- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-03-2023

- US Dollar Index renews intraday low, braces for minor weekly loss.

- Softer US inflation expectations, mixed US data join cautiously optimistic markets to probe DXY bulls.

- Yields, hawkish Fed bets put a floor under the US Dollar Index price.

- Michigan Consumer Sentiment Index, UoM 5-year Consumer Inflation Expectations eyed for fresh impulse.

US Dollar Index (DXY) holds lower ground near 104.35 after snapping a two-day winning streak the previous day. With this, the greenback’s gauge versus the six major currencies brace for minor weekly loss as traders brace for the last clues for the next week’s Federal Reserve (Fed) monetary policy meeting.

That said, the mixed US data joins downbeat inflation expectations and hopes of no financial crisis like 2008 seem to weigh on the US Dollar. However, expectations that the Fed will be able to keep its monetary policy tighter for longer join the upbeat Treasury bond yields to put a floor under the price.

Talking about the US data, Weekly Initial Jobless Claims dropped to 192K for the week ended on March 10 versus 205K expected and 212K prior whereas the four-week average figure dropped to 196.5K versus 197.25K prior (revised). Further, Housing Starts jumped to 1.45M in February from 1.321M previous reading and 1.31M analysts’ estimations while the Housing Starts jumped to 1.524M during the said month versus 1.34M expected and 1.339M prior. Additionally, the Philadelphia Fed Manufacturing Survey gauge came in as -23.2 compared to -14.5 consensus and -24.3 prior.

On the other hand, the US inflation expectations per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) remain pressured around the multi-day low and challenge the policy hawks, as well as the US Dollar bulls, of late. That said, the 10-year breakeven from the FRED data dropped to a fresh six-week low of 2.22% by the end of Thursday’s North American trading session during a two-day downtrend. However, the two-year counterpart revisits the week-start of 2.26%, previously poked in early February, while dropping for the second consecutive day.

It should be noted that the Fed fund futures recently bolster the case of the US central bank’s 0.25% rate hike in the next week’s monetary policy meeting.

Elsewhere, comments from Saudi National Bank's Chairman, Ammar Al Khudairy, conveying the “sound” conditions of Credit Suisse join the major US banks’ efforts to help California-based First Republic Bank to avoid a liquidity crunch to favor the risk-on mood. On the same line was the news that Credit Suisse eyes borrowing up to CHF50 billion from the Swiss National Bank (SNB) to strengthen liquidity, as well as Reuters quoting anonymous sources to confirm that the US banks are less vulnerable to the Credit Suisse debacle. Furthermore, US Treasury Secretary Janet Yellen’s assurance over the US banking industry’s health and European Central Bank’s (ECB) 50 bps rate hike, matching expectations, also favored the sentiment and allowed the latest run-up in the AUD/USD prices.

Against this backdrop, United States 10-year and two-year Treasury bond yields are down for the second consecutive week despite the previous day’s rebound from the multi-day low. Further, Wall Street closed in the green with more than 1.0% gains by each of the benchmark indices while S&P 500 Futures print mild gains of late.

Looking ahead, preliminary readings of the US Michigan Consumer Sentiment Index for March and the UoM 5-year Consumer Inflation Expectations for the said month will be important for clear directions.

Technical analysis

Failure to cross the 100-DMA, around 104.85 by the press time, directs US Dollar Index (DXY) towards the 50-DMA retest, close to 103.45 at the latest.

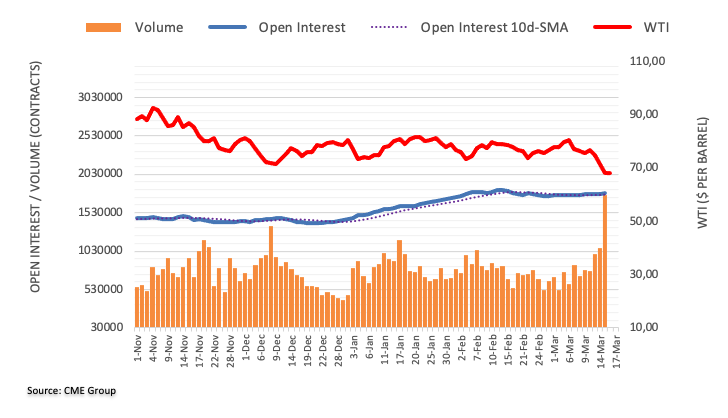

- The oil price has shown a stellar recovery after printing a fresh 15-month low at $65.88 and is aiming to stretch it further.

- US Biden’s denial of further sanctions on Russian oil and revised China’s GDP forecast have supported oil price.

- A bullish reversal has been pinned as the oil price has crossed the critical resistance of $69.00.

West Texas Intermediate (WTI), futures on NYMEX, is making efforts in sustaining its auction above the critical resistance of 68.50 in the early Asian session. The oil price has shown a stellar recovery after printing a fresh 15-month low at $65.88 and is aiming to stretch it further on expectations of a smaller interest rate hike by the Federal Reserve (Fed).

Despite soaring fears of banking turmoil, the oil price has shown a recovery due to the least appetite of the United States for levying more sanctions on oil supply from Russia. US President Joe Biden believes that Russia won’t deliver oil below the current $60/barrel, which could disturb the demand-supply equilibrium.

Also, a surprise upside in China’s Gross Domestic Product (GDP) forecasts has fueled a sense of optimism in the oil price. Goldman Sachs revised 2023 China’s GDP projections higher to 6% from 5.5% anticipated earlier.

WTI has shown a confident recovery after testing a fresh 15-month low at $65.88 on Thursday. The oil price has formed a Double Bottom chart pattern on an hourly scale, which indicates a bullish reversal as the asset re-tested its prior crucial lows with less selling pressure. A bullish reversal has been pinned as the oil price has crossed the critical resistance of $69.00.

The black gold is aiming to shift its auction above the 20-period Exponential Moving Average (EMA) at $68.50, which will underpin a short-term upside trend.

Meanwhile, the Relative Strength Index (RSI) (14) has delivered a range shift move from the bearish territory of 20.00-40.00 to the neutral region of 40.00-60.00, which cements a bullish reversal.

For further upside, the oil price needs to break Thursday’s high at $69.53, which will drive the asset toward the horizontal resistance plotted around $71.00. A break above the latter will further push the oil price to near February 22 low at $73.85.

On the contrary, a downside move below the 15-month low at $65.88 would drag the asset toward 30 November 2021 low at $64.40 followed by 02 December 2021 low at 62.41.

WTI hourly chart

-638146066394935632.png)

Having witnessed immense volatility in the last few days, the global markets portray the much-needed inaction while depicting the traders’ cautious mood ahead of the next week’s Federal Open Market Committee (FOMC) monetary policy meeting. Even so, the recently downbeat US inflation expectations and financial market turmoil seem to favor the risk-on mood while also probing the US Dollar.

It should, however, be noted that the Fed fund futures recently bolster the case of the US central bank’s 0.25% rate hike in the next week’s FOMC.

That said, the US inflation expectations per the 10-year and 5-year breakeven inflation rates from the St. Louis Federal Reserve (FRED) remain pressured around the multi-day low and challenge the policy hawks, as well as the US Dollar bulls, of late.

The 10-year breakeven from the FRED data dropped to a fresh six-week low of 2.22% by the end of Thursday’s North American trading session during a two-day downtrend. However, the two-year counterpart revisits the week-start of 2.26%, previously poked in early February, while dropping for the second consecutive day.

To confirm the latest weakness in the US inflation expectations, the traders might wait for Friday’s UoM 5-year Consumer Inflation Expectations for March, 2.9% prior, which in turn could confirm the Fed’s 0.25% rate hike and propel the US Dollar in case of upbeat readings.

Also read: Forex Today: Unexpected consolidation, DXY drops as risk sentiment improves

- NZD/USD struggles to extend the previous day’s recovery moves but stays on the way to posting weekly gains.

- 100-HMA probes buyers even as upbeat oscillators, one-week-old support line suggest further upside of the Kiwi pair.

- Descending trend line from early March appears the key upside hurdle for the bulls to cross.

NZD/USD makes rounds to the key moving average as buyers struggle to keep the reins around 0.6200, bracing for the weekly gains, during early Friday.

In doing so, the Kiwi pair benefits from the upbeat RSI (14), not overbought, as well as bullish MACD signals. Not only the price-positive oscillators but the quote’s U-turn from a one-week-old ascending trend line also keeps the NZD/USD buyers hopeful of witnessing further upside.

Hence, the buyers are ready to overcome the immediate 100-Hour Moving Average (HMA), surrounding the 0.6200 threshold.

However, the 61.8% Fibonacci retracement level of the pair’s March 01-08 downside, near 0.6205, could act as a validation point for the rally targeting a downward-sloping resistance line since the month’s start, around 0.6245 at the latest.

Should the NZD/USD bulls stay in the driver’s seat beyond 0.6245, the odds of witnessing a fresh monthly high, currently around 0.6280, can’t be ruled out.

Alternatively, pullback moves may initially aim for the 50% Fibonacci retracement level of 0.6180 before directing the NZD/USD bears towards the aforementioned one-week-old support line, close to 0.6150 by the press time.

It should be noted, however, that the NZD/USD pair’s sustained trading below 0.6150 makes it vulnerable to testing the monthly low of 0.6084. During the fall, the 0.6100 round figure may act as an intermediate halt.

NZD/USD: Hourly chart

Trend: Limited upside expected

- GBP/JPY recovers as UK government bond yields ease and risk appetite returns.

- Central banks intervene to address the liquidity crisis in the banking sector.

- Fed opens the discount window and major US banks support First Republic Bank, boosting market sentiment.

GBP/JPY marches higher on the back of easing UK Government bond 10-Year yield (Gilts) and a risk-on environment. It all started earlier this week with back-to-back liquidity issues involving Silicon Valley Bank (SVB), Signature Bank, Credit Suisse, and First Republic Bank.

The worsening financial conditions among banks injected turbulence and prompted a risk-averse environment earlier in the week. As a result, yield complexes began to fall in anticipation that central banks would scale down their aggressive tightening cycles amid receding liquidity.

Surging borrowing costs globally have prompted small to medium banks to struggle with their reserve requirement ratios to maintain normal banking operations. Consequently, investor confidence started to fade during this financial turbulence, and the market exerted pressure on yield complexes. This led to increased Japanese Yen safe-haven demand and a significant fall in GBP/JPY.

