- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-03-2021

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 (GMT) | Germany | Factory Orders s.a. (MoM) | January | -1.9% | |

| 07:45 (GMT) | France | Trade Balance, bln | January | -3.39 | |

| 08:00 (GMT) | Switzerland | Foreign Currency Reserves | February | 8969 | |

| 08:30 (GMT) | United Kingdom | Halifax house price index | February | -0.3% | |

| 08:30 (GMT) | United Kingdom | Halifax house price index 3m Y/Y | February | 5.4% | |

| 13:30 (GMT) | U.S. | Manufacturing Payrolls | February | -10 | 11 |

| 13:30 (GMT) | U.S. | Average workweek | February | 35 | 34.9 |

| 13:30 (GMT) | U.S. | Government Payrolls | February | 43 | |

| 13:30 (GMT) | U.S. | Average hourly earnings | February | 0.2% | 0.2% |

| 13:30 (GMT) | U.S. | Labor Force Participation Rate | February | 61.4% | |

| 13:30 (GMT) | U.S. | Private Nonfarm Payrolls | February | 6 | 100 |

| 13:30 (GMT) | Canada | Trade balance, billions | January | -1.67 | |

| 13:30 (GMT) | U.S. | Nonfarm Payrolls | February | 49 | 110 |

| 13:30 (GMT) | U.S. | Unemployment Rate | February | 6.3% | 6.4% |

| 13:30 (GMT) | U.S. | International Trade, bln | January | -66.6 | -65.8 |

| 15:00 (GMT) | Canada | Ivey Purchasing Managers Index | February | 48.4 | |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | March | ||

| 20:00 (GMT) | U.S. | Consumer Credit | January | 9.73 | 12 |

| 20:00 (GMT) | U.S. | FOMC Member Bostic Speaks |

According to ActionForex, analysts at Wells Fargo Securities suggest that modest gain in initial claims for unemployment in the U.S. reflects some catch-up in filings after mid-month storms, and they expect that tomorrow’s payrolls report will show a pickup in job growth.

"The rise in initial jobless claims to 745K last week reflects some catch-up after winter storms delayed filings in the middle of February."

"While the President’s Day holiday has also interjected some noise to recent weeks’ figures, the four-week average dropped to the lowest level since early December. In short, initial jobless claims are finally indicating that the jobs picture is beginning to firm up again after a rough winter."

"Other data suggest the jobs recovery has regained its footing. Job postings according to Indeed.com in February surpassed their pre-COVID baseline. The latest employment reading from the ISM services index gave back some ground in February, but still logged the second-highest reading since the pandemic began."

"With vaccinations hitting their stride and substantial fiscal support making its way through the economy, growing optimism around growth should help shift the jobs recovery into higher gear in the next few months. We look for payrolls to have increased by 210K in February, but expect a marked pickup in the spring and summer."

The U.S.

Commerce Department reported on Thursday that the value of new factory orders climbed

2.6 percent m-o-m in January 2021, following a revised 1.6 percent m-o-m gain

in December 2020 (originally a 1.1 percent m-o-m advance). That marked the largest

increase in factory orders since last July 2020.

Economists had

forecast a 2.1 percent m-o-m climb.

According to

the report, orders for transportation equipment surged 7.7 percent m-o-m in

January compared to a 0.8 percent m-o-m drop in December. Gains also were

recorded in orders for electrical equipment, appliances, and components (+4.0

percent m-o-m), primary metals (+3.3 percent m-o-m) and fabricated metal

products (+1.8 percent m-o-m). However, these advances were partially offset by

declines in orders for machinery (-0.6 percent m-o-m) and computers and

electronic products (-0.5 percent m-o-m).

Meanwhile,

total factory orders excluding transportation, a volatile part of the overall

reading, rose 1.7 percent m-o-m in January (compared to an upwardly revised 1.9

percent m-o-m gain in December), while orders for nondefense capital goods

excluding aircraft, a measure of business spending plans, increased 0.4 percent

m-o-m instead of advancing 0.5 percent m-o-m as reported

last month. The report also showed that shipments of core capital goods jumped

1.8 percent m-o-m in January, rather than gaining 2.1 percent m-o-m as previously

reported.

Overall,

durable goods orders rose 3.4 percent m-o-m in January, while orders for

nondurable goods grew 1.9 percent m-o-m.

