- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-05-2022

- The Australian dollar finished the week in an upbeat tone, with gains of 0.15%.

- A dismal market mood was not an excuse for the AUD to appreciate vs. the greenback.

- The pace of rate hikes by the RBA/Fed would favor the US dollar.

The AUD/USD snapped five consecutive weekly losses and is recording decent gains of 0.15%, as Wall Street closes in the red amidst a dismal sentiment, courtesy of central bank tightening, as investors reposition their portfolios once the US central bank hiked rates 50-bps for the first time in 20-years. At the time of writing, the AUD/USD is trading at 0.7070.

Wall Street’s printed losses between 1.03% and 2.42%, putting an end to a volatile week led by three central banks tightening monetary policies as they scramble to tackle inflation towards their target levels. Furthermore, the US Department of Labor reported that the US economy added 428K new jobs to the economy, smashing expectations, while the Unemployment Rate at 3.6% was unchanged.

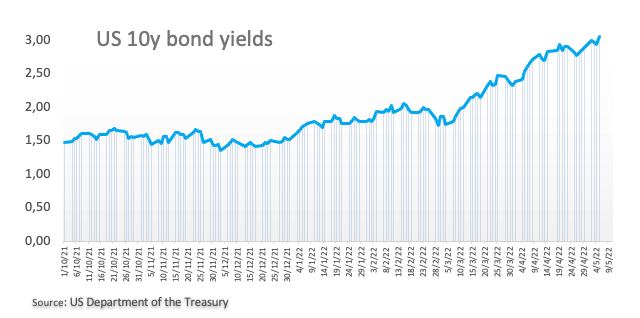

Aside from this, the US Dollar Index, a measurement of the greenback’s value against a six currencies basket, is pairing early day losses, up 0.11%, currently at 103.658, while the US 10-year Treasury yield reached a YTD high around 3.131%.

The RBA and the Fed hiked rates, but at a pace that favors the greenback

At the beginning of the week, the Reserve Bank of Australia (RBA) surprised the markets with a 25-bps rate hike, the first since November 2010. Market participants expected a lift-off of 15-bps, to leave rates around 0.25% though the central bank stuck to the 25-bps path. Also, the RBA began the reduction of the stimulus, allowing its portfolio of bonds to run down as they mature.

The AUD/USD initially reacted upwards, though faced strong resistance around 0.7147 as traders prepared for the Federal Reserve’s meeting.

On Wednesday, the Fed decided to increase the Federal Funds Rates (FFR) by 50-bps points to the 1% threshold as foreseen by the majority of the economists and announced the quantitative tightening at a pace of $47.5 billion in the first three months, followed by an adjustment capped at $95 billion a month.

At his press conference, Fed Chair Powell said that 75-bps increases are not something the Fed is not actively considering it. He added that “if we see what we expect to see,” 50-bps increases would be“on the table” at the following couple of FOMC meetings.

On the headline, the AUD/USD immediately surged above the R1 daily pivot at 0.7150, rallying sharply towards the R3 pivot point around 0.7250, and paired some of the last week’s losses.

That said, Wednesday’s rally in global equities was perceived as a sign of relief that a higher Fed rate hike, probably a 75-bps, brought Fed’s St. Louis President Bullard, did not happen. However, on Thursday, market participants made a U-turn, dumping equities, flighting towards safe-haven assets, and boosting the USD, the JPY, and the CHF.

Therefore, once both central banks’ decisions are in the rearview mirror, the AUD/USD might depreciate in the near to medium term, as money market futures expect the FFR to be around 2% by the summer, contrarily to the RBA's cash rate, which is expected to be at around 0.85%.

Key Technical Levels

- Risk-aversion lifted the low-yielder EUR, despite broad US dollar strength.

- The US labor market keeps strengthening, adding 428K jobs to the economy.

- EUR/USD Price Forecast: In the long-term downward biased, but the 1-hour chart depicts the pair as neutral-upwards.

The EUR/USD trimmed some of Thursday’s losses, and it is set to finish the week on the right foot, snapping four consecutive weeks of losses amidst a risk-aversion environment in the financial markets. At 1.0552, the EUR/USD edges up some 0.13%.

Sentiment remains negative, as reflected by US equities, extending their losses for the second straight day. Earlier in the North American session, the US Department of Labour unveiled April’s Nonfarm Payrolls report, which showed that the US economy added 428K jobs, higher than the 391K foreseen by analysts. Job gains were led by leisure, hospitality, manufacturing, transportation, and warehousing.

The Unemployment Rate remained unchanged at 3.6%, and Average Hourly Earnings rose by 5.5% y/y, lower than the 5.6% last month’s previous reading.

“Nothing in today’s employment report would change the Fed’s expected path ... current market sentiment does not place a lot of confidence in the Fed getting inflation under control without a recession,” according to sources cited by Reuters.

Analysts at ING wrote in a note that “the unemployment rate held steady at 3.6% rather than dropping to 3.5% as expected, which in combination with a softer average hourly earnings figure of 0.3% month-on-month rather than the 0.4% consensus forecast (and slower than the 0.5% gain in March) may been taken as a signal of less inflationary pressures in the jobs market.”

Meanwhile, the US Dollar Index, a measurement of the greenback’s value against a six currencies basket, is pairing early day losses, up 0.11%, currently at 103.664, while the US 10-year Treasury yield reached a YTD high around 3.131%.

EUR/USD Price Forecast: Technical Outlook

From a daily chart perspective, the EUR/USD remains downward biased. Despite Friday’s price action, which favored the shared currency, the major remains vulnerable to further selling pressure, albeit ECB’s member efforts to boost the EUR.

The 1-hour chart in the near-term depicts the EUR/USD as neutral-upward biased. The 50-hour simple moving average (HSMA) crossed over the 200-HSMA, a bullish signal, but the almost horizontal slope keeps the EUR/USD range-bound.

Upwards, the EUR/USD’s first resistance would be April 2017 high at around 1.0569. Break above would expose Friday’s daily high, shy of the 1.0600 figure, followed by the R1 daily pivot at 1.0620. On the downside, the EUR/USD’s first support would be the 200-HSMA at 1.0550. A breach of the latter would expose the February 2017 swing low at 1.0494, followed by the S1 daily pivot at 1.0470, and then 1.0450.

- The USD/CHF would finish the week with hefty losses of around 1.48%.

- US equities recording losses reflect a downbeat market mood, boosting the greenback.

- USD/CHF Price Forecast: The bias shifted from upwards to neutral-upwards, consolidating in the 0.9820-80 range.

The Swiss franc remains defensive during the day, failing to recover from heavy losses in the week, which amount to 1.45% so far, with some time ahead of Wall Street’s close. At the time of writing, the USD/CHF is trading at 0.9877 amidst a risk-off market mood.

On Friday, US equities prepare to finish the week on a lower note. In the meantime, US Treasury yields keep pushing higher, led by the 10-year benchmark note at around 3.12%, one bps short of YTD highs.

The US Dollar Index, a measurement of the greenback’s value against a six currencies basket, is pairing early day losses, up 0.04%, currently at 103.589.

During Friday’s trading session, the USD/CHF opened near 0.9850 in the Asian Pacific session and fluctuated in a 30-pip range of 0.9850-80 amid the lack of catalyst as FX traders head into the weekend.

USD/CHF Price Forecast: Technical outlook

The USD/CHF seems poised to extend its gains towards the next week, despite that the major retreated from YTD highs around 0.9890. The Relative Strength Index (RSI) at 80.33 shows the pair well within overbought territory but is still aiming higher, meaning that a leg-up might be on the cards.

In the meantime, the 1-hour chart shows that once the USD/CHF re<ched 0.9890, 2022’s YTD high consolidated in the 0.9825-90 area. It’s worth noting that the 50, 100, and 200-simple moving averages (SMAs) remain below the spot price, meaning that USD bulls remain in charge.

If the USD/CHF breaks the top of the range, the first resistance would be the 0.9900 mark. Once cleared, the R1 daily pivot would be the next supply zone around 0.9920, followed by the R2 pivot point at the USD/CHF parity.

On the other hand, the USD/CHF first support would be the confluence of the 50-SMA and the daily pivot at around 0.9818-20. A breach of the latter would expose the 100-SMA at 0.9802, followed by the confluence of the S1 daily pivot and the 200-SMA near the 0.9740-47 range.

Key Technical Levels

- The USD/JPY is about to register its modest weekly gains in the last five weeks, up 0.47%.

