- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-03-2023

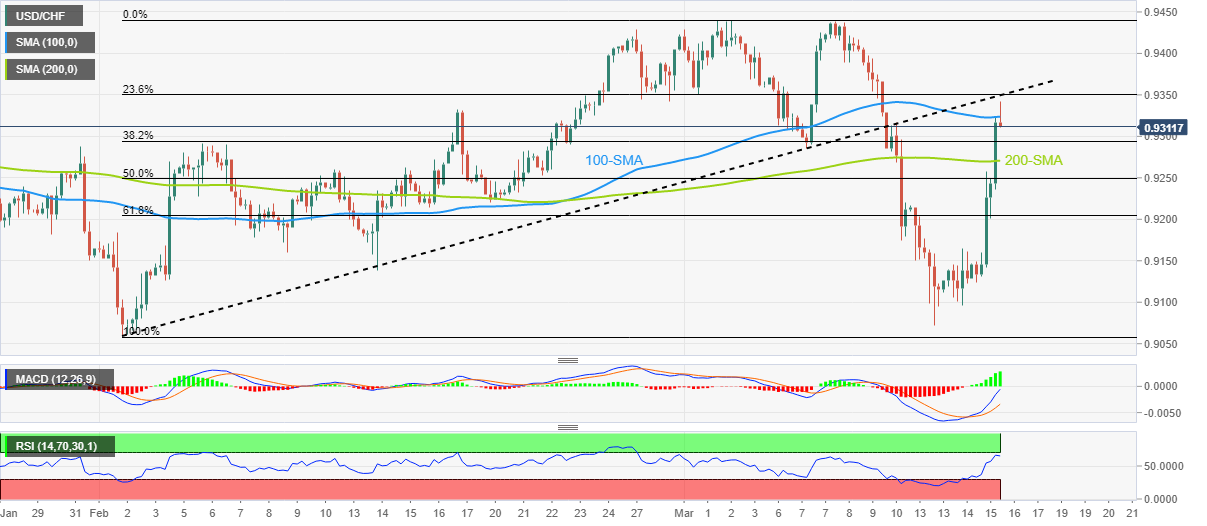

- USD/CHF eases from the one-week high to pare the previous day’s heavy gains.

- Nearly overbought RSI favors pullback from 100-SMA, six-week-old previous support line adds to the upside filters.

- 200-SMA holds the key to the further downside; bullish MACD signals also test Swiss currency pair sellers.

USD/CHF drops to 0.9313 as bulls take a breather during active trading hours of early Thursday, following a stellar run-up during the previous day.

In doing so, the Swiss currency pair retreats from the 100-bar Simple Moving Average (SMA) amid the overbought RSI conditions. Adding strength to the latest pullback could be the global policymakers’ recent announcements to tame the financial market risks, especially after the Credit Suisse turmoil.

Also read: Forex Today: Dollar and Yen jump as panic takes over markets

It’s worth noting, however, that the bullish MACD signals challenge the USD/CHF bears, which in turn highlights the importance of the 200-SMA level of 0.9270 as the key support. That said, the pair sellers also need validation from the 0.9300 immediate support.

In a case where USD/CHF breaks the 200-SMA support, the odds of witnessing a slump towards the 50% and 61.8% Fibonacci retracement levels of February-March run-up, respectively near .9250 and 0.9200, can’t be ruled out.

Alternatively, the 100-SMA and the previous support line from early February, close to 0.9325 and 0.9350 in that order, restrict short-term USD/CHF upside.

Following that, a run-up towards crossing the double tops near 0.9435-40 appears more likely.

To sum up, USD/CHF is expected to pare recent gains but the downside room seems limited.

USD/CHF: Four-hour chart

Trend: Limited downside expected

- GBP/USD has delivered a breakdown of the Inventory Distribution formed in the 1.2140-1.2200 range.

- The 20-period EMA at 1.2081 will act as a barricade for the Pound Sterling.

- The BoE officials were in talks with counterparts, as they all raced to assess the potential impact of the Credit Suisse fiasco.

The GBP/USD pair has attempted a recovery move from the psychological support of 1.2000 in the early Asian session. The Cable witnessed a sell-off on Wednesday after reports citing internal ‘materialistic weaknesses’ in Credit Suisse spooked market sentiment. The release of the financial budget by United Kingdom Finance Minister (FM) Jeremy Hunt failed to provide a cushion to the Pound Sterling.

The US Dollar Index (DXY) has corrected after challenging the critical resistance of 105.00 as the release of weak United States Retail Sales and lower Producer Price Index (PPI) figures confirmed that the US inflation is meaningfully declining. This eased hawkish Federal Reserve (Fed) bets dramatically.

Meanwhile, Bank of England (BoE) officials were in talks with counterparts, as they all raced to assess the potential impact of the problems at Credit Suisse, a ‘systemically important’ institution that is enmeshed in the global financial system, as reported by the Telegraph. It further added that experts predicted that it will require a bailout to prevent a collapse that would rock banks and pension funds around the world.

On an hourly scale, GBP/USD has witnessed a breakdown after an Inventory Distribution in which inventory is transferred from institutional investors to the retail participants. The Cable has sensed a cushion plotted near 1.2020.

Going forward, the 20-period Exponential Moving Average (EMA) at 1.2081 will act as a barricade for the Pound Sterling.

The Relative Strength Index (RSI) (14) has climbed into the 40.00-60.00 range from the bearish range of 20.00-40.00. Usually, a power-pack action is followed by a volatility squeeze.

Should the Cable break below the psychological support of 1.2000, US Dollar bulls would drag the asset toward February 27 low at 1.1922, followed by March 08 low at 1.1803.

Alternatively, a move above February 21 high of around 1.2140 will drive the Cable toward March 14 high at 1.2203. A breach above the latter would expose the asset to the round-level resistance at 1.2300.

GBP/USD hourly chart

February month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

Market consensus suggests that the headline Unemployment Rate may ease to 3.6% on a seasonally adjusted basis versus the 3.7% prior whereas Employment Change could rise by 48.5K versus the previous contraction of 11.5K. Further, the Participation Rate is expected to improve to 66.6% versus 66.5% prior level.

Adding importance to the 00:30 GMT is the Reserve Bank of Australia (RBA) Bulletin for the fourth quarter (Q4).

Considering the RBA policymakers’ struggle to defend the hawkish bias, as well as the fresh banking crisis and easing inflation clues, today’s Aussie jobs report become crucial for the AUD/USD pair traders.

Ahead of the event, FXStreet’s Valeria Bednarik mentioned

An upbeat report could help it recover some ground, although the sour sentiment extends throughout the different sessions, the bounce could be short-lived, and the pair would resume its decline once the dust settles. A strong static resistance area comes in at around 0.6710, where the pair topped a couple of times this week.

How could the data affect AUD/USD?

AUD/USD licks its wounds around 0.6620 after falling the most in a week drowned by the Credit Suisse turmoil the previous day. The Aussie pair’s latest moves could be linked to the major policymakers’ rush to placate the financial market fears.

Although the pre-data anxiety probes AUD/USD bears amid hopes of upbeat Aussie data, the risk barometer pair is likely to remain depressed, after showing an initial reaction to the actual outcome, unless witnessing too optimistic Aussie employment numbers. It should be noted that the RBA Bulletin must avoid dovish words to defend the pair’s latest corrective bounce.

The reason for the AUD/USD pair’s likely weakness could be linked to comparatively more hawkish Federal Reserve (Fed) bets despite the latest financial market fears, as well as the broad weakness in the pair due to its risk-barometer status.

Technically, a U-turn from the 1.5-month-old resistance line, around 0.6670 by the press time, keeps the AUD/USD bears hopeful of revisiting the monthly low of 0.6564.

Key Notes

AUD/USD struggles to extend recovery above 0.6620 ahead of Australian Employment

Australian Employment Preview: Job creation to add pressure on the RBA

AUD/USD Forecast: Risk aversion hits the Aussie; Australian employment numbers unlikely to help

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

- Credit Suisse-led oil weakness sent USD/CAD to the 1.3800 level.

- WTI dips below the $70 mark as financial turmoil weighs on risk assets.

- Rumor around some emergency meetings among central banks.

USD/CAD took a wild ride on Wednesday due to oil weakness. The pair touched the 1.3800 resistance as renewed price pressure affected oil prices. It all started with some floating rumors about Credit Suisse bank, which was perceived as a contagion effect following Silicon Valley Bank's (SVB) fallout. There were some threats attributed to Credit Suisse that might have been tangled up with SVB's financial crisis and could be the next liquidity victim, although all allegations have been denied by Credit Suisse's CEO. Later on, the Swiss banking regulator intervened and committed to providing liquidity solutions if required.