FXStreet notes that a surge in the U.S. real yields pushed down XAU/USD in February. While strategists at Capital Economics don’t expect the U.S. real yields to rise much more if at all, reduced safe-haven demand as the global economy recovers will mean that the gold price falls a little further over the course of this year.

“The price of gold continued to fall in February, and now sits close to an eight-month low. This has been primarily due to the significant rise in real yields over the last two weeks. Outflows from gold ETFs also continued, reflecting reduced investor demand for safe-havens.”

“While the price of silver also declined over the past month, this was largely a reflection of heightened price volatility at the start of February. The silver price is still above its level at the start of the year and is high relative to the price of gold, potentially as a result of the recent rally in industrial metals.”

U.S. stock-index futures traded flat on Thursday, as stabilized U.S. Treasury yields and better-than-expected weekly jobless claims supported investors’ sentiment ahead of the comments by the Federal Reserve Chair Jerome Powell later in the day.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 28,930.11 | -628.99 | -2.13% |

Hang Seng | 29,236.79 | -643.63 | -2.15% |

Shanghai | 3,503.49 | -73.41 | -2.05% |

S&P/ASX | 6,760.70 | -57.30 | -0.84% |

FTSE | 6,651.85 | -23.62 | -0.35% |

CAC | 5,830.36 | +0.300 | +0.01% |

DAX | 14,065.64 | -14.39 | -0.10% |

Crude oil | $62.22 | +1.53% | |

Gold | $1,712.20 | -0.21% |

FXStreet reports that S&P 500 remains capped at its near-term downtrend and analysts at Credit Suisse continue to look for a more protracted consolidation/corrective phase to emerge. The spotlight turns back to key flagged supports at the 63-day average and early February price gap at 3792/74, a close below which should clear the way for a deeper setback.

“We continue to look for a more protracted consolidation/corrective phase to unfold, but with the risk now seen growing steadily that we are in fact set for a deeper correction lower.”

“Key flagged support remains seen at 3792/74 – the early February price gap, rising 63-day average and recent low. A close below here should clear the way for a fall to potential trend support at 3735/34, with the real risk for an overshoot to the late January low at 3694. A sustained move below here would warn of a more concerning top.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 178 | -0.06(-0.03%) | 2363 |

ALCOA INC. | AA | 30.18 | -0.65(-2.11%) | 88463 |

ALTRIA GROUP INC. | MO | 45.09 | 0.04(0.09%) | 11730 |

Amazon.com Inc., NASDAQ | AMZN | 3,018.26 | 13.26(0.44%) | 36265 |

American Express Co | AXP | 142.9 | 0.31(0.22%) | 1950 |

AMERICAN INTERNATIONAL GROUP | AIG | 46.99 | -0.02(-0.04%) | 255 |

Apple Inc. | AAPL | 122.1 | 0.04(0.03%) | 1510617 |

AT&T Inc | T | 28.75 | 0.03(0.10%) | 135654 |

Boeing Co | BA | 233 | 4.44(1.94%) | 237591 |

Caterpillar Inc | CAT | 213.57 | -1.34(-0.62%) | 7703 |

Chevron Corp | CVX | 104.45 | 0.86(0.83%) | 33462 |

Cisco Systems Inc | CSCO | 45.05 | -0.08(-0.18%) | 21681 |

Citigroup Inc., NYSE | C | 70.53 | 0.15(0.21%) | 80992 |

Deere & Company, NYSE | DE | 343.03 | -0.03(-0.01%) | 2297 |

E. I. du Pont de Nemours and Co | DD | 75.16 | 0.58(0.78%) | 10777 |

Exxon Mobil Corp | XOM | 57.05 | 0.53(0.94%) | 176985 |

Facebook, Inc. | FB | 256.12 | 0.71(0.28%) | 72314 |

FedEx Corporation, NYSE | FDX | 258 | -0.77(-0.30%) | 3808 |

Ford Motor Co. | F | 12.29 | 0.12(0.99%) | 640732 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 34.23 | -0.77(-2.20%) | 604553 |