Amid this shift in the banking sectors, major central banks like the Federal Reserve (Fed), Bank of England (BoE), and Swiss National Bank (SNB) intervened to stem the liquidity crisis.

On Wednesday, the BoE intervened in Credit Suisse's situation, while the SNB provided a covered loan facility. Several large-sized US banks announced a joint effort to provide up to $30 billion in deposits for First Republic Bank, including J.P. Morgan, Bank of America, Wells Fargo, and Citibank. On Thursday, the Fed also opened its discount window to provide liquidity in an exercise to tame any possible contagion in the banking sector. All these efforts have boosted risk sentiment, resulting in muted demand for the Japanese Yen across the board.

Levels to watch

- EUR/JPY is looking to extend its rally above 142.00 on ECB’s hawkish interest rate guidance.

- ECB Lagarde confirmed that wage pressures are keeping Eurozone CPI at elevated levels.

- ECB policymakers agreed to go ahead with a 50 bps hike after the SNB "threw a lifeline" to Credit Suisse.

The EUR/JPY pair has sensed barricades while extending its rally above the immediate resistance of 142.00 in the early Asian session. The cross is expected to continue its upside momentum as the European Central Bank (ECB) would continue to hike its interest rates further as the Eurozone inflation looks persistent and would take plenty of time in declining to near the targeted level.

ECB President Christine Lagarde confirmed that wage pressures are keeping Eurozone Consumer Price Index (CPI) at elevated levels while responding to questions from the press after the monetary policy announcement.

The street was mixed for the ECB’s interest rate decision as the debacle of Credit Suisse, the second-largest Swiss banking firm, alarmed fears of banking turmoil. There is no denying the fact that the announcement of the interest rate decision by the central banks is executed by commercial banks and instability in the latter could create troubles in managing the monetary policy.

Reuters reported on Thursday that European Central Bank (ECB) policymakers agreed to go ahead with a 50 basis points increase in key rates after the Swiss National Bank (SNB) "threw a lifeline" to Credit Suisse. Also, ECB's policy debate was between a 50 basis points hike or leaving rates unchanged. There was no discussion of a 25 bps hike.

For further guidance, analysts at Rabobank see two more hikes of 25bp. Persistent unrest in financial markets is the main downside risk, but if this fades, inflation persistence could still require higher rates.”

On the Japanese Yen front, Bank of Japan (BoJ) policymakers and Japanese officials are pulling their socks to provide a cushion to inflation to remain steady above the 2% target. Japan’s PM Fumio Kishida said this week that they are aiming to raise minimum wages beyond JPY¥1,000 nationwide. Superlative wage gains are going to add effectively to the upside filters for the inflationary pressures as households will be equipped with more funds for disposal.

- The three major indices, the S&P 500, the Nasdaq, and the Dow Jones, finished the day with gains.

- Finance authorities and US banks providing aid to First Republic Bank improved the market sentiment.

- US Initial Jobless Claims rose less than expected, making the labor market tight.

- Money market futures are expecting a 25 bps rate hike by the Fed.

Wall Street finished Thursday’s session with gains after the financial markets turmoil spurred by the collapse of two US regional banks and the Credit Suisse liquidity crisis. However, US banks stepped in and gave $30 billion to First Republic Bank, while Swiss authorities endorsed Credit Suisse.

On Thursday, the S&P 500 gained 1.76%, at 3960.28, and the heavy-tech Nasdaq 100 rose 2.48% at 11,717.28. The Dow Jones Industrial Average registered gains of 1.17%.

During the week, turbulence in the global financial markets reminded us of the Global Financial Crisis in the 2000s. That triggered volatility amongst the different asset classes, with safe-haven assets like Gold, Silver, and US Treasuries, amongst others, being the gainers.

Therefore, US Treasury bond yields collapsed, with them, the greenback. The US Dollar Index closed at 104.203, down 0.29%, undermined by the fall of the 10-year bond yield. The US 10-year benchmark note rate is 3.579%, down 0.11%.

Sector-wise, Technology, Communication Services, and Financials were the pack’s leaders, up 2.82%, 2.77%, and 1.95%, respectively. The laggards were Consumer Staples and Real Estate, each down 0.06% and 0.07%.

The Bureau of Labor Statistics (BLS) revealed that unemployment claims for the week ending on March 12 increased by 192K, beneath estimates of 205K, lower than the previous week’s 212K. At the same time, housing data like Building Permits and Housing Starts came above estimates, and the Philadelphia Fed revealed that manufacturing activity contracted at a slower rate in March.

In the meantime, expectations for a 25 bps rate hike by the Federal Reserve (Fed) shifted up. The CME FedWatch Tool odds for a 25 bps hike lie at 79.7% to the 4.75% - 5.00% range.

What to watch?

The US calendar will feature Industrial Production for February in monthly and annual readings. The MoM figures are estimated at 0.2%, above January’s 0%. In addition, the University of Michigan (UoM) Consumer Sentiment poll will update American sentiment regarding the economy and revise inflation expectations.

S&P 500 Daily chart

Global rating agency S&P crossed wires via Reuters during late Thursday, amid concerns about the health of the US financial markets. The major rating agency initially confirmed the US 'Aa+/A-1+' sovereign ratings before unveiling the stable outlook.

Additional comments

US ratings constrained by a high general government debt burden, reflecting substantial annual increases in general government's net debt.

Outlook remains stable, indicating expectation of continued resilience in the US economy.

View that us congress will resolve debt ceiling impasse in a timely manner.

Stable outlook reflects US institutional checks & balances, strong rule of law, free flow of information.

US fed has reacted swiftly amid recent problems in some segments of the US banking sector.

Expect the US Fed to navigate the challenges of lowering domestic inflation and addressing financial market vulnerabilities.

Expect that congress will not pass major fiscal legislation aimed at curtailing the fiscal deficit before the 2024 national elections.

Expect consumer price inflation to exceed 4% in 2023 and decline toward 2% over the next couple of years.

Extraordinary monetary flexibility is key to the sovereign rating

Expect GDP growth to decelerate below 1% in 2023 and average 1.6% in the next three years (or 1.3% on a per capita basis).

Expect the US economy to grow close to 2% in the next two to three years following a slowdown in 2023.

Market implications

The news adds to the list of recent catalysts that favored risk-on mood. However, the immediate reaction to the headlines appears muted.

Also read: Forex Today: Unexpected consolidation, DXY drops as risk sentiment improves

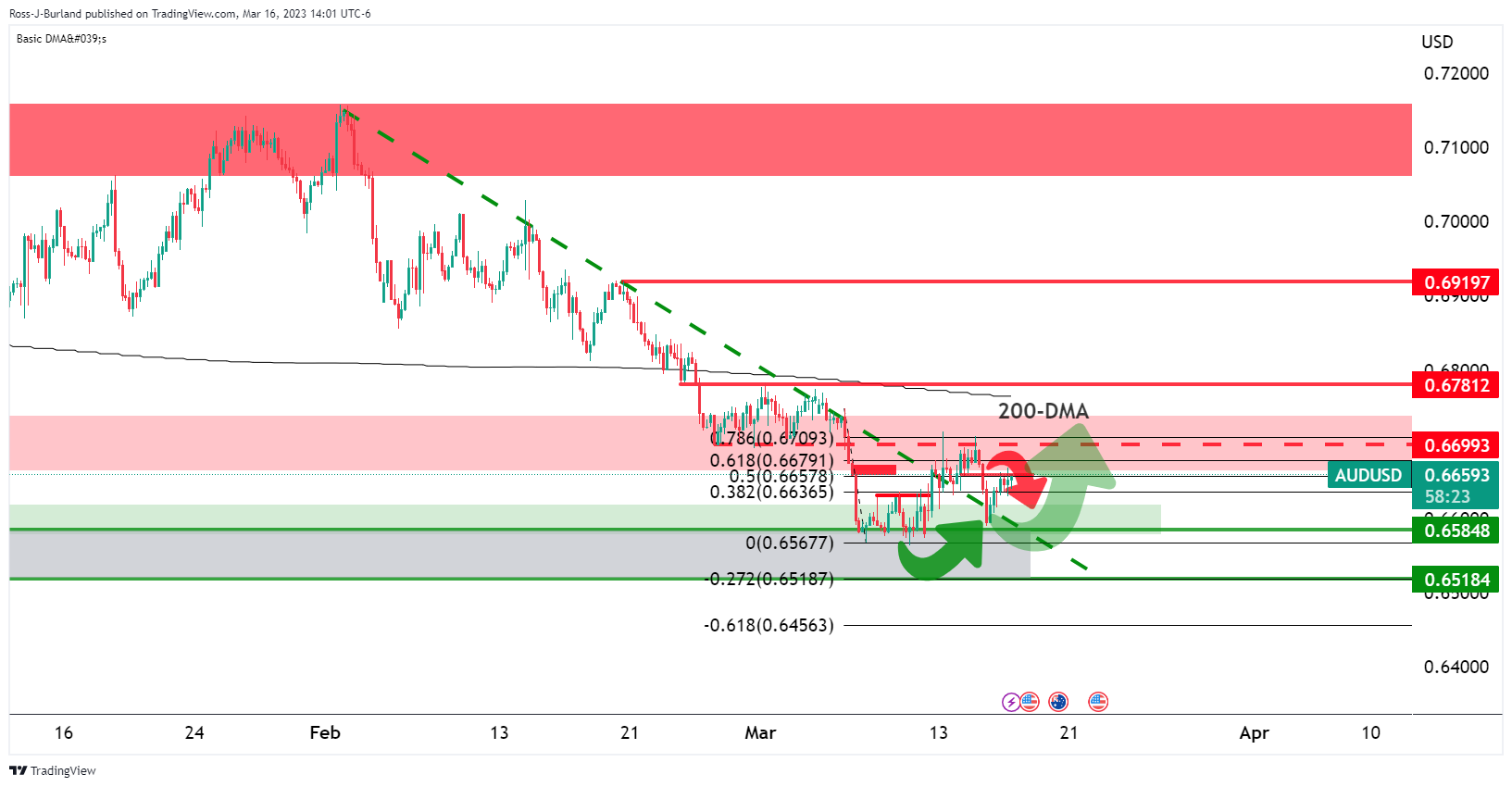

- AUD/USD remains sidelined after Aussie data, risk-on mood favor bulls to eye the biggest weekly gains since late January.

