- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-03-2023

- USD/CHF consolidates as Swiss Franc stabilizes post-UBS and Credit Suisse merger.

- Anticipation builds for Federal Reserve: 25 bps hike or pause.

- Adversity is likely to remain amid the unfolding banking crisis.

USD/CHF has entered a consolidation phase this week, with the Swiss Franc finding some stability following the merger of UBS and Credit Suisse. After Credit Suisse defaulted amid a liquidity crunch, Swiss authorities intervened and facilitated the UBS takeover of the troubled bank.

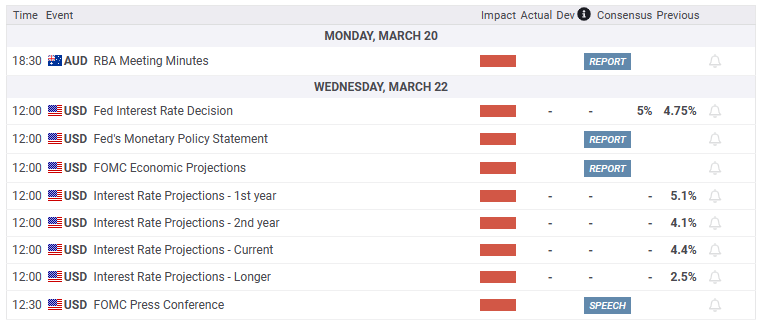

Attention has now shifted to the upcoming Federal Reserve (Fed) policy decision on Wednesday. Investors are divided on whether the Fed will deliver a 25 basis point (bps) rate hike at the forthcoming FOMC meeting or not.

It is noteworthy that the Fed has recently opened its swap line to provide US Dollar liquidity to all central banks in need. Additionally, the Fed has been conducting instant lending operations through its discount window, resulting in a spike in the Fed's balance sheet despite ongoing Quantitative Tightening (QT).

These actions appear contradictory, raising rates while injecting liquidity. However, such a scenario is not unprecedented, as the Bank of England (BoE) has demonstrated in the past. Thus, one cannot dismiss the possibility of similar Fed action.

Although the odds favor a 25 bps rate hike from the Fed, it will be crucial to monitor the central bank's assessment of the underlying banking conditions for the US economy, given the recent failures of commercial banks.

Market pricing has fluctuated dramatically over the past 10 days, with investors initially anticipating a larger half-point rate increase before banking stresses emerged, then at one point expecting rates to remain unchanged. Among economists, those predicting a quarter-point rise do not discount the possibility of a pause.

Following the Fed's decision, markets will await the Swiss National Bank's (SNB) policy announcement. In light of the Credit Suisse turmoil, the likelihood of a 50 bps rate hike has diminished.

Levels to watch

- EUR/JPY takes offers to renew intraday low, fades bounce off ascending support line from early August 2022.

- Failure to cross 200-EMA, bearish MACD signals keep sellers hopeful.

- Buyers need validation from three-month-old horizontal resistance to retake control.

EUR/JPY bears appear determined to break the multi-month-old support line as the quote drops to 140.75 as Tokyo opens for trading on Tuesday. The cross-currency pair’s latest weakness could be linked to its failure to cross the 200-Exponential Moving Average (EMA) despite bouncing off an upward-sloping support line from early August 2022.

Not only a retreat from the 200-EMA but the bearish MACD signals also keep the EUR/JPY sellers hopeful of breaking the aforementioned key support, around 139.35 by the press time.

Following that, the 61.8% Fibonacci retracement level of the pair’s May-October 2022 upside, near 138.65, can act as an additional filter towards the south.

In a case where the EUR/JPY remains bearish past the key Fibonacci retracement level, also known as the golden ratio, the sellers won’t hesitate to aim for August 2022 low surrounding 133.40.

Meanwhile, the 200-EMA and 38.2% Fibonacci retracement could challenge the EUR/JPY pair’s recovery moves around 141.00 and 142.40.

Should the pair buyers keep the reins past 142.40, the odds of witnessing a run-up towards the three-month-old horizontal resistance area surrounding 143.00 will be crucial to watch for further upside.

EUR/JPY: Daily chart

Trend: Further downside expected

- GBP/JPY has sensed a buying interest around 161.00 as the BoJ has reiterated the need for an easy policy.

- Higher food prices and a shortage of labor have been major drivers for the extremely sticky UK inflation.

- The BoE could continue its interest rates hiking spell by 25 bps ahead.

The GBP/JPY pair has picked strength after defending the crucial support of 161.00 in the early Tokyo session. The cross is looking to extend its gains further above 161.70 as the expectations of an exit from the ultra-loose monetary policy by the Bank of Japan (BoJ) have faded dramatically.

The release of the BoJ Summary of Opinions associated with March’s monetary policy meeting on Monday indicated that board members advocated the need to maintain an ultra-loose monetary policy for now, even as some warned of the need to scrutinize its side effects such as deteriorating market functions, as reported by Reuters.

Going forward, Friday’s Japan inflation data will be keenly watched. As per the estimates, the annual headline Consumer Price Index (CPI) will decline to 4.1% from the former release of 4.3%. And, the core CPI that excludes oil and food prices is expected to jump to 3.4% vs. the prior release of 3.2%. Scrutiny of inflation estimates indicate that the impact of higher energy and food prices is declining, however, the impact of higher import prices is still persistent. Also, recent efforts made by the Japanese administration to increase wages to keep inflation steady at desired levels could have fueled the core CPI.

On the United Kingdom front, investors are awaiting the release of the UK’s inflation, which is scheduled for Wednesday. Higher food prices and a shortage of labor have been major drivers for the extremely sticky UK inflation. No doubt, the UK administration has proposed some measures to push individuals to delay their retirement plans. However, sufficient time will be required for efficient execution.

This week, the major trigger will be the interest rate decision by the Bank of England (BoE), which would unleash sheer volatility for the cross. Analysts at ING Global cite that despite encouraging signs that inflationary pressures are easing, the Bank of England will probably opt for one final 25 basis point (bp) hike on Thursday if it can, though that's undoubtedly contingent on what happens in financial markets. Remember that the BoE has set a much lower bar for pausing hikes than the likes of the Federal Reserve (Fed) and the European Central Bank (ECB).

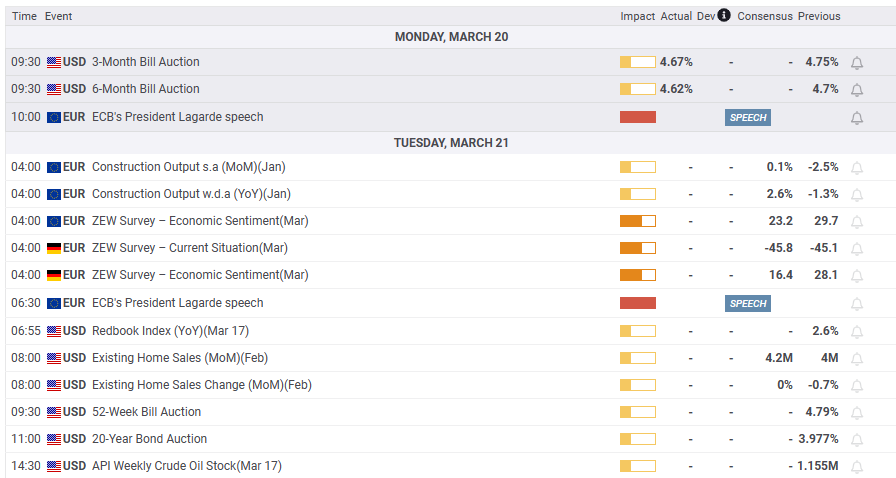

Early Tuesday morning in Asia, at 00:30 GMT, the Reserve Bank of Australia (RBA) will release the minutes of the latest monetary policy meeting held in March.

The Australian central bank teased policy doves by announcing a softer rate hike of 0.25% in its latest meeting, which in turn raised expectations that the pivot is in play. The same could be confirmed from the latest comments of the RBA officials and make it important for the policy hawks to step back.

As a result, today’s RBA Minutes will be closely observed for the details on the latest decision which raised bearish bets on the AUD/USD as it rises of late. Also important inside the Minutes statement, especially for the AUD/USD pair traders, will be the economic outlook and the central bankers’ optimism towards overcoming the recession fears amid the banking sector fallouts.