General Electric Co | GE | 13.95 | 0.51(3.79%) | 1957288 |

General Motors Company, NYSE | GM | 53.23 | 0.56(1.06%) | 196344 |

Goldman Sachs | GS | 335 | 0.57(0.17%) | 247452 |

Google Inc. | GOOG | 2,022.00 | -4.71(-0.23%) | 3368 |

Hewlett-Packard Co. | HPQ | 29.64 | -0.18(-0.60%) | 5951 |

Home Depot Inc | HD | 257 | -0.36(-0.14%) | 14745 |

Intel Corp | INTC | 59.86 | -0.04(-0.07%) | 48116 |

International Business Machines Co... | IBM | 122.3 | -0.06(-0.05%) | 10425 |

International Paper Company | IP | 53.23 | 0.01(0.02%) | 391 |

Johnson & Johnson | JNJ | 155.88 | -0.34(-0.22%) | 17392 |

JPMorgan Chase and Co | JPM | 152.89 | -0.02(-0.01%) | 31716 |

McDonald's Corp | MCD | 206.95 | 1.13(0.55%) | 12590 |

Merck & Co Inc | MRK | 73.15 | -0.15(-0.20%) | 11490 |

Microsoft Corp | MSFT | 227.1 | -0.46(-0.20%) | 140672 |

Pfizer Inc | PFE | 34.29 | -0.10(-0.29%) | 113165 |

Procter & Gamble Co | PG | 123.41 | 0.25(0.20%) | 3824 |

Starbucks Corporation, NASDAQ | SBUX | 106.49 | 0.27(0.25%) | 10410 |

Tesla Motors, Inc., NASDAQ | TSLA | 654.5 | 1.30(0.20%) | 766707 |

The Coca-Cola Co | KO | 49.82 | -0.16(-0.32%) | 27959 |

Verizon Communications Inc | VZ | 55.5 | 0.12(0.22%) | 47880 |

Visa | V | 214.38 | -0.47(-0.22%) | 7812 |

Wal-Mart Stores Inc | WMT | 127.87 | 0.28(0.22%) | 59846 |

Walt Disney Co | DIS | 191.2 | -1.06(-0.55%) | 51093 |

Yandex N.V., NASDAQ | YNDX | 67.23 | 1.14(1.72%) | 9797 |

The revised

data from the U.S. Labour Department showed on Tuesday that nonfarm business

sector labor productivity in the United States decreased 4.2 percent q-o-q in

the fourth quarter of 2020, as output rose 5.5 percent q-o-q and hours worked surged

10.1 percent q-o-q (seasonally adjusted). That was better than the initial estimate

of a drop of 4.8 percent q-o-q and economists’ forecast for a decline of 4.7

percent q-o-q. In the third quarter, labor productivity surged 4.2 percent

q-o-q (revised from initially reported +4.6 percent q-o-q).

In y-o-y terms,

the labor productivity increased 2.4 percent, reflecting a 2.6-percent fall in

output and a 4.9-percent drop in hours worked.

Meanwhile, unit

labor costs in the nonfarm business sector in the fourth quarter rose 6.0

percent q-o-q compared to an initial estimate of a 6.8 percent q-o-q advance

and a revised 9.7 percent q-o-q plunge in the prior quarter (originally a 7.0

percent q-o-q decrease). Economists had forecast a 6.6 percent q-o-q jump in fourth-quarter

unit labor costs.

Unit labor

costs quarterly gain reflected a 1.5-percent q-o-q climb in compensation and a

4.2-percent q-o-q fall in productivity.

Compared to the

corresponding period of 2019, unit labor costs rose 4.2 percent.

The data from

the Labor Department revealed on Thursday the number of applications for

unemployment rose slightly less than expected last week, remaining elevated, as

the U.S. labor market struggles to recover from its biggest shock in history,

caused by the COVID-19 pandemic.

According to

the report, the initial claims for unemployment benefits increased by 9,000 to

745,000 for the week ended February 27. Claims remained well above the pre-pandemic levels.

Economists had

expected 750,000 new claims last week.

Claims for the

prior week were revised upwardly to 736,000 from the initial estimate of 730,000.

Meanwhile, the

four-week moving average of jobless claims declined to 790,750 from a downwardly

revised 807,500 in the previous week.

Continuing

claims dropped to 4,295,000 from an unrevised 4,419,000 in the previous week.

Kroger (KR) reported Q4 FY 2020 earnings of $0.81 per share (versus $0.57 per share in Q4 FY 2019), beating analysts’ consensus estimate of $0.68 per share.