- Global policymakers, banks try their hands to placate fears of financial crisis but traders seem less-convinced, despite latest optimism.

- Yields bounce off multi-day low, equities improve but weekly performance suggests market’s indecision.

- Final clues for next week’s FOMC eyed to confirm 25 bps rate hike.

AUD/USD treads water around 0.6650, after the previous day’s upbeat performance, as bulls brace for the biggest weekly gain in seven heading into the next week’s Federal Open Market Committee (FOMC) monetary policy meeting. It should be noted that the upbeat Aussie data and improvement in the market sentiment favored the risk-barometer pair even as the latest moves seem to portray traders’ cautious mood amid a light calendar at home.

Global policymakers and banks rushed to tame the banking industry fallout and favored the market sentiment the previous day. However, the investors aren’t all in and remain cautious as some of the latest market performance resembles the 2008 financial crisis.

That said, comments from Saudi National Bank's Chairman, Ammar Al Khudairy, conveying the “sound” conditions of Credit Suisse join the major US banks’ efforts to help California-based First Republic Bank to avoid a liquidity crunch to favor the risk-on mood. On the same line was the news that Credit Suisse eyes borrowing up to CHF50 billion from the Swiss National Bank (SNB) to strengthen liquidity, as well as Reuters quoting anonymous sources to confirm that the US banks are less vulnerable to the Credit Suisse debacle. Furthermore, US Treasury Secretary Janet Yellen’s assurance over the US banking industry’s health and European Central Bank’s (ECB) 50 bps rate hike, matching expectations, also favored the sentiment and allowed the latest run-up in the AUD/USD prices.

Elsewhere, US Weekly Initial Jobless Claims dropped to 192K for the week ended on March 10 versus 205K expected and 212K prior whereas the four-week average figure dropped to 196.5K versus 197.25K prior (revised). Further, Housing Starts jumped to 1.45M in February from 1.321M previous reading and 1.31M analysts’ estimations while the Housing Starts jumped to 1.524M during the said month versus 1.34M expected and 1.339M prior. Additionally, the Philadelphia Fed Manufacturing Survey gauge came in as -23.2 compared to -14.5 consensus and -24.3 prior.

At home, Australia’s headline Employment Change jumps by 64.6K versus 48.5K expected and 11.5K prior while the Unemployment Rate also dropped to 3.5% from 3.7% previous readings and 3.6% expected. Furthermore, Australia’s Consumer Inflation Expectations eased to 5.0% for March versus 5.4% market forecasts and 5.1% prior.

Amid these plays, United States 10-year and two-year Treasury bond yields are down for the second consecutive week despite the previous day’s rebound from the multi-day low. Further, Wall Street closed in the green with more than 1.0% gains by each of the benchmark indices whereas US Dollar Index (DXY) marked a negative daily closing. It’s worth mentioning that the Fed fund futures recently bolster the case of the US central bank’s 0.25% rate hike in the next week’s monetary policy meeting.

Moving on, the Michigan Consumer Sentiment Index for March and the UoM 5-year Inflation Expectation for clear directions are the final clues for the next week’s Fed meeting.

Technical analysis

A two-week-old symmetrical triangle restricts immediate AUD/USD moves between 0.6700 and 0.6600 at the latest.

- EUR/USD is showing a sideways performance above 1.0600 as investors are shifting their focus toward Fed policy.

- An interest rate hike of 50 bps by the ECB has trimmed the Fed-ECB policy divergence.

- S&P500 futures showed a rampant recovery after battered banks received support.

The EUR/USD pair is defending its auction above the round-level resistance of 1.0600 in the early Tokyo session. The major currency pair is looking to hold a bullish bias as the interest rate decision of 50 basis points (bps) rate hike by the European Central Bank (ECB) has trimmed the Federal Reserve (Fed)-ECB policy divergence.

On Thursday, ECB President Christine Laragde pushed interest rates to 3.50% despite discouraging headlines about banking turmoil. ECB Lagarde preferred to maintain its entire focus on the Eurozone inflation, which is extremely stubborn, and hawkish monetary policy is not showing any meaningful improvement in the battle against the former.

Also, the announcement of a fresh infusion of 50bln Swiss Francs into Credit Suisse promised by the Swiss National Bank (SNB) supported the ECB to go for a bigger rate hike.

Support from various financial institutions for the First Republic Bank after an infusion of fresh life into Credit Suisse by the SNB indicated that the mass banking crisis could be avoided. This infused a sense of optimism in investors and risk-perceived assets was heavily bought. S&P500 futures showed a rampant recovery and settled Thursday’s session with bumper gains.

Meanwhile, demand for US government bonds trimmed as investors channelized funds into US equities. The alpha offered on the 10-year US Treasury yields scaled to 3.58%.

The US Dollar Index (DXY) is displaying a sideways performance as investors are shifting their focus toward the monetary policy decision by the Fed, which will be announced next week. As per the CME FedWatch tool, the odds for a 25 basis point (bps) interest rate hike by Fed chair Jerome Powell have scaled to near 80%.

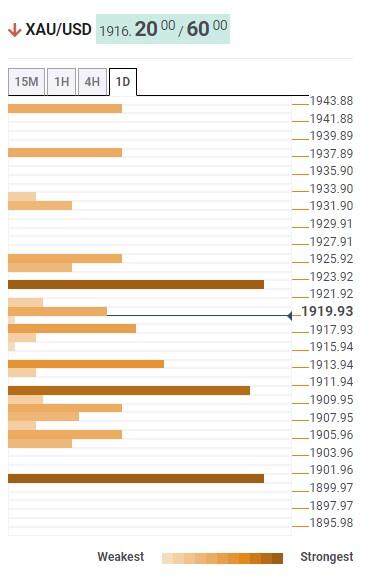

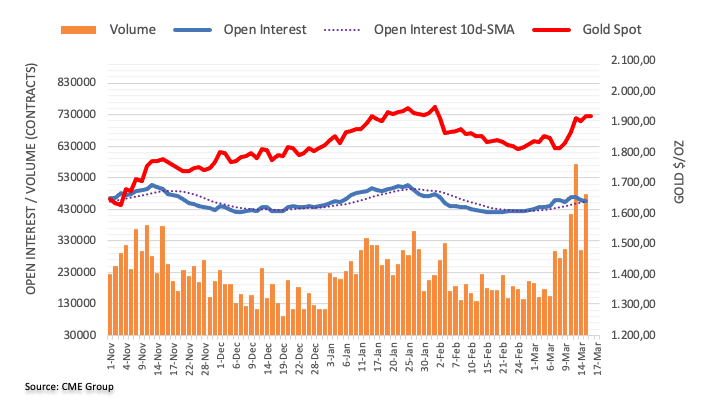

- Gold price eyes the biggest weekly gains in two months despite easing from 1.5-month high of late.

- XAU/USD bulls cheer softer United States 10-year, two-year Treasury bond yields, improved market sentiment.

- Mixed US data, market’s lack of confidence probe the Gold price buyers of late.

- XAU/USD traders eye Michigan Consumer Sentiment Index, inflation precursor ahead of next week’s Federal Reserve monetary policy meeting.

Gold price (XAU/USD) dribbles around $1,920, after a zigzag session that initially refreshed the six-week high but ended the day without any major moves. That said, the Gold price earlier cheered the softer United States Treasury bond yields before the improvement in market sentiment and a rebound in the bond coupons probed the XAU/USD bulls. Also likely to have probed the Gold buyers could be the cautious mood ahead of next week’s Federal Open Market Committee (FOMC) monetary policy meeting. It’s worth noting, however, that the US bond coupons are down for the second consecutive week and hence allow the bullion to remain firmer on a weekly basis.

Gold price contradicts United States Treasury bond yields

Gold price recently eased from the multi-day high as the United States Treasury bond yields bounced off the latest troughs as the market sentiment improves and traders gear up for the next week’s Federal Reserve (Fed) meeting. Even so, the second consecutive weekly loss for the benchmark bond coupons allows the XAU/USD to brace for a three-week uptrend, as well as the biggest weekly gain since early January.

That said, United States 10-year and two-year Treasury bond yields are down for the second consecutive week despite the previous day’s rebound from the multi-day low. It should be noted that the US 10-year Treasury bond yields bounced off a six-week low to end Thursday’s North American trading session around 3.58% while the two-year counterpart recovered from the lowest level since mid-September 2022 to 4.17% at the latest.

It’s worth noting that the recent shrinking in the US 10-year and two-year Treasury bond yields inversion seems to help the Gold buyers.

Jittery markets, mixed US data also please XAU/USD bulls

Gold price pullback could be linked to the latest actions from global policymakers and banks to tame the banking industry fallout. However, the investors aren’t all in and remain cautious as some of the latest market performance resembles the 2008 financial crisis. Apart from the sentiment, the mixed United States data also probe the Gold buyers but allow the XAU/USD to remain firmer amid receding hopes of higher Federal Reserve (Fed) rates.

On Wednesday, Saudi National Bank, the largest shareholder of Credit Suisse Group AG, ruled out another call for additional liquidity and triggered the financial market rout as Credit Suisse is a G-SIB – a global systemically important bank and the drama erupts after the latest fallouts of the US banks, namely Silicon Valley Bank (SVB) and Signature Bank.

However, comments from Saudi National Bank's Chairman, Ammar Al Khudairy, shared by Bloomberg, eased the market’s pain as the bank leader mentioned Credit Suisse Group AG isn’t likely to seek more capital and the bank is generally “sound”. On the same line is the news that major US banks are working with the government to support California-based First Republic Bank to avoid a liquidity crunch.

The news that Credit Suisse eyes borrowing up to CHF50 billion from the Swiss National Bank (SNB) to strengthen liquidity also gained attention while Reuteres’ news that anonymous sources conveyed that the US banks are less vulnerable to the Credit Suisse debacle helped sentiment too. Additionally convincing the markets were comments from US Treasury Secretary Janet Yellen saying, “I can reassure the members of the committee that our banking system remains sound, and that Americans can feel confident that their deposits will be there when they need them."

It should be noted that the European Central Bank’s (ECB) 50 bps rate hike, matching expectations, also favored the sentiment and allowed the latest rebound in the yields, which in turn probed the Gold buyers.

