- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-03-2023

- Silver price seesaws near seven-week high after refreshing the multi-day top.

- Sustained break of nine-month-old horizontal resistance area, upbeat oscillators favor XAG/USD bulls.

- Silver bears stay unconvinced beyond ascending support line from September 2022.

Silver price (XAG/USD) remains firmer at the highest level since early February, after rising the most in a week the previous day, as bulls take a breather around $23.00 during early Thursday.

In doing so, the bright metal seems struggling amid the nearly overbought RSI but stays on the buyer’s radar amid a successful upside break of the previous resistance area from early June 2022 and the key Daily Moving Averages (DMAs) amid bullish MACD signals.

That said, multiple hurdles marked during early 2023 guard the XAG/USD’s immediate upside near $23.30, $24.00 round figure and the $24.30 hurdles before challenging the Year-To-Date (YTD) high surrounding $24.65.

Meanwhile, the aforementioned horizontal resistance-turned-support appears a tough nut to crack for the Silver bears as it comprises multiple levels marked since June 2022, as well as the 50-DMA and 100-DMA, while challenging the bears near $22.25-55.

Should the XAG/USD remains weak past $22.25, the mid-March bottom of around $21.50 and the 50% Fibonacci retracement level of the metal’s upside from September 2022 to March 2023, near $21.10, could test the downside moves.

It’s worth noting that the 61.8% Fibonacci retracement level and an upward-sloping support line from September 2022, respectively near $20.25 and $20.10, quickly followed by the $20.00 psychological magnet, appear the last defenses of the XAG/USD bears.

To sum up, Silver is likely to remain firmer despite multiple hurdles prod the XAG/USD bulls.

Silver price: Daily chart

Trend: Further upside expected

- US Dollar on its knees after the Fed dovish hike.

- The Weekly M-formation could hamstring the downside.

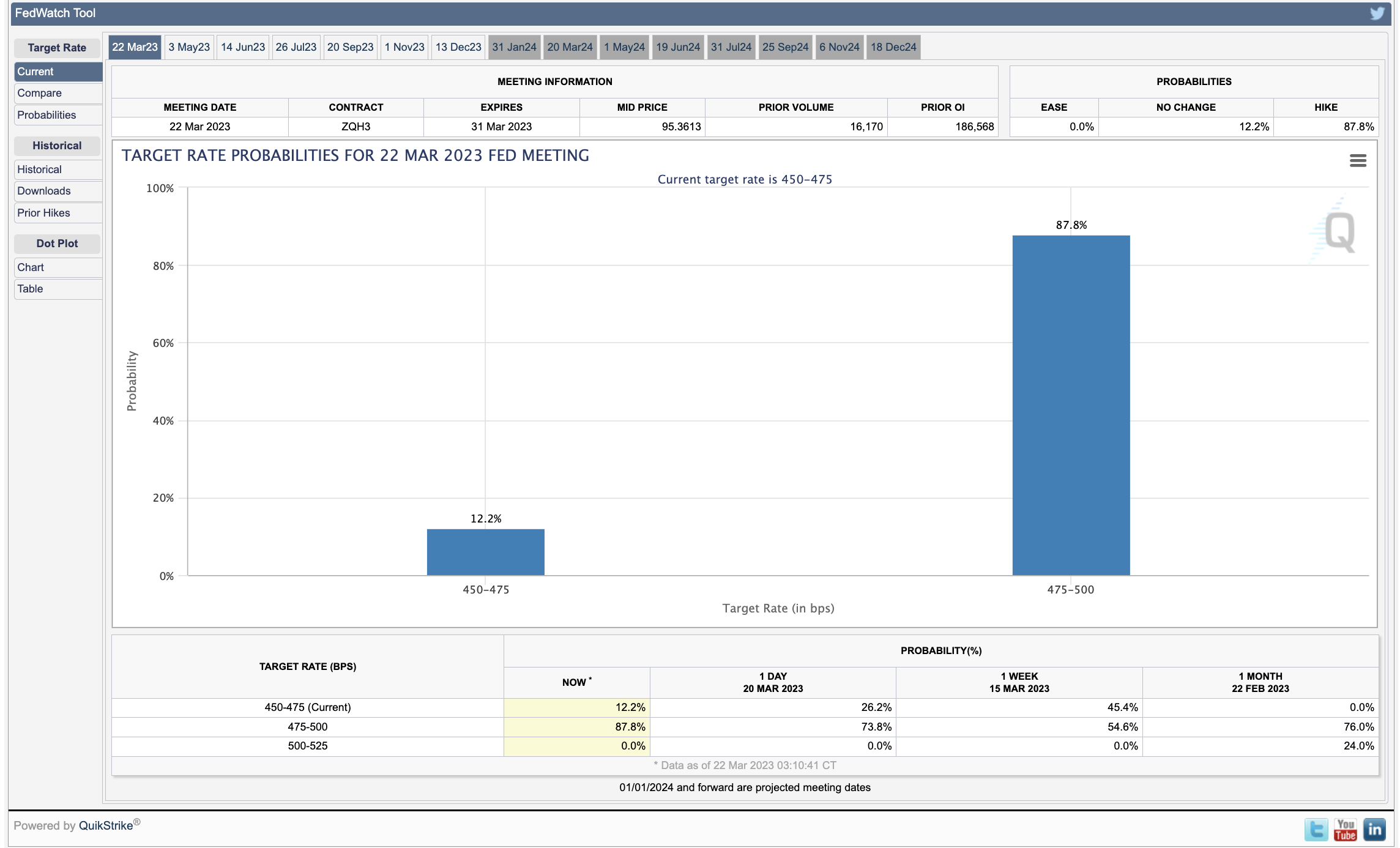

Federal Reserve hikes rates by 25 bps, as expected but the Fed statement deleted reference to 'ongoing increases' in rates. Ahead of the decision, the money markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%.

In the Fed's statement, the members of the Federal Open Markets Committee (FOMC) suggested it was on the verge of pausing future hikes in view of the recent turmoil in the financial sector. however, Jerome Powell vowed to commit to reining in inflation.

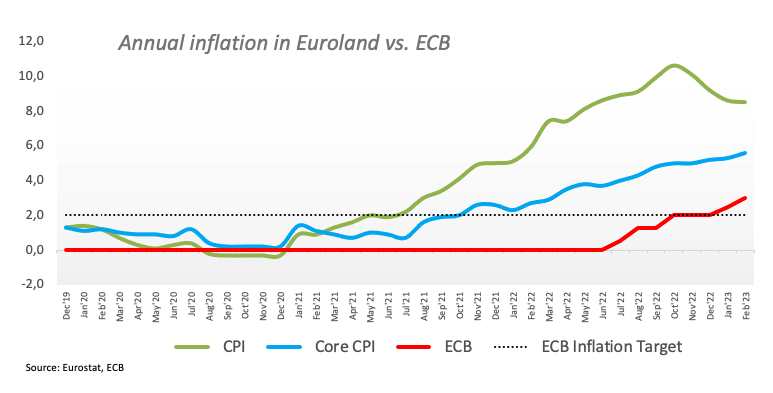

On top of that, we had hawkish comments by European Central Bank President Christine Lagarde on Wednesday that gave the Euro a boost when she said the ECB would take a "robust" approach to inflation risks.

Specifically, ECB President Lagarde said, "we do not see clear evidence that underlying inflation is trending downwards," and the ECB will take a "robust" approach that allows it to respond to inflation risks as needed but also aid financial markets if threats emerge.

Consequently, the US 2-year Treasury yields were dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265.

Fed Powell´s key notes

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

Powell speech: Recent banking events will result in tighter credit conditions

Powell speech: Before banking stress, thought we would have to raise terminal rate

Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

´´If we need to raise rates higher we will, for now we see likely hood of credit tightening.´

US Dollar technical analysis

From a weekly perspective, the price is headed to the support zone while leaving an M-formation in its tracks. This is a bullish reversion pattern that would be expected to see the index correct back toward the neckline in due course.

- EUR/GBP is looking to add gains further as ECB Lagrade sees inflation to remain high ahead.

- UK’s inflation showed a surprise rise led by higher food prices and energy costs.

- A 25bp rate hike by the BoE looks likely as UK inflation continues to stay in the double-digit figure.

The EUR/GBP pair has shifted its auction above the critical resistance of 0.8850 in the early Asian session. The cross is aiming to deliver more gains ahead despite bumper odds of 25 basis points (bps) by the Bank of England (BoE) in its monetary policy meeting, scheduled for Thursday.

On Wednesday, the United Kingdom (UK) Office for National Statistics reported a surprise rise in the Consumer Price Index (CPI) data. Monthly CPI (Feb) accelerated by 1.1% while the street was anticipating growth of 0.6%. The annual headline CPI jumped to 10.4%, higher than the consensus of 9.8% and the former release of 10.1%.

ONS chief economist Grant Fitzner cited "Food and non-alcoholic drink prices rose to their highest rate in over 45 years with particular increases for some salad and vegetable items as high energy costs and bad weather across parts of Europe led to shortages and rationing," as reported by Telegraph.

The release of the higher-than-anticipated UK inflation is going to make the interest rate decision from the BoE extremely difficult for policymakers. The central bank has already remained split between hiking rates further to continue to weigh on sticky inflation or pausing the restrictive spell amid the banking fiasco.

The street is anticipating a 25bp interest rate hike by the BoE to 4.25% as the inflation situation has become vulnerable.

On the Eurozone front, the Euro was heavily bought by the market participants on Wednesday after European Central Bank (ECB) President Christine Lagarde reiterated "Inflation is still high and uncertainty around its path ahead has increased." She further added, "While more restrictive credit conditions are part of the mechanism by which our tightening ultimately brings inflation back to target, we will make sure that the process will be orderly."

Going forward, Germany and Eurozone’s preliminary S&P Global PMI (March) data will be keenly watched, which will release on Friday.

- GBP/JPY keeps pullback from one-week high, fades corrective bounce off 160.80.

- Yields tumbled after Federal Reserve, US Treasury announcements.

- Reuters Tankan Survey for Japan suggests pessimism at big manufacturing firms.

- Strong UK inflation backs BoE’s 0.25% rate hike but Brexit woes, banking fears may probe GBP bulls.

GBP/JPY drops to 161.00 as it traces downbeat Treasury bond yields during early hours of “Super Thursday”, ahead of the Bank of England (BoE) monetary policy announcements. In doing so, the cross-currency pair not only traces bond coupons but also portrays the broad weakness in the British Pound (GBP) ahead of the key event.

US 10-year and two-year Treasury bond yields both dropped the most in a week after the US Federal Reserve (Fed) failed to push back the banking sector fears despite announcing a 0.25% rate hike. The reason could be linked to the statements saying, “some additional policy firming may be appropriate,” instead of previous remarks like “ongoing increases in the target range will be appropriate”.

It should be noted that Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen’s comments triggered a corrective bounce in the bond market but the same couldn’t last long.

