- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-03-2023

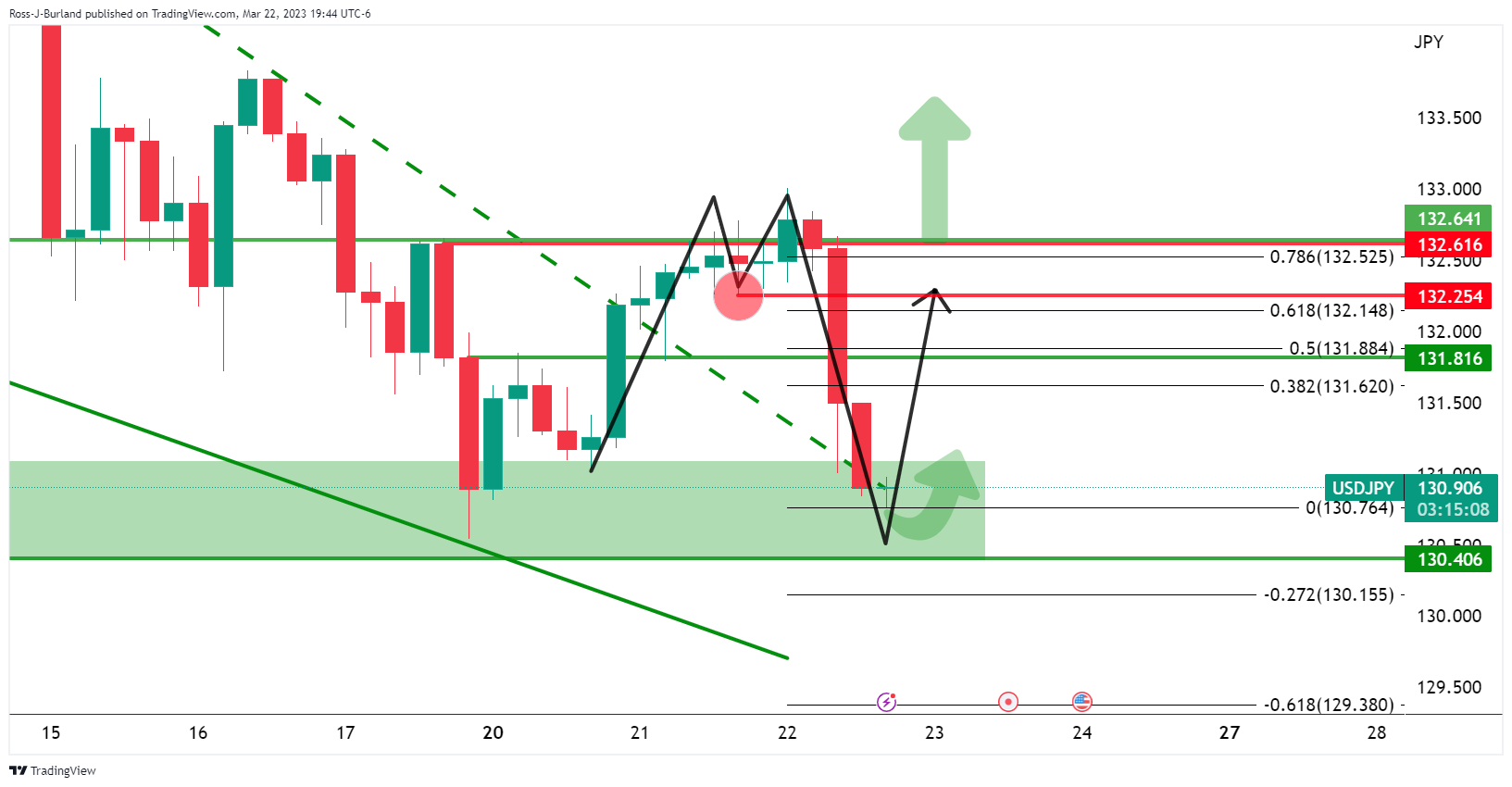

- USD/JPY prods two-day downtrend at the lowest levels since February 10.

- Japan’s National Consumer Price Index eased in February, National CPI ex Food, Energy improved.

- Shift in market’s mood, corrective bounce in yields also put a floor under the Yen price.

- US data, risk catalysts will be crucial for fresh impulse.

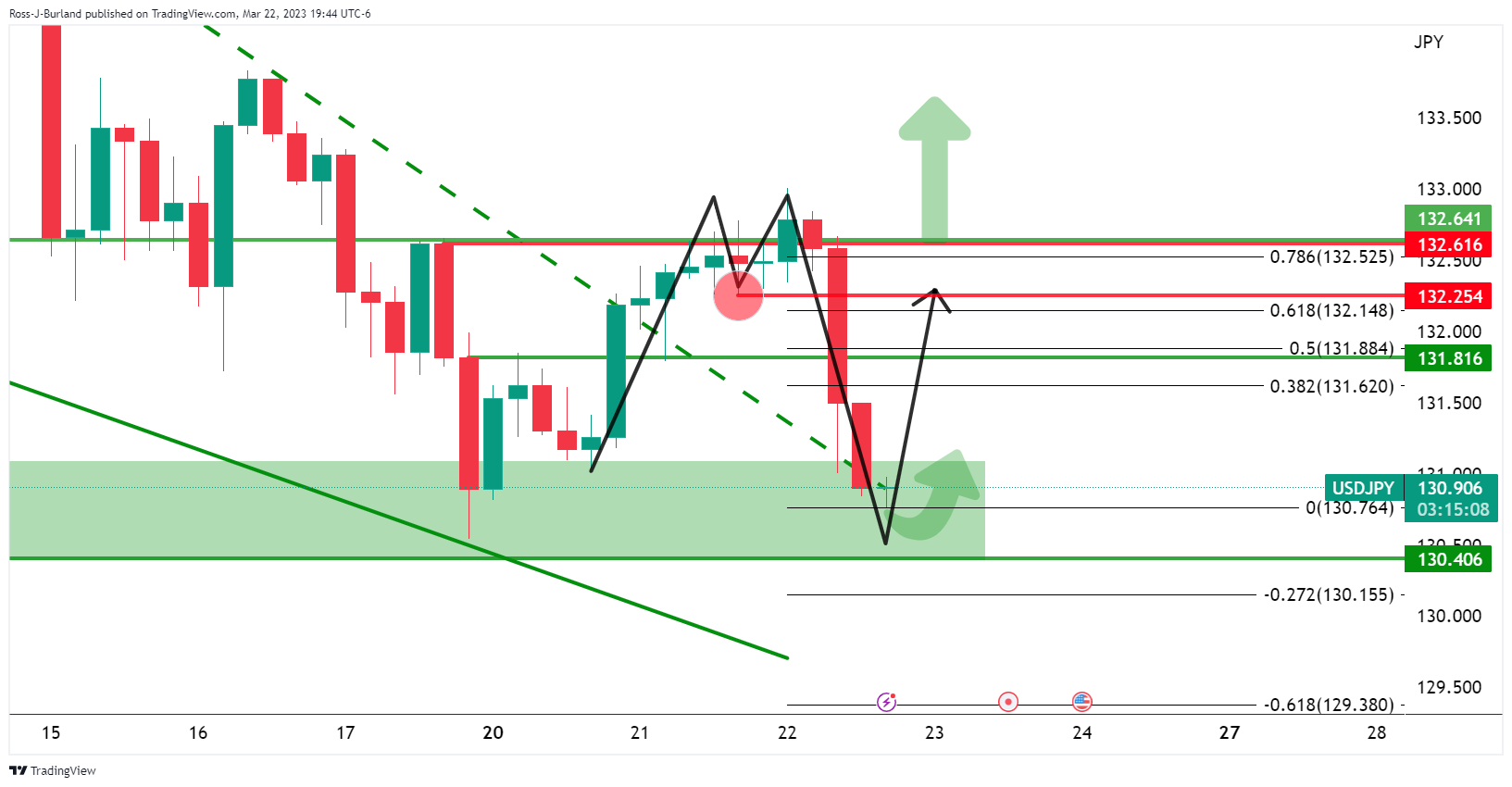

USD/JPY portrays a corrective bounce off the multi-day low amid mixed inflation numbers from Japan and a shift in the sentiment during early Friday, following a volatile week. That said, the Yen pair picks up bids to 130.80 as it prints the first daily gain in three while keeping the late Thursday’s bounce off the lowest levels since February 10.

Japan’s National Consumer Price Index eased to 3.3% YoY in February from 4.3% prior and 4.1% market forecasts. However, the National CPI ex Food, Energy rose to 3.5% YoY compared to the analysts’ estimates of 3.4% and the 3.2% prior readings.

Apart from the mixed Japan data, a shift in the market’s mood, amid increasing fears of banking rout and Fed rate hikes seems to also allow the US Dollar to pare the weekly losses, which in turn allows the Yen pair to consolidate the latest losses.

It should be noted that a collapse in the banking shares and chatters that the Fed’s emergency lending to the banks has ballooned the balance sheet, renewing fears of more Fed rate hikes, which in turn allowed the DXY to pare recent losses. Also favoring the US Dollar Index buying could be the mixed US data.

Reuters said, “Federal Reserve emergency lending to banks, which hit record levels the last week, remained high in the latest week, amid continued large-scale extensions of credit to the financial system, which now includes official foreign borrowing.” The news also mentioned that borrowing from the Fed caused the size of its overall balance sheet to move to $8.8 trillion from $8.7 trillion the prior week.

Elsewhere, mixed US data and comments from US Treasury Secretary Janet Yellen also allow USD/JPY to lick its wounds.

That said, the US Chicago Fed National Activity Index (CFNAI) dropped to -0.19 in February versus 0.0 expected and 0.23 prior. Further, Weekly Initial Jobless Claims declined to 191K for the week ended on March 18, versus 192K prior and 203K market forecasts. It should be noted that the US New Home Sales rose 1.1% in February from 1.8% prior, versus 1.6% analysts’ estimation, whereas Kansas Fed Manufacturing Index for March rose to 3.0 from -9.0 prior and 6.0 expected.

On the other hand, the US Treasury Secretary’s testimony in front of the House Appropriations Financial Services Subcommittee probed the market’s previous risk-on mood and allowed the USD/JPY to recover from multi-day low as she said, “China and Russia may want to develop an alternative to the US dollar,” while also showing preparedness for additional deposit actions `if warranted'. “Strong actions have been taken to ensure deposits are safe,” said US Treasury Secretary Yellen.