- High US Treasury yields led by the 10-year, reaching 3.10%, underpinned the major.

- USD/JPY Price Forecast: Upward biased in the daily chart, while the 4-hour shows consolidation around current levels.

The USD/JPY records decent gains during the North American session of 0.18% and is about to finish the week above the 130.00 mark amidst a dismal market mood for the second consecutive week. At 130.48, the USD/JPY is still upward pressured by the US 10-year Treasury yield, rising almost six basis points, sitting at 3.10%.

Sentiment remains downbeat post-Wednesday’s Federal Reserve rate hike of 50-bps. Albeit higher US Treasury yields on Friday, the greenback edges down, as portrayed by the US Dollar Index, which registers losses of 0.13% and was last seen at 103.428.

On Friday, the USD/JPY opened above the 130.00 mark and edged towards the daily high at around 130.81. However, late in the Asian session dipped towards the confluence of the 50 and the 100-hour simple moving averages (SMAs), but positive US macroeconomic data lifted the pair to current price levels.

USD/JPY Price Forecast: Price Forecast

The USD/JPY remains uptrend, though Friday’s price action failed to reach a fresh YTD high above 131.25. Despite USD/JPY bulls taking a breather, it is worth noting that as of today, the 100-day moving average (DMA) at 110.31 crossed over the 200-DMA at 109.97, further cementing the upward bias.

The 4-hour chart depicts the USD/JPY consolidating around current levels, and the R1 daily pivot at 130.91 proved to be solid resistance challenging to overcome. If the USD/JPY is to break upwards, the previous-mentioned 130.91 would be its first resistance. Break above would expose the 131.00 mark, followed by the YTD high at 131.25, followed by the R2 pivot point at 131.64.

On the flip side, the USD/JPY first support would be the 130.00 mark. A breach of the latter would expose the confluence of the 50-simple moving average (SMA) and the daily pivot around 129.75-83. Once cleared, the next support would be the 100-SMA at 128.69.

Key Technical Levels

- The GBP/USD will finish the week with hefty losses of 1.74%.

- Positive US employment figures and BoE’s speaking keeps the GBP downward pressured.

- GBP/USD Price Forecast: To remain downward biased unless GBP bulls reclaim 1.2600.

The British pound appears to regain composture but remains losing in the day, down 0.06%, after the Bank of England hiked rates by 25-bps on Thursday. At the time of writing, the GBP/USD is trading at 1.2352.

US employment figures came positive, and the BoE expects inflation to reach 10%

Global equities remain down during the North American session, while the US 10-year Treasury yield rose to a YTD high of around 3.131%. Albeit higher US yields, the greenback is giving back some earlier weekly gains, as portrayed by the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, down 0.18%, sitting at 103.370.

The US Department of Labour reported April’s Nonfarm Payrolls figures, showing that the economy added 428K new jobs, higher than the 391K, though the Unemployment Rate remained unchanged. Also, the Average Hourly Earnings rose by 5.5%, slightly lower than expected, and would not deter the Federal Reserve from continuing its tightening cycle.

Analysts at ING perceived the report as mixed. They added in a written note that “the unemployment rate held steady at 3.6% rather than dropping to 3.5% as expected, which in combination with a softer average hourly earnings figure of 0.3% month-on-month rather than the 0.4% consensus forecast (and slower than the 0.5% gain in March) may been taken as a signal of less inflationary pressures in the jobs market.”

Elsewhere, the Bank of England (BoE) Chief Economist Huw Pill crossed the wires in the mid-European session. He said that inflation in the UK is becoming more persistent, added that inflation is going up to 10%, and expects growth to stagnate in Q2.

Next week, the UK economic docket will reveal the Gross Domestic Product (GDP) for March, alongside the Balance of Trade and Manufacturing Production. Across the pond, a raft of Fed speaking throughout the week would dominate the headlines, alongside the Consumer Price Index (CPI) and Producer Price Index (PPI) for April.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is still downward biased, though it faced solid support at June’s 2020 lows around 1.2251. Also, the MACD, as the histogram shows, is “forming” a positive divergence, which is usually a signal that the trend is about to shift. However, unless the MACD-line crosses above the signal line, GBP/USD traders should refrain from opening fresh long bets in the pair.

To the upside, the first resistance would be the figure at 1.2400. Break above would expose crucial resistance areas like July 2020 swing low-turned-resistance at 1.2479, followed by 1.2500. On the other hand, the GBP/USD first support would be 1.2300. A breach of the latter would expose the YTD low at 1.2275, closely followed by June’s 2020 swing low at 1.2251.

The US economy created 428.000 jobs for the second month in a row, near market expectations. According to analysts at Wells Fargo, the report is solid and reinforces their belief that the Federal Reserve will execute another 50 bps interest rate hike at its next meeting on June 14-15.

Key Quotes:

“Nonfarm payroll growth barreled ahead in April. Employment rose by 428K in the month, more or less in line with consensus expectations after accounting for modestly negative revisions to prior months. The labor force participation rate disappointingly fell two-tenths of a percentage point, but the decline came on the heels of a string of solid increases, and we are cautious about reading too much into today's drop. Wage growth looks to be showing some tentative signs of peaking on a year-ago basis but is still running more than double its average pace in the 2010s.”

“As workers stream back into the labor market and the Fed steps on demand, we expect wage growth to moderate ahead. While the first quarter's rise in the Employment Cost Index was a scorcher, there are other signs that wage hikes may start ease, indicated by small business compensation plans and reports from the Fed's latest Beige Book. That said, wages are unlikely to slow to a pace consistent with 2% inflation anytime soon and point to elevated labor costs keeping the Fed on its hawkish path.”

“In the near-term today's solid job report reinforces our belief that the FOMC will execute another 50 bps rate hike at its next meeting on June 14-15.”

Data released on Friday showed the Canadian economy created 15.3K jobs in April below the 55K of market consensus. Analysts at CIBC, point out that investors judged that the slight disappointment of the jobs numbers likely didn’t change the expected course of Bank of Canada interest rate hikes.

Key Quotes:

“After sprinting ahead in the previous two months, Canadian employment growth slowed to a gentle jog in April. The 15K gain in jobs was below the consensus forecast of +40K, and well below the pace seen in the prior two months as the economy quickly emerged from Omicron-driven restrictions of January. However, today's modest disappointment doesn’t change the overall view of a labour market that is much stronger than had been expected at the start of the year. As such, the figures shouldn’t deter the Bank of Canada from delivering one more non-standard 50bp rate hike at its next meeting.”

“Nationally, the unemployment rate fell to a fresh low of 5.2%, but this time it was driven lower by a decline in participation rather than the strong employment readings of prior months. The adjusted unemployment rate, which takes into account persons who wanted a job but did not look in the current period, also fell below its pre-pandemic level in the latest month (7.2% vs 7.4%).”

“Today's data were a little weaker than expected, but not by enough to change the overall view of a very strong labour market. As such, the Bank of Canada shouldn't be deterred from delivering another non-standard 50bp rate hike at its next meeting. However, signs of a slowing in growth, including the decline in hours worked today, will likely become more frequent and see rate hikes later in the year revert to the usual 25bp increments.”

- Wild week for AUD/NZD with NZ employment and a rate hike in Australia.

- Cross about to end week with gains although far from the top.

- Correction could extend next strong support at 1.0970.

The AUD/NZD cross is about to post the highest weekly close since August 2018. The aussie peaked near 1.1200 and then pulled back. It is hovering around 1.1030/40. The close far from the top adds to some exhaustion signs, like the daily RSI turning to the downside.

The ongoing pullback could continue while the cross holds below 1.1060. A daily close above 1.1100 should increase the odds of another test of 1.1200.

The correction found support at 1.1015. A break lower should open the doors to more losses targeting 1.1000 first and below the next support at 1.0975. If AUD/NZD reaches 1.0975, a rebound seems likely, while a slide below could damage the outlook for the aussie.

On a long-term perspective, the 1.0750 area contains and uptrend line from November low and the 100-day Simple Moving Average.

After a volatile week, with employment data from New Zealand and a rate hike from the Reserve Bank of Australia, AUD/NZD is likely to calm, starting to move in smaller ranges.

