- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-05-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Westpac Consumer Confidence | May | 75.6 | |

| 01:30 | Australia | Wage Price Index, q/q | Quarter I | 0.5% | 0.5% |

| 01:30 | Australia | Wage Price Index, y/y | Quarter I | 2.2% | 2.1% |

| 02:00 | New Zealand | RBNZ Interest Rate Decision | 0.25% | ||

| 04:00 | New Zealand | RBNZ Press Conference | |||

| 05:00 | Japan | Eco Watchers Survey: Current | April | 14.2 | |

| 05:00 | Japan | Eco Watchers Survey: Outlook | April | 18.8 | |

| 06:00 | United Kingdom | Business Investment, y/y | Quarter I | 1.8% | |

| 06:00 | United Kingdom | Business Investment, q/q | Quarter I | -0.5% | -2.5% |

| 06:00 | United Kingdom | Manufacturing Production (YoY) | March | -3.9% | -10.4% |

| 06:00 | United Kingdom | Manufacturing Production (MoM) | March | 0.5% | -6% |

| 06:00 | United Kingdom | Industrial Production (YoY) | March | -2.8% | -9.3% |

| 06:00 | United Kingdom | Industrial Production (MoM) | March | 0.1% | -5.6% |

| 06:00 | United Kingdom | GDP, y/y | March | 0.3% | |

| 06:00 | United Kingdom | GDP m/m | March | -0.1% | -8% |

| 06:00 | United Kingdom | GDP, q/q | Quarter I | 0.0% | -2.5% |

| 06:00 | United Kingdom | GDP, y/y | Quarter I | 1.1% | -2.1% |

| 06:00 | United Kingdom | Total Trade Balance | March | -2.8 | |

| 09:00 | Eurozone | Industrial production, (MoM) | March | -0.1% | -12.1% |

| 09:00 | Eurozone | Industrial Production (YoY) | March | -1.9% | -12.4% |

| 12:30 | U.S. | PPI, y/y | April | 0.7% | -0.2% |

| 12:30 | U.S. | PPI, m/m | April | -0.2% | -0.5% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | April | 1.4% | 0.9% |

| 12:30 | U.S. | PPI excluding food and energy, m/m | April | 0.2% | 0.0% |

| 13:00 | United Kingdom | NIESR GDP Estimate | April | -4.8% | |

| 13:00 | U.S. | Fed Chair Powell Testimony | |||

| 14:30 | U.S. | Crude Oil Inventories | May | 4.59 | 4.295 |

| 20:10 | New Zealand | RBNZ Gov Orr Speaks | |||

| 22:45 | New Zealand | Visitor Arrivals | March | -10.8% |

- There have been positive developments from Gilead's remdesivir; there have been statistically significant details, but only modest

- There are at least eight COVID vaccine candidates in development

- NIH trial on vaccine moved "very quickly"

- Phase 2 and 3 will start in late Spring and early Summer

- If vaccines are successful, it will be known by late Fall or early Winter

FXStreet reports that Sal Guatieri from the Bank of Montreal (BMO) notes that consumer prices remained under heavy downward pressure in April as social distancing measures slashed demand and fuel costs.

“The CPI tumbled 0.8% in the month, led by a 20.6% plunge in gasoline costs, axing the yearly CPI rate to 0.3% from 1.5% in March.”

“Core prices posted their largest monthly decline (-0.4%) on record (back to 1957) and the first back-to-back monthly decrease in over 37 years, carving the yearly core rate to 1.4% from 2.1%.”

“Even as the economy reopens, core inflation is likely headed below 1% in the coming year in the face of high unemployment and low commodity prices.”