While portraying the mood, Wall Street pared intraday gains and closed with a light green number whereas the Treasury bond yields also recovered but failed to post a positive closing. That said, S&P 500 Futures print mild gains at the latest.

Moving on, preliminary readings of the US S&P Global PMIs for March and the Durable Goods Orders for February will be crucial for the USD/JPY pair traders to watch for clear directions.

Also read: S&P Global PMIs Preview: EU and US figures to shed light on economic progress

Technical analysis

A successful rebound from the 10-week-old ascending support line, around 130.40 by the press time, allows USD/JPY to challenge the downward-sloping resistance line stretched from March 08, near 131.25 at the latest.

- NZD/USD is gauging a cushion below 0.6250 as US Inflation will be attacked by Fed’s rates and tight credit conditions.

- The upside for the USD Index looks restricted as the Fed is set to terminate its policy-tightening cycle sooner.

- Widening insurance blanket for deposits from US Yellen infused confidence among market participants.

The NZD/USD pair is showing signs of exhaustion in the corrective move below 0.6250 in the early Asian session. The Kiwi asset displayed a downside move on late Thursday after the US Dollar Index (DXY) rebounded from 102.00. The market tone is still upbeat as investors are cheering signals of a policy-tightening end recovered from Federal Reserve (Fed) chair Jerome Powell’s commentary.

The comment from Fed Powell that ‘some additional policy firming may be appropriate’ was sensed as music to the ears of investors. It is highly likely that the Fed is one rate hike far from reaching the terminal rate but the battle against sticky United States inflation will continue till Consumer Price Index (CPI) gets softened to 2%.

Meanwhile, S&P500 futures have carry-forwarded their positive move in early Asia as US Treasury Secretary Janet Yellen has stated that the government is ‘prepared for additional deposits actions if warranted’. Widening insurance blanket for deposits has infused confidence among market participants.

The US Dollar Index (DXY) has rebounded to near 102.60 but is likely to face stiff barriers ahead. US inflation would face dual attacks from now as the Fed is not willing to consider rate cuts this year and tight credit conditions from US banks for households and businesses would result in lower demand, weaker activities, and inflation softening.

Going forward, preliminary S&P Global PMI (March) data will be keenly watched. The Manufacturing PMI is expected to trim to 47.0 from the former release of 47.3. And, Service PMI might soften to 50.5 from the prior release of 50.6. Weaker-than-anticipated PMI data might impact the USD Index further.

The New Zealand Dollar is expected to gain strength ahead as the Reserve Bank of New Zealand’s (RBNZ) battle against inflation is far from over. More rate hikes are in pipeline from the RBNZ as NZ inflation has not meaningfully decelerated yet.

- EUR/USD stays defensive after reversing from seven-week high, as well as snapping five-day uptrend.

- Break of weekly support line, downbeat oscillators favor sellers even if 61.8% Fibonacci retracement prods immediate declines.

- Recovery moves need validation from 1.0935 to aim for fresh 2023 high.

EUR/USD seesaws around 1.0830-20 as the key Fibonacci retracement level probes bears during early Friday, following the Euro pair’s U-turn from a seven-week high the previous day.

EUR/USD marked the first daily loss in six on Thursday as it failed to cross the two-month-old horizontal resistance area surrounding 1.0930-35. The following pullback also broke an upward-sloping support line from Monday and allowed intraday sellers to tighten the grip.

It should be noted that the RSI’s U-turn from the overbought territory breaks short-term support and the MACD also teases bears, which in turn suggests the EUR/USD pair’s further downside even if the 61.8% Fibonacci retracement of February-March fall prods sellers of late.

That said, an upward-sloping support line from March 15 joins the mid-month high to keep the EUR/USD bear’s focus on the 1.0765-60 support zone.

If the pair manages to break the same, it could quickly drop to a convergence of the 100-SMA and 200-SMA, around 1.0670-65.

Alternatively, the EUR/USD pair’s recovery moves may initially aim for the support-turned-resistance line stretched from Monday, near 1.0885 at the latest.

However, bulls should remain cautious unless witnessing a clear break of 1.0935. Following that, a run-up towards refreshing the yearly high, around 1.1035 at the latest, can’t be ruled out.

EUR/USD: Four-hour chart

Trend: Further downside expected

- EUR/GBP has gauged an intermediate cushion around 0.8810 as BoE claims rapid inflation softening ahead.

- The BoE announced a 25 bps rate hike and pushed rates to 4.25% despite fears of banking turmoil.

- ECB Knot is in favor of further rate hikes in May as inflation is showing no signs of abating.

The EUR/GBP pair has found an intermediate cushion around 0.8810 in the early Tokyo session. Earlier, the cross witnessed a sell-off after the Bank of England (BoE) announced an eleventh consecutive rate hike to sharpen its tools in the battle against double-digit inflation. BoE Governor Andrew Bailey announced a rate hike by 25 basis points (bps) and pushed rates to 4.25%.

The asset is expected to deliver more weakness ahead as the street believes that the United Kingdom (UK) inflation is extremely stubborn and will take plenty of time to get contained. The BoE has come a long way by hiking rates to 4.25% and the annual inflation is still in the double-digit figure, showing no evidence of softening ahead.

On Wednesday, the UK Office for National Statistics reported a surprise jump in the headline Consumer Price Index (CPI) to 10.4% while the street was anticipating a decline to 9.8%. BoE stated that the surprise upside was mainly the impact of less often volatile clothing prices, which won’t last long.

The central bank is very much confident that inflation will start decelerating rapidly from the second quarter. However, the labor shortage and higher food prices might continue to keep inflation at elevated levels. For further guidance, investors will focus on the Retail Sales data, which is expected to contract by 4.7% on an annual basis.

On the Eurozone front, European Central Bank (ECB) policymaker Klaas Knot said that the ECB is unlikely to be done with rate hikes and added that they still think that they need to raise the policy rate in May. Investors should be aware that the ECB hiked rates by 50 bps last week. No doubt, more hikes must be in pipeline as ECB President Christine Lagarde has been reiterating that higher inflation would stay for a longer period.

- Market absorbs aftermath of Fed meeting, impacting USD/CAD.

- Investors foresee a halt in Fed rate hikes and rate reduction by 2023 end.

- US Treasury Secretary Yellen reassures bank deposit safety.

Since the Federal Reserve(Fed) meeting, the USD/CAD has experienced continuous choppy price action, with the US Dollar remaining indecisive as market forces have yet to determine a clearer direction for the greenback. On Thursday, US Initial Jobless Claims were released, coming in at 191K, compared to the previous 192K and an expected 197K. These figures remain close to 200K, suggesting firmer labor conditions.

Following the FOMC meeting and comments from US Treasury Secretary Janet Yellen, the market has leaned towards significant dovish repricing and anticipates a pause in the Federal Reserve's (Fed) rate hiking path. By the end of 2023, the market expects a 100 basis point (bps) rate cut from the Fed, due to gloomy banking concerns and a cautious approach from the central bank.

US Treasury Secretary Janet Yellen has taken charge of commentary amid the ongoing banking crisis, reassuring investors of a safe and sound US banking system. She has reiterated her preparedness to take further action if necessary to protect the US banking system.

Despite the backstop provided by the US Treasury Department and a dovish FOMC, US indices have failed to capitalize and remain in choppy conditions. Amid this jittery sentiment, oil prices struggle to find a clear direction, fluctuating between gains and losses. U.S. Energy Secretary Jennifer Granholm informed lawmakers that refilling the country's Strategic Petroleum Reserve (SPR) would be challenging this year and could take several years.

Geopolitical factors are also not improving risk sentiment, as US Defense Secretary Austin noted that the meeting between Chinese President Xi and Russian President Putin sent a troubling signal.

On the economic data front, Friday's US calendar will feature Durable Goods, S&P Purchasing Managers Index (PMI), and Canadian retail sales data for January, all set to be released.

Levels to watch

- US Dollar Index grinds higher after bouncing off seven-week low.

- Slump in banking stocks, mixed US data allow US Dollar to pare weekly loss.

- Comments from US Treasury Secretary Yellen, fears of more Fed rate hikes renew USD demand.

- A slew of economics to offer an interesting end to the volatile week.

US Dollar Index (DXY) holds onto the late Thursday’s rebound from a multi-day low to 102.65 during early Friday. In doing so, the greenback’s gauge versus the biggest weekly loss since early January amid fresh hopes of higher Federal Reserve (Fed) rates and more banking turmoil.

That said, a collapse in the banking shares and chatters that the Fed’s emergency lending to the banks has ballooned the balance sheet, renewing fears of more Fed rate hikes, which in turn allowed the DXY to pare recent losses. Also favoring the US Dollar Index buying could be the mixed US data.

“Federal Reserve emergency lending to banks, which hit record levels the last week, remained high in the latest week, amid continued large-scale extensions of credit to the financial system, which now includes official foreign borrowing.,” reported Reuters. The news also said that borrowing from the Fed caused the size of its overall balance sheet to move to $8.8 trillion from $8.7 trillion the prior week.

Elsewhere, the US Chicago Fed National Activity Index (CFNAI) dropped to -0.19 in February versus 0.0 expected and 0.23 prior. Further, Weekly Initial Jobless Claims declined to 191K for the week ended on March 18, versus 192K prior and 203K market forecasts. It should be noted that the US New Home Sales rose 1.1% in February from 1.8% prior, versus 1.6% analysts’ estimation.

It should be noted that the US Treasury Secretary’s testimony in front of the House Appropriations Financial Services Subcommittee probed the market’s previous risk-on mood and allowed the US Dollar Index (DXY) to pare losses at the seven-week low. “China and Russia may want to develop an alternative to the US dollar,” while also showing preparedness for additional deposit actions `if warranted'. “Strong actions have been taken to ensure deposits are safe,” said US Treasury Secretary Yellen.

Against this backdrop, Wall Street pared intraday gains and closed with a light green number whereas the Treasury bond yields also recovered but failed to post a positive closing.

Looking ahead, preliminary readings of the US S&P Global PMIs for March and the Durable Goods Orders for February will be crucial for the US Dollar Index traders to watch as firmer readings could join the aforementioned factors to extend the latest DXY recovery.

Technical analysis

Although the lower band of the Bollinger on the daily chart restricts US Dollar Index (DXY) downside near 102.30, the DXY bulls need validation from the 50-DMA hurdle of 103.45 to extend the rebound.