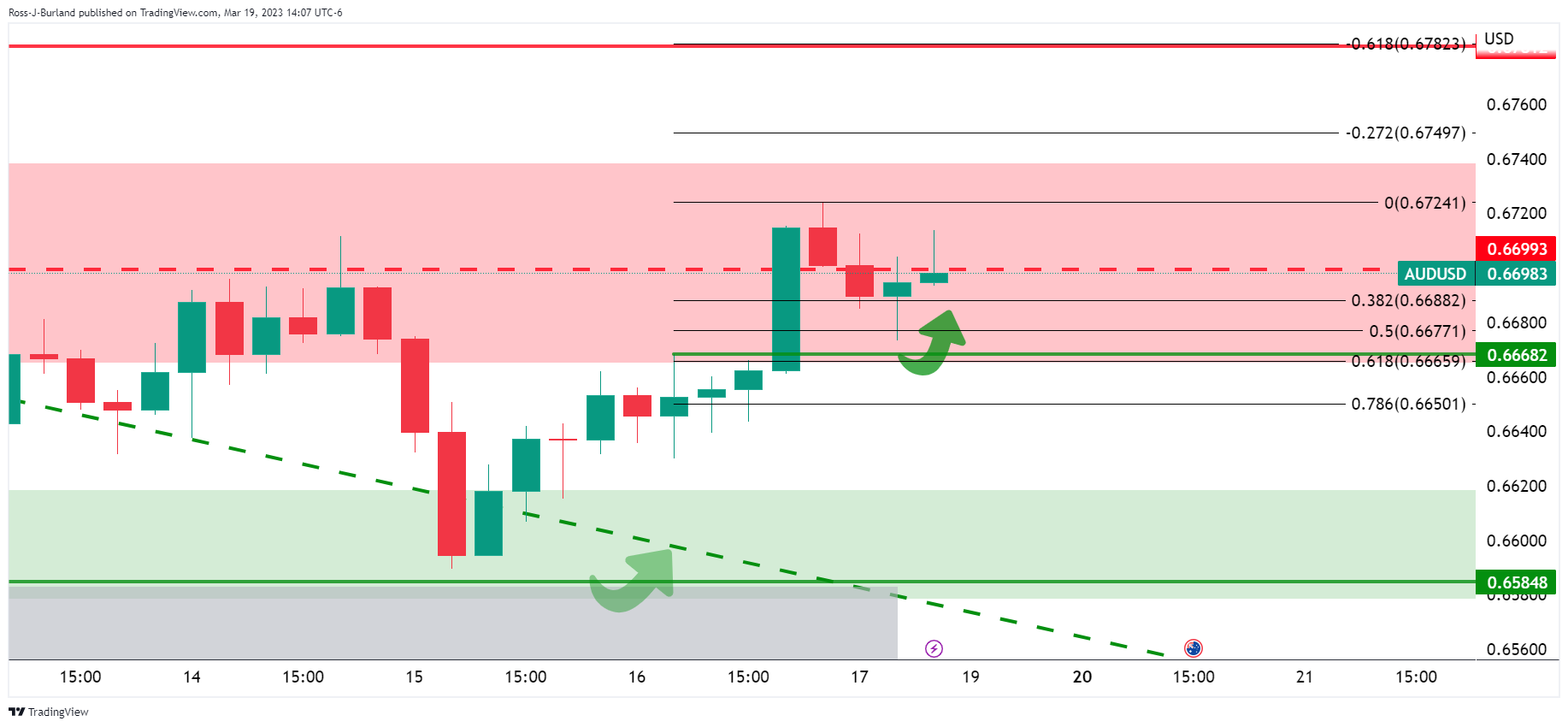

How could the minutes affect AUD/USD?

AUD/USD portrays the market’s pre-event anxiety as it makes rounds to 0.6715-20 after rising in the last three consecutive days. The Aussie pair previously cheered the market’s easing fears of the banking sector collapse, as well as the cautious optimism showed by Christopher Kent, Reserve Bank of Australia’s (RBA) Assistant Governor (Financial Markets).

That said, the Aussie pair’s further upside hinges on how the RBA Minutes manage to keep the bulls happy even after promoting the ability to announce further rate hikes. That being said, talks over the economic transition and neutral rate, as well as surrounding employment conditions, will also be crucial to watch for short-term AUD/USD forecast.

Technically, clear upside break of the six-week-old descending resistance line, now immediate support around 0.6635, directs AUD/USD buyers towards the 100-DMA hurdle of near 0.6765.

Key Notes

AUD/USD floats near two-week high past 0.6700 as fears of banking collapse ease, RBA Minutes eyed

AUD/USD Forecast: Bullish bias, testing the 0.6725 resistance area

About the RBA minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision. The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee. Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

- GBP/USD seesaws within a choppy range after refreshing six-week high, pauses three-day uptrend.

- Fears that financial market turmoil can push BoE to pause rate hike gain momentum ahead of “Super Thursday”.

- DUP appears dissatisfied from Brexit deal, chooses to vote against the same in Wednesday’s poll.

GBP/USD dribbles around a six-week high, making rounds to 1.2270-80 during early Tuesday, as the banking crisis challenges the Bank of England (BoE) hawks. Also testing the Cable pair buyers are the looming fears of another Brexit disappointment, despite UK Prime Minister Rishi Sunak’s hard efforts to strike a deal over the Northern Ireland Protocol (NIP).

The Telegraph conveys multiple analysts’ estimations while saying, “The Bank of England (BoE) will be forced to abandon an interest rate rise this week following turmoil in global financial markets.” The forecasts become too important ahead of the “Super Thursday” as some on the floor expected a 50 bps rate hike from the “Old Lady”, as the BoE is casually known.

On the other hand, BBC News quotes Democratic Unionist Party (DUP) Leader Sir Jeffrey Donaldson as saying that the agreement was not sufficient to deal with concerns that his party had raised about post-Brexit trade rules for Northern Ireland. “The DUP has confirmed that it will oppose the deal - known as the Windsor Framework - when MPs are given a vote on part of it on Wednesday,” adds BBC News.

Elsewhere, hopes of easing the banking crisis seem to have favored the market sentiment and drowned the US Dollar. UBS’ takeover of the troubled Credit Suisse, by paying 3 billion Swiss francs (£2.6bn), eased the market’s baking fears. On the same line were statements from the US Federal Deposit Insurance Corporation (FDIC) mentioning that the deposits of Signature Bridge Bank will be assumed by a subsidiary of New York Community Bancorporation.

Additionally, news that five major banks, including the BoE, joined the US Federal Reserve (Fed) to ease the US Dollar liquidity crunch via currency swaps and added strength to the market’s risk-on mood.

It should be noted, however, that a Senior Swiss lawmaker warned on Monday that “the UBS-Credit Suisse merger is an enormous risk,” which in turn probed the optimists amid the market’s anxiety ahead of this week’s top-tier data/events.

Against this backdrop, the US Dollar Index (DXY) dropped to the lowest levels in a month while the US Treasury bond yields stays pressured. Further, Wall Street closed on the positive side where Gold price refreshed Year-To-Date (YTD) high before retreating to $1,980 at the latest.

Moving on, Cable traders should keep their eyes on the risk catalysts for fresh impulse ahead of Wednesday’s Federal Open Market Committee (FOMC) Monetary Policy Meeting and Thursday’s top-tier outcomes from the Bank of England.

Technical analysis

A successful upside break of the 1.2200 horizontal resistance, now support, enables GBP/USD bulls to keep the reins.

- AUD/JPY jumped from YTD lows of 87.12 and reclaimed 88.00 as sentiment turned upbeat.

- AUD/JPY Price Analysis: To remain sideways within the 87.00/89.00 range.

AUD/JPY trimmed some of its earlier losses and finished Monday’s session with losses of 0.13%. However, as the Asian session begins, the AUD/JPY is up 0.09%, exchanging hands at 88.25 at the time of writing.

AUD/JPY Price action

After falling to multi-week lows at 87.12, the AUD/JPY staged a late recovery and closed above the 88.00 figure, portraying a spinning top indicating neither buyers nor sellers are in control. Nevertheless, the AUD/JPY is consolidating around the 87.00-89.20 range, below the daily Exponential Moving Averages (EMAs), with a neutral to a bearish bias.

Oscillators remain bearish, but the Relative Strength Index (RSI) turned flat, suggesting that selling pressure is waning. Contrarily, the Rate of Change (RoC) portrays sellers are gathering momentum, but they need to bring the AUD/JPY below 88.00, so they could have a chance to drag prices lower.

Therefore, the AUD/JPY’s first support would be the 88.00 mark. Once cleared, the AUD/JPY could dive towards the daily low at 87.12 before stumbling toward the 86.00 mark, ahead of testing March 2022 lows at around 84.59.

Conversely, the AUD/JPY first resistance would be 89.00. Break above will expose the March 20 daily high at 89.23 before testing the 20-day EMA at 89.82. After that, the next supply zone would be the 90.00 figure, followed by the 50-day EMA at 90.66, ahead of 91.00.

AUD/JPY Daily chart

AUD/JPY Technical levels

European Central Bank (ECB) policymaker Robert Holzmann on Monday watered down his recent call for three further interest-rate increases of 50 basis points in quick succession, reported Reuters.

The news also quotes the Austrian National Bank leader’s two-week-old interview with German business daily Handelsblatt as he mentioned the ECB should raise rates by 50 basis points at each of its next four meetings because inflation was proving stubborn.

While the first of the expected four rate hikes recently gone, the policymaker was asked in an interview on Austrian national broadcaster ORF TV if he stood by that call given recent turbulence in the banking sector, when ECB’s Holzmann said: "I would not rule them out but I would also not say that they will necessarily come either."

ECB’s Holzmann also mentioned that since his Handelsblatt interview liquidity in the financial system had decreased, referring to banking stocks' recent fall on fears of a new banking crisis.

"What we are concerned with is fighting inflation," ECB’s Holzmann said, adding that if deflation or an inflation reduction began because of tightening liquidity, the central bank would no longer need to raise rates or could raise them more gradually.

Asked if UBS Group's state-backed takeover of Credit Suisse was dangerous because it will create such a big bank in such a small country, Switzerland, he said: "It could become dangerous but it does not have to become dangerous."

Elsewhere, ECB policymaker Yannis Stournaras spoke on the CNBC while stating that policy will be data dependent from now on. ECB’s Stournaras also said, “European banking system well-equipped with capital.”

Also read: EUR/USD juggles above 1.0700, upside looks solid as uncertainty for Fed policy deepens