- Theory of ETF purchase program is that"a little bit of money"might sell things so trading continues on some

- If virus changes daily life extensively, it could put a lot of universities at risk

- Says there are other tools that Fed could use before introducing negative rates but he does not want to say never on the possibility

- There will need to be more support for unemployed workers

- U.S. government can borrow cheaply and has ability to raise funds to help American people

- When crisis is over, we will need to put fiscal house in order

- We are not going to fix economy until we get our hands around virus; we might be in this for a long time

- Coronavirus led to a collapse in most forms of consumer spending

- Q2 will be brutally painful because of coronavirus and mandates economic shutdown

- We can expect U.S. economy to underperform until virus is under control

- Crisis is severely harming the nonprofit sector and higher education

- A scenario where economy opens too quickly and leads to second wave of virus would reverse the recovery

- Recovery will be on even, with manufacturers rebounding more quickly than travel and hospitality

- Banks shouldn't be issuing large dividends now

FXStreet reports that economists at TD Securities note that an exceptionally weak report, and not just because of energy prices as core inflation weakened sharply as well.

“The total CPI was -0.8% m/m in April, matching the BBG consensus (TD: -0.7%.) The core index was -0.4%, below the -0.2% consensus (TD: -0.2%).”

“We caution against simply extrapolating the weakness, as some of it is likely to either run its course or be reversed over time as the economy starts to normalize again. We certainly don't expect a negative trend in core prices on an ongoing basis.”

“We expect the crisis to result in a sustained slowing in inflation due to a net increase in slack. The trend in inflation was already too low from the perspective of Fed officials.”

- Negative interest rates would impact intermediaries, money market funds

- I would be against negative interest rates

- More fiscal stimulus will be necessary for growth

- With an 8%-10% unemployment rate at the end of the year, the overall effect on consumer spending power will be negative

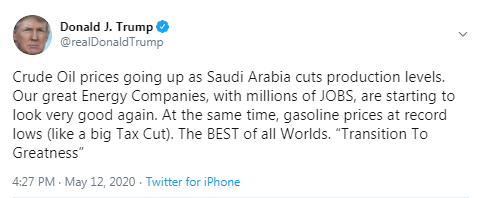

- May take to the end of 2021 to work off the excess oil inventories

- Permian basin output will shrink by a million barrels a day, will see bankruptcies, restructuring

- Drug and vaccine development, testing, contact tracing are essential to bringing economy back

- Fed programs had clear announcement effect on markets

- Fed's dollars swamplands also helped to calm markets

- Goal to stop health crisis morph into financial crisis

- Cannot continue economic shutdown for too long

- Prolonged shutdown risks bankruptcy, depression

- Everyone understands rates on hold for quite a while; not worried about normalizing Fed policy a moment

U.S. stock-index futures rose slightly on Tuesday, as a rebound in coronavirus infections around the world dampened optimism surrounding the countries' attempts to reopen their economies.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 20,366.48 | -24.18 | -0.12% |

| Hang Seng | 24,245.68 | -356.38 | -1.45% |

| Shanghai | 2,891.56 | -3.25 | -0.11% |

| S&P/ASX | 5,403.00 | -58.20 | -1.07% |

| FTSE | 6,000.67 | +60.94 | +1.03 |

| CAC | 4,474.74 | -15.48 | -0.34 |

| DAX | 10,850.49 | +25.50 | +0.24% |

| Crude oil | $25.45 | | +5.43% |

| Gold | $1,703.90 | | +0.35% |

FXStreet reports that Ho Woei Chen, CFA, economist at UOB Group, reviewed the latest round of monetary policy measures announced by the PBoC.

“The People’s Bank of China (PBoC) released its 1Q20 monetary policy implementation report on Sunday (10 May) which highlighted the support measures introduced during the quarter and the direction of the monetary policy going forward.”

“In 1Q20, the Chinese economy contracted by 6.8% y/y, its deepest fall since 1976 and inflation remained elevated at 4.9% y/y. However, the overall labour market and balance of payments were basically stable.”

“The report pledged to increase the flexibility of the monetary policy and the use of more tools to effectively curb the impact of the COVID-19 pandemic on the economy.”

“Year-to-date, 1Y and 5Y & above LPR have moved down by a total of 30 bps and 15 bps, respectively. Despite the larger move in April, the pace of monetary easing in China has remained very gradual compared to more aggressive cuts in the other economies. We see room for interest rates and the RRR to be lowered further to support the growth recovery in the year ahead.”

“As such, we maintain our forecast for the 1Y LPR to be lowered to 3.65% by end-2Q20 (10 bps cut each in May and June) and then to 3.55% by end-3Q20. We also see room for another one to two rounds of reserve requirement ratio (RRR) cut in the next 3-6 months to support small and medium enterprises (SMEs) in particular.”