- EUR/JPY opens the Asian session with minuscule gains of 0.08%.

- An evening star in the EUR/JPY daily chart could drive prices lower.

- For a bullish resumption, EUR/JPY buyers must reclaim 142.00.

EUR/JPY fell for the second straight day, as the Euro (EUR) weakened despite European Central Bank (ECB) members' hawkish rhetoric. In the early Asian session, the EUR/JPY is trading at 141.83, above its opening price by 0.10%, after hitting a weekly high of 143.63 on Wednesday.

EUR/JPY Price action

The EUR/JPY daily chart portrays the formation of a three-candlestick chart pattern, an evening star, which implies that the pair might be headed lower. However, Japanese Yen (JPY) bulls must reclaim 141.61, so the EUR/JPY could test the 200-day Exponential Moving Average (EMA) at 141.05. A breach of the latter could open the door for further downside.

Conversely, if Euro (EUR) bulls move in and reclaim 142.00, that could pave the way for them to reclaim the 100-day EMA and the confluence of the 20/50-day EMAs. Once the EUR/JPY breaks above 142.00, the 100-day EMA at 142.33 would be challenged. Upside risks lie at the confluence of the 20/50-day EMA at 142.55/60, on its way toward 143.00.

Oscillators like the Relative Strength Index (RSI) are in bearish territory but shifted flat, and meaning sellers are taking a respite. The Rate of Change (RoC) shifted gears and turned bearish, signaling that sellers are in control.

EUR/JPY Daily chart

EUR/JPY Technical levels

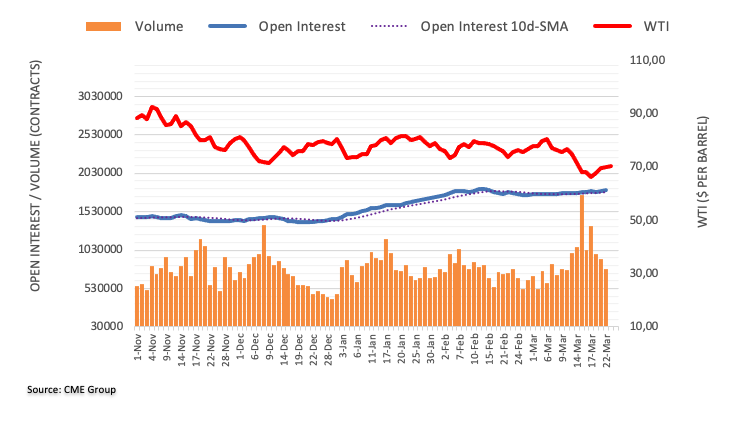

- WTI licks its wounds after posting the first daily loss in four.

- U-turn from one-week-old resistance line breaks 200-HMA and joins downbeat oscillators to favor sellers.

- 100-HMA offers breathing space to bears before directing them to multi-month low.

- Bulls need successful break of $72.70 for confirmation.

WTI crude oil flirts with the 200-HMA as bears take a breather after returning to the table, following a three-day absence, during early Friday. In doing so, the black gold consolidates the previous day’s U-turn from a one-week high amid a sluggish Asian session.

That said, the quote reversed from an upward-sloping resistance line from March 16 the previous day to welcome bears. The downside move gained momentum after breaking the 200-Hour Moving Average (HMA). It should be noted that the bearish MACD signals and the downbeat RSI (14) line, not oversold, also back the energy benchmark’s latest weakness.

Hence, the quote’s corrective bounce remains elusive unless crossing the aforementioned resistance line, near $71.80 at the latest.

Even so, the mid-March swing high and 50% Fibonacci retracement of the commodity’s fall from March 07 to 20, around $72.70 by the press time, appears crucial for the WTI crude oil buyers to retake control.

Alternatively, the 100-HMA level of $68.65 puts a floor under the WTI crude oil price, a break of which could direct bears towards the seven-day-old horizontal support area surrounding $66.00-65.45.

In a case where the quote resists bouncing off the stated key support, the odds of witnessing a slump to refresh the multi-day low marked earlier in the week, around $64.40, can’t be ruled out.

WTI: Hourly chart

Trend: Further downside expected

- GBP/JPY has sensed buying interest near 160.00 as investors digest dovish guidance from BoE on interest rates.

- An absence of inflation softening in the UK despite pushing rates to 4.25% could create vulnerabilities ahead.

- Japan’s inflation is expected to cool off due to moderation in oil prices.

The GBP/JPY pair has sensed a buying interest after crashing to near 160.00 in the early Asian session. The cross has found a cushion as investors have digested the dovish commentary on interest rate guidance from the Bank of England (BoE).

Notable persistent inflation in the United Kingdom economy led by higher food prices, shortage of labor, and recent higher energy costs has been creating a mess for the BoE policymakers for a longer period.

In spite of a dismal economic outlook and global banking fiasco, BoE Governor Andrew Bailey went for an eleventh consecutive rate hike as inflationary pressures are getting beyond their control. Out of the seven-member team, Monetary Policy Committee (MPC) members Swati Dhingra and Silvana Tenreyro voted for an unchanged monetary policy while others favored a 25 basis point (bp) rate hike.

On the inflation guidance, BoE said that Consumer Price Index (CPI) figures would start scaling lower from the second quarter. They further added that Wednesday’s surprise jump in the price index was the outcome of volatile clothing prices, which could prove less persistent.

Analysts at Danske Bank consider that both growth and domestic inflation have surprised to the upside and given BoE’s message, they pencil in an additional 25 bps hike in May 2023.

On Friday, volatility from the Pound Sterling would continue as UK Office for National Statistics will report the Retail Sales (Feb) data. The economic data is expected to expand by 0.2% vs. 0.5% reported earlier. On an annual basis, a contraction is expected by 4.7%.

Meanwhile, the Japanese Yen will remain in action ahead of the release of the inflation data. Analysts at Standard Chartered expect “Headline CPI inflation to have expanded to 3.3% YoY, down from 4.3% in January. Similarly, core CPI inflation excluding fresh food may also have increased to 3.2%, less than 4.2% prior. However, core CPI excluding food and energy likely grew by 3.4% YoY in February, higher than 3.2% prior. The moderation in headline and core CPI inflation is mainly due to the base effect of oil prices, as per their view.

Late Thursday, Reuters reported that Federal Reserve emergency lending to banks, which hit record levels the last week, remained high in the latest week, amid continued large scale extensions of credit to the financial system, which now includes official foreign borrowing.

“Borrowing from the Fed caused the size of its overall balance sheet to move to $8.8 trillion from $8.7 trillion the prior week,”

Additional quotes

The Fed reported that discount window borrowing, its main source of emergency credit to depository institutions, ticked down to $110.2 billion as of Wednesday, from the $152.9 billion reported last week.

Last week's level had surged from $4.6 billion on March 8, shredding the $112 billion record set during the fall of 2008, during the global financial crisis’s most perilous phase.

The Fed also reported lending to foreign central banks and monetary authorities went from nothing on March 15 to $60 billion on Wednesday. Several major central banks announced recently they would draw on Fed dollar liquidity as needed.

Last week's increase set back the Fed’s work since last summer to reduce the size of its stockpile of cash and bonds that topped out at just shy of $9 trillion during the summer, a development the Fed views as having no implications for monetary policy.

Fed data also showed the $142.8 billion in credit it had extended to the Federal Deposit Insurance Corporation (FDIC) to deal with the failed California banks rose further and stood at $179.8 billion.

Market reaction

The news increase market’s fears of more Fed rate hikes and banking crisis, which in turn could be linked to the latest rebound in the US Treasury bond yields and the US Dollar from the recent troughs.

Also read: Forex Today: The Dollar says hello as Wall Street’s rally fades

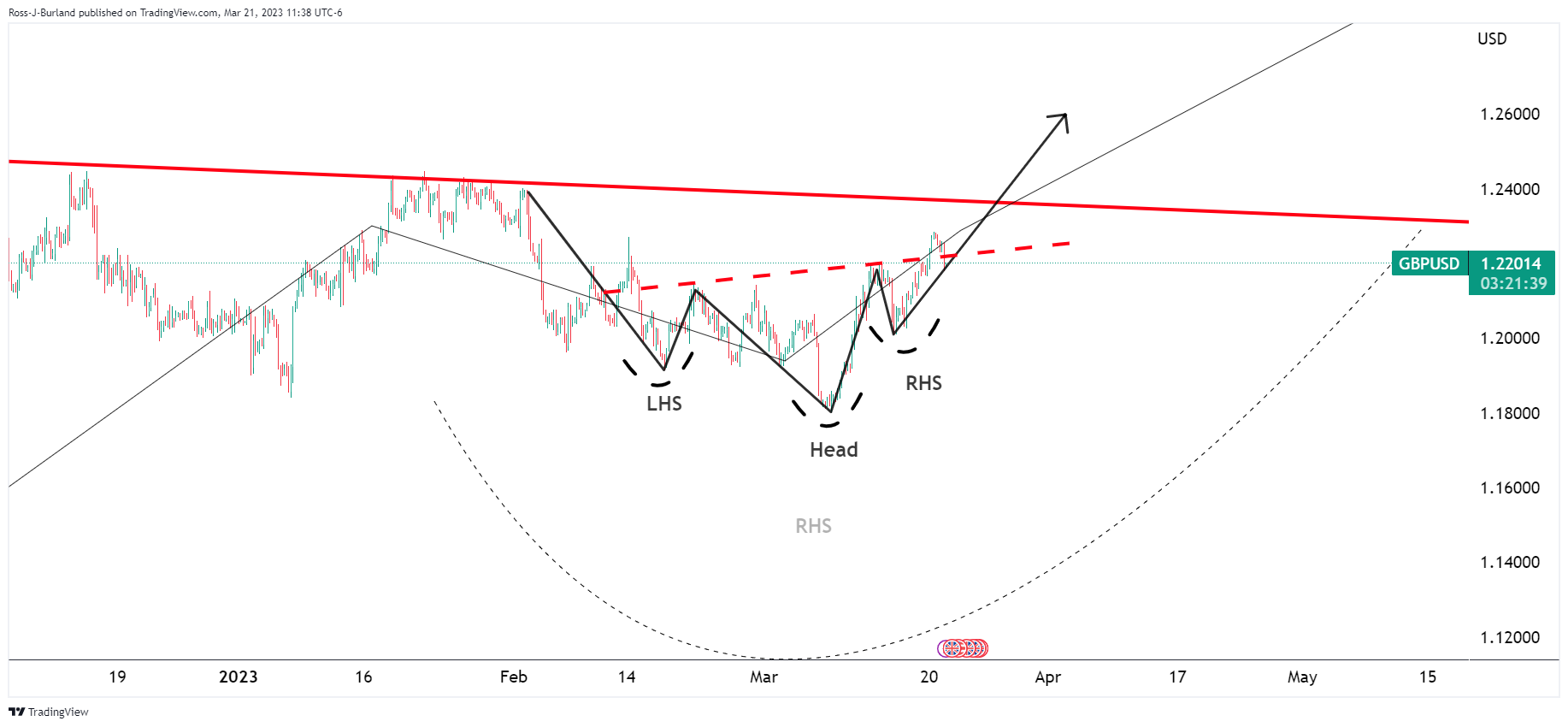

- GBP/USD seesaws around seven-week high, pauses two-day uptrend.