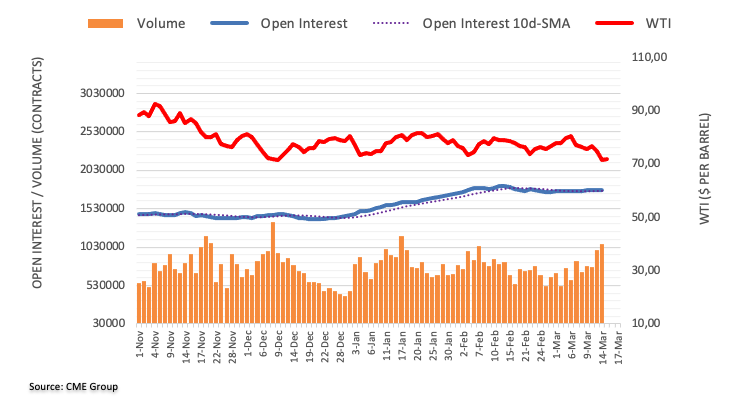

The aforementioned situation triggered a fresh wave of sell-offs among risky assets, and oil prices were affected the most. West Texas Intermediate (WTI) price fell below the $70 mark as panic was triggered among investors. The falling oil prices have been signaling "something to break" on surging borrowing costs since cracks began to appear in financial systems.

A corrective downturn in oil prices that started earlier this week has weakened the Canadian Dollar and given a boost to USD/CAD. Although falling US Treasury yields are keeping a lid on any appreciation in the US Dollar, the pair is mainly driven by oil prices rather than anything else. Since the Bank of Canada took a pause on the rate hiking cycle, USD/CAD is more likely to be driven by either US Dollar dynamics or oil's story.

Meanwhile, the US released its Retail Sales figures and Producer Price Index (PPI) data for February on Wednesday. The Retail Sales came in at a relatively massive downbeat; the MoM came in at -0.4% from the previous 3.2%, and the Control Group came in at 0.5% from the previous 2.3%. The PPI data showed some relief signs: the MoM reading came in at -0.1% from the prior 0.3%, and the YoY reading came in at 4.6% from the prior 5.7%.

Levels to watch

- GBP/JPY registered a bearish engulfing candle pattern but jumped off the weekly lows below 160.00.

- If the pair aims upwards, the GBP/JPY will face solid resistance around 161.70-90.

- Conversely, a GBP/JPY’s fall below 160.00 could pave the way toward 159.00.

GBP/JPY collapsed on Wednesday and lost 1.43% due to a deterioration in market sentiment, sponsored by fears of a banking contagion after regulators seized two US banks. In the Europan session, Credit Suisse (CS) sell-off sent its CDS skyrocketing as odds for a default increased. However, Swiss authorities stepped in and cushioned the bank’s fall. Therefore, the GBP/JPY exchanges hands at 160.50, gaining a minuscule 0.03% in the Asian session.

GBP/JPY Price action

After consolidating around the confluence of the 20, 50, 100, and 200-day Exponential Moving Averages (EMAs), the GBP/JPY distance from them, and edged towards a fresh 4-week low at 159.20. However, the GBP/JPY gained some traction late in the session and closed the day at 160.77.

Oscillators like the Relative Strength Index (RSI) are in bearish territory. However, the Rate of Change (RoC), showed that selling pressure eased toward the end of the trading day. Therefore, the path of least resistance is sideways.

Upwards, the GBP/JPY first resistance would be the 161.00 figure. Once the pair surges above that area, the confluence of the daily EMAs would be exposed, led by the 50 and 200-day EMAs, each at 161.75 and 161.94, respectively. Once cleared, the next stop would be the 20-day EMA at 162.00.

For a bearish continuation, the GBP/JPY needs to clear the March 13 low at 160.04 before posing a threat at the March 15 low at 159.20. Below that area looms the 159.00 figure.

GBP/JPY Daily chart

GBP/JPY Technical levels

The Bank of England was holding emergency talks with international counterparts last night amid rising concerns as the crisis deepens in Swiss bank Credit Suisse Group AG, the Telegraph reported on Wednesday per Reuters.

Key quotes

Bank of England officials were in talks with counterparts, as they all raced to assess the potential impact of the problems at Credit Suisse, a ‘systemically important’ institution that is enmeshed in the global financial system.

Experts predicted that it will require a bailout to prevent a collapse that would rock banks and pension funds around the world.

The crisis was in contrast to the improving picture that the Chancellor attempted to paint as he unveiled forecasts from the Office for Budget Responsibility that the UK will avoid a recession this year.

The Chancellor said the brighter outlook was “proving the doubters wrong” as the latest projections showed inflation falling to 2.9 per cent by the end of the year.

Mr Hunt said the economy was now “on the right track” after the Office for Budget Responsibility (OBR), the government's tax and spending watchdog, said any downturn would be “shorter and shallower” than predicted just four months ago.

However, senior economists warned that the collapse of Credit Suisse had the potential to upend a recovery from the twin shocks of pandemic and war in Ukraine.

GBP/USD licks its wounds

GBP/USD picks up bids to 1.2065 to pare the biggest daily loss in a week during Thursday’s inactive session.

Also read: Forex Today: Dollar and Yen jump as panic takes over markets

- Gold price picks up bids to reverse the day-end pullback from six-week high.

- Risk aversion underpins XAU/USD price as banking crisis reaches Europe with Credit Suisse in target.

- United States 10-year Treasury bond yields drop the most in four months, two-year counterpart renews six-month low.

- US Dollar’s gains fail to weigh on Gold price amid mixed United States statistics.

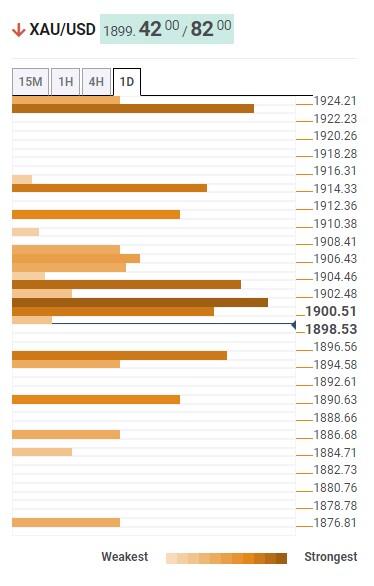

Gold price (XAU/USD) buyers flex muscles around $1,920, after refreshing the highest levels in 1.5 months during a stellar show of Credit Suisse (CS) inflicted risk aversion the previous day. The risk profile deteriorates more as the CS episode follows the latest fallouts of Silicon Valley Bank (SVB) and Signature Bank. Given the precious metal’s haven status, the Gold buyers even ignored the jump in the US Dollar prices amid a broad downward move in the United States Treasury bond yields.

Credit Suisse drama propels Gold price via United States Treasury bond yields

With the United States banking crisis reaching the old continent Europe, via a G-SIB – a global systemically important bank, namely Credit Suisse (CS), global market players fear the return of the 2008 financial crisis and rushed for risk-safety. The risk-aversion drowned the US Treasury bond yields but propelled the Gold price, as well as the US Dollar Index (DXY).

The Saudi National Bank’s rejection of infusing more funds into Credit Suisse propelled the key European bank’s Credit Default Swaps (CDS) and triggered the crisis for the financial markets on Wednesday. On the same line was the news that the European Central Bank (ECB) officials contacted banks to ask about exposures to Credit Suisse, which in turn fanned the risk-off mood.

That said, the US 10-year Treasury bond yields dropped the most in four months before bouncing off a four-month low to 3.46% at the latest. On the same line, the US two-year bond coupons refreshed a six-month low before ending the volatile Wednesday near 3.89%.

Elsewhere, the US Dollar Index (DXY) bounced off the 50-DMA to portray the biggest daily gains in a week before ending the day at around 104.75.

It should be noted that the European stock market closed in the red but Wall Street closed mixed as the Swiss National Bank (SNB) stepped forward to help CS.

As a result, the yellow metal rallied to refresh the multi-day high earlier on Wednesday before the SNB news allowed XAU/USD bulls to take a breather.

US data fails to impress XAU/USD traders

Amid the broad fears surrounding Credit Suisse, as well as the woes of another financial crisis, traders paid little heed to the United States data.

US Retail Sales dropped to -0.4% in February versus -0.3% expected and upwardly revised 3.2% prior while the Producer Price Index (PPI) slide to 4.6% YoY from 5.7% in January and 5.6% market forecasts. Further, NY Empire State Manufacturing Index dropped to -24.6 for March compared to analysts’ estimations of -8.0 and -5.8 prior.

Even so, global rating giant Moody’s expects the Federal Open Market Committee (FOMC) to raise the federal funds rate by 25 basis points at its March 22 meeting, per Reuters.

ECB, Risk catalysts are the key

Moving on, the second-tier data surrounding employment and activities from the United States may entertain the Gold traders. However, major attention will be given to the headlines surrounding Credit Suisse and the market’s fears of another financial crisis, which in turn could keep the XAU/USD firmer. Also important to watch will be the European Central Bank’s (ECB) action considering the latest banking fiasco in the bloc.

Also read: ECB Preview: Set for 50 bps rate hike, Lagarde holds the key

Gold technical analysis

Having bounced off the 100-DMA in the last week, the Gold price crossed the 50-DMA hurdle on Monday. The follow-on corrective pullback couldn’t last long and the fresh recovery rose past the two-month-old horizontal hurdle surrounding $1,920 which holds the key for the metal’s run-up towards the Year-To-Date (YTD) high of near $1,960.