On a different page, US Weekly Initial Jobless Claims dropped to 192K for the week ended on March 10 versus 205K expected and 212K prior whereas the four-week average figure dropped to 196.5K versus 197.25K prior (revised). Further, Housing Starts jumped to 1.45M in February from 1.321M previous reading and 1.31M analysts’ estimations while the Housing Starts jumped to 1.524M during the said month versus 1.34M expected and 1.339M prior. Additionally, the Philadelphia Fed Manufacturing Survey gauge came in as -23.2 compared to -14.5 consensus and -24.3 prior.

It’s worth mentioning that the Fed fund futures recently bolster the case of the US central bank’s 0.25% rate hike in the next week’s monetary policy meeting.

Amid these plays, Wall Street closed in the green with more than 1.0% gains by each of the benchmark indices whereas US Dollar Index (DXY) marked the negative daily closing.

Looking ahead, Gold traders should pay attention to the Michigan Consumer Sentiment Index for March and the UoM 5-year Inflation Expectation for clear directions as these are the final clues for the next week’s Fed meeting.

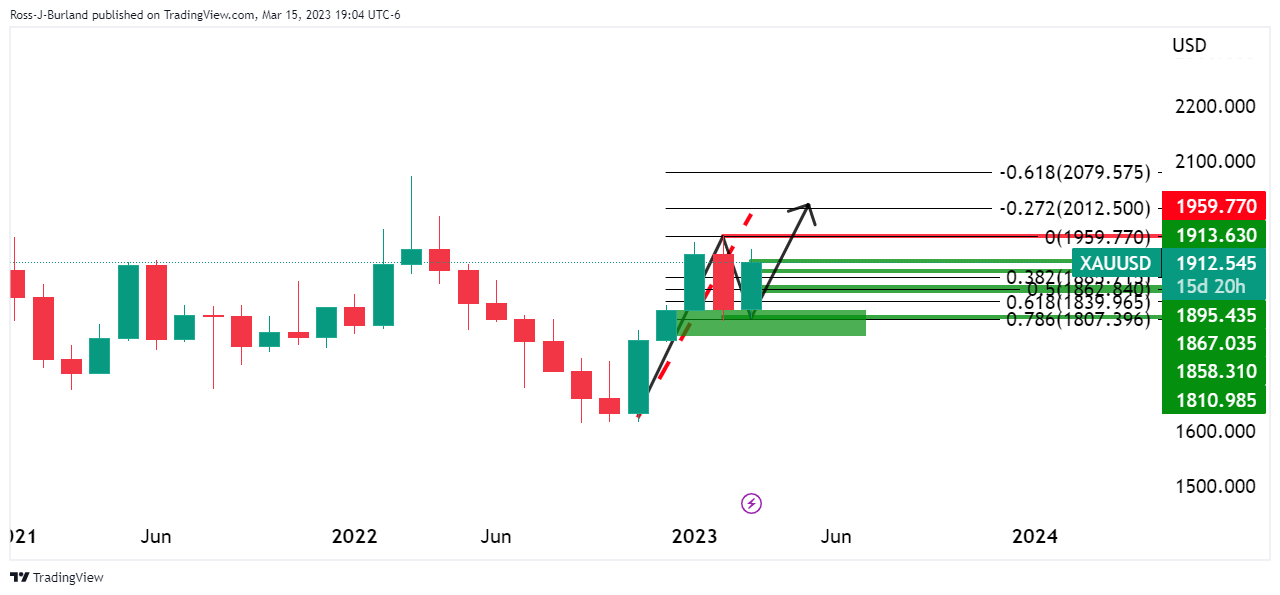

Gold price technical analysis

Gold price portrays a rising wedge bearish chart formation on the four-hour play. Also challenging the XAU/USD bulls is the overbought conditions of the Relative Strength Index (RSI) line, placed at 14, as well as sluggish signals from the Moving Average Convergence and Divergence (MACD) indicator.

With this, the stated wedge’s upper line, currently around $1,945, appears the key hurdle for the Gold price to tackle to avoid chances of a pullback. Even so, the Year-To-Date (YTD) high surrounding $1,960 can act as an extra filter toward the north.

Meanwhile, a downside break of the stated wedge’s support line, close to $1,913 at the latest, could confirm the bearish chart pattern suggesting a theoretical target of $1,790. During the anticipated fall, the 50-bar and 200-bar Simple Moving Averages (SMAs), around $1,866 and $1,858 respectively, will precede the $1,800 threshold to test the Gold bears.

It’s worth noting, however, that the 50-SMA stays well beyond the 200-SMA and portrays a “golden cross” suggesting the metal’s further upside.

Hence, the XAU/USD is likely to grind higher inside the aforementioned bearish chart formation.

Gold price: Four-hour chart

Trend: Limited upside expected

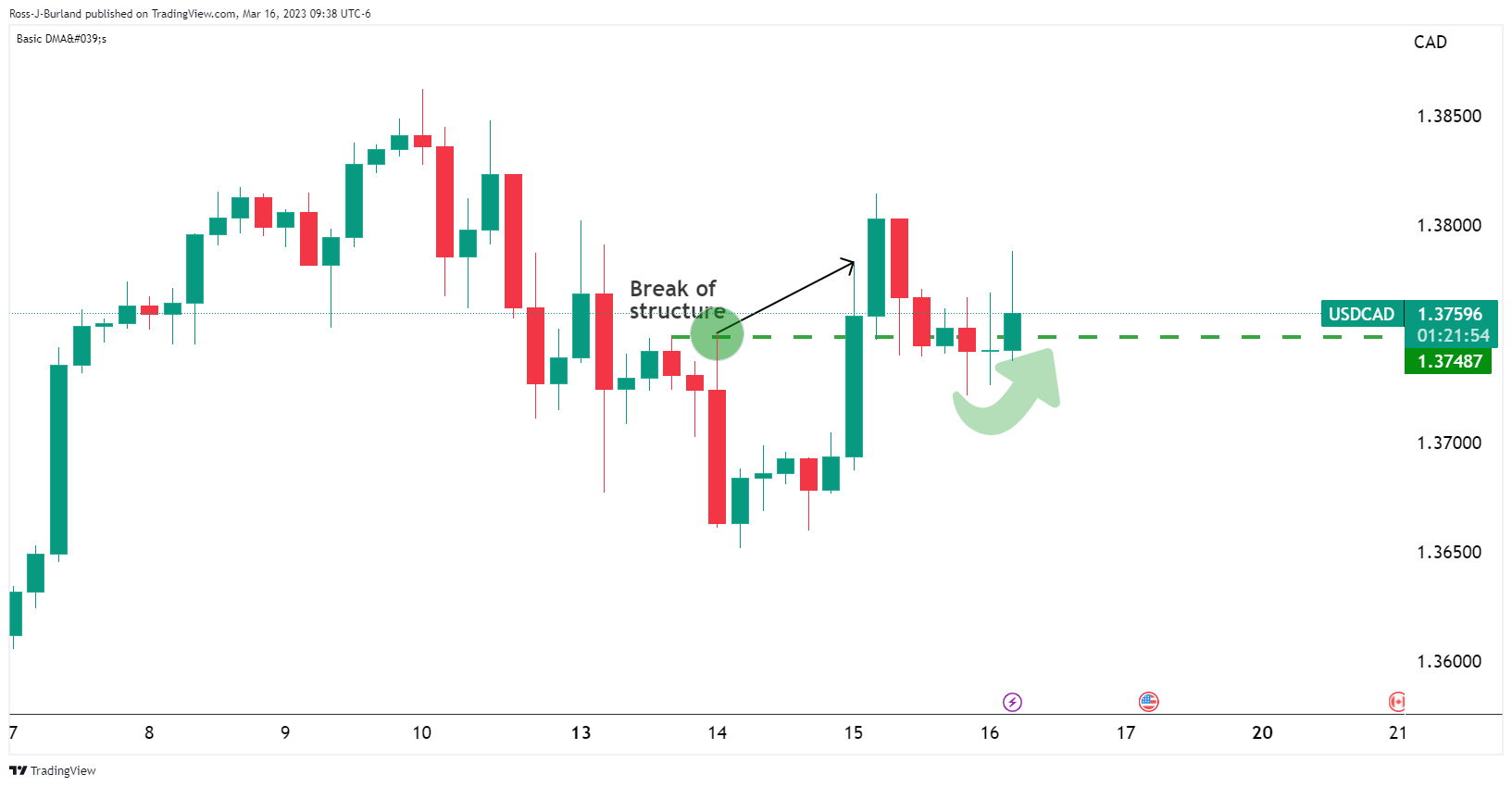

- USD/CAD is demonstrating a sideways auction, following the footprints of the USD Index.

- After the fiasco of SVB, Signature Bank, and Credit Suisse, a US-based First Republic Bank came under scrutiny.

- The demand for US government bonds dropped as investors are now considering an unchanged monetary policy by the Fed.

The USD/CAD pair is displaying a back-and-forth action around 1.3720 in the early Asian session. The Loonie asset has turned sideways after a downside move and is expected to continue further toward the round-level support of 1.3700. The downside bias for the major has built as investors are worried about global banking turmoil, which is stretching day after day.

After the fiasco of Silicon Valley Bank (SVB), Signature Bank, and Credit Suisse, a US-based First Republic Bank has come under scrutiny. As reported by Reuters, financial institutions including JP Morgan Chase & Co and Morgan Stanley, confirmed earlier reports they would deposit up to $30 billion into First Republic Bank's coffers to stabilize the lender.

Although the move would infuse fresh life into the foreign exchange bank, it won’t fade the fact that global banking turmoil is for real and central banks are going to face various problems in executing their monetary policies, which are operated through commercial banks.

S&P500 futures recovered early losses and settled Thursday’s session on a promising note. The demand for US government bonds dropped as investors are now considering an unchanged monetary policy by the Federal Reserve (Fed) as the banking crisis is deepening. Also, the declining trend of the United States Consumer Price Index (CPI) is also supportive. Therefore, the 10-year US Treasury yields have gained to 3.58%.

The US Dollar Index (DXY) remained sideways around 104.40 as the street is mixed about unchanged monetary policy or a 25 basis point (bps) interest rate hike by the Fed next week.