- BoE matches market forecasts and announced 0.25% rate hike, showing readiness for more if inflation stays high.

- Fed’s dovish hike, banking crisis weigh on Treasury bond yields and US Dollar.

- Mixed US data allowed markets to consolidate recent moves ahead of a slew of data.

GBP/USD bulls take a breather around the highest levels in nearly two months, making rounds to 1.2290 after rising in the last two consecutive days, as the volatile week is left with one last ball to play. The Cable pair cheered the US Federal Reserve’s (Fed) dovish rate hike, as well as the Bank of England’s (BoE) readiness for more rate increases to renew the multi-day top of late. However, the mixed US data and sentiment seem to allow the quote to pare recent gains ahead of the key statistics.

On Thursday, the Bank of England (BoE) raised the policy rate by 25 basis points (bps) to 4.25%, as expected. The policy statement highlighted an increase in Q2 Gross Domestic Product (GDP) forecast while also estimating a slower growth in Consumer Price Index (CPI) for the same. "UK banking system is well-placed to support the economy, including in a period of higher interest rates," added the BoE statement. It should be noted, however, that the policymakers clearly showed readiness for more rate hikes if inflation stays high, which in turn allowed the GBP/USD to remain firmer.

On the other hand, the US Chicago Fed National Activity Index (CFNAI) dropped to -0.19 in February versus 0.0 expected and 0.23 prior. Further, Weekly Initial Jobless Claims declined to 191K for the week ended on March 18, versus 192K prior and 203K market forecasts. It should be noted that the US New Home Sales rose 1.1% in February from 1.8% prior, versus 1.6% analysts’ estimation.

It should be noted that the US Treasury Secretary’s testimony in front of the House Appropriations Financial Services Subcommittee probed the market’s previous risk-on mood and allowed the US Dollar Index (DXY) to pare losses at the seven-week low. “China and Russia may want to develop an alternative to the US dollar,” while also showing preparedness for additional deposit actions `if warranted'. “Strong actions have been taken to ensure deposits are safe,” said US Treasury Secretary Yellen.

Amid these plays, Wall Street pared intraday gains and closed with a light green number whereas the Treasury bond yields also recovered but failed to post a positive closing.

Moving on, UK Retail Sales for February and preliminary readings of the UK and US PMIs for March will be crucial for the GBP/USD pair traders.

Technical analysis

A 10-month-old resistance line, around 1.2345 by the press time, restricts immediate GBP/USD upside amid overbought RSI.

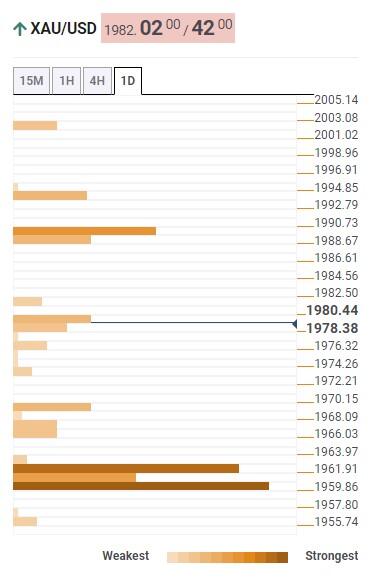

- Gold price is looking to shift its auction above $2,000.00 as the Fed doesn’t believe more rate hikes are appropriate.

- Further tightening of credit conditions by US banks would result in lower inflation, and cooling demand.

- Gold price is now marching towards the ultimate resistance plotted from August 2020 high at $2,075.32.

Gold price (XAU/USD) is oscillating in a narrow range of $1,990-2,000 in the early Asian session. The precious metal is struggling to shift its auction above the psychological resistance of $2,000. However, the upside looks favored as the Federal Reserve (Fed) has come closer to halting its policy-tightening cycle after eight consecutive hikes in the past year.

Fed chair Jerome Powell commented that some hikes might be appropriate to make the policy restrictive enough to tame the stubborn inflation. Also, it would not be worth hiking rates further in times when the United States economy is facing the fears of a potential banking crisis.

As the battle against stick inflation is still on, higher rates for a longer period will continue to weigh on persistent US inflation. Also, further tightening of credit conditions by commercial banks to avoid increment in Non-Performing Assets (NPAs) would result in lower inflation, cooling demand, and a dismal economic outlook.

Meanwhile, S&P500 futures showed some recovery on Thursday as investors are cheering that the economy is somehow clear about the terminal rate, which would help firms to design their strategy for further operations, portraying a risk-appetite theme. The US Dollar Index (DXY) defended the 102.00 support, however, the expression of fewer rate hikes ahead would maintain pressure on it.

On Friday, investors will keenly watch the US Durable Goods Orders data. As per the consensus, the economic data will expand by 0.6% against a contraction of 4.5%. Investors should be aware that the mighty Fed is not bound to stay on commentary and could continue its rate-hiking spell if forward demand continues to grow.

Gold technical analysis

Gold price has rebounded from the demand zone plotted in a range of $1,947-1,960 on a weekly scale. The precious metal is now marching towards the ultimate resistance plotted from August 2020 high at $2,075.32.

The 10-period Exponential Moving Average (EMA) will continue to act as a cushion for the Gold price.

Meanwhile, the Relative Strength Index (RSI) (14) has reclaimed the bullish range of 60.00-80.00. More upside looks solid as the momentum oscillator is not showing any sign of divergence and overbought situation.

Gold weekly chart

- USD/CHF bounced off the weekly lows around 0.9110s as the US Dollar pares its losses.

- USD/CHF Price Analysis: To shift neutral, above 0.9200; otherwise, the YTD lows would be tested.

The USD/CHF finished Thursday’s session with a loss of 0.11% after hitting a low of 0.9118 and closing at around 0.9163. As the Asian session begins, the USD/CHF is trading at around 0.9160s, as sellers continued to drive prices for the fourth straight day.

USD/CHF Price action

The USD/CHF daily chart portrays the pair as downward biased, but Thursday’s price action formed a hammer candlestick preceded by a downtrend; it’s usually a bullish candle. But buyers need to crack March’s 23 daily high at 0.9180 if they want to drive the USD/CHF higher.

For a bullish resumption, the USD/CHF first resistance would be 0.9200. Break above, and the 20-day Exponential Moving Average (EMA) at 0.9249 would be up for grabs. The 50-day EMA would be tested at 0.9278 before the USD/CHF reaches 0.9300.

On the flip side, and the path of least resistance, the USD/CHF first support would be March’s 23 low at 0.9118. A breach of the latter and the USD/CHF will fall to the March 13 daily low at 0.9070 before challenging the YTD low at 0.9059.

USD/CHF Daily chart

USD/CHF Technical levels

- AUD/USD consolidates a choppy number of past sessions.

- The focus is on the RBA as markets weigh the minutes and prospects for the next move.

AUD/USD is trading at around 0.6680 in early Asian Friday morning following a choppy number of sessions in financial markets. The pair traveled between a high of 0.6755 to a low of 0.6669 on Thursday but closed near its open and in the red as the US Dollar pared earlier losses on Thursday. The US Dollar index, DXY, which measures the currency against six major peers, was trading between 101.95 and 102.65 on the day.

Risk rallied as markets continued to digest the more dovish guidance from the Federal Open Market Committee, analysts at ANZ Bank said. ´´At the crux of future FOMC decisions will be the supply of credit in the economy. Current market interest rate pricing is skewed heavily towards expecting a persistent deterioration in the flow of credit,´´ the analysts explained.

´´For the foreseeable future, the Fed will proceed cautiously. We maintain our 5.50% forecast for fed funds, which implies two more 25bp hikes. The Fed’s 2023 core PCE forecast of 3.6% implies that sequential inflation will soon subside. The data have yet to confirm that,´´ the analysts said.

Meanwhile, domestically, the minutes from the March Reserve Bank of Australia meeting suggested that the Board is considering a pause in the rate hike cycle. Another 25bp hike at the April meeting is being priced in, so far although this assumes that financial market volatility recedes.

- EUR/USD stumbled and headed to the 1.0830s area after printing a weekly high at 1.0929.

- US jobs data suggests that the US Federal Reserve is not done raising rates.

- European Central Bank policymakers continue to emphasize that more hikes are coming.

EUR/USD hit a seven-week high but reversed its course, dropping below 1.0900 as the US Dollar (USD) pared some of its earlier losses. On Wednesday, the US Federal Reserve (Fed) raised rates by 25 bps, though market participants perceived it as dovish. That underpinned the EUR/USD, but traders booking profits weakened the Euro (EUR). The EUR/USD is trading at 1.0829, down 0.17%.

Yellen’s soft tone improved sentiment and lifted the US Dollar

Wall Street finished positively. The US Secretary of Treasure Janet Yellen testified before the house and backpedaled on Wednesday’s remarks that the US government is not planning to introduce blanket insurance to all depositors. Yellen said, “The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted.”

Data-wise, the US Department of Labor revealed that the labor market remains tight, unveiling the Initial Jobless Claims for the last week. Claims rose by 191K, less than the 201K estimates by the market. The Chicago Fed National Activity Index for February plunged to -0.19 vs. the prior’s month 0.23.

Meanwhile, European Central Bank (ECB) officials crossed the wires and remained hawkish. ECB Muller said that the ECB should likely raise rates a little. Echoing some of his comments was Klas Know, adding that the ECB is unlikely to stop raising interest rates.