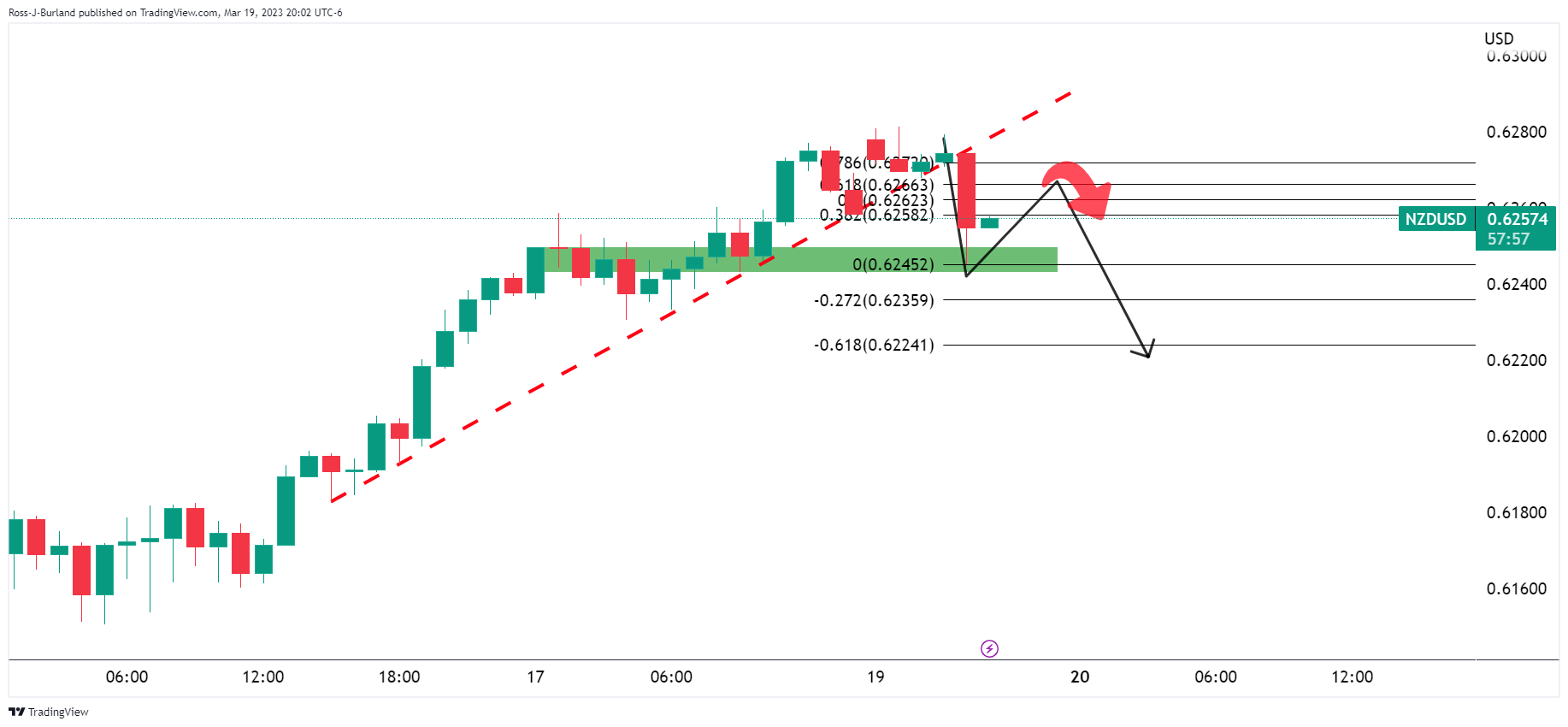

- NZD/USD has remained sideways after failing to recapture the immediate resistance of 0.6280.

- The formation of an Inverted H&S formation solidifies a bullish reversal ahead.

- The 20-period EMA at 0.6234 is providing a cushion to the New Zealand Dollar.

The NZD/USD pair is making efforts in defending the critical support of 0.6240 in the early Asian session. The Kiwi asset has remained sideways from Monday after failing to recapture the immediate resistance of 0.6280. Mixed responses to the interest rate policy of the Federal Reserve (Fed) have shifted the major to the sideline.

S&P500 futures have continued their upside momentum after a decent recovery on Monday, portraying appreciation in the risk-taking ability of the market participants. The US Dollar Index (DXY) continued its losing spell on Monday led by United States banking shakedown.

The New Zealand Dollar didn’t display any significant action on steady monetary policy by the People’s Bank of China (PBoC). The street was anticipating further rate cuts to spurt the overall demand in the Chinese economy. It is worth noting that New Zealand is one of the crucial trading partners of China and further expansion in PBoC’s monetary policy would have supported the New Zealand Dollar.

NZD/USD is forming an Inverted Head and Shoulder chart pattern on a four-hour scale. The chart pattern displays a prolonged consolidation and results in a bullish reversal after a breakout of the neckline, which is plotted from the March 01 high at 0.6276.

The 20-period Exponential Moving Average (EMA) at 0.6234 is providing a cushion to the New Zealand Dollar.

Meanwhile, the Relative Strength Index (RSI) (14) is making efforts in reclaiming the bullish range of 60.00-80.00. An occurrence of the same would solidify the Kiwi asset further.

A buying opportunity in the Kiwi asset will emerge it will surpass March 1 high at 0.6276, which will drive the pair toward the round-level resistance at 0.6300 followed by February 14 high at 0.6389.

In an alternate scenario, a breakdown of the January 6 low at 0.6193 will drag the asset toward November 28 low at 0.6155. A slippage below the latter will expose the asset for more downside toward the round-level support at 0.6100.

NZD/USD four-hour chart

- USD/JPY responding to evolving US Treasury yield dynamics amid banking turmoil.

- Japanese Yen gains ground over US Dollar as a safe haven.

- Financial crisis reverberation as the Fed navigates uncertain times.

The USD/JPY closely following the short end of the US Treasury (UST) yield curve, as diminishing demand for the US Dollar weighs on the pair. This comes amid speculation that the Federal Reserve (Fed) may not pursue aggressive rate hikes as anticipated due to the recent banking turmoil.

On Monday, the US dollar weakened as investors responded to UBS' acquisition of its struggling competitor Credit Suisse for CHF 3 billion. Following the global banking crisis, the US Dollar is losing its safe-haven status, while the Japanese Yen has regained there conventional safe-haven status.

The collapse of Silicon Valley Bank and Signature Bank earlier this month sent shockwaves through the markets, causing a plunge in banking stocks and concerns that central bank monetary tightening could lead to a recession.

In response to the ongoing banking crisis, the Fed has opened swap lines to other central banks to provide US Dollar liquidity. This move may contribute to the downward pressure on US Dollar demand.

Investors are cautiously watching the Fed's decision on Wednesday's conclusion of a two-day meeting. Before the banking turmoil, many market participants had expected a 50 basis-point (bps) interest rate hike from the Fed at its March meeting.

However, Fed funds futures now indicate a 28.4% probability of the Fed maintaining its overnight rate at 4.5%-4.75%, and a 71.6% likelihood of a 25 basis-point increase, according to CME's FedWatch Tool.

Citing some earlier Wall Street Journal (WSJ) reports, the Fed faces a difficult decision, should they continue raising rates to combat persistent high inflation or pause due to the intense banking crisis?

Levels to watch

Analysts at the S&P think that it is unlikely that some US bank failures will prevent policymakers from sticking to task of taming inflation, reported Reuters during early Tuesday in Asia.

More to come

- USD/CAD is likely to deliver a fresh downside below 1.3650 amid a weaker USD Index and oil price recovery.

- Led by the declining US inflation, Fed Powell might look for achieving the terminal rate with the least pace.

- Further softening of Canadian inflation would delight the Bank of Canada.

The USD/CAD pair is demonstrating a back-and-forth action around the critical support of 1.3650 in the early Tokyo session. The Loonie asset is expected to deliver a fresh downside as investors are expecting Federal Reserve (Fed) chair Jerome Powell to sound less hawkish on interest rates.

Deepening fears of a potential global banking fiasco after the collapse of three United States-based commercial banks and the second-largest Swiss banking firm Credit Suisse are bolstering the case of a 25 basis point (bps) rate hike by the Fed. Apart from that, the dot plot for further rate hikes will be keenly watched.

There is no denying the fact that the US inflation is in a declining trend, therefore, Fed Powell might look for achieving the terminal rate with the least pace.

S&P500 futures showed a decent recovery on Monday after the mayhem in the last week, portraying a revival in the risk appetite of the market participants. The US Dollar Index (DXY) has ended in negative straight for the third trading session amid a weak safe-haven appeal due to banking shakedown.

Analysts at ING believe “We do not expect too much volatility if conditions allow the Fed to hike 25 bps and the dot plots do not surprise too much and an unlikely 50 bps hike would be very bullish for the Dollar.”

Meanwhile, the Canadian Dollar is expected to remain in action amid the release of the Consumer Price Index (CPI) data. Economists at TDS Securities cited “We look for CPI to continue trending lower to 5.3% YoY as core measures soften to 4.8%. Base effects will play a large role with prices up 0.5% MoM, but energy prices will also exert a drag. This would leave Q1 CPI tracking slightly below the January MPR, but we would note the evolution of financial sector vulnerabilities will be the larger factor for the near-term Bank of Canada (BoC) outlook.”

On the oil front, oil price showed significant recovery after a fresh 15-month low at $64.32 on expectations that OPEC could intervene amid falling prices. The black gold has recovered to near $67.70 and is eyeing the interest rate decision by the Fed for further guidance.

- AUD/NZD picks up bids to cross three-week-old resistance line despite mixed New Zealand trade numbers for February.

- New Zealand Trade Balance improved but Exports and Imports eased.

- “Double bottom” bullish formation lures buyers but 1.0800 is the key hurdle.

AUD/NZD extends the previous day’s strong gains to 1.0760 amid mixed New Zealand trade data, published early Tuesday in Auckland. In doing so, the exotic pair crosses a three-week-old resistance line while highlighting the “double bottom” bullish chart pattern on the four-hour play.

That said, New Zealand’s Trade Balance improved to $-714M in February versus $-1,450M expected and $-2,113M prior (revised). However, the Imports eased to $5.95B from $7.42B while the Exports also declined to $5.23B compared to $5.30B prior during the stated period.

Given the double bottom formation and the quote’s sustained break of the previous key resistance line, the AUD/NZD is very much expected to rise further, backed by bullish MACD signals.

However, a one-week-old resistance line joins the 100-SMA to highlight the importance of the 1.0800 as the strong upside resistance.

Should the quote remains firmer past 1.0800, the odds of witnessing a rally toward the early-month high close to 1.0890 can’t be ruled out.

Alternatively, the resistance-turned-support line of near 1.0750 restricts the immediate downside of the AUD/NZD pair, a break of which could drag the quote back to the 1.0700 round figure before challenging the double bottoms surrounding 1.0675.

AUD/NZD: Four-hour chart

Trend: Further upside expected

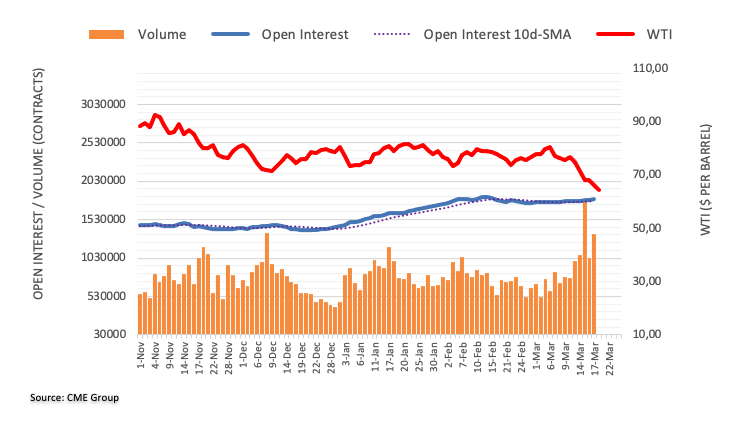

- Western Texas Intermediate registers minimal losses at the beginning of the Asian session.