Although the Moving Average Convergence and Divergence (MACD) indicator flashes bullish signals and back the latest run-up, overbought conditions of the Relative Strength Index (RSI) line, placed at 14, suggests the bulls are running out of steam.

Hence, the XAU/USD’s further upside appears difficult but the occurrence of the same could challenge the 61.8% Fibonacci Expansion (FE) of the Gold price run-up from November 2022 to February 2023, around $2,017.

On the flip side, pullback moves remain unimpressive till the quote stays beyond the $1,900 threshold, a break of which could help the Gold sellers to aim for the 50-DMA support of $1,875.

In a case where the Gold price remains weak past $1,875, the early March high surrounding $1,858 precedes the 100-DMA support of $1,818 to challenge the XAU/USD bears.

Overall, the Gold price remains firmer but the road toward the north appears long and bumpy.

Gold price: Daily chart

Trend: Further upside expected

- AUD/JPY dipped below 88.00 and reached a YTD low at 87.35 on Wednesday.

- The cross-currency pair bias remains downwards, albeit reclaiming the 88.00 figure.

- AUD/JPY Price Analysis: Downward biased, though once 89.00 is reclaimed, a leg-up to 90.00 is on the cards.

The AUD/JPY tumbled sharply on Wednesday, more than 1.50%, spurred by a risk-off impulse. Fears around global bank contagion weighed on global bank stocks, particularly Credit Suisse (CS), which seeks support from Swiss authorities like FINMA and the Swiss National Bank (SNB). At the time of writing, the AUD/JPY exchanges hands at $88.19.

AUD/JPY Price action

After breaking a four-month-old upslope trendline, the AUD/JPY has fallen to new YTD lows reached on March 15 at 87.35. However, news from Switzerland sponsored a bounce off the lows, and the AUD/JPY pair closed above the 88.00 figure.

Oscillators remain bearish territory, but the Relative Strength Index (RSI) shifted flat, meaning consolidation lies ahead. In the meantime, the Rate of Change (RoC) portrays selling pressure as waning.

The AUD/JPY path of least resistance is downwards. Backed by the daily EMAs resting above the exchange rate and oscillators in bearish territory. Therefore, the AUD/JPY's first support would be the 88.00 figure. Once broken, the pair might test the YTD lows at 87.35, which, once cleared, the AUD/JPY would dive towards the December 20 swing low at 87.01, ahead of the figure.

As an alternate scenario, the AUD/JPY first resistance would be 89.00. A surge above the figure and the AUD/JPY could rally towards 90.00, ahead of testing the 20-day EMA at 90.30.

AUD/JPY Daily chart

AUD/JPY Technical levels

- EUR/USD is aiming to recapture the 1.0600 resistance as hawkish ECB bets are solid despite brewing Eurozone banking system troubles.

- Despite the turmoil in the banking sector, ECB policymakers expect inflation to remain too high in the Eurozone.

- Fed Powell is expected to halt the rate-hiking spell or to announce a small rate hike to keep pressure on US inflation.

The EUR/USD pair is juggling in a narrow range near 1.0580 in the early Tokyo session after a recovery move from below 1.0520. The major currency pair is likely to recapture the round-level resistance of 1.0600 as the European Central Bank (ECB) is expected to continue its 50 basis points (bps) rate hike spell.

It looks like ECB President Christine Lagarde would hike interest rates by 50 bps consecutively for the third time to 3.5% while ignoring the Credit Suisse fiasco as inflationary pressures in the Eurozone economy have not eased yet. Eurozone inflation is still operating at elevated levels and will take sufficient time in softening amid solid labor demand.

Reuters reported that “Despite the turmoil in the banking sector, policymakers expect inflation to remain too high in the Eurozone.” Additionally, the Governing Council doesn't want to damage its credibility by ditching the 50 bps rate increase after having repeatedly noted that this was their intention.

S&P500 futures are showing minor gains in early Asia after a sell-off on Wednesday, propelled by material weakness in Credit Suisse's internal financial reporting. A minor recovery in the 500-US stocks futures basket could be a dead cat bounce as the risk-aversion theme is quite healthy.

The US Dollar Index (DXY) has dropped to near 104.70 after facing barricades around 105.00, however, the upside seems favored amid the risk aversion theme. Good days for the USD Index look counted as the Federal Reserve (Fed) is expected to sound less hawkish while announcing its interest rate decision next week. After considering financial stress in the United States economy led by Silicon Valley Bank (SVB) collapse and softening of Consumer Price Index (CPI), Fed chair Jerome Powell is expected to halt the rate-hiking spell or announce a small rate hike to continue weighing pressure on the stubborn inflation.

Global rating giant Moody’s crossed wires, via Reuters, late Wednesday as it conveys the guidance for the global central banks, especially for the US Federal Reserve (Fed), amid the Credit Suisse turmoil.

“Expect the Federal Open Market Committee (FOMC) to raise the federal funds rate by 25 basis points at its March 22 meeting, said Moody’s per Reuters.

Additional comments

If banking stress intensifies, the Fed may well pause rate hikes to assess the situation.

Fed and other central banks could convene emergency meetings to provide guidance and stem the potential panic.

Financial markets are likely to remain volatile over the coming weeks.

Market reaction

The news tries to placate the risk-off mood and can do so during the generally inactive early Asian trading hours.

Also read: Sources: Large US banks view Credit Suisse exposure as manageable – Reuters

Reuters cites three anonymous industry sources on Wednesday to say, “Large US banks have managed their exposure to Credit Suisse in recent months and view risks from the lender as contained so far.”

The industry sources spoke before Swiss financial regulator Financial Market Supervisory Authority (FINMA) and the Swiss National Bank (SNB) said on Wednesday that the SNB would provide Credit Suisse liquidity "if necessary", a first for a global bank since the financial crisis, reported Reuters.

Additional quotes

Credit Suisse said in a statement that it welcomed the news.

Bankers were more concerned about contagion or unexpected effects of the Swiss lender's troubles that are not yet understood, one source said.

A top U.S. bank is still dealing with Credit Suisse as a counterparty, but is carefully managing its exposure, which is small, according to a source.

One asset manager in New York was assessing its trading counterparty risk with Credit Suisse, according to a source familiar with the situation.

People are all examining their books, what open positions we have with Credit Suisse.

The European Central Bank (ECB) had contacted banks on its watch to quiz them about their exposures to Credit Suisse, two supervisory sources told Reuters.

Also read: Forex Today: Dollar and Yen jump as panic takes over markets

- AUD/USD is facing the heat in extending its recovery above 0.6620 amid the risk-aversion theme.

- S&P500 futures tumbled as investors considered the Credit Suisse fiasco, after the SVB collapse, a blown out of the global banking system.

- An upbeat Australian labor market data could propel inflationary pressures again

The AUD/USD pair is facing barricades in extending its recovery move above the immediate resistance of 0.6620 in the early Asian session. The Aussie asset is sensing heat as investors are awaiting the release of the Australian Employment data before making any significant fresh position. The major was beaten down dramatically on Wednesday after the Credit Suisse fiasco, which squeezed the risk appetite of the market participants.

S&P500 futures tumbled on Wednesday as investors considered the Credit Suisse fiasco, after the Silicon Valley Bank (SVB) collapse, a blown out of the global banking system. The US Dollar Index (DXY) recovered firmly from 103.50 and challenged the elevated resistance of 105.00, portraying a risk aversion theme. Investors ran heavily for safe-haven assets to dodge sheer volatility due to which the alpha offered on US government bonds squeezed heavily. The 10-year US Treasury yields plummeted to 3.46%.

The Australian Dollar is expected to remain in action amid the release of the Employment data. As per the consensus, the Australian economy has added fresh 48.5K jobs in February vs. 11.5K lay-offs registered in January. And, the Unemployment Rate is expected to drop to 3.6% from the former release of 3.7%. Higher employment generation and a lower jobless rate are indicating an expression of higher forward earnings as upbeat demand for labor would be offset by bumper offerings from firms.

An upbeat Australian labor market data could propel the inflationary pressures again as households would be equipped with higher funds for disposal.

Apart from that, Consumer Inflation Expectations (Mar) data that demonstrate inflation projections for the next 12 months is expected to increase to 5.4% from the former release of 5.1%. An occurrence of the same would support more rates from the Reserve Bank of Australia (RBA).

The release of the downbeat US Retail Sales and lower-than-anticipated Producer Price Index (PPI) figures after inflation softening and higher Unemployment Rate have faded the expectations of bigger rates from the Federal Reserve (Fed). There is no denying the fact that Fed chair Jerome Powell could look for halting the rate-hiking spell for now considering escalating financial stress in the US economy.

- AUD/NZD picks up bids to rebound from 2.5-month low as NZ Q4 GDP disappoints.

- New Zealand Q4 GDP drops to -0.6% QoQ versus -0.2% expected and 2.0% prior.

- Credit Suisse turmoil previously weighed on the cross-currency pair.

- Australia employment report for February, RBA Bulletin eyed for fresh impulse.