The company’s quarterly revenues amounted to $30.737 bln (+6.4% y/y), roughly in line with analysts’ consensus estimate of $30.786 bln.

KR rose to $33.70 (+1.35%) in pre-market trading.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:30 | United Kingdom | PMI Construction | February | 49.2 | 51 | 53.3 |

| 10:00 | Eurozone | Unemployment Rate | January | 8.1% | 8.3% | 8.1% |

| 10:00 | Eurozone | Retail Sales (YoY) | January | 0.9% | -1.2% | -6.4% |

| 10:00 | Eurozone | Retail Sales (MoM) | January | 1.8% | -1.1% | -5.9% |

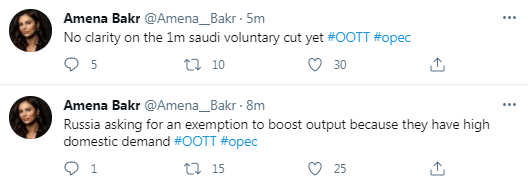

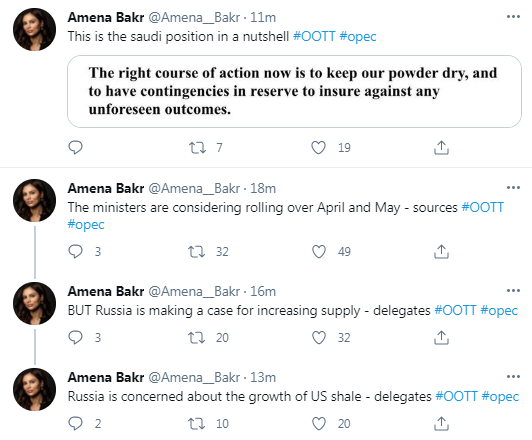

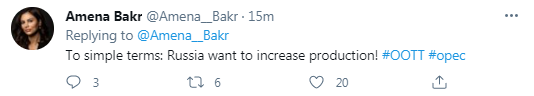

| 12:00 | OPEC | OPEC Meetings |

GBP traded mixed against its major counterparts in the European session on Thursday as investors continued to digest the UK's bumper budget, which was presented by the British finance minister Rishi Sunak on Wednesday.

The pound rose against JPY, CHF and EUR, fell against CAD, AUD and NZD, and changed little against USD.

Sunak's 2021 budget, which he delivered to the UK's parliament yesterday, set out generous measures to prop up Britain's economy as the country emerges from coronavirus lockdown. The extension of the furlough and self-employed support to September 2021 as well as the continuation of the business rates relief and grants were among the many measures of the budget. In addition, the chancellor announced plans to increase corporation tax in 2023 from 19 percent to 25 percent. The announced tax hike was sharper than businesses expected, as the UK's government tries to get to grips with the cost of its pandemic debts. Sunak, however, heightened that the headline tax rate of 25 percent meant the UK would still have the lowest corporation tax rate among the G7 countries.

The pound also remained supported by optimism over the UK's progress on vaccinations, the fact of the country averted a no-deal Brexit by reaching a last-minute trade deal with the EU at the end of 2020 as well as signals from the Bank of England (BoE) that negative interest rates are not to be implemented any time soon.

Bloomberg reported that the U.S. agreed to suspend retaliatory tariffs on the UK's products caught up in the longstanding dispute over illegal aid to Boeing and Airbus in a boost for post-Brexit Britain’s trade agenda.

The British government stated that the tariff suspension would last four months to “focus on negotiating a balanced settlement to the disputes”. This means that products like Scotch whisky, biscuits and clotted cream can be imported to the U.S. from Britain without being subject to an additional 25% duty.

The U.S.’s temporary rollback could help resolve part of the World Trade Organization (WTO) dispute over the aid to Boeing and Airbus, which involves the U.S. and the four European countries Germany, France, Spain and the UK and has resulted in WTO-authorized tariffs targeting nearly $12 billion worth of transatlantic trade.

Britain unilaterally removed tariffs on some U.S. goods indefinitely in January in a bid to reduce trade tensions.

FXStreet notes that U.S. commercial crude stocks skyrocketed last week as refinery activity plunged and net imports surged. Strategists at Capital Economics expect stocks to rise a bit further in the coming weeks as refinery throughput remains constrained.

