- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-09-2020

On Monday, at 01:30 GMT Australia will release the index of number of vacancies from ANZ for August. At 03:00 GMT, China will announce a change in the foreign trade balance for August. At 05:00 GMT, Japan will release an index of leading economic indicators for July. At 06:00 GMT, Germany will announce the change in industrial production for July. At 07:00 GMT, Switzerland will report changes in the SNB's foreign currency reserves for August. At 07:30 GMT, Britain will release the Halifax house price index for August. At 08:30 GMT, the Euro zone will publish the Sentix investor confidence indicator for September. At 23:30 GMT, Japan will announce changes in the level of wages and household spending for July. At 23:50 GMT, Japan will report changes in GDP for the 2nd quarter and the current account balance for July.

On Tuesday, at 01:30 GMT, Australia will release the NAB business confidence index for August. At 05:30 GMT, France will report changes in the number of people employed in the private sector for the 2nd quarter. At 06:00 GMT, Germany will announce a change in the foreign trade balance for July. At 06:45 GMT, France will announce a change in the foreign trade balance for July. At 09:00 GMT, the Euro zone will report changes in GDP and employment for the 2nd quarter. At 19:00 GMT, the US will report changes in consumer credit for July.

On Wednesday, at 01:00 GMT, New Zealand will release ANZ's business confidence indicator for September. At 01:30 GMT, China will publish the consumer price index and producer price index for August. At 05:45 GMT, Switzerland will announce the change in the unemployment rate for August. At 06:00 GMT, Japan will report a change in the volume of orders for equipment for August. At 12:15 GMT, Canada will announce a change in the housing starts for August. At 14:00 GMT, in Canada, the Bank of Canada's interest rate decision will be announced. Also at 14: 00 GMT, the US will announce changes in the level of vacancies and labor turnover for July. At 23:50 GMT, Japan will announce a change in orders for machinery and equipment for July.

On Thursday, at 01:00 GMT, Australia will report a change in expectations for consumer price inflation for September. At 06:45 GMT France will announce the change of volume of industrial production for July. At 11:45 GMT, in the Euro zone, the ECB's interest rate decision will be announced. At 12:30 GMT the ECB will hold a press conference. Also at 12:30 GMT in the US, the producer price index for August will be released and a change in the number of initial applications for unemployment benefits will be announced. At 14:00 GMT, the US will announce changes in the wholesale inventories for July. At 15:00 GMT, the US will report changes in oil reserves according to the Department of energy. At 16: 30 GMT Bank of Canada Governor Macklem will deliver a speech. At 17: 00 GMT ECB President Lagarde will speak. At 22:30 GMT in New Zealand, the index of business activity in the manufacturing sector from Business NZ for August will be released. At 22:45 GMT, New Zealand will announce a change in the food price level for August. At 23:50 GMT, Japan will publish the BSI business conditions index for major manufacturers for August.

On Friday, at 06:00 GMT, Britain will report changes in GDP, industrial output, manufacturing output, visible trade balance and construction volume for July. At 08:30 GMT, Britain will publish the results of the survey on expected inflation for the 3rd quarter. The Eurogroup will also meet on Friday. At 12:30 GMT, Canada will announce a change in the capacity utilization factor for the 2nd quarter. Also at 12:30 GMT, the US will release the consumer price index for August. At 13:00 GMT in Britain, NIESR GDP estimate for August will be released. At 17:00 GMT, in the United States, the Baker Hughes report on the number of active oil drilling rigs will be released. At 18:00 GMT in the US, the budget performance report for August will be presented.

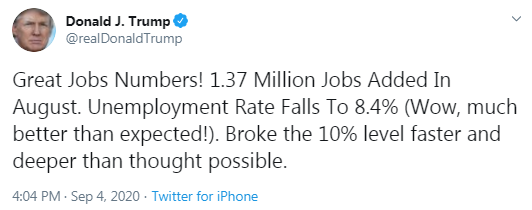

eFXdata reports that CIBC discusses its reaction to today's US jobs report for the month of August.

"Americans continued to get back to work in August, but the job market remained a long way from home nevertheless. The 1.4 million advance in payrolls was in line with market expectations, and drove the jobless rate from double digits to a still-elevated 8.4%. Note that about a quarter of the gain came in government jobs, largely due to temporary census worker hiring. That said, gains elsewhere stretched across retailing, other services and manufacturing. Total hours worked were up 1.2%, slightly faster than July." CIBC notes.