Fed Chair Powell said that officials do not see rate cuts for this year, which in turn allowed breathing space to the greenback bears in the last. On the other hand, US Treasury Secretary Janet Yellen ruled out considering “blanket insurance” for bank deposits. Recently, Bloomberg also came out with the news suggesting that the Federal Deposit Insurance Corporation is said to delay the bid deadline for a silicon valley private bank.

Amid these plays, the US 10-year and two-year Treasury bond yields stay pressured around 3.45% and 3.96% at the latest while the S&P 500 Futures print mild gains even after Wall Street’s downbeat performance.

It’s worth noting that the GBP/JPY pair’s latest losses ignore downbeat results from the monthly Reuters Tankan survey as it said, “Big Japanese manufacturers remained pessimistic about business conditions for a third straight month in March.”

Furthermore, strong inflation data from the UK and British PM Rishi Sunak’s victory in getting the Brexit bill passed through the House of Commons, despite major Tory rebels, also should have favored the GBP/JPY buyers but could not.

That said, UK’s headline inflation data, namely the Consumer Price Index (CPI) rose to 10.4% YoY in February versus 9.8% expected and 10.1% previous readings while the Core CPI rose to 6.2% compared to 5.8% market forecasts and previous readings. Given the improvement in the British inflation figures, the Bank of England (BoE) may be able to perform well in its likely last hawkish dance.

On the other hand, The Guardian said, "Rishi Sunak has escaped an overly damaging Commons rebellion over his revised plan for post-Brexit Northern Ireland trade, winning a vote on the measure with 22 of his own MPs voting against the deal."

Moving on, the BoE's 0.25% rate hike is already given and may not entertain GBP/JPY traders much, apart from initial whipsaw, unless the inflation outlook and BoE Minutes suggest further rate lifts.

Also read: BoE Interest Rate Decision Preview: Preparing the ground for a rate hike pause in May

Technical analysis

A one-month-old descending trend line and 200-DMA, respectively around 163.15 and 163.30, restrict short-term upside of the GBP/JPY pair.

- USD/JPY is sensing hurdles around 131.50 as Yen's solid appeal has faded the impact of Fed’s rate hike.

- Fed Powell has confirmed that rate cuts are not on the agenda in 2023.

- The recent US banking debacle cannot rule out the expectations of credit tightening for businesses and households.

The USD/JPY pair is struggling to stretch its recovery above the immediate resistance of 131.50 in the early Tokyo session. It seems that attempts made by the major to surpass the 131.50 resistance are delicate. The asset is failing in following the footprints of the US Dollar Index (DXY) as the latter has displayed a decent recovery after a perpendicular sell-off.

It looks like the solid appeal of the Japanese Yen as a safe-haven has faded the impact of the interest rate hike by the Federal Reserve (Fed). Investors should be aware of the fact that the market participants were ‘gung-ho’ for the Japanese Yen amid fears of United States banking sector turmoil.

While delivering the monetary policy statement, Fed chair Jerome Powell confirmed that rate cuts are not on the agenda in 2023 as the central bank is dedicated to scaling down the stubborn inflation. However, commentary on interest rate guidance remained absent to which the street is anticipating that the Fed is close to pausing the policy-tightening program.

On the recent banking fiasco, Fed Powell has loaded blame on the management of Silicon Valley Bank (SVB) citing it as ‘failed badly’. He further added that the US banking system is sound and resilient. Still, the recent debacle cannot rule out the expectations of credit tightening for businesses and households, which will cool off overall demand and inflation further.

The burden of consecutive 25 basis points (bps) rate hikes by the Fed critically impacted S&P500. The 500-US stocks banks were heavily dumped as further credit tightening would result in more contraction in the economic activities, portraying a risk-off market mood. The US Dollar Index (DXY) is demonstrating a back-and-forth action around 102.50 after a recovery move as investors await a Q&A session with Fed Powell for further clarity.

Big Japanese manufacturers remained pessimistic about business conditions for a third straight month in March, the closely watched Reuters Tankan survey showed. The results also reflect worry about slowing global growth that could hurt the country's export engine.

“The sentiment index for big manufacturers stood at minus 3, slightly up from minus 5 seen in the previous month, according to the survey conducted March 8-17,” reported Reuters.

Key results

Compared with three months ago, the manufacturers' index was down 11 points, suggesting a worsening of sentiment in the BOJ tankan's headline big manufacturers index.

The Reuters Tankan index is expected to rebound to plus 10 over the next three months.

The large service-sector firms' index rebounded to plus 21 in March from plus 17 seen in the previous month. The index is expected to fall to plus 16 in June.

Service-sector firms' mood rebounded in a sign of domestic demand-driven recovery, in which the prospects of higher wages among big firms at the spring labor talks may encourage households to spend their way out of the COVID-induced doldrums.

The mixed results underscored the fragility of the world's No.3 economy as exports slow and private consumption, which accounts for more than half the economy, lacks momentum.

The central bank's survey due next April 3 will likely show deterioration in business confidence at big manufacturers.

USD/JPY stays pressured

USD/JPY holds onto the Fed-induced losses near 131.30, fading the bounce off previous low surrounding 131.00 by the press time.

Also read: USD/JPY drops on the dovish Fed 25 bp rate hike

- The US Federal Reserve’s 25 bps rate hike undermined the US Dollar.

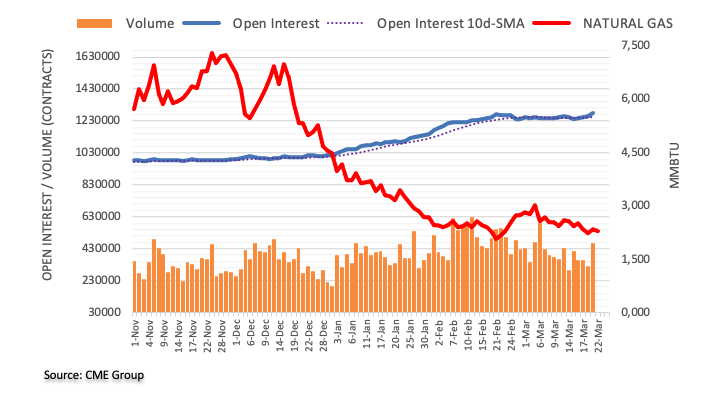

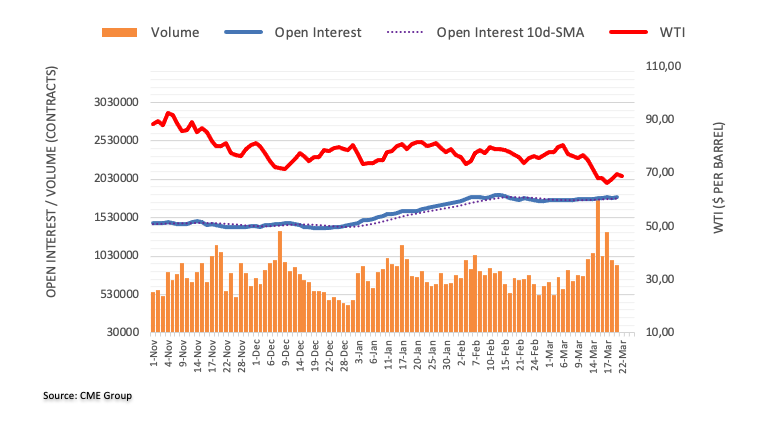

- WTI shrugged off the rise in US oil inventories to a 22-month high.

- OPEC+ countries would likely adhere to its output cut of 2 million barrels daily.

Western Texas Intermediate (WTI), the US crude oil benchmark, rises 0.17% as Thursday’s Asian session begins. On Wednesday, the black gold advanced 0.59% to $68.94 a barrel as New York finished its session. However, WTI is pushing for a second attempt in the week, above the $70.00 a barrel. At the time of writing, WTI exchanges hands at $70.02.

WTI advanced steadily, boosted by a soft US Dollar

Wall Street finished the session with losses. The US Federal Reserve (Fed) decided to lift rates a quarter of a percentage point, as estimated, though it remained worried about inflation and the tightness of the labor market. However, Powell and Co. backpedaled against a 50 bps hike and removed the phrase “ongoing increases” that might be “appropriate” from the monetary policy statement.

That sent US Treasury bond yields collapsing and undermining the greenback. The US Dollar Index (DXY), a measure of the buck’s value vs. a basket of six currencies, falls 0.66%, at 102.533. That helped the US Dollar denominated commodity by making crude cheaper for buyers that use other currencies but the US Dollar.

Although oil rallied, it was capped by weekly data revealed by the US Energy Information Administration (EIA) agency, which showed that US stockpiles rose by 1.1 million in the last week.

Since December, US inventories have grown to their highest level since May 2021.

The Organization of the Petroleum Exporting Countries (OPEC) and its partners, such as Russia, who are collectively known as OPEC+, are expected to continue with its agreement to reduce oil production by 2 million barrels per day until the year-end, even though there has been a significant drop in the price of crude oil, according to three representatives from OPEC.

WTI Technical levels

- NZD/USD prints mild gains after bouncing off two-week-old ascending support line.

- Bullish MACD signals, steady RSI (14) joins sustained trading beyond 200-DMA to favor bulls.

- 100-DMA, 50-DMA restrict short-term upside before mid-February high.

- Bears need validation from 0.6130 before challenging monthly low.

NZD/USD grinds higher past 0.6200, mildly bid near 0.6225 during early Thursday, as it defends the Federal Reserve (Fed) inspired gains despite the latest pullback from the 100-DMA.

In doing so, the Kiwi pair stays firmer above a fortnight-long support line, as well as the 200-DMA. Adding strength to the upside bias could be the bullish MACD signals and the firmer RSI (14).

As a result, the NZD/USD price is likely to mark another attempt in crossing the 100-DMA hurdle of 0.6280, which in turn will highlight the 50-DMA resistance surrounding the 0.6300 threshold for the Kiwi pair buyers.

In a case where the quote remains firmer past 0.6300, the odds of its run-up towards challenging the mid-February high of near 0.6390 and then to the 0.6400 round figure can’t be ruled out.

Alternatively, NZD/USD pullback remains elusive unless the quote stays beyond the aforementioned immediate support line, close to 0.6200 by the press time.

Following that, the 200-DMA level of 0.6158 and the 0.6130 level may act as the last defenses of the buyers before directing the quote toward the monthly low of 0.6084.

Overall, NZD/USD is likely to grind higher but the road toward the north appears bumpy.

NZD/USD: Daily chart

Trend: Further recovery expected

- USD/CAD has reclaimed the previous day’s high around 1.3740 as Fed’s Powell rules out hopes of rate cuts in 2023.

- The Loonie is hovering near the downward-sloping trendline of the Descending Triangle chart pattern.

- Investors should be aware of the fact that responsive selling is expected as the Loonie asset is at make-or-break levels.

The USD/CAD pair has recovered its entire losses and has reclaimed region around Wednesday’s high at 1.3740 in the early Asian session. The Loonie asset witnessed a significant buying interest near 1.3680 as the Federal Reserve (Fed) ruled out hopes of rate cuts in 2023 citing price stability as their utmost priority.