“The EIA’s weekly US Petroleum Report estimates that crude oil in commercial storage ballooned by a record 21.6 M barrels last week. This was much larger than the 7.4 M barrel increase reported by the American Petroleum Institute (API).

“The main factor behind the increase in crude stocks was the sharp decline in crude inputs to refineries. Refinery throughput plummeted by 2.3 M bpd to just 9.9 M bpd, the lowest level since records began in 1982, owing to the ongoing freezing weather-related disruption in the southern parts of the country.”

“The partial easing of quarantine measures and the warmer weather has supported road travel activity. We expect that gasoline stocks will rise further in the next few weeks as demand continues to revive as the virus is brought under control and as refinery throughput remains soft.”

USD/JPY to see profit-taking ahead of Powell's critical speech - OCBC

FXStreet notes that the USD/JPY extension persists, after closing above 107.00 on Wednesday. However, the extension is looking stretched, and longs may want to take profits ahead of Fed Chair Powell's speech (17:05 GMT) and Nonfarm Payrolls figure on Friday, Terence Wu, FX Strategist at OCBC Bank, briefs.

“The USD/JPY close above 107.00 will give courage to the bulls to push for the 107.50/80 mark, although that may be a bridge too far ahead of the risk events into the end of the week (Powell’s speech and NFP).”

“Stretched technicals provide arguments to take profit on longs, before re-entering at better levels.”

USD/CNH: Upside momentum looks under pressure - UOB

FXStreet reports that according to FX Strategists at UOB Group, USD/CNH needs to regain the area above 6.4900 to extend the buying interest.

24-hour view: “USD subsequently traded between 6.4580 and 6.4782. The underlying tone has improved and this could lead to USD edging higher to 6.4900. For now, a sustained advance above this level is unlikely. Support is at 6.4700 followed by 6.4600.”

Next 1-3 weeks: “In our latest narrative from last Friday, we highlighted that ‘upward momentum has been boosted’ and ‘there is room for USD to move towards 6.5150’. However, since then, USD has not been able to make much headway on the upside as it traded in a quiet manner after retreating from 6.5080. Upward momentum is beginning to wane and in order to rejuvenate the flagging momentum, USD has to move and stay above 6.4900 or the prospect for further USD strength would diminish quickly. Conversely, a break of 6.4400 (no change in ‘strong support level) would indicate that the positive phase has run its course.”

USD/CHF breaks above the key 0.9195/9208 resistance area, next stop at 0.9296/9330 - Credit Suisse

FXStreet reports that the Credit Suisse analyst team notes that the USD/CHF pair is breaking above the crucial 0.9195/9208 resistance area, a close above which would expose 0.9296/9330 next and eventually 0.9498/9546.

“We expect further upside, with resistance seen next at 0.9296/9330 – a cluster containing the September high, the 50% retracement of the 2020 fall and the 38.2% retracement of the 2019 bear move. We expect to see a temporary pause here, however, we have raised our core objective to 0.9498/9546.”

“Support moves initially to 0.9141/25, beneath which would ease the immediate upside bias and see an intraday top completed to point towards a correction lower."

FXStreet reports that economists at Westpac discusses EUR/USD outlook.

“The EU’s covid vaccine rollout has suffered several logistic and bureaucratic obstacles. Regional lockdown restrictions may be on the cusp of being relaxed, but there are growing concerns over the persistence of new COVID-19 cases as new variants take hold. The economic consequence is a potential delay in recoveries which could undermine the optimism which had been featured in recent PMIs.”

“The ECB has underscored that it will maintain PEPP flexibility and that it has further policy tools to provide support if needed. This may well be a feature as the ECB meets next week. EUR/USD is likely to remain contained within an effective 1.1950-1.2350 range.”

According to the report from the Eurostat, in January 2021, the seasonally adjusted volume of retail trade fell by 5.9% in the euro area and by 5.1% in the EU, compared with December 2020. Economists had expected a 1.1% decrease in the euro area. In December 2020, the retail trade volume rose by 1.8% in the euro area and by 1.4% in the EU.

In January 2021 compared with January 2020, the calendar adjusted volume of retail trade decreased by 6.4% in the euro area and by 5.4% in the EU. Economists had expected a 1.2% decrease in the euro area.