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 146.38 | 0.65(0.45%) | 3529 |

| ALCOA INC. | AA | 7.85 | 0.08(1.03%) | 18818 |

| ALTRIA GROUP INC. | MO | 36.49 | 0.07(0.20%) | 10634 |

| Amazon.com Inc., NASDAQ | AMZN | 2,413.05 | 4.05(0.17%) | 25884 |

| American Express Co | AXP | 86 | 0.67(0.79%) | 12457 |

| AMERICAN INTERNATIONAL GROUP | AIG | 27.75 | 0.20(0.73%) | 5944 |

| Apple Inc. | AAPL | 317.37 | 2.36(0.75%) | 352742 |

| AT&T Inc | T | 29.5 | 0.12(0.41%) | 44005 |

| Boeing Co | BA | 129.97 | 1.06(0.82%) | 195069 |

| Caterpillar Inc | CAT | 109.1 | 0.49(0.45%) | 115546 |

| Chevron Corp | CVX | 93.65 | 0.28(0.30%) | 27824 |

| Cisco Systems Inc | CSCO | 43.8 | 0.48(1.11%) | 140225 |

| Citigroup Inc., NYSE | C | 44.42 | 0.35(0.79%) | 90985 |

| E. I. du Pont de Nemours and Co | DD | 46.97 | 0.77(1.67%) | 2620 |

| Exxon Mobil Corp | XOM | 45.41 | 0.54(1.20%) | 119581 |

| Facebook, Inc. | FB | 213.59 | 0.41(0.19%) | 47842 |

| FedEx Corporation, NYSE | FDX | 118 | 0.44(0.37%) | 1481 |

| Ford Motor Co. | F | 5.16 | 0.04(0.78%) | 296828 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.08 | 0.10(1.11%) | 27401 |