AUD/NZD picks up bids to reverse from the lowest levels in a year, jumping nearly 50 pips to 1.0745 after New Zealand’s (NZ) fourth quarter (Q4) Gross Domestic Product (GDP) disappoints Kiwi traders during early Thursday. The figures become even more worrisome after the global rating giant S&P warned of an NZ rating cut.

NZ Q4 GDP slide to -0.6% QoQ versus -0.2% market forecasts and 2.0% previous readings. Further, the YoY figures also eased to 2.2% compared to 3.3% expected and 6.4% in previous readings.

Also read: Breaking: NZD/USD dumps on big miss in NZ GDP

On Wednesday, Bloomberg quoted Anthony Walker, a director of sovereign ratings for Australia, New Zealand and the Pacific at S&P to mention that "New Zealand’s credit grades with S&P Global Ratings could come under pressure if the nation’s current account deficit remains too big." It should be noted that the national Current Account Deficit shrank to $-9.45B in Q4, from $-10.2B in Q3. However, the Current Account – GDP Ratio slumped to -8.9% from -7.9% prior and -8.4% market forecasts.

Apart from the data at home and fears of the NZ rating cut, the market’s risk-off mood previously weighed on the AUD/NZD prices, mainly due to the Australia Dollar’s (AUD) risk-barometer status. The sentiment soured as the banking crisis reached Europe with a G-SIB – a global systemically important bank, namely Credit Suisse (CS), struggling with its Credit Default Swaps (CDS).

That said, the Yields slumped and the European stock market closed in the red but Wall Street closed mixed as the Swiss National Bank (SNB) stepped forward to help CS.

Looking ahead, AUD/NZD is likely to reverse amid broad risk-off mood and challenges for the AUD. However, today’s Aussie jobs report for February and the Reserve Bank of Australia’s (RBA) fourth-quarter (Q4) Bulletin will be important for the pair traders to watch for fresh impulse.

Technical analysis

Despite the latest rebound, a daily closing beyond a three-week-old resistance line, currently around 1.0735 appears necessary for the AUD/NZD bulls to keep the reins.

- NZD/USD has dropped sharply below 0.6160 on weaker NZ GDP figures.

- A catastrophic collapse of Credit Suisse forced investors to shift their funds into the USD Index.

- Fed Powell might consider a pause in the policy-tightening spell considering the deceleration in the US Inflation.

The NZD/USD pair has slipped firmer below 0.6160 as Statistics New Zealand has reported weak Gross Domestic Product (Q4) data. The economy contracted by 0.6% in the fourth quarter while the street was expecting a contraction of 0.2%. The New Zealand economy showed a growth rate of 1.7%.

On an annual basis, the NZ economy has expanded by 2.2%, lower than the estimates of 3.3% and the former release of 6.7%. A deteriorating economy demonstrates weakness in overall demand, which would also reduce inflationary pressures. In times when NZ inflation is extremely stubborn, the headline of economic contraction would delight the Reserve Bank of New Zealand (RBNZ).

The Kiwi asset remained solid on early Tuesday as China’s Retail Sales data justified the expectations from the street and the US Dollar Index (DXY) was beaten down by the declining United States Consumer Price Index (CPI) and the collapse of Silicon Valley Bank (SVB).

However, the ‘material weakness’ in internal controls of Credit Suisse’s financial reporting triggered demand for safe-haven assets. The stretch of banking system failure from the US to Europe deepened fears among market participants and they shift back to the USD Index to dodge liquidity.

A blunt decline by the Saudi National Bank for infusing more funds into Credit Suisse, the leading investor in the Swiss banking firm, raised alarms of some internal financial issues, which led to a nosedive move in the share price of Credit Suisse.

S&P500 futures failed to continue Tuesday’s upbeat recovery and were heavily sold by investors, portraying a risk-aversion theme. The demand for US government bonds rose dramatically as investors gung-ho for safe-haven appeal. This led to a sheer decline in the 10-year US Treasury yields to 3.46%.

Meanwhile, the odds for a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) has faded as US Producer Price Index (PPI) dropped lower than expected and Retail Sales contracted more than anticipation. There is no denying the fact that Fed chair Jerome Powell could also consider a pause in the policy-tightening spell considering the deceleration in the US Inflation and huge stress on the financial system.

- XAG/USD clings to Wednesday’s gains of 0.36%, despite overall US Dollar strength.

- Silver dropped below the 200-day EMAs after reaching a daily high of $22.37.

- XAG/USD Price Analysis: Silver remains downward biased.

Silver price retraced some of its earlier gains after hitting a daily high of $22.37; a slight improvement in market sentiment strengthened the US Dollar (USD). Therefore, the XAG/USD is trading at $21.75, above its opening price by 0.36%, below the 200-day Exponential Moving Average (EMA).

XAG/USD Price action

After reaching a daily high, the XAG/USD retreated from levels around $22.30s and cleared the confluence of the 50, 100, and 200-day EMAs at around $21.79-86. Therefore, the bearish bias remains intact, as the XAG/USD is set to achieve a daily close below the 200-day EMA.

Although oscillators shifted bullish, price action is the leading indicator. The Relative Strength Index (RSI) turned flat in bullish territory, while the Rate of Change (RoC) portrays buying pressure is waning. Therefore, the XAG/USD would remain trading sideways in the near term.

For a bearish resumption, the XAG/USD needs to crack the March 14 low of $21.50. A breach of the latter will expose the February 17 daily low at $21.18, followed by the November 28 swing low at 20.87. Once those two areas are reclaimed, the YTD low would be for grabs.

In an alternate scenario, the XAG/USD first resistance would be the confluence of the 200/100/50-day EMAs, around $21.79-86. Once buyers reclaim that area, the $22.00 figure would be up for grabs, before testing the weekly high of $22.37.

XAG/USD Daily chart

XAG/USD Technical levels

Stats New Zealand released the further quarter Gross Domestic Product as follows:

- New Zealand GDP SA QoQ for Q4: -0.6% vs. est -0.2%; prev 2.0%.

- GDP +2.2% YoY vs. expected +3.3%, prior 6.4%.

NZD/USD has dropped around 25 pips on the data:

0.6150 support is eyed as a key level to the downside as per the daily chart´s M-formation pulling the price into the neckline:

About New Zealand´s GDP

The Gross Domestic Product released by the Statistics New Zealand is a measure of the total value of all goods and services produced by New Zealand. The GDP is considered as a broad measure of New Zealand economic activity and health. Generally speaking, a high reading is seen as positive (or bullish) for the NZD, while a falling trend is seen as negative (or bearish) for the NZD.

Stats New Zealand will release the further quarter Gross Domestic Product today at 21.45 GMT.

Analysts at ANZ Bank have penciled in a 0.3% QoQ contraction, which is weaker than their previous forecast of +0.3% QoQ, and the Reserve Bank of New Zealand February MPS forecast of +0.7% QoQ.

´´A 1.7% QoQ fall in goods-producing industries (led by weaker manufacturing and construction) is expected to offset a modest 0.3% q/q lift in services activity. Given the ongoing noise in the data, we’re not convinced a weak read in Q4 can be considered much more than payback from the whopper 2.0% q/q lift in GDP in Q3,´ the analysts said.

The analysts said that the RBNZ will likely to look through some of the weakness in Q4 if the data print broadly as expected.´´

How might it affect NZD/USD?

NZD/USD is lower on the day while the US Dollar, as measured by the DXY index, is recovering on contagion fears in a slight to safety as markets derisk due to the banking crisis. However, NZ GDP data today will be important, as analysts at ANZ Bank explained. ´´But local factors are being overshadowed by global events and generalised fear in global markets. Keep an open mind, be mindful of sinking risk appetite/safe haven appeal. Things are fluid, but not liquid.´´

There is a downside bias currently that exposes the neckline of the W-formation near 0.6150.

About New Zealand´s GDP

The Gross Domestic Product released by the Statistics New Zealand is a measure of the total value of all goods and services produced by New Zealand. The GDP is considered as a broad measure of New Zealand economic activity and health. Generally speaking, a high reading is seen as positive (or bullish) for the NZD, while a falling trend is seen as negative (or bearish) for the NZD.

Here is what you need to know on Thursday, March 16:

Wall Street indexes finished far from the lows on a wild session that included moments of panic. The Nasdaq scratched a 0.05% gain while the Dow Jones lost 0.80%. Expectations of central bank tightening continue to ease, boosting government bonds. The banking crisis reached Europe, with focus on the health of Credit Suisse (CS). The DXY gained more than 1%, erasing weekly losses, boosted by the risk-off scenario. Emerging market currencies were under pressure.

EUR/USD tumbled toward 1.0500 and then trimmed losses, still posting the worst day in months. On Thursday, the European Central Bank (ECB) meets. A 50 bps hike is still expected amid elevated inflation but the current turmoil put all options on the table. Central banks are now in a more difficult position.

The Swiss Franc was among the worst performers, hit by the Credit Suisse drama. It even lost ground against the Euro. The Swiss National Bank (SNB) said it would provide liquidity to CS if necessary. USD/CHF jumped from near 0.9100 above 0.9300, while EUR/CHF rebounded from 0.9710 to 0.9850.