S&P500 futures were heavily dumped by the market participants as a continuation of higher rates by the Fed would bolster the case of a recession in the United States. The continuation of severe policy tightening in times when banking turmoil is promising a cooing demand and credit tightening is assuring a dismal economic outlook.

The US Dollar Index (DXY) has turned sideways below 102.60 after a stellar recovery from 102.00 as the market participants are digesting a whole lot of commentary from Fed chair Jerome Powell.

USD/CAD is hovering near the downward-sloping trendline of the Descending Triangle chart pattern on a two-hour scale, which is plotted from March 10 high at 1.3862. While the horizontal support of the chart pattern is placed from March 14 low around 1.3652.

The Loonie asset has scaled above the 20-period Exponential Moving Averages (EMAs) at 1.3713, which indicates that the short-term trend is bullish.

Investors should be aware of the fact that responsive selling can be kicked in as the Loonie asset is at make-or-break levels.

The Relative Strength Index (RSI) (14) is hovering near 60.00. A break above the same would trigger the upside momentum.

A decisive breakdown of March 14 low at 1.3652 would drag the loonie asset toward March 07 low at 1.3600, followed by March 03 low at 1.3555.

In an alternate scenario, a confident recovery above March 14 high at 1.3773 would drive the major toward March 09 high at 1.3835 and the round-level resistance at 1.3900.

USD/CAD two-hour chart

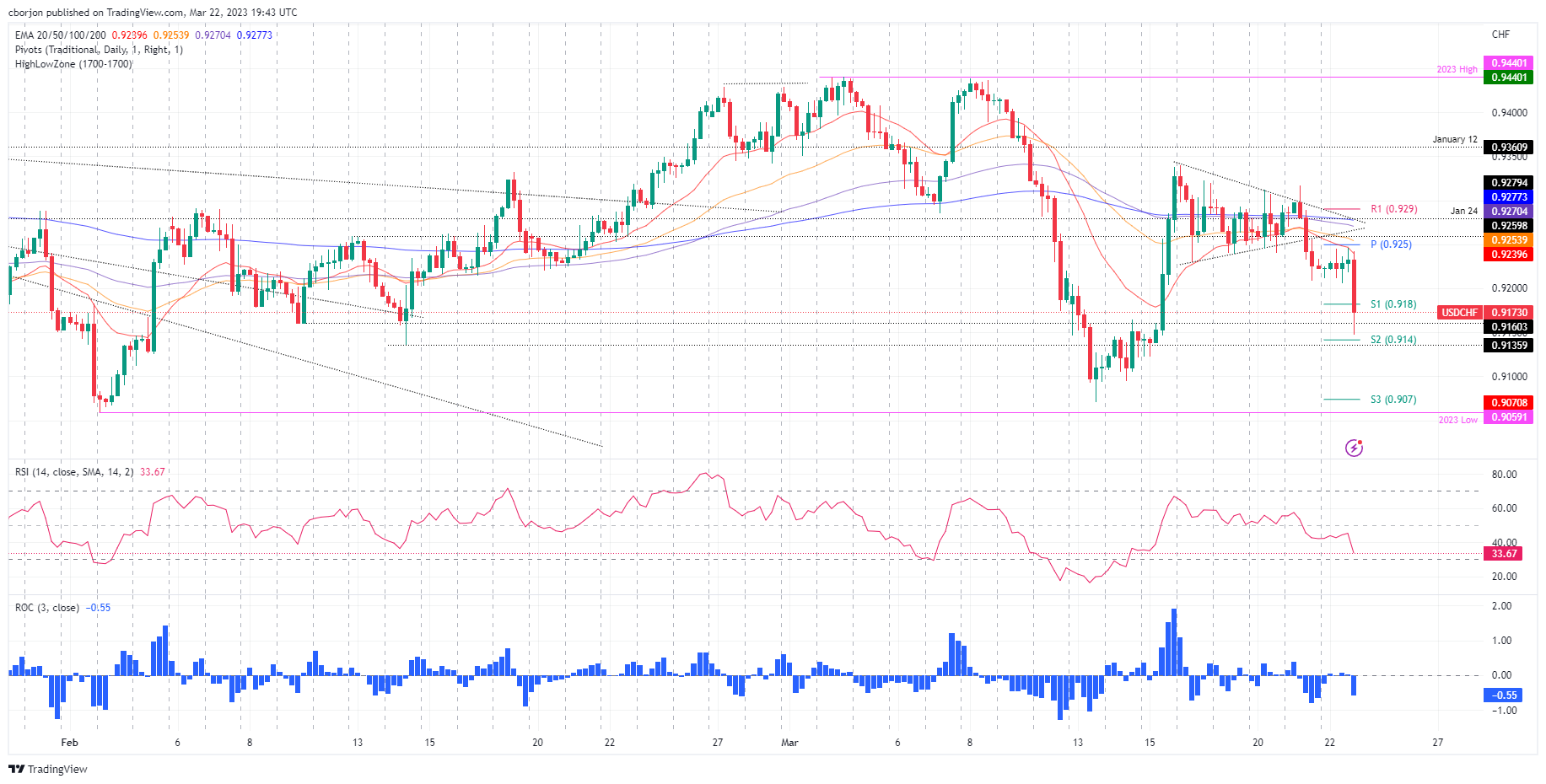

- USD/CHF fades bounce off one-week low ahead of Swiss National Bank Monetary Policy announcements.

- Fed’s dovish rate hike drown US Dollar even as Chairman Powell, US Treasury Secretary Yellen offered corrective bounce afterward.

- SNB is likely to announce 0.50% rate hike but Monetary Policy Assessment will be crucial to watch amid banking crisis.

USD/CHF retreats to 0.9173, following the Federal Reserve (Fed) induced slump to one-week low, as traders prepare for the Swiss National Bank (SNB) announcements during early Thursday.

On Wednesday, US Federal Reserve (Fed) matched market forecasts and announced 0.25% rate hike but failed to propel the US Dollar as the Fed statement mentioned “some additional policy firming may be appropriate,” instead of “ongoing increases in the target range will be appropriate”. Fed Chair Jerome Powell, however, tried to tame the rate cut hopes by saying that officials do not see rate cuts for this year, which in turn allowed breathing space to the greenback bears in the last.

Apart from the Fed announcements, US Treasury Secretary Janet Yellen’s comments also allowed the US Dollar Index to rebound from a seven-week low, by way of challenging the risk appetite, as she ruled out considering “blanket insurance” for bank deposits.

Against this backdrop, Wall Street closed in the red but yields and the US Dollar Index (DXY) both closed in the red.

Looking ahead, the Swiss National Bank’s (SNB) Interest Rate Decision is the key for the USD/CHF pair traders to watch as the bank is likely to announce a dovish hike considering the latest banking sector fallouts, mainly surrounding Credit Suisse. Should the SNB accepts challenges to the economic outlook from the latest banking sector turmoil, the USD/CHF may pay recent losses.

Apart from the SNB, the second-tier US data relating to activities and jobs will also be important to watch for clear directions.

Technical analysis

A sustained break of the 50-DMA, around 0.9255 by the press time, directs USD/CHF towards the 0.9100 threshold but multiple lows marked near 0.9085 and 0.9070 can probe the bears afterward.

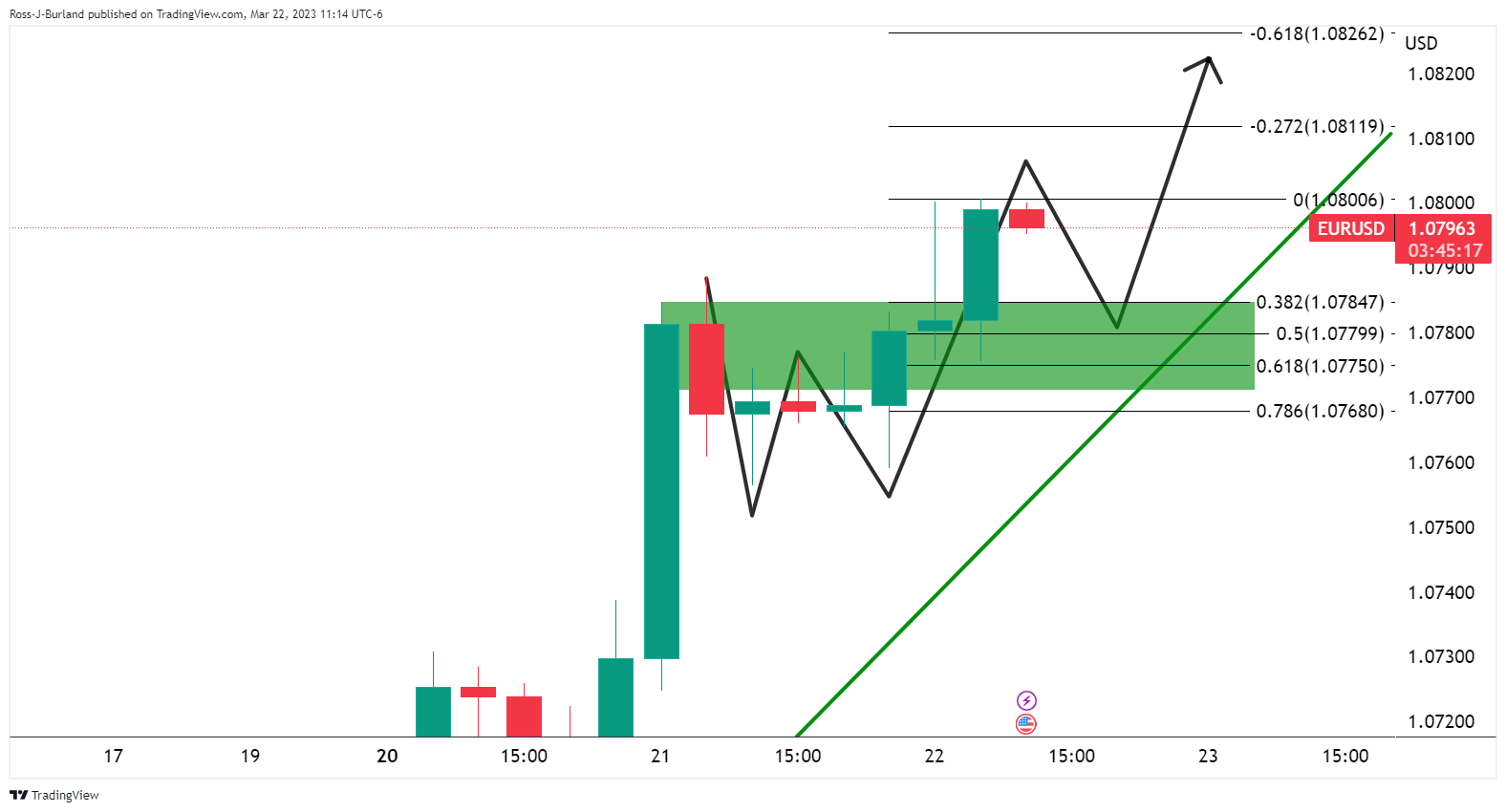

- EUR/USD grinds near multi-day top despite retreating in the last hour, stabilizes after five-day uptrend.