AUD/NZD daily chart

Technical levels

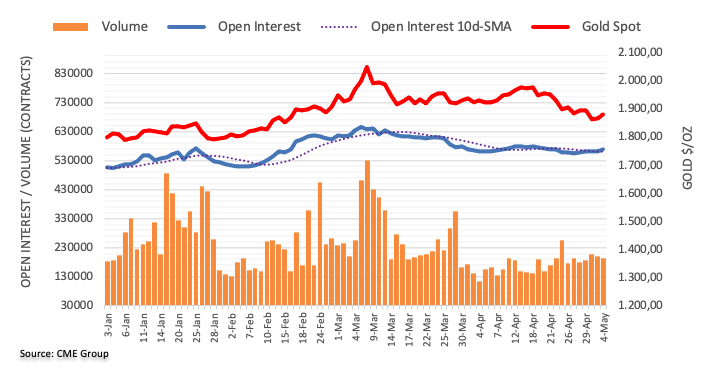

- The yellow metal prepares to finish the week with losses near 0.60%.

- High US Treasury yields, led by the 10-year, around 3.12%, keep gold prices pressured.

- Gold Price Forecast (XAU/USD): Failure at $1890 would send gold prices tumbling towards $1835 (200-DMA).

Gold spot (XAU/USD) persist downward pressured, and it seems that it would finish the week with losses of around 0.60%, extending its fall from April’s swing high at around $1998.30s, below March’s lows around $1890. At $1884.74 a troy ounce, Gold Prices reflect the greenback’s strength.

Gold set to extend its weekly losing streak to three, as US Nonfarm Payrolls smashed expectations

The gold push above the $1900 figure proved short-lived. It lasted no longer than some hours, shedding earlier gains post-Fed hike on Wednesday, retreating below solid resistance around $1890, so the yellow metal is ready to print its third weekly loss in a row. It is worth noting that the dip in XAU/USD is courtesy of higher US Treasury yields, led by the 10-year benchmark note, which rose to a daily high near 3.12%, closing to the 2018 year high at 3.24%.

Headwind for gold was also generated by a firm US dollar in the week. Albeit printing losses on Friday, down 0.03%, is up 0.29% in the week, as shown by the US Dollar Index, sitting at 103.511.

On Friday morning, the US Department of Labour reported the Nonfarm Payrolls report for April, which showed an increase of 428K jobs added to the economy, beating the estimations of 391K. The Unemployment Rate remained unchanged at 3.6%, and according to the report, it was led by gains in leisure, hospitality, manufacturing, transportation, and warehousing.

Regarding Average Hourly Earnings, on private nonfarm payrolls rose by 0.3% m/m. Meanwhile, the annual-based measure increased by 5.5%, almost unchanged, compared to the previous month’s reading of 5.6%.

Analysts at Commerzbank, in a note, commented that the labor market is robust, and it puts the US decline in GDP for the Q1 in perspective. They added that “this decline was due exclusively to significantly higher imports and lower inventory buildup. By contrast, domestic final demand increased strongly.”

“Employment growth remains high. In addition, companies still offer more than 11.5 million open jobs, indicating unchanged robust demand for workers. This demand is drawing from an increasingly empty pool of available labor, which is likely to keep wage pressures high,” added Commerzbank analysts.

Still, Commerzbank expects that the Federal Funds Rate upper bound would be 3.00% by the end of the year.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is still neutral-upward biased, but as long as it struggles to reclaim $1890, that could open the door for further downward pressure. Additionally, the 50 and the 100-day moving average (DMAs), with the latter at $1883.16, below the former, are resistance levels that cap higher prices.

Upwards, XAU/USD’s first resistance would be March’s lows around $1890. A break above would expose the $1900 mark, followed by May 4 swing high at $1909.66. On the flip side, gold’s first support would be the 100-DMA, at $1883.16. Once cleared, the next support would be May 3 cycle low, around $1850.34, followed by the 200-DMA at $1835.77.

- The pound remains under pressure, still hit by the BoE meeting.

- Euro among top performers on Friday.

- EUR/GBP posting a weekly gain of almost 200 pips, the best in months.

The EUR/GBP rose further on Friday and climbed to 0.8590, reaching the highest intraday level since December. It then pulled back to 0.8565. Over the last two days, it gained more than 150 pips

The cross is about to post the highest weekly close since October, the biggest gain in months. The technical outlook has improved dramatically for the euro, that faces 0.8600 as the next critical resistance. The 20-week moving average at 0.8375 is now a critical support. The line is turning flat and could turn positive for the first time since 2020.

A tough week for GBP

The pound is about to end the week with losses across the board weakened, particularly after the Bank of England meeting. The central bank announced a rate hike on Thursday from 0.75% to 1.00% as expected. Market participants put their attention on forward guidance and it was not clear. Three members asking for a rate hike of 50 basis points were offset by two members arguing it would be appropriate to remove the forward guidance on future hikes.

While the pound remains under pressure, the euro received support from talk regarding the European Central Bank with more board members speaking about rate hikes and even a positive rate by year-end. Those comments helped the euro on Friday.

Analysts at Danske Bank expect EUR/GBP to remain rangebounded around 0.84. “On the one hand, a re-pricing of Bank of England (and perhaps a more hawkish ECB) is likely to weigh on GBP but on the other hand GBP usually appreciated vs EUR in an environment where USD performs.”

Technical levels

- Major US indices have bounced from earlier intra-day lows hit after strong US jobs data, but are still lower.

- The latest NFP report was deemed as easing US growth weakness concerns and strengthening Fed tightening conviction.

- The main focus for equity markets next week will be US CPI.

After testing multi-month lows printed earlier in the week following strong US jobs data, major US equity indices have seen a decent intra-day rebound in recent trade. The S&P 500 went as low as the 4,060s (down 1.8% at the time), but has since rebounded to the 4,120s, where it now trades down closer to 0.5%. Despite further upside in the US 10-year yield, which recently surpassed 3.10% for the first time since 2018, the big tech/growth stock dense, rate-sensitive Nasdaq 100 index was last trading near 12,800 and down about 0.4%, having pared earlier losses to near 12,500. The Dow was last down about 0.5% in the 32,800 area, having seen similar price action.

The latest US jobs report showed that the US labour market remained in good health in April. The economy added over 400K jobs, a little more than the 391K expected and the unemployment rate remained unchanged at 3.6%, practically in line with pre-pandemic levels. Granted, it was expected to fall to 3.5%, and other labour slack metrics like the underemployment rate and participation rate deteriorated ever so slightly, but the data was received as robust.

Analysts said that the report would ease any fears about the US economy being in a recession after data last week showed that US real GDP unexpectedly shrunk in Q1, mostly due to a record trade deficit. Labour market strength is typically associated with an economy that is still growing. This, analysts reasoned, may partly explain the negative reaction to the data seen in US equity markets.

While the Fed, which hiked interest rates by 50 bps earlier in the week and signaled significant further tightening ahead, is mostly focused on tackling inflation right now, signs of economic weakness (such as last week’s GDP report) might discourage them from tightening as quickly/far. In that sense, Friday’s US jobs report has been interpreted increasing the confidence that Fed policymakers will feel that the US economy can handle significant, rapid monetary policy tightening.

It is perhaps then not surprising to see US equities experiencing further losses and ending the week close to lows. However, with US Consumer Price Inflation data upcoming next Tuesday, it appears as though traders lacked the conviction, or at least there remains enough dip-buying demand, to keep the major US equity bourses above recent lows. Nonetheless, the S&P 500 still looks on course to post a fifth successive week in the red.

In a blog post on Medium, Minneapolis Fed President and traditionally dovish FOMC member Neel Kashkari argued that, given that long-term real rates have the greatest influence on the demand for credit, financial conditions are already nearly back to neutral levels. But Kashkari argued that the Fed still needs to follow through with its forward guidance on rate hikes and balance sheet reduction to ensure that conditions remain neutral. Kashkari said his assessment of the nominal neutral rate of interest is still that it is around 2.0%.

His remarks come after the Fed lifted interest rates by 50 bps in a widely expected move earlier in the week and outlined quantitative tightening plans.

- FX markets didn’t react much to the latest US jobs data, but could react to a continued drop in US equities.

- NZD/USD looks vulnerable to a potential fall below 0.6400 and test of support in the 0.6380 area.

- The main focus next week will be on US CPI data.

While FX markets did not see much of a reaction to a largely as expected US labour market report that hasn’t been interpreted as having much of an impact on Fed tightening expectations, a continued collapse in Wall Street sentiment looks likely to weigh on NZD/USD on Friday. Less than one hour since the US open, the S&P 500 index is trading a further nearly 2.0% lower, after cratering more than 3.5% on Thursday.