- Weakness in the US Dollar, and an upbeat sentiment, caused WTI’s jump.

- Two major central banks hosting monetary policy decisions could turn sentiment sour and drag oil prices down.

Western Texas Intermediate (WTI), the US crude oil benchmark, advanced 2.31% on Monday, bolstered by a soft US Dollar (USD) and market sentiment improvement. As Tuesday’s Asian session begins, WTI exchanges hands at $67.68 PB.

Oil prices advanced on an offered US Dollar

Wall Street’s finished the session with gains spurred by risk appetite. Oil price was underpinned by an offered US Dollar, as shown by the US Dollar Index, down 0.54%, at 103.305. Nevertheless, the sentiment would remain fragile ahead of the US Federal Reserve (Fed) monetary policy meeting and the Bank of England’s (BoE) interest rates decision. Any hawkish tilt by central banks could derail traders’ mood and sour sentiment.

In the meantime, the G7 commented that it’s not expected an adjustment to Russia’s oil barrel level at $60.00 this week, as reported by Reuters.

The G7 had planned to reconsider the price limit implemented in December. Still, the officials mentioned that the European Commission informed EU ambassadors over the weekend that there is currently no interest among the G7 to conduct a prompt reassessment. This was supposed to take place in mid-March.

OPEC, Russia, and other producer allies (OPEC+) will hold a ministerial committee meeting on April 3. As per the agreement made in October, the group had decided to reduce their oil production targets by 2 million barrels per day until the end of 2023.

WTI Technical levels

- AUD/USD seesaws around multi-day high as bulls take a breather after three-day winning streak.

- UBS-Credit Suisse deal, joint central bank efforts to tame liquidity crunch improve market’s mood.

- Yields remain depressed while Gold and equities improve, which in turn weigh on US Dollar.

- RBA’s Kent praised soundness of Aussie banks, defends rate hike bias.

AUD/USD portrays the market’s cautious optimism, as well as cheers the broad US Dollar weakness, as it seesaws near the highest levels in two weeks during early Tuesday morning in Canberra. That said, the Aussie pair makes rounds to 0.6715-20 after rising in the last three consecutive days.

The Aussie pair’s latest gains could be linked to the market’s easing fears of the banking sector collapse, as well as the cautious optimism showed by Christopher Kent, Reserve Bank of Australia’s (RBA) Assistant Governor (Financial Markets). Adding to the quote’s upside momentum could be the upbeat performance of Gold and softer Treasury bond yields, which in turn exerted downside pressure on the US Dollar.

That said, RBA’s Kent spoke a speech on "Long and Variable Monetary Policy Lags" at the KangaNews Debt Capital Market Summit, in Sydney, early Monday morning, while saying that the Australian banks are unquestionably strong. The policymaker also said that RBA is very conscious of the challenges facing borrowers from rapid rate rises.

Elsewhere, news of UBS’ takeover of the troubled Credit Suisse, by paying 3 billion Swiss francs (£2.6bn), also eased the market’s fears. On the same line were statements from the US Federal Deposit Insurance Corporation (FDIC) mentioning that the deposits of Signature Bridge Bank will be assumed by a subsidiary of New York Community Bancorporation.

Furthermore, around five major banks joined the US Federal Reserve (Fed) to ease the US Dollar liquidity crunch via currency swaps and added strength to the market’s risk-on mood. “The Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, and Swiss National Bank are all up for announcing joint actions to provide more liquidity via standing US dollar liquidity swap line arrangements,” said Reuters.

It should be noted, however, that a Senior Swiss lawmaker warned on Monday that “the UBS-Credit Suisse merger is an enormous risk,” which in turn probed the optimists amid the market’s anxiety ahead of this week’s top-tier data/events.

Against this backdrop, the US Dollar Index (DXY) dropped to the lowest levels in a month while the US Treasury bond yields stays pressured. Further, Wall Street closed on the positive side where Gold price refreshed Year-To-Date (YTD) high before retreating to $1,980 at the latest.

To sum up, the AUD/USD buyers are likely to keep the reins amid the firmer sentiment and the hawkish RBA talks. However, today’s RBA Monetary Policy Meeting Minutes will be crucial to watch as the bulls may want to reconfirm policymaker Kent’s hawkish bias. That said, the Aussie central bank announced a 0.25% rate hike in the last meeting and appeared a bit tense over the future rate increase.

Technical analysis

A clear upside break of the six-week-old descending resistance line, now immediate support around 0.6635, directs AUD/USD buyers towards the 100-DMA hurdle of near 0.6765.

- EUR/USD is hovering around 1.0720, eyes 1.0750 amid a recovery in investors’ risk appetite.

- Fed could pause further rate hikes to restore confidence among the market participants.

- ECB Lagarde confirms that Eurozone banks' exposure to Credit Suisse was in Euro millions, not billions.

The EUR/USD pair is displaying a sideways performance around 1.0720 in the early Asian session. The major currency asset is expected to extend its journey toward the critical resistance of 1.0750 ahead. The shared currency pair has registered a three-day winning streak and is expected to extend further as investors are skeptical about the interest rate decision by the Federal Reserve (Fed), which is scheduled for Wednesday.

A late recovery in S&P500 allowed it to settle Monday’s session on a decent positive note. It seems that investors cheered the collaborative efforts made by various financial institutions to rescue the First Republic after the collapse of Silicon Valley Bank (SVB) and Signature Bank. The recovery move by United States equities is portraying a decent attempt for bulls to settle their feet.

The US Dollar Index (DXY) is expected to settle on a negative note consecutively for the third time as investors are still ambiguous about Fed’s monetary policy.

As per the CME Fedwatch tool, more than 76% odds are in favor of a 25 basis point (bps) interest rate hike, which would push rates to 4.75-5.00%. However, the efforts by various central banks to safeguard the global economy from potential banking turmoil indicate that Fed chair Jerome Powell could pause further rate hikes to restore confidence among the market participants.

The discussions over the interest rate guidance could soften the US Dollar for a longer period. Economists at Scotiabank believe that the US Dollar could weaken if the market believes that the Fed is near to end of its tightening cycle.

On the Eurozone front, positive commentaries from European Central Bank (ECB) President Christine Lagarde and other policymakers fueled strength in the Euro. ECB Lagaqrde told European Parliament's Committee on Economic and Monetary Affairs on Monday that Eurozone banks' exposure to Credit Suisse was in Euro millions, not billions, per Reuters.

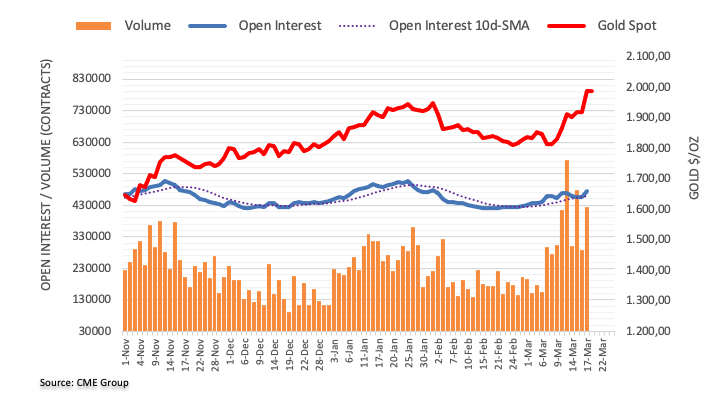

- Gold price is meeting resistance in the right-hand shoulder.

- All eyes are on the Federal Reserve this week.

The Gold price is carving out a topping pattern below the highs of the $2,000s that were scored at the start of this week. At the time of writing, Gold price is trading near $1,979 and has traveled between $2,009.85 and $1,965.99 so far this week for the initial balance.

Fundamentally, bank stocks are a driving force that rallied on Monday with a tentative sigh of relief due to the rescue of Credit Suisse with UBS buying the troubled bank for 3 billion francs ($3.2 billion). The speedy measure to stem contagion, however, does not guarantee anything and some argue that was has occurred is just the tip of the iceberg. For instance, shares in First Republic Bank, the lender drawing the most concern from US investors right now cratered 33.5% on Wall Street on Monday following S&P Global downgrading its credit ratings deeper into junk on Sunday.

"If you think about where we were a year ago, the Fed was just starting its rate-hiking cycle. So over the next couple of quarters, you're going to get those long and variable, cumulative and lagged impacts hitting the market further," Bob Michele, the global head and CIO of fixed income at J.P. Morgan Asset Management, told Bloomberg TV. "So I think this is the tip of the iceberg. I think there's a lot more consolidation, a lot more pain yet to come."

It’s also possible that “we just go from one weak institution falling over to the next,” said Vicky Redwood, senior economic adviser at Capital Economics. There are no other obvious candidates that could be singled out like Credit Suisse, but it’s “hard to predict where the problems will emerge,” she explained.

All eyes on the Fed

Meanwhile, the Gold price will be sensitive to the US Dollar and the Federal Reserve this week. Fed funds futures show a 26.9% probability of the Fed holding its overnight rate at a current 4.5%-4.75% when policymakers conclude a two-day meeting on Wednesday. Consequently, the yield on benchmark 10-year Treasury notes to was at its highest in 3.50% compared with its US close of 3.397% on Friday. The two-year yield, which rises with traders' expectations of higher Fed fund rates, touched 4.00% compared with Friday's close of 3.846%.

´´Despite banking regulators rushing to shore up market confidence, the uncertain macro backdrop continues to entice buying. Bullion-backed ETF saw strong inflows, with SPDR Gold Share’s holding increasing by more than 204kz last session,´´ analysts at ANZ bank explained.