GBP/USD did not escape Dollar’s strength, falling toward 1.2000. The Pound however, held relatively well with EUR/GBP reaching three months lows at 0.8715 before rebounding to 0.8770.

USD/CAD soared, hitting levels above 1.3800 and then pulled back. NZD/USD fell modestly, losing 0.6200. New Zealand will report Q4 GDP on Thursday. AUD/USD gave up recent gains and is looking again at January lows (0.6580), although it climbed back above 0.6600 during the American afternoon. Australia will report February’s employment numbers.

Gold jumped to $1,937/oz, a one-month high amid lower US yields, and then trimmed gains. Silver reached monthly highs above $22.00 and then pulled back to end flat around $21.70.

Bitcoin held relatively well despite all the turmoil, with the price hovering around $24,000 after hitting on Tuesday $26,550, the highest level since June 2022. Ethereum dropped 5% to $1,630.

- USD/JPY sinks as US yields fall out of the sky.

- The Credit Suisse crisis is roiling markets and supporting the safe havens.

USD/JPY sank to a 4-week low on Wednesday while US and European yields tumble in the face of a slide in the European banking index that fell in its biggest one-day drop in nearly 13 months. Credit Suisse's 2022 annual report was published on Tuesday and it cited "material weaknesses" in its internal controls over financial reporting, noting that it had not yet stemmed customer outflows. This has provoked a flight to safety in financial markets, massaging the downside in USD/JPY.

At the time of writing, USD/JPY is done by over 0.7% but off the lows of the day that were printed at 132.21. The currency pair dropped from a high of 135.11 in the Europen session and is back to trading at around 133.30 at the time of writing. Two-year Treasury notes have dropped 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987.

Markets are now pricing in an 80% chance of a 25 basis point Federal Reserve hike next week. Investors are also pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign market expect the Federal Reserve to be cutting interest rates by year's end, if not before.

USD/JPY weekly chart

The price is meeting a potential support zone in this correction into the 61.8% Fibonacci retracement of the price´s bullish impulse. A bullish could be started to be built if a bullish structure should emerge on the lower time frame over the course of the next few sessions and/or days.

Credit Suisse shares tumbled on Wednesday amid increasing difficulties following the collapse of two US banks. The Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) released a statement indicating that the “problems of certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets.”

According to the statement, Credit Suisse meets the capital requirements imposed on banks. It added, that the Swiss National Bank will provide liquidity to the bank if necessary.

Key quotes from the statement:

“The SNB and FINMA are pointing out in this joint statement that there are no indications of a direct risk of contagion for Swiss institutions due to the current turmoil in the US banking market.”

“Regulation in Switzerland requires all banks to maintain capital and liquidity buffers that meet or exceed the minimum requirements of the Basel standards. Furthermore, systemically important banks have to meet higher capital and liquidity requirements. This allows negative effects of major crises and shocks to be absorbed.”

“Credit Suisse’s stock exchange value and the value of its debt securities have been particularly affected by market reactions in recent days. FINMA is in very close contact with the bank and has access to all information relevant to supervisory law. Against this background, FINMA confirms that Credit Suisse meets the higher capital and liquidity requirements applicable to systemically important banks.”

“The SNB will provide liquidity to the globally active bank if necessary. FINMA and the SNB are following developments very closely and are in close contact with the Federal Department of Finance to ensure financial stability.”

The USD/CHF is trading slightly below 0.9300, after rising more than 150 pips. The Swiss Franc is among the worst performers on Wednesday.

- USD/CHF rallied on deteriorated market sentiment spurred by banking contagion fears.

- Retail Sales in the United States contracted while inflation on the producer side eased.

- IF needed, the Swiss National Bank would act as a liquidity provider for Credit Suisse.

USD/CHF soars sharply as sentiment shifts sour on fears that the United States (US) banking crisis could spread globally. On Wednesday, Credit Suisse (CS) stock plunged 24% in an interview with one of its top shareholders, saying they won’t increase their stake at the bank due to regulation. At the time of writing, the USD/CHF is trading at 0.9287, up by 1.61% or 145 pips.

Swiss Franc collapses on Credit Suisse fall

The market sentiment remains sour, as portrayed by Wall Street, extending its losses. Credit Suisse’s sell-off continued in the European session, while the bank’s Credit Default Swaps (CDS) “ spiked to levels that signal Credit Suisse is in deep financial distress,” according to Bloomberg. Therefore, the CBOE Volatility Index (VIX) increased and reached a high of 30.81 before easing to current levels of 27.16.

The US economic docket featured Retail Sales for February. Figures came at -0.4% MoM, exceeding estimates for a 0.3% contraction. Although the data was negative, data showed American consumers’ resilience to spend. On another tranche of data, the Department of Labor (DoL) revealed the Producer Price Index (PPI) for February, in headline and core figures, were below estimates. That shows that the cumulative tightening of the Federal Funds rate (FFR) is working, despite the tightness of the labor market.

Therefore, safe-haven flows bolstered the US Dollar (USD), with the US Dollar index advancing 1.13%, at 104.836. However, US Treasury bond yields have been punished by investors, with US 2s and 10s extending their losses, each down by 37 basis points (bps) and 24 bps, respectively, at 3.889% and 3.453%.

Aside from this, the latest news crossing wires said that the Swiss Regulator FINMA would likely make a statement on Credit Suisse soon.

As of typing, the Swiss National Bank and the Swiss Financial Market Supervisory Authority issued a statement. It says: “Credit Suisse meets the capital and liquidity requirements imposed on systemically important banks. If necessary, the SNB will provide Credit Suisse with liquidity.”

Also read: SNB and FINMA issue statement on market uncertainty.

USD/CHF Technical levels

- Gold price firmer on risk-off sentiment due to the Credit Suisse crisis.

- Investors question whether the Federal Reserve can keep hiking interest rates to curb inflation.

- On a weekly basis, a continuation in the Gold price opens the risk of a move to test $2,012.50 as the -272% Fibonacci.

Gold price soared from a low of $1,885.79 to a high of $1,937.39 on the day but has come under some selling pressure in recent trade. Gold price has fallen back to trade around $1,916 at the time of writing, reflecting the volatility in the market as a consequence of the Credit Suisse risk.

Credit Suisse is in crisis

Bank stocks, already reeling from two large bank failures in the past week, were under pressure on Wednesday as the sharp drop of Credit Suisse. Shares of the Swiss lender fell more than 20% after the chairman of its biggest backer — the Saudi National Bank — said it won’t provide further financial support. On Tuesday, the institution announced that it had found “material weakness” in its financial reporting process from prior years.

The Guardian reports,´´the bank is in the process of a major restructuring plan, meant to stem major losses, which ballooned to 7.3bn Swiss francs (£6.6bn) in 2022, and revive operations hampered by multiple scandals over the past decade involving alleged misconduct, sanctions busting, money laundering and tax evasion.´´

Long story short, there is a loss of confidence in the bank and this is leading to additional fears of contagion in the global banking arena which is benefitting the Gold price on derisking as well as dialed-back expectations for central bank tightening.

Federal Reserve rate hike expectations dialed back

As recently as last week, markets were getting set for the return of large Fed interest rate rises. However, concerns about the banking sector have triggered a sharp decline US bond yields as investors questioned if the Federal Reserve and other central banks can keep hiking interest rates to curb inflation.

Two-year Treasury notes, which move in step with interest rate expectations, have tumbled 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987. On Wednesday, they have fallen from 4.413% to pay as low as 3.72%. Markets are now pricing in an 80% chance of a 25 basis point Federal Reserve hike next week and are pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign market expect the Federal Reserve to be cutting interest rates by year's end, if not before.

Gold price shines on falling US Treasury yields

Consequently to the turmoil, the Gold price is recovering and has rallied in four of the past five trading sessions. Last year, higher interest rates made it more appealing to hold government bonds over gold, since the latter doesn't pay any regular income. However, a jolt of uncertainty among investors is seeing the yields paid on government debt tanking. The yield curve, as a result, narrowed its inversion further, with the gap between two-year and 10-year yields contracting to -28.60 bps and the tightest spread since October.

Gold price technical analysis

From a daily perspective, the momentum is with the Gold price bulls and a bullish close on Wednesday opens prospects of a move to test the 2023 highs near $1,960.

On a weekly basis, the Gold price has recovered from support and a 78.6% Fibonacci correction. A continuation in the Gold price opens the risk of a move to test $2,012.50 as the -272% Fibonacci.

The EUR/USD lost more than 200 pips on Wednesday amid the turmoil around Credit Suisse. On Thursday, the European Central Bank will have it monetary policy meeting. Analysts at Rabobank warn that a 50 bps rate hike may fail to lift the Euro if investors assume that it is deepening the risk of a downturn.

Key quotes:

“The EUR has been impacted despite reports that the ECB will stay the course an announced the 50 bps move that its has already indicated.”

“Hiking rates by 50 bps against the backdrop of a jittery market and a tightening of financial conditions may fail to lift the EUR if investors assume that the central bank is deepening the risk of a downturn.”