Traders are citing a combination of factors from concerns about the rapid pace of expected Fed tightening this year to the weakening outlook for global growth amid still sky-high inflation. The net result for NZD/USD is that Thursday’s highs in the upper 0.6500s now look well in the rear-view mirror and a break below 0.6400 and towards 0.6380 support appears to be on the cards.

If US yields, which broke higher this week (the 10-year went above 3.0% for the first time since December 2018), continue their upwards march next week and risk appetite in equities remains ropey, it’s a good bet to think that the US dollar will remain bid. A break below 0.6380 in NZD/USD could open the door to a run lower to the next supply zone in the 0.6200 region.

The main focus next week will be on April US Consumer Price Inflation data, out on Tuesday. But NZD/USD traders would also do well to keep an eye on quarterly New Zealand Inflation Expectations figures out on Thursday, as this will likely have an impact on RBNZ tightening expectations.

Barnabas Gan, Economist at UOB Group, reviews the latest Retail Sales figures in Singapore.

Key Takeaways

“Singapore’s retail sales surprised with an 8.7% y/y expansion in Mar 2022, against market expectations for a much slower 0.7% y/y growth. Retail sales excluding motor vehicles surged 13.4% y/y in the same month.”

“The advance in retail sales suggests that Singapore’s domestic retail environment has improved in tandem with a tighter labour market. More importantly, the decline in Feb 2022 was short-lived, and was largely seasonal due to Chinese New Year (CNY).”

“The advance in retail sales suggests that Singapore’s domestic retail environment has improved in tandem with a tighter labour market. More importantly, the decline in Feb 2022 was short-lived, and was largely seasonal due to Chinese New Year (CNY).”

- DXY met some selling bias following new 19-year peaks.

- US Nonfarm Payrolls rose by 428K jobs in April.

- The jobless rate remained unchanged at 3.6% last month.

The US Dollar Index (DXY), which tracks the buck vs. a basket of key rival currencies, now alternates gains with losses in the mid-103.00s on Friday.

US Dollar Index apathetic after upbeat NFP

After printing new highs in the area last seen back in late December 2002 just past the 104.00 hurdle, the index met some selling pressure and receded to the 103.20/15 band against the backdrop of the mixed performance in US yields.

The pullback in the index came despite the US economy added 428K jobs during April, as per the latest Payrolls figures. In addition, the Unemployment Rate stayed put at 3.6%, the Average Hourly Earnings expanded a tad below expectations vs. the previous month and the Participation Rate corrected a little lower to 62.2%.

Later in the session, NY Fed J.Williams (permanent voter, centrist) and Atlanta Fed R.Bostic (2024 voter, centrist) are due to speak, while the Consumer Credit Change for the month of March will close the weekly calendar.

What to look for around USD

The dollar regained its solid appeal and managed to record new highs just beyond the 104.00 mark, or fresh 19-year peaks, as investors’ expectations for a tighter rate path by the Federal Reserve have been nothing but reinforced by the FOMC event on Wednesday. The constructive stance in the dollar is also underpinned by the current elevated inflation narrative and the solid health of the labour market as well as bouts of geopolitical tensions and higher US yields.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is losing 0.05% at 103.49 and the breakout of 104.06 (2022 high May 6) would open the door to 105.00 (round level) and finally 105.63 (high December 11 2002). On the other hand, the next support emerges at 102.35 (low May 5) seconded by 99.81 (weekly low April 21) and then 99.57 (weekly low April 14).

- AUD/USD faded the post-NFP spike and dropped to a fresh multi-day low.

- Rising US bond yields acted as a tailwind for the USD and exerted pressure.

- Sustained break below the monthly low will set the stage for further losses.

The AUD/USD pair reversed an early North American session spike to the 0.7135 region and dropped to a fresh multi-day low in the last hour. The pair was last seen hovering around the 0.7065 region, down over 0.60% for the day.

The US dollar witnessed some selling in reaction to the mixed US jobs report and moved further away from a two-decade high touched earlier this Friday. The headline NFP print showed that the US economy added 428K new jobs in April as compared to the 391K anticipated. This, however, was offset by a slight disappointment from Average Hourly Earnings and the unemployment rate, which, in turn, weighed on the buck.

That said, expectations that the Fed would need to take more drastic action to bring inflation under control helped limit the USD slide. In fact, the markets are still pricing in a further 200 bps rate hike for the rest of 2022, which was evident from a fresh leg up in the US Treasury bond yields. This, along with a weaker risk tone, drove haven flows towards the buck at the expense of the perceived riskier aussie.

With the latest leg down, the AUD/USD pair has now reversed its weekly gains and has now moved well within the striking distance of the monthly low, around the 0.7030 region touched on Monday. Some follow-through selling would be seen as a fresh trigger for bearish traders and drag spot prices to the 0.7000 psychological mark. The downward trajectory could further get extended towards the YTD low, around the 0.6965 region.

Technical levels to watch

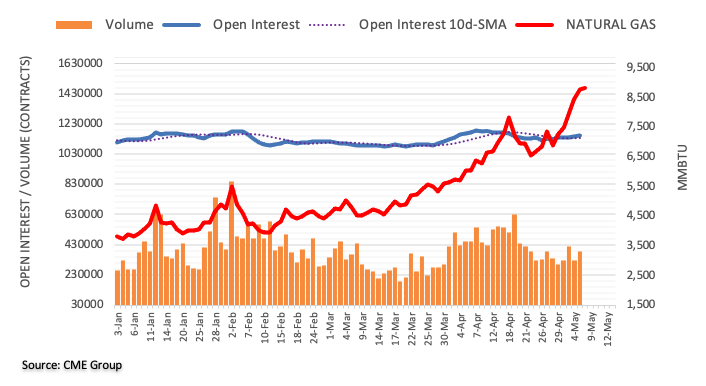

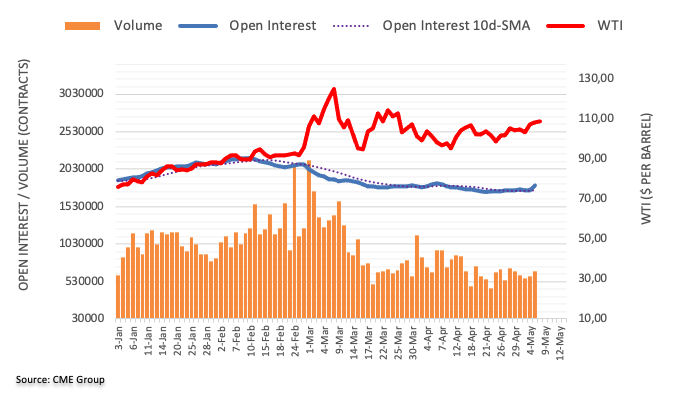

- Oil looks set to end the week on the front foot, with WTI set to end the week near $110.

- Anticipation of imminent agreement on an EU embargo on Russian oil is being cited as supportive.

- Growth worries, China lockdown risks and torrid conditions in equity markets are for now stopping WTI from pushing above $110.

Global oil prices continued to rise on Friday and look on course to post a second successive weekly gain. Front-month WTI futures were unable to break above Thursday’s highs in the $111.00s per barrel, but nonetheless was last trading up by nearly $1.50 near the $110 mark, with weekly gains currently standing at over $5.50. Market commentators continued to cite expectations for EU nations to soon reach an agreement on a phased Russian oil import ban as supporting the price action.

Sources told Reuters on Friday that the EU is looking at ways to appease some of the small EU nations that have so far refused to sign up for the ban. Another factor being cited as supporting the price action is OPEC+ continued slow pace of bringing fresh supply back to the market. The cartel agreed earlier this week to stick to its current policy of lifting output quotas by 432K barrels per day each month, though there is little confidence that the group will actually be able to meet this output hike target, as Russian output falls amid Western sanctions and smaller OPEC+ nations struggle amid chronic underinvestment.

“The looming EU embargo on Russian oil has the makings of an acute supply squeeze,” one oil market analyst at broker PVM said on Friday. “In any case, OPEC+ is in no mood to help out, even as rallying energy prices spur harmful levels of inflation,” they added.

WTI bulls continue to eye a test of late-March highs in the $116.00s, though for now, worries about slowing global growth and demand in China amid ongoing lockdowns in major cities there is holding back the upside. In its latest forecasts, the Bank of England on Thursday forecast a decent chance of a recession in the UK in 2023 and it is feared that the Eurozone economy may be headed the same way.

Meanwhile, torrid conditions in US (and global) equity markets as investors fret about aggressive Fed tightening, slowing growth, geopolitical risks and China lockdowns risks is also likely dampening crude oil upside. Though weakened as of late, WTI historically has a positive correlation to US equities given its status as a risk-sensitive commodity.