In the euro area in January 2021, compared with December 2020, the volume of retail trade decreased by 12.0% for non-food products and by 1.1% for automotive fuels, while it increased by 1.1% for food, drinks and tobacco. In the EU the volume of retail trade decreased by 9.9% for non-food products and by 0.3% for automotive fuels, while it increased by 1.0% for food, drinks and tobacco.

In the euro area in January 2021, compared with January 2020, the volume of retail trade decreased by 18.3% for automotive fuels and by 13.6% for non-food products (within this category mail orders and internet increased by 39.1%), while it increased by 5.9% for food, drinks and tobacco. In the EU, the volume of retail trade decreased by 15.7% for automotive fuels and by 11.5% for non-food products (mail orders and internet increased by 40.0%), while it increased by 5.4% for food, drinks and tobacco.

According to the report from the Eurostat, in January 2021, the euro area seasonally-adjusted unemployment rate was 8.1%, stable compared with December 2020 and up from 7.4% in January 2020. The EU unemployment rate was 7.3% in January 2021, also stable compared with December 2020 and up from 6.6% in January 2020.

Eurostat estimates that 15.663 million men and women in the EU, of whom 13.282 million in the euro area, were unemployed in January 2021. Compared with December 2020, the number of persons unemployed increased by 29 000 in the EU and by 8 000 in the euro area. Compared with January 2020, unemployment rose by 1.465 million in the EU and by 1.010 million in the euro area.

In January 2021, 2.929 million young persons (under 25) were unemployed in the EU, of whom 2.356 million were in the euro area. In January 2021, the youth unemployment rate was 16.9% in the EU and 17.1% in the euro area, compared with 16.9% and 17.2% respectively in the previous month. Compared with December 2020, youth unemployment increased by 3 000 in the EU and decreased by 15 000 in the euro area. Compared with January 2020, youth unemployment increased by 184 000 in the EU and by 89 000 in the euro area.

According to the report from IHS Markit/CIPS, UK construction companies experienced a solid return to growth in February after a setback at the start of 2021. New orders also regained momentum as project starts increased in anticipation of improving UK economic conditions over the course of the year. Extended supplier lead times persisted in February as vendors struggled with transport delays and stronger demand conditions. Stretched global supply chains, greater shipping charges and rising commodity prices all contributed to the sharpest increase in average cost burdens across the construction sector since August 2008.

The headline seasonally adjusted UK Construction Total Activity Index posted 53.3 in February, up from 49.2 in January, to signal a solid increase on overall construction output. The index has registered above the 50.0 no-change mark in eight of the past nine months.

Residential work remained the strongest area of growth in February, although the speed of recovery eased slightly since January. There were some reports citing temporary delays on site arising from adverse weather and supply chain issues (especially for timber).

The slowdown in house building was more than offset by the sharpest rise in commercial work since last September and a slower fall in civil engineering activity. Survey respondents commented on contract awards for commercial building that had been delayed earlier in the pandemic and some reported a boost from infrastructure work related to major transport projects.

According to the report from the Society of Motor Manufacturers and Traders (SMMT), the UK new car market declined by -35.5% in February as 28,282 fewer units were registered during a traditionally weak month for new vehicle uptake. The industry recorded its lowest February uptake since 1959, with 51,312 new cars registered.

With showrooms closed nationwide since 5 January – and in many parts of the country, since December – both private and fleet sector demand fell, by -37.3% and -33.5% respectively. All vehicle segments saw declines save for luxury saloons, which recorded a 3.8% increase against a statistically very small proportion of the market.

Plug-in vehicles continued to enjoy growth, with BEVs and PHEVs taking a combined 13.0% market share for the month, up from just 5.7% in February 2020. BEV uptake increased by 40.2% to 3,516, and PHEVs by 52.1% to 3,131 as the industry continues to promote a broad range of lower-emission technologies for consumers.

FXStreet reports that economists at Westpac said that vaccine rollouts and restriction easing should keep the GBP/USD pair within a lower 1.38-1.43 range.

“The UK's March 2021 Budget once again underscored the extraordinary scale of the UK's support for the economy. Chancellor Sunak announced the inevitable lifting of the tax burden in coming years to pay for the fiscal blowout, which is still of a scale unprecedented in peacetime. Markets have taken the Budget in their stride, largely because the bulk of details had been profiled (rather than merely leaked) in the past two weeks.”