"Overall, this was brighter than some of the high frequency numbers that showed a larger deceleration in August, but essentially in line with expectations for the headline hiring gain," CIBC adds.

Reuters reports that Britain is ready for every possible outcome from Brexit negotiations with the European Union, Prime Minister Boris Johnson said on Friday.

"We're ready for any eventuality," he told reporters.

"We will get through this. It's absolutely vital that our partners understand that the UK is going to do what we need to do, if we have to have an ... Australia-style solution then that is what we will achieve and we will prosper mightily one way or the other."

He said if the EU was sensible, it would give Britain the Canada-style solution it is seeking.

The Ivey Business School Purchasing Managers Index (PMI), measuring Canada’s economic activity, decreased to 67.8 in August from 68.5 in July (that was the highest level since April 2018). Economists had expected a decline to 65.0. A reading above 50 signals expansion, while a reading below 50 indicates contraction.

Within sub-indexes, the employment measure fell to 56.1 in August from 57.6 in the previous month and the prices index decreased to 57.6 from 60.5. At the same time, the inventories indicator edged down to 50.9 in August from 61.7 in July and the supplier deliveries gauge rose to 51.3 from 50.1.

- Says that squaring the circle on the rule of law mechanism for EU's funds is the biggest challenge to implementing coronavirus recovery deal

- Not certain there will be new, post-Brexit deal with Britain; hoping that there will be a deal but not at all cost

- Britain must come clean on state aid plans; level-playing field is key and essential

U.S. stock-index futures traded mixed on Friday: futures tracking the S&P 500 and Dow indexes rose after the data showed the U.S. unemployment rate fell more than forecast in August, while futures contracts tied to the Nasdaq declined as tech stocks remained under pressure.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,205.43 | -260.10 | -1.11% |

Hang Seng | 24,695.45 | -312.15 | -1.25% |

Shanghai | 3,355.37 | -29.61 | -0.87% |

S&P/ASX | 5,925.50 | -187.10 | -3.06% |

FTSE | 5,871.39 | +20.53 | +0.35% |

CAC | 5,031.08 | +21.56 | +0.43% |

DAX | 13,044.39 | -13.38 | -0.10% |

Crude oil | $41.41 | +0.10% | |

Gold | $1,936.80 | -0.05% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 168.66 | 2.35(1.41%) | 10405 |

ALCOA INC. | AA | 14.36 | 0.13(0.91%) | 5506 |

ALTRIA GROUP INC. | MO | 43.44 | 0.15(0.35%) | 15924 |

Amazon.com Inc., NASDAQ | AMZN | 3,338.00 | -30.00(-0.89%) | 99854 |

American Express Co | AXP | 106.5 | 2.04(1.95%) | 7355 |

AMERICAN INTERNATIONAL GROUP | AIG | 30.02 | 0.62(2.11%) | 7187 |

Apple Inc. | AAPL | 119.5 | -1.38(-1.14%) | 5419232 |

AT&T Inc | T | 29.75 | 0.16(0.54%) | 86295 |

Boeing Co | BA | 171.5 | 2.73(1.62%) | 197415 |

Caterpillar Inc | CAT | 148.02 | 1.26(0.86%) | 9593 |

Chevron Corp | CVX | 82.87 | 0.59(0.72%) | 65356 |

Cisco Systems Inc | CSCO | 41.08 | 0.13(0.32%) | 159719 |

Citigroup Inc., NYSE | C | 52.6 | 1.10(2.14%) | 151005 |

Deere & Company, NYSE | DE | 212 | 1.19(0.56%) | 542 |

Exxon Mobil Corp | XOM | 39.52 | 0.41(1.05%) | 56973 |

Facebook, Inc. | FB | 288.14 | -2.98(-1.02%) | 189886 |

FedEx Corporation, NYSE | FDX | 222.39 | 1.42(0.64%) | 12246 |

Ford Motor Co. | F | 6.86 | 0.04(0.59%) | 198530 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.62 | 0.06(0.39%) | 96616 |