| General Electric Co | GE | 6.24 | 0.05(0.81%) | 283646 |

| General Motors Company, NYSE | GM | 23.04 | 0.24(1.05%) | 40521 |

| Goldman Sachs | GS | 184.08 | 0.92(0.50%) | 1531 |

| Google Inc. | GOOG | 1,407.02 | 3.76(0.27%) | 5797 |

| Hewlett-Packard Co. | HPQ | 15.4 | -0.02(-0.13%) | 559 |

| Home Depot Inc | HD | 238.01 | 1.45(0.61%) | 7256 |

| HONEYWELL INTERNATIONAL INC. | HON | 135.2 | 0.92(0.69%) | 169 |

| Intel Corp | INTC | 60.05 | -0.08(-0.13%) | 65893 |

| International Business Machines Co... | IBM | 123 | 0.41(0.33%) | 4639 |

| Johnson & Johnson | JNJ | 149.59 | 0.48(0.32%) | 88444 |

| JPMorgan Chase and Co | JPM | 90.84 | 0.87(0.97%) | 66358 |

| McDonald's Corp | MCD | 182.2 | 1.32(0.73%) | 2030 |

| Merck & Co Inc | MRK | 78.3 | 0.39(0.50%) | 1200 |

| Microsoft Corp | MSFT | 187.11 | 0.37(0.20%) | 205517 |

| Nike | NKE | 91.57 | 0.64(0.70%) | 147883 |

| Pfizer Inc | PFE | 38.25 | 0.15(0.39%) | 26037 |

| Procter & Gamble Co | PG | 115.5 | 0.19(0.16%) | 134961 |

| Starbucks Corporation, NASDAQ | SBUX | 76.32 | 0.45(0.59%) | 19372 |

| Tesla Motors, Inc., NASDAQ | TSLA | 829 | 17.71(2.18%) | 238710 |

| The Coca-Cola Co | KO | 45.84 | 0.30(0.66%) | 21446 |

| Twitter, Inc., NYSE | TWTR | 29.95 | 0.26(0.88%) | 101937 |

| UnitedHealth Group Inc | UNH | 289.91 | 1.22(0.42%) | 2736 |

| Verizon Communications Inc | VZ | 56.65 | 0.25(0.44%) | 8898 |

| Visa | V | 184.5 | 0.94(0.51%) | 60179 |

| Wal-Mart Stores Inc | WMT | 124.25 | 0.58(0.47%) | 11628 |

| Walt Disney Co | DIS | 108.65 | 0.88(0.82%) | 71181 |

| Yandex N.V., NASDAQ | YNDX | 40.44 | 0.26(0.65%) | 4619 |

Chevron (CVX) downgraded to Neutral from Buy at UBS; target $95

The Labor Department announced on Tuesday the U.S. consumer price index (CPI) fell 0.8 percent m-o-m in April, following an unrevised 0.4 percent m-o-m decline in the previous month. That marked the largest monthly decline since December 2008.

Over the last 12 months, the CPI rose 0.3 percent y-o-y last month, following an unrevised 1.5 percent m-o-m advance in the 12 months through March. That the lowest inflation rate since October 2015.

Economists had forecast the CPI to decline 0.8 percent m-o-m and to increase 0.4 percent y-o-y in the 12-month period.

According to the report, a 20.6-percent m-o-m plunge in the gasoline index was the largest contributor to the April decrease in the seasonally adjusted all items index, but the indexes for apparel (-4.7 percent m-o-m), motor vehicle insurance (-7.2 percent m-o-m), airline fares (-15.2 percent m-o-m), and lodging away from home (-7.1 percent m-o-m) all fell sharply as well. In contrast, food indexes rose in April, with the index for food at home (+2.6 percent m-o-m) recording its largest monthly increase since February 1974.

Meanwhile, the core CPI excluding volatile food and fuel costs dropped 0.4 percent m-o-m in April after a 0.1 percent m-o-m fall in the previous month. That marked the largest monthly decline on record.

In the 12 months through April, the core CPI rose 1.4 percent, following a 2.1 percent advance in the 12 months ending March. That was the lowest rate since April 2011.

Economists had forecast the core CPI to drop 0.2 percent m-o-m but to rise 1.7 percent y-o-y last month.

USD fell against its major rivals in the European session on Tuesday, as investors' risk appetite improved after the World Health Organization (WHO) said that some treatments appear to be limiting the severity or length of the COVID-19 respiratory disease and said the organization is focusing on learning more about four or five of the most promising ones. "We do have potentially positive data coming out but we need to see more data to be 100% confident that we can say this treatment over that one," the WHO's spokeswoman Margaret Harris told reporters.

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, dropped 0.43% to 99.81.

However, the markets' sentiment remained clouded by the reports that major economies that eased coronavirus restrictions, including Germany and China, had seen increases in the number of positive Covid-19 cases. Market participants worried that a rebound in coronavirus infections around the world could embrace reopening activity.

The further decline of the U.S. currency was also limited by the latest comments of the Fed's representatives, which signaled that the policymakers were unlikely to take interest rates below zero to boost the economy, hit by COVID-19.

FXStreet reports that in the opinion of FX Strategists at UOB Group, USD/CNH faces extra consolidation in the next weeks.

24-hour view: “We noted yesterday that ‘downward pressure has dissipated’ and expected USD to ‘consolidate and trade between 7.0800 and 7.1050’. USD subsequently traded within a higher range than expected (between 7.0840 and 7.1118) before ending the day slightly higher at 7.1072. While USD is likely to continue to consolidate, the underlying tone has improved somewhat and this would likely translate in a higher trading range of 7.1000/7.1220.”

Next 1-3 weeks: “After dropping sharply late last week, USD has not been able to make much headway on the downside. Downward pressure has eased and our expectation for USD to move toward the end-April low of 7.0535 is not likely to work out. From here, USD is more likely to trade sideways and within a broad range of 7.0700 and 7.1400 for a period.”

FXStreet notes that S&P 500 remains capped at major resistance at 2934 – the 61.8% retracement of the Q1 collapse – and stretching up to its 200-day average at 3002 – and analysts at Credit Suisse continue to look for a top to form here.

“Although a push higher above here to the 200-day average at 3002 should still be allowed for, our base case remains to look for a top to be established here, especially now with the VIX also at its major support, starting at 27.27 and stretching down to 23.65, which we look to hold.”