“Data over the coming week is extremely light. This may well mean that markets will focus upon the fallout from the Budget as well as the UK’s successful vaccine rollout (now over 21mn citizens have been vaccinated) and the start of lockdown restrictions being eased from next Monday. Although GBP/USD has broken below 1.40, it is likely to remain well supported and remain in an effective 1.38-1.43 range.”

According to the report from IHS Markit, the Eurozone Construction Total Activity Index ticked up from 44.1 in January to 45.0 in February, indicating a softer, albeit solid decline in construction activity. The latest contraction meant that eurozone construction activity has now declined for a full year, as companies continued to note the impact of the coronavirus disease 2019 (COVID-19) pandemic on construction projects as well as reduced order volumes. The downturn was broad based across the three monitored subsectors, with the sharpest decline recorded in civil engineering activity, followed by commercial construction.

Work undertaken on housing by eurozone construction firms decreased further in February. The decline marked the twelfth consecutive monthly fall in activity although the pace of contraction eased slightly from that seen in January. That said, the reduction remained solid.

Meanwhile, commercial construction activity contracted again in the latest survey period. Yet, the pace of the decrease eased slightly from January, and the softest recorded since September 2020.

The downturn in eurozone civil engineering activity continued in February, as work undertaken on infrastructure projects contracted sharply. The rate of decline was the quickest since May 2020, and the fastest among the monitored sub-sectors.

Employment levels among eurozone constructors decreased further in the latest survey period. That said, the pace of job shedding eased and was marginal overall.

Despite activity and order books remaining subdued, eurozone construction companies signalled stronger optimism regarding the outlook for activity over the coming 12 months. This marked the second successive month of positive sentiment among the bloc's constructors, and was the strongest recorded since February 2020.

FXStreet reports that economists at Westpac discusses NZD/USD outlook.

“The year-old NZD/USD rally peaked at 0.7465 last week. It’s unclear whether that level will represent a minor or major top. Should the recent pullback extend below 0.7200, we’d opt for the latter interpretation.”

“Domestic fundamentals remain NZD-supportive, particularly commodity prices. This week we saw a surprisingly large jump in GDT dairy auction prices, with WMP gaining 21% and the overall dairy index gaining 15%. The NZD didn’t react, though, perhaps because markets ceased closely following GDT results after fairly stable prices over the past five years.”

“Global factors will dominate NZD/USD direction. Our medium-term outlook for upbeat global sentiment and a weaker USD could be tested during the weeks ahead.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Trade Balance | January | 7.133 | 6.5 | 10.142 |

| 00:30 | Australia | Retail Sales, M/M | January | -4.1% | 0.6% | 0.5% |

| 05:00 | Japan | Consumer Confidence | February | 29.6 | 33.8 |

During today's Asian trading, the US dollar consolidated against the euro and the yen.

Investors continue to watch the change in the yield of US Treasury bonds. The day before, the yield on ten-year US Treasuries rose by 8 basis points to 1.485%. On Thursday, it is about 1.457%.

The ICE Dollar index, which shows the value of the US dollar against six major world currencies, rose by 0.07%.

Today, investors are waiting for the publication of data from the US Department of Labor on the number of applications for unemployment benefits last week, as well as a speech by the head of the US Federal Reserve System Jerome Powell. The U.S. Department of Labor will also release data on labor productivity and labor costs in the fourth quarter.

In addition, the European Union will release data on retail sales and unemployment in January.

On the eve of the British Finance Minister Rishi Sunak presented a new package of measures totaling 65 billion pounds, which should help the country's economy recover from the crisis caused by the coronavirus pandemic.

Bloomberg reports that Fed Chairman Jerome Powell will probably seek to convince suddenly skeptical financial markets on Thursday that the central bank will be ultra-patient in pulling back its support for the economy after the pandemic has ended.

Rather than trying to cap rising long-term interest rates, Fed watchers expect Powell to reaffirm the Fed’s determination to meet its revamped employment and inflation goals by keeping monetary policy looser for longer, and to make clear he’d like to avoid a repeat of last week’s disorderly bond market.

“It’s not an issue of trying to talk down the market,” said JPMorgan Chase & Co. chief U.S. economist Michael Feroli. “But you do want interest rates to be aligned with the Fed’s objectives.”