´´Swaps traders remain split on whether the US Federal Reserve will hike again this year. All eyes now shift to the Fed’s two-day meeting. Any dovish commentary should help support the precious metals sector.´´

Gold technical analysis

The Gold price could be forming a topping pattern in the right-hand shoulder of the head and shoulders on the 4 and 1-hour charts:

- USD/CHF consolidates within the 20 and 50-day EMAs at around 0.9285/95.

- USD/CHF Price Analysis: To remain sideways, ahead of the FOMC’s meeting

USD/CHF traded sideways after Wall Street closed, with gains as risk appetite improved. Safe-haven flows spurred a light gain for the greenback on Monday of 0.35%. However, as the Asian session begins, the USD/CHF exchanges hands at 0.9287, almost flat.

USD/CHF Price action

After bottoming nearby the 2023 lows, the USD/CHF rallied 2.80%, near last week’s high at 0.9340. Nevertheless, the recent developments in the financial markets triggered flows toward the Swiss Franc (CHF), which recovered some ground. However, the exchange rate is stills above the 20-day Exponential Moving Average (EMA), acting as support at around 0.9283.

Oscillators suggest the USD/CHF pair would be seesawing around the 0.9300 area. With the US Federal Reserve (Fed) interest rate decision looming, the USD/CHF would remain trading within familiar levels.

Therefore, the USD/CHF first resistance would be the 100-day EMA at 0.9296. A breach of the latter will expose the 0.9300 figure, followed by the March 16 high at 0.9340 and the 100-day EMA at 0.9362, ahead of the 200-day EMA.

For a bearish continuation, the USD/CHF first’s test would be the 20-day EMA at 0.9285. Once cleared, the USD/CHF could dive towards 0.9229, the March 16 low, before falling to the March 15 daily low at 0.9122.

USD/CHF Daily chart

USD/CHF Technical levels

Here is what you need to know on Tuesday, March 21:

Wall Street cheered the weekend’s news (UBS buying Credit Suisse and coordinated central bank action). The Dow Jones gained more than 1%. US yields ended flat after hitting fresh monthly lows, with the US 10-year yield rebounding toward 3.50%. The CBOE Volatility Index (VIX) dropped by almost 6%, while the US Dollar Index fell by 0.54%, posting the lowest close in a month.

Forex market responded to the improvement in market sentiment. Developments in the banking sector and the Federal Reserve’s meeting will be a key driver for the next sessions. The FOMC meeting kicks off on Tuesday. The US central bank is in a difficult position. The market is pricing a 70% probability of a 25 basis points rate hike, with attention on the forward guidance and the wording of the statement.

French President Emmanuel Macron’s government survived a no-confidence vote. European Central Bank (ECB) President Christine Lagarde spoke at the European Parliament, repeating that inflation is projected to remain “too high” for “too long.” In Germany, the Producer Price Index in February rose 15.8% from a year ago, which represents a smaller-than-expected slowdown. EUR/USD rose above 1.0700, approaching last week’s high, while EUR/CHF soared to 0.9960.

GBP/USD broke its 5-day trading range, rising to above 1.2270, the highest since early February. The Bank of England will announce its monetary policy decision on Thursday.

The Kiwi was among the worst performers on Monday, with NZD/USD retreating from monthly highs to 0.6230. New Zealand will release trade data on Tuesday. AUD/USD is holding above 0.6700 after rebounding at 0.6660. The Reserve Bank of Australia (RBA) will release the minutes of its latest meeting.

USD/CAD dropped, matching last week’s low at 1.3650, a key support area reinforced by the 20-day Simple Moving Average (SMA). On Tuesday, Canada will report February’s Consumer Price Index, forecast to rise 0.6% in February.

Gold stabilized around $1,980 on a volatile session that included a fresh one-year high above $2,000 and a correction to $1,965. Bitcoin fell modestly to $28,000 in a session it reached a fresh nine-month high. Crude oil prices hit the lowest since December 2021 and rebounded, rising by almost 2%. The improvement in sentiment helped offset concerns about the economic backdrop.

Like this article? Help us with some feedback by answering this survey:

- NZD/USD fails to capitalize on sentiment improvement and tumbles influenced by a technical indicator.

- The US Dollar tumbled while UST bond yields rose, a headwind for the NZD/USD.

- NZ Trade of Balance and US Existing Home Sales data eyed.

NZD/USD reversed its course after piercing the 200-day Exponential Moving Average (EMA), tumbling 0.12%, as Wall Street is about to close. US equities are about to finish the day in an upbeat mode, though the New Zealand Dollar (NZD) is at the mercy of technical indicators. At the time of writing, the NZD/USD exchanges hands at 0.6248.

NZD/USD stumbles at the 200-day EMA, despite a risk-on impulse

With the looming US Federal Reserve (Fed) monetary policy meeting, the markets could begin to trade sideways. Even though sentiment improved, the NZD could not capitalize, with markets focusing on Jerome Powell and Co. Therefore, the NZD/USD edged lower after printing a daily high of 0.6281.

Last Friday, the latest round of US economic data cemented the case for an ongoing economic slowdown. Industrial Production eased, Consumer Sentiment deteriorated, as reported by the University of Michigan (UoM), and inflation expectations cooled down amidst ongoing turbulence in the financial markets.

Traders continued to digest the news that UBS bought Credit Suisse, which supposedly could stop the bank’s stock riot. Nonetheless, newswires reported that First Republic Bank stock halted for a ninth time in the day, with shares plunging 50% at one point before pairing losses, dropping 33%.

In the meantime, the US Dollar Index, a gauge for the buck’s value against a basket of six currencies, losses 0.53%, at 103.312. Contrarily, US Treasury bond yields erased their earlier losses, with the 10-year bond yield gaining six basis points at 3.498%.

Aside from this, the New Zealand (NZ) economic docket will feature the NZ Trade of Balance for February, with estimates at NZ $-1.450 B, less than the previous reading of NZ $-1.954B. Exports for January came at NZ $5.47B, while Imports were NZ $7.42 B. Another factor that could underpin the NZD is the Reserve Bank of Australia’s monetary policy.

On the US front, the docket will feature Existing Home Sales and the beginning of the two-day US Federal Reserve Open Market Committee (FOMC) monetary policy meeting

NZD/USD Technical levels

- GBP/USD bulls are moving in on equal highs.

- Bears are lurking and 1.2200 is a critical support.

GBP/USD has popped the 1.22 level for the first time since early February as the flight to safety eased around the latest developments in the banking sector. The following illustrates a meanwhile bullish bias albeit into the bear's lair.

GBP/USD H4 charts

GBP/USD is on the backside of the bullish market but is riding a micro-bull trend for the time being. 1.2200 is key in this regard. While holding above 1.2200, the focus is on the upside with the bulls taking on equal highs from February in the upper quarter of the 1.22 area. Eyes are on the 1.2320s at this juncture.

If the bears move in, considering that the price is on the backside of the prior dominant bull trend, then there will be prospects of a break of the micro bull trend and structure in and around 1.2200. If this were to give, then the bears will be considered to be back in control again.

- Silver is in the hands of the bulls.

- Bulls need to stay on the front side and Gold price H1 H&S is a concern.

- Banking crisis remains a key theme for safe havens.

Silver has been climbing through the $20s over the course of the month so far ad reached a high of the trend at $22.7169 in London. The white metal has moved up from a low of $22.2210 where a support structure has formed and the bulls might be expected to remain engaged while above it.

Despite a historic weekend rescue of financial heavyweight Credit Suisse with UBS buying the troubled bank for 3 billion francs ($3.2 billion), risk sentiment remains fragile, supportive of safe havens such as silver.

The speedy orchestration of Credit Suisse's takeover was received well, initially, in order to stem contagion, but there are persistent worries that other struggling banks might teeter next. More large and tiny corporations might need to be rescued.

The latest banking crisis started after two US lenders, Silicon Valley Bank, and Signature Bank, collapsed this month. Additionally, even though the First Republic Bank received emergency support, this has so far failed to shore up investor confidence.

"If you think about where we were a year ago, the Fed was just starting its rate-hiking cycle. So over the next couple of quarters, you're going to get those long and variable, cumulative and lagged impacts hitting the market further," Bob Michele, the global head and CIO of fixed income at J.P. Morgan Asset Management, told Bloomberg TV. "So I think this is the tip of the iceberg. I think there's a lot more consolidation, a lot more pain yet to come."

It’s also possible that “we just go from one weak institution falling over to the next,” said Vicky Redwood, senior economic adviser at Capital Economics. There are no other obvious candidates that could be singled out like Credit Suisse, but it’s “hard to predict where the problems will emerge,” she said.

Silver and Gold price technical analysis

Silver, above is on the front side of the trend and a break of $22.56 will open risk to $22.90 and then $23.50.

(Gold)

While there are prospects of a continuation higher in Silver being on the front side of the trend, a break of structure to the downside is also a possibility.

Silver tends to track Gold price and a head and shoulders that is a topping pattern are emerging on the hourly and lower time frames. This could spell danger for trapped bulls in both Gold and silver markets.

- AUD/USD maintains a positive tone on a soft US Dollar.

- Money markets expect a 25 bps rate hike by the Fed on Wednesday.

- AUD/USD Price Analysis: Daily close above 0.6714 would add upward pressure; otherwise, it could fall to 0.6600.

AUD/USD prints a leg-up above the 0.6700 figure, helped by an improvement in market sentiment. Investors shrugged off banking crisis contagion woes after UBS decided to buy Credit Suisse, perceived by traders as an excuse to buy riskier assets. That, alongside speculations for less aggressive monetary policies amongst central banks, weighed on the US Dollar. At the time of writing, the AUD/USD exchanges hands at 0.6715.

AUD/USD to hover around 0.6700 ahead of the FOMC’s meeting

The financial markets’ mood remains upbeat after the banking crisis saga and appears to be calm. However, in the United States (US), First Republic Bank stock plunged after another credit downgrade. The US Federal Reserve (Fed) would begin its two-day monetary policy meeting on Tuesday, with money markets estimating a 70% chance of a 25 basis point rate hike by the Fed. That would lift the Federal Funds Rate (FFR) to the 4.75% - 5.00% threshold. After the Fed’s decision, Chair Powell will hit the stand.

The latest round of US economic data witnessed Industrial Production shrinking and the University of Michigan (UoM) Consumer Sentiment deteriorating. However, Americans expected inflation to fall, with 1-year expectations estimated to finish at 3.8% from 4.1%, while for 5-yeard, it dropped to 2.8% from 2.9%.

