rose to $ 1.5155.

USD / JPY: during the Asian session the pair fell to Y93.00.

No UK data of note on the calendar with moves to come from position adjustments ahead of Thursday's rate decisions from the BOE and ECB. Eurozone Q4 GDP due at 1000GMT with US ADP jobs data at 1315GMT and US factory orders at 1500GMT the only key data releases on the day. Position adjustments ahead of Thursday's ECB Draghi's press conference could see market probing for stops.

Change % Change Last

Oil 90.64 -0.18 -0.20%

Gold $1,574.80 -0.10 -0.01%

Change % Change Last

Nikkei 225 11,683.45 +31.16 +0.27%

Hang Seng 22,560.5 +22.69 +0.10%

S&P/ASX 200 5,075.36 +64.84 +1.29%

Shanghai Composite 2,326.31 +52.90 +2.33%

FTSE 100 6,431.95 +86.32 +1.36%CAC 40 3,787.19 +77.43 +2.09%

DAX 7,870.31 +178.63 +2.32%

S&P 500 1,539.79 +14.59 +0.96%

NASDAQ 3,224.13 +42.10 +1.32%

Dow 14,253.77 +125.95 +0.89%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3049 +0,18%

GBP/USD $1,5125 +0,07%

USD/CHF Chf0,9407 0,00%

USD/JPY Y93,28 -0,21%

EUR/JPY Y121,74 -0,02%

GBP/JPY Y141,08 -0,13%

AUD/USD $1,0255 +0,59%

NZD/USD $0,8309 +0,40%

USD/CAD C$1,0269 -0,03%

00:30 Australia Gross Domestic Product (QoQ) Quarter IV +0.5% +0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter IV +3.1% +3.0%

08:00 United Kingdom Halifax house price index February -0.2% +0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y February +1.3%

09:45 United Kingdom BOE Gov King Speaks

09:45 United Kingdom BOE Executive Director Andrew Bailey Speaks

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV -0.6% -0.6%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV -0.9% -0.9%

13:15 U.S. ADP Employment Report February 192 168

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

15:00 Canada Ivey Purchasing Managers Index February 58.9 56.2

15:00 U.S. Factory Orders January +1.8% -2.1%

15:30 U.S. Crude Oil Inventories +1.1

19:00 U.S. Fed's Beige Book March© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.