That’s important for the economy’s long-run health. If the markets and the Fed are in sync, they’ll work together to attain the central bank’s objectives of maximum employment and 2% average inflation under its new strategic framework.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2155 (2367)

$1.2114 (4017)

$1.2088 (1554)

Price at time of writing this review: $1.2057

Support levels (open interest**, contracts):

$1.2030 (4136)

$1.1993 (7329)

$1.1947 (6768)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 5 is 103889 contracts (according to data from March, 3) with the maximum number of contracts with strike price $1,2000 (7329);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4153 (304)

$1.4106 (408)

$1.4061 (1861)

Price at time of writing this review: $1.3958

Support levels (open interest**, contracts):

$1.3893 (142)

$1.3881 (313)

$1.3841 (315)

Comments:

- Overall open interest on the CALL options with the expiration date March, 5 is 15364 contracts, with the maximum number of contracts with strike price $1,4250 (2483);

- Overall open interest on the PUT options with the expiration date March, 5 is 18866 contracts, with the maximum number of contracts with strike price $1,3500 (1331);

- The ratio of PUT/CALL was 1.23 versus 1.21 from the previous trading day according to data from March, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

eFXdata reports that CIBC Research discusses CAD outlook.

"Given higher levels of crude than previously assumed, and the persistence in the CAD’s correlation with movements in the broader USD index, we now see scope for an appreciation in the C$ over the next few months, with USDCAD expected to sit near 1.24 at midyear and at 1.27 by year-end. Momentum trading and enthusiasm for commodities currencies could swamp longer-term fundamentals, including a chronic trade deficit, that suggest that the C$ is already too rich for the economy’s blood," CIBC adds.

RTTNews reports that according to the report from the Australian Bureau of Statistics, the total value of retail sales in Australia was up a seasonally adjusted 0.5 percent on month in January, coming in at A$30.512 billion. That was shy of expectations for an increase of 0.6 percent following the 4.1 percent decline in December.

Individually, sales were higher for food (1.6 percent), household goods (0.1 percent) and other (1.4 percent). Sales were down for clothing (-3.6 percent), department stores (-0.4 percent) and restaurants (-0.8 percent).

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 64.16 | 1.91 |

| Silver | 26.102 | -2.37 |

| Gold | 1711.477 | -1.52 |

| Palladium | 2343.54 | -0.79 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Trade Balance | January | 6.785 | |

| 00:30 (GMT) | Australia | Retail Sales, M/M | January | -4.1% | 0.6% |

| 05:00 (GMT) | Japan | Consumer Confidence | February | 29.6 | |

| 09:30 (GMT) | United Kingdom | PMI Construction | February | 49.2 | |

| 10:00 (GMT) | Eurozone | Unemployment Rate | January | 8.3% | |

| 10:00 (GMT) | Eurozone | Retail Sales (YoY) | January | 0.6% | |

| 10:00 (GMT) | Eurozone | Retail Sales (MoM) | January | 2% | |

| 12:00 (GMT) | OPEC | OPEC Meetings | |||

| 13:30 (GMT) | Canada | Labor Productivity | Quarter IV | -10.3% | |

| 13:30 (GMT) | U.S. | Continuing Jobless Claims | February | ||

| 13:30 (GMT) | U.S. | Unit Labor Costs, q/q | Quarter IV | -7% | 6.6% |

| 13:30 (GMT) | U.S. | Nonfarm Productivity, q/q | Quarter IV | 4.6% | -4.6% |

| 13:30 (GMT) | U.S. | Initial Jobless Claims | February | ||

| 15:00 (GMT) | U.S. | Factory Orders | January | 1.1% | 1% |

| 17:05 (GMT) | U.S. | Fed Chair Powell Speaks | |||

| 21:30 (GMT) | Australia | AIG Services Index | February | 54.3 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.77745 | -0.57 |

| EURJPY | 129.072 | 0.11 |

| EURUSD | 1.20618 | -0.21 |

| GBPJPY | 149.266 | 0.28 |

| GBPUSD | 1.39489 | -0.03 |

| NZDUSD | 0.7245 | -0.41 |

| USDCAD | 1.26539 | 0.22 |

| USDCHF | 0.91986 | 0.61 |

| USDJPY | 107.002 | 0.32 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.