- US Dollar fails to cheer Fed’s 0.25% rate hike despite bouncing off multi-day low in the last.

- Fed Chair Powell’s rejection of rate cuts in 2023, US Treasury Secretary Yellen’s comments on deposit insurance favored USD rebound.

- ECB policymakers appear more hawkish than Fed signals, suggesting more room for Euro upside.

EUR/USD bulls take a breather close to a two-month high, following a five-day uptrend, after Federal Reserve’s (Fed) failure to please US Dollar bulls despite announcing a 0.25% rate hike. That said, the Euro pair seesaws around 1.0860, after a brief run-up to 1.0912, as the latest greenback licked its wounds during the last hour.

Fed matched market forecasts by announcing 25 basis points (bps) rate hike but statements like “some additional policy firming may be appropriate,” instead of “ongoing increases in the target range will be appropriate” gained major attention and drowned the USD.

Fed Chair Jerome Powell, however, tried to tame the rate cut hopes by saying that officials do not see rate cuts for this year, which in turn allowed breathing space to the greenback bears in the last.

Apart from the Fed announcements, US Treasury Secretary Janet Yellen’s comments also allowed the US Dollar Index to rebound from a seven-week low, by way of challenging the risk appetite, as she ruled out considering “blanket insurance” for bank deposits.

On the other hand, policymakers from the European Central Bank (ECB) appear more hawkish and stand ready for heavy rate hikes if the banking crisis eases, which in turn propelled the EUR/USD more. That said, ECB President Christine Lagarde reiterated on Wednesday that underlying inflation dynamics in the Eurozone remain strong, as reported by Reuters. ECB’s Lagarde, however, also said that they are neither committed to raising further nor are we finished with hiking rates. Further, ECB policymaker and Bundesbank Chief Joachim Nagel said, “There’s still some way to go, but we are approaching restrictive territory.”

Amid these plays, Wall Street closed in the red but yields and the US Dollar Index (DXY) both closed in the red.

Moving on, the Asia-Pacific market’s reaction to the Fed moves and second-tier US data will be important for fresh impulse.

Technical analysis

A clear upside break of the mid-February top, around 1.0800, allows EUR/USD to aim for 1.0930 horizontal hurdle before targeting the YTD high surrounding 1.1033.

- AUD/USD dropped below 0.6700 after Fed’s dovish rate hike.

- Fed policymakers remained compromised to tame inflation and mentioned the tight labor market.

- The Fed’s dot plot remained unchanged, with officials expecting to raise rates toward 5.10%.

The AUD/USD finished Wednesday’s session in the green, gaining 0.26%, though well below the day’s highs at 0.6758. As the Asian Pacific session begins, the AUD/USD trades at 0.6683, slightly below its opening price by 0.01%.

AUD/USD opens the Asian session flat after Fed’s hike

On Wednesday, the US Federal Reserve (Fed) revealed its decision to raise rates by 25 bps and opened the door for an additional quarter of a percentage hike. The banking crisis spurred three weeks ago changed Fed officials’ approach to the March meeting. Given that the US government had to step in after the collapse of two regional banks in the United States (US), it pushed Fed’s Powell 50 bps off the table.

Fed policymakers stressed that inflation remains elevated, and the labor market is tight. Policymakers commented that the balance sheet reduction, known as Quantitative Tightening (QT), would continue as planned. The dot plot was almost unchanged, with most Fed officials expecting the Federal Funds Rate (FFR) to peak at around 5.10%.

At the same time, the US Secretary of Treasure Janet Yellen said that “regulators aren’t looking to provide “blanket” deposit insurance to stabilize the US banking system,” according to Bloomberg. That rattled the US equity markets, which ended with an average of 1.60% losses on its three major indices, blamed on Yellen comments.

All that said, US Treasury bond yields registered losses as investors reassessed a less hawkish Fed. The US 10-year benchmark note rate collapsed 17 bps at 3.451%, undermining the greenback. The US Dollar Index fell to a fresh monthly low of 102.065 but reversed its course and is trading at 102.544, down 0.65%.

On the Australian front, an absent economic docket will leave traders adrift to US Dollar (USD) dynamics and market sentiment.

AUD/USD Technical analysis

The AUD/USD remains neutral to downward biased after failing to hold to gains above the 20-day Exponential Moving Average (EMA). Furthermore, the Relative Strength Index (RSI) is bearish, while the Rate of Change (RoC) suggests that sellers are gathering momentum. Hence, the AUD/USD first support would be 0.6600, followed by the YTD low at 0.6564. Once broken, the AUD/USD pair would tumble as low as the November 10 low at 0.6386.