On the oil front, oil price has corrected marginally after a recovery move and an upside extension is expected as the G7 countries are restricting themselves from further sanctions on Russia after setting the price cap at $60/barrel. It is worth noting that Canada is a leading exporter of oil to the US and a recovery in the oil price would support the Canadian Dollar.

- USD/CHF hovers slightly below the 0.9300 figure and remains around the 20-day EMA.

- USD/CHF Price Analysis: Upward biased in the near term, but downside risks remain on a break below the 20-day EMA.

USD/CHF retreats from weekly highs of 0.9340 and meanders between two daily Exponential Moving Averages (EMAs), at around 0.9290s. An improvement in market sentiment, and a soft US Dollar (USD), triggered flows toward the Swiss Franc (CHF), which recovered some ground.

USD/CHF Price action

Following Wednesday’s price action that saw the USD/CHF pair gaining 2%, Thursday’s session turned red. Nevertheless, the USD/CHF stayed nearby the 20/50-day EMAs, each at 0.9288 and 0.9297, respectively. If the USD/CHF cracks the top of the range, that will poise the pair towards 0.9300 and beyond. Once the figure is conquered, the USD/CHF will test the 100-day EMA at 0.9366, followed by the 0.9400 mark. A rally above will lift the USD/CHF toward the 200-day EMA at 0.9435.

In an alternate scenario, the USD/CHF first support will be the 20-day EMA At 0.9288. a breach of the latter and the USD/CHF will dive towards March 16 low at 0.9229 before stumbling to 0.9200.

USD/CHF Daily chart

USD/CHF Technical levels

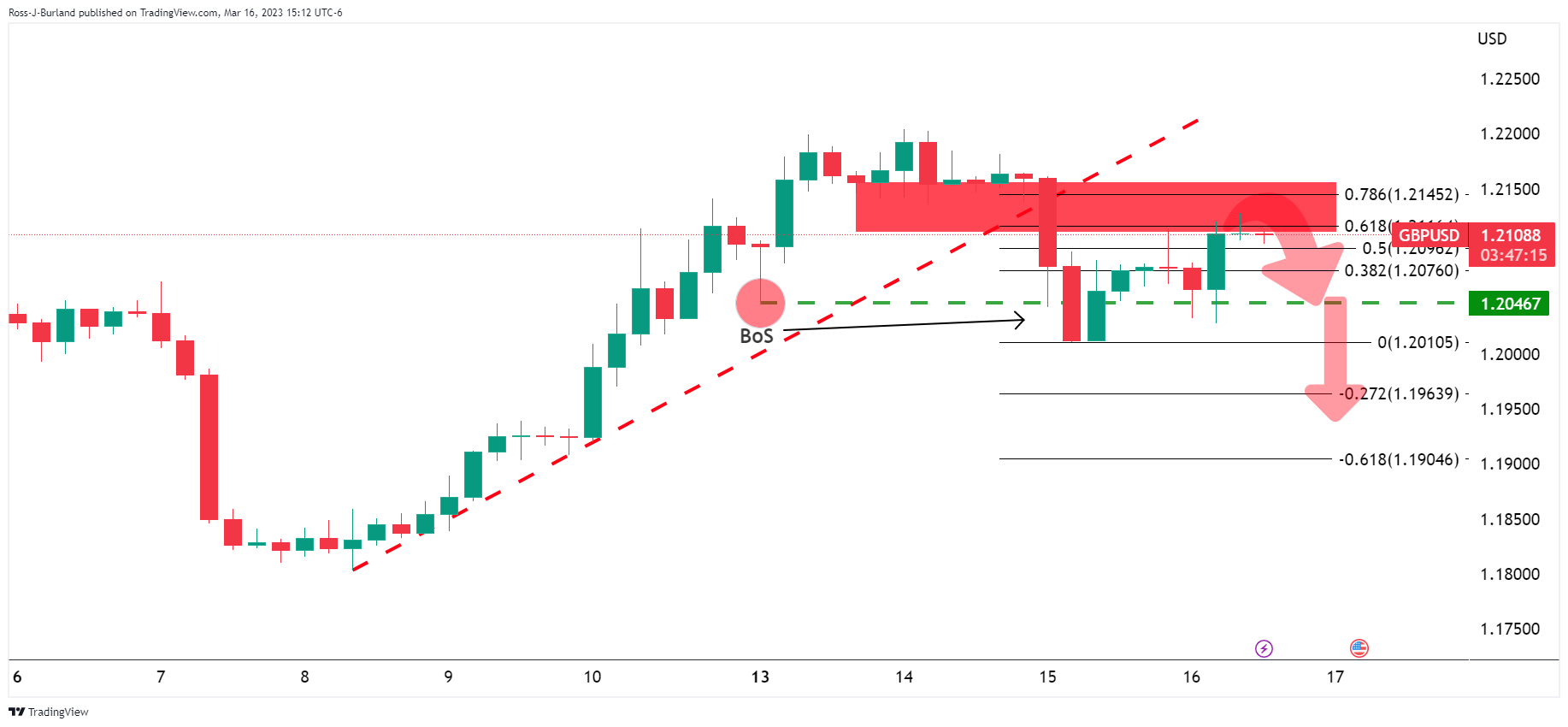

- GBP/USD bears are in the market but bulls coming up for air.

- A break below 1.2050 again will likely seal the deal for the bears.

GBP/USD is meeting resistance near 1.2100 while traders assess the risks associated with the banking system crisis and weigh the prospects of a hawkish Federal Reserve and the Bank of England that both meet next week to decide on their interest rate paths.

From a technical perspective, a multi-timeframe analysis arrives at a bearish bias while GBP/USD remains pressured on the front side of the dominant bear trend.

GBP/USD monthly chart

The break of structure, BoS, on the monthly chart is bearish for the immediate future as the bulls struggle to maintain form, on the correction back into the micro bear trend.

GBP/USD daily chart

The daily chart sees the price trapped between structure and resistance, leaning with a bearish bias again.

GBP/USD H4 chart

The bulls are testing the 1.21s but are on the backside of the prior bullish trend. There was a break of structure below 1.2050 which leaves the prospects also bearish for now.

Here is what you need to know on Friday, March 17:

The stock market stole volatility on Thursday. Wall Street indexes opened in the red to finish in the green with a gain of more than 1%. The Nasdaq led with a rally of 2.48%. Systemic risk fears eased, helping the market’s mood. Contributing to the improvement, 11 of the largest US banks announced a $30 billion deposit into First Republic Bank. The First Republic stock reversed a 36% drop to close the day up 10%.

Regarding US data, the Federal Reserve Bank of Philadelphia's Manufacturing Business Index for current general activity improved in March to -23.2 from -24.3 in February, a reading worse than the -14.5 of market consensus; Initial Jobless Claims pulled back after surging last week; Housing Starts rebounded unexpectedly to 1.45 million, significantly above the 1.31 million of market consensus.

As expected, the European Central Bank raised interest rates by 50 basis points. The words of the monetary policy statement and Lagarde’s were chosen carefully. In the first sentence, the ECB recognized that inflation is projected to remain too high for too long. At the same time, they are “monitoring” recent developments. The reaction in the currency market was limited. The Euro fell modestly following the ECB meeting.

On Friday, the final reading of Eurozone consumer inflation should bring no surprises. Also in the docket are US Industrial Production and the University of Michigan’s Consumers Sentiment report.

It was a quiet American session in the currency market despite what happened in Wall Street. Most of currency majors moved in small ranges. EUR/USD consolidated around 1.0600 while GBP/USD held firm above 1.2100.

Higher government bond yields and risk pushed USD/JPY back above 133.00, with the Japanese Yen flipping across the board.

NZD/USD bottomed at 0.6131 after New Zealand reported weaker-than-expected Q4 GDP numbers; it then rebounded toward 0.6200. On the contrary, Australian employment data boosted the Aussie, sending AUD/USD to 0.6650.

Gold tested recent highs but it pulled back, as yields moved to the upside; XAU/USD remains firm around $1,920/oz. The improvement in market sentiment helped modestly Crude Oil prices; WTI rose 1% to settle above $68.00.

- NZD/USD is subdued, around the 0.6190s ahead of Friday’s US economic data.

- A risk-on impulse spurred the NZD/USD’s bounce from daily lows despite printing bad NZ GDP data.

- NZD/USD Analysis: Short-term is upwards, though a break above 0.6200 will poise the pair towards the 200-DMA.

NZD/USD is about to finish Thursday’s session flat after diving towards a daily low of 0.6139. The European Central Bank (ECB) lifted rates amidst turbulent times. However, news that Swiss authorities backed Credit Suisse and major US banks stepping in to help First Republic Bank eased investors’ fears. Therefore, the NZD/USD recovered and is trading at 0.6191, a gain of 0.06%.

Sentiment improvement, the excuse for NZD buyers to lift the exchange rate

Wall Street finished with gains between 1.12% and 2.48%. Employment data in the United States (US), delivered by the Bureau of Labor Statistics (BLS), showed that unemployment claims for the last week rose by 192K below estimates of 205K, less than the prior week’s 212K. In the meantime, housing data like Building Permits and Housing Starts came above estimates and the prior’s month data.

At the same time, the Philadelphia Fed revealed that manufacturing activity contracted at a slower rate in March.

In the meantime, the US Dollar Index, a measure of the buck’s value against a basket of six currencies, losses 0.30%, at 104.430, a tailwind for the NZD/USD.

Earlier in the Asian session, the New Zealand Dollar (NZD) weakened on the release of the New Zealand (NZ) Gross Domestic Product (GDP) for Q4, which contracted 0.6% QoQ, and below the Reserve Bank of New Zealand (RBNZ) MPS projection of 0.7% expansion.

Analysts at ANZ Bank said, “the record Q4 current account deficit, amid waning appetite for NZGBs, the Kiwi may face headwinds in coming weeks. A Fed hike and/or higher dot plots next week, alongside reduced financial instability, may also see markets become more positive on the USD.”

What to watch?

The NZ economic docket is empty toward the end of the week. In monthly and annual readings, the US calendar wil feature Indutstiral Production for February. The MoM figures are estimated at 0.2%, above January’s 0%. In addition, the University of Michigan (UoM) Consumer Sentiment poll will update American sentiment regarding the economy and revise inflation expectations.