“The best-case scenario is that jitters across the wider financial sector in Europe settle. This would allow the market to return its focus to economic fundamentals and specifically the risks around inflation. This would make it easier for the market to absorb a 50-bps rate hike from the ECB tomorrow and for EUR/USD to rally back above 1.06.”

“The market has already pared back expectations about how much further central banks can hike rates. Guidance offered by the ECB on this front tomorrow, and by the Fed and the BoE next week will be instrumental in setting the medium-term outlook for the FX market. Almost certainly further volatility is in store.”

- USD/CAD climbs on market sentiment deterioration, as investors seeking safety bolstered the US Dollar.

- US Retail Sales were lower than expected, but prices paid by producers cooled.

- USD/CAD Price Analysis: To resume its uptrend, buyers are eyeing 1.3900.

USD/CAD rallies on safe-haven flows towards the greenback sponsored by the US financial banking crisis woes threatening to spread around the globe. The failure of two banks in the United States (US) spurred a sell-off in Credit Suisse’s (CS) stock, amongst increasing fears of a financial crisis. Therefore, the USD/CAD is trading at 1.3774 after hitting a low of 1.3659.

Sentiment shifts negative, bolstering the US Dollar

Investors’ mood remains deteriorated, as shown by global equities treading water. Wall Street continues to trade with losses amidst a possible default by Credit Suisse, as more banks take less exposure to the latter. The CBOE Volatility Index (VIX), known as the fear index, shot up and reached the 30.00 level, portraying the sour sentiment in the financial markets.

In the meantime, economic data from the United States (US) witnessed Retail Sales plunging 0.4% MoM vs. estimates of 0.3% contraction. Even though it’s a negative print, January’s 3.2% jump and February’s data still show that Americans are spending at a slower pace. At the same time, the US Bureau of Labor Statistics revealed that prices paid by producers in February, also known as the Producer Price Index (PPI), dropped 0.1% MoM, beneath forecasts of 0.3% expansion. Core PPI was 0%, below estimates for a 0.4% increase, showing signs that prices are heading downwards amidst the Fed’s aggressive tightening cycle of 20220.

Therefore, safe-haven flows bolstered the US Dollar (USD), with the US Dollar index advancing 1.13%, at 104.836. However, US Treasury bond yields have been punished by investors, with US 2s and 10s extending their losses, each down by 37 basis points (bps) and 24 bps, respectively, at 3.889% and 3.453%.

On the Canadian side, Housing Starts in February exceeded estimates of 220K, rising to 224K units from 216.5K revised in January, according to the Canadian Mortgage and Housing Corporation (CMHC).

Therefore, the USD/CAD would remain underpinned by market sentiment and flows toward safety. In addition, the Bank of Canada (BoC) pausing interest rate increases would keep the US Dollar underpinned by the interest rate differential. This means the USD/CAD bias remains upwards.

USD/CAD Technical analysis

The USD/CAD is still upward biased, snapping three days of consecutive losses. Although the pair tested the 20-day Exponential Moving Average (EMA) at 1.3645, it jumped from that area and formed a bullish engulfing candle chart pattern. Oscillators remain in bullish territory, except for the Rate of Change (RoC), which shows that selling pressure is waning, about to cross above neutral.

In case of a bullish continuation, the USD/CAD first resistance would be 1.3814, today’s high. A breach of the latter will expose the YTD high at 1.3862 before the pair edges to 1.3900. As an alternate scenario, the USD/CAD cracking the 20-day EMA at 1.3645 would pave the way toward the 50-day EMA At 1.3550.

- GBP/USD weighed by safe-haven US Dollar buying in face of a banking crisis.

- Bob Michele, JPMorgan Asset Management CIO and global head of fixed income said Credit Suisse is the tip of the iceberg.

GBP/USD continuation traders are in the market as renewed unease gripped world markets on Wednesday on the news that Credit Suisse's largest investor said it could not provide the Swiss bank with more financial assistance, prompting the Swiss bank's CEO to make new assurances on its financial strength.

Credit Suisse has been battling to recover from a string of scandals that have undermined the confidence of investors and clients and the institution´s plunging stock price has re-ignited jitters among investors about the resilience of the global banking system following the collapse of Silicon Valley Bank last week. Credit Suisse CEO Ulrich Koerner moved to calm nerves, saying the bank's liquidity base remained strong and was well above all regulatory requirements.

However, investors are worried that a full-blown global banking crisis may be brewing with some analysts saying that Credit Suisse is the tip of the iceberg. Bob Michele, JPMorgan Asset Management CIO and global head of fixed income, says Credit Suisse shows the lagged impact of central bank tightening have caught up during an interview with Jonathan Ferro on "Bloomberg The Open," saying that this is the tip of the iceberg with a lot more consolidation and pain to come, ´´so you put your money into the highest quality assets that you can find´´. He also says that the Federal Reserve should pause.

In this regard, concerns about the Swiss bank triggered a sharp decline in European and US bond yields as investors questioned if the Federal Reserve and other central banks can keep hiking interest rates to curb inflation. Two-year Treasury notes, which move in step with interest rate expectations, have tumbled 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987. On Wednesday, they have fallen from 4.413% to pay as low as 3.72%. As recently as last week, markets braced for the return of large Fed interest rate rises but markets are now pricing in an 80% chance of a 25 basis point Federal Reserve hike next week and are pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign market expects the Fed to be cutting interest rates by year's end, if not before.

Safe haven USD buying overshadows UK budget

Nevertheless, the US Dollar has rallied on safe-haven buying. DXY, an index that measures the greenback vs. a basket of currencies, vaulted 104 the figure on a tear all the way to 105.103, in turn, crushing everything in its way, including GBP, and despite the UK government´s budget.

The measures announced by Chancellor Jeremy Hunt are seen as an effort to support productivity and investment without adding strain on public finances, which would otherwise see GBP should react well. However, the risk-off themes have ignored such positive implications for Sterling so far. The Chancellor says the UK economy is on the right track and the government’s plan for the economy was “working” as he announced what he called a “budget for growth”.

- The S&P 500, the Nasdaq 100, and the Dow Jones collapsed as the banking system crisis deepened.

- The US Producer Price Index cooled, while Retail Sales dropped after an outstanding January report.

- Investors expect the Federal Reserve to keep the Federal Funds Rate unchanged at the next meeting.

Wall Street collapsed as the banking crisis deepened, with Credit Suisse’s (CS) stock plunged 24% in the day amidst comments from its largest shareholder to not invest in the bank due to “regulatory and statutory reasons.” That has triggered a collapse in CS stock, while its Credit Default Swaps (CDS) are reaching levels last seen since the Global Financial Crisis (GFC).

Therefore, the S&P 500 is dropping 1.46%, at 3,862.14. Following suit is the heavy-tech Nasdaq 100, falling 0.76% at 11,342.55, while the Dow Jones is losing 1.74%, at 31,598.13.

Sentiment remains sour amidst the Credit Suisse panic sale. Bank’s shares across the board registered losses, while more than 80% of the S&P 500 stocks listed fell. Aside from this, the United States (US) economic calendar revealed the Retail Sales and Producer Price Index (PPI) for February. Retail Sales came lower than the expected plunge of 0.3% MoM, dropped 0.4%, in part blamed on the astonishing January report of 3.2%

The US Producer Price Index (PPI) dropped 0.1% MoM, the US Bureau of Labor Statistics reported today. Core PPI, which excludes volatile items like food and energy, cooled down from 0.4% estimates to 0%.

In the meantime, expectations for a 25 bps rate hike by the Federal Reserve (Fed) had waned. The CME FedWatch Tool odds for a 25 bps hike lie at 37%, with investors estimating no change to the Federal Funds rate (FFR) at next week’s meeting.

Sector-wise, Utilities and Communications Services are the two leaders of the pack, up 1.16% and 0.25%. The laggards are Energy and Materials, each losing 6.18% and 4.42%, respectively.

Meanwhile, the greenback is recovering after three days of consecutive losses, as the US Dollar Index shows, advancing 1.21% at 104.937. US Treasury bond yields continued to plunge across the curve, with 2s falling 43 bps, at 3.823%, while the 10-year dropping 28 bps at 3.410%.

What to watch

The US economic calendar will feature February Housing Starts, Building Permits, and Initial Jobless Claims.

S&P 500 Daily chart

- AUD/USD opens at 0.6679 and hits an intraday low of 0.6601 before settling at 0.6606.

- Critical concerns due to the Credit Suisse woes increase investor risk aversion.

- Traders await Australia’s Employment Change and Employment Rate data.

AUD/USD faces selling pressure on Wednesday as investors turned risk-averse amid growing concerns about recent catastrophic developments relating to Credit Suisse just after the collapse of Silicon Valley Bank (SVB).

Aussie prints an intraday low of 0.6601 before settling at 0.6606, down 1.09% on Wednesday at the press time.

The Credit Suisse predicament and expectations of a 25-basis-point (bps) hike – albeit lower than previously forecast – by the Federal Reserve (Fed) in March are still driving up the US Dollar's value.