Sources linked to the ECB commented that policymakers are confident that the Eurozone (EU) banking system stood tall in the recent turbulence. Therefore that would allow the ECB to resume additional interest rate increases.

EUR/USD Daily chart

EUR/USD Technical levels

- NZD/USD was testing the 0.6270s in a soft US dollar environment.

- The RBNZ still have a job on its hands.

NZD/USD is higher into the close of the New York session by some 0.5% after rallying from 0.6211 to test the bear´s commitments near 0.6300 with the price making a high of 0.6294.

´´The Kiwi held strength attained following yesterday’s Fed decision and starts the day at the upper end of March’s trading ranges, at around 0.6275,´´ analysts at ANZ Bank explained, noting yesterday’s speech by Reserve Bank of New Zealand´s Chief Economist Paul Conway.

´´While he didn’t really say anything new, media reports made it look hawkish, and to be fair, the RBNZ still have a job on their hands. But of course, so do others even if the Fed is possibly wavering. Our forecasts see Kiwi mildly higher, but we remain worried about the imbalances that bears continue to cite,´´ the analysts said.

Meanwhile, the US Dollar pared earlier losses on Thursday after the US Federal Reserve sounded close to calling time on interest rate hikes. The dollar index, DXY, which measures the currency against six major peers, is trading between 101.95 and 102.65 on the day.

Here is what you need to know on Friday, March 24:

After the meetings of the Federal Reserve (Fed), the Swiss National Bank (SNB) and the Bank of England (BoE), the focus is back on economic data on Friday, with the preliminary reading of March PMIs across the globe. Traders will also pay attention to renewed banking concerns.

Equity prices in Wall Street finished with gains but far from session highs, pointing lower amid renewed banking concerns. The Dow Jones gained 75 points after being up by more than 400 points. Technology stocks outperformed while regional banks tumbled.

On Friday, markets will have the first numbers of global activity during March, the PMIs. Central banks around the globe adopted the “data-dependent” mantra, so economic figures should be relevant. Overall, activity is expected to have remained near February’s levels.

Data released on Thursday showed US New Home Sales rose 1.1% to 640,000 (annual rate) in February, slightly below expectations. The Chicago Fed National Activity Index fell from 0.23 to -0.19 in March, against forecasts of a 0 reading. Initial Jobless Claims dropped unexpectedly in the week ended March 18 to 191,000, the lowest in three weeks.

Late on the day, the deterioration in market sentiment boosted Treasury Bonds. The US 10-year yield settled at 3.39%, the lowest in three days. Despite the moves in the bond market, the US Dollar Index rebounded, ending with marginal gains above 102.50.

USD/JPY staged a short-lived recovery to 131.60 after US employment data and then fell to 130.32, a one-month low. The Japanese Yen was the main winner of the American session on the back of lower yields.

EUR/USD failed again to hold above 1.0900 and retreated sharply from monthly highs to below 1.0850. GBP/USD also pulled back, sliding under 1.2300. The Bank of England, as expected, raised its key interest rate by 25 basis points to 4.25%. The Monetary Policy Committee voted by a majority of 7-2 for the hike (Dhingra and Tenreyro voted to keep the rate at 4%). UK February Retail Sales are due on Friday.

AUD/USD battled again with the 0.6730/50 level, and retreated, falling under 0.6700 amid a stronger Greenback. The Australian PMI is due on Friday. NZD/USD was also affected by USD’s recovery and dropped from near 0.6300 to 0.6250. The Kiwi was among the top performers on Thursday. USD/CAD bounced from weekly lows at 1.3620 back above 1.3700. Canada will report January Retail Sales on Friday.

Gold rose again and traded above $2,000, while Silver rose past $23.00. Bitcoin recovered from Wednesday’s slide, rising to $28,500. Crude oil prices dropped more than 1% after spending most of the day in positive ground.

Like this article? Help us with some feedback by answering this survey:

- USD/JPY is trapped between 129.80 and 131.66.

- The bears remain in charge while the price is on the front-side of the trendline.

As per the prior analysis, USD/JPY Price Analysis: Bulls about to make their move with eyes on 61.8% retracement, The bulls made their move but were met with strong supply.

USD/JPY prior analysis

It was explained that the price was moving into the lower support and that the bulls could be committed near the 130.70s for a retest of the prior support.

USD/JPY update

USD/JPY bulls met a 38.2% Fibonacci retracement before the supply came on. at this juncture, there is little bias one way or the other.

In the hourly chart above, 129.80 and 131.66 are the extremities of the current range and there is a neutral/bearish bias while between there.

Treasury Secretary Janet Yellen, Council of Economic Advisers Chair Cecila Rouse, and Office of Management and Budget Director Shalanda Young are delivering their testimony before the House Appropriations Financial Services Subcommittee.

Treasury futures are climbing higher across the board in late trade as a result.

Watch live

The prepared text came out earlier than expected: Yellen was expected to say, "we have used important tools to act quickly to prevent contagion. And they are tools we could use again," she said in prepared testimony to Congress.

"The strong actions we have taken ensure that Americans' deposits are safe. Certainly, we would be prepared to take additional actions if warranted."

Key notes

Prepared for additional deposit actions `if warranted'.

Strong actions have been taken to ensure deposits are safe.

Important anti-contagion tools could be used again.

Seeing reduced pressure on supply chains, lower shipping costs - us house appropriations subcommittee hearing.

Easing supply pressures will eventually pass through to lower inflation.

Front-month 30Y futures tap 132-01, 30Y yield 3.6690% low, while yield curves continue to climb off deeper inverted levels.

Implied rate cuts by year end accelerate with Dec'23 cumulative -86.6 at 3.946%, Fed Terminal slips to 4.89% in May.

Meanwhile, Wednesday's testimony from Treasury Secretary Yellen weighed on stocks after stating the Tsy is "not considering broad increase in deposit insurance", at odds with Chairman Powell's comment supportive of regional banks.

- Wall Street remains mixed across the board despite the US Dollar weakening.

- US Treasury bond yields collapsed after the Fed raised rates by 25 bps.

- Investors focus shifted toward the Federal Reserve’s monetary policy decision.

Wall Street is mixed during Thursday’s session as traders brace for a possible pause in the Federal Reserve (Fed) tightening cycle. Money market futures expect three rate cuts by the Fed at the end of 2023 following Wednesday’s 25 bps hike. The S&P 500 losses 0.18%, at 3,932.41, while the Dow Jones followed suit, down 0.20%, at 31,966.32. The Nasdaq Composite is the outlier, boosted by mega-cap companies, up 0.36%, at 11,711.29.

Sentiment improved after US Treasury Secretary Janet Yellen rattled financial markets, expressing that the United States (US) government is not planning to introduce blanket insurance to all depositors on Wednesday. At the same time, the US Federal Reserve Chair Jerome Powell emphasized that the banking system is solid after the Fed took steps to provide liquidity to the markets.

Additionally, traders shrugged off a 25 bps rate hike by the Fed, even though Jerome Powell expressed that inflation is too high and the labor market remains tight. Regarding the latter, US Initial Jobless Claims for the last week rose less than estimates, reaching 191K, below forecasts of 201K. Therefore, further tightening is expected by the US central bank.

The Chicago Fed National Activity Index for February plunged to -0.19 vs. the prior’s month 0.23

US Treasury bond yields continue to fall, weighed by investors expecting an additional rate hike by the Fed and then a pause. The 2-year bond yield dropped to 3.833%, down nine bps, while the 10-year bond yield fell one bps to 3.428%.

Sector-wise, Communication Services, Technology, and Real Estate led the pack, each up 1.66 %, 1.38%, and 0.01%. Contrarily, Energy, Utilities, and Financials, finished with losses of 1.47%, 0.87%, and 0.51%m respectively.

In the FX space, the US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, lost 0.01%, down at 102.528, after hitting a weekly low of 101.910.

S&P 500 Daily chart

- West Texas Intermediate crude is sinking on Thursday.

- Investors fear a recession in the aftermath of the Fed.

West Texas Intermediate crude oil is lower on Thursday despite risk-on markets that continued to digest the more dovish guidance from the Federal Open Market Committee. However, the prediction from the central bank of more to come renewed recession concerns and has weighed on the oil price. West Texas Intermediate is currently down by some 1% after falling from a high of $71.63 and printing a low of $69.24 so far.

The drop came after the Federal Reserve on Wednesday raised interest rates as expected by 25 basis points and said more hikes are likely on the way. However, a clouded outlook due to the risks associated with the banking sector troubles is weighing on the oil price also. Additionally, US Treasury Secretary Janet Yellin warned that the United States government will not automatically insure all deposits in future bank rescues.

Meanwhile, the rise in US oil inventories was seen in the report from the Energy Information Administration. There was a rise of 1.1-million barrels in stock the prior week vs. the estimate of a 1.8-million barrel drop.

Analysts at TD Securities argued that the spring is coiled in energy markets. ´´While CTA short acquisitions helped to fuel downside before a technical break catalyzed a large-scale stop-out, buying activity is unlikely to gain steam until WTI crude prices break the $78.50/bbl range,´´ the analysts argued.

´´With every single trend indicator on our screen already pointing to the downside, selling activity has run out of steam and algos stand ready to lift some offers. Strong crack spreads associated with refinery outages dampening supply and resilient demand could potentially act as a catalyst.´´

- GBP/USD bulls are tiring following the recent run to fresh bull cycle highs.

- US Dollar, DXY, is consolidating the slide in a support area.

As per the prior analysis, GBP/USD Price Analysis: Bulls are in the market and eye a bullish extension, the currency pair has indeed rallied as being supported on the front side of the bullish trend.

Since the prior analysis, both the Federal Reserve and the Bank of England have made their interest rate decisions, the former forcing some observers to reconsider their US Dollar forecasts as the currency slides to the lowest levels last seen at the end of January in the DXY index:

The weekly chart for DXY shows the price plummeting this week so far into a support area and the M-formation is a reversion pattern that could draw the index back towards the neckline in the foreseeable future.

Nevertheless, the bears are in the market still but there is some deceleration of the slide taking place currently as per the following 4-hour chart:

GBP/USD technical analysis

Meanwhile, GBP/USD is also consolidating fresh corrective highs.

GBP/USD prior analysis

it was explained that there were inverse head and shoulders on both the daily and 4-hour charts

Given the 4-hour neckline was already broken, and owing to the M-formation being a reversion pattern, the bias was bullish with the price on the front side of the trend.