“Support is seen at 2921 initially, then 2903/02, below which is needed to clear the way for a move back lower in the range with support then seen next at the 13-day average and gap support at 2876/67, a close below which is needed to add weight to our topping story.”

“A close above 2934 would suggest strength can extend further to the 2955 April high, then what we look to be tougher resistance, starting at 2986 – the beginning of the price gap from early March – and stretching up to the 200-day average at 3002, where we look for a top.”

NZD/USD seen within 0.6000/0.6130 range – UOB

FXStreet reports that FX Strategists at UOB Group note that NZD/USD keeps the neutral stance unaltered so far and is expected to navigate within the 0.6000/0.6130 in the next weeks.

24-hour view: “Our view for NZD to ‘test last month’s peak at 0.6176 first before easing’ was wrong as it plummeted by -1.11% (from a high of 0.6157) and closed at 0.6071. The rapid decline is running ahead of itself and further sustained decline is unlikely. That said, there is room for NZD to edge lower but any weakness is viewed as part of a 0.6030/0.6090 range (a sustained below 0.6030 is not expected).”

Next 1-3 weeks: “While we a held a positive view on NZD, we highlighted last Friday (08 May, spot at 0.6115) that NZD ‘has to post a daily closing above 0.6176 before further gains can be expected’. However, the 0.6176 level remains intact as NZD plummeted after touching a high of 0.6157 yesterday (11 May). Upward pressure has eased and NZD has likely moved into a consolidation phase. From here, NZD is likely to trade within a 0.6000/0.6130 range for the next several days. Looking ahead, there is no early indication on which side of the range is more vulnerable.”

FXStreet reports that according to Natixis, rather than maintaining the fiction of independent central banks having an inflation target and thereby ensuring financial stability, it would be better to accept the idea that central banks are not independent.

“Central bank independence is a fiction since they are forced to intervene to prevent government insolvency crises: what they are doing is pure monetisation of public debt, which in theory is prohibited.”

“The inflation target has lost its meaning since money creation is no longer correlated with inflation in goods and services prices, but with inflation in asset prices.”

“Ensuring government solvency by monetising public debt is incompatible with the financial stability objective (stabilisation of asset prices).”

FXStreet reports that according to Credit Suisse, USD/CAD has seen a reversal back higher within the range, with the market posting a small bullish ‘reversal day’, to suggest further in-range strength.

“We see resistance initially at 1.4065, then 1.4078, ahead of 1.4173. Removal of here would negate the previous bearish ‘outside day’ and turn the short-term risk back higher, with resistance seen back at the upper end of the range at the April highs at 1.4262/65, where we would expect to see fresh sellers at first.”

“Support moves initially at 1.4004, then 1.3976, ahead of 1.3856/51, which ideally continues to hold.”

FXStreet reports that EUR/USD is bouncing off its near-term uptrend and analysts at Commerzbank favour recovery in the range.

"EUR/USD has again tested and is currently holding the near-term support line at 1.0773."

"We should see a recovery to the top of the range at 1.0983. This latter level will be reinforced by the 200-day ma at 1.1025 currently. The market is side lined, but capable of recovery."

"Below 1.0773 will target the 1.0727 24th April low and potentially the 1.0636 March low and the 1.0340 2017 low."

-

EU governments are not matching the ECB's efforts

-

EU fiscal response to the crisis is inadequate

-

Not opposed to increasing PEPP size, but decision should be based on data

-

No urgency to increase purchases, must examine how easing of lockdown measures are impacting the economy

FXStreet reports that FX Strategists at UOB Group noted USD/JPY now faces a key barrier at the 107.80 region.

24-hour view: "While our view for USD to strengthen yesterday was correct; our expectation that '107.50 is likely out of reach' was not as USD surged to an overnight high of 107.76 before ending the day higher by +0.95% (the largest 1-day gain since mid-March). The rapid rise is deep in overbought territory and further gain appears unlikely. That said, it is too early to expect a pull-back. For today, USD is more likely to consolidate and trade between 107.10 and 107.80."