General Electric Co | GE | 6.39 | 0.07(1.11%) | 603613 |

General Motors Company, NYSE | GM | 29.8 | 0.32(1.09%) | 45100 |

Goldman Sachs | GS | 212 | 4.44(2.14%) | 27463 |

Google Inc. | GOOG | 1,635.00 | -6.84(-0.42%) | 14147 |

Hewlett-Packard Co. | HPQ | 19.25 | -0.05(-0.26%) | 8502 |

Home Depot Inc | HD | 276.6 | 1.97(0.72%) | 16009 |

HONEYWELL INTERNATIONAL INC. | HON | 168.83 | 2.53(1.52%) | 5002 |

Intel Corp | INTC | 50.46 | 0.07(0.14%) | 241982 |

International Business Machines Co... | IBM | 124.91 | 0.46(0.37%) | 14622 |

Johnson & Johnson | JNJ | 151.47 | 1.92(1.28%) | 19281 |

JPMorgan Chase and Co | JPM | 103.73 | 2.40(2.37%) | 136368 |

McDonald's Corp | MCD | 214.88 | 1.08(0.51%) | 8526 |

Merck & Co Inc | MRK | 85.99 | 0.50(0.58%) | 10036 |

Microsoft Corp | MSFT | 216.15 | -1.15(-0.53%) | 528594 |

Nike | NKE | 113.51 | 0.66(0.58%) | 13994 |

Pfizer Inc | PFE | 36.6 | 0.20(0.55%) | 53541 |

Procter & Gamble Co | PG | 137.18 | -1.08(-0.78%) | 5515 |

Starbucks Corporation, NASDAQ | SBUX | 86.92 | 0.44(0.51%) | 112443 |

Tesla Motors, Inc., NASDAQ | TSLA | 398.85 | -8.15(-2.00%) | 2948154 |

The Coca-Cola Co | KO | 50.85 | 0.37(0.73%) | 33138 |

Twitter, Inc., NYSE | TWTR | 41.14 | -0.49(-1.18%) | 58221 |

UnitedHealth Group Inc | UNH | 320.4 | 4.17(1.32%) | 5606 |

Verizon Communications Inc | VZ | 60.79 | 0.18(0.30%) | 13809 |

Visa | V | 208.96 | -0.00(-0.00%) | 27984 |

Wal-Mart Stores Inc | WMT | 144 | -0.54(-0.37%) | 59976 |

Walt Disney Co | DIS | 133.8 | 0.56(0.42%) | 33608 |

Yandex N.V., NASDAQ | YNDX | 66 | 0.75(1.15%) | 161658 |

McDonald's (MCD) target raised to $230 from $210 at Telsey Advisory Group

Statistics

Canada reported on Friday that the number of employed people surged by 245,800

m-o-m in August (or +1.4 percent m-o-m) after an unrevised increase of 418,500

m-o-m in the previous month. Economists had forecast an increase of 275,000

m-o-m.

Meanwhile,

Canada's unemployment fell to 10.2 percent in August from 10.9 percent in July,

slightly worse than economists’ forecast for 10.1 percent.

According to

the report, full-time employment climbed by 205,800 (or +1.4 percent m-o-m) in August,

while part-time jobs rose by 40,000 (or +1.2 percent m-o-m).

In August, the

number of public sector employees increased by 28,300 (or +0.7 percent m-o-m),

while the number of private sector employees surged by 275,500 (or +2.4 percent

m-o-m). At the same time, the number of self-employed declined by 58,000 (or -2.1

percent m-o-m) last month.

Sector-wise,

employment increased both in goods-producing (+0.7 percent m-o-m) and

service-producing (+1.5 percent m-o-m) businesses.

The U.S. Labor

Department announced on Friday that nonfarm payrolls rose by 1,371,000 in August

after a downwardly revised 1,734,000 advance in the prior month (originally a

gain of 1,763,000), reflecting the continued resumption of economic activity

that had been curtailed due to the coronavirus pandemic and efforts to contain

it.

According to

the report, employment rose sharply in government (+344,000 jobs, largely

reflecting temporary hiring for the 2020 Census), retail trade (+249,000), in

professional and business services (+197,000), in leisure and hospitality (+174,000),

and in education and health services (+147,000).

The unemployment

rate fell to 8.4 percent in August from 10.2 percent in July.

Economists had

forecast the nonfarm payrolls to increase by 1,400,000 and the jobless rate to

drop to 9.8 percent.

The labor force

participation rate increased by 0.3 percentage point in August to 61.7 percent,

while hourly earnings for private-sector workers rose 0.4 percent m-o-m (or $0.11)

to $29.47, following a revised 0.1 percent m-o-m increase in July (originally a

gain of 0.2 percent m-o-m). Economists had forecast the average hourly earnings

to be unchanged m-o-m in August. Over the year, average hourly earnings

increased by 4.7 percent in August, following a revised 4.7 percent rise in July

(originally an increase of 4.8 percent).