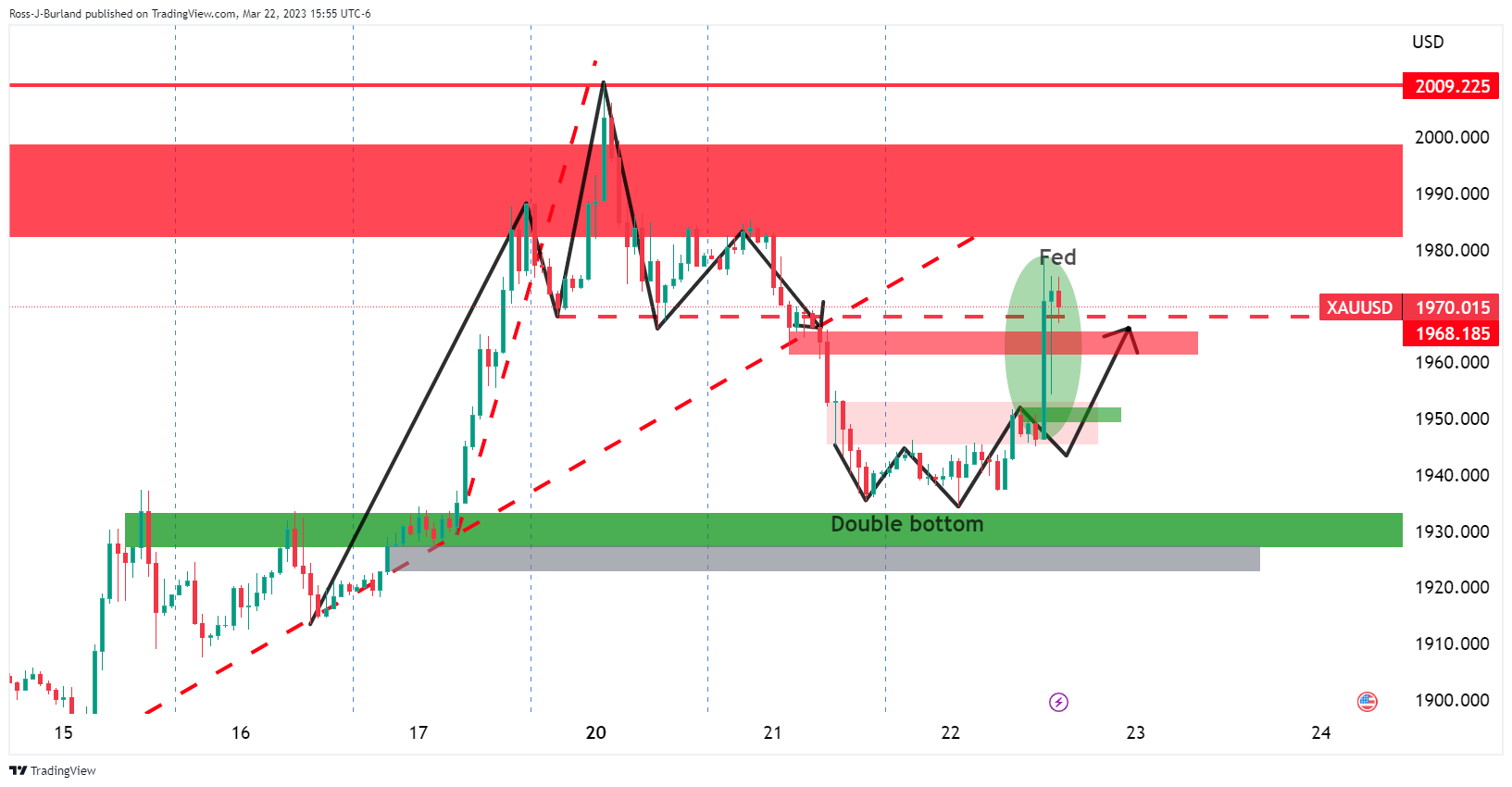

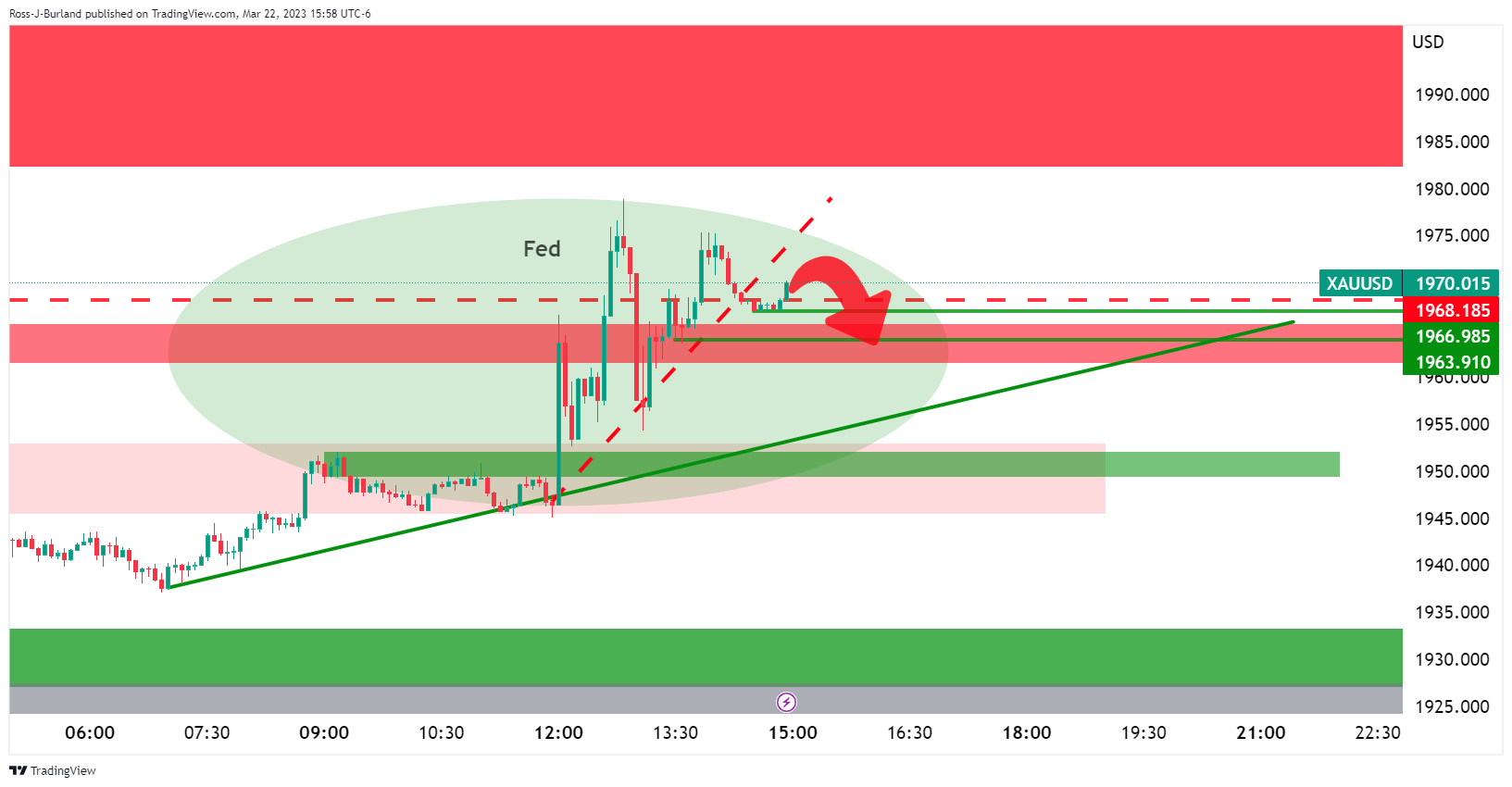

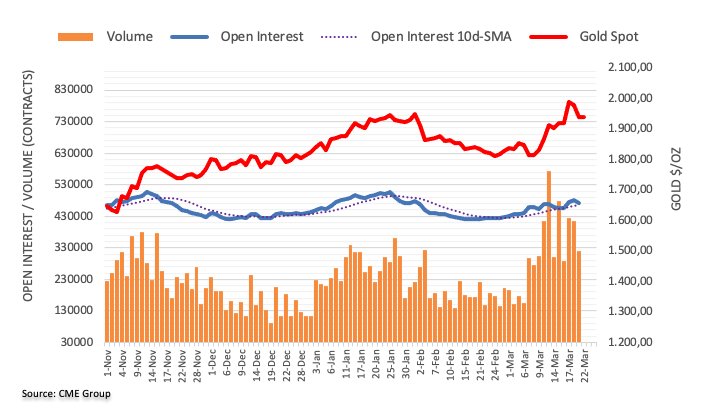

- Gold price is under pressure following the knee-jerk rally.

- Fed´s dovish 25bp rate hike leaves the sentiment mixed and Gold price in limbo.

As per the start of the week´s analysis, Gold, Chart of the Week: XAU/USD is front side of the trend ahead of the Fed, where a correction was expected ahead of the Federal Reserve, we have seen two 'way business into and around the event.

The Federal Reserve´s dovish interest rate decision when the central bank announced its 25 bp rate hike flagged “some additional policy firming” with the dot plot median pointing to one more hike. Before today´s Federal Reserve event, markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265 and Gold price ook off.

Gold prior analysis

Gold update

Ahead of the event, the Gold price was poised for a move up:

After the Fed:

Gold price 5-min chart

The bears have moved in but they need to get below the $1,960s for a look-in at the $1,950s support area. If the $1,950s were to give then the H&S on the daily chart´s target will be eyed below the prior double bottom.

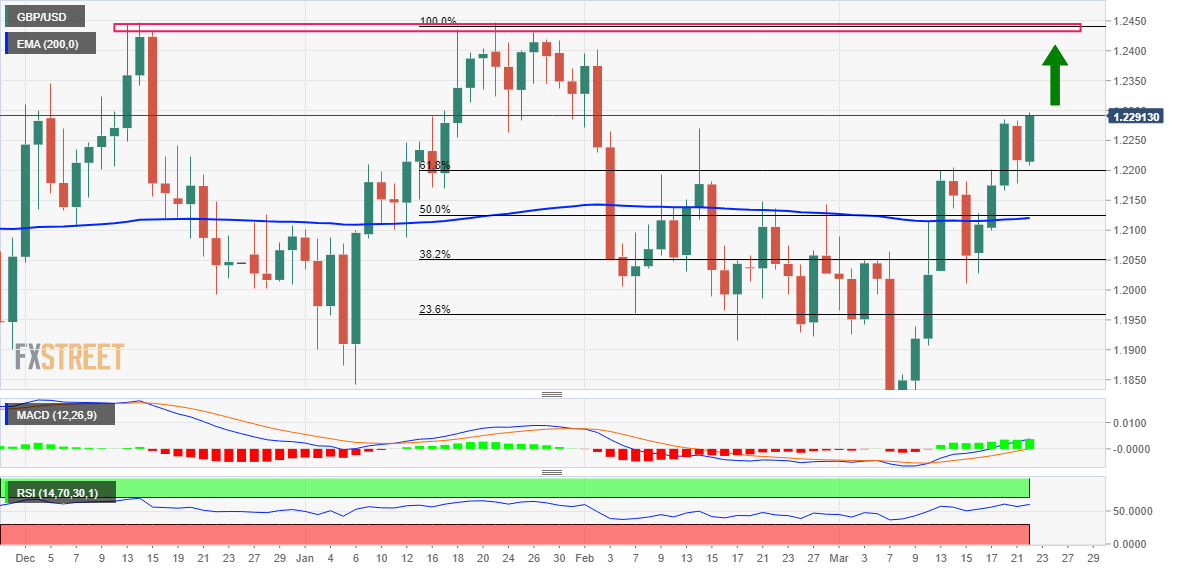

- GBP/USD corrects vertically from 1.2335 as Fed Powell denies rate cuts this year.

- US Yellen commented that they are not considering insuring all uninsured bank deposits.

- Going forward, the interest rate decision by the BoE will be keenly watched.

The GBP/USD pair has surrendered the majority of its gains generated after the Federal Reserve (Fed) announced a 25 basis point (bp) rate hike to 4.75-5.00% in its monetary policy meeting. The Cable has dropped vertically after printing a fresh six-week high at 1.2335 as Fed chair Jerome Powell has cleared that the central bank is not expecting any rate cut this year.

The main agenda of the Fed that inflation has to bring down to the desired rate of 2% is intact and the central bank would do ‘whatever it takes’ required for the same. Fed Powell has cleared, "Recent liquidity provision for rescuing the collapse of commercial banks that has increased balance sheet size is not intended to alter the stance of monetary policy."

Meanwhile, S&P500 has surrendered its entire gains delivered on Tuesday after Fed Powell cleared that rate cuts are not in pipeline at least this year. This has strengthened the fears of a recession in the United States. Apart from that, commentary from US Treasury Secretary Janet Yellen that they are not considering insuring all uninsured bank deposits has spooked market sentiment further. The statement came contradictory as she stated on Tuesday that the administration will safeguard all deposits.

The US Dollar Index (DXY) has shown some recovery after dropping to near 102.00 as hopes of rate cuts have faded well. The USD Index has recovered to near 102.60 and a volatility contraction is expected ahead.

On the United Kingdom front, investors are awaiting the interest rate decision by the Bank of England (BoE) for fresh impetus. A surprise rise in the UK inflation released on Wednesday has bolstered the need of more rate hikes from the BoE. Analysts at UOB are of the view that BoE Governor Andrew Bailey would hike rates further by 25 bps.

Here is what you need to know on Thursday, March 23:

On a volatile session, Wall Street finished lower on Fed’s monetary policy decision day. The US central bank raised rates as expected by 25 bps. The end of the tightening cycle is near as the Federal Reserve balances between elevated inflation and banking turmoil. Stocks jumped after the announcement but then pulled back, making a reversal, helped by US Treasury Secretary Janet Yellen’s comments. She said they are not considering “blanket insurance” for bank deposits.

US yields dropped on Wednesday, with the US 10-year falling to 3.43% and the 2-year to 3.92%. The US Dollar Index lost 0.65%, falling for the fifth consecutive day. Despite reaching weekly lows against most of its rivals, the greenback finished far from the lows, giving some positive signs. Volatility across the FX board will likely stay elevated and could trigger a broad-based recovery or send the Dollar to fresh lows.

The Japanese Yen was among the top performers, helped by the decline in US yields. USD/JPY posted the second-lowest close in a month, below 131.50.

The Euro also rose across the board, supported by comments from European Central Bank (ECB) officials that suggest that if the banking crisis eases, more rate hikes seem the way to go. The combination of a weaker US Dollar post-FOMC and a robust Euro, sent EUR/USD to 1.0911, the highest since February 2, before retreating to 1.0860.

The Bank of England is likely to deliver another rate hike on Thursday after its Monetary Policy Committee meeting. Forecast consensus point to an increase of 25 bps, particularly after inflation accelerated unexpectedly in February, with the annual rate rising to 10.4%. GBP/USD hit levels above 1.2300 on Wednesday, but finished around 1.2260. It still holds a bullish bias, but continues to be unable to consolidate above 1.2300.

USD/CHF dropped below 0.9200 to the lowest in a week. The Swiss National Bank (SNB) announces its monetary policy decision on Thursday, with market participants expecting a rate hike of 50 bps to 1.50%.

SNB Preview: Forecasts from six major banks, acting with caution

Commodity currencies were hit by the decline in equity prices on Wall Street. AUD/USD reversed sharply from 0.6759 to 0.6680, NZD/USD approached 0.6300 and ended closer to 0.6200 while USD/CAD spiked down to 1.3655, to finish the day higher above 1.3730. Stocks are driving the directions of the pairs at the moment.

Bitcoin tumbled after the FOMC meeting, falling from $28,800 to as low as $27,700. Gold and Silver jumped, boosted by lower US yields. Crude oil prices finished practically flat after reaching weekly highs.

Like this article? Help us with some feedback by answering this survey:

- Dow Jones Industrial Average lost 530.49 points, or 1.63%, to 32,030.11.

- The S&P 500 dropped 65.9 points, or 1.65%, to 3,936.97.

- Nasdaq Composite slid 190.15 points, or 1.6%, to 11,669.96.

Wall Street ended sharply lower on Wednesday despite the dovish US Federal Reserve that delivered a widely expected 25 basis point policy hike. The Fed also hinted that it was on the verge of pausing future increases in view of the recent turmoil in the financial sector.

The three major US stock indexes, lept higher on dovish language tweaks in the statement and then deflated as investors digested both the accompanying statement and Chair Jerome Powell's subsequent Q&A press conference.

In the Fed's statement, the members of the Federal Open Markets Committee (FOMC) suggested it was on the verge of pausing future hikes in view of the recent turmoil in the financial sector. however, Jerome Powell vowed to commit to reining in inflation.

By the closing bell, all three indexes were off more than 1.6% The Dow Jones Industrial Average lost 530.49 points, or 1.63%, to 32,030.11, the S&P 500 dropped 65.9 points, or 1.65%, to 3,936.97 and the Nasdaq Composite slid 190.15 points, or 1.6%, to 11,669.96.

S&P 500 falling wedge

The weekly chart shows the index in a falling wedge scenario, bullish, but the market is on the backside of the bullish trend and the M-formation´s neckline resistance is proving to be a tough nut to crack, so far.