GBP/USD update

GBP/USD rallied as per the bullish bias and is moving in on the longer-term chart´s head shoulders neckline:

- Silver price remains underpinned by a soft US Dollar and depressed US bond yields.

- XAG/USD Price Analysis: A daily close above $23.00 could exacerbate a rally toward YTD highs.

Silver price advances sharply to fresh six-week highs in the North American session, courtesy of a weak US Dollar (USD), which remains downward pressured by falling US Treasury bond yields. Hence, the XAG/USD is trading at $23.12 after hitting a daily low of $22.76.

XAG/USD Price action

During the Federal Reserve’s (Fed) monetary policy decision, the XAG/USD traded sideways around the $22.20s area before the US Treasury bond yields tumbled. After that, Silver rallied and tested the $23.00 figure before pulling back and closing at $22.97. However, Thursday’s price action resumed upwards, with buyers piling around the $22.70 area, and lifted XAG/USD price above the $23.00 mark.

Although the XAG/USD bias is neutral, the 20-day Exponential Moving Average (EMA) at $21.87 exceeded the 200-day EMA at $21.83. That could exacerbate another leg-up in Silver prices, and the white metal could test the YTD high at $24.63.

The XAG/USD first resistance would be the February 3 daily high at $23.59. Once cleared, the XAG/USD will be headed toward the $24.00 mark. Once broken, Silver will be poised to test the YTD high at $24.63.

In an alternate scenario, the XAG/USD first support would be $23.00. A daily close below the latter will keep XAG/USD price downward pressured.

XAG/USD Daily chart

XAG/USD Technical levels

On Thursday, the Bank of England (BoE) announced a 25 basis point rate hike to 4.25% as expected. Analysts at Danske Bank consider that with both growth and domestic inflation having surprised to the upside and given BoE’s message, they pencil in an additional 25 bps hike in May 2023.

BoE rate to peak at 4.50%

“As the 25bp hike was fully priced in by markets, the market reaction upon announcement was limited. 10-30Y was close to unchanged while 2Y rates were a few basis points lower. The market pricing of the peak policy rate was pushed slightly lower to 4.5% in August (from 4.6%).”

“We revise our call to expect the BoE to deliver a final 25bp hike in May. Our expectations are in line with current market pricing (currently 30bp priced until August 2023) as we expect the rest of the BoE committee to increasingly turn less hawkish amid a weakening growth backdrop and easing labour market conditions. Markets are pricing in 30bp of cuts during H2. We still believe that the first rate cuts will not be delivered before the beginning of 2024.”

- USD/CAD creeps lower below the 1.3700 figure on sentiment improvement and falling UST bond yields.

- US jobs data continues to justify further tightening by the Federal Reserve.

- USD/CAD Price Analysis: Once it falls below 1.3600, the 100-DMA is eyed.

USD/CAD sellers moved in on Thursday after being kept at the sidelines on a risk-on impulse. Although the US Federal Reserve (Fed) raised rates as expected, market participants perceived Powell and Co.’s move as dovish. That said, the USD/CAD has fallen 0.56% or 76 pips, exchanging hands at 1.3654.

Unemployment claims in the US remain depressed as the Fed battles inflation

Wall Street remains bolstered by an upbeat mood. Investors had digested words from Janet Yellen, the US Treasury Secretary, who said that the United States (US) government is not planning to introduce blanket insurance to all depositors. However, a dovish rate hike by the Fed improved risk appetite.

Data-wise, the US economic docket featured Initial Jobless Claims for the week ending on March 18, which fell by 1,000, to 191,000 below estimates of 201,000. That reinforced the Fed’s view of a tight labor market and warranted further action by the US central bank. At the same time, the Chicago Fed National Activity Index for February plunged to -0.19 vs. the prior’s month 0.23

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, continues to stumble and is down 0.31% at 102.213, undermined by falling US Treasury bond yields.

Therefore, the Canadian Dollar (CAD) is being boosted by a softer US Dollar and high oil price, with Western Texas Intermediate (WTI) rising above the $70.00 a barrel threshold, for the first time since March 15. Therefore, the USD/CAD is set to continue to fall as the US Dollar continues to weaken.

USD/CAD Technical levels

After sliding below the 1.3700 figure, the USD/CAD is extending its losses past the 20-day Exponential Moving Average (EMA) at 1.3668. Additionally, the pair is trading at two-week new lows, with sellers eyeing a test of the March 3 low at 1.3550. But firstly, the USD/CAD needs to conquer the 1.3600 figure. A breach of the latter will expose the 50-day EMA at 1.3584 before testing 1.3550, ahead of dropping to the 100-day EMA at 1.3509.

Dollar’s dominance is losing momentum with recent geopolitical events. De-dollarisation is a secular process and is likely to benefit Gold, economists at Société Générale report.

Central banks diversifying into Gold

“Ahead of the next US general elections, the risks are growing that the US will stay tough, and with a war backdrop, this should mean a continuation of geopolitical tensions.”

“The longer the Russia-Ukraine conflict endures, the faster countries not aligned with the west will be willing to isolate themselves from the USD. This will encourage central banks to continue their strong Gold purchases.”

“The central banks of non-aligned countries should continue to de-dollarise their portfolios and keep buying Gold (6% of our allocation, unchanged) which, at a later stage, will be backed by lower real yields.”

The FOMC unanimously decided to raise the target range for the federal funds rate by 25 bps to 4.75-5.00% from 4.50-4.75%. Economists at Rabobank remove the June rate hike of 25 bps from their forecasts. However, they still believe that the Fed will keep rates unchanged for the remainder of the year.

Fed to raise the FFR one more time and keep it there for the remainder of the year

“The FOMC unanimously decided to raise the target range for the federal funds rate by 25 bps. However, the FOMC does not want to go much higher and expects only one more 25 bps rate hike this year. Instead, the FOMC expects credit tightening by banks to do the rest of the inflation fighting for the central bank. During the Q&A you could easily get the idea that credit tightening is the Fed’s new monetary policy tool.”

“We lower our forecast for the target range of the fed funds rate to 5.00-5.25% from 5.25-5.50%. In other words, we now expect only one more hike of 25 bps instead of two. However, we stick to our forecast that the FOMC will not pivot this year.”

Japan is set to release February Consumer Price Index data on Thursday, March 23 at 23:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of four major banks regarding the upcoming Japanese inflation data.

Headline is expected at 3.3% year-on-year vs. 4.3% in January, core (ex-fresh food) is expected at 3.1% YoY vs. 4.2% in January, and core ex-energy is expected at 3.4% YoY vs. 3.2% in January.

Standard Chartered

“We expect headline CPI inflation to have expanded to 3.3% YoY, down from 4.3% in January. Similarly, core CPI inflation excluding fresh food may also have increased to 3.2%, less than 4.2% prior. However, core CPI excluding food and energy likely grew by 3.4% YoY in February, higher than 3.2% prior. The moderation in headline and core CPI inflation is mainly due to the base effect of oil prices, in our view. Tokyo CPI inflation, which is a leading indicator of national CPI inflation, increased to 3.4%, down from 4.4% in January. Tokyo core CPI inflation also dropped to 3.3% from 4.4% prior. However, core Tokyo CPI inflation rose to 3.2% from 3.0% prior, indicating that CPI inflation is sticky and headline CPI may take time to fall below the Bank of Japan's 2% target level.”

ING

“Consumer inflation in Japan is expected to cool to 3.5% YoY in February (vs 4.3% in January) due to the government’s energy subsidy programme, helped along by the base effects of a slowdown.”

SocGen

“We forecast nationwide core CPI of 3.2% YoY in February, significantly down from the 4.2% YoY seen in January. However, there is considerable uncertainty about the future.”

CitiBank

“Citi Forecast: 3.1% YoY, Previous: 4.3% YoY; Excluding Fresh Food: Citi Forecast: 3.0% YoY, Previous: 4.2% YoY; Excluding Fresh Food and Energy: Citi Forecast: 3.4% YoY, Previous: 3.2% YoY. We expect nationwide core CPI measures to rise from the previous month but fall sub 2% YoY from early autumn as the impact of past rises of commodity prices and Yen depreciation diminishes.”

- Consumer Confidence Indicator came in weaker than expected in March's flash estimate.

- EUR/USD continues to trade in positive territory slightly below 1.0900.

Consumer sentiment in the Eurozone weakened modestly with the Consumer Confidence Indicator edging lower to -19.2 in March's flash estimate from -19.1 in February. This reading came in weaker than the market expectation of -18.3. For the EU, the Consumer Confidence Indicator stood unchanged at -20.7.

Market reaction

This data doesn't seem to be having a noticeable impact on the Euro's performance against its major rivals. As of writing, the EUR/USD pair was trading at 1.0890, rising 0.33% on a daily basis.

- US Initial Jobless Claims continued their downward trend, portraying a tight labor market.

- Retail Sales in Mexico exceeded estimates and bolstered the Mexican Peso.

- USD/MXN Price Analysis: Could resume its bearish bias below $18.50.

The Mexican Peso (MXN) recovers against the US Dollar (USD) as the USD/MXN registers losses of 0.57% and stumbles below the 20-day EMA. Following the US Federal Reserve’s (Fed) decision to tighten monetary conditions, a risk-on impulse keeps the emerging country currency underpinned at around $18.50. At the time of writing, the USD/MXN is trading at 18.4868.

US bond yield fall as investors expect a less hawkish Fed

Wall Street is trading with solid gains after the US Treasury Secretary Janet Yellen rattled investors after saying that the United States (US) government is not planning to introduce blanket insurance to all depositors. Contrarily, Fed Chair Jerome Powell said that the banking system is solid after the Fed took steps to provide liquidity to the markets.

Unemployment claims for the week ending on March 18 fell by 1,000, warranting further tightening by the Fed amidst a tight labor market. The US Department of Labor (DoL) revealed that 191,000 Americans filled for aid after being laid off, contrary to the expected jump of 201,000 as reported by the consensus. At the same time, the Chicago Fed National Activity Index for February plunged to -0.19 vs. the prior’s month 0.23

Consequently, US Treasury bond yields continue to fall, weighed by investors expecting an additional rate hike by the Fed and then a pause. The 2-year bond yield dropped to 3.90%, down one bps, while the 10-year bond yield climbed to 3.464%. That undermined the greenback, with the US Dollar Index (DXY) falling 0.33% at 102.187.