The US Dollar Index, a gauge of the bucks’ value against a basket of peers, continues to extend its losses, down 0.51%, at 103.343, a tailwind for the AUD/USD.

On the Australian front, the lack of data left traders adrift to risk appetite. Even though China’s reopening should bolster the Australian Dollar (AUD), the latest rate hike by the Reserve Bank of Australia (RBA), was perceived as a dovish one, which would exert downward pressure on the AUD/USD.

AUD/USD Technical analysis

After dropping below the 0.6600 figure, the AUD/USD reclaimed the 0.6700 figure. Nevertheless, the 20-day Exponential Moving Average (EMA) at 0.6713 is difficult to surpass, as the AUD/USD is forming a dragonfly doji. If the AUD/USD registers a daily close above the 20-day EMA, that will set the pair to test the intersection of the 50/100-day EMAs, each at 0.6779-85, respectively. Once cleared, the 0.6800 could be tested. Otherwise, the AUD/USD could extend its losses below 0.6700 toward the 0.6600 figure.

What to watch?

The French National Assembly rejected a no-confidence vote against the government of President Emmanuel Macron by just nine votes. The motion needed 287 votes to pass and got 278.

Macron’s government is facing strong opposition to the bill to increase the retirement age from 62 to 64. It has led to protests across the country after Prime Minister Elisabeth Borne used an article of the constitution to force the bill through the Parliament without a vote.

The rejection of the no-confidence vote was not a surprise, but the margin of victory was narrower than expected.

- GBP/JPY bulls eye 162.20s while holding above 161.00. A break of 162.50 opens risk towards 163.00.

- UK inflation data and the BoE are in focus.

The Great British Pound is on the form to start the week ahead of key events in the Bank of England (BoE) rate decision and inflation data, Consumer Price Index. A risk-on tone helped lift the cross, GBP/JPY, as the Swiss government-backed takeover by UBS of Credit Suisse helped to soothe some tensions in the market. Additionally, the Federal Reserve and five other central banks have announced coordinated action to improve liquidity in US dollar swap arrangements to maintain the stability of the global financial system.

At the time of writing, GBP/JPY is trading at 161.50 and has been traveling higher between a low of 158.95 and reached a high of 161.73. However, while the moves by the Swiss government and central banks are welcomed, there is still uncertainty over how the UBS and Credit Suisse deal will play out for the combined lender and the shareholders as per the implications of a ´´forced´´ merger. Moreover, the question hanging over the markets is what comes next for the wider banking system. The worry is that this may just be the tip of the iceberg.

"If you think about where we were a year ago, the Fed was just starting its rate-hiking cycle. So over the next couple of quarters you're going to get those long and variable, cumulative and lagged impacts hitting the market further," Bob Michele, the global head and CIO of fixed income at J.P. Morgan Asset Management, told Bloomberg TV. "So I think this is the tip of the iceberg. I think there's a lot more consolidation, a lot more pain yet to come."

It could be that no more banks get into trouble, but it’s also possible that “we just go from one weak institution falling over to the next,” said Vicky Redwood, senior economic adviser at Capital Economics. There no other obvious candidates that could be singled out like Credit Suisse, but it’s “hard to predict where the problems will emerge,” she said.

UK key events for the week

Meanwhile, UK inflation data on Wednesday is expected to show some easing and amid the global financial market instability. Analysts at TD Securities said that ´´headline inflation likely fell 0.2ppts in March, in line with the MPC's forecast, on the back of another decline in petrol prices. A shortage of certain vegetables and fruits adds some upside risk to the print. We also expect a rebound in hotel prices and continued strong core goods momentum to keep core inflation elevated.´´ Economists polled by Reuters expected the year-on-year CPI inflation figure to fall to 9.9% in February from 10.1% in January.

For the Bank of England, money markets are pricing in a 50% chance of no interest rate hike on Thursday and the same chance of a 25 basis-point increase. ´´Of all the major March CB decisions, the BoE was always the most uncertain, given the MPC hadn't clearly signaled another hike,´´ the analysts at TD Securities said. ´´But we think they'll still do it (barring another deterioration in financial conditions), and as before, with Bank Rate at a terminal of 4.25%, we expect this to be their last hike. It's not clear they'll be so decisive in their guidance though.´´

GBP/JPY technical analysis

The bulls are in control and eye a test of 161.70s and then the 162.20s while holding above 161.00 and 161.50 supports on the front side of the bullish opening trend. A break of 162.50 opens risk towards 163.00.

- USD/CAD drops from weekly highs above 1.3700 on sentiment improvement.

- The USD/CAD fall was capped by sellers unable to crack the 20-day EMA.

- USD/CAD Price Analysis: For a bearish resumption, the USD/CAD needs a daily close below 1.3661.

USD/CAD is erasing last Friday’s gains, hovering at around the 20-day Exponential Moving Average (EMA) at 1.3661 after hitting a daily high of 1.3746. A risk-on impulse on news that UBS bought Credit Suisse calmed tensions amidst turbulence in the banking system. Therefore, the USD/CAD exchanges hands at 1.3676, down 0.41%.

USD/CAD Price action

After peaking at 1.3862 ten days ago, the USD/CAD resumed its downtrend amidst overall US Dollar (USD) weakness. However, it should be said that the 20-day EMA has acted as a solid support, so for a bearish resumption, the USD/CAD must register a daily close below 1.3661.

Oscillators portray sellers gathering momentum, though the Relative Strength Index (RSI) needs to punch below the 50-midline, to further confirm a bearish continuation. Contrarily, the Rate of Change (RoC) indicates selling pressure increased. Therefore, the USD/CAD might test lower prices in the near term.

The USD/CAD first support would be the 20-day EMA at 1.3661, followed by the March 14 low at 1.3651. Break below, and the USD/CAD could tumble to 1.3600 before testing the 50-day EMA at 1.3570. Once cleared, the 100-day EMA at around 1.3500 would be challenged.

On the flip side, the USD/CAD first resistance would be the 1.3700 figure. A breach of the latter will expose the daily high at 1.3746, followed by 1.3800 and the last week’s high at 1.3814.

USD/CAD Daily chart

USD/CAD Technical levels

European Central Bank (ECB) President Christine Lagarde told European Parliament's Committee on Economic and Monetary Affairs on Monday that Eurozone banks' exposure to Credit Suisse was in Euro millions, not billions, per Reuters.

"Vulnerabilities in the non-bank financial sector could exacerbate volatility and asset price corrections," Lagarde further noted. "Individual financial institutions should carefully preserve their current levels of resilience, to ensure that they could weather a potentially less favorable environment."

Market reaction

EUR/USD holds its ground in the American session and was last seen rising 0.5% on the day at 1.0720.

- As investors shrugged off banking crisis woes, EUR/USD gained traction above 1.0700.

- PPI in German was mixed, with annual reading shooting above 15%< while MoM data shrank.

- EUR/USD: Bullish in the near term but needs to clear 1.0760, to extend its gains.

The EUR/USD breaks the 1.0700 barrier and climbs 0.50% after hitting a daily low of 1.0631. An improvement in market mood and European Central Bank (ECB) speakers lend a hand to the Euro (EUR), while the US Dollar (USD) continues to weaken across the board. At the time of writing, the EUR/USD is trading at 1.0720.

Germany’s PPI and ECB speaking among the factors boosting the Euro

Market sentiment improved after UBS bought its Swiss rival Credit Suisse. The financial market turbulence has spurred speculations that global central banks could pause the pace of tightening. However, traders expect a 25 bps rate hike by the Federal Reserve (Fed) on Wednesday. The CME FedWatch Tool odds for a quarter of a percentage point lift at 73.10%.

The EUR/USD price action has been driven by ECB speakers. The President of the ECB, Christine Lagarde, said that inflation is expected to continue excessively high for a more extended period. She added that there’s no trade-off between inflation and financial stability, and without tensions, the ECB would’ve indicated that additional rate hikes were required.

At around the same time, ECB’s Stoumaras commented the ECB would not give more forward guidance and said that meetings would be data dependant.

Earlier, Germany’s inflation in the producer side, known as the Producer Price Index (PPI), contracted -0.3% MoM, less than estimates of -0.5%. Annually basis, the PPI jumped 15.45, above forecasts of 14.5%.

Aside from this, last Friday’s US economic data revealed that Industrial Production experienced a -0.2% YoY decrease, marking the first contraction in the past year. The monthly reading was 0%, lower than the estimated 0.2%. Additionally, Consumer Sentiment in the US, as measured by the University of Michigan (UoM), decreased from 67 in February to 63.4 in March, the first drop in four months.

The US Dollar Index, a measure of the buck’s value, extended its losses to 0.44%, down at 103.417, a tailwind for the EUR/USD. US Treasury bond yields are recovering but failing to underpin the greenback.

EUR/USD Technical analysis

The EUR/USD has printed three consecutive bullish candles, though it remains shy of testing last week’s high of 1.0759. The daily chart suggests a triple bottom is in place, though it would need to reclaim the latter to confirm its validity. That would pave the way for a rally towards the YTD high of 1.1032, but firstly, traders need to clear the February 14 at 1.0804 before aiming towards 1.1000. Conversely, a fall below the 100 and 200-day EMAs, around 1.0545/1.0569, would shift the EUR/USD bias to bearish.

What to watch?