The average

workweek increased by 0.1 hour to 34.6 hours in August, exceeding economists'

forecast for 34.5 hours.

FXStreet reports that economists at Credit Suisse note that the S&P 500 has suffered a sharp setback from the upper end of its “typical” extreme and with the VIX holding a base and US Breakevens retreating from medium-term resistance the threat of finally a correction lower stays seen high, with key support seen at 3413/3397.

“Despite the fall yesterday though key supports remain intact still at last week’s low, the 23.6% retracement of the rally from May and price and gap support at 3413/3397, with a move below here needed in our view to confirm a corrective phase is finally underway. Indeed, if we were to close below here today this would add further potency to the likelihood of a corrective downturn as this would also see a bearish ‘reversal week’ established. If seen we would then see support at the late August low at 3355 initially and eventually and we think more importantly at a cluster of supports at 3285/55.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Germany | Factory Orders s.a. (MoM) | July | 28.8% | 5% | 2.8% |

| 08:30 | United Kingdom | PMI Construction | August | 58.1 | 58.5 | 54.6 |

| 09:30 | United Kingdom | MPC Member Saunders Speaks |

GBP fell against most other major currencies in the European session on Friday, as uncertainty around the trade relationship between the UK and the EU beyond a transition period that ends on December 31 continued to weigh on the pound.

Market participants also assessed the comments by the Bank of England's (BoE) policymaker Michael Saunders, who sounded warning over economic recovery. He noted that "risks lie on the side of a slower recovery over the next year or two" and if these risks develop "then some further monetary loosening may be needed in order to support the economy and prevent a persistent undershoot of the 2% inflation target." The policymaker also forecast that unemployment will "rise significantly" in the coming quarters. He also stressed that uncertainties in the outlook are unusually high at present and added that the outlook for the economy will depend in large part on dynamics of the COVID-19 pandemic, the extent of progress in vaccines, as well as the reaction of households, businesses and governments to those developments.

Broadcom (AVGO) reported Q3 FY 2020 earnings of $5.40 per share (versus $5.16 per share in Q3 FY 2019), beating analysts’ consensus estimate of $5.24 per share.

The company’s quarterly revenues amounted to $5.821 bln (+5.5% y/y), beating analysts’ consensus estimate of $5.763bln.

The company also issued upside guidance for Q4 FY 2020, projecting revenues of $6.25-6.55 bln versus analysts’ consensus estimate of $6.20 bln.

AVGO fell to $348.56 (-1.00%) in pre-market trading.

Petr Krpata, an FX strategist at ING, notes that the negative USD story remains intact and they look for a multi-quarter bearish dollar trend, with the latest USD rebound being a short-term correction, rather than the start of a new trend.

"The rout in equity markets and the sharp sell-off in tech stocks yesterday reversed some of the past gains in pro-cyclical currencies and temporarily helped USD, yet FX markets have already shown signs of stability overnight, with the USD rebound pausing. Some form of correction in stock markets does not come as a surprise, following their multi-month sharp rise as well as concerns about the lofty valuations, but given the Fed’s willingness to ease more as well as the uninspiring USD outlook, we don’t expect a long-lasting negative spillover into FX markets."

"The negative USD story remains intact and we look for a multi-quarter bearish dollar trend, with the latest USD rebound being a short-term correction, rather than a new trend."

"Today, the focus is on the US labour market report. Our economists look for a below-consensus NFP and an unchanged unemployment rate. With the current nervousness in the market, softer US numbers may modestly weigh on risk and further help the dollar today."

FXStreet notes that the USD/CAD pair has weakened further below the 1.3100 mark and is now trading near daily lows around 1.3080 after reaching a daily high at 1.3162. Economists at Credit Suisse look for the downtrend from March at 1.3183 to cap for an eventual test of medium-term support at 1.2952.

“USD/CAD has extended its rebound for a test of the 23.6% retracement of the fall from June and price resistance at 1.3162/67. With the downtrend from March not far above at 1.3183, we look for this 1.3162/83 to now ideally cap further strength and for the risk to turn lower again.”

“Near-term support moves to 1.3087, but with a break below 1.3038 needed to reassert a bearish bias again for a fall back to 1.2994, then medium-term support at 1.2952. Beneath here would suggest we are seeing the formation of a significant and long-lasting top with support seen next at the downward sloping trendline from February 2019, currently seen at 1.2867, with the 78.6% retracement of the 2017/2020 bull trend seen at 1.2620.”