Next 1-3 weeks: "The sudden surge higher in USD that easily took out the strong 107.50 resistance yesterday was unexpected. While upward momentum has picked up considerably, USD has to clear the 107.80 resistance first before further sustained advance can be expected (next resistance is at 108.50) The prospect for a such a scenario is quite high but in order to maintain the current build-up in momentum, USD should not move back below the 'strong support' level at 106.60 within these few days."

CNBC reports that according to Deputy Governor for Monetary Policy Ben Broadbent, the U.K. may be headed toward negative interest rates at impending Bank of England monetary policy meetings.

The BOE's Monetary Policy Committee (MPC) voted to hold interest rates at a historic low of 0.1% last Thursday, having cut rates twice from 0.75% since the start of the coronavirus pandemic.

"The committee are certainly prepared to do what is necessary to meet our remit with risks still to the downside," Broadbent told CNBC on Tuesday.

"Yes, it is quite possible that more monetary easing will be needed at the time."

Along with the two previous rate cuts, the Bank has also announced £200 billion of new quantitative easing, bringing its bond buying program to a total of £645 billion.

FXStreet reports that AUD/USD saw a rebound lower from just ahead of the April high at 0.6570 as expected, posting a mild bearish 'reversal day', per Credit Suisse.

"The market rejected the 0.6570 April high and completed a small bearish 'reversal day.' Furthermore, it's notable that daily MACD momentum is now crossing lower."

"Support is initially seen at 0.6432, then the 21-exponential average at 0.6414/12. Removal of here would see a push back to 0.6379/73, below which would now complete a small 'double top' as well as negating the previous bullish 'outside day'."

"A clear and closing break above 0.6570 would likely see a test of the 200-day average and 78.6% retracement at 0.6672/6706, where we would expect to see a cap if reached."

Reuters reports that Japanese Finance Minister Taro Aso said on Tuesday he was not considering tax cuts, including a reduction in the sales tax, for the time being as a way of easing the economic pain from the coronavirus pandemic.

"Japan's fiscal condition is in a severe state and will likely turn more dire due to the pandemic," Aso told parliament.

"Cutting tax isn't something I have in mind for the time being," Aso said, when asked by a lawmaker whether the government could cut tax as part of efforts to support an economy suffering from the fallout of the pandemic.

FXStreet reports that a return of inflation in 2021, which is likely given the decline in labour productivity due to the new health rules, would be very bad news, according to Natixis.

"Companies will be in trouble (increased debt, declining earnings), and they will therefore be unable to increase nominal wages. As a result of inflation, this will lead to a decline in real wages, and in purchasing power and household demand."

"The ECB would be unable to maintain a large-scale bond purchase programme, especially after the ruling of the German Federal Constitutional Court; the peripheral countries' yield spreads would then widen and there would be a threat of a debt crisis in these countries."

"The upturn in expected inflation, which is currently very low, would lead to a rise in long-term interest rates, leading to a slowdown in the recovery in corporate investment and in housing purchases.

"The rise in unit production costs will affect industry, retail, restaurants and culture, but also construction, leading to a rise in construction prices and in new housing prices, which also affects purchasing power."

-

While prevention and control measures have normalised, that does not mean they should be eased yet

FXStreet reports that supply side issues continue to drive sentiment in the crude oil market, strategists at ANZ Bank apprise.

"Saudi Arabia aims to pump just under 7.5mb/d in June, compared with its official target of 8.5mb/d. This would take its output to the lowest level since mid-2002. The United Arab Emirates also announced it would cut by an additional 100kb/d in June."

"Continental Resources expects the market to re-balance by mid-year, and will reopen oil wells quickly once prices recover."

"And while demand appears to be recovering, there are also doubts as to its timing. In the US, the volume of fuel sold by retailers rose by only 7% in the week ending 2 May. In Europe, the varying degrees of lockdowns continue to hobble demand."

Reuters reports that France's economic downturn is easing as the country emerges from a lockdown imposed in mid March, although activity remains mired at levels far below normal, the central bank said on Tuesday.

The euro zone's second-biggest economy was operating 27% below normal levels in April after 32% in the second half of March, the Bank of France said, basing its estimates on responses from its monthly business climate survey.

"The ambition we could have for the end of May is to recover another 10 points," Bank of France Governor Francois Villeroy de Galhau said on France Inter radio.