NZD/USD Technical analysis

The NZD/USD 4-hour chart portrays the pair bottomed around the 0.6120 area. On Thursday’s session, the pair’s low was around the S1 daily pivot, used as a springboard, with prices rising towards the confluence of the 20 and 50-Exponential Moving Averages (EMAs) at 0.6183-87. A breach of the 100-EMA at 0.6200 and the NZD/USD might test the 200-EMA in the near term at 0.6239. Otherwise, an NZD/USD fall beneath 0.6139, and the 0.6100 would be up for grabs.

- AUD/USD bulls are testing the bears as failures persist on the downside.

- There are prospects of to test 200 DMA and 0.6780.

At the time of writing, AUD/USD is up 0.6% on the day and has traveled from a low of 0.6606 to a high of 0.6668 so far. While pressured below the 200-DMA, AUD/USD is now trading on the backside of the trendline but is yet to break the 0.6700 key resistance level. Bulls are fending off the bears while keeping them back above 0.6580. The following illustrates the market structure on the 4-hour chart:

AUD/USD H4 charts

There is a price imbalance to the downside, greyed area, but so long as the bulls commit to the 0.6580s then there will be prospects of a move to test 200 DMA and 0.6780 as the accumulation process kicks in.

In a short statement, the Federal Reserve (Fed), the Department of the Treasury, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) announced a massive deposit of 11 banks into the Frist Republic Bank.

Full statement:

“Today, 11 banks announced $30 billion in deposits into First Republic Bank. This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.”

Market reaction

US markets are up on Thursday with the Dow Jones up by more than 1% and the Nasdaq gaining by 2.45%. The support from banks to the Frist Republic Bank was a key factor on today’s rally. Shares of the bank reversed a 36% decline, and near the end of the session, are up by 10%.

- Gold price is making the case for the downside.

- Banking sector jitters ease as authorities come to the rescue.

- The break of the Gold price trendline support is compelling and points to a downside continuation to test key structure of $1,912 to open risk to $1,900.

Gold Price was two-way over the European Central bank interest rate decision but then gave in to the bears that took control and moved towards a key structure area on the hourly chart, $1,912.49 where the lows reached $1,913. The initial reaction to the 50 basis point Refinancing Rate hike was a drop to test $1,926 before returning to $1,930 from where the bears piled in again to take out the bullish trendline support as illustrated below.

Meanwhile, the ECB hiked as follows:

ECB rate hike

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

ECB statement key notes

- Refrains from signalling future rate moves in statement.

- Inflation projected to remain too high for too long.

- Headline inflation expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

- Forecasts done before market turmoil.

- Elevated level of uncertainty reinforces importance of a data-dependent approach to ECB policy decision, which will be determined by its assessment of inflation outlook in light of incoming data and dynamics.

- Banking sector sector is resilient, with strong capital and liquidity positions

- Policy toolkit is fully equipped to provide liquidity support to eurozone financial system if needed.

As a result, markets have now priced the terminal rate at 3% and the Euro was put under pressure.

Banking crisis fears dwindle

Meanwhile, Gold price came under pressure in the main on the back of a pause in safe-haven buying as concerns over the health of Credit Suisse diminished after the institution secured funding from the Swiss National Bank to firm up its liquidity.

Analysts at ANZ Bank explained that ´´mainstream reports in the US that major US banks, working with the government, are in discussions to support California based First Republic Bank, also buoyed sentiment. US regional bank stocks climbed 5.0% and December 2023 fed funds futures sold off more than 40bp.¨´

´´The announcement of a bank funding plan sparked a sell-off in gold prices overnight, with CTA trend followers readjusting their length in response, but we continue to expect prices to remain resilient,´´ ´the analysts at TD Securities explained.

´´Meanwhile, risks that the tightening cycle is coming to an end should also realign discretionary flows with strong physical flows, which could translate into substantial upside,´´ the analysts argued.

Gold price technical analysis

The break of the trendline support is compelling and points to a downside continuation to test key structure of $1,912 to open risk to $1,900.

- USD/JPY is almost flat during the North American session.

- Oscillators remain in bearish territory, but price action signals consolidation.

- USD/JPY Price Analysis: Sellers reclaiming 132.21 would exacerbate a fall toward 127.20s.

USD/JPY rises after dropping to a fresh four-week low at 131.71 but stages a comeback and has reclaimed the 133.00 figure. Nevertheless, a wall of resistance with all the daily Exponential Moving Averages (EMAs) above the exchange rate supports a bearish bias. Hence, the USD/JPY is trading at 133.56, above its opening price by a decent 0.14%.

USD/JPY Price action

The USD/JPY is neutral biased after the 20, 50, 100, and 200-day EMAs intersected at around the 134.05-92 area. However, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), suggest that sellers are in charge. But price action, as the leading indicator, needs sellers to reclaim the February 10 daily low at 129.79, which could open the door for further downside.

For a bearish continuation, the USD/JPY must fall below the March 15 low of 132.21. Once cleared, the 132.00 figure would be for grabs. Seller's next stop would be the February 2 daily low at 128.08, followed by the YTD low at 127.21.

In an alternate scenario, the USD/JPY first resistance would be the 200-day EMA at 134.05. A breach of the latter would expose the 50 and 20-day EMAs, each at 134.13 and 134.59, ahead of testing the 100-day EMA at 134.92. Once broken, the buyers would reclaim 135.00.

USD/JPY Daily chart

USD/JPY Technical levels

The EUR/USD pair remained steady following the decision of the European Central Bank to raise rates by 50 basis points on Thursday. Analysts at Danske Bank see the pair at lower than current levels on a three to six months horizon.

Limited market reaction to the ECB

“Despite the large uncertainty with respect to the rate decision, the reaction in FX markets was remarkably limited. We entered the meeting with a fundamental predisposition of wanting to sell EUR/USD rallies on a 50bp hike but the cross hardly reacted with the FRA curve flattening upon announcement.”

“Looking ahead, systemic risk fears look set to dominate price action among majors. Our bias remains for systemic fears to subside over the coming weeks, but we humbly acknowledge the high sensitivity to negative news, which leaves us side-lined with no high-conviction calls near term. On a 3-6M horizon, we still pencil in a lower EUR/USD compared with current spot levels.”

“We expect the ECB deposit rate to peak at 4%, with a 50bp rate hike in May followed by a 25bp hike in both June and July.”

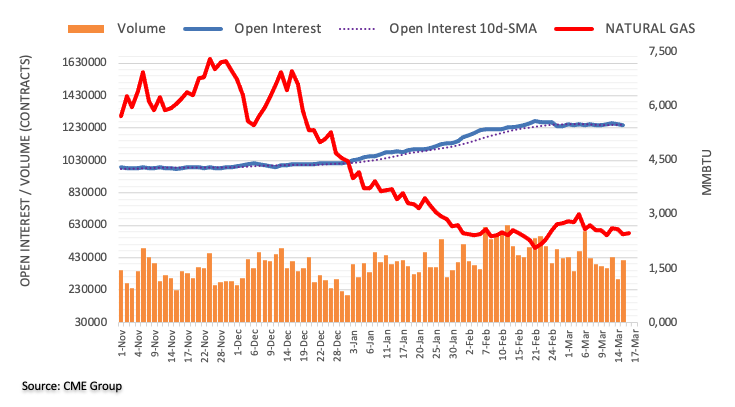

- WTI is recovering from falling 5% on Wednesday due to a risk-off impulse.

- OPEC: The week’s fall is blamed on sentiment shifting sour on turbulence in the financial market.

- The market sentiment improved on Swiss authorities supporting Credit Suisse.

Western Texas Intermediate (WTI), the US crude oil benchmark, gains traction after dropping to a 15-month-low at around 65.72, sponsored by a risk-on impulse. The Wall Street Journal (WSJ) reported that major banks in the US are stepping in to help First Republic Bank, an action cheered by US equities and oil prices. WTI is trading at 68.25, above its opening price by 0.03%.

Saudi Arabia and Russia’s discussion capped WTI’s fall

Additionally to the abovementioned factors, WTI is underpinned by reports that Saudi Arabia and Russia met to discuss enhancing market stability. Saudi’s energy minister Prince Abdulaziz bin Salman and Russian deputy prime minister Alexander Novak met in the Saudi capital to discuss the OPEC+ group’s efforts to maintain market balance.

Delegates from the Organization of Petroleum Exporting Countries (OPEC) and its allies told Reuters that “this week’s slide in oil prices to be driven by financial fears, not any imbalance between demand and supply, and expects the market to stabilize.”

WTI fell due to the turbulence in the financial markets. Swiss authorities backing up Credit Suisse (CS) and US Treasury Secretary Janet Yellen assuring lawmakers that the US banking system remained sound were a tailwind for WTI.

This week, OPEC and the International Energy Agency (IEA) have both predicted an increase in oil demand, but the market is still being affected by concerns about excess supply.

The IEA commented that stockpiles in developed countries hit an 18-month high, while Russian output stayed around familiar levels in February.

WTI Technical levels

- EUR/USD holds in familiar territories after the ECB.

- Markets are calmer after Credit Suisse said it would borrow up to $54 billion from the Swiss National Bank.

- The bias is for a break of the horizontal support of 1.0480 to open prospects of a move to 1.0450.

EUR/USD is higher on the day but hardly making headway after the European Central Bank raised interest rates as planned despite market turmoil and the banking crisis. At the time of writing, EUR/USD is trading at 1.0595 and higher by 0.18% on the day. The pair has traveled between a low of 1.0551 and 1.0635.

The ECB announced a half-percentage point rate hike as promised to curb inflation as follows:

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

All in all, the Governing Council remains highly concerned about inflation, analysts at TD Securities explained, noting the first sentence of the release as being: "Inflation is projected to remain too high for too long".

No LTROs were announced, but the statement shows a willingness to provide liquidity if needed. Moreover, there was no indication in the statement of future policy hikes. Treasury yields rose at the short end, while notes and bonds with maturities of 10 years or more fell after an initial volatile reaction by markets to the ECB decision.

Meanwhile, markets were broadly calmer on Thursday after Credit Suisse said it would borrow up to $54 billion from the Swiss National Bank to shore up liquidity and investor confidence. The bank's shares sank like a stone by 30% on Wednesday.