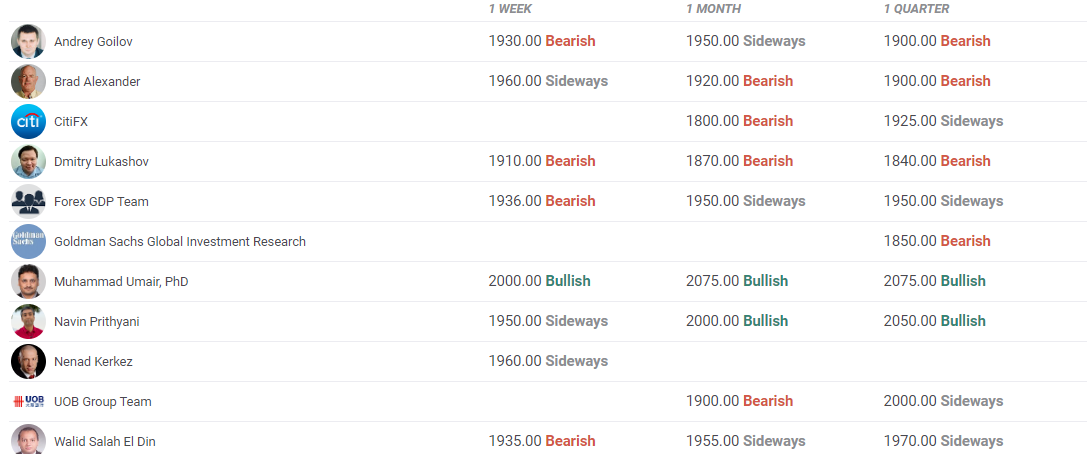

Gold has embarked on a steady up move. Economists at Société Générale expect the yellow metal to enjoy further gains toward the $2,055/75 region.

Recent bullish gap at $1,870 should be an important support

“Gold is in proximity to April 2022 levels of $2,000. A brief pause is not ruled out, however, signals of a meaningful pullback are not yet visible; recent bullish gap at $1,870 should be an important support.”

“Gold is expected to head gradually towards the upper part of its range since 2020 at $2,055/$2,075. This is a key resistance zone; overcoming it could mean the onset of a larger uptrend.”

Statistics Canada will release February Consumer Price Index (CPI) data on Tuesday, March 21 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming Canadian inflation data.

Headline is expected at 5.4% year-on-year vs. 5.9% in January. If so, CPI would be the lowest since January 2022 but still well above the 1-3% target range. However, on a monthly basis, it is expected to have risen by 0.6% after a 0.5% gain in January.

RBC Economics

“We expect Canadian headline CPI growth slipped to 5.4% YoY in February from 5.9% in January. Lower gasoline prices in February (down 3.6% monthly) could push energy CPI below year-ago levels for the first time in two years. Food inflation is still exceptionally high, and likely remained elevated in February. Shelter CPI is expected to have trended over, though accelerating mortgage interest costs partially offset weaker price growth for expenses related to home-buying. More importantly, the BoC’s preferred core measures – CPI trim and median – are expected to continue to moderate on a three-month moving average basis. That together with narrowing breadth of inflation pressure suggests persistent easing in fundamental price pressure, which should be enough to keep the BoC on hold through the end of this year.”

TDS

“We look for CPI to continue trending lower to 5.3% YoY as core measures soften to 4.8%. Base-effects will play a large role with prices up 0.5% MoM, but energy prices will also exert a drag. This would leave Q1 CPI tracking slightly below the January MPR, but we would note the evolution of financial sector vulnerabilities will be the larger factor for the near-term BoC outlook.”

CIBC

“While the annual pace of inflation likely cooled further in February, the monthly increase excluding food/energy may look a little firmer than in the prior month. Gasoline will be the main driving force behind a deceleration in the headline rate of inflation to 5.4%, from 5.9% in the prior month, as pump prices were broadly unchanged this February, but saw a big jump in the same month a year ago. While another sharp monthly increase in food prices is likely to be seen, it isn’t expected to be any stronger than the surge seen in February 2022. Excluding food and energy, prices are expected to increase by a seasonally adjusted 0.25%, which would be an acceleration from a 0.14% advance in January, due to increases in air fares, rents and other items. The BoC’s core measures of inflation are expected to ease a little further on a YoY basis, but the three-month annualized rates will likely remain sticky around 3½% due to the impact that food prices can have on these measures.”

NBF

“A slight decline in gasoline prices, combined with a drop in the natural gas segment, should have benefited consumers during the month. The increase in food costs, meanwhile, could have moderated following January’s surge. Headline inflation could nonetheless have increased 0.5% MoM (0.2% after seasonal adjustment) on gains in several services categories. If we’re right, the 12-month rate could still drop six ticks to 5.3% on account of a strongly negative base effect. The annual rate of core measures should have moderated as well, with CPI-trim likely easing from 5.1% to 4.9% and CPI-median moving from 5.0% to 4.8%.”

CitiBank

“We expect a 0.5% MoM rise in CPI in February, although with risks tilted slightly to the upside. Key shelter prices should remain soft in line with modestly declining new home prices, although with possible further upside to shelter prices such as rents. The 3mth pace of core inflation is still running around 3-4% on an annualized basis, which notably was referred to for the first time in the March policy statement as too high. This could eventually be cited as a factor leading the BoC to adjust rates higher again.”

"We are very confident that capital and liquidity positions of the Euro area banks are well in excess of requirements," European Central Bank (ECB) President Christine Lagarde told European Parliament's Committee on Economic and Monetary Affairs on Monday.

"Financial tensions might dampen demand, do some of the work that would otherwise be done by monetary policy," Lagarde further explain and said that without tensions, they would have indicated that further hikes would be needed.

Market reaction

EUR/USD continues to trade in positive territory above 1.0700 after these comments.

Economists at Scotiabank discuss FOMC’s policy decision. In their view, the US Dollar could weaken if the market believes that the Fed is near to end its tightening cycle.

Any hike is very likely to be accompanied by neutral or dovish language

“Our call remains +25 bps but any hike is very likely to be accompanied by neutral or dovish language that leaves the outlook for rates contingent on how the economy and banking sector evolve from here.”

“If markets believe the situation means the Fed tightening cycle is nearly complete, the USD is likely to soften.”

Since the onset of the banking sector turmoil last Thursday, the Pound is the second best performing G10 currency. Economists at MUFG Bank expect GBP to remain resilient.

GBP/Risk correlation is weakening

“A turn higher in risk aversion and a pause from the BoE could test the recent resilient performance of the Pound.”

“The correlation between GBP and risk has weakened of late which may reflect some improved fundamentals.”

“Improved fiscal credibility, greater political stability and a shrinking current account deficit should all help to limit the fallout for the GBP.”

Economist at UOB Group Lee Sue Ann reviews the latest ECB gathering.

Key Takeaways

“The European Central Bank (ECB) stuck with the 50bps hike that it had flagged in Feb as its intention for Mar, with the opening statement of the accompanying press release clearly showing the ECB’s determination to fight inflation. Both the statement and the press conference conducted by both ECB President Christine Lagarde and ECB Vice-President Luis de Guindos highlighted the resilience of the banking sector.”

“The ECB now expects headline inflation to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025. It sees core inflation averaging 4.6% in 2023, 2.5% in 2024 and 2.2% in 2025. On GDP, the ECB now expects 1.0% growth in 2023, and for the pace to pick up further to 1.6%, in both 2024 and 2025.”

“In all, the ECB has given us very little in terms of what to expect at the next monetary policy decision on 4 May. From now till then, a lot can happen. It could still bring the current hiking cycle to an abrupt end, especially if banking tensions worsen. We are, nonetheless, penciling in a 25bps hike at the May meeting, on the latest indication of the ECB’s willingness to put out fires in banking woes, as well as fresh forecasts confirming that it probably does not think the fight against inflation is over.”

- EUR/CHF adds to Friday’s uptick above 0.9900.

- The upbeat tone in the risk complex lends legs to the cross.

- ECB Lagarde said elevated inflation will persist for longer.

The better tone in the risk-associated universe motivates EUR/CHF to extend last week’s recovery north of the 0.9900 barrier on Monday.

EUR/CHF bid on risk-on mood

EUR/CHF advances for the second session in a row and manages to regain the area above 0.9900 the figure amidst an auspicious start of the new trading week.

Indeed, concerns around the banking sector in the old continent appear somewhat alleviated in response to news involving UBS and Credit Suisse, although this does not prevent shares of the latter to shed nearly 60% at the beginning of the week.

Looking at the bigger picture, the better tone in the risk complex helps the cross regain the 0.9900 barrier and beyond and clinch fresh 2-week tops against the backdrop of another negative session in the greenback.

Around the single currency, Chair C.Lagarde reiterated there is no trade-off between prices and financial stability, adding that the central bank could provide liquidity in case of need. More from Lagarde, she noted that the interest rate remain the exclusive tool in setting monetary policy, at the time when she insisted on the persistence of elevate inflation and highlighted the data-dependent stance from the ECB when it comes to decision on rates.

EUR/CHF significant levels

As of writing the cross is advancing 0.49% at 0.9917 and faces the next resistance at 1.0041 (monthly high March 2) ahead of 1.0097 (2023 high January 13) and finally 1.0514 (monthly high June 9 2022). On the downside, the breach of 0.9842 (200-day SMA) would expose 0.9705 (2023 low March 15) and then 0.9643 (weekly low October 12 2022).

S&P 500 broke out above the highs of last September/December, however, the move petered out after facing interim resistance near 4195. Crucial support is seen at 3800/3760, analysts at Société Générale report.

S&P 500 must surpass 4000 to affirm an extended up move

“Low of December near 3800/3760 which is also the 61.8% retracement from October is a crucial support zone.”

“A bounce is expected but the index must re-establish itself beyond the 50-DMA (now at 4000) to affirm an extended up move.”

“Should the index establish itself below 3800/3760, a deeper down move is not ruled out. Next potential objectives could be at 3630 and last October's low of 3490.”

- USD/MXN retreated after hitting a six-week high of around 19.2327.

- Last Friday, US economic data pointed to further weakness in the economy.

- Traders are expecting a 25 bps rate hike by the Federal Reserve.

USD/MXN is almost flat on Monday, losing 0.18% after traveling from a daily low of 18.8123. But buyers stepped in and lifted the pair above the $19.00 threshold. Nevertheless, the 100-day Exponential Moving Average (EMA) at 18.9929 capped the USD/MXN pair gains. The USD/MXN is trading at 18.8390at the time of writing.

Sentiment improvement bolstered the Mexican Peso

Investors shrugged off fears of the banking crisis after UBS’s takeover of Credit Suisse. Global central banks welcomed the news, though sentiment would remain fragile ahead of the Federal Reserve’s (Fed) interest rate decision this week. Money market futures odds for a 25 basis point rate hike lie at 73.1%, compared to last week’s 65%.