- Review will look at indirect effects on banks, lending

- I am not theologically opposed to negative rates

- BoE did not discuss negative rates at August meeting

- If we were to shift to average inflation targeting, I'm not sure it would have that much impact for UK

- QE is clearly an option for further stimulus; there is a certain scope to expand the QE

Carsten Brzeski, Chief Economist, Eurozone and Global Head of Macro for ING Research, notes that another increase in Germany's industrial orders in July masks an enormous twist between domestic and foreign demand.

"German orders increased by 2.8% month-on-month in July, from 28.8% MoM in June."

"On the year, industrial orders were still down by 7.3% making it the first three-month increase since late 2017. The increase, however, masks a remarkable twist between domestic and foreign orders. While domestic orders dropped by some 10%, foreign orders increased by more than 14%. In any case, both domestic and foreign order books were at more than 90% of their pre-crisis levels in July."

"The hopes for a strong rebound stay alive, as much as the fears of a weak recovery after the initial rebound."

USD/CNH faces some consolidation ahead of potential losses – UOB

FXStreet notes that following the recent price action, USD/CNH is likely to embark on a consolidative trip in the near-term, suggested FX Strategists at UOB Group.

24-hour view: “We expected USD to ‘consolidate further within a 6.8200/6.8430 range’ yesterday but it rebounded to a high of 6.8493 (low has been 6.8250). The recovery lacks momentum and while there is room for USD to test the 6.8530 resistance from here, a sustained advance above this level is unlikely. Support is at 6.8320 followed by 6.8250.”

Next 1-3 weeks: “We expected ‘the current weakness to extend to 6.8300, possibly 6.8160’. USD subsequently plummeted and quickly exceeded the 6.8160 level as it dropped to a low of 6.8143. From here, we continue to see risk for further USD weakness even though oversold conditions could lead to a few days of consolidation first. Only a break of 6.8800 (‘strong resistance’ level was at 6.8950 yesterday) would indicate that the current weak phase in USD that started about 2 weeks ago has run its course. Until then, the roundnumber support level of 6.8000 is likely beckoning to USD.”

The economy’s faster-than-expected rebound in the last few months has reflected a benign window in which large fiscal support has coincided with the relaxation of lockdown measures and low infection rates. This window may now be closing.

Unemployment is likely to rise significantly in coming quarters as the furlough scheme winds down and workforce participation recovers.

The strength in money growth is an indication of the exceptional level of fiscal and monetary policy support in recent months. It is unlikely to translate into excess spending given the economic impact from Covid-19.

Looking forward, I suspect that risks lie on the side of a slower recovery over the next year or two and a longer period of excess supply than the forecast in the August MPR.

If these risks develop, then some further monetary loosening may be needed in order to support the economy and prevent a persistent undershoot of the 2% inflation target.

CNBC reports that Wall Street could be headed for correction territory if there is a shift in investor attitude, Allianz’s chief economist Mohamed El-Erian said after the biggest market decline in months.

Investors have taken a liquidity approach to the market and buying the dips, thanks to stimulus action from the Federal Reserve. That mindset will be tested in the coming days as market fundamentals come into play, he said in an interview on CNBC.

If a mindset shift is looming, El-Erian suggests market players should look out below.

“We could have another 10% fall, easily ... if people start thinking fundamentals,” El-Erian predicted.

“If the mindset changes from technicals to fundamentals then this market has further to go,” he added, “but it remains to be seen whether it will change.”

El-Erian said the market, though, remains decoupled from not only the U.S. economy, but the VIX, treasury and high-yield markets at current levels. With the tech-heavy Nasdaq up double digits and the benchmark index up nearly 7%, the market was ripe for a pullback after five straight months of gains and the strongest August in decades, he said.

Should the market be judged by fundamentals, investors will be forced to take into account the precarious state of the economy as corporate bankruptcies still loom. He warned almost a month ago that large-scale bankruptcies could doom the market’s rally from its pandemic-induced lows in the first half of 2020.

Reuters reports that China's auto market, the world's biggest, is expected to grow only slightly in the next five years, the country's top auto industry body said.

"The next five years will be the key period of industry's transformation and upgrade," Li Shaohua, senior executive at the China Association of Automobile Manufacturers (CAAM) told an industry conference.

CAAM predicts China's auto sales will reach around 27.75 million vehicles in 2025, up from 25.77 million units in 2019, Li's presentation showed.