The recent unsatisfactory macroeconomic reports from the US, which include a 0.1% decrease in the Producer Price Index (PPI) for February and a lower-than-expected core PPI rate, have not negatively impacted the US Dollar.

The US Retail Sales also falls by 0.4% in February, lower than the previous month's 3.2% increase and the anticipated 0.3% drop. In addition, the New York Fed's Empire State Manufacturing Index falls sharply to -24.6, below the predicted decrease to -8 from the previous -5.8.

However, concerns regarding a broader financial crisis continue to boost the US Dollar with safe-haven demand. Additionally, the Reserve Bank of Australia's (RBA) dovish shift, indicating that it might be nearing the end of its rate-hiking cycle, indicates that the AUD/USD pair is likely to trend downwards.

Key economic events:

Australia’s Employment Change s.a. (Feb) and Unemployment Rate s.a. (Feb), to be released at 00:30 GMT, is Thursday’s most critical vital data.

Additionally, traders will closely monitor the US Initial Job Claims data on Thursday at 12:30 GMT.

Technical View:

From a technical perspective, the AUD/USD pair remains in a downtrend, with the daily 20-SMA at 0.6747 acting as a significant resistance level.

Today’s high coincided with a major trendline joining the tops of the descending price trend since the start of February. The intraday decline that followed the retest of the trendline suggests the next move down in the bear trend may be unfolding. The March 10 lows are an obvious next target to the downside at 0.6565. A key support level also sits at 0.6580.

The daily 50-SMA at 0.6881 also adds to the downside pressure, indicating a bearish bias. The daily RSI(14) is currently at 36.970, suggesting that the pair is close to entering oversold territory, and there is an increased risk AUD/USD price may consolidate prior to further losses.

The pair's intraday high of 0.6712 forms the immediate resistance, followed by the 38.2% Fibonacci level at 0.6671, the daily pivot point at 0.6670, and the resistance levels at 0.6709, 0.6735, and 0.6773.

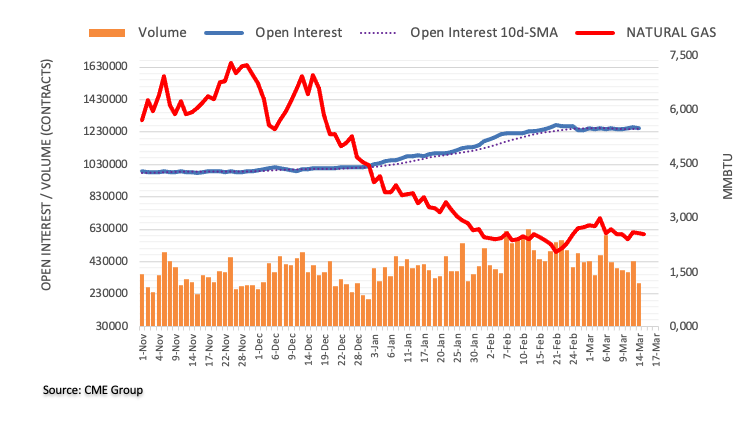

- Crude oil prices tumble on market jitters and inventories.

- Stocks indexes move sharply lower on banking concerns.

- WTI heads for the lowest close since December 2021.

Crude oil prices are falling sharply again on Wednesday as markets continue to be shaken by banking-industry concerns. Adding to the downside, the latest EIA weekly reports showed US inventories rose last week.

WTI in free fall

As of writing, WTI is trading at $67.40, at the lowest level since December 2021, down 5.45% for the day. Since the beginning of the week, it lost 11.5%.

Risk aversion is driving commodities and shares sharply lower on Wednesday. Concerns about the health of Credit Suisse spread fear across financial markets.

Adding weight to Crude Oil prices, the Energy Information Administration (EIA) informed that crude inventories rose by 1.55 million barrels last week, above expectations. It was the eleventh increase in inventories out of the past 12 weeks.

Technical factors contribute to the sharp decline in WTI. The price broke on Tuesday below the critical $73.00 support and on Wednesday fell below December 2022 lows and also cracked the $70.00 mark. The chart shows clearly oversold readings but, so far, no sign of an immediate pause. The next strong level emerges around $66.00/20.

WTI Technical levels

Gold has found a floor as expected above its 200-Day Moving Average (DMA), currently seen at $1,775. A weekly close above $1,890/1900 is needed to clear the way for a retest of $1,973/90, strategists at Credit Suisse report.

55-DMA at $1,869 now holds to keep XAU/USD within its range

“A solid weekly close above $1,890/1900 is needed to clear the way for a retest of $1,973/98. Beyond here stays seen needed to reassert an upward bias for a test of long-term resistance from the $2,070/72 record highs of 2020 and 2022.”

“Ideally, the 55-DMA, currently seen at $1,869 now holds to keep the precious metal within its range. Nevertheless, if this would break, we could see further weakness toward the recent range low at $1,804, before the crucial 200-DMA, currently seen at $1,775, which we would once more expect to provide a floor.”

- EUR/GBP extends its losses amidst fear of further contagion in the financial markets.

- Sentiment shifting sour punishes the Euro ahead of the European Central Bank interest rate decision.

- EUR/GBP Price Analysis: To extend its downtrend in the near term.

EUR/GBP dropped sharply from around two-day highs of 0.8843 as the UK Finance minister Jeremy Hunt unveiled the new budget that would get Britain out of stagnation. Therefore, the Pound Sterling (GBP) appreciates, even though an upcoming European Central Bank (ECB) interest rate decision is approaching. At the time of writing, the EUR/GBP trades at 0.8735, down by 0.93%.

EUR/GBP drops on expectations of a lower ECB rate hike

Market sentiment remains negative. The failure of some banks in the United States (US) has spread around the globe, with Credit Suisse (CS) sinking 13% after one of its top holders ruled out investing more. That has triggered the alarms around Europe, with traders expecting the European Central Bank (ECB) would hike rates by just 25 bps, as World Interest Rates Probabilities (WIRP) hinted.

In Eurozone (EU) data, Industrial Production recovered in January, as shown by official data on Wednesday. The report highlighted an improvement in manufacturing. EU’s Industrial Output rose 0.7% MoM vs. 0.4% estimated and exceeded the previous print of -1.3%. Annually based, exceeded forecasts of 0.2%, jumped 0.9%.

In the UK, the latest employment report was solid, with the economy adding more people to the workforce and wages cooled. That released some pressure on the Bank of England (BoE) to continue to increase rates amidst an ongoing economic deceleration.

However, the spotlight of the day turned to UK’s budget. The Chancellor of the Exchequer, Jeremy Hunt, announced a plan to increase the pace of growth in the UK, which includes childcare and tax reforms.

Jeremy Hunt has announced a plan to extend help for households struggling with high energy bills and freeze a tax on gasoline. The plan will cancel the planned £500 hike in average energy bills, which was due to come into force next month, in a move that would see bills for the average household staying at around £1,138 a year

What to watch?

The UK economic docket is absent. On the Eurozone front, the European Central Bank (ECB) will reveal its monetary policy decision, followed by President Christine Lagarde’s press conference on Thursday.

EUR/GBP Technical analysis

The EUR/GBP retraced after peaking at around 0.8925 last week. Additionally, the cross fell below the 20, 50, and 100-day Exponential Moving Averages (EMAs), exacerbating a fall to test the 200-day EMA at 0.8701. However, the EUR/GBP fell shy of reaching the latter, though it tested the YTD lows at 0.8718. With oscillators turning negative, a bearish continuation of the EUR/GBP is the path of least resistance.

Hence, the EUR/GBP first support would be 0.8718, followed by the 200-day EMA at 0.8701. Once those levels are cleared, the pair would be headed toward the December 13 low at 0.8558.

Australia is set to report its February employment figures on Thursday, March 16 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers at five major banks regarding the upcoming employment data.

Australia is expected to have added 48.5K jobs vs. -11.5K in January, while the unemployment rate is seen falling a tick to 3.6% even as the participation rate is set to rise a tick to 66.6%.

ANZ

“Like the RBA, we think the labour market will rebound in February. Our forecast is very strong employment growth of 90K, enough to have pushed unemployment back down to 3.5%. But if there’s another soft labour market result or if the other aforementioned prints prove lacklustre, this could keep the RBA on hold in April.”

ING

“The upcoming labour data will give an indication as to whether the previous releases were arbitrary or if there is confirmation that the economy really is slowing down. With the RBA indicating that it is getting close to peak cash rates, a much weaker employment number could even give rise to thoughts that rates may have already peaked at 3.6%.”

TDS

“One of the most closely watched employment prints in a long time. The larger-than-usual increase in u/e people in Jan, and the larger-than-usual rise in the number of u/e people who had a job to go to in the future suggests a bounce is likely. We forecast 47K jobs were added in Feb, the participation rate rising to 66.6%, keeping the u/e rate unchanged at 3.7%.”