EUR/USD technical analysis

EUR/USD´s daily chart is meeting the daily support and is capped by daily resistance. While on the backside of the prior bullish trend and resisted below 1.0700, the bias is for a break of the horizontal support of 1.0480 to open prospects of a move to 1.0450 ahead of the 200 DMA.

The hourly chart has seen the price resisted below a 50% mean reversion after piercing the horizontal support. If the bears commit, then a break of the support will put the -272% Fibo in focus near 1.0450.

On Thursday, the European Central Bank raised its key interest rates by 50bps as expected. Analysts at Rabobank see two more rate hikes of 25 bps ahead.

More ground to cover

“Despite the market turmoil, the ECB stuck to the 50bp hike it had flagged beforehand, as inflation is still seen as too high. This reinforces the ECB’s commitment to getting inflation back to target, although we believe that markets are nonetheless underestimating the terminal rate in the wake of the meeting. To the extent that this is driven by financial stability concerns, the ECB made clear that Eurozone banks are resilient. If intervention is nonetheless necessary, it will be done in such a way that it doesn’t conflict with the price stability mandate.”

“Significant uncertainty forced the ECB to fully abandon forward guidance.”

“We maintain our call for two more hikes of 25bp. Persistent unrest in financial markets is the main downside risk, but if this fades, inflation persistence could still require higher rates.”

“President Lagarde made it clear that the inflation fight is not over. Nonetheless, markets are currently only reluctantly pricing higher policy rates again. This muted response was perhaps the best the ECB could hope for at this time. When calm returns to the markets, the Council can gradually fine-tune policy expectations. We maintain our call for two more 25bp hikes.”

- USD/MXN dropped from daily highs above $19.00 as market sentiment improved.

- Data from the United States shows the economy’s resilience despite the ongoing Fed’s aggression.

- Investors are eyeing US Industrial Production, Consumer Sentiment, and next week’s FOMC meeting.

USD/MXN hovers nearby the $19.00 figure on Thursday, with risk aversion taking center stage, amidst a turbulent week, in the global banking system. Investors’ flight to safety weighed on the Mexican Peso (MXN), which is set to finish the week with losses of 0.15% after testing multi-year lows of 17.8967. However, the MXN holds to gains. At the time of writing, the USD/MXN is trading at around 18.90s, below its opening price by 0.23%.

Sentiment improvement a headwind for USD/MXN

Traders’ mood improved on headlines that major banks in the United States (US) stepped in to help the First Republic Bank. The European Central Bank (ECB) lifted rates by 50 bps, stating that inflation remained elevated and did not offer any cues about future monetary policy meetings.

Aside from this, the economic data in the United States (US) revealed that the number of people filing for unemployment benefits, as reported by the US Bureau of Labor Statistics (BLS), decreased to less than 200,000. This indicates that the job market is still tight, warranting further action by the Fed. The number of initial jobless claims increased by 192,000, lower than the 205,000 expected by experts. The housing data, including Housing Starts and Building Permits, also surpassed expectations, indicating that the economy is strong despite the Federal Reserve’s aggressive tightening cycle.

Lately, the Mexican Peso recovered ground vs. the US Dollar (USD), which according to the US Dollar Index, is down 0.33%, at 104.397. As sentiment improved, the USD/MXN fell from 19.7986 to the day’s low of 18.8812.

US Treasury bond yields are edging, with the 10-year Treasury bond yielding up six basis points, at 3.522%. For the upcoming meeting, money market futures odds for a 25 bps lift by the Fed moved from 45.4% to 83.4%.

Also read: USD/MXN rallies sharply above $18.80 on SVB crisis, Fed rates repricing

What to watch?

The US economic calendar will feature Industrial Production, Capacity Utilization, and the University of Michigan (UoM) Consumer Sentiment. Traders are eyeing the following week’s Federal Open Market Committee (FOMC) monetary policy decision.

USD/MXN Technical levels

Citing three sources familiar with the matter, Reuters reported on Thursday that European Central Bank (ECB) policymakers agreed to go ahead with a 50 basis points increase in key rates after the Swiss National Bank (SNB) "threw a lifeline" to Credit Suisse.

Reuters further noted that the ECB's policy debate was between a 50 basis points hike or leaving rates unchanged. There was no discussion of a 25 bps hike.

Market reaction

EUR/USD gained traction on this headline and was last seen rising 0.45% on the day at 1.0622.

The outlook for the Gold price is currently highly uncertain. he further development of the precious metal depends heavily on whether and how quickly the market turmoil subsides and the Fed is able to raise its interest rates further, economists at Commerzbank report.

Gold would likely give up its recent gains if market mood improves

“If further bankruptcies follow or if the market increasingly prices in the risk of contagion effects, interest rate expectations could fall further and the Gold price could, in turn, receive further tailwind as a result.”

“We had previously assumed a Gold price of $1,950 at the end of the year, as we had expected that the market would only increasingly bet on a turnaround of interest rates in the second half of the year. This has now occurred much earlier due to the turmoil in the banking sector. Thus, if these continue, XAU/USD should reach our year-end forecast already in the near future.”

“If fears can be allayed, this could allow the Fed to raise interest rates further in order to curb inflation, which remains too high. In this case, Gold would likely give up its recent gains.”

“For the second half of the year, we would continue to expect Gold to recover even in this scenario, as the aggressive interest rate hikes should then start to be felt in the real economy. The market's focus would subsequently turn to possible interest rate cuts, which should make Gold look more attractive again in relative terms.”

- USD/CAD bulls are attempting to break H1 resistance.

- H4 charts are bullish while above support.

USD/CAD is building a bullish case across the time frames and the following illustrates this on the 4-hour and 1-hour chartsÑ

USD/CAD H4 chart

We have the price climbing along a dynamic support line and breaking structure on the front side of the trend following a pullback. This could be the makings for a bullish extension.

Support around the prior structure sees the price stabilizing in the W-formations retest as illustrated above.

USD/CAD H1 chart

Bulls need to break the current resistance. On a restest of this area, which would be expected to act as a support. the thesis is that there will be prospects of further demand there to take the pair higher and test prior highs.

- Silver price dropped sharply recently, following solid US jobs and housing data.

- The ECB surprised the markets with a 50 bps hike; the following meetings are live.

- XAG/USD Price Analysis: To remain downward biased, below $21.80.

Silver price fluctuates between gains and losses after hitting a daily high of $22.08, erasing some of its earlier gains. The European Central Bank (ECB) surprised the markets with a 50 bps lift, amidst a turmoil period in the financial markets, with Credit Suisse (CS) at the brisk of defaulting. At the time of writing, the XAG/USD exchanges hands at $21.54.

Unemployment claims in the US dropped, warranting further action by the Fed

Sentiment remains fragile, with most global equities dropping except the Nasdaq 100. The European Central Bank (ECB) raised rates by 50 basis points (bps) and stated that inflation remains too high. However, the statement did not provide forward guidance regarding future monetary policy decisions.

The US economic docket revealed that unemployment claims, reported by the US Bureau of Labor Statistics (BLS), eased below the 200K mark, a sign of the labor market tightness. Initial Jobless Claims rose by 192K vs. 205K, estimated by market participants. At the same time, housing data, led by Housing Starts and Building Permits, exceeded estimates, showing the economy’s resilience despite Fed’s aggressive tightening cycle.

The greenback remains under pressure, as shown by the US Dollar Index (DXY), down 0.26% at 104.478. US Treasury bond yields are recovering some ground, with 2s up 13 bps at 4.019%. On the contrary, the 10-year benchmark note rate is 3.432%, down two bps, a tailwind for XAG/USD.

What to watch?

The US economic calendar will feature Industrial Production, Capacity Utilization, and the University of Michigan (UoM) Consumer sentiment.

XAG/USD Technical analysis

The XAG/USD reached for two straight days the $22.00 mark but failing to hold to gains showed sellers’ commitment to keeping the price below the figure. Why? Because after the two attempts, the XAG/USD dropped below the confluence of daily Exponential Moving Averages (EMAs), particularly the 200-day at $21.78. therefore the path of least resistance is downwards. The XAG/USD first support would be $21.50, followed by the 20-day EMA at $21.29, and then the figure at $21. Alternatively, a daily close above $22.00 could pave the way for further upside.

The ECB hiked rates by 50 bps. Economists at Nordea think the ECB remains worried about the inflation picture and will continue hiking in the upcoming meetings.

Finally truly driven by incoming data

“The ECB hiked rates by 50 bps despite ongoing market turbulence. The uncertain market situation led to the ECB not giving any signals about the future – the central bank is finally truly in a data-dependent mode.”

“We think the ECB will continue hiking rates in upcoming meetings, likely favouring 25 bps steps going forward.”

- GBP/USD holds firm in a correction following ECB.

- Bears are lurking near a 61.8% Fibo on the 4-hour chart.

GBP/USD is taking on hourly resistance in the aftermath of the European Central Bank interest rate decision and press conference. The ECB went ahead with a half-point rate hike on Thursday. Prior to the decision, market participants wondered if the Governing Council might balk. Nevertheless, the Euro sank and the US Dollar stabilized which is a weight for GBP. At the time of writing, GBP/USD is trading 0.28% higher on the day and has traveled between a low of 1.2026 and 1.2112 so far.

In the face of recent banking sector turmoil, including and especially Credit Suisse's worst day yesterday after its shares on Wednesday plunged as much as 30%, the ECB went ahead and raised interest rates as follows;

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

The bottom line here is that the Governing Council remains highly concerned about inflation, analysts at TD Securities explained, noting the first sentence of the release as being: "Inflation is projected to remain too high for too long".

No LTROs were announced, but the statement shows a willingness to provide liquidity if needed. Moreover, there was no indication in the statement of future policy hikes.

In the presser, the governor Christine Lagarde said the bank remains committed to the 2% inflation target and that they are not seeing a lot of improvement in underlying inflation.

ECB statement key notes

- Refrains from signalling future rate moves in statement.

- Inflation projected to remain too high for too long.

- Headline inflation expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

- Forecasts done before market turmoil.

- Elevated level of uncertainty reinforces importance of a data-dependent approach to ECB policy decision, which will be determined by its assessment of inflation outlook in light of incoming data and dynamics.

- Banking sector sector is resilient, with strong capital and liquidity positions

- Policy toolkit is fully equipped to provide liquidity support to eurozone financial system if needed.