Friday’s data in the United States (US) revealed that Industrial Production for February contracted for the first time in the last 12 months, at -0.2% YoY. The monthly reading came at 0%, below the 0.2% estimates. In the meantime, as measured by the University of Michigan (UoM), March’s Consumer Sentiment in the US dropped for the first time in four months, from 67, to 63.4 in March.

The UOM poll updated American’s inflation expectations for a 5-year from 2.9% to 2.8%, while for one year, it dropped to 3.8% from 4.1%.

That has weighed in the greenback, as shown by the US dollar Index (DXY), falling 0.48%, at 103.371. US Treasury bond yields continue to collapse, a headwind for the USD/MXN

On the Mexican side, the Bank of Mexico (Banxico) Governor Victoria Rodriguez Oceja commented that she’s considering a more gradual approach to interest rate increases after hiking 50 bps in February. She added, “We’ll take into account the decision of the Fed and many other factors to the extent that they affect the inflation panorama.”

USD/MXN Technical analysis

The USD/MXN hit a daily high at 19.2327, shy of testing the 200-day EMA at 19.3888. Since then, the USD/MXN erased those gains and dropped beneath the 100-day EMA, though it found support at 18.8047. For a bearish continuation, the USD/MXN must reclaim the 50-day ENA at 18.6822 to test the 20-day EMA at 18.5487. Otherwise, if the USD/MXN regains the 100-day EMA at 18.99, the pair would be poised to finish the day above $19.00.

What to watch?

While testifying before European Parliament's Committee on Economic and Monetary Affairs, European Central Bank (ECB) President Christine Lagarde said that inflation is projected to remain too high for too long, per Reuters.

Lagarde reiterated that wage pressures have strengthened on the back of robust labour markets and added that employees are aiming to recoup some of the purchasing power. "The key ECB interest rates remain our primary tool for setting the monetary policy stance," she concluded.

Market reaction

EUR/USD keeps its footing following these comments and was last seen gaining 0.5% on the day at 1.0720.

The Federal Reserve is focused on inflation and will look to hike 25 bps if conditions allow. Economists at ING analyze how Wednesday’s meeting could impact the US Dollar.

A pause could see the Dollar weaken a little

“We do not expect too much volatility if conditions allow the Fed to hike 25 bps and the dot plots do not surprise too much.”

“An unlikely 50 bps hike would be very bullish for the Dollar – and EUR/USD could well trade under big support at 1.05 on the news.”

“A pause could see the Dollar weaken a little – but it would be understandable after recent bank failures.”

- USD/JPY stages a goodish recovery from over a one-month low touched earlier this Monday.

- A positive turnaround in the risk sentiment weighs on the safe-haven JPY and lends support.

- Bearish traders might wait for acceptance below the 61.8% Fibo. before placing fresh bets.

The USD/JPY pair finds decent support in the vicinity of the mid-130.00s and stages a goodish intraday recovery of over 100 pips from its lowest level since February 10 touched earlier this Monday. The pair, however, keeps the red for the second straight day and trades just above the 131.50 region during the early North American session, down less than 0.15% for the day.

From a technical perspective, the intraday failure near the 50% Fibonacci retracement level of the recent rally from the January monthly swing low exerts heavy pressure on the USD/JPY pair amid the emergence of fresh US Dollar selling. That said, spot prices struggle to find bearish acceptance below the 61.8% Fibo. level amid an intraday turnaround in the global risk sentiment, which tends to undermine the safe-haven Japanese Yen (JPY).

Apart from this, the Fed-Bank of Japan (BoJ) policy outlook turns out to be another factor that assists the USD/JPY pair to attract some buyers at lower levels. Traders also opt to lighten their bearish bets ahead of the highly-anticipated FOMC monetary policy meeting, starting this Tuesday. The Fed will announce its decision on Wednesday, which will drive the USD demand and help determine the next leg of a directional move for the major.

In the meantime, any subsequent recovery is more likely to confront some resistance near the 132.00 mark ahead of the 50% Fibo. level, around the 132.60-132.65 region. A sustained move beyond has the potential to lift the USD/JPY pair back towards the 133.00 round figure en route to the next relevant hurdle near the 133.50 region. This is closely followed by 38.2% Fibo. level, around the 133.80 zone, which should now act as a pivotal point.

On the flip side, the daily swing low, around the 130.55-130.50 region, now seems to protect the immediate downside. Some follow-through selling will confirm a bearish breakdown and make the USD/JPY pair vulnerable to challenging the 130.00 psychological mark. The downward trajectory could get extended towards intermediate support near the 129.55-129.50 area en route to the 129.00 round figure and the 128.50 horizontal zone.

USD/JPY daily chart

Key levels to watch

EUR/USD is starting the week on a firm note. Economists at Scotiabank expect the pair to rise if the Fed blinks at its Wednesday's monearty policy decsion.

More range trading seems the likely course of events for now

“More range trading seems the likely course of events for now but the EUR will benefit if the Fed blinks on Wednesday after the ECB delivered last week.”

“Weak trend momentum on the short (intraday/daily) DMIs suggests that the roughly sideways Feb/Mar range in the EUR should extend a little more – with EUR gains slowing above 1.07.”

“We see firm resistance around 1.0750/60 for now.”

“Support is 1.0625/30 intraday.”

- GBP/USD scales higher for the third straight day and touches a fresh one-month high on Monday.

- Bets for a less hawkish Fed, a recovery in the risk sentiment weigh on the USD and lend support.

- Traders might refrain from placing fresh bets ahead of the key central bank meetings this week.

The GBP/USD pair builds on last week's rally from the vicinity of the 1.2000 psychological mark and gains positive traction for the third successive day on Monday. The momentum remains uninterrupted through the early North American session and lifts spot prices to over a one-month high, around the 1.2240 region in the last hour.

An intraday turnaround in the global risk sentiment - as depicted by a solid recovery in the US equity futures - drags the safe-haven US Dollar (USD) to its lowest level since February 14, which, in turn, acts as a tailwind for the GBP/USD pair. The USD is further pressured by diminishing odds for a more aggressive policy tightening by the Federal Reserve (Fed), especially after the recent collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank.

In fact, the markets are now pricing in a smaller 25 bps lift-off at the end of a two-day FOMC monetary policy meeting, starting this Tuesday. The US central bank is also expected to start cutting interest rates during the second half of the year, which had led to the recent sharp downfall in the US Treasury bond yields. It is worth recalling that the rate-sensitive 2-year US government bond last week recorded its biggest three-day slump since Black Monday in October 1987.

That said, some repositioning trade ahead of the key central bank event risk pushes the US bond yields high, albeit does little to impress the USD bulls. This, along with the possibility of some short-term trading stops being triggered above the 1.2200 mark, further contributes to the bid tone surrounding the GBP/USD pair. It, however, remains to be seen if the intraday positive move is backed by genuine buying or turns out to be a stop run, warranting some caution for bulls.

In the absence of any major market-moving economic data on Monday, the focus will remain glued to the FOMC decision on Wednesday and the Bank of England policy meeting on Thursday. Apart from this, traders, this week will confront the release of the latest consumer inflation figures from the UK on Wednesday. The crucial macro data, along with the highly-anticipated central bank meetings, will help to determine the near-term trajectory for the GBP/USD pair.

Technical levels to watch

USD/IDR us now expected to navigate within the 15,285-15,450 range in the short term, according to Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

“USD/IDR traded between 15,250 and 15,450 last week, narrower than our expected consolidation range of 15,330/15,450.”

“The price actions offer no fresh clues and we continue to expect USD/IDR to consolidate. Expected range for this week, 15,285/15,450.”

- EUR/USD picks up extra impulse and surpasses 1.0700.

- Further north emerges the monthly high near 1.0760.

EUR/USD climbs to 3-day highs past 1.0700 the figure and extends the rebound for the third consecutive session on Monday.

If the recovery gathers impulse, then the pair could confront the March high at 1.0759 (March 15) ahead of the weekly peak at 1.0804 (February 14).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0325.

EUR/USD daily chart

USD/CAD holds range. Economists at Scotiabank note that the technical picture shows that the risks are tilted slightly to the downside.

Auguring a period of more dynamic movement shortly

“USD/CAD has settled into a flat range trade over the past couple of weeks but the narrowing parameters of the range are producing a triangular type pattern on the intraday chart that augurs for a break out (one way or the other) and – perhaps – a period of more dynamic movement shortly.”

“Resistance is 1.3780, support is 1.3685.”

“Broader patterns – the early March peak/reversal above 1.38 and the USD’s longer run overbought condition – tilt technical risks (slightly) to the downside.”

Markets Strategist Quek Ser Leang at UOB Group noted USD/MYR could brewak below the 4.4500 level in the near term.

Key Quotes

“We highlighted last Monday (13 Mar, spot at 4.4810) that ‘4.5290 is likely a short-term top’ and we expected USD/MYR to ‘edge lower but any decline is viewed as a lower trading range of 4.4500/4.5150’. Our view was not wrong even though USD/MYR traded in a narrower range of 4.4650/4.5130 before closing the week at 4.4830 (-0.38%). Downward momentum has improved, albeit not much.”

“This week, USD/MYR could edge lower to 4.4500. The next support at 4.4300 is unlikely to come under challenge. On the upside, a breach of 4.5100 (minor resistance is at 4.4850) would indicate that the current mild downward pressure has eased.”

- DXY extends the decline for the third session in a row on Monday.

- A minor support aligns at the weekly low at 102.58.

DXY retreats for the third session in a row and prints new monthly lows in the 103.40/35 band on Monday.

The continuation of the retracement appears likely in the very near term at least. Against that, there is a minor support at the weekly low at 102.58 (February 14), while the loss of this region could spark a deeper pullback to the YTD low near 101.80 (February 2).

Looking at the broader picture, while below the 200-day SMA (106.63), the outlook for the greenback is expected to remain negative.

DXY daily chart

The broad USD has been oscillating between risk appetite and rates. When the stage for a more positive environment is set, long-held view of the broad USD decline would then resume, economists at HSBC report.

Uncertainties are high

“If the financial contagion effects are much more adverse than we anticipate, then the USD should strengthen as a ‘safe haven’ currency. However, in our view, the more probable outcome is that these financial stability risks will eventually be contained.”