Though sales have picked up in recent months, CAAM predicts they will fall around 10% for all of 2020, as the COVID-19 pandemic hit the market hard early in the year.

FXStreet reports that a move to 104.70 in USD/JPY appears to be losing momentum for the time being, in opinion of FX Strategists at UOB Group.

24-hour view: “Yesterday, we held the view that USD ‘could edge upwards but a clear break of the major resistance at 106.55 appears unlikely’. Our view was not wrong as USD touched a high of 106.55 before easing off to close the day little changed at 106.17 (-0.01%). Momentum indicators have turned ‘neutral’ and for today, USD is likely to trade sideways between 105.80 and 106.35.”

Next 1-3 weeks: “After plunging to a low of 105.18 last week, USD has not been able to make much headway to the downside as it traded sideways to slightly higher over the past few days. Downward momentum has deteriorated rapidly and the odds for USD to test the solid support at 104.70 have diminished. However, only a breach of 106.55 would indicate that USD has moved back into a consolidation phase. Meanwhile, USD has to move and stay below 105.80 within these 1 to 2 days or a breach of 106.55 would not be surprising.”

According to the report from IHS Markit/CIPS, August data pointed to a setback for the recovery in UK construction output, with growth easing from the near five-year high seen during July. Survey respondents mostly suggested that a lack of new work to replace completed contracts had acted as a brake on the speed of expansion.

The headline seasonally adjusted UK Construction Total Activity Index registered 54.6 in August, down from 58.1 in July. Any figure above 50.0 indicates growth of total construction output. Higher levels of activity have been recorded in each of the past three months, but the latest expansion was the weakest over this period. All three broad categories of construction provided a weaker contribution to the headline index in comparison to those seen in July.

House building has registered the strongest rebound since the stoppages of work on site in late-March due to the coronavirus disease 2019 (COVID-19) pandemic. This trend continued in August, with the seasonally adjusted Housing Activity Index posting well inside expansion territory (60.7). The equivalent figures for commercial work (52.5) and civil engineering activity (46.6) were notably weaker than the headline index in August. Total new business volumes increased for the third month running during August, but the rate of expansion remained only modest and slowed since July.

According to the report from Society of Motor Manufacturers and Traders (SMMT), UK new car registrations declined by -5.8% in August. Just over 87,000 vehicles were registered during what is traditionally the quietest month of the year for new car sales.

While registrations to private buyers held relatively steady, down by 699 units in the month, demand from businesses of all sizes was much more subdued, with 2,650 fewer new cars joining UK fleets, down -5.5% on August 2019. Demand also fell across all segments except superminis, with the biggest declines in demand seen in the mini (-64.2%) and specialist sports (-41.9%) categories.

Zero emission-capable vehicles enjoyed a bumper August as a result of new models coming to market, with sales of plug-in hybrids increasing by 221.1%, although they still only accounted for 1 in 30 sales. Registrations of battery electric cars increased by 77.6% in the month, accounting for 6.4%. However, they make up just 4.9% of registrations year to date, up from 1.1% in the same period last year – clearly illustrating the scale of the challenge ahead to reach the government target for EVs to comprise 70% of new car sales by 2030.

Overall, registrations remain down by -39.7% in the year to date, some 600,000 units behind this time in 2019, following coronavirus enforced lockdowns.

According to the report from IHS Markit, Eurozone Construction Total Activity Index fell from 48.9 in July to 47.8 in August, indicating the sharpest decline in construction activity across the eurozone for three months. Survey data showed a broad-based downturn in output across the three sectors, with the sharpest decline recorded in civil engineering activity, followed by commercial building output.

The level of work undertaken on home construction projects in the eurozone was marginally lower during August. Mild growth in housing construction activity in Germany and Italy was insufficient to offset a solid decline in home building activity in France.

Commercial building activity across the eurozone continued to fall in the middle of the third quarter. The rate of decline quickened from July and was marked overall.

Meanwhile, eurozone civil engineering activity fell further in August, extending the current sequence of contraction to just over a year. The rate of decline accelerated from July and was marked overall.

New business received by eurozone construction firms fell further in August, though the rate of decline eased again and was the slowest in the current six-month sequence. Greater competition was cited as a reason for lower sales. Employment in the eurozone construction sector was reduced further in August amid lower activity. The rate of reduction eased from July, however, and was the softest in the current six-month period of decline.

Overall sentiment among eurozone building companies turned negative again in August.