- Silver shoots to test the $23.00s as markets adjust to a less hawkish Fed.

- A dovish 25BP rate hike sent the US Dollar and yields lower.

The Silver price shot higher on Wednesday following the Federal Reserve´s dovish interest rate decision when the central bank announced its 25 bp rate hike. The decision was mostly expected while the Federal Open Market Committee Statement flagged “some additional policy firming” with the dot plot median pointing to one more hike.

Before today´s Federal Reserve event, markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265 and the bird took off.

Fed event main points

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Meanwhile, Fed´s chairman Jerome Powell spoke to the press:

-

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

- Powell speech: Recent banking events will result in tighter credit conditions

- Powell speech: Before banking stress, thought we would have to raise terminal rate

- Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

- ´´If we need to raise rates higher we will, for now we see likely hood of credit tightening.´´

In summary, analysts at RBC Economics explained that ´´today’s move was in line with consensus and market pricing but much less of a foregone conclusion than typical Fed decisions.´´

the analysts explained that ´´two weeks ago the market was leaning toward a 50 bp hike with Chair Powell having opened the door to a larger move if the totality of incoming data warranted it. One week ago there were doubts that the Fed would raise rates at all amid turmoil in the banking sector. The market finally coalesced around a 25 bp increase, though there were some odds and several calls for the Fed to take a pass.´´

The analysts expected a hike but wouldn’t have argued with the Fed waiting six weeks until its next meeting to better assess the impact of recent events and any further risks to the banking sector. ´´Today’s dovish tone and guidance, at least, suggests policymakers are now more mindful of the risks of over-tightening. And if today’s hike isn’t the last, we’re getting very close to the terminal,´´ the analysts concluded.

Meanwhile, with respect to Silver prices, analysts at TD Securities said, ´´ CTA trend followers are relatively under positioned in silver markets, where a break above $24.00/oz would spark large-scale buying activity.´´

- USD/CHF dived to its daily lows of 0.9147 after the Fed decided to raise rates.

- Powell Q&A: Fed officials are not expecting to cut rates in 2023, as it’s not their baseline scenario.

- US central bank policymakers foresee rates to stay at around 5.10%.

The USD/CHF stumbles to fresh 5-day lows beneath the 0.9200 figure as the Federal Reserve Chair Jerome Powell speaks. In addition, the US central bank decided to raise rates by 25 basis points on Wednesday, leaving the Federal Funds Rates (FFR) at 4.75% - 5.00%. At the time of writing, the USD/CHF is trading volatile, at around the 0.9170s – 0.9200 area.

Fed’s monetary policy statement and Powell’s remarks

The Federal Reserve announced on Wednesday that it has decided to increase interest rates by 25 basis points. The policymakers highlighted that inflation is currently high, and the labor market is experiencing a shortage of workers. Additionally, they recognized the banking crisis and said, “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

Regarding monetary policy forward guidance, the Summary of Economic Projections (SEP) revealed the dot plot, which showed that policymakers expect rates to finish at around 5.10% in 2023. Regarding the balance sheet reduction, also known as Quantitative Tightening (QT), would remain unchanged, as planned in May of 2022.

Meanwhile, the US Federal Reserve Chair Jerome Powell began his Q&A. According to the Fed Chair, Fed officials are not anticipating a reduction in interest rates in the current year, as it is not their primary prediction. He also mentioned a disinflation trend and that the upcoming monetary policy decisions will be made, meeting by meeting. Powell recently stated that if there is a need to increase interest rates, the Federal Reserve will take action.

USD/CHF Price action

The USD/CHF resumed its downward trajectory and printed a new daily/weekly low at 0.9147, shy of testing the S2 daily pivot at 0.9141. The USD/CHF bounced off that level and is testing the S1 daily pivot at 0.9183. Once that resistance is cleared, the USD/CHF might regain the 0.9200 mark, opening the door to the daily pivot point at 0.9250.

- NZD/USD bulls jump in on a dovish Federal Reserve 25bp rate hike.

- Federal Open Market Committee Statement flags “some additional policy firming”.

With a dovish 25 bp hike, markets are pricing for the Fed's tightening cycle nearing an end and the US Dollar was sold off to test the bottom end of 102 DXY. Consequently, the NZ Dollar flew to a fresh high for the month at 0.6282 and was up from a low of 0.6171.

Today’s 25 bp hike was largely anticipated, but only aftermarket expectations whipsawed in recent weeks and the Federal Open Market Committee Statement flags “some additional policy firming” with the dot plot median pointing to one more hike.

Before today´s Federal Reserve event, markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265 and the bird took off.

Fed event highlights

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Meanwhile, Fed´s chairman Jerome Powell spoke to the press:

-

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

- Powell speech: Recent banking events will result in tighter credit conditions

- Powell speech: Before banking stress, thought we would have to raise terminal rate

- Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

- ´´If we need to raise rates higher we will, for now we see likely hood of credit tightening.´´

Analysts at ANZ Bank explained said, for NZD specifically, ´´it’s still a bit of a tug of war between stock and flow, with the bullish flow traders citing the cyclone rebuild, remoteness from global banking issues, and Reserve Bank of New Zealand hawkishness, and the bearish stock traders citing our current account deficit, one-trick pony housing-centric economy, and credit ratings at risk.´´

US Treasury Secretary Janet Yellen said on Wednesday that they are not considering or discussing anything to do with blank insurance or guarantees for bank assets. She is testifying before the Senate Appropriations Committee.

"I am working closely with financial stability oversight council on restoring capacity to designate non-bank financial institutions as systemic, subjecting them to regulation,” Yellen mentioned.

“The failure of a small or community bank could trigger bank runs as much as a larger bank failure,” said Yellen. She mentioned they are not considering insuring all uninsured bank deposits. This comment weighed on market sentiment that is digesting the latest Federal Reserve meeting.

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"We need to answer how Fed authorities enforce their warnings to banks in these situations."

"But this review is going on and I want to find out what we can do better."

"Then we will implement changes needed."

"I am confident this review will produce a satisfactory result."

"We have not talked about changing balance sheet implementation."

"Financial conditions have tightened probably more than by what traditional indices say."

"Other measures of bank lending etc, show some more tightening."

"Question for us is the extent and duration of financial conditions tightening."

"Our first task is to see if this is sustained tightening or not."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"We have the tools to protect depositors when there is the threat to economy, and are prepared to use them."

"Depositors should assume their deposits are safe."

"Takeover of credit suisse seems to have been a positive outcome."

"Unemployment rate estimate for this year is a highly uncertain estimate."

"Recessions tend to be nonlinear so very hard to model."

"We are very focused on getting inflation down."

"Too early to say if recent effects change odds of soft landing."

"There is still a pathway to a soft landing, trying to find it."

- USD/MXN drops beneath $18.50 on Fed’s decision to raise rates.

- Federal Reserve: Inflation remains high, and the labor market is tight.

- Fed officials expect rates to peak at around 5.10%.

The USD/MXN drops to fresh 7-days lows at 18.3777 following the US Federal Reserve’s (Fed) decision to raise rates as expected by 25 bps, in a perceived dovish hike. Fed officials’ removal of the phrase “ongoing increases” spurred US Dollar (USD) weakness; therefore, the USD/MXN fell. At the time of writing, the USD/MXN is trading volatile within the 18.35-55 range as Fed Chair Jerome Powell takes the stand.

Summary of the monetary policy statement and Fed Projections

On Wednesday, the Federal Reserve decided to raise rates by 25 bps and emphasized that inflation is elevated and that the labor market is tight. Fed policymakers acknowledged the banking crisis and said, “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

In the meantime, the so-called dot plot was almost unchanged, with most Fed officials expecting the Federal Funds Rate (FFR) to peak at around 5.10%. The Quantitative Tightening (QT) would continue, with the balance sheet reduction set to continue as planned.

Meanwhile, the US Federal Reserve Chair Jerome Powell began his Q&A. He said that Fed officials are not expecting rate cuts this year; it’s not their baseline expectation. He added that disinflation is happening and that the following monetary policy decisions would be live. Of late, Powell said that if the Fed needs to raise rates, they will do it.

USD/MXN Price action on Fed day

As Jerome Powell speaks, the USD/MXN dived to its daily low at 18.3776, before reversing its course. Upward moves could be capped at the 20-EMA at 18.5595. On the other hand, any dovish comments by Powell could send the USD/MXN diving toward the $18.00 mark.

- US Dollar collapses after the FOMC decision, DXY drops by more than 1%.

- Fed raises rates by 25 bps, as expected.

- EUR/USD rises a hundred pips, reaching the highest level since early February.

The US Dollar is falling sharply on Wednesday following the Federal Reserve meeting. The EUR/USD has risen so far more than a hundred pips and printed monthly highs above 1.0900.

As expected, the US central bank raised rates by 25 bps to 4.75% - 5.00%. In the statement, the Fed sounded dovish, suggesting no clear path of action for the future.

During the press conference, Chair Powell said that tighter credit conditions can be seen as a substitute for interest rate hikes. “Disinflation is absolutely occurring”, he said. Regarding the “dot plot”, Powell explained that Fed’s officials do not see a rate cut for this year.

US bonds soared after the FOMC meeting, pushing the US Dollar to the downside. Wall Street indices are moving between gains and losses, without a clear direction. Markets are not moving in sync.

The weaker US Dollar is keeping EUR/USD around 1.0900, at the momentum. The pair peaked at 1.0911 and then pulled back to the 1.0860 area. It is rising for the fifth consecutive day.

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

Powell speech: Recent banking events will result in tighter credit conditions

Powell speech: Before banking stress, thought we would have to raise terminal rate

Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

Technical levels

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"If we need to raise rates higher, we will. But right, now we see the likelihood of credit tightening."

"We will be watching that carefully."

"Recent liquidity provision that has increased balance sheet size is not intended to alter stance of monetary policy."

"We don't see ourselves as running reserve shortages."

"We are always prepared to change if that changes, but see no evidence so far."

"Our supervisory team was very much engaged with SVB and escalated issues but we need to try and understand how the bank still failed."

"The speed of the run on SVB suggests need for possible regulatory, supervisory changes."

- US Dollar is pressured by a dovish Federal Reserve rate hike.

- Bears are in the market as the US yields sink during Fed Powell´s presser.

The US Dollar is under pressure while traders price out the Federal Reserve´s hawkish stance due to a dovish rate hike of just 25 basis points. Additionally, traders are moving out of the greenback due to less hawkish language in the Federal Open Market committee´s statement and forward guidance from Federal Reserve´s Jerome Powell during his presser.

Before today´s Federal Reserve event, markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265.

Fed event highlights

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Meanwhile, Federal Reserve chairman Jerome Powell is speaking to the press in an event that started at 18.30GMT.

-

Powell Speech: Dovish remarks after raising interest rates to 5%

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

Powell speech: Recent banking events will result in tighter credit conditions

Powell speech: Before banking stress, thought we would have to raise terminal rate

Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

´´If we need to raise rates higher we will, for now we see likely hood of credit tightening.´´

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"Rate cuts this year are not our baseline expectation."