GBP/USD technical analysis

The break below the 50-day moving average is bearish:

H4 chart

´´We see room for the USD to reverse this week’s losses and would look for a move back to GBP/USD1.19 on a 1-month view,´´ analysts at Rabobank said.

According to the Wall Street Journal, JPMorgan, Morgan Stanley and other banks are “discussing a potential deal with First Republic that could include a sizable capital infusion to shore up the beleaguered lender, people familiar with the matter said.”

Market reaction

First Republic shares are falling 23% on Thursday at $24.00, after rebounding from $21.00 following the WSJ report.

After opening with losses, Wall Street indexes turned positive during the last hour. The Nasdaq is up 0.90% and the Dow Jones rises by 0.16%.

The Indonesian Rupiah is down 0.7% against the US Dollar this month, the biggest decliner among major Asia FX. Nevertheless, economists at TD Securities remain constructive on IDR.

Holding jets before going short USD/IDR

“BI is not sounding overly concerned on FX now, sticking to its stance that it stands ready to intervene to stabilise the currency.”

“We still remain constructive on IDR as real yields are positive across the curve and should support bond inflows, giving a boost to IDR.”

“Amid volatile markets, we will hold our jets before going short USD/IDR.”

- The index maintains the familiar range in the mid-104.00s.

- No meaningful reaction after the ECB hiked rates as promised.

- The Philly Fed index improved marginally to -23.2 in March.

The greenback hovers around the 104.50 region when measured by the USD Index (DXY) amidst the mild rebound in the appetite for the risk complex on Thursday.

USD Index unchanged on data, ECB

The index keeps the trade well below the 105.00 mark against the backdrop of shrinking fears over a potential crisis in the banking system on both sides of the ocean, while the mixed tone in US yields also adds to the lack of traction in the dollar.

In the US calendar, Initial Jobless Claims rose by 192K in the week to March 11, while the Philly Fed Manufacturing Index ticked marginally higher to -23.2 for the current month. From the housing sector, Building Permits rose 13.8% MoM in February (or 1.524M units) and Housing Starts expanded 9.8% MoM, or 1.45M units.

In the meantime, investors’ concerns around the banking system look somewhat alleviated after the Swiss National Bank (SNB) will lend around $54B to Credit Suisse.

What to look for around USD

The index comes under pressure after hitting fresh tops past the 105.00 mark on Wednesday.

The risk aversion derived from banking jitters appears somewhat diminished and supports some selling pressure in the dollar amidst firmer conviction among investors of a 25 bps rate hike by the Federal Reserve at the March 22 meeting.

So far, the index remains under pressure against the backdrop of reinvigorated bets of a Fed’s pivot in the short-term horizon. However, the still elevated inflation and the resilience of the US economy continue to play against that view.

Key events in the US this week: Initial Jobless Claims, Housing Starts, Building Permits, Philly Fed Manufacturing Index (Thursday) – Industrial Production, Flash Michigan Consumer Sentiment, CB Leading Index (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Persistent narrative for a Fed’s tighter-for-longer stance. Terminal rates near 5.5%? Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.17% at 104.56 and the breakdown of 103.48 (monthly low March 13) would open the door to 102.58 (weekly low February 14) and finally 100.82 (2023 low February 2). On the other hand, the next hurdle emerges at 105.88 (2023 high March 8) seconded by 106.64 (200-day SMA) and then 107.19 (weekly high November 30 2022).

Economists at MUFG Bank held a neutral bias for USD/JPY in February. But now, they expect the pair to move downward.

Higher volatility means risk skewed more to the downside

“We must stress that we could quickly see justification for the Fed to do nothing next week. Risks are extremely high at present and the continued to decline of share prices for European banks underlines the risks of this risk event morphing into something greater which would have implications for risk sentiment and likely mean a larger downside move for USD/JPY over the short-term.”

“While the FOMC may well hike this month if conditions stabilise, we believe the collapse of SVB in the US does certainly take out the prospect of the FOMC hiking by 100 bps in total from here. We believe this change in market conditions – that effectively brings the end to Fed tightening sooner – will weigh on USD/JPY going forward.”

“We have a clear bearish bias for the outlook going forward with extraordinarily high levels of volatility very possible.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in March.

Key takeaways

"Not seeing a lot of improvement in underlying inflation."

"Beginning to see transmission of policy through the credit channel."

"Not yet had to decide whether Transmission Protection Instrument (TPI) is needed, but could be the case at some point."

Meanwhile, ECB Vice President Luis de Guindos said that banks in the Eurozone were resilient with a robust liquidity position. De Guindos further argued that higher rates were positive for the margins of the banks and added that the exposure to Credit Suisse was "quite limited."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- EUR/JPY pressured over the ECB event.

- ECB´s Laggard is speaking to the press following the 50 bp rate hike.

EUR/JPY is under pressure, down by some 0.7% as the Euro sells off due to the rate hike by 50bps today by the European Central Bank, taking the deposit rate to 3.00%.

The ECB also highlighted that it will regularly assess how TLTROs are affecting its monetary policy stance. ´´The bottom line here is that the Governing Council remains highly concerned about inflation: the first sentence of the release is "Inflation is projected to remain too high for too long". This does not sound like an ECB that wants to stop hiking rates yet, but the statement does fairly reflect the heightened uncertainty going forward,´´ analysts at TD Securities said.

ECB rate hike

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

ECB statement key notes

- Refrains from signalling future rate moves in statement.

- Inflation projected to remain too high for too long.

- Headline inflation expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

- Forecasts done before market turmoil.

- Elevated level of uncertainty reinforces importance of a data-dependent approach to ECB policy decision, which will be determined by its assessment of inflation outlook in light of incoming data and dynamics.

- Banking sector sector is resilient, with strong capital and liquidity positions

- Policy toolkit is fully equipped to provide liquidity support to eurozone financial system if needed.

Meanwhile, markets are now pricing the terminal rate at 3% and the Euro is under pressure.

Markets are now tuned in to the ECB Governing Council Press Conference:

Watch Live: ECB Governing Council Press Conference

ECB President Christine Lagarde explains the Governing Council's monetary policy decisions and is taking questions from journalists at the Governing Council press conference.

The key here is how the governor is guiding the markets in terms of the path of rate hikes given the lack of substance in the statement.

Lagarde speech: Can exercise creativity in short order if there is a liquidity crisis

Lagarde speech: Wage pressures have strengthened

Lagarde speech: Monitoring market tension closely

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in March.

Key takeaways

"Given uncertainty, better to make a decision that we believe is robust."

"The board proposed no other option, the decision was adopted by a very large majority."

"3-4 didn't support the decision, dissenters wanted more time."

"No tradeoff between price and financial stability."

"We stand ready to provide new facilities if needed."

"Euro liquidity is perfectly addressed."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

- USD/CHF attracts some dip-buying near the 0.9230 area and trims a part of its intraday losses.

- Fears of turmoil in the banking sector lend support to the pair amid a modest USD rebound.

- The risk-off mood could underpin the safe-haven CHF and keep a lid on any meaningful upside.

The USD/CHF pair recovers over 50 pips from the daily low and now trades just below the 0.9300 mark during the early North American session, still down around 0.45% for the day.

The Swiss Franc initially reacted positively and forced the USD/CHF pair to reverse a part of the previous day's huge rally after Credit Suisse announced that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to shore up liquidity. The early optimism, however, fades rather quickly as the markets are still trying to determine whether fears of a systemic crisis have been tamed.

Apart from this, a modest US Dollar recovery from the daily low, supported by the mostly upbeat US macro data, assists the USD/CHF pair to attract some buying near the 0.9230-0.9225 region. The US Department of Labor reported that Initial Jobless Claims fell to 192K during the week ended March 10 from 212K previous. Adding to this, the US housing market data also surpassed market estimates.

This, to a larger extent, helps offset the disappointing release of the Philly Fed Manufacturing Index, which came in at -23.2 for the current month against expectations for an improvement to -14.5 from the -24.3 previous. This, along with expectations that the Federal Reserve will deliver at least a 25 bps rate hike next week, acts as a tailwind for the Greenback and lends some support to the USD/CHF pair.

That said, the prevalent risk-off environment - as depicted by an extended downfall in the equity markets - could underpin the safe-haven CHF and keep a lid on any meaningful upside for the USD/CHF pair, at least for the time being. Hence, it will be prudent to wait for strong follow-through buying before positioning for an extension of this week's solid rebound from the lowest level since early January.

Technical levels to watch

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in March.

Key takeaways

"We have seen further slowdown in loan growth to households."

"Impossible to determine what the rate path will be."

"Banking sector is currently in a much stronger position than 2008."

"We can exercise creativity in short order if there is a liquidity crisis but this is not what we are seeing."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

As the end of the Fed's hiking cycle gets closer, the Dollar becomes more vulnerable, Kit Juckes, Head of FX Strategy at Société Générale report.

Getting close to Fed easing cycle

“I might need another holiday sooner than planned, but f I'm patient, I should be able to go to the US and enjoy a cheaper Dollar.”

“Fed tightening has seen two-year yields rise above both the last cyclical peak and the one before that. That's the root cause of volatility, which brings peak rates a lot closer. And while the Dollar sometimes peaks before rates, sometimes after the downtrend has started, the downcycle in rates usually sends the Dollar lower too.”

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in March.

Key takeaways

"Underlying price pressures remain strong."

"Services inflation is driven by past energy increases."

"Wage pressures have strengthened."

"Most meansures of long term inflation expectations stand around 2%."

"These warrant continued monitoring in light of recent volatility."

"Risks to growth outlook tilted to downside."

About ECB's press conference

Following the ECB´s monetary policy decisions, the ECB President delivers a prepared statement and responds to questions from the press on the policy outlook. Her comments may influence the volatility of EUR and determine a short-term positive or negative trend. Her hawkish view is considered as positive, or bullish for the EUR, whereas her dovish view is considered as negative, or bearish.

Christine Lagarde, President of the European Central Bank (ECB), is delivering her remarks on the policy outlook and responding to questions from the press following the Governing Council's decision to hike key rates by 50 basis points in March.

Key takeaways

"We are monitoring market tension closely."

"Our policy toolkit is fully equipped to provide liquidity support."

"ECB forecasts were finalized in early March."

"Economy looks set to recover over coming quarters."

"Industrial production should pick up as supply conditions improve further."

"Labour market remains strong."

About ECB's press conference