European Central Bank Executive Board Member Frank Elderson said on Friday that the ECB must ensure that high inflation doesn't become entrenched in people's expectations, reported Reuters. Weaker economic data so far doesn't suggest that the Eurozone is entering a recession, he added.

Elderson's remarks come after a series of hawkish remarks from other ECB officials earlier in the day. German central bank head Joachim Nagel said that the window for the ECB to take monetary policy measures was slowly closing. France central bank head Francois Villeroy de Galhau said it is “reasonable to raise rates into positive territory by the year-end.”

Economist at UOB Group Barnabas Gan comments on the recent decision by the RBI to raise the interest rate.

Key Takeaways

“The Reserve Bank of India (RBI) raised interest rates in an unscheduled policy move yesterday (4 May 2022). The decision to raise the benchmark repo rate by 40bps to 4.40% was voted by all six members. This is the first repo rate hike since Aug 2018, after keeping it unchanged for 11 straight policy meetings prior.”

“Effective 21 May 2022, the cash reserve ratio will also be raised by 50bps to 4.5% of net demand and time liabilities. This is estimated to absorb a total of INR870bn of liquidity from the banking system.”

“The decision to raise interest rates was likely in view of higher inflationary pressures for the year ahead. Notably, inflation was 6.95% y/y in Mar 2022, and significantly above the central bank’s upper tolerance threshold of 6.0%.”

“Moreover, policy-makers cited further downside risks following the geopolitical tensions and sanctions against Russia. Notwithstanding the risks, we note that high-frequency data since the start of this year had been supportive of India’s economic growth.”

“As cited in our previous RBI report, the decision to adopt a hawkish stance and a higher liquidity adjustment rate in Apr 2022 is a decisive signal for RBI to gradually exit its accommodative monetary policy stance. RBI’s decision to hike rates in May, while being earlier than we had thought, is in line with our call for higher policy rates into the year ahead. As such, we expect further 25bps rate hike each in 3Q22 and 4Q22, to bring the repo rate to 4.90% by year-end.”

Copper has lost all the gains it made this year. But in the view of strategists at ING, the metal should rally once China recovers from covid.

China demand to recover once covid is under control

“Despite all the doom and gloom in the short-term picture, we are cautiously optimistic about copper in the medium term once China brings the virus under control and becomes more confident in easing lockdowns. However, the magnitude of demand pick-up will depend largely on the scale of the stimulus and, in particular, the policies relevant to those copper intensive sectors, such as the power infrastructure and the property market.”

“Our base case average prices remained unchanged for 2Q at $10,000/t from the previous update, but some potential upside episodes driven by a demand recovery may be delayed into late 2Q22 or 2H22 rather than sooner. And currently, our price forecasts remain unchanged for 3Q at$9,900/t and 4Q at $9,800/t (LME 3M quarterly average).”

- EUR/USD faltered just pips below the 1.0600 mark.

- ECB’s Nagel defended a move on rates as soon as this year.

- US Nonfarm Payrolls surprised to the upside in April.

EUR/USD comes under some selling pressure after the daily recovery stalled near the 1.0600 region at the end of the week.

EUR/USD remains capped by 1.0640

EUR/USD deflates from earlier peaks and now faces some selling interest following a positive surprise from the US docket after the economy added 428K jobs in April, while the Unemployment Rate stayed unchanged at 3.6% in the same period.

Further data from the labour market saw Average Hourly Earnings expand 0.3% MoM and 5.5% from a year earlier. The Participation Rate, in the meantime, ticked a tad lower to 62.2%.

Indeed, the greenback regains some ground lost in the wake of the mixed results from the US labour market, which in turn puts the pair under some downside pressure in a context where yields on both sides of the Atlantic continue to march higher.

What to look for around EUR

EUR/USD came under renewed downside pressure in the wake of the FOMC event. The downtick, however, seems to have met contention around 1.0480 so far this week, while the upside looks limited near 1.0640. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is gaining 0.32% at 1.0572 and faces the next up barrier at 1.0641 (weekly high May 5), followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level). On the flip side, a breach of 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

- USD/CAD attracted some buying and refreshed daily high during the early North American session.

- Expectations for a further tightening by the Fed acted as a tailwind for the USD and extended support.

- The mixed US/Canadian employment data did little to provide any meaningful impetus to the major.

- An uptick in crude oil prices underpinned the loonie and held back bulls from placing aggressive bets.

The USD/CAD pair quickly reversed an early North American session dip and jumped to a fresh daily high, around the 1.2875 region post-US/Canadian monthly jobs report.

The headline NFP print showed that the US economy added 428K new jobs in April as compared to the 391K anticipated. This, however, was offset by a slight disappointment from the unemployment rate, which held steady at 3.6% against a downtick to 3.5% anticipated. Moreover, Average Hourly Earnings also missed market expectations and rose 0.3% MoM in April.

The mixed US employment data did little to provide any impetus, though expectations that the Fed would need to take more drastic action to bring inflation under control acted as a tailwind for the buck. In fact, the markets are still pricing in a further 200 bps rate hike for the rest of 2022, which was evident from a fresh leg up in the US Treasury bond yields.

Apart from this, a generally weaker tone around the equity markets further drove haven flows towards the greenback. This, along with a rather unimpressive Canadian employment data, acted as a tailwind for the USD/CAD pair. Statistics Canada reported that the number of employed people rose by 15.3K in April, as against 55K anticipated, and the jobless rate edged down to 5.2%.

This, however, was offset by modest uptick in crude oil prices, which extended some support to the commodity-linked loonie and kept a lid on any further gains for the USD/CAD pair. Hence, it will be prudent to wait for some follow-through buying before traders start positioning for an extension of the recent appreciating move witnessed over the past two weeks or so.

Technical levels to watch

S&P 500 has been unable to clear key resistance at 4308. Thus immediate risk stays seen lower for a conclusive break of the 4115 Q1 low for a fall back to 4063/57 and eventually the 38.2% retracement of the 2020/2021 uptrend at 3855/15, analysts at Credit Suisse report.

Resistance at 4308 caps to keep the risk lower

“Whilst the market has just managed to again close above the 4115 Q1 low with weekly MACD momentum below zero and falling the immediate risk stays seen lower and below 4115/06 would be seen to clear the way for a retest of the recent and May 2021 lows at 4063/57.”

“A break below 4063/57 can see downside momentum increase further with potential channel support seen next at 4034/33.”

“Big picture, we would look for an eventual fall to the 38.2% retracement of the 2020/2021 uptrend at 3855/15.”

“Resistance is seen moving to 4174/75 initially, then 4199, with the 13-day exponential average now at 4255. Only a break above 4308 though would be seen to mark a near-term base and we shall maintain an immediate tactical negative outlook whilst beneath here.”

- USD/JPY struggled to preserve modest intraday gains to the weekly high amid some USD selling.

- The mixed US monthly jobs report did little to impress the USD bulls or provide any impetus.

- The Fed-BoJ policy divergence continued lending support to the pair and helped limit losses.

The USD/JPY pair surrendered its modest intraday gains to the weekly high and eased back closer to the daily low, around the 130.15 region in reaction to the mixed US monthly jobs report.

The headline NFP print showed that the US economy added 428K new jobs in April as compared to the 391K anticipated. This, however, was offset by a slight downward revision of March's reading to 428K from the 431K reported previously. Moreover, the unemployment rate missed consensus estimates and held steady at 3.6% during the reported month.

The report further revealed that Average Hourly Earnings rose 0.3% MoM in April and 5.5% YoY as against 0.4% and 5.5% expected, respectively. The data forced the US dollar to extend its modest pullback from a two-decade high. Apart from this, a weaker risk tone benefitted the safe-haven Japanese yen and acted as a headwind for the USD/JPY pair.

That said, a big divergence in the monetary policy adopted by the Fed and the Bank of Japan helped limit any deeper losses, at least for the time being. The markets seem convinced that the Fed would need to take more drastic action to bring inflation under control and are still pricing in a further 200 bps rate hike for the rest of 2022.

This, in turn, remained supportive of elevated US Treasury bond yields, which supports prospects for the emergence of some USD dip-buying. In contrast, the BoJ has promised to conduct unlimited bond purchases to defend its “near-zero” target for 10-year yields and vowed to keep its existing ultra-loose policy settings.