"Policy has to be tight enough to bring down inflation, some of that tightness can come from credit conditions."

"At end of day, we will do enough to bring inflation down to 2%."

"We are well aware of concentrations in commercial real estate."

"I don't think it is comparable to these other banking strains."

"100% certainty there will be outside investigations in SVB, we welcome them."

"I welcome all investigations into this banking failure."

"Fiscal impulse is not driving inflation right now."

- USD/JPY is dropping like a stone on a dovish Fed rate hike.

- Bears are in the market as the US yields US Dollar sinks during Fed Powell´s presser.

USD/JPY is under pressure as the Federal Reserve drives markets to reprice interest rate expectations due to a dovish rate hike of just 25 basis points and tweaks to the Federal Open Market committee´s statement and forward guidance.

Ahead of the decision, the money markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. USD/JPY is plummeting as a result to test the 131.20s and it has fallen from a high of 133.00.

Fed event key notes, so far

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Meanwhile, Federal Reserve chairman Jerome Powell is speaking to the press in an event that started at 18.30GMT.

Fed hikes policy rate by 25 bps as expected, focus shifts to Powell – LIVE

Powell speech: Isolated banking problems can threaten banking system if left unaddressed

Powell speech: Recent banking events will result in tighter credit conditions

Powell speech: Before banking stress, thought we would have to raise terminal rate

Powell speech: Tightening in credit conditions may mean monetary tightening has less work to do

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"The story on disinflation is intact."

"Goods inflation is coming down even if more slowly than we would like."

"We still don't have sign of progress on services ex housing sector."

"That's just something that will have to come through softening of demand, labor conditions."

"We don't yet see progress on core services inflation excluding housing."

"Inflation data, however, did point to stronger inflation."

"We don't know the extent of impact of tighter credit conditions."

"We don't know how significant, or sustained, the effect of this credit tightening will be."

"That said, we think it's quite real."

"That argues for being alert when we think of further rate hikes."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"Last two weeks will cause a weigh on demand and inflation."

"Need for further hikes will be based on actual and expected effects of credit tightening in particular."

"Focus is on the words 'may' and 'some' as opposed to 'ongoing' increases."

"Our statement was trying to reflect uncertainty in outlook from banking strains."

"It's possible that banking stresses ebb and we have more work to do; opposite may also be true."

"Possible tightening in credit conditions may mean monetary tightening has less work to do."

"We are really focused on potential credit tightening and what that can produce."

"With banks, we are focused on our financial stability tools."

"At the meeting, I heard a significant number of people anticipating tightening credit conditions."

"This was included in their projections."

"Therefore, they were including that foreceast for tighter credit conditions in their forecasts."

"But banking strains are so recent, there is so much uncertainty."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"Banking system is sound and resilient."

"Deposit flows in banking system have stabilized."

"We are undertaking thorough review to see if we need to strengthen regulation."

"Considered banking system issues in days running up to meeting."

"Inter-meeting data on jobs and inflation came in stronger than expected."

"A couple of weeks ago we thought we would have to raise terminal rate, before banking stresses."

"Important to sustain confidence with actions and words."

"In principle, we can think of banking strain as equivalent to a rate hike."

"In assessing need for further hikes, we will particularly be focused on actual, expected effects of credit tightening."

- USD/CAD collapsed below the 1.3700 figure, trades volatile in the 1.3670-1.3740 range.

- The Federal Reserve raised rates by 25 bps, as expected by analysts.

- Traders eyed the Federal Reserve Chair Jerome Powell’s press conference.

The USD/CAD collapsed toward its daily lows at 1.3678 after the US Federal Reserve decided to lift rates by 25 bps. The so-called dot-plot was almost unchanged compared to December’s Summary of Economic Projections (SEP), meaning another 25 bps increase is expected. Therefore, the USD/CAD is trading volatile, around 1.3680-1.3720, ahead of the Fed Chair Powell press conference.

Fed’s monetary policy decision

In their decision, Federal Reserve officials decided to raise rates by a quarter percentage point and acknowledged the recent turmoil in the financial markets, which caused the collapse of two regional banks. Though, the US central bank commented that the US banking system is solid and resilient

Aside from this, the monetary policy statement was in line with expectations, with the Fed emphasizing that inflation is too high and that the labor market is too tight. In addition, the balance sheet reduction would continue as planned in May, reiterating that the Committee “is strongly committed to returning inflation to its 2 percent objective.”

Nevertheless, it should be said that the phrase “ongoing increases as appropriate” was removed from March’s monetary policy statement.

Fed’s Summary of Economic Projections

The Summary of Economic Projections (SEP) has remained largely the same, with little change. The dot plots, which represent the interest rate projections of Federal Reserve officials, have remained at 5.10%. The expected Real GDP for this period has been revised slightly downward from 0.5% to 0.4%, while the predicted Unemployment Rate has been modified slightly upward from 4.5% to 4.6%. The preferred inflation gauge of the Federal Reserve, the core PCE, is expected to be 3.6%, up from 3.5% in December’s SEP report. Meanwhile, headline inflation is estimated at 3.3%, up from 3.1% in the previous SEP report.

USD/CAD reaction to the headline

The USD/CAD collapsed toward its daily low at 1.3678, beneath the daily pivot point at 1.3700. A further fall below the S1 daily pivot at 1.3658 would pave the way toward the 1.3600 figure, but firstly the USD/CAD needs to crack the March 21 daily low at 1.3643. Once that happens, 1.3600 is up for grabs.

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"Inflation has moderated somewhat but strength of recent readings indicate inflation pressures continue to run high."

"Process of getting inflation back down has a long way to go."

"Longer-term inflation expectations remain well anchored."

"We are continuing process of significantly reducing our balance sheet."

"Since last meeting, economic data has come in stronger than expected."

"But we think recent banking events will result in tighter credit conditions."

"That would impact the economy and how we need to respond."

"We will closely monitor incoming data, actual and expected effects of tighter credit conditions."

"We will use that as basis for decisions."

"Path of policy will adjust as appropriate, and we'll make decisions meeting by meeting."

"Reducing inflation is likely to require period of below trend growth and also softer labor conditions."

FOMC Chairman Jerome Powell comments on the policy outlook after the Federal Reserve's decision to raise the policy rate by 25 basis points to the range of 4.75-5% following the March policy meeting.

Key quotes

"Isolated banking problems if left unaddressed can threaten banking system."

"That's why we took decisive action."

"All depositors' savings are safe."

"Our lending programs are effectively meeting banks needs."

"Also shows ample liquidity available."

"Will use all the tools needed."

"We will continue to closely monitor, prepared to use all tools to keep banking system safe and sound."

"We will also learn lessons from this episode."

"Inflation remains too high."

"Labor market still too tight."

"We remain strongly committed to bringing inflation to 2%."

"Economy doesn't work for anyone without low inflation."

"Consumer spending appears to have picked up this quarter although some of that is weather related."

"Activity in housing remains weak."

"Policymakers generally expect subdued growth to continue and almost all on FOMC sees risks on growth as weighted to the downside."

"Wage growth has shown some signs of easing but demand still outstrips supply."

"We expect that to come into better balance over time."

"Inflation remains well above our goal."

- Fed raises rates by 25 bps, as expected.

- US yields and Dollar tumble on initial reaction; before Powell.

- AUD/USD testing key resistance around 0.6730

The AUD/USD jumped to 0.6727 after the decision of the Federal Reserve, hitting a fresh daily high. It is testing the critical resistance zone around 0.6730 amid the broad-based Dollar’s weakness.

The Federal Reserve (Fed) raised its key interest rate by 25 bps as expected to 4.75%-5.00%. The vote was unanimous. The Fed warned that inflation remains elevated while at the same time dropping the forward guidance toward further rate hikes. The central bank said it was too soon to assess the impact of the banking crisis on the economy.

The greenback tumbled together with US yields. The US 10-year fell to 3.50% before bouncing to 3.53% while the 2-year reached momentarily levels under 4.00%.

Wall Street indices reacted to the upside; however, they have retreated a bit during the last minutes. The improvement in market sentiment offers extra support to the AUD/USD.

Fed Chair Powell is about to start its press conference. If his words align with the statement, the US Dollar could continue its slide, boosting AUD/USD above the key resistance zone of 0.6730.

Powell Speech Preview: Dovish remarks after raising interest rates to 5% - Follow LIVE

Technical levels

- GBP/USD rallied towards its daily high at 1.2304 on the headlines.

- The US Federal Reserve hikes rates by 25 bps to the 4.75% - 5.00% range.

- Traders eyed the Federal Reserve Chair Jerome Powell’s press conference.

The GBP/USD is rallying sharply after the US Federal Reserve raised rates by 25 bps. Federal Reserve officials updated its dot-plot, with 10 out of 18 policymakers expecting another 25 bps rate hike by the end of the year. At the time of typing, the GBP/USD is trading volatile within the 1.2240-1.2300 range as traders brace for Fed’s Powell press conference.

Summary of the Federal Reserve’s statement

In its statement, the Fed acknowledged that the recent developments in the financial markets could tighten monetary conditions for households and businesses. However, the US central bank emphasized that the US banking system is solid and resilient.

Fed officials commented that the labor market remains strong and inflation is still elevated. Regarding the Quantitative Tightening (QT), the Fed commented that the balance sheet reduction would continue as planned and reiterated that the Committee “is strongly committed to returning inflation to its 2 percent objective.”

From the monetary policy statement, Federal Reserve’s policymakers removed the phrase “ongoing increases.”

The Summary of Economic Projections (SEP) was almost unchanged. The dot plots, the Federal Reserve’s officials’ projections for interest rates, remained unchanged at 5.10%. Real GDP is expected at 0.4% vs. December 0.5%, while the Unemployment Rate is expected at 4.6% vs. 4.5%. The Federal Reserve’s preferred gauge for inflation, the core PCE is expected at 3.6%, compared to the last SEP report in December at 3.5%, while headline inflation is estimated at 3.3%, vs. 3.1% of the prior’s SEP.

GBP/USD’s reaction to the headline

The GBP/USD skyrocketed in the first 10 minutes following the Fed’s monetary policy statement release. The GBP/USD rallied to new 7-week highs but has retraced its gains ahead of the Fed Chair Powell press conference.

GBP/USD Technical levels

The Federal Reserve's revised Summary of Economic Projections (SEP), the so-called dot plot, showed that the median view of the policy rate at end-2023 stood at 5.1%, matching December's projection.

Additional takeaways

"Fed's median view of fed funds rate at end-2024 4.3% (prev 4.1%)."

"Fed's median view of fed funds rate at end-2025 3.1% (prev 3.1%)."

"Fed's median view of fed funds rate in longer run 2.5% (prev 2.5%)."

"Fed policymakers see slower 2023 GDP growth, lower unemployment and less progress on inflation than they saw in December."

"Fed projections imply one more 25-basis-point rate hike this year and 75 bps of rate cuts in 2024."