FXStreet reports that August saw gold hit thee objective at $2075/80 and strategists at Credit Suisse are seeing a consolidation phase emerge from here as looked for.

“Whilst we continue to see the long-term trend higher, reinforced by falling US Real Yields and a falling USD, our immediate bias remains for further consolidation above a cluster of supports at $1887/37, which includes the 23.6% retracement of the entire rally from the 2018 low. Post this consolidation, we look for an eventual move above $2075 with resistance seen next at $2175, then $2300. Whilst we would look for a fresh consolidation at this latter level, a direct break would suggest scope for $2700/20 over the longer-term.”

“Below $1837 though would warn of a more significant but still corrective setback with support seen next at $1765, then $1726.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | July | 2.7% | 3.3% | 3.2% |

| 06:00 | Germany | Factory Orders s.a. (MoM) | July | 28.8% | 5% | 2.8% |

The US dollar rose slightly against the euro and the pound, and stabilized against the yen, as traders wait for statistical data on the US labor market. Today, the US Department of labor will release data on unemployment in August.

According to data released on Thursday, the number of Americans who applied for unemployment benefits for the first time in the week ending August 29, decreased by 130 thousand to 881 thousand people. Thus, the number of new applications has become the lowest since the beginning of the pandemic. According to the revised data, a week earlier, the number of requests was 1.011 million, not 1.006 million, as originally reported. Experts expected a decrease to 950 thousand..

The Austrian dollar declined against the US dollar. Retail sales in Australia in July increased by 3.2% compared to the previous month. Thus, the indicator increased for the third consecutive month on the back of economic recovery after the COVID-19 pandemic.

The ICE index, which tracks the dynamics of the US dollar against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), rose 0.10% in trading.

FXStreet reports that a weak US dollar has been one of the key drivers of the AUD/USD two-year highs around 0.74. But US dollar sentiment has picked up in recent days. Global sentiment is set to drive the aussie in the week ahead, according to economists at Westpac.

“The Fed adopted a new policy framework that should mean that it keeps interest rates very low for even longer than previously thought. This lack of yield support for the US dollar seems likely to weigh on it for some time. But short-term, the US dollar has found support from a few different sources. One is relative growth prospects. The latest US data suggests less damage than expected from businesses having to shut their doors once again in response to the virus.”

“After its meeting on Tuesday, the RBA noted the Aussie’s rally but pointed out the strength of commodity prices as well as the US dollar’s broad-based decline. However, while the RBA kept interest rates on hold at 0.25%, it expanded its facility which provides cheap funding to banks on the condition that they increase lending to businesses. The RBA also said it would quote ‘consider how further monetary measures could support the recovery.’ So perhaps this will weigh on the Aussie in coming months.”

“In the week ahead, we will see updates on Australian business and consumer confidence but the global mood is likely to be key. On the positive side, iron ore prices are up to $130 per tonne as Australia continues to record trade surpluses.”

Reuters, citing The Times, reported that senior officials in British Prime Minister Boris Johnson's office see only a 30-40% chance that there will be an Brexit trade agreement with the European Union due to an impasse over state aid rules.

The Times said that Britain’s desire to use state aid to build up its technology sector means that Johnson's top ministers are unwilling to budge in negotiations on state aid.

"Senior officials now think there is only a 30 to 40 per cent chance that there will be an agreement," James Forsyth, political editor of The Spectator, wrote in a column. "The sticking point isn’t fish — I’m told that there is a 'deal to be done' there — but state aid."

The UK wants the percentage of fish quotas reserved for UK vessels in British waters to increase from some 25% now to more than 50%

eFXdata reports that Credit Suisse discusses EUR/USD technical outlook and flags a scope for a top and a more concerted retracement lower on a break below 1.1764/54.

"With key price support from the recent lows seen just below at 1.1764/54, we would look for an attempt to find a floor here at first. But with a potential momentum top in place and a bearish divergence the risk for a top is seen increasing and below 1.1754 can confirm a top to open the door to a more concerted move lower with support seen next at 1.1699/89 – the August low – then what we look to be better support from the 55 -day average and 50% retracement at 1.1598/90," CS notes.