The fundamental backdrop suggests that any meaningful pullback might still be seen as a buying opportunity and remain limited. Nevertheless, the USD/JPY pair remains on track to post gains for the ninth successive week and the highest weekly close since April 2002.

Technical levels to watch

The Canadian economy added 15,300 jobs in April, the latest data release by Statistics Canada revealed on Friday. That was below expectations for a 55,000 job gain and marked a substantial slowdown after March's 72,500 job gain. In terms of the job breakdown, full-time employment fell by 31,600 in April versus a 47,100 rise in part-time employment.

The Unemployment Rate fell as expected to 5.2% from 5.3% in March, but this was driven by a surprise fall in the Participation Rate from 65.4% in March to 65.3% in April.

Market Reaction

The loonie saw a choppy reaction to the latest jobs report and USD/CAD continues to trade flat in the 1.2830s versus pre-data release levels.

- The US economy added 428K jobs in April, more than the 391K expected.

- But the unemployment rate remained unchanged at 3.6% against forecasts for a drop to 3.5%.

- FX markets did not see any notable reaction to the latest data.

The US economy added 428,000 jobs in April, according to the latest Non-farm Payrolls (NFP) report released by the US Bureau of Labour Statistics on Friday. That was a little above the median economist forecast for a gain of 391,000 jobs, and exactly in line with the pace of jobs gains in March (which was revised lower to 428,000 from 431,000). The headline job gain was driven by a 406,000 gain in private-sector jobs, which came in above the 385,000 expected increase.

Factory jobs were up 55,000 on the month, above the expected 35,000. Goods-producing jobs were up 66,000, Construction jobs were up 2,000, private sector service-providing jobs were up 340,000 and retail jobs were up 4,000. Government jobs rose by 22,000, above the expected 4,000 rise.

In terms of measures of labour market slack; the Unemployment Rate remained unchanged at 3.6% in April versus the median economic forecast for a drop to 3.5%. The U6 Underemployment measure, meanwhile, rose a tad to 7.0% from 6.9% previously. The Labour Force Participation Rate fell slightly to 62.2% from 62.4% a month earlier. In terms of major US ethnic minority employment rates; the Black Unemployment Rate fell to 5.9% in April from 6.2% in March, while the Hispanic jobless rate fell to 4.1% from 4.2%. The White unemployment rate remained unchanged at 3.2%.

Finally, Average Hourly Earnings growth came in at 5.5% YoY as expected, with wages posting a slightly more modest MoM growth rate of 0.3% than the expected 0.4%. The Average Hourly Wage was $31.85 in April versus $31.75 in March. The average number of hours worked in the week remained unchanged at 34.6, versus expectations for a rise to 34.7.

Market Reaction

Slightly weaker than forecast measures of labour market slack seemed to negative the slightly stronger than expected headline NFP print, with FX markets not showing much, if any, reaction to the latest data.

Gold has broken price support at $1,877. XAUUSD is seen at risk to a test of support from its nine-month uptrend and 200-day moving average (DMA) at $1,836/26, economists at Credit Suisse report.

Move above $1,998 is needed to reassert an upward bias

“We look for a fall back to the uptrend from last August and 200-DMA at $1,836/26, but with fresh buyers expected here.”

“A weekly close below $1,826 though would warn of a retest of pivotal long-term support at $1,691/77.”

“Above $1,998 is needed to reassert an upward bias for a retest of the $2,070/75 record highs.”

Ukrainian President Volodymyr Zelenskyy said on Friday that he can see no willingness on the Russian side to end the war in Ukraine, reported Reuters. Zelenskyy said that Russia thinks it can escape war crimes prosecutions because of its nuclear threat.

Russo-Ukrainian peace talks have been deadlocked over the past few weeks as Russia has ramped up its offensive in the east and south of Ukraine. Zelenskyy said last Friday that peace talks with Russia at a high risk of ending given the action of Russian troops during the war.

Bank of England Chief Economist Huw Pill said on Friday that the BoE should not over-respond to short-term developments and should not be over-aggressive with policy moves, reported Retuters. Pill added that the BoE's Monetary Policy Committee is cautious about commenting too much on market policy rate expectations, and reiterated that the bank is not driven by financial market developments.

Pill had earlier remarked that two members of the bank's rate-setting committee did not sign up to the new guidance on interest rates because they felt that enough may have already been done.

- Silver is trading with a negative bias but is for now holding above support in the $22.00 area.

- Traders are focused on the imminent release of US jobs data and how it might impact Fed policy expectations.

- If markets react by upping Fed tightening bets, XAG/USD could slide towards Q4 2021 lows in the mid-$21.00s.

Spot silver (XAG/USD) is trading with a negative bias, though for now remains supported above the $22.00 per troy ounce mark, ahead of the release of US labour market data at 1330BST, as well as lots of Fed speak thereafter. $22.00 has acted as a significant support level in 2022 and a break below it could open the door to technical selling into the Q4 2021 lows in the $21.50 area.

The upcoming Bureau of Labour Statistics data release, which is expected to show nearly job gains of nearly 400,000 in the US last month, as well as the unemployment rate falling to 3.5% from 3.6%, will be viewed in the context of how it impacts the outlook for Fed policy. Earlier this week, the Fed raised interest rates by 50 bps and outlined quantitative tightening plans as expected, whilst also signaling intent to continue with 50 bps rate hikes at upcoming meetings in a bid to get interest rates back to around 2.5% by the end of the year.

A sharp rally in US yields on Thursday as bond market participants took a more hawkish view of Wednesday’s Fed announcement saw XAG/USD pull sharply lower from earlier weekly highs in the $23.30 area. Silver is currently on course to post a third successive week in the red, during which time it has reversed nearly 15% lower from mid-April highs in the low-$26.00s. If anything in the labour market report triggers fresh hawkish Fed bets and further yield upside, XAG/USD is at risk of breaking lower.

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly jobs report for April later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 55K jobs during the reported month, down from the 72.5K rise reported in March. Meanwhile, the unemployment rate is expected to tick lower from 5.3% to 5.2% in April.

Analysts at NBF offered a brief preview of the report and explained: “Job creation should have continued apace during the month, reflecting a strong economy. That said, the number of jobs added may have come down after two extremely solid months. Our call is for 25K gain. Such an improvement of the labour market would leave the unemployment rate unchanged, assuming the participation rate remained at 65.4%.”

How could the data affect USD/CAD?

Ahead of the key release, rising crude oil prices underpinned the commodity-linked loonie and acted as a headwind for the USD/CAD pair amid a modest US dollar pullback from a two-decade higher. The data is likely to be overshadowed by the simultaneous release of the US NFP report, though any significant divergence from the expected readings might still infuse some volatility around the pair.

From current levels, any meaningful upside is likely to confront stiff resistance near the 1.2900 mark. Some follow-through buying should pave the way for additional gains and lift spot prices to December 2021 high, around the 1.2960-1.2965 zone, en-route the key 1.3000 psychological mark.

On the flip side, the 1.2800 round figure now seems to protect the immediate downside ahead of the 1.2780-1.2775 region. The downtick could be seen as a buying opportunity around the 1.2750-1.2745 area. This, in turn, should help limit the downside near the 1.2715-1.2710 zone, or the weekly low touched on Thursday, which is closely followed by the 1.2700 round-figure mark.

Key Notes

• Canada Employment Preview: Forecasts from five major banks, battling a labour crunch

• USD/CAD Forecast: Bulls await descending trend-line breakout, US/Canadian jobs data in focus

• USD/CAD: Canadian Employment should prove broadly supportive of the loonie – ING

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- After slumping over 2.0% on Thursday after a dovish BoE policy announcement, GBP/USD is consolidating in the mid-1.2300s.

- Traders are focused on the upcoming release of US jobs data, as well as upcoming commentary from Fed policymakers.

- Bears are eyeing a test of June 2020 lows in the 1.2250 area.

GBP/USD is consolidating at multi-month lows in the 1.2350s ahead of the release of key US labour market data at 1330BST followed by a barrage of commentary from Fed policymakers later in the day. The sterling bears are currently taking a breather after GBP was hammered in wake of a dovish leaning Bank of England policy announcement on Thursday that saw cable drop over 2.0% from the 1.2630s to current levels in the mid-1.2350s.

To recap, the BoE on Thursday raised interest rates by 25 bps as expected to 1.0% and, while a few members of the Monetary Policy Committee (MPC) wanted a larger 50 bps rate hikes, the bank also softened its tone on the need for further tightening. The meeting minutes revealed that two MPC members deemed the reference to further tightening as inappropriate given risks to the economic outlook, which were reflected in the BoE’s new forecasts which signal a risk of a recession in 2023.