The central bank said manufacturing activity remained down 37% last month, but was nonetheless better than the 48% seen in March, while private sector service firms' activity was reduced by 27% in April after 37% in March.

The Bank of France did not venture to make a quarterly GDP forecast it usually does when it publishes its business climate survey given the unprecedented nature of the current downturn.

-

Phase One trade deal is beneficial for China and the US, and the world

FXStreet reports that a potential base on the EUR/GBP pair will be completed on a close above 0.8865, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, informs.

"EUR/GBP is showing early signs of recovery and is trading above the 200-day ma at 0.8717 - it looks well placed to challenge 0.8864/65. A close above here will confirm a short-term base targeting 0.9060."

"The 0.8865 potential base will remain valid while the market continues to trade above the April low at 0.8671."

"Above resistance at 0.8864/65 sits the March 20 low at 0.8994."

The US dollar traded steadily against the euro and declined against the yen, but rose against Asian currencies.

Demand for safe haven assets is growing as strict restrictions imposed earlier to curb the spread of COVID-19 coronavirus infection are gradually easing around the world. Markets are afraid of a second wave of pandemics as a result of the beginning of the lifting of restrictive measures.

A warning signal was the situation in South Korea: after the recent cancellation of strict social distancing measures, the government of the country reported a new jump in coronavirus infections and declared the need to be prepared for the second wave of the pandemic.

Traders will closely monitor whether the decline in the number of cases continues after the increase in population mobility, experts say.

The ICE index, which tracks the dynamics of the dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell by 0.06%.

FXStreet reports that FX Strategists at UOB Group expect EUR/USD to remain within the broad 1.0730 and 1.0950 for the time being.

24-hour view: "EUR traded between 1.0799 and 1.0850 yesterday, lower and narrower than our expected 1.0805/1.0885 range. The daily closing in NY is on the soft side (1.0806, -0.31%) and downward momentum is beginning to build up. From here, EUR is likely to drift lower but for today, a break of last week's 1.0765 low is unlikely (minor support is at 1.0780). On the upside, a move above 1.0845 would indicate the current mild downward pressure has eased (minor resistance is at 1.0825)."

Next 1-3 weeks: "There is not much to add to our update from Wednesday (06 May, spot at 1.0835). As highlighted, the recent sharp but short-lived swings have resulted in a mixed outlook. From here, EUR could continue to trade in an erratic manner and within a relatively broad range of 1.0730/1.0950 for a period."

Reuters reports that Bank of Japan Governor Haruhiko Kuroda said on Tuesday the central bank would do "whatever it can" to combat the growing fallout from the coronavirus pandemic, warning that a collapse in global activity would hamstring the economy.

In a semi-annual testimony to parliament, Kuroda said the raft of monetary easing steps the central bank has taken so far is helping ease corporate funding strains and market jitters.

But he warned the outlook for Japan's economy was "highly uncertain" and dependent on when the pandemic is contained, with risks skewed to the downside.

"Japan's economy is in an increasingly severe state. The outlook will remain severe for the time being," he said.

"What's most important for us is to take steps to smoothen corporate financing and stabilise markets," Kuroda added. "We will do whatever we can as a central bank, working closely with the government."

eFXdata reports that Citi sees a scope for NZD to shoot higher after the RBNZ policy meeting this week.

"Positioning is so one sided that it alone dictates higher levels over this week if the USD remains under pressure from negative rates implications. That pricing also makes the NZ curve vulnerable if the market goes after those rates/central banks that suggest negative rates a real and viable alternative. We will get a better sense of where Orr is at on Wednesday and the market is positioned to be underwhelmed," Citi notes.

"Overnight headlines that lockdown restrictions will be further relaxed with retail and public spaces reopening from May 15 (schools - May 18, bars - May 21) reinforces our view that the country will be firing quickly, and negates the case for negative rates ahead of RBNZ this week," Citi adds.

-

CNBC said that South Korea on Tuesday reported reported 27 new cases of the coronavirus, said the Korea Centers for Disease Control and Prevention. Cases have ticked up since the weekend as Seoul was relaxing social distancing measures.