On the Mexican front, Retail Sales in January jumped 1.6% from December, as the national statistics agency (INEGI) reported. Annually based, sales rose 5.3%.

Additionally, Mid-month inflation for March rose 0.15% MoM, less than estimates of 0.28%, while the YoY reading decelerated to 7.12%, from the prior’s 7.76%. Core inflation on its annual and monthly readings was unchanged for the same period.

USD/MXN Technical analysis

On Wednesday, the USD/MXN failed to close below the 20-day Exponential Moving Average (EMA) of 18.5524 and formed a dragonfly doji, which could open the door for further upside. Though USD/MXN traders need to reclaim the 18.8769, the pair could head up toward the $19.00 barrier. On the other hand, if the USD/MXN closes below $18.50, that would pave the way for further losses. The USD/MXN first support would be the March 23 low of 18.3776, followed by the March 13 low of 18.4487, ahead of testing the YTD low at 17.8967.

The FX market is well-advised not to base too much USD weakness on this new FOMC approach and to wait and see first. There are three reasons for that, according to economists at Commerzbank.

USD-positive risks exist

“Nobody can say with any certainty to what extent credit conditions will be tightened medium-term. Not even the Fed. If for example, everything is sunny and happy again the Fed might revise yesterday’s approach towards a steeper rate path. What is of particular relevance over the coming weeks is to what extent lending by US banks will change.”

“The ‘dots’ have shifted slightly to the upside compared with December. Without the currently expected tighter credit conditions, the FOMC would be much more aggressive. That is why there are risks towards USD strength too.”

“In the end, there is still a large discrepancy between market and FOMC expectations. It has increased as a result of last week’s events and was confirmed yesterday by the FOMC: the market expects rapid rate cuts; the FOMC does not expect that it will do that.”

- EUR/USD keeps the bid bias unchanged near the 1.0900 region.

- Further upside could see the 2023 peak near 1.1030 revisited.

EUR/USD manages to clear the 1.0900 barrier and advance to fresh multi-week highs on Thursday.

The continuation of the strong uptrend appears on the table for the time being. That said, the pair now needs to clear the March high at 1.0929 (March 23) to allow for a probable challenge of the 2023 top at 1.1032 (February 2) in the short-term horizon.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0331.

EUR/USD daily chart

Commodities are linked with currencies, especially the USD, and they usually share an inverse relationship. A weaker USD should provide some support to commodity prices in 2023, strategists at ANZ Bank report.

Supply-side issues are now subsiding

“The likely return of the traditional inverse relationship between commodity prices and the US dollar has important implications for commodity markets. With inflation easing, a weaker USD should be a tailwind for the sector.”

“Supply-side issues are now subsiding. Energy shortages in Europe have eased, and the number of disruptions to metal and oil supplies is also past its peak. So, the commodity price-USD relationship should re-emerge in 2023.”

“With the Fed’s aggressive rate hike cycle nearing its end, we expect the USD to weaken, which is likely to be a strong tailwind for commodity markets.”

- DXY remains under pressure, albeit off earlier lows in the sub-102.00 zone.

- Below the 102.00 region, the index could retest the 2023 low.

DXY retreats for the sixth consecutive session and keeps navigating the multi-week zone in the low-102.00s.

The bearish mood appears unabated for the time being. Against that, the breach of the March low at 101.91 (March 23) should put a potential test of the 2023 low near 100.82 (February 2) back on the investors’ radar.

Looking at the broader picture, while below the 200-day SMA, today at 106.60, the outlook for the index is expected to remain negative.

DXY daily chart

- Australian Dollar falls against G10 rivals during the European session.

- US Initial Jobless Claims drops unexpectedly, helping DXY.

- AUD/USD reverses again from 0.6750, finds support at 0.6690.

The AUD/USD was rejected again from above 0.6750 and retreat to as low as 0.6690, before bouncing back above 0.6700 after Wall Street’s opening.

Data from the US showed a larger-than-expected decline in Jobless Claims, helping the US Dollar gained some ground. Still the greenback remains under pressure after the FOMC meeting. The Federal Reserve raised it key interest rate by 25 basis points but did not commit to further rate hikes.

The US Dollar rose after the data but is weakening again after a positive opening in Wall Street. Equity prices are recovering after Wednesday’s sell-off. At the same time, US yields are moving off daily highs, adding bearish pressure to the greenback.

The Aussie was among the worst performers of the European session, with AUD/NZD reaching fresh three-day lows under 1.0700. The recovery in AUD/USD is being driven by higher equity prices and a weaker US Dollar, as the Aussie still remains weak.

From a technical perspective, AUD/USD was again rejected from above 0.6750 and pulled back. The pair is showing difficulties in extending the rally but corrections are limited, reflecting that the bullish bias is still intact.

Technical levels

- New Home Sales in the US rose at a softer pace than expected in February.

- US Dollar Index stays in negative territory but holds above 102.00.

Sales of new single‐family houses rose by 1.1% in February to a seasonally adjusted annual rate of 640,000, the data published jointly by the US Census Bureau and the Department of Housing and Urban Development showed on Thursday.

This reading followed January's growth of 1.8% came in weaker than the market expectation for an increase of 1.6%.

Market reaction

This data failed to trigger a noticeable market reaction and the US Dollar Index was last seen losing 0.3% on the day at 102.22.

Kit Juckes, Head of FX Strategy at Société Générale, analyzes the Swiss Franc outlook. He believes that the CHF is an interesting currency.

EUR/CHF is lagging EUR/USD – a feature this time, not a bug

“The speed with which the Swiss banking system was stabilised reinforces Franc’s safe-haven status. That suits the SNB now, more than usual.”

“Whereas in the past, EUR/CHF would fall when EUR/USD did (the Swiss Franc falling by less than the euro against the Dollar) and rise when EUR/USD did, EUR/CHF has decoupled from EUR/USD, allowing the CHF to rise as fast against a falling Dollar, as the Euro does.”

“The SNB appears to be more tolerant of a stronger Swiss Franc than in the past; at the same time as being less tolerant of a weaker currency in these inflationary times. Which makes the Franc a rather interesting currency.”

- EUR/JPY loses some upside momentum around 143.20.

- Further recovery looks likely above 141.81 so far.

EUR/JPY leaves behind Wednesday’s irresolute price action and advances past the 143.00 barrier, where it has so far met some decent resistance.

Despite the weekly rebound seems to have run out so steam, further upside should not be ruled out. Against that, the 2023 high at 145.56 (March 2) emerges as the next target of note prior to a potential visit to the December 2022 peak at 146.72 (December 15).

In the meantime, extra gains remain in store while the cross trades above the 200-day SMA, today at 141.81.

EUR/JPY daily chart

The Bank of England hiked Bank Rate today by 25 bps which triggered a fairly muted GBP response. TD Securities' bearish medium-term USD view should support GBP regardless of the BoE outlook.

GBP on a lower tier relative to EUR and JPY

“While we expect another hike in May, we don't think it will provide too much upside impetus to GBP.”

“A deeper correction in the USD should support GBP but we still think it underperforms on key crosses.”

“EUR has more upside on the links to China reopening and has seen a nice shift in the current account dynamics linked to the terms of trade reversal. EUR/GBP trades near the midpoint of the 60d range, so we would look to buy dips below 0.88.”

“Rate compression and a likely BoJ shift should boost the JPY, favoring relative outperformance versus GBP.”

“Regarding GBP/USD, we think the Fed reinforces our medium-term bearish USD outlook, increasing downside risks to our current USD forecasts. That would support GBP, but that theme favors others just a bit more.”

"We have raised interest rates a lot already, we believe inflation will fall quite rapidly before the summer," Bank of England (BoE) Governor Andrew Bailey said on Thursday.

"February inflation data means we need to see a fall in inflation happen," Bailey added. "We will go on making decisions needed for sustained low inflation."

Market reaction

These comments don't seem to be having a significant impact on Pound Sterling's performance against its rivals. As of writing, GBP/USD was up 0.4% on the day at 1.2313.

From September 2022 to January, the Dollar weakened by over 6%. Where will the USD go from here? Economists at JP Morgan expect to see a cycle of Dollar weakness.

Expensive starting point vs. fair value

“After ten years of strength, the Dollar is close to its highest level since 2001 and expensive versus long-term variables that define its ‘fair value’, such as the current account.”

Widening growth differentials

From 2012-2022, the rest of the world only grew 0.5% more than the US, a stark difference versus the 2.3% from 2001-2011. This gap is set to widen again in favor of the rest of the world to 1.2% over the next five years. This year’s positive upgrades to growth in Europe and China versus rising probabilities of a US recession is a move in that direction.”

Shrinking interest rate differentials

“By October, US 10-year yields were 2.2% higher than other developed markets. Since then, yield differentials shrank to 1.7% as other central banks joined the tightening trend. This gap is set to shrink further should the Fed pause and soon start cutting rates, as seems more likely after the regional banking stress.”

Flows returning to non-US markets

“Over the past decade, due to US economic and earnings resilience and higher interest rates, global capital flocked to US markets. However, we seem to be at the beginning of a turnaround given the change in the international growth and interest rate backdrop, together with a potential shift in market leadership.”

Sentiment is key short-term

“During risk-off moments, a flight to US safe-haven assets can overwhelm other variables. Since the regional banking stress began, bond volatility has surged. A short-term period of Dollar strength versus emerging markets currencies may follow.”

- USD Dollar gains momentum ahead of Wall Street opening bell.

- US Jobless Claims dropped more than expected.

- USD/JPY is up more than a hundred pips from the monthly low it reached earlier on Thursday.

The USD/JPY extended the rebound following the release of US economic data and printed a fresh daily high at 131.65. On Asian hours, the pair bottomed at 130.39, the lowest since February 10.

Data helps DXY’s rebound

The US Dollar was attempting to stabilize and following the release of US data it gained some momentum, helping the greenback. The DXY is down by just 0.10%, near 102.50, after hitting earlier levels below 102.00.

Initial Jobless Claims dropped by 1,000 during the week of March 18 to 191,000, against expectations of an increase to 201,000. Continuing Claims dropped by 14,000 in the week ended March 11 to 1,694,000. The numbers show the labor market remains tight.

The Chicago Fed National Activity Index (CFNAI) came in at –0.19 in February, down from 0.23 in January; forecasts were for 0.