Sterling has been battered since mid-April amid a combination of growing pessimism about the outlook for the UK economy and BoE tightening as the UK endures its worst cost-of-living crunch in decades. This has been a major contributor to GBP/USD’s more than 5.0% drop from mid-April levels in the 1.30-31 region, though another driver has been USD strength, as traders price in a more hawkish Fed outlook.

The upcoming US labour market data release and commentary from Fed officials on Friday will be viewed in the context of how it influences market expectations for Fed tightening this year and next. The recent rally in US bond yields, with the 10-year on Thursday moving above 3.0% for the first time since December 2018, suggests markets are pricing for a higher terminal interest rate from the US central bank.

Should that trend continue on Friday, GBP/USD is at risk of further losses. Bears will be eyeing the next key support level in the form of June 2020 lows in the 1.2250 area. To the upside, April lows just above 1.2400 will likely offer resistance, and any such rebound into the 1.2400s might entice sellers.

Bank of England Chief Economist Huw Pill said on Friday that two members of the bank's rate-setting committee (the Monetary Policy Committee or MPC) did not sign up to the new guidance on interest rates because they felt that enough may have already been done, reported Reuters.

Pill's remarks come after he said earlier in the day that “key message we hoped to land yesterday is that we face risks on both sides of the economic outlook.” Arguments about balancing risks with rates are quite finely balanced themselves, he added.

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for April. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 391K jobs during the reported month, down from the 431K in March. The unemployment rate, however, is expected to edge lower to 3.5% in April from 3.6% previous. Apart from this, investors will take cues from Average Hourly Earnings, which could add to rising inflationary pressures.

Analysts at Goldman Sachs offered a brief preview and sounded less optimistic about the report: “We estimate NFP rose by 300K in April. We estimate a one-tenth drop in the unemployment rate to 3.5%, reflecting a solid or strong rise in household employment partially offset by another 0.1pp rise in labour force participation to 62.5%. While labour demand remains at elevated levels and dining activity has returned to normal, seasonally-adjusted job growth tends to slow during the spring hiring season when the labour market is tight.”

How could the data affect EUR/USD?

Heading into the key data risk, the US dollar eased a bit from a two-decade high touched earlier this Friday and assisted the EUR/USD pair to rebound over 100 pips from sub-1.0500 levels. That said, expectations that the Fed would need to take more drastic action to curb soaring and elevated US Treasury bond yields should act as a tailwind for the buck. A stronger NFP report will reinforce speculations and attract fresh USD buying. Conversely, any disappointment is more likely to be overshadowed by a generally weaker tone around the equity markets. This, along with concerns that the European economy will suffer the most from the Ukraine crisis, suggests that the path of least resistance for the pair is to the downside.

Eren Sengezer, Editor FXStreet, offered a brief technical outlook and outlined important technical levels to trade EUR/USD: “The pair is trading near the static resistance of 1.0560, which is reinforced by the 50-period SMA on the four-hour chart, and a four-hour close above that level could open the door for a rebound toward 1.0600 (psychological level, Fibonacci 23.6% retracement level of the latest downtrend). Finally, 1.0660 (Fibonacci 38.2% retracement) forms the next significant resistance.”

“On the downside, 1.0540 (20-period SMA) aligns as interim support ahead of 1.0500 (psychological level and 1.0470 (multi-year low set on April April 26),” Eren added further.

Key Notes

• Nonfarm Payrolls Preview: Could employment become a new headache for the Fed?

• NFP Preview: Forecasts from 12 major banks, robust job growth

• EUR/USD Forecast: Euro's recovery attempts to remain as technical corrections

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

- Gold prices are trading resiliently in the mid-$1880s on Friday ahead of US jobs data.

- It’s been a choppy week for gold after the Fed hiked interest rates by 50 bps as expected on Wednesday.

- Ultimately, XAU/USD looks set to end the week lower as US yields press higher.

Despite the US Dollar Index (DXY) hitting fresh 20-year highs to the north of the 104.00 level earlier in the day on Friday, spot gold (XAU/USD) prices have remained resilient. An earlier dip into the upper $1860s per troy ounce has been reversed and the precious metal is currently changing hand in the mid-$1880s, up about 0.3% on the day, as the US dollar pares earlier gains and focus shifts to the upcoming release of US labour market data at 1330BST.

The upcoming Bureau of Labour Statistics data release, which is expected to show nearly job gains of nearly 400,000 in the US last month, as well as the unemployment rate falling to 3.5% from 3.6%, will be viewed in the context of how it impacts the outlook for Fed policy. Earlier this week, the Fed raised interest rates by 50 bps and outlined quantitative tightening plans as expected, whilst also signaling intent to continue with 50 bps rate hikes at upcoming meetings in a bid to get interest rates back to around 2.5% by the end of the year.

The market’s initial interpretation of Fed Chair Jerome Powell’s post-meeting message was dovish given he essentially ruled out the possibility of a 75 bps move at any upcoming meeting. That helped XAU/USD prices rally to weekly highs above the $1900 level in early Thursday trade. However, a sharp rise in US yields and bond markets took a more hawkish view of events saw gold quickly release its grip on the $1900 level.

While a historic drop in US equity markets on Thursday helped keep safe-haven gold’s losses fairly contained (XAU/USD still trades more than 1.5% above earlier weekly lows), gold is nonetheless on course to post a third consecutive weekly loss. If the upcoming jobs report triggers further fears of a US wage-price spiral that would require a more aggressive monetary tightening response from the Fed, XAU/USD may retest weekly lows just above the $1850 level.

- DXY clinches new cycle tops just above the 104.00 mark.

- Next on the upside emerges the 105.32 level.

DXY comes under some selling pressure after hitting fresh 19-year peaks past 104.00 the figure on Friday.

The underlying bullish view for the dollar, remains well in place for the time being. That said, extra gains above the 104.00 region should prompt the index to meet the next target at 105.63 (December 11 2002 high) ahead of the December 2002 peak at 107.31.

The current bullish stance in the index remains supported by the 8-month line in the 96.85/90 band, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.98.

DXY daily chart

- EUR/JPY attempts to break above the multi-day consolidative theme.

- A test of the 2022 high around 140.00 remains on the cards.

EUR/JPY adds to the weekly recovery and manages to reclaim the area beyond the 138.00 hurdle at the end of the week.

If the cross surpasses the 138.00 area on a sustainable basis, then the door could open to a potential visit to the 2022 high at 140.00 (April 21). Beyond this level emerges the June 2015 high at 141.05.

In the meantime, while above the 200-day SMA at 130.87, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Senior Economist Alvin Liew and Rates Strategist Victor Yong at UOB Group review the latest FOMC event (May 4).

Key Takeaways

“The 3/4 May 2022 FOMC as widely expected, continued it rate hiking cycle by lifting the policy Fed Funds Target rate (FFTR) by 50bps to 0.75-1.00%, the biggest hike since 2000, and importantly, it signaled clearly that more rate hikes will follow with its focus on reining in inflation as it ‘anticipates that ongoing increases in the target range will be appropriate’. Unlike the Mar FOMC, the decision this time was unanimous (9-0).”

“The other key element was the release of the plans for the Balance Sheet Reduction [BSR] also termed as Quantitative Tightening, [QT] which will start on 1 Jun 2022, just three months after it concluded its Quantitative Easing (QE) in Mar 2022. The timeline is much more accelerated when compared to the previous episode in 2017-2019.”

“Even as FOMC Chair Powell confirmed that the Fed is ‘on a path to move policy rate expeditiously to more normal levels…Additional 50 bps increases should be on table at next couple of meetings’, he dismissed speculation that the Fed was contemplating an even larger increase of 75bps hike in the months ahead, saying that it is ‘not something that the committee is actively considering’.”

“Given the clear indications for on-going hikes to combat inflation spelt out in the May FOMC and Powell’s explicit comment that ‘additional 50 bps increases should be on table at next couple of meetings’, we now expect the FFTR will be hiked faster by 50bps in the June and July FOMC (from our previous forecast of 25bps).”

“We continue to expect 25bps in every remaining meeting of this year. Including the Mar FOMC’s 25bps hike and yesterday’s 50bps hike, this upgrade now implies a cumulative 250bps of increases in 2022, bringing the FFTR higher to the range of 2.50-2.75% by end of 2022 (from our previous forecast of 200bps hikes to 2.00-2.25% by end 2022). We maintain our forecast for two 25bps rate hikes in 2023, bringing our terminal FFTR to 3.00-3.25% by mid-2023 (versus previous forecast of 2.50-2.75%).”