-

China's National Health Commission reported there was one new case of the coronavirus on Monday, taking the total number of infected people to 82,919.

-

India reported 3,604 new confirmed cases of the coronavirus disease over the last 24 hours, according to the Ministry of Health and Family Welfare.

-

Global cases: More than 4.18 million

-

Global deaths: At least 286,336

-

Most cases reported: United States (1.347,916), Spain (227,436), United Kingdom (224,332), Russia (221,344), and Italy (219,814).

EUR/USD

Resistance levels (open interest**, contracts)

$1.0943 (1528)

$1.0913 (891)

$1.0887 (571)

Price at time of writing this review: $1.0814

Support levels (open interest**, contracts):

$1.0773 (1192)

$1.0754 (2240)

$1.0729 (2379)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 5 is 84065 contracts (according to data from May, 11) with the maximum number of contracts with strike price $1,0600 (4019);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2550 (1266)

$1.2487 (1203)

$1.2440 (617)

Price at time of writing this review: $1.2332

Support levels (open interest**, contracts):

$1.2295 (1083)

$1.2266 (538)

$1.2220 (440)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 22978 contracts, with the maximum number of contracts with strike price $1,3500 (3410);

- Overall open interest on the PUT options with the expiration date June, 5 is 25769 contracts, with the maximum number of contracts with strike price $1,3500 (3095);

- The ratio of PUT/CALL was 1.12 versus 1.13 from the previous trading day according to data from May, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 29.17 | -1.12 |

| Silver | 15.47 | 0.13 |

| Gold | 1697.913 | -0.22 |

| Palladium | 1886.41 | 1.21 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 211.57 | 20390.66 | 1.05 |

| Hang Seng | 371.89 | 24602.06 | 1.53 |

| KOSPI | -10.42 | 1935.4 | -0.54 |

| ASX 200 | 70.1 | 5461.2 | 1.3 |

| FTSE 100 | 3.75 | 5939.73 | 0.06 |

| DAX | -79.49 | 10824.99 | -0.73 |

| CAC 40 | -59.42 | 4490.22 | -1.31 |

| Dow Jones | -109.33 | 24221.99 | -0.45 |

| S&P 500 | 0.52 | 2930.32 | 0.02 |

| NASDAQ Composite | 71.02 | 9192.34 | 0.78 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | April | -66 | |

| 01:30 | China | PPI y/y | April | -1.5% | -2.6% |

| 01:30 | China | CPI y/y | April | 4.3% | 3.7% |

| 05:00 | Japan | Coincident Index | March | 95.5 | |

| 05:00 | Japan | Leading Economic Index | March | 91.7 | |

| 12:30 | U.S. | CPI, m/m | April | -0.4% | -0.7% |

| 12:30 | U.S. | CPI excluding food and energy, m/m | April | -0.1% | -0.2% |

| 12:30 | U.S. | CPI, Y/Y | April | 1.5% | 0.4% |

| 12:30 | U.S. | CPI excluding food and energy, Y/Y | April | 2.1% | 1.7% |

| 13:00 | U.S. | FOMC Member Kashkari Speaks | |||

| 13:00 | U.S. | FOMC Member James Bullard Speaks | |||

| 14:00 | U.S. | FOMC Member Quarles Speaks | |||

| 14:00 | U.S. | FOMC Member Harker Speaks | |||

| 16:00 | U.S. | FOMC Member Harker Speaks | |||

| 18:00 | U.S. | Federal budget | April | -119 | |

| 21:00 | U.S. | FOMC Member Mester Speaks | |||

| 22:45 | New Zealand | Food Prices Index, y/y | April | 3.3% | |

| 23:50 | Japan | Current Account, bln | March | 3168.8 | 2210.6 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6489 | -0.5 |

| EURJPY | 116.314 | 0.7 |

| EURUSD | 1.08052 | -0.24 |

| GBPJPY | 132.734 | 0.33 |

| GBPUSD | 1.23324 | -0.51 |

| NZDUSD | 0.60792 | -0.86 |

| USDCAD | 1.40131 | 0.54 |

| USDCHF | 0.97282 | 0.12 |

| USDJPY | 107.629 | 0.92 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.