USD/JPY rebounds

US yields printed fresh highs after the latest economic reports, although they are significantly below yesterday’s levels. The yield on the US 10-year bond rose above 3.50% while the 2-year approached 4%. The Japanese Yen was modestly impacted by the rebound in yield.

USD/JPY is hovering around 131.50, in positive ground for the day, after bouncing from monthly lows. The pair is attempting to remain above the critical support of 130.50. The bias is still to the downside.

Technical levels

S&P 500 has recovered, but economists at Credit Suisse remain biased to fade strength.

Break above 4078/90 to reassert an upward bias

“Whilst capped below the downtrend from the beginning of February and price/gap resistance at 4078/90, we continue to view the broader risk as marginally lower for a fall back to 3809, then support next at the 61.8% retracement at 3764/60 with the key 200-week average now at 3736. Our bias would then be to look for the market to stabilize around 3764/36.”

“A weekly close below 3736 would be seen to re-expose the 2022 low and 50% retracement of the 2020/2022 bull trend at 3505/3492.”

“Above 4078/90 would suggest we have seen a ‘false’ break lower to reassert an upward bias for strength back to 4195, possibly even 4312/4325.”

European Central Bank (ECB) policymaker Klaas Knot said that the ECB is unlikely to be done with rate hikes and added that the still thinks that they need to raise the policy rate in May. Knot, however, refrained from mentioning the size of the hike, as reported by Reuters.

Additional takeaways

"Core inflation shows no sign of abating; wages and services are its main drivers."

"Inflation risks clearly tilted to upside; second round wage effects increasingly visible."

"Bank turbulence must have significant permanent impact to alter inflation baseline."

"Could gradually move to full stop in AOO reinvestments if there is no more market turmoil."

Market reaction

EUR/USD continues to trade in positive territory slightly below 1.0800 following these comments.

The US Dollar is sharply weaker. FOMC shift in tone is set to undermine USD, economists at MUFG Bank report.

US banking sector substantially underperforming Europe

“The overall tone of both the statement following the expected 25 bps rate hike and the press conference by Fed Chair Powell was clearly more dovish.”

“The S&P Bank Index fell 5.6% yesterday. The sector in the US is clearly underperforming Europe which we believe will reinforce EUR/USD support.”

“The US Dollar low from early February is in sight and with banking sector confidence fragile once again we see high risks of that low for the Dollar being tested. It is really a matter of monitoring US banking sector stocks for now.”

- Chicago Fed National Activity Index declined more than expected in February.

- The US Dollar Index recovers toward 102.50 after the data.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) declined to -0.19 in February from 0.23 in January. This reading came in weaker than the market expectation of 0.

"The CFNAI Diffusion Index, which is also a three-month moving average, moved up to +0.02 in February from –0.07 in January," the Chicago Fed noted in its publication. "Thirty-eight of the 85 individual indicators made positive contributions to the CFNAI in February, while 47 made negative contributions."

Market reaction

The US Dollar Index stages a modest rebound in the early American session and was last seen losing 0.12% on the day at 102.40.

- Initial Jobless Claims in the US decreased by 1,000 in the week ending March 18.

- US Dollar Index stays in negative territory below 102.50.

There were 191,000 initial jobless claims in the week ending March 18, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 192,000 and came in better than the market expectation of 201,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 196,250, a decrease of 250 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending March 11 was 1,694,000, an increase of 14,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen losing 0.2% on the day at 102.30.

The Swiss Franc rose after the SNB hike. Economists at ING expect the EUR/CHF pair to stabilise above the 1.00 level.

Franc gains likely to emerge versus the Dollar

“The SNB actively favours a stronger CHF to limit imported inflation, but the ECB-SNB policy differential and an improvement in European sentiment are tilting the bias towards a stronger EUR/CHF at the moment, where a stabilisation above parity seems likely in light of recent developments.”

The channel where we could see the SNB hawkishness play in favour of CHF is probably through USD/CHF, where we may see a break below the 0.9080 early-February lows, also aided by the generalised USD weakness.”

Solid Euro gains saw EUR/USD extend through the low 1.09s before slipping back. Economists at Scotiabank believe that a pause and correction in the rally is due out.

Intraday price action looks weak

“Broader EUR gains look solid and well supported by bullish-leaning trend oscillators. But intraday price action looks weak and warns of a squeeze higher in the USD.”

“Short-term signals suggest a top/reversal (bearish ‘evening star’) is developing around the daily high at 1.0930.”

“Spot has gained relentlessly from last week’s low just above 1.05 so a pause and correction in the rally may be appropriate.”

“We look for support around 1.08 and (firmer) at 1.0750/75.”

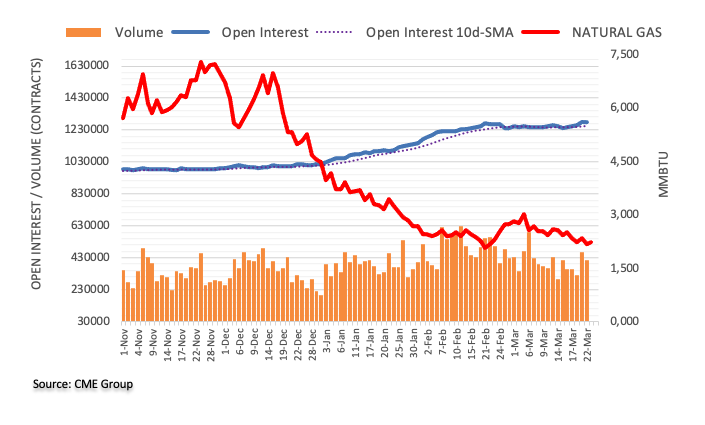

- Gold price bulls come back after Federal Reserve triggers dovish interest rate hike.

- Silver price makes seven-week highs as precious metals appreciate.

- US Treasury yields fall below 3.5%, sink US Dollar value.

Gold traders are again rejoicing after the Federal Reserve (Fed) confirmed expectations of a modest 25 basis points interest rate hike on Wednesday. The bright metal has re-gained the $1,970 mark, back on the uptrend after having retraced from year-to-date highs on Monday and Tuesday. Precious metals have all benefited from the super-important central banking decision, as Silver triggered a seven-week high just short of $23 to continue with its uptrend.

The fall of the US Treasury bond yields, with the benchmark 10-year bond netting below 3.5% after the Fed decision, is behind this move, as the US Dollar, the measure of all commodity markets, including Gold and Silver, is highly correlated to it.

Gold price technicals suggest more gains to come for the bulls

Gold price still has some way to go before testing the levels above $2,000 seen on early Monday peak, a trend that is likely to continue according to market analysts.

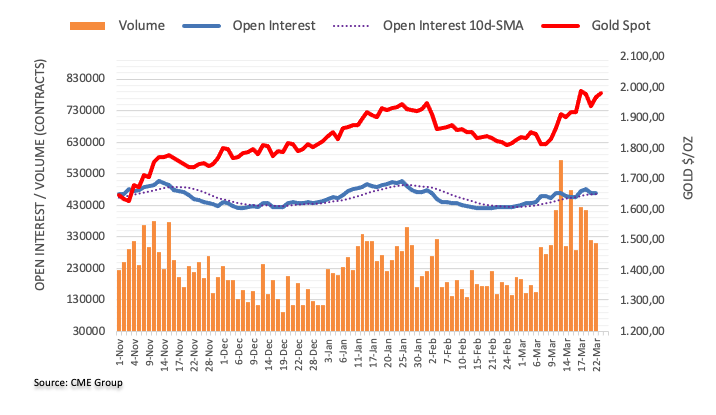

Pablo Piovano, News Editor at FXStreet, deems another visit to the psychological round mark “on the cards”. Piovano analyzes open interest data from the CME Group in the Gold futures market to support that bullish thesis:

“The uptick in the precious metal was on the back of a small build in open interest, which remains supportive of the continuation of the upside momentum in the very near term.”

Anil Panchal, Technical Analyst at FXStreet, looks deep at the technicals of the XAU/USD price action, seeing room for a consistent rise, as Gold price remains out of overbought territory despite the uptrend seen in recent weeks:

“Gold price extends bounce off the 50-bar Simple Moving Average (SMA), backed by the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator and upbeat Relative Strength Index (RSI) line, not overbought.”

Gold price technical analysis by Anil Panchal, News Editor at FXStreet

According to Panchal, the “two-month-old upward-sloping resistance line, near $2,015, acts as the last defense of the Gold bears”.

Silver price rises to seven-week highs, but bulls face multiple hurdles ahead

The price of Silver has made even more strides than its shinier counterpart, as XAG/USD triggered a seven-week high on the back of the Federal Reserve meeting, shortly reaching the $23 mark before retracing just below it. Silver price had not rallied as abruptly last week, but it is now making more gains than Gold.

The upside of the precious metal number two is a bit more capped than Gold’s, though, as the year-to-date highs set in January are still away and remain a thick resistance cluster. According to Anil Panchal, it will not be easy for the Silver metal to make new year-to-date highs:

“Multiple hurdles marked during early 2023 guard the XAG/USD’s immediate upside near $23.30, $24.00 round figure and the $24.30 levels before challenging the Year-To-Date (YTD) high surrounding $24.65.

“Meanwhile, the aforementioned horizontal resistance-turned-support appears a tough nut to crack for the Silver bears as it comprises multiple levels marked since June 2022, as well as the 50-DMA and 100-DMA, while challenging the bears near $22.25-55.”

Silver price technical analysis by Anil Panchal, News Editor at FXStreet

- GBP/USD maintains the bullish bias beyond 1.2300.

- The BoE raised the policy rate by 25 bps, as expected.

- The MPC voted 7-2 to lift the key rate to 4.25%.

The upbeat note around the Sterling remains in place and motivates GBP/USD to maintain the daily bullish tone above the 1.2300 region in the wake of the BoE’s decision on rates.

GBP/USD remains bid post-BoE

GBP/USD recedes from earlier tops near 1.2340 and revisits the 1.2300 neighbourhood after the BoE raised the policy rate by 25 bps to 4.25%, as widely expected on Thursday. The vote to hike rates was 7-2, with members Tenreyro and Dhingra favouring an unchanged stance.

From the statement, the central bank still expects inflation to drop significantly in Q2 2023, while it sees the economic activity to increase slightly during the same period.

Regarding the recent effervescence in the banking sector, the Financial Policy Committee (FPC) stressed that the UK banking system remains resilient and maintained robust capital and strong liquidity positions.

GBP/USD levels to consider