- Gold price rallies to session highs on the Federal Reserve statement and interest rate decision.

- Gold price prints a high of $1,966.55 and pulls back ahead of Federal Reserve chairman Jerome Powell´s presser.

Gold price rallies some $20.00 on the knee-jerk reaction to the Federal Reserve´s interest rate decision and statement. At the time of writing, Gold price is trading near $1,962 and up 1.14% on the day from a low of $1,934.

Federal Reserve hikes rates by 25 bps, as expected but the Fed statement deleted reference to 'ongoing increases' in rates. Ahead of the decision, the money markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%.

Key points so far

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Next up will be the Federal Reserve´s chairman Jerome Powell whop will speak to the press.

Fed hikes policy rate by 25 bps as expected, focus shifts to Powell – LIVE

Gold price technical analysis

(Daily and H1 charts, ahead of the Fed, above and below respectively)

Gold price reaction to the Fed

On the knee-jerk to the decision, Gold price rallied as follows:

(5-min charts)

The price popped and dropped as markets await Fed´s Powell.

- FOMC raises key rate by 25 bps as expected, despite recent turmoil.

- US Dollar tumbles after FOMC statement, attention turns to Chair Powell.

- EUR/USD breaks 1.0800 and climbs toward 1.0850.

The EUR/USD jumped from 1.0790 to 1.0845, following the decision of the Federal Reserve (Fed) to raise interest rates by 25 bps as expected. The US Dollar tumbled as US yields dropped sharply.

Fed moves as expected

The Federal Reserve (Fed) raised its key interest rate by 25 bps as expected to 4.75% -5.00%. The vote was unanimous. They dropped the forward guidance, mentioning that “some additional policy firming may be appropriate”, instead of “ongoing increases in the target range will be appropriate”. In a few minutes, Chair Powell's press conference will begin.

The US Dollar dropped sharply boosting the EUR/USD to the upside. Markets are looking at the decisions as a “dovish hike”. Wall Street indices printed fresh highs. The improvement in risk sentiment weighs on the US dollar.

Technical levels

- XAG/USD is firm at around the $22.60s area, with traders eyeing Powell and his colleagues.

- Silver Price Analysis: Neutral upwards, but Powell’s press conference could rock the boat.

Silver price tests the higher boundaries of the week, at around $22.70s, as the Fed’s decision looms. Falling US Treasury bond yields and an offered US Dollar (USD) are the main drivers of Silver’s gain of 1.28%.

XAG/USD Price action

Silver price remains neutral to upward biased, as shown by the daily chart. Oscillators like the Relative Strength Index (RSI) turned bullish, while the Rate of Change (RoC) displays that buying pressure is waning. Due to mixed signals, caution is warranted.

For a bullish continuation, the XAG/USD needs to reclaim the $23.00 barrier, exposing the February 3 daily high at $23.59, followed by the $24.00 figure, ahead of the YTD high at $24.62. On the other hand, if the XAG/USD drops below the week’s low of $22.14, that would put into play essential support levels.

Given the backdrop, the XAG/USD first support would be the 50-day Exponential Moving Average (EMA) at $21.94. A breach of the latter will expose the 100-day EMA at $21.91, followed by the 200-day EMA at $21.81, and the 20-day EMA at $21.71.

XAG/USD Daily chart

XAG/USD Technical levels

- EUR/USD bulls are in the market and target a move beyond 1.08 resistance.

- Bulls need to stay committed between 1.0700/50.

- First key support is located near 1.0770/85.

EUR/USD is meeting supply at the 1.08 resistance ahead of the Federal Reserve interest rate decision at 1400ET/1800 GMT. Implied Fed futures are erring towards pricing in a 25 bp rate hike.

The Fed is due to publish new economic projections and the market will be focussing on whether the dot plots are pricing in an easing of policy. ´´In our view, there is the risk that the market will not see the dovish hike that has been predicted today. This should provide support to the USD and reinforce the strength of the EUR/USD1.08 resistance,´´ analysts at Rabobank argued.

EUR/USD technical analysis

The 4-hour charts have the price on the backside of the bullish trend, which is a bearish factor. However, the falling wedge, and triple bottom are bullish:

So long as the support structure holds between 1.0700 and 1.0750/60, there will be prospects of a bullish continuation for the foreseeable future.

In the meanwhile, we have a W-formation in play. This is a reversion pattern and the bears are already moving in.

The price remains on the front side of the bullish dynamic trendline support so if there are any pullbacks, bulls will be keen to see a deceleration above the 78.6% Fibonacci retracement and in line with the neckline and trendline support.

- AUD/USD is subdued around the 0.6670s ahead of the Fed’s decision.

- The US Federal Reserve is expected to raise rates to the 4.75% - 5.00% range.

- The RBA’s latest minutes were dovish, as the central bank took off higher interest rate increases.

The Australian Dollar (AUD) holds to its earlier gains against the US Dollar (USD) amidst a so-far dull trading session with traders awaiting the Fed’s decision. Sentiment remains fragile and mixed, while US Treasury bond yields have turned south. At the time of writing, the AUD/USD is trading at 0.6675 after hitting a high of 0.6702.

The Fed is expected to hike, Powell’s press conference eyed

Investors’ mood shifted sour as the time closed to read the Federal Reserve’s monetary policy statement and hear its Chairman Jerome Powell at the stand. Money market futures foresee a 25 bps rate hike, with odds at an 86.4% chance.

Three weeks ago, Jerome Powell opened the door for faster rate hikes before a banking crisis hit the US and abroad. Two lenders in the United States (US) collapsed, while First Republic Bank got aided by 11 banks pledging $30 billion. Late Tuesday, the US Secretary of Treasury Janet L. Yellen calmed the financial markets after stating that the government would intervene to protect depositors of small banks.

That was a green light for traders hungry for risk ahead of the Fed’s decision. Nevertheless, the three major US equity indices are trading below Tuesday’s close by a minimum percentage.

US Treasury bond yields had recovered some ground in the fixed income space, with 2s and 10s almost unchanged at 4.197% and 3.583%, respectively. The greenback is on the defensive, as shown by the US Dollar Index (DXY), down 0.07%, at 103.144.

On the Australian front, the minutes of the last meeting of the Reserve Bank of Australia (RBA) forgot to mention discussions for a higher rate hike, with board members considering only 25 bps. Regarding the strength of the banking system, the RBA’s Governor Kent states that banks are “unquestionably strong.”

AUD/USD Technical levels

Gold saw a brief retest of $1,973/98. A break above here would see the yellow metal gaining further upside momentum, strategists at Credit Suisse report.

55-DMA at $1,881 to floor Gold

“A sustained move beyond $1,973/98 stays seen needed to clear the way for a retest of long-term resistance from the $2,070/75 record highs of 2020 and 2022. Whilst this should clearly be respected, a clear and sustained break higher would be seen to open the door to a move to $2,300 next.”

“Ideally, the 55-DMA, currently seen at $1,881 floors the market now. If this breaks, we could see further weakness towards the recent range low at $1,805, before the crucial 200-DMA, currently seen at $1,778, which we would once more expect to provide a floor.”

- Jerome Powell will explain Fed interest rate decision, economic projections in press conference.

- Fed chair will face tough Q&A session trying to balance inflation and financial stress risks.

Jerome Powell, Chairman of the Federal Reserve System (Fed), will speak in a press conference on Wednesday at 18:30 GMT, 30 minutes after the Fed Interest Rate decision is announced. The speech of Powell will reflect the current views of the Federal Open Market Committee (FOMC) on monetary policy and will also update the Summary of Economic Projections, also known as the dot plot.

Powell will face tough questions from the press on whether the US central bank can keep going with its interest rate hikes considering the financial stress that the banking system has suffered recently. Jerome Powell’s words will carry enormous importance for the market, with the US Dollar, and the US Treasury bonds leading the way and affecting the valuation of most asset classes.

According to Yohay Elam, Senior Analyst at FXStreet, Powell should persevere in the interest rate hikes and “convey a message of confidence” to the markets. Elam expects Powell’s press conference to alleviate any market over-reaction to the likely interest rate hike:

“The sweetener for markets could come in the accompanying statement. Powell and his colleagues will have to comment on the banking crisis, probably by saying they are working closely to resolve the issues and are ready to act if the situation deteriorates.

Such remarks would ease and balance the pain coming from raising rates and defying expectations for rate cuts later this year.”

National Bank of Belgium Governor and European Central Bank (ECB) Governing Council member Pierre Wunsch, said on Wednesday that the central bank will probably need to raise rates further if market stabilize, but he warned they need time to assess the full impact of the recent banking crisis.

Wunsch, one of the more hawkish ECB members, argued that recent developments could have an impact on lending, helping the central bank in curbing inflation. Eurozone banks have strong liquidity ratios, he added.

Earlier, ECB President Christine Lagarde said it is important that ECB's monetary policy “works robustly in the restrictive direction and that process is only starting to take effect now."

Last week, the ECB raised its key interest rates by 50 basis points and dropped their forward guidance of significant rates ahead on the back of the financial turmoil. A different outcome, Wunsch explained, would make people say “they know something we don’t know” and he said that "what they know is what they see."

Market reaction

The EUR/USD is up for the fifth consecutive day on Wednesday, hovering slightly below 1.0800, moving sideways as market participants await the Federal Reserve’s decision.

- USD/JPY will remain subdued as traders await the US Federal Reserve.

- Caution is warranted, given the fact that oscillators are giving mixed signals.

- USD/JPY Price Analysis: Short-term, a bearish continuation is likely; otherwise, buyers can reclaim 133.00.

USD/JPY remains in choppy trading price action, with investors eyeing Wednesday’s US Federal Reserve decision. At the time of typing, the USD/JPY pair exchanges hands at around 132.50s after traveling from a daily low of 132.25 and hitting a high at 133.00.

USD/JPY Price action

The USD/JPY pair trades nearby the weekly highs, though it remains sideways. The Exponential Moving Averages (EMAs) in the daily chart turned flat, while oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) give mixed signals.

In the short-term, the USD/JPY 4-hour chat paints the pair as downward biased, trading below the 50, 100, and 200-EMAs. Also, a three-week-old downslope resistance trendline would cap any rallies should the USD/JPY exceed the 133.50 area.

For a bearish continuation, the USD/JPY is backed by oscillators, like the RSI is about to turn bearish, while the RoC portrays buying pressure waning. That said, the USD/JPY first support would be the 20-EMA at 132.38. A breach of the latter could send the pair to the daily pivot at 132.04, followed by a drop to the S1 pivot point at 131.46. Once cleared, the USD/JPY would challenge the 131.00 figure.

In an alternate scenario, the USD/JPY first resistance would be the R1 pivot at 133.06. Once broken, the pair would immediately test the 50-EMA at 133.11, followed by the R2 daily pivot point at 133.64, ahead of the confluence of the 100/200-EMAs at 133.76/77.

USD/JPY 4-hour chart

USD/JPY Technical levels

Economists at TD Securities discuss the Federal Reserve interest rate decision and its implications for EUR/USD and USD/JPY.

Hawkish (20%)