"Immediate resistance moves to 1.1859, above which is needed to ease the immediate downside bias with resistance then seen next at 1.1878, then 1.1913. Above 1.1930 is needed to suggest the correction is over for a resumption of the uptrend and a move back to 1.2011," CS adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1911 (2683)

$1.1881 (1908)

$1.1866 (2295)

Price at time of writing this review: $1.1847

Support levels (open interest**, contracts):

$1.1828 (1129)

$1.1793 (1242)

$1.1748 (1358)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 4 is 99582 contracts (according to data from September, 3) with the maximum number of contracts with strike price $1,0500 (5007);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3402 (974)

$1.3355 (837)

$1.3315 (1350)

Price at time of writing this review: $1.3273

Support levels (open interest**, contracts):

$1.3233 (139)

$1.3194 (70)

$1.3084 (50)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 21087 contracts, with the maximum number of contracts with strike price $1,3800 (2994);

- Overall open interest on the PUT options with the expiration date September, 4 is 20073 contracts, with the maximum number of contracts with strike price $1,3000 (1567);

- The ratio of PUT/CALL was 0.95 versus 0.92 from the previous trading day according to data from September, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to provisional results of the Destatis, real (price adjusted) new orders increased by a seasonally and calendar adjusted 2.8% in July 2020 compared with June 2020. Economists had expected a 5.0% increase.

Compared with July 2019, the decrease in calendar adjusted new orders amounted to 7.3%. Excluding major orders, real new orders in manufacturing seasonally and calendar adjusted were 6.2% higher than in the previous month.

Compared with February 2020, the month before restrictions were imposed due to the corona pandemic in Germany, new orders in July 2020 were 8.2% lower in seasonally and calendar adjusted terms.

Domestic orders decreased by 10.2% and foreign orders rose by 14.4% in July 2020 on the previous month. New orders from the euro area went up 7.3%, and new orders from other countries increased by 19.2% compared with June 2020.

In July 2020 the manufacturers of intermediate goods saw new orders increase by 9.5% compared with June 2020. The manufacturers of capital goods saw a decrease of 0.4% on the previous month. Regarding consumer goods, new orders rose 0.2%.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 43.57 | -0.95 |

| Silver | 26.55 | -3.03 |

| Gold | 1930.43 | -0.63 |

| Palladium | 2291.55 | 2.12 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 218.38 | 23465.53 | 0.94 |

| Hang Seng | -112.49 | 25007.6 | -0.45 |

| KOSPI | 31.53 | 2395.9 | 1.33 |

| ASX 200 | 49.4 | 6112.6 | 0.81 |

| FTSE 100 | -90.09 | 5850.86 | -1.52 |

| DAX | -185.66 | 13057.77 | -1.4 |

| CAC 40 | -22.22 | 5009.52 | -0.44 |

| Dow Jones | -807.77 | 28292.73 | -2.78 |

| S&P 500 | -125.78 | 3455.06 | -3.51 |

| NASDAQ Composite | -598.34 | 11458.1 | -4.96 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | July | 2.7% | 3.3% |

| 06:00 | Germany | Factory Orders s.a. (MoM) | July | 27.9% | 5% |

| 08:30 | United Kingdom | PMI Construction | August | 58.1 | 58.5 |

| 09:30 | United Kingdom | MPC Member Saunders Speaks | |||

| 12:30 | U.S. | Average workweek | August | 34.5 | 34.5 |

| 12:30 | U.S. | Government Payrolls | August | 301 | |

| 12:30 | U.S. | Manufacturing Payrolls | August | 26 | 50 |

| 12:30 | U.S. | Average hourly earnings | August | 0.2% | 0.0% |

| 12:30 | U.S. | Private Nonfarm Payrolls | August | 1462 | 1265 |

| 12:30 | U.S. | Labor Force Participation Rate | August | 61.4% | |

| 12:30 | Canada | Employment | August | 418.5 | 275 |

| 12:30 | Canada | Unemployment rate | August | 10.9% | 10.1% |

| 12:30 | U.S. | Nonfarm Payrolls | August | 1763 | 1400 |

| 12:30 | U.S. | Unemployment Rate | August | 10.2% | 9.8% |

| 14:00 | Canada | Ivey Purchasing Managers Index | August | 68.5 | |

| 17:00 | U.S. | Baker Hughes Oil Rig Count | September |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72705 | -0.86 |

| EURJPY | 125.798 | -0.04 |

| EURUSD | 1.1849 | -0.04 |

| GBPJPY | 140.885 | -0.58 |

| GBPUSD | 1.32735 | -0.57 |

| NZDUSD | 0.67051 | -0.86 |

| USDCAD | 1.31229 | 0.6 |

| USDCHF | 0.90869 | -0.16 |

| USDJPY | 106.139 | -0.02 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.