SocGen

“We expect February’s labour market data to show a sizeable gain (40K) in employment after seeing consecutive dips in the months of December and January. The contraction in employment during those months can partially be ascribed to the changing seasonal patterns in hiring. This would lead to a significant increase in February that will offset the seasonal anomaly. But we also believe that the slowdown in employment growth has materialised due to consumption weakness, which is likely to be seen in the sustained decline in three-month moving average of employment change (from 35 in November to 3 in February if our forecast is correct). The unemployment rate will likely decline a bit (3.6%), while the participation rate is likely to remain largely unchanged. Hours worked is also expected to pick up after experiencing contraction in three consecutive months, showing the underlying momentum in economic growth. In conclusion, we foresee that employment data will continue to show signs of an easing in labour market conditions. This would support our base scenario that the 25 bps hike in April will be the final one under the current tightening cycle.”

CitiBank

“Citi employment change forecast; 56K,, Citi unemployment rate forecast; 3.5%, Citi participation rate forecast; 66.6%. The February labour force survey will be crucial to determine whether the RBA hikes or pauses in April. Strong employment gains are a necessary condition for the RBA to hike in the April Policy Board meeting. If the unemployment rate remains unchanged at 3.7% because of softer job growth – rather than strong labour force participation – then the odds of an RBA pause in April will increase.”

Economists at Société Générale see the S&P 500 Index Index trading between 3,500 and 4,200.

Marginally down to 3,800 by the end of the year

“1Q23: 4,200 in the first quarter has seen the peak for this year (early China-boom than expected but not a straight-line growth).”

“2Q23: 3,500 on increased Fed expectations, inflation uncertainty from June onwards and EPS downturn.”

“3Q23 and 4Q23: should see 3,800 as Fed peaks, US 10y yield visibly down, timing rate-cuts talks pick-up again, jobless claims should rise.”

- GBP/USD comes under pressure after climbing to 1.2180.

- The strong rebound in the greenback weighs on the risk complex.

- UK Chancellor Hunt delivered the Spring Budget.

In line with the rest of the risk-linked assets, GBP/USD faces renewed and strong downside pressure and revisits the 1.2040 region on Wednesday.

GBP/USD weaker on risk-off mood

GBP/USD adds to Tuesday’s decline and probes the area of 3-day lows in the 1.2045/40 band midweek on the back of the acute move higher in the greenback, which appears propped up by increasing risk aversion in the global market.

Indeed, the bearish mood among investors remains on the rise following fears over the European banking system, all exacerbated in response to negative news from Swiss lender Credit Suisse.

On the domestic front, Chancellor J.Hunt delivered the Spring Budget. On this, the Office for Budget Responsibility (OBR) now sees the economy avoiding a technical recession this year and expects inflation to drop to 2.9% at some point by year end. The OBR also sees the economy contracting just 0.2% this year and expanding 1.8% in 2024 and 2.5% in 2025.

What to look for around GBP

Same as with the rest of the risk complex, the British pound is expected to track the dollar’s price action and the policy divergence between the Federal Reserve and the Bank of England when it comes to near-term direction.

Furthermore, the UK economy’s bleak outlook for the remainder of the year in combination with persistent elevated inflation leaves the prospects for further gains in the Sterling somewhat curtailed in the short term, while the BoE approaching its terminal rate does not look helpful for the quid either.

GBP/USD levels to consider

As of writing, the pair is retreating 0.90% at 1.2045 and faces the next support at 1.1891 (200-day SMA) followed by 1.1802 (2023 low March 8) and finally 1.1142 (monthly low November 4 2022). On the flip side, the breakout of 1.2203 (monthly high March 14) would open the door to 1.2269 (weekly high February 14) and then 1.2447 (2023 high January 23).

- US Dollar Index rises 1% even as US yields tumble.

- Risk-off sentiment dominates Wall Street opening, Dow Jones drops by more than 500 points.

- EUR/USD suffers worst day in months, tests crucial support area.

The EUR/USD is falling sharply on Wednesday and recently printed a fresh two-month low at 1.0521. It is hovering around 1.0550, after testing a critical level. The US Dollar rocketed as markets tumbled on banking concerns.

USD up on risk aversion, despite yields and data

Economic data from the US came in below expectations, adding to expectations of a softer Federal Reserve. The economic figures are offset by ongoing developments around the banking crisis that crossed the Atlantic on Wednesday.

Fears about the health of Credit Suisse (CS) triggered a sell-off in banking shares across the globe. CS shares are falling 13% in Wall Street; after being down by almost 30%. Its monn shareholder, the Saudi National Bank, ruled out providing more money.

Government bonds are rising considerably, with yields hitting fresh lows. In Wall Street, the Dow Jones tumbles 1.85% and the Nasdaq drops by 1.45%.

ECB Preview: Set for 50 bps rate hike, Lagarde holds the key

In the currency market, the Japanese Yen is the best performer followed by the US Dollar. The Euro is falling against it main European competitors. EUR/GBP dropped to the its lowest level in two months below 0.8730 while EUR/CHF fell toward 0.8700.

The EUR/USD is losing more than 200 pips, on the worst day in months.

So far, EUR/USD’s slide found support at the critical area between 1.0500 and 1.0525, the confluence of previous lows and the 100-day Simple Moving Average. A consolidation below would open the doors to more weakness for the euro.

Technical levels

EUR/USD needs to move back above 1.0806 to ease the pressure off the 1.0483/63 key support, economists at Credit Suisse report.

Break above 1.0806 needed to reassert an upward bias

“EUR/USD continues to hold above key support from the 38.2% retracement of the 2022/2023 rally and early January YTD low at 1.0483/63 and our bias remains for this to hold for a broad range.”

“Above 1.0806 remains seen needed to reassert an upward bias for strength back to the 50% retracement of the 2021/2022 fall at 1.0944, then a retest of the 1.1035 YTD high.”

“Below 1.0463 though would mark a ‘head and shoulders’ top and a potentially more significant downturn, although we would still need to see the 200-DMA at 1.0326 removed to suggest this is indeed the case for support next at 1.0223/1.0198.”

- NZD/USD trades at 0.6206, down 0.47% at the press time.

- US Retail Sales data declines by 0.4%, a little more than the 0.3% expected.

- DXY maintains significant daily gains after US Retail Sales data, remaining above the 104.90 level.

Daily price movements:

NZD/USD sees a bearish intraday movement on Wednesday, with the last recorded price at 0.6206 where it appears to be temporarily finding a floor. The currency pair started the session at 0.6235, and the overall intraday price change was -0.47% at press time.

Daily economic events:

New Zealand’s Gross Domestic Product (GDP) (QoQ & YoY for Q4) is to be released by Statistics New Zealand on Wednesday (21:45 GMT). It highlights the overall economic performance on a quarterly and yearly basis.

Already out is Retail Sales for February from the United States. This showed a fall of 0.4% MoM to $697.9 billion, according to data from the US Census Bureau report on Wednesday. This figure follows a 3.2% increase in January and was slightly below market expectations, which predicted a decline of 0.3%.

Following this data, the US Dollar Index (DXY) maintains its upward momentum, printing a 1.30% increase on the day, trading above 104.90 at the press time. A relatively more substantial DXY pressures the NZD/USD currency pair ahead of New Zealand’s GDP data releases on Wednesday at 21:45 GMT.

Technical View:

The NZD/USD pair trades just below its daily 20-SMA (0.6195) and significantly below its 50-SMA (0.6313), indicating a bearish bias in short to medium term.

The daily RSI(14) of 47.057 suggests a nearly neutral momentum as the pair trades close to the 50 mark. However, the market may encounter some resistance, as the daily resistance levels are at 0.6257, 0.6278, and 0.6308.

The daily pivot point for the NZD/USD pair is 0.6228, slightly above the last intraday price at press time. The daily support levels are found at 0.6207, 0.6177, and 0.6157. If the pair manages to break above the pivot point, it may test the resistance levels, while a break below the pivot point could trigger a test of the support levels.

- EUR/USD melts down and revisits the area of multi-week lows.

- A deeper drop to the 2023 low should not be ruled out now.

EUR/USD comes under heavy selling pressure and fully reverses last week’s strong rebound, revisiting at the same time the 1.0520 area on Wednesday.

The pronounced sell-off carries the potential to retest the 2023 low near 1.0480 (January 6) ahead of the key 200-day SMA, today at 1.0323.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA.

EUR/USD daily chart

Gold has surged to $1,930, its highest level since February 2. The yellow metal could stage a significant race higher, strategists at TD Securities report.

Do not fade the rally in Gold

“The risk of a dash-for-cash is mitigated by substantial physical demand in Gold and by neutral discretionary trader positioning.”

“The yellow metal still appears to offer the most competitive risk/reward on our screen as strong physical demand driven by the East should keep losses subdued if central banks remain on the war path to combat inflation despite bank liquidity concerns.”

“Risks that the tightening cycle is coming to an end should also realign discretionary flows with strong physical flows, which could translate into substantial upside.”

- USD/JPY witnessed an intraday turnaround from a fresh weekly high touched earlier this Wednesday.

- Credit Suisse crisis triggers a massive sell-off in equities and boosts demand for the safe-haven JPY.

- A blowout intraday USD rally lends some support to the pair and helps limit losses, at least for now.