Bundesbank President and European Central Bank (ECB) Governing Council member Joachim Nagel argued on Friday that the window for the ECB to take monetary policy measures was slowly closing, per reuters.

Additional takeaways

"Optimistic about a 2022 move."

"I see no recession but a much weaker growth rate."

"I don't buy the argument that the monetary policy should hold back because of the economy right now."

Market reaction

The EUR/USD pair edged slightly higher following these comments and was last see rising 0.5% on a daily basis at 1.0590.

- USD/CAD attracted some selling on Friday and was pressured by a combination of factors.

- Rising oil prices underpinned the loonie and exerted pressure amid modest USD weakness.

- The downside seems cushioned as the focus remains glued to the US/Canadian jobs report.

The USD/CAD pair edged lower during the first half of the European session and dropped to a fresh daily low, around the 1.2815-1.2810 region in the last hour.

A combination of factors failed to assist the USD/CAD pair to capitalize on the overnight strong bounce from a near two-week low and attracted fresh selling near the 1.2865 region on Friday. A pickup in crude oil prices underpinned the commodity-linked loonie and acted as a headwind for spot prices amid modest intraday US dollar pullback.

An impending European Union embargo on Russian oil continued fueling worries about tightening supply and helped offset concerns about slowing global economic growth. In fact, the EU had proposed a plan to phase out Russian oil imports by end of the year. This, in turn, was seen as a key factor that extended some support to crude oil prices.

On the other hand, the USD witnessed some profit-taking amid some repositioning trade ahead of Friday's release of the closely-watched US monthly jobs report - popularly known as NFP. This further exerted some downward pressure on the USD/CAD pair, though hawkish Fed expectations and elevated US Treasury bond yields should limit the USD losses.

Fed Chair Jerome Powell had said that policymakers were ready to approve a 50 bps increase at upcoming meetings. Moreover, the markets expect that the Fed would need to take more drastic action to curb soaring and are pricing in an additional 200 bps rate hike for the rest of 2022. This, in turn, supports prospects for the emergence of some USD dip-buying.

Investors might also prefer to wait for a fresh impetus from the release of monthly employment details from the US and Canada, due later during the early North American session. This, along with the US bond yields, will influence the USD. Traders will further take cues from oil price dynamics for some short-term opportunities around the USD/CAD pair.

Technical levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comments on the latest CPI release in the Philippines.

Key Takeaways

“Headline inflation jumped further to 4.9% y/y in Apr (from 4.0% in Mar), exceeding Bangko Sentral ng Pilipinas (BSP)’s 2.0%-4.0% medium-term target range for the first time in seven months. The reading also surpassed our estimate (4.5%) and Bloomberg consensus (4.6%). It was again a broad-based increase in prices, led by higher fuel and food prices as well as electricity rates amid persistent weakness in Peso (PHP).”

“We believe that inflation will likely stay near the 5.0% level for the rest of the year as the Russia-Ukraine conflict lingers while China is still grappling with its COVID-19 outbreak. These two event risks alongside a more hawkish Fed will tilt inflation pressures higher amid elevated commodity prices, prolonged supply-chain disruptions, and weaker local currency due to narrower interest rate differentials with US rates. The ongoing petitions for a hike in minimum wage and public transport fare domestically will also lift inflation should they be approved. We reiterate our inflation forecast of 4.5% for this year (BSP est: 4.3%; 2021: 3.9%).”

“In view of broadening inflationary pressures, continued expansion in domestic economic activities and narrowing interest rate differentials with US Fed Funds rate, we stick to our BSP call for a 25bps hike in the overnight reverse repurchase rate to 2.25% by 2Q22. The next two Monetary Board meetings are scheduled on 19 May and 23 Jun.”

- EUR/USD bounces off lows near 1.0480 on Friday.

- ECB’s Villeroy suggested rates could be positive by year end.

- All the attention will be on US Nonfarm Payrolls later in the NA session.

After bottoming out in the 1.0480 region earlier in the session, EUR/USD manages to regain some buying interest and now reclaims the area further north of the 1.0500 barrier.

EUR/USD up on rates chatter, dollar weakness

EUR/USD regains some composure following Thursday’s sharp selloff and after dropping to fresh multi-session lows in the 1.0485/80 band during early trade.

Indeed, some selling pressure in the greenback sponsors the ongoing bounce in the pair well north of 1.0500 the figure as the sentiment in the risk-associated universe appears somewhat improved in the European morning.

Also lending some support to the shared currency, ECB’s Villeroy suggested that the bank’s policy rates could return to the positive territory by the end of the year. In the same line, the German 10y bund yields climb to fresh peaks near 1.10% for the first time since later July 2014.

In the euro docket, Industrial Production in Germany contracted at a monthly 3.9% in March. In the US calendar, April’s Payrolls are due seconded by the Unemployment Rate, Consumer Credit Change and the speeches by FOMC’s Williams and Bostic.

What to look for around EUR

EUR/USD came under renewed downside pressure in the wake of the FOMC event. The downtick, however, seems to have met contention around 1.0480 so far this week and ahead of the key NFP due later on Friday. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is gaining 0.18% at 1.0558 and faces the next up barrier at 1.0641 (weekly high May 5) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level). On the flip side, a breach of 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

- AUD/USD witnessed some follow-through selling for the second successive day on Friday.

- Bulls seemed rather unimpressed by RBA’s hawkish outlook and modest USD weakness.

- The market focus remains glued to the release of the latest US monthly jobs report (NFP).

The AUD/USD pair maintained its offered tone through the first half of the European session and was last seen trading near a multi-day low, just below the 0.7100 mark.

The pair extended the previous day's sharp retracement slide from the 0.7265 region, or a near two-week high and witnessed some follow-through selling for the second successive day on Friday. The downtick seemed rather unaffected by the Reserve Bank of Australia’s (RBA) hawkish Statement on Monetary Policy, suggesting a further increase in interest rates is needed to restrain inflation.

On the other hand, the US dollar eased a bit from the two-decade high touched earlier this Friday, though did little to impress bullish traders or lend any support to the AUD/USD pair. The modest USD pullback could be solely attributed to some repositioning trade ahead of the closely-watched US monthly jobs report and is likely to remain limited amid hawkish Fed expectations.

Fed Chair Jerome Powell had said that policymakers were ready to approve a 50 bps increase at upcoming meetings. Moreover, the markets expect that the Fed would need to take more drastic action to curb soaring and are pricing in an additional 200 bps rate hike for the rest of 2022. This remained supportive of elevated US Treasury bond yields, which should act as a tailwind for the buck.

Investors, however, seem reluctant to place aggressive bets and preferred to wait for a fresh catalyst from the US NFP report, scheduled for release later during the early North American session. The data is anticipated to be consistent with tightening labour market conditions, which, along with the US bond yields, might influence the USD and provide a fresh impetus to the AUD/USD pair.

Technical levels to watch

FX option expiries for May 6 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0425 491m

- 1.0575 413m

- 1.0600 581m

- 1.0650 782m

- 1.0700 569m

- GBP/USD: GBP amounts

- 1.2450 542m

- 1.2500 415m

- 1.2550 482m

- 1.3000 330m

- USD/JPY: USD amounts

- 128.00 400m

- 128.50 410m

- 130.00 310m

- 131.00 375m

- AUD/USD: AUD amounts

- 0.7000 524m

- 0.7100 786m

- 0.7200 942m

- 0.7300 2.2b

- 0.7375 607m

- 0.7400 578m

- USD/CAD: USD amounts

- 1.2500 1.1b

- 1.2600 601m

- 1.2700 592m

- 1.2725 382m

- 1.2800 972m

- 1.2840 1.2b

- 1.2900 486m

- 1.3055 1.9b

- EUR/GBP: EUR amounts

- 0.8450 568m

- 0.8500 351m

- 0.8575 755m

- 0.8725 697m

Gold’s excursion above the $1,900 mark proved short-lived. April Nonfarm Payrolls data from the US will be the last significant data release of the week. However, the jobs report is unlikely to impact Gold Price unless deviates significantly from expectations, economists at Commerzbank report.

Sharp rise in bond yields puts gold under pressure of late

“Gold is set to post its third weekly loss in a row. Bond yields are probably the main factor weighing on its price. Because the market-based inflation expectations have not changed, real interest rates have likewise increased noticeably. This has made gold less attractive as an alternative investment.”